SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2006 |

| OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-28522

ASE TEST LIMITED

(Exact Name of Registrant as Specified in Its Charter)

NOT APPLICABLE

(Translation of Registrant’s Name into English)

REPUBLIC OF SINGAPORE

(Jurisdiction of Incorporation or Organization)

(Company Registration No. 199508552K

under Section 144(1A) of

the Singapore Companies Act)

10 WEST FIFTH STREET

NANTZE EXPORT PROCESSING ZONE

KAOHSIUNG, TAIWAN

REPUBLIC OF CHINA

(Address of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class Ordinary Shares | Name of Each Exchange on which Registered The Nasdaq Global Market* |

*Ordinary Shares are traded on the Nasdaq Global Market

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

100,138,232 Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ___ No Ö

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ___ No Ö

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes Ö No ___

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ___ | Accelerated filer Ö | Non-accelerated filer ___ |

Indicate by check mark which financial statement item the Registrant has elected to follow.

Item 17 ___ Item 18 Ö

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ___ No Ö

Page

| 1 |

| 1 |

| 1 |

| 1 |

| 1 |

| 2 |

| 2 |

| 6 |

| 6 |

| 6 |

| 16 |

| 16 |

| 17 |

| 31 |

| 32 |

| 33 |

| 33 |

| 33 |

| 51 |

| 53 |

| 54 |

| 54 |

| 55 |

| 55 |

| 57 |

| 58 |

| 59 |

| 60 |

| 61 |

| 61 |

| 61 |

| 63 |

| 63 |

| 63 |

| 64 |

| 64 |

| 64 |

| 65 |

| 65 |

| 65 |

| 65 |

| 65 |

| 65 |

| 65 |

| 65 |

| 70 |

| 70 |

| 71 |

| 73 |

| 73 |

| 73 |

| 74 |

| 74 |

| 75 |

| 75 |

| 75 |

| 75 |

| 75 |

| 76 |

| 76 |

| 76 |

| 76 |

| 77 |

| 77 |

| 77 |

| 77 |

| 77 |

| 78 |

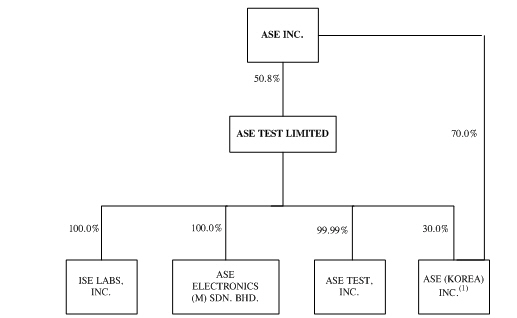

All references herein to (i) “ASE Test,” the “Company,” “we,” “us” or “our” are to ASE Test Limited and, unless the context requires otherwise, its subsidiaries, (ii) “ASE Group” are to Advanced Semiconductor Engineering, Inc. (“ASE Inc.”) and its subsidiaries and affiliates, (iii) “ASE Test Taiwan” are to ASE Test, Inc., a company incorporated under the laws of the Republic of China (“ROC”), (iv) “ASE Test Malaysia” are to ASE Electronics (M) Sdn. Bhd., a company incorporated under the laws of Malaysia, (v) “ISE Labs” are to ISE Labs, Inc., a corporation incorporated under the laws of the State of California, U.S.A., (vi) “ASE Chung Li” are to ASE (Chung Li) Inc., a company previously incorporated under the laws of the ROC that merged into ASE Inc. on August 1, 2004, (vii) “ASE Korea” are to ASE (Korea) Inc., a company incorporated under the laws of the Republic of Korea (“South Korea”), (viii) “ASE Material” are to ASE Material Inc., a company previously incorporated under the laws of the ROC that merged into ASE Inc. on August 1, 2004, (ix) “ASE Electronics” are to ASE Electronics Inc., a company incorporated under the laws of the ROC, (x) “U.S. dollars,” “US$” or “$” are to the currency of the United States, (xi) “NT dollars” or “NT$” are to the currency of the ROC, (xii) “RM” are to the currency of Malaysia, (xiii) “S$” are to the currency of Singapore, (xiv) “JP¥” are to the currency of Japan, (xv) “EUR” are to the currency of the European Union and (xvi) “SEC” are to the U.S. Securities and Exchange Commission. On May 31, 2007, the noon buying rate in The City of New York for cable transfers in NT dollars per U.S. dollar as certified for customs purposes by the Federal Reserve Bank of New York was NT$33.09 = US$1.00.

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, including statements regarding our future results of operations and business prospects. Although these forward-looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. We were not involved in the preparation of these projections. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify these forward-looking statements in this annual report. Our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons, including risks associated with cyclicality and market conditions in the semiconductor industry; demand for the outsourced semiconductor testing and packaging services we offer and for such outsourced services generally; the highly competitive semiconductor industry; our ability to introduce new testing technologies in order to remain competitive; our ability to maintain a high capacity utilization rate relative to our fixed costs; international business activities; our business strategy; our future expansion plans and capital expenditures; the strained relationship between the ROC and the People’s Republic of China, or the PRC; general economic and political conditions; possible disruptions in commercial activities caused by natural and human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion of these risks and other factors, please see “Item 3. Key Information––Risk Factors.”

Not applicable.

Not applicable.

The selected consolidated income statement data and cash flow data for the years ended December 31, 2004, 2005 and 2006 and the selected consolidated balance sheet data as of December 31, 2005 and 2006 set forth below are derived from our audited consolidated financial statements included in this annual report and should be read in conjunction with, and are qualified in their entirety by reference to, these consolidated financial statements. The selected consolidated income statement data and cash flow data for the years ended December 31, 2002 and 2003 and the selected consolidated balance sheet data as of December 31, 2002, 2003 and 2004 set forth below are derived from our audited consolidated financial statements not included in this annual report. Our consolidated financial statements have been prepared and presented in accordance with accounting principles generally accepted in the ROC, or ROC GAAP, which differ in certain material respects from accounting principles generally accepted in the United States of America, or U.S. GAAP. See note 24 to our consolidated financial statements included in this annual report for a description of the significant differences between ROC GAAP and U.S. GAAP for the periods covered by these consolidated financial statements. In October 2005, we disposed of our camera module assembly operations in Malaysia. Information in this annual report from our consolidated statements of income for the years ended December 31, 2003, 2004 and 2005 has been adjusted to reflect the reclassification of our camera module assembly operations as discontinued operations. Information from our consolidated statements of cash flows was appropriately not adjusted. Because we commenced our camera module assembly operations in 2003, no reclassification for periods prior to 2003 is required. See “Item 5. Operating and Financial Review and Prospects – Operating Results and Trend Information – Discontinued Operations.”

| | | Year Ended and as of December 31, | |

| | | | | | | | | | | | | | | | |

| | | (in thousands, except shares, per share data, operating data and percentages) | |

Consolidated Statement of Income Data: ROC GAAP: | | | | | | | | | | | | | | | |

| Net revenues | | $ | 301,962 | | | $ | 345,660 | | | $ | 427,763 | | | $ | 420,929 | | | $ | 517,706 | |

| Cost of revenues | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 21,389 | | | | 62,525 | | | | 87,100 | | | | 90,143 | | | | 195,052 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative(1) | | | 33,582 | | | | 37,502 | | | | 43,762 | | | | 46,160 | | | | 42,080 | |

| Research and development | | | 18,342 | | | | 19,513 | | | | 23,223 | | | | 24,993 | | | | 20,714 | |

Goodwill amortization(2) | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from operations | | | (40,640 | ) | | | (4,595 | ) | | | 10,010 | | | | 14,024 | | | | 132,258 | |

| Non-operating income (expense): | | | | | | | | | | | | | | | | | | | | |

| Interest, net | | | (14,396 | ) | | | (12,614 | ) | | | (6,187 | ) | | | (11,146 | ) | | | (9,796 | ) |

Equity in earnings (loss) of equity method investees(3) | | | (1,496 | ) | | | 4,259 | | | | 9,844 | | | | 6,637 | | | | 18,005 | |

| Impairment of long-lived assets | | | (35,321 | )(4) | | | — | | | | — | | | | — | | | | — | |

| Impairment of goodwill | | | — | | | | — | | | | (26,500 | ) | | | — | | | | — | |

Gain (loss) on valuation of financial assets, net (5) | | | — | | | | — | | | | 314 | | | | 685 | | | | (961 | ) |

Loss on valuation of financial liabilities, net (5) | | | — | | | | — | | | | — | | | | — | | | | (770 | ) |

Foreign exchange gain (loss), net (5) | | | (1,169 | ) | | | (795 | ) | | | (139 | ) | | | 703 | | | | 294 | |

| Gain on insurance settlement and impairment recovery | | | — | | | | — | | | | — | | | | — | | | | 32,145 | |

| Loss on fire damage | | | — | | | | — | | | | — | | | | (51,224 | ) | | | — | |

| Other, net | | | | | | | | | | | (380 | ) | | | (3,465 | ) | | | (7,839 | ) |

| Income (loss) from continuing operations before income tax | | | (91,511 | ) | | | (13,071 | ) | | | (13,038 | ) | | | (43,786 | ) | | | 163,336 | |

| Income tax expense (benefit) | | | (10,243 | ) | | | (6,009 | ) | | | (21,209 | ) | | | 2,537 | | | | 12,567 | |

Discontinued operations(6) | | | — | | | | 5,750 | | | | 16,968 | | | | 10,839 | | | | — | |

| Extraordinary loss | | | | | | | (2,203 | ) | | | | | | | | | | | | |

| Net income (loss) | | $ | (81,268 | ) | | $ | (3,515 | ) | | $ | | | | $ | (35,484 | ) | | $ | | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.82 | ) | | $ | (0.04 | ) | | $ | 0.25 | | | $ | (0.35 | ) | | $ | 1.51 | |

| Diluted | | $ | (0.82 | ) | | $ | (0.04 | ) | | $ | 0.25 | | | $ | (0.35 | ) | | $ | 1.50 | |

| Income (loss) from operations per share | | $ | (0.41 | ) | | $ | (0.05 | ) | | $ | 0.10 | | | $ | 0.14 | | | $ | 1.32 | |

| Income (loss) from continuing operations | | $ | (81,268 | ) | | $ | (7,062 | ) | | $ | 8,171 | | | $ | (46,323 | ) | | $ | 150,769 | |

| Income (loss) from continuing operations per share | | $ | (0.82 | ) | | $ | (0.08 | ) | | $ | 0.08 | | | $ | (0.46 | ) | | $ | 1.51 | |

| Shares used in earnings per share calculation: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 98,600,205 | | | | 99,110,225 | | | | 100,037,524 | | | | 100,059,031 | | | | 100,081,418 | |

| Diluted | | | 98,600,205 | | | | 99,110,225 | | | | 100,111,113 | | | | 100,059,031 | | | | 100,338,261 | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | | | |

| Net revenues | | $ | 301,962 | | | $ | 345,660 | | | $ | 427,763 | | | $ | 420,929 | | | $ | 517,706 | |

| Cost of revenues | | | | | | | | | | | | | | | | | | | | |

| Gross profit | | | 20,956 | | | | 55,640 | | | | 85,369 | | | | 85,774 | | | | 181,763 | |

Operating expenses (8) | | | | | | | | | | | 109,456 | (7) | | | | | | | | |

Income (loss) from operations(8) | | | (66,282 | ) | | | (6,082 | ) | | | (24,087 | ) | | | (38,157 | ) | | | 111,791 | |

Non-operating income (expense)(8) | | | (17,286 | ) | | | (9,168 | ) | | | | | | | (5,591 | ) | | | | |

| Income (loss) from continuing operations before income taxes | | | (83,568 | ) | | | (15,250 | ) | | | (20,287 | ) | | | (43,748 | ) | | | 137,228 | |

| Income tax expense (benefit) | | | (10,243 | ) | | | (6,009 | ) | | | (21,209 | ) | | | 2,537 | | | | 20,291 | |

Discontinued operations(6) | | | — | | | | 5,750 | | | | 16,968 | | | | 10,839 | | | | — | |

Cumulative effect of change in accounting principles(9) | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | | $ | (73,325 | ) | | $ | (3,491 | ) | | $ | | | | $ | (35,446 | ) | | $ | | |

| Earnings (loss) per share: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | (0.74 | ) | | $ | (0.04 | ) | | $ | 0.18 | | | $ | (0.35 | ) | | $ | 1.17 | |

| Diluted | | $ | (0.74 | ) | | $ | (0.04 | ) | | $ | 0.18 | | | $ | (0.35 | ) | | $ | 1.17 | |

| | | Year Ended and as of December 31, | |

| | | | | | | | | | | | | | | | |

| | | (in thousands, except shares, per share data, operating data and percentages) | |

Consolidated Statement of Income Data: U.S. GAAP: | | | | | | | | | | | | | | | | | | | | |

| Shares used in earnings per share calculation: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 98,600,205 | | | | 99,110,225 | | | | 100,037,524 | | | | 100,059,031 | | | | 100,081,418 | |

| Diluted | | | 98,600,205 | | | | 99,110,225 | | | | 100,111,113 | | | | 100,059,031 | | | | 100,234,402 | |

| | | | | | | | | | | | | | | | | | | | | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

ROC GAAP: | | | | | | | | | | | | | | | | | | | | |

| Current assets | | $ | 203,124 | | | $ | 209,683 | | | $ | 227,026 | | | $ | 285,487 | | | $ | 305,554 | |

| Long-term investments | | | 93,702 | | | | 104,021 | | | | 133,699 | | | | 140,225 | | | | 281,830 | |

| Property, plant and equipment, net | | | 529,958 | | | | 570,580 | | | | 634,796 | | | | 430,079 | | | | 389,435 | |

| Total assets | | | 926,499 | | | | 978,047 | | | | 1,083,109 | | | | 940,339 | | | | 1,044,428 | |

| Current liabilities | | | 138,690 | | | | 176,880 | | | | 201,884 | | | | 128,219 | | | | 102,716 | |

| Long-term debts | | | 244,271 | | | | 248,028 | | | | 273,020 | | | | 245,303 | | | | 85,706 | |

| Total liabilities | | | 387,560 | | | | 432,060 | | | | 483,518 | | | | 382,134 | | | | 201,300 | |

| Capital stock | | | 24,767 | | | | 24,887 | | | | 25,015 | | | | 25,015 | | | | 25,035 | |

| Cash dividend on ordinary shares | | | — | | | | — | | | | — | | | | — | | | | — | |

| Shareholders’ equity | | | 538,939 | | | | 545,987 | | | | 599,591 | | | | 558,205 | | | | 843,128 | |

| | | | | | | | | | | | | | | | | | | | | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | | | |

| Current assets | | $ | 203,124 | | | $ | 209,683 | | | $ | 227,026 | | | $ | 285,487 | | | $ | 305,554 | |

| Long-term investments | | | 94,050 | | | | 104,717 | | | | 53,381 | | | | 60,366 | | | | 78,371 | |

| Property, plant and equipment | | | 528,363 | | | | 568,552 | | | | 632,289 | | | | 427,005 | | | | 380,863 | |

| Total assets | | | 935,357 | | | | 996,762 | | | | 1,015,599 | | | | 877,687 | | | | 844,990 | |

| Current liabilities | | | 138,690 | | | | 179,083 | | | | 206,660 | | | | 128,228 | | | | 111,506 | |

| Long-term debts | | | 244,271 | | | | 248,028 | | | | 273,020 | | | | 245,303 | | | | 85,706 | |

| Total liabilities and minority interest | | | 387,660 | | | | 434,263 | | | | 488,389 | | | | 382,231 | | | | 211,879 | |

| Shareholders’ equity | | | 547,697 | | | | 562,499 | | | | 527,210 | | | | 495,456 | | | | 633,111 | |

| | | | | | | | | | | | | | | | | | | | | |

Consolidated Statement of Cash Flow Data: ROC GAAP: | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | $ | 154,251 | | | $ | 142,377 | | | $ | 164,908 | | | $ | 154,302 | | | $ | 120,638 | |

| Acquisition of property, plant and equipment | | | 126,009 | | | | 171,271 | | | | 210,656 | | | | 47,875 | | | | 87,408 | |

| Net cash provided by operating activities | | | 103,900 | | | | 134,665 | | | | 153,712 | | | | 170,064 | | | | 252,775 | |

| Net cash provided by (used in) investing activities | | | (131,547 | ) | | | (156,585 | ) | | | (253,621 | ) | | | 13,779 | | | | (121,596 | ) |

| Net cash provided by (used in) financing activities | | | 38,711 | | | | (24,041 | ) | | | 69,375 | | | | (84,447 | ) | | | (184,387 | ) |

| Net cash inflow (outflow) | | | 12,763 | | | | (47,879 | ) | | | (31,460 | ) | | | 98,722 | | | | (48,496 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Segment Net Revenues: | | | | | | | | | | | | | | | | | | | | |

| Testing | | $ | 214,331 | | | $ | 257,490 | | | $ | 343,116 | | | $ | 346,639 | | | $ | 423,341 | |

| Packaging | | | 87,631 | | | | 88,170 | | | | 84,647 | | | | 74,290 | | | | 94,365 | |

Percentage of Net Revenues: | | | | | | | | | | | | | | | | | | | | |

| Testing | | | 71.0 | % | | | 74.5 | % | | | 80.2 | % | | | 82.4 | % | | | 81.8 | % |

| Packaging | | | 29.0 | % | | | 25.5 | % | | | 19.8 | % | | | 17.6 | % | | | 18.2 | % |

| | | | | | | | | | | | | | | | | | | | | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

| Gross margin | | | 7.1 | % | | | 18.1 | % | | | 20.4 | % | | | 21.4 | % | | | 37.7 | % |

| Operating margin | | | (13.5 | )% | | | (1.3 | )% | | | 2.4 | % | | | 3.3 | % | | | 25.5 | % |

| ROC GAAP net margin | | | (26.9 | )% | | | (1.0 | )% | | | 5.9 | % | | | (8.4 | )% | | | 29.1 | % |

| U.S. GAAP net margin | | | (24.3 | )% | | | (1.0 | )% | | | 4.2 | % | | | (8.4 | )% | | | 22.7 | % |

| (1) | Includes selling expenses and general and administrative expenses, but excludes goodwill amortization. |

| (2) | Included in general and administrative expenses in our consolidated financial statements. See “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies—Goodwill.” |

| (3) | Includes investment income (loss) from ASE Korea, a wholly owned subsidiary of ASE Investment (Labuan) of which we hold 30.0%, and prior to their merger into ASE Inc. on August 1, 2004, ASE Chung Li and ASE Material. |

| (4) | This impairment loss related to long-lived assets of $35.3 million has been reclassified from operating expense to non-operating income (expense) to conform to the current year’s presentation. See “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies—Realizability of Long-Lived Assets.” |

| (5) | As a result of our adoption of the ROC Statement of Financial Accounting Standards, or ROC SFAS, No. 34 “Financial Instruments: Recognition and Measurement,” and ROC SFAS No. 36, “Financial Instruments: Disclosure and Presentation,” the balances in 2004 and 2005 were reclassified to be consistent with the classification used in our consolidated financial statements for 2006. Balances in 2002 and 2003 were not reclassified accordingly. See note 3 to our consolidated financial statements included in this annual report. |

| (6) | Amount for 2005 includes income from discontinued operations of $3.9 million and gain on disposal of discontinued operations of $6.9 million in 2005, both of which are net of income tax expense. In October 2005, we disposed of our camera module assembly operations in Malaysia. Such operations were formerly classified as part of our packaging operations. Information in this annual report from our consolidated statements of income for the years ended December 31, 2003, 2004 and 2005 has been adjusted to reflect the reclassification of our camera module assembly operations as discontinued operations. Information from our consolidated statements of cash flows was appropriately not adjusted. Because we commenced our camera module assembly operations in 2003, no reclassification for periods prior to 2003 is required. See “Item 5. Operating and Financial Review and Prospects – Operating Results and Trend Information – Discontinued Operations.” |

| (7) | Includes impairment of goodwill. See “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies—Goodwill.” |

| (8) | Loss of $52.0 million from the fire at our production lines in Chung Li, Taiwan in May 2005, originally classified as non-operating income (expense) under U.S. GAAP, was reclassified as income (loss) from operations under U.S. GAAP. |

| (9) | Represents the cumulative effect of our adoption of U.S. SFAS No. 123R “Share-Based Payment.” See note 24 to our consolidated financial statements included in this annual report. |

Not applicable.

Not applicable.

Risks Relating to Our Business

Since we are dependent on the highly cyclical semiconductor industry and conditions in the markets for the end-use applications of our products, our revenues and net income may fluctuate significantly.

Our semiconductor testing and packaging business is affected by market conditions in the highly cyclical semiconductor industry. All of our customers operate in this industry, and variations in order levels from our customers and service fee rates may result in volatility in our revenues and net income. From time to time, the semiconductor industry has experienced significant, and sometimes prolonged, downturns. As our business is, and will continue to be, dependent on the requirements of semiconductor companies for independent testing and packaging services, any future downturn in the semiconductor industry would reduce demand for our services. For example, in the fourth quarter of 2000, a worldwide downturn resulted in a significant deterioration in the average selling prices of, as well as demand for, our services in 2001 and adversely affected our operating results in 2001. Although the modest recovery in the semiconductor industry, evident in 2002 and 2003, strengthened in 2004, 2005 and 2006, we expect market conditions to continue to exert downward pressure on the average selling prices for our testing and packaging services. If we cannot reduce our costs or adjust our product mix to sufficiently offset any decline in average selling prices, our profitability will suffer and we may incur losses.

Market conditions in the semiconductor industry depend to a large degree on conditions in the markets for the end-use applications of semiconductor products, such as communications, personal computer and consumer electronics products. In 2004, 2005 and 2006, the substantial majority of our sales was attributable to the testing and packaging of semiconductors used in communications, personal computer and consumer electronics products. These industries are subject to intense competition and significant shifts in demand which could put pricing pressure on our testing and packaging services and adversely affect our revenues and net income.

A reversal or slowdown in the outsourcing trend for semiconductor testing and packaging services could adversely affect our growth prospects and profitability.

In recent years, semiconductor manufacturers that have their own in-house testing and packaging capabilities, known as integrated device manufacturers, have increasingly outsourced stages of the semiconductor production process, including testing and packaging, to independent companies in order to reduce costs and shorten production cycles. In addition, the availability of advanced independent semiconductor manufacturing services has also enabled the growth of so-called “fabless” semiconductor companies that focus exclusively on design and marketing and outsource their manufacturing, testing and packaging requirements to independent companies. We cannot assure you that these integrated device manufacturers and fabless semiconductor companies will continue to outsource their testing and packaging requirements to third parties like us. A reversal of, or a slowdown in, this outsourcing trend could result in reduced demand for our services and adversely affect our growth prospects and profitability.

If we are unable to compete favorably in the highly competitive semiconductor testing and packaging markets, our revenues and net income may decrease.

The semiconductor testing and packaging markets are very competitive. We face competition from a number of sources, including other independent semiconductor testing and packaging companies, especially those that offer turnkey testing and packaging services. We believe that the principal competitive factors in the testing and packaging market are:

| · | the ability to provide total solutions to our customers; |

| · | technological expertise; |

| · | the range of testing platforms and package types available; |

| · | testing program development capability; |

| · | the ability to work closely with customers at the product development stage; |

| · | responsiveness and flexibility; |

We face increasing competition from other testing and packaging companies, as most of our customers obtain testing or packaging services from more than one source. In addition, some of our competitors may have access to more advanced technologies and greater financial and other resources than we do. Many of our competitors have shown a willingness to quickly and sharply reduce prices, as they did in 2001, in order to maintain capacity utilization in their facilities during periods of reduced demand. Although prices have stabilized, any renewed erosion in the prices for our testing and packaging services could cause our revenues and net income to decrease and have a material adverse effect on our financial condition and results of operations.

The complexity of the semiconductor testing and packaging process increases the costs and production risks of our business.

Semiconductor testing and packaging involve significant technological and process expertise. In order to improve capacity utilization and efficiencies in our testing operations, we maintain advanced and expensive equipment and develop software conversion programs which enable us to test semiconductors utilizing different testing platforms. If we fail to successfully develop software conversion programs or if we are unable to effectively reduce the lead time necessary to interface our customers’ semiconductors with our testing equipment, our operational efficiency could suffer. In addition, our testing and packaging operations take place in clean rooms where air purity, temperature and humidity are controlled. If we are unable to effectively control our testing and packaging environment, some semiconductors could be damaged. Although we believe our operational efficiency has generally improved in recent years, we have from time to time experienced, and may in the future experience, production interruptions due to technical problems or operator errors in our testing and packaging processes. Any interruption in our operations could have a material adverse effect on our business.

Our profitability depends on our ability to respond to rapid technological changes in the semiconductor industry.

The semiconductor industry is characterized by rapid increases in the diversity and complexity of semiconductors. As a result, we expect that we will need to constantly offer more sophisticated testing and packaging technologies and processes in order to respond to competitive industry conditions and customer requirements. If we fail to develop, or obtain access to, advances in testing or packaging technologies or processes, we may become less competitive and less profitable. In addition, advances in technology typically lead to declining average selling prices for semiconductors tested or packaged with older technologies or processes. As a result, if we cannot reduce the costs associated with our testing or packaging services, the profitability of a given service and our overall profitability may decrease over time.

Our operating results are subject to significant fluctuations, which could adversely affect the market value of your investment.

Our operating results have varied significantly from period to period and may continue to vary in the future. Downward fluctuations in our operating results may result in decreases in the market price of our shares. Among the more important factors affecting our quarterly and annual operating results are the following:

| | · | changes in general economic and business conditions, particularly given the cyclical nature of the semiconductor industry and the markets served by our customers; |

| · | our ability to quickly adjust to unanticipated declines or shortfalls in demand and market prices for our testing and packaging services, due to our high percentage of fixed costs; |

| · | changes in prices for our testing and packaging services; |

| · | volume of orders relative to our testing and packaging capacity; |

| · | timing of capital expenditures in anticipation of future orders; |

| · | changes in costs and availability of raw materials, equipment and labor; and |

| · | earthquakes, drought, epidemics and other natural disasters, as well as industrial and other incidents such as fires and power outages. |

Due to the factors listed above, our future operating results or growth rates may be below the expectations of research analysts and investors. If so, the market price of our shares, and thus the market value of your investment, may fall.

Due to our high percentage of fixed costs, we will be unable to maintain our gross margin at past levels if we are unable to achieve relatively high capacity utilization rates.

Our operations, in particular our testing operations, are characterized by relatively high fixed costs. We expect to continue to incur substantial depreciation and other expenses in connection with previous acquisitions of testing and packaging equipment and facilities. Our profitability depends not only on pricing levels for our services, but also on utilization rates for our testing and packaging equipment, commonly referred to as “capacity utilization rates.” In particular, increases or decreases in our capacity utilization rates can significantly affect gross margins since the unit cost of testing and packaging services generally decreases as fixed costs are allocated over a larger number of units. In periods of low demand, we experience relatively low capacity utilization rates in our operations, which leads to reduced margins. During 2001, we experienced lower than anticipated utilization rates in our operations due to a significant decline in worldwide demand for our testing and packaging services, which resulted in reduced margins during that period. Although our capacity utilization rates have improved, we cannot assure you that we will be able to maintain or surpass our past gross margin levels if we cannot consistently achieve or maintain relatively high capacity utilization rates.

Because of the highly cyclical nature of our industry, our capital requirements are difficult to plan. If we cannot obtain additional capital when we need it, our growth prospects and future profitability may be adversely affected.

Our capital requirements are difficult to plan in our highly cyclical and rapidly changing industry. We will need capital to fund the expansion of our facilities as well as fund our research and development activities in order to remain competitive. We believe that our existing cash, marketable securities, expected cash flow from operations and existing credit lines under our short-term loan facilities will be sufficient to meet our capital expenditures, working capital, cash obligations under our existing debt and lease arrangements, and other requirements for at least the next twelve months. However, future capacity expansions or market or other developments may cause us to require additional funds. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including:

| · | our future financial condition, results of operations and cash flows; |

| · | general market conditions for financing activities by semiconductor companies; and |

| · | economic, political and other conditions in Taiwan and elsewhere. |

If we are unable to obtain funding in a timely manner or on acceptable terms, our growth prospects and future profitability may decline.

Restrictive covenants and broad default provisions in our existing debt agreements may materially restrict our operations as well as adversely affect our liquidity, financial condition and results of operations.

We are a party to numerous loan and other agreements relating to the incurrence of debt, many of which include restrictive covenants and broad default provisions. In general, covenants in the agreements governing our existing debt, and debt we may incur in the future, may materially restrict our operations, including our ability to incur debt, pay dividends, make certain investments and payments and encumber or dispose of assets. In the event of a prolonged downturn in the demand for our services as a result of a downturn in the worldwide semiconductor industry or otherwise, we cannot assure you that we will be able to remain in compliance with our financial covenants which, as a result, may lead to a default. Furthermore, a default under one agreement may also trigger cross-defaults under our other agreements. In the event of default, we may not be able to cure the default or obtain a waiver on a timely basis. An event of default under any agreement governing our existing or future debt, if not cured or waived, could have a material adverse effect on our liquidity, financial condition and results of operations.

We and our subsidiaries have on occasion failed to comply with certain financial covenants in some of our loan agreements as a result of reduced levels of operating cash flow due primarily to a downturn in the worldwide semiconductor industry in the fourth quarter of 2000, although our cash flow has subsequently improved. Such noncompliance may also have, through broadly worded cross-default provisions, resulted in defaults under some of the agreements governing our other existing debt. We and our subsidiaries obtained waivers from the relevant lenders relating specifically to such noncompliance. Such noncompliance has not had any significant effect on our ability to repay or refinance amounts due in respect of our existing debt. For these and other reasons, including our financial condition and our relationship with our lenders, no lender has to date sought and we do not believe that any of our lenders would seek to declare a default or enforce remedies in respect of our existing debt, as a result of cross-default provisions or otherwise, although we cannot provide any assurance in this regard.

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our executive officers and skilled technical and other personnel. Our business could suffer if we lose the services of any of these personnel and cannot adequately replace them. Although some of these management personnel have entered into employment agreements with us, they may nevertheless leave before the expiration of these agreements. We are not insured against the loss of any of our personnel. In addition, we may be required to increase substantially the number of these employees in connection with our expansion plans, and there is intense competition for their services in the semiconductor industry. We may not be able to either retain our present personnel or attract additional qualified personnel as and when needed. In addition, we may need to increase employee compensation levels in order to attract and retain our existing officers and employees and the additional personnel that we expect to require. Furthermore, a portion of the workforce at our facilities in Taiwan are foreign workers employed by us under work permits which are subject to government regulations on renewal and other terms. Consequently, our business could also suffer if the Taiwan regulations relating to the import of foreign workers were to become significantly more restrictive or if we are otherwise unable to attract or retain these workers at a reasonable cost.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

The United States Securities and Exchange Commission, or the SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. In addition, an independent registered public accounting firm must attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting. As an accelerated filer, this requirement for such attestation report is effective for us for our annual report on Form 20-F for the year ended December 31, 2007. Our management may conclude that our internal controls over our financial reporting are not effective. Moreover, even if our management concludes that our internal controls over financial reporting are effective, our independent registered public accounting firm may still decline to attest to our management’s assessment or may issue a report that is qualified if it identifies a material weakness in our controls related to how they are documented, designed, operated or reviewed. Furthermore, during the course of the evaluation, documentation and attestation, we may identify deficiencies that we may not be able to remedy in time to meet the deadline imposed by the Sarbanes-Oxley Act for compliance with the requirements of Section 404. If we fail to achieve and maintain the adequacy of our

internal controls, we may not be able to conclude that we have effective internal controls, on an ongoing basis, over financial reporting in accordance with the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our shares. Furthermore, we incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

If we are unable to obtain additional testing and packaging equipment or facilities in a timely manner and at a reasonable cost, our competitiveness and future profitability may be adversely affected.

The semiconductor testing and packaging businesses are capital-intensive and require significant investment in expensive equipment manufactured by a limited number of suppliers. The market for semiconductor testing and packaging equipment is characterized, from time to time, by intense demand, limited supply and long delivery cycles. Our operations and expansion plans depend on our ability to obtain a significant amount of such equipment from a limited number of suppliers, including, in the case of testers, Verigy Ltd., Teradyne, Inc., Credence Systems Corporation, LTX Corporation and, in the case of wire bonders, Kulicke & Soffa Industries Inc. In the case of handlers, we purchase equipment from Seiko Epson and, in the case of probers, we purchase equipment from Tokyo Electron Limited. From time to time we have also leased certain equipment and have in the past three years increased the amount of equipment we lease. See “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Cost of Revenues.” We have no binding supply agreements with any of our suppliers and acquire our testing and packaging equipment on a purchase order basis, which exposes us to changing market conditions and other substantial risks. For example, shortages of capital equipment could result in an increase in the price of equipment and longer delivery times. Semiconductor testing and packaging also require us to operate sizeable facilities. If we are unable to obtain equipment or facilities in a timely manner, we may be unable to fulfill our customers’ orders, which could adversely affect our growth prospects as well as financial condition and results of operations. See “Item 4. Information on the Company—Business Overview—Equipment.”

Fluctuations in exchange rates could result in foreign exchange losses.

Currently, the majority of our revenues from testing and packaging services is denominated in U.S. dollars and NT dollars. Our cost of revenues and operating expenses associated with testing and packaging services, on the other hand, are incurred in several currencies, primarily in NT dollars, U.S. dollars, Malaysian ringgit and Singapore dollars, as well as, to a lesser extent, Japanese yen. In addition, a substantial portion of our capital expenditures, primarily for the purchase of testing and packaging equipment, has been, and is expected to continue to be, denominated in U.S. dollars with much of the remainder in Japanese yen. Fluctuations in exchange rates, primarily among the U.S. dollar, the NT dollar, the Malaysian ringgit and the Japanese yen, will affect our costs and operating margins. In addition, these fluctuations could result in exchange losses and increased costs in NT dollar and other local currency terms. Despite hedging and mitigating techniques implemented by us, fluctuations in exchange rates have affected, and may continue to affect, our financial condition and results of operations. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk—Foreign Currency Exchange Rate Risk.”

The loss of a large customer or disruption of our strategic alliance or other commercial arrangements with semiconductor foundries and providers of other complementary semiconductor manufacturing services may result in a decline in our revenues and profitability.

Although we have over 200 customers, we have derived and expect to continue to derive a large portion of our revenues from a small group of customers during any particular period due in part to the concentration of market share in the semiconductor industry. Our five largest customers together accounted for approximately 30%, 32% and 32% of our net revenues in 2004, 2005 and 2006, respectively. There has been significant variation in the composition of our largest five customers over time. No customer accounted for more than 10% of our net revenues in 2004, 2005 or 2006. This variation is due primarily to the high level of competition in the semiconductor industry in which our customers operate. The demand for our services from a customer is directly dependent upon that customer’s level of business activity, which could vary significantly from year to year. Our key customers typically operate in the cyclical semiconductor business and, in the past, have varied, and may in the future vary, order levels significantly from period to period. Some of these companies are relatively small, have limited operating histories and financial resources and are highly exposed to the cyclicality of the industry. We cannot assure you that these

customers or any other customers will continue to place orders with us in the future at the same levels as in past periods. The loss of one or more of our significant customers, or reduced orders by any one of them, and our inability to replace these customers or make up for such orders could adversely affect our revenues and profitability. In addition, during cyclical market downturns, we have in the past reduced, and may in the future reduce, our prices to limit the level of order cancellations. Any price reduction would likely reduce our margins and profitability.

Our strategic alliance with TSMC, currently the world’s largest dedicated semiconductor foundry, and ASE Inc., as well as ASE Inc.’s and our other commercial arrangements with providers of complementary semiconductor manufacturing services, enable us, in conjunction with ASE Inc., to offer total semiconductor manufacturing solutions to our customers. This strategic alliance and any of our other commercial arrangements may be terminated at any time. A termination of this strategic alliance and other commercial arrangements, and our failure to enter into substantially similar alliances and commercial arrangements, may adversely affect our competitiveness and our revenues and profitability.

Adverse developments in ASE Inc.’s operations, competitive position or customer base could negatively affect us.

We believe that we have benefited significantly from our relationship with ASE Inc. Our proximity to, and close working relationship with, ASE Inc. have enabled us to provide value-added services to our customers. A substantial majority of our net revenues from testing services performed at our Kaohsiung, Taiwan facilities has historically been, and is expected to continue to be, derived from customers who are also customers of ASE Inc. We have from time to time billed ASE Inc. directly for some of our testing services performed in Taiwan as part of turnkey services provided by ASE Inc. and by us. Because of our close relationship with ASE Inc., any adverse development in ASE Inc.’s operations, competitive position or customer base could have a material adverse effect on our business, future revenues and profitability.

Our interests may conflict with those of our controlling shareholder, who may take actions that are not in our or our shareholders’ best interest.

ASE Inc., our controlling shareholder, is principally engaged in the semiconductor packaging business. ASE Inc. is also engaged in the semiconductor testing business through its 50.9% shareholding in our company and otherwise. ASE Inc. does not, under Singapore law, owe any fiduciary obligation to our minority shareholders. ASE Inc. is in a position to control actions that require shareholders’ approval by ordinary resolution, including the timing and payment of dividends and the election of our entire board of directors. In addition, some members of our board of directors are employed by, or serve as directors of, companies within the ASE Group, and our Chairman and five other directors hold similar positions at ASE Inc. Accordingly, ASE Inc. or its affiliates may take actions that are not in our or our other shareholders’ best interest.

ASE Inc. and we have had, and will continue to have, some common customers. These customers conduct separate qualification procedures of ASE Inc.’s and our facilities based on their own evaluation of various factors, including geographic location of the facilities, range and quality of testing platforms available, technical expertise, testing capacity and price, and generally indicate which facilities they desire to use. There are no agreements between ASE Inc. and us with respect to the allocation of business from our common customers.

We and ASE Inc. and its affiliates continue to have contractual and other business relationships and may, from time to time, engage in transactions that are material to us.

The ownership by ASE Inc. of a substantial percentage of our outstanding shares and ASE Inc.’s affiliation with members of our board of directors may have the effect of:

| · | delaying, deferring or preventing a change in who controls us; |

| · | discouraging bids for our shares at a premium over the market price; and |

| · | adversely affecting the market price of our shares. |

Our revenues and profitability may decline if we are unable to obtain adequate supplies of raw materials in a timely manner and at a reasonable price.

Our packaging operations require that we obtain adequate supplies of raw materials on a timely basis. Shortages in the supply of raw materials experienced by the semiconductor industry have in the past resulted in occasional price increases and delivery delays. For example, in 1999 and the first half of 2000, the industry experienced a shortage in the supply of advanced substrates used in ball grid array, or BGA, packaging. Raw materials such as advanced substrates are prone to supply shortages since such materials are produced by a limited number of suppliers such as Phoenix Precision Technology Corporation, Kinsus Interconnect Technology Corporation, SMI Electronic Devices Inc., Nanya Printed Circuit Board Corporation and Daeduck Electronics Technology Co. Ltd. ASE Electronics Inc., a wholly-owned subsidiary of ASE Inc. that now operates ASE Inc.’s interconnect materials business formerly operated by ASE Material prior to the merger of ASE Material with and into ASE Inc. in August 2004, and ASE (Shanghai) Inc., a wholly-owned subsidiary of ASE, have improved ASE Inc.’s and our ability to obtain advanced substrates on a timely basis and at a reasonable cost. However, we do not expect ASE Inc.’s in-house interconnect materials operations to be able to meet all of our interconnect materials requirements. Consequently, we will remain dependent on market supply and demand for our raw materials. We cannot guarantee that we will not experience shortages in the near future or that we will be able to obtain adequate supplies of raw materials in a timely manner or at a reasonable price. Our revenues and net income could decline if we are unable to obtain adequate supplies of high quality raw materials in a timely manner or if there are significant increases in the costs of raw materials that we cannot pass on to our customers.

Any environmental claims or failure to comply with any present or future environmental regulations, as well as any fire or other industrial accident, may require us to spend additional funds and may materially and adversely affect our financial condition and results of operations.

We are subject to a various laws and regulations relating to the use, storage, discharge and disposal of chemical by-products of, and water used in, our packaging process. Although we have not suffered material environmental claims in the past, the failure to comply with any present or future regulations could result in the assessment of damages or imposition of fines against us, suspension of production or a cessation of our operations. New regulations could require us to acquire costly equipment or to incur other significant expenses that we may not be able to pass on to our customers. See “Item 4. Information on the Company – Business Overview –Raw Materials.” Additionally, any failure on our part to control the use, or adequately restrict the discharge, of hazardous substances could subject us to future liabilities that may have a material adverse effect on our financial condition and results of operations.

Any impairment charges may have a material adverse effect on our net income.

Under ROC GAAP and U.S. GAAP, we are required to evaluate our long-lived assets, including equipment and goodwill, for possible impairment at least annually or whenever there is an indication of impairment. If certain criteria are met, we are required to record an impairment charge.

With respect to long-lived assets, we did not recognize any impairment charges with regards to equipment for the years ended December 31, 2004 and 2006. In 2005, we recognized a loss of $52.0 million on damage to our property, plant and equipment caused by a fire at our production lines in Chung Li, Taiwan. In 2006, we reversed $5.6 million of the impairment loss recognized in 2005 under ROC GAAP due to an increase in the estimated service potential of the relevant assets. Reversal of the amount is not allowed under U.S. GAAP. See note 24 to our consolidated financial statements for reconciliation of the differences in the cost basis of the damaged machinery and associated depreciation expense. With respect to goodwill, in 2004, we recognized an impairment charge of $26.5 million under ROC GAAP and $41.5 million under U.S. GAAP. We did not recognize any goodwill impairment in 2005 and 2006. As of December 31, 2006, goodwill under ROC GAAP and U.S. GAAP amounted to $20.6 million and $40.9 million, respectively. See “Item 5. Operating and Financial Review and Prospects – Operating Results and Trend Information – Critical Accounting Policies – Realizability of Long-Lived Assets,” “Item 5. Operating and Financial Review and Prospects – Operating Results and Trend Information – Critical Accounting Policies – Goodwill” and “Item 5. Operating and Financial Review and Prospects – Operating Results and Trend Information – Goodwill Amortization under ROC GAAP.”

We are unable to estimate the extent and timing of any impairment charges for long-lived assets or goodwill for future years under ROC GAAP or under a reconciliation with U.S. GAAP, and we cannot give any assurance that impairment charges will not be required in periods subsequent to December 31, 2006. Any impairment charge may have a material adverse effect on our net income. The determination of an impairment charge at any given time is based significantly on our expected results of operations over a number of years subsequent to that time. As a result, an impairment charge is more likely to occur during a period in which our operating results and outlook are otherwise already depressed.

Risks Relating to Countries in Which We Conduct Operations

Adverse economic conditions in Asia could negatively affect our business, financial condition and results of operations.

Our current testing and packaging facilities are located in Taiwan, Malaysia, the United States and Singapore. Our affiliated company, ASE Korea, has operations in South Korea. Furthermore, our customers are located in North America, Europe and Asia. As a result, our business is subject to various risks beyond our control, such as the instability of economies and governments, as well as changes in laws and policies affecting trade and investment, including foreign exchange controls.

In addition, the currencies of several countries in Asia, including Malaysia and Taiwan, where our principal operating facilities are located and where many of our customers have facilities, have in the past experienced, and may in the future experience, substantial depreciation and volatility. In response to these declines, some governments in the region have in the past taken, and may in the future take, drastic steps to stabilize their currencies, including raising official interest rates and other measures. Some governments in the region have in the past imposed, and may in the future impose, foreign currency exchange controls. In September 1998, the Malaysian government imposed strict foreign currency exchange controls. Although such foreign exchange controls imposed by Malaysia have since been liberalized and do not restrict the flow of funds arising from trade transactions and repatriation of profits to investors, we cannot assure you that Malaysia or other countries in Asia will not impose similar or other currency control measures in the future.

Furthermore, economies of the countries in Asia, including Malaysia and Taiwan, have in the past been adversely affected by prolonged inflation, drastic increases in interest rates, widespread failures of financial institutions, political instabilities and other factors in the region. If this were to occur in any future period, our liquidity, financial condition and results of operations could be materially and adversely affected. Adverse economic conditions in the region could result in reduced availability of credit and other financing sources and, as a result, ASE Test Malaysia, ASE Test Taiwan and our other subsidiaries would have to rely more heavily on us for funding. In addition, any adverse economic development in the region, if prolonged, could result in lower demand for, and exert further pressures on the prices of, the services and products provided by companies in the region, including us.

Strained relations between the ROC and the PRC could negatively affect our business and the market value of our shares.

Our principal executive offices and our principal testing facilities are located in Taiwan and approximately 61.4% of our net revenues in 2006 was derived from our operations in Taiwan. The ROC has a unique international political status. The government of the PRC asserts sovereignty over all of China, including Taiwan and does not recognize the legitimacy of the ROC government. Although significant economic and cultural relations have been established in recent years between the ROC and the PRC, relations have often been strained and the PRC government has indicated that it may use military force to gain control over Taiwan in some circumstances, such as the declaration of independence by the ROC. Political uncertainty could adversely affect the prices of our shares. Relations between the ROC and the PRC and other factors affecting the political or economic conditions in Taiwan could have a material adverse effect on our financial condition and results of operations, as well as the market price and the liquidity of our shares.

As a substantial portion of our business and operations is located in Taiwan, we are vulnerable to earthquakes, typhoons, drought and other natural disasters, as well as power outages and other industrial incidents, which could severely disrupt the normal operation of our business and adversely affect our results of operations.

Taiwan is susceptible to earthquakes and has experienced severe earthquakes which caused significant property damage and loss of life, particularly in the central and eastern parts of Taiwan. Earthquakes have damaged production facilities and adversely affected the operations of many companies involved in the semiconductor and other industries. We have never experienced structural damage to our facilities or damage to our machinery and equipment as a result of these earthquakes. In the past, however, we have experienced interruptions to our production schedule primarily as a result of power outages caused by earthquakes.

Taiwan is also susceptible to typhoons, which may cause damage and business interruptions to companies with facilities located in Taiwan. In 2001, Taiwan experienced severe damage from typhoons, including a typhoon on September 16 that caused over 100 deaths, severe flooding and extensive damage to property and businesses. In the third quarter of 2004, there was a typhoon that interrupted water supplies in Chung Li, Taiwan. We have not experienced any material damage or business interruption from typhoon activity in Taiwan.

In May 2002, Taiwan experienced a severe drought. Although our manufacturing process does not rely on an adequate supply of water, and we were not affected by the May 2002 drought directly, a drought may interrupt the manufacturing process of the foundries located in Taiwan, in turn disrupting some of our customers’ production, which could result in a decline in the demand for our services. In addition, the supply of electrical power in Taiwan, which is primarily provided by Taiwan Power Company, the state-owned electric utility, is susceptible to disruption that could be prolonged and frequent, caused by overload as a result of high demand or other reasons.

Our production facilities as well as many of our suppliers and customers and providers of complementary semiconductor manufacturing services, including foundries, are located in Taiwan. If our customers are affected by an earthquake, a typhoon, a drought or any other natural disasters, or power outage or other industrial incidents, it could result in a decline in the demand for our packaging and testing services. If our suppliers or providers of complementary semiconductor manufacturing services are affected, our production schedule could be interrupted or delayed. As a result, a major earthquake, typhoon, drought, or other natural disaster in Taiwan or a power outage or other industrial incident could severely disrupt the normal operation of our business and have a material adverse effect on our financial condition and results of operations.

Any outbreak of avian flu or recurrence of SARS or other contagious disease may have an adverse effect on the economies and financial markets of certain Asian countries and may adversely affect our results of operations.

The World Health Organization, or WHO, reported in January 2005 that “during 2004, large parts of Asia experienced unprecedented outbreaks of highly pathogenic avian influenza, caused by the H5N1 virus,” which moved the world closer than at any time since 1968 to an influenza pandemic “with high morbidity, excess mortality, and social and economic disruption.” There have continued to be cases of outbreaks of avian flu in certain regions of Asia, Europe and Africa with human casualties reported in countries such as Azerbaijan, Cambodia, Egypt, Indonesia, Iraq, the PRC, Thailand, Turkey and Vietnam. Additionally, in the first half of 2003, the PRC, Hong Kong, Taiwan, Singapore, Vietnam and certain other countries encountered an outbreak of severe acute respiratory syndrome, or SARS, which is a highly contagious form of atypical pneumonia. The SARS outbreak had an adverse effect on our results of operations for the first half of 2003, primarily due to the lower than expected demand for our packaging and testing services that resulted from the adverse effect of such SARS outbreak on the level of economic activity in the affected regions. There is no guarantee that an outbreak of avian flu, SARS or other contagious disease will not occur again in the future and that any future outbreak of avian flu, SARS or other contagious disease, or the measures taken by the governments of the ROC, Hong Kong, the PRC or other countries against such potential outbreaks, will not seriously interrupt our production operations or those of our suppliers and customers, which may have a material adverse effect on our results of operations. The perception that an outbreak of avian flu, SARS or other contagious disease may occur again may have an adverse effect on the economic conditions of certain countries in Asia.

Risks Relating to Our Holding Company Structure

Our ability to receive dividends and other payments from our subsidiaries may be restricted by commercial, statutory and legal restrictions.

We are a holding company, and our only significant assets are our ownership interests in ASE Test Taiwan, ASE Test Malaysia, ISE Labs and our 30.0% interest in ASE Korea. Dividends we receive from our subsidiaries, if any, may be subject to taxation. The ability of our subsidiaries to pay dividends, repay intercompany loans from us or make other distributions to us may be restricted by, among other things, the availability of funds, the terms of various credit arrangements entered into by such subsidiaries, as well as statutory and other legal restrictions. In addition, although there are currently no foreign exchange control regulations which restrict the ability of our subsidiaries to distribute dividends to us, we cannot assure you that the relevant regulations will not be changed and that the ability of our subsidiaries to distribute dividends to us will not be restricted in the future.

Our ability to make further investments in our subsidiaries may depend on regulatory approvals.

Our subsidiaries depend on us for future equity-related financings, and any capital contribution by us to our subsidiaries may require the approval of the relevant authorities in the jurisdiction in which the subsidiary is incorporated. For example, any capital contribution by us to ASE Test Taiwan requires the approval of the authorities of the Export Processing Zone Administration of the ROC Ministry of Economic Affairs. We may not be able to obtain any such approval in the future in a timely manner or at all.

Risks Relating to the Shares

Our shareholders may have difficulty protecting their shareholders rights.

Our corporate affairs are governed by our Memorandum of Association and Articles of Association and by the laws governing corporations incorporated in Singapore. The rights of our shareholders and the responsibilities of members of our board of directors under Singapore law may be different from those applicable to a corporation incorporated in the United States. Therefore, our shareholders may have more difficulty protecting their interests in connection with actions by our management, members of our board of directors or our controlling shareholders than they would as shareholders of a corporation incorporated in the United States.

Volatility in the markets for our shares may result in fluctuations in the market price of our shares.

The market price of our shares and Taiwan depositary shares, also known as TDSs, representing our shares have been, and may continue to be, highly volatile and subject to wide fluctuations in response to:

| · | quarterly variations in operating results; |

| · | changes in financial estimates by securities analysts; and |

| · | other events or factors. |

In addition, the Nasdaq Global Market, on which our shares trade, has experienced significant price and volume fluctuations that have particularly affected the market prices of equity securities of many technology companies. These fluctuations have often been unrelated to the operating performance of such companies. The resulting volatility in the markets for our securities may cause the market price of our shares to fluctuate widely. Our TDSs are traded on the Taiwan Stock Exchange, which has often experienced greater fluctuations than the Nasdaq Global Market or other national stock exchanges or quotation systems in the United States. As a result, our TDSs generally experience greater price volatility than our shares.

It may be difficult for you to enforce any judgment obtained in the United States against us or our affiliates.

Our company is incorporated under the laws of the Republic of Singapore. A substantial majority of our directors and executive officers reside outside the United States. In addition, a substantial majority of our assets and the assets of those persons are located outside the United States. As a result, it may be difficult for investors to enforce in the United States any judgment obtained in the United States against us or any of these persons, including judgments based upon the civil liability provisions of the United States securities laws. In addition, in original

actions brought in courts in jurisdictions located outside the United States, it may be difficult for investors to enforce in or out of the United States liabilities based upon United States securities laws. We have been advised by Allen & Gledhill, our Singapore legal counsel, that judgments of United States courts based on the civil liability provisions of the federal securities laws of the United States are not automatically enforceable in Singapore courts. Allen & Gledhill has also advised us that there is doubt as to whether Singapore courts will enter judgments in original actions brought in Singapore courts based solely upon the civil liability provisions of the federal securities laws of the United States.

Singapore law contains provisions that could discourage a takeover of our company.

The Singapore Code on Takeovers and Mergers, or the Code, contains provisions that may delay, deter or prevent a future takeover or change in control of our company. Anyone acquiring an interest, either on his or her own or together with parties acting in concert, in 30.0% or more of our voting shares may be required to extend a takeover offer for the remaining voting shares in accordance with the Code. A person holding between 30.0% and 50.0% (both inclusive) of our voting shares (either on his or her own or together with parties acting in concert) must also make a takeover offer if that person acquires more than 1.0% of our voting shares in any six-month period. In addition, the offeror must make an appropriate offer or proposal to holders of our securities which are convertible into non-voting shares and may also be required to make such offer to holders of securities of our subsidiaries, which are convertible into our shares. These provisions may discourage or prevent some types of transactions involving an actual or threatened change of control of our company. Our shareholders may therefore be disadvantaged because a transaction of that kind might otherwise provide an opportunity for our shareholders to sell shares at a price above the prevailing market price.

The Code provides that certain corporations, including but not limited to public companies incorporated in Singapore with a primary listing overseas, such as our company, may apply to the Securities Industry Council, or the SIC, in Singapore to waive the application of the Code to takeovers or changes in control of such corporations. In considering such waiver applications, the SIC will take into account, among other things, factors such as the number of shareholders of the relevant corporation in Singapore, the extent of trading in the shares of the relevant corporation in Singapore and the existence of protection available to shareholders of the relevant corporation in Singapore provided under any statute or code regulating take-overs and mergers outside Singapore. The grant of any waiver of the application of the Code is at the discretion of the SIC and no assurance can be given that an application made by our company to the SIC for a waiver of the application of the Code to takeovers or changes in control of our company will be successful. The grant of a waiver of the application of the Code may reduce the protection available to our shareholders in the event of a takeover or change of control of our company.

ASE Test Limited is a Singapore holding company incorporated on December 1, 1995 as Jarich Test Private Limited, which changed its name to ASE Test Private Limited on February 13, 1996 and to ASE Test Limited on April 23, 1996. We acquired, through an exchange of shares with our parent company, ASE Inc., and other individuals, substantially all of the shares of ASE Test, Inc. in May 1996. The exchange was accounted for as a reorganization of companies under common control.

Our registered offices are located at One Marina Boulevard #28-00, Singapore 018989, and the telephone number at the location is (65) 6890-7188. Our principal executive offices are located at 10 West Fifth Street, Nantze Export Processing Zone, Kaohsiung, Taiwan, Republic of China, and our telephone number at the location is (886-7) 363-6641.

ASE Test, Inc., whose predecessor was a subsidiary of ETC Flextronics, Inc., is located in Taiwan and is engaged in the testing of semiconductors. In 2003, ASE Test, Inc. dissolved its wholly-owned subsidiary in the United States, ASE Test (U.S.A.) Inc., which was incorporated in 1996 and was engaged in after-sales service to customers of ASE Test, Inc.

In June 1996, our shares were approved for quotation on the Nasdaq National Market in the United States, which was subsequently renamed as the Nasdaq Global Market in 2006.

On April 15, 1997, we issued 18,000,000 shares (after retroactive adjustments for two-for-one stock splits in 1998 and 1999) to ASE Holdings (Bermuda), Inc., a wholly-owned subsidiary of ASE Inc., in exchange for all of

the shares of ASE Holdings (Singapore) Pte. Ltd., which is a Singapore holding company that owns 100.0% of the shares of ASE Electronics (M) Sdn. Bhd., also known as ASE Test Malaysia. ASE Test Malaysia is engaged in the testing and packaging of semiconductors.

In December 1997 and January 1999, we obtained approval from the ROC Securities and Futures Commission (since renamed the ROC Securities and Futures Bureau) to issue TDSs, representing 6,000,000 and 5,000,000 shares (after retroactive adjustments for two-for-one stock splits in 1998 and 1999) offered by our shareholder, J&R Holding Limited. Our TDSs are listed on the Taiwan Stock Exchange and trade under the code 9101.

ISE Labs

In May 1999, we acquired 70.0% of the outstanding shares of ISE Labs, a semiconductor testing company with its principal facilities located in Fremont and Santa Clara, California. We subsequently increased our holding to 100.0% through purchases made in April, July and November 2000 and in January 2002.

ASE Chung Li and ASE Korea

In July 1999, we and our parent company, ASE Inc., jointly acquired Motorola’s semiconductor businesses in Chung Li, Taiwan and Paju, South Korea for the testing and packaging of semiconductors with principally communications, consumer and automotive applications. We and ASE Inc. together acquired substantially all of the assets of ASE Chung Li and 100.0% of the outstanding shares of ASE Korea. ASE Inc. acquired a 70.0% interest in each of the two businesses, and we acquired the remaining 30.0% interest. This division of the investment reflected in part our estimate of the relative testing and packaging values at the facilities. We and ASE Inc. hold our interests in ASE Korea through ASE Investment (Labuan).

ASE Chung Li and ASE Material’s Merger into ASE Inc.

On August 1, 2004, ASE Chung Li and ASE Material merged with and into ASE Inc. with ASE Inc. as the surviving corporation. As a result of the merger, all of the assets and liabilities of ASE Chung Li and ASE Material are owned and have been assumed by ASE Inc. and the operations of ASE Chung Li and ASE Material have been integrated with the operations of ASE Inc.

The merger was consummated by means of a share exchange pursuant to which we, along with other respective shareholders, other than ASE Inc., of ASE Chung Li and ASE Material, received common shares of ASE Inc. in exchange for the common shares of each of ASE Chung Li and ASE Material. ASE Inc. issued 282,315,437 common shares in connection with the merger, representing approximately 7.9% of its outstanding shares as of October 28, 2003 before giving effect to such issuance. Following the completion of this merger, our ownership interests in ASE Chung Li were reduced to zero. See “Item 7. Major Shareholders and Related Party Transactions—Related Party Transactions.”

Introduction

We believe that we are one of the world’s largest independent semiconductor testing companies, providing a complete range of testing services, including:

| · | front-end engineering testing at our facilities in Silicon Valley, California; Austin, Texas; and Taiwan; |

| · | final testing of complex, high-performance logic/mixed-signal semiconductors at our facilities in Taiwan, Malaysia, Singapore, Silicon Valley, California and Austin, Texas; and |

| · | turnkey services, which include drop shipment of tested and packaged semiconductors to end users designated by our customers. |

In addition, we also provide a broad range of leadframe and laminate-based semiconductor packaging services, including ball grid array and low ball grid array, also called BGA and LBGA, respectively, quad flat packages, thin quad flat packages and low-profile quad flat packages, also called QFP, TQFP and LQFP, respectively, at our facilities in Malaysia.

We have a close working relationship with ASE Inc., our parent company, and our facilities in Kaohsiung are located close to the facilities of ASE Inc., which enables us to provide value-added services to our customers. A substantial majority of our net revenues from testing services performed at our Kaohsiung facilities has historically been, and is expected to continue to be, derived from customers who are also customers of ASE Inc.