UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07685

Frontier Funds, Inc.

(Exact name of registrant as specified in charter)

400 Skokie Blvd.

Suite 500

Northbrook, IL 60062

(Address of principal executive offices) (Zip code)

William D. Forsyth III

400 Skokie Blvd., Suite 500

Northbrook, Illinois 60062

(Name and address of agent for service)

(847) 509-9860

Registrant's telephone number, including area code

Date of fiscal year end: June 30

Date of reporting period: June 30, 2020

Item 1. Reports to Stockholders.

ANNUAL REPORT

Frontier MFG Global Equity Fund

Frontier MFG Global Plus Fund

Frontier MFG Global Sustainable Fund

Frontier MFG Core Infrastructure Fund

Frontier MFG Select Infrastructure Fund

Frontier Caravan Emerging Markets Fund

Frontegra Asset Management, Inc.

June 30, 2020

Beginning in February 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds' shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you invest through a financial intermediary, you may elect to receive shareholder reports and other communications electronically from the Funds by contacting your financial intermediary (such as a broker-dealer or bank). If you invest directly with the Funds, you will receive shareholder reports electronically beginning in February 2021.

You may elect to receive all future shareholder reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with a Fund, calling 1-888-825-2100 to let the Fund know of your request. Your election to receive shareholder reports in paper will apply to all funds held with Frontier Funds, Inc.

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

Frontier MFG Global Equity Fund and Frontier MFG Global Plus Fund | |

Report from MFG Asset Management | | | 4 | | |

Investment Highlights | | | 6 | | |

Frontier MFG Global Sustainable Fund | |

Report from MFG Asset Management | | | 10 | | |

Investment Highlights | | | 12 | | |

Frontier MFG Core Infrastructure Fund and Frontier MFG Select Infrastructure Fund | |

Report from MFG Asset Management | | | 14 | | |

Investment Highlights | | | 16 | | |

Frontier Caravan Emerging Markets Fund | |

Report from Caravan Capital Management, LLC | | | 20 | | |

Investment Highlights | | | 22 | | |

Expense Example | | | 23 | | |

Schedules of Investments | |

Frontier MFG Global Equity Fund | | | 26 | | |

Frontier MFG Global Plus Fund | | | 28 | | |

Frontier MFG Global Sustainable Fund | | | 30 | | |

Frontier MFG Core Infrastructure Fund | | | 32 | | |

Frontier MFG Select Infrastructure Fund | | | 35 | | |

Frontier Caravan Emerging Markets Fund | | | 37 | | |

Statements of Assets and Liabilities | | | 44 | | |

Statements of Operations | | | 46 | | |

Statements of Changes in Net Assets | | | 48 | | |

Financial Highlights | | | 51 | | |

Notes to Financial Statements | | | 61 | | |

Report of Independent Registered Public Accounting Firm | | | 70 | | |

Additional Information | |

Directors and Officers | | | 71 | | |

Foreign Tax Credit | | | 74 | | |

Qualified Dividend Income/Dividends Received Deduction | | | 74 | | |

Board of Directors' Approval of Advisory and Subadvisory Agreements | | | 75 | | |

Statement Regarding Liquidity Risk Management Program | | | 79 | | |

This report is submitted for the general information of the shareholders of the above-listed Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by an effective Prospectus for the applicable Fund. The Prospectuses may be obtained by calling 1-888-825-2100. Each Prospectus includes more complete information about management fees and expenses, investment objectives, risks and operating policies of the applicable Fund. Please read the applicable Prospectus carefully.

Frontier Funds, Inc. are distributed by Frontegra Strategies, LLC, 400 Skokie Blvd., Suite 500, Northbrook, IL 60062. Frontegra Strategies, LLC, member of FINRA and SIPC, is an affiliate of Frontegra Asset Management, Inc., the Funds' investment adviser.

DEAR FELLOW SHAREHOLDERS:

We are pleased to report on the progress of the Frontier Funds over the past twelve months ending June 30, 2020. The S&P 500 Index was up 7.51%. International stocks, as measured by the MSCI EAFE Index, returned -5.13% over the twelve-month period.

Fund Results

The Frontier MFG Global Equity Fund, managed by MFG Asset Management ("MFG"), returned 7.58% (net) versus the MSCI World Index (Net) return of 2.84% for the twelve-month period ending June 30, 2020.

The Frontier MFG Global Plus Fund — Institutional Class, also managed by MFG, returned 7.65% (net) versus the MSCI World Index (Net) return of 2.84% for the twelve-month period ending June 30, 2020. The Service Class shares returned 7.50% (net) over the same time period.

For the period from October 9, 2019, (inception), through June 30, 2020, the Frontier MFG Global Sustainable Fund, also managed by MFG Asset Management, returned 4.36% (net) versus the MSCI World Index (Net) return of 4.29%.

For the twelve-month period ending June 30, 2020, the Frontier MFG Core Infrastructure Fund — Institutional Class, managed by MFG, returned -2.40% (net) versus the S&P Global Infrastructure Index return of -14.76%. The Service Class shares returned -2.49% (net) over the same time period.

The Frontier MFG Select Infrastructure Fund — Institutional Class, also managed by MFG, returned -8.26% (net) versus the S&P Global Infrastructure Index return of -14.76% for the twelve-month period ending June 30, 2020. The Service Class shares returned -8.32% (net) over the same time period.

For the period from December 4, 2019, (inception), through June 30, 2020, the Frontier Caravan Emerging Markets Fund, managed by Caravan Capital Management, returned -9.44% (net) versus the MSCI Emerging Markets Index (Net) return of -2.74%. The Service Class shares returned 15.01% (net) versus the 17.32% return of the Fund's benchmark for the period April 6, 2020, (inception of Service Class), through June 30, 2020.

Outlook

The past twelve months have been dominated by the COVID-19 pandemic, which took hold in the U.S. in early 2020. Markets suffered a sharp drop in Q1 but bounced back nicely in Q2. Like all investors, we are considering what the future holds and what that means from an economic, and therefore investment, perspective. The landscape may well worsen before it gets better. While coming into the crisis economic fundamentals were robust and the financial system was healthy, the pandemic has put an enormous strain on virtually every sector of the economy. The path forward is unclear, especially as it pertains to unemployment, manufacturing and the resumption of routine activities.

We will continue to oversee the investment management of the Frontier Funds with the skill and agility that have served our shareholders well in the past. As always, we appreciate your investment and continued confidence.

Best regards,

William D. Forsyth, CFA

President

Frontier Funds, Inc.

page 1

This page intentionally left blank.

FRONTIER

MFG GLOBAL EQUITY FUND

AND

FRONTIER

MFG GLOBAL PLUS FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Global Equity Fund and the Frontier MFG Global Plus Fund is capital appreciation. The objective is measured against the MSCI World Index (Net).

Performance Review

The Frontier MFG Global Equity Fund returned 7.58%, net of fees, for the year ended June 30, 2020, while the Frontier MFG Global Plus Fund (Institutional Class) returned 7.65%, net of fees, for the same period. Both Funds outperformed the 2.84% return of their benchmark, the MSCI World Index (Net).

Global stocks rose in the twelve months ended June 30, 2020, after huge fiscal and monetary stimulus offset the damage from the coronavirus to economic activity, company profits and investor confidence. In the June quarter, stocks recovered from post-virus lows after an ebbing in infection rates in developed countries allowed governments to ease restrictions on everyday life, even though the economic hit from the virus was so stark that the U.S. entered its first recession in nearly 11 years.

The stocks that performed best in local currency terms included the investments in Microsoft, Alphabet and Tencent Holdings. Microsoft surged to a record high over the period after its cloud business helped the software giant beat earnings and revenue forecasts and then held up relatively well when COVID-19 hit because it was judged a stock that would benefit from greater online activity. Alphabet, the owner of Google, gained as it reported higher earnings over the twelve months and as online advertising held up better than expected during the pandemic. Tencent rose on an improving earnings outlook and as the virus forced Chinese citizens to work from home and engage more with the company's suite of digital services.

The stocks that detracted from performance included the investments in Yum! Brands, Anheuser-Busch InBev and HCA Healthcare. Yum! Brands fell after posting downbeat earnings and after its KFC, Pizza Hut and Taco Bell outlets were closed when countries ordered lockdowns or restrictions on restaurants to stop the transmission of the virus. AB InBev fell after the world's biggest brewer said that a decline in beer sales in Brazil, China and the U.S. slowed profit growth and the company said it expects only "moderate" full-year earnings growth, down from "strong" before. HCA Healthcare dropped on disappointing earnings and after elective surgeries were deferred as hospitals built capacity to respond to the pandemic and investors weighed the impact of the unprecedented jump in U.S. unemployment on HCA's revenue.

Fund Outlook and Strategy

The outlooks for the economy and equity markets remain uncertain. Key will be the pace of economic reopening and policymaker responses. We continue to see four scenarios.

The best scenario is a V-shaped recovery; a fleeting recession. This would require a quick and successful reopening supported by policymakers, with most furloughed workers returning to their pre-pandemic hours. This scenario still appears relatively unlikely.

The worst scenario is a depression, where reopening is very slow and there is a policy error, hurting employment and output. This would be the worst outcome for markets but also appears relatively unlikely.

The two middle scenarios are a U-shaped recovery from a recession and a prolonged and deep recession. The downturn that occurred after the global financial recession lay between these two scenarios. It is still challenging to definitively predict if the current downturn will be more or less severe than the recession of 2008-2009.

page 4

Due to our cautious economic outlook and the risks confronting equities, we only reduced the cash position in the strategy over the June quarter from approximately 16% to approximately 15% for Global Equity and from approximately 17% to approximately 16% for Global Plus.

Even amid the uncertainty hovering over stock markets, we are confident about the long-term outlook for the investments selected for our portfolio and the portfolio's risk profile. Many of the stocks in the portfolio benefit from having a stronghold on the enterprise software market, being leading digital platforms, the shift to a cashless society, consumption growth in China, resilient demand given the essential nature of their services or the dynamics of ageing populations.

Yours sincerely,

Hamish Douglass

Portfolio Manager

MFG Asset Management

page 5

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 12/28/11 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS ENDED 6/30/20 | | FUND | | INDEX | |

SIX MONTHS | | | (1.10 | )% | | | (5.77 | )% | |

ONE YEAR | | | 7.58 | % | | | 2.84 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 10.56 | % | | | 6.90 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 12.84 | % | | | 9.91 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 0.88 | % | |

NET EXPENSE RATIO | | | 0.83 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 12/28/11 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2022, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

page 6

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 3/23/15 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS ENDED 6/30/20 | | FUND | | INDEX | |

SIX MONTHS | | | (0.94 | )% | | | (5.77 | )% | |

ONE YEAR | | | 7.65 | % | | | 2.84 | % | |

FIVE YEAR

AVERAGE ANNUAL | | | 10.37 | % | | | 6.90 | % | |

AVERAGE ANNUAL

SINCE INCEPTION | | | 9.62 | % | | | 6.19 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 0.92 | % | |

NET EXPENSE RATIO | | | 0.83 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 3/23/15 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2022, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 7

This page intentionally left blank.

FRONTIER

MFG GLOBAL SUSTAINABLE FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Global Sustainable Fund is to seek attractive risk-adjusted returns over the medium to long-term while reducing the risk of permanent capital loss.

The Fund invests, under normal market conditions, at least 80% of its net assets in shares of common stock of issuers listed on U.S. and international stock exchanges that meet our criteria for environmental, social and governance ("ESG") and low carbon investments. In selecting ESG investments, we review a broad spectrum of ESG issues for their materiality of impact on the future earnings and risks of companies. We consider amongst other things and where applicable: environmental issues, such as climate change and pollution; social issues, such as human rights and health and safety; and corporate governance issues, such as governance and compensation structures. The choice of ESG factors for any company will vary by industry and company. In addition, we incorporate a proprietary process that facilitates the identification of companies with materially lower carbon factor risk through the analysis of factors such as carbon emissions intensity and fossil fuel exposure.

The Fund invests in a non-diversified portfolio of high-quality companies, which are companies that we believe are market leaders in their industry, earn returns on capital above the cost of capital, and have long-term and sustainable competitive advantages. The Fund will normally hold a limited number (generally 20 to 50) of companies in its portfolio that meet these criteria. The Fund may invest in companies of any size, but generally invests in companies with a market capitalization of at least $5 billion.

Performance Review

The Frontier MFG Global Sustainable Fund returned 4.36%, net of fees, for the partial period from the inception date of the Fund on October 9, 2019, to June 30, 2020, versus the 4.29% return of the benchmark, the MSCI World Index (Net) over the same period.

Global stocks rose from the inception of the strategy in October to June 2020 after huge fiscal and monetary stimulus offset the damage from the coronavirus to economic activity, company profits and investor confidence. Over the June quarter, stocks recovered from post-virus lows after an ebbing in infection rates in developed countries allowed governments to ease restrictions on everyday life, even though the economic hit from the virus was so stark that the U.S. entered its first recession in nearly 11 years.

The stocks that contributed the most to performance in local currency terms included the investments in Microsoft, Chipotle Mexican Grill and Facebook. Microsoft surged to record highs after its cloud business helped the software giant beat earnings and revenue forecasts and held up relatively well during the pandemic lockdowns as it was judged a beneficiary from greater online activity. Chipotle rose strongly as management noted its digital strategy had performed strongly during the lockdown and mused it expected sales and margins to rise with further digital penetration and rollout of Chipotlanes, its drive-through concept. Facebook proved resilient as its financial results beat expectations, supported by increased consumer engagement during the lockdown and advertising revenues remaining robust, notwithstanding challenges faced by certain economic sectors such as travel and bricks-and-mortar retailers.

Stocks that detracted from performance included the investments in Yum! Brands, Anheuser-Busch InBev and Lowe's. Yum! Brands and AB InBev were hit by market concerns about their elevated levels of debt, as well as the closure of their restaurants (in the case of Yum! Brands) and decreased on-premises consumption as bars and locales were ordered shut. Lowe's fell as prospects of a U.S. recession dented stocks such as home-improvement companies that are tied to the state of the economy.

Fund Outlook and Strategy

The outlooks for the economy and equity markets remain uncertain. Key will be the pace of economic reopening, policymaker responses, scientific advances in dealing with the pandemic, and consumer and business behaviours. We continue to see four scenarios.

page 10

The best scenario is a V-shaped recovery; a deep, but fleeting, recession. This would require a quick and successful reopening supported by policymakers, with most furloughed workers returning to their pre-pandemic hours. This scenario still appears relatively unlikely.

The worst scenario is a depression, where reopening is very slow and there is a policy error, hurting employment and output. This would be the worst outcome for markets but also appears relatively unlikely.

The two middle scenarios are a U-shaped recovery from a recession or a prolonged and deep recession. The downturn that occurred after the global financial recession lay between these two scenarios. It is still too early to form strong conviction on whether or not the current downturn will be more or less severe than the recession of 2008-2009.

Due to our cautious economic outlook and the risks confronting equities, we held the cash position in the strategy at approximately 16% over the June quarter.

Even amid the uncertainty hovering over stock markets, we are confident about the long-term outlook for the investments selected for our portfolio and the portfolio's risk profile. Many of the stocks in the portfolio benefit from having a stronghold on the enterprise software market, being leading digital platforms, the shift to a cashless society, consumption growth in China, resilient demand given the essential nature of their services, or the dynamics of ageing populations.

Yours sincerely,

Domenico Giuliano

Portfolio Manager

MFG Asset Management

page 11

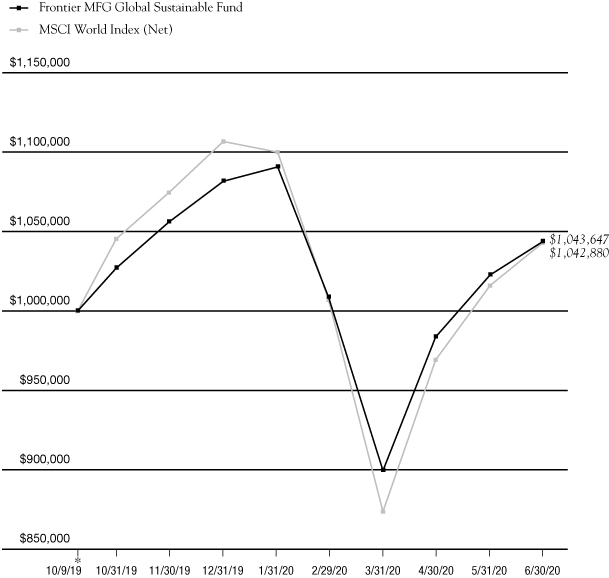

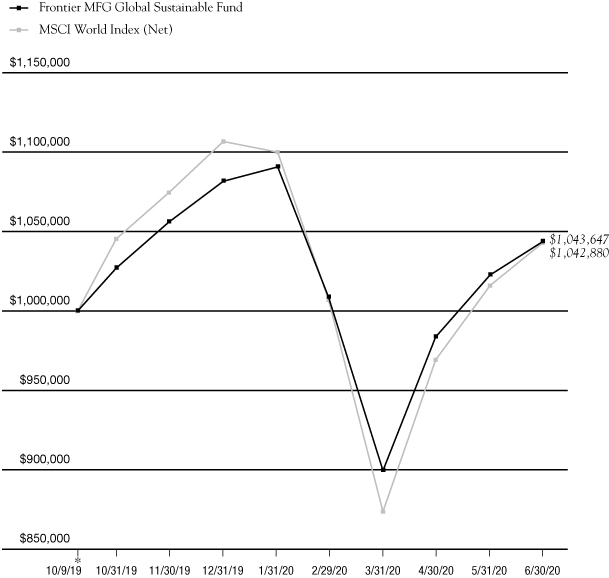

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 10/9/19 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS ENDED 6/30/20 | | FUND | | INDEX | |

SIX MONTHS | | | (3.52 | )% | | | (5.77 | )% | |

SINCE INCEPTION | | | 4.36 | % | | | 4.29 | % | |

Fund Expenses | |

GROSS EXPENSE RATIO | | | 1.45 | % | |

NET EXPENSE RATIO | | | 0.80 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 10/9/19 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions and other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2022, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

page 12

FRONTIER

MFG CORE INFRASTRUCTURE FUND

AND

FRONTIER

MFG SELECT INFRASTRUCTURE FUND

REPORT FROM MFG ASSET MANAGEMENT

Dear Fellow Shareholders:

The investment objective of the Frontier MFG Core Infrastructure Fund is long-term capital appreciation. The investment objective of the Frontier MFG Select Infrastructure Fund is to seek attractive risk-adjusted returns over the medium- to long-term, while reducing the risk of permanent capital loss. The objectives for both Funds are measured against the S&P Global Infrastructure Index.

Over time, the stable, reliable earnings of infrastructure assets are expected to lead to a combination of income and capital growth for investors. The types of companies purchased in the Funds are generally natural monopolies that provide essential services to the community. The universe of infrastructure assets held in both Funds is made up of two main sectors:

• Utilities: Utilities includes both regulated energy utilities and regulated water utilities. Utilities are typically subject to economic regulation. The terms of regulation typically require a utility to efficiently provide an essential service to the community and, in return, permit the utility to earn a fair rate of return on the capital it has invested in its operations. As a utility provides a basic necessity, such as energy or water, there is minimal fluctuation in demanded volumes in response to the economic cycle, while the price charged for the utility service can be adjusted with limited impact upon demanded volumes. As a result, the earnings of regulated utilities have been, and are expected to continue to be, stable irrespective of economic conditions.

• Infrastructure: This includes airports, ports, toll roads and broadcast communications infrastructure. Regulation of infrastructure companies is generally less intensive than regulation of utilities and this allows companies to accrue the benefits of volume growth (i.e. the returns of infrastructure companies are linked to growth in passengers, vehicles or containers). As economies develop, grow and become more inter-dependent, we expect the underlying level of aviation, shipping and vehicle traffic to increase. As a result, the revenues and earnings derived by infrastructure assets are expected to grow.

If a company isn't either a regulated utility or an infrastructure asset per se, we require at least 75% of its earnings to be consistently derived from either regulated assets or infrastructure assets before it can be included in the Funds.

Performance Review

Global stocks rose in the twelve months ended June 30, 2020, after huge fiscal and monetary stimulus offset the damage from the coronavirus to economic activity, company profits and investor confidence. But infrastructure stocks fell over the twelve months as the restrictions on everyday activity, including air and road travel, hit these stocks to a greater degree.

The Frontier MFG Core Infrastructure Fund, Institutional Class, returned -2.40%, net of fees, for the year ended June 30, 2020. The Fund's return outperformed the -14.76% return of its benchmark, the S&P Global Infrastructure Index.

Stocks that detracted the most in local currency terms included the investments in the airport operators Aeroports De Paris of France, Aena of Spain and Power Assets Holdings of Hong Kong. Aeroports De Paris, which runs the airports of Paris, and Aena, the world's largest airport operator, dived after the outbreak of the virus that causes the illness called COVID-19 prompted governments to close borders and order their populations not to travel to control the pandemic. Power Assets fell after China moved to implement new security laws that were widely viewed to reduce the region's political independence.

Stocks that contributed the most included the investments in Cellnex Telecom of Spain, and American Tower and SBA Communications of the U.S. The trio of companies that own communications towers that provide co-location space to wireless carriers rose as investors judged they would benefit from higher demand for data across mobile telephony and the internet as a locked-down world went online.

The Frontier MFG Select Infrastructure Fund, Institutional Class, returned -8.26%, net of fees, for the year ended June 30, 2020. The Fund's return outperformed the -14.76% return of its benchmark, the S&P Global Infrastructure Index, for the same time period.

page 14

Stocks that detracted the most in local currency terms included the investments in the airport operators Aeroports De Paris of France, Sydney Airport and Aena of Spain. Aeroports De Paris, which runs the airports of Paris, Sydney Airport and Aena, the world's largest airport operator, dived after the outbreak of the virus that causes the illness called COVID-19 prompted governments to close borders and order their populations not to travel to control the pandemic.

Stocks that contributed the most included the investments in Crown Castle International of the U.S., Koninklijke Vopak of the Netherlands and Snam of Italy. Crown Castle rose as investors judged that the company that owns more than 40,000 communications towers in the U.S. that provide co-location space to wireless carriers would benefit from higher demand for data across mobile telephony and the internet as a locked-down world went online. Vopak gained as demand for oil storage surged as the oil price fell. Snam, a gas transmission utility, rose as investors sought highly defensive stocks.

Portfolio Outlook and Strategy

Notwithstanding our expectations for greater volatility in the short to medium term driven by the COVID-19 crisis, we are confident that the underlying businesses that we have included in our defined universe and in our investment strategy will prove resilient over the longer term. We regard the businesses that we invest in to be of high quality and, while short-term movements in share prices reflect issues of the day, we expect that share prices over the longer term will reflect the underlying cash flows leading to investment returns consistent with our expectations.

The strategy seeks to provide investors with attractive risk-adjusted returns from infrastructure securities. It does this by investing in a portfolio of listed infrastructure companies that meet our strict definition of infrastructure. We believe that infrastructure assets, with requisite earnings reliability and a linkage of earnings to inflation, offer attractive, long-term investment propositions. Furthermore, given the resilient nature of earnings and the structural linkage of those earnings to inflation, investment returns generated by infrastructure stocks are different from standard asset classes and offer investors diversification when included in an investment portfolio. In the current uncertain economic and investment climate, the reliable financial performance of infrastructure investments makes them attractive and an investment in listed infrastructure can be expected to reward patient investors with a long-term time frame.

Yours sincerely,

Gerald Stack

Portfolio Manager

MFG Asset Management

page 15

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 1/18/12 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS

ENDED

6/30/20 | | FUND | | MSCI

INDEX | | S&P

GLOBAL

INDEX | |

SIX MONTHS | | | (9.77 | )% | | | (5.77 | )% | | | (19.35 | )% | |

ONE YEAR | | | (2.40 | )% | | | 2.84 | % | | | (14.76 | )% | |

FIVE YEAR

AVERAGE | | | 7.61 | % | | | 6.90 | % | | | 2.62 | % | |

AVERAGE

ANNUAL

SINCE

INCEPTION | | | 8.96 | % | | | 9.38 | % | | | 5.72 | % | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 0.61 | % | |

NET EXPENSE RATIO | | | 0.52 | % | |

This chart assumes an initial gross investment of $100,000 made on 1/18/12 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The S&P Global Infrastructure Index is a global developed markets infrastructure and utilities benchmark. Neither index reflects investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in an index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2022, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.50% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 16

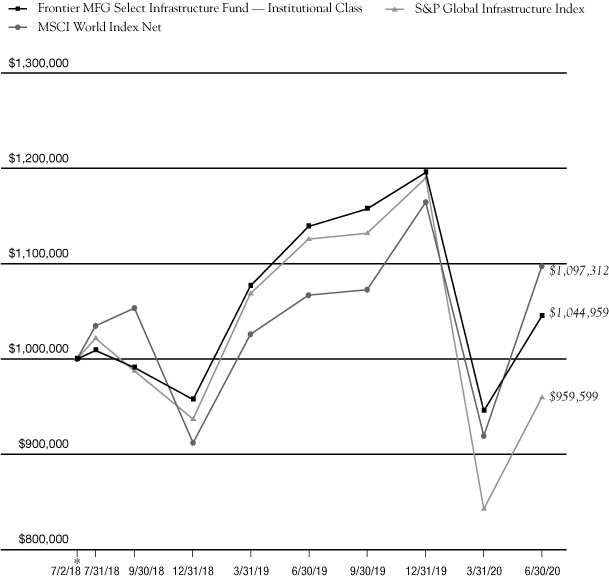

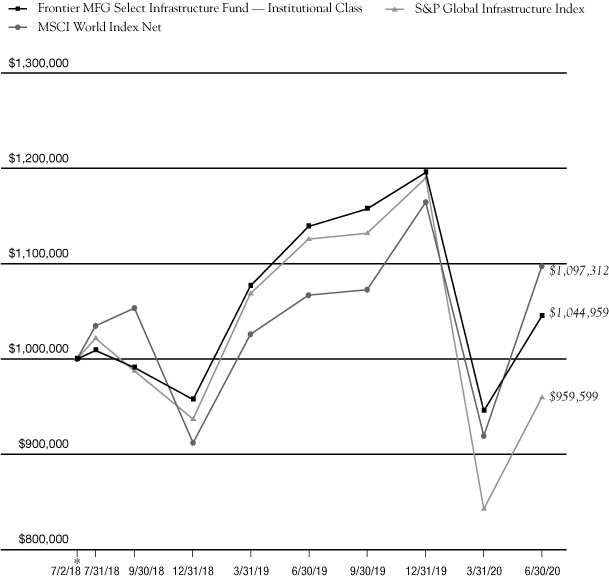

INVESTMENT HIGHLIGHTS

Growth of a $1,000,000 Investment (Unaudited)

* 7/2/18 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS

ENDED

6/30/20 | | FUND | | MSCI

INDEX | | S&P

GLOBAL

INDEX | |

SIX MONTHS | | | (12.60 | )% | | | (5.77 | )% | | | (19.35 | )% | |

ONE YEAR | | | (8.26 | )% | | | 2.84 | % | | | (14.76 | )% | |

AVERAGE

ANNUAL

SINCE

INCEPTION | | | 2.23 | % | | | 4.77 | % | | | (2.05 | )% | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 1.25 | % | |

NET EXPENSE RATIO | | | 0.81 | % | |

This chart assumes an initial gross investment of $1,000,000 made on 7/2/18 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI World Index (Net) represents large and mid cap equities across 23 Developed Markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The S&P Global Infrastructure Index is a global developed markets infrastructure and utilities benchmark. Neither index reflects investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in an index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2022, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 17

This page intentionally left blank.

FRONTIER

CARAVAN EMERGING MARKETS FUND

REPORT FROM CARAVAN CAPITAL MANAGEMENT, LLC

Dear Shareholders:

The investment objective of the Frontier Caravan Emerging Markets Fund is long-term capital appreciation.

Performance Review

The Frontier Caravan Emerging Markets Fund returned -9.44%, net of fees, for the partial period from the inception date of the Fund on December 4, 2019, to June 30, 2020, versus the -2.74% return of the benchmark, the MSCI Emerging Markets (Net), over the same period.

A significant source of the underperformance was the Fund's lower relative country allocations to the index heavyweight countries of China, Taiwan, and Korea — all of which were strong outperformers. The lower weights to these large market cap countries resulted from the Fund's more balanced investment approach to portfolio construction that caps any single country exposure and reduces concentration risks. China, Taiwan, and Korea comprised an average weight in the index over this period of 61% while they only accounted for 30% of the Fund. As a group, during this period these three countries returned +8.9%, far ahead of the -18.7% aggregate return of the remaining countries in the index. In addition, timing and cost impacts of investing the initial contribution at start-up of the Fund in its first month of operation also contributed to the relative underperformance.

This period stands out as unique, because almost all countries in the world were confronted with the same, unexpected massive risk — the health and economic fallout from the pandemic. We believe how each country effectively worked to contain the pandemic and "re-open" its economy was an important driver of market performance during this period. Based on these criteria, the three heavyweight countries of northeast Asia did particularly well relative to not just the other emerging market countries, but also most of the developed market countries. In terms of equity market performance, China, Taiwan, and Korea delivered positive returns that clearly separated them from the rest of the emerging markets pack. The Fund was not as well positioned as the market cap weighted index for the unexpected shocks that came with COVID-19.

Most other emerging markets (with notable exceptions such as Vietnam) were weighed down by concerns about the lack of healthcare infrastructure to absorb the surge in infections and limited financial resources to offset the sharp fall in economic activity with large-enough stimulus measures. COVID-19 also amplified pre-existing country-specific risks. For instance, the ongoing credit crunch in India and political instability in Brazil became even more onerous as downside risk factors. We note the Fund's lower relative weights to India and Brazil were top positive contributors to the portfolio's return as these large market cap countries returns were sharply below the index return.

Relative value, correlation and recent volatility are factors that drive country allocation in our investment process. As a result, the Fund tended to allocate larger relative weights to countries that are on paths to recovery following economic crises such as Egypt, Pakistan, and Turkey. These positions became significant drags to relative performance, as COVID-19 effectively derailed these countries' comeback stories in the near-term. These markets sold off sharply on concerns that the hard-won improvements in their external balances may reverse on increased fiscal spending to staunch the effects of the healthcare/economic fallout. They were also at risk of facing deep cuts to their hard-currency earnings streams. Egypt and Turkey depend heavily on tourism which grounded to a standstill, while Egypt and Pakistan rely on remittances, a large percentage of which come from oil-dependent Gulf countries whose economies were reeling from a collapse in oil prices.

Within each country, the Fund tilts its holdings heavily towards secular growth sectors such as technology and consumer-facing sectors with a particular focus on digital e-commerce plays. This sector strategy was positive for the Fund's relative performance over the period. While the lower relative weights to northeast Asia hurt the Fund's relative return, the Fund actually posted higher country returns in China, Taiwan, and Korea compared to their respective country benchmarks. Megacap e-commerce and tech names benefited from the

page 20

sudden and sizeable shifts in consumer behavior brought about by the pandemic. Lockdowns accelerated the adoption and usage intensity of internet consumer services from Alibaba and Tencent. The jump in e-commerce and the broader virtual economy worldwide, in turn, increased demand from data centers (the cloud) for chips supplied by TSMC and Samsung Electronics.

Sector-wise, the Fund's higher weight to the banking sector was the largest detractor to relative performance. While COVID-19 gave digital economy stocks an unexpected boost, it had the opposite effect on banks. The unprecedented level of monetary loosening via rate cuts and quantitative easing lifted investor sentiment particularly for tech stocks but were detrimental to banks' fundamentals. The Fund's position in the sector is not entirely a reflection of our bullish view on the banking sector per se, but an outcome of our bullish country views. Banking is an under-penetrated sector that provides a broad, leveraged exposure to these countries' reform-driven, idiosyncratic macro growth stories. Amid an environment of ultra-low interest rates and steep economic contractions, we acknowledge that banks worldwide are faced with the same predicament of contracting net investment margins and surging credit costs, while differentiated long-term growth outlooks for emerging market banks may be overlooked in the near-term.

Fund Outlook and Strategy

For most of this year, markets have mostly shrugged off the rising and broadening US-China tensions across multiple fronts (in trade, technology, geopolitics, human rights, and COVID-19). We believe the markets may be underestimating this risk. An anti-China stance is one of the few issues that appears to unite the two U.S. political parties. Ahead of the November U.S. Presidential election, we expect the two candidates to compete on who is tougher on China. This raises the possibility of President Trump placing additional economic sanctions to prove his toughness and deflect criticism about his own handling of the virus.

During 2018 and 2019, when the U.S. and China were engaged in an escalation of tit-for-tat trade tariffs, China mostly underperformed against the MSCI Emerging Markets Index. We expect similar market dynamics to play out in the second half of 2020 given the escalating geo-political tensions. In June, we realized some profits in China and lowered our country target relative to the index.

There has been a significant divergence in returns and valuations between stocks in tech and the traditional cyclical/financial sectors. We believe tech stocks have run up too much relative to fundamentals (even after accounting for ultra-low interest rates) and expect laggards such as banks to catch up. The extent of this catch-up, however, may hinge on a factor that has little visibility — scientific progress in the development of an effective healthcare solution to the virus that in turn, will shape expectations on how quickly economies can return to a semblance of normality. We take comfort in the fact that all earlier pandemics in history came to an end. In addition, while the pandemic continues, we believe many of the emerging market countries we have positioned at weights higher than the benchmark have younger populations which should weather the pandemic better than countries with older demographics.

Yours sincerely,

Cliff Quisenberry

Portfolio Manager

Caravan Capital Management, LLC

page 21

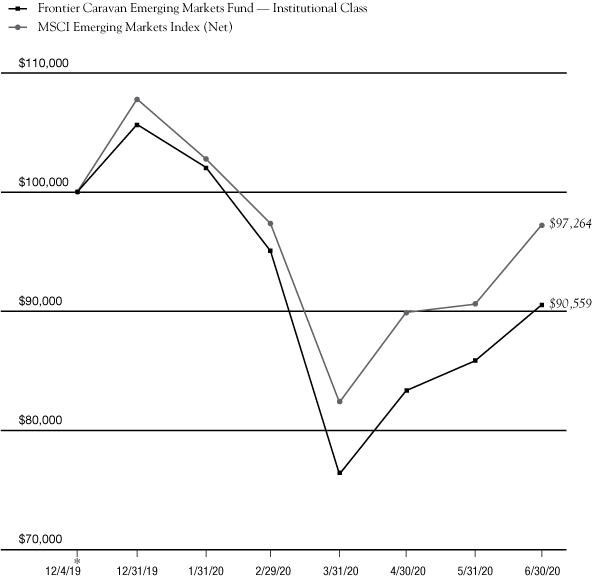

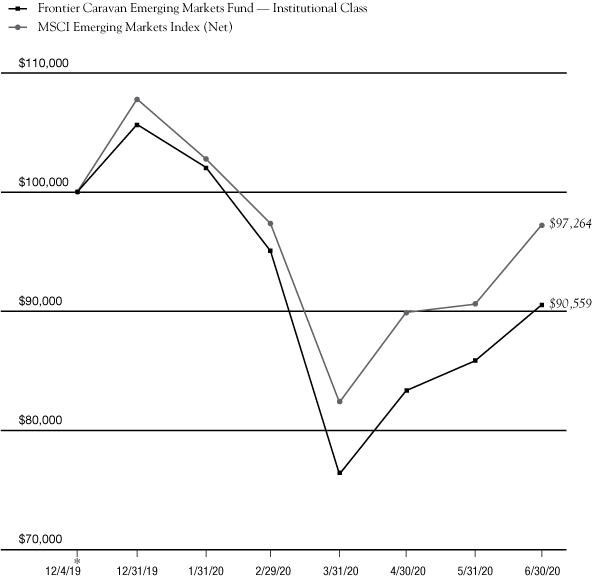

INVESTMENT HIGHLIGHTS

Growth of a $100,000 Investment (Unaudited)

* 12/4/19 commencement of operations.

Portfolio Total Return** | |

FOR PERIODS

ENDED 6/30/20 | | FUND | | INDEX | |

SIX MONTHS | | | (14.31 | )% | | | (9.78 | )% | |

SINCE INCEPTION | | | (9.44 | )% | | | (2.74 | )% | |

Institutional Class Expenses | |

GROSS EXPENSE RATIO | | | 2.00 | % | |

NET EXPENSE RATIO | | | 0.80 | % | |

This chart assumes an initial gross investment of $100,000 made on 12/4/19 (commencement of operations). Returns shown include the reinvestment of all distributions. Past performance is not predictive of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than the original cost. In the absence of existing fee waivers, total return would be reduced. To receive current to the most recent month-end performance, please call 1-888-825-2100.

The MSCI Emerging Markets Index (Net) represents large and mid cap equities across 26 Emerging Markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The index does not reflect investment management fees, brokerage commissions or other expenses associated with investing in equity securities. A direct investment in the index is not possible.

Frontegra Asset Management, Inc. has contractually agreed through October 31, 2021, to waive its management fee and/or reimburse the Fund's operating expenses to the extent necessary to ensure that the Fund's total operating expenses (excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) do not exceed 0.80% of the Fund's average daily net assets for the Institutional Class. The expense ratios presented are based on the annualized expense ratios as reported in the Fund's current prospectus, which may differ from the expense ratios presented in the Fund's financial highlights.

** The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The above graph relates to Institutional Class shares of the Fund. Performance for Service Class shares will vary from the performance of the Institutional Class shares shown above due to differences in expenses.

page 22

Frontier Funds

EXPENSE EXAMPLE

June 30, 2020 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees and other fund expenses. Although the Funds charge no sales loads, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently the Funds' transfer agent charges a $15.00 fee. A redemption fee of 2.00% of the then current value of the shares redeemed may be imposed on certain redemptions of shares made within 30 days of purchase for the Frontier MFG Global Equity, Frontier MFG Global Plus, Frontier MFG Global Sustainable, Frontier MFG Core Infrastructure and Frontier MFG Select Infrastructure Funds and within 90 days of purchase for the Frontier Caravan Emerging Markets Fund.

This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (1/1/20 – 6/30/20).

Actual Expenses

The first line of the table on the following page for each Fund provides information about actual account values and actual expenses. The Example includes management fees, registration fees, fee waivers/reimbursements and other expenses. However, the Example does not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under generally accepted accounting principles. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table for each Fund provides information about hypothetical account values and hypothetical expenses based on each of the Fund's actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each of the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

page 23

Frontier Funds

EXPENSE EXAMPLE (continued)

June 30, 2020 (Unaudited)

| | | Beginning Account

Value 1/1/2020 | | Ending Account

Value 6/30/2020 | | Annualized

Expense Ratio* | | Expenses Paid

During the Period* | |

MFG Global Equity Fund | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 989.00 | | | | 0.80 | % | | $ | 3.96 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.89 | | | | 0.80 | % | | $ | 4.02 | | |

MFG Global Plus Fund –

Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 990.60 | | | | 0.80 | % | | $ | 3.96 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.89 | | | | 0.80 | % | | $ | 4.02 | | |

MFG Global Plus Fund –

Service Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 989.10 | | | | 0.90 | % | | $ | 4.45 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.39 | | | | 0.90 | % | | $ | 4.52 | | |

MFG Global Sustainable

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 964.80 | | | | 0.80 | % | | $ | 3.91 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.89 | | | | 0.80 | % | | $ | 4.02 | | |

MFG Core Infrastructure

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 902.30 | | | | 0.50 | % | | $ | 2.36 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,022.38 | | | | 0.50 | % | | $ | 2.51 | | |

MFG Core Infrastructure

Fund – Service Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 902.50 | | | | 0.60 | % | | $ | 2.84 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,021.88 | | | | 0.60 | % | | $ | 3.02 | | |

MFG Select Infrastructure

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 874.00 | | | | 0.80 | % | | $ | 3.73 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.89 | | | | 0.80 | % | | $ | 4.02 | | |

MFG Select Infrastructure

Fund – Service Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 873.00 | | | | 0.90 | % | | $ | 4.19 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.39 | | | | 0.90 | % | | $ | 4.52 | | |

Caravan Emerging Markets

Fund – Institutional Class | |

Actual Fund Return | | $ | 1,000.00 | | | $ | 856.90 | | | | 0.80 | % | | $ | 3.69 | | |

Hypothetical 5% Return | | $ | 1,000.00 | | | $ | 1,020.89 | | | | 0.80 | % | | $ | 4.02 | | |

* Expenses are equal to each Fund's annualized expense ratio indicated above, multiplied by the average account value over the period, multiplied by 182/366 to reflect the one-half year period.

page 24

Frontier Funds

EXPENSE EXAMPLE (continued)

June 30, 2020 (Unaudited)

| | | Beginning

Account Value | | Ending Account

Value 6/30/2020 | | Annualized

Expense Ratio | | Expenses Paid

During the Period | |

Caravan Emerging Markets

Fund – Service Class | |

Actual Fund Return** | | $ | 1,000.00 | | | $ | 1,150.10 | | | | 0.90 | % | | $ | 2.27 | | |

Hypothetical 5% Return*** | | $ | 1,000.00 | | | $ | 1,020.39 | | | | 0.90 | % | | $ | 4.52 | | |

** Actual expenses are equal to the Fund's annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 86/366 to reflect the most recent fiscal period end since the Caravan Emerging Markets Fund — Service Class commenced operations on April 6, 2020.

*** Hypothetical expenses are equal to the Funds' annualized expense ratio of 0.90% multiplied by the average account value over the period commencing January 1, 2020, multiplied by 182/366 to reflect information had the Caravan Emerging Markets Fund — Service Class been in operation for the entire fiscal half year.

page 25

Frontier MFG Global Equity Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

Number of Shares | | | | Value | |

COMMON STOCKS 84.6% | | | |

| | | China 13.3% | |

| | 357,775 | | | Alibaba Group

Holding Ltd. - ADR (a) | | $ | 77,172,067 | | |

| | 1,208,720 | | | Tencent Holdings Ltd. | | | 77,452,255 | | |

| | | | 154,624,322 | | |

| | | France 1.1% | |

| | 29,478 | | | LVMH Moet Hennessy

Louis Vuitton SE | | | 13,014,335 | | |

| | | Germany 3.9% | |

| | 322,866 | | | SAP SE | | | 45,133,063 | | |

| | | Switzerland 7.7% | |

| | 366,744 | | | Nestle SA | | | 40,661,137 | | |

| | 556,297 | | | Novartis AG | | | 48,465,188 | | |

| | | | 89,126,325 | | |

| | | United Kingdom 4.6% | |

| | 589,096 | | | Reckitt Benckiser Group PLC | | | 54,195,730 | | |

| | | United States 54.0% | |

| | 5,871 | | | Alphabet, Inc. - Class A (a) | | | 8,325,372 | | |

| | 43,471 | | | Alphabet, Inc. - Class C (a) | | | 61,451,040 | | |

| | 275,755 | | | Crown Castle International

Corp. | | | 46,147,599 | | |

| | 483,176 | | | Eversource Energy | | | 40,234,066 | | |

| | 294,035 | | | Facebook, Inc. - Class A (a) | | | 66,766,527 | | |

| | 101,948 | | | Mastercard, Inc. - Class A | | | 30,146,024 | | |

| | 133,361 | | | McDonald's Corp. | | | 24,601,104 | | |

| | 463,255 | | | Microsoft Corp. | | | 94,277,025 | | |

| | 252,171 | | | PepsiCo, Inc. | | | 33,352,136 | | |

| | 672,465 | | | Starbucks Corp. | | | 49,486,699 | | |

| | 111,642 | | | The Estee Lauder

Companies, Inc. - Class A | | | 21,064,613 | | |

| | 228,213 | | | Visa, Inc. - Class A | | | 44,083,905 | | |

| | 388,089 | | | WEC Energy Group, Inc. | | | 34,016,001 | | |

Number of Shares | | | | Value | |

| | | United States 54.0% (continued) | |

| | 668,245 | | | Xcel Energy, Inc. | | $ | 41,765,312 | | |

| | 374,803 | | | Yum! Brands, Inc. | | | 32,574,129 | | |

| | | | 628,291,552 | | |

| | | Total Common Stocks | |

| | | | | (Cost $640,986,004) | | | 984,385,327 | | |

SHORT-TERM INVESTMENTS 15.1% | | | |

| | | Money Market Deposit Account 15.1% | |

| | 175,108,478 | | | U.S. Bank N.A., 0.07% (b) | | | 175,108,478 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $175,108,478) | | | 175,108,478 | | |

| | | Total Investments 99.7% | |

| | | | | (Cost $816,094,482) | | | 1,159,493,805 | | |

| | | | | Other Assets in Excess of

Liabilities 0.3% | | | 2,954,578 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 1,162,448,383 | | |

(a) Non-Income Producing.

(b) The Money Market Deposit Account ("MMDA") is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and may change daily and by any amount. The rate shown is as of June 30, 2020.

ADR - American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

page 26

Frontier MFG Global Equity Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Consumer Discretionary | | | 18.4 | % | |

Information Technology | | | 18.4 | | |

Communication Services | | | 16.9 | | |

Consumer Staples | | | 12.8 | | |

Utilities | | | 10.0 | | |

Health Care | | | 4.1 | | |

Real Estate | | | 4.0 | | |

Total Common Stocks | | | 84.6 | | |

Total Short-Term Investments | | | 15.1 | | |

Total Investments | | | 99.7 | | |

Other Assets in Excess of Liabilities | | | 0.3 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 27

Frontier MFG Global Plus Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

Number of Shares | | | | Value | |

COMMON STOCKS 84.1% | | | |

| | | China 13.2% | |

| | 163,924 | | | Alibaba Group

Holding Ltd. - ADR (a) | | $ | 35,358,407 | | |

| | 554,369 | | | Tencent Holdings Ltd. | | | 35,522,809 | | |

| | | | 70,881,216 | | |

| | | France 1.1% | |

| | 13,550 | | | LVMH Moet Hennessy

Louis Vuitton SE | | | 5,982,232 | | |

| | | Germany 3.9% | |

| | 148,409 | | | SAP SE | | | 20,745,921 | | |

| | | Switzerland 7.6% | |

| | 168,534 | | | Nestle SA | | | 18,685,470 | | |

| | 255,374 | | | Novartis AG | | | 22,248,455 | | |

| | | | 40,933,925 | | |

| | | United Kingdom 4.6% | |

| | 269,941 | | | Reckitt Benckiser Group PLC | | | 24,834,067 | | |

| | | United States 53.7% | |

| | 2,704 | | | Alphabet, Inc. - Class A (a) | | | 3,834,407 | | |

| | 19,942 | | | Alphabet, Inc. - Class C (a) | | | 28,190,211 | | |

| | 126,702 | | | Crown Castle International Corp. | | | 21,203,580 | | |

| | 221,047 | | | Eversource Energy | | | 18,406,584 | | |

| | 134,744 | | | Facebook, Inc. - Class A (a) | | | 30,596,320 | | |

| | 46,831 | | | Mastercard, Inc. - Class A | | | 13,847,927 | | |

| | 61,289 | | | McDonald's Corp. | | | 11,305,982 | | |

| | 212,388 | | | Microsoft Corp. | | | 43,223,082 | | |

| | 115,373 | | | PepsiCo, Inc. | | | 15,259,233 | | |

| | 308,290 | | | Starbucks Corp. | | | 22,687,061 | | |

| | 51,197 | | | The Estee Lauder

Companies, Inc. - Class A | | | 9,659,850 | | |

| | 104,636 | | | Visa, Inc. - Class A | | | 20,212,536 | | |

Number of Shares | | | | Value | |

| | | United States 53.7% (continued) | |

| | 177,597 | | | WEC Energy Group, Inc. | | $ | 15,566,377 | | |

| | 306,095 | | | Xcel Energy, Inc. | | | 19,130,937 | | |

| | 171,631 | | | Yum! Brands, Inc. | | | 14,916,450 | | |

| | | | 288,040,537 | | |

| | | Total Common Stocks | |

| | | | | (Cost $345,411,895) | | | 451,417,898 | | |

SHORT-TERM INVESTMENTS 15.5% | | | |

| | | Money Market Deposit Account 15.5% | |

| | 83,035,429 | | | U.S. Bank N.A., 0.07% (b) | | | 83,035,429 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $83,035,429) | | | 83,035,429 | | |

| | | Total Investments 99.6% | |

| | | | | (Cost $428,447,324) | | | 534,453,327 | | |

| | | | | Other Assets in Excess of

Liabilities 0.4% | | | 2,028,669 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 536,481,996 | | |

(a) Non-Income Producing.

(b) The Money Market Deposit Account ("MMDA") is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and may change daily and by any amount. The rate shown is as of June 30, 2020.

ADR - American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

page 28

Frontier MFG Global Plus Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Communication Services | | | 18.3 | % | |

Information Technology | | | 18.3 | | |

Consumer Discretionary | | | 16.8 | | |

Consumer Staples | | | 12.7 | | |

Utilities | | | 9.9 | | |

Health Care | | | 4.2 | | |

Real Estate | | | 3.9 | | |

Total Common Stocks | | | 84.1 | | |

Total Short-Term Investments | | | 15.5 | | |

Total Investments | | | 99.6 | | |

Other Assets in Excess of Liabilities | | | 0.4 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 29

Frontier MFG Global Sustainable Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

Number of Shares | | | | Value | |

COMMON STOCKS 83.5% | | | |

| | | China 11.5% | |

| | 3,089 | | | Alibaba Group

Holding Ltd. - ADR (a) | | $ | 666,297 | | |

| | 8,414 | | | Tencent Holdings Ltd. | | | 539,152 | | |

| | | | 1,205,449 | | |

| | | France 2.3% | |

| | 3,521 | | | Danone SA | | | 244,402 | | |

| | | Germany 3.9% | |

| | 2,963 | | | SAP SE | | | 414,195 | | |

| | | Italy 2.2% | |

| | 34,101 | | | Terna Rete Elettrica

Nazionale SpA | | | 235,212 | | |

| | | Netherlands 3.8% | |

| | 7,530 | | | Unilever NV | | | 401,481 | | |

| | | Spain 2.9% | |

| | 16,396 | | | Red Electrica Corp SA | | | 306,760 | | |

| | | Switzerland 7.8% | |

| | 3,404 | | | Nestle SA | | | 377,403 | | |

| | 5,103 | | | Novartis AG | | | 444,579 | | |

| | | | 821,982 | | |

| | | United Kingdom 4.7% | |

| | 5,375 | | | Reckitt Benckiser Group PLC | | | 494,490 | | |

| | | United States 44.4% | |

| | 542 | | | Alphabet, Inc. - Class C (a) | | | 766,177 | | |

| | 290 | | | Chipotle Mexican Grill, Inc. (a) | | | 305,184 | | |

| | 818 | | | CME Group, Inc. | | | 132,958 | | |

| | 1,269 | | | Eversource Energy | | | 105,670 | | |

| | 2,502 | | | Facebook, Inc. - Class A (a) | | | 568,129 | | |

| | 2,742 | | | Intercontinental Exchange, Inc. | | | 251,167 | | |

| | 876 | | | Mastercard, Inc. - Class A | | | 259,033 | | |

| | 3,665 | | | Microsoft Corp. | | | 745,864 | | |

Number of Shares | | | | Value | |

| | | United States 44.4% (continued) | |

| | 3,636 | | | Mondelez International, Inc. -

Class A | | $ | 185,909 | | |

| | 2,447 | | | PepsiCo, Inc. | | | 323,640 | | |

| | 3,969 | | | Starbucks Corp. | | | 292,079 | | |

| | 1,645 | | | Visa, Inc. - Class A | | | 317,765 | | |

| | 1,621 | | | Walmart, Inc. | | | 194,163 | | |

| | 2,647 | | | Yum! Brands, Inc. | | | 230,051 | | |

| | | | 4,677,789 | | |

| | | Total Common Stocks | |

| | | | | (Cost $7,840,303) | | | 8,801,760 | | |

SHORT-TERM INVESTMENTS 15.9% | | | |

| | | Money Market Deposit Account 15.9% | |

| | 1,672,923 | | | U.S. Bank N.A., 0.07% (b) | | | 1,672,923 | | |

| | | Total Short-Term Investments | |

| | | | | (Cost $1,672,923) | | | 1,672,923 | | |

| | | Total Investments 99.4% | |

| | | | | (Cost $9,513,226) | | | 10,474,683 | | |

| | | | | Other Assets in Excess of

Liabilities 0.6% | | | 61,911 | | |

| | | | | TOTAL NET ASSETS 100.0% | | $ | 10,536,594 | | |

(a) Non-Income Producing.

(b) The Money Market Deposit Account ("MMDA") is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and may change daily and by any amount. The rate shown is as of June 30, 2020.

ADR - American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

page 30

Frontier MFG Global Sustainable Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Consumer Staples | | | 21.1 | % | |

Communication Services | | | 17.8 | | |

Information Technology | | | 16.5 | | |

Consumer Discretionary | | | 14.2 | | |

Utilities | | | 6.1 | | |

Health Care | | | 4.2 | | |

Financials | | | 3.6 | | |

Total Common Stocks | | | 83.5 | | |

Total Short-Term Investments | | | 15.9 | | |

Total Investments | | | 99.4 | | |

Other Assets in Excess of Liabilities | | | 0.6 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 31

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

Number of Shares | | | | Value | |

COMMON STOCKS 88.7% | | | |

| | | Australia 7.3% | |

| | 1,172,217 | | | APA Group | | $ | 9,063,929 | | |

| | 808,689 | | | Atlas Arteria Ltd. | | | 3,734,520 | | |

| | 4,016,566 | | | AusNet Services | | | 4,640,625 | | |

| | 1,505,111 | | | Spark Infrastructure Group | | | 2,247,953 | | |

| | 2,245,177 | | | Sydney Airport | | | 8,860,765 | | |

| | 1,827,792 | | | Transurban Group | | | 17,924,592 | | |

| | | | 46,472,384 | | |

| | | Canada 11.9% | |

| | 188,300 | | | Canadian Utilities Ltd. - Class A | | | 4,688,082 | | |

| | 239,563 | | | Emera, Inc. | | | 9,426,529 | | |

| | 539,231 | | | Enbridge, Inc. | | | 16,396,181 | | |

| | 451,284 | | | Fortis, Inc. | | | 17,162,487 | | |

| | 593,120 | | | Hydro One Ltd. | | | 11,153,767 | | |

| | 386,459 | | | TC Energy Corp. | | | 16,510,476 | | |

| | | | 75,337,522 | | |

| | | Chile 0.3% | |

| | 6,257,149 | | | Aguas Andinas SA - Class A | | | 2,119,234 | | |

| | | France 5.6% | |

| | 98,314 | | | Aeroports de Paris | | | 10,149,958 | | |

| | 546,447 | | | Getlink SE (a) | | | 7,901,983 | | |

| | 188,971 | | | Vinci SA | | | 17,521,931 | | |

| | | | 35,573,872 | | |

| | | Germany 0.6% | |

| | 87,628 | | | Fraport AG Frankfurt

Airport Services

Worldwide (a) | | | 3,838,519 | | |

| | | Hong Kong 1.8% | |

| | 2,120,573 | | | Power Assets Holdings Ltd. | | | 11,586,950 | | |

| | | Italy 7.0% | |

| | 223,289 | | | ACEA SpA | | | 4,293,310 | | |

| | 152,100 | | | ASTM SpA (a) | | | 3,482,396 | | |

| | 480,410 | | | Enav SpA | | | 2,170,136 | | |

Number of Shares | | | | Value | |

| | | Italy 7.0% (continued) | |

| | 753,707 | | | Italgas SpA | | $ | 4,386,280 | | |

| | 3,373,387 | | | Snam SpA | | | 16,445,701 | | |

| | 1,997,289 | | | Terna Rete Elettrica

Nazionale SpA | | | 13,776,344 | | |

| | | | 44,554,167 | | |

| | | Mexico 1.4% | |

| | 324,904 | | | Grupo Aeroportuario del

Centro Norte SAB de CV (a) | | | 1,510,126 | | |

| | 439,880 | | | Grupo Aeroportuario del

Pacifico SAB de CV - Class B | | | 3,175,396 | | |

| | 257,847 | | | Grupo Aeroportuario del

Sureste SAB de CV - Class B (a) | | | 2,888,712 | | |

| | 322,178 | | | Infraestructura Energetica

Nova SAB de CV | | | 926,676 | | |

| | | | 8,500,910 | | |

| | | Netherlands 1.2% | |

| | 138,483 | | | Koninklijke Vopak NV | | | 7,330,195 | | |

| | | New Zealand 1.4% | |

| | 1,546,837 | | | Auckland International

Airport Ltd. | | | 6,578,318 | | |

| | 1,044,104 | | | Vector Ltd. | | | 2,430,131 | | |

| | | | 9,008,449 | | |

| | | Portugal 0.3% | |

| | 621,444 | | | REN - Redes Energeticas

Nacionais SGPS SA | | | 1,695,768 | | |

| | | Spain 8.2% | |

| | 122,363 | | | Aena SME SA (a) | | | 16,364,951 | | |

| | 308,149 | | | Cellnex Telecom SA | | | 18,820,960 | | |

| | 260,337 | | | Enagas SA | | | 6,368,737 | | |

| | 537,661 | | | Red Electrica Corp SA | | | 10,059,344 | | |

| | | | 51,613,992 | | |

| | | Switzerland 0.6% | |

| | 28,597 | | | Flughafen Zuerich AG (a) | | | 3,734,976 | | |

The accompanying notes are an integral part of these financial statements.

page 32

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020

Number of Shares | | | | Value | |

| COMMON STOCKS 88.7% (continued) | | | |

| | | United Kingdom 6.2% | |

| | 1,521,943 | | | National Grid PLC | | $ | 18,568,246 | | |

| | 418,224 | | | Pennon Group PLC | | | 5,791,422 | | |

| | 236,383 | | | Severn Trent PLC | | | 7,234,192 | | |

| | 677,389 | | | United Utilities Group PLC | | | 7,611,617 | | |

| | | | 39,205,477 | | |

| | | United States 34.9% | |

| | 17,333 | | | ALLETE, Inc. | | | 946,555 | | |

| | 90,439 | | | Alliant Energy Corp. | | | 4,326,602 | | |

| | 87,986 | | | Ameren Corp. | | | 6,190,695 | | |

| | 139,510 | | | American Electric

Power Co., Inc. | | | 11,110,576 | | |

| | 12,310 | | | American States Water Co. | | | 967,935 | | |

| | 45,305 | | | American Tower Corp. | | | 11,713,155 | | |

| | 63,636 | | | American Water Works Co., Inc. | | | 8,187,408 | | |

| | 41,264 | | | Atmos Energy Corp. | | | 4,109,069 | | |

| | 108,628 | | | Avangrid, Inc. | | | 4,560,203 | | |

| | 24,153 | | | Avista Corp. | | | 878,928 | | |

| | 19,149 | | | Black Hills Corp. | | | 1,084,982 | | |

| | 15,472 | | | California Water Service Group | | | 738,014 | | |

| | 99,911 | | | CMS Energy Corp. | | | 5,836,801 | | |

| | 117,336 | | | Consolidated Edison, Inc. | | | 8,439,978 | | |

| | 67,938 | | | Crown Castle International Corp. | | | 11,369,424 | | |

| | 146,907 | | | Dominion Energy Corp. | | | 11,925,910 | | |

| | 67,533 | | | DTE Energy Co. | | | 7,259,797 | | |

| | 142,700 | | | Duke Energy Corp. | | | 11,400,303 | | |

| | 10,450 | | | El Paso Electric Co. | | | 700,150 | | |

| | 75,193 | | | Entergy Corp. | | | 7,053,855 | | |

| | 91,237 | | | Essential Utilities, Inc. | | | 3,853,851 | | |

| | 76,540 | | | Evergy, Inc. | | | 4,538,057 | | |

| | 119,865 | | | Eversource Energy | | | 9,981,159 | | |

| | 190,083 | | | FirstEnergy Corp. | | | 7,371,419 | | |

| | 15,745 | | | IDACORP, Inc. | | | 1,375,641 | | |

| | 10,756 | | | MGE Energy, Inc. | | | 693,870 | | |

Number of Shares | | | | Value | |

| | | United States 34.9% (continued) | |

| | 129,691 | | | NiSource, Inc. | | $ | 2,949,173 | | |

| | 8,491 | | | Northwest Natural

Holding Company | | | 473,713 | | |

| | 15,312 | | | NorthWestern Corp. | | | 834,810 | | |

| | 16,970 | | | ONE Gas, Inc. | | | 1,307,539 | | |

| | 38,013 | | | Pinnacle West Capital Corp. | | | 2,785,973 | | |

| | 24,868 | | | PNM Resources, Inc. | | | 955,926 | | |

| | 29,679 | | | Portland General Electric Co. | | | 1,240,879 | | |

| | 274,648 | | | PPL Corp. | | | 7,096,904 | | |

| | 38,886 | | | SBA Communications Corp. | | | 11,584,917 | | |

| | 93,860 | | | Sempra Energy | | | 11,003,208 | | |

| | 8,232 | | | SJW Group | | | 511,290 | | |

| | 28,661 | | | South Jersey Industries, Inc. | | | 716,238 | | |

| | 16,083 | | | Spire, Inc. | | | 1,056,814 | | |

| | 211,137 | | | The Southern Co. | | | 10,947,453 | | |

| | 116,357 | | | WEC Energy Group, Inc. | | | 10,198,691 | | |

| | 175,875 | | | Xcel Energy, Inc. | | | 10,992,188 | | |

| | | | 221,270,053 | | |

| | | Total Common Stocks | |

| | | | | (Cost $498,388,396) | | | 561,842,468 | | |

CLOSED-END FUNDS 1.2% | | | |

| | | United Kingdom 1.2% | |

| | 2,013,608 | | | HICL Infrastructure PLC | | | 4,312,189 | | |

| | 1,489,602 | | | International Public

Partnerships Ltd. | | | 3,099,165 | | |

| | | | 7,411,354 | | |

| | | Total Closed-End Funds | |

| | | | | (Cost $7,193,624) | | | 7,411,354 | | |

The accompanying notes are an integral part of these financial statements.

page 33

Frontier MFG Core Infrastructure Fund

SCHEDULE OF INVESTMENTS (continued)

June 30, 2020

Number of Shares | | | | Value | |

SHORT-TERM INVESTMENTS 2.0% | |

| | | Money Market Deposit Account 2.0% | |

| | 12,697,565 | | | U.S. Bank N.A., 0.07% (b) | | $ | 12,697,565 | | |

| | | Total Short-Term Investments | |

| | | (Cost $12,697,565) | | | 12,697,565 | | |

| | | Total Investments 91.9% | |

| | | (Cost $518,279,585) | | | 581,951,387 | | |

| | | Other Assets in Excess of

Liabilities 8.1% | | | 51,334,062 | | |

| | | TOTAL NET ASSETS 100.0% | | $ | 633,285,449 | | |

(a) Non-Income Producing.

(b) The Money Market Deposit Account ("MMDA") is a short-term investment vehicle in which the Fund holds cash balances. The MMDA will bear interest at a variable rate that is determined based on market conditions and may change daily and by any amount. The rate shown is as of June 30, 2020.

PORTFOLIO DIVERSIFICATION

Sectors | | Percentage | |

Integrated Power | | | 22.9 | % | |

Transmission & Distribution | | | 19.1 | | |

Airports | | | 9.4 | | |

Communications | | | 8.4 | | |

Toll Roads | | | 8.0 | | |

Energy Infrastructure | | | 7.9 | | |

Gas Utilities | | | 7.2 | | |

Water Utilities | | | 5.8 | | |

Total Common Stocks | | | 88.7 | | |

Social | | | 1.2 | | |

Total Closed-End Funds | | | 1.2 | | |

Total Short-Term Investments | | | 2.0 | | |

Total Investments | | | 91.9 | | |

Other Assets in Excess of Liabilities | | | 8.1 | | |

Total Net Assets | | | 100.0 | % | |

The accompanying notes are an integral part of these financial statements.

page 34

Frontier MFG Select Infrastructure Fund

SCHEDULE OF INVESTMENTS

June 30, 2020

Number of Shares | | | | Value | |

COMMON STOCKS 89.0% | | | |

| | | Australia 15.4% | |

| | 206,242 | | | APA Group | | $ | 1,594,724 | | |

| | 701,958 | | | Atlas Arteria Ltd. | | | 3,241,638 | | |

| | 1,473,348 | | | Spark Infrastructure Group | | | 2,200,513 | | |

| | 258,150 | | | Sydney Airport | | | 1,018,809 | | |

| | 554,096 | | | Transurban Group | | | 5,433,848 | | |

| | | | 13,489,532 | | |

| | | Canada 4.6% | |

| | 131,304 | | | Enbridge, Inc. | | | 3,992,508 | | |

| | | Chile 0.9% | |

| | 2,305,075 | | | Aguas Andinas SA - Class A | | | 780,706 | | |

| | | France 4.1% | |

| | 5,876 | | | Aeroports de Paris | | | 606,639 | | |

| | 32,627 | | | Vinci SA | | | 3,025,269 | | |

| | | | 3,631,908 | | |

| | | Italy 8.4% | |

| | 78,637 | | | ASTM SpA (a) | | | 1,800,428 | | |

| | 659,918 | | | Snam SpA | | | 3,217,186 | | |

| | 344,645 | | | Terna Rete Elettrica

Nazionale SpA | | | 2,377,197 | | |

| | | | 7,394,811 | | |

| | | Netherlands 4.2% | |

| | 69,326 | | | Koninklijke Vopak NV | | | 3,669,570 | | |

| | | New Zealand 1.4% | |

| | 288,319 | | | Auckland International

Airport Ltd. | | | 1,226,150 | | |

| | | Spain 8.2% | |

| | 20,866 | | | Aena SME SA (a) | | | 2,790,640 | | |

| | 236,886 | | | Red Electrica Corp SA | | | 4,432,008 | | |

| | | | 7,222,648 | | |

| | | United Kingdom 3.4% | |

| | 178,766 | | | National Grid PLC | | | 2,181,009 | | |

| | 69,066 | | | United Utilities Group PLC | | | 776,074 | | |

| | | | 2,957,083 | | |

Number of Shares | | | | Value | |

| | | United States 38.4% | |

| | 23,939 | | | American Water Works Co., Inc. | | $ | 3,079,992 | | |

| | 50,774 | | | Atmos Energy Corp. | | | 5,056,075 | | |

| | 27,306 | | | Crown Castle International Corp. | | | 4,569,659 | | |

| | 40,900 | | | CSX Corp. | | | 2,852,366 | | |

| | 48,839 | | | Eversource Energy | | | 4,066,823 | | |

| | 49,801 | | | FirstEnergy Corp. | | | 1,931,283 | | |