H. Caplan received an option to purchase 5,811 shares under the Salary Investment Option Grant program because he elected to receive this option in lieu of the payment of a portion of his base salary.

In January 2002, the Company’s Chief Executive Officer, Christos Cotsakos, was party to an employment agreement with the Company, pursuant to which he received a base salary of $800,000 and a target annual bonus of ten times the base salary (or $8 million). Just as for other Named Executive Officers, the Committee set performance targets for the CEO’s bonus based on the Company’s achievement of earnings per share from ongoing operations in 2001. The performance target would be achieved only upon the close of the fiscal year and confirmation that the performance target had been met. Thus, a bonus, if any, was paid in January based on performance targets achieved for the prior year. Just as a bonus was paid out to other Named Executive Officers, Mr. Cotaskos was paid a bonus in January 2002 at the minimum threshold level of 80 percent of target based on the Company’s performance in 2001. This bonus payment is reflected in the Summary Compensation Table, above.

In May 2002, the Company entered into a new employment contract with Mr. Cotsakos that provided for a base salary of zero for at least the first year of the contract and a target bonus payment of $4 million. The contract specifically provided that the target bonus would be based on the Company’s meeting its performance objectives in 2002. The performance objectives established under the contract were the achievement of a target earnings per share from ongoing operations of $.45 (the Company’s performance guidance disclosed in January 2002). The Company met these performance objectives; consequently, the target bonus was paid in January 2003.

In January 2003, Mr. Cotsakos resigned from his position as Chairman and Chief Executive Officer. The Board appointed Mitchell Caplan, formerly the President and Chief Operating Officer of the Company, as the new Chief Executive Officer. As discussed above, as President and Chief Operating Officer, Mr. Caplan received a base salary of $650,000 per year and a target bonus opportunity of three times his base salary. Following his promotion as the new Chief Executive Officer, the Committee has made no changes to Mr. Caplan’s base salary or his bonus opportunity. The Committee (as reconstituted) is undertaking a thorough review of the compensation programs applicable to each of the Company’s senior executives to ensure that they appropriately reward executives for creating both short and long term shareholder value and that they are appropriate for the marketplace and current market conditions. The Committee anticipates that in the near future it will enter into new employment agreements with Mr. Caplan and the remainder of the senior management team incorporating these revised compensation programs and providing for appropriate protections to the executives to ensure that their primary focus is on the long term success of the Company.

In addition, the Company’s 1996 Stock Incentive Plan is structured so that any compensation deemed paid to an executive officer in connection with the exercise of his or her outstanding options under the 1996 Stock Incentive Plan will qualify as performance-based compensation not subject to the $1.0 million limitation. However, the Committee generally reserves the right to pay amounts of compensation that may not be fully deductible if it believes that it is in the Company’s best interests to do so.

Submitted by the Company’s Board of Directors.

Retirement Benefits

In October 2000, the Compensation Committee approved the adoption of a Supplemental Executive Retirement Plan (“SERP”), effective January 1, 2001. The purpose of the SERP was to attract, retain and motivate executive officers of the Company and to provide those executive officers with flexibility to meet their retirement and estate planning needs. At the time of its adoption, the Company faced significant competition for executive talent, and the SERP was viewed as an important tool for attracting and retaining more senior executive talent. The Board reviewed this program in late 2002 and early 2003 and, with the consent and full support of the Company’s management in place in April 2003, ultimately determined that the program was no longer appropriate in light of the business and economic conditions the Company faced. Consequently, the Board elected to terminate the SERP in April 2003. The Company is currently in the process of winding down the plan.

The SERP was a defined contribution plan, pursuant to which the Company had the discretion to make an annual contribution to the plan on behalf of those executive officers eligible to participate in the plan. The amounts contributed to the plan were held in a Rabbi Trust and invested through that trust; until distribution to a plan participant, the amounts contributed remained assets of the Company which could become subject to claims of creditors in the event of a bankruptcy of the Company. To be eligible to participate in the plan, at the commencement of the plan year (January 1) an individual was required to be: (i) an executive officer; and (ii) age 45 or above. For those executive officers eligible to participate in the SERP, a target contribution was set in an amount calculated to provide the individual a specified benefit upon retirement.

To receive full benefits available under the SERP, a participating individual was required to have 15 years of participation in the plan at the time of retirement. The Company’s former Chairman and Chief Executive Officer was immediately vested in 100% of those benefits available to him under the SERP. All other participating individuals were not to vest until they had participated in the SERP for at least five years, at which time a participant was to become vested in 50% of the benefits available to him or her under the SERP. However, those individuals who are age 60 or above and have five years participation in the plan will be 100% vested in benefits under the SERP. For each additional year of participation in the SERP, the individual was to become vested in an additional 10% of the benefits available to him or her under the SERP, until he or she was fully vested in all benefits after ten years of participation. However, in the event of a Change in Control of the Company (as defined in the SERP), all participants were to be immediately vested in all benefits contributed into the SERP as of the occurrence of the event which constituted the Change in Control, and any and all future contributions into the SERP.

Prior to May 2002, the target benefit for the Chairman and Chief Executive Officer was 100% of the average of the total annual compensation in the highest three of the five years prior to retirement (presumed to be at age 60). Compensation for the purpose of determining SERP benefits consists of base salary and regular annual cash bonuses. Severance pay, income derived from equity-based awards and other forms of special remuneration were excluded. The May 2002 employment agreement with Mr. Cotsakos set a maximum target benefit of $5 million. At the same time, Mr. Cotsakos disclaimed all interest in all but $5 million previously contributed to his account. Consequently, as of the time of his resignation, there was approximately $5 million in his account. As required by the terms of the SERP, this amount was distributed to Mr. Cotsakos following his resignation.

As of January 1, 2003, Messrs. Purkis and Levine had two years of credited service under the SERP. However, Mr. Levine disclaimed any interest in any contribution made to his SERP account in 2002. Of the remaining Named Executive Officers, Mr. Caplan reached age 45 during calendar year 2002 and was therefore first eligible to participate in the SERP beginning in the SERP’s 2003 Plan Year. However, as discussed above, in late 2002 the Board began consideration of whether the SERP was an appropriate program for the Company. As it considered the ongoing viability of the plan, the Board determined that it would make no contributions to the SERP for any participant for the 2003 Plan Year.

For 2002, a total of $6,872,721 was contributed to and retained in the accounts of those individuals participating in the SERP; no amount was (or will be) contributed to any account in the SERP during 2003. No amount was distributed to any participant in 2002; however, $5,071,696 was distributed to Mr. Cotsakos in 2003 following his resignation.

Employment Contracts, Termination of Employment and Change in Control Arrangements

Prior to May 2002 the Company was party to an employment agreement with Christos Cotsakos, Chairman of the Board and Chief Executive Officer of E*TRADE Group, Inc. that first became effective in May 31, 1999 and was subsequently amended effective October 1, 2000 and again effective August 27, 2001 (the “1999 Agreement”). Under the 1999 Agreement as amended, Mr. Cotsakos was to receive a base salary of at least $690,000, which salary was subject to review and increase

23

by the Company’s Board of Directors. For calendar year 2001, Mr. Cotsakos received a base salary of $800,000 per year, which salary remained in effect through May 15, 2002. As discussed above, Mr. Cotsakos was also eligible to participate in the Company’s shareholder-approved bonus plan, with a target bonus established by the Compensation Committee of ten times his base salary, and other standard employee benefits. He also received a life insurance policy in the face amount of $10,000,000, and participated in the SERP adopted by the Company effective January 1, 2001 as discussed above. The 1999 Agreement also provided for a severance payment of four times annual compensation (including base salary and target bonus) in the event of the termination of employment in circumstances other than a Change in Control and for a severance of five times annual compensation in the event of the termination of employment in connection with a Change in Control. With a base salary of $800,000 and a bonus potential of ten times base salary (or $8 million), under the 1999 Agreement as amended, in the event of a termination of employment in circumstances other than a Change in Control, the severance payment would have been $32 million; in the event of a termination of employment in connection with a Change in Control, the severance payment would have been $40 million.

Effective May 15, 2002, the Company entered into a new employment agreement with Mr. Cotsakos (the “2002 Agreement”). The 2002 Agreement provided that Mr. Cotsakos would receive a base salary of zero dollars for at least one year, which salary could be reviewed and adjusted by the Board. The agreement also provided for a target bonus of $4 million, to be paid if the Company achieved pre-established performance targets. As discussed above, this bonus was paid in January 2003 based on the Company’s having met its performance objectives for 2002. Mr. Cotsakos also continued to participate in all benefit plans applicable to other senior officers of the Company. The 2002 Agreement provided for a severance payment of $4 million in the event of a termination of employment, regardless of whether such termination was in connection with a Change in Control. This is in contrast to the potential payments of $32 million or $40 million under the 1999 Agreement. In January 2003, in connection Mr. Costakos separation from employment, the Company agreed to pay Mr. Cotsakos a $4 million severance as provided in the 2002 Agreement.

Effective October 1, 2001, the Company entered into employment agreements with Mitchell H. Caplan, who was then the Company’s Chief Financial Products Officer; R. (Robert) Jarrett Lilien, who was then the Company’s Chief Brokerage Officer; and Joshua Levine, the Company’s Chief Technology and Administrative Officer (the “Executive Employment Agreements”). Effective May 1, 2002, the Company entered into an employment agreement in the identical form with Arlen Gelbard when he was appointed Chief Banking Officer. Collectively, these are referred to as the “Executive Employment Agreements.” The Executive Employment Agreements superseded all other employment agreements between the executive and the Company. Each of the Executive Employment Agreements provides that the executive is eligible to participate in the Company’s bonus plan, under which his target bonus is three times his base salary, which may be modified as determined by the Compensation Committee. Each is also entitled to participate in the Company’s general benefit plans. Each of the agreements also provided that in the event of a Change in Control of the Company (as defined in the Executive Employment Agreement), all stock options held by the executive that are outstanding but unvested would become immediately and fully vested. Effective January 22, 2003, the Company entered into Amendments to each of the Executive Employment Agreements that eliminated this “single trigger” acceleration; no other provisions of the agreements were affected. In the event that the executive’s employment is involuntarily terminated (as defined in the Executive Employment Agreement) less than 60 days before or within three years after a Change in Control of the Company (as defined in the Executive Employment Agreement), the executive is entitled to: (i) severance payments equal to two years’ base salary and two years’ bonus calculated at the target bonus of three times base salary; (ii) continuation of health care, life insurance and certain other benefits (or, at the Company’s discretion, a lump sum payment sufficient to allow the executive to obtain such benefits on his own) for an additional two years; and (iii) outplacement services valued at a minimum of $40,000, plus attendant office facilities and administrative support. In the event that the executive’s employment is involuntarily terminated (as defined in the Executive Employment Agreement) in circumstances other than those relating to a Change in Control, the executive is entitled to: (i) severance payments equal to one year’s base salary (with no bonus payment); and (ii) continuation of health care, life insurance and certain other benefits (or, at the Company’s discretion, a lump sum payment sufficient to allow the executive to obtain such benefits on his own) for an additional one year. The current base salary for Mr. Caplan is $650,000; the current base salary for Messrs. Lilien and Levine is $615,000; and the current base salary for Mr. Gelbard is $525,000.

When Mr. Caplan was promoted to the position of Chief Executive Officer, the Company amended his employment agreement to provide that, if prior to January 23, 2005, Mr. Caplan does not remain in the position of Chief Executive Officer, the Company would pay him a severance payment equal to the greater of the base salary Caplan would have otherwise received through January 23, 2005 or one year’s base salary. When Mr. Lilien was promoted to the position of President and Chief Operating Officer, the Company made no changes to his Executive Employment Agreement.

24

Further, the Company has entered into Management Retention Agreements, covering all other executive officers, including Leonard C. Purkis, a Named Executive Officer. The agreements provide that if the executive officer is involuntarily terminated (as defined in the Management Retention Agreement) within 60 days prior to the occurrence of a change in control or within 18 months following an occurrence of a Change of Control (as defined in the Management Retention Agreement), then the executive shall be entitled to receive a severance payment equal to two years’ base salary and two years’ bonus calculated at the target bonus rate for the officer.

Outstanding options held by the Named Executive Officers, as well as other employees, are subject to a Special Addendum to Stock Option Agreement that provides that unvested options will automatically vest in full and all unvested shares of Common Stock held by such individuals subject to direct issuance made under the 1996 Plan will immediately vest in full in the event of the termination of the officer’s employment within eighteen months following: (i) a Corporate Transaction (as defined in the 1996 Plan); or (ii) a Change in Control.

As discussed above, the Board is currently reviewing all compensation arrangements with each of the Company’s executive officers. In connection with this review, and with the full support of senior management, the Board will also review all employment and/or severance agreements with each of its executive officers. The Company expects that it will enter into new employment agreements with each executive officer providing for terms that are appropriate for the Company and its shareholders, including terms related to severance. The Board expects that these terms will be appropriate for the market and business environment in which the Company currently operates.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently composed of Cathleen Raffaeli, Vaughn Clarke, Michael Parks and Donna Weaver. During 2002, the Committee consisted of, at various times, Lester Thurow, Ron Fisher, David Hayden and William Ford. None of these individuals was at any time during 2002 or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Certain Relationships and Related Transactions

1. In 1999 and 2000, the Company sponsored two venture capital funds to invest in early and mid-stage information technology companies. The Company invested $25.2 million in marketable securities, and subsequently invested $6.8 million in cash, in the first fund (“Fund I”). The Company made a $50.0 million capital commitment to the second fund (“Fund II”), of which $8.2 million in cash has been invested to date. The total committed capital of Fund I is $107.7 million and of Fund II is $207.3 million. The Company had a remaining outstanding capital funding commitment of $0.7 million to Fund I at December 31, 2002. At December 31, 2002, the Company’s outstanding capital funding commitment to Fund II was $41.8 million.

The funds are managed by affiliates of ArrowPath Ventures, LLC (“ArrowPath”). From the inception of the funds, Christos Cotsakos, the Company’s former Chairmen and CEO, and Thomas Bevilacqua, the Company’s former Chief Strategic Investments Officer, acted as managing members of the ArrowPath affiliate that serves as general partner of the Funds (the “General Partner”). In March 2003, Mr. Bevilacqua resigned from his employment with the Company. The Company is a non-managing member of the General Partner. To the extent that the Funds generate profits, 20% (as to Fund I) and 25.6% (as to Fund II) will be payable to the Company. Messrs Cotsakos and Bevilacqua, in their capacity as managing members and the investment professionals of ArrowPath, were entitled to receive the balance of net profits that are payable to the General Partner. An ArrowPath affiliate owned by Messrs. Cotsakos and Bevilacqua in which the Company has no interest is entitled to receive an annual management fee equal to 1.75% of the committed capital of the Funds and is responsible for the payment of all expenses of the Fund for which the General Partner is otherwise responsible. In connection with his resignation as Chairman and CEO of the Company, Mr. Cotsakos entered into arrangements pursuant to which he withdrew as a managing member of the General Partner, agreed to forego any right to distributions or profit allocations from the General Partner and withdrew as an owner of the management company. To date, the Funds have not distributed any amounts in respect of net profits. In several instances, Messrs. Cotsakos and Bevilacqua have received stock options in portfolio companies of the Funds for service on the boards of directors of such companies. Following the resignations of Mr. Cotsakos and Mr. Bevilacqua, there are no executive officers of the Company who have any responsibility (or receive any payment of any kind) for management of the funds or their investments.

25

2. In November 2000, in lieu of selling his shares of the Company’s Common Stock on the open market, William A. Porter, founder of the Company, Chairman Emeritus and currently a director of the Company, borrowed from the Company the principal amount of $15.0 million on a full recourse, collateralized basis. The loan accrues interest at the rate of 6.09% annually, the applicable federal rate for a loan of this nature at that time. Accrued interest is to be paid annually and the principal amount of the loan is due to be paid in November 2010. In May 2001, Mr. Porter pre-paid all interest for calendar year 2001. In December 2001, Mr. Porter repaid $1.0 million of the principal amount of the loan, leaving a remaining balance outstanding of $14.0 million. In August 2002, Mr. Porter pre-paid all interest for 2002 and paid $.5 million of principal, leaving a remaining balance outstanding of $13.5 million. The loan is fully collateralized by equity interests in various limited liability companies and properties owned by Mr. Porter.

3. The Company has always encouraged its executive officers to hold significant equity in the Company to properly ally the interests of the executive officers with those of the shareholders of the Company. To facilitate such holdings, during 2000 the Company adopted a program pursuant to which the Company made loans to executive officers to allow them to exercise stock options to purchase shares of the Company’s stock. From May 2000 to June 2001, the Company made loans to six executive officers of the Company under this program. The principal amount of each loan was due thirteen months after it was made. Interest on each loan was initially set at 7.75% (the Company’s applicable margin lending rate at that time) and began to accrue immediately. Accrued and unpaid interest on each loan was due one year from the date of that loan and additional accrued but unpaid interest for the last month of the term was due on maturity. The loans were subsequently renegotiated with each executive with an interest rate of 5.75% (the Company’s applicable margin rate at that time) and a due date of November 2002. Each loan was a full recourse loan collateralized by a stock pledge of the number of shares purchased with the proceeds of the loan. These loans were all repaid in full during 2002. In connection with the repayment of these loans, the Company redeemed Common Stock held by certain of the individuals valued at $5.735 per share, the fair market value of the Company’s Common Stock on the due date of the notes. Each of the individuals paid all accrued interest on their loans in cash. The following table lists each loan to an individual who is currently an executive officer, member of senior management and/or individual reported in the Summary Compensation Table:

| Name | Total Principal

Amount of Loans | | Total Shares Purchased

With Proceeds of Loan | | Shares Redeemed

by Company |

|

| |

| |

|

| Christos Cotsakos | $26.9 million | | 4,240,895 | | | 4,685,284 | |

| Jerry Gramaglia | $1.5 million | | 200,000 | | | 0 | |

| Leonard Purkis | $1.8 million | | 200,000 | | | 200,000 | |

| Connie Dotson | $1.3 million | | 157,064 | | | 134,817 | |

| Pamela Kramer | $80,000 | | 7,184 | | | 0 | |

There are no loans outstanding under this program, and the Board has terminated the program; therefore there will be no further such related party transactions.

26

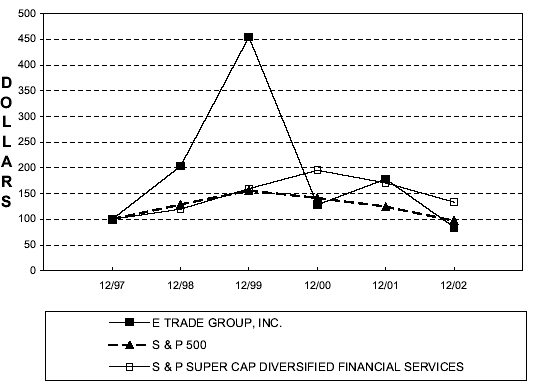

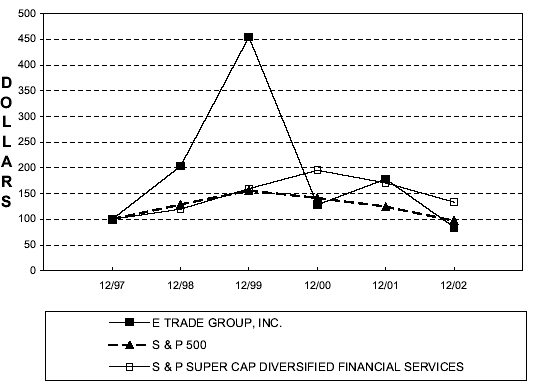

Performance Graph

The following performance graph shows the cumulative total return to a holder of the Company’s Common Stock, assuming dividend reinvestment, compared with the cumulative total return, assuming dividend reinvestment, of the Standard & Poor’s 500 and the Standard & Poor’s Supercap Composite Diversified Financial Services Index during the period from December 31, 1997 through December 31, 2002.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG E*TRADE GROUP, INC., THE S & P 500 INDEX

AND THE S & P SUPER CAP DIVERSIFIED FINANCIAL SERVICES INDEX

| | 12/97 | | 12/98 | | 12/99 | | 12/00 | | 12/01 | | 12/02 |

| |

| |

| |

| |

| |

| |

|

| E*TRADE GROUP, INC | $ | 100 | | $ | 203.40 | | $ | 454.35 | | $ | 128.26 | | $ | 178.26 | | $ | 84.52 |

| S&P 500 | $ | 100 | | $ | 128.58 | | $ | 155.64 | | $ | 141.46 | | $ | 124.65 | | $ | 97.10 |

| S&P SUPERCAP COMPOSITE DIVERSIFIED | | | | | | | | | | | | | | | | | |

| FINANCIAL SERVICES | $ | 100 | | $ | 119.61 | | $ | 159.47 | | $ | 195.38 | | $ | 170.81 | | $ | 133.36 |

· $100 invested on 12/31/97 in stock or index, including reinvestment of dividends.

·© 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership of Common Stock and other equity securities of the Company with the Securities and Exchange Commission (the “SEC”). Officers, directors and beneficial owners of more than 10% of any class of the Company’s equity securities are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file.

27

Based solely upon review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that during the fiscal year ended December 31, 2002, all filing requirements under Section 16(a) applicable to its officers, directors, and greater than 10% beneficial owners were complied with.

SHAREHOLDER PROPOSALS

Shareholder proposals intended to be included in the Company’s proxy statement may be submitted for inclusion after the meeting to be held on May 22, 2003, but must be received by the Company no later than December 22, 2003. If the Company is notified of a shareholder proposal within the period beginning April 7, 2003 and ending on May 22, 2003, such notice will be considered untimely and the proxies held by management of the Company provide such proxy holders the discretionary authority to vote against such shareholder proposal even if the shareholder proposal is not discussed in the proxy statement. The proposal must be mailed to the Company’s principal executive offices, 4500 Bohannon Drive, Menlo Park, California 94025, Attention: Russell S. Elmer, Corporate Secretary. Such proposals may be included in next year’s proxy statement if they comply with certain rules and regulations promulgated by the Securities and Exchange Commission.

Under the terms of the Company’s Bylaws, shareholders who intend to present an item of business at the 2004 Annual Meeting of Shareholders (other than a proposal submitted for inclusion in the Company’s proxy materials) must provide notice of such business to the Corporate Secretary no earlier than November 22, 2003 and no later than December 22, 2003, as set forth more fully in such Bylaws.

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

In accordance with its amended and restated written charter (a copy of which is attached hereto asAppendix A)as adopted by the Board of Directors (the “Board”), the Audit Committee of the Board (the “Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. During the year ended December 31, 2002, the Committee met eleven times, and the Committee chair, as representative of the Committee, discussed the interim financial information contained in each quarterly earnings announcement with the Company’s Chief Financial Officer and independent auditors prior to public release. The Audit Committee is entirely made up of independent directors as defined in the New York Stock Exchange Listing Standards.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with the auditors any relationships that may impact their objectivity and independence, including whether the independent auditors’ provision of non-audit services to the Company is compatible with the auditors’ independence, and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee reviewed with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted accounting standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of the internal audit examinations.

The Committee reviewed and discussed the audited financial statements of the Company as of and for the year ended December 31, 2002, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

28

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission. The Committee also recommended the reappointment, subject to shareholder ratification, of the independent auditors, and the Board concurred in such recommendation.

Submitted by the Audit Committee of the Company’s Board of Directors:

| | Dr. Lester C. Thurow (Chair)

Lewis E. Randall

Peter Chernin |

FORM 10-K

The Company filed an Annual Report on Form 10-K for the year ended December 31, 2002 with the Securities and Exchange Commission on March 27, 2003. Shareholders may obtain a copy of this report, without charge, by writing to Russell S. Elmer, Corporate Secretary, at the Company’s principal offices located at 4500 Bohannon Drive, Menlo Park, California 94025.

OTHER MATTERS

Management does not know of any matters to be presented at this Annual Meeting other than those set forth herein and in the Notice accompanying this Proxy Statement.

29

APPENDIX A: Audit Committee Charter

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

E*TRADE Group, Inc.

A Delaware corporation

(the “Company”)

Audit Committee Charter

This charter was adopted by the Board of Directors of the Company on January 22, 2003.

Purpose

The Audit Committee (the “Committee”) is created by the Board of Directors of the Company to serve as an independent and objective party to monitor the Company’s financial reporting process and internal control system and to provide an open avenue of communication among the independent auditors, financial and senior management and the Board of Directors.

The Committee shall assist the Board in its oversight of:

- the integrity of the financial statements of the Company;

- the qualifications, independence and performance of the Company’s independent auditor;

- the performance of the Company’s internal audit function; and

- compliance by the Company with legal and regulatory requirements.

The Committee shall prepare the audit committee report that Securities and Exchange Commission rules require to be included in the Company’s annual proxy statement.

Membership

The Committee shall consist of at least three members, each of whom is “independent” according to the standards of the New York Stock Exchange and the Company (to the extent the Company maintains requirements that are more stringent). The Nominating and Corporate Governance Committee of the Company (the ”Governance Committee“) shall recommend nominees for appointment to the Committee annually and as vacancies or newly created positions occur. Committee members shall be appointed by the Board annually and may be removed by the Board at any time. The Board shall designate the Chair of the Committee.

Authority and Responsibilities

In addition to any other responsibilities which may be assigned from time to time by the Board, the Committee is authorized to undertake, and has responsibility for, the following matters.

Independent Auditors

The Committee has the sole authority to retain and terminate the independent auditors of the Company (subject, if applicable, to shareholder ratification), including sole authority to approve all audit engagement fees and terms and all non-audit services to be provided by the independent auditors. The Committee must pre-approve each such non-audit service to be provided by the Company’s independent auditors. The Committee may consult with management in the decision making process, but may not delegate this authority to management. The Committee may, from time to time, delegate its authority to approve non-audit services on a preliminary basis to one or more Committee members, provided that such designees present any such approvals to the full Committee at the next Committee meeting.

The Committee shall review and approve the scope and staffing of the independent auditors’ annual audit plan(s).

The Committee shall evaluate the independent auditors’ qualifications, performance and independence, and shall present its conclusions and recommendations with respect to the independent auditors to the full Board on at least an annual basis. As part of such evaluation, at least annually, the Committee shall:

A-1

- obtain and review a report from the Company’s independent auditors:

- describing the independent auditor’s internal quality-control procedures;

- describing any material issues raised by (i) the most recent internal quality-control review or peer review of the independent auditor, or (ii) any inquiry or investigation by governmental or professional authorities, within the preceding five years, regarding one or more independent audits carried out by the auditing firm; and any steps taken to deal with any such issues;

- describing all relationships between the independent auditor and the Company; and

- assuring that Section 10A of the Securities Exchange Act of 1934 has not been implicated;

- evaluate the adequacy of the auditors’ quality-control procedures and their compliance with such controls;

- review and evaluate the senior members of the independent auditor team, particularly the lead audit partner;

- consider whether the lead audit partner or the audit firm should be rotated in addition to the rotation of the lead audit or reviewing partner as required by law, so as to assure continuing auditor independence; and

- obtain the opinion of management and the internal auditors of the independent auditor’s performance.

The Committee shall establish clear policies for the Company’s hiring of employees or former employees of the independent auditors.

Internal Auditors

At least annually, the Committee shall evaluate the performance, responsibilities, budget and staffing of the Company’s internal audit function and review the annual internal audit plan. Such evaluation shall include a review of the responsibilities, budget and staffing of the Company’s internal audit function with the independent auditors. The primary function of the Internal Audit Department shall be to assist the Audit Committee in fulfilling its oversight responsibilities by reviewing, in detail and on an on-going, daily basis: the financial reports and other financial information provided by the Company to any governmental body or the public; the Company’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Company’s auditing, accounting and financial reporting processes generally.

At least annually, the Committee shall evaluate the performance of the senior internal auditing executive.

Financial Statements; Disclosure and Other Risk Management and Compliance Matters

The Committee shall review with management, the internal auditors and the independent auditor, in separate meetings if the Committee deems it appropriate:

- the annual audited financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis and Analysis of Financial Condition and Results of Operations”, prior to the filing of the Company’s Form 10-K;

- the quarterly financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis and Analysis of Financial Condition and Results of Operations”, prior to the filing of the Company’s Form 10-Q;

- any analyses or reports prepared by management, the internal auditors and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements;

- the critical accounting policies and practices of the Company;

- the effect of regulatory and accounting initiatives (including any SEC investigations or proceedings) on the financial statements of the Company;

- the effect of off-balance sheet structures on the financial statements of the Company; and

A-2

- any major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles.

The Committee shall review, in conjunction with management, the Company’s policies with respect to the Company’s earnings press releases and all financial information, such as earnings guidance, provided to analysts and rating agencies, including the types of information to be disclosed and the types of presentation to be made and paying particular attention to the use of “pro forma” or “adjusted” “non-GAAP” information.

The Committee shall review periodically with the General Counsel, legal and regulatory matters that may have a material impact on the Company’s financial statements, compliance policies and programs.

The Committee shall, in conjunction with the CEO and CFO of the Company, periodically review the Company’s internal controls (including computerized information system controls and security) and disclosure controls and procedures, including whether there are any significant deficiencies in the design or operation of such controls and procedures, material weaknesses in such controls and procedures, any corrective actions taken with regard to such deficiencies and weaknesses and any fraud involving management or other employees with a significant role in such controls and procedures.

The Committee shall review and discuss with the independent auditor any audit problem or difficulties and management’s response thereto; including those matters required by Statement on Auditing Standards No. 61, including the following:

- any restrictions on the scope of the independent auditor’s activities or access to requested information;

- any accounting adjustments that were noted or proposed by the auditor but were “passed” (as immaterial or otherwise);

- any communications between the audit team and the audit firm’s national office regarding auditing or accounting issues presented by the engagement;

- any management or internal control letter issued, or proposed to be issued, by the auditor; and

- any significant disagreements between the Company’s management and the independent auditor.

The Committee shall review the Company’s policies and practices with respect to risk assessment and risk management, including discussing with management and the internal auditors the Company’s major financial risk exposures and the steps that have been taken to monitor and control such exposures.

The Committee shall establish and oversee procedures for:

- the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and

- the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

The Committee shall prepare the audit committee report that Securities and Exchange Commission rules require to be included in the Company’s annual proxy statement.

Reporting to the Board

The Committee shall report to the Board at least quarterly. This report shall include a review of any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the Company’s independent auditors, the performance of the internal audit function and any other matters that the Committee deems appropriate or is requested to be included by the Board.

At least annually, the Committee shall arrange for the independent auditors to be available to the full Board.

At least annually, the Committee shall review and assess the adequacy of this charter and recommend any proposed changes to the Board for approval.

At least annually, the Committee shall evaluate its own performance and report to the Board on such evaluation.

A-3

Procedures

The Committee shall meet as often as it determines is appropriate to carry out its responsibilities under this charter, but not less frequently than quarterly. Special meetings may be held from time to time pursuant to the call of the Chair of the Committee. The Chair of the Committee, in consultation with the other committee members, shall determine the frequency and length of the committee meetings, shall set meeting agendas consistent with this charter and shall, when present, preside at the meetings of the Committee. In lieu of a meeting, the Committee may also act by unanimous written consent resolution. The Committee shall designate a person (who need not be a member of the Committee) to keep minutes of its meetings. The minutes shall be retained by the Corporate Secretary of the Company.

At least quarterly, the Committee shall meet separately with management, with internal auditors or other personnel responsible for the internal audit function and with the independent auditor.

The Committee is authorized (without seeking Board approval) to retain special legal, accounting or other advisors and may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to meet with any members of, or advisors to, the Committee. The Committee may also meet with the Company’s investment bankers or financial analysts who follow the Company.

The Committee may, to the full extent permitted by applicable law and regulation, delegate its authority to subcommittees of the Committee when it deems appropriate and in the best interests of the Company.

Limitations Inherent in the Audit Committee’s Role

It is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with GAAP. This is the responsibility of management and the independent auditor. It is also not the duty of the Committee to conduct investigations, to resolve disagreements, if any, between management and the outside auditors or to assure compliance with laws and regulations and the Company’s policies generally. Furthermore, it is the responsibility of the CEO and senior management to avoid and minimize the Company’s exposure to risk, and while the Committee is responsible for reviewing with management the guidelines and policies to govern the process by which risk assessment and management is undertaken, it is not the sole body responsible.

A-4

E*TRADE GROUP, INC.

4500 BOHANNON DRIVE

MENLO PARK, CA 94025

| VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call. You will be prompted to enter your 12-digit Control Number which is located below and then follow the simple instructions the Vote Voice provides you.

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site. You will be prompted to enter your 12-digit Control Number which is located below to obtain your records and to create an electronic voting instruction form.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return to E*TRADE Group, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| | | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | ETRDE1 | KEEP THISPORTION FOR YOUR RECORDS |

|

| | | DETACH AND RETURN THIS PORTION ONLY |

| THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

|

| E*TRADE GROUP, INC. | | | | | | | | |

| | 1. | Election of Directors. | | | For

All | | Withhold

All | | For All

Except | | To withhold authority to vote, mark “For All Except”

and write the nominee's number on the line below. |

| | | 01) Lewis E. Randall

02) Lester C. Thurow

03) Michael K. Parks

04) Mitchell H. Caplan | 05) Vaughn A. Clarke

06) C. Cathleen Raffaeli

07) Donna L. Weaver

| | |_| | | |_| | | |_| | |

|

| | | | | | | | | | | | |

| | Vote on Proposal

| | For | | Against | | Abstain |

| | 2. | To ratify the selection of Deloitte & Touche LLP as independent public accountants for the Company for fiscal year 2003.

| | |_| | | |_| | | |_| |

| | 3. | In their discretion, the Proxies are authorized to vote upon such other matters as may properly come before the meeting.

| | | | | | |

| | THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NOS. 1 AND 2. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS SPECIFIED ABOVE. IN THE ABSENCE OF CONTRARY INSTRUCTIONS, THIS PROXY WILL BE VOTED FOR PROPOSAL NOS. 1 AND 2.

| | | | | | |

| | | PLEASE COMPLETE, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE.

| | | | | | |

| | | | |

| |

| |

|

| | | | |

| |

| |

|

| | Signature [PLEASE SIGN WITHIN BOX] Date | | Signature (Joint Owners) Date |

COMMON STOCK

PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

MAY 22, 2003

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Mr. George Hayter, Mr. Mitchell H. Caplan, Mr. Russell S. Elmer and Mr. Leonard C. Purkis, and each or any of them, as Proxies of the undersigned, with full power of substitution, and hereby authorizes them to represent and to vote, as designated on the reverse side, all of the shares of Common Stock of E*TRADE Group, Inc., held of record by the undersigned on March 31, 2003 at the Annual Meeting of Shareholders of E*TRADE Group, Inc. to be held May 22, 2003, or at any postponement or adjournment thereof.

PLEASE SIGN EXACTLY AS YOUR NAME(S) IS (ARE) SHOWN ON THE SHARE CERTIFICATE TO WHICH THE PROXY APPLIES. WHEN SHARES ARE HELD BY JOINT TENANTS, BOTH SHOULD SIGN. WHEN SIGNING AS AN ATTORNEY, EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE AS SUCH. IF A CORPORATION, PLEASE SIGN IN FULL CORPORATE NAME BY PRESIDENT OR OTHER AUTHORIZED OFFICER. IF A PARTNERSHIP, PLEASE SIGN IN PARTNERSHIP NAME BY AUTHORIZED PERSON.