The following table sets forth information regarding the beneficial ownership of the Company’s Common Stock and the Company’s Series A Preferred Stock (see footnote 2 below) as of March 1, 2004 by (i) each person who is known to the Company to own beneficially more than 5% of the outstanding shares of the Common Stock or Series A Preferred Stock of the Company; (ii) each director; (iii) each current executive officer listed in the Summary Compensation Table; and (iv) all directors and current executive officers as a group. All shares are subject to the named person’s sole voting and investment power except where otherwise indicated.

(1) Based on 370,380,560 shares outstanding on March 1, 2004. Shares of Common Stock subject to options that are exercisable within 60 days of March 1, 2004 are deemed beneficially owned by the person holding such options for the purpose of computing the percentage of ownership of such person but are not treated as outstanding for the purpose of computing the percentage of any other person.

(2) No Exchangeable Shares of EGI Canada Corporation (which are entitled to vote in accordance with the terms of issuance of the one (1) outstanding share of the Company’s Series A Preferred Stock), are held by the individuals or entities listed above as of March 1, 2004.

(3) Includes 397,842 shares held by Caplan Associates and 462,500 shares of unvested restricted Common Stock subject to repurchase. Also includes 2,245,356 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(4) Includes 102,610 shares held by the Piston Share Ownership Trust under agreement dated November 15, 1991 and 337,500 shares of unvested restricted Common Stock subject to repurchase. Also includes 1,030,128 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of March 1, 2004.

(5) Includes 187,500 shares of unvested restricted Common Stock subject to repurchase and 285,230 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of March 1, 2004.

(6) Includes 187,500 shares of unvested restricted Common Stock subject to repurchase. Also includes 58,250 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of Mach 1, 2004.

(7) Includes 100,000 shares of unvested restricted Common Stock subject to repurchase. Also includes 1,234,242 shares of Common Stock issuable upon the exercise of stock options exercisable within 60 days of Mach 1, 2004.

(8) Includes 5,780,306 shares held by William A. and M. Joan Porter as Trustees of the Porter Revocable Trust under agreement dated August 15, 1998. Also includes 100,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, 40,000 shares of which are subject to repurchase, and 5,653 shares of Common Stock issuable upon exercise of options exercisable within 60 days of March 1, 2004.

(9) Includes 90,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, 52,500 of which are subject to the Company’s right of repurchase. Also includes 46,388 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(10) Includes 140,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, 40,000 of which are subject to the Company’s right of repurchase. Also includes 249,327 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(11) Includes 20,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, all of which are subject to the Company’s right of repurchase. Also includes 735 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(12) Includes 20,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, all of which are subject to the Company’s right of repurchase. Also includes 735 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(13) Includes 627,100 shares held by Lewis or Martha Randall, as Trustees of the Lewis E. and Martha E. Randall Living Trust dated August 16, 1984. Includes 220,000 shares held solely by Mr. Randall’s wife. Mr. Randall disclaims beneficial ownership of such shares. Also includes 140,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, 40,000 of which are subject to the Company’s right of repurchase. Also includes 96,000 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(14) Includes 140,000 shares of Common Stock issuable upon exercise of immediately exercisable stock options, 40,000 of which are subject to the Company’s right of repurchase. Also includes 245,653 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(15) Includes 20,000 shares of unvested restricted Common Stock subject to repurchase. Also includes 735 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004.

(16) Includes the information in the notes above, as applicable. Also includes an additional 604,908 shares of Common Stock issuable upon exercise of stock options exercisable within 60 days of March 1, 2004, which options are held by executive officers of the Company who are not identified in the table above.

(17) All addresses are c/o E*TRADE Financial Corporation, 135 E. 57th Street, New York, New York 10022.

17

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table sets forth the compensation paid to (i) the Company’s current and former Chief Executive Officer, and (ii) the Company’s four other highest-paid executive officers (“Named Executive Officers”) for services rendered in all capacities to the Company and its subsidiaries for the calendar years ended December 31, 2003, December 31, 2002 and December 31, 2001.

Under the Company’s performance bonus program, payments for performance for the year ended December 31 are typically paid in January or February of the following year. Historically, the Company has reported compensation on a “cash paid” basis, noting that bonus payments reported in one year reflect payment for performance in the prior year. In the interest of providing the most current information as to the payment of bonuses, the Company has elected for this year and going forward to report bonuses on an “accrual” basis. As a result, bonuses that were accrued for performance in 2003 but not paid until February 2004 will be reported as an accrued payment for 2003. Reporting for prior years has been modified for consistent reporting and those items affected have been footnoted to describe the difference.

SUMMARY COMPENSATION TABLE (1)

| | Annual Compensation | | Long-Term Compensation Awards | | | |

| |

| |

| | | |

Name and Principal Position | | Year | | Salary ($) | | Bonus ($)(2) | | Other Annual

Compensation ($) | | Restricted

Stock

Awards ($) | | Securities

Underlying

Options/SARs | | All Other

Compensation($)(3) | |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | |

Mitchell H. Caplan | | 2003 | | 705,385 | | 3,750,000 | | 89,269 | (4) | | 3,351,250 | (5) | 1,312,500 | | 6,181 | | |

Chief Executive Officer | | 2002 | | 637,616 | (6) | — | | — | | | — | | 5,811 | (6) | 10,000 | | |

| | 2001 | | 609,420 | | 1,462,609 | | — | | | 742,190 | (7) | 854,042 | | 8,500 | | |

| | | | | | | | | | | | | | | | | |

Christos M. Cotsakos | | 2003 | | 0 | | 0 | (8) | — | | | — | | — | | — | | |

Former Chairman of the | | 2002 (9) | | 313,846 | | 4,000,000 | | 236,016 | | | — | | — | | 5,281,089 | | |

Board and Chief Executive | | 2001 (10) | | 797,880 | | 10,509,448 | | 32,970,453 | | | 29,347,928 | | 1,332,090 | | 9,940,726 | | |

Officer | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

R. (Robert) Jarrett Lilien | | 2003 | | 634,385 | | 3,297,308 | | 66,386 | (11) | | 2,393,750 | (5) | 937,500 | | 10,000 | | |

President and Chief | | 2002 | | 568,992 | | — | | — | | | — | | — | | 10,000 | | |

Operating Officer | | 2001 | | 608,939 | | 1,333,754 | | — | | | 742,190 | (7) | 911,837 | | 8,500 | | |

| | | | | | | | | | | | | | | | | |

Louis A. Klobuchar, Jr. | | 2003 | | 452,308 | | 2,781,563 | | 3,600,000 | (12) | | 1,436,250 | (5) | 562,500 | | 10,000 | | |

Chief Brokerage Officer | | 2002 | | 232,992 | | — | | 2,700,000 | (12) | | — | | 29,000 | | — | | |

| | 2001 (13) | | 250,000 | | 5,624,681 | (14) | 2,700,000 | (12) | | — | | 50,000 | | 9,500 | | |

| | | | | | | | | | | | | | | | | |

Arlen W. Gelbard | | 2003 | | 552,692 | | 2,824,688 | | — | | | 1,436,250 | (5) | 562,500 | | 10,000 | | |

Chief Banking Officer | | 2002 | | 445,385 | | — | | — | | | — | | 4,000 | | 10,000 | | |

| | 2001 | | 185,000 | | 68,080 | | — | | | — | | 100,000 | | 6,145 | | |

| | | | | | | | | | | | | | | | | |

Joshua S. Levine | | 2003 | | 615,000 | | 1,393,352 | | | | | 574,500 | (5) | 225,000 | | 10,000 | | |

Chief Technology and | | 2002 | | 635,769 | | — | | — | | | — | | — | | 10,000 | | |

| | 2001 | | 522,111 | | 1,004,526 | | — | | | 742,190 | (7) | 650,000 | | 283,830 | (15) | |

|

(1) | In accordance with SEC rules, the compensation described in this table does not include medical, group life insurance or other benefits received by the Named Executive Officers that are available generally to all salaried employees of the Company, and, except as expressly noted, certain perquisites and other personal benefits received by the Named Executive Officers that do not exceed the lesser of $50,000 or 10% of any such officer’s salary and bonus disclosed in this table. |

18

(2) | Bonus payments reported for 2003 were accrued for performance in 2003 and paid in February 2004. In 2002, no bonuses were accrued under the Company’s performance bonus plan for Mitch Caplan, Jarrett Lilien, Arlen Gelbard, Lou Klobuchar or Joshua Levine. Amounts previously reported in this column for 2002 were accrued in 2001 for performance in 2001 and paid in January 2002. For Mitch Caplan, Jarrett Lilien and Joshua Levine, prior years reported “zero” in this column for 2001 because no bonuses were actually paid in 2001. |

(3) | Unless otherwise noted, amounts reported in this column represent employer contributions to the Company’s 401(k) Plan. |

(4) | Represents $74,250 for personal use of corporate aircraft and other perquisites of $15,019 of which no one item exceeded 25% of the total perquisites for this person. |

(5) | Effective June 3, 2003, the Board made grants of restricted stock to the Company’s senior executives. The fair market value of the Company’s Common Stock on that date was $7.66 per share. Amounts reported in this column for 2003 represent the dollar value, based on a price of $7.66 per share, of: 437,500 shares of restricted stock granted to Mr. Caplan, 312,500 shares of restricted stock granted to Mr. Lilien, 187,500 shares of restricted stock granted to each of Mr. Gelbard and Mr. Klobuchar and 75,000 shares of restricted stock granted to Mr. Levine. For each of the individuals, the right to retain these shares vests in one installment on the fifth anniversary of the date of the grant; there is no vesting prior to that time. |

(6) | For 2002, Mr. Caplan elected to participate in the Salary Investment Option Grant program under the Company’s 1996 Stock Incentive Plan. Under this program, certain management-level employees may elect to receive a portion of his or her base salary in the form of stock options in lieu of cash. The total value of the options on the date of grant is equal to the amount by which salary was reduced. For purposes of reporting in the Summary Compensation Table, the Company has reported both the full salary to which Mr. Caplan was entitled as well as the stock options that were granted. |

(7) | Represents the dollar value of 100,000 shares of restricted stock granted to this individual on January 2, 2001 based upon the closing price of $7.4219 per share of the Company’s Common Stock on the date of grant. The individual’s right to retain this stock vests in four equal annual installments. |

(8) | No bonus was accrued for Mr. Cotsakos in 2003. However, a bonus of $4 million was accrued for performance in 2002 and paid in January 2003. |

(9) | Previously the amount reported for “Bonus” for Mr. Cotsakos for 2002 was $6,383,043 because this amount was actually paid in January 2002. The amount currently reported ($4,000,000) reflects the amount of bonus accrued in 2002 for performance in 2002 for this individual. Amounts reported for “Other Annual Compensation” represent $99,931 for security systems and tax gross-ups, the benefit of $23,890 for Company provided automobile, tax planning services of $97,715 and other perquisites of $14,480 of which no one item exceeded 25% of the total perquisites reported for this individual. Amounts reported for “All Other Compensation” represents $5,000,000 for the Company’s contribution to the Supplemental Executive Retirement Plan paid in accordance with the terms of the plan adopted in 2000, $271,089 for the value of a Company provided life insurance policy and tax gross-up on the benefit and $10,000 for employer contributions to the Company’s 401(k) plan. |

(10) | Amounts reported for Mr. Cotsakos under “Bonus” represent bonus payments accrued in 2001 for performance in 2001. Of this amount, $6,383,043 was accrued in 2001 but paid in January 2002 and $4,126,405 was accrued and paid in 2001. Previously, the amount reported as bonus for 2001 was $4,126,405 because that amount was actually paid in 2001. The portion of bonus actually paid in 2002 was previously reported for 2002. Amounts reported under “Restricted Stock Awards” represent the dollar value of 666,666 shares of restricted stock granted to Mr. Cotsakos on January 2, 2001, based on the closing price of $7.4219 per share of the Company’s Common Stock on the date of grant and the value of 4,000,000 shares of restricted stock granted on April 4, 2001 based upon the closing price of $6.10 per share of the Company’s common stock on the date of grant. In May 2002 Mr. Cotsakos waived his right to retain the 3.2 million shares of restricted stock in this grant that had not yet vested. After adjustment for this waiver, the actual compensation rights retained as would be reported under this column had a value of $9,827,928. Amounts reported under “Other Annual Compensation” represent the benefit received for $15,000,000 in connection with the settlement of a loan agreement between this individual and the Company and $15,211,481 paid as a tax gross-up for the value of the loan settlement. The loan was settled in connection with the renegotiation of the Company’s employment contract with Mr. Cotsakos and as part of other contractual renegotiations undertaken by the Company in August 2001. In addition, Mr. Cotsakos also received other perquisites of $2,758,972 of which no one item exceeded 25% of the total perquisites reported for this individual. Amounts reported under “All Other Compensation” include $9,579,674 as the value of the Company’s contribution to its Supplemental Executive Retirement Plan on behalf of Mr. Cotsakos; however, in May 2002 Mr. Cotsaksos waived his right to vested benefits in the amount of $9,579,674 that had previously been contributed to the Company’s Supplemental Executive Retirement Plan on his behalf. After adjustment for this waiver, the actual compensation rights retained as would be reported under this column are $361,052, representing the benefit of $357,902 arising from premiums paid for a life insurance policy, including tax gross-up, and $3,150 for employer contributions to the Company’s 401(k) Plan. |

(11) | Represents $35,318 for personal use of corporate aircraft and other perquisites of $31,068 of which no one item exceeded 25% of the total perquisites for this person. |

(12) | In connection with the Company’s acquisition of Dempsey & Co. in 2001 and as partial consideration for the sale of his interest in Dempsey, effective October 1, 2001 the Company entered into a management continuity agreement with Mr. Klobuchar (Dempsey’s CEO) that provided for, among other things, three guaranteed payments that would be made on December 31, 2001, December 31, 2002 and December 31, 2003, provided that Mr. Klobuchar remained employed by the Company. The payment provided for in the agreement for 2001 was $2,700,000; the bonus payment for 2002 was |

19

| $2,700,000; and the bonus payment for 2003 was $3,600,000. All bonus payments described in the management continuity agreement have now been paid |

(13) | Amounts reported for “Salary” and “Bonus” and “All Other Compensation” were paid by Dempsey & Co. (“Dempsey”) pursuant to compensation arrangements in effect prior to the Company’s acquisition of Dempsey in 2001. These arrangements were replaced by the arrangements included in the Company’s management continuity agreement with Mr. Klobuchar as described in note 12, above. |

(14) | Of this amount, $2,574,503 represents a tax gross-up payment made by Dempsey & Co. to reimburse Mr. Klobuchar for the tax impact of his exercise of an option to purchase and interest in Dempsey & Co. |

(15) | Represents $280,946 for the Company’s contribution to the Supplemental Executive Retirement Plan and $2,884 for employer contributions to the Company’s 401(k) plan. The Company subsequently terminated the SERP with the encouragement of Company management, and the SERP contributions were returned to the Company’s general assets. |

Equity Compensation Plan Information

The following table provides information about the Company’s Common Stock that may be issued upon the exercise of options, warrants and rights under all of our existing equity compensation plans as of December 31, 2003, including the 1996 Stock Incentive Plan, the 1996 Stock Purchase Plan and the 2002 Associate Stock Purchase Plan.

Plan Category (1) | | (a) Number of securities

to be issued upon

exercise of outstanding

options, warrants and

rights | | (b) Weighted-average

exercise price of

outstanding options,

warrants and rights | | (c) Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a)) | |

| |

| |

| |

| |

Equity compensation plans

approved by shareholders | | | 42,406,450 | | | | $ | 11.18 | | | | 28,786,497 | (2) | |

Equity compensation plans not

approved by shareholders (3) | | | 90,000 | | | | $ | 15.00 | | | | — | | |

Total | | | 42,496,450 | | | | $ | 11.19 | | | | 28,786,497 | | |

(1) | In connection with the acquisition of certain wholly-owned subsidiaries of the Company during the period from 1996 through the present, the Company assumed certain outstanding options under certain of the acquired companies’ stock option plans existing at the time of acquisition. The number of shares of the Company’s Common Stock to be issued upon exercise of these outstanding assumed options, warrants and rights is 1,962,175 shares, with a weighted-average exercise price of $4.35. No additional options will be granted under any of the assumed option plans. |

| |

(2) | At the Company’s Annual Meeting of Shareholders, held December 21, 2000, the shareholders approved an amendment to the 1996 Stock Incentive Plan which provides for an automatic increase in the number of shares available for grant under the 1996 Plan in each of the four years beginning in 2002 by an amount equal to 5% of the number of shares of Common Stock of the Company issued and outstanding on the last trading day in December of the immediately preceding year. The number of shares of Common Stock by which the 1996 Plan share reserve was increased in 2002, in accordance with the amendment, was 17,379,624 shares. These shares are included in the table. The number of shares of Common Stock by which the 1996 Plan share reserve was increased in 2003 was 17,902,215 shares. These shares are included in the table. For 2004, the Board of Directors approved a resolution pursuant to which the 2004 evergreen addition was waived for 2004 only. Thus, the 1996 Plan share reserve was not increased in 2004. |

| |

(3) | The Company granted Nonstatutory Stock Options to certain newly-hired executive officers outside of the 1996 Incentive Stock Plan as an inducement to enter into employment contracts with the Company, which shares were registered with the Securities and Exchange Commission on Form S-8 registration statements dated February 11, 1999 and April 18, 2000. Options to purchase 1,300,000 shares were granted, of which options to purchase 90,000 shares are currently outstanding and have not been exercised. Of these, options for 800,000 shares were granted with an exercise price equal to the fair market value on the date of grant while 500,000 shares were granted with exercise prices ranging between a 40% and 50% discount from the fair market value per share on the date of grant. The options were fully vested on the date of grant and have terms ranging between five and ten years. The Company has no current plans to grant stock options outside its shareholder-approved equity compensation plans described above or subsequently adopted by the Board and approved by its shareholders. |

20

Stock Options

The following table contains information concerning the grant of stock options under the Company’s 1996 Stock Incentive Plan for 2003. No stock appreciation rights were granted to those individuals during 2003.

Option/SAR Grants in 2003

| | | | Individual Grants | | | | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for Option

Term ($)(2) | |

| | | |

| | | |

| |

Name | | Number of Securities Underlying Options Granted | | % of total Options Granted to Employees in 2003 | | Exercise Price

(per Share) ($) (1) | | Expiration Date | | 5% | | 10% | |

| |

| |

| |

| |

| |

| |

| |

Christos M. Cotsakos | | | — | | | | — | | | | — | | | | — | | — | | — | |

| | | | | | | | | | | | | | | | | | | | |

Mitchell H. Caplan | | | 1,312,500 | | | | 8.5080 | | | | 7.660 | | | | 06/03/2013 | | 6,322,749.35 | | 16,023,088.26 | |

| | | | | | | | | | | | | | | | | | | | |

R. (Robert) Jarrett

Lilien | | | 937,500 | | | | 6.0772 | | | | 7.660 | | | | 06/03/2013 | | 4,516,249.54 | | 11,445,063.04 | |

| | | | | | | | | | | | | | | | | | | | |

Arlen W. Gelbard | | | 562,500 | | | | 3.6463 | | | | 7.660 | | | | 06/03/2013 | | 2,709,749.72 | | 6,867,037.82 | |

| | | | | | | | | | | | | | | | | | | | |

Louis A. Klobuchar | | | 562,500 | | | | 3.6463 | | | | 7.660 | | | | 06/03/2013 | | 2,709,749.72 | | 6,867,037.82 | |

| | | | | | | | | | | | | | | | | | | | |

Joshua S. Levine | | | 225,000 | | | | 1.4585 | | | | 7.660 | | | | 06/03/2013 | | 1,083,899.89 | | 2,746,815.13 | |

(1) | The exercise price of each option may be paid in cash, in shares of Common Stock valued at fair market value on the exercise date or through a cashless exercise procedure involving the issuance of net shares equal to the difference between the number of options exercised and the shares of Common Stock constructively exchanged. |

| |

(2) | The potential realizable value is reported net of the option price, but before income taxes associated with exercise. These amounts represent assumed annual compounded rates of appreciation at 5% and 10% only from the date of grant to the expiration date of the option. There is no assurance provided to any executive officer or any other holder of the Company’s securities that the actual stock price appreciation over the 10-year option term will be at the assumed 5% and 10% levels or at any other defined level. Unless the market price of the Common Stock does in fact appreciate over the option term, no value will be realized from the option grants made. |

Option Exercises and Holdings

The following table provides information with respect to the Named Executive Officers concerning the exercise of options during 2003 and unexercised options held as of the end of 2003. No stock appreciation rights were exercised during 2003.

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year End

Option/SAR Values

Name | | Number of

Shares

Acquired on

Exercise | | $ Value

Realized(1) | | Number of Securities

Underlying Unexercised

Options/SARs at FY-End | | Value of Unexercised in-the-

Money Options/SARs at

FY-End ($)(2) | | |

| |

|

| |

Exercisable | | Unexercisable | Exercisable | | Unexercisable | |

| |

| |

| |

| |

| |

| |

| | |

| | | | | | | | | | | | | | | | | | | | |

Christos M. Cotsakos | | | 1,899,032 | | $ | 8,041,599.37 | | | 3,500,000 | | | 0 | | $ | 0.00 | | $ | 0.00 | | |

| | | | | | | | | | | | | | | | | | | | |

Mitchell H. Caplan | | | 0 | | | 0.00 | | | 1,785,463 | | | 1,656,199 | | $ | 11,440,074.06 | | $ | 8,581,268.93 | | |

| | | | | | | | | | | | | | | | | | | | |

R. (Robert) Jarrett Lilien | | | 0 | | | 0.00 | | | 890,919 | | | 1,378,418 | | $ | 3,204,445.64 | | $ | 6,693,466.08 | | |

| | | | | | | | | | | | | | | | | | | | |

Arlen W. Gelbard | | | 0 | | | 0.00 | | | 275,080 | | | 594,250 | | $ | 1,655,013.50 | | $ | 2,936,684.00 | | |

| | | | | | | | | | | | | | | | | | | | |

Louis A. Klobuchar | | | 0 | | | 0.00 | | | 57,250 | | | 584,250 | | $ | 432,407.50 | | $ | 2,979,847.50 | | |

| | | | | | | | | | | | | | | | | | | | |

Joshua S. Levine | | | 0 | | | 0.00 | | | 1,165,160 | | | 457,449 | | $ | 3,842,756.07 | | $ | 2,608,293.93 | | |

21

| |

(1) | Equal to the fair market value of the purchased shares on the option exercise date less the exercise price paid for those shares. |

| |

(2) | Based on the market price, as applicable, of $12.670 per share, which was the average of the high and low selling price per share of the Company’s Common Stock on the New York Stock Exchange on the last trading day of 2003 (December 31, 2003). |

Compensation Committee Report on Executive Compensation

Compensation Committee Charter

The Compensation Committee is responsible for establishing and administering compensation programs for the senior executives of the Company, including those programs in which the Company’s Named Executive Officers participate. However, while the Committee is responsible for reviewing CEO compensation and making recommendations to the full Board, the full Board retains the exclusive authority to take any action affecting the compensation of the CEO. Each and every member of the Compensation Committee is independent within the meaning of the Company’s Corporate Governance Guidelines and the guidelines established by the New York Stock Exchange. The Compensation Committee has full authority to retain any consultant(s) it deems appropriate, and the Committee regularly reviews its consulting relationships to ensure they are optimally effective.

Compensation Philosophy

The Company operates its business in an industry and in geographic areas in which the demand for top level executive talent is extremely high. Consequently, the Company strives to provide competitive compensation, using both annual and long term incentives as tools to retain senior talent and to optimize their performance. Because the Company is uniquely positioned as a high growth, diversified financial services company delivering its products and services primarily through the use of technology, it is difficult to determine precise competitors. Executive talent may be recruited by either or both of diversified financial services companies or technology companies. During 2003, members of the Committee worked with and evaluated significant market information gathered with the assistance of its outside compensation consultant Pearl Meyer & Partners, to establish proposed comparator companies. After a thorough review and evaluation, including several formal and informal meetings and discussions both together and without assistance from Pearl Meyer & Partners, the Committee determined that the appropriate set of comparator companies to be used as a reference in reviewing and evaluating compensation programs for the Company’s senior executives are high growth companies in the brokerage industry with revenues and/or earnings that are comparable to the Company’s. The Committee used this comparator group, together with an individualized analysis of the responsibilities and performance of each of the senior executives, to determine the compensation appropriate for each individual. The Committee recognizes that the Company’s more direct competitors for executive talent are not exclusively its primary peer companies or companies that would be included in a peer group established to compare shareholder returns on investment. Thus, the compensation peer group is not the same as the peer group index in the Comparison of Five Year Cumulative Total Return graph included in this Proxy Statement.

The Company’s Named Executive Officers generally participate in the same compensation plans as all other Company employees. These plans generally include a base salary, an annual cash bonus potential, and equity compensation programs. The base salary constitutes just one portion of overall compensation for the Named Executive Officers and is periodically reviewed by the Committee and/or the full Board (in the case of the CEO).

The cash bonus potential is primarily designed to ensure that senior executives achieve annual objectives that drive the creation of long term value for shareholders. Bonuses are administered through the Employee Bonus

22

Program. This program was approved by shareholders in 2000 and is a performance based compensation program for purposes of Section 162(m) of the Internal Revenue Code. For 2003, the Committee, with the assistance of its compensation consultants, evaluated various approaches to the establishment of payout targets. Ultimately the Committee determined to establish a bonus pool for senior executives, equal to the sum of bonus targets for the senior executives at various levels of performance. The Committee established four separate performance levels and established bonus pool targets for each level. The Committee established four criteria to be utilized in determining bonus: revenues; earnings per share from ongoing operations; cash generated from operations; and overall effectiveness of management. These criteria were selected because the Committee considered them the most essential drivers of the business during 2003 and are in contrast to the approach taken in prior years, in which the Company used a single criteria (earnings per share from ongoing operations, a non-GAAP measure) to determine achievement of bonus targets.

For 2004, the Committee has established five criteria upon which performance will be measured: revenues; earnings per share as reported under generally accepted accounting principles; cash generated from operations; certain market share metrics; and overall effectiveness of management.

The Committee believes strongly that equity compensation is the most effective tool available to ensure that senior executives remain focused on creating long term value for shareholders. Equity compensation is administered primarily through the Company’s 1996 Stock Incentive Plan. In addition, senior executives may participate in the Company’s 2002 Associate Stock Purchase Plan which allows employees of the Company to purchase shares of the Company’s stock at a discount, as provided under Section 423 of the Internal Revenue Code. No equity incentives were awarded to the Company’s senior executives at any time during 2002. Consequently, for 2003 the Compensation Committee and the Board determined to make somewhat larger equity awards than would otherwise have been made to ensure that the interests of senior executives remain properly focused on creating long term shareholder value. Awards of both stock options and restricted stock were made. Stock options were subject to the Company’s standard vesting schedule, providing for vesting in four equal annual installments. Vesting for restricted stock awards occurs in one “cliff” on the five year anniversary date of the grant. Prior to that time, there is no vesting absent a special acceleration event as described in the “Employment Contracts, Termination of Employment and Change in Control Arrangements” below.

Compensation for 2003 for Named Executive Officers other than CEO

As discussed above, compensation for the Named Executive Officers other than the Chief Executive Officer was comprised of three basic elements: base salary, a cash bonus opportunity under the Company’s Employee Bonus Program and long term incentives under the 1996 Stock Incentive Plan. For 2003 the programs were administered as follows:

Base Salaries

In February 2003, Mr. Lilien was appointed as President and Chief Operating Officer, and Mr. Klobuchar was appointed as Chief Brokerage Officer. At the time of these appointments there were no modifications to base salary, as the Compensation Committee was undertaking a comprehensive review of compensation programs for all senior executives. After the Committee completed its review in June 2003, Mr. Lilien’s salary was set at $650,000 and Mr. Klobuchar’s salary was set at $575,000, as was the salary of Mr. Gelbard, the Chief Banking Officer. No other changes were made to the base salaries of any of the Named Executive Officers in 2003.

Bonus Program

Each of the Named Executive Officers has participated in the Company’s Employee Bonus Program. Based on the performance achieved, the Company’s senior executives, including the Named Executive Officers, could receive a performance bonus, measured as a multiple of base salary. For Messrs. Lilien, Klobuchar and Gelbard, the bonus payment targets ranged from one to five times base salary, depending on performance achieved. For Mr. Levine, the bonus payment targets ranged from one to two times base salary, depending on performance achieved.

23

As discussed above, performance thresholds were established for four separate criteria. For each of the four performance criteria, the Company’s actual performance in 2003 exceeded the highest target established. Because the Company performed at this level, Messrs. Lilien, Klobuchar and Gelbard each earned a bonus equal to approximately five times base salary and Mr. Levine earned a bonus equal to approximately two times his base salary. These bonuses were paid in February, 2004. The Summary Compensation Table, above, has reported bonuses on an “accrual” basis to provide shareholders with the most recent compensation information. In prior years, the Company reported bonuses only on a “cash paid” basis. The result of reporting in this manner would be that bonuses for performance in 2003 and paid in 2004 would not be reported until the proxy statement filed in 2005.

Equity Compensation

The Committee (and the full Board, in the case of the CEO) awards grants of stock options and restricted stock to its senior executives, including the Named Executive Officers, both as a reward for past performance and as a retention tool. Typically, awards are made on an annual basis; however, in 2002 there were no equity compensation awards. In June 2003, following a thorough review of all compensation programs for senior executives, the Compensation Committee made awards of stock options and restricted stock to the Company’s senior executives, including the Named Executive Officers. The awards are reported in the Summary Compensation Table, above.

Compensation for the Chief Executive Officer

The CEO has participated in all programs applicable to the remainder of the Company’s senior executives; there are no programs uniquely available to the CEO. In January 2003, when Mr. Caplan was named CEO, there was no modification to his base salary from his prior position as President and Chief Operating Officer as the Compensation Committee and full Board reviewed compensation programs for all senior executives. Following that review, in June 2003 Mr. Caplan’s salary was set at $750,000. Mr. Caplan also participated in the Employee Bonus Program, with the same performance targets applicable for the four categories listed above. As it was for Messrs. Lilien, Klobuchar and Gelbard, the bonus payment targets for Mr. Caplan ranged from one to five times base salary, depending on performance. As for the other individuals, because performance in all categories exceeded the highest performance targets, Mr. Caplan earned a bonus equal to five times base salary. Similarly, just as equity compensation was reviewed for all other senior executives, so were Mr. Caplan’s equity compensation incentives reviewed in early 2003 and the Board approved awards of stock options and restricted stock as reported in the Summary Compensation Table, above.

Deduction Limit for Executive Compensation. Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to publicly-held companies for compensation paid to certain executive officers, to the extent that compensation exceeds $1.0 million per officer in any year. In calendar year 2000, the Company’s shareholders approved a performance-based bonus plan that would allow the amounts paid under the bonus plan to qualify for tax deduction. While the Company does follow the terms of that plan, the Committee and the Company continue to believe that it is important to retain discretion over the compensation paid to the Company’s executive officers, and may elect to make certain awards outside of, or in addition to, the awards provided for in the plan. The Company and the Committee would make such awards only if they believe that those awards are in the long term interests of the Company’s shareholders.

In addition, the Company’s 1996 Stock Incentive Plan is structured so that any compensation deemed paid to an executive officer in connection with the exercise of his or her outstanding options under the 1996 Stock Incentive Plan will qualify as performance-based compensation not subject to the $1.0 million limitation. However, the Committee generally reserves the right to pay amounts of compensation that may not be fully deductible if it believes that it is in the Company’s best interests to do so.

Submitted by Compensation Committee of the Board of Directors.

C. Cathleen Raffaeli, Chair

Michael K. Parks

Donna L. Weaver

24

Retirement Benefits

In October 2000, the Compensation Committee approved the adoption of a Supplemental Executive Retirement Plan (“SERP”), effective January 1, 2001. The purpose of the SERP was to attract, retain and motivate executive officers of the Company and to provide those executive officers with flexibility to meet their retirement and estate planning needs. The Board reviewed this program in late 2002 and early 2003 and, with the consent and full support of the Company’s management in place in April 2003, ultimately determined that the program was no longer appropriate in light of the business and economic conditions the Company faced. Consequently, the Board elected to terminate the SERP, effective April 30, 2003. All assets remaining in the SERP were removed and the plan was then terminated. The Company has no other retirement plan or benefit arrangements in place with any senior executives other than the Company’s 401(k) Plan, which is available to all employees.

Employment Contracts, Termination of Employment and Change in Control Arrangements

Prior to May 2002, the Company had been a party to multiple employment contracts with its Chairman and CEO. Effective May 15, 2002, the Company entered into a new employment agreement with Mr. Cotsakos (the “2002 Agreement”). The 2002 Agreement provided that Mr. Cotsakos would receive a base salary of zero dollars for at least one year, and a target bonus of $4 million. The 2002 Agreement also provided for a severance payment of $4 million in the event of a termination of employment, regardless of whether such termination was in connection with certain changes in ownership or control of the Company.

In January 2003, in connection Mr. Costakos’ separation from employment, the Company agreed to pay Mr. Cotsakos a $4 million severance (as provided in the 2002 Agreement), continuation of certain health and insurance benefits (if he paid the premiums) and a distribution of $5.1 million in vested SERP benefits. The Company also agreed to extend the exercise date of Mr. Cotsakos’s vested stock options for one year. The Company paid the first $1 million installment of Mr. Cotsakos’s severance payments on January 23, 2003, but subsequently a dispute arose between the parties as to certain corporate charitable contributions and the personal use of corporate aircraft, the value of which exceeded the remaining severance payments. Each party felt that its position was justified, and in December 2003 the parties entered into a settlement agreement (the “Settlement Agreement”) that resolved all issues. Pursuant to the terms of the Settlement Agreement, Mr. Costakos waived his right to receive the remaining $3 million in severance payments and paid the Company approximately $1.6 million. The Settlement Agreement also contained releases, indemnities and certain other standard provisions.

Effective October 1, 2001, the Company entered into employment agreements with Mitchell H. Caplan, who was then the Company’s Chief Financial Products Officer; R. (Robert) Jarrett Lilien, who was then the Company’s Chief Brokerage Officer; and Joshua S. Levine, the Company’s Chief Technology and Administrative Officer (the “Executive Employment Agreements”). Effective May 1, 2002, the Company entered into an employment agreement in the identical form with Arlen W. Gelbard when he was appointed Chief Banking Officer. Collectively, these are referred to as the “Executive Employment Agreements.” The Executive Employment Agreements superseded all other employment agreements between the executives and the Company. Each of the Executive Employment Agreements provides that the respective executive is eligible to participate in the Company’s bonus plan, which may be modified as determined by the Compensation Committee. Each is also entitled to participate in the Company’s general benefit plans. Each of the agreements also provided that in the event of a Change in Control of the Company (as defined in the Executive Employment Agreements), all stock options held by the executive that are outstanding but unvested would become immediately and fully vested. Effective January 22, 2003, the Company and the executives entered into Amendments to each of the Executive Employment Agreements that eliminated this “single trigger” acceleration; no other provisions of the agreements were affected. Rather, in the event that the executive’s employment is involuntarily terminated (as defined in the Executive Employment Agreements) less than 60 days before or within three years after a Change in Control of the Company (as defined in the Executive Employment Agreements), the executive is entitled to: (i) severance payments equal to two years’ base salary and two years’ bonus calculated at the target bonus rate of three times base salary; (ii) continuation of health care, life insurance and certain other benefits (or, at the Company’s discretion, a lump sum payment sufficient to allow the executive to obtain such benefits on his own) for an additional two years; and (iii) outplacement services valued at a minimum of $40,000, plus attendant office facilities and administrative support. In the event that the executive’s employment is involuntarily terminated (as defined in the Executive Employment Agreements) in

25

circumstances other than those relating to a Change in Control, the executive is entitled to: (i) severance payments equal to one year’s base salary (with no bonus payment); and (ii) continuation of health care, life insurance and certain other benefits (or, at the Company’s discretion, a lump sum payment sufficient to allow the executive to obtain such benefits on his own) for an additional one year. The current base salary for Mr. Caplan is $750,000; the current base salary for Mr. Lilien is $650,000, and the current base salaries for Mr. Gelbard and Mr. Levine is $575,000.

When Mr. Caplan was promoted to the position of Chief Executive Officer, the Company further amended his employment agreement to provide that, if prior to January 23, 2005, Mr. Caplan does not remain in the position of Chief Executive Officer, the Company would pay him a severance payment equal to the greater of: the base salary Caplan would have otherwise received through January 23, 2005 or one year’s base salary. When Mr. Lilien was promoted to the position of President and Chief Operating Officer, the Company made no changes to his Executive Employment Agreement.

Further, the Company has entered into Management Retention Agreements, covering all other executive officers. The agreements provide that if the executive officer is involuntarily terminated (as defined in the Management Retention Agreement) within 60 days prior to or within 18 months following an occurrence of a Change of Control (as defined in the Management Retention Agreement), then the executive shall be entitled to receive a severance payment equal to two years’ base salary and two years’ bonus calculated at the target bonus rate for the officer.

Outstanding options held by the Named Executive Officers, as well as other employees, are subject to a Special Addendum to Stock Option Agreement that provides that unvested options will automatically vest in full and all unvested shares of Common Stock held by such individuals subject to direct issuance made under the 1996 Plan will immediately vest in full in the event of the termination of the officer’s employment within eighteen months following: (i) a Corporate Transaction (as defined in the 1996 Plan); or (ii) a Change in Control.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is currently composed of Cathleen Raffaeli, Michael Parks and Donna Weaver. For a portion of 2003, prior to his resignation from the Board, Vaughn Clarke served as a member of the Committee. None of these individuals was at any time during 2003 or at any other time, an officer or employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Certain Relationships and Related Transactions

In the ordinary course of its business, E*TRADE Securities LLC has made margin loans to directors or executive officers. No margin loans were used to purchase Company stock. All margin loans are on terms and conditions no more favorable than terms offered to customers of the Company and did not involve more than the normal risk of collectability or present other unfavorable features.

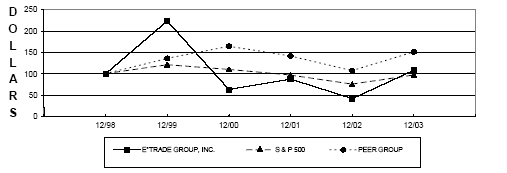

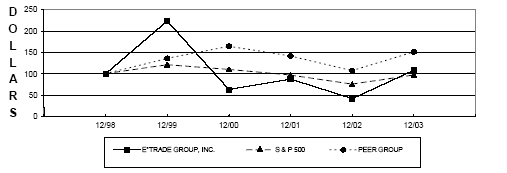

Performance Graph

The following performance graph shows the cumulative total return to a holder of the Company’s Common Stock, assuming dividend reinvestment, compared with the cumulative total return, assuming dividend reinvestment, of the Standard & Poor’s 500 and the Standard & Poor’s Supercap Composite Diversified Financial Services Index during the period from December 31, 1998 through December 31, 2003.

26

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG E*TRADE FINANCIAL CORPORATION., THE S & P

AND A PEER GROUP

* $100 invested on 12/31/98 in stock or index-including reinvestment of dividends. Fiscal year ending December 31.

| | 12/98 | | 12/99 | | 12/00 | | 12/01 | | 12/02 | | 12/03 | |

| |

| |

| |

| |

| |

| |

| |

E*TRADE FINANCIAL CORPORATION | | $ | 100 | | $ | 223.38 | | $ | 63.06 | | $ | 87.64 | | $ | 41.56 | | $ | 108.16 | |

S&P 500 | | $ | 100 | | $ | 121.04 | | $ | 110.02 | | $ | 96.95 | | $ | 75.52 | | $ | 97.18 | |

S&P SUPERCAP COMPOSITE DIVERSIFIED

FINANCIAL SERVICES | | $ | 100 | | $ | 135.76 | | $ | 164.45 | | $ | 141.51 | | $ | 107.05 | | $ | 151.34 | |

|

• | $100 invested on 12/31/98 in stock or index, including reinvestment of dividends. |

• | © 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership of Common Stock and other equity securities of the Company with the Securities and Exchange Commission (the “SEC”). Officers, directors and beneficial owners of more than 10% of any class of the Company’s equity securities are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely upon review of the copies of such reports furnished to the Company and written representations that no other reports were required, the Company believes that during the fiscal year ended December 31, 2003, all filing requirements under Section 16(a) applicable to its officers, directors, and greater than 10% beneficial owners were complied with except as follows: Due to administrative error, the Company was late in filing a report reflecting the grant of 20,081 shares of restricted stock to Mr. George Hayter, the Chairman of the Board of Directors, on April 23, 2003. When the error was discovered, the issuance was reported on January 2, 2004. The Company’s intention to make this grant was disclosed in the Company’s proxy statement filed April 29, 2003.

27

SHAREHOLDER PROPOSALS

Shareholder proposals intended to be included in the Company’s proxy statement may be submitted for inclusion after the meeting to be held on May 27, 2004, but must be received by the Company no later than December 22, 2004. If the Company is notified of a shareholder proposal within the period beginning April 7, 2003 and ending on May 27, 2004, such notice will be considered untimely and the proxies held by management of the Company provide such proxy holders the discretionary authority to vote against such shareholder proposal even if the shareholder proposal is not discussed in the proxy statement. The proposal must be mailed to the Company’s principal executive offices, 135 E. 57th Street, Suite 31, New York, New York 10022, Attention: Russell S. Elmer, Corporate Secretary. Such proposals may be included in next year’s proxy statement if they comply with certain rules and regulations promulgated by the Securities and Exchange Commission.

Under the terms of the Company’s Bylaws, shareholders who intend to present an item of business at the 2005 Annual Meeting of Shareholders (other than a proposal submitted for inclusion in the Company’s proxy materials) must provide notice of such business to the Corporate Secretary no earlier than November 22, 2004 and no later than December 22, 2004, as set forth more fully in such Bylaws.

28

AUDIT COMMITTEE REPORT

The information contained in this report shall not be deemed to be “soliciting material” or “filed” or incorporated by reference in future filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates it by reference into a document filed under the Securities Act of 1933, as amended, or the Exchange Act.

In accordance with its amended and restated written charter (a copy of which is attached hereto asAppendix A)as adopted by the Board of Directors (the “Board”), the Audit Committee of the Board (the “Committee”) assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company. During the year ended December 31, 2003, the Committee met thirteen times, and the Committee chair, as representative of the Committee, discussed the interim financial information contained in each quarterly earnings announcement with the Company’s Chief Financial Officer and independent auditors prior to public release. The Audit Committee is entirely made up of independent directors as defined in the New York Stock Exchange Listing Standards. These independent directors meet in executive session with the Company’s independent and internal auditors without management on at least a quarterly basis.

In discharging its oversight responsibility as to the audit process, the Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with the auditors any relationships that may impact their objectivity and independence, including whether the independent auditors’ provision of non-audit services to the Company is compatible with the auditors’ independence, and satisfied itself as to the auditors’ independence. The Committee also discussed with management, the internal auditors and the independent auditors the quality and adequacy of the Company’s internal controls and the internal audit function’s organization, responsibilities, budget and staffing. The Committee reviewed with both the independent and the internal auditors their audit plans, audit scope, and identification of audit risks.

The Committee discussed and reviewed with the independent auditors all communications required by generally accepted accounting standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements. The Committee also discussed the results of internal audit examinations.

The Committee reviewed and discussed the audited financial statements of the Company as of and for the year ended December 31, 2003, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission. The Committee also recommended the reappointment, subject to shareholder ratification, of the independent auditors, and the Board concurred in such recommendation.

Submitted by the Audit Committee of the Company’s Board of Directors:

| Michael K. Parks (Chair) |

| Lewis E. Randall |

| Lester C. Thurow |

| Donna L. Weaver |

29

FORM 10-K

The Company filed an Annual Report on Form 10-K for the year ended December 31, 2003 with the Securities and Exchange Commission on March 11, 2003. Shareholders may obtain a copy of this report without charge on its website or by writing to Russell S. Elmer, Corporate Secretary, at the Company’s principal offices located at 135 E. 57th Street, 31st Floor, New York, New York 10022.

OTHER MATTERS

Management does not know of any matters to be presented at this Annual Meeting other than those set forth herein and in the Notice accompanying this Proxy Statement.

30

APPENDIX A: Audit Committee Charter

AMENDED AND RESTATED AUDIT COMMITTEE CHARTER

E*TRADE Financial Corporation

A Delaware corporation

(the “Company”)

Audit Committee Charter

This charter was adopted by the Board of Directors of the Company on January 22, 2003.

Purpose

The Audit Committee (the “Committee”) is created by the Board of Directors of the Company to serve as an independent and objective party to monitor the Company’s financial reporting process and internal control system and to provide an open avenue of communication among the independent auditors, financial and senior management and the Board of Directors.

The Committee shall assist the Board in its oversight of:

| • | the integrity of the financial statements of the Company; |

| | |

| • | the qualifications, independence and performance of the Company’s independent auditor; |

| | |

| • | the performance of the Company’s internal audit function; and |

| | |

| • | compliance by the Company with legal and regulatory requirements. |

The Committee shall prepare the audit committee report that Securities and Exchange Commission rules require to be included in the Company’s annual proxy statement.

Membership

The Committee shall consist of at least three members, each of whom is “independent” according to the standards of the New York Stock Exchange and the Company (to the extent the Company maintains requirements that are more stringent). The Nominating and Corporate Governance Committee of the Company (the “Governance Committee”) shall recommend nominees for appointment to the Committee annually and as vacancies or newly created positions occur. Committee members shall be appointed by the Board annually and may be removed by the Board at any time. The Board shall designate the Chair of the Committee.

Authority and Responsibilities

In addition to any other responsibilities which may be assigned from time to time by the Board, the Committee is authorized to undertake, and has responsibility for, the following matters.

31

Independent Auditors

| The Committee has the sole authority to retain and terminate the independent auditors of the Company (subject, if applicable, to shareholder ratification), including sole authority to approve all audit engagement fees and terms and all non-audit services to be provided by the independent auditors. The Committee must pre-approve each such non-audit service to be provided by the Company’s independent auditors. The Committee may consult with management in the decision making process, but may not delegate this authority to management. The Committee may, from time to time, delegate its authority to approve non-audit services on a preliminary basis to one or more Committee members, provided that such designees present any such approvals to the full Committee at the next Committee meeting. |

|

The Committee shall review and approve the scope and staffing of the independent auditors’ annual audit plan(s). |

|

| The Committee shall evaluate the independent auditors’ qualifications, performance and independence, and shall present its conclusions and recommendations with respect to the independent auditors to the full Board on at least an annual basis. As part of such evaluation, at least annually, the Committee shall: |

| • | obtain and review a report from the Company’s independent auditors: |

| | |

| | • | describing the independent auditor’s internal quality-control procedures; |

| | | |

| | • | describing any material issues raised by (i) the most recent internal quality-control review or peer review of the independent auditor, or (ii) any inquiry or investigation by governmental or professional authorities, within the preceding five years, regarding one or more independent audits carried out by the auditing firm; and any steps taken to deal with any such issues; |

| | | |

| | • | describing all relationships between the independent auditor and the Company; and |

| | | |

| | • | assuring that Section 10A of the Securities Exchange Act of 1934 has not been implicated; |

| | | |

| • | evaluate the adequacy of the auditors’ quality-control procedures and their compliance with such controls; |

| | |

| • | review and evaluate the senior members of the independent auditor team, particularly the lead audit partner; |

| | |

| • | consider whether the lead audit partner or the audit firm should be rotated in addition to the rotation of the lead audit or reviewing partner as required by law, so as to assure continuing auditor independence; and |

| | |

| • | obtain the opinion of management and the internal auditors of the independent auditor’s performance. |

| | | | |

| The Committee shall establish clear policies for the Company’s hiring of employees or former employees of the independent auditors. |

|

Internal Auditors |

|

| At least annually, the Committee shall evaluate the performance, responsibilities, budget and staffing of the Company’s internal audit function and review the annual internal audit plan. Such evaluation shall include a review of the responsibilities, budget and staffing of the Company’s internal audit function with the independent auditors. The primary function of the Internal Audit Department shall be to assist the Audit Committee in fulfilling its oversight responsibilities by reviewing, in detail and on an on-going, daily basis: |

32

| the financial reports and other financial information provided by the Company to any governmental body or the public; the Company’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established; and the Company’s auditing, accounting and financial reporting processes generally. |

|

At least annually, the Committee shall evaluate the performance of the senior internal auditing executive. |

|

Financial Statements; Disclosure and Other Risk Management and Compliance Matters |

|

| The Committee shall review with management, the internal auditors and the independent auditor, in separate meetings if the Committee deems it appropriate: |

| • | the annual audited financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis and Analysis of Financial Condition and Results of Operations”, prior to the filing of the Company’s Form 10-K; |

| | |

| • | the quarterly financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis and Analysis of Financial Condition and Results of Operations”, prior to the filing of the Company’s Form 10-Q; |

| | |

| • | any analyses or reports prepared by management, the internal auditors and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements; |

| | |

| • | the critical accounting policies and practices of the Company; |

| | |

| • | the effect of regulatory and accounting initiatives (including any SEC investigations or proceedings) on the financial statements of the Company; |

| | |

| • | the effect of off-balance sheet structures on the financial statements of the Company; and |

| | |

| • | any major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company’s selection or application of accounting principles. |

| | | |

The Committee shall review, in conjunction with management, the Company’s policies with respect to the Company’s earnings press releases and all financial information, such as earnings guidance, provided to analysts and rating agencies, including the types of information to be disclosed and the types of presentation to be made and paying particular attention to the use of “pro forma” or “adjusted” “non-GAAP” information.

The Committee shall review periodically with the General Counsel, legal and regulatory matters that may have a material impact on the Company’s financial statements, compliance policies and programs.

The Committee shall, in conjunction with the CEO and CFO of the Company, periodically review the Company’s internal controls (including computerized information system controls and security) and disclosure controls and procedures, including whether there are any significant deficiencies in the design or operation of such controls and procedures, material weaknesses in such controls and procedures, any corrective actions taken with regard to such deficiencies and weaknesses and any fraud involving management or other employees with a significant role in such controls and procedures.

The Committee shall review and discuss with the independent auditor any audit problem or difficulties and management’s response thereto; including those matters required by Statement on Auditing Standards No. 61, including the following:

| • | any restrictions on the scope of the independent auditor’s activities or access to requested information; |

33

| • | any accounting adjustments that were noted or proposed by the auditor but were “passed” (as immaterial or otherwise); |

| | |

| • | any communications between the audit team and the audit firm’s national office regarding auditing or accounting issues presented by the engagement; |

| | |

| • | any management or internal control letter issued, or proposed to be issued, by the auditor; and |

| | |

| • | any significant disagreements between the Company’s management and the independent auditor. |

| The Committee shall review the Company’s policies and practices with respect to risk assessment and risk management, including discussing with management and the internal auditors the Company’s major financial risk exposures and the steps that have been taken to monitor and control such exposures. |

The Committee shall establish and oversee procedures for:

| • | the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and |

| | |

| • | the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| The Committee shall prepare the audit committee report that Securities and Exchange Commission rules require to be included in the Company’s annual proxy statement. |

|

Reporting to the Board |

|

| The Committee shall report to the Board at least quarterly. This report shall include a review of any issues that arise with respect to the quality or integrity of the Company’s financial statements, the Company’s compliance with legal or regulatory requirements, the performance and independence of the Company’s independent auditors, the performance of the internal audit function and any other matters that the Committee deems appropriate or is requested to be included by the Board. |

|

At least annually, the Committee shall arrange for the independent auditors to be available to the full Board. |

|

| At least annually, the Committee shall review and assess the adequacy of this charter and recommend any proposed changes to the Board for approval. |

|

At least annually, the Committee shall evaluate its own performance and report to the Board on such evaluation. |

Procedures

The Committee shall meet as often as it determines is appropriate to carry out its responsibilities under this charter, but not less frequently than quarterly. Special meetings may be held from time to time pursuant to the call of the Chair of the Committee. The Chair of the Committee, in consultation with the other committee members, shall determine the frequency and length of the committee meetings, shall set meeting agendas consistent with this charter and shall, when present, preside at the meetings of the Committee. In lieu of a meeting, the Committee may also act by unanimous written consent resolution. The Committee shall designate a person (who need not be a member of the Committee) to keep minutes of its meetings. The minutes shall be retained by the Corporate Secretary of the Company.

At least quarterly, the Committee shall meet separately with management, with internal auditors or other personnel responsible for the internal audit function and with the independent auditor.

34

The Committee is authorized (without seeking Board approval) to retain special legal, accounting or other advisors and may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to meet with any members of, or advisors to, the Committee. The Committee may also meet with the Company’s investment bankers or financial analysts who follow the Company.

The Committee may, to the full extent permitted by applicable law and regulation, delegate its authority to subcommittees of the Committee when it deems appropriate and in the best interests of the Company.

Limitations Inherent in the Audit Committee’s Role

It is not the duty of the Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and are in accordance with GAAP. This is the responsibility of management and the independent auditor. It is also not the duty of the Committee to conduct investigations, to resolve disagreements, if any, between management and the outside auditors or to assure compliance with laws and regulations and the Company’s policies generally. Furthermore, it is the responsibility of the CEO and senior management to avoid and minimize the Company’s exposure to risk, and while the Committee is responsible for reviewing with management the guidelines and policies to govern the process by which risk assessment and management is undertaken, it is not the sole body responsible.

END APPENDIX A

35

| VOTE BY INTERNET -www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

E*TRADE FINANCIAL CORPORATION

135 E. 57TH STREET

NEW YORK, NY 10022 |

| |

| VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. |

| |

| VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we’ve provided or return to E*TRADE Financial Corporation, c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

| |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | ETRADE | KEEP THIS PORTION FOR YOUR RECORDS |

| | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

E*TRADE FINANCIAL CORPORATION |

|

|

|

| | |

| | | | | | |

| 1. | Election of Directors: | | For

All | Withhold

All | For All

Except | | To withhold authority to vote, mark “For All Except”

and write the nominee’s number on the line below. | |

| | 01) Ronald D. Fisher | | | | | | |

| | 02) George A. Hayter | | ¡ | ¡ | ¡ | | ____________________________________________ |

| | 03) Donna L. Weaver | | | | | | |

| | |

| | |

| | For | Against | Abstain | |

| Vote On Proposal | | | | |

| | | | | | |

| 2. | To ratify the selection of Deloitte & Touche LLP as independent public accountants for the Company for fiscal year 2004. | ¡ | ¡ | ¡ | |

| | | | | | |

| 3. | To act upon such other business as may properly come before the meeting or any adjournment or postponement thereof. | | | | |

| | |

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NOS. 1 AND 2. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTEDAS SPECIFIED ABOVE. IN THE ABSENCE OF CONTRARY INSTRUCTIONS, THIS PROXY WILL BE VOTED FOR PROPOSAL NOS. 1 AND 2. | | | | |

| |

| PLEASE COMPLETE, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE. | | | | |

| |

| For comments, please check this box and write them on the

back where indicated | ¡ | |

| |

| Please indicate if you plan to attend this meeting | | ¡ | | ¡ | |

| |

| | | Yes | | No | |

| |

| | | | | | | | | |

| | | | | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | | | | Signature (Joint Owners) | Date | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

| | |

| COMMON STOCK | |

| | |

| PROXY FOR ANNUAL MEETING OF SHAREHOLDERS

MAY 27, 2004 | |

| | |

| THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS | |

| | |

| The undersigned hereby appoints Mr. George Hayter, Mr. Mitchell H. Caplan, Mr. Russell S. Elmer and Mr. Robert J. Simmons, and each or any of them, as Proxies of the undersigned, with full power of substitution, and hereby authorizes them to represent and to vote, as designated on the reverse side, all of the shares of Common Stock of E*TRADE Financial Corporation, held of record by the undersigned on April 5, 2004 at the Annual Meeting of Shareholders of E*TRADE Financial Corporation to be held May 27, 2004, or at any postponement or adjournment thereof. | | |

| | |

| PLEASE SIGN EXACTLY AS YOUR NAME(S) IS (ARE) SHOWN ON THE SHARE CERTIFICATE TO WHICH THE PROXY APPLIES. WHEN SHARES ARE HELD BY JOINT TENANTS, BOTH SHOULD SIGN. WHEN SIGNING AS AN ATTORNEY, EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE GIVE FULL TITLE AS SUCH. IF A CORPORATION, PLEASE SIGN IN FULL CORPORATE NAME BY PRESIDENT OR OTHER AUTHORIZED OFFICER. IF A PARTNERSHIP, PLEASE SIGN IN PARTNERSHIP NAME BY AUTHORIZED PERSON. | | |

| | |

| | |

Comments:

|

| | | |

| | |

| | | |

| | |

| | | |

|

(If you noted any Comments above, please mark corresponding box on the reverse side.)

| |

| | |

| | | |