| Fund (Class) | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

| Driehaus Emerging Markets Growth Fund (Institutional Class/DIEMX) | $52 | 0.99% |

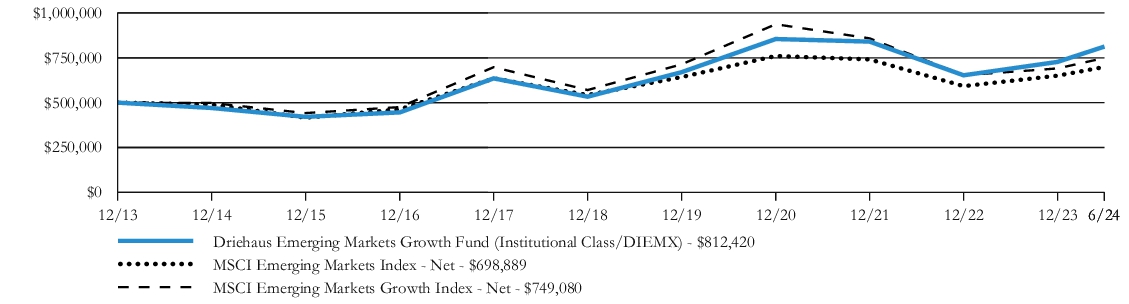

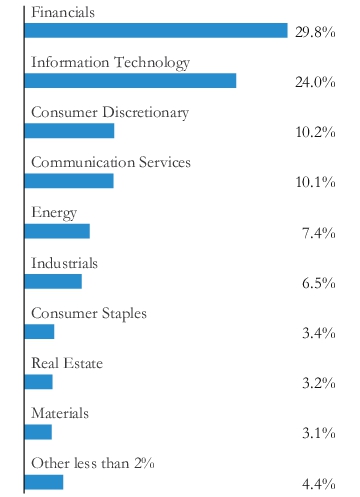

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Emerging Markets Growth Fund (Institutional Class/DIEMX) | 16.96% | 5.75% | 4.59% |

| MSCI Emerging Markets Index - Net | 12.55% | 3.10% | 2.79% |

| MSCI Emerging Markets Growth Index - Net | 11.08% | 3.18% | 3.51% |

| Fund net assets | $3,106,022,559% |

| Total number of portfolio holdings | $122% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $63% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - SP ADR | 8.5% |

| Tencent Holdings Ltd. | 6.6% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 6.5% |

| Samsung Electronics Co. Ltd. | 5.7% |

| ICICI Bank Ltd. - SP ADR | 2.5% |

| SK Hynix, Inc. | 1.8% |

| Reliance Industries Ltd. | 1.7% |

| Tencent Music Entertainment Group - ADR | 1.5% |

| Shell PLC | 1.4% |

| PetroChina Co. Ltd. - H | 1.4% |

| Fund (Class) | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

| Driehaus Emerging Markets Growth Fund (Investor Class/DREGX) | $65 | 1.23% |

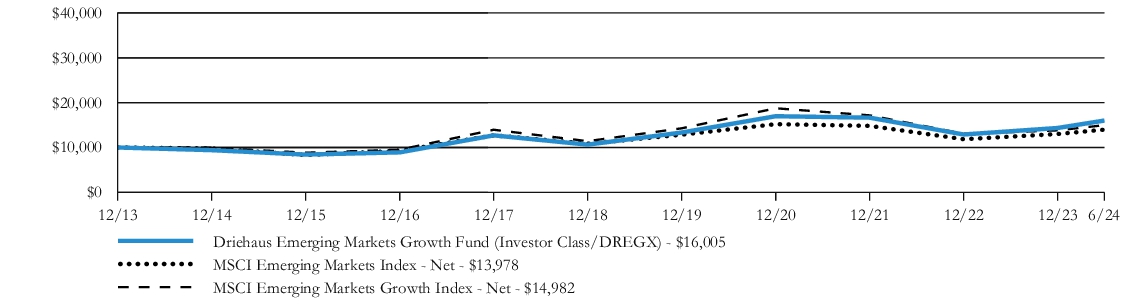

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Emerging Markets Growth Fund (Investor Class/DREGX) | 16.69% | 5.51% | 4.43% |

| MSCI Emerging Markets Index - Net | 12.55% | 3.10% | 2.79% |

| MSCI Emerging Markets Growth Index - Net | 11.08% | 3.18% | 3.51% |

| Fund net assets | $3,106,022,559% |

| Total number of portfolio holdings | $122% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $63% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - SP ADR | 8.5% |

| Tencent Holdings Ltd. | 6.6% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 6.5% |

| Samsung Electronics Co. Ltd. | 5.7% |

| ICICI Bank Ltd. - SP ADR | 2.5% |

| SK Hynix, Inc. | 1.8% |

| Reliance Industries Ltd. | 1.7% |

| Tencent Music Entertainment Group - ADR | 1.5% |

| Shell PLC | 1.4% |

| PetroChina Co. Ltd. - H | 1.4% |

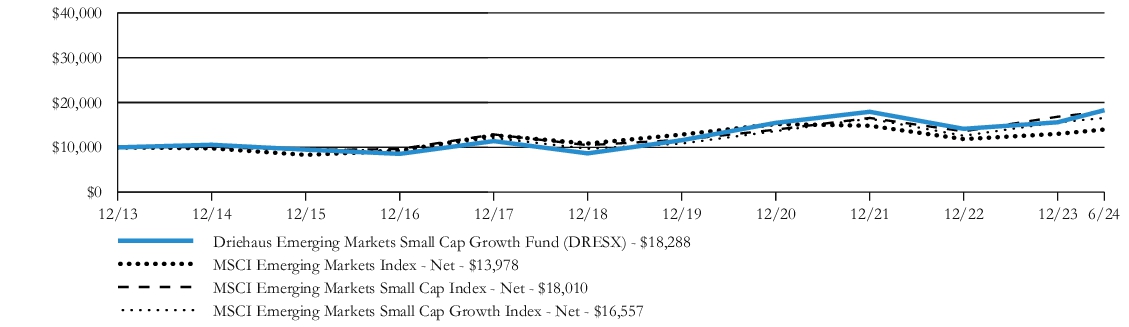

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

| Driehaus Emerging Markets Small Cap Growth Fund (DRESX) | $67 | 1.24% |

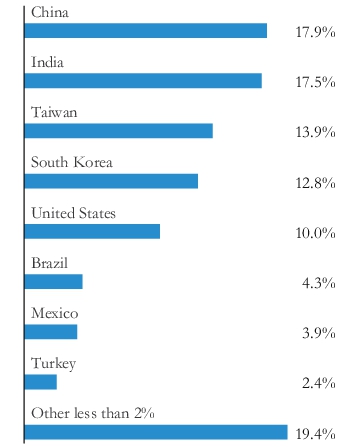

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Emerging Markets Small Cap Growth Fund (DRESX) | 21.04% | 11.95% | 5.38% |

| MSCI Emerging Markets Index - Net | 12.55% | 3.10% | 2.79% |

| MSCI Emerging Markets Small Cap Index - Net | 20.04% | 9.99% | 5.15% |

| MSCI Emerging Markets Small Cap Growth Index - Net | 16.82% | 10.07% | 4.22% |

| Fund net assets | $118,135,190% |

| Total number of portfolio holdings | $84% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $50% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 5.9% |

| FPT Corp. | 3.8% |

| HD Hyundai Electric Co. Ltd. | 3.7% |

| Vista Energy SAB de CV - ADR | 2.4% |

| Titagarh Rail System Ltd. | 2.2% |

| ASPEED Technology, Inc. | 2.1% |

| Hanwha Aerospace Co. Ltd. | 2.1% |

| GMR Airports Infrastructure Ltd. | 1.8% |

| Cury Construtora e Incorporadora SA | 1.8% |

| LIG Nex1 Co. Ltd. | 1.7% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

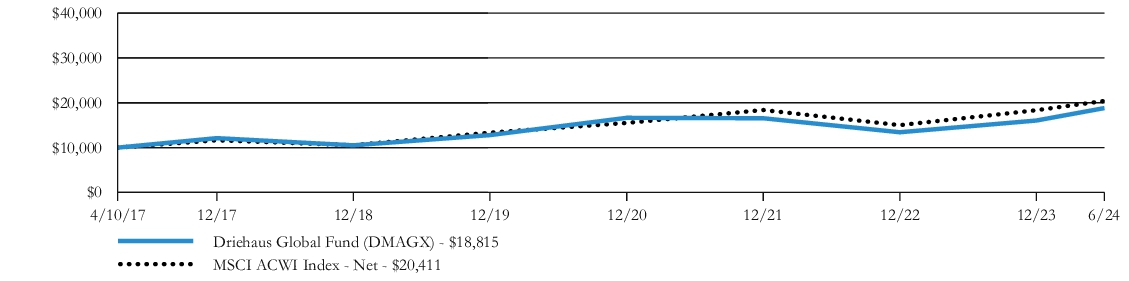

| Driehaus Global Fund (DMAGX) | $41 | 0.75% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | Since Inception |

| Driehaus Global Fund (DMAGX) | 25.03% | 9.46% | 9.14% |

| MSCI ACWI Index - Net | 19.37% | 10.76% | 10.38% |

| Fund net assets | $59,249,777% |

| Total number of portfolio holdings | $84% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $58% |

| Apple, Inc. | 4.9% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 4.8% |

| Microsoft Corp. | 4.5% |

| NVIDIA Corp. | 4.2% |

| Alphabet, Inc. - A | 3.6% |

| Amazon.com, Inc. | 2.9% |

| Exxon Mobil Corp. | 2.5% |

| Shell PLC | 2.2% |

| Tencent Holdings Ltd. | 2.2% |

| Rolls-Royce Holdings PLC | 2.1% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

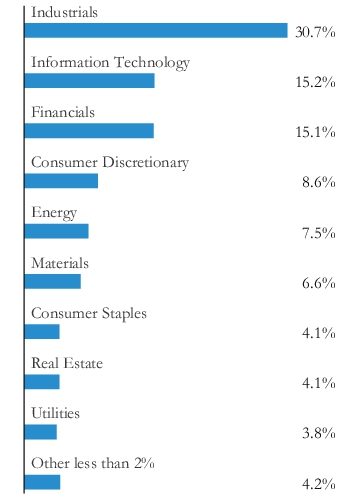

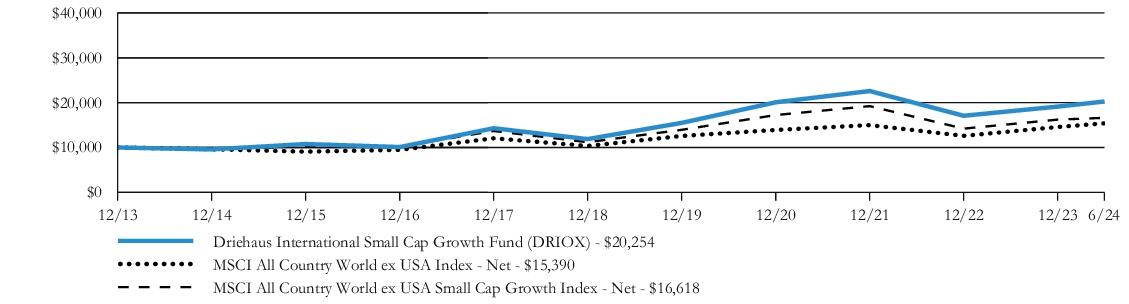

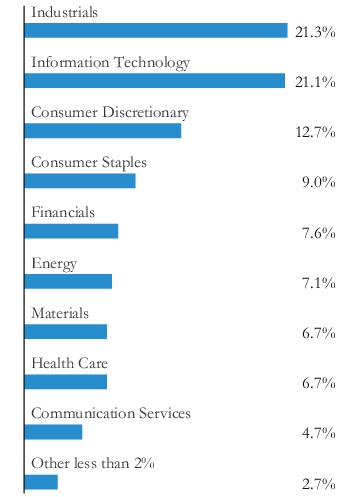

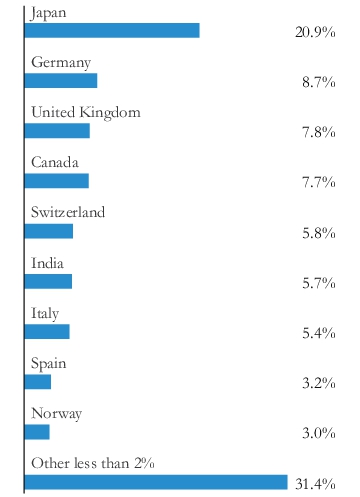

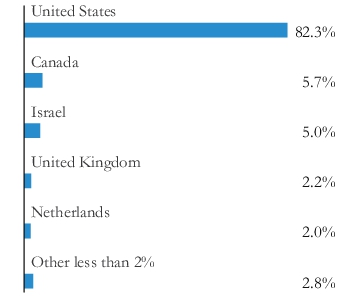

| Driehaus International Small Cap Growth Fund (DRIOX) | $58 | 1.14% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus International Small Cap Growth Fund (DRIOX) | 12.90% | 7.89% | 6.75% |

| MSCI All Country World ex USA Index - Net | 11.62% | 5.55% | 3.84% |

| MSCI All Country World ex USA Small Cap Growth Index - Net | 8.75% | 5.52% | 4.52% |

| Fund net assets | $234,459,899% |

| Total number of portfolio holdings | $110% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $44% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 2.5% |

| Saipem SpA | 2.0% |

| Indra Sistemas SA | 1.7% |

| Asics Corp. | 1.7% |

| DO & CO AG | 1.7% |

| Glanbia PLC | 1.7% |

| DOF Group ASA | 1.6% |

| SUESS MicroTec SE | 1.6% |

| Comet Holding AG | 1.6% |

| Intermediate Capital Group PLC | 1.5% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

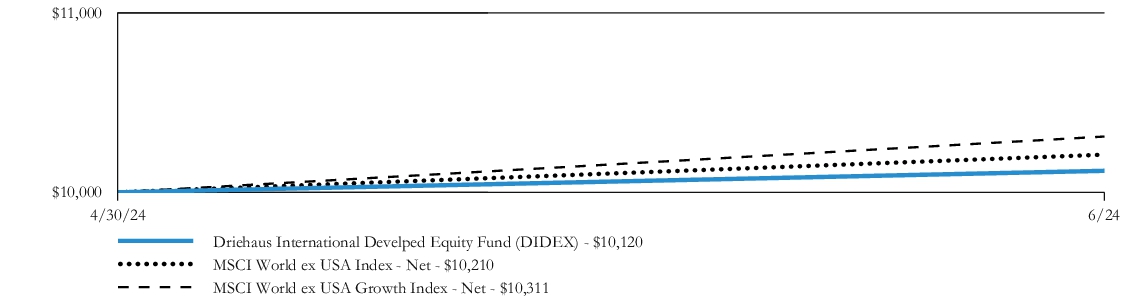

| Driehaus International Developed Equity Fund (DIDEX) | $13 | 0.80% |

| AVERAGE ANNUAL TOTAL RETURNS | Since Inception |

| Driehaus International Developed Equity Fund (DIDEX) | 1.20% |

| MSCI World ex USA Index - Net | 2.10% |

| MSCI World ex USA Growth Index - Net | 3.11% |

| Fund net assets | $1,128,966% |

| Total number of portfolio holdings | $49% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $17% |

| ASML Holding NV | 5.3% |

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% | 4.4% |

| Novo Nordisk A/S - B | 4.3% |

| Industria de Diseno Textil SA | 3.2% |

| Siemens Energy AG | 2.9% |

| Nestle SA | 2.8% |

| Cameco Corp. | 2.6% |

| Lonza Group AG | 2.6% |

| Alcon, Inc. | 2.6% |

| Rolls-Royce Holdings PLC | 2.6% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

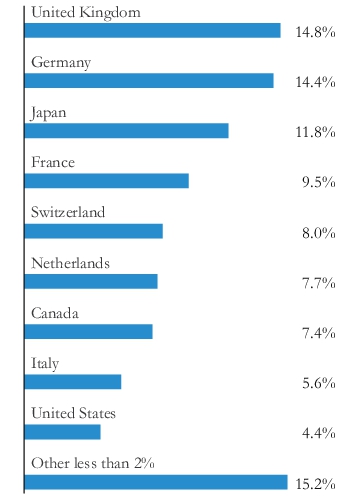

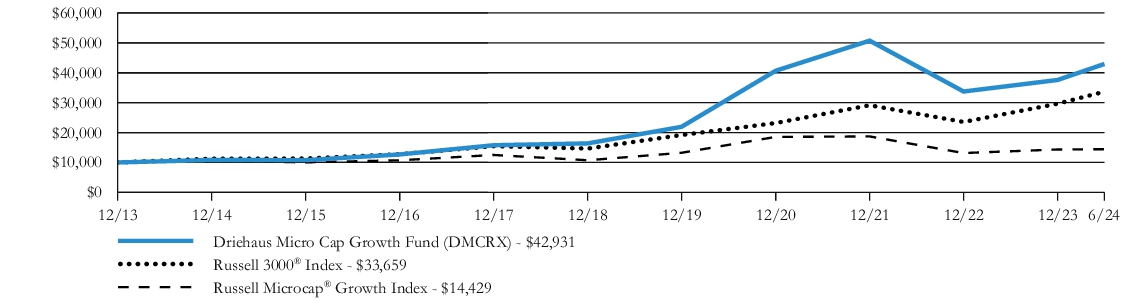

| Driehaus Micro Cap Growth Fund (DMCRX) | $73 | 1.37% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Micro Cap Growth Fund (DMCRX) | 14.44% | 15.40% | 15.84% |

| Russell 3000® Index | 23.13% | 14.14% | 12.15% |

| Russell Microcap® Growth Index | 2.49% | 2.92% | 3.61% |

| Fund net assets | $266,782,685% |

| Total number of portfolio holdings | $113% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $52% |

| Crinetics Pharmaceuticals, Inc. | 2.8% |

| Modine Manufacturing Co. | 2.8% |

| TransMedics Group, Inc. | 2.6% |

| Camtek Ltd. | 1.9% |

| FTAI Aviation Ltd. | 1.9% |

| Veeco Instruments, Inc. | 1.9% |

| Credo Technology Group Holding Ltd. | 1.9% |

| Xenon Pharmaceuticals, Inc. | 1.7% |

| Sterling Infrastructure, Inc. | 1.7% |

| Arlo Technologies, Inc. | 1.7% |

| Fund (Class) | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

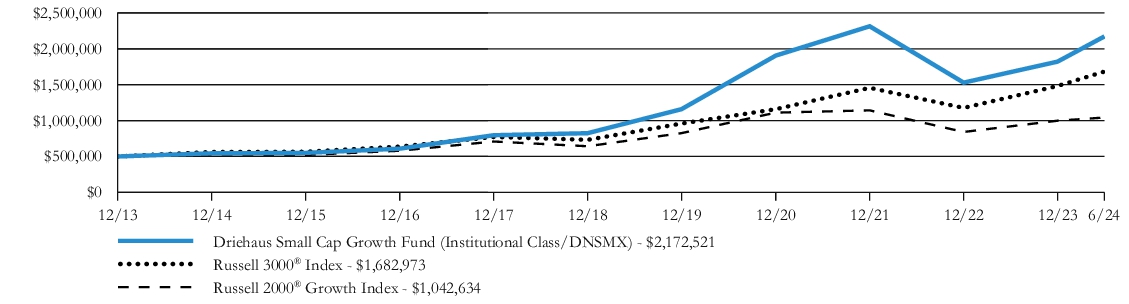

| Driehaus Small Cap Growth Fund (Institutional Class/DNSMX) | $38 | 0.70% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Small Cap Growth Fund (Institutional Class/DNSMX) | 24.84% | 14.44% | 15.33% |

| Russell 3000® Index | 23.13% | 14.14% | 12.15% |

| Russell 2000® Growth Index | 9.14% | 6.17% | 7.39% |

| Fund net assets | $784,729,182% |

| Total number of portfolio holdings | $110% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $58% |

| TransMedics Group, Inc. | 2.9% |

| FTAI Aviation Ltd. | 2.3% |

| Crinetics Pharmaceuticals, Inc. | 2.2% |

| Cameco Corp. | 2.1% |

| Vaxcyte, Inc. | 2.0% |

| Natera, Inc. | 2.0% |

| BellRing Brands, Inc. | 1.9% |

| Camtek Ltd. | 1.9% |

| Axon Enterprise, Inc. | 1.9% |

| Onto Innovation, Inc. | 1.8% |

| Fund (Class) | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

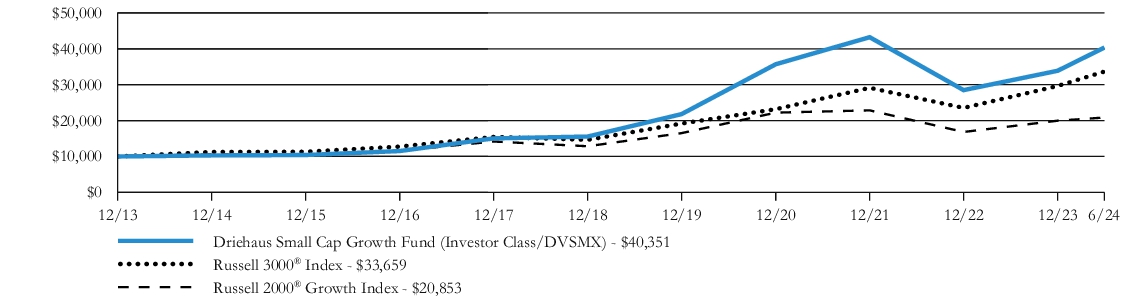

| Driehaus Small Cap Growth Fund (Investor Class/DVSMX) | $50 | 0.91% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Small Cap Growth Fund (Investor Class/DVSMX) | 24.57% | 14.13% | 15.12% |

| Russell 3000® Index | 23.13% | 14.14% | 12.15% |

| Russell 2000® Growth Index | 9.14% | 6.17% | 7.39% |

| Fund net assets | $784,729,182% |

| Total number of portfolio holdings | $110% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $58% |

| TransMedics Group, Inc. | 2.9% |

| FTAI Aviation Ltd. | 2.3% |

| Crinetics Pharmaceuticals, Inc. | 2.2% |

| Cameco Corp. | 2.1% |

| Vaxcyte, Inc. | 2.0% |

| Natera, Inc. | 2.0% |

| BellRing Brands, Inc. | 1.9% |

| Camtek Ltd. | 1.9% |

| Axon Enterprise, Inc. | 1.9% |

| Onto Innovation, Inc. | 1.8% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

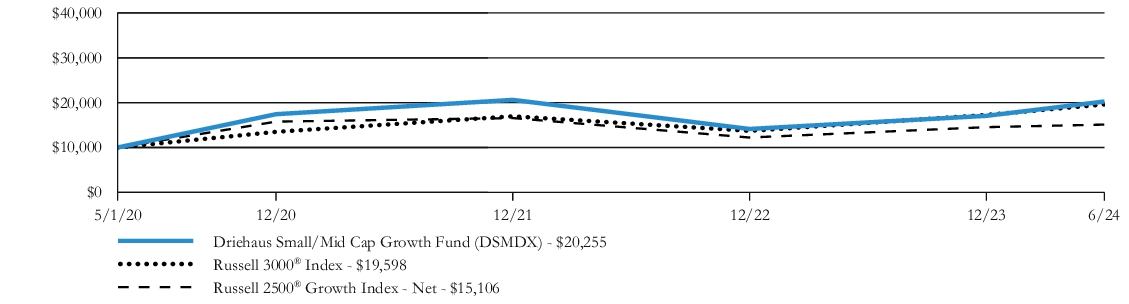

| Driehaus Small/Mid Cap Growth Fund (DSMDX) | $43 | 0.80% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | Since Inception |

| Driehaus Small/Mid Cap Growth Fund (DSMDX) | 24.15% | 18.47% |

| Russell 3000® Index | 23.13% | 18.37% |

| Russell 2500® Growth Index - Net | 9.02% | 11.24% |

| Fund net assets | $54,451,615% |

| Total number of portfolio holdings | $102% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $62% |

| Axon Enterprise, Inc. | 2.6% |

| Cameco Corp. | 2.4% |

| Natera, Inc. | 2.2% |

| Crinetics Pharmaceuticals, Inc. | 2.1% |

| Onto Innovation, Inc. | 2.1% |

| TransMedics Group, Inc. | 2.1% |

| HEICO Corp. | 2.0% |

| Camtek Ltd. | 2.0% |

| BellRing Brands, Inc. | 2.0% |

| Monday.com Ltd. | 1.9% |

| Fund | Cost of a $10,000 Investment | Costs paid as a percentage of a $10,000 investment |

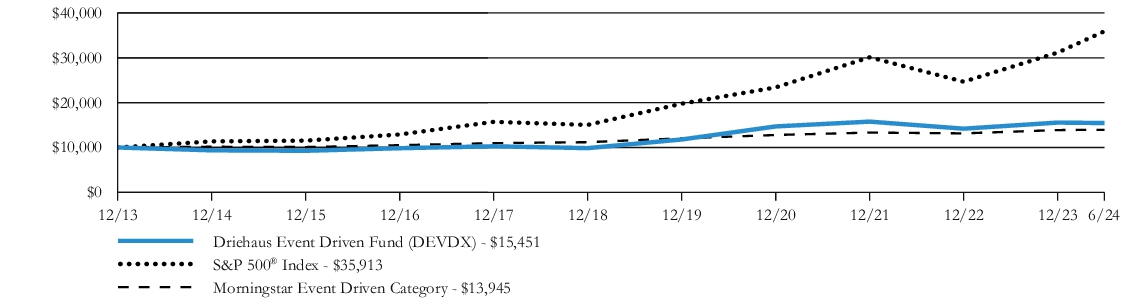

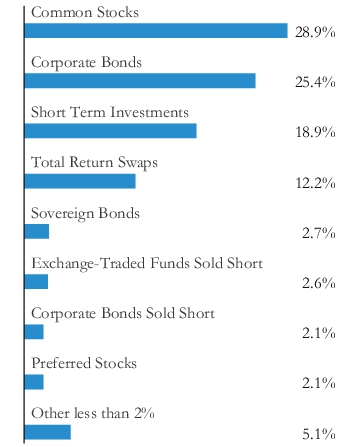

| Driehaus Event Driven Fund (DEVDX) | $72 | 1.45% |

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Year | 10 Year |

| Driehaus Event Driven Fund (DEVDX) | 5.80% | 5.97% | 4.14% |

| S&P 500® Index | 24.56% | 15.05% | 12.86% |

| Morningstar Event Driven Category | 5.13% | 3.61% | 3.14% |

| Fund net assets | $207,407,695% |

| Total number of portfolio holdings | $62% |

| Portfolio turnover rate as of the end of the reporting period (not annualized) | $55% |

Item 2. Code of Ethics.

Not applicable to this reporting period.

Item 3. Audit Committee Financial Expert.

Not applicable to this reporting period.

Item 4. Principal Accountant Fees and Services.

Not applicable to this reporting period.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Schedule of Investments in securities of unaffiliated issuers as of the close of the reporting period is included as part of the Financial Statements filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) The Financial Statements are attached herewith.

(b) The Financial Highlights are attached herewith.

Driehaus Mutual Funds

Trustees & Officers

Theodore J. Beck

Chairman of the Board

Christopher J. Towle

Trustee

Dawn M. Vroegop

Trustee

Stephen T. Weber

President & Trustee

Robert M. Kurinsky

Vice President & Treasurer

Janet L. McWilliams

Chief Legal Officer &

Assistant Vice President

Anne Kochevar

Chief Compliance Officer &

Anti-Money Laundering

Compliance Officer

Tanya S. Tancheff

Secretary

Christina E. Algozine

Assistant Secretary

Malinda M. Sanborn

Assistant Treasurer

Investment Adviser

Driehaus Capital Management LLC

25 East Erie Street

Chicago, IL 60611

Distributor

Foreside Financial Services, LLC

Three Canal Plaza

Portland, ME 04101

Administrator, Custodian & Transfer Agent

The Northern Trust Company

50 South LaSalle Street

Chicago, IL 60603

Financial Report

June 30, 2024

®

MUTUAL FUNDS

Driehaus Emerging Markets Growth Fund

Driehaus Emerging Markets Small Cap Growth Fund

Driehaus Global Fund

Driehaus International Small Cap Growth Fund

Driehaus International Developed Equity Fund

Driehaus Micro Cap Growth Fund

Driehaus Small Cap Growth Fund

Driehaus Small/Mid Cap Growth Fund

Driehaus Event Driven Fund

Distributed by:

Foreside Financial Services, LLC

This report has been prepared for the shareholders of the Funds and is not an offer to sell or buy any Fund securities. Such offer is only made by the Funds’ prospectus.

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 94.98% | ||

| FAR EAST — 67.38% | ||

| China — 17.93% | ||

| China Merchants Bank Co. Ltd. - H | 7,100,000 | $32,263,421 |

| Contemporary Amperex Technology Co. Ltd. - A | 352,181 | 8,724,041 |

| Fuyao Glass Industry Group Co. Ltd. - A | 2,103,700 | 13,868,227 |

| Haier Smart Home Co. Ltd. - A | 6,178,474 | 24,064,300 |

| Industrial & Commercial Bank of China Ltd. - H | 54,203,000 | 32,217,154 |

| Luxshare Precision Industry Co. Ltd. - A | 5,946,894 | 32,077,513 |

| Meituan - B 1,* | 1,837,000 | 26,111,650 |

| NARI Technology Co. Ltd. - A | 3,909,204 | 13,400,138 |

| New Oriental Education & Technology Group, Inc. - SP ADR 2,* | 375,644 | 29,198,808 |

| PDD Holdings, Inc. 2,* | 78,610 | 10,451,200 |

| PetroChina Co. Ltd. - H | 43,412,000 | 43,835,505 |

| Shenzhou International Group Holdings Ltd. | 909,000 | 8,879,463 |

| Tencent Holdings Ltd. | 4,321,045 | 204,991,792 |

| Tencent Music Entertainment Group - ADR 2 | 3,278,988 | 46,069,781 |

| Trip.com Group Ltd. - ADR 2,* | 651,237 | 30,608,139 |

| Zhongji Innolight Co. Ltd. - A | 0 | 11 |

| 556,761,143 | ||

| India — 17.46% | ||

| Adani Ports & Special Economic Zone Ltd. | 1,664,185 | 29,459,050 |

| Ambuja Cements Ltd. | 2,432,635 | 19,509,181 |

| Axis Bank Ltd. | 1,311,134 | 19,869,998 |

| Bajaj Auto Ltd. | 153,748 | 17,515,332 |

| Bharti Airtel Ltd. | 1,432,784 | 24,789,223 |

| Cipla Ltd. | 437,577 | 7,755,966 |

| Colgate-Palmolive India Ltd. | 339,914 | 11,575,662 |

| DLF Ltd. | 1,074,050 | 10,603,157 |

| GMR Airports Infrastructure Ltd. * | 9,350,330 | 10,796,268 |

| Godrej Consumer Products Ltd. | 1,156,057 | 19,041,381 |

| HDFC Bank Ltd. | 788,879 | 15,930,788 |

| Hindustan Aeronautics Ltd. | 516,393 | 32,569,581 |

| ICICI Bank Ltd. - SP ADR 2 | 2,761,581 | 79,561,149 |

| ICICI Lombard General Insurance Co. Ltd. 1 | 1,322,029 | 28,310,385 |

| Indian Hotels Co. Ltd. | 1,129,191 | 8,447,593 |

| Indian Railway Catering & Tourism Corp. Ltd. | 509,774 | 6,037,534 |

| IRB Infrastructure Developers Ltd. | 11,169,609 | 8,661,249 |

| JSW Energy Ltd. | 2,987,839 | 26,281,572 |

| KEI Industries Ltd. | 43,023 | 2,278,864 |

| Mahindra & Mahindra Ltd. | 518,680 | 17,805,026 |

| Max Healthcare Institute Ltd. | 1,203,727 | 13,556,792 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Mazagon Dock Shipbuilders Ltd. | 9,694 | $496,879 |

| NTPC Ltd. | 3,831,572 | 17,375,348 |

| Power Finance Corp. Ltd. | 4,351,076 | 25,263,644 |

| Reliance Industries Ltd. | 1,402,301 | 52,567,537 |

| Sun Pharmaceutical Industries Ltd. | 706,270 | 12,860,953 |

| Supreme Industries Ltd. | 101,312 | 7,220,361 |

| UltraTech Cement Ltd. | 116,386 | 16,261,070 |

| 542,401,543 | ||

| Taiwan — 13.94% | ||

| ASPEED Technology, Inc. | 156,000 | 23,148,961 |

| Chunghwa Telecom Co. Ltd. | 3,396,000 | 13,159,122 |

| King Yuan Electronics Co. Ltd. | 2,437,176 | 8,904,434 |

| Lotes Co. Ltd. | 271,000 | 13,583,968 |

| MediaTek, Inc. | 803,000 | 34,583,929 |

| Quanta Computer, Inc. | 1,720,000 | 16,442,596 |

| Taiwan Semiconductor Manufacturing Co. Ltd. | 737,000 | 21,835,559 |

| Taiwan Semiconductor Manufacturing Co. Ltd. - SP ADR 2 | 1,513,818 | 263,116,706 |

| Wiwynn Corp. | 248,000 | 20,084,888 |

| Yageo Corp. | 800,000 | 17,969,717 |

| 432,829,880 | ||

| South Korea — 12.76% | ||

| Amorepacific Corp. | 39,568 | 4,789,744 |

| Hanwha Aerospace Co. Ltd. | 95,718 | 17,262,580 |

| HD Hyundai Electric Co. Ltd. | 110,554 | 24,705,431 |

| KB Financial Group, Inc. | 417,703 | 23,759,004 |

| Kia Corp. | 402,384 | 37,651,626 |

| LEENO Industrial, Inc. | 22,137 | 3,741,840 |

| Macquarie Korea Infrastructure Fund | 1,718,565 | 15,424,498 |

| Samsung Electronics Co. Ltd. | 2,989,982 | 175,971,854 |

| Samsung Heavy Industries Co. Ltd. * | 2,040,327 | 13,838,367 |

| Samsung Life Insurance Co. Ltd. | 378,413 | 24,203,532 |

| SK Hynix, Inc. | 324,453 | 55,062,471 |

| 396,410,947 | ||

| Indonesia — 1.93% | ||

| Bank Central Asia Tbk PT | 41,225,075 | 24,944,921 |

| Bank Mandiri Persero Tbk PT | 93,623,400 | 35,025,805 |

| 59,970,726 | ||

| Hong Kong — 1.79% | ||

| ASMPT Ltd. | 1,038,900 | 14,387,077 |

| Hong Kong Exchanges & Clearing Ltd. | 1,288,800 | 41,245,664 |

| 55,632,741 | ||

| Philippines — 0.86% | ||

| BDO Unibank, Inc. | 6,283,920 | 13,745,304 |

| International Container Terminal Services, Inc. | 2,179,077 | 13,008,219 |

| 26,753,523 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| Malaysia — 0.71% | ||

| YTL Corp. Bhd. | 30,211,700 | $22,033,725 |

| Total FAR EAST (Cost $1,478,344,017) | 2,092,794,228 | |

| NORTH AMERICA — 8.67% | ||

| Mexico — 3.92% | ||

| Arca Continental SAB de CV | 2,149,509 | 21,136,741 |

| BBB Foods, Inc. - A 2,* | 342,892 | 8,181,403 |

| Corp. Inmobiliaria Vesta SAB de CV | 5,281,707 | 15,832,130 |

| Fibra Uno Administracion SA de CV | 18,498,020 | 22,830,571 |

| Gruma SAB de CV - B | 464,010 | 8,499,283 |

| Grupo Financiero Banorte SAB de CV - O | 2,606,908 | 20,288,142 |

| Vista Energy SAB de CV - ADR 2,* | 549,821 | 25,005,859 |

| 121,774,129 | ||

| United States — 3.50% | ||

| Analog Devices, Inc. | 52,114 | 11,895,541 |

| Cognizant Technology Solutions Corp. - A | 200,880 | 13,659,840 |

| MercadoLibre, Inc. * | 14,490 | 23,812,866 |

| Samsonite International SA 1 | 2,057,000 | 6,131,279 |

| Southern Copper Corp. | 313,970 | 33,827,128 |

| Teradyne, Inc. | 130,954 | 19,419,169 |

| 108,745,823 | ||

| Canada — 1.25% | ||

| Alamos Gold, Inc. - A 2 | 679,704 | 10,657,758 |

| Cameco Corp. 2 | 572,380 | 28,161,096 |

| 38,818,854 | ||

| Total NORTH AMERICA (Cost $225,143,416) | 269,338,806 | |

| EUROPE — 8.49% | ||

| Turkey — 2.42% | ||

| BIM Birlesik Magazalar AS | 1,885,347 | 31,489,756 |

| Ford Otomotiv Sanayi A/S | 188,292 | 6,481,146 |

| Haci Omer Sabamci Holdings AS * | 1,655,986 | 4,893,703 |

| Yapi ve Kredi Bankasi AS | 31,273,419 | 32,366,815 |

| 75,231,420 | ||

| United Kingdom — 1.69% | ||

| Antofagasta PLC | 300,737 | 7,992,398 |

| Shell PLC | 1,239,466 | 44,665,813 |

| 52,658,211 | ||

| Greece — 1.66% | ||

| National Bank of Greece SA * | 4,781,183 | 39,723,830 |

| OPAP SA | 754,696 | 11,832,658 |

| 51,556,488 | ||

| Poland — 1.29% | ||

| Powszechny Zaklad Ubezpieczen SA | 3,141,873 | 40,112,919 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Austria — 0.62% | ||

| Erste Group Bank AG | 405,157 | $19,178,167 |

| Portugal — 0.51% | ||

| Galp Energia SGPS SA | 748,360 | 15,806,026 |

| France — 0.30% | ||

| Hermes International SCA | 3,992 | 9,220,022 |

| Russia — 0.00% | ||

| Polyus PJSC 2,*,^ | 63,751 | — |

| Total EUROPE (Cost $233,965,964) | 263,763,253 | |

| SOUTH AMERICA — 4.94% | ||

| Brazil — 3.67% | ||

| Banco do Brasil SA | 7,580,500 | 36,111,825 |

| Direcional Engenharia SA | 2,407,084 | 11,449,592 |

| Iguatemi SA | 3,137,100 | 11,549,260 |

| NU Holdings Ltd. - A 2,* | 1,356,687 | 17,487,696 |

| Santos Brasil Participacoes SA | 5,658,156 | 13,836,424 |

| Telefonica Brasil SA * | 1,775,600 | 14,487,239 |

| Telefonica Brasil SA - ADR 2,* | 1,120,402 | 9,198,500 |

| 114,120,536 | ||

| Peru — 0.84% | ||

| Credicorp Ltd. 2 | 161,441 | 26,045,276 |

| Argentina — 0.43% | ||

| Grupo Financiero Galicia SA - ADR 2,* | 251,431 | 7,683,732 |

| YPF SA - SP ADR 2,* | 285,052 | 5,735,246 |

| 13,418,978 | ||

| Total SOUTH AMERICA (Cost $147,993,679) | 153,584,790 | |

| MIDDLE EAST — 3.73% | ||

| United Arab Emirates — 1.88% | ||

| Abu Dhabi Ports Co. PJSC * | 5,054,516 | 7,018,250 |

| Aldar Properties PJSC | 10,689,594 | 18,218,584 |

| Dubai Electricity & Water Authority PJSC | 21,657,243 | 12,971,939 |

| Emaar Properties PJSC | 9,040,504 | 20,182,993 |

| 58,391,766 | ||

| Saudi Arabia — 1.50% | ||

| Dr Sulaiman Al Habib Medical Services Group Co. | 180,208 | 13,825,214 |

| Saudi Arabian Oil Co. 1 | 1,737,521 | 12,804,160 |

| The Saudi National Bank | 2,014,744 | 19,873,944 |

| 46,503,318 | ||

| Israel — 0.35% | ||

| Teva Pharmaceutical Industries Ltd. - SP ADR 2,* | 675,524 | 10,977,265 |

| Total MIDDLE EAST (Cost $114,004,959) | 115,872,349 | |

| AFRICA — 1.77% | ||

| South Africa — 1.77% | ||

| FirstRand Ltd. | 7,133,821 | 30,256,078 |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Naspers Ltd. - N | 125,146 | $24,577,717 | |

| 54,833,795 | |||

| Total AFRICA (Cost $54,878,514) | 54,833,795 | ||

| Total COMMON STOCKS (Cost $2,254,330,549) | 2,950,187,221 | ||

| PREFERRED STOCKS — 0.64% | |||

| SOUTH AMERICA — 0.64% | |||

| Brazil — 0.64% | |||

| Itau Unibanco Holding SA - SP ADR, 3.85% 2,3 | 3,377,874 | 19,726,784 | |

| Total SOUTH AMERICA (Cost $22,472,435) | 19,726,784 | ||

| Total PREFERRED STOCKS (Cost $22,472,435) | 19,726,784 | ||

| SHORT TERM INVESTMENTS — 6.48% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 4 (Cost $201,293,199) | 201,293,199 | 201,293,199 | |

| TOTAL INVESTMENTS (Cost $2,478,096,183) | 102.10% | $3,171,207,204 | |

| Liabilities in Excess of Other Assets | (2.10)% | (65,184,645) | |

| Net Assets | 100.00% | $3,106,022,559 | |

| ADR | American Depositary Receipt |

| PJSC | Public Joint Stock Company |

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $73,357,474, which represents 2% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| 4 | 7 day current yield as of June 30, 2024 is disclosed. |

| ^ | Security valued at fair value as determined in good faith by the Adviser, in accordance with procedures established by, and under the general supervision of, the Trust’s Board of Trustee. The security is valued using significant unobservable inputs. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 94.98% | |

| Preferred Stocks | 0.64% | |

| Short Term Investments | 6.48% | |

| Total Investments | 102.10% | |

| Liabilities In Excess of Other Assets | (2.10)% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Far East | 67.38% | |

| North America | 15.15% | |

| Europe | 8.49% | |

| South America | 5.58% | |

| Middle East | 3.73% | |

| Africa | 1.77% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 1.63% | |

| Automobile Components | 0.45% | |

| Automobiles | 2.55% | |

| Banks | 16.76% | |

| Beverages | 0.68% | |

| Broadline Retail | 1.90% | |

| Capital Markets | 1.83% | |

| Chemicals | 0.23% | |

| Commercial Services & Supplies | 0.20% | |

| Communications Equipment | 0.00% | |

| Construction & Engineering | 0.28% | |

| Construction Materials | 1.15% | |

| Consumer Staples Distribution & Retail | 1.27% | |

| Diversified Consumer Services | 0.94% | |

| Diversified Real Estate Investment Trusts | 0.74% | |

| Diversified Telecommunication Services | 1.19% | |

| Electrical Equipment | 1.57% | |

| Electronic Equipment, Instruments & Components | 2.05% | |

| Entertainment | 1.48% | |

| Financial Services | 1.79% | |

| Food Products | 0.27% | |

| Health Care Providers & Services | 0.89% | |

| Hotels, Restaurants & Leisure | 2.48% |

| Industry | Percent of Net Assets | |

| Household Durables | 1.14% | |

| Independent Power and Renewable Electricity Producers | 1.41% | |

| Insurance | 2.98% | |

| Interactive Media & Services | 6.60% | |

| IT Services | 0.44% | |

| Machinery | 0.45% | |

| Metals & Mining | 1.68% | |

| Money Market Fund | 6.48% | |

| Multi-Utilities | 1.13% | |

| Oil, Gas & Consumable Fuels | 7.36% | |

| Personal Care Products | 1.13% | |

| Pharmaceuticals | 1.02% | |

| Real Estate Management & Development | 2.46% | |

| Semiconductors & Semiconductor Equipment | 14.67% | |

| Technology Hardware, Storage & Peripherals | 6.85% | |

| Textiles, Apparel & Luxury Goods | 0.79% | |

| Transportation Infrastructure | 2.38% | |

| Wireless Telecommunication Services | 0.80% | |

| Liabilities In Excess of Other Assets | (2.10)% | |

| TOTAL | 100.00% |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 94.01% | ||

| FAR EAST — 66.72% | ||

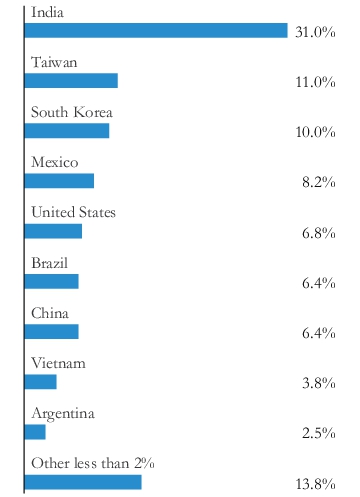

| India — 31.01% | ||

| ACC Ltd. | 49,154 | $1,541,611 |

| AU Small Finance Bank Ltd. 1 | 145,853 | 1,174,548 |

| Azad Engineering Ltd. * | 50,459 | 1,142,881 |

| Bharti Hexacom Ltd. * | 104,594 | 1,400,879 |

| BLS International Services Ltd. | 317,634 | 1,332,851 |

| Brigade Enterprises Ltd. | 67,744 | 1,093,560 |

| Century Textiles & Industries Ltd. | 66,892 | 1,854,381 |

| GMR Airports Infrastructure Ltd. * | 1,796,518 | 2,074,332 |

| Indian Hotels Co. Ltd. | 83,149 | 622,046 |

| IRB Infrastructure Developers Ltd. | 1,582,119 | 1,226,823 |

| JSW Infrastructure Ltd. * | 386,896 | 1,519,074 |

| Jyoti CNC Automation Ltd. * | 70,242 | 1,135,461 |

| Kalyan Jewellers India Ltd. | 218,334 | 1,309,901 |

| Kaynes Technology India Ltd. * | 36,521 | 1,686,176 |

| Kfin Technologies Ltd. * | 153,672 | 1,286,954 |

| Max Healthcare Institute Ltd. | 124,889 | 1,406,543 |

| Mazagon Dock Shipbuilders Ltd. | 27,825 | 1,426,207 |

| NHPC Ltd. | 1,011,852 | 1,219,773 |

| Nuvama Wealth Management Ltd. * | 19,355 | 1,146,267 |

| Poonawalla Fincorp Ltd. | 233,917 | 1,144,788 |

| Rainbow Children's Medicare Ltd. | 57,429 | 857,099 |

| Sobha Ltd. | 58,508 | 1,369,161 |

| Swan Energy Ltd. | 72,334 | 508,238 |

| Techno Electric & Engineering Co. Ltd. | 55,252 | 1,027,919 |

| Titagarh Rail System Ltd. | 114,188 | 2,543,906 |

| Transformers & Rectifiers India Ltd. | 120,626 | 1,042,538 |

| United Breweries Ltd. | 60,062 | 1,429,002 |

| Venus Pipes & Tubes Ltd. 1 | 45,060 | 1,108,835 |

| 36,631,754 | ||

| Taiwan — 11.00% | ||

| AP Memory Technology Corp. | 48,000 | 569,655 |

| Asia Vital Components Co. Ltd. | 39,000 | 913,228 |

| ASMedia Technology, Inc. | 23,000 | 1,580,604 |

| ASPEED Technology, Inc. | 17,000 | 2,522,643 |

| Eclat Textile Co. Ltd. | 64,000 | 1,042,712 |

| eMemory Technology, Inc. | 11,000 | 864,075 |

| Faraday Technology Corp. | 108,000 | 1,113,740 |

| Gloria Material Technology Corp. | 319,000 | 475,331 |

| King Slide Works Co. Ltd. | 31,000 | 1,178,811 |

| Kinik Co. | 118,000 | 1,190,752 |

| Makalot Industrial Co. Ltd. | 119,000 | 1,541,985 |

| 12,993,536 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| South Korea — 10.04% | ||

| Hanwha Aerospace Co. Ltd. | 13,941 | $2,514,236 |

| HD Hyundai Electric Co. Ltd. | 19,647 | 4,390,502 |

| HPSP Co. Ltd. | 28,252 | 794,468 |

| Korea Aerospace Industries Ltd. | 30,241 | 1,160,792 |

| LEENO Industrial, Inc. | 5,599 | 946,404 |

| LIG Nex1 Co. Ltd. | 12,887 | 2,057,209 |

| 11,863,611 | ||

| China — 6.36% | ||

| Akeso, Inc. 1,* | 263,000 | 1,267,831 |

| Henan Pinggao Electric Co. Ltd. - A | 631,000 | 1,690,235 |

| Pacific Basin Shipping Ltd. | 3,577,000 | 1,127,412 |

| Proya Cosmetics Co. Ltd. - A | 39,348 | 599,706 |

| Silergy Corp. | 90,000 | 1,276,589 |

| SITC International Holdings Co. Ltd. | 303,000 | 821,611 |

| Xinyi Glass Holdings Ltd. | 664,000 | 727,161 |

| 7,510,545 | ||

| Vietnam — 3.78% | ||

| FPT Corp. | 873,749 | 4,471,953 |

| Kazakhstan — 1.66% | ||

| Kaspi.KZ JSC 2,3 | 15,190 | 1,959,662 |

| Australia — 1.44% | ||

| Paladin Energy Ltd. * | 205,550 | 1,696,811 |

| Malaysia — 1.43% | ||

| YTL Power International Bhd. | 1,662,500 | 1,692,805 |

| Total FAR EAST (Cost $56,139,036) | 78,820,677 | |

| NORTH AMERICA — 10.19% | ||

| Mexico — 8.15% | ||

| Alsea SAB de CV | 427,400 | 1,485,796 |

| BBB Foods, Inc. - A 2,* | 66,370 | 1,583,588 |

| FIBRA Macquarie Mexico 1 | 412,015 | 699,491 |

| GCC SAB de CV | 147,900 | 1,394,197 |

| Prologis Property Mexico SA de CV | 225,583 | 735,380 |

| TF Administradora Industrial S de RL de CV | 417,300 | 889,799 |

| Vista Energy SAB de CV - ADR 2,* | 62,424 | 2,839,043 |

| 9,627,294 | ||

| Canada — 1.21% | ||

| Filo Corp. * | 77,700 | 1,424,448 |

| United States — 0.83% | ||

| Copa Holdings SA - A | 10,320 | 982,258 |

| Total NORTH AMERICA (Cost $10,241,743) | 12,034,000 | |

| SOUTH AMERICA — 8.94% | ||

| Brazil — 6.43% | ||

| Cury Construtora e Incorporadora SA | 558,504 | 2,058,135 |

| Inter & Co., Inc. - BDR | 266,678 | 1,626,754 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Orizon Valorizacao de Residuos SA * | 208,100 | $1,440,667 |

| PRIO SA | 142,100 | 1,114,664 |

| Santos Brasil Participacoes SA | 554,200 | 1,355,238 |

| 7,595,458 | ||

| Argentina — 2.51% | ||

| Grupo Financiero Galicia SA - ADR 2,* | 40,618 | 1,241,286 |

| Pampa Energia SA - SP ADR 2,* | 23,308 | 1,031,612 |

| YPF SA - SP ADR 2,* | 34,429 | 692,712 |

| 2,965,610 | ||

| Total SOUTH AMERICA (Cost $8,657,738) | 10,561,068 | |

| MIDDLE EAST — 4.12% | ||

| Saudi Arabia — 1.62% | ||

| Catrion Catering Holding Co. | 18,724 | 626,424 |

| Saudia Dairy & Foodstuff Co. | 13,769 | 1,287,906 |

| 1,914,330 | ||

| United Arab Emirates — 1.46% | ||

| Abu Dhabi Ports Co. PJSC * | 807,845 | 1,121,701 |

| Emirates Central Cooling Systems Corp. | 1,516,302 | 602,723 |

| 1,724,424 | ||

| Qatar — 1.04% | ||

| Qatar Gas Transport Co. Ltd. | 948,814 | 1,226,857 |

| Total MIDDLE EAST (Cost $4,653,087) | 4,865,611 | |

| EUROPE — 2.64% | ||

| Turkey — 1.54% | ||

| Pegasus Hava Tasimaciligi A/S * | 80,407 | 560,995 |

| Turkiye Sinai Kalkinma Bankasi A/S * | 3,510,771 | 1,260,038 |

| 1,821,033 | ||

| Norway — 1.10% | ||

| Seadrill Ltd. 2,* | 25,182 | 1,296,873 |

| Total EUROPE (Cost $2,853,832) | 3,117,906 | |

| AFRICA — 1.40% | ||

| South Africa — 1.40% | ||

| Truworths International Ltd. | 321,972 | 1,656,193 |

| Total AFRICA (Cost $1,387,411) | 1,656,193 | |

| Total COMMON STOCKS (Cost $83,932,847) | 111,055,455 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| RIGHTS — 0.02% | |||

| FAR EAST — 0.02% | |||

| India — 0.02% | |||

| Sobha Ltd. * | 7,469 | $26,361 | |

| Total FAR EAST (Cost $0) | 26,361 | ||

| Total RIGHTS (Cost $0) | 26,361 | ||

| SHORT TERM INVESTMENTS — 5.91% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 4 (Cost $6,983,740) | 6,983,740 | 6,983,740 | |

| TOTAL INVESTMENTS (Cost $90,916,587) | 99.94% | $118,065,556 | |

| Other Assets In Excess of Liabilities | 0.06% | 69,634 | |

| Net Assets | 100.00% | $118,135,190 | |

| ADR | American Depositary Receipt |

| JSC | Joint Stock Company |

| PJSC | Public Joint Stock Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $4,250,705, which represents 4% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by Driehaus Capital Management LLC (the “Adviser”), investment adviser to the Fund. |

| 4 | 7 day current yield as of June 30, 2024 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Rights | 0.02% | |

| Common Stocks | 94.01% | |

| Short Term Investments | 5.91% | |

| Total Investments | 99.94% | |

| Other Assets In Excess of Liabilities | 0.06% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| Far East | 66.74% | |

| North America | 16.10% | |

| South America | 8.94% | |

| Middle East | 4.12% | |

| Europe | 2.64% | |

| Africa | 1.40% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 6.06% | |

| Banks | 3.42% | |

| Beverages | 1.21% | |

| Biotechnology | 1.07% | |

| Building Products | 0.62% | |

| Capital Markets | 2.06% | |

| Commercial Services & Supplies | 1.75% | |

| Construction & Engineering | 1.91% | |

| Construction Materials | 2.48% | |

| Consumer Finance | 2.63% | |

| Consumer Staples Distribution & Retail | 1.34% | |

| Electric Utilities | 0.87% | |

| Electrical Equipment | 6.03% | |

| Electronic Equipment, Instruments & Components | 1.43% | |

| Energy Equipment & Services | 1.10% | |

| Financial Services | 1.07% | |

| Food Products | 1.09% | |

| Health Care Providers & Services | 1.91% | |

| Hotels, Restaurants & Leisure | 1.79% | |

| Household Durables | 1.74% | |

| Independent Power and Renewable Electricity Producers | 1.03% | |

| Industrial Real Estate Investment Trusts | 1.96% |

| Industry | Percent of Net Assets | |

| IT Services | 3.78% | |

| Machinery | 5.09% | |

| Marine | 1.65% | |

| Metals & Mining | 2.55% | |

| Money Market Fund | 5.91% | |

| Multi-Utilities | 1.43% | |

| Oil, Gas & Consumable Fuels | 6.42% | |

| Paper & Forest Products | 1.57% | |

| Passenger Airlines | 1.30% | |

| Personal Care Products | 0.51% | |

| Professional Services | 1.13% | |

| Real Estate Management & Development | 2.10% | |

| Semiconductors & Semiconductor Equipment | 8.18% | |

| Specialty Retail | 1.40% | |

| Technology Hardware, Storage & Peripherals | 1.77% | |

| Textiles, Apparel & Luxury Goods | 3.73% | |

| Transportation Infrastructure | 5.15% | |

| Water Utilities | 0.51% | |

| Wireless Telecommunication Services | 1.19% | |

| Other Assets In Excess of Liabilities | 0.06% | |

| TOTAL | 100.00% |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 94.95% | ||

| NORTH AMERICA — 64.22% | ||

| United States — 61.67% | ||

| Alphabet, Inc. - A | 11,795 | $2,148,459 |

| Amazon.com, Inc. * | 8,869 | 1,713,934 |

| Amphenol Corp. - A | 4,354 | 293,329 |

| Apple, Inc. | 13,738 | 2,893,498 |

| Ball Corp. | 5,203 | 312,284 |

| Bank of America Corp. | 17,572 | 698,838 |

| Broadcom, Inc. | 529 | 849,325 |

| CACI International, Inc. - A * | 840 | 361,309 |

| Chipotle Mexican Grill, Inc. * | 9,050 | 566,983 |

| Cloudflare, Inc. - A * | 5,039 | 417,380 |

| Colgate-Palmolive Co. | 7,502 | 727,994 |

| Dell Technologies, Inc. - C | 2,533 | 349,326 |

| Domino's Pizza, Inc. | 814 | 420,293 |

| DraftKings, Inc. - A * | 8,608 | 328,567 |

| elf Beauty, Inc. * | 2,684 | 565,572 |

| Eli Lilly & Co. | 1,307 | 1,183,332 |

| Exxon Mobil Corp. | 13,064 | 1,503,928 |

| Gitlab, Inc. - A * | 8,754 | 435,249 |

| Huntington Bancshares, Inc. | 23,474 | 309,387 |

| JPMorgan Chase & Co. | 4,697 | 950,015 |

| KKR & Co., Inc. | 9,737 | 1,024,722 |

| McKesson Corp. | 963 | 562,431 |

| Medpace Holdings, Inc. * | 1,716 | 706,735 |

| Meta Platforms, Inc. - A | 2,139 | 1,078,527 |

| Microsoft Corp. | 5,909 | 2,641,028 |

| Mondelez International, Inc. - A | 4,308 | 281,916 |

| Motorola Solutions, Inc. | 2,129 | 821,900 |

| NVIDIA Corp. | 20,154 | 2,489,825 |

| Pinterest, Inc. - A * | 14,666 | 646,331 |

| Quanta Services, Inc. | 2,261 | 574,497 |

| Roper Technologies, Inc. | 996 | 561,405 |

| ServiceNow, Inc. * | 694 | 545,949 |

| Southern Copper Corp. | 2,507 | 270,104 |

| Spotify Technology SA * | 2,904 | 911,246 |

| Stryker Corp. | 980 | 333,445 |

| Synopsys, Inc. * | 626 | 372,508 |

| Teradyne, Inc. | 2,838 | 420,847 |

| The Charles Schwab Corp. | 6,901 | 508,535 |

| The Southern Co. | 4,820 | 373,887 |

| The Trade Desk, Inc. - A * | 9,700 | 947,399 |

| Thermo Fisher Scientific, Inc. | 978 | 540,834 |

| Truist Financial Corp. | 9,842 | 382,362 |

| Uber Technologies, Inc. * | 11,178 | 812,417 |

| United Airlines Holdings, Inc. * | 11,006 | 535,552 |

| Vertex Pharmaceuticals, Inc. * | 934 | 437,784 |

| Walmart, Inc. | 10,755 | 728,221 |

| 36,539,409 | ||

| Canada — 2.55% | ||

| Cameco Corp. 1 | 12,114 | 596,009 |

| Shopify, Inc. - A 1,* | 5,674 | 374,768 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Suncor Energy, Inc. | 14,100 | $537,491 |

| 1,508,268 | ||

| Total NORTH AMERICA (Cost $28,516,870) | 38,047,677 | |

| EUROPE — 21.49% | ||

| United Kingdom — 9.00% | ||

| AstraZeneca PLC - SP ADR 1 | 10,514 | 819,987 |

| London Stock Exchange Group PLC | 5,770 | 684,197 |

| RELX PLC | 20,050 | 918,669 |

| Rolls-Royce Holdings PLC * | 217,379 | 1,248,460 |

| Shell PLC | 36,611 | 1,319,327 |

| Unilever PLC | 6,285 | 344,967 |

| 5,335,607 | ||

| Switzerland — 3.59% | ||

| Alcon, Inc. | 5,217 | 463,749 |

| Lonza Group AG | 960 | 522,629 |

| Novartis AG | 3,315 | 352,953 |

| On Holding AG - A 1,* | 12,257 | 475,572 |

| Roche Holding AG | 1,126 | 311,968 |

| 2,126,871 | ||

| Germany — 2.18% | ||

| BASF SE | 6,957 | 336,319 |

| Deutsche Telekom AG | 18,862 | 474,106 |

| Vonovia SE | 16,914 | 481,346 |

| 1,291,771 | ||

| Netherlands — 1.65% | ||

| Adyen NV 2,* | 270 | 320,673 |

| ASM International NV | 860 | 657,363 |

| 978,036 | ||

| Ireland — 1.62% | ||

| Linde PLC 1 | 1,687 | 740,272 |

| Weatherford International PLC 1,* | 1,773 | 217,104 |

| 957,376 | ||

| Spain — 1.21% | ||

| Industria de Diseno Textil SA | 14,451 | 717,107 |

| France — 0.78% | ||

| Accor SA | 11,238 | 459,848 |

| Italy — 0.53% | ||

| UniCredit SpA | 8,514 | 315,069 |

| Greece — 0.47% | ||

| National Bank of Greece SA * | 33,485 | 278,206 |

| Poland — 0.46% | ||

| Powszechny Zaklad Ubezpieczen SA | 21,616 | 275,976 |

| Total EUROPE (Cost $10,879,852) | 12,735,867 | |

| FAR EAST — 9.24% | ||

| Japan — 2.92% | ||

| Kokusai Electric Corp. | 9,700 | 285,211 |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Mitsubishi UFJ Financial Group, Inc. | 55,700 | $601,116 | |

| Nintendo Co. Ltd. | 6,700 | 357,791 | |

| Renesas Electronics Corp. | 25,700 | 487,391 | |

| 1,731,509 | |||

| China — 2.18% | |||

| Tencent Holdings Ltd. | 27,253 | 1,292,891 | |

| India — 1.82% | |||

| ICICI Bank Ltd. - SP ADR 1 | 30,212 | 870,408 | |

| Titan Co. Ltd. | 5,065 | 206,411 | |

| 1,076,819 | |||

| South Korea — 0.73% | |||

| Samsung Electronics Co. Ltd. | 7,383 | 434,518 | |

| Philippines — 0.58% | |||

| BDO Unibank, Inc. | 156,000 | 341,231 | |

| Taiwan — 0.54% | |||

| Taiwan Semiconductor Manufacturing Co. Ltd. | 10,668 | 316,068 | |

| Indonesia — 0.47% | |||

| Bank Central Asia Tbk PT | 462,045 | 279,579 | |

| Total FAR EAST (Cost $3,921,258) | 5,472,615 | ||

| Total COMMON STOCKS (Cost $43,317,980) | 56,256,159 | ||

| SHORT TERM INVESTMENTS — 4.79% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 3 (Cost $2,840,737) | 2,840,737 | 2,840,737 | |

| TOTAL INVESTMENTS (Cost $46,158,717) | 99.74% | $59,096,896 | |

| Other Assets In Excess of Liabilities | 0.26% | 152,881 | |

| Net Assets | 100.00% | $59,249,777 | |

| PLC | Public Limited Company |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $320,673, which represents 1% of Net Assets (see Note F in the Notes to Financial Statements). |

| 3 | 7 day current yield as of June 30, 2024 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 94.95% | |

| Short Term Investments | 4.79% | |

| Total Investments | 99.74% | |

| Other Assets In Excess of Liabilities | 0.26% | |

| Net Assets | 100.00% |

| Regional Weightings | Percent of Net Assets | |

| North America | 69.01% | |

| Europe | 21.50% | |

| Far East | 9.23% |

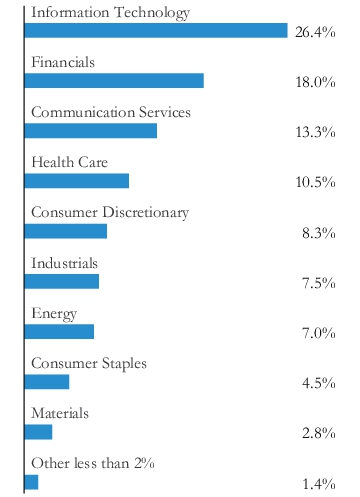

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 2.11% | |

| Banks | 8.49% | |

| Biotechnology | 0.74% | |

| Broadline Retail | 2.89% | |

| Capital Markets | 3.74% | |

| Chemicals | 1.82% | |

| Communications Equipment | 1.39% | |

| Construction & Engineering | 0.97% | |

| Consumer Staples Distribution & Retail | 1.23% | |

| Containers & Packaging | 0.53% | |

| Diversified Telecommunication Services | 0.80% | |

| Electric Utilities | 0.63% | |

| Electronic Equipment, Instruments & Components | 0.50% | |

| Energy Equipment & Services | 0.37% | |

| Entertainment | 2.14% | |

| Financial Services | 0.54% | |

| Food Products | 0.48% | |

| Ground Transportation | 1.37% | |

| Health Care Equipment & Supplies | 1.34% | |

| Health Care Providers & Services | 0.95% | |

| Hotels, Restaurants & Leisure | 3.00% | |

| Household Products | 1.23% |

| Industry | Percent of Net Assets | |

| Insurance | 0.47% | |

| Interactive Media & Services | 8.72% | |

| IT Services | 1.33% | |

| Life Sciences Tools & Services | 2.98% | |

| Media | 1.60% | |

| Metals & Mining | 0.46% | |

| Money Market Fund | 4.79% | |

| Oil, Gas & Consumable Fuels | 6.69% | |

| Passenger Airlines | 0.90% | |

| Personal Care Products | 1.53% | |

| Pharmaceuticals | 4.51% | |

| Professional Services | 2.16% | |

| Real Estate Management & Development | 0.81% | |

| Semiconductors & Semiconductor Equipment | 9.28% | |

| Software | 7.69% | |

| Specialty Retail | 1.21% | |

| Technology Hardware, Storage & Peripherals | 6.20% | |

| Textiles, Apparel & Luxury Goods | 1.15% | |

| Other Assets In Excess of Liabilities | 0.26% | |

| TOTAL | 100.00% |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 96.04% | ||

| EUROPE — 47.11% | ||

| United Kingdom — 7.78% | ||

| Babcock International Group PLC | 394,600 | $2,607,068 |

| ConvaTec Group PLC 1 | 627,072 | 1,857,838 |

| Cranswick PLC | 44,859 | 2,525,655 |

| Intermediate Capital Group PLC | 125,626 | 3,445,206 |

| Marks & Spencer Group PLC | 630,336 | 2,279,129 |

| Renishaw PLC | 37,067 | 1,724,394 |

| RS GROUP PLC | 129,901 | 1,147,988 |

| Serco Group PLC | 1,175,125 | 2,661,694 |

| 18,248,972 | ||

| Germany — 7.59% | ||

| Bilfinger SE | 45,401 | 2,387,569 |

| CTS Eventim AG & Co. KGaA | 35,336 | 2,941,700 |

| KION Group AG | 28,202 | 1,178,093 |

| LEG Immobilien SE | 21,120 | 1,725,422 |

| Nordex SE * | 246,525 | 3,013,758 |

| Scout24 SE 1 | 37,257 | 2,846,575 |

| SUESS MicroTec SE | 56,305 | 3,708,931 |

| 17,802,048 | ||

| Switzerland — 5.85% | ||

| Comet Holding AG | 9,238 | 3,703,383 |

| Flughafen Zurich AG | 15,008 | 3,322,167 |

| PolyPeptide Group AG 1,* | 42,603 | 1,355,947 |

| Siegfried Holding AG * | 2,683 | 2,782,680 |

| Tecan Group AG | 7,593 | 2,542,267 |

| 13,706,444 | ||

| Italy — 5.36% | ||

| Banco BPM SpA | 374,237 | 2,408,515 |

| Buzzi SpA | 61,237 | 2,465,889 |

| Leonardo SpA | 127,993 | 2,965,446 |

| Saipem SpA * | 1,841,425 | 4,721,947 |

| 12,561,797 | ||

| Spain — 3.17% | ||

| Fluidra SA | 104,692 | 2,182,697 |

| Indra Sistemas SA | 197,655 | 4,058,810 |

| Tecnicas Reunidas SA * | 87,738 | 1,187,946 |

| 7,429,453 | ||

| Norway — 3.03% | ||

| DOF Group ASA * | 425,642 | 3,849,228 |

| Seadrill Ltd. 2,* | 63,284 | 3,259,126 |

| 7,108,354 | ||

| Netherlands — 2.48% | ||

| Fugro NV | 116,619 | 2,812,311 |

| Iveco Group NV | 78,939 | 883,949 |

| Merus NV 2,* | 35,973 | 2,128,522 |

| 5,824,782 | ||

| Ireland — 2.39% | ||

| Glanbia PLC | 198,012 | 3,859,509 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Greencore Group PLC * | 831,955 | $1,749,505 |

| 5,609,014 | ||

| France — 2.04% | ||

| Coface SA | 76,407 | 1,063,714 |

| Eramet SA | 19,523 | 1,976,777 |

| Sopra Steria Group | 8,979 | 1,746,077 |

| 4,786,568 | ||

| Sweden — 1.94% | ||

| Hemnet Group AB | 58,860 | 1,773,173 |

| Mycronic AB | 49,854 | 1,931,769 |

| The Thule Group AB 1 | 32,428 | 846,955 |

| 4,551,897 | ||

| Austria — 1.70% | ||

| DO & CO AG | 22,387 | 3,985,201 |

| Belgium — 1.35% | ||

| Lotus Bakeries NV | 219 | 2,258,601 |

| Shurgard Self Storage Ltd. | 23,318 | 901,279 |

| 3,159,880 | ||

| Finland — 1.22% | ||

| Metso OYJ | 269,021 | 2,859,259 |

| Denmark — 1.21% | ||

| ALK-Abello A/S * | 81,664 | 1,784,151 |

| GN Store Nord AS * | 37,445 | 1,043,172 |

| 2,827,323 | ||

| Total EUROPE (Cost $91,295,552) | 110,460,992 | |

| FAR EAST — 35.48% | ||

| Japan — 20.94% | ||

| ABC-Mart, Inc. | 131,000 | 2,299,056 |

| Asics Corp. | 262,800 | 4,051,896 |

| Azbil Corp. | 109,200 | 3,050,208 |

| CKD Corp. | 148,600 | 2,948,667 |

| Fujitec Co. Ltd. | 109,150 | 2,930,069 |

| Fukuoka Financial Group, Inc. | 38,700 | 1,042,157 |

| Harmonic Drive Systems, Inc. | 62,500 | 1,768,237 |

| Hoshizaki Corp. | 68,800 | 2,188,370 |

| Isetan Mitsukoshi Holdings Ltd. | 68,400 | 1,285,702 |

| Jeol Ltd. | 73,800 | 3,351,449 |

| Kewpie Corp. | 57,000 | 1,133,339 |

| Kyoritsu Maintenance Co. Ltd. | 80,900 | 1,515,433 |

| Life Corp. | 44,100 | 1,080,875 |

| Mizuno Corp. | 19,100 | 940,605 |

| Modec, Inc. | 94,200 | 1,702,987 |

| Morinaga Milk Industry Co. Ltd. | 88,400 | 1,860,084 |

| Nichias Corp. | 53,630 | 1,576,964 |

| NOF Corp. | 105,600 | 1,448,317 |

| OBIC Business Co.nsultants Co. Ltd. | 52,300 | 2,203,799 |

| Resonac Holdings Corp. | 72,900 | 1,610,631 |

| Ryohin Keikaku Co. Ltd. | 126,000 | 2,096,886 |

| Seria Co. Ltd. | 150,000 | 2,718,138 |

| Skylark Holdings Co. Ltd. * | 82,800 | 1,102,983 |

| Tazmo Co. Ltd. | 68,400 | 1,521,371 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Yokogawa Electric Corp. | 68,600 | $1,666,025 |

| 49,094,248 | ||

| India — 5.69% | ||

| APL Apollo Tubes Ltd. | 93,169 | 1,735,135 |

| EIH Ltd. | 231,894 | 1,192,197 |

| ICICI Lombard General Insurance Co. Ltd. 1 | 86,199 | 1,845,895 |

| Indian Hotels Co. Ltd. | 369,767 | 2,766,265 |

| KPIT Technologies Ltd. | 90,873 | 1,776,942 |

| Max Healthcare Institute Ltd. | 226,102 | 2,546,440 |

| United Breweries Ltd. | 62,759 | 1,493,169 |

| 13,356,043 | ||

| Taiwan — 2.82% | ||

| King Slide Works Co. Ltd. | 27,000 | 1,026,706 |

| Lotes Co. Ltd. | 58,000 | 2,907,270 |

| Wiwynn Corp. | 33,000 | 2,672,586 |

| 6,606,562 | ||

| South Korea — 2.65% | ||

| Eugene Technology Co. Ltd. | 29,482 | 1,052,739 |

| KT Corp. | 79,772 | 2,161,919 |

| LEENO Industrial, Inc. | 6,538 | 1,105,125 |

| TechWing, Inc. | 41,350 | 1,893,080 |

| 6,212,863 | ||

| Australia — 1.35% | ||

| AUB Group Ltd. | 103,575 | 2,178,382 |

| Paladin Energy Ltd. * | 119,495 | 986,430 |

| 3,164,812 | ||

| Indonesia — 1.09% | ||

| Indosat Tbk PT | 1,959,700 | 1,280,537 |

| Sumber Alfaria Trijaya Tbk PT | 7,562,400 | 1,270,021 |

| 2,550,558 | ||

| Thailand — 0.49% | ||

| Fabrinet 2,* | 4,680 | 1,145,617 |

| Malaysia — 0.45% | ||

| YTL Corp. Bhd. | 1,460,800 | 1,065,377 |

| Total FAR EAST (Cost $73,396,607) | 83,196,080 | |

| NORTH AMERICA — 9.58% | ||

| Canada — 7.73% | ||

| Aritzia, Inc. * | 93,000 | 2,632,184 |

| Boardwalk REIT | 50,974 | 2,626,108 |

| Capstone Copper Corp. * | 313,700 | 2,224,254 |

| Celestica, Inc. * | 44,000 | 2,519,616 |

| Element Fleet Management Corp. | 179,700 | 3,269,422 |

| Kinaxis, Inc. * | 15,111 | 1,742,562 |

| NexGen Energy Ltd. * | 148,800 | 1,037,646 |

| NFI Group, Inc. * | 118,700 | 1,374,371 |

| Xenon Pharmaceuticals, Inc. 2,* | 17,491 | 681,974 |

| 18,108,137 | ||

| Mexico — 1.85% | ||

| Alsea SAB de CV | 291,300 | 1,012,663 |

| GCC SAB de CV | 180,686 | 1,703,258 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Gruma SAB de CV - B | 88,910 | $1,628,567 |

| 4,344,488 | ||

| Total NORTH AMERICA (Cost $19,354,089) | 22,452,625 | |

| SOUTH AMERICA — 1.76% | ||

| Brazil — 1.76% | ||

| Direcional Engenharia SA | 479,012 | 2,278,480 |

| Embraer SA - SP ADR 2,* | 71,217 | 1,837,398 |

| 4,115,878 | ||

| Total SOUTH AMERICA (Cost $2,918,946) | 4,115,878 | |

| MIDDLE EAST — 1.31% | ||

| Israel — 1.31% | ||

| Camtek Ltd. 2 | 12,446 | 1,558,737 |

| Nice Ltd. - SP ADR 2,* | 8,749 | 1,504,566 |

| 3,063,303 | ||

| Total MIDDLE EAST (Cost $2,336,910) | 3,063,303 | |

| AFRICA — 0.80% | ||

| South Africa — 0.80% | ||

| Mr Price Group Ltd. | 166,034 | 1,878,967 |

| Total AFRICA (Cost $1,502,082) | 1,878,967 | |

| Total COMMON STOCKS (Cost $190,804,186) | 225,167,845 | |

| PREFERRED STOCKS — 1.07% | ||

| EUROPE — 1.07% | ||

| Germany — 1.07% | ||

| FUCHS SE, 2.61% 3 | 55,124 | 2,519,929 |

| Total EUROPE (Cost $2,013,550) | 2,519,929 | |

| Total PREFERRED STOCKS (Cost $2,013,550) | 2,519,929 | |

| Shares, Principal Amount, or Number of Contracts | Value | ||

| SHORT TERM INVESTMENTS — 2.46% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 4 (Cost $5,772,060) | 5,772,060 | $5,772,060 | |

| TOTAL INVESTMENTS (Cost $198,589,796) | 99.57% | $233,459,834 | |

| Other Assets In Excess of Liabilities | 0.43% | 1,000,065 | |

| Net Assets | 100.00% | $234,459,899 | |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| SP ADR | Sponsored American Depositary Receipt |

| 1 | Security is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. The total value of these securities is $8,753,210, which represents 4% of Net Assets (see Note F in the Notes to Financial Statements). |

| 2 | Foreign security denominated and/or traded in U.S. dollars. |

| 3 | Current yield is disclosed. Dividends are calculated based on a percentage of the issuer’s net income. |

| 4 | 7 day current yield as of June 30, 2024 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 96.04% | |

| Preferred Stocks | 1.07% | |

| Short Term Investments | 2.46% | |

| Total Investments | 99.57% | |

| Other Assets In Excess of Liabilities | 0.43% | |

| Net Assets | 100.00% |

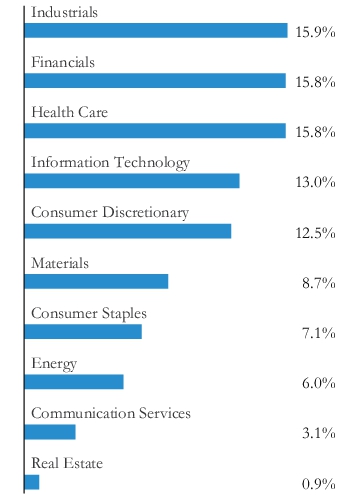

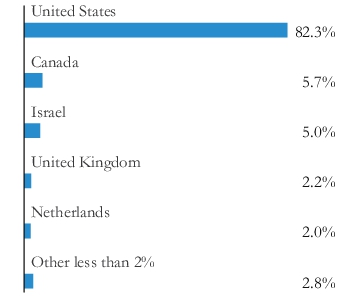

| Regional Weightings | Percent of Net Assets | |

| Europe | 48.18% | |

| Far East | 35.48% | |

| North America | 12.04% | |

| South America | 1.76% | |

| Middle East | 1.31% | |

| Africa | 0.80% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 3.17% | |

| Banks | 1.48% | |

| Beverages | 0.63% | |

| Biotechnology | 1.20% | |

| Broadline Retail | 2.60% | |

| Building Products | 0.67% | |

| Capital Markets | 1.47% | |

| Chemicals | 2.38% | |

| Commercial Services & Supplies | 5.25% | |

| Construction & Engineering | 1.20% | |

| Construction Materials | 1.78% | |

| Consumer Staples Distribution & Retail | 1.97% | |

| Diversified Telecommunication Services | 0.92% | |

| Electrical Equipment | 1.29% | |

| Electronic Equipment, Instruments & Components | 9.39% | |

| Energy Equipment & Services | 6.28% | |

| Entertainment | 1.25% | |

| Food Products | 6.39% | |

| Health Care Equipment & Supplies | 0.79% | |

| Health Care Providers & Services | 1.08% | |

| Hotels, Restaurants & Leisure | 3.24% | |

| Household Durables | 1.42% | |

| Insurance | 2.17% | |

| Interactive Media & Services | 1.97% |

| Industry | Percent of Net Assets | |

| IT Services | 2.48% | |

| Leisure Products | 0.76% | |

| Life Sciences Tools & Services | 2.85% | |

| Machinery | 7.80% | |

| Metals & Mining | 2.53% | |

| Money Market Fund | 2.46% | |

| Multi-Utilities | 0.45% | |

| Oil, Gas & Consumable Fuels | 0.86% | |

| Pharmaceuticals | 0.76% | |

| Real Estate Management & Development | 0.74% | |

| Residential Real Estate Investment Trusts (REITs) | 1.12% | |

| Semiconductors & Semiconductor Equipment | 4.63% | |

| Software | 3.08% | |

| Specialized Real Estate Investment Trusts | 0.39% | |

| Specialty Retail | 2.90% | |

| Technology Hardware, Storage & Peripherals | 1.58% | |

| Textiles, Apparel & Luxury Goods | 1.73% | |

| Trading Companies & Distributors | 0.49% | |

| Transportation Infrastructure | 1.42% | |

| Wireless Telecommunication Services | 0.55% | |

| Other Assets In Excess of Liabilities | 0.43% | |

| TOTAL | 100.00% |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 94.41% | ||

| EUROPE — 75.24% | ||

| United Kingdom — 14.82% | ||

| AstraZeneca PLC | 175 | $27,236 |

| Compass Group PLC | 831 | 22,639 |

| Halma PLC | 425 | 14,486 |

| London Stock Exchange Group PLC | 200 | 23,716 |

| RELX PLC | 509 | 23,322 |

| Rolls-Royce Holdings PLC * | 5,008 | 28,762 |

| Unilever PLC | 494 | 27,114 |

| 167,275 | ||

| Germany — 14.41% | ||

| BASF SE | 521 | 25,187 |

| Deutsche Telekom AG | 959 | 24,105 |

| Infineon Technologies AG | 421 | 15,451 |

| KION Group AG | 200 | 8,355 |

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen | 37 | 18,498 |

| SAP SE | 141 | 28,323 |

| Siemens Energy AG * | 1,248 | 32,541 |

| Vonovia SE | 360 | 10,245 |

| 162,705 | ||

| France — 9.46% | ||

| Accor SA | 304 | 12,439 |

| AXA SA | 489 | 16,025 |

| EssilorLuxottica SA | 105 | 22,563 |

| Hermes International SCA | 9 | 20,787 |

| Safran SA | 62 | 13,067 |

| Sodexo SA | 243 | 21,890 |

| 106,771 | ||

| Switzerland — 8.01% | ||

| Alcon, Inc. | 330 | 29,334 |

| Lonza Group AG | 54 | 29,398 |

| Nestle SA | 311 | 31,745 |

| 90,477 | ||

| Netherlands — 7.67% | ||

| Akzo Nobel NV | 245 | 14,933 |

| ASML Holding NV | 59 | 60,131 |

| STMicroelectronics NV | 293 | 11,476 |

| 86,540 | ||

| Italy — 5.64% | ||

| Leonardo SpA | 834 | 19,323 |

| Saipem SpA * | 9,175 | 23,527 |

| UniCredit SpA | 562 | 20,797 |

| 63,647 | ||

| Denmark — 4.30% | ||

| Novo Nordisk A/S - B | 339 | 48,506 |

| Ireland — 4.11% | ||

| CRH PLC | 343 | 25,418 |

| ICON PLC 1,* | 67 | 21,002 |

| 46,420 | ||

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Spain — 3.99% | |||

| Banco Bilbao Vizcaya Argentaria SA | 888 | $8,914 | |

| Industria de Diseno Textil SA | 729 | 36,176 | |

| 45,090 | |||

| Finland — 1.50% | |||

| Kone OYJ - B | 341 | 16,907 | |

| Sweden — 1.33% | |||

| Atlas Copco AB - A | 800 | 15,021 | |

| Total EUROPE (Cost $842,475) | 849,359 | ||

| FAR EAST — 11.80% | |||

| Japan — 11.80% | |||

| Hitachi Ltd. | 1,000 | 22,517 | |

| Mitsubishi UFJ Financial Group, Inc. | 1,400 | 15,109 | |

| Nintendo Co. Ltd. | 200 | 10,680 | |

| Nippon Sanso Holdings Corp. | 700 | 20,788 | |

| Renesas Electronics Corp. | 900 | 17,068 | |

| Seven & i Holdings Co. Ltd. | 1,700 | 20,774 | |

| Tokio Marine Holdings, Inc. | 700 | 26,306 | |

| 133,242 | |||

| Total FAR EAST (Cost $122,361) | 133,242 | ||

| NORTH AMERICA — 7.37% | |||

| Canada — 7.37% | |||

| Cameco Corp. 1 | 600 | 29,521 | |

| Canadian Natural Resources Ltd. | 400 | 14,248 | |

| Capstone Copper Corp. * | 1,700 | 12,054 | |

| Dollarama, Inc. | 300 | 27,391 | |

| 83,214 | |||

| Total NORTH AMERICA (Cost $81,733) | 83,214 | ||

| Total COMMON STOCKS (Cost $1,046,569) | 1,065,815 | ||

| SHORT TERM INVESTMENTS — 4.39% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 2 (Cost $49,584) | 49,584 | 49,584 | |

| TOTAL INVESTMENTS (Cost $1,096,153) | 98.80% | $1,115,399 | |

| Other Assets In Excess of Liabilities | 1.20% | 13,567 | |

| Net Assets | 100.00% | $1,128,966 | |

| PLC | Public Limited Company |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | 7 day current yield as of June 30, 2024 is disclosed. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 94.41% | |

| Short Term Investments | 4.39% | |

| Total Investments | 98.80% | |

| Other Assets In Excess of Liabilities | 1.20% | |

| Net Assets | 100.00% |

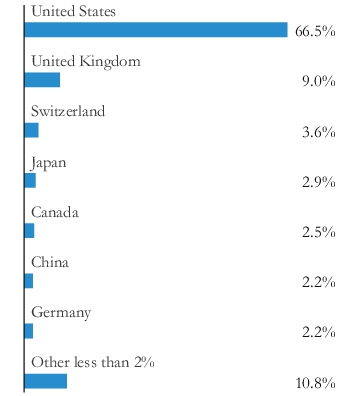

| Regional Weightings | Percent of Net Assets | |

| Europe | 75.24% | |

| Far East | 11.80% | |

| North America | 11.76% |

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 5.42% | |

| Banks | 3.97% | |

| Broadline Retail | 2.43% | |

| Capital Markets | 2.10% | |

| Chemicals | 5.39% | |

| Construction Materials | 2.25% | |

| Consumer Staples Distribution & Retail | 1.84% | |

| Diversified Telecommunication Services | 2.13% | |

| Electrical Equipment | 2.88% | |

| Electronic Equipment, Instruments & Components | 1.28% | |

| Energy Equipment & Services | 2.09% | |

| Entertainment | 0.95% | |

| Food Products | 2.81% | |

| Health Care Equipment & Supplies | 4.60% | |

| Hotels, Restaurants & Leisure | 5.05% | |

| Industrial Conglomerates | 1.99% | |

| Insurance | 5.39% |

| Industry | Percent of Net Assets | |

| Life Sciences Tools & Services | 4.46% | |

| Machinery | 3.57% | |

| Metals & Mining | 1.07% | |

| Money Market Fund | 4.39% | |

| Oil, Gas & Consumable Fuels | 3.87% | |

| Personal Care Products | 2.40% | |

| Pharmaceuticals | 6.71% | |

| Professional Services | 2.07% | |

| Real Estate Management & Development | 0.91% | |

| Semiconductors & Semiconductor Equipment | 9.23% | |

| Software | 2.51% | |

| Specialty Retail | 3.20% | |

| Textiles, Apparel & Luxury Goods | 1.84% | |

| Other Assets In Excess of Liabilities | 1.20% | |

| TOTAL | 100.00% |

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 99.25% | ||

| HEALTH CARE — 31.50% | ||

| Biotechnology — 20.30% | ||

| ADMA Biologics, Inc. * | 384,837 | $4,302,478 |

| Apogee Therapeutics, Inc. * | 75,242 | 2,960,773 |

| Astria Therapeutics, Inc. * | 192,960 | 1,755,936 |

| Autolus Therapeutics PLC - ADR 1,* | 89,234 | 310,534 |

| Biohaven Ltd. * | 26,212 | 909,818 |

| Centessa Pharmaceuticals PLC - ADR 1,* | 156,523 | 1,413,403 |

| CG oncology, Inc. * | 14,340 | 452,714 |

| Crinetics Pharmaceuticals, Inc. * | 167,039 | 7,481,677 |

| Day One Biopharmaceuticals, Inc. * | 95,361 | 1,314,075 |

| Ideaya Biosciences, Inc. * | 58,605 | 2,057,621 |

| KalVista Pharmaceuticals, Inc. * | 71,790 | 845,686 |

| Kiniksa Pharmaceuticals International PLC 1,* | 82,548 | 1,541,171 |

| Larimar Therapeutics, Inc. * | 123,420 | 894,795 |

| Merus NV 1,* | 56,147 | 3,322,218 |

| Nurix Therapeutics, Inc. * | 118,385 | 2,470,695 |

| Nuvalent, Inc. - A * | 30,788 | 2,335,578 |

| Praxis Precision Medicines, Inc. * | 22,197 | 918,068 |

| Protagonist Therapeutics, Inc. * | 45,721 | 1,584,233 |

| Rhythm Pharmaceuticals, Inc. * | 107,635 | 4,419,493 |

| Soleno Therapeutics, Inc. * | 19,456 | 793,805 |

| Twist Bioscience Corp. * | 52,109 | 2,567,931 |

| Vaxcyte, Inc. * | 52,790 | 3,986,173 |

| Vera Therapeutics, Inc. * | 26,277 | 950,702 |

| Xenon Pharmaceuticals, Inc. 1,* | 117,481 | 4,580,584 |

| 54,170,161 | ||

| Health Care Equipment & Supplies — 7.29% | ||

| Alphatec Holdings, Inc. * | 61,263 | 640,198 |

| LeMaitre Vascular, Inc. | 35,430 | 2,915,181 |

| PROCEPT BioRobotics Corp. * | 46,846 | 2,861,822 |

| RxSight, Inc. * | 58,155 | 3,499,186 |

| Tandem Diabetes Care, Inc. * | 63,047 | 2,540,164 |

| TransMedics Group, Inc. * | 46,366 | 6,983,647 |

| 19,440,198 | ||

| Pharmaceuticals — 3.34% | ||

| Avadel Pharmaceuticals PLC 1,* | 63,057 | 886,581 |

| Edgewise Therapeutics, Inc. * | 91,880 | 1,654,759 |

| Longboard Pharmaceuticals, Inc. * | 39,812 | 1,076,118 |

| Mind Medicine MindMed, Inc. 1,* | 135,499 | 976,948 |

| Structure Therapeutics, Inc. - ADR * | 76,041 | 2,986,130 |

| Shares, Principal Amount, or Number of Contracts | Value | |

| Tarsus Pharmaceuticals, Inc. * | 48,871 | $1,328,314 |

| 8,908,850 | ||

| Health Care Providers & Services — 0.57% | ||

| GeneDx Holdings Corp. * | 58,143 | 1,519,858 |

| Total HEALTH CARE (Cost $54,635,588) | 84,039,067 | |

| INDUSTRIALS — 20.84% | ||

| Machinery — 4.70% | ||

| Blue Bird Corp. * | 67,474 | 3,633,475 |

| Federal Signal Corp. | 36,005 | 3,012,538 |

| Mueller Water Products, Inc. - A | 97,510 | 1,747,379 |

| REV Group, Inc. | 114,645 | 2,853,514 |

| The Greenbrier Cos., Inc. | 26,212 | 1,298,805 |

| 12,545,711 | ||

| Construction & Engineering — 4.13% | ||

| Bowman Consulting Group Ltd. * | 37,218 | 1,183,160 |

| Construction Partners, Inc. - A * | 49,575 | 2,737,036 |

| MYR Group, Inc. * | 18,976 | 2,575,233 |

| Sterling Infrastructure, Inc. * | 38,320 | 4,534,789 |

| 11,030,218 | ||

| Commercial Services & Supplies — 4.02% | ||

| ACV Auctions, Inc. - A * | 165,239 | 3,015,612 |

| BrightView Holdings, Inc. * | 131,928 | 1,754,642 |

| CECO Environmental Corp. * | 78,746 | 2,271,822 |

| Montrose Environmental Group, Inc. * | 82,341 | 3,669,115 |

| 10,711,191 | ||

| Aerospace & Defense — 2.81% | ||

| AeroVironment, Inc. * | 10,762 | 1,960,406 |

| Cadre Holdings, Inc. | 54,389 | 1,825,295 |

| Kratos Defense & Security Solutions, Inc. * | 169,016 | 3,382,010 |

| Loar Holdings, Inc. * | 6,106 | 326,121 |

| 7,493,832 | ||

| Electrical Equipment — 2.75% | ||

| American Superconductor Corp. * | 123,527 | 2,889,297 |

| Enovix Corp. * | 186,201 | 2,878,667 |

| Powell Industries, Inc. | 10,900 | 1,563,060 |

| 7,331,024 | ||

| Trading Companies & Distributors — 1.91% | ||

| FTAI Aviation Ltd. | 49,413 | 5,100,904 |

| Ground Transportation — 0.52% | ||

| RXO, Inc. * | 53,056 | 1,387,415 |

| Total INDUSTRIALS (Cost $38,724,532) | 55,600,295 | |

| Shares, Principal Amount, or Number of Contracts | Value | |

| INFORMATION TECHNOLOGY — 15.36% | ||

| Semiconductors & Semiconductor Equipment — 7.70% | ||

| Camtek Ltd. 1 | 41,481 | $5,195,081 |

| Credo Technology Group Holding Ltd. * | 154,617 | 4,938,467 |

| Semtech Corp. * | 82,306 | 2,459,303 |

| SiTime Corp. * | 18,181 | 2,261,353 |

| SkyWater Technology, Inc. * | 93,828 | 717,784 |

| Veeco Instruments, Inc. * | 106,569 | 4,977,838 |

| 20,549,826 | ||

| Software — 4.98% | ||

| Agilysys, Inc. * | 29,273 | 3,048,490 |

| Alkami Technology, Inc. * | 146,322 | 4,167,251 |

| AvePoint, Inc. * | 222,683 | 2,320,357 |

| PROS Holdings, Inc. * | 37,130 | 1,063,774 |

| QXO, Inc. 2,*,^ | 148,673 | 1,358,871 |

| Terawulf, Inc. * | 300,668 | 1,337,973 |

| 13,296,716 | ||

| Electronic Equipment, Instruments & Components — 1.92% | ||

| Arlo Technologies, Inc. * | 347,654 | 4,533,408 |

| Gauzy Ltd. 1,* | 47,810 | 574,676 |

| 5,108,084 | ||

| IT Services — 0.41% | ||

| Couchbase, Inc. * | 59,428 | 1,085,155 |

| Communications Equipment — 0.35% | ||

| Applied Optoelectronics, Inc. * | 112,893 | 935,883 |

| Total INFORMATION TECHNOLOGY (Cost $31,304,803) | 40,975,664 | |

| CONSUMER DISCRETIONARY — 10.72% | ||

| Diversified Consumer Services — 2.88% | ||

| OneSpaWorld Holdings Ltd. 1,* | 249,978 | 3,842,162 |

| Stride, Inc. * | 54,490 | 3,841,545 |

| 7,683,707 | ||

| Automobile Components — 2.77% | ||

| Modine Manufacturing Co. * | 73,821 | 7,396,126 |

| Specialty Retail — 2.60% | ||

| Abercrombie & Fitch Co. - A * | 14,998 | 2,667,244 |

| Arhaus, Inc. | 149,561 | 2,533,563 |

| Warby Parker, Inc. - A * | 108,150 | 1,736,889 |

| 6,937,696 | ||

| Hotels, Restaurants & Leisure — 2.18% | ||

| Kura Sushi USA, Inc. - A * | 16,096 | 1,015,497 |

| Rush Street Interactive, Inc. * | 148,996 | 1,428,871 |

| Sweetgreen, Inc. - A * | 111,934 | 3,373,691 |

| 5,818,059 | ||

| Shares, Principal Amount, or Number of Contracts | Value | |

| Distributors — 0.29% | ||

| A-Mark Precious Metals, Inc. | 23,624 | $764,709 |

| Total CONSUMER DISCRETIONARY (Cost $17,480,763) | 28,600,297 | |

| FINANCIALS — 7.50% | ||

| Insurance — 5.83% | ||

| Bowhead Specialty Holdings, Inc. * | 41,629 | 1,054,879 |

| HCI Group, Inc. | 37,177 | 3,426,604 |

| Heritage Insurance Holdings, Inc. * | 169,082 | 1,197,101 |

| Mercury General Corp. | 54,837 | 2,914,038 |

| Palomar Holdings, Inc. * | 40,250 | 3,266,288 |

| Root, Inc. - A * | 23,784 | 1,227,492 |

| Skyward Specialty Insurance Group, Inc. * | 68,445 | 2,476,340 |

| 15,562,742 | ||

| Banks — 0.85% | ||

| Customers Bancorp, Inc. * | 29,545 | 1,417,569 |

| Triumph Financial, Inc. * | 10,456 | 854,778 |

| 2,272,347 | ||

| Consumer Finance — 0.82% | ||

| Moneylion, Inc. * | 29,699 | 2,184,064 |

| Total FINANCIALS (Cost $17,560,783) | 20,019,153 | |

| ENERGY — 4.27% | ||

| Oil, Gas & Consumable Fuels — 2.41% | ||

| Golar LNG Ltd. 1 | 45,283 | 1,419,622 |

| Gulfport Energy Corp. * | 15,495 | 2,339,745 |

| Uranium Energy Corp. * | 444,852 | 2,673,561 |

| 6,432,928 | ||

| Energy Equipment & Services — 1.86% | ||

| Atlas Energy Solutions, Inc. | 86,705 | 1,728,030 |

| Bristow Group, Inc. * | 18,483 | 619,735 |

| Tidewater, Inc. * | 27,490 | 2,617,323 |

| 4,965,088 | ||

| Total ENERGY (Cost $9,399,536) | 11,398,016 | |

| COMMUNICATION SERVICES — 3.24% | ||

| Interactive Media & Services — 2.74% | ||

| EverQuote, Inc. - A * | 170,615 | 3,559,029 |

| MediaAlpha, Inc. - A * | 129,323 | 1,703,184 |

| QuinStreet, Inc. * | 123,124 | 2,042,627 |

| 7,304,840 | ||

| Shares, Principal Amount, or Number of Contracts | Value | ||

| Media — 0.50% | |||

| Magnite, Inc. * | 100,394 | $1,334,236 | |

| Total COMMUNICATION SERVICES (Cost $7,288,557) | 8,639,076 | ||

| MATERIALS — 3.13% | |||

| Chemicals — 1.32% | |||

| Aspen Aerogels, Inc. * | 147,417 | 3,515,896 | |

| Construction Materials — 0.81% | |||

| Knife River Corp. * | 30,741 | 2,156,174 | |

| Metals & Mining — 0.74% | |||

| Hudbay Minerals, Inc. 1 | 218,047 | 1,973,325 | |

| Containers & Packaging — 0.26% | |||

| Ranpak Holdings Corp. * | 107,854 | 693,501 | |

| Total MATERIALS (Cost $5,787,990) | 8,338,896 | ||

| CONSUMER STAPLES — 2.69% | |||

| Food Products — 1.60% | |||

| Vital Farms, Inc. * | 91,335 | 4,271,738 | |

| Personal Care Products — 0.59% | |||

| elf Beauty, Inc. * | 7,519 | 1,584,404 | |

| Beverages — 0.50% | |||

| The Vita Coco Co., Inc. * | 47,614 | 1,326,050 | |

| Total CONSUMER STAPLES (Cost $3,261,089) | 7,182,192 | ||

| Total COMMON STOCKS (Cost $185,443,641) | 264,792,656 | ||

| SHORT TERM INVESTMENTS — 0.88% | |||

| Northern Institutional U.S. Government Select Portfolio (Shares Class), 5.19% 3 (Cost $2,333,727) | 2,333,727 | 2,333,727 | |

| TOTAL INVESTMENTS (Cost $187,777,368) | 100.13% | $267,126,383 | |

| Liabilities In Excess of Other Assets | (0.13)% | (343,698) | |

| Net Assets | 100.00% | $266,782,685 | |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

| 1 | Foreign security denominated and/or traded in U.S. dollars. |

| 2 | Pursuant to procedures adopted by the Trust’s Board of Trustees, this security has been determined to be illiquid by Driehaus Capital Management LLC (the “Adviser”), investment adviser to the Fund. |

| 3 | 7 day current yield as of June 30, 2024 is disclosed. |

| ^ | Security valued at fair value as determined in good faith by the Adviser, in accordance with procedures established by, and under the general supervision of, the Trust’s Board of Trustee. The security is valued using significant unobservable inputs. |

| * | Non-income producing security. |

| Security Type | Percent of Net Assets | |

| Common Stocks | 99.25% | |

| Short Term Investments | 0.88% | |

| Total Investments | 100.13% | |

| Liabilities In Excess of Other Assets | (0.13)% | |

| Net Assets | 100.00% |

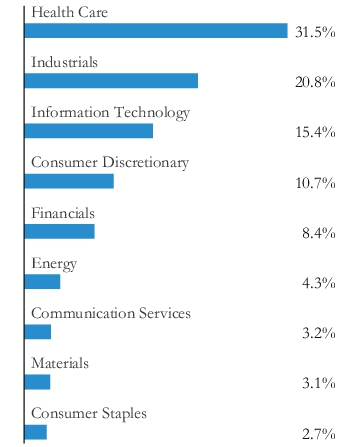

| Industry | Percent of Net Assets | |

| Aerospace & Defense | 2.81% | |

| Automobile Components | 2.77% | |

| Banks | 0.85% | |

| Beverages | 0.50% | |

| Biotechnology | 20.30% | |

| Chemicals | 1.32% | |

| Commercial Services & Supplies | 4.02% | |

| Communications Equipment | 0.35% | |

| Construction & Engineering | 4.13% | |

| Construction Materials | 0.81% | |

| Consumer Finance | 0.82% | |

| Containers & Packaging | 0.26% | |

| Distributors | 0.29% | |

| Diversified Consumer Services | 2.88% | |

| Electrical Equipment | 2.75% | |

| Electronic Equipment, Instruments & Components | 1.92% | |

| Energy Equipment & Services | 1.86% | |

| Food Products | 1.60% | |

| Ground Transportation | 0.52% | |

| Health Care Equipment & Supplies | 7.29% |

| Industry | Percent of Net Assets | |

| Health Care Providers & Services | 0.57% | |

| Hotels, Restaurants & Leisure | 2.18% | |

| Insurance | 5.83% | |

| Interactive Media & Services | 2.74% | |

| IT Services | 0.41% | |

| Machinery | 4.70% | |

| Media | 0.50% | |

| Metals & Mining | 0.74% | |

| Money Market Fund | 0.88% | |

| Oil, Gas & Consumable Fuels | 2.41% | |

| Personal Care Products | 0.59% | |

| Pharmaceuticals | 3.34% | |

| Semiconductors & Semiconductor Equipment | 7.70% | |

| Software | 4.98% | |

| Specialty Retail | 2.60% | |

| Trading Companies & Distributors | 1.91% | |

| Liabilities In Excess of Other Assets | (0.13)% | |

| TOTAL | 100.00% |

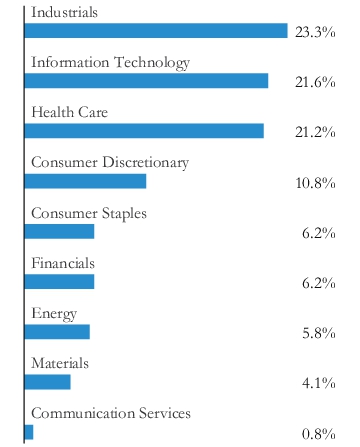

| Shares, Principal Amount, or Number of Contracts | Value | |

| COMMON STOCKS — 99.41% | ||

| INDUSTRIALS — 23.34% | ||

| Aerospace & Defense — 5.78% | ||

| AeroVironment, Inc. * | 22,831 | $4,158,895 |

| Axon Enterprise, Inc. * | 50,234 | 14,780,852 |

| Curtiss-Wright Corp. | 29,667 | 8,039,164 |

| Embraer SA - SP ADR 1,* | 227,575 | 5,871,435 |

| Leonardo DRS, Inc. * | 311,299 | 7,941,238 |

| Moog, Inc. - A | 27,197 | 4,550,058 |

| 45,341,642 | ||

| Trading Companies & Distributors — 3.95% | ||

| Applied Industrial Technologies, Inc. | 20,817 | 4,038,498 |

| Beacon Roofing Supply, Inc. * | 38,944 | 3,524,432 |

| Core & Main, Inc. - A * | 105,996 | 5,187,444 |

| FTAI Aviation Ltd. | 176,680 | 18,238,677 |

| 30,989,051 | ||

| Machinery — 3.88% | ||

| Chart Industries, Inc. * | 23,992 | 3,463,005 |

| Crane Co. | 55,688 | 8,073,646 |

| Federal Signal Corp. | 111,288 | 9,311,467 |

| SPX Technologies, Inc. * | 67,420 | 9,583,079 |

| 30,431,197 | ||

| Construction & Engineering — 3.28% | ||

| API Group Corp. * | 228,604 | 8,602,368 |

| Comfort Systems USA, Inc. | 23,698 | 7,207,036 |

| EMCOR Group, Inc. | 11,085 | 4,046,912 |

| Sterling Infrastructure, Inc. * | 49,676 | 5,878,658 |

| 25,734,974 | ||

| Commercial Services & Supplies — 2.45% | ||

| Montrose Environmental Group, Inc. * | 107,260 | 4,779,505 |

| MSA Safety, Inc. | 25,213 | 4,732,228 |

| Tetra Tech, Inc. | 47,485 | 9,709,733 |

| 19,221,466 | ||

| Professional Services — 1.25% | ||

| Korn Ferry | 59,217 | 3,975,829 |

| Parsons Corp. * | 71,037 | 5,811,537 |

| 9,787,366 | ||

| Ground Transportation — 1.07% | ||

| RXO, Inc. * | 73,859 | 1,931,413 |

| Saia, Inc. * | 13,746 | 6,519,590 |

| 8,451,003 | ||

| Building Products — 0.86% | ||

| AAON, Inc. | 77,167 | 6,732,049 |

| Electrical Equipment — 0.82% | ||

| Enovix Corp. * | 416,927 | 6,445,692 |

| Total INDUSTRIALS (Cost $126,009,675) | 183,134,440 | |

| Shares, Principal Amount, or Number of Contracts | Value | |

| INFORMATION TECHNOLOGY — 21.62% | ||

| Semiconductors & Semiconductor Equipment — 7.86% | ||

| Amkor Technology, Inc. | 186,740 | $7,473,335 |

| Camtek Ltd. 1 | 119,756 | 14,998,241 |

| Credo Technology Group Holding Ltd. * | 360,986 | 11,529,893 |

| FormFactor, Inc. * | 32,023 | 1,938,352 |

| Onto Innovation, Inc. * | 66,259 | 14,547,826 |

| Semtech Corp. * | 168,123 | 5,023,515 |

| Veeco Instruments, Inc. * | 133,046 | 6,214,579 |

| 61,725,741 | ||

| Software — 6.85% | ||

| Appfolio, Inc. - A * | 28,432 | 6,953,614 |