Table of Contents

UNDER THE SECURITIES ACT OF 1933

| Florida | 1520 | 65-0043078 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employee Identification Number) |

(Exact name of registrants as specified in their charters)

| One Park Place, Suite 700 621 Northwest 53rd Street Boca Raton, Florida 33487-8242 (561) 893-0101 (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | John J. Bulfin, Esq. One Park Place, Suite 700 621 Northwest 53rd Street Boca Raton, Florida 33487-8242 (561) 893-0101 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Stephen K. Roddenberry, Esq.

Esther L. Moreno, Esq.

Akerman Senterfitt

One S.E. Third Avenue, 25th Floor

Miami, Florida 33131

(305) 374-5600

Facsimile: (305) 374-5095

Large accelerated filer x | Accelerated filer o | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

| Title of each class of securities | Amount to be | Proposed maximum | Proposed maximum | Amount of | ||||||||||||||||

| to be registered | registered | offering price per unit | aggregate offering price | registration fee | ||||||||||||||||

| 6 5/8% Senior Notes Due 2021 | $ | 300,000,000 | 100 | % | $ | 300,000,000 | (1) | $34,830 | ||||||||||||

| Guarantees of 6 5/8% Senior Notes Due 2021 | — | — | — | None(2) | ||||||||||||||||

| (1) | Represents the maximum principal amount at maturity of the 6 5/8% Senior Notes Due 2021 that may be issued pursuant to the exchange offer described in this registration statement. The registration fee was calculated pursuant to Rule 457(f) under the Securities Act of 1933. | |

| (2) | Pursuant to Rule 457(n) of the Securities Act of 1933, no registration fee is required for the Guarantees. |

Table of Contents

| State or Other | ||||||||

| Jurisdiction of | I.R.S. Employer | |||||||

| Incorporation or | Identification | |||||||

| Exact Name of Subsidiary Guarantor | Formation | Number | ||||||

| GEO RE Holdings LLC | Delaware | 65-0682878 | ||||||

| GEO Care, Inc. | Florida | 65-0749307 | ||||||

| Correctional Services Corporation | Delaware | 11-3182580 | ||||||

| CPT Limited Partner, LLC | Delaware | * | ||||||

| CPT Operating Partnership L.P. | Delaware | 65-0873924 | ||||||

| Correctional Properties Prison Finance LLC | Delaware | * | ||||||

| Public Properties Development and Leasing LLC | Delaware | * | ||||||

| GEO Holdings I, Inc. | Delaware | 56-2635779 | ||||||

| GEO Acquisition II, Inc. | Delaware | 01-0882442 | ||||||

| GEO Transport, Inc. | Florida | 56-2677868 | ||||||

| Just Care, Inc. | Delaware | 63-1166611 | ||||||

| Cornell Companies, Inc. | Delaware | 76-0433642 | ||||||

| Cornell Companies Management Holdings, LLC | Delaware | 74-3024864 | ||||||

| Cornell Companies Administration, LLC | Delaware | 32-6557170 | ||||||

| Cornell Corrections Management, Inc. | Delaware | 74-2650655 | ||||||

| CCG I Corporation | Delaware | 76-0544498 | ||||||

| Cornell Companies Management Services, Limited Partnership | Delaware | 76-0700115 | ||||||

| Cornell Companies Management, LP | Delaware | 76-0700116 | ||||||

| Cornell Corrections of Alaska, Inc. | Alaska | 76-0578707 | ||||||

| Cornell Corrections of California, Inc. | California | 94-2411045 | ||||||

| Cornell Corrections of Texas, Inc. | Delaware | 74-2650651 | ||||||

| Cornell Corrections of Rhode Island, Inc. | Delaware | 74-2650654 | ||||||

| Cornell Interventions, Inc. | Illinois | 74-2918981 | ||||||

| Correctional Systems, Inc. | Delaware | 33-0607766 | ||||||

| WBP Leasing, Inc. | Delaware | 76-0546892 | ||||||

| Cornell Abraxas Group, Inc. | Delaware | 76-0545741 | ||||||

| WBP Leasing, LLC | Delaware | 26-1849095 | ||||||

| BII Holding Corporation | Delaware | 26-3064495 | ||||||

| BII Holding I Corporation | Delaware | 26-3334669 | ||||||

| Behavioral Holding Corp. | Delaware | 20-4244005 | ||||||

| Behavioral Acquisition Corp. | Delaware | 22-3746193 | ||||||

| B.I. Incorporated | Colorado | 84-0769926 | ||||||

| * | Not applicable as these entities are disregarded for Federal Income Tax Purposes |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer is not permitted

Up to $300,000,000 aggregate principal amount

of our 6 5/8% Senior Notes Due 2021

(which we refer to as the new notes)

and the guarantees thereof which have been registered

under the Securities Act of 1933, as amended,

for a like amount of our outstanding

6 5/8% Senior Notes Due 2021

(which we refer to as the old notes)

and the guarantees thereof.

| • | The terms of the new notes are identical to the old notes, except that some of the transfer restrictions, registration rights and additional interest provisions relating to the old notes will not apply to the new notes. |

| • | We are offering to exchange up to $300,000,000 of our old notes for new notes with materially identical terms that have been registered under the Securities Act of 1933. | ||

| • | Subject to the satisfaction or waiver of specified conditions, we will exchange the new notes for all old notes that are validly tendered and not withdrawn prior to the expiration of the exchange offer. | ||

| • | The exchange offer will expire at 5:00 p.m., New York City time, on [• ], 2011, unless extended. | ||

| • | Tenders of old notes may be withdrawn at any time before the expiration of the exchange offer. | ||

| • | We will not receive any proceeds from the exchange offer. | ||

| • | The exchange of outstanding original notes will not be a taxable exchange for U.S. federal income tax purposes. |

| Page | ||||||||

| 1 | ||||||||

| 4 | ||||||||

| 16 | ||||||||

| 30 | ||||||||

| 37 | ||||||||

| 37 | ||||||||

| 39 | ||||||||

| 51 | ||||||||

| 53 | ||||||||

| 84 | ||||||||

| 87 | ||||||||

| 87 | ||||||||

| 88 | ||||||||

| 88 | ||||||||

| F-1 | ||||||||

| EX-12.1 | ||||||||

| EX-23.1 | ||||||||

| EX-23.2 | ||||||||

| EX-25.1 | ||||||||

| EX-99.1 | ||||||||

| EX-99.2 | ||||||||

| EX-99.3 | ||||||||

| EX-99.4 | ||||||||

| EX-99.5 | ||||||||

Table of Contents

| • | if you fail to follow the exchange offer procedures, your original notes will not be accepted for exchange; | ||

| • | if you fail to exchange your original notes for exchange notes, they will continue to be subject to the existing transfer restrictions and you may not be able to sell them; | ||

| • | the notes and the related guarantees are effectively subordinated to our and our subsidiary guarantors’ senior secured indebtedness and structurally subordinated to the indebtedness of our subsidiaries that do not guarantee the notes; | ||

| • | there is no public market for the notes; | ||

| • | we may not be able to satisfy our repurchase obligations in the event of a change of control because the terms of our indebtedness or lack of funds may prevent us from doing so; | ||

| • | fraudulent conveyance laws may permit courts to void the subsidiary guarantees of the notes in specific circumstances, which would interfere with the payment of the subsidiary guarantees; | ||

| • | our significant level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our debt service obligations; | ||

| • | we are incurring significant indebtedness in connection with substantial ongoing capital expenditures. Capital expenditures for existing and future projects may materially strain our liquidity; | ||

| • | despite current indebtedness levels, we may still incur more indebtedness, which could further exacerbate the risks described above; | ||

| • | the covenants in the indenture governing the 73/4% Senior Notes, the indenture governing the 6.625% Senior Notes and our Senior Credit Facility impose significant operating and financial restrictions which may adversely affect our ability to operate our business; | ||

| • | servicing our indebtedness will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control; | ||

| • | because portions of our senior indebtedness have floating interest rates, a general increase in interest rates will adversely affect cash flows; | ||

| • | we depend on distributions from our subsidiaries to make payments on our indebtedness. These distributions may not be made; | ||

| • | from time to time, we may not have a management contract with a client to operate existing beds at a facility or new beds at a facility that we are expanding and we cannot assure you that such a contract will be obtained. Failure to obtain a management contract for these beds will subject us to carrying costs with no corresponding management revenue; | ||

| • | negative conditions in the capital markets could prevent us from obtaining financing, which could materially harm our business; | ||

| • | we are subject to the loss of our facility management contracts, due to terminations, non-renewals or competitive re-bids, which could adversely affect our results of operations and liquidity, including our ability to secure new facility management contracts from other government customers; |

1

Table of Contents

| • | we may not fully realize the anticipated synergies and related benefits of acquisitions or we may not fully realize the anticipated synergies within the anticipated timing; | ||

| • | we will incur significant transaction- and integration-related costs in connection with the Cornell Acquisition and the BI Acquisition; | ||

| • | as a result of our acquisitions, our company has recorded and will continue to record a significant amount of goodwill and other intangible assets. In the future, the company’s goodwill or other intangible assets may become impaired, which could result in material non-cash charges to its results of operations; | ||

| • | our growth depends on our ability to secure contracts to develop and manage new correctional, detention and mental health facilities, the demand for which is outside our control; | ||

| • | we may not be able to meet state requirements for capital investment or locate land for the development of new facilities, which could adversely affect our results of operations and future growth; | ||

| • | we depend on a limited number of governmental customers for a significant portion of our revenues. The loss of, or a significant decrease in business from, these customers could seriously harm our financial condition and results of operations; | ||

| • | a decrease in occupancy levels could cause a decrease in revenues and profitability; | ||

| • | state budgetary constraints may have a material adverse impact on us; | ||

| • | competition for inmates may adversely affect the profitability of our business; | ||

| • | we are dependent on government appropriations, which may not be made on a timely basis or at all and may be adversely impacted by budgetary constraints at the federal, state and local levels; | ||

| • | public resistance to privatization of correctional, detention, mental health and residential facilities could result in our inability to obtain new contracts or the loss of existing contracts, which could have a material adverse effect on our business, financial condition and results of operations; | ||

| • | our GEO Care business, which has become a material part of our consolidated revenues, poses unique risks not associated with our other businesses; | ||

| • | the Cornell Acquisition resulted in our re-entry into the market of operating juvenile correctional facilities which may pose certain unique or increased risks and difficulties compared to other facilities; | ||

| • | adverse publicity may negatively impact our ability to retain existing contracts and obtain new contracts; | ||

| • | we may incur significant start-up and operating costs on new contracts before receiving related revenues, which may impact our cash flows and not be recouped; | ||

| • | failure to comply with extensive government regulation and applicable contractual requirements could have a material adverse effect on our business, financial condition or results of operations; | ||

| • | we may face community opposition to facility location, which may adversely affect our ability to obtain new contracts; | ||

| • | our business operations expose us to various liabilities for which we may not have adequate insurance; | ||

| • | we may not be able to obtain or maintain the insurance levels required by our government contracts; | ||

| • | our international operations expose us to risks which could materially adversely affect our financial condition and results of operations; | ||

| • | we conduct certain of our operations through joint ventures, which may lead to disagreements with our joint venture partners and adversely affect our interest in the joint ventures; | ||

| • | we are dependent upon our senior management and our ability to attract and retain sufficient qualified personnel; | ||

| • | our profitability may be materially adversely affected by inflation; |

2

Table of Contents

| • | various risks associated with the ownership of real estate may increase costs, expose us to uninsured losses and adversely affect our financial condition and results of operations; | ||

| • | risks related to facility construction and development activities may increase our costs related to such activities; | ||

| • | the rising cost and increasing difficulty of obtaining adequate levels of surety credit on favorable terms could adversely affect our operating results; | ||

| • | we may not be able to successfully identify, consummate or integrate acquisitions; | ||

| • | adverse developments in our relationship with our employees could adversely affect our business, financial condition or results of operations; | ||

| • | technological change could cause BI’s electronic monitoring products and technology to become obsolete or require the redesign of BI’s electronic monitoring products, which could have a material adverse effect on BI’s business; | ||

| • | any negative changes in the level of acceptance of or resistance to the use of electronic monitoring products and services by governmental customers could have a material adverse effect on BI’s business, financial condition and results of operations; | ||

| • | BI depends on a limited number of third parties to manufacture and supply quality infrastructure components for its electronic monitoring products. If BI’s suppliers cannot provide the components or services BI requires and with such quality as BI expects, BI’s ability to market and sell its electronic monitoring products and services could be harmed; | ||

| • | as a result of our acquisition of BI, we may face new risks as we enter a new line of business; | ||

| • | the interruption, delay or failure of the provision of BI’s services, BI’s information systems or the provision of telecommunications and cellular services by third parties which BI’s business relies upon could adversely affect BI’s business; | ||

| • | an inability to acquire, protect or maintain BI’s intellectual property and patents could harm BI’s ability to compete or grow; | ||

| • | BI’s products could infringe on the intellectual property rights of others, which may lead to litigation that could itself be costly, could result in the payment of substantial damages or royalties, and/or prevent BI from using technology that is essential to its products; | ||

| • | BI licenses intellectual property rights, including patents, from third party owners. If such owners do not properly maintain or enforce the intellectual property underlying such licenses, BI’s competitive position and business prospects could be harmed. BI’s licensors may also seek to terminate its license; and | ||

| • | BI may be subject to costly product liability claims from the use of its electronic monitoring products, which could damage BI’s reputation, impair the marketability of BI’s products and services and force BI to pay costs and damages that may not be covered by adequate insurance. |

3

Table of Contents

| • | our correctional and detention management services involve the provision of security, administrative, rehabilitation, education, health and food services, primarily at adult male correctional and detention facilities; | ||

| • | our mental health and residential treatment services involve working with governments to deliver quality care, innovative programming and active patient treatment, primarily in state-owned mental healthcare facilities; | ||

| • | our community-based services involve supervision of adult parolees and probationers and the provision of temporary housing, programming, employment assistance and other services with the intention of the successful reintegration of residents into the community; | ||

| • | our youth services include residential, detention and shelter care and community-based services along with rehabilitative, educational and treatment programs; | ||

| • | we develop new facilities, using our project development experience to design, construct and finance what we believe are state-of-the-art facilities that maximize security and efficiency; | ||

| • | we provide secure transportation services for offender and detainee populations as contracted; and |

4

Table of Contents

| • | we provide comprehensive electronic monitoring and supervision services as a result of our acquisition of BI. |

Pro Forma for the Year Ended January 2, 2011

5

Table of Contents

6

Table of Contents

7

Table of Contents

8

Table of Contents

9

Table of Contents

| Issuer | The GEO Group, Inc. | |

| Notes Offered | $300,000,000 aggregate principal amount of 6.625% Senior Notes due 2021. | |

| Maturity Date | February 15, 2021. | |

| Interest Payment Dates | February 15 and August 15, commencing August 15, 2011. | |

| Subsidiary Guarantees | On the issue date, each of our restricted subsidiaries that guarantees our senior credit facility will guarantee the notes. The notes may be guaranteed by additional subsidiaries in the future under certain circumstances. See “Description of Notes — Certain Covenants — Additional Note Guarantees.” GEO and the initial guarantors generated approximately 82.2% of our consolidated revenues for the fiscal year ended January 2, 2011 and held approximately 81.8% of our consolidated assets as of January 2, 2011. | |

| Ranking | The notes and the guarantees will be unsecured, unsubordinated obligations of GEO and the guarantors and will rank: |

| • | pari passu with any unsecured, unsubordinated indebtedness of GEO and the guarantors, including the 73/4% senior notes; | ||

| • | senior to any future indebtedness of GEO and the guarantors that is expressly subordinated to the notes and the guarantees; | ||

| • | effectively junior to any secured indebtedness of GEO and the guarantors, including indebtedness under our senior credit facility, to the extent of the value of the assets securing such indebtedness; and | ||

| • | structurally junior to all obligations of our subsidiaries that are not guarantors. |

| Optional Redemption | On or after February 15, 2016, we may redeem some or all of the notes at any time at the redemption prices specified under “Description of Notes — Optional Redemption.” | |

| Before February 15, 2016, we may redeem some or all of the notes at a redemption price equal to 100% of the principal amount of each note to be redeemed plus a make-whole premium described under “Description of Notes — Optional Redemption” together with accrued and unpaid interest. | ||

| In addition, at any time prior to February 15, 2014, we may redeem up to 35% of the notes with the net cash proceeds from specified equity offerings at a redemption price equal to 106.625% of the principal amount of each note to be redeemed, plus accrued and unpaid interest, if any, to the date of redemption. | ||

| Change of Control | Upon a change of control (as defined in “Description of Notes — Certain Definitions”), we must offer to repurchase the notes at 101% of the principal amount, plus accrued interest to the purchase date. |

10

Table of Contents

| Certain Covenants | The indenture governing the notes contains certain covenants, including limitations and restrictions on our and our restricted subsidiaries’ ability to: |

| • | incur additional indebtedness or issue preferred stock; | ||

| • | make dividend payments or other restricted payments; | ||

| • | create liens; | ||

| • | sell assets; | ||

| • | enter into transactions with affiliates; and | ||

| • | enter into mergers, consolidations, or sales of all or substantially all of our assets. |

| As of the date of the indenture, all of our subsidiaries (other than CSC of Tacoma, LLC, GEO International Holdings, Inc., certain dormant domestic subsidiaries and all of our foreign subsidiaries in existence on the date of the indenture) will be restricted subsidiaries. Our unrestricted subsidiaries will not be subject to any of the restrictive covenants in the indenture. The restrictive covenants set forth in the indenture are subject to important exceptions and qualifications. In addition, most of the covenants will be suspended while the notes are rated investment grade by Moody’s Investment Services, Inc. or Standard & Poor’s Rating Services. See “Description of Notes — Certain Covenants.” | ||

| Risk Factors | Potential investors in the notes should carefully consider the matters set forth under the caption “Risk Factors” prior to making an investment decision with respect to the notes. |

11

Table of Contents

| The Exchange Offer | We are offering to exchange new notes for old notes. | |

| Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on [•], 2011, unless extended. | |

| Condition to the Exchange Offer | The registration rights agreement does not require us to accept old notes for exchange if the exchange offer or the making of any exchange by a holder of the old notes would violate any applicable law or interpretation of the staff of the Securities and Exchange Commission. A minimum aggregate principal amount of old notes being tendered is not a condition to the exchange offer. | |

| Procedures for Tendering Old Notes | To participate in the exchange offer, you must complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal, and transmit it together with all other documents required in the letter of transmittal, including the old notes that you wish to exchange, to Wells Fargo Bank, N.A., as exchange agent, at the address indicated on the cover page of the letter of transmittal. In the alternative, you can tender your old notes by following the procedures for book-entry transfer described in this prospectus. | |

| If your old notes are held through The Depository Trust Company and you wish to participate in the exchange offer, you may do so through the automated tender offer program of The Depository Trust Company. If you tender under this program, you will agree to be bound by the letter of transmittal that we are providing with this prospectus as though you had signed the letter of transmittal. | ||

| If a broker, dealer, commercial bank, trust company or other nominee is the registered holder of your old notes, we urge you to contact that person promptly to tender your old notes in the exchange offer. | ||

| For more information on tendering your old notes, please refer to the sections in this prospectus entitled “Exchange Offer — Terms of the Exchange Offer,” “— Procedures for Tendering” and “— Book-Entry Transfer.” | ||

| Guaranteed Delivery Procedures | If you wish to tender your old notes and you cannot get your required documents to the exchange agent on time, you may tender your old notes according to the guaranteed delivery procedures described in “Exchange Offer — Guaranteed Delivery Procedures.” | |

| Withdrawal of Tenders | You may withdraw your tender of old notes under the exchange offer at any time prior to the expiration date. To withdraw, you must have delivered a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated on the cover page of the letter of transmittal before 5:00 p.m. New York City time on the expiration date of the exchange offer. |

12

Table of Contents

| Acceptance of Old Notes and Delivery of New Notes | If you fulfill all conditions required for proper acceptance of old notes, we will accept any and all old notes that you properly tender in the exchange offer on or before 5:00 p.m. New York City time on the expiration date. We will return any old notes that we do not accept for exchange to you without expense promptly after the expiration date. We will deliver the new notes promptly after the expiration date and acceptance of the old notes for exchange. Please refer to the section in this prospectus entitled “Exchange Offer — Terms of the Exchange Offer.” | |

| Fees and Expenses | We will bear all expenses related to the exchange offer. Please refer to the section in this prospectus entitled “Exchange Offer — Fees and Expenses.” | |

| Use of Proceeds | We will not receive any proceeds from the issuance of the new notes. We are making this exchange offer solely to satisfy our obligations under our registration rights agreement. | |

| Appraisal Rights | Holders of old notes will not have dissenters rights or appraisal rights in connection with the exchange offer. | |

| Resale of New Notes | Based on an interpretation by the Commission set forth in no-action letters issued to third parties, we believe that you may resell or otherwise transfer new notes issued in the exchange offer in exchange for old notes without restrictions under the federal securities laws if: |

| • | you are not our “affiliate”; | ||

| • | you acquire the new notes in the ordinary course of your business; and | ||

| • | you do not intend to participate in a distribution of the new notes. |

| If you tender in the exchange offer with the intention of participating in any manner in a distribution of the new notes, you |

| • | cannot rely on such interpretations by the staff of the Commission; and | ||

| • | must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a secondary resale transaction. |

| Only broker-dealers that acquired the old notes as a result of market-making activities or other trading activities may participate in the exchange offer. Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must deliver a prospectus in connection with any resale of the new notes. | ||

| Consequences of Failure to Exchange Old Notes | If you do not exchange your old notes in the exchange offer, you will no longer be able to require us to register the old notes under the Securities Act of 1933, except in the limited circumstances provided under our registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the old notes unless we have registered the old notes under the Securities Act of 1933, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act of 1933. | |

| U.S. Federal Income Tax Considerations | The exchange of the new notes for the old notes in the exchange offer should not be a taxable event for U.S. federal income tax purposes. Please read “Material U.S. Federal Income Tax Considerations.” | |

| Exchange Agent | We have appointed Wells Fargo Bank, N.A., as exchange agent for the exchange offer. You should direct questions and requests for assistance, requests for additional copies of this prospectus or the letter of transmittal and requests for the notice of guaranteed delivery to the exchange agent as follows: by telephone at (800) 344-5128, Option 0. Eligible institutions may make requests by facsimile at (612) 667-6282, Attn: Bondholder Communications. |

13

Table of Contents

| Pro Forma | ||||||||||||||||

| Fiscal | ||||||||||||||||

| Fiscal Year Ended | Year Ended | |||||||||||||||

| December 28, | January 3, | January 2, | January 2, | |||||||||||||

| 2008 | 2010 | 2011 | 2011 | |||||||||||||

Consolidated Statement of Income: | ||||||||||||||||

| Revenues | $ | 1,043.0 | $ | 1,141.1 | $ | 1,270.0 | $ | 1,630.2 | ||||||||

| Operating costs and expenses | ||||||||||||||||

| Operating expenses | 822.1 | 897.1 | 975.0 | 1,220.6 | ||||||||||||

| Depreciation and amortization | 37.4 | 39.3 | 48.1 | 79.7 | ||||||||||||

| General and administrative expenses | 69.1 | 69.2 | 106.4 | 110.2 | ||||||||||||

| Total operating costs and expenses | 928.6 | 1,005.6 | 1,129.5 | 1,410.5 | ||||||||||||

| Operating income(1) | 114.4 | 135.5 | 140.5 | 219.7 | ||||||||||||

| Interest income | 7.0 | 4.9 | 6.2 | 6.5 | ||||||||||||

| Interest expense(2) | (30.2 | ) | (28.5 | ) | (40.7 | ) | (78.9 | ) | ||||||||

| Loss on extinguishment of debt | — | (6.8 | ) | (7.9 | ) | (7.9 | ) | |||||||||

| Income before income taxes | 91.2 | 105.1 | 98.1 | 139.4 | ||||||||||||

| Provision for income taxes(1) | 34.0 | 42.1 | 39.5 | 53.8 | ||||||||||||

| Equity in earnings of affiliates, net of income tax | 4.6 | 3.5 | 4.2 | 4.2 | ||||||||||||

| Income from continuing operations | 61.8 | 66.5 | 62.8 | 89.8 | ||||||||||||

| Net (income) loss attributable to non-controlling interest(1) | (0.4 | ) | (0.2 | ) | 0.7 | (0.3 | ) | |||||||||

| Net income from continuing operations attributable to GEO | $ | 61.4 | $ | 66.3 | $ | 63.5 | $ | 89.5 | ||||||||

Business Segment Data: | ||||||||||||||||

| Revenues: | ||||||||||||||||

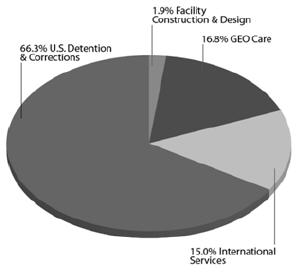

| U.S. Detention & Corrections(3) | $ | 700.6 | $ | 772.5 | $ | 842.4 | $ | 987.7 | ||||||||

| International Services | 128.7 | 137.2 | 190.5 | 190.5 | ||||||||||||

| GEO Care(3) | 127.8 | 133.4 | 213.8 | 428.7 | ||||||||||||

| Facility Construction & Design | 85.9 | 98.0 | 23.3 | 23.3 | ||||||||||||

| Total revenues | $ | 1,043.0 | $ | 1,141.1 | $ | 1,270.0 | $ | 1,630.2 | ||||||||

| Operating income (loss) | ||||||||||||||||

| U.S. Detention & Corrections (3) | $ | 156.3 | $ | 178.3 | $ | 204.4 | $ | 239.8 | ||||||||

| International Services | 10.7 | 8.0 | 12.3 | 12.3 | ||||||||||||

| GEO Care(3) | 16.2 | 18.0 | 27.8 | 75.4 | ||||||||||||

| Facility Construction & Design | 0.3 | 0.4 | 2.4 | 2.4 | ||||||||||||

| Unallocated G&A expenses | (69.1 | ) | (69.2 | ) | (106.4 | ) | (110.2 | ) | ||||||||

| Total operating income | $ | 114.4 | $ | 135.5 | $ | 140.5 | $ | 219.7 | ||||||||

Balance Sheet Data (at period end): | ||||||||||||||||

| Cash and cash equivalents (unrestricted) | $ | 31.7 | $ | 33.9 | $ | 39.7 | $ | 58.1 | ||||||||

| Restricted cash | 32.7 | 34.1 | 90.6 | 90.7 | ||||||||||||

| Accounts receivable, net | 199.7 | 200.8 | 275.5 | 294.9 | ||||||||||||

| Property, plant and equipment, net | 878.6 | 998.6 | 1,511.3 | 1,532.7 | ||||||||||||

| Total assets | 1,288.6 | 1,447.8 | 2,423.8 | 2,935.0 | ||||||||||||

| Total debt | 512.1 | 584.7 | 1,045.0 | 1,497.0 | ||||||||||||

| Total shareholders’ equity | 579.6 | 665.1 | 1,039.5 | 1,035.6 | ||||||||||||

Other Financial Data: | ||||||||||||||||

| Net cash provided by operating activities | $ | 71.5 | $ | 131.1 | 126.2 | * | ||||||||||

| Net cash (used in) investing activities | (131.6 | ) | (185.3 | ) | (368.3 | ) | * | |||||||||

| Net cash provided by financing activities | 53.6 | 51.9 | 243.7 | * | ||||||||||||

| Capital expenditures | 131.0 | 149.8 | 97.1 | * | ||||||||||||

| Depreciation and amortization expense | 37.4 | 39.3 | 48.1 | 79.7 | ||||||||||||

Financial Ratio: | ||||||||||||||||

| Ratio of earnings to fixed charges(4) | 3.1x | 3.1x | 2.5x | 2.2x | ||||||||||||

Business Segment Operational Data: | ||||||||||||||||

| Compensated Mandays (in millions)(5) | ||||||||||||||||

| U.S. Detention & Corrections | 13.2 | 14.4 | 15.1 | * | * | |||||||||||

| International Services | 2.1 | 2.2 | 2.5 | * | * | |||||||||||

| GEO Care | 0.6 | 0.7 | 1.3 | * | * | |||||||||||

| Total Compensated Mandays | 15.9 | 17.3 | 18.9 | * | * | |||||||||||

| Revenue Producing Beds (in thousands) (end of period)(6) | ||||||||||||||||

| U.S. Detention & Corrections | 41.8 | 40.7 | 53.8 | * | * | |||||||||||

| International Services | 5.8 | 6.8 | 7.2 | * | * | |||||||||||

| GEO Care | 1.8 | 2.2 | 6.1 | * | * | |||||||||||

| Total Revenue Producing Beds | 49.4 | 49.7 | 67.1 | * | * | |||||||||||

| Average Occupancy(7) | ||||||||||||||||

| U.S. Detention & Corrections | 95.7 | % | 93.6 | % | 93.8 | % | * | * | ||||||||

| International Services | 100.0 | % | 100.0 | % | 100.0 | % | * | * | ||||||||

| GEO Care | 100.0 | % | 99.5 | % | 92.4 | % | * | * | ||||||||

| Total Average Occupancy | 96.4 | % | 94.6 | % | 94.5 | % | * | * | ||||||||

Other Operational Data (end of period): | ||||||||||||||||

| Facilities in operation(8) | 59 | 57 | 103 | * | * | |||||||||||

| Design capacity of facilities (in thousands)(9) | 53.4 | 52.8 | 70.2 | * | * | |||||||||||

| * | This information is not required for purposes of the pro forma financial data. | |

| ** | This information presents certain measures relative to GEO’s Detention & Corrections facilities and GEO Care’s residential facilities and is not expected to change as a result of the acquisition of BI. | |

| (1) | For fiscal years ended December 28, 2008 and January 3, 2010, the Company has reclassified its noncontrolling interest in South African Custodial Management Pty. Limited (“SACM”) to conform to current presentation. | |

| (2) | Interest expense excludes the following capitalized interest amounts for the periods presented (in millions): |

14

Table of Contents

| Fiscal Year Ended | Pro Forma Fiscal Year Ended | |||||

| December 28, | January 3, | January 2, | January 2, | |||

| 2008 | 2010 | 2011 | 2011 | |||

| $4.3 | $4.9 | $4.1 | $4.1 | |||

| (3) | For fiscal years ended December 28, 2008 and January 3, 2010, we have reclassified Business Segment Data and Business Segment Operational Data for two of our community based facilities which were previously part of our U.S. Detention & Corrections segment and are now part of our GEO Care segment. The combined revenue and operating income for these two facilities during the periods presented is as follows: |

| Pro Forma | ||||||||||||||||

| Fiscal Year Ended | Fiscal Year Ended | |||||||||||||||

| December 28, | January 3, | January 2, | January 2, | |||||||||||||

| 2008 | 2010 | 2011 | 2011 | |||||||||||||

| Revenue | $ | 10.5 | $ | 11.6 | $ | 11.3 | $ | 11.3 | ||||||||

| Operating Income | $ | 3.7 | $ | 4.5 | $ | 4.0 | $ | 4.0 | ||||||||

| (4) | For purposes of calculating the ratio of earnings to fixed charges, earnings consists of income before income taxes and equity in earnings of affiliates plus fixed charges, which consist of interest expense (including the interest element of rental expense), whether expensed or capitalized, and amortization of capitalized interest and deferred financing fees. | |

| (5) | Compensated mandays are calculated as follows: (a) for per diem rate facilities — the number of beds occupied by residents on a daily basis during the period; and (b) for fixed rate facilities — the design capacity of the facility multiplied by the number of days the facility was in operation during the period. | |

| (6) | Revenue producing beds are available beds under contract, excluding facilities under development, idle facilities and discontinued operations. | |

| (7) | The average occupancy is calculated by taking compensated mandays as a percentage of capacity, excluding mandays and capacity of our idle facilities, facilities under development and discontinued operations. | |

| (8) | Facilities in operation exclude facilities under development, idle facilities and discontinued operations. | |

| (9) | Design capacity of facilities is defined as the total available beds, excluding facilities under development, idle facilities and discontinued operations. |

15

Table of Contents

| • | prevailing interest rates for similar securities; | ||

| • | general economic conditions; | ||

| • | our financial condition, performance or prospects; and | ||

| • | the prospects for other companies in the same industry. |

16

Table of Contents

| • | incurred the obligations with the intent to hinder, delay or defraud creditors; or | ||

| • | received less than reasonably equivalent value, or did not receive fair consideration, in exchange for incurring those obligations; and | ||

| (1) | was insolvent or rendered insolvent by reason of that incurrence; | ||

| (2) | was engaged in a business or transaction for which the subsidiary’s remaining assets constituted unreasonably small capital; or | ||

| (3) | intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature. |

| • | the sum of its debts, including contingent liabilities, is greater than the fair saleable value of all of its assets; | ||

| • | the present fair saleable value of its assets is less than the amount that would be required to pay its probable liabilities on its existing debts, including contingent liabilities, as they become absolute and mature; or | ||

| • | it cannot pay its debts as they become due. |

17

Table of Contents

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, and other general corporate purposes; | ||

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; | ||

| • | increase our vulnerability to adverse economic and industry conditions; | ||

| • | place us at a competitive disadvantage compared to competitors that may be less leveraged; and | ||

| • | limit our ability to borrow additional funds or refinance existing indebtedness on favorable terms. |

18

Table of Contents

| • | incur additional indebtedness; | ||

| • | pay dividends and or distributions on our capital stock, repurchase, redeem or retire our capital stock, prepay subordinated indebtedness, make investments; | ||

| • | issue preferred stock of subsidiaries; | ||

| • | guarantee other indebtedness; | ||

| • | create liens on our assets; | ||

| • | transfer and sell assets; | ||

| • | make capital expenditures above certain limits; | ||

| • | create or permit restrictions on the ability of our restricted subsidiaries to make dividends or make other distributions to us; | ||

| • | enter into sale/leaseback transactions; | ||

| • | enter into transactions with affiliates; and | ||

| • | merge or consolidate with another company or sell all or substantially all of our assets. |

19

Table of Contents

20

Table of Contents

21

Table of Contents

22

Table of Contents

23

Table of Contents

| • | the concept of the privatization of the mental health and residential treatment services provided by GEO Care has not yet achieved general acceptance by either government agencies or the public, which could materially limit GEO Care’s growth prospects; | ||

| • | GEO Care’s business is highly dependent on the continuous recruitment, hiring and retention of a substantial pool of qualified psychiatrists, physicians, nurses and other medically trained personnel as well as counselors and social workers which may not be available in the quantities or locations sought, or on the employment terms offered; | ||

| • | GEO Care’s business model often involves taking over outdated or obsolete facilities and operating them while it supervises the construction and development of new, more updated facilities; during this transition period, GEO Care may be particularly vulnerable to operational difficulties primarily relating to or resulting from the deteriorating nature of the older existing facilities; and | ||

| • | the facilities operated by GEO Care are substantially dependent on government funding, including in some cases the receipt of Medicare and Medicaid funding; the loss of such government funding for any reason with respect to any facilities operated by GEO Care could have a material adverse impact on our business. |

24

Table of Contents

25

Table of Contents

26

Table of Contents

27

Table of Contents

28

Table of Contents

| • | cease selling or using any products that incorporate the asserted intellectual property, which would adversely affect BI’s revenue; | ||

| • | pay substantial damages for past use of the asserted intellectual property; | ||

| • | obtain a license from the holder of the asserted intellectual property, which license may not be available on reasonable terms, if at all; or | ||

| • | redesign or rename, in the case of trademark claims, BI’s products to avoid infringing the intellectual property rights of third parties, which may not be possible and could be costly and time-consuming if it is possible to do. |

29

Table of Contents

| • | you are not our “affiliate” within the meaning of Rule 405 under the Securities Act; | ||

| • | the new notes are acquired in the ordinary course of your business; and | ||

| • | you do not intend to participate in a distribution of the new notes. |

| • | cannot rely on such interpretations by the Commission staff; and | ||

| • | must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a secondary resale transaction. |

30

Table of Contents

| • | to delay accepting for exchange any old notes, | ||

| • | to extend the exchange offer, or | ||

| • | to terminate the exchange offer, |

31

Table of Contents

| • | complete, sign and date the letter of transmittal, or a facsimile of the letter of transmittal; | ||

| • | have the signature on the letter of transmittal guaranteed if the letter of transmittal so requires; and | ||

| • | mail or deliver such letter of transmittal or facsimile to the exchange agent prior to 5:00 p.m. New York City time on the expiration date; or | ||

| • | comply with the automated tender offer program procedures of The Depository Trust Company, or DTC, described below. |

| • | the exchange agent must receive old notes along with the letter of transmittal; or | ||

| • | the exchange agent must receive, prior to 5:00 p.m. New York City time on the expiration date, a timely confirmation of book-entry transfer of such old notes into the exchange agent’s account at DTC according to the procedure for book-entry transfer described below or a properly transmitted agent’s message; or | ||

| • | the holder must comply with the guaranteed delivery procedures described below. |

32

Table of Contents

| • | make appropriate arrangements to register ownership of the old notes in your name; or | ||

| • | obtain a properly completed bond power from the registered holder of the old notes. |

| • | by a registered holder who has not completed the box entitled “Special Issuance Instructions” or “Special Delivery Instructions” on the letter of transmittal; | ||

| • | for the account of a member firm of a registered national securities exchange or of the National Association of Securities Dealers, Inc., a commercial bank or trust company having an office or correspondence in the United States, or an eligible guarantor institution. |

| • | DTC has received an express acknowledgment from a participant in its automated tender offer program that is tendering old notes that are the subject of such book-entry confirmation; | ||

| • | such participant has received and agrees to be bound by the terms of the letter of transmittal or, in the case of an agent’s message relating to guaranteed delivery, that such participant has received and agrees to be bound by the notice of guaranteed delivery; and | ||

| • | the agreement may be enforced against such participant. |

33

Table of Contents

| • | old notes or a timely book-entry confirmation of such old notes into the exchange agent’s account at DTC; and | ||

| • | a properly completed and duly executed letter of transmittal and all other required documents or a properly transmitted agent’s message. |

| • | any new notes that you receive will be acquired in the ordinary course of your business; | ||

| • | you have no arrangement or understanding with any person or entity to participate in the distribution of the new notes; | ||

| • | you are not engaged in and do not intend to engage in the distribution of the new notes; | ||

| • | if you are a broker-dealer that will receive new notes for your own account in exchange for old notes, you acquired those notes as a result of market-making activities or other trading activities and you will deliver a prospectus, as required by law, in connection with any resale of such new notes; and | ||

| • | you are not our “affiliate,” as defined in Rule 405 of the Securities Act. |

34

Table of Contents

| • | the tender is made through a member firm of a registered national securities exchange or of the National Association of Securities Dealers, Inc., a commercial bank or trust company having an office or correspondent in the United States, or an eligible guarantor institution, | ||

| • | prior to the expiration date, the exchange agent receives from such member firm of a registered national securities exchange or of the National Association of Securities Dealers, Inc., commercial bank or trust company having a office or correspondent in the United States, or eligible guarantor institution either a properly completed and duly executed notice of guaranteed delivery by facsimile transmission, mail or hand delivery or a properly transmitted agent’s message and notice of guaranteed delivery: | ||

| • | setting forth your name and address, the registered number(s) of your old notes and the principal amount of old notes tendered, | ||

| • | stating that the tender is being made thereby, and | ||

| • | guaranteeing that, within three (3) New York Stock Exchange (“NYSE”) trading days after the applicable expiration date, the letter of transmittal or facsimile thereof, together with the old notes or a book-entry confirmation, and any other documents required by the letter of transmittal will be deposited by the eligible guarantor institution with the exchange agent, and | ||

| • | the exchange agent receives such properly completed and executed letter of transmittal or facsimile thereof, as well as all tendered old notes in proper form for transfer or a book-entry confirmation, and all other documents required by the letter of transmittal, within three (3) NYSE trading days after the expiration date. |

| • | the exchange agent must receive a written notice of withdrawal at the address indicated on the cover page of the letter of transmittal; or | ||

| • | you must comply with the appropriate procedures of DTC’s automated tender offer program system. |

| • | specify the name of the person who tendered the old notes to be withdrawn; and | ||

| • | identify the old notes to be withdrawn, including the principal amount of such old notes. |

35

Table of Contents

| • | Commission registration fees; | ||

| • | fees and expenses of the exchange agent and trustee; | ||

| • | accounting and legal fees and printing costs; and | ||

| • | related fees and expenses. |

| • | certificates representing old notes for principal amounts not tendered or accepted for exchange are to be delivered to, or are to be issued in the name of, any person other than the registered holder of old notes tendered; | ||

| • | tendered old notes are registered in the name of any person other than the person signing the letter of transmittal; or | ||

| • | a transfer tax is imposed for any reason other than the exchange of old notes under the exchange offer. |

36

Table of Contents

| Fiscal Year Ended | ||||||||||||||||||||

| December 31, | December 30, | December 28, | January 3, | January 2, | ||||||||||||||||

| 2006 | 2007 | 2008 | 2010 | 2011 | ||||||||||||||||

Consolidated Statement of Income: | ||||||||||||||||||||

| Revenues | $ | 818.4 | $ | 976.3 | $ | 1,043.0 | $ | 1,141.1 | $ | 1,270.0 | ||||||||||

| Operating costs and expenses | ||||||||||||||||||||

| Operating expenses | 679.9 | 787.9 | 822.1 | 897.1 | 975.0 | |||||||||||||||

| Depreciation and amortization | 21.7 | 33.2 | 37.4 | 39.3 | 48.1 | |||||||||||||||

| General and administrative expenses | 56.2 | 64.5 | 69.1 | 69.2 | 106.4 | |||||||||||||||

| Total operating costs and expenses | 757.8 | 885.6 | 928.6 | 1,005.6 | 1,129.5 | |||||||||||||||

| Operating income(1) | 60.6 | 90.7 | 114.4 | 135.5 | 140.5 | |||||||||||||||

| Interest income | 10.7 | 8.7 | 7.0 | 4.9 | 6.2 | |||||||||||||||

| Interest expense(2) | (28.2 | ) | (36.1 | ) | (30.2 | ) | (28.5 | ) | (40.7 | ) | ||||||||||

| Loss on extinguishment of debt | (1.3 | ) | (4.8 | ) | — | (6.8 | ) | (7.9 | ) | |||||||||||

| Income before income taxes | 41.8 | 58.5 | 91.2 | 105.1 | 98.1 | |||||||||||||||

| Provision for income taxes(1) | 15.3 | 22.3 | 34.0 | 42.1 | 39.5 | |||||||||||||||

| Equity in earnings of affiliates, net of income tax | 1.6 | 2.2 | 4.6 | 3.5 | 4.2 | |||||||||||||||

| Income from continuing operations | 28.1 | 38.4 | 61.8 | 66.5 | 62.8 | |||||||||||||||

| Income (loss) from discontinued operations, net of tax | 2.0 | 3.8 | (2.5 | ) | (0.3 | ) | — | |||||||||||||

| Net income | $ | 30.1 | $ | 42.2 | $ | 59.3 | $ | 66.2 | $ | 62.8 | ||||||||||

| Net (income) loss attributable to non-controlling interest(1) | (0.1 | ) | (0.4 | ) | (0.4 | ) | (0.2 | ) | 0.7 | |||||||||||

| Net income attributable to GEO | $ | 30.0 | $ | 41.8 | $ | 58.9 | $ | 66.0 | $ | 63.5 | ||||||||||

Business Segment Data: | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| U.S. Detention & Corrections(3) | $ | 564.4 | $ | 619.5 | $ | 700.6 | $ | 772.5 | $ | 842.4 | ||||||||||

| International Services | 103.1 | 128.0 | 128.7 | 137.2 | 190.5 | |||||||||||||||

| GEO Care(3) | 76.7 | 120.0 | 127.8 | 133.4 | 213.8 | |||||||||||||||

| Facility Construction & Design | 74.2 | 108.8 | 85.9 | 98.0 | 23.3 | |||||||||||||||

| Total revenues | $ | 818.4 | $ | 976.3 | $ | 1,043.0 | $ | 1,141.1 | $ | 1,270.0 | ||||||||||

| Operating income (loss) | ||||||||||||||||||||

| U.S. Detention & Corrections(3) | $ | 100.1 | $ | 131.2 | $ | 156.3 | $ | 178.3 | $ | 204.4 | ||||||||||

| International Services | 8.6 | 11.0 | 10.7 | 8.0 | 12.3 | |||||||||||||||

| GEO Care(3) | 8.7 | 13.3 | 16.2 | 18.0 | 27.8 | |||||||||||||||

| Facility Construction & Design | (0.5 | ) | (0.3 | ) | 0.3 | 0.4 | 2.4 | |||||||||||||

| Unallocated G&A expenses | (56.3 | ) | (64.5 | ) | (69.1 | ) | (69.2 | ) | (106.4 | ) | ||||||||||

| Total operating income | $ | 60.6 | $ | 90.7 | $ | 114.4 | $ | 135.5 | $ | 140.5 | ||||||||||

Balance Sheet Data (at period end): | ||||||||||||||||||||

| Cash and cash equivalents (unrestricted) | $ | 111.5 | $ | 44.4 | $ | 31.7 | $ | 33.9 | $ | 39.7 | ||||||||||

| Restricted cash | 33.7 | 34.1 | 32.7 | 34.1 | 90.6 | |||||||||||||||

| Accounts receivable, net | 152.0 | 164.8 | 199.7 | 200.8 | 275.5 | |||||||||||||||

| Property, plant and equipment, net | 285.4 | 783.4 | 878.6 | 998.6 | 1,511.3 | |||||||||||||||

| Total assets | 743.5 | 1,192.6 | 1,288.6 | 1,447.8 | 2,423.8 | |||||||||||||||

| Total debt | 306.0 | 463.9 | 512.1 | 584.7 | 1,045.0 | |||||||||||||||

| Total shareholders’ equity | 249.9 | 529.3 | 579.6 | 665.1 | 1,039.5 | |||||||||||||||

Other Financial Data: | ||||||||||||||||||||

| Net cash provided by operating activities | $ | 46.0 | $ | 78.9 | $ | 71.5 | $ | 131.1 | $ | 126.2 | ||||||||||

| Net cash (used in) investing activities | (16.9 | ) | (518.9 | ) | (131.6 | ) | (185.3 | ) | (368.3 | ) | ||||||||||

| Net cash provided by financing activities | 21.7 | 372.3 | 53.6 | 51.9 | 243.7 | |||||||||||||||

| Capital expenditures | 43.2 | 115.2 | 131.0 | 149.8 | 97.1 | |||||||||||||||

| Depreciation and amortization expense | 21.7 | 33.2 | 37.4 | 39.3 | 48.1 | |||||||||||||||

Financial Ratio: | ||||||||||||||||||||

| Ratio of earnings to fixed charges(4) | 1.9 | x | 2.1 | x | 3.1 | x | 3.1 | x | 2.5 | x | ||||||||||

Business Segment Operational Data: | ||||||||||||||||||||

| Compensated Mandays (in millions)(5) | ||||||||||||||||||||

| U.S. Detention & Corrections | 11.4 | 12.4 | 13.2 | 14.4 | 15.1 | |||||||||||||||

| International Services | 2.0 | 2.0 | 2.1 | 2.2 | 2.5 | |||||||||||||||

| GEO Care | 0.4 | 0.6 | 0.6 | 0.7 | 1.3 | |||||||||||||||

| Total Compensated Mandays | 13.8 | 15.0 | 15.9 | 17.3 | 18.9 | |||||||||||||||

| Revenue Producing Beds (in thousands) (end of period)(6) | ||||||||||||||||||||

| U.S. Detention & Corrections | 35.6 | 36.0 | 41.8 | 40.7 | 53.8 | |||||||||||||||

| International Services | 5.6 | 5.8 | 5.8 | 6.8 | 7.2 | |||||||||||||||

| GEO Care | 1.5 | 1.8 | 1.8 | 2.2 | 6.1 | |||||||||||||||

| Total Revenue Producing Beds | 42.7 | 43.6 | 49.4 | 49.7 | 67.1 | |||||||||||||||

| Average Occupancy(7) | ||||||||||||||||||||

| U.S. Detention & Corrections | 97.0 | % | 96.1 | % | 95.7 | % | 93.6 | % | 93.8 | % | ||||||||||

| International Services | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

| GEO Care | 100.0 | % | 100.0 | % | 100.0 | % | 99.5 | % | 92.4 | % | ||||||||||

| Total Average Occupancy | 97.5 | % | 96.7 | % | 96.4 | % | 94.6 | % | 94.5 | % | ||||||||||

Other Operational Data (end of period): | ||||||||||||||||||||

| Facilities in operation(8) | 56 | 57 | 59 | 57 | 103 | |||||||||||||||

| Design capacity of facilities (in thousands)(9) | 46.5 | 47.9 | 53.4 | 52.8 | 70.2 | |||||||||||||||

37

Table of Contents

| (1) | For fiscal years ended December 31, 2006, December 30, 2007, December 28, 2008 and January 3, 2010, the Company has reclassified its noncontrolling interest in South African Custodial Management Pty. Limited (“SACM”) to conform to current presentation. | |

| (2) | Interest expense excludes the following capitalized interest amounts for the periods presented (in millions): |

| Fiscal Year Ended | ||||||||

| December 31, | December 30, | December 28, | January 3, | January 2, | ||||

| 2006 | 2007 | 2008 | 2010 | 2011 | ||||

| $0.2 | $2.9 | $4.3 | $4.9 | $4.1 | ||||

| (3) | For fiscal years ended December 31, 2006, December 30, 2007, December 28, 2008, January 3, 2010, January 2, 2011, we have reclassified Business Segment Data and Business Segment Operational Data for two of our community based facilities which were previously part of our U.S. Detention & Corrections segment and are now part of our GEO Care segment. The combined revenue and operating income for these two facilities during the periods presented is as follows: |

| Fiscal Year Ended | ||||||||||||||||||||

| December 31, | December 30, | December 28, | January 3, | January 2, | ||||||||||||||||

| 2006 | 2007 | 2008 | 2010 | 2011 | ||||||||||||||||

| Revenue | $ | 9.7 | $ | 9.8 | $ | 10.5 | $ | 11.6 | $ | 11.3 | ||||||||||

| Operating Income | $ | 3.5 | $ | 3.2 | $ | 3.7 | $ | 4.5 | $ | 4.0 | ||||||||||

| (4) | For purposes of calculating the ratio of earnings to fixed charges, earnings consists of income before income taxes and equity in earnings of affiliates plus fixed charges, which consist of interest expense (including the interest element of rental expense), whether expensed or capitalized, and amortization of capitalized interest and deferred financing fees. | |

| (5) | Compensated mandays are calculated as follows: (a) for per diem rate facilities — the number of beds occupied by residents on a daily basis during the period; and (b) for fixed rate facilities — the design capacity of the facility multiplied by the number of days the facility was in operation during the period. | |

| (6) | Revenue producing beds are available beds under contract, excluding facilities under development, idle facilities and discontinued operations. | |

| (7) | The average occupancy is calculated by taking compensated mandays as a percentage of capacity, excluding mandays and capacity of our idle facilities, facilities under development and discontinued operations. | |

| (8) | Facilities in operation exclude facilities under development, idle facilities and discontinued operations. | |

| (9) | Design capacity of facilities is defined as the total available beds, excluding facilities under development, idle facilities and discontinued operations. |

38

Table of Contents

39

Table of Contents

40

Table of Contents

UNAUDITED PRO FORMA CONDENSED COMBINED BALANCE SHEET

| Historical | ||||||||||||||||||||||||

| GEO | BII Holding As | |||||||||||||||||||||||

| As of | of December 31, | Pro Forma | Pro Forma | |||||||||||||||||||||

| January 2, 2011 | 2010 | Reclassifications(A) | Adjustments | Note | Combined | |||||||||||||||||||

| (in ‘000’s) | ||||||||||||||||||||||||

Current Assets | ||||||||||||||||||||||||

| Cash and cash equivalents | $ | 39,664 | $ | 5,416 | $ | — | $ | 12,971 | (B | ) | $ | 58,051 | ||||||||||||

| Restricted cash and investments | 41,150 | 100 | — | — | 41,250 | |||||||||||||||||||

| Accounts receivable, less allowance for doubtful accounts | 275,484 | 19,386 | — | — | 294,870 | |||||||||||||||||||

| Income tax receivable | — | 144 | (144 | ) | — | — | ||||||||||||||||||

| Inventories, net | — | 4,516 | (4,516 | ) | — | — | ||||||||||||||||||

| Current portion of sales-type leases receivable | — | 2,018 | (2,018 | ) | — | — | ||||||||||||||||||

| Deferred income tax asset, net | 32,126 | 5,231 | — | 8,311 | (C | ) | 45,668 | |||||||||||||||||

| Other current assets, net | 36,710 | 4,298 | 6,678 | (1,250 | ) | (D | ) | 46,436 | ||||||||||||||||

| Total current assets | 425,134 | 41,109 | — | 20,032 | 486,275 | |||||||||||||||||||

Restricted Cash and Investments | 49,492 | — | — | — | 49,492 | |||||||||||||||||||

Sales-type Leases Receivable, Net of Current Portion | — | 4,267 | (4,267 | ) | — | — | ||||||||||||||||||

Rental and Monitoring Equipment, net | — | 14,962 | (14,962 | ) | — | — | ||||||||||||||||||

Property and Equipment, Net | 1,511,292 | 6,420 | 14,962 | — | 1,532,674 | |||||||||||||||||||

Assets Held for Sale | 9,970 | — | — | — | 9,970 | |||||||||||||||||||

Direct Finance Lease Receivable | 37,544 | — | — | — | 37,544 | |||||||||||||||||||

Deferred Income Tax Assets, Net | 936 | — | — | — | 936 | |||||||||||||||||||

Goodwill | 244,947 | 169,941 | — | 116,779 | (E | ) | 531,667 | |||||||||||||||||

Intangible Assets, Net | 87,813 | 104,484 | — | 22,416 | (F | ) | 214,713 | |||||||||||||||||

Capitalized Software, Net | — | 8,960 | — | (8,960 | ) | (G | ) | — | ||||||||||||||||

Deferred Financing Fees | — | 3,832 | — | (3,832 | ) | (H | ) | — | ||||||||||||||||

Other Non-Current Assets | 56,648 | 341 | 4,267 | 10,496 | (H | ) | 71,752 | |||||||||||||||||

| $ | 2,423,776 | $ | 354,316 | $ | — | $ | 156,931 | $ | 2,935,023 | |||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||

Current Liabilities | ||||||||||||||||||||||||

| Accounts payable | $ | 73,880 | $ | 4,430 | $ | — | $ | — | $ | 78,310 | ||||||||||||||

| Accrued payroll and related taxes | 33,361 | 5,557 | — | — | 38,918 | |||||||||||||||||||

| Deferred revenue | — | 1,267 | (1,267 | ) | — | — | ||||||||||||||||||

| Accrued expenses and other current liabilities | 121,647 | 812 | 1,267 | (2,884 | ) | (I | ) | 120,842 | ||||||||||||||||

| Current portion of long-term debt, capital lease obligations and non-recourse debt | 41,574 | 823 | — | 5,478 | (J | ) | 47,875 | |||||||||||||||||

| Total current liabilities | 270,462 | 12,889 | — | 2,594 | 285,945 | |||||||||||||||||||

Deferred Income Tax Liabilities | 63,546 | 37,465 | — | 7,346 | (K | ) | 108,357 | |||||||||||||||||

Other Non-Current Liabilities | 46,862 | 10,625 | (1,538 | ) | (L | ) | 55,949 | |||||||||||||||||

Deferred Revenue and Other Liabilities | — | 3,075 | (3,075 | ) | — | — | ||||||||||||||||||

Accrued Contingent Consideration | — | 7,550 | (7,550 | ) | — | — | ||||||||||||||||||

Capital Lease Obligations | 13,686 | — | 452 | — | 14,138 | |||||||||||||||||||

Long-Term Debt | 798,336 | 182,512 | (452 | ) | 263,244 | (M | ) | 1,243,640 | ||||||||||||||||

Non-Recourse Debt | 191,394 | — | — | — | 191,394 | |||||||||||||||||||

Shareholders’ Equity | ||||||||||||||||||||||||

| Preferred stock, $0.01 par value, 30,000 shares authorized, none issued or outstanding | — | — | — | — | — | |||||||||||||||||||

| Common stock, $0.01 par value, 90,000 shares authorized, 84,507 issued and 64,432 outstanding | 845 | — | — | — | 845 | |||||||||||||||||||

| Common stock, $0.01 par value, 5,000 shares authorized, 1,225 shares issued and outstanding | — | 12 | — | (12 | ) | (N | ) | — | ||||||||||||||||

| Additional paid-in capital | 718,489 | 133,307 | — | (133,307 | ) | (N | ) | 718,489 | ||||||||||||||||

| Retained earnings/Accumulated Deficit | 428,545 | (22,494 | ) | — | 18,604 | (N | ) | 424,655 | ||||||||||||||||

| Accumulated other comprehensive income | 10,071 | — | — | — | 10,071 | |||||||||||||||||||

| Treasury stock, at cost | (139,049 | ) | — | — | — | (139,049 | ) | |||||||||||||||||

| Total shareholders’ equity attributable to The GEO Group, Inc. | 1,018,901 | 110,825 | — | (114,715 | ) | 1,015,011 | ||||||||||||||||||

| Noncontrolling interests | 20,589 | — | — | — | 20,589 | |||||||||||||||||||

| Total Shareholders’ Equity | 1,039,490 | 110,825 | — | (114,715 | ) | 1,035,600 | ||||||||||||||||||

| $ | 2,423,776 | $ | 354,316 | $ | — | $ | 156,931 | $ | 2,935,023 | |||||||||||||||

41

Table of Contents

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME (LOSS)

Fiscal Year Ended January 2, 2011

| Historical | Historical | |||||||||||||||||||||||||||||||||||||||

| Cornell | BII Holding | |||||||||||||||||||||||||||||||||||||||

| Six Months | Cornell | Twelve Months | ||||||||||||||||||||||||||||||||||||||

| GEO | Ended | July 1- | Pro Forma | Ended | Pro Forma | |||||||||||||||||||||||||||||||||||

| Fiscal Year Ended | June 30, | August 11, | Adjustments | December 31, | Reclassifications | Adjustments | Pro Forma | |||||||||||||||||||||||||||||||||

| January 2, 2011 | 2010 | 2010(a) | of Cornell | Note | 2010 | of BII Holding(OO) | of BII Holding | Note | Combined | |||||||||||||||||||||||||||||||

| (in thousands except per share data) | ||||||||||||||||||||||||||||||||||||||||

Revenues | $ | 1,269,968 | $ | 203,877 | $ | 44,854 | $ | (1,078 | ) | (P | ) | $ | 112,534 | $ | — | $ | — | $ | 1,630,155 | |||||||||||||||||||||

Operating Expenses | 975,020 | 151,476 | 35,774 | (6,072 | ) | (Q | ) | 65,888 | (1,536 | ) | — | 1,220,550 | ||||||||||||||||||||||||||||

Pre-opening and start-up expenses | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||

Provision for Doubtful Accounts | — | — | — | — | 693 | (693 | ) | — | — | |||||||||||||||||||||||||||||||

Depreciation and Amortization | 48,111 | 9,254 | 2,105 | 4,290 | (R | ) | — | 23,553 | (7,586 | ) | (RR) | 79,727 | ||||||||||||||||||||||||||||

Research and Development Expenses | — | — | — | — | 2,073 | (2,073 | ) | — | — | |||||||||||||||||||||||||||||||

General and Administrative Expenses | 106,364 | 13,760 | 23,661 | (38,679 | ) | (S | ) | — | 12,852 | (7,736 | ) | (SS) | 110,222 | |||||||||||||||||||||||||||

Selling, General and Administrative Expenses | — | — | — | — | 33,351 | (32,103 | ) | (1,248 | ) | (TT) | — | |||||||||||||||||||||||||||||

Operating Income (Loss) | 140,473 | 29,387 | (16,686 | ) | 39,383 | 10,529 | — | 16,570 | 219,656 | |||||||||||||||||||||||||||||||

Interest Income | 6,271 | 255 | 67 | — | — | 2 | — | 6,595 | ||||||||||||||||||||||||||||||||

Interest Expense | (40,707 | ) | (12,601 | ) | (2,859 | ) | 3,693 | (U | ) | (20,062 | ) | (2 | ) | (6,369 | ) | (UU) | (78,907 | ) | ||||||||||||||||||||||

Other Expense, net | — | — | — | — | (28 | ) | — | — | (28 | ) | ||||||||||||||||||||||||||||||

Loss on Extinguishment of Debt | (7,933 | ) | — | — | — | — | — | — | (7,933 | ) | ||||||||||||||||||||||||||||||

Income (Loss) Before Income Taxes, Equity in Earnings of Affiliates | 98,104 | 17,041 | (19,478 | ) | 43,076 | (9,561 | ) | — | 10,201 | 139,383 | ||||||||||||||||||||||||||||||

Provision (Benefit) for Income Taxes | 39,532 | 7,477 | (7,030 | ) | 12,784 | (V | ) | (2,500 | ) | — | 3,556 | (V | ) | 53,819 | ||||||||||||||||||||||||||

Equity in Earnings of Affiliates, net of income tax provision | 4,218 | — | — | — | — | — | — | 4,218 | ||||||||||||||||||||||||||||||||

Income (Loss) from Continuing Operations | 62,790 | 9,564 | (12,448 | ) | 30,292 | (7,061 | ) | — | 6,645 | 89,782 | ||||||||||||||||||||||||||||||

| Less: Earnings Attributable to Non-controlling Interests | 678 | (1,155 | ) | (318 | ) | 459 | (W | ) | — | — | — | (336 | ) | |||||||||||||||||||||||||||

Income (Loss) from Continuing Operations Before Estimated Nonrecurring Charges Related to the Transaction Attributable to the Combined Company | $ | 63,468 | $ | 8,409 | $ | (12,766 | ) | $ | 30,751 | $ | (7,061 | ) | — | $ | 6,645 | $ | 89,446 | |||||||||||||||||||||||

Weighted Average Common Shares Outstanding: | ||||||||||||||||||||||||||||||||||||||||

| Basic | 55,379 | 14,903 | 861 | (X | ) | 71,143 | (X) | |||||||||||||||||||||||||||||||||

| Diluted | 55,989 | 15,050 | 714 | (X | ) | 71,753 | (X) | |||||||||||||||||||||||||||||||||

| Earnings per Common Share Basic: | ||||||||||||||||||||||||||||||||||||||||

| Income from Continuing Operations Before Estimated Nonrecurring Charges Related to the Transaction Attributable to the Combined Company | $ | 1.15 | $ | 0.56 | $ | 1.26 | ||||||||||||||||||||||||||||||||||

Diluted: | ||||||||||||||||||||||||||||||||||||||||

| Income from Continuing Operations Before Estimated Nonrecurring Charges Related to the Transaction Attributable to the Combined Company | $ | 1.13 | $ | 0.56 | $ | 1.25 | ||||||||||||||||||||||||||||||||||

| (a) | GEO acquired Cornell on August 12, 2010. In order to present Cornell’s financial results for the fiscal year ended January 2, 2011, the stub period July 1, 2010 through August 11, 2010 has been included. |

42

Table of Contents

CONDENSED COMBINED FINANCIAL INFORMATION

43

Table of Contents

| Accounts receivable | $ | 55,142 | ||

| Prepaid expenses and other current assets | 13,314 | |||

| Deferred income tax assets | 21,273 | |||

| Restricted assets | 44,096 | |||

| Property and equipment | 462,771 | |||

| Intangible assets | 75,800 | |||

| Out of market lease assets | 472 | |||

| Other long-term assets | 7,510 | |||

| Total assets acquired | $ | 680,378 | ||

| Accounts payable and accrued expenses | (56,918 | ) | ||

| Fair value of non-recourse debt | (120,943 | ) | ||

| Out of market lease liabilities | (24,071 | ) | ||

| Deferred income tax liabilities | (42,771 | ) | ||

| Other long-term liabilities | (1,368 | ) | ||

| Total liabilities assumed | $ | (246,071 | ) | |

| Total identifiable net assets | 434,307 | |||

| Goodwill | 204,724 | |||

| Fair value of Cornell’s net assets | $ | 639,031 | ||

| Non-controlling interest | (20,700 | ) | ||

| Total consideration for Cornell, net of cash acquired | $ | 618,331 | ||

| • | Income tax receivable, Inventories, net and Current portion of sales-type leases receivable have been reclassified to Other current assets, net; | ||

| • | Sales-Type Leases Receivable, Net of Current Portion has been reclassified to Other Non-Current Assets; | ||

| • | Rental and Monitoring Equipment, Net, has been reclassified to Property and Equipment, Net; | ||

| • | Deferred revenue has been reclassified to Accrued expenses and other current liabilities; | ||

| • | Deferred Revenue and Other Liabilities and Accrued Contingent Consideration have been reclassified to Other Non-current Liabilities; and | ||

| • | The long-term portion of BII Holding’s capital leases have been reclassified to Capital Lease Obligations. |

| Pro Forma | ||||

| Adjustments | ||||

| Borrowings under term loan and proceeds from issuance of the notes offered hereby used to finance the BI Acquisition | $ | 450,000 | ||

| Cash paid in BI Acquisition(a) | (419,316 | ) | ||

| Cash payment of financing charges | (8,196 | ) | ||

| Cash payment of transaction costs associated with the BI Acquisition | (9,517 | ) | ||

| Net pro forma adjustment to cash | $ | 12,971 | ||

| (a) | A portion of the $419.3 million of merger consideration was used by BII Holding to repay indebtedness of BI under its senior term loan and senior subordinated note purchase agreement. The outstanding balances of the senior term loan and senior subordinated note purchase agreement, excluding the unamortized debt discount, were $78.2 million and $106.1 million, respectively, as of December 31, 2010. |

44

Table of Contents

| Tax impact on acceleration of stock options upon change in control | $ | 2,839 | ||

| Tax impact on write-off of BII Holding’s deferred financing fees | 2,033 | |||

| Tax impact for the deductible portion of non-recurring, direct transaction costs | 3,439 | |||

| Total pro forma adjustments | $ | 8,311 | ||

Preliminary estimated purchase price allocation: | ||||

| Total current assets, net of cash and cash equivalents | $ | 41,678 | ||

| Property and equipment | 21,382 | |||

| Fair value of intangible assets | 126,900 | |||

| Sales-type leases receivable, net of current portion | 4,267 | |||

| Other non-current assets | 341 | |||

| Total assets acquired | $ | 194,568 | ||

| Total current liabilities | (11,433 | ) | ||

| Deferred income tax liabilities | (44,811 | ) | ||

| Other non-current liabilities | (9,087 | ) | ||

| Long-term debt and capital lease obligations, including current portion of debt | (2,057 | ) | ||

| Total liabilities assumed | $ | (67,388 | ) | |

| Net assets acquired | 127,180 | |||

| Goodwill | 286,720 | |||

| Acquisition consideration, net of cash acquired | $ | 413,900 | ||

Pro forma adjustments to goodwill: | ||||

| Elimination of BII Holding’s goodwill as of December 31, 2010 | $ | (169,941 | ) | |

| Excess of purchase price over fair value of assets acquired and liabilities assumed | 286,720 | |||

| Total pro forma adjustments | $ | 116,779 | ||

| Pro Forma | ||||||||

| Adjustments | Useful life | |||||||

| Elimination of the net carrying value of BII Holding’s intangible assets, net, as of December 31, 2010 | $ | (104,484 | ) | |||||

| Fair value of finite lived identifiable intangible assets acquired: | ||||||||

| Customer relationships | 61,600 | 11 to 14 years | ||||||

| Developed technology | 21,800 | 7 years | ||||||

| Non-compete agreements | 1,400 | 2 years | ||||||

| Fair value of indefinite lived identifiable intangible assets acquired: | ||||||||

| Trade Name | 42,100 | Indefinite | ||||||

| Total pro forma adjustments | $ | 22,416 | ||||||

45

Table of Contents

| Pro Forma | ||||

| Adjustments | ||||

| Estimated financing costs associated with additional borrowings | $ | 2,300 | ||

| Estimated non-recurring transaction expenses | 1,300 | |||

| Estimated adjustment to reduce deferred revenue to fair value | (634 | ) | ||

| Accrued transaction costs paid at close | (5,850 | ) | ||

| $ | (2,884 | ) | ||

| Pro Forma | ||||

| Adjustments | ||||

| Current portion of GEO Term loan A-2 | $ | 5,625 | ||

| Repayment of BII Holding’s debt, current portion | (147 | ) | ||

| $ | 5,478 | |||

| Pro Forma | ||||

| Adjustments | ||||

| Elimination of the estimated deferred income tax liabilities associated with BII Holding’s intangible assets | $ | (43,414 | ) | |

| Intangible assets giving rise to deferred tax liabilities: | ||||

| Fair value of customer relationships | 61,600 | |||

| Fair value of trade names acquired | 42,100 | |||

| Fair value of developed technology acquired | 21,800 | |||

| Fair value of non-compete agreements | 1,400 | |||

| 126,900 | ||||

| Domestic estimated statutory income tax rate | 40.00 | % | ||

| Pro forma deferred tax liabilities on acquired intangibles | 50,760 | |||

| Pro forma deferred tax liabilities adjustment | $ | 7,346 | ||

| Pro Forma | ||||

| Adjustments | ||||

| Repayment of BII Holding’s long-term debt | $ | (181,131 | ) | |

| Incremental debt to GEO to finance the BI Acquisition and related costs: | ||||

| Proceeds from New Term Loan A-2, net of current portion | 144,375 | |||

| Proceeds from the 6.625% Senior Notes, net of current portion | 300,000 | |||

| $ | 263,244 | |||

46

Table of Contents

| Pro Forma Adjustments (in ‘000’s) | ||||||||||||||||

| Additional paid-in | Accumulated | Total pro | ||||||||||||||

| Common stock | capital | Earnings (Deficit) | forma | |||||||||||||

| Non-recurring transaction costs, net of tax, not considered in the Unaudited Pro Forma Condensed Combined Statements of Income | $ | — | $ | — | $ | (11,192 | ) | $ | (11,192 | ) | ||||||

| Acceleration of stock options upon change in control | — | 7,098 | (7,098 | ) | — | |||||||||||

| Tax impact of acceleration of stock options upon change in control | — | — | 2,839 | 2,839 | ||||||||||||

| Elimination of equity in purchase accounting, after acceleration of stock options | (12 | ) | (140,405 | ) | 34,055 | (106,362 | ) | |||||||||

| $ | (12 | ) | $ | (133,307 | ) | $ | 18,604 | $ | (114,715 | ) | ||||||

| (a) | Selling, General and Administrative Expenses have been reclassified into GEO’s Operating Expenses and GEO’s General and Administrative Expenses. | ||

| (b) | Research and Development Expenses have been reclassified into GEO’s General and Administrative Expenses. | ||

| (c) | Provision for Doubtful Accounts has been reclassified into GEO’s General and Administrative Expenses. | ||

| (d) | Amortization and depreciation included within Costs of service, monitoring and direct sales, Selling, general and administrative expenses and Research and development expenses have been reclassified into GEO’s consolidated line item. | ||

| (e) | Interest Income included in Interest Expense, net has been reclassified into GEO’s Interest Income line item. |

| Reclassifications | ||||||||||||||||||||||||

| Twelve Months | ||||||||||||||||||||||||

| Ended | ||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | December 31, 2010 | |||||||||||||||||||

| Operating expenses | $ | 10,236 | $ | — | $ | — | $ | (11,772 | ) | $ | — | $ | (1,536 | ) | ||||||||||

| Provision for doubtful accounts | — | — | (693 | ) | — | — | (693 | ) | ||||||||||||||||

| Depreciation and Amortization | — | — | — | 23,553 | — | 23,553 | ||||||||||||||||||

| Research and Development Expenses | — | (1,797 | ) | — | (276 | ) | — | (2,073 | ) | |||||||||||||||

| General and Administrative expenses | 10,362 | 1,797 | 693 | — | — | 12,852 | ||||||||||||||||||

| Selling, General and Administrative expenses | (20,598 | ) | — | — | (11,505 | ) | — | (32,103 | ) | |||||||||||||||

| Interest income | — | — | — | — | 2 | 2 | ||||||||||||||||||

| Interest expense | $ | — | $ | — | $ | — | $ | — | $ | (2 | ) | $ | (2 | ) | ||||||||||

| Pro Forma | ||||

| Adjustments Fiscal | ||||

| Year Ended | ||||

| January 2, 2011 | ||||

| Pro forma adjustments to Operating Expense: | ||||

| Intercompany rent expense elimination | $ | (1,078 | ) | |