UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

OR

| | ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ________

Commission file number 1-14426

| BLUE SQUARE-ISRAEL LTD. |

(Exact name of Registrant as specified in its charter) |

| Israel |

(Jurisdiction of incorporation or organization) |

| 2 Amal Street, Rosh Ha’ayin 48092, Israel |

(Address of principal executive offices) |

| Elli Levinson-Sela, General Counsel & Corporate Secretary; |

| Tel: (972)-3-9282670; Fax: (972)-3-9282498 |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of class | | Name of each exchange on which registered |

American Depositary Shares, each representing one Ordinary Share (1) | | New York Stock Exchange, Inc. |

| | | |

Ordinary Shares, par value NIS 1.0 per share (2) | | New York Stock Exchange, Inc. |

| (1) | Evidenced by American Depositary Receipts. |

| (2) | Not for trading, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

43,717,058 Ordinary Shares, par value NIS 1.0 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨

International Financing Reporting Standards as issued by the International Accounting Standards Board x

Other ¨

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

INTRODUCTION

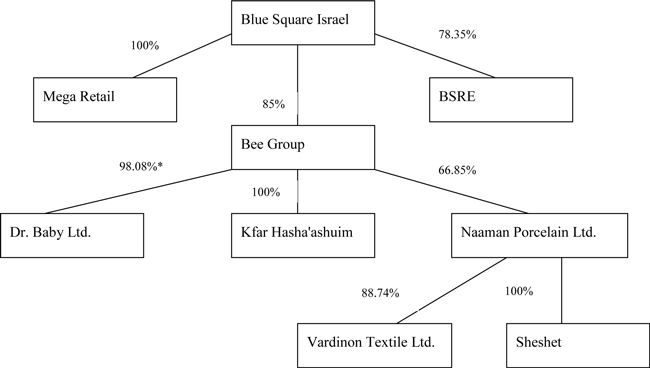

Unless otherwise indicated, as used in this Annual Report, (a) the term “Blue Square” or the “Company” means Blue Square-Israel Ltd., (b) the terms “we,” “us” and “our,” mean Blue Square and its consolidated subsidiaries, (c) “Mega Retail” means Mega Retail Ltd. (formerly known as Blue Square Chain Investments & Properties Ltd.), our wholly-owned subsidiary, (d) "BSRE" means Blue Square Real Estate Ltd., a corporation of which we held 78.35% of the outstanding shares as of May 31, 2010, and the balance of whose shares are publicly held and traded on the Tel Aviv Stock Exchange, and its subsidiaries and (e) "Bee Group" means Bee Group Retail Ltd. (formerly known as Hamachsan Hamerkazi Kfar Hasha’ashuim Ltd.), a corporation of which we held 85% of the outstanding ordinary shares as of May 31, 2010.

We operate in three reporting segments. In our Supermarkets segment, we are the second largest food retailer in the State of Israel. In our "Non-Food" segment, we sell “Non-Food” items both in our supermarkets and in stand alone retail outlets. In our Real Estate segment, we own, lease and develop yield-generating commercial properties.

Through our supermarkets, which are owned and operated through Mega Retail, we offer a wide range of food and beverages products and “Non-Food” items, such as houseware, toys, small electrical appliances, computers and computer accessories, entertainment and leisure products and textile products (called “Non-Food” in this Annual Report), and “Near-Food” products, such as health and beauty aids, baby and young children products, cosmetics and hygiene products (called “Near-Food” in this Annual Report). As of December 31, 2009, we owned and operated 203 supermarkets under the brand names Mega, Mega in Town, Shefa Shuk, Mega Bool and Eden Briut Teva Market Ltd. (“Eden Teva”).

In addition, as of December 31, 2009, the Bee Group consisted of 260 non-food retail outlets, mostly through franchisees, with activities in the houseware and home textile, toys, leisure, and baby and young children sectors. The Bee Group operates under the brand names Naaman, Vardinon, Sheshet, Kfar Hasha’ashuim, Rav-Kat, Dr. Baby and All for a Dollar.

As of December 31, 2009, we were the legal owner (including through long-term leases from the Israel Land Administration and the Municipality of Tel Aviv) of 101 properties owned in connection with our Supermarkets and "Non Food" segments (including warehouses and offices), totaling approximately 218,900 square meters, 39 yield generating real estate properties (including property leased to third parties), totaling approximately 60,800 square meters, and approximately 210,000 square meters of unutilized building rights. For further information regarding our real estate, see “Item 4. Information on the Company - B. Business Overview – Our Real Estate.”

Our revenues and profits during the years described in this Annual Report were principally derived from the operation of our supermarkets. In recent years, we have increased our activity in the "Non-Food" retail, mainly through acquisitions. We expect that the acquisitions we have made in the "Non-Food" retail area will have an increasing effect on our financial results in the coming years.

In May 2010, we signed a share purchase agreement with our controlling shareholder, Alon Israel Oil Company Ltd., or Alon, to acquire from Alon all of Alon's approximately 80% holdings in Dor-Alon Energy In Israel (1988) LTD., or Dor Alon. Dor Alon is one of the four largest fuel retail companies in Israel based on the number of gas stations and is a leader in the convenience stores sector. The closing of the transaction is subject to satisfaction of closing conditions, including shareholder approval. See “Item 7. Major Shareholders and Related Party Transactions – Proposed Acquisition of Controlling Share in Dor-Alon Energy In Israel (1988) LTD."

Please note that unless otherwise indicated, as used in this Annual Report, the term “owned” or “ownership” with respect to our supermarkets means the ownership of the operations of our supermarkets, and not legal title to the real estate underlying our supermarkets.

We were incorporated in June 1988. In 1996, we completed our initial public offering and our American Depositary Shares, or ADSs, were listed for trading on the New York Stock Exchange. In November 2000, our ordinary shares were listed for trading on the Tel Aviv Stock Exchange.

Except for the historical information contained herein, the statements contained in this Annual Report are forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, with respect to our business, financial condition and operating results. Actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including all the risks discussed in “Item 3. Key Information - D. Risk Factors” and elsewhere in this Annual Report.

We urge you to consider that statements which use the terms “believe,” “do not believe,” “expect,” “plan,” “intend,” “estimate,” “anticipate,” “project” and similar expressions are intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and are subject to risks and uncertainties. Except as required by applicable law, including the securities laws of the United States, we do not undertake any obligation nor intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

All references in this Annual Report to dollars or $ are to U.S. dollars and all references in this Annual Report to NIS are to New Israeli Shekels. Unless mentioned otherwise, all figures in U.S. dollars are based on the representative exchange rate between the NIS and the dollar as published by the Bank of Israel for December 31, 2009, which was NIS 3.775 per $1.00, except figures for the first quarter of 2010, which are based on the representative exchange rate between the NIS and the dollar as published by the Bank of Israel for March 31, 2010, which was NIS 3.713 per $1.00.

Presentation of Financial and Share Information

We prepare our consolidated financial statements in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB"). Until and including our financial statements for the year ended December 31, 2007, we prepared our consolidated financial statements in accordance with Israeli GAAP. The influence of the transition to IFRS (from financial statements prepared in accordance with generally accepted accounting principles in Israel, referred to in this Annual Report as Israeli GAAP) on our financial statements for the year ended December 31, 2007 and our results of operations for that year, is detailed in note 36 to our consolidated annual financial statements for the year ended December 31, 2008. Following the Company's adoption of IFRS, as issued by the IASB, the Company is no longer required to reconcile its financial statements prepared in accordance with IFRS to U.S.GAAP.

| | | | Page |

| PART I | | | 2 |

| ITEM 1. | | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 2 |

| ITEM 2. | | OFFER STATISTICS AND EXPECTED TIMETABLE | 2 |

| ITEM 3. | | KEY INFORMATION | 2 |

| ITEM 4. | | INFORMATION ON THE COMPANY | 27 |

| ITEM 4A. | | UNRESOLVED STAFF COMMENTS | 71 |

| ITEM 5. | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 72 |

| ITEM 6. | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 107 |

| ITEM 7. | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 132 |

| ITEM 8. | | FINANCIAL INFORMATION | 154 |

| ITEM 9. | | THE OFFER AND LISTING | 160 |

| ITEM 10. | | ADDITIONAL INFORMATION | 163 |

| ITEM 11. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 180 |

| ITEM 12. | | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 183 |

| PART II | | | 183 |

| ITEM 13. | | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 183 |

| ITEM 14. | | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 183 |

| ITEM 15. | | CONTROLS AND PROCEDURES | 184 |

| ITEM 16. | | [RESERVED] | 185 |

| ITEM 16A. | | AUDIT COMMITTEE FINANCIAL EXPERT | 185 |

| ITEM 16B. | | CODE OF ETHICS | 185 |

| ITEM 16C. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 185 |

| ITEM 16D. | | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES. | 186 |

| ITEM 16E. | | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS. | 186 |

| ITEM 16F. | | CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | 187 |

| ITEM 16G. | | CORPORATE GOVERNANCE | 187 |

| Part III | | | 189 |

| ITEM 17. | | FINANCIAL STATEMENTS | 189 |

| ITEM 18. | | FINANCIAL STATEMENTS | 189 |

| ITEM 19. | | EXHIBITS | 189 |

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| | A. | Selected Financial Data. |

We have derived the following selected consolidated financial data as of December 31, 2007, 2008 and 2009 and for each of the years ended December 31, 2007, 2008 and 2009 from our consolidated financial statements and notes included elsewhere in this Annual Report. We have derived the selected consolidated financial data as of December 31, 2005 and 2006 and for each of the years ended December 31, 2005 and 2006 from our audited consolidated financial statements not included in this Annual Report. We prepare our consolidated financial statements in conformity with IFRS. Until and including our financial statements for the year ended December 31, 2007, we prepared our consolidated financial statements in accordance with Israeli GAAP. To facilitate comparison with the financial results of the years 2008 and 2009, results from the year ended December 31, 2007 have been adjusted in accordance with IFRS and differ from the results reported previously. You should read the selected consolidated financial data together with the section of this Annual Report titled “Item 5. Operating and Financial Review and Prospects”, our consolidated financial statements included elsewhere in this Annual Report, the related notes, and the independent registered public accounting firm's report.

The selected information also includes certain items for the years 2005 and 2006 in accordance with U.S. GAAP. Israeli GAAP differs in certain significant respects from U.S. GAAP. For a summary of certain significant differences, see note 21 to our consolidated financial statements for the year ended December 31, 2007.

| | | For the year ended December 31, | |

| | | 2007 | | | 2008 | | | 2009 | | | 2009 | |

| | | NIS (In thousands, except per ordinary share or ADS data) | | | | $(1) | |

Statement of Income Data: In accordance with IFRS | | | | | | | | | | | | | |

| Sales | | | 6,981,984 | | | | 7,429,121 | | | | 7,349,076 | | | | 1,946,775 | |

| Cost of sales | | | 5,129,578 | | | | 5,369,149 | | | | 5,291,012 | | | | 1,401,593 | |

| Gross profit | | | 1,852,406 | | | | 2,059,972 | | | | 2,058,064 | | | | 545,182 | |

| | | | | | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 1,563,208 | | | | 1,794,720 | | | | 1,817,099 | | | | 481,351 | |

| Operating profit before other gain and losses and net gain from adjustment of investment property to fair value | | | 289,198 | | | | 265,252 | | | | 240,965 | | | | 63,831 | |

| Other gains | | | 15,835 | | | | 12,233 | | | | 4,699 | | | | 1,245 | |

| Other losses | | | (12,755 | ) | | | (14,716 | ) | | | (32,803 | ) | | | (8,690 | ) |

| Net gain from adjustment of investment property to fair value | | | 10,456 | | | | 19,067 | | | | 20,775 | | | | 5,503 | |

| | | | | | | | | | | | | | | | | |

| Operating profit | | | 302,734 | | | | 281,836 | | | | 233,636 | | | | 61,889 | |

| | | | | | | | | | | | | | | | | |

| Finance income | | | 60,978 | | | | 60,700 | | | | 64,780 | | | | 17,160 | |

| Finance expenses | | | (118,297 | ) | | | (166,295 | ) | | | (177,454 | ) | | | (47,006 | ) |

| | | | | | | | | | | | | | | | | |

| Finance expenses, net | | | 57,319 | | | | 105,595 | | | | 112,674 | | | | 29,846 | |

| | | | | | | | | | | | | | | | | |

| Share in profit (loss) of associates | | | 186 | | | | (33 | ) | | | (37 | ) | | | (10 | ) |

| | | | | | | | | | | | | | | | | |

| Income before taxes on income | | | 245,601 | | | | 176,208 | | | | 120,925 | | | | 32,033 | |

| | | | | | | | | | | | | | | | | |

| Taxes on income | | | 69,779 | | | | 43,806 | | | | 23,124 | | | | 6,125 | |

| | | | | | | | | | | | | | | | | |

| Profit for the year | | | 175,822 | | | | 132,402 | | | | 97,801 | | | | 25,908 | |

| | | | | | | | | | | | | | | | | |

| Attributable to: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Equity holders of the company | | | 143,628 | | | | 104,586 | | | | 77,163 | | | | 20,441 | |

| | | | | | | | | | | | | | | | | |

| Minority interests | | | 32,194 | | | | 27,816 | | | | 20,638 | | | | 5,467 | |

| | | | | | | | | | | | | | | | | |

| Earnings per Ordinary share or ADS attributable to equity holders of the Company: | | | | | | | | | | | | | | | | |

| Basic | | | 3.39 | | | | 2.41 | | | | 1.77 | | | | 0.47 | |

| Diluted | | | 3.39 | | | | 1.62 | | | | 1.77 | | | | 0.47 | |

| | | | | | | | | | | | | | | | | |

| Cash dividends declared per ordinary share or ADS | | | 6.52 | | | | 3.46 | | | | - | | | | - | |

| Number of Ordinary Shares Outstanding at the end of each year: | | | 43,372,819 | | | | 43,372,819 | | | | 43,717,058 | | | | 43,717,058 | |

| | | | | | | | | | | | | | | | | |

| Selected Operating Data: | | | | | | | | | | | | | | | | |

| Number of supermarket stores (at year end) | | | 185 | | | | 194 | | | | 203 | | | N.A. | |

| Increase (decrease) in same store sales(2) | | | 1.20 | % | | | 1.10 | % | | | (3.9 | %) | | N.A. | |

| Total square meters (at year end) | | | 342,705 | | | | 354,531 | | | | 365,000 | | | N.A. | |

| Supermarket sales per square meter (in NIS)(3) | | | 19,905 | | | | 19,898 | | | | 19,023 | | | | 5,039 | |

| Supermarket sales per employee (in thousands) | | | 937 | | | | 954 | | | | 997 | | | | 264 | |

| | | For the year ended December 31, | |

| | | 2005 | | | 2006 | |

| | | NIS (In thousands, except per ordinary share or ADS data) | |

Statement of Income Data: In accordance with Israeli GAAP | | | | | | |

| | | | | | | | | |

| Sales | | | 5,797,018 | | | | 6,515,035 | |

| | | | | | | | | |

| Cost of sales | | | 4,298,211 | | | | 4,812,952 | |

| | | | | | | | | |

| Gross profit | | | 1,498,807 | | | | 1,702,083 | |

| Selling, general and administrative expenses | | | 1,269,760 | | | | 1,396,877 | |

| | | | | | | | | |

| Operating income | | | 229,047 | | | | 305,206 | |

| | | | | | | | | |

| Financial expenses, net | | | (59,529 | ) | | | (42,368 | ) |

| | | | | | | | | |

| Amortization of goodwill | | | (6,508 | ) | | | - | |

| | | | | | | | | |

| Other income, net | | | 690 | | | | 78,022 | |

| | | | | | | | | |

| Income before taxes on income | | | 163,700 | | | | 340.860 | |

| | | | | | | | | |

| Taxes on income | | | 58,490 | | | | 96,660 | |

| | | | | | | | | |

| Share in profit of associate | | | 498 | | | | 1,284 | |

| | | | | | | | | |

| Minority interest | | | 15,717 | | | | 31,573 | |

| | | | | | | | | |

| Net income | | | 89,991 | | | | 213,911 | |

| | | | | | | | | |

| Earnings per ordinary share or ADS (basic) | | | 2.32 | | | | 5.46 | |

| Earnings per ordinary share or ADS (fully diluted) | | | 2.26 | | | | 4.92 | |

| Cash dividends declared per ordinary share or ADS | | | 2.35 | | | | 2.81 | |

| | | | | | | | | |

| In accordance with U.S. GAAP: | | | | | | | | |

| | | | | | | | | |

| Net income | | | 88,340 | | | | 166,724 | |

| | | | | | | | | |

| Earnings per ordinary share or ADS (basic) | | | 2.27 | | | | 4.25 | |

| Earnings per ordinary share or ADS (fully diluted) | | | 2.27 | | | | 4.23 | |

| Number of Ordinary Shares Outstanding: | | | 38,950,091 | | | | 39,692,983 | |

| Selected Operating Data: | | | | | | | | |

| | | | | | | | | |

| Number of supermarket stores (at year end) | | | 168 | | | | 175 | |

| | | | | | | | | |

Increase in same store sales (2) | | | 1.7 | % | | | 5.3 | % |

| | | | | | | | | |

| Total square meters (at year end) | | | 312,000 | | | | 323,304 | |

Supermarket sales per square meter (in NIS)(3) | | | 18,621 | | | | 19,739 | |

| Supermarket sales per employee (in thousands) | | | 899 | | | | 938 | |

| (1) | The translation of the NIS amounts into dollars has been made for the convenience of the reader at the representative exchange rate prevailing at December 31, 2009 (NIS 3.775 =$1.00), as published by the Bank of Israel. During 2009, the US dollar depreciated in value vis-à-vis the NIS by approximately (0.7)%. |

| (2) | The percentage in same store sales is the percentage change in sales of those stores that operated continuously during the entire reporting period of both the current year and that preceding it. Stores are not deemed to have operated continuously (and therefore not included as “same stores”) if such stores were permanently closed during the reporting period or the preceding period, were resized significantly during the period or were significantly renovated or expended during the period. Store resizing is considered significant if it exceeds 5% or more of the store’s original size. |

| (3) | Based on an average total square meters at month end during the relevant year. |

| | | | |

| | | 2007 | | | | | | | | | | |

| | | | | | $(1) | |

| Balance Sheet Data: | | | | | | | | | | | | | |

| In accordance with IFRS | | | | | | | | | | | | | |

| Working capital (deficit) | | | 62,436 | * | | | (48,333 | )* | | | 492,156 | | | | 130,372 | |

| Total assets | | | 4,219,071 | | | | 4,445,027 | | | | 5,163,277 | | | | 1,367,756 | |

| Short-term credit from banks and others and current maturities of debentures | | | 240,869 | | | | 236,900 | | | | 351,296 | | | | 93,059 | |

| Long-term debt, net of current maturities | | | 1,202,858 | | | | 1,497,880 | | | | 2,009,243 | | | | 532,250 | |

| Total equity | | | 1,247,680 | | | | 1,096,002 | | | | 1,221,830 | | | | 323,664 | |

*Reclassified

| | | | |

| | | | | | | |

| | | | |

| Balance Sheet Data: | | | | | | |

| In accordance with Israeli GAAP: | | | | | | |

| Working capital (deficit) | | | (450,044 | ) | | | 335,376 | |

| Total assets | | | 3,683,035 | | | | 4,071,733 | |

| Short-term credit from banks and others and current maturities of debentures | | | 359,316 | | | | 264,858 | |

| Long-term debt, net of current maturities | | | 1,102,810 | | | | 1,161,926 | |

| Shareholders’ equity | | | 865,308 | | | | 992,922 | |

| In accordance with U.S. GAAP: | | | | | | | | |

| Total assets | | | 3,757,640 | | | | 4,247,394 | |

| Shareholders’ equity | | | 928,504 | | | | 1,003,384 | |

| (1) | The translation of the NIS amounts into dollars has been made for the convenience of the reader at the representative exchange rate prevailing at December 31, 2009 (NIS 3.775= $1.00), as published by the Bank of Israel. |

| | B. | Capitalization and Indebtedness. |

Not applicable.

| | C. | Reasons for the Offer and Use of Proceeds. |

Not applicable.

Our business, operating results and financial condition could be seriously harmed due to any of the following risks. If we do not successfully address any of the risks described below, our business, operating results and financial condition could be materially adversely affected and the share and ADS price of Blue Square may decline. We cannot assure you that we will successfully address any of these risks.

We are engaged in a highly competitive business. If we are unable to compete effectively against major supermarkets, low-priced supermarkets and other competitors, our business will be materially adversely affected.

Supermarkets

The food retailing industry in Israel is highly competitive and is characterized by high turnover and narrow operating margins. We compete with the other major supermarket chain, Shufersal (formerly known as Super Sol), low-priced smaller supermarket chains, independent grocers, open-air markets, and other retailers selling supermarket goods. Competitive pressures increase as the supermarket sector in Israel approaches higher saturation levels and continue to increase as our competitors expand their operations and new companies enter the market with hard discount formats.

We believe that an important factor in the purchase decisions of a large portion of the Israeli public is the price of the products it purchases. As a result, in recent years, we and our competitors have established or expanded low-price and hard discount store formats. In 2007, we launched our “Mega In Town” format designed to bring discount shopping to neighborhoods and city centers, and in 2008, we launched our new hard discount store format, "Mega Bool".

In addition, smaller supermarket chains during 2009 continued to aggressively increase their market share and expand their presence in selected areas in Israel, often geographically beyond their original locations, increasing competition in an already difficult market. Based on A.C. Nielsen, we estimate that the smaller supermarket chains' market share was approximately 27.7% of the bar-coded market in Israel during 2009. The low barriers of entry, including the relatively low cost of establishing a new smaller supermarket chain, have contributed to the increase in number and expansion of smaller supermarket chains in recent years. These smaller supermarket chains have been able to capture a significant part of the sales from the major chains in their areas by using lower cost non-unionized labor and having lower operating costs and, in some cases by operating on Saturdays and offering non-kosher food. Large supermarket chains in Israel, including us, are kosher and therefore do not offer non-kosher food or generally operate on Saturdays.

In 2005, a number of smaller supermarket chains which operate on local geographic level combined to form a separate entity, Fourth Chain Company Ltd., in order to develop a private label and to jointly negotiate with suppliers. In 2006, the Fourth Chain Company started to market a private label brand. This combination, and possible similar combinations of other smaller supermarket chains, may generate efficiencies of a major national-spread chain and enable them to compete more efficiently with us.

Since the merger of Shufersal with ClubMarket, another major chain, in 2005, we have faced a larger competitor, many of whose stores are characterized by the every day sale of products at low prices. Based on A.C. Nielsen, we estimate that Shufersal's market share was approximately 37.3% of the bar-coded market in Israel during 2009, as opposed to our own approximately 21.8% share of the bar-coded market during 2009. This difference in market share may give Shufersal a greater competitive advantage in its dealings with customers, suppliers and other third parties.

If we are unable to maintain our current level of sales or if we lose market share to our competitors, our negotiating position with suppliers, which is based, in part, on our market share in the Israeli retail market, and our revenues may be adversely affected, with a corresponding impact on profitability. We cannot assure you that we will be able to maintain our sales and market share.

Non-Food Retail

The merchandise we sell in our non-food retail business through Bee Group is varied, and we therefore compete in several different markets. Accordingly, our "Naaman", "Sheshet" and "Vardinon" stores compete in the houseware, home textile and accompanying accessories markets. Our "Dr. Baby" stores compete in the baby and young children accessories market, and our "All for a Dollar" and "Kfar Hasha’ashuim" stores compete in the toys and leisure accessories market and the back-to-school products market.

In recent years competition in the non-food retail industry has increased, primarily due to the entry of retail chains and stores outside the food industry, such as Toys “R” Us, Office Depot, do-it-yourself chains such as Home Center and ACE (a franchisee of Ace Hardware), household stores, home textile stores, such as Golf & Co. Ltd. and Kitan Textile Industries Ltd., houseware stores, electricity appliances stores and also due to the expansion of the houseware and home textile departments in supermarkets. This competition affects the sales prices of our products and the scope of our sales. Nevertheless, our Sheshet chain is positioned as a chain that provides products at competitive prices. Increased competition may adversely affect our scope of sales and our profitability.

In addition, the barriers of entry are low in some of the markets in which the Bee Group competes due to the price and availability of products from overseas suppliers, although the establishment of a network of stores throughout the country together with the required import and marketing of products requires a high level of investment. The entrance of new competitors may reduce our market share and may reduce the sale prices of our products and lead to a reduction in our profitability.

Economic conditions in Israel affect our financial performance.

Supermarkets and Non-Food Retail

All of our supermarket sales are made in Israel, and we acquire a substantial majority of the goods that we sell from Israeli suppliers. Consequently, our financial performance is dependent to a significant extent on the economy of Israel. During 2007 and 2008, Israel's Gross Domestic Product rose by 5.3% and 4.1%, respectively. However, in 2009 the global economic crisis, instability and uncertainty affected the economic conditions in Israel, and initial reports of the Israeli Central Bureau of Statistics indicate that during 2009 Israel's Gross Domestic Product rose by only 0.7%. Initial reports indicate that the Israeli economy increased by 3.3% (annualized) at the first quarter of 2010. We believe that the economic slowdown has affected the buying patterns of our customers, as more customers shift their purchases to low-price and hard discount stores, which have a lower profit margin. As a result, we have expanded our low-price and hard discount store formats. The economic slowdown in Israel may have an adverse effect on our financial performance, among other things, by reducing our sales and our profitability.

The global economic crisis, instability and uncertainty have also affected our non-food retail business by causing a slowdown in the growth of private consumption, which could affect the growth of our houseware, home textile, toys, leisure, and baby and young children accessories businesses. Beginning in the second quarter of 2009, the Israeli economy began to recover and there has been an improvement in the growth of private consumption.

In addition, the global economic crisis has also reduced the availability of credit, increased the costs of financing and the terms under which banks agree to provide financing. These developments may reduce our sales, increase our costs of borrowing and reduce our profitability.

Real Estate

We value our yield-generating real estate property according to IAS 40R and changes to the fair value of our real estate are reflected in our financial statements. The fair value of our properties could be impacted by a number of factors, including the global economic and financial market crisis, as well as the retail sector in Israel because most of our assets are intended for retail businesses. Reductions in the fair value of our real estate may materially adversely affect our financial results.

During 2010, we entered into the residential building sector in Israel. A recession may cause a decrease in the scope of marketing and sales and a decrease in the price of apartments. In addition, government policies may affect the availability and value of real estate designated for building and may also affect the prices of the apartments.

We have a history of quarterly fluctuations in our operating results and expect these fluctuations to continue due to seasonality. This may cause the share and ADS price of Blue Square to be volatile.

Our business is subject to fluctuations in quarterly sales and profits. These fluctuations are primarily attributable to increased sales and higher operating income in the holiday seasons occurring in different quarters from year to year. Thus, for example, in our supermarkets, and in our "Naaman", "Vardinon" and "Sheshet" chains, increased sales attributable to Passover, which occurs in either March or April, may be realized in either the first or the second quarter, and sales attributable to the Jewish New Year, which occurs in either September or October, may be realized in either the third or the fourth quarter. In our "Kfar Hasha'ashuim" chain, increased sales are generally attributable to Purim, which occurs in March, and to the "Back-to-School" season in August. However, the timing of the holidays does not affect our semiannual results.

Many of our expenses are unrelated to the level of sales. Therefore, a relatively modest increase or decrease in sales, whether or not related to the timing of holidays, tends to have a disproportionately large impact on our profitability.

Because of the fluctuations that we have experienced in our quarterly operating results, we do not believe that period-to-period comparisons of our operating results are necessarily meaningful or should necessarily be relied upon as indicators of future performance. Accordingly, our operating results may be below public expectations in future periods. Our failure to meet these expectations may cause the share and ADS price of Blue Square to decline.

Since the issuance of our 5.9% unsecured debentures issued in August 2003, we have limited the cash dividends that we pay on our ordinary shares.

In connection with our issuance of NIS 400 million in aggregate principal amount of unsecured 5.9% convertible and nonconvertible debentures in August 2003, Blue Square’s board of directors resolved that Blue Square would not distribute dividends in any quarter if the ratio of our net financial obligations (as defined by S&P-Maalot, an Israeli rating agency owned by S&P) to EBITDA for any quarter exceeds 3.5 until June 30, 2006 or exceeds 3.0 thereafter. Blue Square’s board of directors also resolved that Blue Square would not distribute dividends in any quarter if the ratio of the unencumbered fixed assets (following depreciation) and investment property as set forth on our financial statements to financial obligations (as defined by S&P-Maalot) for any quarter is below 120%. At the time of the issuance of our debentures, S&P-Maalot informed us that the rating was based among other things upon the Board of Directors resolution and a change in this resolution may lead to a change of the rating on our 5.9% unsecured debentures.

On January 14, 2010, Blue Square's board of directors decided that in view of the changes and development of Blue Square since 2003, including the transfer of Blue Square's and Mega Retail's real estate properties to BSRE (which operates under financial obligations to EBITDA ratios appropriate for real estate companies and currently holds a major part of the consolidated debt), the purchase of Bee Group (a Non Food retailer), and the reorganization of Blue Square's food retail activities in its subsidiary, Mega Retail Ltd., that the ratio of net financial obligations to EBITDA is to be calculated by deducting from the net financial obligations Blue Square's debt which is related by the company to real estate that is not in use by Blue Square (which is equal to 75% of the investment property as recorded on the balance sheet). On December 31, 2009, the net financial obligations to EBITDA (calculated in accordance with the deduction described above) was less than 2. Our board of directors further resolved that Blue Square would not distribute dividends in any quarter if the ratio of our net financial obligations (calculated in accordance with the deduction described above) to EBITDA for any quarter exceeds 4.5.

The 5.9% unsecured debentures that we issued in August 2003 are subject to downgrading upon the occurrence of certain events. A downgrading of the rating on these debentures to "ilBBB" or lower may require us to repurchase our 5.9% unsecured debentures issued in August 2003.

The 5.9% unsecured debentures that we issued in August 2003 are subject to downgrading upon the occurrence of certain events, including as described above. A downgrading of the rating on these debentures to "ilBBB" or lower may require us to repurchase our 5.9% unsecured debentures issued in August 2003.

On October 1, 2009, we announced that we received from S&P Maalot a report including affirmation of "ilA+" rating for the debentures, while revising the outlook to negative. In its rating, S&P Maalot stated that under the current rating it still expects us to maintain an adjusted debt to adjusted EBITDA ratio of less than 4.5. On April 26, 2010, we received a report from S&P Maalot placing the rating for the debentures on CreditWatch with negative implications, following BSRE's announcement of its proposed acquisition of real estate for residential and commercial development in the wholesale market site in downtown Tel Aviv. We have no knowledge whether the proposed Acquisition will have an impact on the rating for the debentures.

We are dependent to a significant extent on a limited number of key suppliers. If these suppliers raise prices or encounter difficulties in providing their products, our operating results will be adversely affected.

We purchase most of our dairy, fresh produce and poultry products from the Tnuva corporation, which holds a leading position in the domestic dairy and poultry markets. In 2009, Tnuva’s products accounted for approximately 14.4% (which percentage includes for the first time, data for Tnuva's subsidiary, Tirat Zvi) of all the products sold at our supermarkets. For more information on our arrangements with Tnuva, see "Item 7. Major Shareholders and Related Party Transactions – B. Related Party Transaction – Arrangements with Tnuva." In addition, the Strauss group, an Israeli food manufacturer, accounted in 2009 for approximately 9.2% of all products sold at our supermarkets, and the Osem group accounted for approximately 7.5% of all products sold at our supermarkets in 2009. Because of our status as a leading food retailer in Israel as a result of which we are able to offer a wide exposure and promotion, on a national level, to these suppliers’ products, and the fact that we maintain an excellent and long-standing relationship with Tnuva, Strauss group and Osem, we do not believe that there is a material risk of future stoppage of supply of products of these key suppliers. However, we do not have a written contract with Tnuva, Strauss group or Osem obligating them to supply products to us. The ten largest suppliers accounted for approximately 55.7% of our product purchases in 2009. Due to the relatively large market share of these suppliers, we depend on them and on a number of other suppliers that supply brands characterized by high customer loyalty, such as the Central Company for the Manufacture of Soft Drinks Ltd., which is the exclusive franchisee of Coca Cola and also distributes other popular soft drinks. For example, during the third and fourth quarters of 2007 and during 2008, some of our suppliers raised the prices of various products that they supply us, principally due to an increase in raw materials prices, which caused an increase in our costs. Increases in prices by our suppliers are generally not offset, fully or as quickly, by increases in our selling prices and revenues because of competitive pressures. We cannot assure that, in the future, Tnuva, Strauss group, Osem or any of these other suppliers will not significantly raise the prices of the products they supply us in the future, or encounter difficulties in providing these products to us, in either of which cases our operating results might be adversely affected.

Alon Retail Ltd. is able to control the outcome of matters requiring shareholder approval.

As of May 31, 2010, Alon Retail Ltd., ("Alon Retail"), owned approximately 68.62% of Blue Square’s outstanding ordinary shares. So long as Alon Retail, or any successor to its shareholdings in Blue Square, continues to own beneficially more than 50% of our outstanding ordinary shares and voting power, it will be able to control the outcome of matters requiring shareholder approval that do not require a special majority, including the election of all Blue Square directors, other than Blue Square two external directors whose election, under the Israeli Companies Law, requires that at least one-third of the non-controlling shareholders who participate in the vote, vote for their nomination, or that the total number of shares of non-controlling shareholders voted against their nomination does not exceed one percent of the aggregate voting rights in the company.

We own a majority interest in most of our subsidiaries. As a majority shareholder, we owe fiduciary duties to the minority shareholders of our subsidiaries and have to share dividends and distributions with these minority shareholders.

In addition to our wholly owned subsidiary, Mega Retail, our two main subsidiaries are Bee Group, in which we owned an 85% interest (with an option to further increase our holdings to 100%) as of May 31, 2010, and BSRE, in which we owned a 78.35% interest as of May 31, 2010.

Through our subsidiary, Bee Group, as of May 31, 2010, we held approximately 66.85% of the outstanding shares of Naaman Porcelain Ltd., which held approximately 88.74% of the share capital interest in Vardinon Textile Ltd., both of which are publicly held and traded on the Tel Aviv Stock Exchange. In addition, as of May 31, 2010 we owned nine supermarkets through our 51% subsidiary, Eden Teva. The ordinary shares of Eden Teva that are not owned by us are held by private third parties (including the CEO of Eden Teva).

Mega Retail leases from BSRE the real estate underlying a substantial portion of the supermarkets that it owns. The ordinary shares of BSRE that are not owned by Blue Square are publicly held and traded on the Tel Aviv Stock Exchange.

In order to satisfy whatever fiduciary obligations we may have under applicable law to the minority shareholders of our partially owned subsidiaries, we endeavor to deal with each of these subsidiaries at “arm’s-length.” Some transactions between Blue Square and a subsidiary, including any cancellation of such transactions, require the approval of the audit committee, the directors, and, under certain circumstances, approval of the shareholders of the subsidiary by special vote and are subject to the receipt of applicable permits and approvals. In addition, any dividend or distribution from a subsidiary requires the approval of the directors of that subsidiary, and may be subject to restrictions imposed by loan and other agreements to which they are parties.

In recent years, we have expanded our non-food retail business by acquiring businesses with stand alone retail outlets. We may not be able to successfully consolidate these business operations with our supermarket business or to capitalize on potential synergies of the internal reorganization of our non-food retail businesses.

As part of our strategy to expand our presence in “Non-Food” stand alone retail outlets, we acquired 50% of Bee Group in 2005 and by 2008 we had increased our holdings in Bee Group to 85%. Concurrently, Bee Group acquired the controlling interest in Vardinon Textile Ltd. (home textile retailer and wholesaler) and the controlling interest in Naaman Porcelain Ltd. (houseware retailer and wholesaler) (the "Bee Group Acquisition"), and Bee Group effected an internal reorganization of its own subsidiaries in order to improve Bee Group's operating efficiency. Realization of the anticipated benefits of our Bee Group acquisitions, including anticipated operating synergies among the various subsidiaries of the Bee Group, and between the Bee Group and the Company as a whole will depend, in large part, on our ability to successfully eliminate redundant corporate functions and consolidate company and shared service responsibilities. We will be required to devote significant management attention and resources to the consolidation of business practices and support functions while maintaining the independence of the Bee Group's stand alone brand names.

The process of consolidating corporate level operations could cause an interruption of, or loss of momentum in, our business and financial performance. The diversion of management’s attention and any delays or difficulties encountered in connection with our Bee Group acquisitions and the realization of corporate synergies and operational improvements could have an adverse effect on our business, financial results, financial condition or share price. The consolidation and integration process may also result in additional and unforeseen expenses. There can be no assurance that the contemplated synergies and other benefits anticipated from the Bee Group acquisition will be realized.

In addition, our expansion into the non-food retail business has required us to enter new markets in which we have no or limited experience and where competitors in such markets may have stronger market positions. If we are not able to successfully compete against our more experienced competitors in the stand alone retail outlet businesses, our business may be adversely affected.

Failure to obtain or maintain permits required for our operations may adversely affect our operating results.

Our operation of supermarkets in Israel requires permits from municipal authorities, which are conditioned on the prior approval of various agencies, including the health and environment ministries, and the police and fire departments. Some of these permits are currently in the name of the Co-Op Blue Square Services Society, or the Co-Op, our former controlling shareholder, and entities other than us, and have not yet been transferred or re-issued to us. Furthermore, as a result of the reorganization of our supermarket retail and real estate activities, these permits are to be transferred in the name of Mega Retail, in which all of our retail activity has been centralized. Also, some of our stores require permits that have not yet been obtained, or have expired or require renewal.

Some of our Bee Group stores do not have permits according to the requirements of Israeli Business Permits Law, 1968. A lack of such permits by any store would be considered a breach of the tenancy agreement for such store, which would allow the landlord to annul the lease agreement. As of May 31, 2010, none of the landlords had made use of this right.

In addition, Kfar Hashashuim received a court issued order to vacate its logistics center due to a lack of a permit to conduct its business in the logistics center and a lack of building permits. However, BSRE is in the process of building a new logistics center for the Bee Group, and therefore Kfar Hasha'ashuim has requested a delay in the execution of the closure order. On February 2, 2009, the court decided that the execution of the order to vacate will be delayed until after further hearing on the matter, a date of which has yet to be determined. On March 15, 2010, the court set the date of July 12, 2010 for receiving further updates on moving into the new logistics center.

As a result of the hostilities between Israel and the Palestinians, the relevant authorities, including the police, have required us to adopt various security measures. These safety requirements prescribe extensive investment in safety equipment, the retaining of security personnel and may lengthen the time dedicated for obtaining permits from the municipal authorities. If we are unable to obtain or maintain one or more required permits, we may be required to close one or more stores or to take other remedial action to obtain or maintain these permits.

Increase in employee minimum wage in Israel may adversely affect our operating results.

A substantial portion of our employees’ wages is adjusted upon a change in the minimum wage in Israel. Under Israeli law, the minimum wage, which is increased from time to time as a result of various economic parameters and updating of employee-union agreements, equals approximately 47.5% of the average wage for an employee in Israel, unless otherwise determined by government regulations. Pursuant to existing legislation, the minimum monthly wage was increased on July 1, 2008, to NIS 3,850 or approximately $1,005 (as of May 31, 2010). On May 23, 2010, a governmental committee of ministers approved a proposal to amend the Minimum Wage Law, 1987, to gradually increase the minimum wage to NIS 4,600 (approximately $1,201 (as of May 31, 2010)) over a period of 15 months. The Knesset has not yet approved such amendment of the Minimum Wage Law and it is unknown if and when such amendment will be approved. An increase in minimum wage will increase our labor costs and thus adversely affect our operating results.

Future issuances of our ordinary shares could reduce our share price.

Out of the NIS 400 million in aggregate principal amount of unsecured 5.9% debentures that we issued in August 2003, NIS 200 million in aggregate principal amount were convertible debentures (principal repayable in three equal installments in the years 2007, 2009 and 2011) which as of February 12, 2010 are convertible into Blue Square ordinary shares at a per share price of NIS 18.390. This conversion ratio is subject to adjustment in the event of distribution of bonus shares, cash dividends and the issuances of rights. On May 31, 2010, the closing price per share of our ordinary shares on the Tel Aviv Stock Exchange was NIS 46.19. As of May 31, 2010, the remaining principal balance of our convertible debentures was approximately NIS 7.5 million. In January, 2008, we adopted a share option plan for officers and employees of Blue Square and its subsidiaries and affiliates. As of May 31, 2010, the total number of shares available for issuance under the plan was 2,584,995 shares, subject to adjustments.

In connection with our proposed acquisition from Alon of all of Alon's approximately 80% holdings in Dor Alon, subject to satisfaction of closing conditions, we expect to issue to Alon an aggregate of 20,327,710 ordinary shares of Blue Square. See “Item 7. Major Shareholders and Related Party Transactions – Proposed Acquisition of Controlling Share in Dor-Alon Energy In Israel (1988) LTD."

The issuance of ordinary shares to holders of our convertible debentures, to holders of options under our share option plan, or to Alon, or the perception that those issuances may occur in the future, could materially and adversely affect the market price for our ordinary shares.

The Israeli Antitrust Authority may take actions that limit our ability to execute our business strategy or otherwise affect our profitability.

Our strategy includes expanding our market presence in existing retail food markets and entering into new retail food and “Non-Food” markets. The Israeli Antitrust Authority may limit our ability to execute our strategy, inter alia, by limiting our ability to acquire existing stores or enter into mergers to acquire existing stores.

On January 5, 2005, the Commissioner of the Israeli Antitrust Authority issued his final position regarding “commercial restrictive practices between the dominant food suppliers and the major supermarket retail chains”. According to the Commissioner’s final position, some of these practices were found to be restrictive trade agreements under the antitrust laws. The Commissioner prohibited these practices unless approved by the Restrictive Trade Practices Court or exempted by the Commissioner himself.

Among the practices that were found to be restrictive according to the Commissioner were the following: arrangements with suppliers that determine the suppliers of the retail chains, their identity and their number; arrangements for the management of product categories in conjunction with suppliers; arrangements regarding the retail selling price; arrangements for determining market share of a particular supplier’s products and arrangements for determining prices made by suppliers to competing chains; arrangements with regard of the use of suppliers’ manpower to stock merchandise on the shelves of the chains’ stores. Limits were imposed on financial benefits to the chains with regard to display areas and on special offers to chains for meeting certain sale targets.

We have been applying most of these directives among others, by an internal compliance program that we have adopted.

Presently we do not know how, if at all, our business would be affected should the Commissioner take any action against us with respect to those issues under dispute which we believe are legal based on our consultations with our legal counsel.

In August 2006, the Restrictive Trade Practices Court approved a consent decree reached between the Commissioner and certain specific food suppliers. The consent decree stipulates various prohibitions, conditions and restrictions that would apply to certain practices of these suppliers. The consent decree addresses the following practices: arrangement by which suppliers influence the number or identity of competing suppliers; acquisition of shelf and off-shelf display space; category management; the use of suppliers’ representatives to physically arrange the shelves in the chains’ stores; discounts and rebates in exchange for meeting sales targets; arrangements that determine a supplier’s market share; exclusivity in sales and price dictation by suppliers. The Company is not a party to the consent decree; however, it could nevertheless have an effect on the practices of the Company’s suppliers and indirectly on the Company.

Increases in oil, raw material and product prices in recent years may affect our operating results.

The sharp increase in oil prices in recent years has led to the increase in our electricity prices and raw materials used in the plastic packing industry. In 2008, a number of our suppliers increased their product prices to us due to increases in raw material prices. While these suppliers have not raised prices further during 2009 , we cannot assure that they will not raise prices in the future. Further increase in oil, raw material and product prices would impose on us significant expenses and costs, which could have an adverse effect on our operation results.

Impact of inflation may adversely affect our financial expenses and operating income.

Our non-financial assets and shareholders equity are not adjusted to the inflation in Israel, while the repayment of interest and principal under part of our loans and all debentures are adjustable, linked to changes to the Israeli consumer price index, as provided in our loan and debenture agreements. As a result, an increase in inflation in Israel would have the effect of increasing our financial expenses without any corresponding offsetting increase in our assets and revenues on our financial statements, leading to lower reported earnings and shareholders equity. The extent of this effect on our financial statement would be dependent on the rate of inflation in Israel. The Company has an excess of CPI-linked liabilities over CPI-linked assets (mainly in respect of outstanding debentures). Toward the end of 2008 and during 2009, we engaged in transactions to partially hedge this inflation risk. We engage in these transactions from time to time to reduce our risk to inflation, although we do not eliminate the risk of inflation.

In addition, some of our operating expenses are either linked to the Israeli consumer price index (such as lease payments payable by us under various real estate property leases in connection with our operations) or are indirectly affected by an increase in Israeli consumer price index. As a result, an increase in the inflation rate in Israel would have the effect of increasing our operating expenses, thereby affecting our operating income. The extent of this effect on our operating income depends on the rate of inflation in Israel.

The value of our securities portfolio may be adversely affected by a change in the capital markets, interest rates or the status of the companies in whose securities we have invested.

As of December 31, 2009, we held approximately NIS 188 million in Israeli corporate and government bonds at fixed interest rates, a portion of which is linked to the Israeli CPI. Therefore, a decrease in the market value of these bonds or interest rates or a change in the status of the companies in whose bonds we have invested could lead to a material increase in our net financing expenses.

Damage to our reputation may have a material adverse effect on our operating results.

Our brand names, including some of our store format brands, are among the most well recognizable brands in Israel. For example, according to internal surveys, the Mega brand is one of the most prominent and well-known brands in Israel. Damage to our reputation or to the reputation of our store format brands due to reports in the media or otherwise may have material adverse effect on our level of sales with a corresponding impact on our profitability and operating results.

We are dependent on franchisees who own and operate a large portion of our Bee Group stores. We have limited control over franchisees, and our financial results could be negatively impacted by the performance of the franchisees.

Our 85% subsidiary, Bee Group, holds and operates through subsidiaries large retail chains with 268 stores as of May 31, 2010, of which 189 stores of our "Kfar Hasha'ashuim", "Dr. Baby" and "Rav-Kat", "Sheshet", "All for a Dollar" and "Naaman" chains, are owned and operated by franchisees. This store ownership mix presents a number of drawbacks, such as our limited control over franchisees and our limited ability to facilitate changes in the ownership and management of their store.

Subject to the terms of our franchise agreement, franchisees independently operate and oversee the daily operations of their stores, and they have a significant amount of flexibility in running their operations. Their employees are not our employees. Although we can exercise control over our franchisees and their store operations to a limited extent through our franchise agreements, the quality of franchise store operations may be diminished by any number of factors beyond our control. Consequently, franchisees may not successfully operate stores in a manner consistent with our standards and requirements, or may not hire and train qualified managers and other store personnel. While we ultimately can take action to terminate franchisees that do not comply with the standards contained in our franchise agreements, we may not be able to identify problems and take action quickly enough and, as a result, our image and reputation may suffer, and our franchise and property revenues could decline.

In addition, our franchise agreements limit our ability to open new stores in the vicinity of existing franchised stores, which may limit our ability to expand our business.

Volatility of Blue Square’s share and ADS price could adversely affect its shareholders.

The market price of Blue Square’s ordinary shares and ADSs could be volatile and could be subject to fluctuations in response to numerous factors, including the following:

| | · | actual or anticipated variations in our quarterly operating results or those of our competitors; |

| | · | changes in financial estimates by securities analysts; |

| | · | conditions or trends in our business; |

| | · | changes in the market valuations of our competitors; |

| | · | announcements by us or our competitors of significant acquisitions; |

| | · | entry into strategic partnerships or joint ventures by us or our competitors; |

| | · | the political, economic, security and military conditions in Israel; |

| | · | additions or departures of key personnel; and |

| | · | sales of ordinary shares by Blue Square’s controlling shareholder. |

Many of these factors are beyond our control and may materially adversely affect the market price of Blue Square’s ordinary shares and ADSs, regardless of our performance.

Since 1996, Blue Square’s ADSs have been listed for trading on the New York Stock Exchange. Since November 2000, Blue Square’s ordinary shares have also been listed for trading on the Tel Aviv Stock Exchange. Volatility of the price of Blue Square’s securities on either market is likely to be reflected in the price of Blue Square’s securities on the other market. In addition, fluctuations in the exchange rate between the NIS and the dollar may affect the price of Blue Square’s ordinary shares on the Tel Aviv Stock Exchange and, as a result, may affect the market price of Blue Square’s ADSs on the New York Stock Exchange.

Currency fluctuations might affect our operating results and translation of operating results.

Any devaluation of the NIS against various non-Israeli currencies in which we or our suppliers pay for imported goods has the effect of increasing the selling price of those products which we sell in Israel in NIS and affecting our operating results. This devaluation would have a greater affect on our non-food retail business because a higher proportion of the goods that we sell in our Bee Group stores are acquired from suppliers overseas. This devaluation would also cause an increase in our expenses as recorded in our NIS denominated financial results even though the expenses denominated in non-Israeli currencies will remain unchanged.

In addition, because our financial results are denominated in NIS and are translated into US dollars for the convenience of US investors, currency fluctuations of the NIS against the US dollar may impact our US dollar translated financial results.

Our profit margin would be adversely affected if our ability to utilize our distribution centers were limited.

We have a distribution center in Rishon Letzion from which we distribute to our supermarkets a large portion of the products they carry. The products distributed by our distribution center to our supermarkets generated approximately 21.5% of our total percentage purchases during 2009. In addition, during 2010 and 2011 we intend to open a new distribution center for non-food sold in our supermarkets and by Bee Group. Our inability to utilize the distribution centers for any reason may significantly impair our ability to distribute our products to our supermarkets and to our Bee Group stores and would adversely affect our profit margin.

We are exposed to risks of fraud and theft with regard to our gift certificates which may cause a loss of revenue and non-recoverable expenses.

We run programs under which we issue and sell gift certificates and electronic prepaid cards to institutions, companies and individuals, particularly during the High Holiday and Passover seasons. The gift certificates and prepaid cards can be used in our stores as well as other stores with which we entered into collaboration agreements. Based on our experience, we are exposed to risks connected with the issuance of gift certificates, including risks that they may be fraudulently forged or stolen, and we are exposed to risks of computer fraud or errors in connection with the issuance of prepaid cards. A substantial or large scale forgery, theft, fraud or error may cause a reduction in our revenue and increase our expenses.

The potential declaration of a boycott by certain segments of Israel’s ultra-orthodox population against our Shefa Shuk stores may affect our financial results.

Since the second half of March 2008, the media has published reports that certain segments of Israel’s ultra-orthodox population are considering the declaration of a boycott against our Shefa Shuk stores due to the operation of stores owned by our controlling shareholder on the Jewish sabbath. Although the Company is unaware of any public declaration of a boycott, since the end of March 2008, the Company has experienced a significant decrease in the sales of several Shefa Shuk stores which appeal to the ultra-orthodox community and/or are located within ultra-orthodox neighborhoods. During 2008 and with the launching of "Mega Bool" chain at the end of 2008, we have converted most of our Shefa Shuk stores to "Mega in Town" and "Mega Bool" stores. As of May 31, 2010, we operated 17 Shefa Shuk stores compared to 21 as of December 31, 2008. An actual declaration of a boycott may adversely affect the company's financial results.

The failure of our use of technological information systems and computer systems may adversely affect our day-to-day operations.

We use several technological information systems and computer systems. Our day-to-day operations are dependent on the proper function of these systems. We take various measures to ensure the integrity and reliability of the data and computer systems, including data protection and data back up. However, a failure of our data and/or computer systems may adversely affect our day-to-day operations.

We are party to legal proceedings in connection with tax assessments.

In July 2005, the Income Tax Authority issued a notice of a deduction assessment for the years 2001-2004 to the Company. The amount claimed under these assessments totaled NIS 34 million, and primarily relates to certain benefits granted to employees in the Company’s branches. In November 2005, several senior employees were questioned under warning, with respect to these benefits. Following these assessments and after the rejection of the Company's position on the matter, the Income Tax Authority issued to the Company deduction assessment orders for the years 2001-2004 in the amounts of approximately NIS 44 million. The Company has filed appeals with the District Court contesting these assessment orders, which as of the date of this Annual Report are still pending. In July 2007, the Israeli Tax Authority issued to the Company value added tax assessment for the years 2001-2006 in the amounts of approximately NIS 22 million in connection with the subject matter of the foregoing deduction assessments. The Israeli Tax Authority did not accept most of the Company's position, although it agreed to reduce the total amount to approximately NIS 16.3 million. On February 29, 2009, the Company filed an appeal with the District Court, which as of May 31, 2010 is still pending. In the opinion of the Company and its advisors, the provisions included in the Company financial statements are sufficient to cover the potential liabilities.

Political conditions in Israel affect our operations and may limit our ability to sell our products.

We and all of our subsidiaries are incorporated under Israeli law and our principal offices and operations are located in the State of Israel. Political, economic, security and military conditions in Israel directly affect our operations. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors and a state of hostility, varying, from time to time, in intensity and degree, has led to security and economic problems for Israel. We could be adversely affected by hostilities involving Israel, the interruption or curtailment of trade between Israel and its trading partners, a significant increase in inflation, or a significant downturn in the economic or financial condition of Israel.

The future of Israel’s relations with its Arab neighbors and the Palestinians is uncertain, and several countries, companies and organizations continue to restrict business with Israel and with Israeli companies. We could be adversely affected by adverse developments in Israel’s relationship with its Arab neighbors and the Palestinians or by restrictive laws, policies or practices directed towards Israel or Israeli businesses.

In the last few years, the establishment of a Hamas government in Gaza has created additional unrest and uncertainty in the region and has increased hostilities between Israel and the Palestinians. These hostilities have included terrorist acts in Israel and military operations in the West Bank and Gaza. In December 2008 Israel was engaged in an armed conflict with Hamas in the Gaza Strip, which reduced the sales of some of our stores that are located in the southern region of Israel. In July 2006, a conflict with Hezbollah escalated significantly on Israel’s northern border. Due to the hostilities in the northern part of Israel and Lebanon, a number of our stores located in the northern region did not operate according to their usual schedule. We cannot predict the effect on our business if hostilities are renewed or the security situation deteriorates in any part of the country.

Many of our officers and employees are currently obligated to perform annual reserve duty and are subject to being called to active duty at any time under emergency circumstances. We cannot assess the full impact of these requirements on our workforce or business if conditions should change, and we cannot predict the effect on us of any expansion or reduction of these obligations.

Disruptions of the Israeli ports may affect our ability to import products used in our Bee Group business.

The Bee Group acquires most of its products from suppliers outside of Israel, and most of its products are imported via the sea. A prolonged general strike, shutdown or a disruption of any of the Israeli ports for an extended period of time, including as a result of a military conflict, would affect our ability to import such products or increase their prices. In addition, since the peak selling season of some of our Bee Group stores is during the holidays, disruptions in the ports during or adjacent to such holiday seasons may adversely affect our sales and financial results.

Political and economic conditions in China may affect the operating results of the Bee Group.

Most of Bee Group's imports during 2008 and 2009 were from suppliers located in China. Because most of the products sold by the Bee Group are manufactured overseas and imported from China, its activity may be affected by changes in the political and economic conditions in China. For instance, any material change in the NIS-Chinese currency exchange rate may increase our manufacturing costs and increase the price of those imported products from China.

Our imports from China are affected by costs and risks inherent in doing business in Chinese markets, including, changes in regulatory requirements or tax laws, export restrictions, quotas, tariffs and other trade barriers, and general economic problems.

Any of these risks could have a material adverse effect on our ability to deliver or receive non-food products on a competitive and timely basis and on our sales and profitability.

Government-imposed price controls may have a material adverse effect on our operating results.

The Israeli government is authorized to control the retail and wholesale prices of goods and services offered in Israel. At present, a few of the products we offer in our stores, including bread, flour, eggs, milk and margarine are subject to government-imposed price controls. In addition, during periods of high inflation in the past, more extensive price controls have been imposed throughout Israel.

We do not believe that current price controls have any material adverse effect on our business or operating results. However, any imposition of more extensive price controls in the future may have a material adverse effect on our operating results. We cannot assure you that broader price controls will not be imposed in the future.

It may be difficult to enforce a U.S. judgment against us and some of our officers and directors, to assert U.S. securities laws claims in Israel or serve process on our officers and directors.

We are incorporated in Israel. Our executive officers and directors are nonresidents of the United States, and substantially all of our assets and most of the assets of these persons are located outside the United States. Therefore, it may be difficult to enforce a judgment obtained in the United States based upon the civil liabilities provisions of the U.S. federal securities laws against us or any of these non-residents of the United States or to effect service of process upon these persons in the United States. Additionally, it may be difficult for you to enforce civil liabilities under U.S. federal securities laws in actions instituted in Israel.

Risks Relating to Real Estate

We are subject to risks regarding the ownership of real estate assets.

We own, through our subsidiaries, real-estate assets, most of which are currently used in connection with the retail operation of our stores, and the remainder is leased to third parties or for future development. These assets are subject to risks with regard to ownership of real-estate assets, including decline in demand and surplus of supply of commercial properties, which might have a material adverse effect on the real-estate markets, occupancy rates, rental fees and revenues from third parties and on the value of the assets in the Company's financial statements. These risks include increase of operational costs, decline of the financial conditions of the lessees and additional factors which are beyond our control. In addition, from time to time we acquire real estate with the intention of changing the zoning of such real estate. We cannot assure that the relevant planning authorities will approve these contemplated zoning changes or, if approved, that we will be able to sell our real estate at a profit following the change of zoning.

The slowdown in the Israeli yield-generating real estate market may adversely affect our business.

Commencing from the beginning of the fourth quarter of 2008 and as a result of global economic and financial market conditions, there has been a slowdown in the Israeli yield-generating real estate market which is evidenced by a decline in the number of real estate transactions, a reduction in the availability of credit sources, an increase in financing costs and stricter requirements by banks for providing such financing. Although in the last few months the availability of credit sources has improved somewhat, we cannot assure that this trend will continue. During 2009, the Israeli market was also affected by the volatility in exchange rates of principal currencies versus the NIS and the volatility of inflation rates within the local market. If the economic conditions in Israel continue, there may be a continued decline in demand for commercial real estate, a reduction in rental fees, a decline in the fair value of our real estate assets and an increase in the cost and availability of financing from Israeli banks, which could adversely affect our real estate business.

BSRE may not be able to obtain additional financing for its future capital needs on favorable terms, or at all, which could limit its growth and increase its costs and could adversely affect the price of its ordinary shares.

BSRE's activities are financed from external sources. We cannot be certain that BSRE will be able to obtain financing on favorable terms for its activities, or at all, and BSRE cannot be certain that its existing credit facilities will be renewed. In addition, an adverse change can occur in the terms of the financing that it receives. Any such occurrence could increase BSRE's financing costs and/or result in a material adverse effect on the results of the Company and its ability to develop its real estate business. In addition, in connection with the transfer of real estate properties from Mega Retail to BSRE in September 2009, BSRE incurred additional loans, which as of December 31, 2009, were in the principal amount of approximately NIS 248 million, secured by a lien on most of the properties transferred by Mega Retail. The amount of long term loans currently outstanding may inhibit BSRE's ability to obtain additional financing for its future capital needs, inhibit BSRE's long-term expansion plans, increase its costs and adversely affect the price of its ordinary shares.

A recession and/or government policies may have a negative impact on BSRE's new operation in residential building, by causing a decrease in the scope of marketing and sales and a decrease in the prices of apartments.

During 2010, we entered into the residential building sector in Israel. A recession may cause a decrease in the scope of marketing and sales and a decrease in the prices of apartments. In addition, government policies may affect the availability and value of real estate designated for building and may also affect the prices of apartments.

Risks Relating to the Proposed Acquisition of Alon’s Equity Interest in Dor-Alon Energy In Israel (1988) LTD.

On May 17, 2010, we signed a share purchase agreement with our controlling shareholder, Alon, to acquire from Alon all of Alon's approximately 80% holdings in Dor Alon. The closing of the transaction is subject to satisfaction of closing conditions, including shareholder approval. See "Item 7. Major Shareholders and Related Party Transactions – Proposed Acquisition of Controlling Share in Dor-Alon Energy In Israel (1988) LTD." Below are risks relating to our proposed acquisition of Alon's equity interest in Dor Alon.

The Acquisition may not result in the benefits that we currently anticipate.