UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| SUN BANCORP, INC. |

| (Name of Registrant as Specified in its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: |

(2) Aggregate number of securities to which transaction applies: |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction: |

(5) Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount previously paid: |

(2) Form, Schedule or Registration Statement No.: |

(3) Filing Party: |

(4) Date Filed: |

April 13, 2012

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of Sun Bancorp, Inc., I cordially invite you to attend the Annual Meeting of Shareholders to be held at the Sun Bancorp, Inc. Corporate Center, 226 Landis Avenue, Vineland, New Jersey, on May 24, 2012, at 9:30 a.m. The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the annual meeting. During the annual meeting, I will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of the Company’s independent registered public accounting firm, Deloitte & Touche LLP, will be present to respond to any questions shareholders may have.

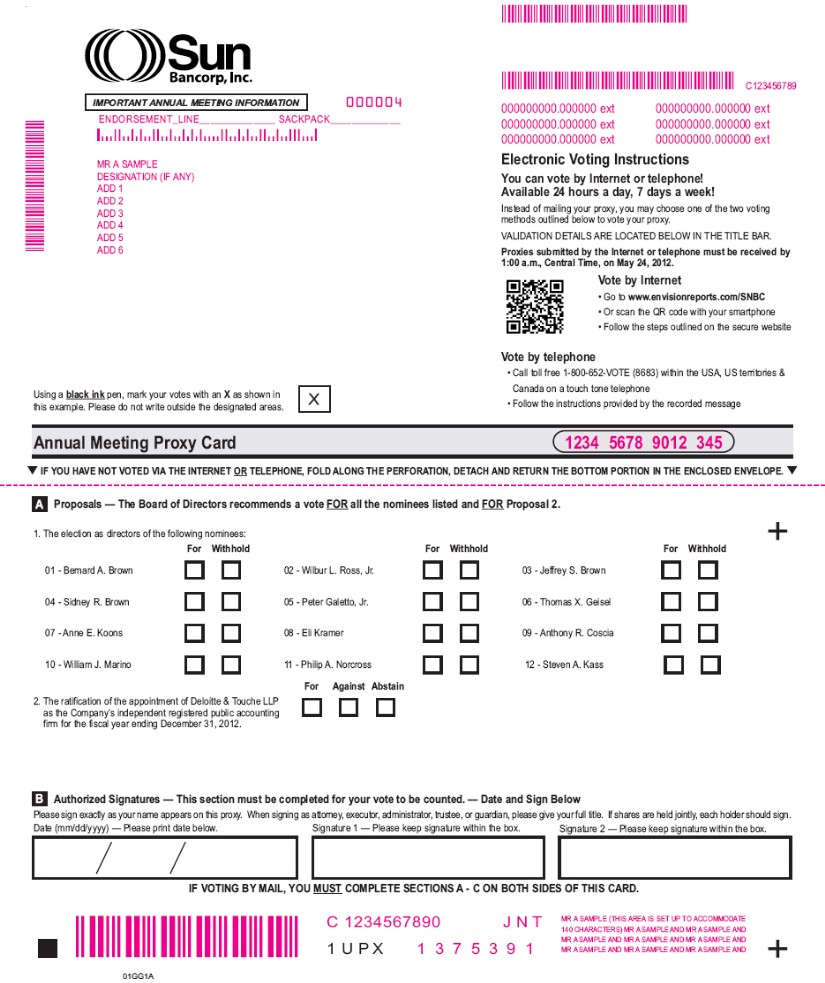

At the annual meeting, shareholders will vote upon (i) the election of twelve directors of the Company; and (ii) the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012. The Board of Directors unanimously recommends a vote “FOR” each of the nominees to the Board of Directors and “FOR” proposal (ii).

This year, pursuant to the Securities and Exchange Commission rule allowing companies to furnish their proxy materials over the Internet, we are mailing shareholders a Notice of Internet Availability instead of a paper copy of the proxy statement and our 2011 Annual Report. The notice contains instructions on how to access those documents over the Internet and authorize a proxy to vote electronically. The notice also contains instructions on how shareholders may receive a paper copy of our proxy materials, including the proxy statement, our 2011 Annual Report and a proxy card. Whether or not you plan to attend the annual meeting I urge you to vote now – by Internet, telephone or mail - even if you plan to attend the annual meeting. Your vote is very important. If you received the traditional hard copy proxy materials, please follow the instructions on the enclosed proxy card. If more than one proxy card is made available to you, please vote each proxy.

Sincerely,

Bernard A. Brown

Chairman of the Board

226 LANDIS AVENUE

VINELAND, NEW JERSEY 08360

NOTICE OF ANNUAL MEETING OF SHAREHOLDERSTO BE HELD ON MAY 24, 2012

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Sun Bancorp, Inc. (the “Company”) will be held at the Sun Bancorp, Inc. Corporate Center, 226 Landis Avenue, Vineland, New Jersey, on May 24, 2012, at 9:30 a.m.

The Annual Meeting is for the purpose of considering and acting upon the following matters:

1. | The election of twelve directors of the Company; |

2. | The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

3. | Such other matters as may properly come before the Annual Meeting or any adjournments thereof. |

The Board of Directors is not aware of any other business to come before the Annual Meeting. Any action may be taken on the foregoing proposals at the Annual Meeting on the date specified above or on any date or dates to which, by original or later adjournment, the Annual Meeting may be adjourned. Shareholders of record at the close of business on April 2, 2012 are the shareholders entitled to vote at the Annual Meeting and any adjournments thereof.

EACH SHAREHOLDER, WHETHER OR NOT HE OR SHE PLANS TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO AUTHORIZE A PROXY BY MAIL OR BY VOTING BY TELEPHONE OR OVER THE INTERNET AS INSTRUCTED ON THE NOTICE OF INTERNET AVAILABILITY OR, IF YOU REQUESTED PAPER COPIES, THE INSTRUCTIONS ARE PRINTED ON THE PROXY CARD. ANY PROXY GIVEN BY A SHAREHOLDER MAY BE REVOKED BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION OR BY VOTING AGAIN AT A LATER DATE BUT PRIOR TO THE ANNUAL MEETING. ANY SHAREHOLDER PRESENT AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE IN PERSON ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, SHAREHOLDERS WHOSE SHARES ARE NOT REGISTERED IN THEIR OWN NAME WILL NEED ADDITIONAL DOCUMENTATION FROM THE RECORD HOLDER TO VOTE IN PERSON AT THE ANNUAL MEETING.

BY ORDER OF THE BOARD OF DIRECTORS

Sidney R. Brown

Secretary

Vineland, New Jersey

April 13, 2012

Important Notice Regarding Internet Availability of Proxy Materials for the Shareholder Annual Meeting to be Held on May 24, 2012 at 9:30 a.m. The Proxy Statement and the 2011 Annual Report to Shareholders are available for review on the Internet at www.envisionreports.com/SNBC. |

PROXY STATEMENT

OF

SUN BANCORP, INC.

226 LANDIS AVENUE

VINELAND, NEW JERSEY 08360

ANNUAL MEETING OF SHAREHOLDERS

MAY 24, 2012

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Sun Bancorp, Inc. (the “Company”) to be used at the 2012 Annual Meeting of Shareholders of the Company (the “Annual Meeting”), which will be held at the Sun Bancorp, Inc. Corporate Center, 226 Landis Avenue, Vineland, New Jersey, on May 24, 2012 at 9:30 a.m. This Proxy Statement and the enclosed form of proxy are first being made available to shareholders on or about April 13, 2012.

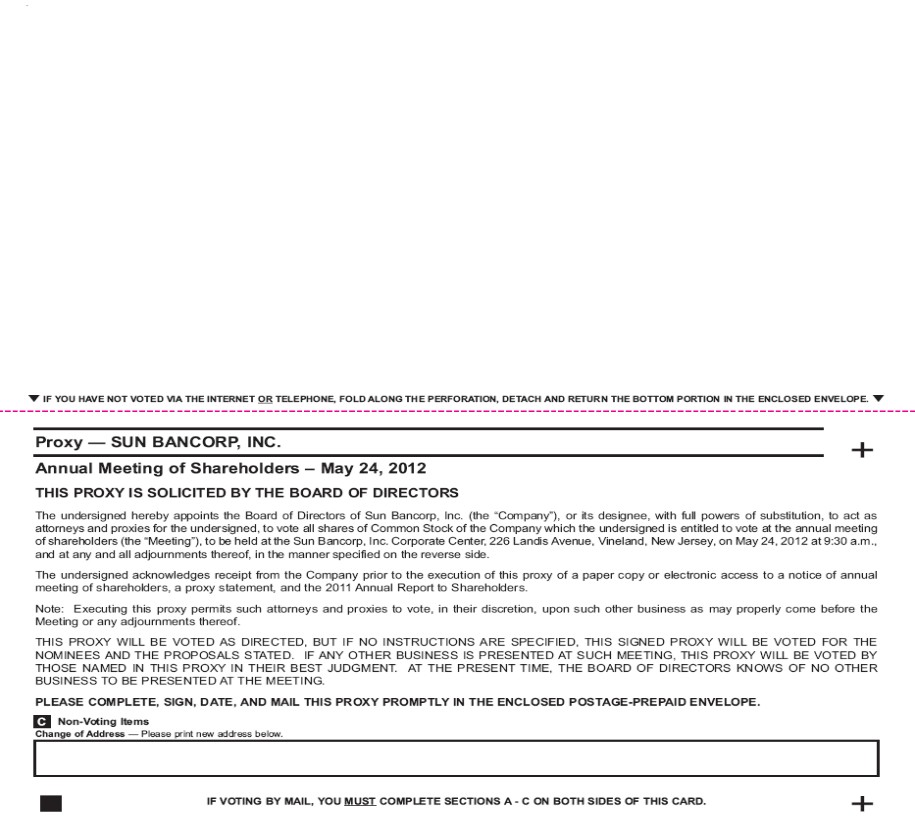

At the Annual Meeting, shareholders will consider and vote upon (i) the election of twelve directors of the Company; (ii) the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and (iii) such other matters as may properly come before the Annual Meeting or any adjournments thereof. The Board of Directors knows of no additional matters that will be presented for consideration at the Annual Meeting. Execution of a proxy, however, confers on the designated proxy holder discretionary authority to vote the shares represented by such proxy in accordance with their best judgment on such other business, if any, that may properly come before the Annual Meeting or any adjournment thereof.

VOTING AND PROXY PROCEDURES

The Board of Directors is making this Proxy Statement available to you electronically for the purpose of requesting that you allow your shares of common stock to be represented at the Annual Meeting by the persons named in the Board of Directors’ form of proxy. Shareholders of record may vote by proxy in any of three different ways:

| | ● | Voting on the Internet or by Telephone. Follow the instructions set forth in the Notice of Internet Availability. |

| | ● | Voting by Mail. If you have requested paper copies complete, sign, date and return the proxy card in the envelope provided. |

Employees who own shares of common stock as of the Record Date in either of the 401(k) Retirement Plan or the Employee Stock Purchase Plan will not receive the Proxy Statement or Annual Report in the mail but will receive an email with instructions on how to download these documents and how to direct how your shares should be voted at the Annual Meeting. Employees who participate in either of those plans must complete these procedures no later than 8:00 a.m., Eastern Time, on May 22, 2012.

Shareholders who execute proxies retain the right to revoke them at any time. Unless so revoked, the shares represented by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies may be revoked by written notice to the Secretary of the Company at the address above or by filing a later-dated proxy. A proxy will not be voted if a shareholder attends the Annual Meeting and votes in person. However, shareholders whose shares are not registered in their own name will need additional documentation from the record holder to vote in person at the Annual Meeting. Proxies solicited by the Board of Directors will be voted as specified thereon. If no direction is given, signed

proxies will be voted “FOR” the nominees for directors set forth below; and “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012. The proxy confers discretionary authority on the persons named therein to vote with respect to the election of any person as a director where a nominee is unable to serve, or for good cause will not serve, and with respect to matters incident to the conduct of the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Shareholders of record as of the close of business on April 2, 2012 (the “Record Date”) are entitled to one vote for each share of the Company’s common stock they held at that date. As of that date, there were 85,826,056 shares of the Company’s common stock outstanding.

The presence in person or by proxy of at least a majority of the outstanding shares of the Company’s common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. For purposes of determining the votes cast with respect to any matter presented for consideration at the Annual Meeting, only those votes cast “FOR” or “AGAINST” are included. Abstentions and broker non-votes (i.e., shares held by brokers on behalf of their customers, which may not be voted on certain matters because the brokers have not received specific voting instructions from their customers with respect to such matters) will be counted solely for the purpose of determining whether a quorum is present. In the event there are not sufficient votes for a quorum or to ratify or adopt any proposal at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors, the proxy being provided by the Board of Directors allows a shareholder to vote for the election of the nominees proposed by the Board of Directors or to withhold authority to vote for any or all of the nominees being proposed. Under the Company’s bylaws, directors are elected by a plurality of votes cast.

Concerning all other matters that may properly come before the Annual Meeting, including the ratification of the appointment of the Company’s independent registered public accounting firm, by checking the appropriate box, a shareholder may: (i) vote “FOR” the item, or (ii) vote “AGAINST” the item, or (iii) “ABSTAIN” with respect to the item. Unless otherwise required, such matters, including the ratification of the appointment of the Company’s independent registered public accounting firm, shall be determined by a majority of votes cast affirmatively or negatively without regard to (a) broker non-votes, or (b) proxies marked “ABSTAIN” as to that matter.

Security Ownership of Certain Beneficial Owners

Persons and groups owning in excess of 5% of the outstanding shares of the Company’s common stock are required to file reports regarding such ownership with the SEC. Other than as set forth in the following table, management knows of no person or group that owns more than 5% of the outstanding shares of the Company’s common stock as of the Record Date, the record date set to determine those shareholders entitled to vote at the 2012 Annual Meeting of Shareholders.

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding |

| | | | | |

| Bernard A. Brown | | | | |

| 71 West Park Avenue | | | | |

| Vineland, New Jersey 08360 | | 7,907,868 | (1) | 9.2% |

| | | | | |

| WL Ross & Co. LLC | | | | |

| 1166 Avenue of the Americas | | | | |

| New York, New York 10036 | | 21,279,241 | | 24.8% |

| | | | | |

| Maycomb Holdings II, LLC | | | | |

| Maycomb Holdings III, LLC | | | | |

| Maycomb Holdings IV, LLC | | | | |

| c/o Siguler Guff & Company, LP | | | | |

| 825 Third Avenue | | | | |

| New York, New York 10022 | | 8,460,421 | (2) | 9.9% |

| | | | | |

| Sidney R. Brown | | | | |

| 226 Landis Avenue | | | | |

| Vineland, New Jersey 08360 | | 4,564,892 | (3)(4) | 5.3% |

| | | | | |

| Anchorage Capital Group, L.L.C. | | | | |

610 Broadway, 6th Floor | | | | |

| New York, New York 10012 | | 8,460,421 | (5) | 9.9% |

| | | | | |

Total of all directors, nominees for director and executive officers of the Company as a group (16 persons) | | 38,981,893 | (6)(7)(8) | 45.1% |

________________

| (1) | Includes shares held directly as well as by spouse, in trust and other indirect ownership, over which shares Mr. Brown exercises sole or shared voting and/or investment power. Includes 86,364 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. |

| (2) | Based on an amended Schedule 13G filed with the SEC on February 14, 2012 and on information from the corporate records of the Company. |

| (3) | Includes shares held directly as well as by spouses or minor children, in trust and other indirect ownership, over which shares the individual exercises sole or shared voting and/or investment power, unless otherwise indicated. Includes 196,498 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. |

| (4) | Excludes 3,899,348 shares held by various companies and partnerships for which the individual disclaims beneficial ownership of shares held in excess of his proportionate ownership interests in such companies and partnerships. |

| (5) | Based on a Form 13F filed with the SEC on February 14, 2012. |

| (6) | Excludes 7,799,951 shares held by various companies and partnerships for which the individual disclaims beneficial ownership of shares held in excess of his proportionate ownership interests in such companies and partnerships. |

| (7) | Includes shares held directly as well as by spouses or minor children, in trust and other indirect ownership, over which shares the individuals effectively exercise sole or shared voting and/or investment power, unless otherwise indicated. Includes 703,722 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date set for the 2012 Annual Meeting of Shareholders. |

| (8) | Includes 52,185 shares beneficially owned by former Executive Vice President and Chief Operating Officer A. Bruce Dansbury whose employment with the Company and the Bank terminated as of December 31, 2011. |

PROPOSAL I – ELECTION OF DIRECTORS

The Board of Directors currently consists of ten persons. Directors of the Company are elected to one-year terms, each to serve until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified. Twelve directors will be elected at the 2012 Annual Meeting of Shareholders. All but two of the nominees are currently a member of the Board of Directors. It is anticipated that the size of the Board will be increased to 12 members and that these two individuals, Messrs. Philip A. Norcross and Steven A. Kass, will be appointed to the Boards of both the Company and Sun National Bank (“the Bank”) prior to the date of the Annual Meeting after receipt of the requisite regulatory approvals for each to serve on the Boards of both entities.

It is intended that the proxies solicited by the Board will be voted for the election of each of the named nominees unless otherwise specified. If any of the nominees is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the size of the Board may be reduced to eliminate the vacancy. At this time, the Board knows of no reason why any of the nominees might be unavailable to serve. Each of the nominees has consented to serve if elected.

The following table sets forth information with respect to the nominees for election as directors and the executive officers of the Company and the Bank, including their names, ages, the years they first became directors or executive officers of the Company or the Bank, and the number of and percentage of shares of the Company’s common stock beneficially owned by each as of April 2, 2012.

| Name | | Age | | Year First

Elected or

Appointed(1) | | Shares of

Common Stock

Beneficially

Owned(2),(3) | | Percent of Shares

of Common Stock

Outstanding |

| |

| NOMINEES FOR DIRECTORS |

| |

| Bernard A. Brown | | 87 | | 1985 | | 7,907,271 | | 9.2% |

| Wilbur L. Ross, Jr. | | 74 | | 2010 | | 21,279,241 | | 24.8% |

| Sidney R. Brown | | 54 | | 1990 | | 4,564,295 | | 5.3% |

| Peter Galetto, Jr. | | 58 | | 1990 | | 549,078 | | * |

| Anne E. Koons | | 59 | | 1990 | | 665,237 | | * |

| Jeffrey S. Brown | | 52 | | 1999 | | 2,900,491 | | 3.4% |

| Eli Kramer | | 57 | | 2004 | | 253,828 | | * |

| Thomas X. Geisel (4) | | 50 | | 2008 | | 435,863 | | * |

| Anthony R. Coscia | | 52 | | 2010 | | 48,629 | | * |

| William J. Marino | | 68 | | 2010 | | 98,931 | | * |

| Philip A. Norcross | | 59 | | 2012 | | 55,000 | | * |

| Steven A. Kass | | 55 | | 2012 | | 2,500 | | * |

| | EXECUTIVE OFFICER OF THE COMPANY AND THE BANK |

| | | | | | | | | | |

| Robert B. Crowl (4) | | 48 | | 2010 | | 84,752 | | * |

| | EXECUTIVE OFFICERS OF THE BANK |

Michele B. Estep Bradley J. Fouss | | 42 44 | | 2008 2001 | | 54,284 29,114 | | * * |

______________

| (1) | For directors, refers to the year such individual became a director of the Company or the Bank, except for Mr. Norcross and Mr. Kass who are not members of the Board of Directors as of the date of this proxy statement. It is anticipated, |

| | however, that Mr. Norcross and Mr. Kass will each be appointed to the Board subsequent to the date of this proxy statement and prior to the Annual Meeting. For officers, refers to the year such individual joined the Company or the Bank. |

| (2) | Includes shares held directly by the individual as well as by such individual’s spouse, or minor children, in trust and other forms of indirect ownership over which shares the individual effectively exercises sole voting and investment power, unless otherwise indicated. |

| (3) | Includes shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. The number of options included for each individual is as follows: Bernard Brown – 86,364; Wilbur Ross – 0; Sidney Brown – 196,498; Peter Galetto – 24,500; Anne Koons – 7,750; Jeffrey Brown – 7,750; Eli Kramer – 38,648; Thomas Geisel – 284,769; Anthony Coscia – 0; William Marino – 0; Philip Norcross – 0; Steven Kass – 0; Robert Crowl – 0; Michele Estep – 39,512; and Bradley Fouss – 17,931. |

| (4) | Includes 55,433 shares for which the individual serves as Trustee under the Directors’ Deferred Fee Plan |

Biographical Information and Qualifications of Directors

Set forth below are biographies of the nominees for director, the continuing directors and the executive officers of the Company. These biographies contain information regarding the person’s service as a director, business experience, other directorships at any point during the last five years with any other public companies, information regarding involvement with certain types of proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Nominating Committee and the Board to nominate the individual for election to the Board in 2012 and that qualify the Continuing Directors to continue to serve on the Board. All directors and executive officers have held their present positions for at least five years unless otherwise stated. Pursuant to the terms of a securities purchase agreement dated July 7, 2010 entered into between the Company and WLR SBI AcquisitionCo, LLC (“WL Ross”), the Company agreed that as long as WL Ross beneficially owns at least 7.5% of the outstanding common stock, WL Ross has the right to nominate one candidate to the Board of the Company and the Bank. Wilbur L. Ross, Jr. is WL Ross’s nominee. Pursuant to the terms of a securities purchase agreement dated July 7, 2010 entered into between the Company and various members of the founding Brown Family, as long as the Brown Family and their affiliates own at least 7.5% of the outstanding common stock, subject to compliance with Nasdaq Listing Rules and related interpretations, the Brown Family has the right to nominate four candidates for election as directors. Pursuant to this provision, Bernard A. Brown, Sidney R. Brown, Jeffrey S. Brown and Anne E. Koons, have been nominated to serve as directors.

Bernard A. Brown has been Chairman of the Board of Directors of the Company and the Bank since its inception in 1985 and has guided the Company and the Bank to a multi-billion dollar financial services company with 65 locations and over 650 employees as of December 31, 2011. Mr. Brown also serves as Chair of the Executive Committee of the Board. Mr. Brown has successfully grown numerous other organizations, such as NFI, a national multi-million dollar logistics conglomerate headquartered in Vineland, New Jersey, Vineland Construction Company and several other real estate companies with extensive property holdings. Mr. Brown also serves as the Chairman of the Board of Directors of NFI and Vineland Construction Company. Directors Sidney R. Brown, Anne E. Koons, and Jeffrey S. Brown are the children of Bernard A. Brown. With his intimate familiarity with the business of the Company and his extensive business background and leadership and management skills, the Board of Directors believes that Mr. Brown is uniquely qualified to serve as a director.

Wilbur L. Ross, Jr. was elected to the Board of Directors of the Company in September, 2010. He is also a director of the Bank. Mr. Ross has been appointed to the Executive Committee and the Nominating and Corporate Governance Committee of the Board of Directors and as a non-voting observer to the Compensation Committee of the Board of Directors. Mr. Ross may be the best known turnaround financier in the U.S., having been involved in the restructuring of over $300 billion of defaulted companies’ assets around the world. In 1998, Fortune Magazine called him "the King of Bankruptcy.” Mr. Ross organized International Steel Group (“ISG”) in April 2002 and was its Board Chairman. By acquiring Bethlehem Steel and other troubled companies, ISG became the largest integrated steel company in North America. It was listed on the New York Stock Exchange until it

merged with Mittal Steel to form the largest steel company in the world. Mr. Ross remains a director of ArcelorMittal. In March, 2004, the firm organized International Textile Group (“ITG”) by buying and consolidating two bankrupt companies, Burlington Industries and Cone Mills. Mr. Ross serves as Chairman of ITG which has developed major investments in China and Vietnam. Also in 2004, WL Ross organized International Coal Group to acquire out of bankruptcy Horizon Natural Resources and two other coal companies and went public. It was listed on the New York Stock Exchange and subsequently acquired by Arch Coal. In 2005, WL Ross & Company (“WL Ross”) formed International Automotive Components (“IAC”) to acquire Collins & Aikman’s European operations and Lear’s European interior plastics division. More recently, the firm acquired control of PLASCAR, the leading Brazilian automotive plastics company, Mitsuboshi in Japan, Lear Corporation’s U.S. European and Asian interior plastics businesses and certain North American plants of Collins & Aikman. IAC now has revenues of $5.5 billion and 23,000 employees in 17 countries. The Ross Funds are major investors in Greenbrier Companies and Assured Guaranty Ltd., and Mr. Ross joined their Boards. Beginning in 2007, the firm organized American Home Mortgage Service by acquiring several floundering companies and creating the second largest independent servicer of subprime mortgages. In 2009, the firm led the $900 million revival of BankUnited with FDIC assistance. The shares now trade on the New York Stock Exchange with a $2.5 billion market value. Subsequently, WL Ross took substantial positions in Virgin Money, First Michigan, Cascade Bank Corp., Sun Bancorp, and Air Lease Corp. In 1999, President Kim Dae Jung awarded Mr. Ross a medal for his help during Korea's 1998 financial crisis. He is a former Chairman of the Smithsonian National Board. Earlier, President Clinton had appointed him to the Board of the U.S.-Russia Investment Fund, and he served as privatization advisor to Mayor Rudolph Giuliani. Mr. Ross serves on the Executive Committee of the New York City Partnership, is Chairman of the Japan Society and is a member of the Chairman’s Circle of the U.S.-India Business Council. He is a member of the Business Roundtable and is a Board member of the Yale University School of Management, which has presented him with its Legend of Leadership Award. He is also a member of the Committee on Capital Markets Regulation. China Institute presented him with its 2007 Blue Cloud Award. He is the only person elected to both the Turnaround Management Hall of Fame and the Private Equity Hall of Fame. He was named Entrepreneur of the Year 2009 by BritishAmerican Business and received the 2010 Business Statesman Award from Harvard Business School Club of New York. Mr. Ross holds an A.B. from Yale University and an M.B.A., with Distinction, from Harvard University. Mr. Ross is a valued member of the Board of Directors given his experience in the financial services industry and his reputation as one of the world’s most respected investors.

Sidney R. Brown is Vice Chairman of the Board of Directors of the Company and has served as a director, treasurer and secretary since 1990. He is also a director of the Bank. Mr. Brown serves as a member and secretary of the Executive Committee of the Board, and is also a member of the ALCO/Investment Committee of the Board. Mr. Brown served as Acting President and CEO of the Company from February 2007 to January 2008. Mr. Brown is Chief Executive Officer of NFI, a premier integrated supply chain solutions company. NFI, founded in 1932 as National Hauling, has evolved from a trucking company in a regulated environment, into one of the largest privately-held third party logistics companies in the country. In the early 1980’s, the company, then known as National Freight, was focused mainly on over-the-road trucking services. The company quickly evolved into four affiliated companies providing transportation services (National Freight), warehousing and inventory management (National Distribution Centers), dedicated fleets and transportation management (Interactive Logistics) and real estate development (Real Estate). In 2008, the company continued to evolve and positioned all its companies under one corporate brand, NFI. NFI in North America now consists of Logistics, Warehousing and Distribution, Transportation, Intermodal, Real Estate, Transportation Brokerage, Contract Packaging, Solar, Global Freight Forwarding and NFI Canada. Mr. Brown attended Georgetown University and graduated in 1979. He began his career working for Morgan Stanley in New York City as financial analyst in the corporate finance department of the investment bank. He moved on to pursue his MBA at Harvard University. Graduating in 1983, he immediately joined the family business. Mr. Brown is also a director of J & J Snack Foods Corp., and has served as a director since 2003 and most recently joined the Board of Franklin Square Energy and Power Fund and Delta Paper

Corporation. With his extensive business background and leadership and management skills, Mr. Brown has helped guide the Company’s Board of Directors successfully for a significant number of years.

Peter Galetto, Jr. has been a director of the Company since April 1990. He is also a director of the Bank. Mr. Galetto also served as the Secretary of the Company from April 1990 to March 1997. He currently serves as secretary of the Bank. As Chair of the Audit & Risk Committee of the Board, Mr. Galetto annually attends numerous audit and risk related webinars and seminars as well as a national conference on audit and risk topics to bring the most current information to the Company. He also serves as a member of the Board’s Executive Committee and Nominating & Corporate Governance Committee. Mr. Galetto is the President of Stanker & Galetto, Inc., an industrial building contractor located in Vineland, New Jersey. He is the Secretary/Treasurer of Tri-Mark Building Contractors, Inc. Mr. Galetto is also a board member of South Jersey Healthcare System (Chairman), Cumberland Cape Atlantic YMCA, Hendricks House and All Saints Finance Committee. Mr. Galetto has been honored by several organizations for his community service. He has been awarded Entrepreneur of the Year by the South Jersey Development Council, Gregor Mendal Award from St. Augustine Prep in 1999, Vineland Rotary Club Outstanding Vocational Accomplishments in 1994 and the Order Sons of Italy in America Distinguished Golden Lion Award, 2000. Mr. Galetto is also an officer and director of several other corporations and organizations. He received a B.S. in Commerce and Engineering from Drexel University, majoring in Finance and Management. Mr. Galetto also graduated from Harvard Business School’s Owner/President Management Program. With his proven business leadership and management skills, in addition to his stature in the local business community, Mr. Galetto has been a significant contributor to the Board of Directors of the Company.

Anne E. Koons has served as a director of the Company since April 1990. She is also a director of the Bank. Ms. Koons serves as a member of the Board’s ALCO/Investment Committee. Ms. Koons is a real estate agent with Prudential Fox & Roach. She has been selling real estate for 27 years and is consistently in the top 1% of agents nationwide. Ms. Koons is a Board member of the Cooper Foundation at Cooper Hospital and also serves on the Executive and Budget and Finance committees. She is also an officer and director of several other companies. Ms. Koons’ business acumen, sales and marketing and negotiation skills, as well as stature in the community have led her to be an important contributor to the directorship of the Company.

Jeffrey S. Brown has been a director of the Company since April 1999. He is also a director of the Bank. Mr. Brown also serves as a member of the Board’s ALCO/Investment Committee. Mr. Brown is Vice Chairman of NFI, a comprehensive provider of freight transportation, warehousing, third party logistics, contract manufacturing, and real estate development. He is also President of NFI Real Estate, one of the top real estate development companies in the industry. Mr. Brown is one of the general partners of The Four B’s, a partnership with extensive holdings primarily in the Eastern United States. He is also an officer and director of several other corporations and partnerships in the transportation, equipment leasing, insurance, warehousing and real estate industries. Mr. Brown serves on the Boards of several regional charities including: The Board of Trustees for the Cooper Foundation, and the Kellman Brown Academy. As a principal in a major logistics company with P&L responsibilities, Mr. Brown possesses financing and acquisition experience, which further strengthens his bank director capabilities. His experience in real estate, leadership skills, and his networking capabilities due to his stature in the local business community, make him a valued member of the Company’s Board of Directors.

Eli Kramer has been a director of the Company since July 2004. He is also a director of the Bank. He serves as Chair of the Board’s Compensation Committee and is also a member of the following Board Committees: Executive; Audit & Risk; and Nominating and Corporate Governance. Mr. Kramer has over 20 years of total bank board experience including six plus years as Vice Chair or Chairman at a previous bank. Mr. Kramer has been a principal in real estate development companies since 1976 and is a partner in Central Jersey Management Co. He is also a principal in Arcturus Group, a real estate advisory

and asset management firm serving the financial industry. He was a co-founder and Vice Chairman of the Board of Directors of Community Bancorp of New Jersey, prior to its acquisition by the Company. He also served as a Director and Chairman of the Board of Colonial State Bank. Mr. Kramer serves as a Trustee on the Boards of the Jewish Educational Center, Elizabeth, NJ, the Holocaust Resource Center at Kean University, and the Trinitas Healthcare Foundation. Mr. Kramer’s bank board experience, proven leadership and business management skills, knowledge of the New Jersey market, and stature in the community are all attributes that are highly valued as a director of the Company.

Thomas X. Geisel joined the Company as President and Chief Executive Officer in January 2008 and is also a director of the Company. Mr. Geisel also serves as the President and Chief Executive Officer of the Bank and is a director of the Bank. He also serves as a member of the Executive Committee of the Board. Prior to joining the Company, Mr. Geisel held a number of positions with KeyCorp. He joined Key in July 1999 in New York City where he served as Managing Director of Investment Banking for the East and West Regions of KeyBanc Capital Markets (formerly McDonald Investments’ Key Business Advisory Services division). In 2002, he was promoted to President of Key’s Capital Region New York District and subsequently to Regional Executive for Commercial Banking for which he relocated to Albany, New York. From 2005 through 2007, he served as President for KeyBank’s Northeast Region, which comprised eight districts across New York, New England and Florida, with assets of approximately $20 billion and revenue exceeding $550 million. Mr. Geisel’s other experience includes representing the U.S. Department of Justice in various capacities domestically and as a diplomat in Latin America and the Caribbean. Mr. Geisel has spoken on topical business, financial and economic issues and trends. His banking and financial insight and expertise have been showcased on prominent business news networks and online media including Bloomberg News, CNBC, Fox Business Channel, TheStreet.com and NJN/NJTV as well as on several regional, expert panels such as the Rutgers Quarterly Business Outlook. He also has contributed to articles that appeared in national publications, including American Banker, US Banker and The Wall Street Journal. Under Mr. Geisel’s tenure, Sun National Bank was chosen by Forbes as one of the nation’s Most Trustworthy Companies. In 2011, Mr. Geisel was named by NJBiz as one of New Jersey’s “50 Most Powerful People in Banking”. Active in both business and community organizations, Mr. Geisel is a member of the New Jersey Chamber of Commerce’s Board of Directors and Ad-hoc Strategic Planning Committee. He is Vice Chairman of the Board of Trustees for the Southern New Jersey Development Council (SNJDC) and a member of the Federal Reserve Board of Philadelphia’s Nominating Advisory Committee (FRNAC), the New Jersey Bankers Association, and the Board of Directors of the Atlantic County Community Development Corporation (CDC). Since 2011, Mr. Geisel has been a Red Tie Brigade member for the American Heart Association’s Southern NJ “Go Red for Women” campaign and is a past Chairman of the American Heart Association’s Southern NJ Spring HeartWalk. Mr. Geisel also received the 2010 Spirit of Edison Community Leader Award from Thomas Edison State College. In addition to his elevated stature in New Jersey, Mr. Geisel’s 20 plus years of well-diversified financial services experience and executive leadership and management skills make him an integral member of the Company’s Board of Directors.

Anthony R. Coscia was elected to the Board of Directors of the Company in November 2010. He is also a director of the Bank. Mr. Coscia currently serves as Chair of the Board’s ALCO/Investment Committee and is a member of the Board’s Compensation/ Personnel Committee. He is admitted to the state bars of New Jersey and New York and is a Partner in the law firm of Windels Marx Lane & Mittendorf, LLP (WMLM), one of the New York region’s oldest law firms. He is a graduate of Georgetown University School of Foreign Service and received his law degree from Rutgers University School of Law. Mr. Coscia specializes in corporate, commercial and real estate matters with a concentration on the financial elements of these transactions. He represents financial institutions, investors and major corporations handling a broad variety of matters, including corporate and real estate finance transactions, asset restructure and recovery, regulatory compliance, mergers and acquisitions and general litigation. He has specific experience in the area of redevelopment finance and has worked extensively on corporate governance issues. Mr. Coscia served as Chairman of the Board of Commissioners of the Port Authority of New York and New Jersey for over eight years, stepping down

from the Board on June 30, 2011. In June 2010, Mr. Coscia was appointed to the Board of Directors of National Passenger Railroad Corporation (“Amtrak”) where he serves as Chair of the Audit and Finance Committees. In addition Mr. Coscia serves as a trustee of the New Jersey Community Development Corporation and is a member of the New Jersey Performing Arts Center Council of Trustees, The Partnership for New York City, the Economic Club of New York, Georgetown University Board of Regents and the Regional Plan Association. From February 1992 to March 2003, he served as Chair of the New Jersey Economic Development Authority (“NJEDA”), one of the largest state-sponsored development banks in the United States. Mr. Coscia has served as a director and audit committee member of several public and closely held corporations in the financial services, investment banking, real estate and manufacturing sectors. With Mr. Coscia’s extensive background and as a well-respected business leader actively involved in both the private and government sectors in New Jersey and New York, he is a significant complement to the Company’s Board of Directors.

William J. Marino was elected to the Board of Directors of the Company in November 2010. He is also a director of the Bank. Mr. Marino currently serves as Chair of the Board’s Nominating and Corporate Governance Committee and is also a member of the Board’s Audit and Risk Committee and ALCO/Investment Committee. He is a graduate of St. Peter’s College with a Bachelor of Science degree in Economics. Mr. Marino has over 40 years of experience in the health and employee benefits field, primarily in managed care, marketing and management. Mr. Marino is the retired Chairman, President and Chief Executive Officer of Horizon Blue Cross Blue Shield of New Jersey, the state’s largest health insurer, providing coverage for over 3.6 million people. He joined Horizon BCBSNJ as Senior Vice President of Health Industry Services in January 1992, responsible for all aspects of Managed Care operations in New Jersey, as well as Market Research, Product Development, Provider Relations and Health Care Management. He became President and CEO in January 1994 and Chairman effective January 2010. Before joining Horizon BCBSNJ, Mr. Marino was VP of Regional Group Operations for NY and CT for Prudential, capping a 23-year career with them. Mr. Marino is currently the Chairman of the Board of Directors of the New Jersey Performing Arts Center (NJPAC), a member of the Board of the New Jersey Symphony Orchestra, as well as Sealed Air Corporation, in which he also serves as Lead Director and Chairman of the Nominating & Governance Committee. He is a member of the Campaign Committee of Saint Vincent Academy and a member of the Board of Trustees of Delbarton School in Morristown. In addition, Mr. Marino is a member of the board of three privately held corporations: LCA Holdings, LLC, a member of the Management Committee of Care Core National and a member of the board of Horizon Healthcare Innovations, a subsidiary of Horizon Blue Cross Blue Shield of New Jersey. Mr. Marino is a recipient of the 1997 Ellis Island Medal of Honor. In 2007 he received The American Conference on Diversity’s Humanitarian of the Year Award. Mr. Marino’s prior board affiliations include: America’s Health Insurance Plans; Blue Cross Blue Shield Association; National Institute for Health Care Management (Past Chairman); Choose New Jersey; NJ State Chamber of Commerce (Past Chairman); New Jersey Network; Newark Alliance; Newark Museum, Liberty Science Center Chairman’s Advisory Council; St. Peter’s College (Past Chairman); Community Theatre of Morristown; Regional Business Partnership (Past Chairman); United Way of Essex and West Hudson (Past Chairman); Kessler Institute for Rehabilitation, Inc.; New York Business Group on Health; and, New York State HMO Conference. As a highly regarded business and philanthropic leader, one who has played an important role in policy and legislative matters in New Jersey, Mr. Marino is an important complement to the Company’s Board of Directors.

Philip A. Norcross is Chief Executive Officer and Managing Shareholder of Parker McCay, a regional law firm headquartered in Mount Laurel, New Jersey, with offices in Lawrenceville and Atlantic City, New Jersey. Mr. Norcross co-chairs the firm’s Public Finance and Business Departments and has particular expertise in finance and transactional law, with an emphasis on government, economic development, redevelopment and other specialized financings. Mr. Norcross also serves as Chairman of Optimus Partners LLC, a business advisory and consulting firm, based in Trenton, New Jersey, that serves a wide array of clients in the financial services, healthcare, gaming, real estate and development, and insurance sectors. Active in both the community and his profession, Mr. Norcross is Vice-Chairman

of the Board of The Cooper Foundation, member of the Board of Trustees of Home Port Alliance of the U.S.S. New Jersey, Inc, a founding member and former vice-president of the Mount Laurel Public Education Foundation and is currently a Board member and past chairman of Burlington County United Way. He is also a member of the National Association of Bond Lawyers, the American Bar Association and the bar associations of New Jersey, Burlington County and Camden County. With his record of success, particularly in the areas of law, finance and economic development, working with both private and public entities, Mr. Norcross will bring valuable experience and talent to the Company’s Board of Directors.

Steven A. Kass is Co-Chief Executive Officer and Co-Managing Principal of Rothstein Kass, a premier professional services firm serving privately held and publicly traded companies and high-net-worth clients. He has extensive experience as a client advisor, is a member of the firm’s Executive Committee and has played an integral role in the growth and national presence of Rothstein Kass. Committed to professional development, Mr. Kass serves on the advisory board for the Lubin School of Accounting at Syracuse University and completed a two-year term as international chairman of AGN International Ltd., a global association of independent accounting and consulting firms in 80 countries. He is a member of the American Institute of Certified Public Accountants (AICPA), the New Jersey Society of Certified Public Accountants (NJSCPA) and the New York State Society of Certified Public Accountants (NYSSCPA). A dedicated philanthropist, Mr. Kass was honored with a Distinguished Achievement award by the banking and finance unit of B’nai B’rith International. As a highly-regarded business and philanthropic leader, who has led the dynamic growth of his own company while serving as a valued advisor to clients, Mr. Kass will be a strong complement to the Company’s Board of Directors.

Executive Officers Who Are Not Directors

Robert B. Crowl joined the Company in March 2010 as the Executive Vice President and Chief Financial Officer. Mr. Crowl also serves as Executive Vice President and Chief Financial Officer of the Bank. He has over 24 years of banking experience. Prior to joining the Company, Mr. Crowl was Executive Vice President and Chief Operating Officer of National City Mortgage, Cleveland, Ohio from November 2007 to February 2009. Prior to that, Mr. Crowl was a Senior Vice President and Corporate Comptroller of National City Corporation from April 2004 to November 2007 where he also held the position of Senior Vice President and Manager of Asset, Liability & Securitization from November 1998 to April 2004. Prior to 1998, Mr. Crowl served in a variety of positions for Crestar Bank in Richmond, Virginia. Mr. Crowl previously held the role of Treasurer of the Northeast Ohio Council on Higher Education.

Michele B. Estep joined the Company in April 2008 as Executive Vice President and Chief Administrative Officer. Ms. Estep brings more than 20 years of experience to her position. In this position, Ms. Estep oversees the Company’s administrative operations, including the Human Resources, Training and Development, Marketing, PR and Communications, and Facilities and Network Management. Her roles include management of the Bank’s Human Capital initiatives - recruiting, hiring, retention and training practices and procedures, as well as the administration of benefits and payroll services. She also oversees the operations related to the Bank’s physical branch network, including vendor contracts, new location construction and growth strategies, consolidations and divestitures. Under her management, the marketing department is charged with developing strategies and tactics designed to support the Company’s lines of business through sales support, branding, and advertising, as well as is responsible for managing communications with all of the Company’s stakeholders, including community relations and investor relations. Prior to joining the Company, she held successive leadership roles at KeyBank in Albany, New York.

Bradley J. Fouss joined the Company in 2001. Mr. Fouss has more than 20 years of banking experience. Currently Executive Vice President and Director of Wholesale Banking for the Company, Mr. Fouss manages all commercial banking efforts and drives key strategic initiatives to expand lines of

business, including wholesale lending, deposits, cash management, and government banking. He also leads the Bank’s growing specialty segment business lines, including Healthcare, Real Estate, and Asset-Based Lending. Prior to joining the Company, Mr. Fouss held commercial banking positions with Wachovia. He also served in the New Jersey National Guard for 10 years, retiring as a captain.

Board Leadership Structure and Role in Risk Oversight

Under the Board of Directors’ current leadership structure, the offices of Chairman of the Board and Chief Executive Officer are held by separate individuals. Bernard A. Brown serves as Chairman of the Board of Directors. The Company’s Chief Executive Officer is Thomas X. Geisel. The Board of Directors has determined that the separation of the roles of Chairman of the Board and Chief Executive Officer will enhance Board independence and oversight. This separation will allow the Chief Executive Officer to better focus on developing and implementing strategic and tactical initiatives, enhancing shareholder value and expanding and strengthening our franchise, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to, and independent oversight of, management.

The Board of Directors has general authority over the Company’s risk oversight function with authority delegated to various board committees to review risk management policies and practices in specific areas of the Company’s business. The Audit Committee is primarily responsible for overseeing the Company’s risk management. The Audit Committee works closely with officers involved in the risk management function including the internal audit staff who report directly to the Audit and Risk Committee.

Meetings and Committees of the Board of Directors

The Company is governed by a Board of Directors and various committees of the Board, which meet regularly throughout the year. During 2011, the Company’s Board of Directors held seven regular meetings, five special meetings, 22 regular committee meetings and eight special committee meetings. No incumbent director attended fewer than 75% of the meetings of the Company’s Board of Directors and committees on which such director served during the year ended December 31, 2011. In addition, the Bank’s Board of Directors held seven regular meetings and five special meetings during 2011.

The Executive Committee met six times during 2011. This committee currently consists of Directors Bernard Brown (Chairman), Sidney R. Brown, Peter Galetto, Jr., Thomas X. Geisel, Eli Kramer, and Wilbur L. Ross, Jr.

The Compensation Committee met seven times during 2011. This committee currently consists of Directors Kramer and Coscia. Mr. Ross serves in a nonvoting observer capacity.

The Audit and Risk Committee met nine times during 2011. This committee currently consists of Directors Galetto, Kramer and Marino. Mr. Marino meets the definition of an audit committee financial expert under the regulations of the SEC.

The Nominating and Corporate Governance Committee met four times during 2011. This committee currently consists of Directors Marino, Galetto, Kramer and Ross.

Each member of the Compensation Committee, Audit and Risk Committee and Nominating and Corporate Governance Committee is independent in accordance with the requirements of the NASDAQ

Listing Rules. Each of these committees operates under a written charter, copies of which are available on the Company’s website at www.sunnb.com.

Compensation Committee Interlocks and Insider Participation

Company directors who served as members of the Compensation Committee of the Company’s Board of Directors during the year ended December 31, 2011 were Eli Kramer (Chair), Anthony R. Coscia, Douglas J. Heun and Alfonse M. Mattia (until his death on October 2, 2011). Wilbur L. Ross, Jr. is a non-voting observer. Jeffrey S. Brown and Sidney R. Brown attend Compensation Committee meetings but are not committee members.

None of the individuals who served on the committee during 2011 was an executive officer of another company whose board of directors has a comparable committee on which one of the Company’s executive officers serves. In addition, during 2011, no executive officer of the Company was a member of a comparable compensation committee of a company of which any of the directors of the Company is an executive officer.

Director Nomination Process

The Company does not currently pay fees to any third party to identify or evaluate or assist in identifying or evaluating potential nominees for director positions. The Nominating and Corporate Governance Committee gives a recommendation to the Board of Directors of the persons to be nominated by the Company for election. The Committee’s process for identifying and evaluating potential nominees includes soliciting recommendations from directors and officers of the Company and the Bank. Additionally, the Committee will consider persons recommended by shareholders of the Company in selecting the Committee’s nominees for election. There is no difference in the manner in which the Committee evaluates persons recommended by directors or officers and persons recommended by shareholders in selecting Board nominees.

To be considered in the Committee’s selection of Board nominees, recommendations from shareholders must be received by the Company in writing by at least 120 days prior to the date the proxy statement for the previous year’s annual meeting was first distributed to shareholders. Recommendations should identify the submitting shareholder, the person recommended for consideration and the reasons the submitting shareholder believes such person should be considered. The Committee believes potential directors should have industry expertise in areas of corporate governance, finance, banking, accounting, the economy, real estate, general business and other areas of importance to the Company, along with familiarity and knowledge of the business, political and economic environments for the markets the Bank serves, and the ability to provide management with guidance, ability to guide in the development and oversight of strategy. The Committee and the Board of Directors may consider diversity in market knowledge, background, experience, qualifications, and other factors as part of its evaluation of each candidate.

Shareholder Communications

The Board of Directors does not have a formal process for shareholders to send communications to the Board. In view of the infrequency of shareholder communications to the Board of Directors, the Board does not believe that a formal process is necessary. Written communications received by the Company from shareholders are shared with the full Board no later than the next regularly scheduled Board meeting. The Board encourages, but does not require, directors to attend the annual meetings of shareholders. Seven members of the Board of Directors attended the 2011 Annual Meeting of Shareholders.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the material elements of the Company’s compensation program for the last fiscal year applicable to the principal executive officer, principal financial officer and the other officers included in the summary compensation table (referred to as the “Named Executive Officers” or the “named officers”).

Executive Summary. The 2011 fiscal year was another challenging year for the financial services industry, and the economy as a whole. National and local economies continued to display the effects of the economic downturn. High unemployment, limited job growth and housing market distress weighed on consumer behavior, while uncertainty surrounding sales growth limited business borrowing and investment. During 2011, the Company took critical steps towards strengthening its balance sheet and foundation by raising approximately $100 million in additional capital and executing on its business plan. The capital raise provided the Company with new strategic partners and the financial flexibility to address problem credits. During 2011, the Company prudently managed its problem loan portfolio by taking appropriate charge-offs and building its allowance for loan losses. During 2011, the Company sold approximately $174.3 million of primarily legacy commercial real estate loans with a book balance of $159.8 million, further reducing the level of classified assets. In addition to the capital and credit efforts, the Company continued to execute its strategic plan by growing its businesses and managing profitability. While commercial real estate lending was deemphasized in 2011, the Company’s specialty businesses (asset-based lending and medical lending) continued to grow, and increased product penetration in our commercial and industrial business led to a substantial increase in cash management services. The net interest margin expanded in 2011 through the careful administration of pricing strategies on loans and deposits. In addition, critical fee businesses such as Sun Financial Services, L.L.C. and Sun Home Loans, Inc. enjoyed record years in revenue. Through the Company’s efficiency initiatives, over $4.2 million in annualized expense and revenue efficiency gains were recorded.

The Compensation Committee took various actions in 2011 in order to reinforce its efforts to focus compensation on rewarding activities which promote safe growth of long-term shareholder value and retention of talented executives to further execute the Company’s strategic plan. Such actions included:

| | · | Granting stock options to various newly hired management in order to align the interests of such management with the long-term interests of shareholders. |

| | · | Granting stock options to the Named Executive Officers as performance and retention incentives. The performance incentives require that Company return on assets target metrics be achieved by December 31, 2013 in order for such equity awards to be earned. |

| | · | The Compensation Committee reviewed its Charter and made revisions deemed appropriate to promote the effective management and oversight of the Company’s incentive compensation and risk management and general corporate governance. |

Shareholder Advisory Votes on Compensation. At the 2011 Annual Meeting of Shareholders, the shareholders approved the advisory vote on the Company's executive compensation policies and practices as disclosed in the CD&A and the proxy by more than 98% of the shares voting on the matter. In addition, the shareholders approved an advisory vote recommending that such advisory vote be taken every three years proxy by more than 75% of the shares voting on the matter. The Company intends to follow this advisory vote on the three year frequency of such shareholder advisory votes.

Compensation Philosophy and Objectives. The underlying goal of the Company’s compensation program is to promote increases in long-term shareholder value by closely aligning the financial interests

of the Company and its shareholders with the Named Executive Officers and other members of executive management (collectively, “Executive Management”).

In accordance with the Charter of the Company’s Compensation Committee, the Compensation Committee seeks to design and administer executive compensation programs that will achieve the following primary objectives:

| | · | Support a pay-for-performance policy that differentiates compensation based on corporate and individual performance; |

| | · | Motivate employees to assume increased responsibility and reward them for their achievement; |

| | · | Provide total compensation opportunities that are comparable to those offered by other leading companies, allowing the Company to recruit and retain top quality, dedicated executives who are critical to its long-term success; |

| | · | Align the interests of executives with the long-term interests of shareholders by providing executives with equity award opportunities that will result in favorable long term compensation opportunities as long-term shareholder value grows; |

| | · | Annually, the Company establishes specific financial performance targets as well as non-financial targets that are defined by the Compensation Committee and are incorporated into the budgeting and planning process. The Company’s goal is to promote and administer a comprehensive pay-for-performance program consistent with such financial performance targets and the goals of the Bank; and |

| | · | Monitor the incentive compensation programs applicable to Executive Management and all employees to ensure that such programs do not expose the Company to unnecessary or excessive risk and to implement policies and practices that may help manage and monitor such risk within acceptable and pre-established parameters. |

The Company’s compensation program is designed to promote performance by the Named Executive Officers and the entire Executive Management group as a team. For 2011, as set by the Compensation Committee of the Board, performance of the Named Executive Officers was evaluated based upon weighted quantitative and qualitative goals; 40% weighted on core earnings, 20% for consistency of maintaining regulatory compliance, 40% based upon stabilizing/managing troubled loan portfolio, 10% for raising capital as appropriate and 10% for maintaining required regulatory capital levels.

The Company strives to provide each Named Executive Officer with a total compensation opportunity that the Compensation Committee deems to be market competitive with comparably-sized community banks, both nationally and regionally, assuming the Company’s performance metrics are at budgeted, targeted levels. The Company believes that this market positioning is appropriate to attract and retain top-caliber talent in a highly competitive labor market for executive staff.

The Company maintains programs to create short-term and longer-term incentive compensation opportunities for its Executive Management. In 2011, the Company made additional stock options awards to its Named Executive Officers and other members of the Executive Management team consistent with its long-term compensation goals. In 2012, the Company made additional awards of stock options and stock awards to its Named Executive Officers and other members of the Executive Management team consistent with its long-term compensation goals. Generally, such equity awards

become earned and non-forfeitable over a two, four or five year period in order to serve as a retention tool in addition to a compensation incentive.

Role of the Compensation Committee. The Compensation Committee’s primary responsibility is to assist the Board of Directors in discharging its responsibilities relating to compensation of the Company’s Executive Management. The Committee determines policies and decisions relative to salary, annual cash incentives, long-term equity-based incentives and other compensation programs for Executive Management, while taking into account appropriate risk management. The CEO’s compensation, as set forth in his employment contract, is evaluated by the Compensation Committee and approved by the Board of Directors.

The Compensation Committee has periodically engaged compensation consultants and advisors to provide advice on both board and executive compensation issues and has the authority to retain advisors as needed. During 2011, the Compensation Committee did not receive specific guidance from any such consultants with respect to compensation paid or awarded to the Named Executive Officers.

Role of Executives in Compensation Committee Deliberations. The Compensation Committee maintains a dialogue with the Company’s Chairman, or his designee, to assist in analyzing existing compensation programs and studying proposed compensation program changes. In 2011, such designee was the Company’s Vice Chairman, and he has provided guidance to the Committee regarding Executive Management performance evaluation, bonus plan recommendations, and other executive compensation matters. As appropriate, the Committee requests the presence of the Company’s Vice Chairman and/or its President and CEO at Committee meetings to discuss executive compensation matters and to evaluate Company and individual performance. Occasionally, other executives may be requested to attend a Committee meeting to provide pertinent financial, tax, accounting, peer data or operational information. Executives in attendance may provide their insights and suggestions, but only independent Compensation Committee members may vote on decisions regarding executive compensation.

The Compensation Committee discusses the compensation of the Company’s President and CEO directly with him, but final deliberations and all votes regarding the President and CEO’s compensation are made in executive session, without the President and CEO being present. The Committee also determines the compensation for the other Named Executive Officers, based on the President and CEO’s recommendations and input from outside advisors and counsel when deemed necessary or appropriate.

Compensation Framework. In developing and administering the Company’s executive compensation policies and programs, the Committee considers the following three aspects of the Compensation program:

| | · | Pay components - each element of total compensation, including the rationale for each component and how each component relates to the total compensation structure; |

| | · | Pay level - the factors used to determine the total compensation opportunity, or potential payment amount at different performance levels, for each pay component; and |

| | · | Relationship of executive compensation to performance - how the Company determines appropriate performance measures and goals for incentive plan purposes, as well as how pay levels change as a function of performance. |

Pay Components. The Company’s executive compensation program includes the components listed below:

| | · | Salary - a fixed base salary generally set at competitive levels that reflect each executive’s position, individual performance, experience, and expertise. Such base salary levels are reviewed annually by the Compensation Committee. |

| | · | Annual Cash Incentive - a bonus pay program that varies based on individual, team and Company performance against annual business objectives; the Company communicates the associated performance metrics, goals, and bonus award opportunities to Executive Management as early in the fiscal year as is practical. Final bonus determinations are made following the end of each fiscal year based upon a review of the stated performance metrics and bonus opportunities as well as the discretionary considerations of the Compensation Committee. |

| | · | Long-Term Incentives - equity-based awards with the compensation values driven by the long-term market performance of the Company’s stock price in order to align Executive Management pay with long-term shareholder interests. |

| | · | Management Agreements - These agreements detail the rights and obligations of the employer and Executive Management in the event of termination of employment following a change-in-control transaction or other involuntary termination of employment. |

| | · | Other Compensation - perquisites consistent with industry practices in comparable banks and broad-based employee benefits such as medical, dental, disability, and life insurance coverage. |

Salary

The Company pays its executives salaries that are intended to be competitive and take into account the individual’s experience, performance, responsibilities, and past and potential contribution to the Company, with annual salary reviews determined in conjunction with an annual performance assessment. The Committee intends that salary, together with annual cash incentive and long-term incentives at targeted Company performance levels will fall between the market median and upper quartile when compared to market competitors for similar executive talent.

The Compensation Committee met in December 2010 and determined to increase the base salary of Mr. Geisel by $50,000 to $550,000 as of January 2011 (the first increase in his pay since his hiring in January of 2008). Additionally, Mr. Crowl received an increase of $7,625 to $312,625 and Ms. Estep received an increase of $20,000 to $250,000 effective March 1, 2011. Mr. Fouss received an increase of $5,000 effective March 1, 2011 and a $60,000 increase to $280,000 in conjunction with his promotion to Executive Vice President Wholesale Banking on May 11, 2011. The CEO, the other Named Executive Officers and members of the Bank’s Executive Management are foregoing pay increases in 2012.

Annual Cash Incentive

The Company uses annual discretionary cash incentives to focus management’s attention on current strategic priorities and to drive achievement of short-term corporate objectives. This program, referred to as the Annual Cash Incentive Plan, provides annual cash incentive compensation for the Named Executive Officers and other Company employees. For the 2011 fiscal year, the Compensation Committee established performance goals for the Named Executive Officers under the Annual Cash Incentive Plan. The performance goals for 2011 included weighted quantitative and qualitative goals; 40% weighted on core earnings, 20% for consistency of maintaining regulatory compliance, 40% based upon stabilizing/managing troubled loan portfolio, 10% for raising capital as appropriate and 10% for maintaining required regulatory capital levels.

The Annual Cash Incentive program for Mr. Geisel, President and CEO, was detailed in Mr. Geisel’s employment agreement dated July 16, 2009. Such program provides for a payment of a cash bonus calculated as a percentage of his base salary and is dependent upon the Company’s attainment of annually agreed upon financial targets. For example, upon attainment of 100% of the Company’s agreed upon financial targets, his bonus would be 70% of base salary; attainment of 110% of the approved financial targets will result in a bonus of 100% of base salary; attainment of 105% of the approved financial targets will result in a bonus of 80% of base salary; attainment of 95% of the approved financial targets will result in a bonus of 65% of salary; attainment of 90% of the approved financial targets will result in a bonus of 60% of salary. Attainment of Company performance below 90% of the approved financial targets may result in a bonus payment determined within the discretion of the Compensation Committee; attainment of Company performance above 110% of the approved financial targets may result in an additional bonus payment (in addition to a bonus of 100% of base salary) determined within the discretion of the Compensation Committee. As with the other Named Executive Officers and Executive Management, the Compensation Committee also considered additional non-financial metrics including core earnings, consistency of maintaining regulatory compliance, stabilizing/managing troubled loan portfolio, raising capital as appropriate, and maintaining required regulatory capital levels and the overall organizational improvement year over year when determining Mr. Geisel’s discretionary cash payment. Such bonus will be paid on or before March 15 following the completion of the Company’s fiscal year and its annual audit.

The Compensation Committee approved Annual Cash Incentive Awards in January 2012 for payment in March 2012 to certain Named Executive Officers based upon its consideration of securely managing and guiding the organization through a difficult economic environment, for creating a foundation for growth, the successful raising of $100 million in capital, closely managing the Company’s loan sale process and maintaining capital levels. Cash incentive awards were made to the Named Executive Officers as follows: Thomas Geisel - $110,000; Robert Crowl - $55,000, Michele Estep $40,000, and Bradley Fouss $40,000. Such incentive awards may still be made within the discretion of the Compensation Committee, in circumstances where the financial performance targets were not met or if such targets are not established by the Compensation Committee.

Long-Term Incentives (“LTI”)

The Company believes that equity ownership by the Named Executive Officers and Directors aligns executive and director interests with those of the shareholders. In 2004, the Company adopted the 2004 Stock-Based Incentive Plan. This omnibus stock plan, as last amended in 2010, provides for granting of up to 4,900,000 shares of common stock in the form of incentive stock options, non-qualified stock options and full-value stock awards; provided that the number of shares which may be awarded as full-value stock awards shall not exceed 1,400,000 shares. The Plan further permits the vesting of stock awards based upon achievement of Company performance measures as well as continued service. In prior years, the Company has used stock options and full-value shares of Company stock as the primary vehicle for long-term incentive compensation for management and Directors. In recent years, including in 2011 and 2012, additional stock options and/or stock awards were made to the Named Executive Officers and other members of the Executive Management as a long-term retention incentive and as part of an effort to adjust the cash-equity mix of compensation for these respective positions, in order to better align compensation with long-term shareholder interests. Typically, such awards will vest over a two, four or five year period as determined by the Compensation Committee at the time of such award.

In February 2011, the Compensation Committee approved stock option awards for Bruce Dansbury – 12,500 options; Rob Crowl – 30,000 options; Michele Estep – 20,000 options and Brad Fouss 7,500 options. Mr. Geisel received no equity awards in 2011 for 2010 performance.

In 2010, the shareholders also approved the 2010 Performance Equity Plan permitting the award of up to 2,700,000 shares of Company Stock. Awards under the plan were made in March 2011 in the

form of stock options to purchase Company Stock at an exercise price equal to 110% of the fair market value of such Company Stock on the date of grant of such award. A portion of such options become earned and first exercisable upon the Company’s attainment of specified performance by December 31, 2013. A portion of such awards will be earned upon the Company achieving a minimum target return on average assets (“ROA”) of at least 0.80% or a peer group ranking of at least the median of such peer group based upon ROA of the peer group companies before an award is earned and such options may be first exercisable. The maximum award will be earned if ROA equals or exceeds 1.05% and a peer group ranking based upon ROA of 75th percentile is achieved. Awards under this plan were made on March 2, 2011, at an exercise price of $4.73. The Compensation Committee granted stock options to acquire the following maximum number of shares to the Named Executive Officers, as follows: Bernard Brown -208,032 stock options; Sidney Brown - 104,016 stock options; Thomas Geisel - 321,037 stock options; Bruce Dansbury - 150,790 stock options; Robert Crowl - 152,067 stock options; Michele Estep - 174,913 stock options; and Bradley Fouss - 195,903 stock options. Upon attainment of the defined performance measures, one-fourth of such award will be first exercisable and one-fourth annually thereafter, after a six month holding period is fulfilled. Such stock options may not be exercised more than ten years from the initial date of grant.

Throughout 2011, the Management Team continued to focus on strengthening the balance sheet and executing the Company’s Strategic Plan. The $100 million capital raise helped improve the Company’s Total Risk-Based Capital ratio to 15.22% at December 31, 2011, up from 12.68% at December 31, 2010. The problem loan sale combined with continued workout efforts resulted in an NPA to gross loans held-for-investment, loans held-for-sale and real estate owned ratio of 4.86% at the end of 2011, down considerably from a high during the year of 8.04% at March 31, 2011. Careful administration of loan and deposit pricing helped increase the net interest margin from 3.26% in the first quarter of 2011 to 3.54% in the fourth quarter of 2011. Commercial loan production increased to $323 million in 2011 from $237 million in 2010 and the Company witnessed continued growth in its specialty lines of business including healthcare and asset-based lending. In the Consumer business the Company continued to rationalize the branch network through the closing of one branch and the opening of two new branch prototypes. Over the past four years, the Company has sold or consolidated fourteen branches in an effort to make the branch network more efficient and reallocate resources to more attractive markets. For the full year 2011, the Company’s cost of interest bearing deposits equaled 0.83%, down from 1.15% for the full year 2010. Sun Financial Services gross revenue reached a record $3.3 million through the sale of insurance and alternative investment products, and Sun Home Loans originated $192 million of mortgage loans. The execution of these strengthening and growth strategies resulted in a net profit of $2.7 million in the third quarter of 2011, the Company’s first quarterly profit since the fourth quarter of 2008, and the Company was profitable in total for the second half of 2011. In February 2012, the Compensation Committee awarded Thomas Geisel 19,298 stock awards and 36,134 stock options. Additionally, Mr. Crowl received 8,845 stock awards and 15,776 stock options; Ms. Estep received 5,346 stock awards and 9,535 stock options; and Mr. Fouss received 5,346 stock awards and 9,535 stock options.