UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

| | | |

Filed by the Registrant þ | | Filed by a Party other than the Registrant o |

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

SUN BANCORP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| | | | |

| | o | | Fee paid previously with preliminary materials. |

| | o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

June 4, 2014

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of Sun Bancorp, Inc. (the “Company”), I cordially invite you to attend the Annual Meeting of Shareholders to be held at the Sun Bancorp, Inc. Executive Office, 350 Fellowship Road, Suite 101, Mount Laurel, New Jersey, on July 17, 2014, at 9:30 a.m. (the “Annual Meeting”). The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting. During the Annual Meeting, I will also report on the operations of the Company. Directors and officers of the Company, as well as a representative of the Company’s independent registered public accounting firm, Deloitte & Touche LLP, will be present to respond to any questions shareholders may have.

At the Annual Meeting, shareholders will be requested to vote upon (i) the election of eleven directors of the Company; (ii) the approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan; (iii) the approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan; (iv) the approval of a non-binding advisory proposal regarding the compensation paid to the named executive officers listed in the Proxy Statement; and (v) the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. The Board of Directors unanimously recommends a vote “FOR” each of the nominees to the Board of Directors and “FOR” proposals (ii), (iii), (iv) and (v).

This year, pursuant to the Securities and Exchange Commission rule allowing companies to furnish their proxy materials over the Internet, we are mailing shareholders a Notice of Internet Availability (the “Notice”) instead of a paper copy of the Proxy Statement and our 2013 Annual Report. The Notice contains instructions on how to access those documents over the Internet and authorize a proxy to vote electronically. The Notice also contains instructions on how shareholders may receive a paper copy of our proxy materials, including the Proxy Statement, our 2013 Annual Report and a proxy card. Whether or not you plan to attend the Annual Meeting, I urge you to vote now – by Internet, telephone or mail - even if you plan to attend the Annual Meeting. Your vote is very important. If you received the traditional hard copy proxy materials, please follow the instructions on the enclosed proxy card. If more than one proxy card is made available to you, please vote each proxy.

350 FELLOWSHIP ROAD, SUITE 101

MOUNT LAUREL, NEW JERSEY 08054

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 17, 2014

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders (the “Annual Meeting”) of Sun Bancorp, Inc. (the “Company”) will be held at the Sun Bancorp, Inc. Executive Office, 350 Fellowship Road, Suite 101, Mount Laurel, New Jersey, on July 17, 2014, at 9:30 a.m.

The Annual Meeting is being held for the purpose of considering and voting upon the following matters:

| 1. | The election of eleven directors of the Company; |

| 2. | The approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan; |

| 3. | The approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan; |

| 4. | The approval of a non-binding advisory proposal regarding the compensation paid to the named executive officers listed in the attached Proxy Statement; |

| 5. | The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| 6. | Such other matters as may properly come before the Annual Meeting or any adjournments thereof. |

The Board of Directors is not aware of any other business to come before the Annual Meeting. Any action may be taken on the foregoing proposals at the Annual Meeting on the date specified above or on any date or dates to which, by original or later adjournment, the Annual Meeting may be adjourned. Shareholders of record at the close of business on May 23, 2014 are the shareholders entitled to vote at the Annual Meeting and any adjournments thereof.

EACH SHAREHOLDER, WHETHER OR NOT HE OR SHE PLANS TO ATTEND THE ANNUAL MEETING, IS REQUESTED TO AUTHORIZE A PROXY BY MAIL OR TO VOTE BY TELEPHONE OR OVER THE INTERNET AS INSTRUCTED ON THE NOTICE OF INTERNET AVAILABILITY OR, IF YOU REQUESTED PAPER COPIES, THE INSTRUCTIONS ARE PRINTED ON THE PROXY CARD. ANY PROXY GIVEN BY A SHAREHOLDER MAY BE REVOKED BY FILING WITH THE SECRETARY OF THE COMPANY A WRITTEN REVOCATION OR BY VOTING AGAIN AT A LATER DATE BUT PRIOR TO THE ANNUAL MEETING. ANY SHAREHOLDER PRESENT AT THE ANNUAL MEETING MAY REVOKE HIS OR HER PROXY AND VOTE IN PERSON ON EACH MATTER BROUGHT BEFORE THE ANNUAL MEETING. HOWEVER, SHAREHOLDERS WHOSE SHARES ARE NOT REGISTERED IN THEIR OWN NAME WILL NEED ADDITIONAL DOCUMENTATION FROM THE RECORD HOLDER TO VOTE IN PERSON AT THE ANNUAL MEETING.

| | BY ORDER OF THE BOARD OF DIRECTORS | |

| | | |

| | Peter Galetto, Jr. | |

| | Secretary | |

Mount Laurel, New JerseyJune 4, 2014

Important Notice Regarding Internet Availability of Proxy Materials for the Shareholder Annual Meeting to be Held on July 17, 2014 at 9:30 a.m. The Proxy Statement and the 2013 Annual Report to Shareholders are available for review on the Internet at www.envisionreports.com/SNBC. |

OF

SUN BANCORP, INC.

350 FELLOWSHIP ROAD, SUITE 101

MOUNT LAUREL, NEW JERSEY 08054

ANNUAL MEETING OF SHAREHOLDERS

JULY 17, 2014

This proxy statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors of Sun Bancorp, Inc. (the “Company”) to be used at the 2014 Annual Meeting of Shareholders of the Company (the “Annual Meeting”), which will be held at the Sun Bancorp, Inc. Executive Office, 350 Fellowship Road, Suite 101, Mount Laurel, New Jersey, on July 17, 2014, at 9:30 a.m. This Proxy Statement and the enclosed form of proxy are first being made available to shareholders on or about June 4, 2014.

At the Annual Meeting, shareholders will be requested to consider and vote upon (i) the election of eleven directors of the Company; (ii) the approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan; (iii) the approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan; (iv) the approval of a non-binding advisory proposal regarding the compensation paid to the Named Executive Officers (as defined herein) listed in the Proxy Statement; (v) the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; and (vi) such other matters as may properly come before the Annual Meeting or any adjournments thereof. The Board of Directors knows of no additional matters that will be presented for consideration at the Annual Meeting. Execution of a proxy, however, confers on the designated proxy holder discretionary authority to vote the shares represented by such proxy in accordance with their best judgment on such other business, if any, that may properly come before the Annual Meeting or any adjournment thereof.

VOTING AND PROXY PROCEDURES

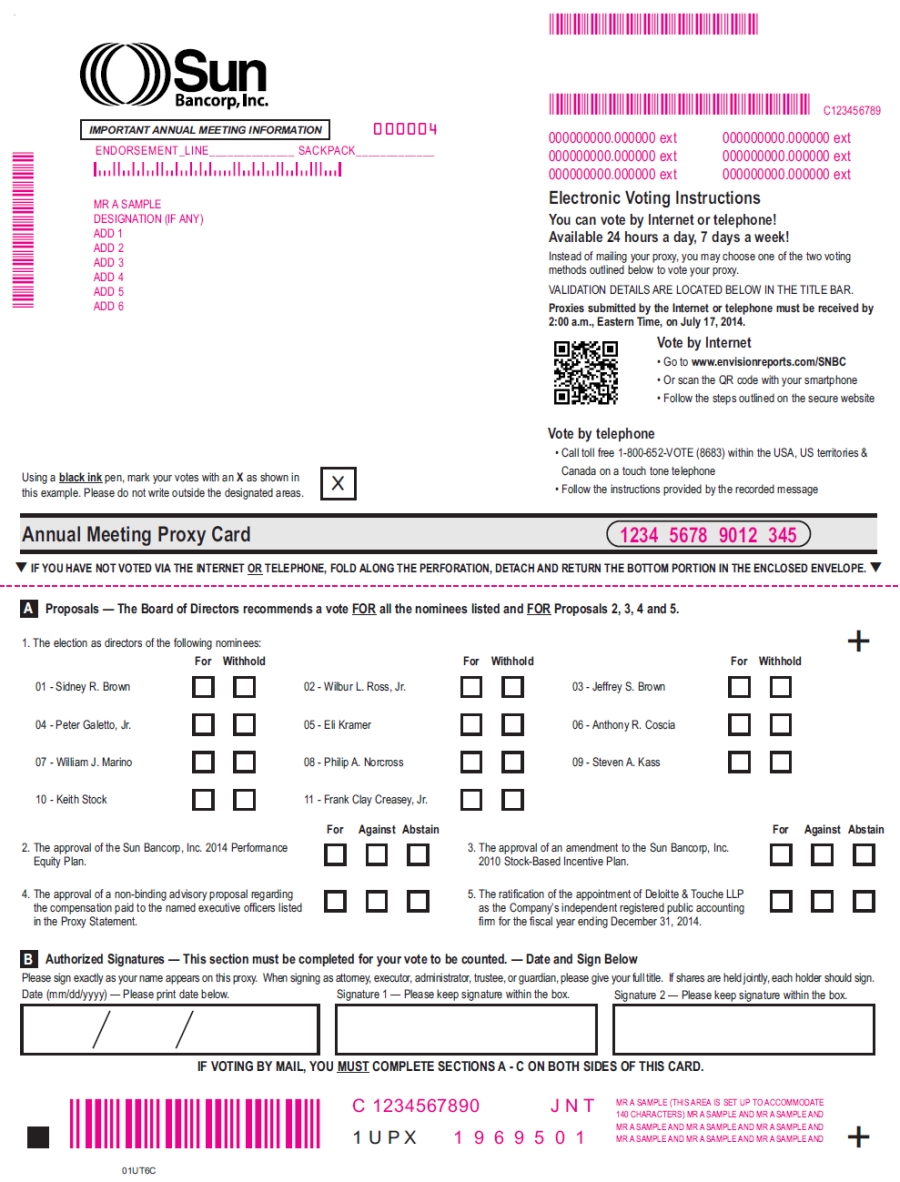

The Board of Directors is making this Proxy Statement available to you electronically for the purpose of allowing your shares of common stock to be represented at the Annual Meeting by the persons named as proxies in the Board of Directors’ form of proxy. Shareholders of record may vote by proxy in any of three different ways:

| | ● | Voting over the Internet. To vote by Internet: |

| · | Go to www.envisionreports.com/SNBC; or |

| · | Scan the QR code on your proxy card with your smartphone. |

| · | The steps for voting by Internet are outlined on the secure website. Proxies submitted by the Internet must be received by 2:00 a.m. Eastern Time on July 17, 2014. |

| | ● | Voting by Telephone. To vote by telephone: |

| · | Call toll free 1-800-652-VOTE (8683) within the USA, US territories & Canada on a touch tone telephone; and |

| · | Follow the instructions on the recorded message. Proxies submitted by the telephone must be received by 2:00 a.m. Eastern Time on July 17, 2014. |

| | ● | Voting by Mail. If you have requested paper copies, complete, sign, date and return the proxy card in the postage-paid envelope provided. To be voted, mailed proxy cards must be received by: 5:00 p.m. Eastern Time on July 16, 2014. |

Voting of 401(k) Retirement Plan and Employee Stock Purchase Plan Shares. Employees who own shares of common stock as of the Record Date (as defined below) in either of the 401(k) Retirement Plan or the Employee Stock Purchase Plan will receive an email with instructions on how to download the proxy materials and direct how their shares should be voted at the Annual Meeting. Employees who participate in either of those plans must complete these procedures no later than 8:00 a.m., Eastern Time, on July 15, 2014.

Shareholders who execute proxies retain the right to revoke them at any time. Unless so revoked, the shares represented by such proxies will be voted at the Annual Meeting and all adjournments thereof. Proxies may be revoked by written notice to the Secretary of the Company at the address above or by filing a later-dated proxy. A proxy will not be voted if a shareholder attends the Annual Meeting and votes in person. However, shareholders whose shares are not registered in their own name will need additional documentation from the record holder to vote in person at the Annual Meeting. Proxies solicited by the Board of Directors will be voted as specified thereon. If no direction is given, signed proxies will be voted “FOR” the nominees for directors set forth below; “FOR” the approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan; “FOR” the approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan; “FOR” the approval of a non-binding advisory proposal regarding the compensation paid to the Named Executive Officers listed in the Proxy Statement; and “FOR” the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014. The proxy confers discretionary authority on the persons named therein to vote with respect to the election of any person as a director where a nominee is unable to serve, or for good cause will not serve, and with respect to matters incident to the conduct of the Annual Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Shareholders of record as of the close of business on May 23, 2014 (the “Record Date”) are entitled to one vote for each share of the Company’s common stock they held at that date. As of that date, there were 87,098,577 shares of the Company’s common stock outstanding.

The presence in person or by proxy of at least a majority of the outstanding shares of the Company’s common stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. For purposes of determining the votes cast with respect to any matter presented for consideration at the Annual Meeting, only those votes cast “FOR” or “AGAINST” are included. Abstentions and broker non-votes (i.e., shares held by brokers on behalf of their customers, which may not be voted on certain matters because the brokers have not received specific voting instructions from their customers with respect to such matters) will be counted solely for the purpose of determining whether a quorum is present. In the event there are not sufficient votes for a quorum or to ratify or adopt any proposal at the time of the

Annual Meeting, the Annual Meeting may be adjourned in order to permit the further solicitation of proxies.

As to the election of directors, the proxy being provided by the Board of Directors allows a shareholder to vote for the election of the nominees proposed by the Board of Directors or to withhold authority to vote for any or all of the nominees being proposed. Under the Company’s bylaws, directors are elected by a plurality of votes cast.

Concerning all matters that may properly come before the Annual Meeting other than the election of directors, including the approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan, the approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan, the approval of a non-binding advisory proposal regarding the compensation paid to the Named Executive Officers listed in the Proxy Statement and the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, by checking the appropriate box, a shareholder may: (i) vote “FOR” the item, or (ii) vote “AGAINST” the item, or (iii) “ABSTAIN” with respect to the item. Unless otherwise required, such matters, including the approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan, the approval of an amendment to the Sun Bancorp, Inc. 2010 Stock-Based Incentive Plan, the approval of a non-binding advisory proposal regarding the compensation paid to the Named Executive Officers listed in the Proxy Statement and the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014, shall be determined by a majority of votes cast affirmatively or negatively without regard to (a) broker non-votes, or (b) proxies marked “ABSTAIN” as to that matter.

Security Ownership of Certain Beneficial Owners

Persons and groups owning in excess of 5% of the outstanding shares of the Company’s common stock are required to file reports regarding such ownership with the Securities and Exchange Commission (the “SEC”). Other than as set forth in the following table, management knows of no person or group that owns more than 5% of the outstanding shares of the Company’s common stock as of the Record Date.

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | Percent of Shares of Common Stock Outstanding |

| | | | | |

| Bernard A. Brown | | | | |

| 71 West Park Avenue | | | | |

| Vineland, New Jersey 08360 | | 6,195,171 | (1) | 7.1% |

| | | | | |

| WL Ross & Co. LLC | | | | |

| 1166 Avenue of the Americas | | | | |

| New York, New York 10036 | | 21,279,241 | | 24.4% |

| | | | | |

| Maycomb Holdings II, LLC | | | | |

| Maycomb Holdings III, LLC | | | | |

| Maycomb Holdings IV, LLC | | | | |

| c/o Siguler Guff & Company, LP | | | | |

| 825 Third Avenue | | | | |

| New York, New York 10022 | | 8,460,421 | (2) | 9.7% |

| | | | | |

| Sidney R. Brown | | | | |

| 226 Landis Avenue | | | | |

| Vineland, New Jersey 08360 | | 4,727,346 | (3)(4) | 5.4% |

| | | | | |

| Anchorage Capital Group, L.L.C. | | | | |

610 Broadway, 6th Floor | | | | |

| New York, New York 10012 | | 8,460,421 | (5) | 9.7% |

| | | | | |

Total of all directors, nominees for director and executive officers of the Company as a group (16 persons) | | 30,259,403 | (6)(7) | 34.7% |

________________

| (1) | Includes shares held directly as well as by spouse, in trust and other indirect ownership, over which shares Mr. Brown exercises sole or shared voting and/or investment power. Includes 143,164 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. |

| (2) | Based on an amended Schedule 13G filed with the SEC on February 14, 2014 and on information from the corporate records of the Company. |

| (3) | Includes shares held directly as well as by spouses or minor children, in trust and other indirect ownership, over which shares the individual exercises sole or shared voting and/or investment power, unless otherwise indicated. Includes 272,768 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. |

| (4) | Excludes 4,012,237 shares held by various companies and partnerships for which the individual disclaims beneficial ownership of shares held in excess of his proportionate ownership interests in such companies and partnerships. |

| (5) | Based on a Form 13F filed with the SEC on February 14, 2014. |

| (6) | Excludes 8,025,729 shares held by various companies and partnerships for which an individual disclaims beneficial ownership of shares held in excess of his or her proportionate ownership interests in such companies and partnerships. |

| (7) | Includes shares held directly as well as by spouses or minor children, in trust and other indirect ownership, over which shares the individuals effectively exercise sole or shared voting and/or investment power, unless otherwise indicated. |

| | Includes 486,749 shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. |

PROPOSAL I – ELECTION OF DIRECTORS

Eleven directors will be elected at the Annual Meeting. All of the nominees are currently members of the Board of Directors. Directors of the Company are elected to one-year terms, each to serve until the next annual meeting of shareholders and until his or her successor has been duly elected and qualified.

It is intended that the proxies solicited by the Board will be voted for the election of each of the named nominees unless otherwise specified. If any of the nominees is unable to serve, the shares represented by all valid proxies will be voted for the election of such substitute as the Board of Directors may recommend or the size of the Board may be reduced to eliminate the vacancy. At this time, the Board knows of no reason why any of the nominees might be unavailable to serve. Each of the nominees has consented to serve, if elected.

The following table sets forth information with respect to all of the directors as of the Record Date (including the nominees for election as directors) and the executive officers of the Company and Sun National Bank (the “Bank”), including their names, ages, the year they first became directors or executive officers of the Company or the Bank, and the number of and percentage of shares of the Company’s common stock beneficially owned by each as of May 23, 2014.

| Name | | Age | | Year First Elected or Appointed(1) | | Shares of Common Stock Beneficially Owned(2),(3) | | Percent of Shares of Common Stock Outstanding |

| | | | | | | | | |

| |

| DIRECTORS |

| |

| Wilbur L. Ross, Jr. | | 76 | | 2010 | | 21,279,241 | | 24.4% |

| Sidney R. Brown | | 57 | | 1990 | | 4,727,346 | | 5.4% |

| Jeffrey S. Brown | | 54 | | 1999 | | 2,950,489 | | 3.4% |

| Peter Galetto, Jr. | | 60 | | 1990 | | 442,114 | | * |

| Eli Kramer | | 59 | | 2004 | | 356,102 | | * |

| Anthony R. Coscia | | 53 | | 2010 | | 98,998 | | * |

| William J. Marino | | 69 | | 2010 | | 113,096 | | * |

| Philip A. Norcross | | 50 | | 2012 | | 116,147 | | * |

| Steven A. Kass | | 56 | | 2012 | | 31,080 | | * |

| Keith Stock | | 61 | | 2014 | | 1,000 | | * |

| Frank Clay Creasey, Jr. | | 65 | | 2014 | | 300 | | * |

EXECUTIVE OFFICER OF THE COMPANY AND THE BANK |

| | | | | | | | | |

| Thomas R. Brugger | | 47 | | 2012 | | 20,000 | | * |

EXECUTIVE OFFICERS OF THE BANK |

| Michele B. Estep | | 45 | | 2008 | | 76,130 | | * |

| Bradley J. Fouss | | 46 | | 2001 | | 44,527 | | * |

| Alberino J. Celini | | 51 | | 2012 | | 405 | | * |

| John R. Allison IV | | 47 | | 2014 | | - | | * |

______________

| (1) | For directors, refers to the year such individual became a director of the Company or the Bank. For officers, refers to the year such individual joined the Company or the Bank. |

| (2) | Includes shares held directly by the individual as well as by such individual’s spouse, or minor children, in trust and other forms of indirect ownership over which shares the individual effectively exercises sole voting and investment power, unless otherwise indicated. |

| (3) | Includes shares that can be acquired pursuant to options that are currently exercisable or that will become exercisable within 60 days of the Record Date. The number of options included for each individual is as follows: Wilbur Ross – 0; Sidney R. Brown – 244,368; Jeffrey S. Brown – 11,625; Peter Galetto, Jr. – 36,750; Eli Kramer – 56,757; Anthony R. Coscia – 0; William J. Marino – 0; Philip A. Norcross – 0; Steven A. Kass – 0; Keith Stock – 0; Frank Clay Creasey, Jr. – 0; Thomas R. Brugger – 0; Michele B. Estep – 45,419; Bradley J. Fouss – 37,647; Alberino J. Celini – 0; and John R. Allison IV – 0. |

Biographical Information and Qualifications of Directors

Set forth below are biographies of the nominees for director (all of which are continuing directors) and the executive officers of the Company and the Bank. These biographies contain information regarding the person’s service as a director, business experience, other directorships at any point during the last five years with any other public companies, information regarding involvement in certain types of proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to nominate the individual for election to the Board in 2014 and that qualify such continuing directors to continue to serve on the Board. Pursuant to the terms of a securities purchase agreement dated July 7, 2010 entered into between the Company and WLR SBI Acquisition Co, LLC (“WL Ross”), the Company agreed that as long as WL Ross beneficially owns at least 7.5% of the outstanding common stock, WL Ross has the right to nominate one candidate to the Board of the Company and the Bank. Wilbur L. Ross, Jr. is WL Ross’s nominee. Pursuant to the terms of a securities purchase agreement dated July 7, 2010 entered into between the Company and various members of the founding Brown family, as long as the Brown family and their affiliates own at least 7.5% of the outstanding common stock, subject to compliance with NASDAQ Listing Rules and related interpretations, the Brown family has the right to nominate four candidates for election as directors. Pursuant to this provision, Sidney R. Brown, and Jeffrey S. Brown have been nominated to serve as directors.

Directors

Sidney R. Brown is Interim President and Chief Executive Officer and Chairman of the Board of Directors of the Company and the Bank. From 1990 to 2013, Mr. Brown, in addition to being a director, served as treasurer and secretary of the Company. Mr. Brown serves as Chair of the Executive and Credit Committees as well as a member of both the ALCO/Investment Committee and Technology Committee. He served as Acting President and CEO of the Company from February 2007 to January 2008 and from December 2013 to the present. Mr. Brown is Chief Executive Officer of NFI Industries, Inc. (“NFI”), a premier integrated supply chain solutions company. NFI, founded in 1932 as National Hauling, has evolved from a trucking company in a regulated environment, into one of the largest privately-held third party logistics companies in the country. In the early 1980s, the company, then known as National Freight, was focused mainly on over-the-road trucking services. The company quickly evolved into four affiliated companies providing transportation services (National Freight), warehousing and inventory management (National Distribution Centers), dedicated fleets and transportation management (Interactive Logistics) and real estate development (Real Estate). In 2008, the company continued to evolve and positioned all its companies under one corporate brand, NFI. NFI in North America now consists of Logistics, Warehousing and Distribution, Transportation, Intermodal, Real Estate, Transportation Brokerage, Contract Packaging, Solar, Global Freight Forwarding and NFI Canada. Mr. Brown attended

Georgetown University and graduated with a BSBA in 1979. Sidney R. Brown began his career working for Morgan Stanley in New York City as a financial analyst in the corporate finance department of the investment bank. He moved on to pursue his MBA at Harvard University. Graduating in 1983, he immediately joined the family business. Mr. Brown is a director of J & J Snack Foods Corp. and Franklin Square Energy and Power Fund. Emeritus Director of the Bank, Bernard A. Brown is Sidney Brown’s parent and Director Jeffrey S. Brown is his sibling. With his extensive business background and leadership and management skills, Mr. Brown has helped guide the Company’s Board of Directors successfully for a significant number of years.

Jeffrey S. Brown has been a director of the Company since April 1999. He is also a director of the Bank. Mr. Brown serves as Chairman of the Technology Committee, and as a member of the Board’s Risk, ALCO/Investment and Credit Committees. He is President and Vice Chairman of NFI, a comprehensive provider of freight transportation, warehousing, third party logistics, contract manufacturing, and real estate development. Mr. Brown is also President of NFI Real Estate, one of the top real estate development companies in the industry. He is one of the general partners of The Four B’s, a partnership with extensive holdings primarily in the Eastern United States. Mr. Brown is an officer and director of several other corporations and partnerships in the transportation, equipment leasing, insurance, warehousing and real estate industries. He serves on the Boards of several regional charities including: The Board of Trustees of the Cooper Foundation. As a principal in a major logistics company with P&L responsibilities, Mr. Brown possesses financing and acquisition experience, which further strengthens his bank director capabilities. Emeritus Director of the Bank, Bernard A. Brown is Jeffrey Brown’s parent and Chairman of the Board of Directors and Interim President and Chief Executive Officer Sidney R. Brown is his sibling. His experience in real estate, leadership skills, and networking capabilities due to his stature in the local business community, make him a valued member of the Company’s Board of Directors.

Anthony R. Coscia was elected to the Board of Directors of the Company in November 2010. He is also a director of the Bank. Mr. Coscia currently serves as Chair of the Board’s ALCO/Investment Committee and is a member of the Board’s Compensation/Personnel and Credit Committees. He is admitted to the state bars of New Jersey and New York and is a Partner in the law firm of Windels Marx Lane & Mittendorf, LLP (WMLM), having been with the firm for over 25 years. He is a graduate of Georgetown University School of Foreign Service and received his law degree from Rutgers University School of Law. Mr. Coscia’s practice focuses on corporate, commercial, and real estate matters, with a concentration on the financial elements of these transactions. He represents financial institutions, investors and major corporations on whose behalf he has handled a broad variety of matters, including corporate and real estate finance transactions, asset restructure and recovery, regulatory compliance, mergers and acquisitions, and general litigation. In addition, Mr. Coscia regularly advises infrastructure funds, private equity firms, technology companies, not-for-profit organizations and investor owned utilities. He also has specific experience in the area of redevelopment finance and has worked extensively on infrastructure development projects. In addition to his private practice, Mr. Coscia also serves as Chairman of the Board of Directors of the National Railroad Passenger Corporation (Amtrak). Previously he served as Chairman of Amtrak’s Finance and Audit Committee. Mr. Coscia’s contributions to Amtrak are the result of his June 2010 appointment by President Obama to the Board of Directors. Mr. Coscia is the Chairman of United Water, Inc., the U.S. subsidiary of Suez Environnement. He has previously served as a director of several public and closely held corporations in the construction, financial services, investment banking, real estate and manufacturing sectors. In addition, he serves as a trustee of the New Jersey Community Development Corporation and is a member of the New Jersey Performing Arts Center Council of Trustees, The Partnership for New York City, The Economic Club of New York and the Regional Plan Association. Mr. Coscia served as Chairman of the Port Authority of New York and New Jersey for over eight years, stepping down from the Board on June 30, 2011. During his tenure, the longest in modern Port Authority history, he served four New Jersey Governors and three New York

Governors. As Chairman, Mr. Coscia oversaw the restoration of the agency after 9/11 as a key player in the region through development of a long term capital program, assuming the lead role in the redevelopment of the World Trade Center site rebuilding, spearheading multi-billion dollar mass transit improvements, port expansion, modernization of aviation facilities and the most significant corporate governance and financial management reforms adopted by the Port Authority in over two decades. From February 1992 to March 2003, Mr. Coscia served as Chair of the New Jersey Economic Development Authority (“NJEDA”), one of the largest state-sponsored development banks in the United States. In 2007 he was awarded an honorary doctorate of humane letters from the New Jersey Institute of Technology. With Mr. Coscia’s extensive background and as a well-respected business leader actively involved in both the private and government sectors in New Jersey and New York, he is a significant complement to the Company’s Board of Directors.

Peter Galetto, Jr. has been a director of the Company since April 1990. He is also a director of the Bank. Mr. Galetto served as the Secretary of the Company from April 1990 to March 1997. He currently serves as secretary of the Company and the Bank, is Chair of the Risk Committee and former Chair of the Audit Committee. He serves as a member of the following Board Committees: Executive; Audit; Nominating & Corporate Governance; and Credit. In his position as Chair of the Risk Committee of the Board, Mr. Galetto annually attends numerous audit and risk related webinars and seminars as well as a national conference on audit and risk topics to bring the most current information to the Company. Mr. Galetto is the President and CEO of Stanker&Galetto, Inc., an industrial building contractor located in Vineland, New Jersey. He is the Secretary/Treasurer of Tri-Mark Building Contractors, Inc. Mr. Galetto is also Chairman of the Board of Inspira Health Network (formerly South Jersey Healthcare System which merged with Underwood Memorial Hospital), board member of Hendricks House and also serves as the Parish of All Saints Finance Council President. Mr. Galetto is also an officer and director of several other corporations and organizations. He has been honored by several organizations for his community service: Entrepreneur of the Year by the South Jersey Development Council, Gregor Mendel Award from St. Augustine Prep, Vineland Rotary Club Outstanding Vocational Accomplishments and the Order Sons of Italy in America Distinguished Golden Lion Award. He received a B.S. in Commerce and Engineering from Drexel University, majoring in Finance and Management. Mr. Galetto also graduated from Harvard Business School’s Owner/President Management Program. With his proven business leadership and management skills, in addition to his stature in the local business community, Mr. Galetto is a significant contributor to the Board of Directors of the Company.

Steven A. Kass was elected to the Board of Directors of the Company in April 2012. He is also a director of the Bank. Mr. Kass currently serves as Chair of the Board’s Audit Committee and is a member of the Risk Committee. Mr. Kass is CEO and a board member of Rothstein Kass, based in Roseland, N.J. He has extensive experience with entrepreneurial businesses and their owners and frequently lectures before trade associations and professional associations. Mr. Kass earned a Bachelor of Science degree in accounting from Syracuse University and began his career with Arthur Young (now Ernst & Young). After three years with the then Big Eight accounting firm, he joined Rothstein Kass. Bringing strong skills and a fresh mindset to the firm, Mr. Kass has played an integral role in the firm’s growth and national presence over the last 20 years. Additionally, he was extensively involved with advising clients within the firm’s Financial Services Group. Professional development and philanthropy have always been important to Mr. Kass. He serves on the advisory board for the Whitman School of Management and the Lubin School of Accounting at Syracuse University. He completed a two-year term as international chairman of AGN International Ltd., a worldwide association of separate and independent accounting and consulting firms in 80 countries. Because of his commitment to philanthropy and his leadership in the accounting and finance profession, Mr. Kass was honored in January 2004 with a Distinguished Achievement award by the banking and finance unit of B’nai B’rith International. In addition to these activities Mr. Kass is a highly regarded industry thought leader and frequently requested speaker. Recent speaking engagements include: AGN World Congress, Lehigh and Syracuse Universities,

UJA-Federation and B’nai B’rith International. Mr. Kass is a member of the American Institute of Certified Public Accountants (AICPA), the New Jersey Society of Certified Public Accountants (NJSCPA) and the New York State Society of Certified Public Accountants (NYSSCPA). He is a certified accountant in the states of New Jersey and New York. As a highly-regarded business and philanthropic leader, who has led the dynamic growth of his own company while serving as a valued advisor to clients, Mr. Kass is a strong complement to the Company’s Board of Directors.

Eli Kramer has been a director of the Company since July 2004. He is also a director of the Bank. He serves as Chair of the Board’s Compensation Committee and is also a member of the following Board Committees: Executive; Audit; Risk; Nominating and Corporate Governance; and Credit. Mr. Kramer has over 20 years of total bank board experience including seven plus years as Vice Chair or Chairman at a previous bank. Mr. Kramer has been a principal in real estate development companies since 1976 and is the owner of CJ Management, LLC. He is also a principal in Arcturus Group, a real estate advisory and asset management firm serving the financial industry. He was a co-founder and Vice Chairman of the Board of Directors of Community Bancorp of New Jersey, prior to its acquisition by the Company. He also served as a Director and Chairman of the Board of Colonial State Bank. Mr. Kramer serves as a Trustee on the Boards of the Jewish Educational Center, Elizabeth, NJ, the Holocaust Resource Center at Kean University, and the Trinitas Healthcare Foundation. Mr. Kramer’s bank board experience, proven leadership and business management skills, knowledge of the New Jersey market, and stature in the community are all attributes that are highly valued as a director of the Company.

William J. Marino was elected to the Board of Directors of the Company in November 2010. He is also a director of the Bank. Mr. Marino currently serves as Chair of the Board’s Nominating and Corporate Governance Committee and is also a member of the Board’s ALCO/Investment Committee. He is a graduate of St. Peter’s College with a Bachelor of Science degree in Economics. Mr. Marino has over 40 years of experience in the health and employee benefits field, primarily in managed care, marketing and management. Mr. Marino is the retired Chairman, President and Chief Executive Officer of Horizon Blue Cross Blue Shield of New Jersey, the state’s largest health insurer, providing coverage for over 3.6 million people. He joined Horizon BCBSNJ as Senior Vice President of Health Industry Services in January 1992, responsible for all aspects of Managed Care operations in New Jersey, as well as Market Research, Product Development, Provider Relations and Health Care Management. He became President and CEO in January 1994 and Chairman effective January 2010. Before joining Horizon BCBSNJ, Mr. Marino was VP of Regional Group Operations for NY and CT for Prudential, capping a 23-year career with them. Mr. Marino is currently the Co-Chairman of the Board of Directors of the New Jersey Performing Arts Center (NJPAC), a member of the Board of the New Jersey Symphony Orchestra, as well as Sealed Air Corporation, in which he serves as Chairman of the Organization & Compensation Committee. He is a member of the Campaign Committee of Saint Vincent Academy and a member of the Board of Trustees of Delbarton School in Morristown. In addition, Mr. Marino is a member of the board of a privately held corporation, LCA Holdings, LLC. Mr. Marino is a recipient of the 1997 Ellis Island Medal of Honor. In 2007 he received The American Conference on Diversity’s Humanitarian of the Year Award. Mr. Marino’s prior board affiliations include: America’s Health Insurance Plans; Blue Cross Blue Shield Association; National Institute for Health Care Management (Past Chairman); Choose New Jersey; NJ State Chamber of Commerce (Past Chairman); New Jersey Network; Newark Alliance; Newark Museum, Liberty Science Center Chairman’s Advisory Council; St. Peter’s College (Past Chairman); Community Theatre of Morristown; Regional Business Partnership (Past Chairman); United Way of Essex and West Hudson (Past Chairman); Kessler Institute for Rehabilitation, Inc.; New York Business Group on Health; and New York State HMO Conference. As a highly regarded business and philanthropic leader, one who has played an important role in policy and legislative matters in New Jersey, Mr. Marino is an important complement to the Company’s Board of Directors.

Philip A. Norcross was elected to the Board of Directors of the Company in April 2012, and currently serves as Treasurer. He is also a director of the Bank. Mr. Norcross serves as a member of the following Board Committees: ALCO/Investment, Compensation, Risk, and Technology. Mr. Norcross is Chief Executive Officer and Managing Shareholder of Parker McCay, a regional law firm headquartered in Mount Laurel, New Jersey, with offices in Lawrenceville and Atlantic City, New Jersey. He co-chairs the firm’s Public Finance and Business Departments and has particular expertise in finance and transactional law, with an emphasis on government, economic development, redevelopment and other specialized financings. Mr. Norcross also serves as Chairman of Optimus Partners LLC, a business advisory and consulting firm, based in Trenton, New Jersey, that serves a wide array of clients in the financial services, healthcare, gaming, real estate and development, and insurance sectors. Active in both the community and his profession, Mr. Norcross is Chairman of the Board of The Cooper Foundation and a member of Cooper Health System’s Treasury Steering Committee. He is a member of the Board and Executive Committee of United Way of Greater Philadelphia and Southern New Jersey as well as a member and past Chairman of Burlington County United Way. Mr. Norcross also serves on the Board of Trustees of the Home Port Alliance of the U.S.S. New Jersey, Inc. and is a founding member and former vice president of the Mount Laurel Public Education Foundation. He is also a member of the National Association of Bond Lawyers, the American Bar Association and the bar associations of New Jersey, Burlington County and Camden County. With his record of success, particularly in the areas of law, finance and economic development, working with both private and public entities, Mr. Norcross brings valuable experience and talent to the Company’s Board of Directors.

Wilbur L. Ross, Jr. was elected to the Board of Directors of the Company in September 2010. He is also a director of the Bank. Mr. Ross is a member of the Executive Committee and the Nominating and Corporate Governance Committee and is a non-voting observer to the Compensation Committee. Wilbur Ross, CEO of WL Ross & Co. LLC, may be one of the best known private equity investors in the U.S. His private equity funds bought Bethlehem Steel and several other bankrupt producers and revitalized them into the largest U.S. producer before merging them into Mittal Steel for $4.5 billion. He remains a director of what is now ArcelorMittal, the world’s largest steel company. He also created and chairs International Textile Group, the most global American company in that industry, and International Auto Components Group, a $4.5 billion producer of instrument panels and other interior components operating in 17 countries. He’s the Chairman of Diamond S Shipping and previously chaired International Coal Group which was sold to Arch Coal for $3.4 billion. He is a member of the boards of Assured Guaranty, Bank of Ireland, BankUnited, EXCO, Navigator Holdings and Ocwen Financial, all NYSE listed. He is also a member of the board of Talmer Bancorp. Mr. Ross was Executive Managing Director of Rothschild Inc. for 24 years before acquiring that firm’s private equity partnerships in 2000. He is a member of the boards of Yale University School of Management, The Dean’s Advisory Board of Harvard Business School, Palm Beach Civic Association, Business Roundtable and the Palm Beach Preservation Foundation. He is Chairman of the Japan Society and the Brookings Institution Economics Studies Council and a trustee of the Town of Palm Beach Retirement System and the Magritte Museum in Brussels. President Kim Dae Jung awarded him a medal for his assistance in Korea’s financial crisis, President Clinton appointed him to the board of the U.S.—Russia Investment Fund and he served as Privatization Advisor to New York City Mayor Rudy Giuliani. Mr. Ross formerly served as Chairman of the Smithsonian Institution National Board. He is a graduate of Yale University and of Harvard Business School (with distinction). He is the only person to be elected to both the Private Equity Hall of Fame and the Turnaround Management Association Hall of Fame. Bloomberg BusinessWeek designated him one of the 50 most influential people in global finance. Mr. Ross is a valued member of the Board of Directors given his experience in the financial services industry and his reputation as one of the world’s most respected investors.

Keith Stock was seated as a director on the Boards of Directors of the Company and the Bank in January 2014. Mr. Stock serves as a member of the Audit and Credit Committees. Since 2011, he is

Chairman and Chief Executive Officer of First Financial Investors, Inc., a financial services investment firm, Senior Executive Advisor with The Brookside Group, and Chairman and Chief Executive Officer of Clarien Group Limited as well as Chairman of its wholly-owned subsidiary, Capital G Bank Limited. Mr. Stock is also a registered securities professional with J.V.B. Financial Group, LLC, a full service investment bank. Previously, from 2009 to 2011, Mr. Stock served as Senior Managing Director and Chief Strategy Officer of TIAA-CREF. He was a member of the Office of the CEO with responsibility for corporate development and strategy including mergers and acquisitions and business strategies for asset management, banking and trust, life insurance, retirement services, and wealth management. From 2004 to 2008 Mr. Stock served as President of MasterCard Advisors, LLC, the professional services business of MasterCard Worldwide. He was a member of the MasterCard Operating Committee and Management Council. Mr. Stock also previously served as Chairman and Chief Executive Officer of St. Louis Bank, FSB and First Financial Partners Fund I, LP, a private equity firm and bank holding company, as well as Chairman and President of Treasury Bank, Ltd. Earlier in his career, Mr. Stock was a partner with McKinsey & Co., a senior officer of A.T. Kearney, and financial services sector executive with Capgemini and Ernst & Young. He began his career with the Mellon Bank (now BNY Mellon). Mr. Stock is a director of the Bermuda Stock Exchange (BSX), the Foreign Policy Association, and Independence Bancshares, Inc. He is a member of the Economic Club of New York, the Advisory Board of the Institute for Ethical Leadership, Rutgers University Business School, and the International Trustee Election Commission of AFS Intercultural Programs, Inc. (formerly known as the American Field Service). He received his undergraduate degree from Princeton University and his M.B.A. in finance from The Wharton School, University of Pennsylvania. As an accomplished business leader with an impressive record of success and in-depth management experience in the financial services industry, Mr. Stock’s qualifications make him an important complement to the Company’s Board of Directors.

Frank Clay Creasey, Jr. was seated as a director on the Boards of Directors of the Company and the Bank in April 2014. Mr. Creasey is a member of the Board’s Audit, Risk, and ALCO/Investment Committees. Mr. Creasey is currently employed by Toys“R”Us, Inc. as Executive Vice President and Chief Financial Officer, a position he has held since May 2006. He joined Toys“R”Us, Inc. in 2006 with more than 25 years of financial management experience in the retail industry. Mr. Creasey began his retail career at Lucky Stores, a large, public grocery, where he spent 11 years in various corporate and division financial roles. More recently, he spent 13 years at Mervyn’s, a subsidiary of Target Corporation, where he served as their Chief Financial Officer for five years. He also spent one year as the financial head of Zoom Systems, a San Francisco-based start-up company in the automated retail sector. During his career, Mr. Creasey has been involved with several corporate and operational restructurings and financial turnarounds. Before entering the retail sector, Mr. Creasey spent two years as an Actuarial Analyst at Fireman’s Fund and six years as a Corporate Lending Officer with Crocker Bank. Mr. Creasey holds a bachelor’s degree and a Masters of Business Administration from Stanford University. He also is a Certified Public Accountant. With Mr. Creasey’s corporate leadership skills, experience with restructurings and financial turnarounds and expertise in risk management, regulatory compliance, credit and corporate lending, he is a valued addition to the Company’s Board of Directors.

Executive Officers Who Are Not Directors

Thomas R. Brugger joined the Company and the Bank in November 2012 as Executive Vice President and Chief Financial Officer. His responsibilities include financial reporting and planning, accounting, treasury, interest rate risk management, investor relations, capital planning and mortgage sales. Before joining the Company, Mr. Brugger was Executive Vice President and Chief Financial Officer of Customers Bancorp, Inc., a bank holding company based in Wyomissing, Pa for three years (from September 2009 to October 2012). Prior to that, Mr. Brugger was Executive Vice President, Corporate Treasurer for Sovereign Bancorp and Sovereign Bank. Mr. Brugger is a graduate of Penn State University and sits on the Advisory Board for Penn State Outreach, a division of Penn State University.

Alberino J. Celini joined the Bank in December 2012 as Executive Vice President and Chief Risk Officer overseeing the credit, operational and market risk management functions of the Bank. Prior to joining the Company, Mr. Celini was Vice President, Regulatory Advisory & Strategy at Freddie Mac in McLean, Virginia. His twenty-five year career spans both functional and business leadership roles within major financial institutions, and his expertise encompasses finance, risk management, regulatory compliance, governance and strategic business development. Mr. Celini also spent a decade at Ally Bank, where he served as founding Chief Financial Officer, Chief Risk Officer and Director of Lending Development, as the Bank grew from start-up to maturity. Other past roles include Financial Officer at Citibank and public accountant with Arthur Andersen & Co. A Certified Public Accountant, Mr. Celini earned a Bachelor of Science degree in Accounting and Finance from Fordham University. He is a member of the NJ Bankers Association and has held executive board roles at the MERS Corporation, Delaware Community Investment Corporation and the Bucks County Boy Scouts of America.

Michele B. Estep joined the Bank in April 2008 as Executive Vice President and Chief Administrative Officer. Ms. Estep brings more than 20 years of experience to her position. In this position, Ms. Estep oversees the Company’s administrative operations, including Human Resources, Training and Development, Marketing, PR and Communications. Her roles include management of the Bank’s Human Capital initiatives - recruiting, hiring, retention and training practices and procedures, as well as the administration of benefits and payroll services. Under her management, the marketing department is charged with developing strategies and tactics designed to support the Company’s lines of business through sales support, branding, advertising and social media. Ms. Estep is also responsible for managing communications with all of the Company’s stakeholders, including community relations and investor relations. Prior to joining the Company, she held successive leadership roles at KeyBank in Albany, New York. Ms. Estep is a member of the Board of Directors of The Food Bank of South Jersey.

Bradley J. Fouss joined the Bank in 2001. Mr. Fouss has more than 20 years of banking experience. Currently Executive Vice President and Director of Wholesale Banking for the Company, a position he has held since May 2011, Mr. Fouss manages all commercial banking efforts and drives key strategic initiatives to expand lines of business, including wholesale lending, deposits, cash management, and government banking. He also leads the Bank’s growing specialty segment business lines, including Healthcare, Real Estate, Asset-Based Lending, and Syndications. Previously, he was Senior Vice President and Director of Commercial Real Estate and Asset-Based Lending from July 2010 to May 2011, Senior Vice President and Director of Specialized Banking from September 2009 to July 2010 and Senior Vice President - Wholesale Lending from December 2001 to September 2009. Prior to joining the Company, Mr. Fouss held commercial banking positions with Wachovia. He also served in the New Jersey National Guard for 10 years, retiring as a captain.

John R. Allison IV joined the Bank in 2014 as Executive Vice President and Chief Operations Officer. In this role, he oversees operations across several key departments in the Bank, including bank and mortgage operations, information technology, consumer banking, small business banking, retail services and support, and Sun Financial Services. Mr. Allison has a track record of strategic execution and customer service and, as a member of the Bank's executive management team, plays a significant role in the Bank’s corporate strategy and growth initiatives. Mr. Allison formerly led information technology at Customers Bank, where he oversaw a major company initiative to implement an advanced technology strategy and optimize that bank’s competitive advantage. He also held progressively responsible positions over 20-plus years at TD Bank/Commerce Bank, where he built a world-class technology and operations infrastructure supporting retail and commercial banking, cash management, finance, human resources, and other departments across the multi-billion-dollar organization. Mr. Allison earned an Executive Masters in Technology Management from the University of Pennsylvania and a Bachelor of Arts degree in Economics from Saint Joseph’s University. An active community volunteer, he is chief operations

officer and board member of Compassionate Friends Riding Center and a member of the strategic planning development committee of Westfield Friends School.

Board Leadership Structure and Role in Risk Oversight

Since the departure of Thomas X. Geisel, former President and Chief Executive Officer, effective December 2, 2013, the offices of Chairman of the Board and Chief Executive Officer are held by the same individual. Sidney R. Brown currently serves as Chairman of the Board of Directors and Interim President and Chief Executive Officer. However, the Board of Directors has determined that the separation of the roles of Chairman of the Board and Chief Executive Officer will enhance Board independence and oversight. Accordingly, the Board of Directors intends to appoint a new Chief Executive Officer who will be separate from the Company’s Chairman of the Board of Directors. The Board of Directors believes that this separation permits the Chief Executive Officer to better focus on developing and implementing strategic and tactical initiatives, enhancing shareholder value and expanding and strengthening the Company’s franchise, while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to, and independent oversight of, management.

The Board of Directors has general authority over the Company’s risk oversight function with authority delegated to various board committees to review risk management policies and practices in specific areas of the Company’s business. The Audit Committee is primarily responsible for overseeing the Company’s risk management. The Audit Committee works closely with officers involved in the risk management function including the internal audit staff who report directly to the Audit Committee.

Meetings and Committees of the Board of Directors

The Company is governed by a Board of Directors and various committees of the Board, which meet regularly throughout the year. During 2013, the Company’s Board of Directors held nine regular meetings, four special meetings, 28 regular committee meetings and 20 special committee meetings. No incumbent directors attended fewer than 75% of the meetings of the Company’s Board of Directors and committees on which such director served during the year ended December 31, 2013. In addition, the Bank’s Board of Directors held nine regular meetings and six special meetings during 2013.

The Executive Committee met four times during 2013. As of the date of this Proxy Statement, the Executive Committee consists of Directors Sidney R. Brown (Chairman), Peter Galetto, Jr., Eli Kramer, and Wilbur L. Ross, Jr.

The Compensation Committee met 13 times during 2013. As of the date of this Proxy Statement, the Compensation Committee consists of Directors Kramer, Coscia and Norcross. Director Ross serves in a nonvoting observer capacity.

The Audit Committee met 11 times during 2013. This committee currently consists of Directors Kass (Chairman), Creasey, Galetto, Kramer and Stock. The Board of Directors has determined that Mr. Kass meets the definition of an audit committee financial expert under the regulations of the SEC.

The Nominating and Corporate Governance Committee met three times during 2013. This committee currently consists of Directors Marino, Galetto, Kramer and Ross.

Each member of the Compensation Committee, Audit Committee and Nominating and Corporate Governance Committee is independent in accordance with the requirements of the NASDAQ Listing Rules. Each of these committees operates under a written charter, copies of which are available on the Company’s website at www.sunnb.com.

Compensation Committee Interlocks and Insider Participation

Company directors who served as members of the Compensation Committee of the Company’s Board of Directors during the year ended December 31, 2013 were Eli Kramer (Chair), Anthony R. Coscia and Philip A. Norcross.

None of the individuals who served on the Compensation Committee during 2013 was an executive officer of another company whose board of directors has a comparable committee on which one of the Company’s executive officers serves. In addition, during 2013, no executive officer of the Company was a member of a comparable compensation committee of a company of which any of the directors of the Company is an executive officer.

Director Nomination Process

The Nominating and Corporate Governance Committee gives a recommendation to the Board of Directors of the persons to be nominated by the Company for election. In seeking to add two new members during 2013 and 2014, the Nominating and Corporate Governance Committee elected to retain an executive search firm to identify qualified candidates for the positions to be filled. The Nominating and Corporate Governance Committee reviewed many resume’s and interviewed a pool of candidates. From that pool, the Nominating and Corporate Governance Committee selected two individuals to be recommended to the Board for nomination. The Nominating and Corporate Governance Committee’s process for identifying and evaluating potential nominees includes soliciting recommendations from directors and officers of the Company and the Bank. Additionally, the Nominating and Corporate Governance Committee will consider persons recommended by shareholders of the Company in selecting the Nominating and Corporate Governance Committee’s nominees for election. There is no difference in the manner in which the Nominating and Corporate Governance Committee evaluates persons recommended by directors or officers and persons recommended by shareholders in selecting Board nominees.

To be considered in the Nominating and Corporate Governance Committee’s selection of Board nominees, recommendations from shareholders must be received by the Company in writing at least 120 days prior to the date the proxy statement for the previous year’s annual meeting was first distributed to shareholders. Recommendations should identify the submitting shareholder, the person recommended for consideration and the reasons the submitting shareholder believes such person should be considered. The Nominating and Corporate Governance Committee believes potential directors should have industry expertise in areas of corporate governance, finance, banking, accounting, the economy, real estate, general business and other areas of importance to the Company, along with familiarity and knowledge of the business, political and economic environments for the markets the Bank serves, and the ability to provide management with guidance on the development and oversight of strategy. The Nominating and Corporate Governance Committee and the Board of Directors may consider diversity in market knowledge, background, experience, qualifications, and other factors as part of its evaluation of each candidate.

Shareholder Communications

The Board of Directors does not have a formal process for shareholders to send communications to the Board. In view of the infrequency of shareholder communications to the Board of Directors, the

Board does not believe that a formal process is necessary. Written communications received by the Company from shareholders are shared with the full Board no later than the next regularly scheduled Board meeting. The Board encourages, but does not require, directors to attend the annual meetings of shareholders. Nine members of the Board of Directors attended the 2013 Annual Meeting of Shareholders.

Code of Ethics

The Company has adopted a Code of Ethics and Conduct that applies to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. A copy of the Code of Ethics and Conduct is posted at the Company’s website at www.sunnb.com.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis describes the material elements of the Company’s compensation program for the last fiscal year applicable to the principal executive officers, principal financial officer and the three other most highly compensated executive officers whose total compensation exceeded $100,000 in the fiscal year ended December 31, 2013 in all capacities with the Company and Bank, which are included in the summary compensation table (referred to as the “Named Executive Officers” or the “named officers”).

Executive Summary: 2013 was a year of transition for Sun National Bank, which was able to make progress amid intense competition among banks, weak economic growth and the ongoing impact of regulatory changes. The transition involved methodically reducing the level of problem loans, enhancing the management team and Board of Directors, rewriting loan policies and procedures, implementing a new enterprise risk management framework, and ongoing implementation of a new risk rating policy among other important foundational changes. Although the Bank did not meet expectations for positive earnings this past year, we had significant reductions in problem loans and saw continued success with ongoing workout strategies. We met goals for commercial loan production, achieved growth in our retail division and introduced new products and services for business and consumer customers. Largely due to a rise in interest rates, we saw a material reduction in mortgage banking activity in the second half of 2013, and we right sized the platform for the resulting lower production volumes. In furtherance of the Company’s efforts to increase risk and compliance infrastructure, the Company’s investment in professional fees ran roughly three times higher than normal for the year but are expected to moderate in 2014. The Bank remains above regulatory required minimum capital levels to be deemed well capitalized and will continue to strive to maintain prudent levels of risk. Going into 2014, the Company will continue to focus on returning to profitability by increasing loan origination capacity, growing loan portfolio outstandings, improving operational effectiveness, continuing risk reduction efforts and reducing expenses.

The Compensation Committee continued to focus on rewarding activities which promote safe growth of long-term shareholder value and the recruitment and retention of talented executives to further execute the Company’s strategic plan. Such actions included:

| · | Granting stock options and stock awards to various newly hired members of senior management in order to align the interests of such management with the long-term interests of shareholders. In order to continue to have a sufficient pool of shares available for such purposes, including compensation to be paid to our new President and Chief Executive Officer, upon the commencement of his employment, shareholders will be requested to approve an amendment to |

| | the 2010 Stock-Based Incentive Plan. See “Proposal III – Approval of an Amendment to the 2010 Stock-Based Incentive Plan.” |

| · | Under the Company’s 2010 Performance Equity Plan (the “2010 Performance Equity Plan” or “Performance Equity Plan”), the performance incentives required that the Company’s return on assets target metrics be achieved by December 31, 2013 in order for such equity awards to be earned or such awards were to be forfeited. As of December 31, 2013, target metrics had not been achieved, which resulted in the forfeiture of all outstanding stock option awards made pursuant to the Performance Equity Plan. Shares underlying such options were returned to plan reserves under the terms of the Performance Equity Plan. Accordingly, shareholders are being requested to approve a new performance equity plan/program at the Annual Meeting. See “Proposal II – Approval of the Sun Bancorp, Inc. 2014 Performance Equity Plan.” |

| · | The Compensation Committee reviewed its Charter and made revisions deemed appropriate to promote the effective management and oversight of the Company’s incentive compensation and risk management and general corporate governance. |

| · | Aligning annual cash and equity award opportunities to weighted quantitative and qualitative performance objectives that drive and reward the achievement of the Bank’s safety and soundness objectives. |

| · | Establishing a retention plan and granting stock awards to Executive Management (as defined below) and select senior officers. |

Shareholder Advisory Votes on Compensation. At the 2011 annual meeting of shareholders, the shareholders approved the advisory vote on the Company’s executive compensation policies and practices as disclosed in the proxy statement for the 2011 annual meeting by more than 98% of the shares voting on the matter. In addition, the shareholders approved an advisory vote recommending that such advisory vote be taken every three years by more than 75% of the shares voting on the matter. The Company intends to follow this advisory vote on the three year frequency of such shareholder advisory votes. Accordingly, the Proxy Statement includes another advisory vote on the Company’s executive compensation policies and practices. See “Proposal IV – Approval of a Non-Binding Advisor Vote on Executive Compensation.”

Compensation Philosophy and Objectives. The underlying goal of the Company’s compensation program is to promote increases in long-term shareholder value by closely aligning the financial interests of the Company and its shareholders with the Named Executive Officers and other members of executive management (collectively, “Executive Management”).

In accordance with the Charter of the Company’s Compensation Committee, the Compensation Committee seeks to design and administer executive compensation programs that will achieve the following primary objectives:

| · | Support a pay-for-performance policy that differentiates compensation based on corporate and individual performance; |

| · | Motivate employees to assume increased responsibility and reward them for their achievement; |

| · | Provide total compensation opportunities that are comparable to those offered by other leading companies, allowing the Company to recruit and retain top quality, dedicated executives who are |

| | critical to its long-term success; |

| · | Align the interests of executives with the long-term interests of shareholders by providing executives with equity award opportunities that will result in favorable long-term compensation opportunities as long-term shareholder value grows; |

| · | Annually, the Company establishes specific financial performance targets as well as non-financial targets such as the Bank’s level of compliance with safety and soundness regulations, credit quality and adhering to other regulatory standards that are defined by the Compensation Committee and incorporated into the budgeting and planning process. The Company’s goal is to promote and administer a comprehensive pay-for-performance program consistent with such financial performance targets and the goals of the Bank; and |

| · | Monitor the incentive compensation programs applicable to Executive Management and all employees to ensure that such programs do not expose the Company to unnecessary or excessive risk and to implement policies and practices that may help manage and monitor such risk within acceptable and pre-established parameters. |

The Company’s compensation program is designed to promote performance by the Named Executive Officers and the entire Executive Management group as a team. For 2013, as set by the Compensation Committee, performance of the Named Executive Officers under the Company’s Annual Cash Incentive Plan (the “Annual Cash Incentive Plan”) was evaluated based upon weighted quantitative and qualitative goals: 60% on protecting the institution, which relates to regulatory safety and soundness and includes regulatory compliance and stabilizing asset quality, 20% weighted on net income, and 20% on strategic initiatives. Each year the Compensation Committee reviews the weightings and goals of this plan to ensure alignment with the Company’s goals. Protecting the institution is the primary goal under the Annual Cash Incentive Plan and all measures related to achieving and maintaining regulatory safety and soundness must be achieved in order for the plan to be funded.

The Company strives to provide each Named Executive Officer with a total compensation opportunity that the Compensation Committee deems to be market competitive with comparably-sized community banks, both nationally and regionally, assuming the Company’s performance metrics are at budgeted, targeted levels. The Company believes that this market positioning is appropriate to attract and retain top-caliber talent in a highly competitive labor market for executive staff.

The Company maintains programs to create short-term and longer-term incentive compensation opportunities for its Executive Management. In recognition of the need to retain key employees, the Company has a stock-based incentive plan, pursuant to which stock options and stock awards are made to Named Executive Officers and other members of the Executive Management team, consistent with the Company’s long-term compensation goals. Stock awards were made to Named Executive Officers in 2013. Generally, such equity awards become earned and non-forfeitable over a two, four or five year period in order to serve as a retention tool in addition to a compensation incentive.

Role of the Compensation Committee. The Compensation Committee’s primary responsibilities are to assist the Board of Directors in discharging its responsibilities relating to compensation of the Company’s Executive Management and to ensure that the compensation plans of the Company do not promote unnecessary or excessive risk. The Committee determines policies and decisions relative to salary, annual cash incentives, long-term equity-based incentives and other compensation programs for Executive Management, while taking into account appropriate risk management. The Chief Executive Officer’s compensation is evaluated by the Compensation Committee and approved by the Board of Directors.

The Compensation Committee has periodically engaged compensation consultants and advisors to provide advice on both director and executive compensation issues and has the authority to retain advisors as needed. During 2013, the Compensation Committee received guidance from Pearl Meyer & Partners regarding compensation paid to a President and CEO of financial institutions with assets of between $2 billion and $10 billion.

Disclosure of Role of Compensation Consultants and potential conflicts of interest assessment. During 2013, the Compensation Committee received guidance from Pearl Meyer & Partners regarding the appropriate level and structure of compensation paid to a President and CEO. Prior to engaging this consultant, the Compensation Committee considered the independence of Pearl Meyer & Partners in light of NASDAQ listing standards related to the Compensation Committee. The Compensation Committee also requested and received a letter from Pearl Meyer & Partners addressing the consulting firm’s independence, including the following factors: (1) other services provided to us by the consultant; (2) fees paid by us as a percentage of the consulting firm’s total revenue; (3) policies or procedures maintained by the consulting firm that are designed to prevent a conflict of interest; (4) any business or personal relationships between the individual consultants involved in the engagement and a member of the Compensation Committee; (5) any Company stock owned by the individual consultants involved in the engagement; and (6) any business or personal relationships between our executive officers and the consulting firm or the individual consultants involved in the engagement. The Compensation Committee discussed these considerations and concluded that the work of the consultant did not raise any conflict of interest.

Role of Executives in Compensation Committee Deliberations. The Compensation Committee maintains a dialogue with the Company’s Chairman, or his designee, to assist in analyzing existing compensation programs and studying proposed compensation program changes. During 2013, Mr. Sidney Brown served as the Chairman’s designee until such time that he was seated as the Company’s Chairman, at which time he continued to serve in such role as Chairman. In December, Mr. Brown also began serving as Interim President and Chief Executive Officer. Mr. Brown has provided guidance to the Compensation Committee regarding Executive Management performance evaluation, bonus plan recommendations, and other executive compensation matters. As appropriate, the Committee requests the presence of the Company’s Chairman or his designee and/or its President and Chief Executive Officer at Committee meetings to discuss executive compensation matters and to evaluate Company and individual performance. Occasionally, other executives may be requested to attend a Committee meeting to provide pertinent financial, tax, accounting, peer data or operational information. Executives in attendance may provide their insights and suggestions, but only independent Compensation Committee members may vote on decisions regarding executive compensation.

The Compensation Committee discusses the compensation of the Company’s President and CEO, or person acting in this role, directly with him, but final deliberations and all votes regarding his or her compensation are made in executive session, without the President and Chief Executive Officer, or person acting in this role, being present. The Compensation Committee also determines the compensation for the other Named Executive Officers, based on the President and Chief Executive Officer’s recommendations and input from outside advisors and counsel when deemed necessary or appropriate. The Named Executive Officers as of December 31, 2013 are: Sidney R. Brown, Chairman of the Board of Directors, Interim President and Chief Executive Officer, Thomas R. Brugger, Executive Vice President and Chief Financial Officer, Alberino J. Celini, Executive Vice President and Chief Risk Officer, Michele B. Estep, Executive Vice President and Chief Administrative Officer, Bradley J. Fouss, Executive Vice President, Wholesale Banking, and Thomas X. Geisel, former President and Chief Executive Officer.

Compensation Framework. In developing and administering the Company’s executive compensation policies and programs, the Compensation Committee considers the following three aspects of the Compensation program:

| · | Pay components - each element of total compensation, including the rationale for each component and how each component relates to the total compensation structure; |

| · | Pay level - the factors used to determine the total compensation opportunity, or potential payment amount at different performance levels, for each pay component; and |

| · | Relationship of executive compensation to performance - how the Company determines appropriate performance measures and goals for incentive plan purposes, as well as how pay levels change as a function of performance. |

Pay Components. The Company’s executive compensation program includes the components listed below:

| · | Salary - a fixed base salary generally set at competitive levels that reflect each executive’s position, individual performance, experience, and expertise. Such base salary levels are reviewed annually by the Compensation Committee; |

| · | Annual Cash Incentive Plan - a bonus pay program that varies based on individual, team and Company performance against annual business objectives; the Company communicates the associated performance metrics, goals, and bonus award opportunities to Executive Management as early in the fiscal year as is practical using the evaluation factors previously referenced. Final bonus determinations are made following the end of each fiscal year based upon a review of the stated performance metrics and bonus opportunities as well as the discretionary considerations of the Compensation Committee; |

| · | Long-Term Incentives - equity-based awards with the compensation values driven by the long-term market performance of the Company’s stock price in order to align Executive Management pay with long-term shareholder interests; |

| · | Management Agreements - These agreements detail the rights and obligations of the employer and Executive Management in the event of termination of employment following a change in control transaction or other involuntary termination of employment; and |