UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

ProsoftTraining

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notes:

ProsoftTraining

410 North 44th Street, Suite 600

Phoenix, Arizona 85008

602-794-4199

Notice of Annual Meeting of Shareholders

To be Held February 7, 2003

TO OUR STOCKHOLDERS:

The Annual Meeting of Stockholders ofProsoftTraining will be held on February 7, 2003, at 2:00 p.m. local time at our headquarters office, located at 410 North 44th Street, Suite 600, Phoenix, Arizona, for the following purposes:

| | 1. | To elect one Class III director to the Board of Directors to hold office for a three-year term; and |

| | 2. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record at the close of business on December 13, 2002 are entitled to notice of, and to vote at, the meeting. All stockholders are cordially invited to attend the meeting. Our Bylaws require that the holders of a majority of the outstanding shares of our common stock entitled to vote be represented in person or by proxy at the meeting in order to constitute a quorum for the transaction of business. Regardless of whether you expect to attend the meeting, you are requested to sign, date and return the accompanying proxy card. You may still attend and vote in person at the annual meeting if you wish, even though you may have submitted your proxy prior to the meeting. If you attend the meeting and wish to vote in person, you must revoke your proxy and only your vote at the meeting will be counted. Thank you in advance for the prompt return of your proxy.

By Order of the Board of Directors,

Robert G. Gwin

Chairman of the Board

Phoenix, Arizona

January 8, 2003

ProsoftTraining

410 North 44th Street, Suite 600

Phoenix, Arizona 85008

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

SOLICITATION, EXERCISE AND REVOCATION OF PROXIES

The accompanying proxy is solicited on behalf of our Board of Directors to be voted at the Annual Meeting of Stockholders to be held at our headquarters office, located at 410 North 44th Street, Suite 600, Phoenix, Arizona, on February 7, 2003, at 2:00 p.m. local time, and any and all adjournments or postponements thereof. In addition to the original solicitation by mail, certain of our employees may solicit proxies by telephone or in person. No specially engaged employees or solicitors will be retained for proxy solicitation purposes. All expenses of this solicitation, including the costs of preparing and mailing this proxy statement and the reimbursement of brokerage firms and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners of shares, will be borne by us. You may vote in person at our annual meeting, if you wish, even though you have previously mailed in your proxy. This proxy statement and the accompanying proxy are being mailed to stockholders on or about January 8, 2003. Unless otherwise indicated, “we,” “us” and “our” mean ProsoftTraining.

All duly executed proxies will be voted in accordance with the instructions thereon. Stockholders who execute proxies, however, retain the right to revoke them at any time before they are voted. The revocation of a proxy will not be effective until written notice thereof has been given to our Secretary unless the stockholder granting such proxy votes in person at our annual meeting.

VOTING OF SECURITIES

The record date for the determination of stockholders entitled to vote at our annual meeting is December 13, 2002. As of such date, we had outstanding 24,197,414 shares of our common stock, $0.001 par value per share. Our common stock is the only class of our stock outstanding and entitled to vote at our annual meeting. Each stockholder is entitled to one vote for each share of our common stock held. All votes on the proposal set forth below will be taken by ballot. For purposes of the votes on the proposal set forth below, the holders of a majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum at our meeting. The stockholders present at our annual meeting may continue to transact business until adjournment, notwithstanding the subsequent withdrawal of enough stockholders to leave less than a quorum or the refusal of any stockholder present in person or by proxy to vote or participate in our annual meeting. Abstentions and broker non-votes (i.e. the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on any particular matter) will be counted as present for purposes of determining the presence or absence of a quorum for the transaction of business. Directors will be elected by a favorable vote of a plurality of the shares of voting stock present and entitled to vote, in person or by proxy, at the Annual Meeting.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, STOCKHOLDERS ARE REQUESTED TO SIGN, DATE AND RETURN THE PROXY CARD AS SOON AS POSSIBLE, WHETHER OR NOT THEY EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON.

1

PROPOSAL 1

ELECTION OF ONE CLASS III DIRECTOR

General

One director is proposed for election at our annual meeting. That person is currently a director. Our Bylaws provide for a Board of Directors of not less than three nor more than twenty-five directors. The current number is set at five. Vacancies on our board shall be filled solely by the majority vote of directors then in office.

Our board is divided into three classes as nearly equal in size as is practicable, designated Class I, Class II and Class III. Directors hold office for staggered terms of three years (or less if they are filling a vacancy) and until their successors are elected and qualified. One of the three classes is elected each year to succeed the directors whose terms are expiring. The term of office of the Class III director elected at this meeting will expire at the 2005 annual meeting. The term of office of the Class II directors will expire at the 2004 annual meeting and the term of office of the Class I directors will expire at the 2003 annual meeting. Directors in each class shall hold office until such annual meeting of stockholders or until his or her successor is elected and has qualified. When these terms expire, persons nominated to serve as director shall be elected to hold office for three years.

Proxies solicited by our board will be voted for the election of the nominee, unless you withhold your vote on your proxy card. However, if the nominee should become unavailable for election (management has no reason to believe that the nominee will be unable to serve), our board may reduce the size of the board or designate a substitute nominee. If the board designates a substitute, shares represented by the proxies will be voted for the substitute nominee. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter.

Board Recommendation

The board recommends that you voteFOR the following nominee for election as a Class III director:

Dr. Edward Walsh, 63. Dr. Walsh has served as a Director since December 1999. Dr. Walsh is the chairman of the Irish Council for Science Technology and Innovation and the chairman of Growcorp, a software incubation organization in Ireland. He also serves on the board of a number of private and public organizations. He was founding president of the University of Limerick, the first new university established by the Republic of Ireland, a post from which he stepped down in l998 after a 28-year term. Dr. Walsh is a graduate of the National University of Ireland and holds Masters and Doctorate qualifications in nuclear and electrical engineering from Iowa State University, where he was an Associate of the US Atomic Energy Commission Laboratory.

OTHER BOARD OF DIRECTORS INFORMATION

Other Directors

Class I Directors:

J. William Fuller, 50. Mr. Fuller has served as a director since December 1998. Mr. Fuller is a Registered Investment Advisor and owner of Fuller Capital Management LLC, a money management firm founded in 1983. Mr. Fuller has been active in venture capital and private investment banking ventures for the past 16 years. Additionally, he is a registered representative of Cambridge Investment Research, a registered broker dealer. Mr. Fuller graduated from Southern Methodist University with a BA in Philosophy in 1974.

Robert G. Gwin, 39. Mr. Gwin is Chairman of the Board, President and Chief Executive Officer. Mr. Gwin joined us in August 2000 as our Chief Financial Officer, was promoted to Executive Vice President and Chief

2

Financial Officer in October 2001 and to President and Chief Financial Officer in May 2002. He has been our Chief Executive Officer and a director since December 5, 2002. Prior to joining Prosoft, he served as Managing Director of Prudential Capital Group, an asset management unit of The Prudential Insurance Company of America. He joined Prudential Capital in 1990, ultimately assuming management of its Dallas-based private investment activities, including both day-to-day operating responsibility and investment portfolio oversight. Mr. Gwin graduated from the University of Southern California with a BS in Business Administration in 1985, earned an MBA from the Fuqua School at Duke University in 1990 and is a Chartered Financial Analyst (CFA).

Class II Directors:

Jeffrey G. Korn, 45. Mr. Korn has served as a director since June 1997. He is an attorney in private practice and a consultant. Mr. Korn was our General Counsel from May 2000 to October 2001. Prior to May 2000, he was a partner in the law firm of Kosto & Rotella, P.A. in Jacksonville, Florida, which he joined in 1983. Mr. Korn specialized in corporate law and dispute resolution. He graduated from the State University of New York at New Paltz with a BA in Political Science in 1979, and received a JD degree from Stetson University in 1982.

Charles P. McCusker, 33. Mr. McCusker has served as a director since December 1998. Currently, Mr. McCusker serves as the President of the ServiceMaster Home Service Center. Since 1997, Mr. McCusker has been responsible for investment opportunities in for-profit education and electronic commerce at ServiceMaster Venture Fund, the venture capital arm of ServiceMaster Company. Prior to that, Mr. McCusker spent three years as a Vice President of Bengur Bryan & Co., Inc., a venture capital and private equity firm. Mr. McCusker graduated from Virginia Tech with a BS in Mechanical Engineering in 1992, and earned an MBA from the University of Chicago in 1998.

Board Committees and Meetings

The board has appointed from among its members three standing committees:

The Compensation Committee is presently composed of Jeffrey G. Korn, who serves as chairperson of the committee, Charles P. McCusker and J. William Fuller. No member of the Compensation Committee is an employee or officer. The principal functions of this committee are to review and approve our organization structure, review performance of our officers and establish overall employee compensation policies. This committee also reviews and approves compensation of directors and our corporate officers, including salary, bonus, and stock option grants, and administers our stock plans. The Compensation Committee met two times during the fiscal year ended July 31, 2002.

The Audit Committee is presently composed of J. William Fuller, who serves as chairperson, Charles P. McCusker, and Dr. Edward Walsh. No member of the Audit Committee is an employee or officer. The functions of the Audit Committee include, among other things, reviewing our annual and quarterly financial statements, reviewing the results of each audit and quarterly review by our independent public accountants, reviewing our internal audit activities and discussing the adequacy of our accounting and control systems. Our board has adopted a written audit committee charter. The Audit Committee met four times during the fiscal year ended July 31, 2002.

The Nominating Committee is presently composed of Dr. Edward Walsh, who serves as chairperson, and Jeffrey G. Korn. The principal functions of the Nominating Committee are to recommend persons for membership on the board and to establish criteria and procedures for selection of new directors. The Nominating Committee met once during the fiscal year ended July 31, 2002.

During fiscal year 2002, our board held nine meetings in person or by telephone. Members of our board are provided with information between meetings regarding our operations and are consulted on an informal basis with respect to pending business. Each director attended at least 75% of the total number of meetings of our board and the total number of meetings held by all committees of our board on which such director served during the year. The Board has determined that all members of the Audit Committee are “independent directors” as that term is defined in Rule 4200 of the listing statutes of the National Association of Securities Dealers.

3

Director Compensation

Each non-employee director is entitled to receive a stock option grant for 5,000 shares of our common stock for each board meeting attended, effective June 2002. Prior to June 2002, no compensation was provided. Directors are reimbursed for expenses incurred in connection with attendance at board and committee meetings.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table and the notes thereto set forth certain information regarding the beneficial ownership of our common stock as of December 13, 2002, by (i) each current director; (ii) each executive officer named in the summary compensation table included herein; (iii) all of our current directors and executive officer as a group; and (iv) each person who is known by us to be a beneficial owner of five percent or more of our common stock.

| | | Shares Beneficially Owned

|

Name and Address of Beneficial Owner (1)

| | Number (2)

| | Percent

|

Hunt Capital Growth Fund II, L.P (3)

1601 Elm, Suite 4000

Dallas, Texas 75201 | | 5,088,339 | | 18.2 |

Fidelity Management & Research

82 Devonshire St.

Boston, MA 02109 | | 2,276,500 | | 9.4 |

| J. William Fuller (4) | | 91,791 | | * |

| Robert G. Gwin (5) | | 318,418 | | 1.3 |

| Jeffrey G. Korn (6) | | 416,553 | | 1.7 |

| Charles McCusker (7) | | 110,245 | | * |

| Dr. Edward Walsh (8) | | 128,800 | | * |

| Jerrell M. Baird (9) | | 20,000 | | * |

| All directors and executive officer, as a group (10) | | 1,065,807 | | 4.3 |

| * | Less than 1% of the outstanding shares of common stock |

| (1) | The address for all officers and directors is 410 North 44th Street, Suite 600, Phoenix, Arizona 85008. |

| (2) | Unless otherwise indicated, the named persons possess sole voting and investment power with respect to the shares listed (except to the extent such authority is shared with spouses under applicable law). The percentages are based upon 24,197,414 shares outstanding as of December 13, 2002, except for certain parties who hold options and warrants that are presently exercisable or exercisable within 60 days, are based upon the sum of shares outstanding as of December 13, 2002 plus the number of shares subject to options and warrants that are presently exercisable or exercisable within 60 days held by them, as indicated in the following notes. |

| (3) | Includes 3,459,119 shares subject to conversion rights (see “Certain Transactions”) and 350,000 shares subject to stock warrant agreements. |

| (4) | Includes 60,000 shares subject to stock options exercisable within 60 days, and 20,641 shares subject to stock warrant agreements. |

| (5) | Includes 245,498 shares subject to stock options exercisable within 60 days. |

| (6) | Includes 260,000 shares subject to stock options exercisable within 60 days. |

| (7) | Includes 38,995 shares owned by ServiceMaster Venture Fund L.L.C., of which 27,784 shares are subject to a stock warrant agreement. Includes 70,000 shares subject to stock options exercisable within 60 days. Mr. McCusker is President of a ServiceMaster subsidiary called ServiceMaster Home Service Center and is a general partner of ServiceMaster Venture Fund L.L.C. |

| (8) | Includes 70,000 shares subject to stock options exercisable within 60 days. |

| (9) | Includes 20,000 shares subject to a stock warrant agreement. |

| (10) | Includes 705,498 shares subject to stock options exercisable within 60 days, and 68,425 shares subject to stock warrant agreements. |

4

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Under Section 16(a) of the Securities Exchange Act of 1934, directors and certain officers, and beneficial owners of 10 percent or more of our common stock, are required from time to time to file with the Securities and Exchange Commission reports on Forms 3, 4 or 5, relating principally to holdings of and transactions in our securities by such persons. Based solely upon a review of Forms 3 and 4 and amendments thereto furnished to us during fiscal 2002 and thereafter, Forms 5 and amendments thereto furnished to us with respect to fiscal year 2002, and any written representations received by us from a director, officer or beneficial owner of 10 percent or more of our common stock that no Form 4 or 5 is required, we believe that all reporting persons filed on a timely basis the reports required by Section 16(a) of the Securities Exchange Act of 1934 during fiscal 2002.

EXECUTIVE OFFICER

Our current executive officer is as follows:

Name

| | Age

| | Position

|

| Robert G. Gwin | | 39 | | Chairman, President and Chief Executive Officer |

For additional information with respect to Mr. Gwin, who is a director of the Company, see “Other Board of Directors Information”.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth, for the years ended July 31, the compensation paid to our chief executive officer and our previous chief executive officer during the fiscal year.

| | | | | | | | | Long-Term Compensation Awards

| | |

Name and Principal Position

| | Fiscal Year

| | Salary

| | Bonus

| | Shares of Common Stock Underlying Stock Options

| | All Other Compensation (1)

|

Robert G. Gwin (2)

Chairman, President and

Chief Executive Officer | | 2002

2001 | | $

| 163,798

170,961 | | $

| 0

49,000 | | 200,000

385,000 | | $ | 3,051

34,499 |

|

Jerrell M. Baird (3)

Former Chairman and

Chief Executive Officer | | 2002

2001

2000 | |

| 194,231

200,000

200,051 | |

| 36,000

89,000

25,000 | | 200,000

364,000

36,000 | | | 4,550

6,647

3,088 |

| (1) | These amounts represent matching contributions made under our 401(k) retirement plan. For Mr. Gwin in fiscal year 2001, this amount also includes $30,000 for moving expense reimbursements. |

| (2) | Mr. Gwin joined us in August 2000 as Chief Financial Officer and became Chairman and Chief Executive Officer in December 2002. |

| (3) | Mr. Baird resigned as Chairman and Chief Executive Officer effective December 9, 2002. |

5

OPTION GRANTS TABLE

The following table sets forth information concerning options to purchase shares of our common stock granted to our named executive officers in the fiscal year ended July 31, 2002.

Executive Officer

| | Shares of Common Stock Underlying Stock Options (1)

| | % of Total Options Granted to Company Employees

| | Exercise Price Per Share (2)

| | Expiration Date

| | Grant Date Present Value (3)

|

| Robert G. Gwin | | 143,000 | | 15.3 | | $1.25 | | 1/02/12 | | $ | 128,700 |

| Robert G. Gwin | | 57,000 | | 6.1 | | 1.13 | | 1/02/12 | | | 51,870 |

| Jerrell M. Baird (4) | | 200,000 | | 21.4 | | 1.25 | | 1/02/12 | | | 180,000 |

| (1) | The options were granted under the ProsoftTraining 2000 Stock Option Plan for a term of no more than ten years, subject to earlier termination in certain events related to termination of employment. The options begin to vest on the first anniversary from the grant date, except for the 57,000 options granted to Mr. Gwin, of which 27,500 options vested on the date of the grant and 27,500 will vest on the first anniversary of the grant date. To the extent not already exercisable, the options generally become exercisable upon a merger or consolidation of the Company with or into another corporation, or upon the acquisition by another corporation or person of all or substantially all of the Company’s assets. |

| (2) | All options were granted at fair market value (the last price for the Company’s Common Stock as reported by NASDAQ on the day previous to the date of grant). |

| (3) | As suggested by the SEC’s rules on executive compensation disclosure, the Company used the Black-Scholes model of option valuation to determine grant date pre-tax present value. The calculation is based on a five-year term and upon the following assumptions: annual dividend growth of zero percent, volatility of approximately 124%, and an interest rate of 4.2%. There can be no assurance that the amounts reflected in this column will be achieved. |

| (4) | Mr. Baird resigned as Chairman and Chief Executive Officer effective December 9, 2002. The 200,000 options have been returned to the Company. |

Equity Compensation Plan Information

The following table provides certain information as of July 31, 2002 with respect to the Company’s equity compensation plans under which equity securities of the Company are authorized for issuance.

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted average exercise price of outstanding options, warrants and rights

| | Number of securities remaining available for future issuances under plan

| |

| Equity compensation plans approved by security holders (1): | | 3,511,876 | | $3.83 | | 692,988 | (2) |

| Equity compensation plans not approved by security holders (3): | | 474,234 | | $1.25 | | 25,766 | |

| | |

| | | |

|

|

| Total | | 3,986,110 | | | | 718,754 | |

| | |

| | | |

|

|

| (1) | These plans consist of the 1996 Stock Option Plan, the 2000 Stock Incentive Plan and the Employee Stock Purchase Plan. |

| (2) | The number of shares reserved for issuance under the Employee Stock Purchase Plan is automatically increased on the first trading day of each calendar year by an amount equal to one half percent (.5%) of the total number of shares of Common Stock outstanding on the last trading day of the preceding calendar year, but in no event will any such annual increase exceed 150,000 shares. As of July 31, 2002, 248,426 shares are reserved for issuance under the Employee Stock Purchase Plan. |

| (3) | This plans consists of the 2001 Stock Option Plan. Under the 2001 Stock Option Plan, which was adopted by the Board of Directors in July 2001, the number of shares of Common Stock that may be optioned and sold is 500,000 shares. The Plan is administered by the Company’s Board of Directors, which determines when and to whom options will be granted and, subject to the terms of the Plan, the exercise price, vesting schedule, expiration date and other terms of each such grant. All of the Company’s employees, other than Officers and Directors, and consultants are eligible to receive option grants under the Plan. Options granted under the Plan have an exercise price equal to fair market value on the date of grant and may not have a term in excess of ten years. |

6

AGGREGATED OPTIONS EXERCISED IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

The following table sets forth information regarding the exercisable and unexercisable options to acquire our common stock granted to our named executive officers.

Name

| | Shares Acquired on Exercise

| | Value Realized

| | Number of Unexercised Options at July 31, 2002

| | Value of Unexercised In-the-Money Options at July 31, 2002 (1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Robert G. Gwin | | — | | — | | 160,811 | | 424,189 | | — | | — |

| Jerrell M. Baird (2) | | — | | — | | 400,000 | | 450,000 | | — | | — |

| (1) | Represents the difference between the fair market value of the shares underlying such options at fiscal year- end ($0.28) and the exercise price of such options. |

| (2) | Mr. Baird resigned as Chairman and Chief Executive Officer effective December 9, 2003. All of the options held by Mr. Baird have been returned to the Company. |

Employment and Separation Agreements and Change in Control Arrangements

On February 1, 2002, we entered into an employment agreement with Jerrell M. Baird, who at that time was our Chairman of the Board and Chief Executive Officer. Mr. Baird’s agreement had a term of one year and provided for a base annual salary of $200,000. Mr. Baird was eligible to receive an annual bonus, at the discretion of the Board of Directors, of up to $100,000. In the event of termination of Mr. Baird’s employment for any reason other than gross negligence or malfeasance, we were obligated to pay an amount equal to his cash compensation for the previous twelve months, plus acceleration and immediate vesting of all unvested options. Also, if a change of control of the Company were to occur where Mr. Baird was not Chairman and Chief Executive Officer of the ultimate parent company, then a payment of $300,000 would be due to be made to Mr. Baird and all his unvested options would have vested.

On December 9, 2002, we entered into a separation agreement with Mr. Baird. The agreement provided for the resignation of Mr. Baird as Chairman of the Board and Chief Executive Officer, effective December 9, 2002. The agreement also provided for a payment of $50,000 on March 1, 2003, in lieu of the severance payment Mr. Baird was entitled to under his February 1, 2002 employment agreement. Also, we agreed that through July 31, 2003, if a change of control of the Company occurs with the party that we had agreed to negotiate with exclusively through November 29, 2002, Mr. Baird would be entitled to a $183,000 payment upon the completion of the change of control. In addition, Mr. Baird returned all of his stock options to the Company.

On July 17, 2000, we entered into an employment agreement with Robert G. Gwin, which was subsequently amended on October 29, 2001, appointing Mr. Gwin our Executive Vice President and Chief Financial Officer. This agreement provided for a base annual salary of $180,000 and an annual bonus of up to $72,000 pursuant to certain stock price and operating performance criteria being achieved. On May 5, 2002, Mr. Gwin was appointed President and Chief Financial Officer. On December 5, 2002 we entered into an amended employment agreement with Mr. Gwin appointing him President and Chief Executive Officer. This agreement terminates July 31, 2003 and provides for a base annual salary of $200,000 and an annual bonus of up to $100,000 pursuant to certain operating and cash management metrics being achieved. In the event of termination of Mr. Gwin’s employment for any reason other than gross negligence or malfeasance, the Company is obligated to pay an amount equal to his cash compensation for the previous twelve months, plus acceleration and immediate vesting of all unvested options. In addition, if a change of control of the Company occurs where Mr. Gwin is not Chief Executive Officer of the ultimate parent company, then a payment shall be made to Mr. Gwin equal to $300,000. In addition, all of Mr. Gwin’s unvested options shall vest upon any change of control.

7

COMPENSATION COMMITTEE REPORT

Overview and Philosophy

The Compensation Committee of the Board of Directors reviews and establishes compensation strategies and programs to ensure that we attract, retain, properly compensate, and motivate qualified executives and other key associates. The Committee consists of Mr. Korn, its chairperson, Mr. McCusker and Mr. Fuller. No member of this committee is an employee or officer.

The philosophy of the Compensation Committee is (i) to provide competitive levels of compensation that integrate pay with the individual executive’s performance and the Company’s annual and long-term performance goals; (ii) to motivate key executives to achieve strategic business goals and reward them for their achievement; (iii) to provide compensation opportunities and benefits that are comparable to those offered by other companies in the training and education industry, thereby allowing us to compete for and retain talented executives who are critical to our long-term success; and (iv) to align the interests of key executives with the long-term interests of stockholders and the enhancement of stockholder value through the granting of stock options. The compensation of our executive officer is currently comprised of annual base salary, a bonus plan pursuant to certain performance criteria being achieved, and long-term performance incentives in the form of stock option grants under the stock option plans.

Chief Executive Officer Compensation

The Compensation Committee set the 2002 annual compensation for our former Chief Executive Officer, Mr. Baird and our current Chief Executive Officer, Mr. Gwin. See “Employment and Separation Agreements and Change in Control Arrangements”.

Mr. Baird’s employment agreement had a term of one year and provided for a base annual salary of $200,000 and an annual bonus, at the discretion of the Board of Directors, of up to $100,000.

Mr. Gwin’s employment agreement terminates on July 31, 2003 and provides for a base annual salary of $200,000 and an annual bonus of up to $100,000 pursuant to certain operating and cash management metrics being achieved. In the event of termination of Mr. Gwin’s employment for any reason other than gross negligence or malfeasance, we are obligated to pay an amount equal to his cash compensation for the previous twelve months, plus acceleration and immediate vesting of all unvested options. Further, we have agreed that if a change of control of the Company occurs where Mr. Gwin is not Chief Executive Officer of the ultimate parent company, then a payment shall be made to Mr. Gwin equal to $300,000. In addition, all of Mr. Gwin’s unvested options shall vest upon any change of control.

By the Compensation Committee,

Jeffrey G. Korn, Chairperson

Charles P. McCusker

J. William Fuller

January 3, 2003

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The members of the Compensation Committee during the fiscal year ended July 31, 2002 were Charles P. McCusker, J.R. Holland, Jeffrey G. Korn and Dr. Edward Walsh. Mr. Holland resigned from the Board of Directors in November 2002. Each member of the Compensation Committee during fiscal 2002 was a non-employee director of the Company while serving on the Committee. Mr. Korn was our General Counsel from May 2000 to October 2001.

J.R. Holland, Jr., a former director of the Company, is President and CEO of Hunt Capital Management, LLC. In October 2001, the Company received $2,500,000 for a 10% Subordinated Secured Convertible Note in that principal amount issued to Hunt Capital Growth Fund II, L.P., an affiliate of Hunt Capital Management, LLC. See “Certain Transactions”.

8

AUDIT COMMITTEE REPORT

The Audit Committee’s role is to act on behalf of the Board of Directors in the oversight of all aspects of our financial reporting, internal control and audit functions. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report for fiscal year 2002 with management.

The Audit Committee also reviewed with Grant Thornton LLP, our independent auditors, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards (including Statement on Auditing Standards No. 61). In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1. The Audit Committee has also considered whether the provision of non-audit services by Grant Thornton LLP is compatible with their independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended July 31, 2002 for filing with the Securities and Exchange Commission.

By the Audit Committee,

J. William Fuller, Chairperson

Charles P. McCusker

Dr. Edward Walsh

January 3, 2003

FEES PAID TO INDEPENDENT AUDITORS

Audit Fees

The aggregate fees billed for professional services rendered by Grant Thornton LLP for the audit of the Company’s annual financial statements for the fiscal year ended July 31, 2002 and the reviews of the financial statements included in the Company’s Form 10-Q’s for such fiscal year were $110,026.

Financial Information Systems Design and Implementation Fees

No fees were billed for professional services rendered by Grant Thornton LLP for financial information systems design and implementation services for the fiscal year ended July 31, 2002.

All Other Fees

The aggregate fees billed for services rendered by Grant Thornton LLP, other than the services referred to above, for the fiscal year ended July 31, 2002 were $6,080.

9

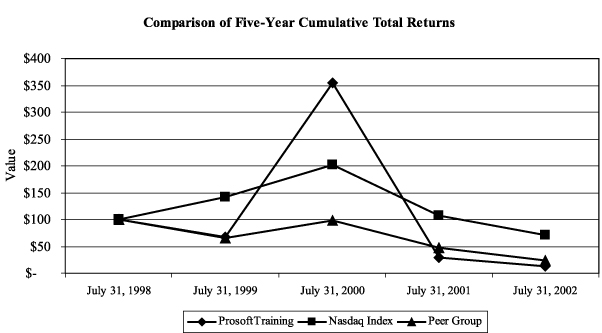

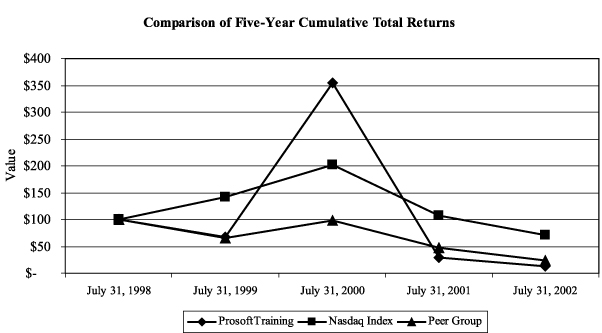

COMPANY STOCK PRICE PERFORMANCE

The graph set forth below compares the cumulative total return as of the end of the Company’s most recent fiscal year on $100 invested in our common stock, the NASDAQ Composite Index (“NASDAQ Index”), and an industry peer group on July 31, 1998, the first trading date, assuming the reinvestment of all dividends. The industry peer group used includes the following issuers: Click2Learn, Inc. (NASDAQ: CLKS); Provant, Inc. (NASDAQ: POVT); Insightful Corporation (NASDAQ: IFUL); V Campus Corporation (NASDAQ: VCMP); and EDT Learning, Inc. (AMEX: EDT). Not included in the Peer Group calculation for 2002 is Learn2.com, which was acquired during 2002 and is no longer a public company. EDT Learning, Inc. replaced Learn2.com in the Peer Group. The historical stock performance shown on the chart is not intended to and may not be indicative of future stock performance.

| | | July 31, 1998

| | July 31, 1999

| | July 31, 2000

| | July 31, 2001

| | July 31, 2002

|

| ProsoftTraining | | $100 | | $ 67 | | $354 | | $ 29 | | $12 |

| Peer Group | | $100 | | $ 65 | | $ 98 | | $ 47 | | $23 |

| NASDAQ Index | | $100 | | $141 | | $201 | | $108 | | $71 |

CERTAIN TRANSACTIONS

On October 16, 2001, the Company issued a $2,500,000 Subordinated Secured Convertible Note to Hunt Capital Growth Fund II, L.P. (“Hunt Capital”), which owned greater than five percent of the Company’s outstanding Common Stock at that time. J.R. Holland, Jr., a director of the Company until his resignation in November 2002, is President and CEO of Hunt Capital Management, LLC, an affiliate of Hunt Capital. The Note is secured by all of the assets of the Company, has a five-year term, carries a 10% coupon, and does not require any interest payments until maturity. The Note is convertible into Common Stock of the Company at $0.795, which was 120% of the ten-day average closing market price of the Common Stock at closing. The Company granted Hunt Capital certain registration rights with respect to the shares issuable upon conversion of the Note,

10

and Hunt Capital agreed not to sell those conversion shares or any other Company shares it owns for at least twelve months. Hunt Capital may accelerate the maturity of the Note upon certain events, including a sale or change of control of the Company or a material financing by the Company. In addition, as further consideration for the investment, Hunt Capital received the right to certain payments upon a sale of the Company in the event the Company is sold in a transaction whose value falls below $145 million. The payment is $1 million unless the transaction value falls below $60 million, at which point the payment would grow on a pro-rata basis to $4.5 million if the transaction value falls below $10 million.

The Company believes that the foregoing transaction was in its best interests. As a matter of policy, this transaction was, and all future transactions between the Company and its officers, directors, principal shareholders or their affiliates will be, approved by a majority of the independent and disinterested members of the Board of Directors, on terms no less favorable than could be obtained from unaffiliated third parties and in connection with bona fide business purposes of the Company.

APPOINTMENT OF INDEPENDENT AUDITORS

The Company has appointed the firm of Grant Thornton LLP independent public auditors for the Company during the 2002 fiscal year, to serve in the same capacity for the year ending July 31, 2003. Representatives of Grant Thornton LLP are expected to be present at the Annual Meeting and will be available to respond to appropriate questions and to make such statements as they may desire.

NOMINATIONS AND STOCKHOLDER PROPOSALS

The Bylaws of the Company require that all nominations for persons to be elected to the Board of Directors, other than those made by or at the direction of the Board of Directors, be made pursuant to written notice to the Secretary of the Company. The notice must be received not less than 35 days prior to the meeting at which the election will take place (or not later than 10 days after public disclosure of such meeting date is given or made to stockholders if such disclosure occurs less than 50 days prior to the date of such meeting). Notice must set forth the name, age, business address and residence address of each nominee, their principal occupation or employment, the class and number of shares of stock which they beneficially own, their citizenship and any other information that is required to be disclosed in solicitations for proxies for election of directors pursuant to the Securities Exchange Act of 1934, as amended. The notice must also include the nominating stockholder’s name and address as they appear on the Company’s books and the class and number of shares of stock beneficially owned by such stockholder.

In addition, the Bylaws require that for business to be properly brought before an annual meeting by a stockholder, the Secretary of the Company must have received written notice thereof (i) in the case of an annual meeting that is called for a date that is within 30 days before or after the anniversary date of the immediately preceding annual meeting, not less than 120 days in advance of the anniversary date of the Company’s proxy statement for the previous year’s annual meeting, nor more than 150 days prior to such anniversary date and (ii) in the case of an annual meeting that is called for a date that is not within 30 days before or after the anniversary date of the immediately preceding annual meeting, not later than the close of business on the 10th day following the day on which notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. The notice must set forth the name and address of the stockholder who intends to bring business before the meeting, the general nature of the business which he or she seeks to bring before the meeting and a representation that the stockholder is a holder of record of shares entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to bring the business specified in the notice before the meeting.

11

Any proposal of a stockholder intended to be presented at the Company’s 2003 Annual Meeting of Stockholders and included in the proxy statement and form of proxy for that meeting is required to be received by the Company no later than September 9, 2003. Management proxies will have discretionary voting authority as to any proposal not received by that date if it is raised at that annual meeting, without any discussion of the matter in the proxy statement.

ANNUAL REPORT

The Company’s Annual Report on Form 10-K/A, including financial statements and schedules thereto, for the fiscal year ended July 31, 2002, accompanies this Proxy Statement.

OTHER MATTERS

At the time of the preparation of this Proxy Statement, the Board of Directors knows of no other matter that will be acted upon at the Annual Meeting. If any other matter is presented properly for action at the Annual Meeting or at any adjournment or postponement thereof, it is intended that the proxies will be voted with respect thereto in accordance with the best judgment and in the discretion of the proxy holders.

By Order of the Board of Directors,

ProsoftTraining

Robert G. Gwin

Chairman of the Board

Phoenix, Arizona

January 8, 2003

12

ProsoftTraining

410 North 44th Street, Suite 600

Phoenix, Arizona 85008

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby nominates, constitutes and appoints each of Robert G. Gwin and Jeffrey G. Korn the attorney, agent and proxy of the undersigned, with full power of substitution, to vote all stock of ProsoftTraining which the undersigned is entitled to represent and vote at the Annual Meeting of Stockholders of the Company to be held at the Company’s headquarters at 410 North 44th Street, Suite 600, Phoenix, Arizona on February 7, 2003, at 2:00 p.m., and at any and all adjournments or postponements thereof, as fully as if the undersigned were present and voting at the meeting, as follows:

THE DIRECTORS RECOMMEND A VOTE “FOR” ITEM 1

¨ FOR nominee listed below | ¨ WITHHOLD AUTHORITY to vote for nominee listed below |

Dr. Edward Walsh

| 2. | In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSAL 1.

IMPORTANT – PLEASE SIGN, DATE AND RETURN PROMPTLY

DATED: , 2003

(Signature)

Please sign exactly as name appears hereon. Executors, administrators, guardians, officers of corporations and others signing in a fiduciary capacity should state their full titles as such.

PLEASE SIGN THIS CARD AND RETURN PROMPTLY USING THE ENCLOSED ENVELOPE. IF YOUR ADDRESS IS INCORRECTLY SHOWN, PLEASE PRINT CHANGES. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, YOU ARE URGED TO SIGN AND RETURN THIS PROXY, WHICH MAY BE REVOKED AT ANY TIME PRIOR TO ITS USE.