UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

ProsoftTraining

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

ProsoftTraining

410 North 44th Street, Suite 600

Phoenix, Arizona 85008

602-794-4199

Notice of Annual Meeting of Stockholders

To be Held January 7, 2005

TO OUR STOCKHOLDERS:

The Annual Meeting of Stockholders of ProsoftTraining will be held on January 7, 2005 at 2:00 p.m., local time, at our headquarters office, located at 410 North 44th Street, Suite 600, Phoenix, Arizona, for the following purposes:

| | 1. | To elect two Class II directors to hold office for a three-year term; |

| | 2. | To consider and vote upon a proposal to approve an amendment to the Company’s amended and restated articles of incorporation to effect, at the board’s discretion, between a two-for-one and a seven-for-one share consolidation. |

| | 3. | To consider and vote upon a proposal to approve an amendment to the Company’s amended and restated articles of incorporation to change the name of the Company to Prosoft Learning Corporation. |

| | 4. | To transact such other business as may properly come before the meeting or any postponement or adjournment thereof. |

Only stockholders of record at the close of business on November 15, 2004 are entitled to notice of, and to vote at, the meeting. All stockholders are cordially invited to attend the meeting. Our Bylaws require that the holders of a majority of the outstanding shares of our common stock entitled to vote be represented in person or by proxy at the meeting in order to constitute a quorum for the transaction of business. Regardless of whether you expect to attend the meeting, you are requested to sign, date and return the accompanying proxy card. You may still attend and vote in person at the annual meeting if you wish, even though you may have submitted your proxy prior to the meeting. If you attend the meeting and wish to vote in person, you must revoke your proxy and only your vote at the meeting will be counted. Thank you in advance for your prompt return of your proxy.

|

By Order of the Board of Directors, |

|

|

| Robert G. Gwin |

| Chairman of the Board |

Phoenix, Arizona

November 29, 2004

ProsoftTraining

410 North 44th Street, Suite 600

Phoenix, Arizona 85008

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

SOLICITATION, EXERCISE AND REVOCATION OF PROXIES

The accompanying proxy is solicited on behalf of our Board of Directors to be voted at our Annual Meeting of Stockholders to be held at our headquarters, located at 410 North 44th Street, Suite 600, Phoenix, Arizona, on January 7, 2005, at 2:00 p.m. local time, and any and all adjournments or postponements thereof. In addition to the original solicitation by mail, certain of our employees may solicit proxies by telephone or in person. No specially engaged employees or solicitors will be retained for proxy solicitation purposes. All expenses of this solicitation, including the costs of preparing and mailing this proxy statement and the reimbursement of brokerage firms and other nominees for their reasonable expenses in forwarding proxy materials to beneficial owners of shares, will be borne by us. You may vote in person at our annual meeting, if you wish, even though you have previously mailed in your proxy. This proxy statement and the accompanying proxy are being mailed to stockholders on or about November 29, 2004. Unless otherwise indicated, “we,” “us,” “our” and “the Company” mean ProsoftTraining.

All duly executed proxies will be voted in accordance with the instructions thereon. Stockholders who execute proxies, however, retain the right to revoke them at any time before they are voted. The revocation of a proxy will not be effective until written notice thereof has been given to our Secretary unless the stockholder granting such proxy votes in person at our annual meeting.

VOTING OF SECURITIES

The record date for the determination of stockholders entitled to vote at our annual meeting is November 15, 2004. As of such date, we had outstanding 24,309,624 shares of our common stock, $0.001 par value per share. Our common stock is the only class of our stock outstanding and entitled to vote at our annual meeting. Each stockholder is entitled to one vote for each share of our common stock held. All votes on the proposal set forth below will be taken by ballot. For purposes of the votes on the proposal set forth below, the holders of a majority of the shares entitled to vote, represented in person or by proxy, will constitute a quorum at our meeting. The stockholders present at our annual meeting may continue to transact business until adjournment, notwithstanding the subsequent withdrawal of enough stockholders to leave less than a quorum or the refusal of any stockholder present in person or by proxy to vote or participate in our annual meeting. Abstentions and broker non-votes (i.e. the submission of a proxy by a broker or nominee specifically indicating the lack of discretionary authority to vote on any particular matter) will be counted as present for purposes of determining the presence or absence of a quorum for the transaction of business. Directors will be elected by a favorable vote of a plurality of the shares of voting stock present and entitled to vote, in person or by proxy, at the Annual Meeting. Accordingly, abstentions or broker non-votes as to the election of directors will not affect the election of the candidates receiving the plurality of the votes. Proposals 2 and 3 require the approval of a majority of the shares outstanding. Therefore, abstentions and broker non-votes as to these proposals will have the same effect as votes against such proposals.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. THEREFORE, STOCKHOLDERS ARE REQUESTED TO SIGN, DATE AND RETURN THE PROXY CARD AS SOON AS POSSIBLE, WHETHER OR NOT THEY EXPECT TO ATTEND THE ANNUAL MEETING IN PERSON.

1

PROPOSAL 1

ELECTION OF TWO CLASS II DIRECTORS

General

Two directors are proposed for election at our annual meeting. Our bylaws provide for a board of directors of not less than three nor more than twenty-five directors. The current number is set at five. Vacancies on the board are filled solely by the majority vote of directors then in office.

Our board is divided into three classes as nearly equal in size as is practicable, designated Class I, Class II and Class III. Directors hold office for staggered terms of three years (or less if they are filling a vacancy) and until their successors are elected and qualified. One of the three classes is elected each year to succeed the directors whose terms are expiring. The term of office of the Class II directors elected at this meeting will expire at the 2007 annual meeting. The term of office of the Class I director will expire at the 2006 annual meeting and the term of office of the Class III directors will expire at the 2005 annual meeting. Directors in each Class shall hold office until such annual meeting of stockholders or until his or her successor is elected and has qualified. When these terms expire, persons nominated to serve as director shall be elected to hold office for three years.

Proxies solicited by our board will be voted for the election of the nominees, unless the vote is withheld on the proxy card. However, if any nominee should become unavailable for election (management has no reason to believe that any nominee will be unable to stand for election), our board may reduce the size of the board or designate a substitute nominee. If the board designates a substitute, shares represented by the proxies will be voted for the substitute nominee. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter.

Nominees for Election as Class II Directors

The following is a brief biography of each nominee for election as a Class II director:

Jeffrey G. Korn, 47. Mr. Korn has served as a director since June 1997. He has served as General Counsel and Corporate Secretary of iMergent, Inc., an eServices provider which helps businesses and entrepreneurs meet their Internet challenges, since November 2003. Mr. Korn also consults with small and mid-size public and private companies on strategic legal business issues. Mr. Korn was our General Counsel from May 2000 to October 2001. Prior to May 2000, he was a partner in the law firm of Kosto & Rotella, P.A. in Jacksonville, Florida, which he joined in 1983. Mr. Korn specializes in corporate law, transactional and compliance issues, and dispute resolution. He graduated from the State University of New York at New Paltz with a BA in Political Science in 1979, and received his JD degree from Stetson University in 1982.

Charles P. McCusker, 35. Mr. McCusker has served as a director since December 1998. Currently, Mr. McCusker has served as General Partner of Patriot Capital a licensed SBIC, investing in small to mid-sized growth opportunities, since 2003. Between 2001 and 2003, Mr. McCusker served as President and Chief Operating Officer of the ServiceMaster Home Service Center, a division of the ServiceMaster Company (NYSE: SVM). Since 1997, Mr. McCusker served as General Partner for the ServiceMaster Venture Fund, responsible for investment opportunities in for-profit education and electronic commerce. Prior to that, Mr. McCusker spent three years as a Vice President of Bengur Bryan & Co., Inc., a venture capital and private equity firm. Mr. McCusker graduated from Virginia Tech with a BS in Mechanical Engineering in 1992, and earned an MBA from the University of Chicago in 1998.

Board Recommendation

The board recommends that you vote “FOR” the above nominees, Jeffrey G. Korn and Charles P. McCusker, for election as Class II directors.

2

Although Mr. McCusker has agreed to stand for re-election, he has indicated to the Nominating Committee that he cannot commit to serving out the entire three-year term, and may need to resign the position during the first year. Our board believes that Mr. McCusker’s continued involvement, even on only an interim basis, provides continuity and is in the best interests of the Company. If Mr. McCusker is re-elected to the board of directors and subsequently elects to resign the position, the board, through its Nominating Committee, will follow its normal procedures to identify a suitable replacement, including one who qualifies as an independent director under the definition of the Nasdaq Stock Market listing standards in accordance with the applicable rules and regulations of the Securities and Exchange Commission (“SEC”).

OTHER BOARD OF DIRECTORS INFORMATION

Directors With Terms That Are Continuing

Class I Directors:

J. William Fuller, 52. Mr. Fuller has served as a director since December 1998. Mr. Fuller is a Registered Investment Advisor and owner of Fuller Capital Management LLC, a money management firm founded in 1983. Mr. Fuller has been active in venture capital and private investment banking ventures for the past 17 years. Additionally, he is a registered representative of Cambridge Investment Research, a registered broker dealer. Mr. Fuller graduated from Southern Methodist University with a BA in Philosophy in 1974.

Robert G. Gwin, 41. Mr. Gwin has served as Chairman of the Board since December 2002. He also served as President and Chief Executive Officer of the Company from December 2002 until November 12, 2004. Mr. Gwin joined us in August 2000 as our Chief Financial Officer, was promoted to Executive Vice President and Chief Financial Officer in October 2001 and became President in May 2002. Prior to joining ProsoftTraining, Mr. Gwin served as Managing Director of Prudential Capital Group, an asset management unit of The Prudential Insurance Company of America. He joined Prudential in 1990, ultimately assuming management of its Dallas-based private investment activities, including both day-to-day operating responsibility and investment portfolio oversight. Mr. Gwin graduated from the University of Southern California with a BS in Business Administration in 1985, earned an MBA from the Fuqua School at Duke University in 1990 and is a Chartered Financial Analyst (CFA).

Class III Director:

Dr. Edward M. Walsh, 65. Dr. Walsh has served as a director since December 1999. Dr. Walsh is the chairman of the Irish Council for Science Technology and Innovation and the chairman of the National Allocation Advisory Group, an organization that advises government on industrial emissions allowances under the Kyoto Accord. He was founding president of the University of Limerick, the first new university established by the Republic of Ireland, a post from which he stepped down in l998 after a 28-year term. Dr. Walsh is a graduate of the National University of Ireland and holds Masters and Doctorate qualifications in nuclear and electrical engineering from Iowa State University, where he was an Associate of the US Atomic Energy Commission Laboratory.

Board Committees and Meetings

Board Committees

The board has appointed from among its members three standing committees:

Compensation Committee. The Compensation Committee is presently composed of Jeffrey G. Korn, who serves as chairperson of the committee, Charles P. McCusker and J. William Fuller. No member of the Compensation Committee is an employee or officer. The principal functions of this committee are to review and approve our organization structure, review performance of our officers and establish overall employee compensation policies. This committee also reviews and approves compensation of directors and our corporate officers, including salary, bonus, and stock option grants, and administers our stock plans. The Compensation Committee met two times during the fiscal year ended July 31, 2004.

3

Audit Committee. The Audit Committee is presently composed of J. William Fuller, who serves as chairperson, Charles P. McCusker, and Dr. Edward Walsh. No member of the Audit Committee is an employee or officer. The functions of the Audit Committee include, among other things, reviewing our annual and quarterly financial statements, reviewing the results of each audit and quarterly review by the Company’s independent public accountants, reviewing our internal audit activities and discussing the adequacy of the Company’s accounting and control systems. Our board has adopted a written audit committee charter. A copy of the written charter is attached as Appendix A to this Proxy Statement. The Audit Committee met four times during the fiscal year ended July 31, 2004.

The board of directors has determined that all members of the Audit Committee are independent in accordance with the Nasdaq Stock Market (“Nasdaq”) listing standards, the Sarbanes-Oxley Act of 2002 and the regulations of the SEC.

Nominating Committee. The Nominating Committee is presently composed of Dr. Edward M. Walsh, who serves as chairperson, and J. William Fuller. No member of the Nominating Committee is an employee or officer of ProsoftTraining. The responsibilities of the Nominating Committee are set forth in the Committee’s Charter, which is available on the Company’s website (www.prosofttraining.com). Any future revisions to this Charter will be posted to the same location on our website. The Nominating Committee met once during fiscal year 2004.

The board of directors has determined that each member of the Nominating Committee is independent as defined by the Nasdaq listing standards, the Sarbanes-Oxley Act of 2002 and the regulations of the SEC.

The Nominating Committee Charter requires that directors possess the highest standards of personal and professional ethics, character and integrity. In identifying candidates for membership on the board, the Nominating Committee takes into account all factors it considers appropriate, which may include professional experience, knowledge, independence, diversity of backgrounds and the extent to which the candidate would fill a present or evolving need on the board.

If there is a need for a new director because of an open position on the board or because the board has determined to increase the total number of directors, the Nominating Committee may retain a third-party search firm to locate candidates that meet the needs of the board at that time. When a search firm is used, the firm typically provides information on a number of candidates, for review and discussion by the Nominating Committee. If appropriate, the Nominating Committee chair and some or all of the members of the Nominating Committee may interview potential candidates. If in these circumstances, in the Nominating Committee’s judgment, the Nominating Committee determines that a potential candidate meets the needs of the board and has the relevant qualifications, the Nominating Committee will vote to recommend to the board the election of the candidate as a director.

The Nominating Committee’s process for considering all candidates for election as directors, including stockholder-recommended candidates, is designed to ensure that the Nominating Committee fulfills its responsibility to recommend candidates that are properly qualified and are not serving any special interest groups, but rather the best interest of all stockholders.

The Nominating Committee will consider director candidates recommended by stockholders if properly submitted to the Nominating Committee. Stockholders wishing to recommend persons for consideration by the Nominating Committee as nominees for election to the board can do so by writing to the Nominating Committee, c/o Corporate Secretary, ProsoftTraining, 410 N. 44th Street, Suite 600, Phoenix, Arizona 85008. Recommendations must include the proposed nominee’s name, detailed biographical data, work history, qualifications and corporate and charitable affiliations, as well as a written statement from the proposed nominee consenting to be named as a nominee and, if nominated and elected, to serve as a director. The Nominating Committee will then consider the candidate and the candidate’s qualifications using the criteria as set above and

4

in the Nominating Committee’s Charter. The Nominating Committee may discuss with the stockholder making the nomination the reasons for making the nomination and the qualifications of the candidate. The Nominating Committee may then interview the candidate and may also use the services of a search firm to provide additional information about the candidate prior to making a recommendation to the board.

In addition, stockholders of record may nominate candidates for election to the board by following the procedures set forth in our bylaws. Information regarding these procedures for nominations by stockholders will be provided upon request to our Corporate Secretary.

Board Meetings

During fiscal year 2004, our board held nine meetings in person or by telephone. Members of the board are provided with information between meetings regarding our operations and are consulted on an informal basis with respect to pending business. Each director attended at least 75% of the total number of meetings of the board and the total number of meetings held by all committees of our board on which such director served during the year.

Director Attendance at Annual Meetings

Unless there is a matter before the stockholders that will require substantial detailed discussion at an annual meeting, we generally do not expect that the Company’s directors will attend our annual meeting, although they often choose to attend either in person or by telephone. Accordingly, with the limited business coming before the meeting last year, one director was in attendance at last year’s annual meeting.

Stockholder Communications with the Board

Stockholders who want to communicate with our board of directors or any individual director can write to them c/o ProsoftTraining, 410 N. 44th Street, Phoenix, Arizona 85008. All such communications will be forwarded by us to the appropriate board member(s).

Director Compensation

Effective June 2002, our directors, other than associates or officers of the Company, are compensated with a stock option grant of 5,000 shares of our common stock for each meeting attended, subject to a maximum of 15,000 stock options per calendar year. Directors, other than associates or officers of the Company, who serve as chairman of a board committee are entitled to an additional grant of 5,000 stock options of our common stock per calendar year. Prior to June 2002, no compensation was provided to directors. Directors are reimbursed for expenses incurred in connection with attendance at board and committee meetings. Directors who are officers or associates of the Company are not compensated separately for service on the board of directors.

Audit Committee Financial Expert

Our board of directors has determined that, in its judgment, Charles P. McCusker qualifies as an “audit committee financial expert” in accordance with the applicable rules and regulations of the SEC. An audit committee financial expert is a person who has (1) an understanding of generally accepted accounting principles and financial statements; (2) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (3) experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (4) an understanding of internal controls and procedures for financial reporting; and (5) an understanding of audit committee functions.

5

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) requires directors, officers, and holders of more than ten percent of a registered class of our equity securities (collectively, “Reporting Persons”) to file certain reports (“Section 16 Reports”) of their trading in our equity securities with the Securities and Exchange Commission. Based on a review of the Section 16 Reports filed by the Reporting Persons during the fiscal year ended July 31, 2003, we believe that all of the Reporting Persons timely complied with all applicable Section 16(a) filing requirements during fiscal 2003, with the exception of one report covering a stock option grant to Robert G. Gwin in January 2004 which was filed late.

Code of Ethics

We have adopted a Code of Ethics (as defined in Item 406 of Regulation S-K) that applies to its chief executive officer, chief financial officer and members of its finance department. The Code of Ethics is posted on our website (www.prosofttraining.com) under the heading “Code of Ethics.” We intend to satisfy the disclosure requirements regarding any amendment to, or a waiver of, a provision of the Code of Ethics by posting such information at the same location on our website.

6

PROPOSAL 2

AUTHORIZATION TO AMEND THE COMPANY’S AMENDED AND RESTATED ARTICLES

OF INCORPORATION TO EFFECT, AT THE BOARD’S DISCRETION, BETWEEN A ONE-

FOR-TWO AND A ONE-FOR-SEVEN SHARE CONSOLIDATION

General

Our board of directors has unanimously adopted resolutions proposing, declaring and recommending that stockholders of the Company authorize an amendment to our amended and restated articles of incorporation to effect a share consolidation (commonly known as a “reverse stock split”) of the issued and outstanding shares of our common stock. The consolidation would combine a number of outstanding shares of the Company’s common stock between two and seven, such number consisting of only whole shares, into one share of the Company’s common stock, at the discretion of our board of directors.

There would be no change in the par value of the Company’s common stock, and the number of authorized shares of common stock would be reduced proportionately. The proposal will permit the board of directors to effect only one share consolidation. The share consolidation ratio will be determined in the judgment of the board of directors, with the intention of maximizing the Company’s ability to remain in compliance with the continued listing maintenance requirements of Nasdaq and realize the other intended benefits of the share consolidation to the Company and our stockholders. See the information below under the caption “Purposes of the Share Consolidation”. The purpose of selecting a range is to give our board of directors the flexibility to best achieve the purposes of the share consolidation.

Our board of directors also reserves the right, notwithstanding stockholder approval and without further action by stockholders, to not proceed with the share consolidation if the board of directors, in its sole discretion, determines that the share consolidation is no longer in the best interests of the Company and our stockholders. The board of directors may consider a variety of factors in determining whether or not to implement the share consolidation and the amount of the consolidation ratio, including, but not limited to overall trends in the stock market, recent changes and anticipated trends in the per share market price of the common stock, changes in Nasdaq’s listing requirements, business and transactional developments and the Company’s actual and projected financial performance.

Description of the Share Consolidation

In general terms, the share consolidation means the outstanding shares of our common stock will be combined and reconstituted as a smaller number of shares of common stock. The number of shares that will be combined into one share of new stock will be between two and seven shares of existing common stock. The consolidation ratio and whether or not a share consolidation is effected at all will be determined by the board of directors based on prevailing market conditions at that time. The share consolidation will be effected by an amendment to the Company’s articles of incorporation. The share consolidation will not affect the valuation of the Company nor will it impact any stockholder’s percentage ownership of the Company.

Purposes of the Share Consolidation

Our common stock is a quoted security on the Nasdaq SmallCap Market. In order for the common stock to continue to be quoted thereon, the Company and the common stock are required to continue to comply with various listing maintenance requirements established by Nasdaq. Among other things, the Company is required to maintain a minimum bid price of at least $1.00 per share.

The primary purpose for the proposed share consolidation is to attempt to increase the market price of our common stock in order to meet the at least the minimum bid price requirement for continued listing of the common stock on the Nasdaq SmallCap Market. On June 23, 2004, we received notification from Nasdaq that for

7

30 consecutive business days the price of our common stock had closed below the minimum $1.00 per share requirement for continued inclusion under Marketplace Rule 4310(c)(4). Therefore, in accordance with Marketplace Rule 4310(c)(8)(D), the Company was provided 180 calendar days, until December 20, 2004, to regain compliance. The Company can regain compliance if the bid price of its common stock closes at $1.00 or more per share for a minimum of 10 consecutive days.

If we do not remedy the $1.00 minimum bid price deficiency by December 20, 2004 and if Nasdaq delists our common stock, then the common stock may be traded on the OTC Bulletin Board or the “pink sheets”. Many institutional and other investors refuse to invest in stocks that are traded at levels below the Nasdaq Markets, which could reduce the trading liquidity in our common stock or make our effort to raise capital more difficult. OTC Bulletin Board and “pink sheets” stocks are often lightly traded or not traded at all on any given day. Any reduction in trading liquidity or active interest on the part of the investors in our common stock could have adverse consequences on our stockholders, either because of reduced market prices or the lack of a regular, active trading market for our common stock.

In addition to the objective of maintaining our current listing on the Nasdaq SmallCap Market, the board of directors also believes that the relatively low per share market price of the Company’s common stock may impair the acceptability of the common stock to certain institutional investors and other members of the investing public. The board of directors believes that certain investors view low-priced stock as unattractive or, as a matter of policy, will not extend margin credit on stock trading at low prices. Many brokerage houses are reluctant to recommend lower-priced stock to their clients or to hold it in their own portfolios. Further, a variety of brokerage house policies and practices discourage individual brokers within those firms from dealing in low-priced stock because of the time-consuming procedures that make the handling of low-priced stock unattractive to brokerage houses from an economic standpoint. Also, because the brokerage commissions on low-priced stock generally represent a higher percentage of the stock price than commissions on higher priced stock, the current share price of the common stock can result in individual stockholders paying transaction costs (commissions, markups, or markdowns) which are a higher percentage of their total share value than would be the case if the share price were substantially higher. These factor are believed to limit the willingness of retail and institutional investors to purchase the Company’s common stock at its current relatively low per share market price.

Certain Effects of the Share Consolidation

The following table illustrates the principal effects of various potential share consolidations on our common stock, giving effect to the consolidation as if it occurred on October 31, 2004.

| | | | | | | | |

Number of Shares

| | Prior to the Share

Consolidation

| | After Share Consolidation

|

| | | 1-for-2

| | 1-for-4

| | 1-for-7

|

Authorized | | 75,000,000 | | 37,500,000 | | 18,750,000 | | 10,714,286 |

Outstanding (1) | | 24,321,536 | | 12,160,768 | | 6,080,384 | | 3,474,505 |

Available for Future Issuance | | 50,678,464 | | 25,339,232 | | 12,669,616 | | 7,239,781 |

| (1) | Numbers exclude an aggregate of approximately 20.5 million shares (pre-consolidation) of common stock issuable (i) upon the exercise of outstanding options under the Company’s equity compensation plans, (ii) upon the exercise of outstanding warrants to purchase common stock and (iii) upon conversion of outstanding convertible promissory notes. Upon effectiveness of the share consolidation, (x) each option and warrant will entitle the holder to acquire a reduced number of shares of common stock equal to the number of shares of common stock which the holder was entitled to acquire immediately prior to the share consolidation divided by the consolidation ratio, at an increased exercise price equal to the price in effect immediately prior to the share consolidation multiplied by the consolidation ratio; and (y) each convertible promissory note will have its conversion price increased to a price equal to the price in effect immediately prior to the share consolidation multiplied by the consolidation ratio. |

8

Certain Risks Associated with the Share Consolidation

Our stockholders should recognize that if the share consolidation is effectuated they will own a fewer number of shares than they presently own (a number equal to the number of shares owned immediately prior to the filing of the amendment divided by the consolidation ratio before adjustment for fractional shares, as described below). While we expect that the share consolidation will result in an increase in the market price of the common stock, there can be no assurance that the share consolidation will increase the market price of the common stock by a multiple of the consolidation ratio or result in any permanent increase in the market price (which is dependent upon many factors, including, but not limited to, the Company’s performance and prospects). As a result, there can be no assurance that our common stock will continue to meet the Nasdaq SmallCap Market continued listing requirements. Also, should the market price of the common stock decline, the percentage decline may be greater than would pertain in the absence of a share consolidation. In some cases, the total market capitalization of a company following a share consolidation is lower, and may be substantially lower, than the total market capitalization before the share consolidation. Furthermore, the possibility exists that liquidity in the market price of the common stock could be adversely affected by the reduced number of shares that would be outstanding after the share consolidation. In addition, the share consolidation will increase the number of our stockholders who own odd lots (fewer than 100 shares). Stockholders who hold odd lots typically will experience an increase in the cost of selling their shares, as well as greater difficulty in effecting such sales. There can be no assurance that the share consolidation will achieve the desired results that have been outlined above.

Procedure for Effecting Share Consolidation and Exchange of Stock Certificates

If the share consolidation is approved by our stockholders, the Company will file the certificate of amendment to our articles of incorporation with the Secretary of State of the State of Nevada promptly after the annual meeting of stockholders in such consolidation ratio as the board of directors determines is then appropriate. The board of directors may elect not to effect the share consolidation at all.

The share consolidation will become effective on the date of filing with the Nevada Secretary of State. Beginning on the consolidation effective date, each certificate representing old shares will be deemed for all corporate purposes to evidence ownership of new shares.

As soon as practicable after the consolidation effective date, stockholders will be notified that the share consolidation has been effected. The share consolidation will take place on the consolidation effective date without any action on the part of the holders of common stock and without regard to current certificates representing shares of common stock being physically surrendered for certificates representing the number of shares of common stock each stockholder is entitle to receive as a result of the share consolidation. New certificates of common stock will not be issued.

Any old shares submitted for transfer, whether pursuant to a sale or other disposition, or otherwise, will automatically be exchanged for new shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNLESS REQUESTED TO DO SO.

Fractional Shares

No fractional shares will be issued in connection with the share consolidation. Stockholders who would otherwise be entitled to receive fractional shares as a result of the share consolidation will have the number of new shares to which they are entitled rounded up to the nearest whole number of shares. No stockholders will receive cash in lieu of fractional shares.

9

Accounting Consequences

The par value per share of our common stock would remain unchanged at $0.001 per share after the share consolidation. As a result, on the effective date of the share consolidation, the stated capital on the Company’s balance sheet attributable to the common stock will be reduced proportionally, based on the exchange ratio of the share consolidation, from its present amount, and the additional paid-in capital account shall be credited with the amount by which the stated capital is reduced. The per share common stock net income or loss and net book value will be increased because there will be fewer shares of our common stock outstanding. We do not anticipate that any other accounting consequences would arise as a result of the share consolidation.

No Dissenter’s Rights

Under Nevada law, stockholders are not entitled to dissenters’ rights with respect to the proposed share consolidation.

Federal Income Tax Consequences of the Reverse Stock Split

The following is a general discussion of the material federal income tax consequences of the share consolidation. This discussion is based upon current provisions of the Internal Revenue Code, applicable U.S. Treasury regulations, judicial authority, and administrative rulings and practice, all as of the date of this document, and all of which are subject to change, possibly with retroactive effect. The Company has not requested, nor will it request, an opinion of tax counsel or an advance ruling from the Internal Revenue Service as to the tax consequences of the share consolidation and there can be no assurance that the Internal Revenue Service will agree with the conclusions set forth in this discussion.

No attempt has been made in this discussion to address all federal income tax consequences of the share consolidation. This discussion does not address any state, local or foreign tax consequences of the share consolidation. Your tax treatment may vary depending on your particular situation. For example, the discussion may not apply to you, in whole or in part, if you are an insurance company, a tax-exempt organization, a financial institution or broker-dealer, a person who is neither a citizen nor a resident of the United States, a trader in securities that elects to mark-to-market, or a person who holds common stock as part of a hedge, straddle or conversion transaction. The following discussion assumes that the old shares were, and the new shares will be, held as a “capital asset” as defined in the Internal Revenue Code (generally property held for investment).

Each stockholder should consult with such stockholder’s own tax advisor with respect to the consequences of the share consolidation.

No gain or loss should be recognized by a stockholder upon such stockholder’s exchange of old shares for new shares pursuant to the share consolidation. The aggregate tax basis of the new shares received in the share consolidation (including any fraction of a new share deemed to have been received) will be the same as the stockholder’s aggregate tax basis in the old shares surrendered therefor. The stockholder’s holding period for the new shares will include the period during which the stockholder held the old shares surrendered in the share consolidation.

Board Recommendation

The board recommends that you vote “FOR” this proposal.

10

PROPOSAL 3

APPROVAL OF AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED

ARTICLES OF INCORPORATION TO CHANGE THE NAME OF THE COMPANY TO

PROSOFT LEARNING CORPORATION

General

Our board of directors has unanimously approved, subject to stockholder approval, an amendment to the Company’s amended and restated articles of incorporation to effect a change in the name of the Company from ProsoftTraining to Prosoft Learning Corporation.

The change of the Company’s name will not affect, in any way, the validity or transferability of currently outstanding stock certificates, nor will the Company’s stockholders be required to surrender or exchange any stock certificates that they currently hold. In addition, the Company will request that Nasdaq allow the Company to continue to use the ticker symbol “POSO”. The cost of changing the Company name will be immaterial.

At the annual meeting, stockholders will be asked to approve the name change. Such approval will require the affirmative vote of a majority of the voting power of all outstanding shares of the Company’s common stock. If the proposal is approved, a certificate of amendment amending the Company’s articles of incorporation will be filed with the Secretary of State of the State of Nevada as soon as possible and the name change will then become effective.

Purposes of the Name Change

The board believes that the change of corporate name is desirable in that the new name better reflects the current business, strategy and operations of the Company. The Company’s historic operations were focused on providing training services, a market that the Company exited approximately two years ago, whereas the current and future operations are increasingly targeted on providing education solutions to the academic and adult learning markets. In addition, while more appropriately describing the Company’s current and future business and strategic focus, the proposed name provides continuity of its primary identity in the market, “Prosoft”.

Board Recommendation

The board recommends that you vote “FOR” this proposal.

11

EXECUTIVE OFFICERS

Our current executive officers are as follows:

| | | | |

Name

| | Age

| | Position

|

| Robert G. Gwin | | 41 | | Chairman of the Board |

| Benjamin M. Fink | | 34 | | Acting President and Chief Executive Officer |

| William J. Weronick | | 63 | | Vice President Finance |

For additional information with respect to Mr. Gwin, see “Proposal 1 – Other Board of Directors Information”.

Benjamin M. Fink, 34. Mr. Fink has served as acting President and Chief Executive Officer since November 12, 2004. Prior to being named to that position, he was the Company’s Chief Operating Officer since February 2003. Mr. Fink joined the Company in April 2001 as founder and Regional Managing Director of ProsoftTraining Asia Ltd., in which capacity he was responsible for all Asia-Pacific activities. Prior to joining the Company, he served as Chief Operating and Financial Officer of Meta4 Networks (formerly HungryForWords.com), one of Japan’s leading email direct marketing companies. Mr. Fink previously spent six years working as a private equity professional with Prudential Asia in Hong Kong and Prudential Capital Group in the United States. In addition, he was founder and president of Truman Intertel, Inc, which at the time was the largest provider of financial and consulting services to holders of Interactive Video and Data Service (IVDS) licenses. Mr. Fink graduated from the Wharton School of the University of Pennsylvania and is a Chartered Financial Analyst (CFA).

William J. Weronick,63. Mr. Weronick joined the Company as Vice President Finance in March 1999. He has more than 30 years of broad experience in public and private accounting. Prior to joining the Company, from 1996 to 1999, Mr. Weronick was Vice President Finance of Meissner+Wurst (“M+W”), an international company specializing in the design and construction of clean rooms for the semiconductor industry. From 1994 to 1996, Mr. Weronick was the Director of Corporate Accounting for The Continuum Company, an international supplier of specialized software and services for the insurance, health care and financial services industry. Mr. Weronick is a Certified Public Accountant and graduated from C.W. Post College in New York with a BS in Accounting.

12

BENEFICIAL OWNERSHIP OF SECURITIES

The following table and the notes thereto set forth certain information regarding the beneficial ownership of our common stock as of October 31, 2004, by (i) each current director; (ii) each executive officer named in the summary compensation table included herein; (iii) all current directors and executive officers as a group; and (iv) each person who is known by us to be a beneficial owner of five percent or more of our common stock.

| | | | | |

| | | Shares Beneficially Owned

| |

Name and Address of Beneficial Owner(1)

| | Number(2)

| | Percent

| |

Hunt Capital Growth Fund II, L.P. (3) 1601 Elm, Suite 4000 Dallas, Texas 75201 | | 6,662,890 | | 22.4 | % |

DKR SoundShore Oasis Holding Fund Ltd. (4) (6) 1281 East Main Street Stamford, Connecticut 06920 | | 4,886,947 | | 16.7 | % |

DKR SoundShore Strategic Holding Fund Ltd. (5) (6) 1281 East Main Street Stamford, Connecticut 06920 | | 977,389 | | 3.9 | % |

Drake Personnel (New Zealand) Limited. (7) 79 Wellington St., W., Suite 2400 Toronto, Ontario M5K 1H6 | | 1,711,431 | | 6.9 | % |

J. William Fuller (8) | | 126,791 | | * | |

Robert G. Gwin (9) | | 876,045 | | 3.5 | % |

Jeffrey G. Korn (10) | | 297,673 | | 1.2 | % |

Charles P. McCusker (11) | | 126,250 | | * | |

Dr. Edward M. Walsh (12) | | 163,800 | | * | |

All directors and executive officers, as a group (7 persons) (13) | | 2,108,314 | | 8.0 | % |

| * | Less than 1% of the outstanding shares of common stock. |

| (1) | The address for all officers and directors is 410 North 44th Street, Suite 600, Phoenix, Arizona 85008. |

| (2) | Unless otherwise indicated, the named persons possess sole voting and investment power with respect to the shares listed (except to the extent such authority is shared with spouses under applicable law). The percentages are based upon 24,309,624 shares outstanding as of October 31, 2004, except that for certain parties who hold options, warrants, or convertible notes that are presently exercisable or convertible, or exercisable or convertible within 60 days, the percentages are based upon the sum of shares outstanding as of October 31, 2004 plus the number of shares subject to options, warrants, or convertible notes that are presently exercisable or convertible, or exercisable or convertible within 60 days, held by them, as indicated in the following notes. |

| (3) | Includes 4,900,361 shares subject to conversion rights and 482,892 shares subject to stock warrant agreements. Hunt Capital’s rights of conversion and exercise of derivative securities is limited under certain circumstances. See “Certain Relationships and Related Transactions.” |

| (4) | Includes 4,886,947 shares which may be acquired upon conversion of notes, assuming conversion of all principal and interest accrued as of October 31, 2004. Principal on the notes is convertible at $0.28 per share and interest is payable in shares at the Company’s option at a conversion price equal to a 7% discount from the market price at the time of payment. Amount shown assumes all interest is paid in stock at a conversion price of $0.28 per share. Does not include 4,050,000 shares which may be acquired under warrants that are exercisable on or after March 2, 2005. |

| (5) | Includes 977,389 shares which may be acquired upon conversion of notes, assuming conversion of all principal and interest accrued as of October 31, 2004. Principal on the notes is convertible at $0.28 per share and interest is payable in shares at the Company’s option at a conversion price equal to a 7% discount from the market price at the time of payment. Amount shown assumes all interest is paid in stock at a conversion price of $0.28 per share. Does not include 1,012,501 shares which may be acquired under warrants that are exercisable on or after March 2, 2005. |

13

| (6) | DKR SoundShore Oasis Holding Fund Ltd. (“DKR Oasis”) and DKR SoundShore Strategic Holding Fund Ltd. (“DKR Strategic”) are affiliated entities. Both DKR Oasis and DKR Strategic have agreed that their rights of exercise and conversion are limited to the extent necessary to insure that, following such exercise or conversion, they and their affiliates will not beneficially own greater than 4.999% of the Company’s common stock then issued and outstanding. This restriction may be waived by DKR Oasis or DKR Strategic on 61 days prior written notice. DKR Oasis and DKR Strategic have also agreed that their rights of exercise and conversion are limited to the extent necessary to insure that, following such conversion or exercise, they and their affiliates will not beneficially own greater than 9.999% of the Company’s common stock then issued and outstanding. This restriction may not be waived. Amounts shown in the table include all shares that may be acquirable by DKR Oasis and DKR Strategic, notwithstanding the foregoing restrictions. |

| (7) | Includes 600,000 shares subject to stock warrant agreements. |

| (8) | Includes 95,000 shares subject to stock options exercisable within 60 days, and 20,641 shares subject to stock warrant agreements. |

| (9) | Includes 802,124 shares subject to stock options exercisable within 60 days. |

| (10) | Includes 255,000 shares subject to stock options exercisable within 60 days. |

| (11) | Includes 125,000 shares subject to stock options exercisable within 60 days. |

| (12) | Includes 105,000 shares subject to stock options exercisable within 60 days. |

| (13) | Includes 1,896,880 shares subject to stock options exercisable within 60 days, and 20,641 shares subject to a stock warrant agreement. |

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Summary Compensation Table

The following table sets forth a summary of the compensation during the fiscal years ended July 31, 2004, 2003 and 2002 paid to or earned by our chief executive officer during fiscal 2004 and any other executive officers during fiscal 2004 whose compensation exceeded $100,000 during those fiscal years.

| | | | | | | | | | |

| | | | | | | | | Long-Term

Compensation Awards

| | |

Name and Principal Position

| | Fiscal

Year

| | Salary

($)

| | Bonus

($)(2)

| | Shares of Common

Stock Underlying

Stock Options

| | All Other

Compensation

($)(3)

|

Robert G. Gwin(1) Chairman, President and Chief Executive Officer | | 2004

2003

2002 | | 191,539

184,039

163,798 | | 80,000

100,000

28,800 | | 200,000

200,000

200,000 | | 3,654

6,071

3,051 |

| (1) | Effective November 12, 2004, Mr. Gwin resigned as President and Chief Executive Officer. He was elected to those positions in December 2002. He remains Chairman of the Board. Mr. Gwin joined us in August 2000 as Chief Financial Officer. |

| (2) | The bonus amounts listed in this table for the fiscal years prior to 2004 have been restated from our prior disclosures to present this information in accordance with Item 402(b)(2)(iii)(B) of Regulation S-K, which requires that the dollar value of bonus earned by the named executive officer be disclosed with respect to the fiscal year during which such bonus was earned. The aggregate amounts of bonuses earned by and paid to the named executive officer remains unchanged. |

| (3) | These amounts represent matching contributions made under our 401(k) retirement plan. |

14

Option Grants Table

The following table sets forth information concerning options to purchase shares of our common stock granted to our named executive officer during the fiscal year ended July 31, 2004.

| | | | | | | | | | | | | | |

Executive Officer

| | Shares of

Common Stock

Underlying

Stock Options

| | | % of Total

Options

Granted to

Employees in

Fiscal Year

| | | Exercise Price

Per Share (1)

| | Expiration

Date

| | Grant Date

Present

Value (2)

|

Robert G. Gwin | | 200,000 | (3) | | 30 | % | | $ | 0.55 | | 1/2/14 | | $ | 84,000 |

| (1) | All options were granted at fair market value (the last price for our common stock as reported by Nasdaq on the day previous to the date of grant). |

| (2) | As suggested by the SEC’s rules on executive compensation disclosure, we used the Black-Scholes model of option valuation to determine grant date pre-tax present value. The calculation is based on a four-year term and upon the following assumptions; annual dividend growth of zero percent, volatility of approximately 116%, and an interest rate of 3.12%. There can be no assurance that the amount reflected in this column will be achieved. |

| (3) | The options were granted under the ProsoftTraining 2000 Stock Option Plan for a term of no more than ten years, subject to earlier termination in certain events related to termination of employment. 50,000 options vested on each of January 2, 2004, April 2, 2004, July 2, 2004 and October 2, 2004. |

Aggregated Options Exercised in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth information concerning each exercise of stock options during the fiscal year ended July 31, 2004 by the named executive officer and the fiscal year-end value of unexercised stock options held by such executive officer as of July 31, 2004.

| | | | | | | | | | | | | |

Name

| | Shares

Acquired

on Exercise

| | Value

Realized

| | Number of Unexercised

Options at July 31, 2004

| | Value of Unexercised In-

the-Money Options at

July 31, 2004(1)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Robert G. Gwin | | — | | — | | 802,124 | | 182,876 | | $ | 50,000 | | — |

| (1) | Represents the difference between the fair value of the shares underlying such options at fiscal year-end ($0.41) and the exercise price of such options. |

Employment Agreements, Termination of Employment, and Change in Control Arrangements

On August 1, 2003, we entered into an employment agreement with Robert G. Gwin, our Chairman, President and Chief Executive Officer. Mr. Gwin’s agreement was to terminate on July 31, 2005 and provided for an annual base salary of $200,000. In addition, Mr. Gwin was entitled to receive an annual bonus of up to $190,000, to be determined by (i) the Company achieving certain operating and cash management metrics (up to $120,000 in total) and (ii) the board of directors at its discretion upon reviewing Mr. Gwin’s overall performance (up to $70,000). In the event of termination of Mr. Gwin’s employment for any reason other than gross negligence or malfeasance, the Company was obligated to pay $300,000, plus acceleration and immediate vesting of all unvested options. In addition, if a change of control of the Company occurred where Mr. Gwin was not President and Chief Executive Officer of the ultimate parent company following the completion of the change of control, then a payment of $300,000 was due to Mr. Gwin. In addition, all of Mr. Gwin’s unvested options would have vested upon any change in control.

15

On November 12, 2004, the employment agreement described above was terminated in connection with Mr. Gwin’s resignation as President and Chief Executive Officer. On that date, we entered into a consulting agreement with Mr. Gwin, which provides for Mr. Gwin to earn payments totaling $54,000 during fiscal 2005, $64,000 during fiscal 2006 and $20,000 during fiscal 2007. Mr. Gwin’s stock options remain in effect due to his status as a director, although there is no provision for accelerated vesting of any of his options upon a change of control. In addition, there is no provision in the consulting agreement for either an annual bonus or a change of control payment.

Compensation Committee Interlocks and Insider Trading Participation

The members of our Compensation Committee during the fiscal year ended July 31, 2004 were Jeffrey G. Korn, Charles P. McCusker, and J. William Fuller. Each member of the Compensation Committee during fiscal 2004 was a non-employee director of the Company. Mr. Korn was an officer of the Company prior to October 2001.

Equity Compensation Plan Information

The following table provides certain information as of July 31, 2004 with respect to our equity compensation plans under which our equity securities are authorized for issuance.

| | | | | | | | |

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available

for future issuances

under plan

| |

Equity compensation plans approved by security holders(1) | | 2,522,420 | | $ | 2.167 | | 1,544,444 | (2) |

Equity compensation plan not approved by security holders(3) | | 112,500 | | $ | 1.250 | | 387,500 | |

| | |

| | | | |

|

|

Total | | 2,634,920 | | | | | 1,931,944 | |

| | |

| | | | |

|

|

| (1) | These plans consist of the 1996 Stock Option Plan, the 2000 Stock Incentive Plan and the Employee Stock Purchase Plan. |

| (2) | The number of shares reserved for issuance under the Employee Stock Purchase Plan (“ESPP”) may be increased on the first trading day of each calendar year by an amount equal to one half percent (.5%) of the total number of shares of common stock outstanding on the last trading day of the preceding calendar year, but in no event will any annual increase exceed 150,000 shares. As of July 31, 2004, 236,426 shares were reserved for issuance under the ESPP. |

| (3) | This plan consists of the 2001 Stock Option Plan and was adopted by the board of directors in July 2001. Under the 2001 Stock Option Plan, the number of shares of common stock that may be optioned and sold is 500,000 shares. The plan is administered by our board of directors, which determines when and to whom options will be granted and, subject to the terms of the Plan, the exercise price, vesting schedule, expiration date and other terms of each such grant. All of our employees, other than officers and directors, and consultants are eligible to receive option grants under the Plan. Options granted under the Plan have an exercise price equal to fair market value on the date previous to the date of grant and may not have a term in excess of ten years. |

16

COMPENSATION COMMITTEE REPORT

The report of the Compensation Committee which follows shall not be deemed incorporated by reference by any general statement elsewhere incorporating by reference this proxy statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference. The report of the Compensation Committee was prepared and adopted prior to Mr. Gwin’s resignation as President and Chief Executive Officer on November 12, 2004.

Overview and Philosophy

The Compensation Committee of the board of directors establishes and reviews the Company’s compensation strategy to ensure that we attract, retain, properly compensate, and motivate qualified executives and other key associates. The Committee consists of Mr. Korn, its chairperson, Mr. McCusker and Mr. Fuller. No member of this committee is an employee or officer.

The Compensation Committee carries out its duties based on the philosophy that the Company’s compensation programs should: (i) provide competitive levels of compensation that integrate pay with the individual executive’s performance and our annual and long-term performance goals; (ii) motivate key executives to achieve strategic business goals and reward them for their achievement; (iii) provide compensation opportunities and benefits that are comparable to those offered by other companies similar to ours, thereby allowing the Company to compete for and retain talented executives who are critical to our long-term success; and (iv) align the interests of key executives with the long-term interests of stockholders and the enhancement of stockholder value. Accordingly, the compensation of our executive officers are currently comprised of annual base salary, incentive compensation based on certain performance criteria being achieved, and long-term performance incentives in the form of stock option grants under the stock option plans.

Chief Executive Officer Compensation

The Compensation Committee set the 2004 annual compensation for our Chief Executive Officer, Mr. Gwin. See “Employment Agreements, Termination of Employment, and Change in Control Arrangements”.

During the fiscal year, the Compensation Committee approved a Employment Agreement for Mr. Gwin which provides for a base annual salary of $200,000 and an annual bonus of up to $190,000. The annual bonus earned is determined pursuant to certain operating and cash management metrics (up to $120,000 in total), with the balance determined by the board of directors upon reviewing Mr. Gwin’s overall performance (up to $70,000). Mr. Gwin was paid the contractual salary of $200,000, less amounts that he voluntarily declined to receive in order to assist the Company in managing its expenses. Mr. Gwin was paid an aggregate incentive bonus of $80,000 for his performance during the fiscal year. In addition, per his employment agreement, Mr. Gwin was granted a stock option to purchase 200,000 shares of the Company’s common stock. Based on the information available to it, the Compensation Committee believes the Chief Executive Officer’s aggregate compensation is fair and appropriate relative to the Company’s size and overall performance.

| | |

By the Compensation Committee, |

|

Jeffrey G. Korn, Chairperson |

Charles P. McCusker |

J. William Fuller |

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We entered into an employment agreement with Robert G. Gwin, our former Chief Executive Officer, in July 2003. This agreement was terminated on November 12, 2004 in connection with Mr. Gwin’s resignation as President and Chief Executive Officer. On that date we entered into a consulting agreement with Mr. Gwin. These agreements are described under “Employment Agreement, Termination of Employment Agreement, and Change in Control Arrangement”.

In October 2001, we received $2,500,000 from Hunt Capital Growth Fund II, L.P. (“Hunt Capital”) pursuant to the issuance to Hunt Capital of a subordinated secured convertible note. At that time, Hunt Capital owned greater than five percent of our outstanding common stock. J.R. Holland, Jr., one of our directors at that time, is president and chief executive officer of Unity Hunt, Inc., chairman of the Unity Hunt Investment Committee, and the president and CEO of Hunt Capital Group, LLC. The note is secured by all of our assets, has a five-year term, carries a 10 percent coupon, and does not require any interest payments until maturity. The note was originally convertible into our common stock at $0.795 per share. As a result of certain antidilution adjustments, the current conversion price is $0.682 per share. Hunt Capital may accelerate the maturity of the note upon certain events, including a sale or change of control of the Company or an equity financing by the Company in excess of $2,500,000. In addition, as further consideration for the investment, Hunt Capital received the right to certain payments upon a sale of the Company in a transaction whose value falls below $145,000,000. The potential payment is $1,000,000 unless the transaction value falls below $60,000,000 at which point the payment would grow on a pro-rata basis to $4,500,000 if the transaction value falls below $10,000,000. In May 2004, the Company and Hunt Capital entered into an exchange agreement pursuant to which Hunt Capital agreed, effective upon the closing of a proposed merger with Trinity Learning Corporation, to exchange the payment rights for a ten-year warrant to purchase 4,981,754 shares of Prosoft common stock at $.001 per share. In addition, as part of this exchange agreement Hunt Capital agreed to vote its shares of Prosoft common stock in favor of the merger proposal and waive its right to accelerate the note as a result of the merger. The merger agreement with Trinity Learning Corporation was subsequently terminated and the exchange with Hunt Capital was never effected. The exchange agreement also provides that Hunt’s rights to convert the note and exercise any of its warrants to purchase our common stock are limited so that Hunt Capital may not exercise such rights to the extent Hunt Capital would then beneficially own shares of our common stock in excess of 9.95% of the common stock then issued and outstanding. This limitation terminates on the maturity date of the note, October 16, 2006, and may be waived by Hunt Capital under limited circumstances, including upon a default by us under the note or upon a sale or change of control of the Company. Under our agreements with Hunt Capital, we have also agreed to register for resale all of the shares of our common stock Hunt Capital owns and all shares it may acquire upon exercise of its warrants or conversion of its note. We currently have an effective registration statement covering the resale of all shares beneficially owned by Hunt Capital.

We believe that the foregoing transactions were in our best interests. As a matter of policy, these transactions were and all future transactions between the Company and its officers, directors, principal stockholders or their affiliates will be, approved by a majority of the independent and disinterested members of the board of directors, on terms no less favorable than could be obtained from unaffiliated third parties and in connection with bona fide business purposes of the Company.

18

AUDIT COMMITTEE REPORT

The Audit Committee’s role is to act on behalf of the Board of Directors in the oversight of all aspects of our financial reporting, internal control and audit functions. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed the audited financial statements in the Annual Report for fiscal year 2004 with management.

The Audit Committee also reviewed with Grant Thornton LLP, our independent auditors, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards (including Statement on Auditing Standards No. 61). In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from management and the Company, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1. The Audit Committee has also considered whether the provision of non-audit services by Grant Thornton LLP is compatible with their independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls, and the overall quality our financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K for the year ended July 31, 2004 for filing with the Securities and Exchange Commission.

|

By the Audit Committee, |

|

J. William Fuller, Chairperson |

Charles P. McCusker |

Dr. Edward Walsh |

19

FEES PAID TO INDEPENDENT AUDITORS

Audit Fees

The following table sets forth certain information concerning the fees of Grant Thornton, LLP for the Company’s last two fiscal years. The reported fees, except the audit fees, are amounts billed to the Company in the indicated fiscal years. The audit fees are for services for those fiscal years.

| | | | | | |

| | | Fiscal Year Ended

July 31,

|

| | | 2004

| | 2003(4)

|

Audit Fees (1) | | $ | 86,500 | | $ | 72,115 |

Audit-Related Fees (2) | | $ | 12,075 | | $ | 13,750 |

Tax Fees (3) | | $ | 26,729 | | $ | 5,610 |

All Other Fees | | | — | | | — |

| (1) | Includes fees for the audit of the Company’s annual financial statements and for review of the unaudited financial statements included in the Company’s quarterly reports to the SEC on Form 10-Q. |

| (2) | Includes fees for the benefit plan audit and, in fiscal year 2004, fees related to an acquisition. |

| (3) | Includes fees for tax compliance, tax advice and tax planning services. Such services principally involved preparation of the Company’s federal and local tax returns. |

| (4) | The reported fees for fiscal 2003 have been reclassified from those reported in last year’s Proxy Statement to conform with the revised presentation now called for by SEC regulations. |

Pre-Approval Policies and Procedures

Pursuant to the Audit Committee Charter, the Audit Committee pre-approves all audit services to be provided by the independent public accountants and, separately, all permitted non-audit services to be performed by the independent public accountants.

20

COMPANY STOCK PRICE PERFORMANCE

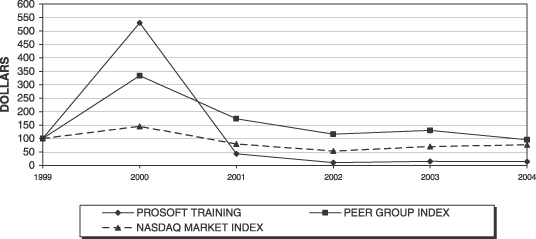

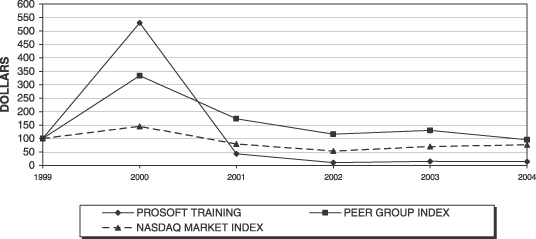

The graph set forth below compares the cumulative total return as of the end of our most recent fiscal year on $100 invested in our common stock, the Nasdaq Composite Index (“Nasdaq Index”), and an industry peer group on July 31, 1999, the first trading date, assuming the reinvestment of all dividends. The industry peer group used includes the following issuers: Learning Tree International. (Nasdaq:LTRE); Insightful Corporation (Nasdaq: IFUL); V Campus Corporation (Nasdaq: VCMP); and iLinc Communications, Inc. (AMEX:ILC). The historical stock performance shown on the chart is not intended to and may not be indicative of future stock performance.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG PROSOFT TRAINING,

NASDAQ MARKET INDEX AND PEER GROUP INDEX

ASSUMES $100 INVESTED ON JULY 31, 1999

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR ENDING JULY 31, 2004

| | | | | | | | | | | | | | | | | | |

| | | July 31,

1999

| | July 31,

2000

| | July 31,

2001

| | July 31,

2002

| | July 31,

2003

| | July 31,

2004

|

ProsoftTraining | | $ | 100.00 | | $ | 530.43 | | $ | 42.78 | | $ | 10.43 | | $ | 15.34 | | $ | 14.26 |

Peer Group | | $ | 100.00 | | $ | 333.85 | | $ | 173.34 | | $ | 116.15 | | $ | 130.65 | | $ | 95.28 |

Nasdaq Index | | $ | 100.00 | | $ | 145.58 | | $ | 80.04 | | $ | 53.49 | | $ | 70.01 | | $ | 76.64 |

21

APPOINTMENT OF INDEPENDENT AUDITORS

ProsoftTraining has appointed the firm of Grant Thornton LLP, independent public auditors for the Company during the 2004 fiscal year, to serve in the same capacity for the year ending July 31, 2005. Representatives of Grant Thornton LLP are expected to be present at the annual meeting and will be available to respond to appropriate questions and to make such statements as they may desire.

NOMINATIONS AND STOCKHOLDER PROPOSALS

The bylaws of the Company require that all nominations for persons to be elected to the board of directors, other than those made by or at the direction of the board of directors, be made pursuant to written notice to the Secretary of the Company. The notice must be received not less than 35 days prior to the meeting at which the election will take place (or not later than 10 days after public disclosure of such meeting date is given or made to stockholders if such disclosure occurs less than 50 days prior to the date of such meeting). Notice must set forth the name, age, business address and residence address of each nominee, their principal occupation or employment, the class and number of shares of stock which they beneficially own, their citizenship and any other information that is required to be disclosed in solicitations for proxies for election of directors pursuant to the Exchange Act. The notice must also include the nominating stockholder’s name and address as they appear on our books and the class and number of shares of stock beneficially owned by such stockholder.

In addition, the bylaws require that for business to be properly brought before an annual meeting by a stockholder, the Secretary of the Company must have received written notice thereof (i) in the case of an annual meeting that is called for a date that is within 30 days before or after the anniversary date of the immediately preceding annual meeting, not less than 120 days in advance of the anniversary date of the Company’s proxy statement for the previous year’s annual meeting, nor more than 150 days prior to such anniversary date and (ii) in the case of an annual meeting that is called for a date that is not within 30 days before or after the anniversary date of the immediately preceding annual meeting, not later than the close of business on the 10th day following the day on which notice of the date of the meeting was mailed or public disclosure of the date of the meeting was made, whichever occurs first. The notice must set forth the name and address of the stockholder who intends to bring business before the meeting, the general nature of the business which he or she seeks to bring before the meeting and a representation that the stockholder is a holder of record of shares entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to bring the business specified in the notice before the meeting.

Any proposal of a stockholder intended to be presented at our 2005 annual meeting and included in the proxy statement and form of proxy for that meeting is required to be received by the Company no later August 2, 2005. Management proxies will have discretionary voting authority as to any proposal not received by that date if it is raised at that annual meeting, without any discussion of the matter in the proxy statement.

22

ANNUAL REPORT

Our Annual Report on Form 10-K, including financial statements and schedules thereto, for the fiscal year ended July 31, 2004, accompanies this proxy statement.

OTHER MATTERS

At the time of the preparation of this proxy statement, the board of directors knows of no other matter that will be acted upon at the annual meeting. If any other matter is presented properly for action at the annual meeting or at any adjournment or postponement thereof, it is intended that the proxies will be voted with respect thereto in accordance with the best judgment and in the discretion of the proxy holders.

|

By Order of the Board of Directors, |

ProsoftTraining

|

|

|

| Robert G. Gwin |

| Chairman of the Board |

Phoenix, Arizona

November 29, 2004

23

Appendix A

Audit Committee Charter

Role and Scope

The Audit Committee of the Board of Directors assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, and reporting practices of the Company, and such other duties as directed by the Board. The Committee’s purpose is to oversee the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements. The Committee’s role includes a particular focus on the qualitative aspects of financial reporting to shareholders, and on the Company’s processes to manage business and financial risk, and for compliance with significant applicable legal, ethical, and regulatory requirements. The Committee is directly responsible for the appointment, compensation, and oversight of the public accounting firm engaged to prepare or issue an audit report on the financial statements of the Company.

Membership

The membership of the Committee consists of at least three directors who are generally knowledgeable in financial and auditing matters, including at least one member with accounting or related financial management expertise. Each member will be free of any relationship that, in the opinion of the board, would interfere with his or her individual exercise of independent judgment. Applicable laws and regulations will be followed in evaluating a member’s independence. The chairperson is appointed by the full Board.

Operations