INVESTOR PRESENTATION: FOURTH QUARTER 2023

Safe Harbor and Other Information 3 Company Overview 5 Q4 2023 and Full Year Results 15 Appendix 21 TABLE OF CONTENTS 2

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 This presentation and related statements by management or spokespeople of A&F contain forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). These statements, including, without limitation, statements regarding our first quarter and annual fiscal 2024 results, relate to our current assumptions, projections and expectations about our business and future events. Any such forward-looking statements involve risks and uncertainties and are subject to change based on various important factors, many of which may be beyond the company’s control. The inclusion of such information should not be regarded as a representation by the company, or any other person, that the objectives of the company will be achieved. Words such as “estimate,” “project,” “plan,” “goal,” “believe,” “expect,” “anticipate,” “intend,” “should,” “are confident,” “will,” “could,” “outlook,” and similar expressions may identify forward-looking statements. Except as may be required by applicable law, we assume no obligation to publicly update or revise any forward-looking statements, including any financial targets or estimates, whether as a result of new information, future events, or otherwise. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to, the factors disclosed in Part I, Item 1A. “Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended January 28, 2023, and otherwise in our reports and filings with the Securities and Exchange Commission, as well as the following factors: risks related to changes in global economic and financial conditions, including inflation, and the resulting impact on consumer spending generally and on our operating results, financial condition, and expense management, and our ability to adequately mitigate the impact; risks related to geopolitical conflict, armed conflict, the conflicts between Russia and Ukraine or Israel and Hamas and the expansion of conflict in the surrounding areas, including the impact of such conflicts on international trade, supplier delivery or increased freight costs, acts of terrorism, mass casualty events, social unrest, civil disturbance or disobedience; risks related to our failure to engage our customers, anticipate customer demand and changing fashion trends, and manage our inventory; risks related to our failure to operate effectively in a highly competitive and constantly evolving industry; risks related to our ability to execute on our strategic and growth initiatives, including those outlined in our Always Forward Plan; risks related to fluctuations in foreign currency exchange rates; risks related to fluctuations in our tax obligations and effective tax rate, including as a result of earnings and losses generated from our global operations, may result in volatility in our results of operations; risks and uncertainty related to adverse public health developments; risks associated with climate change and other corporate responsibility issues; risks related to reputational harm to the company, its officers, and directors; risks related to actual or threatened litigation; risks related to cybersecurity threats and privacy or data security breaches; and the potential loss or disruption to our information systems. OTHER INFORMATION As used in this presentation, unless otherwise defined, references to "Abercrombie" or "Abercrombie brands" includes Abercrombie & Fitch and abercrombie kids and references to "Hollister" or "Hollister brands" includes Hollister and Gilly Hicks. Additionally, references to "Americas" includes North America and South America, "EMEA" includes Europe, the Middle East and Africa and "APAC" includes the Asia-Pacific region, including Asia and Oceania. 3

4 REPORTING AND USE OF GAAP AND NON-GAAP MEASURES The following presentation includes certain adjusted non-GAAP financial measures. Additional details about non-GAAP financial measures and a reconciliation of GAAP financial measures to non-GAAP financial measures is included in the Appendix to this presentation. As used in the presentation, "GAAP" refers to accounting principles generally accepted in the United States of America. Sub-totals and totals may not foot due to rounding. Net income and net income per share financial measures included herein are attributable to Abercrombie & Fitch Co., excluding net income attributable to noncontrolling interests. The company believes that each of the non-GAAP financial measures presented are useful to investors as they provide a measure of the company’s operating performance excluding the effect of certain items which the company believes do not reflect its future operating outlook, such as asset impairment charges, therefore supplementing investors’ understanding of comparability of operations across periods. Management used these non-GAAP financial measures during the periods presented to assess the company’s performance and to develop expectations for future operating performance. Non-GAAP financial measures should be used supplemental to, and not as an alternative to, the company’s GAAP financial results, and may not be calculated in the same manner as similar measures presented by other companies. In addition, the company provides comparable sales, defined as the percentage year-over-year change in the aggregate of: (1) sales for stores that have been open as the same brand at least one year and whose square footage has not been expanded or reduced by more than 20% within the past year, with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation, and (2) digital net sales with prior year’s net sales converted at the current year’s foreign currency exchange rate to remove the impact of foreign currency rate fluctuation. The company also provides certain financial information on a constant currency basis to enhance investors’ understanding of underlying business trends and operating performance, by removing the impact of foreign currency exchange rate fluctuations. The effect from foreign currency, calculated on a constant currency basis, is determined by applying current year average exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share effect from foreign currency is calculated using a 26% tax rate.

5 Abercrombie & Fitch Co. is a global, digitally-led, omnichannel apparel and accessories retailer catering to kids through millennials with assortments curated for their specific lifestyle needs Our corporate purpose of 'We are here for you on the journey to being and becoming who you are' fuels our customer-led brands and our global associates

COMPANY OVERVIEW 6 OUR GLOBAL BRANDS

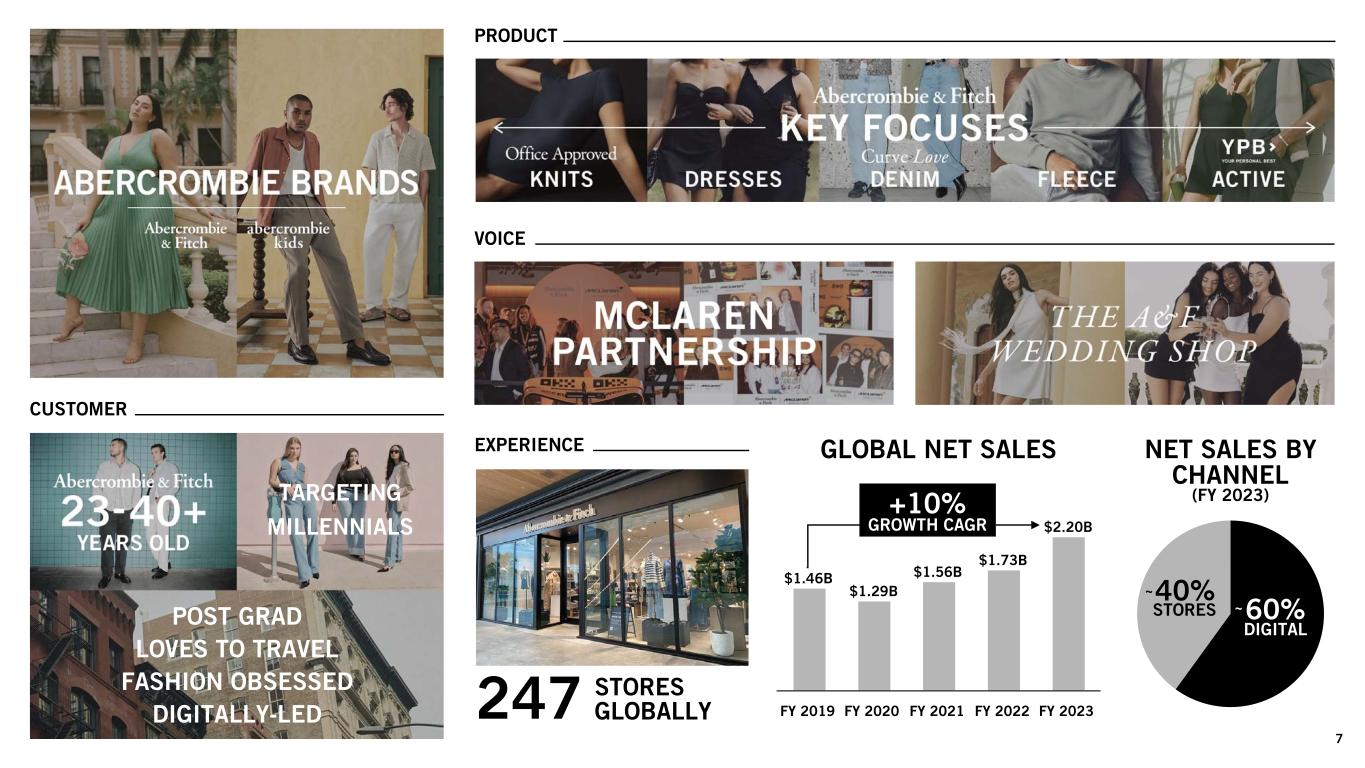

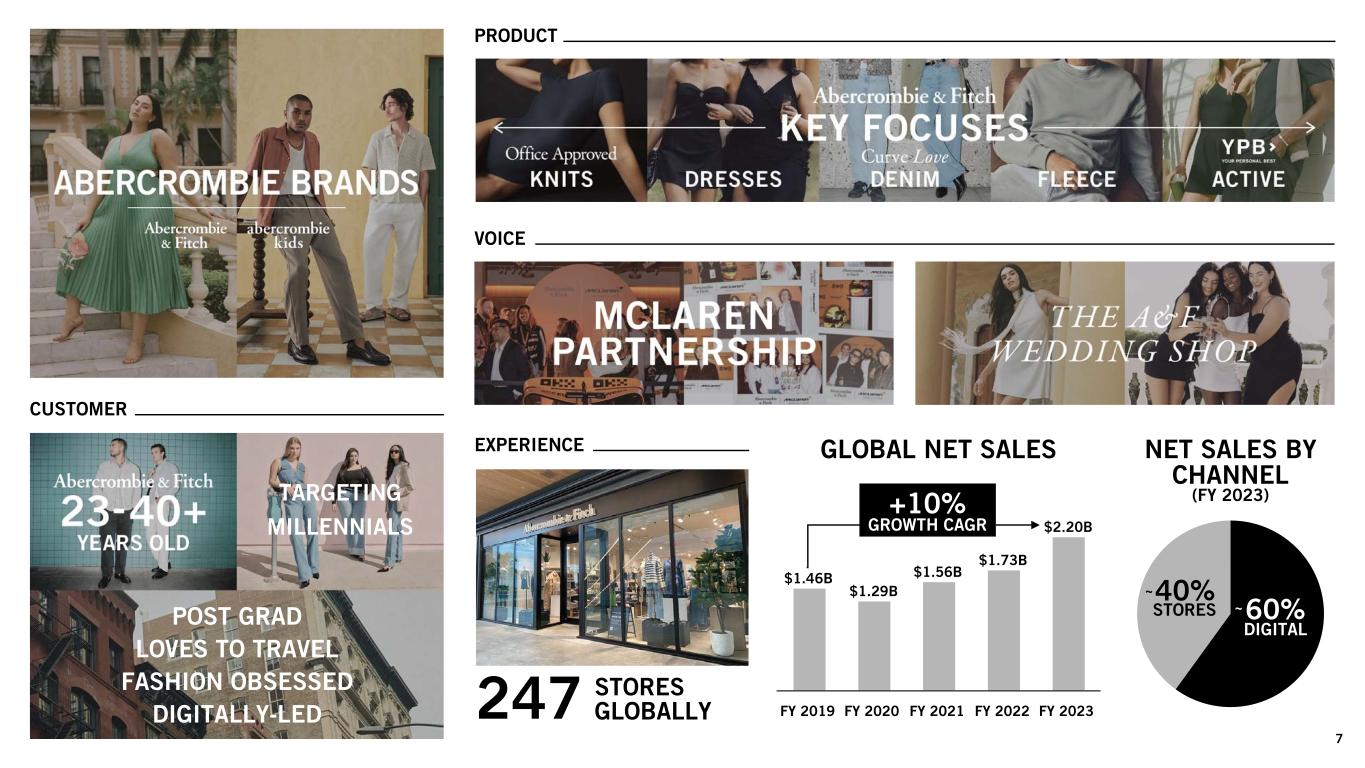

$1.46B $1.29B $1.56B $1.73B $2.20B FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 60% 40% 7 PRODUCT 247 GLOBAL NET SALES CUSTOMER VOICE EXPERIENCE STORES GLOBALLY STORES DIGITAL +10% GROWTH CAGR NET SALES BY CHANNEL (FY 2023) POST GRAD LOVES TO TRAVEL FASHION OBSESSED DIGITALLY-LED TARGETING MILLENNIALS ~ ~

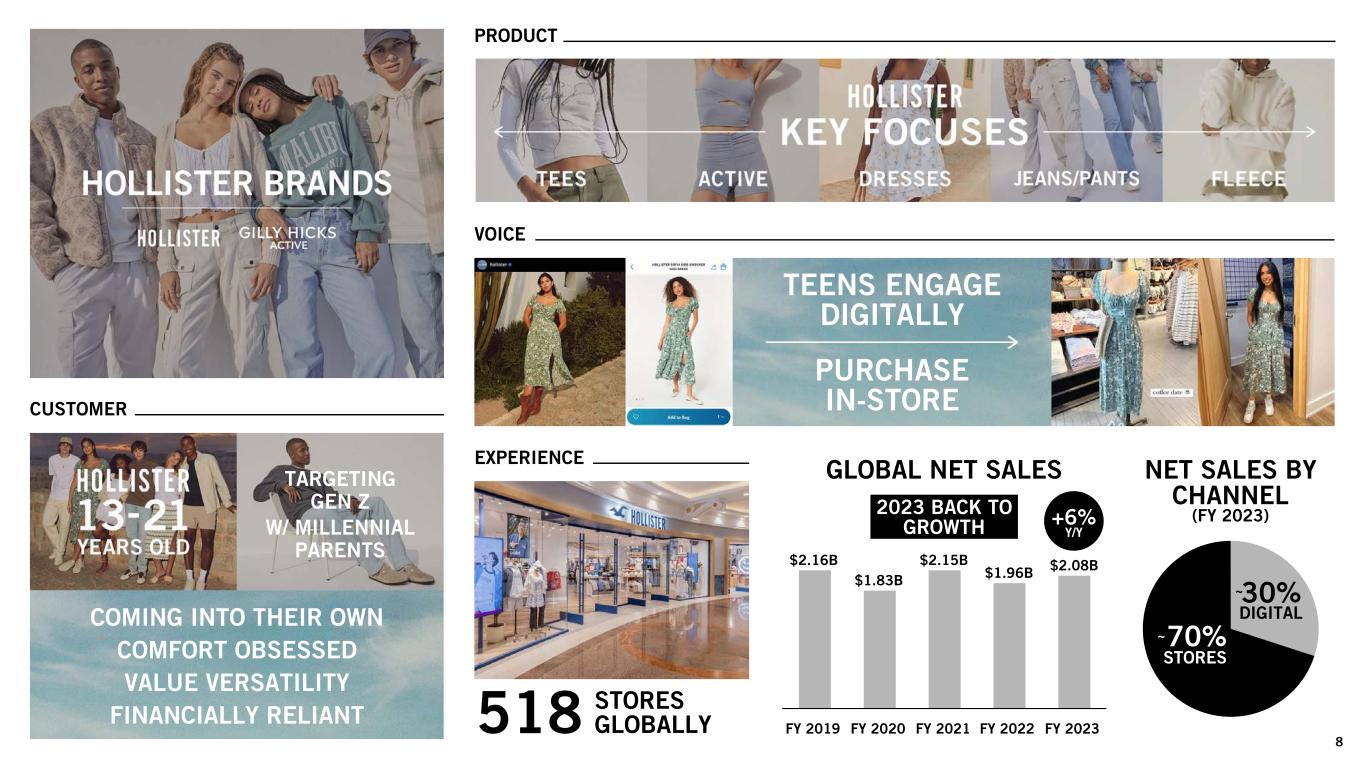

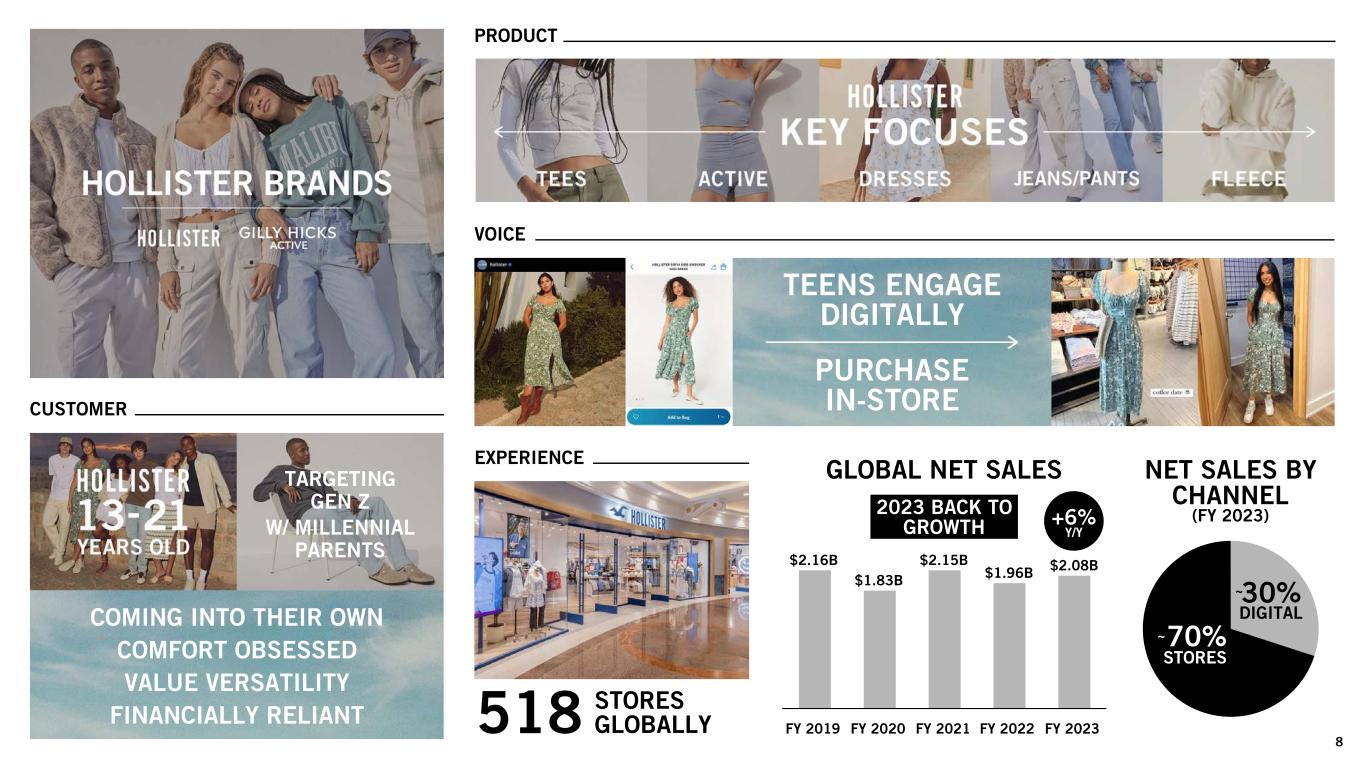

EXPERIENCE $2.16B $1.83B $2.15B $1.96B $2.08B FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 8 518 PRODUCT CUSTOMER VOICE TEENS ENGAGE DIGITALLY GLOBAL NET SALES NET SALES BY CHANNEL (FY 2023) PURCHASE IN-STORE 30% 70% STORES DIGITAL STORES GLOBALLY 2023 BACK TO GROWTH +6% Y/Y COMING INTO THEIR OWN COMFORT OBSESSED VALUE VERSATILITY FINANCIALLY RELIANT TARGETING GEN Z W/ MILLENNIAL PARENTS ~ ~

COMPANY OVERVIEW Fiscal 2017 - 2022 STABILIZE & TRANSFORM 9 FOCUS ON SUSTAINABLE, PROFITABLE GROWTH 2022: $3.7B Sales 3% Op Margin 2025 Target1: $4.1-$4.3B Sales 8%+ Op Margin Longer-Term Ambition1: $5B Sales 10%+ Op Margin 2023 - 2025 ALWAYS FORWARD PLAN BUILT ON YEARS OF TRANSFORMATION 2023 Results: $4.3B Sales 11% Op Margin BEYOND 2025 (1) As presented in our June 2022 Investor Day

COMPANY OVERVIEW STABILIZE & TRANSFORM STABILIZE & TRANSFORM SALES & PROFITABILITY 10 Net Sales (in $ billions) Operating Income (Loss) (in $ millions) COVID CLOSURE IMPACT COVID CLOSURE IMPACT EXPECT +4-6% GROWTH OP MARGIN 11%3%9%(1%)2%4%2% EXPECT ~12% MARGIN Y/Y GROWTH $3.5 $3.6 $3.6 $3.1 $3.7 $3.7 $4.3 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 16%0%19%(14%)1%3%5% $72 $127 $70 $(20) $343 $93 $485 FY 2017 FY 2018 FY 2019 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024

COMPANY OVERVIEW ALWAYS FORWARD PLAN EXECUTE GLOBAL BRAND GROWTH PLANS •Data driven approach to store expansion •Grow brand lovers through digital marketing and social selling ACCELERATE AN ENTERPRISE-WIDE DIGITAL REVOLUTION •"Know Them Better" - continued expansion and acceleration of investments in customer analytics to improve customer engagement •"Wow Them Everywhere" - continued investments in people, systems, and processes to improve the end-to-end customer experience OPERATE WITH FINANCIAL DISCIPLINE •Operate with a more agile cost structure •Seek expense efficiencies while protecting investments in digital, technology and store growth 2025 TARGETS: $4.1B - $4.3B REVENUES 8%+ OPERATING MARGIN $600M MINIMUM FREE CASH FLOW GENERATION OVER 3 YEARS LONG-TERM GOAL OF $5B IN REVENUES AND A 10%+ OPERATING MARGIN 1 2 3 11 ALWAYS FORWARD PLAN INTRODUCED AT JUNE 2022 INVESTOR DAY ALWAYS FORWARD PLAN PILLARS

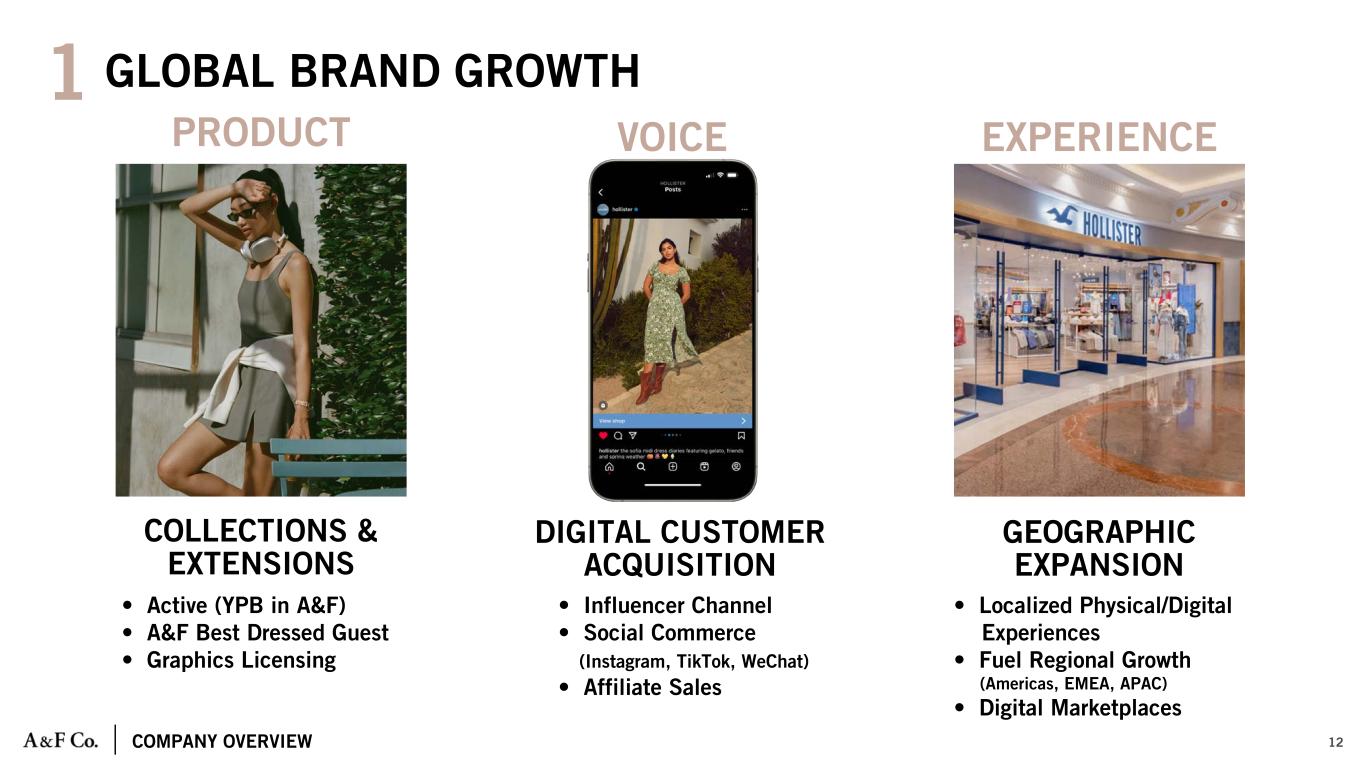

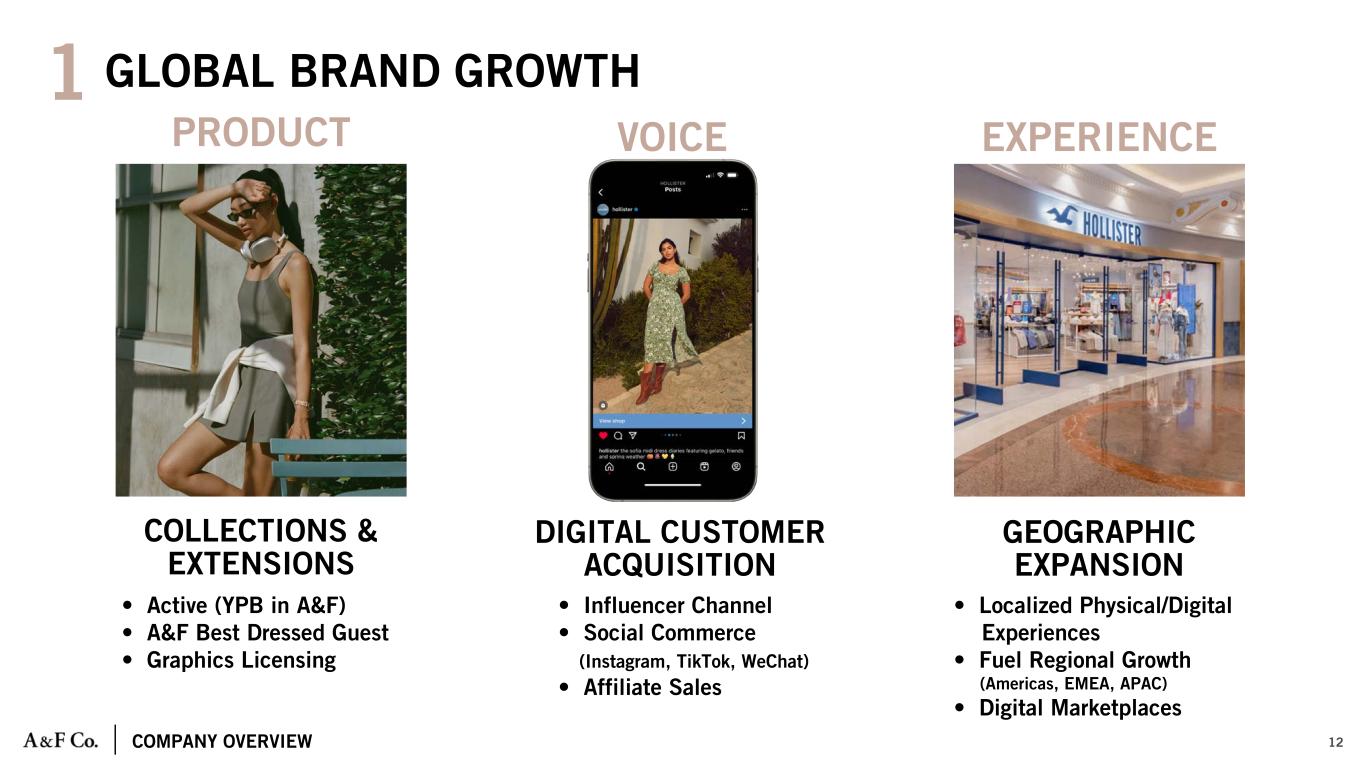

COMPANY OVERVIEW 1 PRODUCT GLOBAL BRAND GROWTH 12 COLLECTIONS & EXTENSIONS • Active (YPB in A&F) • A&F Best Dressed Guest • Graphics Licensing DIGITAL CUSTOMER ACQUISITION • Influencer Channel • Social Commerce (Instagram, TikTok, WeChat) • Affiliate Sales GEOGRAPHIC EXPANSION • Localized Physical/Digital Experiences • Fuel Regional Growth (Americas, EMEA, APAC) • Digital Marketplaces VOICE EXPERIENCE

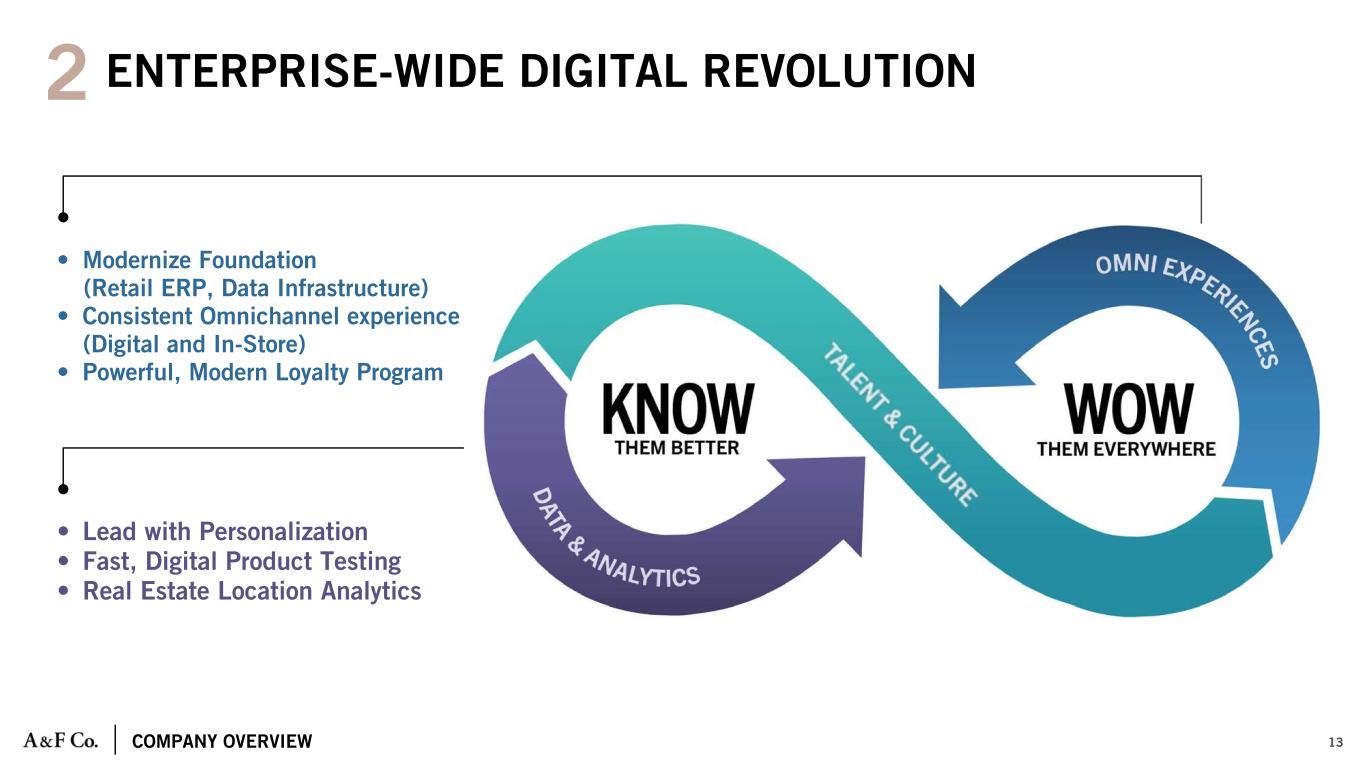

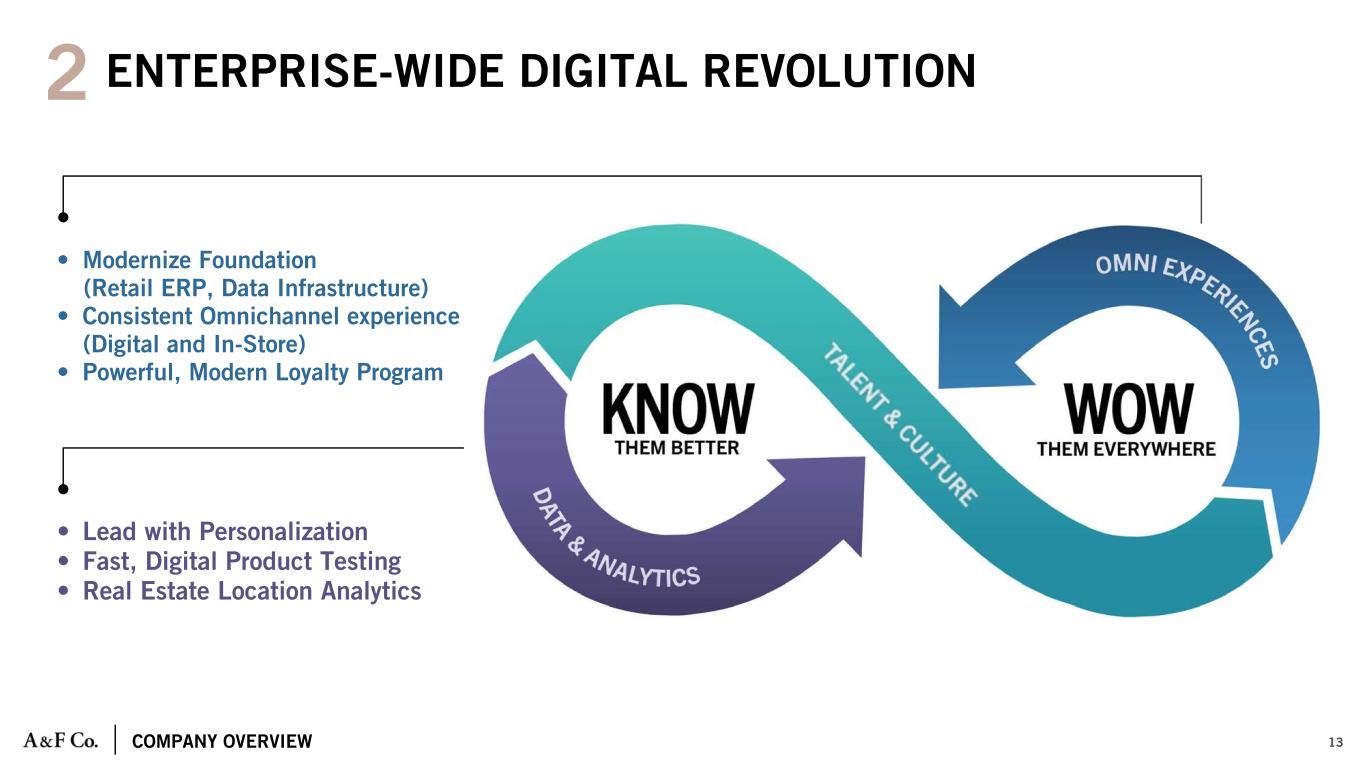

COMPANY OVERVIEW 13 • Lead with Personalization • Fast, Digital Product Testing • Real Estate Location Analytics • Modernize Foundation (Retail ERP, Data Infrastructure) • Consistent Omnichannel experience (Digital and In-Store) • Powerful, Modern Loyalty Program ENTERPRISE-WIDE DIGITAL REVOLUTION2

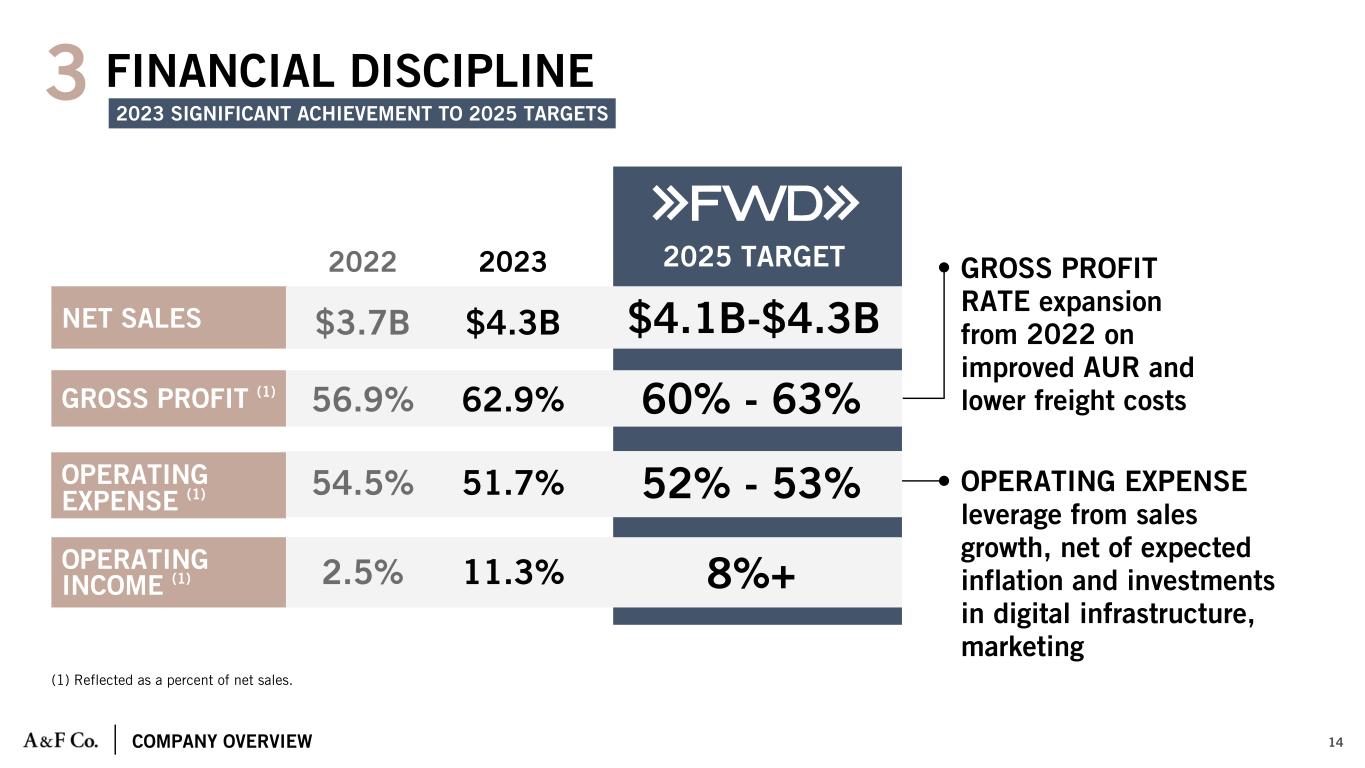

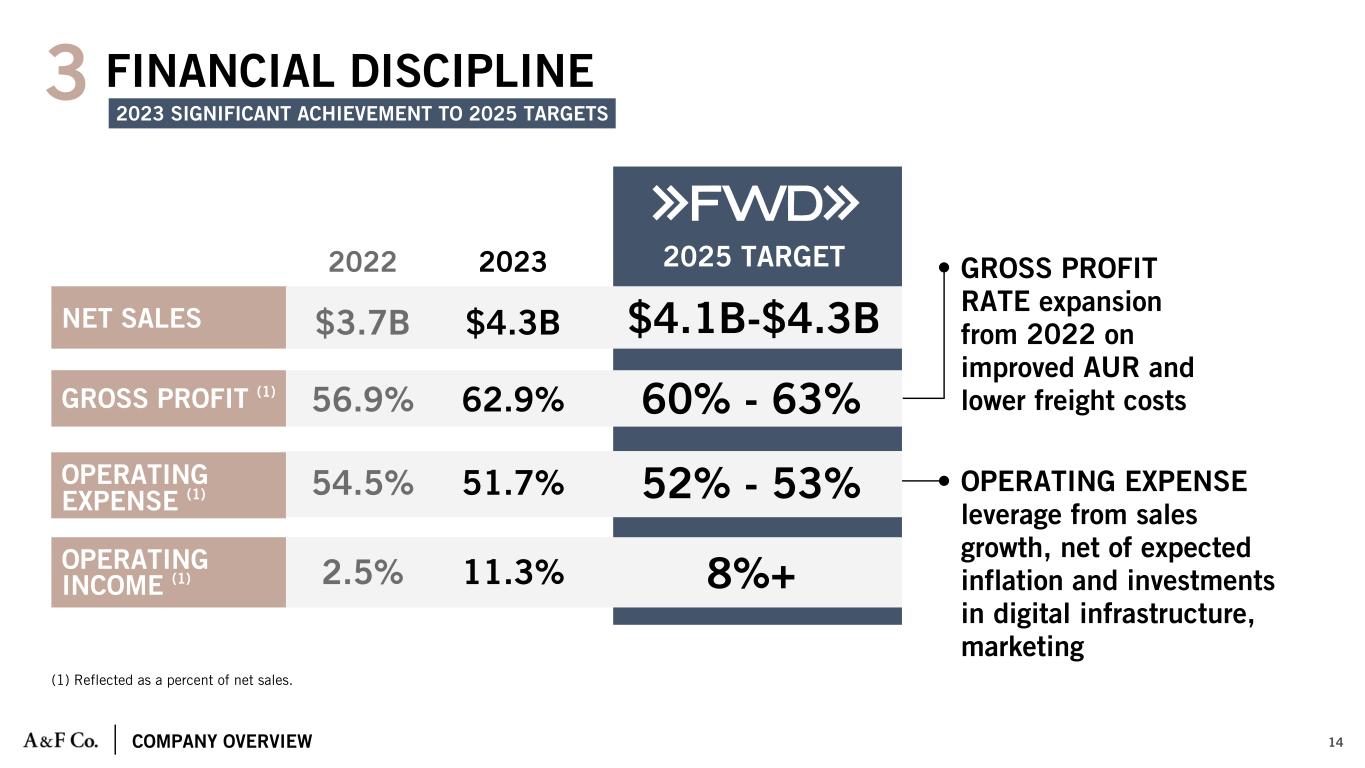

COMPANY OVERVIEW (1) Reflected as a percent of net sales. 14 $4.3B 62.9% 2023 51.7% 11.3% OPERATING EXPENSE (1) $4.1B-$4.3B 60% - 63% 52% - 53% 8%+OPERATING INCOME (1) GROSS PROFIT (1) NET SALES FINANCIAL DISCIPLINE3 $3.7B 56.9% 2022 54.5% 2.5% 2025 TARGET GROSS PROFIT RATE expansion from 2022 on improved AUR and lower freight costs OPERATING EXPENSE leverage from sales growth, net of expected inflation and investments in digital infrastructure, marketing 2023 SIGNIFICANT ACHIEVEMENT TO 2025 TARGETS

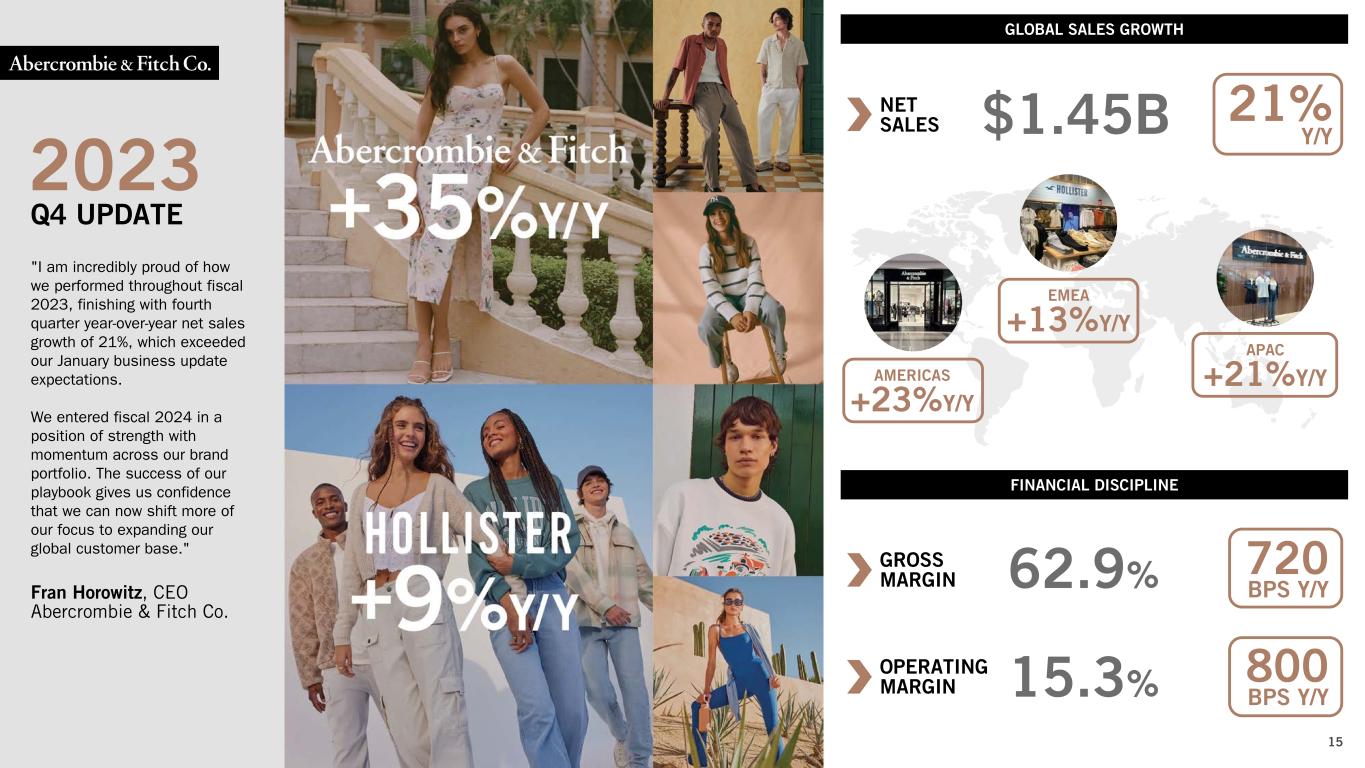

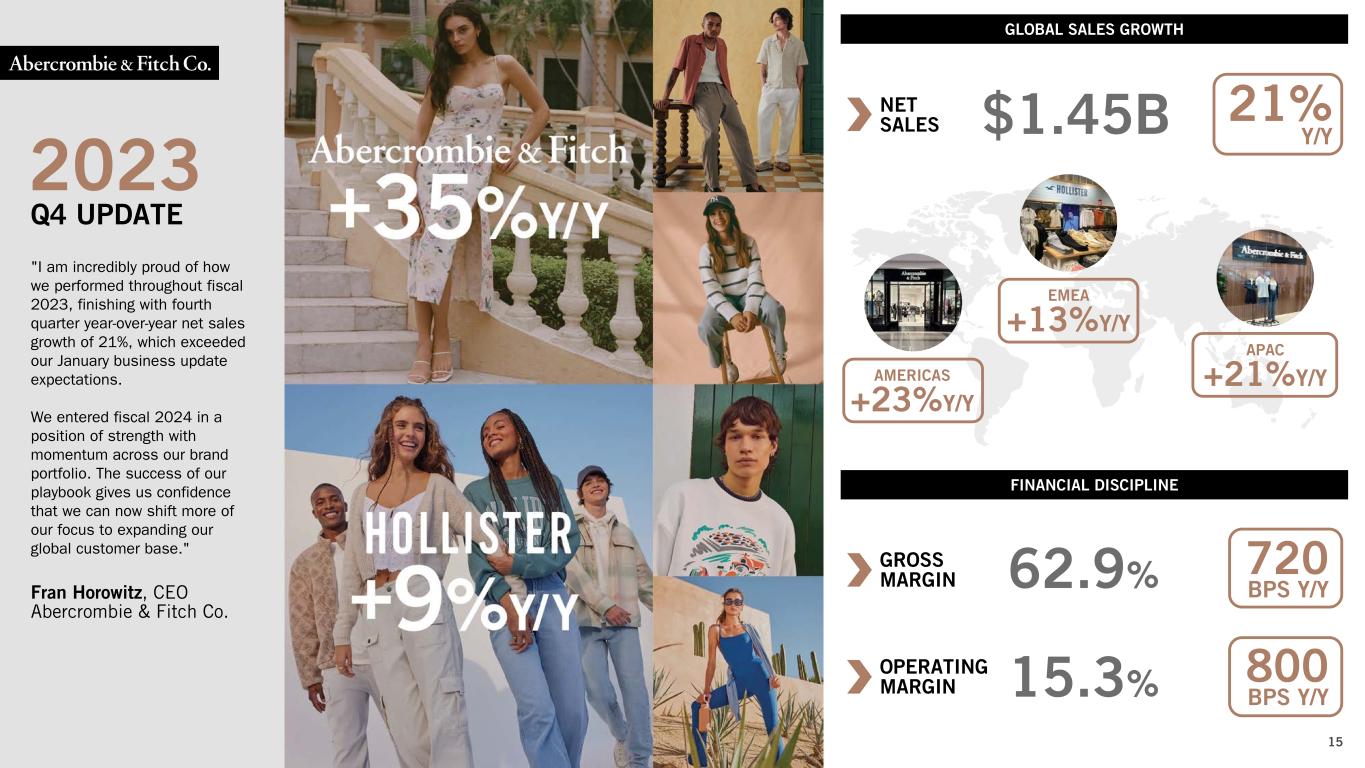

GROSS MARGIN 62.9% 15.3% "I am incredibly proud of how we performed throughout fiscal 2023, finishing with fourth quarter year-over-year net sales growth of 21%, which exceeded our January business update expectations. We entered fiscal 2024 in a position of strength with momentum across our brand portfolio. The success of our playbook gives us confidence that we can now shift more of our focus to expanding our global customer base." Fran Horowitz, CEO Abercrombie & Fitch Co. 15 2023 21% Y/Y OPERATING MARGIN NET SALES GLOBAL SALES GROWTH FINANCIAL DISCIPLINE 800 BPS Y/Y 720 BPS Y/Y $1.45B AMERICAS +23%Y/Y EMEA +13%Y/Y APAC +21%Y/Y Q4 UPDATE

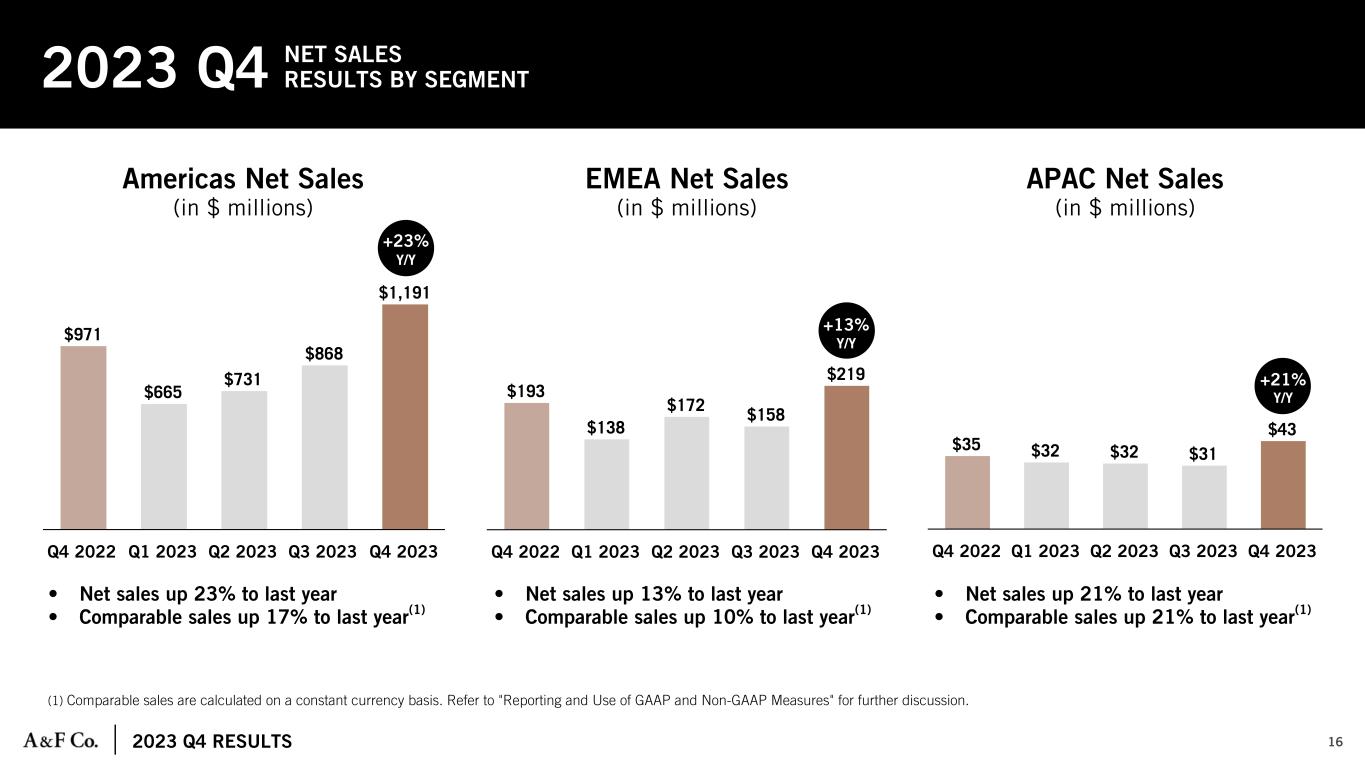

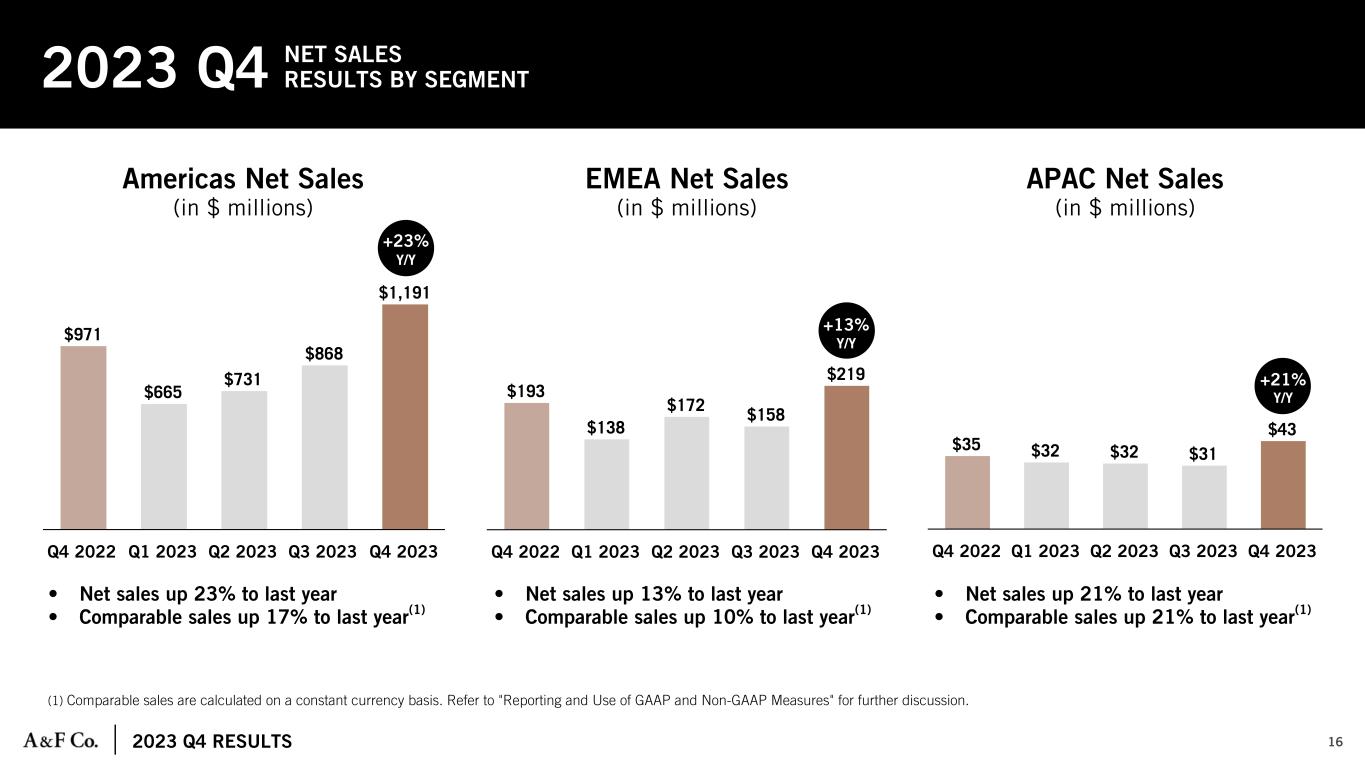

2023 Q4 RESULTS $35 $32 $32 $31 $43 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $971 $665 $731 $868 $1,191 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $193 $138 $172 $158 $219 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 16 Americas Net Sales (in $ millions) EMEA Net Sales (in $ millions) APAC Net Sales (in $ millions) • Net sales up 23% to last year • Comparable sales up 17% to last year(1) • Net sales up 13% to last year • Comparable sales up 10% to last year(1) • Net sales up 21% to last year • Comparable sales up 21% to last year(1) (1) Comparable sales are calculated on a constant currency basis. Refer to "Reporting and Use of GAAP and Non-GAAP Measures" for further discussion. 2023 Q4 NET SALES RESULTS BY SEGMENT +23% Y/Y +13% Y/Y +21% Y/Y

2023 Q4 RESULTS $639 $400 $473 $509 $698 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $1,200 $836 $935 $1,056 $1,453 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $560 $436 $463 $548 $755 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 17 Total Company Net Sales (in $ millions) Abercrombie Brands Net Sales (in $ millions) Hollister Brands Net Sales (in $ millions) • Net sales up 21.1% to last year • Comparable sales up 16% to last year(1) • Third consecutive quarter of sales growth rate acceleration • 52% of total net sales • Third consecutive quarter of sales growth; balance across regions • 48% of total net sales (1) Comparable sales are calculated on a constant currency basis. Refer to "Reporting and Use of GAAP and Non-GAAP Measures" for further discussion. 2023 Q4 NET SALES RESULTS BY BRAND +21% Y/Y +35% Y/Y +9% Y/Y

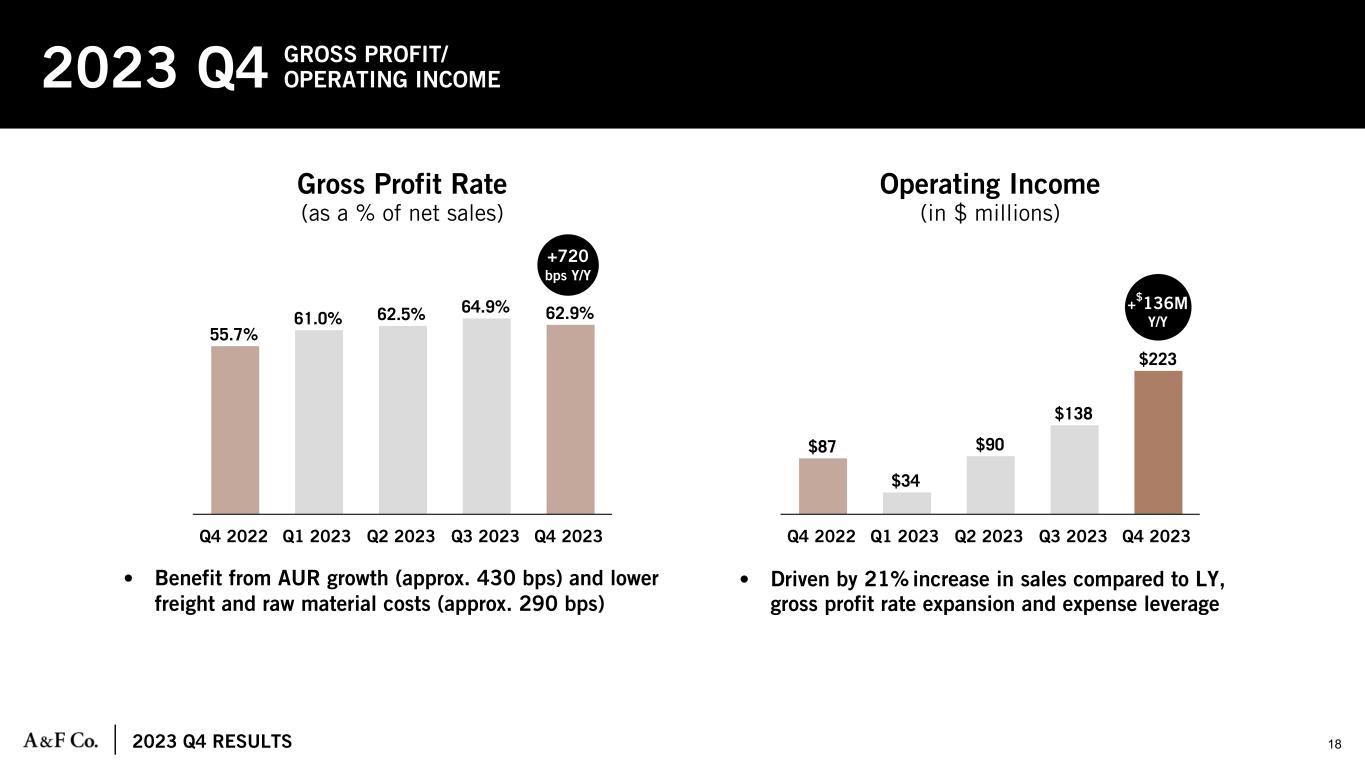

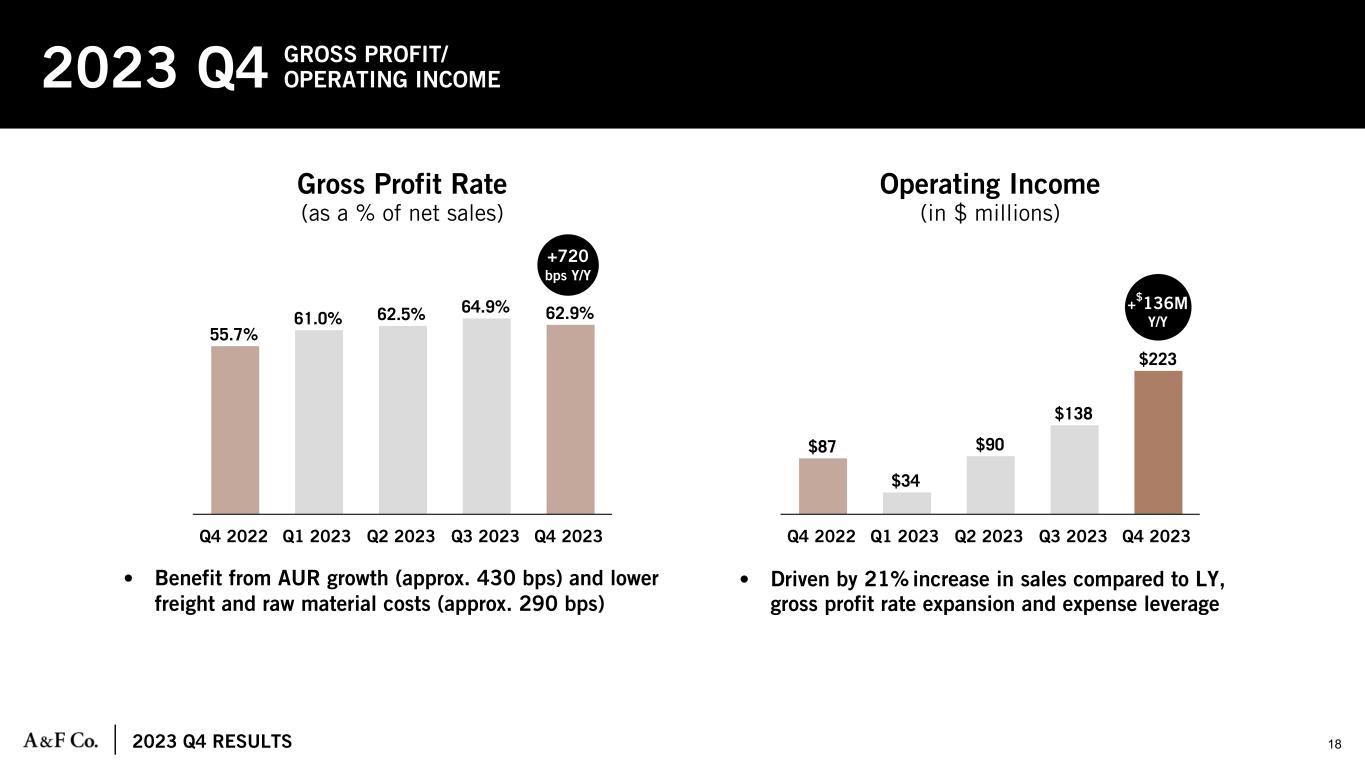

2023 Q4 RESULTS • Benefit from AUR growth (approx. 430 bps) and lower freight and raw material costs (approx. 290 bps) 55.7% 61.0% 62.5% 64.9% 62.9% Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $87 $34 $90 $138 $223 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 18 Gross Profit Rate (as a % of net sales) Operating Income (in $ millions) • Driven by 21% increase in sales compared to LY, gross profit rate expansion and expense leverage 2023 Q4 GROSS PROFIT/ OPERATING INCOME +$136M Y/Y +720 bps Y/Y

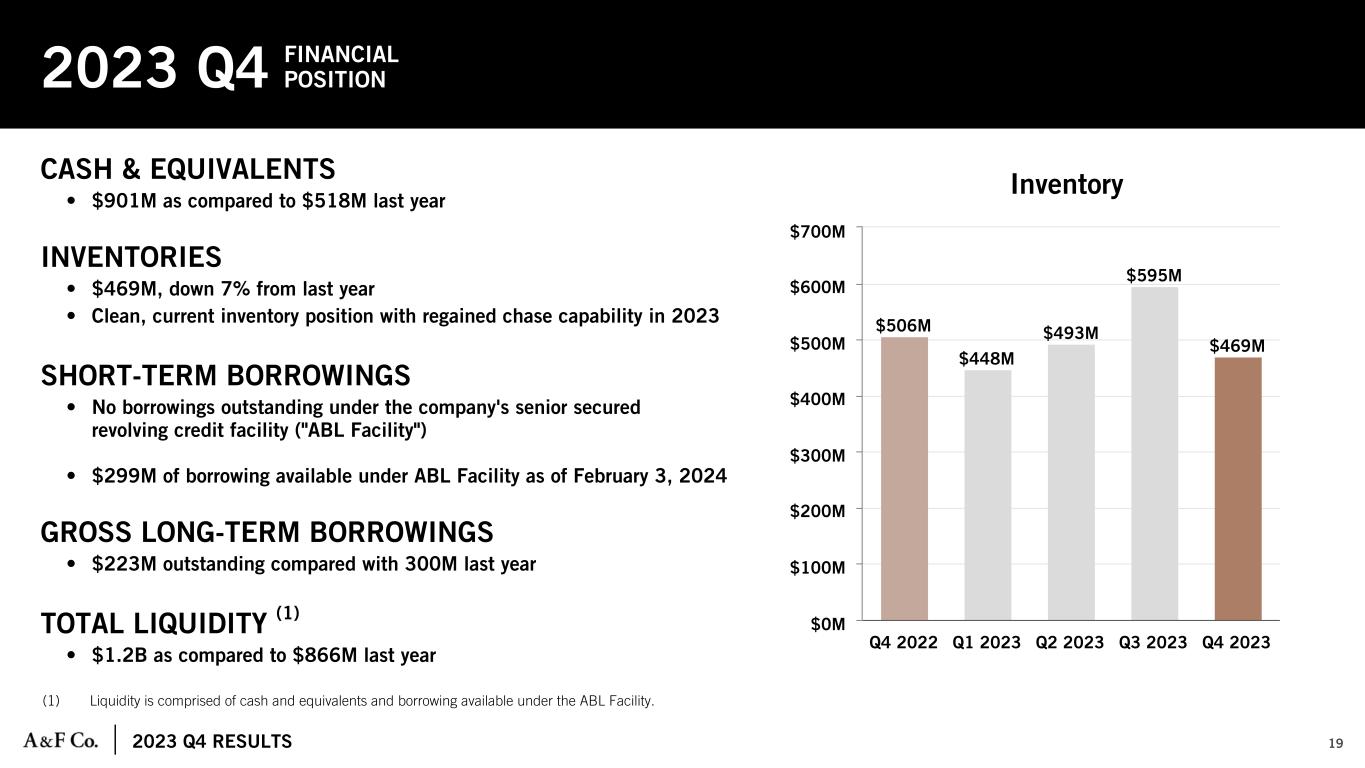

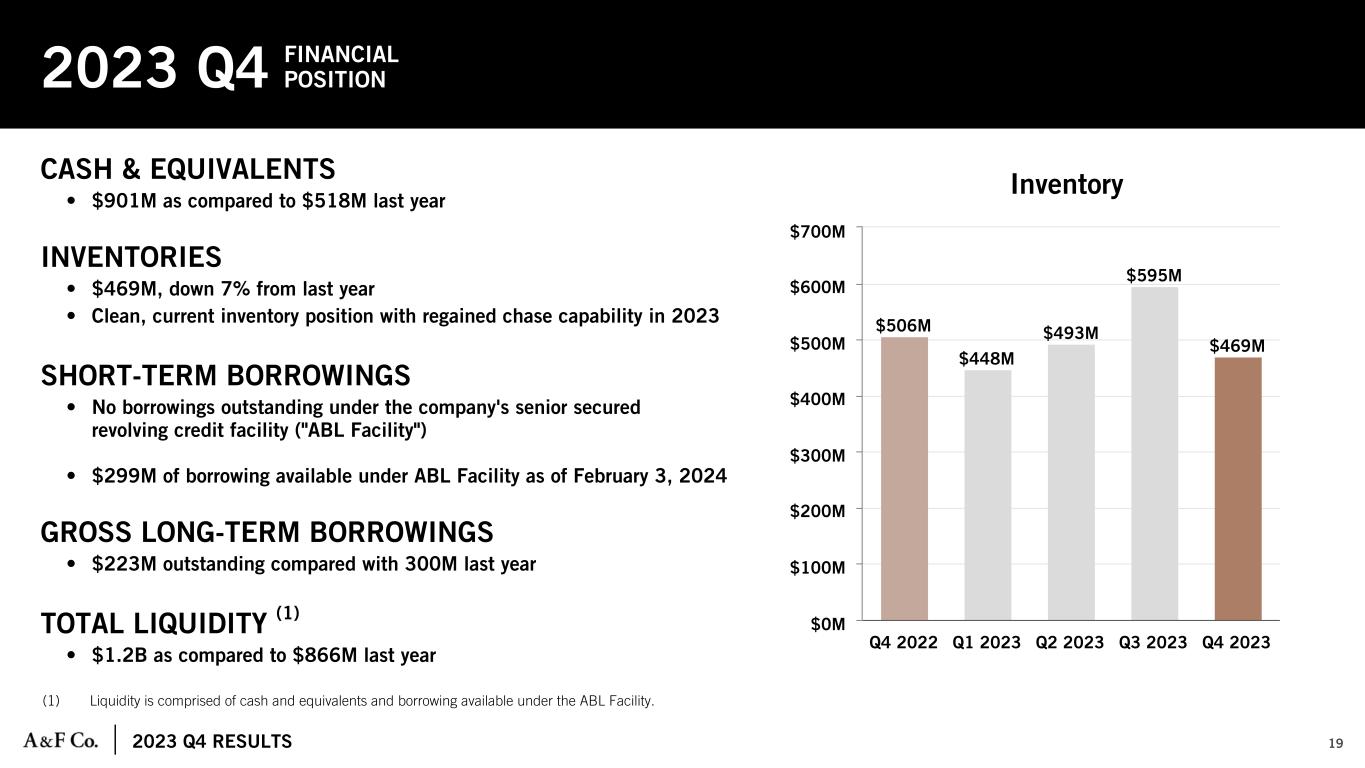

2023 Q4 RESULTS CASH & EQUIVALENTS • $901M as compared to $518M last year INVENTORIES • $469M, down 7% from last year • Clean, current inventory position with regained chase capability in 2023 SHORT-TERM BORROWINGS • No borrowings outstanding under the company's senior secured revolving credit facility ("ABL Facility") • $299M of borrowing available under ABL Facility as of February 3, 2024 GROSS LONG-TERM BORROWINGS • $223M outstanding compared with 300M last year TOTAL LIQUIDITY (1) • $1.2B as compared to $866M last year $506M $448M $493M $595M $469M Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 $0M $100M $200M $300M $400M $500M $600M $700M (1) Liquidity is comprised of cash and equivalents and borrowing available under the ABL Facility. 19 Inventory FINANCIAL POSITION2023 Q4

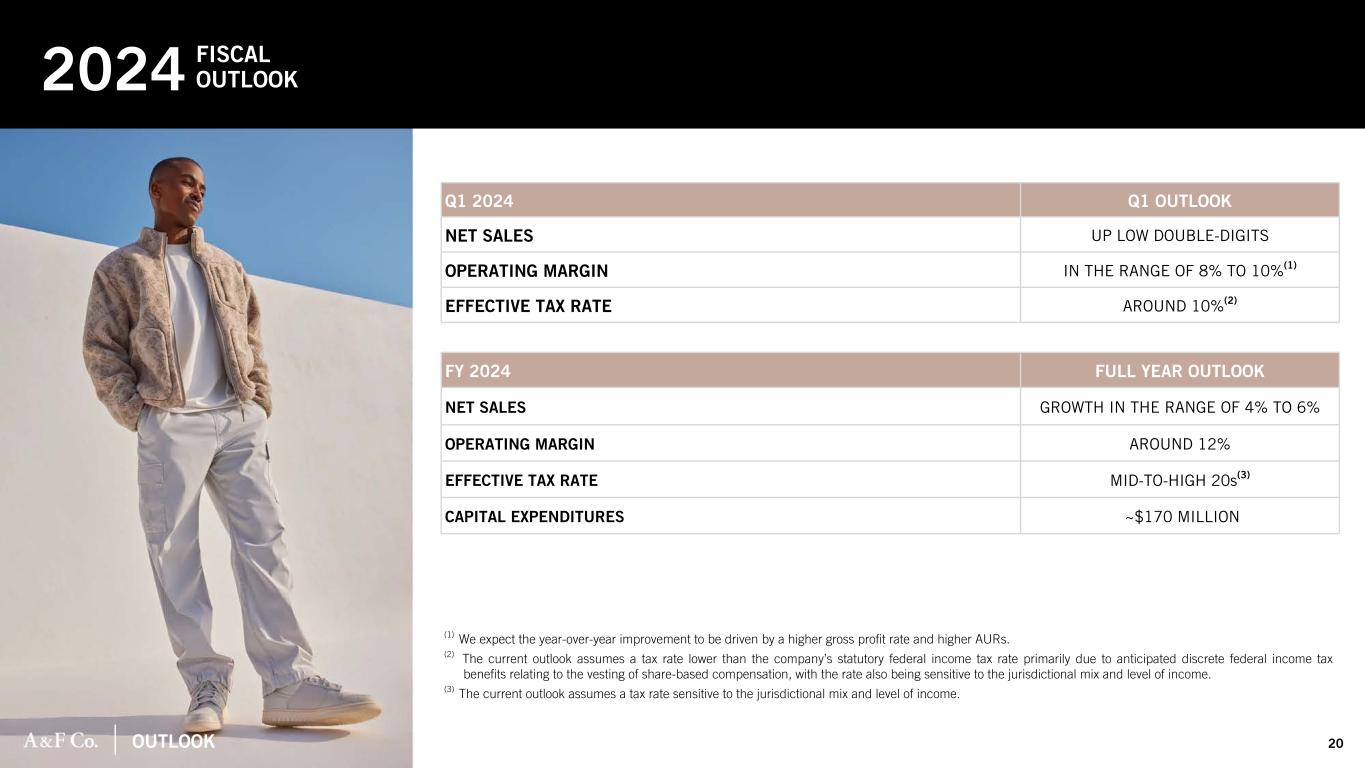

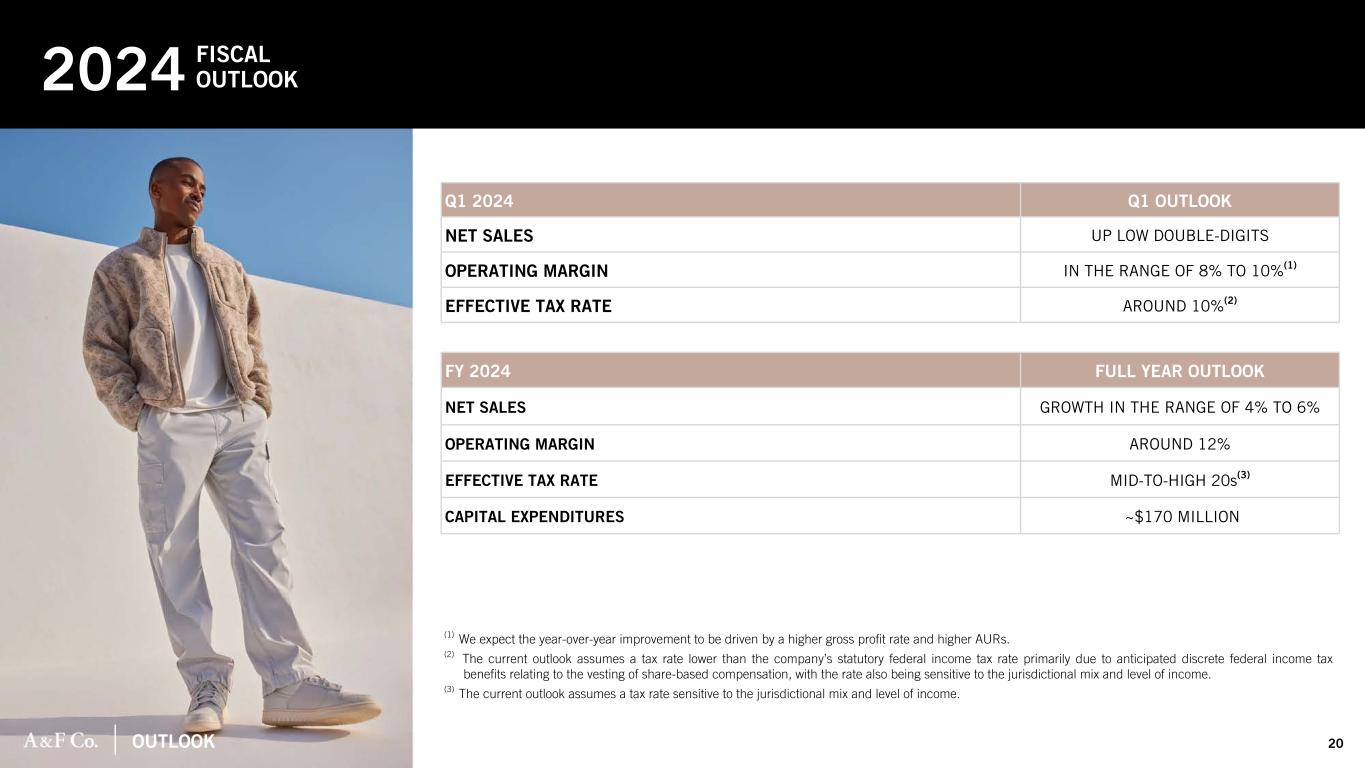

OUTLOOK 20 2024 FISCAL OUTLOOK PREVIOUS FULL YEAR OUTLOOK (1) Q1 2024 Q1 OUTLOOK NET SALES UP LOW DOUBLE-DIGITS OPERATING MARGIN IN THE RANGE OF 8% TO 10%(1) EFFECTIVE TAX RATE AROUND 10%(2) FY 2024 FULL YEAR OUTLOOK NET SALES GROWTH IN THE RANGE OF 4% TO 6% OPERATING MARGIN AROUND 12% EFFECTIVE TAX RATE MID-TO-HIGH 20s(3) CAPITAL EXPENDITURES ~$170 MILLION (1) We expect the year-over-year improvement to be driven by a higher gross profit rate and higher AURs. (2) The current outlook assumes a tax rate lower than the company’s statutory federal income tax rate primarily due to anticipated discrete federal income tax benefits relating to the vesting of share-based compensation, with the rate also being sensitive to the jurisdictional mix and level of income. (3) The current outlook assumes a tax rate sensitive to the jurisdictional mix and level of income.

APPENDIX 21

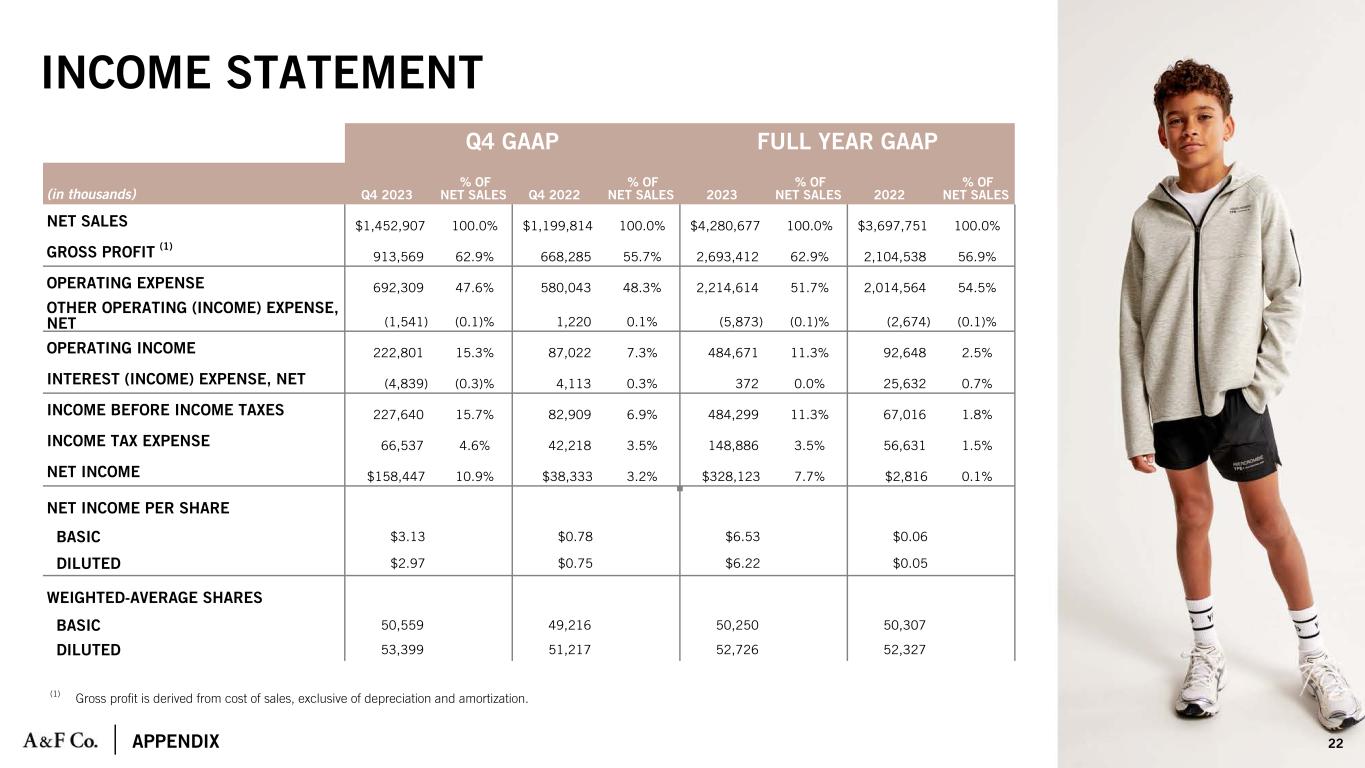

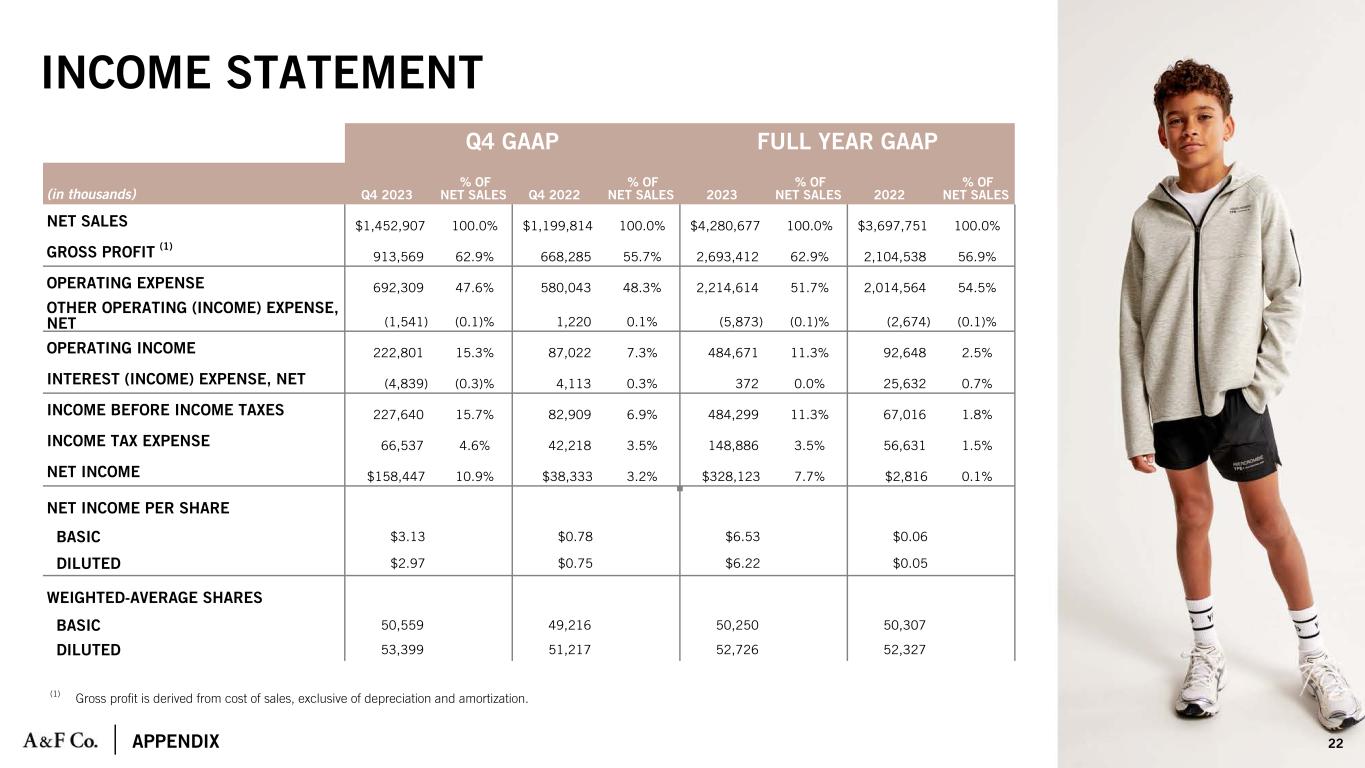

APPENDIX INCOME STATEMENT (1) Gross profit is derived from cost of sales, exclusive of depreciation and amortization. 22 Q4 GAAP FULL YEAR GAAP (in thousands) Q4 2023 % OF NET SALES Q4 2022 % OF NET SALES 2023 % OF NET SALES 2022 % OF NET SALES NET SALES $1,452,907 100.0% $1,199,814 100.0% $4,280,677 100.0% $3,697,751 100.0% GROSS PROFIT (1) 913,569 62.9% 668,285 55.7% 2,693,412 62.9% 2,104,538 56.9% OPERATING EXPENSE 692,309 47.6% 580,043 48.3% 2,214,614 51.7% 2,014,564 54.5% OTHER OPERATING (INCOME) EXPENSE, NET (1,541) (0.1)% 1,220 0.1% (5,873) (0.1)% (2,674) (0.1)% OPERATING INCOME 222,801 15.3% 87,022 7.3% 484,671 11.3% 92,648 2.5% INTEREST (INCOME) EXPENSE, NET (4,839) (0.3)% 4,113 0.3% 372 0.0% 25,632 0.7% INCOME BEFORE INCOME TAXES 227,640 15.7% 82,909 6.9% 484,299 11.3% 67,016 1.8% INCOME TAX EXPENSE 66,537 4.6% 42,218 3.5% 148,886 3.5% 56,631 1.5% NET INCOME $158,447 10.9% $38,333 3.2% $328,123 7.7% $2,816 0.1% NET INCOME PER SHARE BASIC $3.13 $0.78 $6.53 $0.06 DILUTED $2.97 $0.75 $6.22 $0.05 WEIGHTED-AVERAGE SHARES BASIC 50,559 49,216 50,250 50,307 DILUTED 53,399 51,217 52,726 52,327

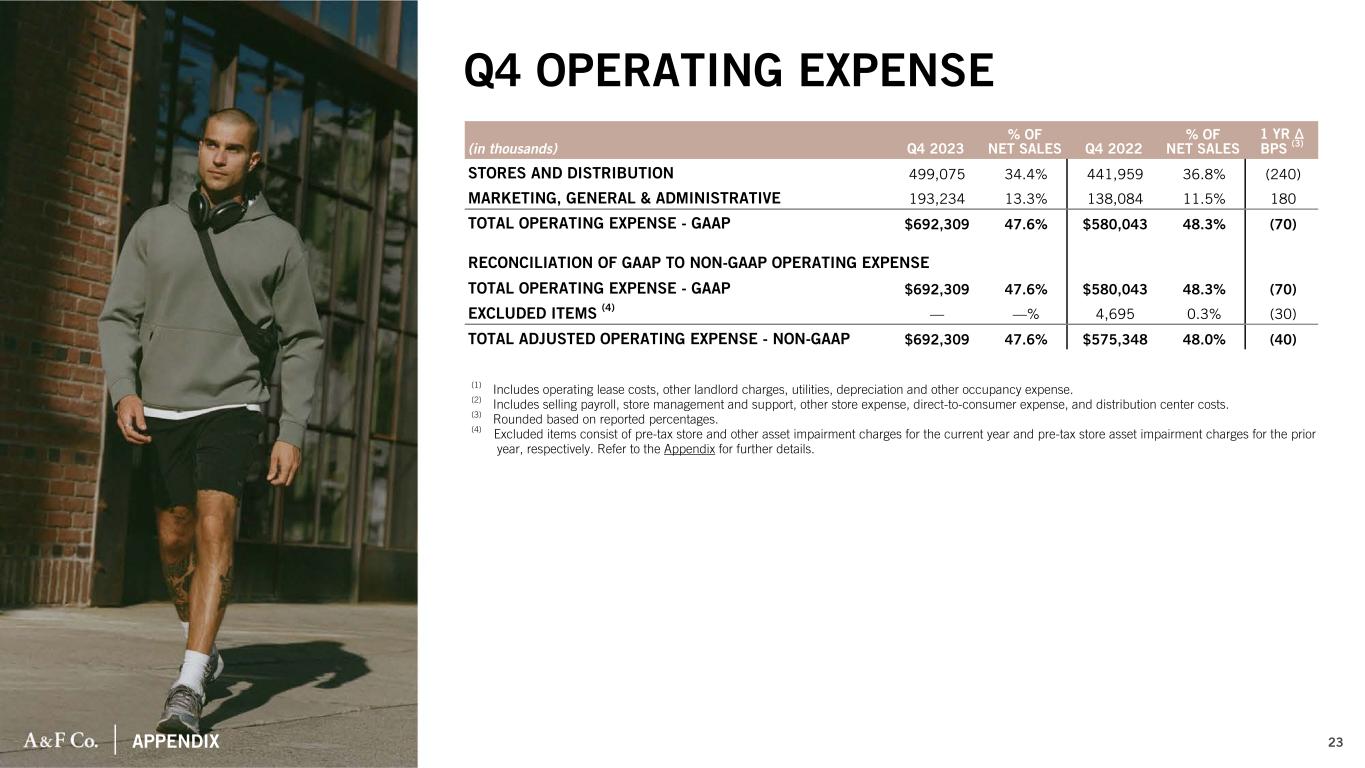

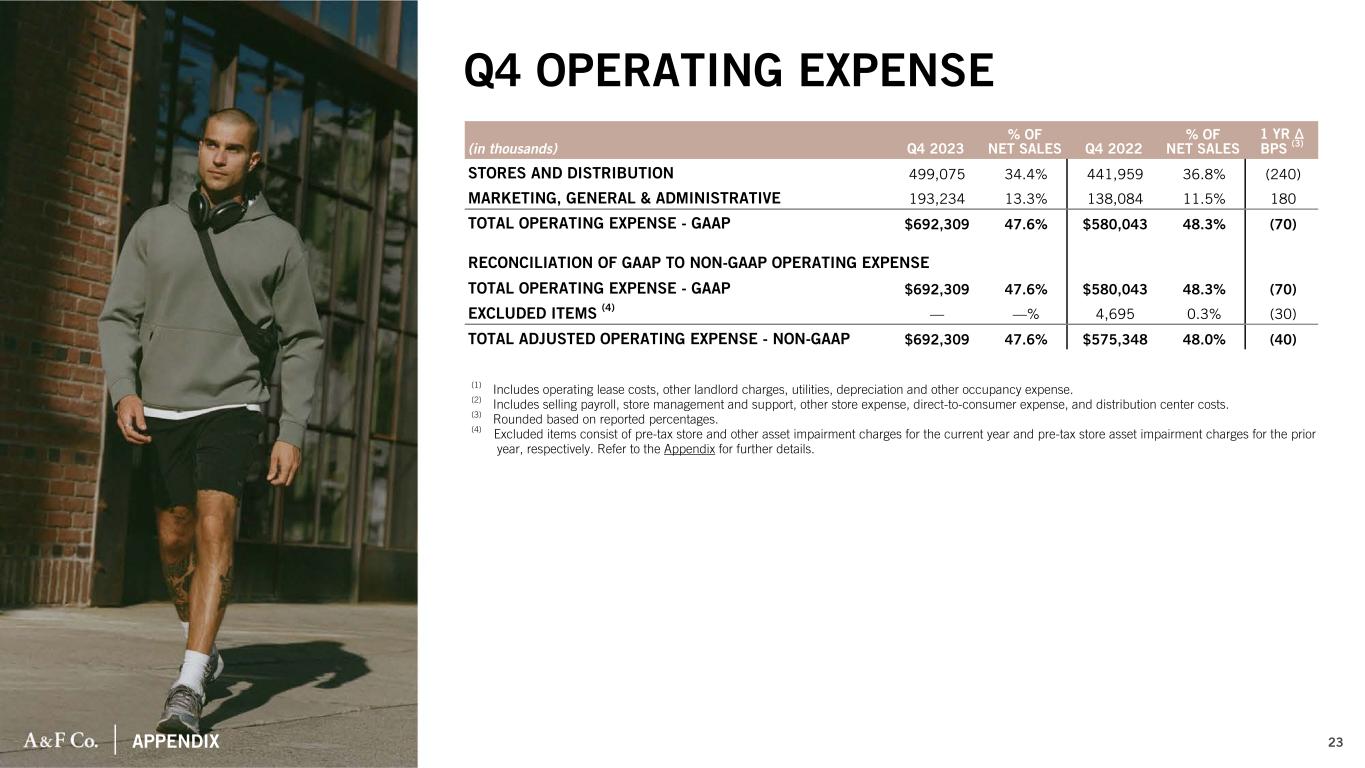

APPENDIX (in thousands) Q4 2023 % OF NET SALES Q4 2022 % OF NET SALES 1 YR Δ BPS (3) STORES AND DISTRIBUTION 499,075 34.4% 441,959 36.8% (240) MARKETING, GENERAL & ADMINISTRATIVE 193,234 13.3% 138,084 11.5% 180 TOTAL OPERATING EXPENSE - GAAP $692,309 47.6% $580,043 48.3% (70) RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSE TOTAL OPERATING EXPENSE - GAAP $692,309 47.6% $580,043 48.3% (70) EXCLUDED ITEMS (4) — —% 4,695 0.3% (30) TOTAL ADJUSTED OPERATING EXPENSE - NON-GAAP $692,309 47.6% $575,348 48.0% (40) (1) Includes operating lease costs, other landlord charges, utilities, depreciation and other occupancy expense. (2) Includes selling payroll, store management and support, other store expense, direct-to-consumer expense, and distribution center costs. (3) Rounded based on reported percentages. (4) Excluded items consist of pre-tax store and other asset impairment charges for the current year and pre-tax store asset impairment charges for the prior year, respectively. Refer to the Appendix for further details. Q4 OPERATING EXPENSE 23

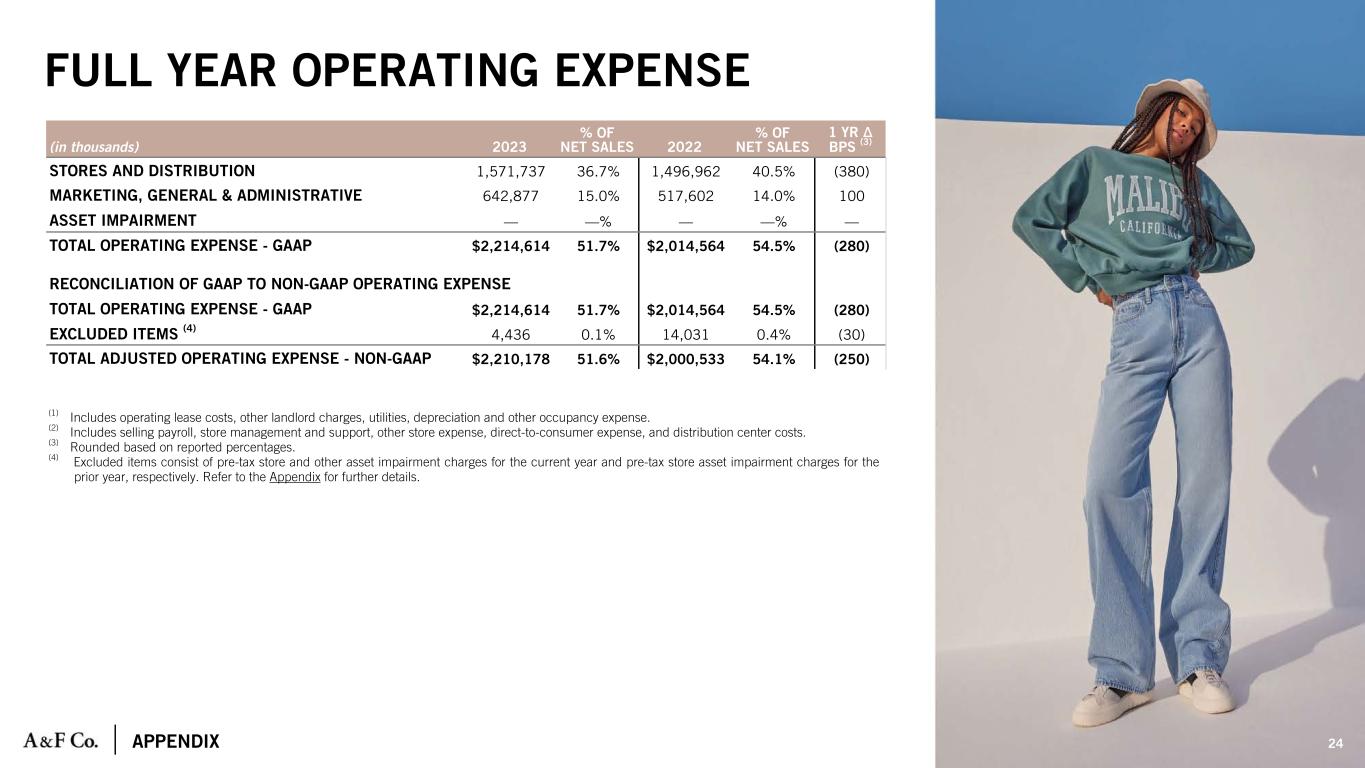

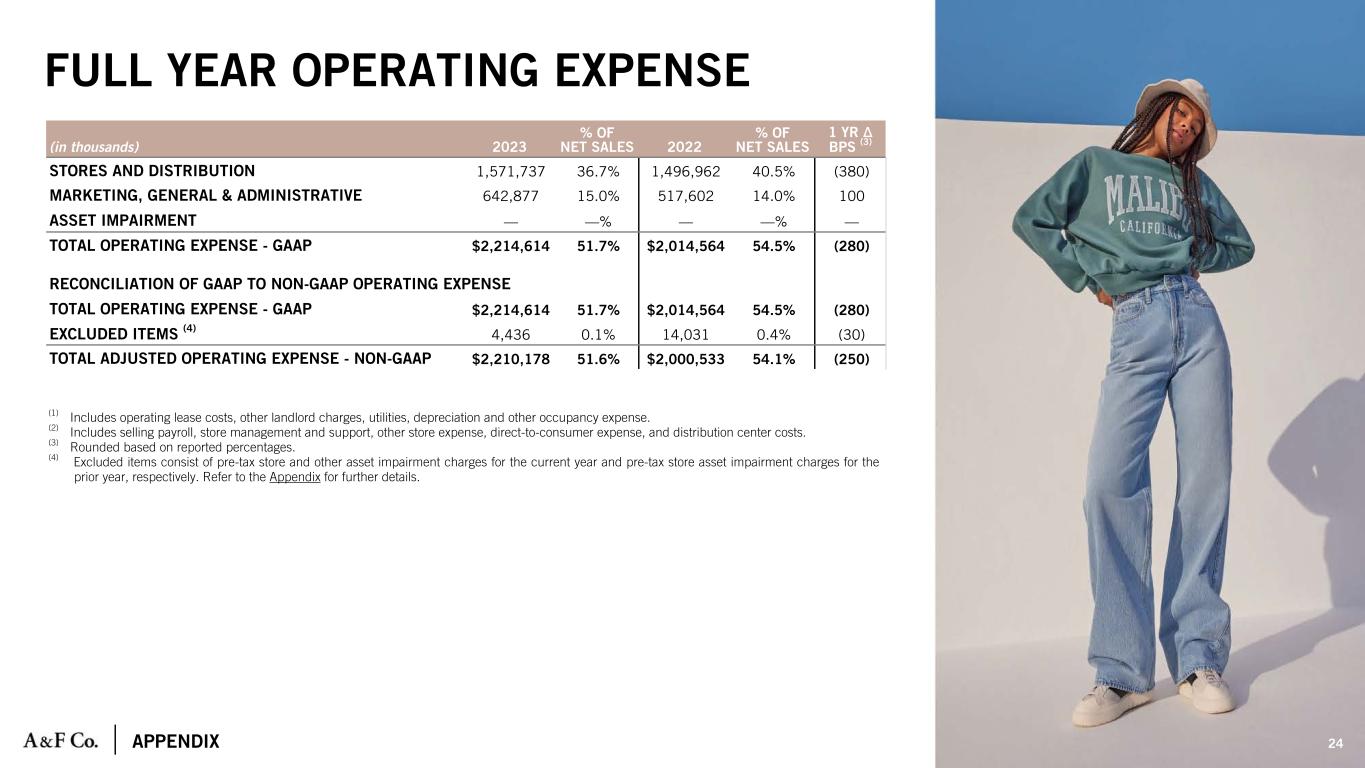

APPENDIX 24 FULL YEAR OPERATING EXPENSE (in thousands) 2023 % OF NET SALES 2022 % OF NET SALES 1 YR Δ BPS (3) STORES AND DISTRIBUTION 1,571,737 36.7% 1,496,962 40.5% (380) MARKETING, GENERAL & ADMINISTRATIVE 642,877 15.0% 517,602 14.0% 100 ASSET IMPAIRMENT — —% — —% — TOTAL OPERATING EXPENSE - GAAP $2,214,614 51.7% $2,014,564 54.5% (280) RECONCILIATION OF GAAP TO NON-GAAP OPERATING EXPENSE TOTAL OPERATING EXPENSE - GAAP $2,214,614 51.7% $2,014,564 54.5% (280) EXCLUDED ITEMS (4) 4,436 0.1% 14,031 0.4% (30) TOTAL ADJUSTED OPERATING EXPENSE - NON-GAAP $2,210,178 51.6% $2,000,533 54.1% (250) (1) Includes operating lease costs, other landlord charges, utilities, depreciation and other occupancy expense. (2) Includes selling payroll, store management and support, other store expense, direct-to-consumer expense, and distribution center costs. (3) Rounded based on reported percentages. (4) Excluded items consist of pre-tax store and other asset impairment charges for the current year and pre-tax store asset impairment charges for the prior year, respectively. Refer to the Appendix for further details.

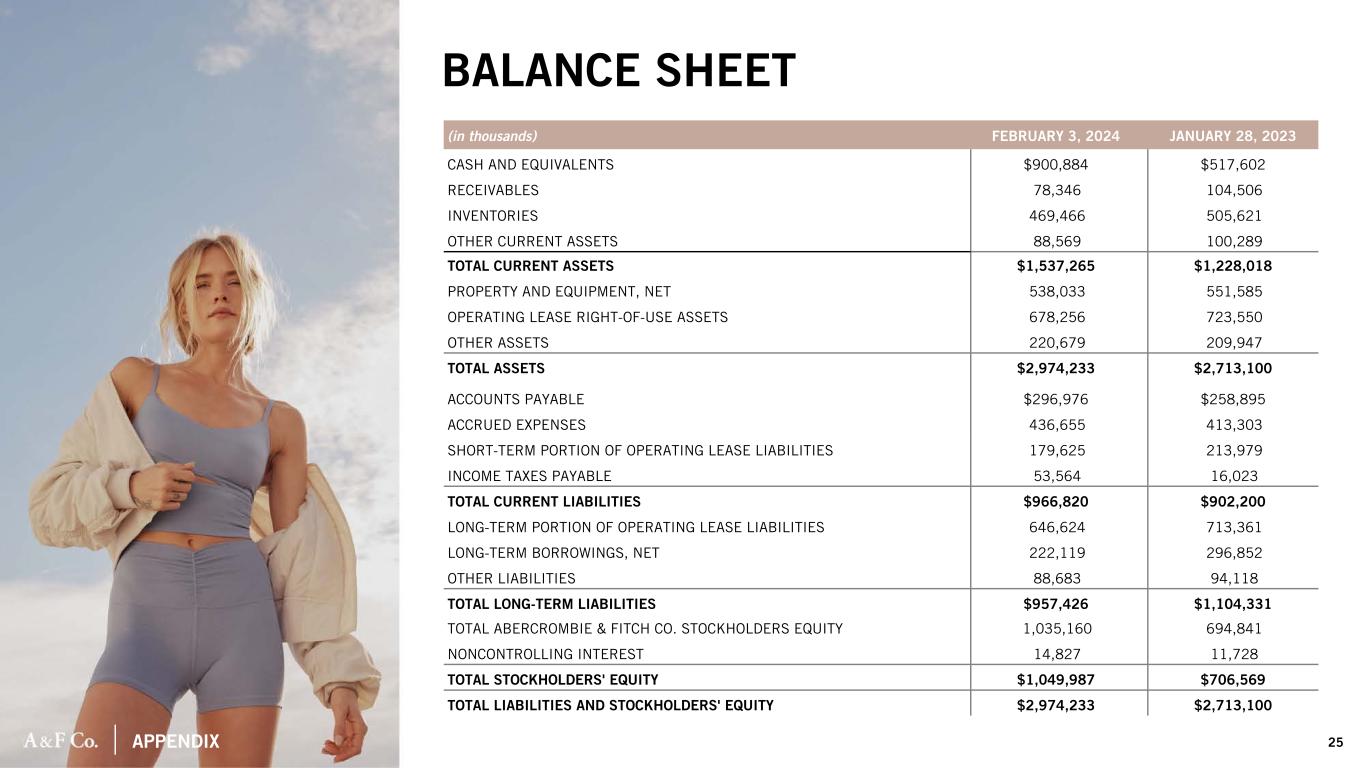

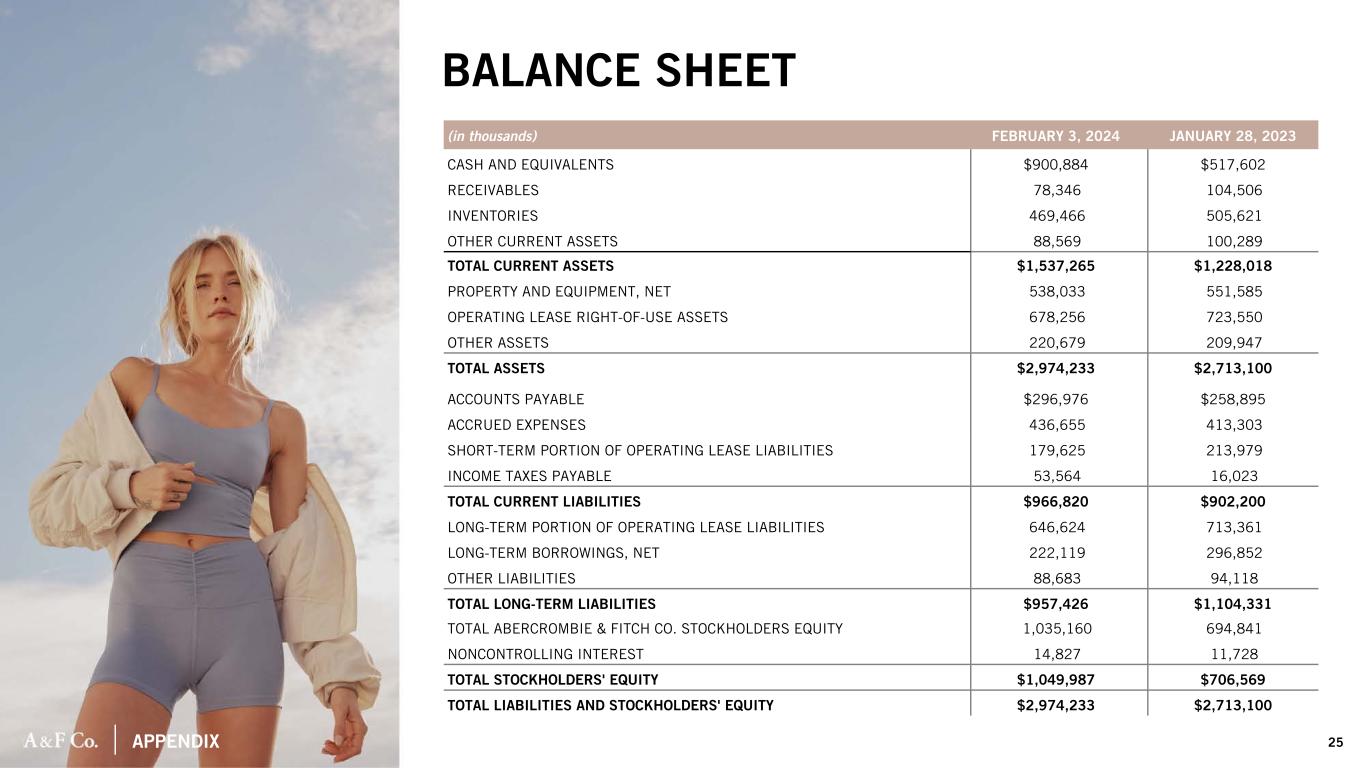

APPENDIX BALANCE SHEET 25 (in thousands) FEBRUARY 3, 2024 JANUARY 28, 2023 CASH AND EQUIVALENTS $900,884 $517,602 RECEIVABLES 78,346 104,506 INVENTORIES 469,466 505,621 OTHER CURRENT ASSETS 88,569 100,289 TOTAL CURRENT ASSETS $1,537,265 $1,228,018 PROPERTY AND EQUIPMENT, NET 538,033 551,585 OPERATING LEASE RIGHT-OF-USE ASSETS 678,256 723,550 OTHER ASSETS 220,679 209,947 TOTAL ASSETS $2,974,233 $2,713,100 ACCOUNTS PAYABLE $296,976 $258,895 ACCRUED EXPENSES 436,655 413,303 SHORT-TERM PORTION OF OPERATING LEASE LIABILITIES 179,625 213,979 INCOME TAXES PAYABLE 53,564 16,023 TOTAL CURRENT LIABILITIES $966,820 $902,200 LONG-TERM PORTION OF OPERATING LEASE LIABILITIES 646,624 713,361 LONG-TERM BORROWINGS, NET 222,119 296,852 OTHER LIABILITIES 88,683 94,118 TOTAL LONG-TERM LIABILITIES $957,426 $1,104,331 TOTAL ABERCROMBIE & FITCH CO. STOCKHOLDERS EQUITY 1,035,160 694,841 NONCONTROLLING INTEREST 14,827 11,728 TOTAL STOCKHOLDERS' EQUITY $1,049,987 $706,569 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $2,974,233 $2,713,100

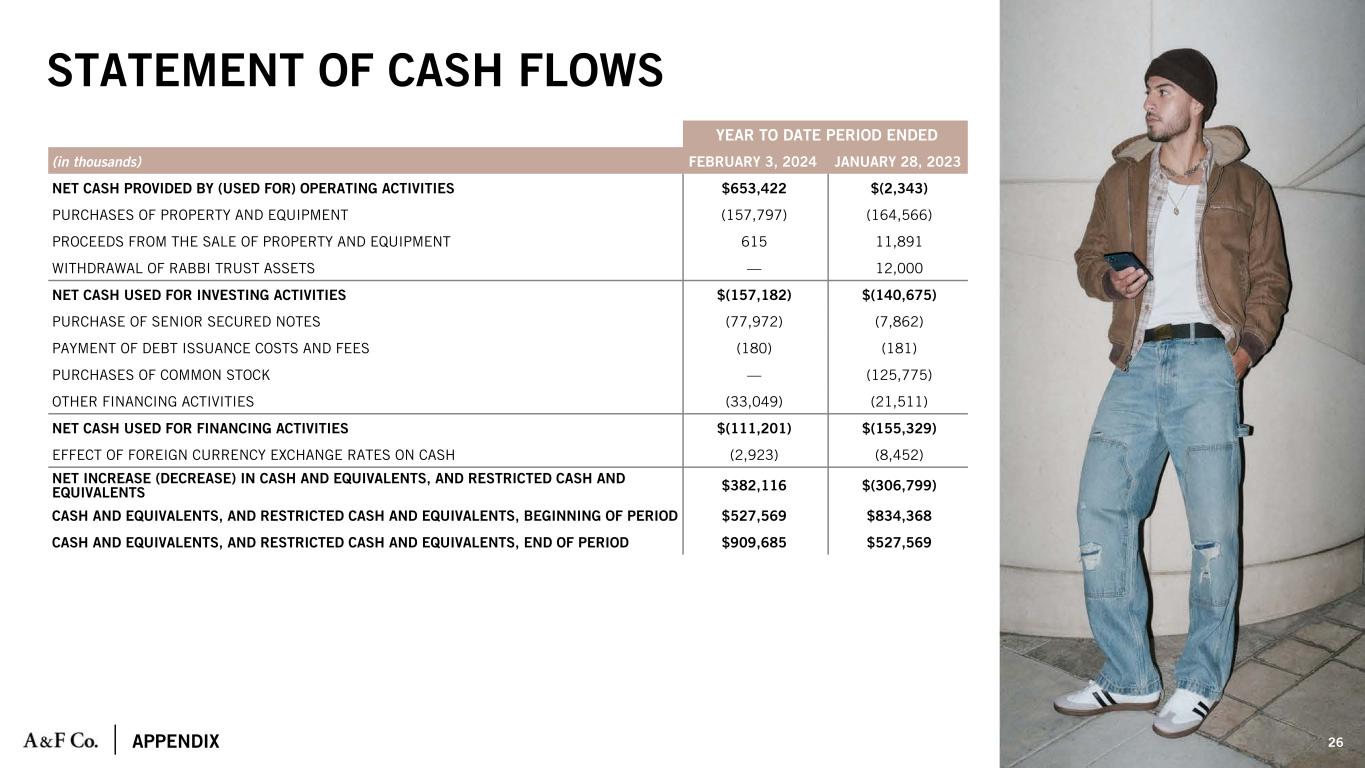

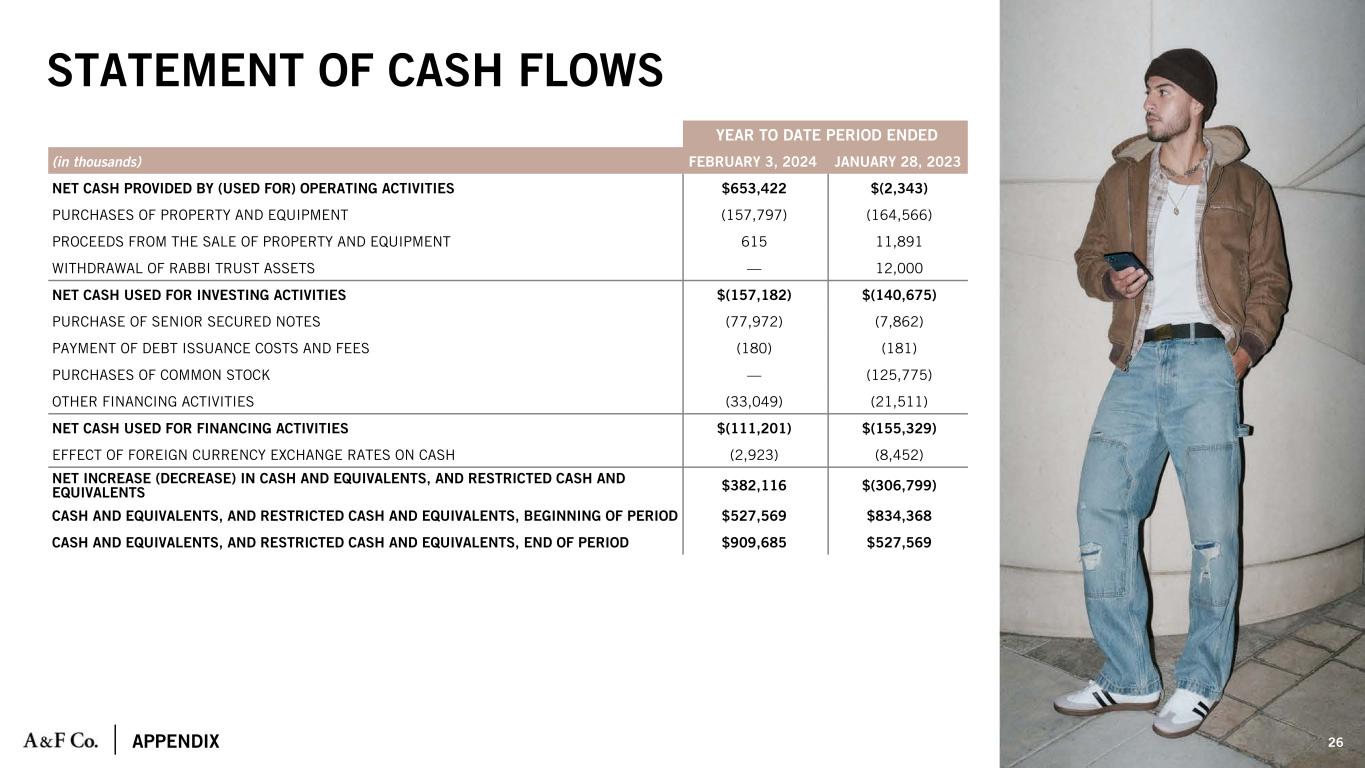

APPENDIX STATEMENT OF CASH FLOWS 26 YEAR TO DATE PERIOD ENDED (in thousands) FEBRUARY 3, 2024 JANUARY 28, 2023 NET CASH PROVIDED BY (USED FOR) OPERATING ACTIVITIES $653,422 $(2,343) PURCHASES OF PROPERTY AND EQUIPMENT (157,797) (164,566) PROCEEDS FROM THE SALE OF PROPERTY AND EQUIPMENT 615 11,891 WITHDRAWAL OF RABBI TRUST ASSETS — 12,000 NET CASH USED FOR INVESTING ACTIVITIES $(157,182) $(140,675) PURCHASE OF SENIOR SECURED NOTES (77,972) (7,862) PAYMENT OF DEBT ISSUANCE COSTS AND FEES (180) (181) PURCHASES OF COMMON STOCK — (125,775) OTHER FINANCING ACTIVITIES (33,049) (21,511) NET CASH USED FOR FINANCING ACTIVITIES $(111,201) $(155,329) EFFECT OF FOREIGN CURRENCY EXCHANGE RATES ON CASH (2,923) (8,452) NET INCREASE (DECREASE) IN CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS $382,116 $(306,799) CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, BEGINNING OF PERIOD $527,569 $834,368 CASH AND EQUIVALENTS, AND RESTRICTED CASH AND EQUIVALENTS, END OF PERIOD $909,685 $527,569

APPENDIX SHARE REPURCHASES 27 SINCE THE START OF 2021, THE COMPANY REPURCHASED APPROXIMATELY 15 MILLION SHARES FOR APPROXIMATELY $503 MILLION. THERE IS APPROXIMATELY 232 MILLION REMAINING UNDER OUR PREVIOUSLY AUTHORIZED SHARE REPURCHASE PROGRAM. SHARE REPURCHASES (in thousands, except for average cost) NUMBER OF SHARES COST AVERAGE COST TOTAL FY 2021 10,200 $377,290 $36.99 $377,290 FY 2022 4,770 $125,775 $26.37 $125,775 FY 2023 — $— $— $— (in thousands) FY 2020 FY 2021 FY 2022 FY 2023 ENDING SHARES OUTSTANDING 62,399 52,985 49,002 50,500

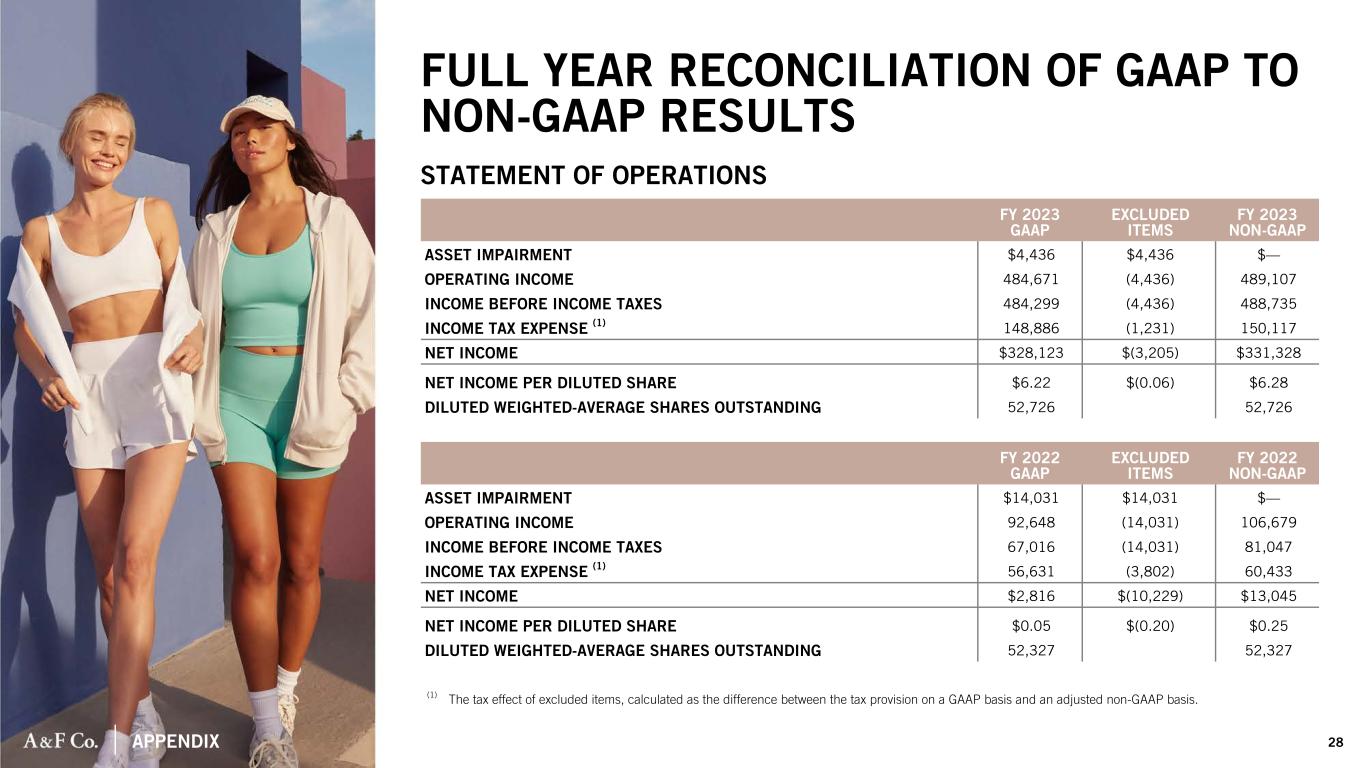

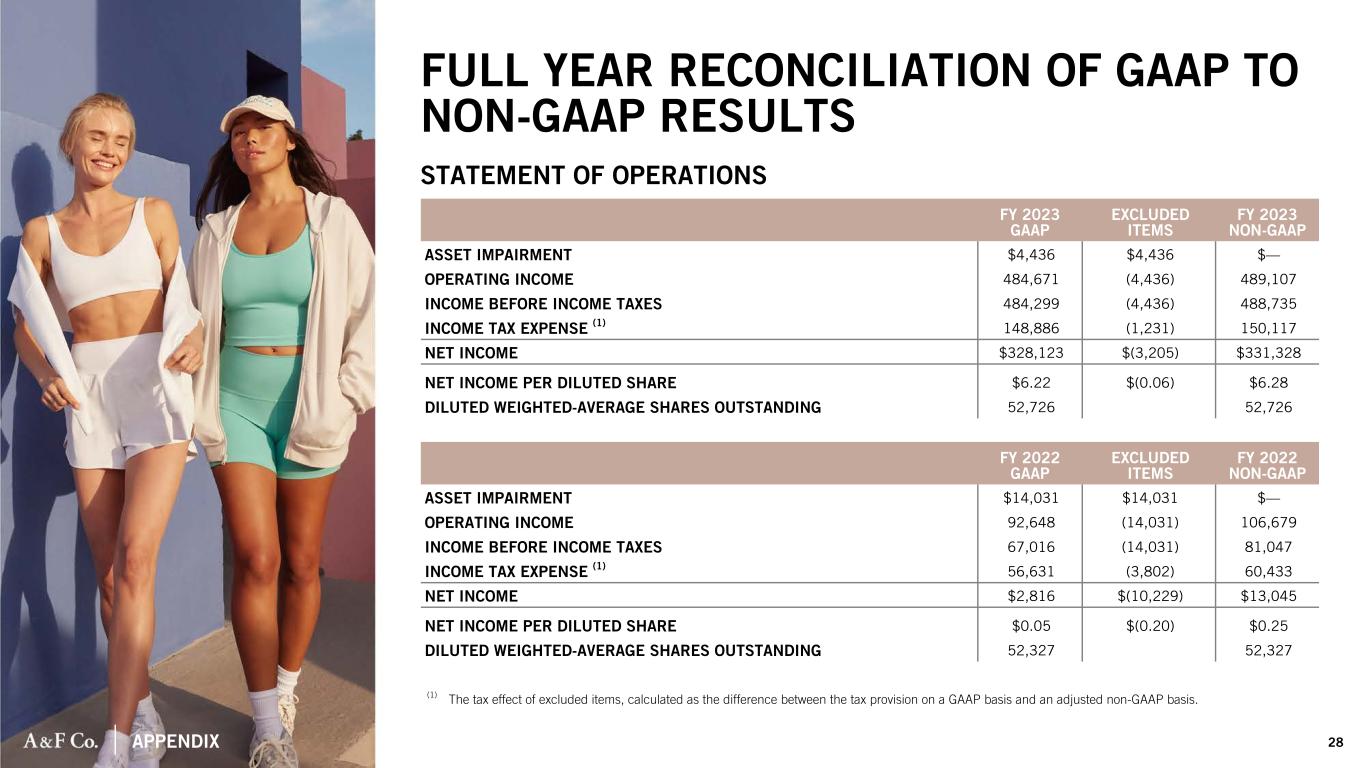

APPENDIX (1) The tax effect of excluded items, calculated as the difference between the tax provision on a GAAP basis and an adjusted non-GAAP basis. FULL YEAR RECONCILIATION OF GAAP TO NON-GAAP RESULTS STATEMENT OF OPERATIONS FY 2023 GAAP EXCLUDED ITEMS FY 2023 NON-GAAP ASSET IMPAIRMENT $4,436 $4,436 $— OPERATING INCOME 484,671 (4,436) 489,107 INCOME BEFORE INCOME TAXES 484,299 (4,436) 488,735 INCOME TAX EXPENSE (1) 148,886 (1,231) 150,117 NET INCOME $328,123 $(3,205) $331,328 NET INCOME PER DILUTED SHARE $6.22 $(0.06) $6.28 DILUTED WEIGHTED-AVERAGE SHARES OUTSTANDING 52,726 52,726 FY 2022 GAAP EXCLUDED ITEMS FY 2022 NON-GAAP ASSET IMPAIRMENT $14,031 $14,031 $— OPERATING INCOME 92,648 (14,031) 106,679 INCOME BEFORE INCOME TAXES 67,016 (14,031) 81,047 INCOME TAX EXPENSE (1) 56,631 (3,802) 60,433 NET INCOME $2,816 $(10,229) $13,045 NET INCOME PER DILUTED SHARE $0.05 $(0.20) $0.25 DILUTED WEIGHTED-AVERAGE SHARES OUTSTANDING 52,327 52,327 28

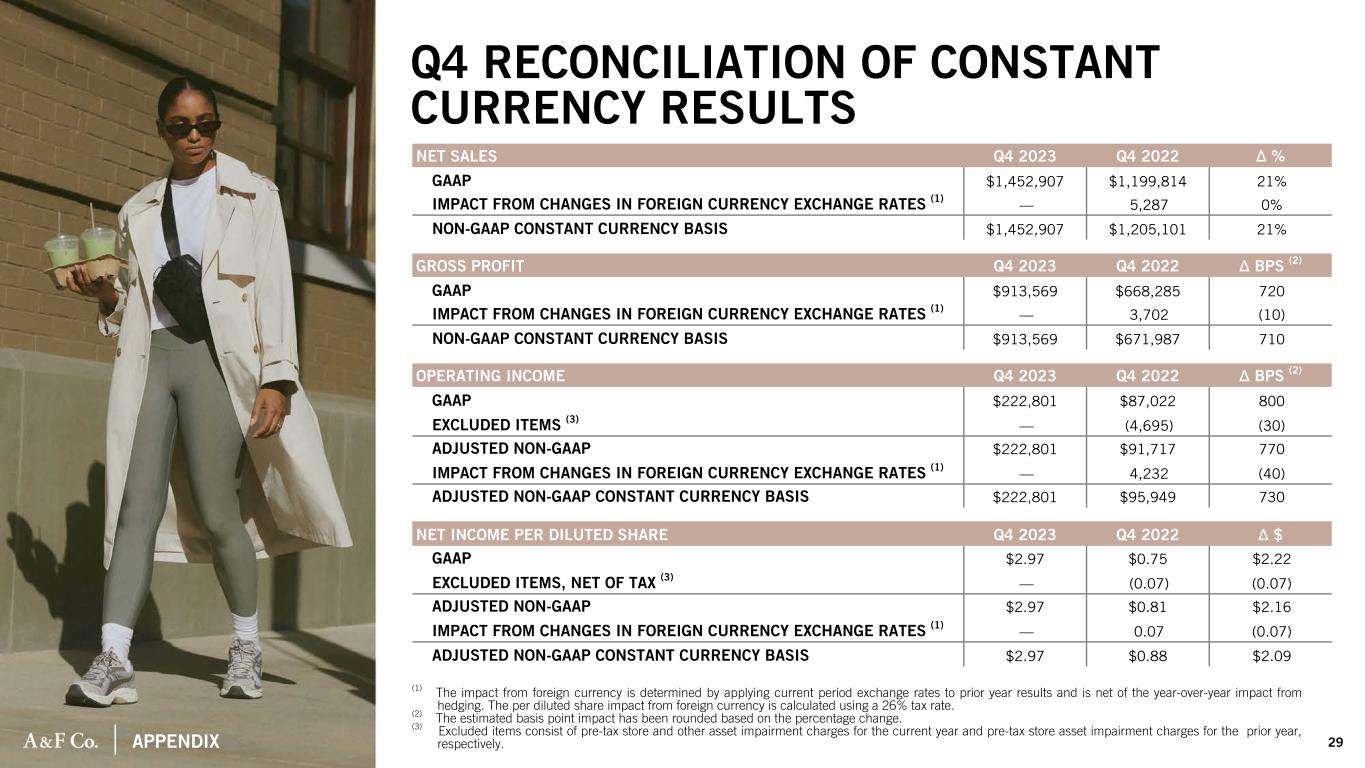

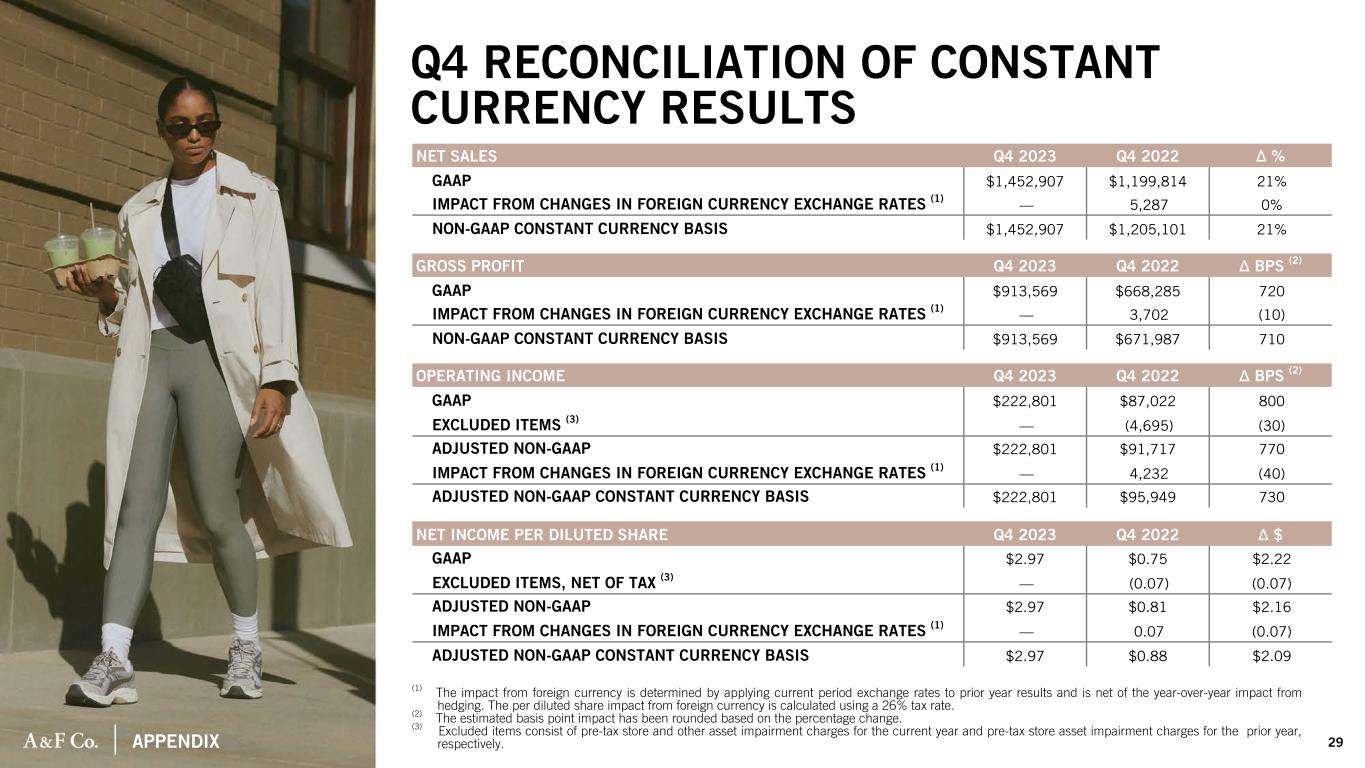

APPENDIX Q4 RECONCILIATION OF CONSTANT CURRENCY RESULTS NET SALES Q4 2023 Q4 2022 Δ % GAAP $1,452,907 $1,199,814 21% IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 5,287 0% NON-GAAP CONSTANT CURRENCY BASIS $1,452,907 $1,205,101 21% GROSS PROFIT Q4 2023 Q4 2022 Δ BPS (2) GAAP $913,569 $668,285 720 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 3,702 (10) NON-GAAP CONSTANT CURRENCY BASIS $913,569 $671,987 710 OPERATING INCOME Q4 2023 Q4 2022 Δ BPS (2) GAAP $222,801 $87,022 800 EXCLUDED ITEMS (3) — (4,695) (30) ADJUSTED NON-GAAP $222,801 $91,717 770 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 4,232 (40) ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $222,801 $95,949 730 NET INCOME PER DILUTED SHARE Q4 2023 Q4 2022 Δ $ GAAP $2.97 $0.75 $2.22 EXCLUDED ITEMS, NET OF TAX (3) — (0.07) (0.07) ADJUSTED NON-GAAP $2.97 $0.81 $2.16 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 0.07 (0.07) ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $2.97 $0.88 $2.09 (1) The impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share impact from foreign currency is calculated using a 26% tax rate. (2) The estimated basis point impact has been rounded based on the percentage change. (3) Excluded items consist of pre-tax store and other asset impairment charges for the current year and pre-tax store asset impairment charges for the prior year, respectively. 29

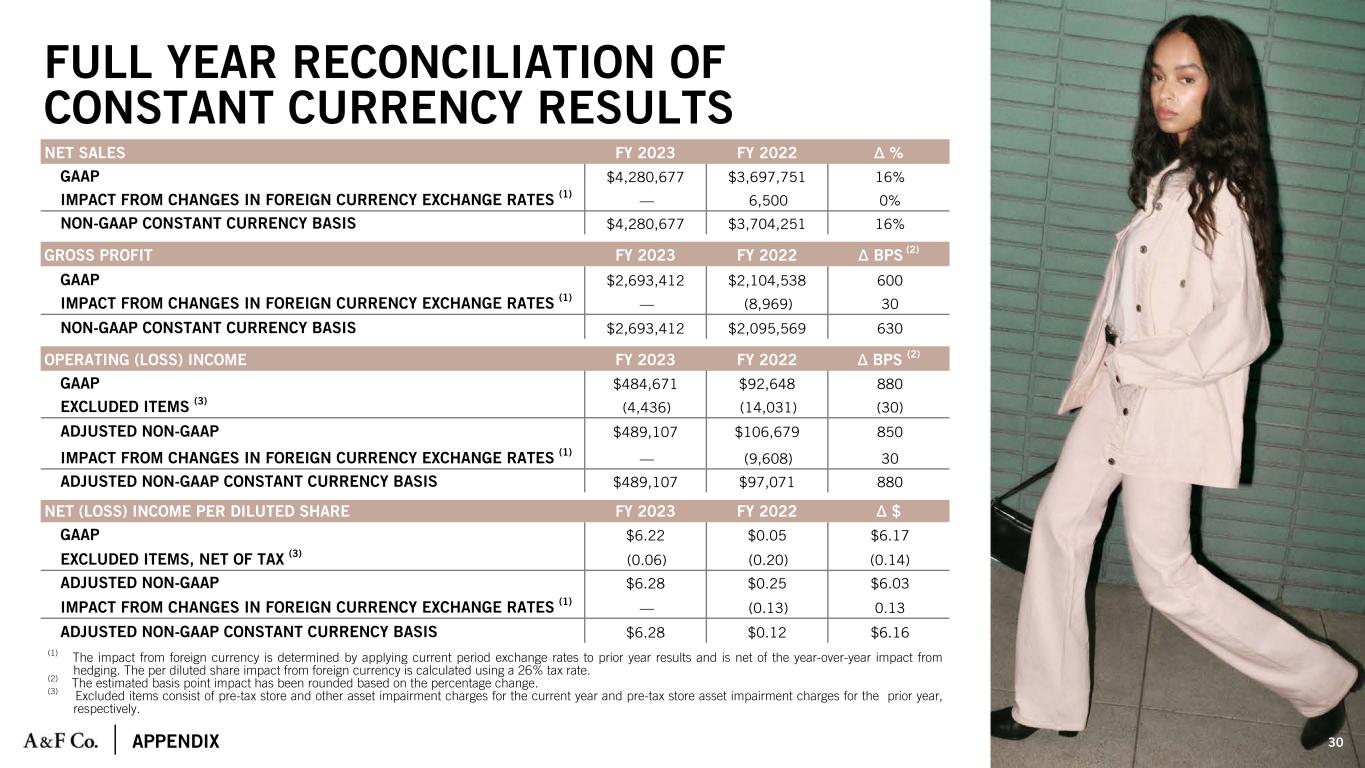

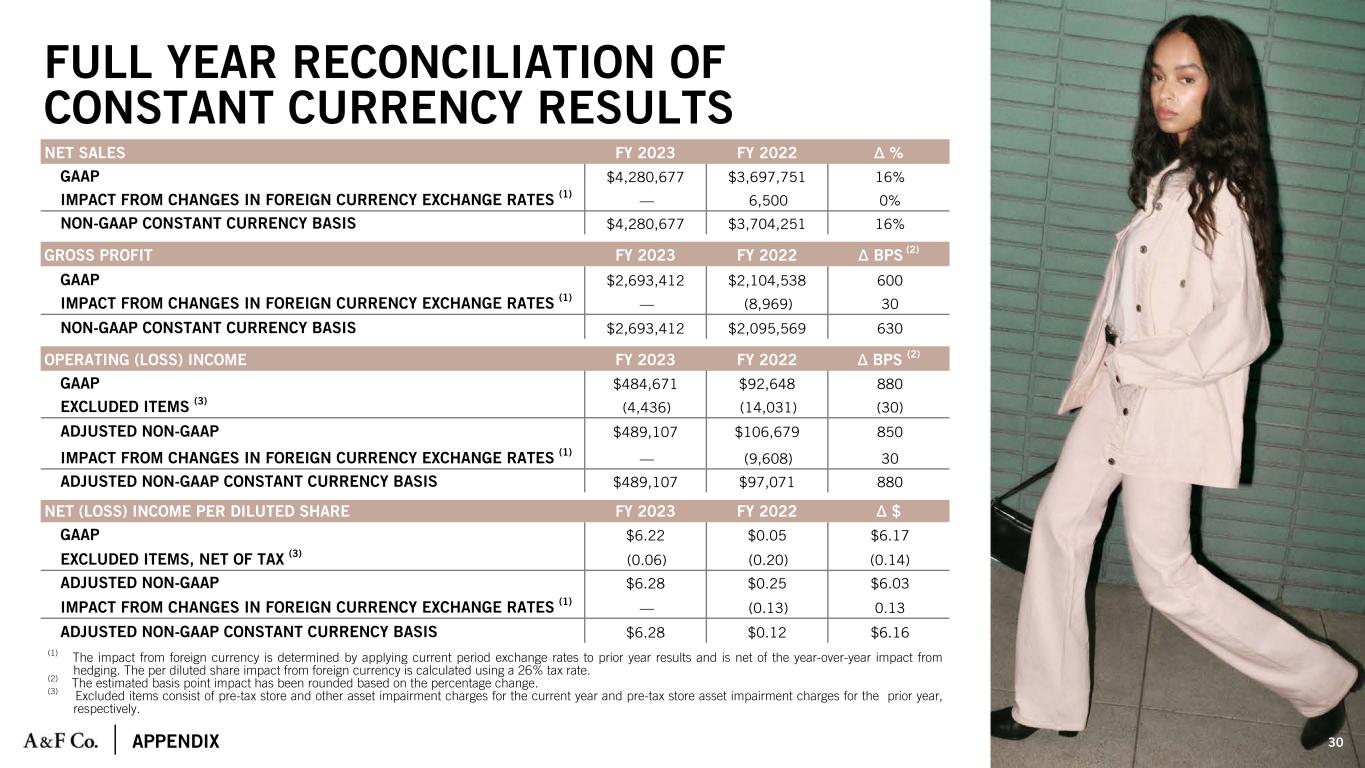

APPENDIX FULL YEAR RECONCILIATION OF CONSTANT CURRENCY RESULTS NET SALES FY 2023 FY 2022 Δ % GAAP $4,280,677 $3,697,751 16% IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — 6,500 0% NON-GAAP CONSTANT CURRENCY BASIS $4,280,677 $3,704,251 16% GROSS PROFIT FY 2023 FY 2022 Δ BPS (2) GAAP $2,693,412 $2,104,538 600 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (8,969) 30 NON-GAAP CONSTANT CURRENCY BASIS $2,693,412 $2,095,569 630 OPERATING (LOSS) INCOME FY 2023 FY 2022 Δ BPS (2) GAAP $484,671 $92,648 880 EXCLUDED ITEMS (3) (4,436) (14,031) (30) ADJUSTED NON-GAAP $489,107 $106,679 850 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (9,608) 30 ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $489,107 $97,071 880 NET (LOSS) INCOME PER DILUTED SHARE FY 2023 FY 2022 Δ $ GAAP $6.22 $0.05 $6.17 EXCLUDED ITEMS, NET OF TAX (3) (0.06) (0.20) (0.14) ADJUSTED NON-GAAP $6.28 $0.25 $6.03 IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) — (0.13) 0.13 ADJUSTED NON-GAAP CONSTANT CURRENCY BASIS $6.28 $0.12 $6.16 (1) The impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share impact from foreign currency is calculated using a 26% tax rate. (2) The estimated basis point impact has been rounded based on the percentage change. (3) Excluded items consist of pre-tax store and other asset impairment charges for the current year and pre-tax store asset impairment charges for the prior year, respectively. 30

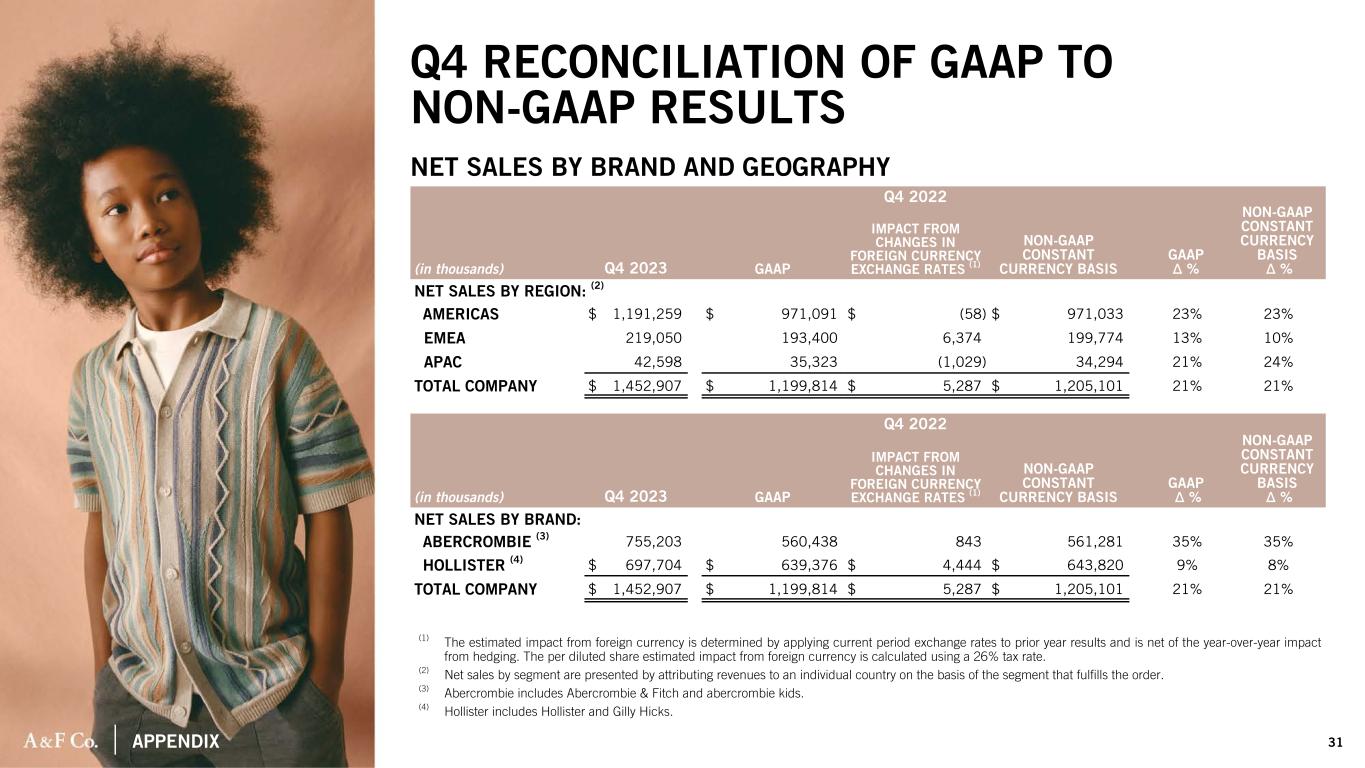

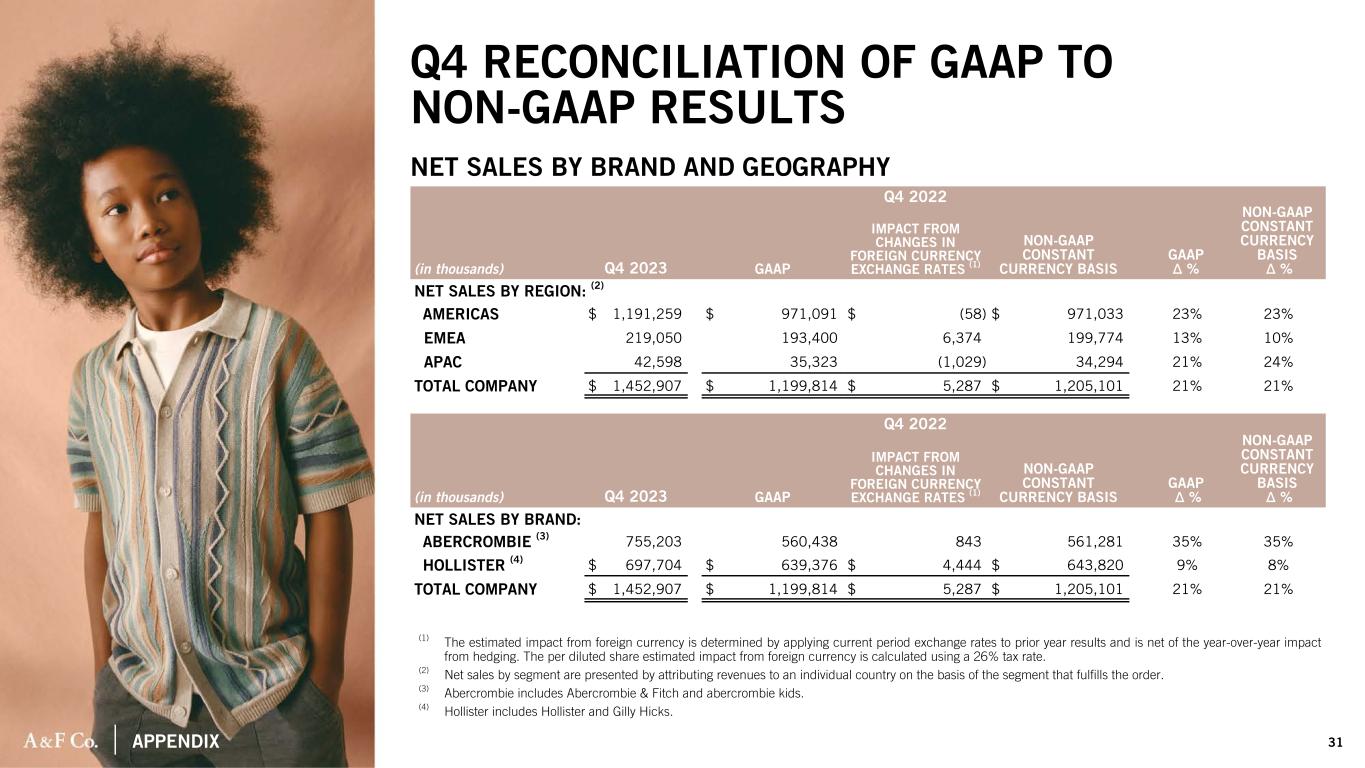

APPENDIX (1) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate. (2) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order. (3) Abercrombie includes Abercrombie & Fitch and abercrombie kids. (4) Hollister includes Hollister and Gilly Hicks. (in thousands) Q4 2023 Q4 2022 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ %GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY REGION: (2) AMERICAS $ 1,191,259 $ 971,091 $ (58) $ 971,033 23% 23% EMEA 219,050 193,400 6,374 199,774 13% 10% APAC 42,598 35,323 (1,029) 34,294 21% 24% TOTAL COMPANY $ 1,452,907 $ 1,199,814 $ 5,287 $ 1,205,101 21% 21% (in thousands) Q4 2023 Q4 2022 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ % GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY BRAND: ABERCROMBIE (3) 755,203 560,438 843 561,281 35% 35% HOLLISTER (4) $ 697,704 $ 639,376 $ 4,444 $ 643,820 9% 8% TOTAL COMPANY $ 1,452,907 $ 1,199,814 $ 5,287 $ 1,205,101 21% 21% Q4 RECONCILIATION OF GAAP TO NON-GAAP RESULTS NET SALES BY BRAND AND GEOGRAPHY 31

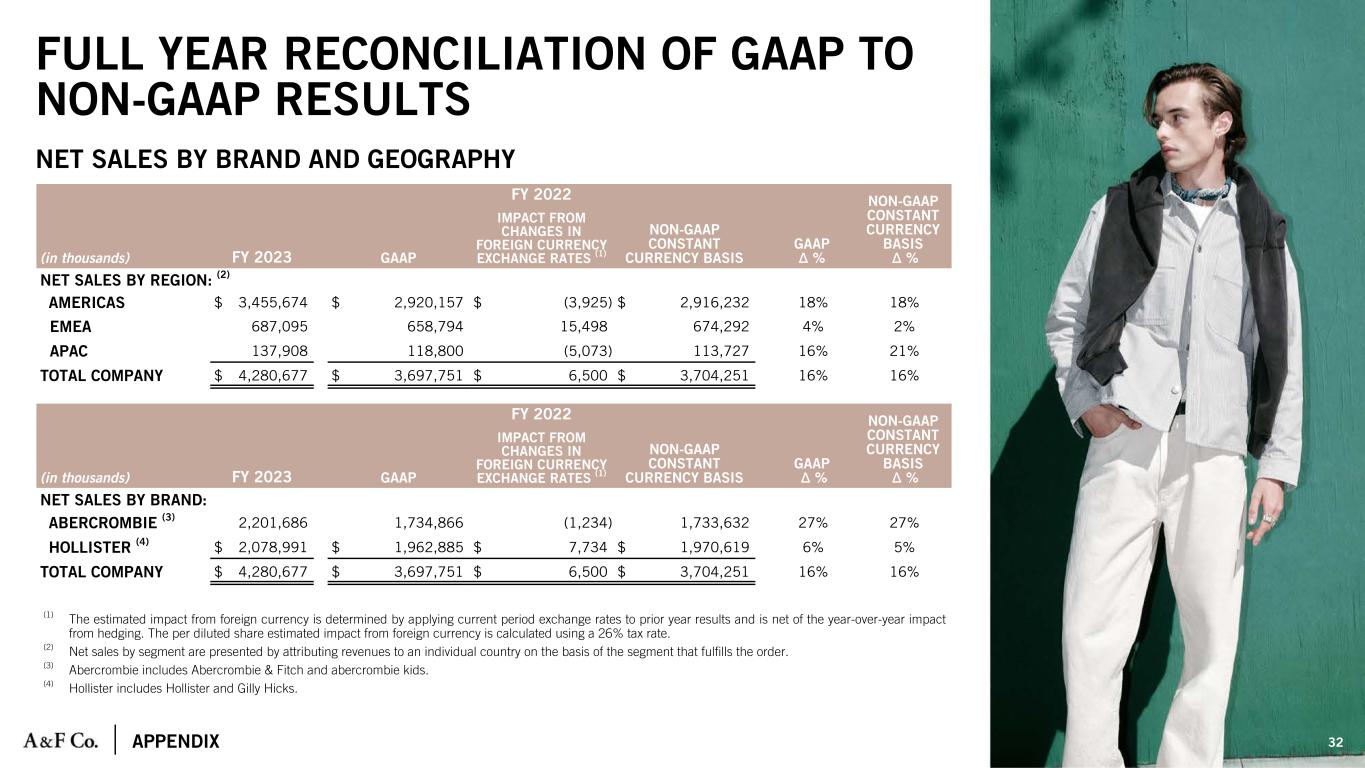

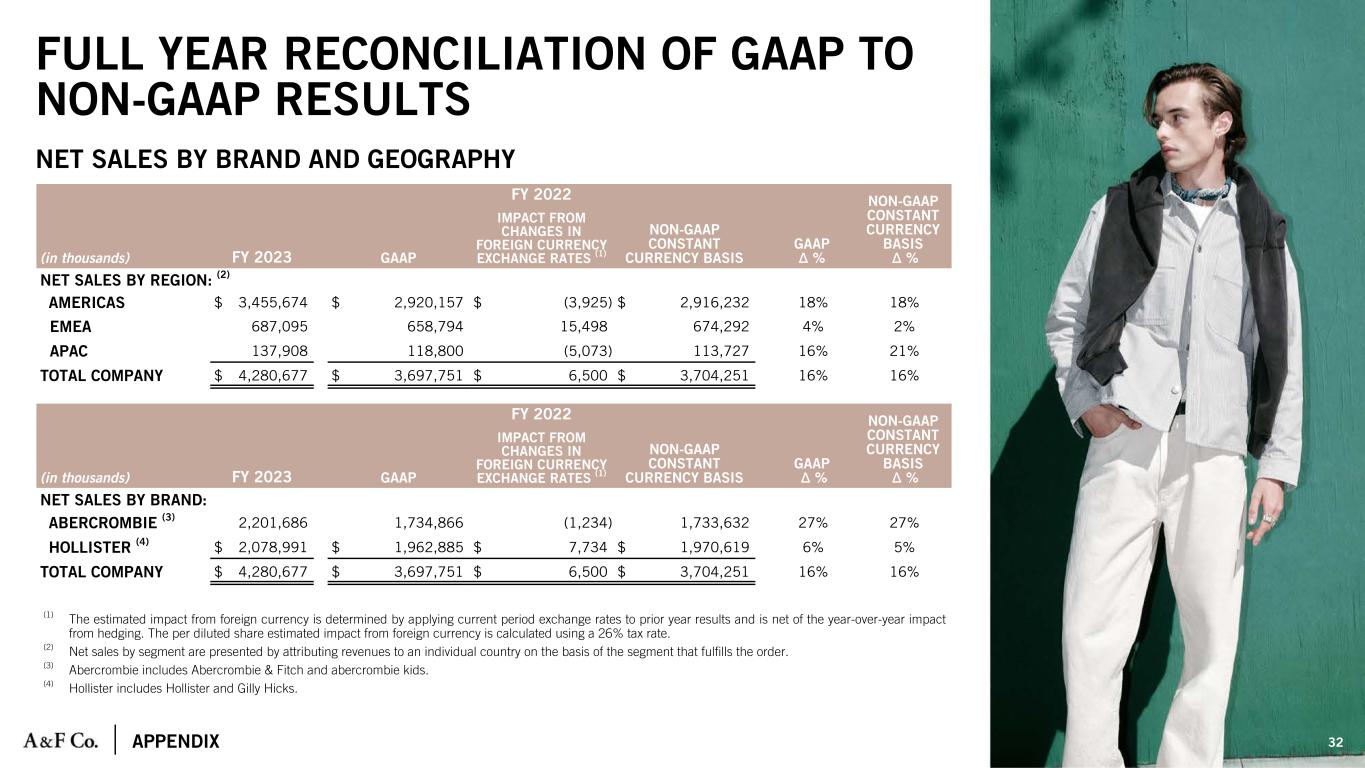

APPENDIX (in thousands) FY 2023 FY 2022 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ %GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY REGION: (2) AMERICAS $ 3,455,674 $ 2,920,157 $ (3,925) $ 2,916,232 18% 18% EMEA 687,095 658,794 15,498 674,292 4% 2% APAC 137,908 118,800 (5,073) 113,727 16% 21% TOTAL COMPANY $ 4,280,677 $ 3,697,751 $ 6,500 $ 3,704,251 16% 16% (in thousands) FY 2023 FY 2022 GAAP Δ % NON-GAAP CONSTANT CURRENCY BASIS Δ % GAAP IMPACT FROM CHANGES IN FOREIGN CURRENCY EXCHANGE RATES (1) NON-GAAP CONSTANT CURRENCY BASIS NET SALES BY BRAND: ABERCROMBIE (3) 2,201,686 1,734,866 (1,234) 1,733,632 27% 27% HOLLISTER (4) $ 2,078,991 $ 1,962,885 $ 7,734 $ 1,970,619 6% 5% TOTAL COMPANY $ 4,280,677 $ 3,697,751 $ 6,500 $ 3,704,251 16% 16% FULL YEAR RECONCILIATION OF GAAP TO NON-GAAP RESULTS NET SALES BY BRAND AND GEOGRAPHY 32 (1) The estimated impact from foreign currency is determined by applying current period exchange rates to prior year results and is net of the year-over-year impact from hedging. The per diluted share estimated impact from foreign currency is calculated using a 26% tax rate. (2) Net sales by segment are presented by attributing revenues to an individual country on the basis of the segment that fulfills the order. (3) Abercrombie includes Abercrombie & Fitch and abercrombie kids. (4) Hollister includes Hollister and Gilly Hicks.