As filed with the SEC on September 6, 2012.

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

570 Carillon Parkway, St. Petersburg, Florida 33716

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (727) 299-1800

Dennis P. Gallagher, Esq. P.O. Box 9012, Clearwater, Florida 33758-9771

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: January 1, 2012 – June 30, 2012

Item 1: Report(s) to Stockholders.

The Semi-Annual Report is attached.

TRANSAMERICA PARTNERS VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Semi-Annual Report

June 30, 2012

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Partners Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the semi-annual report of the Transamerica Asset Allocation Variable Funds and the annual reports of the Transamerica Partners Portfolios and the Calvert VP SRI Balanced Portfolio, the underlying portfolios in which the Transamerica Partners Variable Funds invest.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds and Transamerica Partners Portfolios is included in the Statement of Additional Information (“SAI”), which is available without charge, upon request: (i) by calling 1-888-233-4339; (ii) on the Subaccounts’ website at www.transamericapartners.com or (iii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds and the Transamerica Partners Portfolios are required to file Form N-PX, with the complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2012, is available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at www.sec.gov.

Quarterly Portfolios

Transamerica Asset Allocation Variable Funds will file their portfolios of investments on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Subaccounts’ Form N-Q is available on the SEC’s website at www.sec.gov. The Subaccounts’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information on the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. You may also obtain a copy of Form N-Q without charge, upon request, by calling 1-888-233-4339. Form N-Q for the corresponding Transamerica Partners Portfolios is also available without charge on the SEC website, at the SEC’s Public Reference Room, or by calling 1-888-233-4339.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

June 30, 2012

To Contract Holders with Interests in

the Transamerica Partners Variable Funds:

We are pleased to present the most recent semi-annual reports for the Transamerica Partners Portfolios and for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending these semi-annual reports to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in one or more of the Transamerica Partners Variable Funds. Each subaccount available within the Transamerica Partners Variable Funds, other than the Calvert Subaccount, invests its assets in a corresponding mutual fund that is a series of Transamerica Partners Portfolios. The Calvert Subaccount invests in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Diversified Retirement Corporation, at (800) 755-5801 if you have any questions regarding these reports.

(This page intentionally left blank)

Dear Fellow Shareholder,

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This semi-annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all shareholders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to shareholders that may have required their vote.

We believe it is important to understand market conditions over the last six months in order to provide a context for reading this report. As 2012 began, the crisis in Europe was occupying center stage. Fear of a large European bank failure causing a global banking crisis had previously driven global asset prices down. The European Central Bank responded by lending troubled European banks over one trillion Euros and the Federal Reserve made unlimited dollars available to the European Central Bank. The combined effect was to relieve pressure on the European banks. In turn, the banks used some of this money to buy sovereign bonds which further reduced market pressure. Relieved investors jumped back into risk assets and equity markets across the globe rallied strongly throughout the first quarter of the year. At the same time, the U.S. economy and corporate earnings picked up steam. Equity and bond markets followed suit.

However, the underlying economic imbalances were not addressed and as summer arrived, an economic contraction began appearing in many countries across the globe. As a result, the global equity and corporate bond markets gave up part of their gains as investors sought safety. For the six months ended June 30, 2012, the Dow Jones Industrial Average Index returned 6.83%, the Standard & Poor’s 500® Index returned 9.49%, and the Barclays U.S. Aggregate Bond Index returned 2.37%. It is always important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

| | | | |

| Thomas A. Swank | | Christopher A. Staples | | |

| President & Chief Executive Officer | | Vice President & Chief Investment Officer | | |

| Transamerica Asset Allocation Variable Funds | | Transamerica Asset Allocation Variable Funds | | |

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 1 | | |

Understanding Your Funds’ Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Partners Variable Funds (“TPVF”), a unit investment trust. As a contractholder of a Subaccount, you will bear the ongoing costs of managing the corresponding subaccount in which your Subaccount invests. You will also bear the cost of operating the Subaccount. The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at January 1, 2012 and held for the entire period until June 30, 2012.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number shown under the heading “Expenses paid during Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Subaccount’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Subaccount’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses(A) | | | | |

Fund Name | | Beginning

Account Value | | | Ending Account

Value | | | Expenses Paid

During Period(B) | | | Ending Account

Value | | | Expenses Paid

During Period(B) | | | Annualized

Expense Ratio(C) | |

Transamerica Asset Allocation Variable Funds - | | | | | | | | | | | | | | | | | | | | | | | | |

Short Horizon Subaccount | | $ | 1,000.00 | | | $ | 1,035.00 | | | $ | 1.01 | | | $ | 1,023.87 | | | $ | 1.01 | | | | 0.20 | % |

Transamerica Asset Allocation Variable Funds - | | | | | | | | | | | | | | | | | | | | | | | | |

Intermediate Horizon Subaccount | | | 1,000.00 | | | | 1,053.20 | | | | 1.02 | | | | 1,023.87 | | | | 1.01 | | | | 0.20 | |

Transamerica Asset Allocation Variable Funds - | | | | | | | | | | | | | | | | | | | | | | | | |

Intermediate/Long Horizon Subaccount | | | 1,000.00 | | | | 1,063.00 | | | | 1.03 | | | | 1,023.87 | | | | 1.01 | | | | 0.20 | |

| (A) | 5% return per year before expenses. |

| (B) | Expenses are equal to each Subaccount’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (182 days), and divided by the number of days in the year (366 days). |

| (C) | Expense ratios do not include expenses of the investment companies in which the Subaccounts invest. |

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 2 | | |

Schedules of Investments Composition

At June 30, 2012

(the following charts summarize the Schedule of Investments of each Subaccount by asset type)

(unaudited)

| | | | |

Transamerica Asset Allocation Variable Funds - Short Horizon Subaccount | | % of Net

Assets | |

Fixed Income | | | 89.7 | % |

Domestic Equity | | | 8.2 | |

International Equity | | | 1.9 | |

Money Market | | | 0.2 | |

Other Assets and Liabilities - Net | | | (0.0 | )(A) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Asset Allocation Variable Funds - Intermediate Horizon Subaccount | | % of Net

Assets | |

Fixed Income | | | 49.8 | % |

Domestic Equity | | | 39.3 | |

International Equity | | | 10.7 | |

Money Market | | | 0.2 | |

Other Assets and Liabilities - Net | | | (0.0 | )(A) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Asset Allocation Variable Funds - Intermediate/Long Horizon Subaccount | | % of Net

Assets | |

Domestic Equity | | | 53.8 | % |

Fixed Income | | | 29.2 | |

International Equity | | | 16.8 | |

Money Market | | | 0.2 | |

Other Assets and Liabilities - Net | | | (0.0 | )(A) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (A) | Amount rounds to less than (0.1)%. |

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 3 | | |

Transamerica Asset Allocation Variable –

Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Shares | | | Value

(000’s) | |

INVESTMENT COMPANIES - 100.0% p | | | | | | | | |

Domestic Equity - 8.2% | | | | | | | | |

Transamerica Partners Variable Large Growth ‡ | | | 5,047 | | | $ | 281 | |

Transamerica Partners Variable Large Value ‡ | | | 5,525 | | | | 275 | |

Transamerica Partners Variable Small Core ‡ | | | 4,696 | | | | 184 | |

Fixed Income - 89.7% | | | | | | | | |

Transamerica Partners Variable Core Bond ‡ | | | 100,559 | | | | 4,225 | |

Transamerica Partners Variable High Quality Bond ‡ | | | 81,628 | | | | 1,446 | |

Transamerica Partners Variable High Yield Bond ‡ | | | 36,912 | | | | 965 | |

Transamerica Partners Variable

Inflation-Protected Securities ‡ | | | 52,573 | | | | 1,497 | |

International Equity - 1.9% | | | | | | | | |

Transamerica Partners Variable International Equity ‡ | | | 9,465 | | | | 175 | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market ‡ | | | 798 | | | | 17 | |

| | | | | | | | |

Total Investment Companies

(cost $7,378) Õ | | | | | | | 9,065 | |

Other Assets and Liabilities - Net | | | | | | | (1 | ) |

| | | | | | | | |

Net Assets | | | | | | $ | 9,064 | |

| | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| p | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| Õ | Aggregate cost for federal income tax purposes is $7,378. Aggregate gross/net unrealized appreciation for all securities in which there is an excess of value over tax cost was $1,687. |

VALUATION SUMMARY (all amounts in thousands): '

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Quoted

Prices | | | Level 2 -

Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Value at

06/30/2012 | |

Investment Companies | | $ | 9,065 | | | $ | — | | | $ | — | | | $ | 9,065 | |

| ' | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers into or out of Levels 1 and 2 during the period ended 06/30/2012. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 4 | | |

Transamerica Asset Allocation Variable –

Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Shares | | | Value

(000’s) | |

INVESTMENT COMPANIES - 100.0% p | | | | | | | | |

Domestic Equity - 39.3% | | | | | | | | |

Transamerica Partners Variable Large Growth ‡ | | | 59,628 | | | $ | 3,325 | |

Transamerica Partners Variable Large Value ‡ | | | 66,582 | | | | 3,315 | |

Transamerica Partners Variable Small Core ‡ | | | 57,328 | | | | 2,242 | |

Fixed Income - 49.8% | | | | | | | | |

Transamerica Partners Variable Core Bond ‡ | | | 128,346 | | | | 5,393 | |

Transamerica Partners Variable High Quality Bond ‡ | | | 99,971 | | | | 1,771 | |

Transamerica Partners Variable High Yield Bond ‡ | | | 54,735 | | | | 1,431 | |

Transamerica Partners Variable

Inflation-Protected Securities ‡ | | | 93,776 | | | | 2,671 | |

International Equity - 10.7% | | | | | | | | |

Transamerica Partners Variable International Equity ‡ | | | 131,287 | | | | 2,421 | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market ‡ | | | 1,863 | | | | 39 | |

| | | | | | | | |

Total Investment Companies

(cost $19,442) Õ | | | | | | | 22,608 | |

Other Assets and Liabilities - Net | | | | | | | (4 | ) |

| | | | | | | | |

Net Assets | | | | | | $ | 22,604 | |

| | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| p | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| Õ | Aggregate cost for federal income tax purposes is $19,442. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $3,558 and $392, respectively. Net unrealized appreciation for tax purposes is $3,166. |

VALUATION SUMMARY (all amounts in thousands): '

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Quoted

Prices | | | Level 2 -

Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Value at

06/30/2012 | |

Investment Companies | | $ | 22,608 | | | $ | — | | | $ | — | | | $ | 22,608 | |

| ' | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers into or out of Levels 1 and 2 during the period ended 06/30/2012. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 5 | | |

Transamerica Asset Allocation Variable –

Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Shares | | | Value

(000’s) | |

INVESTMENT COMPANIES - 100.0% p | | | | | | | | |

Domestic Equity - 53.8% | | | | | | | | |

Transamerica Partners Variable Large Growth ‡ | | | 108,346 | | | $ | 6,041 | |

Transamerica Partners Variable Large Value ‡ | | | 108,593 | | | | 5,407 | |

Transamerica Partners Variable Small Core ‡ | | | 103,737 | | | | 4,057 | |

Fixed Income - 29.2% | | | | | | | | |

Transamerica Partners Variable Core Bond ‡ | | | 100,470 | | | | 4,221 | |

Transamerica Partners Variable High Quality Bond ‡ | | | 31,106 | | | | 551 | |

Transamerica Partners Variable High Yield Bond ‡ | | | 44,160 | | | | 1,155 | |

Transamerica Partners Variable Inflation- Protected Securities ‡ | | | 87,934 | | | | 2,505 | |

International Equity - 16.8% | | | | | | | | |

Transamerica Partners Variable International Equity ‡ | | | 262,671 | | | | 4,843 | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market ‡ | | | 2,734 | | | | 58 | |

| | | | | | | | |

Total Investment Companies (cost $25,729) Õ | | | | | | | 28,838 | |

Other Assets and Liabilities - Net | | | | | | | (4 | ) |

| | | | | | | | |

Net Assets | | | | | | $ | 28,834 | |

| | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| p | Each Subaccount invests its assets in an affiliated fund of Transamerica Partners Variable Funds. |

| ‡ | Non-income producing security. |

| Õ | Aggregate cost for federal income tax purposes is $25,729. Aggregate gross unrealized appreciation/depreciation for all securities in which there is an excess of value over tax cost were $3,719 and $610, respectively. Net unrealized appreciation for tax purposes is $3,109. |

VALUATION SUMMARY (all amounts in thousands): '

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Quoted

Prices | | | Level 2 -

Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Value at

06/30/2012 | |

Investment Companies | | $ | 28,838 | | | $ | — | | | $ | — | | | $ | 28,838 | |

| ' | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers into or out of Levels 1 and 2 during the period ended 06/30/2012. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 6 | | |

STATEMENTS OF ASSETS AND LIABILITIES

At June 30, 2012

(all amounts except unit value in thousands)

(unaudited)

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/Long

Horizon | |

Assets: | | | | | | | | | | | | |

Investments in affiliated investment companies, at value | | $ | 9,065 | | | $ | 22,608 | | | $ | 28,838 | |

Receivables: | | | | | | | | | | | | |

Units sold | | | 3 | | | | 5 | | | | 13 | |

Investments in affiliated investment companies sold | | | — | | | | 8 | | | | 181 | |

| | | | | | | | | | | | |

| | | 9,068 | | | | 22,621 | | | | 29,032 | |

| | | | | | | | | | | | |

Liabilities: | | | | | | | | | | | | |

Accounts payable and accrued liabilities: | | | | | | | | | | | | |

Units redeemed | | | 1 | | | | 13 | | | | 105 | |

Investments in affiliated investment companies purchased | | | 1 | | | | — | | �� | | 89 | |

Investment advisory fees | | | 2 | | | | 4 | | | | 4 | |

| | | | | | | | | | | | |

| | | 4 | | | | 17 | | | | 198 | |

| | | | | | | | | | | | |

Net Assets | | $ | 9,064 | | | $ | 22,604 | | | $ | 28,834 | |

| | | | | | | | | | | | |

Net Assets Consist of: | | | | | | | | | | | | |

Cost of accumulation units | | | 4,618 | | | | 13,210 | | | | 20,148 | |

Accumulated net investment loss | | | (231 | ) | | | (649 | ) | | | (899 | ) |

Undistributed net realized gains | | | 2,990 | | | | 6,877 | | | | 6,476 | |

Net unrealized appreciation on investments in affiliated investment companies | | | 1,687 | | | | 3,166 | | | | 3,109 | |

| | | | | | | | | | | | |

Net Assets | | $ | 9,064 | | | $ | 22,604 | | | $ | 28,834 | |

| | | | | | | | | | | | |

Accumulation units | | | 461 | | | | 1,181 | | | | 1,533 | |

| | | | | | | | | | | | |

Unit value | | $ | 19.65 | | | $ | 19.13 | | | $ | 18.81 | |

| | | | | | | | | | | | |

Investments in affiliated investment companies, at cost | | $ | 7,378 | | | $ | 19,442 | | | $ | 25,729 | |

| | | | | | | | | | | | |

STATEMENTS OF OPERATIONS

For the period ended June 30, 2012

(all amounts in thousands)

(unaudited)

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/Long

Horizon | |

Investment advisory fees | | $ | 9 | | | $ | 22 | | | $ | 29 | |

| | | | | | | | | | | | |

Net investment loss | | | (9 | ) | | | (22 | ) | | | (29 | ) |

| | | | | | | | | | | | |

Net realized and unrealized gain (loss) on investments in affiliates: | | | | | | | | | | | | |

Realized gain from investments in affiliated investment companies | | | 167 | | | | 208 | | | | 217 | |

Change in net unrealized appreciation on investments in affiliated investment companies | | | 153 | | | | 955 | | | | 1,579 | |

| | | | | | | | | | | | |

Net realized and change in unrealized gain on investments in affiliated investment companies | | | 320 | | | | 1,163 | | | | 1,796 | |

| | | | | | | | | | | | |

Net increase in net assets resulting from operations | | $ | 311 | | | $ | 1,141 | | | $ | 1,767 | |

| | | | | | | | | | | | |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 7 | | |

STATEMENTS OF CHANGES IN NET ASSETS

For the period or year ended:

(all amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate Horizon | | | Intermediate/Long Horizon | |

| | | Period

Ended

June 30,

2012

(unaudited) | | | Year Ended

December 31,

2011 | | | Period

Ended

June 30,

2012

(unaudited) | | | Year Ended

December 31,

2011 | | | Period

Ended

June 30,

2012

(unaudited) | | | Year Ended

December 31,

2011 | |

From operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | $ | (9 | ) | | $ | (19 | ) | | $ | (22 | ) | | $ | (47 | ) | | $ | (29 | ) | | $ | (60 | ) |

Net realized gain on investments in affiliated investment companies | | | 167 | | | | 315 | | | | 208 | | | | 994 | | | | 217 | | | | 541 | |

Change in net unrealized appreciation (depreciation) on investments in affiliated investment companies | | | 153 | | | | 80 | | | | 955 | | | | (836 | ) | | | 1,579 | | | | (909 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | 311 | | | | 376 | | | | 1,141 | | | | 111 | | | | 1,767 | | | | (428 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

From unit transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 865 | | | | 1,591 | | | | 1,256 | | | | 3,096 | | | | 1,250 | | | | 3,376 | |

Units redeemed | | | (996 | ) | | | (2,691 | ) | | | (1,392 | ) | | | (5,788 | ) | | | (2,186 | ) | | | (5,936 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net decrease in net assets resulting from unit transactions | | | (131 | ) | | | (1,100 | ) | | | (136 | ) | | | (2,692 | ) | | | (936 | ) | | | (2,560 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 180 | | | | (724 | ) | | | 1,005 | | | | (2,581 | ) | | | 831 | | | | (2,988 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period/year | | | 8,884 | | | | 9,608 | | | | 21,599 | | | | 24,180 | | | | 28,003 | | | | 30,991 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

End of period/year | | $ | 9,064 | | | $ | 8,884 | | | $ | 22,604 | | | $ | 21,599 | | | $ | 28,834 | | | $ | 28,003 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Accumulated net investment loss | | $ | (231 | ) | | $ | (222 | ) | | $ | (649 | ) | | $ | (627 | ) | | $ | (899 | ) | | $ | (870 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Units outstanding beginning of period/year | | | 468 | | | | 527 | | | | 1,189 | | | | 1,334 | | | | 1,583 | | | | 1,722 | |

Units sold | | | 45 | | | | 85 | | | | 66 | | | | 169 | | | | 66 | | | | 187 | |

Units redeemed | | | (52 | ) | | | (144 | ) | | | (74 | ) | | | (314 | ) | | | (116 | ) | | | (326 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Units outstanding end of period/year | | | 461 | | | | 468 | | | | 1,181 | | | | 1,189 | | | | 1,533 | | | | 1,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 8 | | |

FINANCIAL HIGHLIGHTS

For the period or years ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | |

For a unit outstanding throughout each period | | June 30, 2012

(unaudited) | | | December 31,

2011 | | | December 31,

2010 | | | December 31,

2009 | | | December 31,

2008 | | | December 31,

2007 | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period/year | | $ | 18.99 | | | $ | 18.24 | | | $ | 16.95 | | | $ | 14.66 | | | $ | 16.28 | | | $ | 15.59 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment loss(A) | | | (0.02 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.03 | ) |

From net realized and unrealized gains (loss) on investments in affiliated investment companies | | | 0.68 | | | | 0.79 | | | | 1.33 | | | | 2.32 | | | | (1.59 | ) | | | 0.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.66 | | | | 0.75 | | | | 1.29 | | | | 2.29 | | | | (1.62 | ) | | | 0.69 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

End of period/year | | $ | 19.65 | | | $ | 18.99 | | | $ | 18.24 | | | $ | 16.95 | | | $ | 14.66 | | | $ | 16.28 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 3.50 | %(B) | | | 4.07 | % | | | 7.65 | % | | | 15.62 | % | | | (9.95 | )% | | | 4.43 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net assets End of Period/Year (000’s) | | $ | 9,064 | | | $ | 8,884 | | | $ | 9,608 | | | $ | 10,112 | | | $ | 9,450 | | | $ | 11,097 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratio and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses to average net assets(C) | | | 0.20 | %(D) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment loss, to average net assets | | | (0.20 | )%(D) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate(E) | | | 24 | %(B) | | | 46 | % | | | 36 | % | | | 28 | % | | | 125 | % | | | 55 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Intermediate Horizon | |

For a unit outstanding throughout each period | | June 30, 2012

(unaudited) | | | December 31,

2011 | | | December 31,

2010 | | | December 31,

2009 | | | December 31,

2008 | | | December 31,

2007 | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period/year | | $ | 18.17 | | | $ | 18.13 | | | $ | 16.22 | | | $ | 13.46 | | | $ | 18.16 | | | $ | 17.44 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment loss(A) | | | (0.02 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.04 | ) |

From net realized and unrealized gains (loss) on investments in affiliated investment companies | | | 0.98 | | | | 0.08 | | | | 1.94 | | | | 2.79 | | | | (4.67 | ) | | | 0.76 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 0.96 | | | | 0.04 | | | | 1.91 | | | | 2.76 | | | | (4.70 | ) | | | 0.72 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

End of period/year | | $ | 19.13 | | | $ | 18.17 | | | $ | 18.13 | | | $ | 16.22 | | | $ | 13.46 | | | $ | 18.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 5.32 | %(B) | | | 0.19 | % | | | 11.81 | % | | | 20.51 | % | | | (25.88 | )% | | | 4.13 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net assets End of Period/Year (000’s) | | $ | 22,604 | | | $ | 21,599 | | | $ | 24,180 | | | $ | 24,295 | | | $ | 21,990 | | | $ | 32,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratio and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses to average net assets(C) | | | 0.20 | %(D) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment loss, to average net assets | | | (0.20 | )%(D) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate(E) | | | 13 | %(B) | | | 42 | % | | | 25 | % | | | 34 | % | | | 111 | % | | | 18 | % |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 9 | | |

FINANCIAL HIGHLIGHTS (continued)

For the period or years ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Intermediate/Long Horizon | |

For a unit outstanding throughout each period | | June 30,

2012

(unaudited) | | | December 31,

2011 | | | December 31,

2010 | | | December 31,

2009 | | | December 31,

2008 | | | December 31,

2007 | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period/year | | $ | 17.70 | | | $ | 17.99 | | | $ | 15.78 | | | $ | 12.89 | | | $ | 19.30 | | | $ | 18.56 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Investment operations | | | | | | | | | | | | | | | | | | | | | | | | |

From net investment loss(A) | | | (0.02 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.03 | ) | | | (0.04 | ) |

From net realized and unrealized gains (loss) on investments in affiliated investment companies | | | 1.13 | | | | (0.25 | ) | | | 2.24 | | | | 2.92 | | | | (6.38 | ) | | | 0.78 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from investment operations | | | 1.11 | | | | (0.29 | ) | | | 2.21 | | | | 2.89 | | | | (6.41 | ) | | | 0.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Unit value | | | | | | | | | | | | | | | | | | | | | | | | |

End of period/year | | $ | 18.81 | | | $ | 17.70 | | | $ | 17.99 | | | $ | 15.78 | | | $ | 12.89 | | | $ | 19.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total return | | | 6.30 | %(B) | | | (1.66 | )% | | | 14.05 | % | | | 22.42 | % | | | (33.21 | )% | | | 3.99 | % |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net assets End of Period/Year (000’s) | | $ | 28,834 | | | $ | 28,003 | | | $ | 30,991 | | | $ | 30,478 | | | $ | 33,453 | | | $ | 52,704 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Ratio and supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses to average net assets(C) | | | 0.20 | %(D) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment loss, to average net assets | | | (0.20 | )%(D) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate(E) | | | 14 | %(B) | | | 34 | % | | | 23 | % | | | 54 | % | | | 105 | % | | | 21 | % |

| (A) | Calculation is based on average number of units outstanding. |

| (C) | Ratios exclude expenses incurred by the underlying affiliated investment companies in which the Subaccounts invest. |

| (E) | Does not include the portfolio activity of the underlying affiliated investment companies. |

| Note: | Prior to January 1, 2010, the financial highlights were audited by another registered public accounting firm. |

The notes to the financial statements are an integral part of this report.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 10 | | |

NOTES TO FINANCIAL STATEMENTS

At June 30, 2012

(all amounts in thousands)

(unaudited)

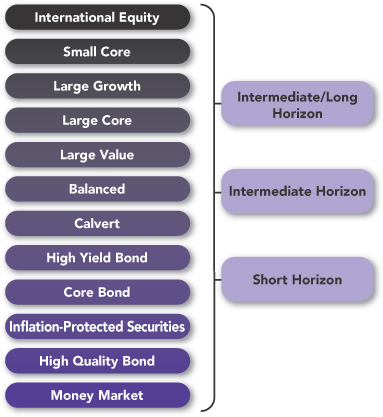

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a management investment company. The Separate Account is composed of three different subaccounts that are separate investment funds: Transamerica Asset Allocation—Short Horizon Subaccount (“Short Horizon”), Transamerica Asset Allocation—Intermediate Horizon Subaccount (“Intermediate Horizon”), and Transamerica Asset Allocation—Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”) (individually, a “Subaccount” and collectively, the “Subaccounts”). Each Subaccount invests all of its investable assets among certain Transamerica Partners Variable Funds (“TPVF”). Certain TPVF subaccounts invest all their investable assets in the Transamerica Partners Portfolios.

This report should be read in conjunction with the Subaccounts’ current prospectus, which contains more complete information about the Subaccounts, including investment objectives and strategies.

In the normal course of business, the Separate Account enters into contracts that contain a variety of representations that provide general indemnifications. The Separate Account’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Separate Account and/or its affiliates that have not yet occurred. However, based on experience, the Separate Account expects the risk of loss to be remote.

In preparing the Separate Account’s financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”), estimates or assumptions may be used that affect reported amounts and disclosures. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Separate Account.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear its share of fees and expenses incurred by TPVF in which it invests. These expenses are not reflected in the expenses in the Statements of Operations and are not included in the ratios to average net assets shown in the Financial Highlights.

Security transactions: Security transactions are recorded on the trade date. Net realized gain (loss) from investments in affiliates for the Subaccounts are from investments in units of affiliated investment companies.

NOTE 2. SECURITY VALUATIONS

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding subaccount of TPVF is valued at the unit value per share of each Subaccount determined as of the close of business of the New York Stock Exchange (“NYSE”), normally, 4:00 P.M. Eastern time, each day the NYSE is open for business. The Subaccount utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, that are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs, which may include Transamerica Asset Management, Inc.’s (“TAM”) Valuation Committee’s own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-advisor, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, TAM’s Valuation Committee’s determination of values may differ significantly from values that would have been realized had a ready market for investments existed and the differences could be material.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 11 | | |

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2012

(all amounts in thousands)

(unaudited)

NOTE 2. (continued)

Fair value measurements: Descriptions of the valuation techniques applied to the Subaccount’s major categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Investment company securities: Investment company securities are valued at the net asset value of the underlying subaccounts. These securities are actively traded and no valuation adjustments are applied. They are categorized in Level 1 of the fair value hierarchy.

The hierarchy classification of inputs used to value the Subaccounts’ investments at June 30, 2012, are disclosed in the Valuation Summary of each of the Subaccounts’ Schedule of Investments.

NOTE 3. RELATED PARTY TRANSACTIONS

The Separate Account has entered into an Investment Advisory Agreement with TAM. TAM is directly owned by Western Reserve Life Assurance Co. of Ohio and AUSA Holding Company (“AUSA”), both of which are indirect, wholly-owned subsidiaries of AEGON NV. AUSA is wholly-owned by AEGON USA, LLC (“AEGON USA”), a financial services holding company whose primary emphasis is on life and health insurance, and annuity and investment products. AEGON USA is owned by AEGON US Holding Corporation, which is owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is owned by The AEGON Trust, which is owned by AEGON International B.V., which is owned by AEGON NV, a Netherlands corporation, and a publicly traded international insurance group.

Pursuant to the Investment Advisory Agreement TAM provides general investment advice to each Subaccount. For providing these services and facilities and for bearing the related expenses, TAM receives a monthly fee from each Subaccount which is accrued daily and payable monthly at an annual rate equal to 0.20% of the average daily net assets of each Subaccount.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain Managing Board Members and officers of TFLIC are also trustees, officers or employees of TAM or its affiliates. No interested Managing Board Members receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers receive compensation from the Subaccounts. The independent board members are also trustees of the Transamerica Partners Portfolios for which they receive fees.

Deferred compensation plan: Under a non-qualified deferred compensation plan, effective January 1, 1996, as amended and restated (the “Deferred Compensation Plan”), available to the Trustees, compensation may be deferred that would otherwise be payable by the Trust to an Independent Trustee on a current basis for services rendered as Trustee. Deferred compensation amounts will accumulate based on investment options under Transamerica Partners Institutional Funds and Transamerica Institutional Asset Allocation Funds, or the value of Class A (or comparable) shares of a series of Transamerica Funds (without imposition of sales charge), as elected by the Trustee.

NOTE 4. SECURITIES TRANSACTIONS

The cost of affiliated investments purchased and proceeds from affiliated investments sold for the period ended June 30, 2012 were as follows:

| | | | | | | | | | | | | | | | |

| | | Purchases of affiliated investments: | | | Proceeds from maturities and

sales of affiliated investments: | |

Fund | | Long-term | | | U.S. Government | | | Long-term | | | U.S. Government | |

Short Horizon | | $ | 2,197 | | | $ | — | | | $ | 2,337 | | | $ | — | |

Intermediate Horizon | | | 2,866 | | | | — | | | | 3,024 | | | | — | |

Intermediate/Long Horizon | | | 4,142 | | | | — | | | | 5,107 | | | | — | |

NOTE 5. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of AEGON USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. Management has evaluated the Separate Account’s tax positions taken for all open tax years (2008-2010), or expected to be taken in the Separate Account’s 2011 tax returns. Each subaccount is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

NOTE 6. SUBSEQUENT EVENT

Management has evaluated subsequent events through the date of issuance of the financial statements, and determined that no other material events or transactions would require recognition or disclosure in the Subaccounts’ financial statements.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 12 | | |

INVESTMENT ADVISORY AGREEMENTS – CONTRACT RENEWAL

(unaudited)

At a meeting of the Managing Board of Transamerica Asset Allocation Variable Funds (the “Board”) held on June 13-14, 2012, the Board reviewed and considered the renewal of the investment advisory agreements (each, an “Investment Advisory Agreement” and collectively the “Investment Advisory Agreements”) between each of Transamerica Asset Allocation—Intermediate Horizon Subaccount, Transamerica Asset Allocation—Intermediate/Long Horizon Subaccount, and Transamerica Asset Allocation—Short Horizon Subaccount (each a “Fund” and collectively the “Funds”) and Transamerica Asset Management, Inc. (“TAM”).

Following their review and consideration, the Board Members determined that the terms of each Investment Advisory Agreement are reasonable and that the renewal of each agreement is in the best interests of the applicable Fund and its shareholders. The Board, including the independent members of the Board (the “Independent Board Members”), unanimously approved the renewal of each Investment Advisory Agreement through June 30, 2013. In reaching their decision, the Board Members requested and received from TAM such information as they deemed reasonably necessary to evaluate the agreements. The Board Members also considered information they had previously received from TAM as part of their regular oversight of each Fund, as well as comparative fee, expense, and performance information prepared by TAM based on information provided by Lipper Inc. (“Lipper”), an independent provider of mutual fund performance information, and other fee and expense information and profitability data prepared by TAM.

In their deliberations, the Independent Board Members had the opportunity to meet privately without representatives of TAM present and were represented throughout the process by independent legal counsel. In considering the proposed continuation of each Investment Advisory Agreement, the Board Members evaluated a number of considerations that they believed, in light of the legal advice furnished to them by independent legal counsel and their own business judgment, to be relevant. They based their decisions on the considerations discussed below, among others, although they did not identify any consideration or particular information that was controlling of their decisions, and each Board Member may have attributed different weights to the various factors.

Nature, Extent and Quality of the Services Provided

The Board considered the nature, extent and quality of the services provided by TAM to the applicable Fund in the past and the services anticipated to be provided in the future. The Board also considered the investment approach for each Fund; the experience, capability and integrity of TAM’s senior management; the financial resources of TAM; and the professional qualifications of TAM’s portfolio management team.

Based on these considerations, the Board determined that TAM can provide investment and related services that are appropriate in scope and extent in light of the applicable Fund’s operations, the competitive landscape of the investment company business and investor needs.

Investment Performance

The Board considered the short- and longer-term performance of each Fund in light of its investment objective, policies and strategies, including relative performance against a peer universe of mutual funds, based on Lipper information, for various trailing periods ended December 31, 2011. On the basis of this information and the Board’s assessment of the nature, extent and quality of the services to be provided by TAM, the Board concluded that TAM is capable of generating a level of investment performance that is appropriate in light of the applicable Fund’s investment objectives, policies and strategies and competitive with other investment companies.

Management Fees and Total Expense Ratios

The Board considered the management fee and total expense ratio of each Fund, including information comparing the management fee and total expense ratio of each Fund to the management fees and total expense ratios of peer investment companies, based on Lipper information. On the basis of these considerations, together with the other information it considered, the Board determined that the management fees to be received by TAM under the Investment Advisory Agreements are reasonable in light of the services provided.

Cost of Services Provided and Level of Profitability

The Board reviewed information provided by TAM about the cost of providing fund management services, as well as the costs of the provision of administration and other services, to each Fund by TAM and its affiliates. The Board considered the profitability of TAM and its affiliates in providing these services for each Fund, as well as the allocation methodology used for calculating profitability.

Based on this information, the Board determined that the profitability of TAM and its affiliates from their relationships with the Funds was not excessive.

Economies of Scale

The Board considered economies of scale with respect to the management of each Fund, whether the Fund had appropriately benefited from any economies of scale, and whether there was the potential for realization of any further economies of scale. The Board also considered the existence of economies of scale with respect to management of the Transamerica funds overall and the extent to which the Funds benefited from these economies of scale. The Board considered each Fund’s management fee schedule and the existence of breakpoints, if any, and also considered the extent to which TAM shared economies of scale with the Funds through investments in capabilities and services. The Board Members concluded that each Fund’s fee structure reflected economies of scale to date but noted that they will have the opportunity to periodically reexamine whether each Fund has achieved economies of scale, and the appropriateness of management fees payable to TAM, in the future.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 13 | | |

INVESTMENT ADVISORY AGREEMENTS – CONTRACT RENEWAL (continued)

(unaudited)

Benefits to TAM or its Affiliates from their Relationships with the Funds

The Board considered any other benefits derived by TAM and its affiliates from their relationship with the Funds. The Board noted that TAM does not realize soft dollar benefits from its relationship with the Funds.

Other Considerations

The Board noted that TAM has made a substantial commitment to the recruitment and retention of high quality personnel, and maintains the financial, compliance and operational resources reasonably necessary to manage each Fund in a professional manner that is consistent with the best interests of the Fund and its shareholders. In this regard, the Board favorably considered the procedures and policies TAM has in place to enforce compliance with applicable laws and regulations. The Board also noted that TAM has made a significant entrepreneurial commitment to the management and success of the Funds.

Conclusion

After consideration of the factors described above, as well as other factors, the Board Members, including all of the Independent Board Members, concluded that the renewal of each Investment Advisory Agreement is in the best interests of the applicable Fund and its shareholders and voted to approve the renewal of each Investment Advisory Agreement.

| | | | |

| Transamerica Asset Allocation Variable Funds | | | | Semi-Annual Report 2012 |

| | Page 14 | | |

Transamerica Partners Portfolios

(This page intentionally left blank)

Schedules of Investments Composition

At June 30, 2012

(the following charts summarize the Schedule of Investments of each portfolio by asset type)

(unaudited)

| | | | |

Transamerica Partners Money Market Portfolio | | % of Net

Assets | |

Short-Term U.S. Government Obligations | | | 26.9 | % |

Certificate of Deposit | | | 18.8 | |

Commercial Paper | | | 14.1 | |

Repurchase Agreements | | | 11.6 | |

U.S. Government Agency Obligations | | | 10.8 | |

U.S. Government Obligations | | | 9.7 | |

Short-Term Foreign Government Obligation | | | 2.4 | |

Foreign Government Obligation | | | 1.9 | |

Other Assets and Liabilities - Net | | | 3.8 | |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners High Quality Bond Portfolio | | % of Net

Assets | |

Corporate Debt Securities | | | 38.4 | % |

Asset-Backed Securities | | | 25.6 | |

Mortgage-Backed Securities | | | 17.4 | |

U.S. Government Obligations | | | 8.3 | |

Securities Lending Collateral | | | 6.0 | |

Repurchase Agreement | | | 3.9 | |

U.S. Government Agency Obligations | | | 3.6 | |

Foreign Government Obligations | | | 2.2 | |

Other Assets and Liabilities - Net | | | (5.4 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Inflation-Protected Securities Portfolio | | % of Net

Assets | |

U.S. Government Obligations | | | 95.9 | % |

Securities Lending Collateral | | | 4.1 | |

Foreign Government Obligations | | | 2.6 | |

Structured Notes Debt | | | 0.4 | |

Short-Term Investment Company | | | 0.2 | |

Purchased Swaptions | | | 0.1 | |

Mortgage-Backed Security | | | 0.0 | (A) |

Purchased Options | | | 0.0 | (A) |

Other Assets and Liabilities - Net(B) | | | (3.3 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Core Bond Portfolio | | % of Net

Assets | |

U.S. Government Agency Obligations | | | 44.1 | % |

Corporate Debt Securities | | | 29.4 | |

U.S. Government Obligations | | | 15.3 | |

Mortgage-Backed Securities | | | 11.6 | |

Securities Lending Collateral | | | 10.4 | |

Asset-Backed Securities | | | 8.0 | |

Foreign Government Obligations | | | 3.2 | |

Short-Term Investment Company | | | 0.9 | |

Preferred Corporate Debt Securities | | | 0.6 | |

Structured Notes Debt | | | 0.5 | |

Municipal Government Obligations | | | 0.3 | |

Preferred Stocks | | | 0.2 | |

Purchased Swaptions | | | 0.0 | (A) |

Purchased Options | | | 0.0 | (A) |

Warrant | | | 0.0 | (A) |

Other Assets and Liabilities - Net(B) | | | (24.5 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| | | | |

Transamerica Partners High Yield Bond Portfolio | | % of Net

Assets | |

Corporate Debt Securities | | | 87.1 | % |

Loan Assignments | | | 6.3 | |

Repurchase Agreement | | | 5.4 | |

Structured Notes Debt | | | 0.8 | |

Common Stocks | | | 0.4 | |

Preferred Stock | | | 0.3 | |

Convertible Preferred Stock | | | 0.1 | |

Warrants | | | 0.0 | (A) |

Right | | | 0.0 | (A) |

Preferred Corporate Debt Security | | | 0.0 | (A) |

Convertible Bond | | | 0.0 | (A) |

Investment Company | | | 0.0 | (A) |

Other Assets and Liabilities - Net | | | (0.4 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Balanced Portfolio | | % of Net

Assets | |

Common Stocks | | | 58.7 | % |

Securities Lending Collateral | | | 18.7 | |

U.S. Government Agency Obligations | | | 17.5 | |

Corporate Debt Securities | | | 11.9 | |

U.S. Government Obligations | | | 5.1 | |

Mortgage-Backed Securities | | | 4.8 | |

Asset-Backed Securities | | | 2.8 | |

Foreign Government Obligations | | | 1.2 | |

Short-Term Investment Company | | | 0.9 | |

Repurchase Agreement | | | 0.7 | |

Preferred Corporate Debt Securities | | | 0.3 | |

Structured Notes Debt | | | 0.2 | |

Short-Term U.S. Government Obligation | | | 0.1 | |

Preferred Stocks | | | 0.1 | |

Municipal Government Obligations | | | 0.1 | |

Warrants | | | 0.0 | (A) |

Purchased Options | | | 0.0 | (A) |

Other Assets and Liabilities - Net(B) | | | (23.1 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Large Value Portfolio | | % of Net

Assets | |

Common Stocks | | | 98.3 | % |

Securities Lending Collateral | | | 4.6 | |

Repurchase Agreement | | | 1.7 | |

Other Assets and Liabilities - Net | | | (4.6 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Large Core Portfolio | | % of Net

Assets | |

Common Stocks | | | 98.5 | % |

Securities Lending Collateral | | | 8.9 | |

Repurchase Agreement | | | 1.5 | |

Other Assets and Liabilities - Net | | | (8.9 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Large Growth Portfolio | | % of Net

Assets | |

Common Stocks | | | 97.4 | % |

Securities Lending Collateral | | | 6.1 | |

Repurchase Agreement | | | 2.1 | |

Other Assets and Liabilities - Net | | | (5.6 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| | |

| Transamerica Partners Portfolios | | Semi-Annual Report 2012 |

Page 1

Schedules of Investments Composition (continued)

At June 30, 2012

(the following charts summarize the Schedule of Investments of each portfolio by asset type)

(unaudited)

| | | | |

Transamerica Partners Mid Value Portfolio | | % of Net

Assets | |

Common Stocks | | | 96.3 | % |

Securities Lending Collateral | | | 11.2 | |

Repurchase Agreement | | | 3.3 | |

Other Assets and Liabilities - Net | | | (10.8 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Mid Growth Portfolio | | % of Net

Assets | |

Common Stocks | | | 99.6 | % |

Securities Lending Collateral | | | 25.5 | |

Repurchase Agreement | | | 1.4 | |

Other Assets and Liabilities - Net | | | (26.5 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Small Value Portfolio | | % of Net

Assets | |

Common Stocks | | | 97.3 | % |

Securities Lending Collateral | | | 25.6 | |

Repurchase Agreement | | | 2.2 | |

Other Assets and Liabilities - Net | | | (25.1 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Small Core Portfolio | | % of Net

Assets | |

Common Stocks | | | 97.3 | % |

Securities Lending Collateral | | | 25.7 | |

Repurchase Agreement | | | 2.4 | |

Short-Term U.S. Government Obligation | | | 0.1 | |

Other Assets and Liabilities - Net(B) | | | (25.5 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners Small Growth Portfolio | | % of Net

Assets | |

Common Stocks | | | 96.4 | % |

Securities Lending Collateral | | | 25.7 | |

Repurchase Agreement | | | 4.4 | |

Warrant | | | 0.0 | (A) |

Other Assets and Liabilities - Net | | | (26.5 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| |

Transamerica Partners International Equity Portfolio | | % of Net

Assets | |

Common Stocks | | | 94.1 | % |

Securities Lending Collateral | | | 9.8 | |

Repurchase Agreement | | | 3.4 | |

Preferred Stock | | | 1.7 | |

Other Assets and Liabilities - Net(B) | | | (9.0 | ) |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (A) | Amount rounds to less than 0.1%. |

| (B) | The other Assets and Liabilities – Net category may include, but is not limited to Forward Foreign Currency contracts, Futures contracts, Swap Agreements, Written Options and Swaptions, Securities Sold Short, and Cash Collateral. |

| | |

| Transamerica Partners Portfolios | | Semi-Annual Report 2012 |

Page 2

Transamerica Partners Money Market Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Principal

(000’s) | | | Value

(000’s) | |

COMMERCIAL PAPER p - 14.1% | | | | | | | | |

Commercial Banks - 3.9% | | | | | | | | |

Commonwealth Bank of Australia | | | | | | | | |

0.21%, 08/21/2012 - 144A | | $ | 22,600 | | | $ | 22,594 | |

KFW | | | | | | | | |

0.22%, 08/13/2012 - 144A | | | 13,050 | | | | 13,046 | |

Consumer Finance - 1.4% | | | | | | | | |

John Deere Capital Corp. | | | | | | | | |

0.14%, 07/19/2012 - 144A | | | 13,200 | | | | 13,199 | |

Diversified Financial Services - 1.6% | | | | | | | | |

Nordea North America, Inc. | | | | | | | | |

0.29%, 08/22/2012 | | | 14,650 | | | | 14,644 | |

Household Products - 2.3% | | | | | | | | |

Procter & Gamble Co. | | | | | | | | |

0.10%, 07/06/2012 - 144A | | | 8,550 | | | | 8,550 | |

0.12%, 07/11/2012 - 144A | | | 12,300 | | | | 12,299 | |

Oil, Gas & Consumable Fuels - 1.3% | | | | | | | | |

Chevron Corp. | | | | | | | | |

0.11%, 08/13/2012 - 144A | | | 12,350 | | | | 12,348 | |

Pharmaceuticals - 3.6% | | | | | | | | |

Novartis Securities Investment, Ltd. | | | | | | | | |

0.16%, 08/14/2012 - 144A | | | 8,650 | | | | 8,648 | |

0.18%, 07/09/2012 - 144A | | | 12,350 | | | | 12,350 | |

Sanofi | | | | | | | | |

0.19%, 09/13/2012 - 144A | | | 12,250 | | | | 12,245 | |

| | | | | | | | |

Total Commercial Paper (cost $129,923) | | | | | | | 129,923 | |

| | | | | | | | |

| | |

CERTIFICATES OF DEPOSIT p - 18.8% | | | | | | | | |

Commercial Banks - 18.8% | | | | | | | | |

Bank of Montreal | | | | | | | | |

0.40%, 09/26/2012 * | | | 11,100 | | | | 11,100 | |

Bank of Nova Scotia | | | | | | | | |

0.18%, 07/13/2012 | | | 18,500 | | | | 18,500 | |

Barclays | | | | | | | | |

0.20%, 07/18/2012 * | | | 15,050 | | | | 15,050 | |

HSBC Bank PLC | | | | | | | | |

0.31%, 09/24/2012 - 144A | | | 22,650 | | | | 22,649 | |

National Australia Bank, Ltd. | | | | | | | | |

0.29%, 10/29/2012 | | | 18,450 | | | | 18,450 | |

Royal Bank of Canada | | | | | | | | |

0.46%, 04/10/2013 * | | | 12,350 | | | | 12,350 | |

Standard Chartered Bank | | | | | | | | |

0.29%, 09/10/2012 * | | | 18,150 | | | | 18,150 | |

Svenska Handelsbanken AB | | | | | | | | |

0.03%, 08/03/2012 | | | 10,750 | | | | 10,750 | |

0.27%, 07/10/2012 | | | 11,000 | | | | 11,000 | |

Toronto Dominion Bank | | | | | | | | |

0.21%, 09/18/2012 | | | 14,900 | | | | 14,900 | |

Westpac Banking Corp. | | | | | | | | |

0.47%, 02/11/2013 * | | | 20,850 | | | | 20,850 | |

| | | | | | | | |

Total Certificates of Deposit (cost $173,749) | | | | | | | 173,749 | |

| | | | | | | | |

| |

SHORT-TERM FOREIGN GOVERNMENT OBLIGATION p - 2.4% | | | | | |

IADB Discount Notes | | | | | | | | |

0.09%, 07/03/2012 | | | 21,950 | | | | 21,950 | |

Total Short-Term Foreign Government Obligation

(cost $21,950) | | | | | | | | |

| |

SHORT-TERM U.S. GOVERNMENT OBLIGATIONS p - 26.9% | | | | | |

Fannie Mae | | | | | | | | |

0.10%, 08/20/2012 | | | 12,350 | | | | 12,348 | |

0.12%, 09/12/2012 | | | 22,400 | | | | 22,394 | |

| | | | | | | | |

| | | Principal

(000’s) | | | Value

(000’s) | |

SHORT-TERM U.S. GOVERNMENT OBLIGATIONS (continued) | | | | | | | | |

Freddie Mac | | | | | | | | |

0.08%, 08/07/2012 | | $ | 21,050 | | | $ | 21,048 | |

0.09%, 07/23/2012 | | | 11,700 | | | | 11,699 | |

0.11%, 07/05/2012 - 08/22/2012 | | | 88,550 | | | | 88,544 | |

0.12%, 07/06/2012 - 08/14/2012 | | | 38,750 | | | | 38,748 | |

0.13%, 08/01/2012 - 10/25/2012 | | | 16,650 | | | | 16,646 | |

0.14%, 09/19/2012 | | | 6,250 | | | | 6,248 | |

U.S. Treasury Bill | | | | | | | | |

0.12%, 08/23/2012 | | | 19,050 | | | | 19,047 | |

0.15%, 09/13/2012 | | | 12,300 | | | | 12,296 | |

| | | | | | | | |

Total Short-Term U.S. Government Obligations (cost $249,018) | | | | | | | 249,018 | |

| | | | | | | | |

| |

FOREIGN GOVERNMENT OBLIGATION - 1.9% | | | | | |

International Bank for Reconstruction & Development

0.80%, 07/13/2012 | | | 17,600 | | | | 17,604 | |

Total Foreign Government Obligation

(cost $17,604) | | | | | |

| |

U.S. GOVERNMENT AGENCY OBLIGATIONS - 10.8% | | | | | |

Fannie Mae | | | | | | | | |

0.24%, 07/26/2012 * | | | 27,200 | | | | 27,204 | |

0.27%, 10/18/2012 * | | | 7,550 | | | | 7,553 | |

0.63%, 09/24/2012 | | | 23,100 | | | | 23,127 | |

Freddie Mac | | | | | | | | |

0.16%, 08/22/2012 | | | 12,350 | | | | 12,350 | |

0.63%, 10/30/2012 | | | 17,250 | | | | 17,277 | |

1.13%, 07/27/2012 | | | 12,600 | | | | 12,609 | |

| | | | | | | | |

Total U.S. Government Agency Obligations

(cost $100,120) | | | | | | | 100,120 | |

| | | | | | | | |

| |

U.S. GOVERNMENT OBLIGATIONS - 9.7% | | | | | |

U.S. Treasury Note | | | | | | | | |

0.38%, 08/31/2012 | | | 25,300 | | | | 25,311 | |

0.50%, 11/30/2012 | | | 24,850 | | | | 24,886 | |

0.63%, 07/31/2012 | | | 29,250 | | | | 29,263 | |

1.38%, 09/15/2012 | | | 10,250 | | | | 10,276 | |

| | | | | | | | |

Total U.S. Government Obligations

(cost $89,736) | | | | | | | 89,736 | |

| | | | | | | | |

| | |

REPURCHASE AGREEMENTS - 11.6% | | | | | | | | |

Barclays Bank PLC

0.15% p, dated 06/29/2012, to be repurchased at $33,900 on 07/02/2012. Collateralized by a U.S. Government Obligation, 2.75%, due 02/15/2019, and with a value of $34,578. | | | 33,900 | | | | 33,900 | |

Deutsche Bank AG

0.15% p, dated 06/29/2012, to be repurchased at $7,700 on 07/02/2012. Collateralized by a U.S. Government Agency Obligation, 0.50%, due 08/09/2013, and with a value of $7,855. | | | 7,700 | | | | 7,700 | |

Goldman Sachs

0.14% p, dated 06/29/2012, to be repurchased at $19,300 on 07/02/2012. Collateralized by a U.S. Government Agency Obligation, 1.13%, due 06/14/2017, and with a value of $19,687. | | | 19,300 | | | | 19,300 | |

HSBC Bank USA

0.13% p, dated 06/29/2012, to be repurchased at $26,860 on 07/02/2012. Collateralized by U.S. Government Agency Obligations, 0.63% - 5.38%, due 09/24/2012 - 04/11/2016, and with a total value of $27,402. | | | 26,860 | | | | 26,860 | |

The notes to the financial statements are an integral part of this report.

| | | | |

Transamerica Partners Portfolios | | | | Semi-Annual Report 2012 |

| | Page 3 | | |

Transamerica Partners Money Market Portfolio

SCHEDULE OF INVESTMENTS (continued)

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Principal

(000’s) | | | Value

(000’s) | |

REPURCHASE AGREEMENTS (continued) | |

JPMorgan Chase & Co.

0.13%, dated 06/29/2012, to be repurchased at $19,200 on 07/02/2012. Collateralized by a U.S. Government Obligation, 1.38%, due 02/28/2019, and with a value of $19,589. | | $ | 19,200 | | | $ | 19,200 | |

State Street Bank & Trust Co.

0.03% p, dated 06/29/2012, to be repurchased at $5 on 07/02/2012. Collateralized by a U.S. Government Agency Obligation, 4.00%, due 08/15/2039, and with a value of $6. | | | 5 | | | | 5 | |

| | | | | | | | |

Total Repurchase Agreements (cost $106,965) | | | | | | | 106,965 | |

| | | | | | | | |

Total Investment Securities (cost $889,065) Õ | | | | | | | 889,065 | |

Other Assets and Liabilities - Net | | | | | | | 35,084 | |

| | | | | | | | |

Net Assets | | | | | | $ | 924,149 | |

| | | | | | | | |

NOTES TO SCHEDULE OF INVESTMENTS (all amounts in thousands):

| * | Floating or variable rate note. Rate is listed as of 06/29/2012. |

| p | Rate shown reflects the yield at 06/29/2012. |

| Õ | Aggregate cost for federal income tax purposes is $889,065. |

DEFINITION (all amounts in thousands):

| | |

| 144A | | 144A Securities are registered pursuant to Rule 144A of the Securities Act of 1933. These securities are deemed to be liquid for purposes of compliance limitations on holdings of illiquid securities and may be resold as transactions exempt from registration, normally to qualified institutional buyers. At 06/30/2012, these securities aggregated $137,928, or 14.92% of the portfolio’s net assets. |

VALUATION SUMMARY (all amounts in thousands): '

| | | | | | | | | | | | | | | | |

Investment Securities | | Level 1 -

Quoted

Prices | | | Level 2 -

Other

Significant

Observable

Inputs | | | Level 3 -

Significant

Unobservable

Inputs | | | Value at

06/30/2012 | |

Certificates of Deposit | | $ | — | | | $ | 173,749 | | | $ | — | | | $ | 173,749 | |

Commercial Paper | | | — | | | | 129,923 | | | | — | | | | 129,923 | |

Foreign Government Obligation | | | — | | | | 17,604 | | | | — | | | | 17,604 | |

Repurchase Agreements | | | — | | | | 106,965 | | | | — | | | | 106,965 | |

Short-Term Foreign Government Obligation | | | — | | | | 21,950 | | | | — | | | | 21,950 | |

Short-Term U.S. Government Obligations | | | — | | | | 249,018 | | | | — | | | | 249,018 | |

U.S. Government Agency Obligations | | | — | | | | 100,120 | | | | — | | | | 100,120 | |

U.S. Government Obligations | | | — | | | | 89,736 | | | | — | | | | 89,736 | |

Total | | $ | — | | | $ | 889,065 | | | $ | — | | | $ | 889,065 | |

| ' | Transfers between levels are considered to have occurred at the end of the reporting period. There were no transfers into or out of Levels 1 and 2 during the period ended 06/30/2012. See the notes to the financial statements for more information regarding pricing inputs and valuation techniques. |

The notes to the financial statements are an integral part of this report.

| | | | |

Transamerica Partners Portfolios | | | | Semi-Annual Report 2012 |

| | Page 4 | | |

Transamerica Partners High Quality Bond Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2012

(unaudited)

| | | | | | | | |

| | | Principal

(000’s) | | | Value

(000’s) | |

U.S. GOVERNMENT OBLIGATIONS - 8.3% | | | | | | | | |

U.S. Treasury Inflation Indexed Note

1.25%, 04/15/2014 | | $ | 3,804 | | | $ | 3,928 | |

U.S. Treasury Note

0.25%, 03/31/2014 - 04/30/2014 | | | 19,000 | | | | 18,978 | |

0.25%, 05/31/2014 ^ | | | 11,000 | | | | 10,986 | |

| | | | | | | | |

Total U.S. Government Obligations

(cost $33,911) | | | | | | | 33,892 | |

| | | | | | | | |

U.S. GOVERNMENT AGENCY OBLIGATIONS - 3.6% | | | | | |

Fannie Mae

| | | | | | | | |

2.50%, 05/15/2014 | | | 950 | | | | 988 | |

4.00%, 07/25/2033 | | | 8 | | | | 9 | |

5.50%, 12/01/2022 | | | 577 | | | | 634 | |

6.00%, 07/01/2014 - 09/01/2014 | | | 89 | | | | 92 | |

Freddie Mac | | | | | | | | |

3.38%, 03/15/2018 | | | 1,427 | | | | 1,469 | |

4.00%, 09/15/2017 | | | 157 | | | | 159 | |

5.50%, 04/01/2017 | | | 205 | | | | 223 | |

6.00%, 10/15/2021 | | | 285 | | | | 287 | |

6.50%, 02/01/2013 - 04/01/2013 | | | 14 | | | | 14 | |

Ginnie Mae | | | | | | | | |

5.59%, 11/20/2059 | | | 4,130 | | | | 4,561 | |

5.65%, 06/20/2059 | | | 4,882 | | | | 5,428 | |

5.75%, 12/15/2022 | | | 662 | | | | 737 | |

| | | | | | | | |

Total U.S. Government Agency Obligations

(cost $14,296) | | | | | | | 14,601 | |

| | | | | | | | |

FOREIGN GOVERNMENT OBLIGATIONS - 2.2% | | | | | |

Province of Ontario Canada

2.30%, 05/10/2016 ^ | | | 4,795 | | | | 5,003 | |

Province of Quebec Canada

4.88%, 05/05/2014 ^ | | | 3,650 | | | | 3,940 | |

| | | | | | | | |

Total Foreign Government Obligations

(cost $8,819) | | | | | | | 8,943 | |

| | | | | | | | |

MORTGAGE-BACKED SECURITIES - 17.4% | | | | | |

CFCRE Commercial Mortgage Trust

Series 2011-C1, Class A2

3.76%, 04/15/2044 - 144A | | | 3,000 | | | | 3,199 | |

Commercial Mortgage Pass-Through Certificates

Series 2001-J2A, Class B

6.30%, 07/16/2034 - 144A | | | 2,425 | | | | 2,433 | |

Series 2006-C8, Class A3

5.31%, 12/10/2046 | | | 5,690 | | | | 5,827 | |

Series 2012-9W57, Class A

2.37%, 02/10/2029 - 144A | | | 4,050 | | | | 4,143 | |

Credit Suisse Mortgage Capital Certificates

Series 2007-C5, Class A2

5.59%, 09/15/2040 | | | 2,469 | | | | 2,468 | |

CW Capital Cobalt, Ltd.

Series 2006-C1, Class A2

5.17%, 08/15/2048 | | | 266 | | | | 267 | |

DBUBS Mortgage Trust

Series 2011-LC1A, Class A1

3.74%, 11/10/2046 - 144A | | | 4,374 | | | | 4,686 | |

Series 2011-LC3A, Class A2

3.64%, 08/10/2044 | | | 1,400 | | | | 1,509 | |

GS Mortgage Securities Corp. II

Series 2006-GG6, Class A2

5.51%, 04/10/2038 * | | | 411 | | | | 413 | |

Series 2006-GG6, Class AAB

5.59%, 04/10/2038 * | | | 3,358 | | | | 3,554 | |

| | | | | | | | |

| | | Principal

(000’s) | | | Value

(000’s) | |

MORTGAGE-BACKED SECURITIES (continued) | | | | | | | | |

GS Mortgage Securities Corp. II (continued)

Series 2006-GG8, Class AAB

5.54%, 11/10/2039 | | $ | 4,076 | | | $ | 4,282 | |

Series 2007-GG10, Class AAB

5.98%, 08/10/2045 * | | | 5,010 | | | | 5,271 | |

JPMorgan Chase Commercial Mortgage

Securities Corp.

Series 2006-LDP7, Class A2

6.05%, 04/15/2045 * | | | 115 | | | | 115 | |

Series 2007-C1, Class A3

5.79%, 02/15/2051 | | | 7,000 | | | | 7,289 | |

LB-UBS Commercial Mortgage Trust

Series 2003-C7, Class A3

4.56%, 09/15/2027 * | | | 4,459 | | | | 4,474 | |

Series 2005-C7, Class A2

5.10%, 11/15/2030 | | | 126 | | | | 127 | |

Series 2006-C4, Class AAB

6.04%, 06/15/2032 * | | | 3,132 | | | | 3,257 | |

Series 2006-C7, Class A2

5.30%, 11/15/2038 | | | 1,384 | | | | 1,407 | |

Series 2007-C2, Class A2

5.30%, 02/15/2040 | | | 592 | | | | 592 | |

Merrill Lynch Mortgage Trust

Series 2005-MKB2, Class A2

4.81%, 09/12/2042 | | | 806 | | | | 805 | |

Series 2006-C1, Class A2

5.80%, 05/12/2039 * | | | 442 | | | | 452 | |

Merrill Lynch/Countrywide Commercial

Mortgage Trust

Series 2007-8, Class A2

6.13%, 08/12/2049 * | | | 1,698 | | | | 1,771 | |