As filed with the Securities and Exchange Commission on September 8, 2015

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

(Exact Name of Registrant as Specified in Charter)

4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (720) 493-4256

Tané T. Tyler, Esq., 4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: January 1, 2015 – June 30, 2015

| Item 1: | Report(s) to Shareholders. |

The Semi-Annual Report is attached.

TRANSAMERICA PARTNERS VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Semi-Annual Report

June 30, 2015

Table of Contents

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Partners Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the semi-annual report of the Transamerica Asset Allocation Variable Funds and the semi-annual reports of the Transamerica Partners Portfolios and the Calvert VP SRI Balanced Portfolio, the underlying portfolios in which the Transamerica Partners Variable Funds invest.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds and Transamerica Partners Portfolios is included in the Statement of Additional Information (“SAI”), which is available without charge, upon request: (i) by calling 1-888-233-4339; (ii) on the Subaccounts’ website at www.transamericapartners.com or (iii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds and the Transamerica Partners Portfolios are required to file Form N-PX, with the complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2015, is available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolios

Transamerica Asset Allocation Variable Funds will file their portfolios of investments on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Subaccounts’ Form N-Q is available on the SEC’s website at www.sec.gov. The Subaccounts’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information on the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. You may also obtain a copy of Form N-Q without charge, upon request, by calling 1-888-233-4339. Form N-Q for the corresponding Transamerica Partners Portfolios is also available without charge on the SEC website, at the SEC’s Public Reference Room, or by calling 1-888-233-4339.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

June 30, 2015

To Contract Holders with Interests in

the Transamerica Partners Variable Funds:

We are pleased to present the most recent semi-annual reports for the Transamerica Partners Portfolios and for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending these semi-annual reports to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in one or more of the subaccounts of Transamerica Partners Variable Funds. Each subaccount available within the Transamerica Partners Variable Funds, other than the Calvert Subaccount, invests its assets in a corresponding mutual fund that is a series of Transamerica Partners Portfolios. The Calvert Subaccount invests in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Transamerica Retirement Solutions Corporation, at (800) 755-5801 if you have any questions regarding these reports.

Dear Fellow Contract Holder,

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This semi-annual report is provided to you with the intent of presenting a comprehensive review of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all Contract Holders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review of your investments, this report provides a discussion of accounting policies as well as matters presented to Contract Holders that may have required their vote.

We believe it is important to understand market conditions over the last year to provide a context for reading this report. At the beginning of this fiscal period, markets focused heavily on the U.S. Federal Reserve’s (“Fed”) pending conclusion to its quantitative easing (“QE”) program. While interest rate volatility picked up slightly in the fall of 2014 when QE ended, equity markets remained resilient and continued to climb to new all-time highs in the following months.

The U.S. economy gained momentum as evidenced by reports of increasing gross domestic product growth rates in the second and third quarters of 2014, however, weaker exports and declining capital spending in the energy sector slowed the rate of growth as markets entered 2015. That having been said, continued positive results in regard to job growth and consumer spending appear to bode well for future economic momentum.

The energy sector contributed most to overall market volatility during the fall and winter as crude oil prices declined by more than 50% due to surging stockpiles and no action by OPEC to cut output. Many metals and agricultural goods also saw lower prices during this period, contributing to broad commodity weakness. While these lower prices for raw materials at times added to market weakness, consumers and business still stand to benefit going forward from lower gas prices at the pump and aggregate fuel costs. Annual inflation metrics have fallen close to zero, well below both historical averages and the Fed’s target range of 2.0% to 2.5%.

As the period drew to a close, the crisis in Greece began to weigh more prominently on the markets as the question again emerged as to whether this country could ultimately meet its debt obligations and remain part of the European Monetary Union. However, unlike years past when concerns of a possible Greek default roiled markets and brought about fears of bank failures and financial contagion, investors have taken the recent developments more in stride, bolstered by the fact that global banks have heavily reduced their exposure to Greek debt. While Greece’s ultimate position within the European Union remains to be resolved, investors seem to have concluded that a Greek exit would not pose the same risk to global markets as previously believed.

For the period ending June 30, 2015, the S&P 500® returned 7.4% while the MSCI EAFE Index, representing international developed market equities, lost 3.8%. During the same period, the Barclays U.S. Aggregate Bond Index returned 1.9%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica Partners Funds

Tom Wald, CFA

Chief Investment Officer

Transamerica Partners Funds

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of the Transamerica Partners Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of the Transamerica Partners Funds.

Understanding Your Subaccounts’ Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (each individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Partners Variable Funds (“TPVF”), a unit investment trust. Subaccount contract holders bear the cost of operating the Subaccount (such as the advisory fee).

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at January 1, 2015, and held for the entire period until June 30, 2015.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Subaccounts’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Subaccounts’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Subaccount | | Beginning

Account Value | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Annualized

Expense Ratio (C) | |

| | | | | | |

Transamerica Asset Allocation Variable -

Short Horizon Subaccount | | $ | 1,000.00 | | | $ | 1,002.70 | | | $ | 0.99 | | | $ | 1,023.80 | | | $ | 1.00 | | | | 0.20 | % |

Transamerica Asset Allocation Variable -

Intermediate Horizon Subaccount | | | 1,000.00 | | | | 1,017.30 | | | | 1.00 | | | | 1,023.80 | | | | 1.00 | | | | 0.20 | |

Transamerica Asset Allocation Variable -

Intermediate/Long Horizon Subaccount | | | 1,000.00 | | | | 1,023.90 | | | | 1.00 | | | | 1,023.80 | | | | 1.00 | | | | 0.20 | |

| (A) | 5% return per year before expenses. |

| (B) | Expenses are calculated using the Subaccount’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (181 days), and divided by the number of days in the year (365 days). |

| (C) | These expense ratios do not include the expenses of the underlying funds in which the Subaccounts invest. The annualized expense ratios, as stated in the fee table of the Prospectus, may differ from the expense ratios disclosed in this report. |

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 4

Schedules of Investments Composition

At June 30, 2015

(unaudited)

| | | | |

Transamerica Asset Allocation Variable - Short Horizon

Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Fixed Income | | | 89.1 | % |

Domestic Equity | | | 8.6 | |

International Equity | | | 2.1 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

Transamerica Asset Allocation Variable - Intermediate Horizon

Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Fixed Income | | | 47.0 | % |

Domestic Equity | | | 41.6 | |

International Equity | | | 11.2 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

Transamerica Asset Allocation Variable - Intermediate/Long

Horizon Subaccount | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Domestic Equity | | | 55.9 | % |

Fixed Income | | | 27.7 | |

International Equity | | | 16.2 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 5

Transamerica Asset Allocation Variable - Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2015

(unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | | | | | | | | |

Domestic Equity - 8.6% | | | | | | | | |

Transamerica Partners Variable Large Growth (A) (B) | | | 2,495 | | | | $ 223,618 | |

Transamerica Partners Variable Large Value (A) (B) | | | 2,733 | | | | 221,207 | |

Transamerica Partners Variable Small

Core (A) (B) | | | 2,660 | | | | 149,511 | |

| | | | | | | | |

| | | | | | | 594,336 | |

| | | | | | | | |

Fixed Income - 89.1% | | | | | | | | |

Transamerica Partners Variable Core Bond (A) (B) | | | 72,629 | | | | 3,253,238 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 61,281 | | | | 1,084,632 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 23,844 | | | | 737,064 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 39,331 | | | | 1,059,348 | |

| | | | | | | | |

| | | | | | | 6,134,282 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | | | | |

International Equity - 2.1% | | | | | | | | |

Transamerica Partners Variable International Equity (A) (B) | | | 6,288 | | | | $ 140,767 | |

| | | | | | | | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market (A) (B) | | | 652 | | | | 13,763 | |

| | | | | | | | |

Total Investment Companies

(Cost $6,096,580) | | | | | | | 6,883,148 | |

| | | | | | | | |

Total Investments

(Cost $6,096,580) (C) | | | | | | | 6,883,148 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | | | | (1,221 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 6,881,927 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value at

June 30, 2015 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 6,883,148 | | | $ | — | | | $ | — | | | $ | 6,883,148 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 6,883,148 | | | $ | — | | | $ | — | | | $ | 6,883,148 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $6,096,580. Aggregate gross unrealized appreciation for all securities is $786,568. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Levels 1, 2 and 3 during the period ended June 30, 2015. See the Security Valuation section of the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 6

Transamerica Asset Allocation Variable - Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2015

(unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | |

Domestic Equity - 41.6% | |

Transamerica Partners Variable Large Growth (A) (B) | | | 33,725 | | | | $ 3,022,590 | |

Transamerica Partners Variable Large Value (A) (B) | | | 38,916 | | | | 3,150,097 | |

Transamerica Partners Variable Small Core (A) (B) | | | 35,314 | | | | 1,985,006 | |

| | | | | | | | |

| | | | | | | 8,157,693 | |

| | | | | | | | |

Fixed Income - 47.0% | |

Transamerica Partners Variable Core Bond (A) (B) | | | 97,929 | | | | 4,386,521 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 85,573 | | | | 1,514,573 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 36,832 | | | | 1,138,514 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 80,539 | | | | 2,169,282 | |

| | | | | | | | |

| | | | | | | 9,208,890 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | | | | |

International Equity - 11.2% | |

Transamerica Partners Variable International Equity (A) (B) | | | 98,422 | | | | $ 2,203,444 | |

| | | | | | | | |

Money Market - 0.2% | |

Transamerica Partners Variable Money Market (A) (B) | | | 1,859 | | | | 39,218 | |

| | | | | | | | |

Total Investment Companies

(Cost $14,580,532) | | | | | | | 19,609,245 | |

| | | | | | | | |

Total Investments

(Cost $14,580,532) (C) | | | | | | | 19,609,245 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | (3,474 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 19,605,771 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value at

June 30, 2015 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 19,609,245 | | | $ | — | | | $ | — | | | $ | 19,609,245 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 19,609,245 | | | $ | — | | | $ | — | | | $ | 19,609,245 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $14,580,532. Aggregate gross unrealized appreciation for all securities is $5,028,713. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Levels 1, 2 and 3 during the period ended June 30, 2015. See the Security Valuation section of the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 7

Transamerica Asset Allocation Variable - Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At June 30, 2015

(unaudited)

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | |

Domestic Equity - 55.9% | |

Transamerica Partners Variable Large Growth (A) (B) | | | 73,328 | | | | $ 6,571,980 | |

Transamerica Partners Variable Large Value (A) (B) | | | 78,935 | | | | 6,389,485 | |

Transamerica Partners Variable Small Core (A) (B) | | | 71,241 | | | | 4,004,490 | |

| | | | | | | | |

| | | | | | | 16,965,955 | |

| | | | | | | | |

Fixed Income - 27.7% | |

Transamerica Partners Variable Core Bond (A) (B) | | | 94,052 | | | | 4,212,871 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 32,849 | | | | 581,400 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 36,790 | | | | 1,137,222 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 92,360 | | | | 2,487,653 | |

| | | | | | | | |

| | | | | | | 8,419,146 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | | | | |

International Equity - 16.2% | |

Transamerica Partners Variable International Equity (A) (B) | | | 219,876 | | | | $ 4,922,517 | |

| | | | | | | | |

Money Market - 0.2% | |

Transamerica Partners Variable Money Market (A) (B) | | | 2,879 | | | | 60,735 | |

| | | | | | | | |

Total Investment Companies

(Cost $21,003,818) | | | | | | | 30,368,353 | |

| | | | | | | | |

Total Investments

(Cost $21,003,818) (C) | | | | | | | 30,368,353 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | (5,418 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 30,362,935 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value at

June 30, 2015 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 30,368,353 | | | $ | — | | | $ | — | | | $ | 30,368,353 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 30,368,353 | | | $ | — | | | $ | — | | | $ | 30,368,353 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $21,003,818. Aggregate gross unrealized appreciation for all securities is $9,364,535. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Levels 1, 2 and 3 during the period ended June 30, 2015. See the Security Valuation section of the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 8

STATEMENTS OF ASSETS AND LIABILITIES

At June 30, 2015

(unaudited)

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/

Long Horizon | |

Assets: | | | | | | | | | | | | |

Affiliated investments, at value (A) | | $ | 6,883,148 | | | $ | 19,609,245 | | | $ | 30,368,353 | |

Receivables: | | | | | | | | | | | | |

Units sold | | | 7,769 | | | | 15,136 | | | | 24,324 | |

Investments sold | | | 11,959 | | | | 22,412 | | | | 32,147 | |

Total assets | | | 6,902,876 | | | | 19,646,793 | | | | 30,424,824 | |

| | | | |

Liabilities: | | | | | | | | | | | | |

Payables and other liabilities: | | | | | | | | | | | | |

Units redeemed | | | — | | | | 1,302 | | | | 10,000 | |

Investments purchased | | | 19,728 | | | | 36,246 | | | | 46,471 | |

Investment advisory fees | | | 1,221 | | | | 3,474 | | | | 5,418 | |

Total liabilities | | | 20,949 | | | | 41,022 | | | | 61,889 | |

Net assets | | $ | 6,881,927 | | | $ | 19,605,771 | | | $ | 30,362,935 | |

| | | | |

Net assets consist of: | | | | | | | | | | | | |

Costs of accumulation units | | $ | 1,826,193 | | | $ | 5,677,055 | | | $ | 13,204,147 | |

Undistributed (distributions in excess of) net investment income (loss) | | | (275,506 | ) | | | (769,332 | ) | | | (1,077,779 | ) |

Accumulated net realized gain (loss) | | | 4,544,672 | | | | 9,669,335 | | | | 8,872,032 | |

Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

Affiliated investments | | | 786,568 | | | | 5,028,713 | | | | 9,364,535 | |

Net assets | | $ | 6,881,927 | | | $ | 19,605,771 | | | $ | 30,362,935 | |

Accumulation units | | | 324,299 | | | | 821,224 | | | | 1,211,705 | |

Unit value | | $ | 21.22 | | | $ | 23.87 | | | $ | 25.06 | |

| | | | | | | | | | | | | |

(A) Affiliated investments, at cost | | $ | 6,096,580 | | | $ | 14,580,532 | | | $ | 21,003,818 | |

STATEMENTS OF OPERATIONS

For the period ended June 30, 2015

(unaudited)

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/

Long Horizon | |

Expenses: | | | | | | | | | | | | |

Investment advisory fees | | $ | 7,115 | | | $ | 19,636 | | | $ | 30,713 | |

Net investment income (loss) | | | (7,115 | ) | | | (19,636 | ) | | | (30,713 | ) |

| | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Affiliated investments | | | 221,961 | | | | 343,585 | | | | 352,189 | |

Net realized gain (loss) | | | 221,961 | | | | 343,585 | | | | 352,189 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

Affiliated investments | | | (192,488 | ) | | | 13,956 | | | | 409,275 | |

Net change in unrealized appreciation (depreciation) | | | (192,488 | ) | | | 13,956 | | | | 409,275 | |

Net realized and change in unrealized gain (loss) | | | 29,473 | | | | 357,541 | | | | 761,464 | |

Net increase (decrease) in net assets resulting from operations | | $ | 22,358 | | | $ | 337,905 | | | $ | 730,751 | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 9

STATEMENTS OF CHANGES IN NET ASSETS

For the period and year ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate Horizon | | | Intermediate/Long Horizon | |

| | | June 30, 2015

(unaudited) | | | December 31, 2014 | | | June 30, 2015

(unaudited) | | | December 31, 2014 | | | June 30, 2015

(unaudited) | | | December 31, 2014 | |

From operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (7,115 | ) | | $ | (14,028 | ) | | $ | (19,636 | ) | | $ | (40,067 | ) | | $ | (30,713 | ) | | $ | (61,226 | ) |

Net realized gain (loss) | | | 221,961 | | | | 226,353 | | | | 343,585 | | | | 748,746 | | | | 352,189 | | | | 652,900 | |

Net change in unrealized appreciation (depreciation) | | | (192,488 | ) | | | (1,393 | ) | | | 13,956 | | | | (69,527 | ) | | | 409,275 | | | | 391,373 | |

Net increase (decrease) in net assets resulting from operations | | | 22,358 | | | | 210,932 | | | | 337,905 | | | | 639,152 | | | | 730,751 | | | | 983,047 | |

| | | | | | | |

Unit transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 635,136 | | | | 1,511,417 | | | | 1,023,965 | | | | 2,508,533 | | | | 1,119,046 | | | | 4,450,226 | |

Units redeemed | | | (844,006 | ) | | | (1,485,860 | ) | | | (1,190,914 | ) | | | (4,487,328 | ) | | | (2,113,490 | ) | | | (5,408,405 | ) |

Net increase (decrease) in net assets resulting from unit transactions | | | (208,870 | ) | | | 25,557 | | | | (166,949 | ) | | | (1,978,795 | ) | | | (994,444 | ) | | | (958,179 | ) |

Net increase (decrease) in net assets | | | (186,512 | ) | | | 236,489 | | | | 170,956 | | | | (1,339,643 | ) | | | (263,693 | ) | | | 24,868 | |

| | | | | | | |

Net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of period/year | | | 7,068,439 | | | | 6,831,950 | | | | 19,434,815 | | | | 20,774,458 | | | | 30,626,628 | | | | 30,601,760 | |

End of period/year | | $ | 6,881,927 | | | $ | 7,068,439 | | | $ | 19,605,771 | | | $ | 19,434,815 | | | $ | 30,362,935 | | | $ | 30,626,628 | |

Undistributed (distributions in excess of) net investment income (loss) | | $ | (275,506 | ) | | $ | (268,391 | ) | | $ | (769,332 | ) | | $ | (749,696 | ) | | $ | (1,077,779 | ) | | $ | (1,047,066 | ) |

| | | | | | | |

Unit transactions - shares: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 29,731 | | | | 71,872 | | | | 42,658 | | | | 108,689 | | | | 44,553 | | | | 186,268 | |

Units redeemed | | | (39,415 | ) | | | (70,809 | ) | | | (49,557 | ) | | | (194,442 | ) | | | (84,250 | ) | | | (226,240 | ) |

Net increase (decrease) | | | (9,684 | ) | | | 1,063 | | | | (6,899 | ) | | | (85,753 | ) | | | (39,697 | ) | | | (39,972 | ) |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 10

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the period and years indicated: | | Short Horizon | |

| | | June 30, 2015

(unaudited) | | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of period/year | | $ | 21.16 | | | $ | 20.52 | | | $ | 20.37 | | | $ | 18.99 | | | $ | 18.24 | | | $ | 16.95 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.02 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) | | | 0.08 | | | | 0.68 | | | | 0.19 | | | | 1.42 | | | | 0.79 | | | | 1.33 | |

Total investment operations | | | 0.06 | | | | 0.64 | | | | 0.15 | | | | 1.38 | | | | 0.75 | | | | 1.29 | |

Unit value, end of period/year | | $ | 21.22 | | | $ | 21.16 | | | $ | 20.52 | | | $ | 20.37 | | | $ | 18.99 | | | $ | 18.24 | |

Total return (B) | | | 0.27 | %(C) | | | 3.13 | % | | | 0.73 | % | | | 7.30 | % | | | 4.07 | % | | | 7.65 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets end of period/year (000’s) | | $ | 6,882 | | | $ | 7,068 | | | $ | 6,832 | | | $ | 8,227 | | | $ | 8,884 | | | $ | 9,608 | |

Expenses to average net assets (D) | | | 0.20 | %(E) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )%(E) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (F) | | | 25 | %(C) | | | 36 | % | | | 63 | % | | | 51 | % | | | 46 | % | | | 36 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (D) | Does not include expenses of the underlying funds in which the Subaccount invests. |

| (F) | Does not include portfolio activity of the underlying funds in which the Subaccount invests. |

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the period and years indicated: | | Intermediate Horizon | |

| | | June 30, 2015

(unaudited) | | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of period/year | | $ | 23.47 | | | $ | 22.73 | | | $ | 20.10 | | | $ | 18.17 | | | $ | 18.13 | | | $ | 16.22 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.02 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) | | | 0.42 | | | | 0.79 | | | | 2.67 | | | | 1.97 | | | | 0.08 | | | | 1.94 | |

Total investment operations | | | 0.40 | | | | 0.74 | | | | 2.63 | | | | 1.93 | | | | 0.04 | | | | 1.91 | |

Unit value, end of period/year | | $ | 23.87 | | | $ | 23.47 | | | $ | 22.73 | | | $ | 20.10 | | | $ | 18.17 | | | $ | 18.13 | |

Total return (B) | | | 1.73 | %(C) | | | 3.24 | % | | | 13.07 | % | | | 10.67 | % | | | 0.19 | % | | | 11.81 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets end of period/year (000’s) | | $ | 19,606 | | | $ | 19,435 | | | $ | 20,774 | | | $ | 19,718 | | | $ | 21,599 | | | $ | 24,180 | |

Expenses to average net assets (D) | | | 0.20 | %(E) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )%(E) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (F) | | | 15 | %(C) | | | 29 | % | | | 54 | % | | | 37 | % | | | 42 | % | | | 25 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (D) | Does not include expenses of the underlying funds in which the Subaccount invests. |

| (F) | Does not include portfolio activity of the underlying funds in which the Subaccount invests. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 11

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| For a unit outstanding during the period and years indicated: | | Intermediate/Long Horizon | |

| | | June 30, 2015

(unaudited) | | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of period/year | | $ | 24.47 | | | $ | 23.70 | | | $ | 19.93 | | | $ | 17.70 | | | $ | 17.99 | | | $ | 15.78 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.02 | ) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) | | | 0.61 | | | | 0.82 | | | | 3.81 | | | | 2.27 | | | | (0.25 | ) | | | 2.24 | |

Total investment operations | | | 0.59 | | | | 0.77 | | | | 3.77 | | | | 2.23 | | | | (0.29 | ) | | | 2.21 | |

Unit value, end of period/year | | $ | 25.06 | | | $ | 24.47 | | | $ | 23.70 | | | $ | 19.93 | | | $ | 17.70 | | | $ | 17.99 | |

Total return (B) | | | 2.39 | %(C) | | | 3.28 | % | | | 18.93 | % | | | 12.60 | % | | | (1.66 | )% | | | 14.05 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets end of period/year (000’s) | | $ | 30,363 | | | $ | 30,627 | | | $ | 30,602 | | | $ | 27,794 | | | $ | 28,003 | | | $ | 30,991 | |

Expenses to average net assets (D) | | | 0.20 | %(E) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )%(E) | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (F) | | | 8 | %(C) | | | 17 | % | | | 32 | % | | | 30 | % | | | 34 | % | | | 23 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (D) | Does not include expenses of the underlying funds in which the Subaccount invests. |

| (F) | Does not include portfolio activity of the underlying funds in which the Subaccount invests. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 12

NOTES TO FINANCIAL STATEMENTS

At June 30, 2015

(unaudited)

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

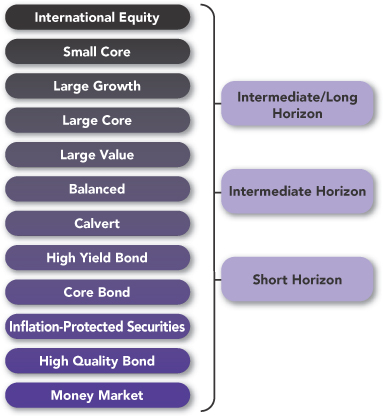

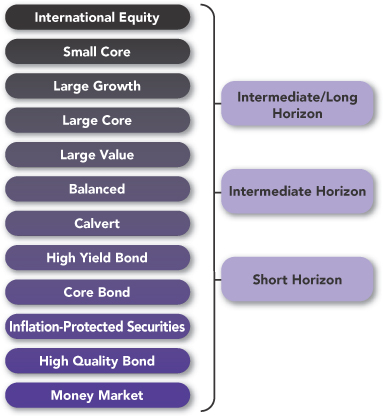

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered as a management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Separate Account applies investment company accounting and reporting guidance. The Separate Account is composed of three different subaccounts (each, a “Subaccount” and collectively, the “Subaccounts”) that are separate investment funds and are listed below. Each Subaccount invests substantially all of its investable assets among certain Transamerica Partners Variable Funds (“TPVF”). Certain TPVF subaccounts invest substantially all of their investable assets in the Transamerica Partners Portfolios (the “Portfolios”).

|

| Subaccount |

Transamerica Asset Allocation Variable-Short Horizon Subaccount (“Short Horizon”) |

Transamerica Asset Allocation Variable-Intermediate Horizon Subaccount (“Intermediate Horizon”) |

Transamerica Asset Allocation Variable-Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”) |

Transamerica Asset Management, Inc. (“TAM”) is responsible for the day-to-day management of the Subaccounts. For each of the Portfolios, TAM currently acts as a “manager of managers” and hires sub-advisers to furnish day-to-day investment advice and recommendations to the Portfolios.

TAM provides continuous and regular investment advisory services to the Portfolios. TAM acts as a manager of managers, providing advisory services that include, without limitation, the design and development of each Portfolio and its investment strategy and the ongoing review and evaluation of that investment strategy including recommending changes in strategy where it believes appropriate or advisable; the selection of one or more sub-advisers for each Portfolio employing a combination of quantitative and qualitative screens, research, analysis and due diligence; oversight and monitoring of sub-advisers and recommending changes to sub-advisers where it believes appropriate or advisable; recommending and implementing fund combinations and liquidations where it believes appropriate or advisable; regular supervision of the Portfolios’ investments; regular review of sub-adviser performance and holdings; ongoing trade oversight and analysis; regular monitoring to ensure adherence to investment process; risk management oversight and analysis; design, development, implementation and regular monitoring of the valuation of portfolio holdings; design, development, implementation and regular monitoring of the compliance process; review of proxies voted by sub-advisers; oversight of preparation, and review, of materials for meetings of the Portfolios’ Board of Trustees (the “Board”), participation in these meetings and preparation of regular communications with the Board; oversight of preparation and review of prospectuses, shareholder reports and other disclosure materials and filings; and oversight of other service providers to the Portfolios, such as the custodian, the transfer agent, the Portfolios’ independent registered public accounting firm and legal counsel; supervision of the performance of recordkeeping and shareholder relations for the Portfolios; and ongoing cash management services. TAM uses a variety of quantitative and qualitative tools to carry out its investment advisory services. Where TAM employs sub-advisers, the sub-advisers carry out and effectuate the investment strategy designed for the Portfolios by TAM and are responsible, subject to TAM’s and the Board’s oversight, among other things, for making decisions to buy, hold or sell a particular security.

In the normal course of business, the Subaccounts enter into contracts that contain a variety of representations that provide general indemnifications. The Subaccounts’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Subaccounts and/or its affiliates that have not yet occurred. However, based on experience, the Subaccounts expect the risk of loss to be remote.

In preparing the Subaccounts’ financial statements in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States of America, estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Subaccounts.

Cash overdraft: Throughout the period, the Subaccounts may have cash overdraft balances. A fee is incurred on these overdrafts, calculated by multiplying the overdraft by a rate based on the federal funds rate.

Payables, if any, are reflected as Due to custodian in the Statements of Assets and Liabilities. Expenses, if any, from U.S. cash overdrafts and foreign cash overdrafts are reflected in Custody fees and Interest income within the Statements of Operations, respectively.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear its share of fees and expenses incurred by TPVF. These expenses are not reflected in the expenses in the Statements of Operations and are not included in the ratios to Average Net Assets (“ANA”) shown in the Financial Highlights.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 13

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2015

(unaudited)

NOTE 1. (continued)

Security transactions: Security transactions are recorded on the trade date. Security gains and losses are calculated on the specific indentification basis. Net realized gain (loss) is from investments in units of investment companies.

NOTE 2. SECURITY VALUATION

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding subaccount of the TPVF is valued at the unit value per share of each Subaccount at the close of the New York Stock Exchange (“NYSE”), normally 4:00 p.m. Eastern Time, each day the NYSE is open for business. The Subaccounts utilize various methods to measure the fair value of their investments on a recurring basis.

GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, which are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs, which may include TAM’s internal valuation committee’s (the “Valuation Committee”) own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety. The hierarchy classification of inputs used to value the Subaccounts’ investments, at June 30, 2015, is disclosed in the Security Valuation section of each Subaccount’s Schedule of Investments.

Under supervision of the Board, TAM provides day-to-day valuation functions. TAM formed the Valuation Committee to monitor and implement the fair valuation policies and procedures as approved by the Board. These policies and procedures are reviewed at least annually by the Board. The Valuation Committee, among other tasks, monitors for when market quotations are not readily available or are unreliable and determines in good faith the fair value of the portfolio investments. For instances in which daily market quotes are not readily available, securities may be valued, pursuant to procedures adopted by the Board, with reference to other instruments or indices. Depending on the relative significance of valuation inputs, these instruments may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Valuation Committee may employ a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the security to determine the fair value of the security. An income-based valuation approach may also be used in which the anticipated future cash flows of the security are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the securities. When the Subaccounts use fair value methods that rely on significant unobservable inputs to determine a security’s value, the Valuation Committee will choose the method that is believed to accurately reflect fair value. These securities are categorized in Level 3 of the fair value hierarchy. The Valuation Committee reviews fair value measurements on a regular and ad hoc basis and may, as deemed appropriate, update the security valuations as well as the fair valuation guidelines. The Board reviews Valuation Committee determinations at its regularly scheduled meetings.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, the Valuation Committee’s determination of values may differ significantly from values that would have been realized had a ready market for investments existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches, including a regular review of valuation methodologies, key inputs and assumptions, transactional back-testing, and reviews of any market related activity.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 14

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2015

(unaudited)

NOTE 2. (continued)

Fair value measurements: Each Subaccount invests substantially all of its investable assets among certain TPVF subaccounts and the TPVF subaccounts invest all of their investable assets in the Portfolios. The summary of the inputs used for valuing each Portfolio’s assets carried at fair value is discussed in the Security Valuation section of the Portfolios’ Notes to Financial Statements, which are attached to this report. Descriptions of the valuation techniques applied to the Subaccounts’ significant categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Investment companies and exchange-traded funds (“ETF”): Investment companies are valued at the Net Asset Value of the underlying funds. These securities are actively traded and no valuation adjustments are applied. ETFs are stated at the last reported sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded. They are categorized in Level 1 of the fair value hierarchy. Investments in privately held investment funds with significant restrictions on redemptions where the inputs of NAVs are unobservable will be valued based upon the NAVs of such investments and are categorized in Level 3 of the fair value hierarchy.

NOTE 3. RELATED PARTY TRANSACTIONS

TAM, the Subaccounts’ investment adviser, is directly owned by Transamerica Premier Life Insurance Company (“TPLIC”) and AUSA Holding Company (“AUSA”), both of which are indirect, wholly owned subsidiaries of Aegon NV. TPLIC is owned by Commonwealth General Corporation (“Commonwealth”) and Aegon USA, LLC (“Aegon USA”). Commonwealth and AUSA are wholly owned by Aegon USA. Aegon USA is wholly owned by Aegon US Holding Corporation, which is wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by The Aegon Trust, which is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group.

Pursuant to the investment advisory agreement, and subject to further policies as the Board may determine, TAM provides general investment advice to each Subaccount, for which it receives a monthly advisory fee that is accrued daily and payable monthly at an annual rate equal to 0.20% of each Subaccount’s daily ANA.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain Managing Board Members and officers of TFLIC are also trustees, officers, or employees of TAM or its affiliates. No interested Managing Board Member, who is deemed an interested person due to current or former service with TAM or an affiliate of TAM, receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers receive compensation from the Subaccounts. The independent board members of TFLIC are also trustees of the Portfolios for which they receive fees.

All of the Portfolio holdings in investment companies are considered affiliated. Interest, dividends, realized and unrealized gains (losses) are broken out on the Statements of Operations.

Deferred compensation plan: Under a non-qualified deferred compensation plan effective January 1, 2008, as amended and restated January 1, 2010, available to the trustees, compensation may be deferred that would otherwise be payable by the Separate Account to an independent trustee on a current basis for services rendered as trustee. Deferred compensation amounts will accumulate based on the value of the investment option, as elected by the trustee.

NOTE 4. PURCHASES AND SALES OF SECURITIES

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the period ended June 30, 2015 were as follows:

| | | | | | | | | | |

| Subaccount | | Purchases of

Securities | | | | | Sales of

Securities | |

Short Horizon | | $ | 1,790,291 | | | | | $ | 2,006,352 | |

Intermediate Horizon | | | 2,917,077 | | | | | | 3,103,679 | |

Intermediate/Long Horizon | | | 2,329,867 | | | | | | 3,355,139 | |

NOTE 5. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of Aegon USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 15

NOTES TO FINANCIAL STATEMENTS (continued)

At June 30, 2015

(unaudited)

NOTE 5. (continued)

for federal income tax purposes. The Subaccounts recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Subaccounts’ federal and state tax returns remain subject to examination by the Internal Revenue Service and state tax authorities for the prior three years. Management has evaluated the Subaccounts’ tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Subaccounts’ financial statements. If applicable, the Subaccounts recognize interest accrued related to unrecognized tax benefits in interest and penalties expense in Other on the Statements of Operations. The Subaccounts identify their major tax jurisdictions as U.S. Federal, the state of Colorado and foreign jurisdictions where the Subaccounts make significant investments; however, the Subaccounts are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

NOTE 6. ACCOUNTING PRONOUNCEMENTS

In June 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2014-11, “Transfers and Servicing, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures”. The guidance changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The guidance is required to be presented for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. Management is currently evaluating the implication, if any, of the additional disclosure requirements and its impact on the Subaccounts’ financial statements.

In May 2015, the FASB issued ASU No. 2015-07, “Disclosures for Investments in Certain Entities that Calculate NAV per Share (or its Equivalent)”. The guidance removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the NAV per share practical expedient. Sufficient information must be provided to permit reconciliation of the fair value of assets categorized within the fair value hierarchy to the amounts presented in the Statements of Assets and Liabilities. The guidance is required to be presented for annual periods beginning after December 15, 2015, and for interim periods within those fiscal years. Management is currently evaluating the implication, if any, of the additional disclosure requirements and its impact on the Subaccounts’ financial statements.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 16

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL

At a meeting of the Managing Board of Transamerica Asset Allocation Variable Funds (the “Trustees” or the “Board”) held on June 9-10, 2015, the Board considered the renewal of the investment advisory agreements (each an “Investment Advisory Agreement” and collectively the “Investment Advisory Agreements”) between each of Transamerica Asset Allocation – Intermediate Horizon Subaccount, Transamerica Asset Allocation – Intermediate/Long Horizon Subaccount, and Transamerica Asset Allocation – Short Horizon Subaccount (each a “Fund” and collectively the “Funds”) and Transamerica Asset Management, Inc. (“TAM”).

Following its review and consideration, the Board determined that the terms of each Investment Advisory Agreement were reasonable and that the renewal of the Investment Advisory Agreements was in the best interests of the applicable Fund and the contract holders. The Board, including the independent members of the Board (the “Independent Board Members”), unanimously approved the renewal of each Investment Advisory Agreement through June 30, 2016. Prior to reaching their decision, the Board Members requested and received from TAM certain information. They then reviewed such information as they deemed reasonably necessary to evaluate the Investment Advisory Agreements. The Board Members also considered information they had previously received from TAM as part of their regular oversight of each Fund, as well as comparative fee, expense, and performance information prepared by TAM based on information provided by Lipper Inc. (“Lipper”), an independent provider of mutual fund performance information, and other fee, expense and profitability information prepared by TAM.

In their deliberations, the Independent Board Members had the opportunity to meet privately without representatives of TAM present and were represented throughout the process by independent legal counsel. In considering the proposed continuation of each Investment Advisory Agreement, the Board Members evaluated a number of considerations that they believed, in light of the legal advice furnished to them by counsel, including independent legal counsel, and/or their own business judgment, to be relevant. They based their decisions on the considerations discussed below, among others, although they did not identify any particular consideration or information that was controlling of their decisions, and each Board Member may have attributed different weights to the various factors.

Nature, Extent and Quality of the Services Provided

The Board considered the nature, extent and quality of the services provided by TAM to the applicable Fund in the past and the services anticipated to be provided in the future. The Board also considered the investment approach for each Fund; the experience, capability and integrity of TAM’s senior management; the financial resources of TAM; and the professional qualifications of TAM’s portfolio management team.

Based on these considerations, the Board determined that TAM can provide investment and related services that are appropriate in scope and extent in light of the applicable Fund’s operations, the competitive landscape of the investment company business and investor needs.

Investment Performance

The Board considered the short- and longer-term performance of each Fund in light of its investment objective, policies and strategies, including relative performance against a peer universe of mutual funds, based on Lipper information, for various trailing periods ended December 31, 2014. On the basis of this information and the Board’s assessment of the nature, extent and quality of the services to be provided by TAM, the Board concluded that TAM is capable of generating a level of investment performance that is appropriate in light of the applicable Fund’s investment objectives, policies and strategies and that is competitive with comparable investment companies.

Investment Advisory Fees and Total Expense Ratios

The Board considered the investment advisory fee and total expense ratio of each Fund, including information comparing the investment advisory fee and total expense ratio of each Fund to the investment advisory fees and total expense ratios of comparable investment companies, based on Lipper information. On the basis of these considerations, together with the other information it considered, the Board determined that the investment advisory fees to be received by TAM under the Investment Advisory Agreements are reasonable in light of the services provided.

Cost of Services Provided and Level of Profitability

The Board reviewed information provided by TAM about the cost of providing fund management, administration and other services to each Fund by TAM and its affiliates. The Board considered the profitability of TAM and its affiliates in providing these services for each Fund, as well as the allocation methodology used for calculating profitability.

Based on this information, the Board determined that the profitability of TAM and its affiliates from their relationships with the Funds was not excessive.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 17

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

INVESTMENT ADVISORY AGREEMENTS — CONTRACT RENEWAL (continued)

Economies of Scale

The Board considered economies of scale with respect to the management of each Fund, whether the Fund had appropriately benefited from any economies of scale and whether there was the potential for realization of any future economies of scale. The Board also considered the existence of economies of scale with respect to management of the Transamerica mutual funds overall and the extent to which the Funds benefited from any economies of scale. The Board considered each Fund’s investment advisory fee schedule and the existence of breakpoints, if any, and also considered the extent to which TAM shared economies of scale, if any, with the Funds through investments in maintaining and developing its capabilities and services. The Board Members concluded that each Fund’s fee structure reflected an appropriate sharing of any efficiencies or economies of scale to date and noted that they will have the opportunity to periodically reexamine the appropriateness of the investment advisory fees payable to TAM in light of any economies of scale experienced in the future.

Benefits to TAM or its Affiliates from their Relationships with the Funds

The Board considered other benefits derived by TAM and its affiliates from their relationships with the Funds. The Board noted that TAM does not realize soft dollar benefits from its relationship with the Funds.

Other Considerations

The Board noted that TAM has made a substantial commitment to the recruitment and retention of high quality personnel and maintains the financial, compliance and operational resources reasonably necessary to manage each Fund in a professional manner that is consistent with the best interests of each Fund and the contract holders. In this regard, the Board favorably considered the procedures and policies TAM has in place to enforce compliance with applicable laws and regulations. The Board also noted that TAM has made a significant entrepreneurial commitment to the management and success of the Funds.

Conclusion

After consideration of the factors described above, as well as other factors, the Board Members, including the Independent Board Members, concluded that the renewal of each Investment Advisory Agreement was in the best interests of the applicable Fund and the contract holders and voted to approve the renewal of each Investment Advisory Agreement.

| | |

| Transamerica Asset Allocation Variable Funds | | Semi-Annual Report 2015 |

Page 18

Appendix A

Transamerica Partners Portfolios

Schedules of Investments Composition

At June 30, 2015

(unaudited)

| | | | |

| Transamerica Partners Money Market Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Commercial Paper | | | 57.3 | % |

Repurchase Agreements | | | 21.3 | |

Certificates of Deposit | | | 17.1 | |

Corporate Debt Securities | | | 4.3 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners High Quality Bond Portfolio | |

| |

| Credit Quality ‡ | | Percentage of Net

Assets | |

AAA | | | 46.1 | % |

AA | | | 9.7 | |

A | | | 17.4 | |

BBB | | | 10.0 | |

NR (Not Rated) | | | 24.7 | |

Net Other Assets (Liabilities) | | | (7.9 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Inflation-Protected Securities Portfolio | |

| |

| Credit Quality ‡ | | Percentage of Net

Assets | |

AAA | | | 94.7 | % |

AA | | | 1.2 | |

A | | | 1.0 | |

BBB | | | 1.7 | |

CCC and Below | | | 0.0 | * |

NR (Not Rated) | | | 1.2 | |

Net Other Assets (Liabilities)^ | | | 0.2 | |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Core Bond Portfolio | |

| |

| Credit Quality ‡ | | Percentage of Net

Assets | |

AAA | | | 44.7 | % |

AA | | | 4.0 | |

A | | | 20.5 | |

BBB | | | 19.8 | |

BB | | | 2.9 | |

B | | | 1.4 | |

CCC and Below | | | 1.6 | |

NR (Not Rated) | | | 21.8 | |

Net Other Assets (Liabilities) | | | (16.7 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners High Yield Bond Portfolio | |

| |

| Credit Quality ‡ | | Percentage of Net

Assets | |

AAA | | | 1.8 | % |

BBB | | | 6.0 | |

BB | | | 39.4 | |

B | | | 40.0 | |

CCC and Below | | | 10.0 | |

NR (Not Rated) | | | 1.5 | |

Net Other Assets (Liabilities) | | | 1.3 | |

Total | | | 100.0 | % |

| | | | |

| | | | |

| Transamerica Partners Balanced Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 57.6 | % |

Corporate Debt Securities | | | 15.4 | |

U.S. Government Obligations | | | 9.6 | |

U.S. Government Agency Obligations | | | 6.9 | |

Short-Term U.S. Government Obligations | | | 5.8 | |

Mortgage-Backed Securities | | | 5.3 | |

Securities Lending Collateral | | | 5.3 | |

Asset-Backed Securities | | | 2.9 | |

Repurchase Agreement | | | 1.4 | |

Foreign Government Obligations | | | 0.6 | |

Municipal Government Obligations | | | 0.2 | |

Preferred Stocks | | | 0.1 | |

Net Other Assets (Liabilities) ^ | | | (11.1 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Large Value Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 98.8 | % |

Securities Lending Collateral | | | 4.3 | |

Repurchase Agreement | | | 0.1 | |

Net Other Assets (Liabilities) | | | (3.2 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Large Core Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 98.8 | % |

Securities Lending Collateral | | | 7.7 | |

Repurchase Agreement | | | 2.0 | |

Net Other Assets (Liabilities) | | | (8.5 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Large Growth Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 99.4 | % |

Securities Lending Collateral | | | 7.5 | |

Exchange-Traded Fund | | | 0.3 | |

Repurchase Agreement | | | 0.2 | |

Net Other Assets (Liabilities) | | | (7.4 | ) |

Total | | | 100.0 | % |

| | | | |

| |

| Transamerica Partners Mid Value Portfolio | | | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 95.7 | % |

Securities Lending Collateral | | | 10.5 | |

Repurchase Agreement | | | 5.0 | |

Net Other Assets (Liabilities) | | | (11.2 | ) |

Total | | | 100.0 | % |

| | | | |

| | |

| Transamerica Partners Portfolios | | Semi-Annual Report 2015 |

Page 2

Schedules of Investments Composition (continued)

At June 30, 2015

(unaudited)

| | | | |

| Transamerica Partners Mid Growth Portfolio | | | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 99.4 | % |

Securities Lending Collateral | | | 28.5 | |

Repurchase Agreement | | | 0.6 | |

Net Other Assets (Liabilities) | | | (28.5 | ) |

Total | | | 100.0 | % |

| | | | |

| |

| Transamerica Partners Small Value Portfolio | | | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 95.3 | % |

Securities Lending Collateral | | | 15.6 | |

Repurchase Agreement | | | 5.3 | |

Net Other Assets (Liabilities) | | | (16.2 | ) |

Total | | | 100.0 | % |

| | | | |

| |

| Transamerica Partners Small Core Portfolio | | | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 99.0 | % |

Securities Lending Collateral | | | 18.8 | |

Repurchase Agreement | | | 1.4 | |

Net Other Assets (Liabilities) | | | (19.2 | ) |

Total | | | 100.0 | % |

| | | | |

|

| Transamerica Partners Small Growth Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 98.5 | % |

Securities Lending Collateral | | | 28.4 | |

Repurchase Agreement | | | 1.5 | |

Net Other Assets (Liabilities) | | | (28.4 | ) |

Total | | | 100.0 | % |

| | | | |

| | | | |

| Transamerica Partners International Equity Portfolio | |

| |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 93.0 | % |

Securities Lending Collateral | | | 6.3 | |

Preferred Stocks | | | 5.2 | |

Convertible Preferred Stock | | | 1.2 | |

Repurchase Agreement | | | 0.2 | |

Net Other Assets (Liabilities) | | | (5.9 | ) |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| ‡ | Credit quality represents a percentage of net assets at the end of the reporting period. Ratings BBB or higher are considered investment grade. Not rated securities do not necessarily indicate low credit quality, and may or may not be equivalent of investment grade. The table reflects Standard and Poor’s (“S&P”) ratings; percentages may include investments not rated by S&P but rated by Moody’s, or if unrated by Moody’s, by Fitch ratings, and then included in the closest equivalent S&P rating. Credit ratings are subject to change. The Portfolio itself has not been rated by an independent agency. |

| ^ | The Net Other Assets (Liabilities) category may include, but is not limited to, reverse repurchase agreements, forward foreign currency contracts, futures contracts, swap agreements, written options and swaptions, securities sold short, TBA short commitments, and cash collateral. |

| | |

| Transamerica Partners Portfolios | | Semi-Annual Report 2015 |

Page 3

Transamerica Partners Money Market Portfolio

SCHEDULE OF INVESTMENTS

At June 30, 2015

(unaudited)

| | | | | | | | |

| | | Principal | | | Value | |

CERTIFICATES OF DEPOSIT - 17.1% | | | | | | | | |

Banks - 17.1% | | | | | | | | |

Bank of Nova Scotia | | | | | | | | |

0.25%, 07/06/2015 (A) | | | $ 8,000,000 | | | | $ 8,000,000 | |

0.34%, 06/10/2016 (A) | | | 27,000,000 | | | | 27,000,000 | |

Bank of Tokyo-Mitsubishi UFJ, Ltd. | | | | | | | | |

0.62%, 06/22/2016 (A) | | | 22,000,000 | | | | 22,000,000 | |

Cooperatieve Centrale Raiffeisen-Boerenleenbank BA | | | | | | | | |

0.28%, 07/07/2015 - 07/09/2015 (A) | | | 35,000,000 | | | | 35,000,000 | |

Mizuho Bank, Ltd. | | | | | | | | |

0.25%, 07/02/2015 (A) | | | 15,000,000 | | | | 15,000,000 | |

Standard Chartered Bank | | | | | | | | |

0.33%, 11/16/2015 (A) | | | 16,000,000 | | | | 16,000,000 | |

Svenska Handelsbanken AB | | | | | | | | |

0.27%, 07/02/2015 (A) | | | 20,000,000 | | | | 20,000,003 | |

| | | | | | | | |

Total Certificates of Deposit (Cost $143,000,003) | | | | | | | 143,000,003 | |

| | | | | | | | |

| | |

CORPORATE DEBT SECURITIES - 4.3% | | | | | | | | |

Capital Markets - 2.3% | | | | | | | | |

Goldman Sachs & Co. | | | | | | | | |

0.62%, 11/09/2015 (B) | | | 19,000,000 | | | | 19,000,000 | |

| | | | | | | | |

Diversified Financial Services - 2.0% | | | | | | | | |

Bank of America NA | | | | | | | | |

0.31%, 10/01/2015 | | | 17,000,000 | | | | 17,000,000 | |

| | | | | | | | |

Total Corporate Debt Securities (Cost $36,000,000) | | | | | | | 36,000,000 | |

| | | | | | | | |

| | |

COMMERCIAL PAPER - 57.3% | | | | | | | | |

Automobiles - 2.0% | | | | | | | | |

Toyota Motor Credit Corp. | | | | | | | | |

0.29%, 11/09/2015 (A) | | | 17,000,000 | | | | 17,000,000 | |

| | | | | | | | |

Banks - 29.5% | | | | | | | | |

ANZ New Zealand International, Ltd. | | | | | | | | |

0.29%, 11/16/2015 (A) (C) | | | 12,500,000 | | | | 12,500,000 | |

Australia & New Zealand Banking Group, Ltd. | | | | | | | | |

0.30%, 11/24/2015 (A) (C) | | | 16,000,000 | | | | 15,999,602 | |

Bedford Row Funding Corp. | | | | | | | | |

0.33%, 03/18/2016 (A) (C) | | | 20,000,000 | | | | 20,000,000 | |

HSBC USA, Inc. | | | | | | | | |

0.33%, 10/19/2015 (A) | | | 16,000,000 | | | | 15,983,867 | |

Korea Development Bank | | | | | | | | |

0.34%, 10/29/2015 (A) | | | 10,000,000 | | | | 9,988,667 | |

0.46%, 12/16/2015 (A) | | | 20,000,000 | | | | 19,957,067 | |

PNC Bank NA | | | | | | | | |

0.35%, 07/13/2015 - 09/04/2015 (A) | | | 22,000,000 | | | | 21,991,250 | |

Skandinaviska Enskilda Banken AB | | | | | | | | |

0.32%, 10/08/2015 (A) (C) | | | 12,000,000 | | | | 11,989,605 | |

Sumitomo Mitsui Banking Corp. | | | | | | | | |

0.12%, 07/02/2015 (A) (C) | | | 20,000,000 | | | | 19,999,933 | |

0.31%, 07/02/2015 (A) (C) | | | 12,500,000 | | | | 12,499,892 | |

Swedbank AB | | | | | | | | |

0.24%, 07/06/2015 (A) | | | 20,000,000 | | | | 19,999,333 | |

US Bank NA | | | | | | | | |

0.10%, 07/01/2015 (A) | | | 35,250,000 | | | | 35,250,000 | |

Westpac Banking Corp. | | | | | | | | |

0.26%, 08/03/2015 (A) (C) | | | 31,000,000 | | | | 30,999,742 | |

| | | | | | | | |

| | | | | | | 247,158,958 | |

| | | | | | | | |

| | | | | | | | |

| | | Principal | | | Value | |

COMMERCIAL PAPER (continued) | | | | | | | | |

Chemicals - 0.5% | | | | | | | | |

Ecolab, Inc. | | | | | | | | |

0.46%, 07/24/2015 (A) (C) | | | $ 4,000,000 | | | | $ 3,998,824 | |

| | | | | | | | |

Diversified Financial Services - 18.7% | | | | | | | | |

Alpine Securitization Corp. | | | | | | | | |

0.29%, 07/23/2015 (A) (C) | | | 3,000,000 | | | | 2,999,468 | |

CAFCO LLC | | | | | | | | |

0.27%, 09/22/2015 (A) (C) | | | 3,265,000 | | | | 3,262,968 | |

Cancara Asset Securitisation LLC | | | | | | | | |

0.28%, 10/07/2015 (A) (C) | | | 15,000,000 | | | | 14,988,567 | |

Collateralized Commercial Paper II Co. LLC | | | | | | | | |

0.30%, 10/26/2015 (A) (C) | | | 13,000,000 | | | | 12,987,325 | |

0.36%, 09/08/2015 (A) (C) | | | 20,000,000 | | | | 19,986,583 | |

Fairway Finance Co. LLC | | | | | | | | |

0.27%, 10/16/2015 (A) (C) | | | 3,000,000 | | | | 2,997,592 | |

Gotham Funding Corp. | | | | | | | | |

0.18%, 07/22/2015 (A) (C) | | | 15,000,000 | | | | 14,998,425 | |

ING Funding LLC | | | | | | | | |

0.25%, 07/01/2015 (A) | | | 17,000,000 | | | | 17,000,000 | |

0.37%, 09/21/2015 (A) | | | 9,300,000 | | | | 9,292,162 | |

JPMorgan Securities LLC | | | | | | | | |

0.45%, 10/26/2015 (A) (C) | | | 20,000,000 | | | | 19,970,750 | |

Mont Blanc Capital Corp. | | | | | | | | |

0.25%, 08/07/2015 (A) (C) | | | 11,000,000 | | | | 10,997,174 | |

Old Line Funding LLC | | | | | | | | |

0.27%, 10/05/2015 (A) (C) | | | 3,000,000 | | | | 2,997,840 | |

South Carolina Fuel Co., Inc. | | | | | | | | |

0.45%, 07/30/2015 (A) (C) | | | 4,000,000 | | | | 3,998,550 | |

Thunder Bay Funding LLC | | | | | | | | |