As filed with the Securities and Exchange Commission on March 9, 2015

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07717

TRANSAMERICA ASSET ALLOCATION VARIABLE FUNDS

(Exact Name of Registrant as Specified in Charter)

4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (720) 493-4256

Tané T. Tyler, Esq., 4600 S. Syracuse St., Suite 1100, Denver, Colorado 80237

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: January 1- December 31, 2014

| Item 1: | Report(s) to Shareholders. |

The Registrant’s annual report is attached. The annual report for Calvert VP SRI Balanced Portfolio, an underlying portfolio, is filed with the Commission as part of Calvert Variable Series Inc., CIK#0000708950.

TRANSAMERICA PARTNERS VARIABLE FUNDS

TRANSAMERICA ASSET

ALLOCATION VARIABLE FUNDS

Annual Report

December 31, 2014

This report is not to be construed as an offering for sale of any contracts participating in the Subaccounts (Series) of the Transamerica Partners Variable Funds or the Transamerica Asset Allocation Variable Funds, or as a solicitation of an offer to buy contracts unless preceded by or accompanied by a current prospectus which contains complete information about charges and expenses.

This report consists of the annual report of the Transamerica Asset Allocation Variable Funds and the annual reports of the Transamerica Partners Portfolios and the Calvert VP SRI Balanced Portfolio, the underlying portfolios in which the Transamerica Partners Variable Funds invest.

Proxy Voting Policies and Procedures

A description of the proxy voting policies and procedures of the Transamerica Asset Allocation Variable Funds and Transamerica Partners Portfolios is included in the Statement of Additional Information (“SAI”), which is available without charge, upon request: (i) by calling 1-888-233-4339; (ii) on the Subaccounts’ website at www.transamericapartners.com or (iii) on the SEC’s website at www.sec.gov. In addition, the Transamerica Asset Allocation Variable Funds and the Transamerica Partners Portfolios are required to file Form N-PX, with the complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. Form N-PX for the twelve months ended June 30, 2014, is available without charge, upon request by calling 1-800-851-9777 and on the SEC’s website at http://www.sec.gov.

Quarterly Portfolios

Transamerica Asset Allocation Variable Funds will file their portfolios of investments on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Subaccounts’ Form N-Q is available on the SEC’s website at www.sec.gov. The Subaccounts’ Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. For information on the operation of the SEC’s Public Reference Room, call 1-800-SEC-0330. You may also obtain a copy of Form N-Q without charge, upon request, by calling 1-888-233-4339. Form N-Q for the corresponding Transamerica Partners Portfolios is also available without charge on the SEC website, at the SEC’s Public Reference Room, or by calling 1-888-233-4339.

TRANSAMERICA FINANCIAL LIFE INSURANCE COMPANY

440 Mamaroneck Avenue

Harrison, New York 10528

December 31, 2014

To Contract Holders with Interests in

the Transamerica Partners Variable Funds:

We are pleased to present the most recent annual reports for the Transamerica Partners Portfolios and for the Calvert VP SRI Balanced Portfolio. As required under applicable law, we are sending these annual reports to contract holders of Group Variable Annuity Contracts issued by Transamerica Financial Life Insurance Company with unit interests in one or more of the subaccounts of Transamerica Partners Variable Funds. Each subaccount available within the Transamerica Partners Variable Funds, other than the Calvert Subaccount, invests its assets in a corresponding mutual fund that is a series of Transamerica Partners Portfolios. The Calvert Subaccount invests in the Calvert VP SRI Balanced Portfolio, a series of Calvert Variable Series, Inc.

Please call your retirement plan administrator, Transamerica Retirement Solutions Corporation, at (800) 755-5801 if you have any questions regarding these reports.

Dear Fellow Contract Holder,

On behalf of Transamerica Asset Allocation Variable Funds, we would like to thank you for your continued support and confidence in our products as we look forward to continuing to serve you and your financial adviser in the future. We value the trust you have placed in us.

This annual report is provided to you with the intent of presenting a comprehensive review of the investments of each of your funds. The Securities and Exchange Commission requires that annual and semi-annual reports be sent to all Contract Holders, and we believe this report to be an important part of the investment process. In addition to providing a comprehensive review, this report also provides a discussion of accounting policies as well as matters presented to Contract Holders that may have required their vote.

We believe it is important to understand market conditions over the last year in order to provide a context for reading this report. “Divergence” seems like the appropriate word to describe markets and economies in 2014. Central Bank policies diverged throughout the world to accommodate varying degrees of economic health. While the U.S. Federal Reserve finally wound down six years of ongoing quantitative easing, the Bank of Japan accelerated its accommodative monetary policy, increasing its balance sheet to record levels. Europe muddled through the year with bouts of hope followed by disappointment, concluding the year with the expectation of its own quantitative easing in the year ahead. In the emerging world, some countries like India were quite strong, while commodity dependent economies like Russia and Brazil suffered.

The fixed income markets also saw large divergences. Wall Street consensus seemed to think that 2014 would be the year that interest rates in the U.S. would finally rise. Just the opposite occurred, as yields on the benchmark 10-year U.S. Treasury fell from 3.04% to 2.17% over the course of the year. Credit markets began the year on a positive note but succumbed to profit taking as geopolitical strains and commodity weakness caused a flight to quality. International fixed income markets diverged as well, largely due to currency fluctuations and the above mentioned differences in Central Bank policies.

Perhaps the biggest surprise of 2014 was the precipitous decline in energy prices as reflected in crude oil, which fell from more than $107 per barrel at mid-year to near $54 as of year-end. This was not only attributable to some global demand concerns, but also a calculated strategy by OPEC to reduce prices and challenge their North American competitors. This added to market volatility in the latter part of the year.

Given the notable differences in Central Bank policies and the different degrees of economic health in which major economies found themselves, it is little surprise that the returns from major asset classes varied. For the year ended December 31, 2014, the S&P 500® returned 13.69% while the MSCI Europe, Australasia, Far East Index, representing international developed market equities, lost 4.48%. During the same period, the Barclays U.S. Aggregate Bond Index returned 5.97%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial adviser is a key resource to help you build a complete picture of your current and future financial needs. Financial advisers are familiar with the market’s history, including the long-term returns and volatility of various asset classes. With your financial adviser, you can develop an investment program that incorporates factors such as your goals, your investment timeline, and your risk tolerance.

Please contact your financial adviser if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica Partners Funds

Tom Wald, CFA

Chief Investment Officer

Transamerica Partners Funds

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica Partners Funds. These views are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica Partners Funds.

Understanding Your Funds’ Expenses

(unaudited)

UNIT HOLDER EXPENSES

Transamerica Asset Allocation Variable Funds (each individually, a “Subaccount” and collectively, the “Subaccounts”) is a separate investment account established by Transamerica Financial Life Insurance Company, Inc. (“TFLIC”), and is used as an investment vehicle under certain tax-deferred annuity contracts issued by TFLIC. Each Subaccount invests in underlying subaccounts of Transamerica Partners Variable Funds (“TPVF”), a unit investment trust. Subaccount contract holders bear the cost of operating the Subaccount, such as the advisory fee.

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Subaccounts and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at July 1, 2014, and held for the entire period until December 31, 2014.

ACTUAL EXPENSES

The information in the table under the heading “Actual Expenses” provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your share class titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table under the heading “Hypothetical Expenses” provides information about hypothetical account values and hypothetical expenses based on the Subaccounts’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Subaccounts’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Subaccount versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Subaccount | | Beginning

Account Value | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Annualized

Expense Ratio (C) (D) | |

| | | | | | |

Transamerica Asset Allocation Variable -

Short Horizon Subaccount | | $ | 1,000.00 | | | $ | 994.10 | | | $ | 1.01 | | | $ | 1,024.20 | | | $ | 1.02 | | | | 0.20 | % |

Transamerica Asset Allocation Variable -

Intermediate Horizon Subaccount | | | 1,000.00 | | | | 991.30 | | | | 1.00 | | | | 1,024.20 | | | | 1.02 | | | | 0.20 | |

Transamerica Asset Allocation Variable -

Intermediate/Long Horizon Subaccount | | | 1,000.00 | | | | 988.60 | | | | 1.00 | | | | 1,024.20 | | | | 1.02 | | | | 0.20 | |

| (A) | 5% return per year before expenses. |

| (B) | Expenses are calculated using the Subaccount’s annualized expense ratio (as disclosed in the table), multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| (C) | Expense ratios are based on the most recent six-months; the percentage may differ from the expense ratio displayed in the Financial Highlights which covers a twelve-month period. |

| (D) | During the period ended December 31, 2014, expense ratios do not include expenses of the investment companies in which the Subaccounts invest. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 1

Schedules of Investments Composition

At December 31, 2014

(unaudited)

| | | | |

Transamerica Asset Allocation Variable - Short Horizon

Subaccount | |

| |

| Asset Allocation | | Percentage of

Net Assets | |

Fixed Income | | | 89.0 | % |

Domestic Equity | | | 8.9 | |

International Equity | | | 1.9 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

Transamerica Asset Allocation Variable - Intermediate Horizon

Subaccount | |

| |

| Asset Allocation | | Percentage of

Net Assets | |

Fixed Income | | | 46.9 | % |

Domestic Equity | | | 42.2 | |

International Equity | | | 10.7 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

|

Transamerica Asset Allocation Variable - Intermediate/Long

Horizon Subaccount | |

| |

| Asset Allocation | | Percentage of

Net Assets | |

Domestic Equity | | | 55.8 | % |

Fixed Income | | | 28.3 | |

International Equity | | | 15.7 | |

Money Market | | | 0.2 | |

Net Other Assets (Liabilities) | | | (0.0 | )* |

Total | | | 100.0 | % |

| | | | |

| * | Percentage rounds to less than 0.1% or (0.1)%. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 2

Transamerica Asset Allocation Variable - Short Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | | | | | | | | |

Domestic Equity - 8.9% | | | | | | | | |

Transamerica Partners Variable Large Growth (A) (B) | | | 2,775 | | | | $ 233,827 | |

Transamerica Partners Variable Large Value (A) (B) | | | 3,024 | | | | 239,858 | |

Transamerica Partners Variable Small Core (A) (B) | | | 2,747 | | | | 156,359 | |

| | | | | | | | |

| | | | | | | 630,044 | |

| | | | | | | | |

Fixed Income - 89.0% | | | | | | | | |

Transamerica Partners Variable Core Bond (A) (B) | | | 74,678 | | | | 3,358,065 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 62,468 | | | | 1,104,208 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 24,566 | | | | 746,243 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 40,075 | | | | 1,080,397 | |

| | | | | | | | |

| | | | | | | 6,288,913 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | | | | |

International Equity - 1.9% | | | | | | | | |

Transamerica Partners Variable International Equity (A) (B) | | | 6,448 | | | | $ 136,643 | |

| | | | | | | | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market (A) (B) | | | 670 | | | | 14,136 | |

| | | | | | | | |

Total Investment Companies

(Cost $6,090,680) | | | | | | | 7,069,736 | |

| | | | | | | | |

Total Investments

(Cost $6,090,680) (C) | | | | | | | 7,069,736 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | | | | (1,297 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 7,068,439 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable Inputs | | | Level 3

Significant

Unobservable Inputs | | | Value at

December 31, 2014 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 7,069,736 | | | $ | — | | | $ | — | | | $ | 7,069,736 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 7,069,736 | | | $ | — | | | $ | — | | | $ | 7,069,736 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $6,090,680. Aggregate gross unrealized appreciation for all securities is $979,056. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Level 1, 2 and 3 during the period ended December 31, 2014. See the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 3

Transamerica Asset Allocation Variable - Intermediate Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | | | | | |

Domestic Equity - 42.2% | | | | | | | | |

Transamerica Partners Variable Large Growth (A) (B) | | | 36,404 | | | | $ 3,067,197 | |

Transamerica Partners Variable Large Value (A) (B) | | | 39,183 | | | | 3,107,609 | |

Transamerica Partners Variable Small Core (A) (B) | | | 35,496 | | | | 2,020,763 | |

| | | | | | | | |

| | | | | | | 8,195,569 | |

| | | | | | | | |

Fixed Income - 46.9% | | | | | | | | |

Transamerica Partners Variable Core Bond (A) (B) | | | 97,780 | | | | 4,396,906 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 80,972 | | | | 1,431,300 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 36,830 | | | | 1,118,800 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 80,431 | | | | 2,168,381 | |

| | | | | | | | |

| | | | | | | 9,115,387 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | |

International Equity - 10.7% | | | | | | | | |

Transamerica Partners Variable International Equity (A) (B) | | | 98,305 | | | | $ 2,083,376 | |

| | | | | | | | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market (A) (B) | | | 2,085 | | | | 43,975 | |

| | | | | | | | |

Total Investment Companies (Cost $14,423,550) | | | | | | | 19,438,307 | |

| | | | | | | | |

Total Investments

(Cost $14,423,550) (C) | | | | | | | 19,438,307 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | | | | (3,492 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 19,434,815 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable Inputs | | | Level 3

Significant

Unobservable Inputs | | | Value at

December 31, 2014 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 19,438,307 | | | $ | — | | | $ | — | | | $ | 19,438,307 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 19,438,307 | | | $ | — | | | $ | — | | | $ | 19,438,307 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $14,423,550. Aggregate gross unrealized appreciation for all securities is $5,014,757. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Level 1, 2 and 3 during the period ended December 31, 2014. See the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 4

Transamerica Asset Allocation Variable - Intermediate/Long Horizon Subaccount

SCHEDULE OF INVESTMENTS

At December 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES - 100.0% | | | | | | | | |

Domestic Equity - 55.8% | | | | | | | | |

Transamerica Partners Variable Large Growth (A) (B) | | | 75,952 | | | | $ 6,399,320 | |

Transamerica Partners Variable Large Value (A) (B) | | | 81,747 | | | | 6,483,338 | |

Transamerica Partners Variable Small Core (A) (B) | | | 73,749 | | | | 4,198,473 | |

| | | | | | | | |

| | | | | | | 17,081,131 | |

| | | | | | | | |

Fixed Income - 28.3% | | | | | | | | |

Transamerica Partners Variable Core Bond (A) (B) | | | 97,263 | | | | 4,373,654 | |

Transamerica Partners Variable High Quality Bond (A) (B) | | | 32,143 | | | | 568,177 | |

Transamerica Partners Variable High Yield Bond (A) (B) | | | 38,048 | | | | 1,155,779 | |

Transamerica Partners Variable Inflation-Protected Securities (A) (B) | | | 95,516 | | | | 2,575,062 | |

| | | | | | | | |

| | | | | | | 8,672,672 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

INVESTMENT COMPANIES (continued) | | | | | |

International Equity - 15.7% | | | | | | | | |

Transamerica Partners Variable International Equity (A) (B) | | | 227,298 | | | | $ 4,817,094 | |

| | | | | | | | |

Money Market - 0.2% | | | | | | | | |

Transamerica Partners Variable Money Market (A) (B) | | | 2,904 | | | | 61,263 | |

| | | | | | | | |

Total Investment Companies

(Cost $21,676,900) | | | | 30,632,160 | |

| | | | | | | | |

Total Investments

(Cost $21,676,900) (C) | | | | 30,632,160 | |

Net Other Assets (Liabilities) - (0.0)% (D) | | | | (5,532 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 30,626,628 | |

| | | | | | | | |

SECURITY VALUATION:

Valuation Inputs (E)

| | | | | | | | | | | | | | | | |

| | | Level 1

Quoted Prices | | | Level 2

Other Significant

Observable Inputs | | | Level 3

Significant

Unobservable Inputs | | | Value at

December 31, 2014 | |

ASSETS | | | | | | | | | | | | | | | | |

Investments | | | | | | | | | | | | | | | | |

Investment Companies | | $ | 30,632,160 | | | $ | — | | | $ | — | | | $ | 30,632,160 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 30,632,160 | | | $ | — | | | $ | — | | | $ | 30,632,160 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| (A) | Non-income producing security. |

| (B) | Investment in shares of an affiliated fund of Transamerica Partners Variable Funds. |

| (C) | Aggregate cost for federal income tax purposes is $21,676,900. Aggregate gross unrealized appreciation for all securities is $8,955,260. |

| (D) | Percentage rounds to less than 0.1% or (0.1)%. |

| (E) | The Subaccount recognizes transfers between Levels at the end of the reporting period. There were no transfers between Levels 1, 2 and 3 during the period ended December 31, 2014. See the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 5

STATEMENTS OF ASSETS AND LIABILITIES

At December 31, 2014

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/

Long Horizon | |

Assets: | | | | | | | | | | | | |

Affiliated investments, at value (A) | | $ | 7,069,736 | | | $ | 19,438,307 | | | $ | 30,632,160 | |

Receivables: | | | | | | | | | | | | |

Units sold | | | 3,691 | | | | 7,489 | | | | 21,058 | |

Investments sold | | | 8,071 | | | | — | | | | 48,075 | |

Total assets | | | 7,081,498 | | | | 19,445,796 | | | | 30,701,293 | |

| | | | |

Liabilities: | | | | | | | | | | | | |

Payables and other liabilities: | | | | | | | | | | | | |

Units redeemed | | | 1,317 | | | | 2,547 | | | | 2,818 | |

Investments purchased | | | 10,445 | | | | 4,942 | | | | 66,314 | |

Investment advisory fees | | | 1,297 | | | | 3,492 | | | | 5,533 | |

Total liabilities | | | 13,059 | | | | 10,981 | | | | 74,665 | |

Net assets | | $ | 7,068,439 | | | $ | 19,434,815 | | | $ | 30,626,628 | |

| | | | |

Net assets consist of: | | | | | | | | | | | | |

Costs of accumulation units | | $ | 2,035,063 | | | $ | 5,844,004 | | | $ | 14,198,591 | |

Undistributed (distributions in excess of) net investment income (loss) | | | (268,391 | ) | | | (749,696 | ) | | | (1,047,066 | ) |

Accumulated net realized gain (loss) | | | 4,322,711 | | | | 9,325,750 | | | | 8,519,843 | |

Net unrealized appreciation (depreciation) on:

Affiliated investments | | | 979,056 | | | | 5,014,757 | | | | 8,955,260 | |

Net assets | | $ | 7,068,439 | | | $ | 19,434,815 | | | $ | 30,626,628 | |

Accumulation units | | | 333,983 | | | | 828,123 | | | | 1,251,402 | |

Unit value | | $ | 21.16 | | | $ | 23.47 | | | $ | 24.47 | |

| | | | | | | | | | | | | |

(A) Affiliated investments, at cost | | $ | 6,090,680 | | | $ | 14,423,550 | | | $ | 21,676,900 | |

STATEMENTS OF OPERATIONS

For the year ended December 31, 2014

| | | | | | | | | | | | |

| | | Short

Horizon | | | Intermediate

Horizon | | | Intermediate/

Long Horizon | |

Expenses: | | | | | | | | | | | | |

Investment advisory fees | | $ | 14,028 | | | $ | 40,067 | | | $ | 61,226 | |

Net investment income (loss) | | | (14,028 | ) | | | (40,067 | ) | | | (61,226 | ) |

| | | | |

Net realized gain (loss) on: | | | | | | | | | | | | |

Affiliated investments | | | 226,353 | | | | 748,746 | | | | 652,900 | |

Net realized gain (loss) | | | 226,353 | | | | 748,746 | | | | 652,900 | |

| | | | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | |

Affiliated investments | | | (1,393 | ) | | | (69,527 | ) | | | 391,373 | |

Net change in unrealized appreciation (depreciation) | | | (1,393 | ) | | | (69,527 | ) | | | 391,373 | |

Net realized and change in unrealized gain (loss) | | | 224,960 | | | | 679,219 | | | | 1,044,273 | |

Net increase (decrease) in net assets resulting from operations | | $ | 210,932 | | | $ | 639,152 | | | $ | 983,047 | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 6

STATEMENTS OF CHANGES IN NET ASSETS

For the years ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | | | Intermediate Horizon | | | Intermediate/Long Horizon | |

| | | December 31, 2014 | | | December 31, 2013 | | | December 31, 2014 | | | December 31, 2013 | | | December 31, 2014 | | | December 31, 2013 | |

From operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | $ | (14,028 | ) | | $ | (14,851 | ) | | $ | (40,067 | ) | | $ | (39,711 | ) | | $ | (61,226 | ) | | $ | (58,474 | ) |

Net realized gain (loss) | | | 226,353 | | | | 740,897 | | | | 748,746 | | | | 921,391 | | | | 652,900 | | | | 1,000,128 | |

Net change in unrealized appreciation (depreciation) | | | (1,393 | ) | | | (668,118 | ) | | | (69,527 | ) | | | 1,566,907 | | | | 391,373 | | | | 4,127,435 | |

Net increase (decrease) in net assets resulting from operations | | | 210,932 | | | | 57,928 | | | | 639,152 | | | | 2,448,587 | | | | 983,047 | | | | 5,069,089 | |

| | | | | | | |

Unit transactions: | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 1,511,417 | | | | 1,408,609 | | | | 2,508,533 | | | | 3,256,968 | | | | 4,450,226 | | | | 2,848,907 | |

Units redeemed | | | (1,485,860 | ) | | | (2,861,136 | ) | | | (4,487,328 | ) | | | (4,649,264 | ) | | | (5,408,405 | ) | | | (5,110,086 | ) |

Net increase (decrease) in net assets resulting from unit transactions | | | 25,557 | | | | (1,452,527 | ) | | | (1,978,795 | ) | | | (1,392,296 | ) | | | (958,179 | ) | | | (2,261,179 | ) |

Net increase (decrease) in net assets | | | 236,489 | | | | (1,394,599 | ) | | | (1,339,643 | ) | | | 1,056,291 | | | | 24,868 | | | | 2,807,910 | |

| | | | | | | |

Net assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Beginning of year | | | 6,831,950 | | | | 8,226,549 | | | | 20,774,458 | | | | 19,718,167 | | | | 30,601,760 | | | | 27,793,850 | |

End of year | | $ | 7,068,439 | | | $ | 6,831,950 | | | $ | 19,434,815 | | | $ | 20,774,458 | | | $ | 30,626,628 | | | $ | 30,601,760 | |

Undistributed (distributions in excess of) net investment income (loss) | | $ | (268,391 | ) | | $ | (254,363 | ) | | $ | (749,696 | ) | | $ | (709,629 | ) | | $ | (1,047,066 | ) | | $ | (985,840 | ) |

Unit transactions - shares | | | | | | | | | | | | | | | | | | | | | | | | |

Units sold | | | 71,872 | | | | 69,050 | | | | 108,689 | | | | 150,607 | | | | 186,268 | | | | 131,770 | |

Units redeemed | | | (70,809 | ) | | | (139,938 | ) | | | (194,442 | ) | | | (217,513 | ) | | | (226,240 | ) | | | (235,284 | ) |

Net increase (decrease) | | | 1,063 | | | | (70,888 | ) | | | (85,753 | ) | | | (66,906 | ) | | | (39,972 | ) | | | (103,514 | ) |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 7

FINANCIAL HIGHLIGHTS

For a unit outstanding during the years indicated:

| | | | | | | | | | | | | | | | | | | | |

| | | Short Horizon | |

| | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of year | | $ | 20.52 | | | $ | 20.37 | | | $ | 18.99 | | | $ | 18.24 | | | $ | 16.95 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) |

Net realized and unrealized gain (loss) | | | 0.68 | | | | 0.19 | | | | 1.42 | | | | 0.79 | | | | 1.33 | |

Total investment operations | | | 0.64 | | | | 0.15 | | | | 1.38 | | | | 0.75 | | | | 1.29 | |

Unit value, end of year | | $ | 21.16 | | | $ | 20.52 | | | $ | 20.37 | | | $ | 18.99 | | | $ | 18.24 | |

Total return (B) | | | 3.13 | % | | | 0.73 | % | | | 7.30 | % | | | 4.07 | % | | | 7.65 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 7,068 | | | $ | 6,832 | | | $ | 8,227 | | | $ | 8,884 | | | $ | 9,608 | |

Expenses to average net assets (C) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (D) | | | 36 | % | | | 63 | % | | | 51 | % | | | 46 | % | | | 36 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Does not include portfolio activity of the investment companies in which the Subaccount invests. |

| | | | | | | | | | | | | | | | | | | | |

| | | Intermediate Horizon | |

| | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of year | | $ | 22.73 | | | $ | 20.10 | | | $ | 18.17 | | | $ | 18.13 | | | $ | 16.22 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) | | | 0.79 | | | | 2.67 | | | | 1.97 | | | | 0.08 | | | | 1.94 | |

Total investment operations | | | 0.74 | | | | 2.63 | | | | 1.93 | | | | 0.04 | | | | 1.91 | |

Unit value, end of year | | $ | 23.47 | | | $ | 22.73 | | | $ | 20.10 | | | $ | 18.17 | | | $ | 18.13 | |

Total return (B) | | | 3.24 | % | | | 13.07 | % | | | 10.67 | % | | | 0.19 | % | | | 11.81 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 19,435 | | | $ | 20,774 | | | $ | 19,718 | | | $ | 21,599 | | | $ | 24,180 | |

Expenses to average net assets (C) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (D) | | | 29 | % | | | 54 | % | | | 37 | % | | | 42 | % | | | 25 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Does not include portfolio activity of the investment companies in which the Subaccount invests. |

| | | | | | | | | | | | | | | | | | | | |

| | | Intermediate/Long Horizon | |

| | | December 31,

2014 | | | December 31,

2013 | | | December 31,

2012 | | | December 31,

2011 | | | December 31,

2010 | |

Unit value, beginning of year | | $ | 23.70 | | | $ | 19.93 | | | $ | 17.70 | | | $ | 17.99 | | | $ | 15.78 | |

Investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (A) | | | (0.05 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) |

Net realized and unrealized gain (loss) | | | 0.82 | | | | 3.81 | | | | 2.27 | | | | (0.25 | ) | | | 2.24 | |

Total investment operations | | | 0.77 | | | | 3.77 | | | | 2.23 | | | | (0.29 | ) | | | 2.21 | |

Unit value, end of year | | $ | 24.47 | | | $ | 23.70 | | | $ | 19.93 | | | $ | 17.70 | | | $ | 17.99 | |

Total return (B) | | | 3.28 | % | | | 18.93 | % | | | 12.60 | % | | | (1.66 | )% | | | 14.05 | % |

Ratio and supplemental data: | | | | | | | | | | | | | | | | | | | | |

Net assets end of year (000’s) | | $ | 30,627 | | | $ | 30,602 | | | $ | 27,794 | | | $ | 28,003 | | | $ | 30,991 | |

Expenses to average net assets (C) | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % | | | 0.20 | % |

Net investment income (loss) to average net assets | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% | | | (0.20 | )% |

Portfolio turnover rate (D) | | | 17 | % | | | 32 | % | | | 30 | % | | | 34 | % | | | 23 | % |

| (A) | Calculated based on average number of units outstanding. |

| (B) | Total return reflects Subaccount expenses. |

| (C) | Does not include expenses of the investment companies in which the Subaccount invests. |

| (D) | Does not include portfolio activity of the investment companies in which the Subaccount invests. |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 8

NOTES TO FINANCIAL STATEMENTS

At December 31, 2014

NOTE 1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

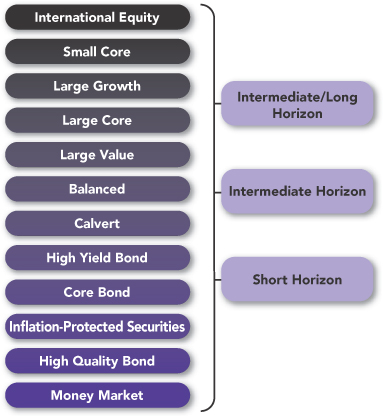

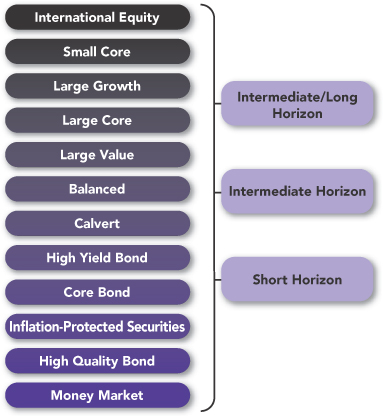

Transamerica Asset Allocation Variable Funds (the “Separate Account”), is a non-diversified separate account of Transamerica Financial Life Insurance Company (“TFLIC”), and is registered as a management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Separate Account applies investment company accounting and reporting guidance. The Separate Account is composed of three different subaccounts that are separate investment funds: Transamerica Asset Allocation Variable—Short Horizon Subaccount (“Short Horizon”), Transamerica Asset Allocation Variable—Intermediate Horizon Subaccount (“Intermediate Horizon”), and Transamerica Asset Allocation Variable—Intermediate/Long Horizon Subaccount (“Intermediate/Long Horizon”), (each, a “Subaccount” and collectively, the “Subaccounts”). Each Subaccount invests substantially all of its investable assets among certain Transamerica Partners Variable Funds (“TPVF”). Certain TPVF subaccounts invest substantially all of their investable assets in the Transamerica Partners Portfolios (the “Portfolios”).

Transamerica Asset Management, Inc. (“TAM”) is responsible for the day-to-day management of the Subaccounts. For each of the Portfolios, TAM currently acts as a “manager of managers” and hires sub-advisers to furnish day-to-day investment advice and recommendations to the Portfolios.

TAM provides continuous and regular investment advisory services to the Portfolios. TAM acts as a manager of managers, providing advisory services that include, without limitation, the design and development of each Portfolio and its investment strategy and the ongoing review and evaluation of that investment strategy including recommending changes in strategy where it believes appropriate or advisable; the selection of one or more sub-advisers for each Portfolio employing a combination of quantitative and qualitative screens, research, analysis and due diligence; oversight and monitoring of sub-advisers and recommending changes to sub-advisers where it believes appropriate or advisable; recommending and implementing fund combinations and liquidations where it believes appropriate or advisable; regular supervision of the Portfolios’ investments; regular review of sub-adviser performance and holdings; ongoing trade oversight and analysis; regular monitoring to ensure adherence to investment process; risk management oversight and analysis; design, development, implementation and regular monitoring of the valuation of portfolio holdings; design, development, implementation and regular monitoring of the compliance process; review of proxies voted by sub-advisers; oversight of preparation, and review, of materials for meetings of the Portfolios’ Board of Trustees (the “Board”), participation in these meetings and preparation of regular communications with the Board; oversight of preparation and review of prospectuses, shareholder reports and other disclosure materials and filings; and oversight of other service providers to the Portfolios, such as the custodian, the transfer agent, the Portfolios’ independent registered public accounting firm and legal counsel; supervision of the performance of recordkeeping and shareholder relations for the Portfolios; and ongoing cash management services. TAM uses a variety of quantitative and qualitative tools to carry out its investment advisory services. Where TAM employs sub-advisers, the sub-advisers carry out and effectuate the investment strategy designed for the Portfolios by TAM and are responsible, subject to TAM’s and the Board’s oversight, among other things, for making decisions to buy, hold or sell a particular security.

In the normal course of business, the Subaccounts enter into contracts that contain a variety of representations that provide general indemnifications. The Subaccounts’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Subaccounts and/or its affiliates that have not yet occurred. However, based on experience, the Subaccounts expect the risk of loss to be remote.

In preparing the Subaccounts’ financial statements in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States of America, estimates or assumptions (which could differ from actual results) may be used that affect reported amounts and disclosures. The following is a summary of significant accounting policies followed by the Subaccounts.

Cash overdraft: Throughout the year, the Subaccounts may have cash overdraft balances. A fee is incurred on these overdrafts, calculated by multiplying the overdraft by a rate based on the federal funds rate.

Payables, if any, are reflected as Due to custodian in the Statements of Assets and Liabilities.

Operating expenses: The Separate Account accounts separately for the assets, liabilities, and operations of each Subaccount. Each Subaccount will indirectly bear its share of fees and expenses incurred by TPVF. These expenses are not reflected in the expenses in the Statements of Operations and are not included in the ratios to Average Net Assets (“ANA”) shown in the Financial Highlights.

Security transactions: Security transactions are recorded on the trade date. Security gains and losses are calculated on the specific identification basis. Net realized gain (loss) is from investments in units of investment companies.

NOTE 2. SECURITY VALUATION

All investments in securities are recorded at their estimated fair value. The value of each Subaccount’s investment in a corresponding subaccount of the TPVF is valued at the unit value per share of each Subaccount at the close of the New York Stock Exchange

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 9

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2014

NOTE 2. (continued)

(“NYSE”), normally 4:00 p.m. Eastern Time, each day the NYSE is open for business. The Subaccounts utilize various methods to measure the fair value of their investments on a recurring basis.

GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The three Levels of inputs of the fair value hierarchy are defined as follows:

Level 1—Unadjusted quoted prices in active markets for identical securities.

Level 2—Inputs, other than quoted prices included in Level 1, that are observable, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data.

Level 3—Unobservable inputs, which may include TAM’s internal valuation committee’s (the “Valuation Committee”) own assumptions in determining the fair value of investments. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the sub-adviser, issuer, analysts, or the appropriate stock exchange (for exchange-traded securities), analysis of the issuer’s financial statements or other available documents and, if necessary, available information concerning other securities in similar circumstances.

The inputs used to measure fair value may fall into different Levels of the fair value hierarchy. In such cases, for disclosure purposes, the Level in the fair value hierarchy that is assigned to the fair value measurement of a security is determined based on the lowest Level input that is significant to the fair value measurement in its entirety. The hierarchy classification of inputs used to value the Subaccounts’ investments, at December 31, 2014, is disclosed in the Security Valuation section of each Subaccount’s Schedule of Investments.

Under supervision of the Board, TAM provides day-to-day valuation functions. TAM formed the Valuation Committee to monitor and implement the fair valuation policies and procedures as approved by the Board. These policies and procedures are reviewed at least annually by the Board. The Valuation Committee, among other tasks, monitors for when market quotations are not readily available or are unreliable and determines in good faith the fair value of the portfolio investments. For instances in which daily market quotes are not readily available, securities may be valued, pursuant to procedures adopted by the Board, with reference to other instruments or indices. Depending on the relative significance of valuation inputs, these instruments may be classified in either Level 2 or Level 3 of the fair value hierarchy.

The Valuation Committee may employ a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the security to determine the fair value of the security. An income-based valuation approach may also be used in which the anticipated future cash flows of the security are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the securities. When the Subaccounts use fair value methods that rely on significant unobservable inputs to determine a security’s value, the Valuation Committee will choose the method that is believed to accurately reflect fair value. These securities are categorized in Level 3 of the fair value hierarchy. The Valuation Committee reviews fair value measurements on a regular and ad hoc basis and may, as deemed appropriate, update the security valuations as well as the fair valuation guidelines. The Board reviews Valuation Committee determinations at its regularly scheduled meetings.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, but not limited to, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is generally greatest for instruments categorized in Level 3. Due to the inherent uncertainty of valuation, the Valuation Committee’s determination of values may differ significantly from values that would have been realized had a ready market for investments existed, and the differences could be material. The Valuation Committee employs various methods for calibrating these valuation approaches, including a regular review of valuation methodologies, key inputs and assumptions, transactional back-testing, and reviews of any market related activity.

Fair value measurements: Each Subaccount invests substantially all of its investable assets among certain TPVF subaccounts and the TPVF subaccounts invest all of their investable assets in the Portfolios. The summary of the inputs used for valuing each Portfolio’s assets carried at fair value is discussed in Note 2 of the Portfolios’ Notes to Financial Statements, which are attached to this report. Descriptions of the valuation techniques applied to the Subaccounts’ major categories of assets and liabilities measured at fair value on a recurring basis are as follows:

Investment companies: Investment companies are valued at the Net Asset Value of the underlying funds. These securities are actively traded and no valuation adjustments are applied. Exchange-Traded Funds are stated at the last reported sale price or closing price on the day of valuation taken from the primary exchange where the security is principally traded. They are categorized in Level 1 of the fair value hierarchy.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 10

NOTES TO FINANCIAL STATEMENTS (continued)

At December 31, 2014

NOTE 3. RELATED PARTY TRANSACTIONS

TAM, the Subaccounts’ investment adviser, is directly owned by Transamerica Premier Life Insurance Company (“TPLIC”) and AUSA Holding Company (“AUSA”), both of which are indirect, wholly owned subsidiaries of Aegon NV. TPLIC is owned by Commonwealth General Corporation (“Commonwealth”) and Aegon USA, LLC (“Aegon USA”). Commonwealth and AUSA are wholly owned by Aegon USA. Aegon USA is wholly owned by Aegon US Holding Corporation, which is wholly owned by Transamerica Corporation (DE). Transamerica Corporation (DE) is wholly owned by The Aegon Trust, which is wholly owned by Aegon International B.V., which is wholly owned by Aegon NV, a Netherlands corporation, and a publicly traded international insurance group.

Pursuant to the investment advisory agreement, and subject to further policies as the Board may determine, TAM provides general investment advice to each Subaccount, for which it receives a monthly advisory fee that is accrued daily and payable monthly at an annual rate equal to 0.20% of each Subaccount’s daily ANA.

TFLIC is the legal holder of the assets in the Subaccounts and will at all times maintain assets in the Subaccounts with a total market value of at least equal to the contract liabilities for the Subaccounts.

Certain Managing Board Members and officers of TFLIC are also trustees, officers, or employees of TAM or its affiliates. No interested Managing Board Member, who is deemed an interested person due to current or former service with TAM or an affiliate of TAM, receives compensation from the Separate Account. Similarly, none of the Separate Account’s officers receive compensation from the Subaccounts. The independent board members of TFLIC are also trustees of the Portfolios for which they receive fees.

All of the Portfolio holdings in investment companies are considered affiliated. Interest, dividends, realized and unrealized gains (losses) are broken out on the Statements of Operations.

Deferred compensation plan: Under a non-qualified deferred compensation plan effective January 1, 2008, as amended and restated, available to the trustees, compensation may be deferred that would otherwise be payable by the Separate Account to an independent trustee on a current basis for services rendered as trustee. Deferred compensation amounts will accumulate based on the value of the investment option, as elected by the trustee.

NOTE 4. PURCHASES AND SALES OF SECURITIES

The cost of securities purchased and proceeds from securities sold (excluding short-term securities) for the year ended December 31, 2014 were as follows:

| | | | | | | | |

| Subaccount | | Purchases

of securities | | | Sales

of securities | |

Short Horizon | | $ | 2,538,595 | | | $ | 2,526,948 | |

Intermediate Horizon | | | 5,741,622 | | | | 7,760,609 | |

Intermediate/Long Horizon | | | 5,333,144 | | | | 6,352,315 | |

NOTE 5. FEDERAL INCOME TAXES

The operations of the Separate Account form a part of, and are taxed with, the operations of TFLIC, a wholly-owned subsidiary of Aegon USA. TFLIC does not expect, based upon current tax law, to incur any income tax upon the earnings or realized capital gains attributable to the Separate Account. Based upon this expectation, no charges are currently being deducted from the Separate Account for federal income tax purposes. The Subaccounts recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. The Subaccounts’ federal and state tax returns remain subject to examination by the Internal Revenue Service and state tax authorities for the prior three years. Management has evaluated the Subaccounts’ tax provisions taken for all open tax years, and has concluded that no provision for income tax is required in the Subaccounts’ financial statements. If applicable, the Subaccounts recognize interest accrued related to unrecognized tax benefits in interest and penalties expense in Other on the Statements of Operations. The Subaccounts identify their major tax jurisdictions as U.S. Federal, the states of Colorado and Florida, and foreign jurisdictions where the Subaccounts make significant investments; however, the Subaccounts are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

NOTE 6. ACCOUNTING PRONOUNCEMENT

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 2014-11, “Transfers and Servicing, Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures”. The guidance changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The guidance is required to be presented for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. Management is currently evaluating the implication, if any, of the additional disclosure requirements and its impact on the Subaccounts’ financial statements.

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 11

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Transamerica Financial Life Insurance Company and the Contractholders of Transamerica Asset Allocation Variable Funds:

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Transamerica Asset Allocation Variable Funds (comprising, respectively, Transamerica Asset Allocation - Short Horizon Subaccount, Transamerica Asset Allocation - Intermediate Horizon Subaccount and Transamerica Asset Allocation - Intermediate/Long Horizon Subaccount) (collectively, the “Subaccounts”), as of December 31, 2014, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Subaccounts’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Subaccounts’ internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Subaccounts’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2014, by correspondence with the custodian and others or by other appropriate auditing procedures where replies from others were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the aforementioned Subaccounts constituting Transamerica Asset Allocation Variable Funds at December 31, 2014, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 26, 2015

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 12

Management of the Trust

Board Members and Officers

(unaudited)

The Board Members and executive officers of each Trust are listed below.

Interested Board Member means a board member who may be deemed an “interested person” (as that term is defined in the 1940 Act) of each Trust because of his current or former service with TAM or an affiliate of TAM. Interested Board Members may also be referred to herein as “Interested Trustees.” Independent Board Member means a Board Member who is not an “interested person” (as defined under the 1940 Act) of each Trust and may also be referred to herein as an “Independent Trustee.”

The Board governs each Subaccount and is responsible for protecting the interests of the shareholders. The Board Members are experienced executives who meet periodically throughout the year to oversee the business affairs of each Subaccount and the operation of each Subaccount by its officers. The Board also reviews the management of each Subaccount’s assets by the investment adviser and its respective sub-adviser.

The Subaccounts are among the Subaccounts advised and sponsored by TAM (collectively, “Transamerica Mutual Funds”). The Transamerica Mutual Funds consist of Transamerica Funds, Transamerica Series Trust (“TST”), Transamerica Income Shares, Inc. (“TIS”), Transamerica Partners Funds Group (“TPFG”), Transamerica Partners Funds Group II (“TPFG II”), Transamerica Partners Portfolios (“TPP”) and Transamerica Asset Allocation Variable Funds (“TAAVF”) and consists of 172 funds as of the date of this Annual Report.

The mailing address of each Board Member is c/o Secretary, 4600 South Syracuse St., Suite 1100, Denver, CO 80237.

The Board Members of each Trust and each Portfolio Trust, their year of birth, their positions with the Trusts, and their principal occupations for the past five years (their titles may have varied during that period) the number of Funds in Transamerica Mutual Funds the Board oversees, and other board memberships they hold are set forth in the table below. The length of time served is provided from the date a Trustee became a Trustee of either of the Trusts or Transamerica Partners Portfolios.

| | | | | | | | | | |

Name and

Year of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

During the Past

Five Years |

INTERESTED BOARD MEMBERS | | | | |

Marijn P. Smit (1973) | | Chairman of the Board, President and Chief Executive Officer | | Since 2014 | | Chairman of the Board, President and Chief Executive Officer, Transamerica Funds, TST, TPP, TPFG, TPFG II, TAAVF and TIS (2014 – present); Director, Chairman of the Board, President and Chief Executive Officer, Transamerica Asset Management, Inc. (“TAM”) and Transamerica Fund Services, Inc. (“TFS”) (2014 – present); President, Investment Solutions, Transamerica Investments & Retirement (2014 – present); Vice President, Transamerica Premier Life Insurance Company (2010 – present); Vice President, Transamerica Life Insurance Company (2010 – present); | | 172 | | N/A |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 13

| | | | | | | | | | |

Name and

Year of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

During the Past

Five Years |

INTERESTED BOARD MEMBERS — continued | | | | |

Marijn P. Smit (continued) | | | | | | Senior Vice President, Transamerica Financial Life Insurance Company (2013 – present); Senior Vice President, Transamerica Retirement Advisors, Inc. (2013 – present); Senior Vice President, Transamerica Retirement Solutions Corporation (2012 – present); and President and Director, Transamerica Stable Value Solutions, Inc. (2010 – present) | | | | |

Alan F. Warrick (1948) | | Board Member | | Since 2012 | | Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2012 – present); Consultant, Aegon USA (2010 – 2011); Senior Advisor, Lovell Minnick Equity Partners (2010 – present); Retired (2010 – present); and Managing Director for Strategic Business Development, Aegon USA (1994 – 2010). | | 172 | | First Allied

Holdings Inc.

(2013 – 2014) |

INDEPENDENT BOARD MEMBERS | | | | | | |

Sandra N. Bane (1952) | | Board Member | | Since 2008 | | Retired (1999 – present); Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2008 – present); Board Member, Transamerica Investors, Inc. (“TII”) (2003 – 2010); and Partner, KPMG (1975 – 1999). | | 172 | | Big 5 Sporting

Goods (2002 –

present); AGL

Resources, Inc.

(energy services

holding

company)

(2008 – present) |

Leo J. Hill (1956) | | Lead Independent Board Member | | Since 2007 | | Principal, Advisor Network Solutions, LLC (business consulting) (2006 – present); Board Member, TST (2001 – present); Board Member, Transamerica Funds and TIS (2002 – present); Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present); Board Member, TII (2008 – 2010); Market President, Nations Bank of Sun Coast Florida (1998 – 1999); | | 172 | | Ameris Bancorp

(2013 –present);

Ameris Bank

(2013 – present) |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 14

| | | | | | | | | | |

Name and

Year of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

During the Past

Five Years |

INDEPENDENT BOARD MEMBERS — continued | | | | | | |

Leo J. Hill (continued) | | | | | | Chairman, President and Chief Executive Officer, Barnett Banks of Treasure Coast Florida (1994 – 1998); Executive Vice President and Senior Credit Officer, Barnett Banks of Jacksonville, Florida (1991 – 1994); and Senior Vice President and Senior Loan Administration Officer, Wachovia Bank of Georgia (1976 – 1991). | | | | |

David W. Jennings (1946) | | Board Member | | Since 2009 | | Board Member, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2009 – present); Board Member, TII (2009 – 2010); Managing Director, Hilton Capital (2010 – present); Principal, Maxam Capital Management, LLC (2006 – 2008); and Principal, Cobble Creek Management LP (2004 – 2006). | | 172 | | N/A |

Russell A. Kimball, Jr. (1944) | | Board Member | | Since 2007 | | General Manager, Sheraton Sand Key Resort (1975 – present); Board Member, TST (1986 – present); Board Member, Transamerica Funds, (1986 – 1990), (2002 – present); Board Member, TIS (2002 – present); Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present); and Board Member, TII (2008 – 2010). | | 172 | | N/A |

Eugene M. Mannella (1954) | | Board Member | | Since 1993 | | Chief Executive Officer, HedgeServ Corporation (hedge fund administration) (2008 – present); Self-employed consultant (2006 – present); Managing Member and Chief Compliance Officer, HedgeServ Investment Services, LLC

(limited purpose broker-dealer) (2011 – present); President, ARAPAHO Partners LLC (limited purpose broker-dealer) (1998 – 2008); | | 172 | | N/A |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 15

| | | | | | | | | | |

Name and

Year of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

During the Past

Five Years |

INDEPENDENT BOARD MEMBERS — continued | | | | | | |

Eugene M. Mannella (continued) | | | | | | Board Member, TPP, TPFG, TPFG II and TAAVF (1993 – present); Board Member, Transamerica Funds, TST and TIS (2007 – present); Board Member, TII (2008 – 2010); and President, International Fund Services (alternative asset administration) (1993 – 2005). | | | | |

Norman R. Nielsen, Ph.D. (1939) | | Board Member** | | Since 2007 | | Retired (2005 – present); Board Member, Transamerica Funds, TST and TIS (2006 – 2014); Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – 2014); Board Member, TII (2008 – 2010); Interim President, Mt. Mercy University (2013 – 2014); Director, Aspire Inc. (formerly, Iowa Student Loan Service Corporation) (2006 – present); Director, League for Innovation in the Community Colleges (1985 – 2005); Director, Iowa Health Systems

(1994 – 2003); Director, U.S. Bank

(1985 – 2006); and President, Kirkwood Community College (1985 – 2005). | | 172 | | Buena Vista

University Board

of Trustees

(2004 – present);

Chairman

(2012 – present) |

Joyce G. Norden (1939) | | Board Member** | | Since 1993 | | Retired (2004 – present); Board Member, TPFG, TPFG II and TAAVF (1993 – 2014); Board Member, TPP (2002 – 2014); Board Member, Transamerica Funds, TST and TIS (2007 – 2014); Board Member, TII (2008 – 2010); and Vice President, Institutional Advancement, Reconstructionist Rabbinical College (1996 – 2004). | | 172 | | Board of

Governors,

Reconstructionist

Rabbinical

College

(2007 – 2012) |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 16

| | | | | | | | | | |

Name and

Year of Birth | | Position(s)

Held with

Trust | | Term of

Office and

Length

of Time

Served* | | Principal Occupation(s)

During Past Five Years | | Number of

Funds in

Complex

Overseen

by Board

Member | | Other

Directorships

During the Past

Five Years |

INDEPENDENT BOARD MEMBERS — continued | | | | | | |

Patricia L. Sawyer (1950) | | Board Member | | Since 1993 | | Retired (2007 – present); President/Founder, Smith & Sawyer LLC (management consulting) (1989 – 2007); Board Member, Transamerica Funds, TST and TIS (2007 – present); Board Member, TII (2008 – 2010); Board Member, TPP, TPFG, TPFG II and TAAVF (1993 – present); Trustee, Chair of Finance Committee and Chair of Nominating Committee (1987 – 1996), Bryant University. | | 172 | | Honorary Trustee,

Bryant University

(1996 – present) |

John W. Waechter (1952) | | Board Member | | Since 2007 | | Attorney, Englander Fischer (2008 – present); Retired (2004 – 2008); Board Member, TST and TIS (2004 – present); Board Member, Transamerica Funds (2005 – present); Board Member, TPP, TPFG, TPFG II and TAAVF (2007 – present); Board Member, TII (2008 – 2010); Employee, RBC Dain Rauscher (securities dealer) (2004); Executive Vice President, Chief Financial Officer and Chief Compliance Officer, William R. Hough & Co. (securities dealer) (1979 – 2004); and Treasurer, The Hough Group of Funds (1993 – 2004). | | 172 | | Operation PAR,

Inc. (2008 – present);West Central Florida

Council – Boy Scouts

of America

(2008 – 2013);

Remember Honor

Support, Inc. (non-profit

organization) (2013 – present) Board Member,

WRH Income

Properties, Inc.

(real estate)

(2014 – present) |

| * | Each Board Member shall hold office until: 1) his or her successor is elected and qualified or 2) he or she resigns, retires or his or her term as a Board Member is terminated in accordance with the Trust’s Declaration of Trust. |

| ** | Ms. Norden & Mr. Nielsen served as Board members through December 31, 2014, at which time they retired. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 17

Officers

The mailing address of each officer is c/o Secretary, 4600 South Syracuse St., Suite 1100, Denver, CO 80237. The following table shows information about the officers, including their year of birth, their positions held with the Trust and their principal occupations during the past five years (their titles may have varied during that period). Each officer will hold office until his or her successor has been duly elected or appointed or until his or her earlier death, resignation or removal.

| | | | | | |

Name and

Year of Birth | | Position | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) or Employment

During Past Five Years |

Marijn P. Smit (1973) | | Board Member, President and Chief Executive Officer | | Since 2014 | | See Table Above. |

Tané T. Tyler (1965) | | Vice President, Associate General Counsel, Chief Legal Officer and Secretary | | Since 2014 | | Vice President, Associate General Counsel, Chief Legal Officer and Secretary, Transamerica Funds, TST, TPP, TPFG, TPFG II, TAAVF and TIS (2014 – present); Director, Vice President, Associate General Counsel, Chief Legal Officer and Secretary, TAM and TFS (2014 – present); Senior Vice President, Secretary and General Counsel, ALPS, Inc., ALPS Fund Services, Inc. and ALPS Distributors, Inc. (2004 – 2013); and Secretary, Liberty All-Star Funds (2005 – 2013) |

Christopher A. Staples (1970) | | Vice President and Chief Investment Officer, Advisory Services | | Since 2007 | | Vice President and Chief Investment Officer, Advisory Services (2007 – present), Senior Vice President – Investment Management (2006 – 2007), Vice President – Investment Management (2005 – 2006), Transamerica Funds, TST and TIS; Vice President and Chief Investment Officer, Advisory Services, TPP, TPFG, TPFG II and TAAVF (2007 – present); Vice President and Chief Investment Officer (2007 – 2010); Vice President – Investment Administration (2005 – 2007), TII; Director (2005 – present), Senior Vice President (2006 – present) and Chief Investment Officer, Advisory Services (2007 – present), TAM; Director, TFS (2005 – present); and Assistant Vice President, Raymond James & Associates (1999 – 2004). |

Thomas R. Wald (1960) | | Chief Investment Officer | | Since 2014 | | Chief Investment Officer, Transamerica Funds, TST, TPP, TPFG, TPFG II, TAAVF and TIS

(2014 – present); Senior Vice President and Chief Investment Officer, TAM (2014 – present); Chief Investment Officer, Transamerica Investments & Retirement (2014 – present); Vice President and Client Portfolio Manager, Curian Capital, LLC (2012 – 2014); Portfolio Manager, Tactical Allocation Group, LLC (2010 – 2011); Mutual Fund Manager, Munder Capital Management (2005 – 2008); and Mutual Fund Manager, Invesco Ltd. (1997 – 2004). |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 18

| | | | | | |

Name and

Year of Birth | | Position | | Term of Office

and Length of

Time Served* | | Principal Occupation(s) or Employment

During Past Five Years |

Vincent J. Toner (1970) | | Vice President and Treasurer | | Since 2014 | | Vice President and Treasurer (2014 – present) Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF; Vice President and Treasurer, TAM and TFS

(2014 – present); Senior Vice President and Vice President, Fund Administration, Brown Brothers Harriman

(2010 – 2014); and Vice President Fund Administration & Fund Accounting, OppenheimerFunds (2007 – 2010) |

Matthew H. Huckman, Sr. (1968) | | Tax Manager | | Since 2014 | | Tax Manager, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2014 – present); Tax Manager, TFS (2012 – present); and Assistant Mutual Fund Tax Manager, Invesco

(2007 – 2012). |

Scott M. Lenhart (1961) | | Chief Compliance Officer and Anti-Money Laundering Officer | | Since 2014 | | Chief Compliance Officer and Anti-Money Laundering Officer, Transamerica Funds, TST, TIS, TPP, TPFG, TPFG II and TAAVF (2014 – present); Chief Compliance Officer and Anti-Money Laundering Officer (2014 – present), Senior Compliance Officer (2008 – 2014), TAM; Vice President and Chief Compliance Officer, TFS (2014 – present); Director of Compliance, Transamerica Investments & Retirement (2014 – present); Vice President and Chief Compliance Officer, Transamerica Financial Advisors, Inc.

(1999 – 2006); and Assistant Chief Compliance Officer, Raymond James Financial, Inc., Robert Thomas Securities, Inc. (1989 –1998). |

| * | Elected and serves at the pleasure of the Board of the Trust. |

| | |

| Transamerica Asset Allocation Variable Funds | | Annual Report 2014 |

Page 19

| | | | | | | | |

Transamerica Partners Portfolios | | | | | | | | |

| | | | I | | | | |

| | | | | | | | |

(This page intentionally left blank)

Transamerica Partners High Quality Bond Portfolio

(unaudited)

MARKET ENVIRONMENT

2014 can best be described as a tale of two halves. At the start of the year, geopolitical concerns, a slowdown in China, and soft economic data sparked a rally in treasuries. Comments late in the quarter from U.S. Federal Reserve (“Fed”) chairwoman Janet Yellen that rate increases could come sooner than expected quickly ended the party. The comment triggered a back-up in rates that erased the January rally on all but the longest treasuries. Sentiment in the fixed income market was “risk-on” and spreads tightened, generating excess returns in most sectors during the quarter. The exception was the agency residential mortgage-backed security sector (“RMBS”) as the Fed tapering weighed heavily on the sector. The bond market posted strong results during the second quarter as credit spreads narrowed and treasury yields continued to fall in response to weaker-than-expected first quarter gross domestic product growth. Foreign central bank buying and shifting global demand from sovereign debt buyers also contributed to the decline in yields on long term treasury securities. All spread sectors had positive excess returns during the quarter with lower quality corporates outperforming their higher quality brethren.

U.S. economic data was somewhat mixed in the third quarter. While the housing sector was somewhat anemic, economic reports in the third quarter indicated an economy growing at a moderate pace, with continued employment gains and the expansion on firmer footing. The stronger third quarter saw a backup in rates between the two-year and seven-year part of the treasury curve. Increased geopolitical tension in the Middle East, concerns about growth prospects in China and Europe, weakness in oil and commodity prices and equity friendly actions by corporations shifted investor sentiment to “risk-off”, causing spreads to widen. The net result was that excess returns were negative. The fourth quarter saw a continuation of economic disparity in the global economy. While the U.S. economy strengthened, Europe, Japan and many emerging markets were stagnating causing a rally in the U.S. dollar and treasury securities between five-year and 30-year maturities. The short-end sold off due to uncertainty regarding the timing of monetary policy changes. The rout in oil prices initially led to a selloff in the energy, basic industries, metals and mining and industrials, but later spread to other corporate sectors. According to Merrill Lynch, the corporate sector was the worst performer during the 4th quarter, generating excess returns of (1.35)%. Spreads in the agency RMBS tightened, while commercial mortgage-backed security (“CMBS”) and asset-backed security (“ABS”) spreads widened modestly during the quarter resulting in positive excess returns for the quarter.

PERFORMANCE

For the year ended December 31, 2014, Transamerica Partners High Quality Bond Portfolio returned 0.81%. By comparison, its benchmark, the Bank of America Merrill Lynch U.S. Corporate & Government 1-3 Years Index, returned 0.78%.

STRATEGY REVIEW