| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-07749 |

|

| |

| T. Rowe Price Financial Services Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: December 31 |

| |

| |

| Date of reporting period: December 31, 2009 |

Item 1: Report to Shareholders| Financial Services Fund | December 31, 2009 |

The views and opinions in this report were current as of December 31, 2009. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

The recoveries in global economies and the share prices of financial services companies that began in March 2009 continued relatively unabated through the end of the year. Key measures of economic strength—jobless claims, housing prices, capital spending, and GDP growth—all moved in the right direction, albeit off of dismal levels. The U.S. banking system is now sound and well capitalized as banks have raised more than $200 billion in 2009. Losses and reserve-building for future losses in the banking system, while at high levels and still rising, are probably near their peak and should decline substantially in 2010 and 2011. We anticipate earnings and returns of financial companies will improve steadily over the next two to three years.

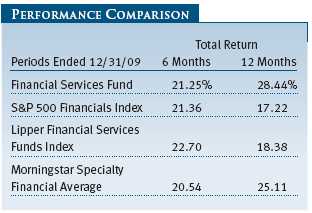

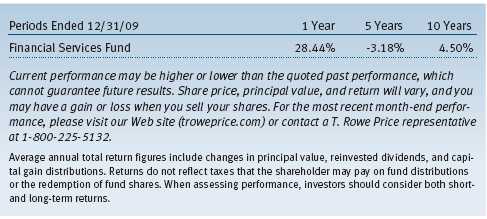

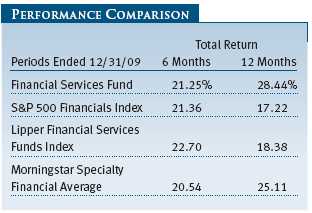

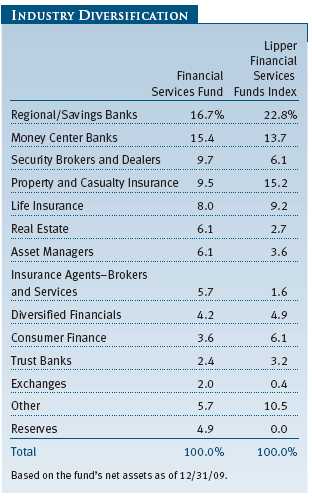

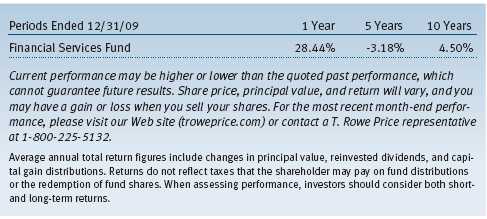

The Financial Services Fund returned 21.25% in the second half of 2009 and kept pace with its benchmarks, as shown in the Performance Comparison table. For the entire year, the fund outperformed its benchmarks with a 28.44% return. Performance in both periods was helped by our timely increases in exposure to banks and capital markets companies, but our allocations to more defensive areas, such as property and casualty (P&C) insurers, cash reserves, and convertible securities, limited our potential gains. The poor performance of some small-cap regional banks also worked against us.

Nevertheless, we are satisfied with the fund’s performance in both periods, given that the portfolio was somewhat defensively postured versus its peers during the downturn. We believe that the securities in the portfolio are trading much closer to their intrinsic value than they were at midyear 2009. However, valuations in the financials sector are still attractive, and there is more evidence today that a reasonable economic recovery is indeed at hand. With a modest but steady economic recovery under way, we think the portfolio can deliver solid absolute returns in 2010 despite headwinds from increased regulation, higher capital requirements, and potential increases in interest rates and inflation.

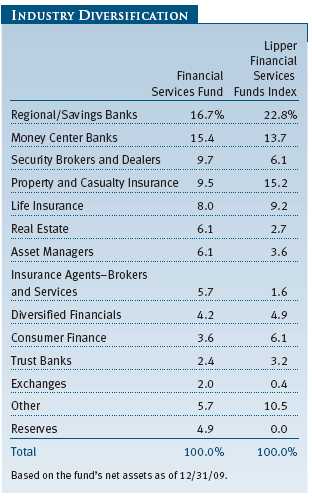

A note about our benchmarks: We think the Lipper and Morningstar categories are the most representative benchmarks against which to measure our performance. Although our performance versus the S&P 500 Financials Index has been strong over the past few years, that partially reflects the fact that banks, which represent almost half of the index, have been weak. Investors should expect the fund to be structurally underweighted in banks relative to the S&P 500 Financials Index because we don’t think it is prudent—from a risk-management perspective—to put 50% of our assets in any single industry. As a result, the fund is likely to outperform the S&P 500 Financials Index when banks are weak and underperform when they are strong.

As always, we would like to remind our investors that the Financial Services Fund is a relatively narrow offering that is subject to a greater risk of capital losses than more diversified portfolios. We believe that only a relatively small portion of one’s investment portfolio should be allocated to this strategy.

EVOLVING PERSPECTIVES AND FUND POSITIONING

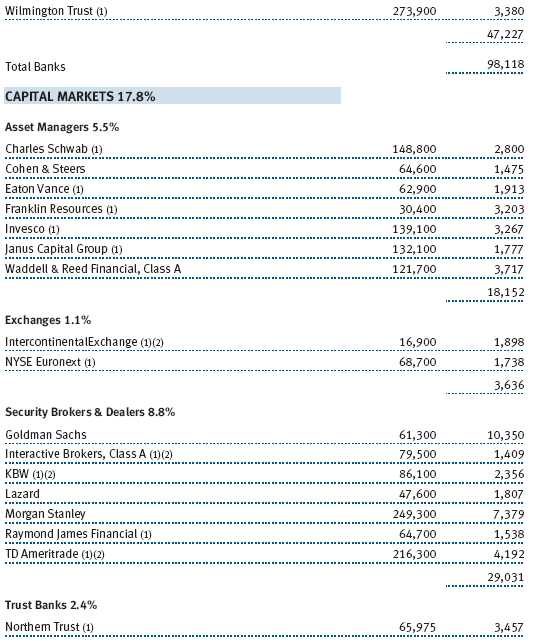

In our last report to you six months ago, we discussed a number of portfolio changes. First, we significantly increased our common stock investments in the riskier bank, brokerage, and capital markets industries. These investments proved timely as a significant portion of the fund’s gains in the second half of 2009 came from these sectors. We are maintaining this stance because we anticipate additional gains in these areas across all market capitalizations. As of December 31, 2009, regional/savings banks and money center banks were our two largest industry allocations, collectively representing approximately 32% of the fund’s assets.

Second, we noted that our longstanding overweighting of the P&C industry was beginning to come down, given the rebound in market-sensitive financial industries. Since our last letter, we have reduced our exposure to the P&C industry. During the period, several events led us to conclude that P&C investments were not likely to be very rewarding in the intermediate term. Part of our rationale for continuing to invest in this area—despite how well it performed in relative terms during the downturn—depended on the potential for troubled industry leaders like AIG, XL Capital, and Hartford Financial Services to exit certain markets and reduce the number of insurance policies they write. Such a reduction of supply probably would have led to increased pricing power for other competitors. We now believe that the troubled companies have the balance sheet wherewithal to continue to write new business, and they are likely to do so at relatively unattractive prices. We think profitability and reserve adequacy has peaked for the time being and is likely to decline for some time until supply comes out of the insurance market. As such, we are focusing our investments in the P&C industry on insurance brokers such as Aon and special situations like Allstate and Assured Guaranty. We have reduced exposure to primary underwriters such as Chubb and Travelers and eliminated some reinsurance underwriters like Renaissance Re. These companies have generated solid returns for the fund, but in our opinion, they offer a less-favorable opportunity versus other areas of the financials sector over the next 12 to 24 months. (Please refer to the fund’s portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

Third, we noted that underweighting regional banks contributed to the fund’s outperformance in the first half of 2009. At the same time, we acknowledged that a number of the regional banks we did hold were among the biggest detractors to our performance. Nevertheless, we were planning to add to our positions because valuations did not reflect our belief that worsening credit metrics would moderate and that the regional banks’ primary revenue driver—net interest margins (NIM)—would expand. As of this writing, we now hold substantial positions in the regional banks and still believe that this could be one of the better-performing financial industries in the intermediate term. The fundamentals are playing out as expected: Loan losses remain high, but the pace of nonperforming loan formation and delinquencies is moderating. Also, reserves for future losses are at historically high levels (implying there is ample cushion for the balance sheet to endure substantial future write-downs), and the amount that companies need to set aside for future losses is declining. Pricing on new loans is very attractive, and the cost of deposits has come down, resulting in a steady expansion of NIM.

Finally, we noted that 2010 would likely be a year of meaningful improvement for bank balance sheets and that a return to “normalized” earnings for the banking industry is most likely a 2012 event. We are more confident in this view today given the supporting economic and company-specific developments we have observed in the last six months.

PORTFOLIO REVIEW

Our fund continues to be well diversified across more than 80 issuers of securities and is now more aggressively postured than it was in late 2008 and in the first half of 2009. We believe that the portfolio is well positioned for an economic recovery and a return to normalized earnings in 2012. The portfolio does contain a number of defensive investments, including shares of a few nonfinancial companies and 5% in cash reserves, and we remain focused on both the risks and potential rewards of all fund holdings. However, we believe we can make a cogent argument that there will be a reasonable economic recovery and that valuations of riskier banks and capital markets companies are attractive against this backdrop and among the best places to invest your capital. The fund is unlikely to perform well if the economy dips back into recession, housing prices fall precipitously, or unemployment increases significantly.

During the last six months, our largest purchases were an eclectic mix. Wells Fargo common stock was our top purchase. We sold a successful investment in the convertible debt of Wells Fargo, which more than doubled from its lows. We then made Wells Fargo common stock one of our largest holdings once the company repaid the money it borrowed from the Treasury’s Troubled Asset Relief Program (TARP). We think Wells Fargo is poised to generate earnings of approximately $4.00 per share in 2012 and is significantly undervalued at this time. In contrast to previous periods when we favored the convertible bonds of large banks such as Wells Fargo and Bank of America in an attempt to manage risk, we now believe the common stocks for these two banks offer the best opportunity for our shareholders. This is based on our assessment that their balance sheets are solid and that either their earnings power in 2012 is greater than that of the market or we are more willing than other investors to buy well ahead of a return to normalized earnings in 2012.

Another large purchase was a new position in Sun Life Financial, a Canada-based life insurance company that is now one of fund’s 25 largest holdings. The company has leading positions in North America in the life insurance and wealth management markets and owns the majority of MFS—one of the oldest and most successful investment management firms in the U.S. We think the risk/reward profile of our investment is very appealing. With an average cost of $28 per share, we calculate that we paid only a 10% premium-to-book value for an industry-leading company with a strong balance sheet that should generate at least a low-teens return on equity (ROE) in 2010 and beyond. In addition, we expect to earn a 5% annual dividend.

The bulk of our largest sales in the last six months reflected two distinct themes: managing position sizes of large holdings that appreciated significantly and taking profits in the P&C industry. We trimmed our positions in Bank of America and Goldman Sachs. Both companies were among the top performance contributors in the first half of 2009 and were the two top contributors for the full year. We thought it was prudent to trim a portion of these holdings to fund our large purchase of Wells Fargo, a stock that had significantly underperformed both Goldman Sachs and Bank of America in 2009 but had similar risks. Goldman Sachs and Bank of America remain two of our largest positions and together account for almost 8% of the fund’s assets. Also, we significantly reduced our exposure to Travelers and Chubb.

As discussed earlier, we think the P&C industry is poised to underperform other financial segments in 2010. Both companies performed admirably over the last few years, registering solid absolute gains and significantly outperforming the financials sector in 2007 and 2008. At year-end, each company represented approximately 1% of fund assets.

OUTLOOK

There is a healthy “wall of worry” for the markets to climb in 2010. While global economies are beginning to recover and excessive risk aversion has subsided—allowing asset prices to reflate—we expect to see governments around the world remove market support, stimulative policies, and credit facilities. There is plenty of well-founded concern over inflationary pressures, and we expect to see the beginning of a series of interest rate hikes over the next year. Elevated losses at banks, government regulation, and the potential for damaging populist legislation will also give investors pause, particularly in the financials sector. It is this level of uncertainty and the significance of the risks that investors face that allow T. Rowe Price’s analysts and portfolio managers to add value through thorough research on a stock-by-stock basis.

We like how the Financial Services Fund’s portfolio is positioned, with a higher risk/return potential tilt toward banks and away from P&C insurers. Banks have registered losses for three straight years, a fate they hadn’t suffered since they fell for four consecutive years during the Great Depression. Banks have also underperformed the S&P 500 for six straight years through 2009—something not seen since the 1982–1987 period. We think there is a significant opportunity for patient investors to benefit from a moderation in losses and the ultimate return to profitability in the banking sector that is already well under way. While we expect the banking sector’s ROE to peak at lower levels than in prior cycles given higher capital requirements and regulatory changes, the banks will be stronger, and the ROE will likely revert to levels well in excess of the cost of capital. We think this will support valuations that are significantly higher than the modest price-to-book value premium that the market is putting on the banking sector today.

In closing, the fund’s returns in 2009 were strong, and we are optimistic that financial services companies can generate acceptable returns over the next year or two with the economy on reasonably solid footing. Banks look particularly attractive to us, and we are willing to wait for the market to price in a return to normalized earnings in 2012. We will continue to scour the financials sector for the best investment candidates and, as risks and opportunities arise, respond accordingly. We look forward to reporting back to you in six months.

Thank you for your confidence in T. Rowe Price.

Respectfully submitted,

Jeffrey W. Arricale

Chairman of the fund’s Investment Advisory Committee

January 25, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

The fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance, even in rising markets.

Funds that invest only in specific industries will experience greater volatility than funds investing in a broad range of industries. The banking industry can be significantly affected by legislation that has reduced the separation between commercial and investment banking businesses, changed the laws governing capitalization requirements and the savings and loan industry, and increased competition. In addition, changes in general economic conditions and interest rates can significantly affect the banking industry. Financial services companies may be hurt when interest rates rise sharply, although not all companies are affected equally. The stocks may also be vulnerable to rapidly rising inflation.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

Morningstar Specialty Financial Average: A benchmark that tracks the performance of funds that seek capital appreciation by investing primarily in equity securities of financial services companies.

Price/earnings (P/E) ratio: A ratio that shows the “multiple” of earnings at which a stock is selling. It is calculated by dividing a stock’s current price by its current earnings per share. For example, if a stock’s price is $60 per share and the issuing company earns $2 per share, the P/E ratio is $60/$2, or 30.

Price/book value (P/BV) ratio: A ratio used to compare a stock’s market value with its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value.

Return on equity (ROE): Calculated by dividing a company’s net income by shareholders’ equity (i.e., the company’s book value), ROE measures how much a company earns on each dollar that common stock investors have put into that company. ROE indicates how effectively and efficiently a company and its management are using stockholder investments.

S&P 500 Financials Index: A subindex of the S&P 500 Stock Index that includes all of the financials sector components of the S&P 500.

S&P 500 Stock Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

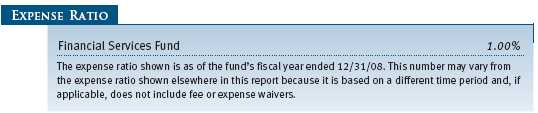

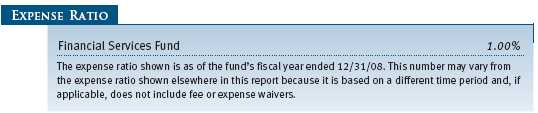

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

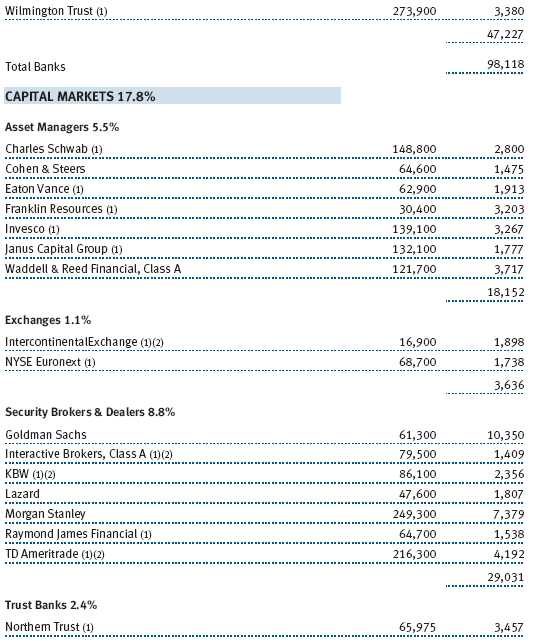

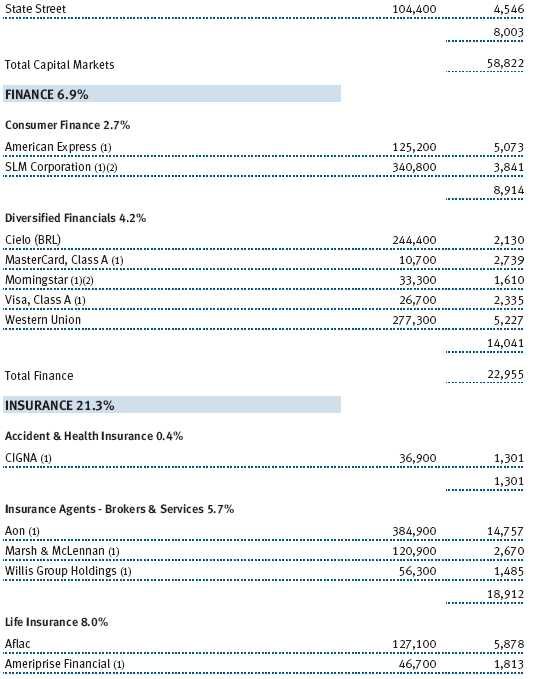

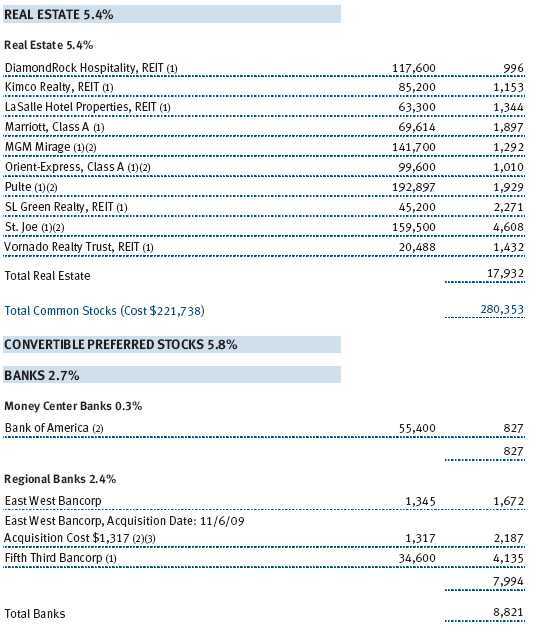

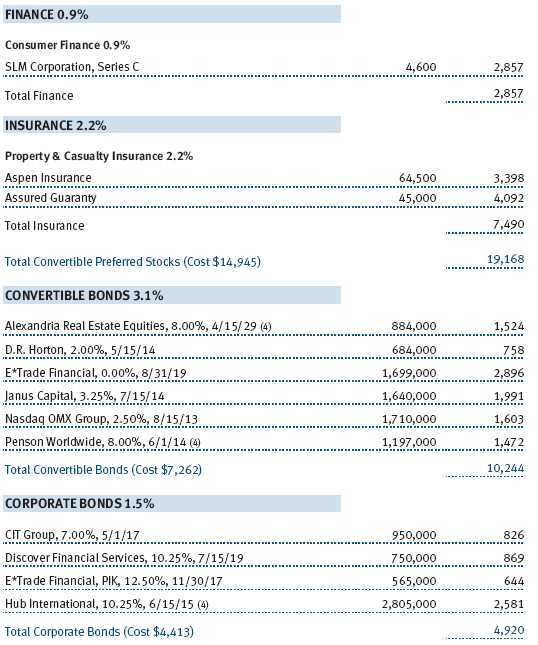

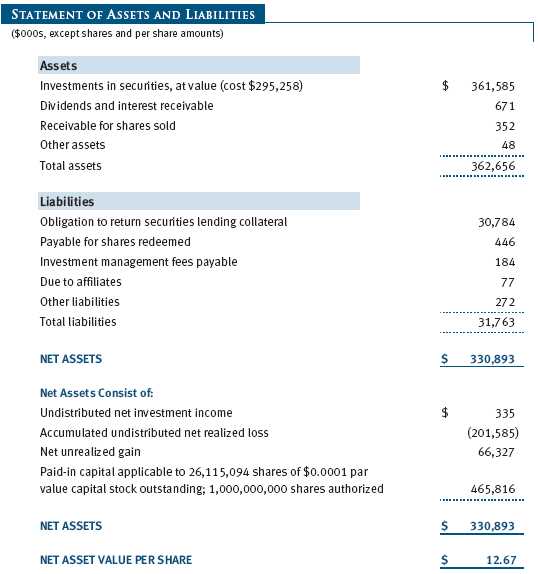

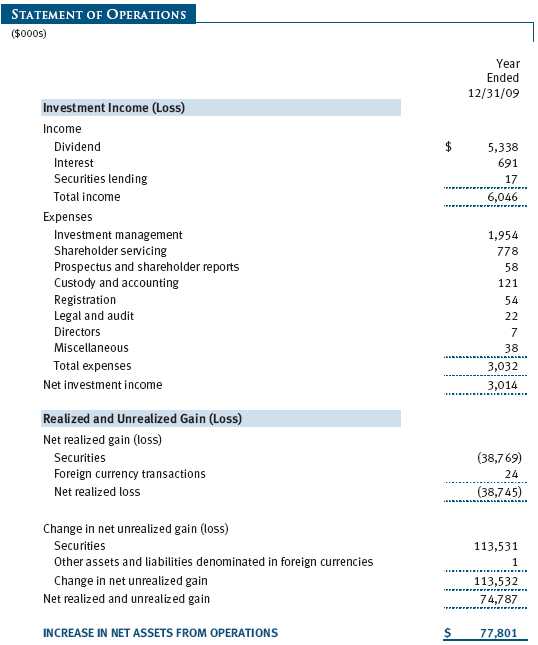

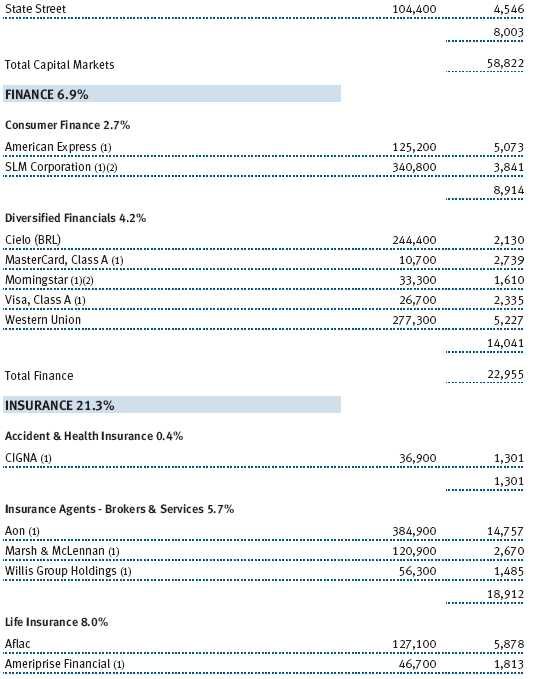

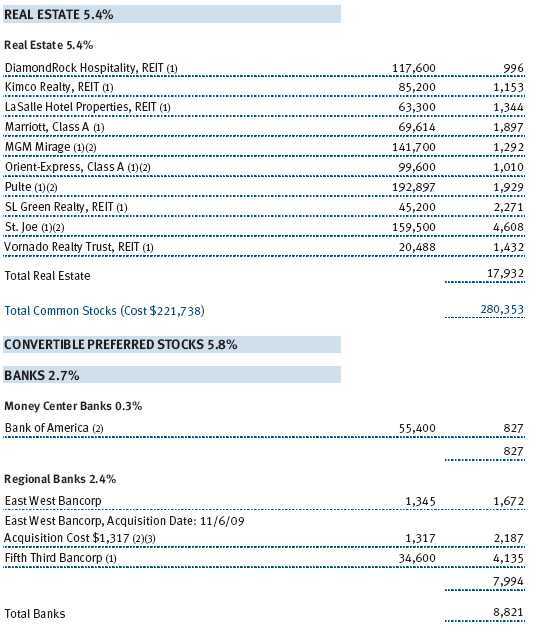

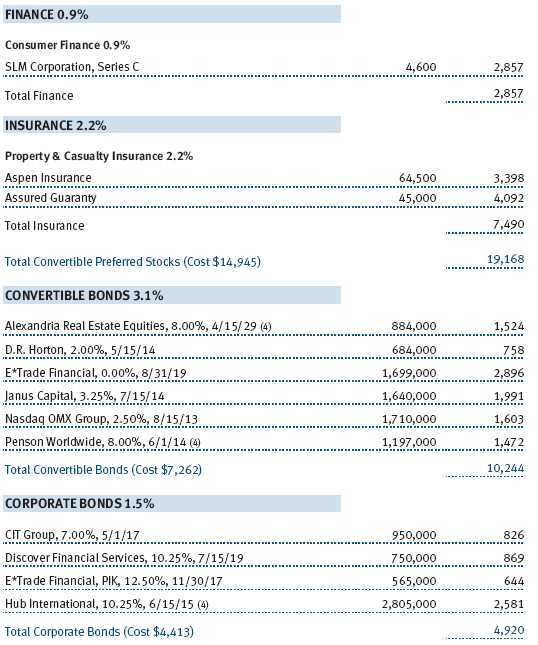

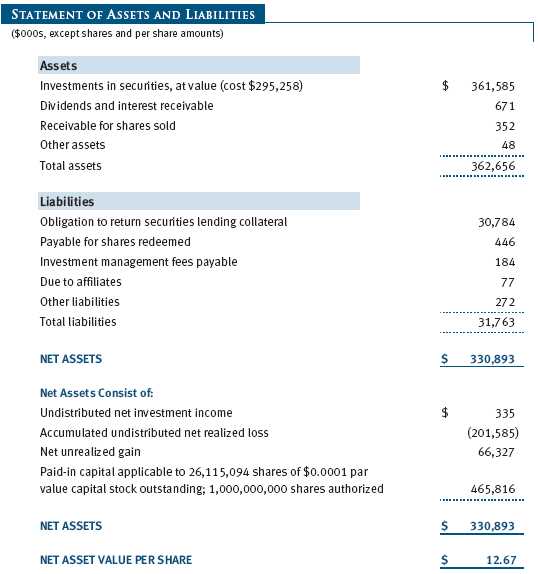

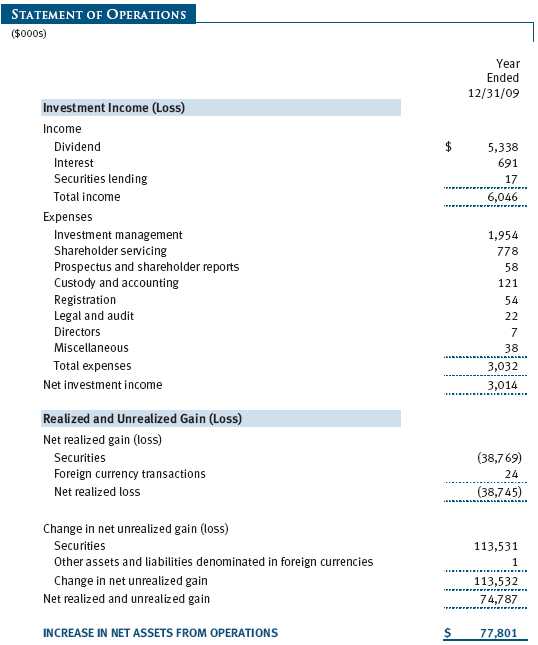

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price Financial Services Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on September 30, 1996. The fund seeks long-term growth of capital and a modest level of income.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of the securities. Further, fund management believes that no events have occurred between December 31, 2009, the date of this report, and February 25, 2010, the date of issuance of the financial statements, that require adjustment of, or disclosure in, the accompanying financial statements.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid annually. Capital gain distributions, if any, are generally declared and paid by the fund, annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $15,000 for the year ended December 31, 2009. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

New Accounting Pronouncement On January 1, 2009, the fund adopted new accounting guidance that requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance, and cash flows. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Debt securities are generally traded in the OTC market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

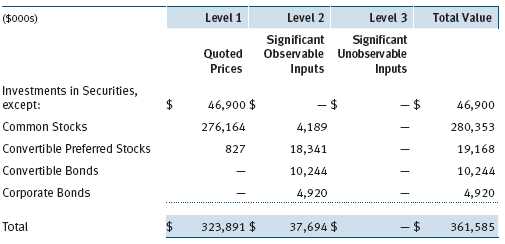

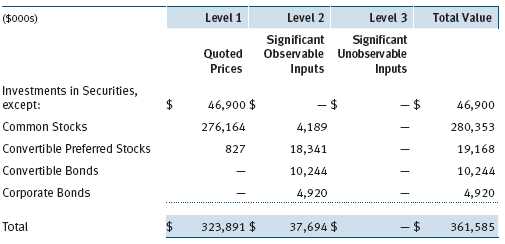

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2009:

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Cash collateral is invested by the fund’s lending agent(s) in accordance with investment guidelines approved by fund management. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. On December 31, 2009, the value of loaned securities was $29,583,000; aggregate collateral received included U.S. government securities valued at $4,000.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $235,704,000 and $246,531,000, respectively, for the year ended December 31, 2009.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after filing of the tax return but could be longer in certain circumstances.

Reclassifications between income and gain relate primarily to per share rounding of distributions. For the year ended December 31, 2009, the following reclassifications were recorded to reflect tax character; there was no impact on results of operations or net assets:

Distributions during the years ended December 31, 2009 and December 31, 2008, totaled $3,124,000 and $6,898,000, respectively, and were characterized as ordinary income for tax purposes. At December 31, 2009, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. The fund’s unused capital loss carryforwards as of December 31, 2009, expire: $119,942,000 in fiscal 2016, and $60,423,000 in fiscal 2017.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.35% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2009, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the year ended December 31, 2009, expenses incurred pursuant to these service agreements were $74,000 for Price Associates; $453,000 for T. Rowe Price Services, Inc.; and $53,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2009, the fund was charged $37,000 for shareholder servicing costs related to the college savings plans, of which $25,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2009, approximately 4% of the outstanding shares of the fund were held by college savings plans.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of December 31, 2009, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 225,117 shares of the fund, representing 1% of the fund’s net assets.

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

To the Board of Directors and Shareholders of

T. Rowe Price Financial Services Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Financial Services Fund, Inc. (the “Fund”) at December 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2009 by correspondence with the custodian, and confirmation of the underlying fund by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 25, 2010

| TAX INFORMATION (UNAUDITED) FOR THE TAX YEAR ENDED 12/31/09 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $260,000 from short-term capital gains.

For taxable non-corporate shareholders, $3,059,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $3,059,000 of the fund’s income qualifies for the dividends-received deduction.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| ABOUT THE FUND’S DIRECTORS AND OFFICERS |

Your fund is governed by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of Board members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and T. Rowe Price International, Inc. (T. Rowe Price International); “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the directors and is available without charge by calling a T. Rowe Price representative at 1-800-225-5132.

| Independent Directors | |

| |

| Name | |

| (Year of Birth) | Principal Occupation(s) During Past Five Years and Directorships of |

| Year Elected* | Other Public Companies |

| | |

| William R. Brody, M.D., Ph.D. | President and Trustee, Salk Institute for Biological Studies (2009 to |

| (1944) | present); Director, Novartis, Inc. (2009 to present); Director, IBM |

| 2009 | (2007 to present); President and Trustee, Johns Hopkins University |

| | (1996 to 2009); Chairman of Executive Committee and Trustee, |

| | Johns Hopkins Health System (1996 to 2009) |

| | |

| Jeremiah E. Casey | Director, National Life Insurance (2001 to 2005); Director, The Rouse |

| (1940) | Company, real estate developers (1990 to 2004) |

| 2005 | |

| | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 to |

| (1945) | present); Director, Under Armour (2008 to present); Director, Vornado |

| 2001 | Real Estate Investment Trust (2004 to present); Director, Mercantile |

| | Bankshares (2002 to 2007); Member, Advisory Board, Deutsche |

| | Bank North America (2004 to present); Director, Chairman of the |

| | Board, and Chief Executive Officer, The Rouse Company, real estate |

| | developers (1997 to 2004) |

| | |

| Donald W. Dick, Jr. | Principal, EuroCapital Advisors, LLC, an acquisition and management |

| (1943) | advisory firm (1995 to present) |

| 1996 | |

| | |

| Karen N. Horn | Director, Eli Lilly and Company (1987 to present); Director, Simon |

| (1943) | Property Group (2004 to present); Director, Norfolk Southern (2008 |

| 2003 | to present); Director, Georgia Pacific (2004 to 2005) |

| | |

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) |

| (1941) | |

| 2005 | |

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate invest- |

| (1946) | ment company (1991 to present); Partner, Blackstone Real Estate |

| 2001 | Advisors, L.P. (1992 to present) |

| | |

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy (2008 |

| (1957) | to present); Managing Director, The Goldman Sachs Group, Inc. |

| 2009 | (1984 to 2008) |

| |

| *Each independent director oversees 124 T. Rowe Price portfolios and serves until retirement, resignation, |

| or election of a successor. | |

| Inside Directors | |

| |

| Name | |

| (Year of Birth) | |

| Year Elected* | |

| [Number of T. Rowe Price | Principal Occupation(s) During Past Five Years and Directorships of |

| Portfolios Overseen] | Other Public Companies |

| | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | Chairman of the Board, Director, and President, T. Rowe Price |

| [124] | Investment Services, Inc.; Chairman of the Board and Director, |

| | T. Rowe Price Global Asset Management Limited, T. Rowe Price |

| | Global Investment Services Limited, T. Rowe Price Retirement |

| | Plan Services, Inc., T. Rowe Price Savings Bank, and T. Rowe Price |

| | Services, Inc.; Director, T. Rowe Price International, Inc.; Chief |

| | Executive Officer, Chairman of the Board, Director, and President, |

| | T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | |

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice |

| 2006 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price |

| [69] | Trust Company |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | |

| |

| Name (Date of Birth) | |

| Position Held With Financial | |

| Services Fund | Principal Occupation(s) |

| | |

| Jeffrey W. Arricale, CPA (1971) | Vice President, T. Rowe Price and T. Rowe Price |

| President | Group, Inc. |

| | |

| Anna M. Dopkin, CFA (1967) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., and T. Rowe Price Trust Company |

| | |

| Roger L. Fiery III, CPA (1959) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Group, Inc., T. Rowe Price International, Inc., |

| | and T. Rowe Price Trust Company |

| | |

| Christopher T. Fortune (1973) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc.; formerly intern, Hillman Capital |

| | Management (to 2005) |

| | |

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | |

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Trust Company |

| | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly Partner, PricewaterhouseCoopers LLP |

| | (to 2007) |

| | |

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and |

| Secretary | T. Rowe Price Investment Services, Inc. |

| | |

| Ian C. McDonald (1971) | Vice President, T. Rowe Price; formerly |

| Vice President | Insurance Correspondent, The Wall Street |

| | Journal (to 2007); Staff Reporter, The Wall |

| | Street Journal (to 2006) |

| | |

| Michael J. McGonigle (1966) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Hwee Jan Ng, CFA (1966) | Vice President, T. Rowe Price Group, Inc., and |

| Vice President | T. Rowe Price International, Inc.; formerly Vice |

| | President of Equity Research, Merrill Lynch |

| | Investment Managers (Singapore) (to 2005) |

| David Oestreicher (1967) | Director and Vice President, T. Rowe Price |

| Vice President | Investment Services, Inc., T. Rowe Price Trust |

| | Company, and T. Rowe Price Services, Inc.; Vice |

| | President, T. Rowe Price, T. Rowe Price Global |

| | Asset Management Limited, T. Rowe Price |

| | Global Investment Services Limited, T. Rowe |

| | Price Group, Inc., T. Rowe Price International, |

| | Inc., and T. Rowe Price Retirement Plan |

| | Services, Inc. |

| | |

| Jason B. Polun, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc.; formerly Vice President, Wellington |

| | Management LLP (to 2006); student, The |

| | Wharton Business School, University of |

| | Pennsylvania (to 2004) |

| | |

| Frederick A. Rizzo (1969) | Vice President, T. Rowe Price Group, Inc., and |

| Vice President | T. Rowe Price International, Inc.; formerly |

| | Analyst, F&C Asset Management (London) (to |

| | 2006); Senior Equity Analyst, Citigroup (London) |

| | (to 2004) |

| | |

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | |

| Gabriel Solomon (1977) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc. |

| | |

| Mitchell J.K. Todd (1974) | Vice President, T. Rowe Price Group, Inc., and |

| Vice President | T. Rowe Price International, Inc. |

| | |

| Eric L. Veiel, CFA (1972) | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | Group, Inc.; formerly Senior Equity Analyst, |

| | Wachovia Securities (to 2005) |

| | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price |

| Vice President | |

| | |

| Tamara P. Wiggs (1979) | Vice President, T. Rowe Price; formerly Vice |

| Vice President | President, Institutional Equity Trading, Merrill |

| | Lynch & Co., Inc. (to 2007) |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for |

| at least five years. | |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed to the registrant for the last two fiscal years for professional services rendered by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,879,000 and $1,922,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Financial Services Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | February 25, 2010 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | February 25, 2010 |