Supplemental Financial Information Fourth Quarter 2018 Unaudited www.ironmountain.com

Safe Harbor Statement Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws and is subject to the safe-harbor created by such Act. Forward-looking statements include, but are not limited to, our financial performance outlook and statements concerning our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations, such as our expectations for 2019, our 2020 plan, trends in our business and expected shifts in customer behavior, and statements about our investment and other goals. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors. When we use words such as "believes," "expects," "anticipates," "estimates" or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) our ability to remain qualified for taxation as a real estate investment trust for U.S. federal income tax purposes ("REIT"); (ii) the adoption of alternative technologies and shifts by our customers to storage of data through non-paper based technologies; (iii) changes in customer preferences and demand for our storage and information management services; (iv) the cost to comply with current and future laws, regulations and customer demands relating to data security and privacy issues, as well as fire and safety standards; (v) the impact of litigation or disputes that may arise in connection with incidents in which we fail to protect our customers' information or our internal records or IT systems and the impact of such incidents on our reputation and ability to compete; (vi) changes in the price for our storage and information management services relative to the cost of providing such storage and information management services; (vii) changes in the political and economic environments in the countries in which our international subsidiaries operate and changes in the global political climate; (viii) our ability or inability to manage growth, expand internationally, complete acquisitions on satisfactory terms, to close pending acquisitions and to integrate acquired companies efficiently; (ix) changes in the amount of our growth and maintenance capital expenditures and our ability to invest according to plan; (x) our ability to comply with our existing debt obligations and restrictions in our debt instruments or to obtain additional financing to meet our working capital needs; (xi) the impact of service interruptions or equipment damage and the cost of power on our data center operations; (xii) changes in the cost of our debt; (xiii) the impact of alternative, more attractive investments on dividends; (xiv) the cost or potential liabilities associated with real estate necessary for our business; (xv) the performance of business partners upon whom we depend for technical assistance or management expertise outside the United States; (xvi) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently contemplated; and (xvii) other risks described more fully in our filings with the Securities and Exchange Commission, including under the caption “Risk Factors” in our periodic reports, or incorporated therein. You should not rely upon forward-looking statements except as statements of our present intentions and of our present expectations, which may or may not occur. You should read these cautionary statements as being applicable to all forward-looking statements wherever they appear. Except as required by law, we undertake no obligation to release publicly the result of any revision to these forward- looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Reconciliation of Non-GAAP Measures: Throughout this presentation, Iron Mountain will discuss (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO Nareit”), (4) FFO (Normalized) and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and their definitions are included later in this document (see Table of Contents). Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition property, plant and equipment (including of real estate) and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. www.ironmountain.com Selected metric definitions are available in the Appendix 2

Table of Contents Section I - Company Profile 4 Section II - Financial Highlights and Guidance 5 - 8 Section III - Operating Metrics 9 - 12 Section IV - Balance Sheets, Statements of Operations and Reconciliations 13 - 18 Section V - Storage Net Operating Income and EBITDA, and Service Business EBITDA 19 - 21 Section VI - Real Estate Metrics and Records Management Customer Data 22 - 27 Section VII - Data Center Customer and Portfolio Metrics 28 Section VIII - Debt Schedule and Capitalization 29 - 30 Section IX - Capital Expenditures and Investments 31 - 33 Section X - Components of Value 34 Section XI - Appendix and Definitions 35 - 46 All figures except per share, Megawatts (MW) and facility counts in 000s unless noted All figures in reported dollars unless noted Figures may not foot due to rounding Investor Relations Contacts: Greer Aviv, 617-535-2887 Anjaneya Singh, 617-535-8577 Senior Vice President, Investor Relations Director, Investor Relations greer.aviv@ironmountain.com anjaneya.singh@ironmountain.com www.ironmountain.com Selected metric definitions are available in the Appendix 3

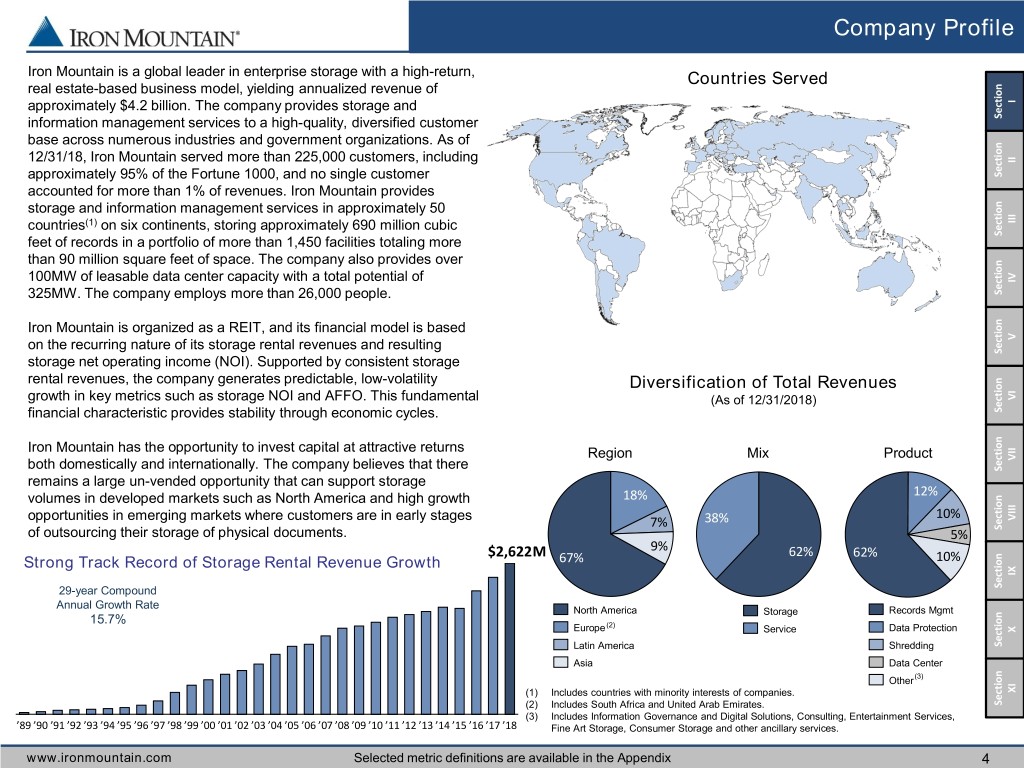

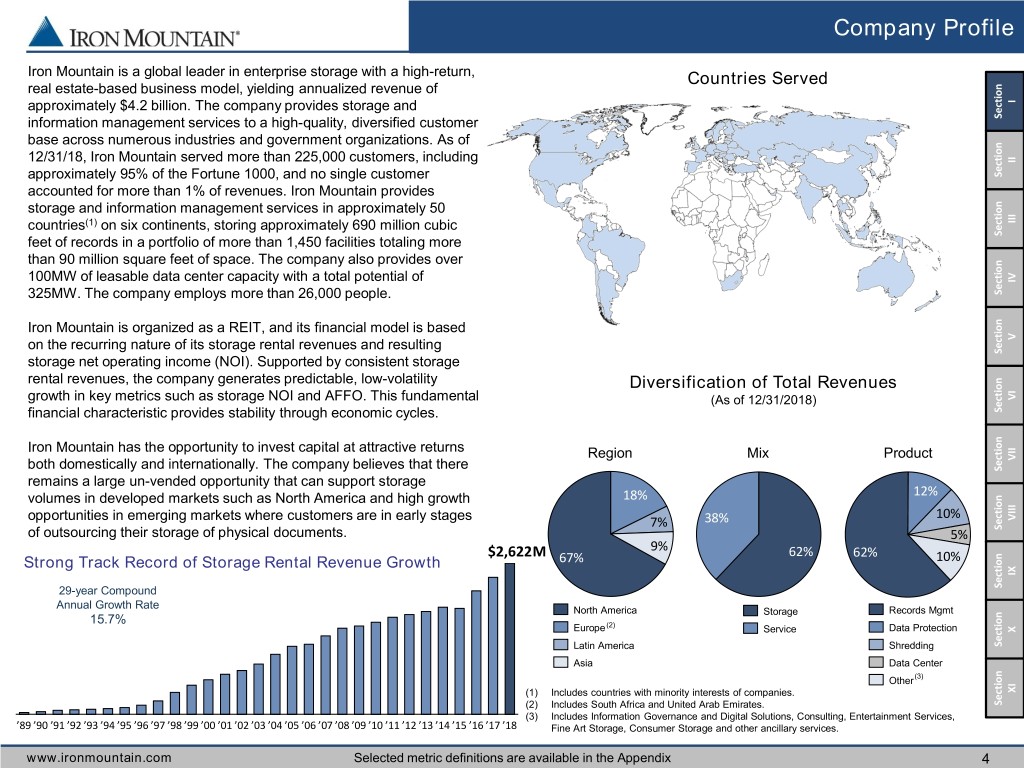

Company Profile Iron Mountain is a global leader in enterprise storage with a high-return, Countries Served real estate-based business model, yielding annualized revenue of approximately $4.2 billion. The company provides storage and I information management services to a high-quality, diversified customer Section base across numerous industries and government organizations. As of 12/31/18, Iron Mountain served more than 225,000 customers, including II approximately 95% of the Fortune 1000, and no single customer Section accounted for more than 1% of revenues. Iron Mountain provides storage and information management services in approximately 50 countries(1) on six continents, storing approximately 690 million cubic III feet of records in a portfolio of more than 1,450 facilities totaling more Section than 90 million square feet of space. The company also provides over 100MW of leasable data center capacity with a total potential of IV 325MW. The company employs more than 26,000 people. Section Iron Mountain is organized as a REIT, and its financial model is based on the recurring nature of its storage rental revenues and resulting V Section storage net operating income (NOI). Supported by consistent storage rental revenues, the company generates predictable, low-volatility Diversification of Total Revenues growth in key metrics such as storage NOI and AFFO. This fundamental (As of 12/31/2018) VI financial characteristic provides stability through economic cycles. Section Iron Mountain has the opportunity to invest capital at attractive returns Region Mix Product VII both domestically and internationally. The company believes that there Section remains a large un-vended opportunity that can support storage volumes in developed markets such as North America and high growth 18% 12% opportunities in emerging markets where customers are in early stages 38% 10% VIII 7% Section of outsourcing their storage of physical documents. 5% $2,622M 9% 62% 62% Strong Track Record of Storage Rental Revenue Growth 67% 10% IX 29-year Compound Section Annual Growth Rate North America Storage Records Mgmt 15.7% (2) Europe Service Data Protection X Latin America Shredding Section Asia Data Center Other (3) (1) Includes countries with minority interests of companies. XI (2) Includes South Africa and United Arab Emirates. Section (3) Includes Information Governance and Digital Solutions, Consulting, Entertainment Services, ’89 ’90 ’91 ’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’11 ’12 ’13 ’14 ’15 ’16 ’17 ’18 Fine Art Storage, Consumer Storage and other ancillary services. www.ironmountain.com Selected metric definitions are available in the Appendix 4

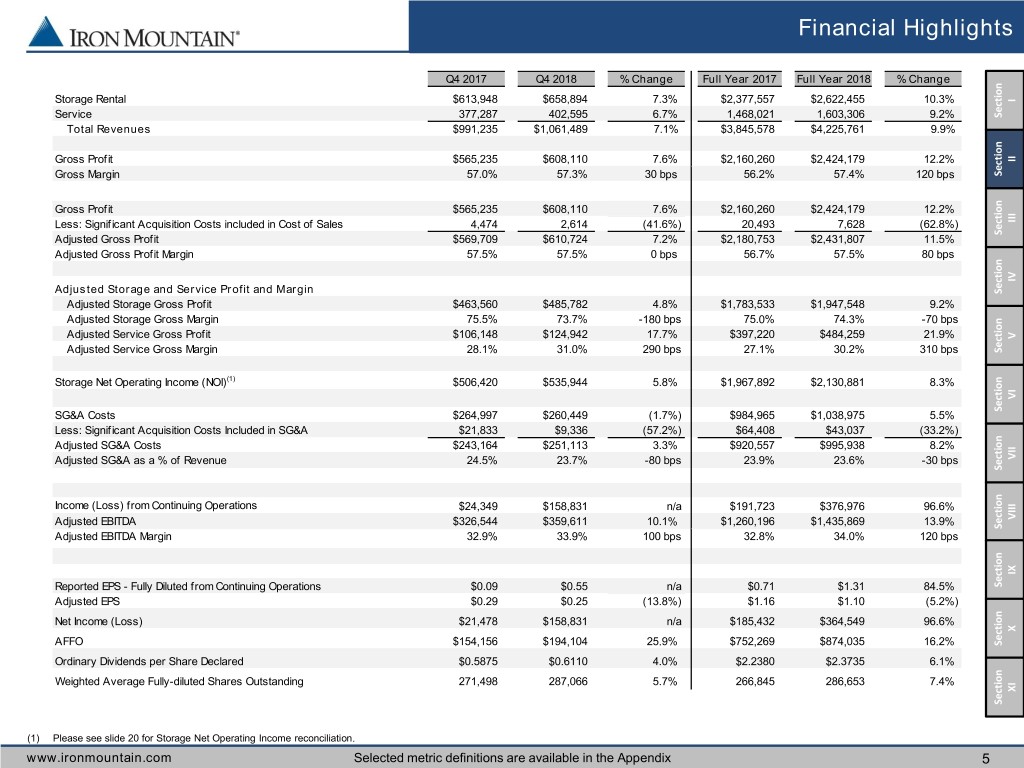

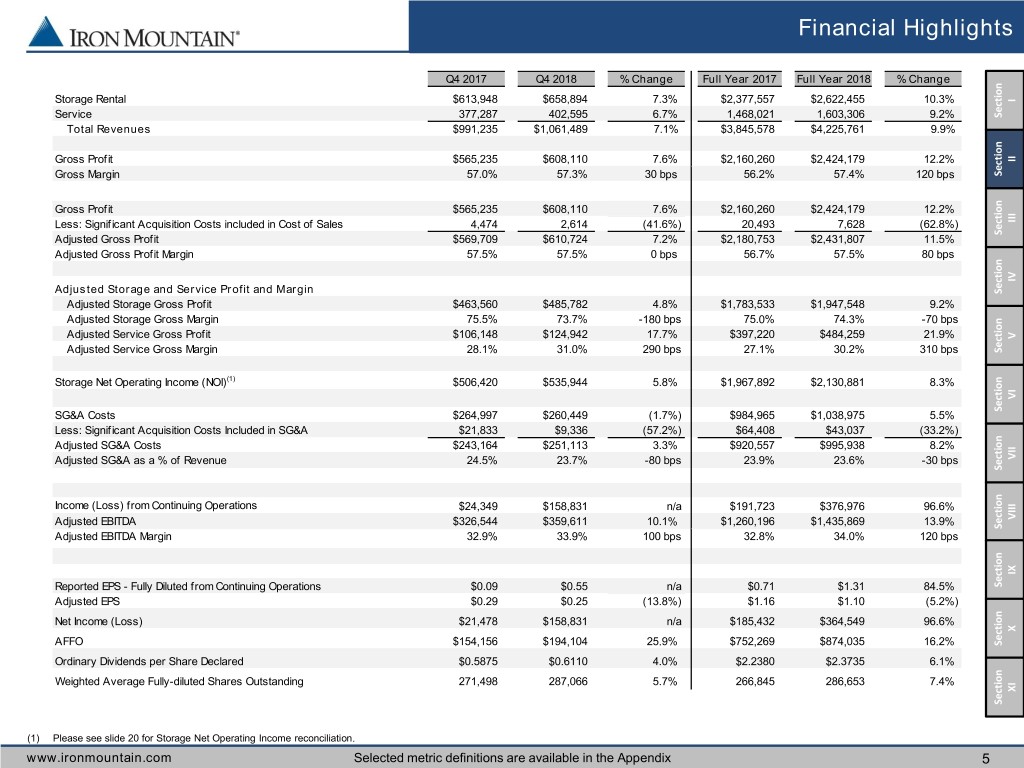

Financial Highlights Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Storage Rental $613,948 $658,894 7.3% $2,377,557 $2,622,455 10.3% I Service 377,287 402,595 6.7% 1,468,021 1,603,306 9.2% Section Total Revenues $991,235 $1,061,489 7.1% $3,845,578 $4,225,761 9.9% Gross Profit $565,235 $608,110 7.6% $2,160,260 $2,424,179 12.2% II Gross Margin 57.0% 57.3% 30 bps 56.2% 57.4% 120 bps Section Gross Profit $565,235 $608,110 7.6% $2,160,260 $2,424,179 12.2% Less: Significant Acquisition Costs included in Cost of Sales 4,474 2,614 (41.6%) 20,493 7,628 (62.8%) III Adjusted Gross Profit $569,709 $610,724 7.2% $2,180,753 $2,431,807 11.5% Section Adjusted Gross Profit Margin 57.5% 57.5% 0 bps 56.7% 57.5% 80 bps IV Adjusted Storage and Service Profit and Margin Section Adjusted Storage Gross Profit $463,560 $485,782 4.8% $1,783,533 $1,947,548 9.2% Adjusted Storage Gross Margin 75.5% 73.7% -180 bps 75.0% 74.3% -70 bps Adjusted Service Gross Profit $106,148 $124,942 17.7% $397,220 $484,259 21.9% V Adjusted Service Gross Margin 28.1% 31.0% 290 bps 27.1% 30.2% 310 bps Section Storage Net Operating Income (NOI)(1) $506,420 $535,944 5.8% $1,967,892 $2,130,881 8.3% VI SG&A Costs $264,997 $260,449 (1.7%) $984,965 $1,038,975 5.5% Section Less: Significant Acquisition Costs Included in SG&A $21,833 $9,336 (57.2%) $64,408 $43,037 (33.2%) Adjusted SG&A Costs $243,164 $251,113 3.3% $920,557 $995,938 8.2% Adjusted SG&A as a % of Revenue 24.5% 23.7% -80 bps 23.9% 23.6% -30 bps VII Section Income (Loss) from Continuing Operations $24,349 $158,831 n/a $191,723 $376,976 96.6% Adjusted EBITDA $326,544 $359,611 10.1% $1,260,196 $1,435,869 13.9% VIII Section Section Adjusted EBITDA Margin 32.9% 33.9% 100 bps 32.8% 34.0% 120 bps IX Reported EPS - Fully Diluted from Continuing Operations $0.09 $0.55 n/a $0.71 $1.31 84.5% Section Adjusted EPS $0.29 $0.25 (13.8%) $1.16 $1.10 (5.2%) Net Income (Loss) $21,478 $158,831 n/a $185,432 $364,549 96.6% X AFFO $154,156 $194,104 25.9% $752,269 $874,035 16.2% Section Ordinary Dividends per Share Declared $0.5875 $0.6110 4.0% $2.2380 $2.3735 6.1% Weighted Average Fully-diluted Shares Outstanding 271,498 287,066 5.7% 266,845 286,653 7.4% XI Section (1) Please see slide 20 for Storage Net Operating Income reconciliation. www.ironmountain.com Selected metric definitions are available in the Appendix 5

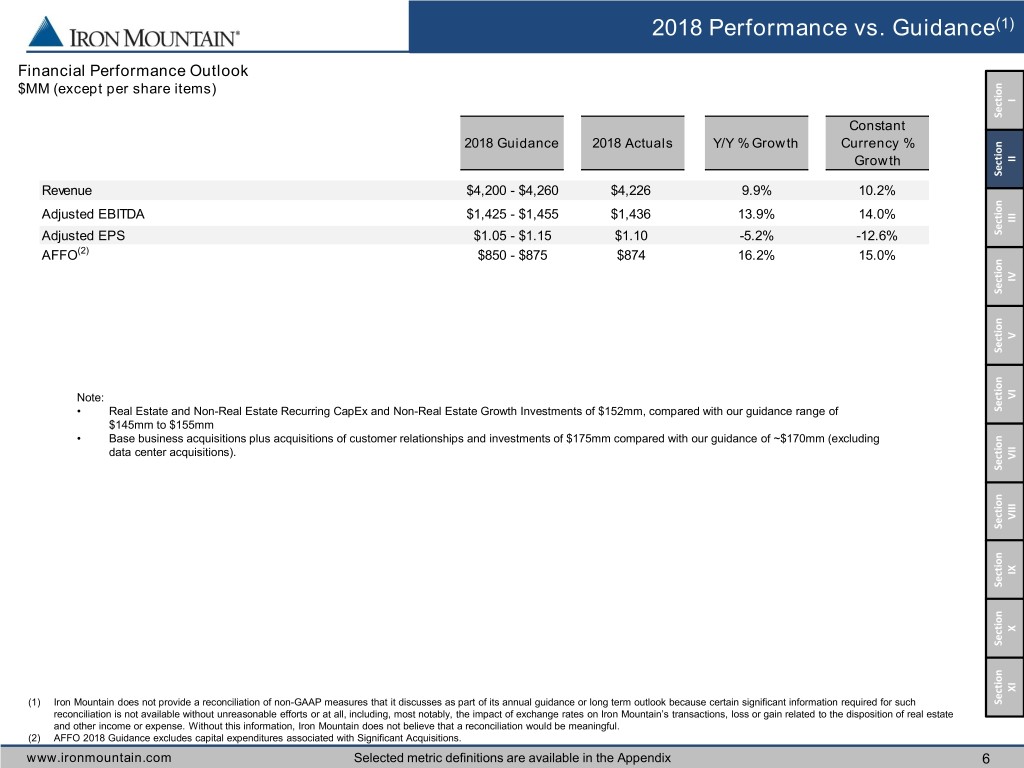

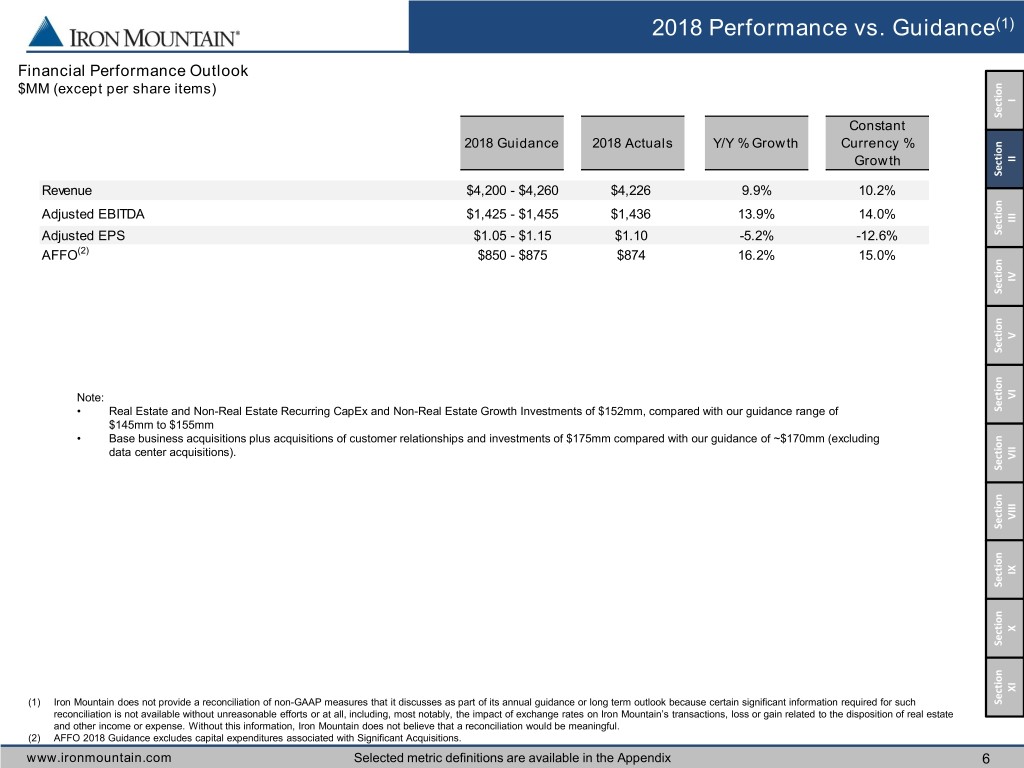

2018 Performance vs. Guidance(1) Financial Performance Outlook $MM (except per share items) I Section Constant 2018 Guidance 2018 Actuals Y/Y % Growth Currency % Growth II Section Revenue $4,200 - $4,260 $4,226 9.9% 10.2% Adjusted EBITDA $1,425 - $1,455 $1,436 13.9% 14.0% III Adjusted EPS $1.05 - $1.15 $1.10 -5.2% -12.6% Section AFFO(2) $850 - $875 $874 16.2% 15.0% IV Section V Section Note: VI • Real Estate and Non-Real Estate Recurring CapEx and Non-Real Estate Growth Investments of $152mm, compared with our guidance range of Section $145mm to $155mm • Base business acquisitions plus acquisitions of customer relationships and investments of $175mm compared with our guidance of ~$170mm (excluding data center acquisitions). VII Section VIII Section Section IX Section X Section XI (1) Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such Section reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. (2) AFFO 2018 Guidance excludes capital expenditures associated with Significant Acquisitions. www.ironmountain.com Selected metric definitions are available in the Appendix 6

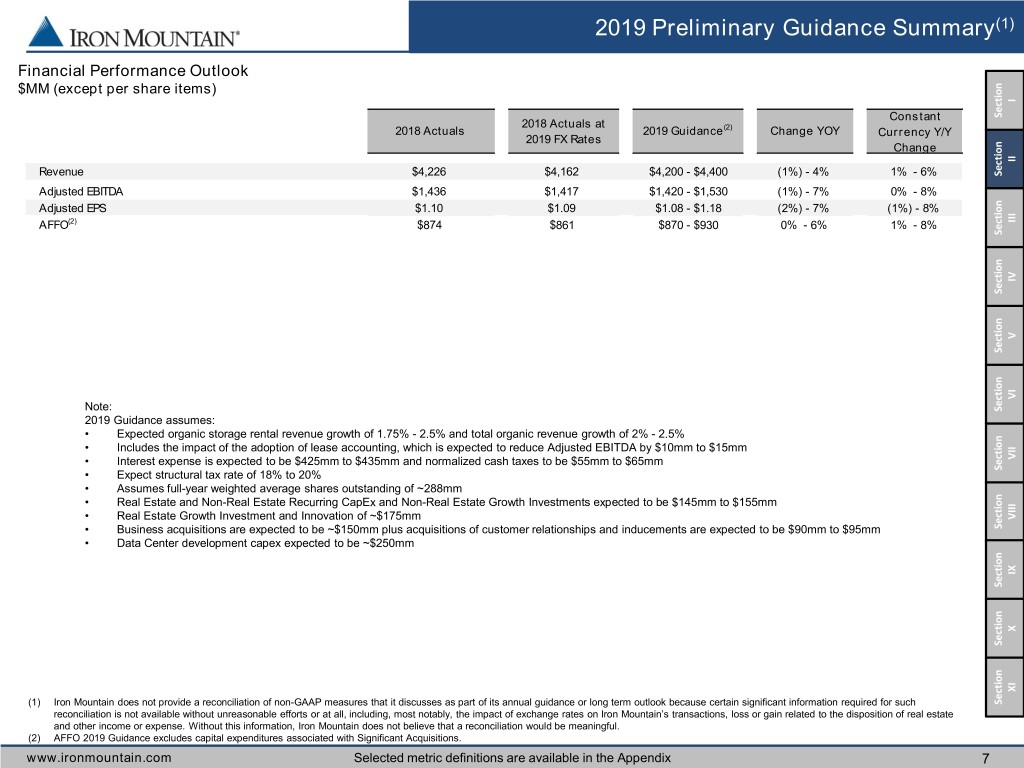

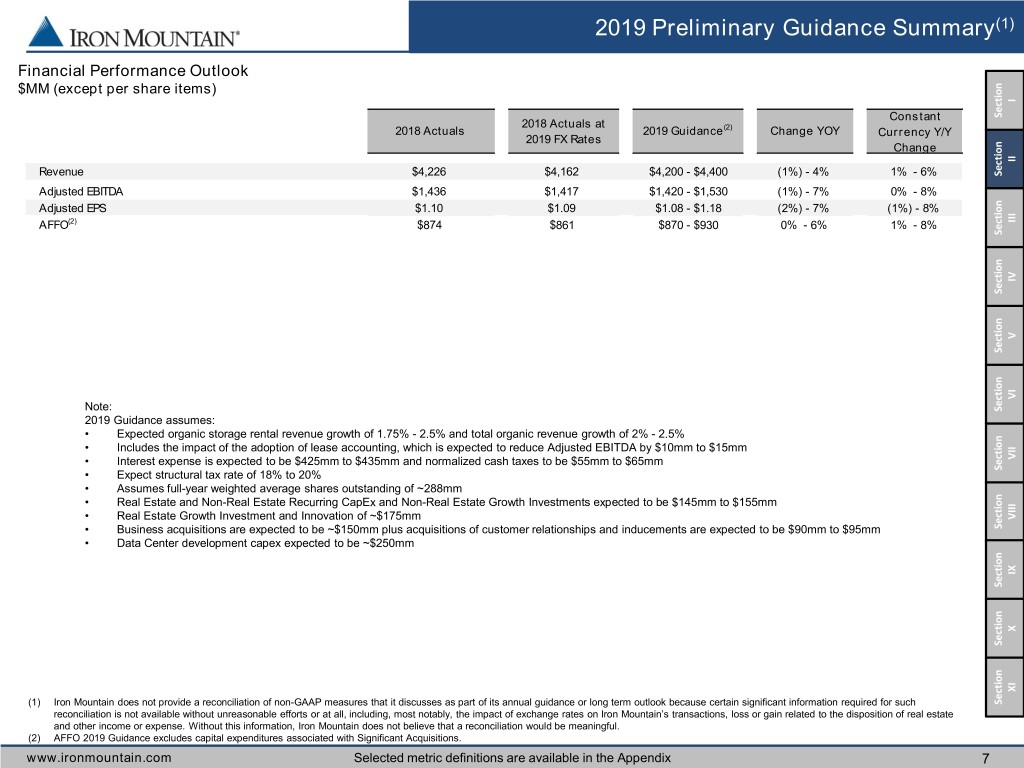

2019 Preliminary Guidance Summary(1) Financial Performance Outlook $MM (except per share items) I Constant Section 2018 Actuals at 2018 Actuals 2019 Guidance(2) Change YOY Currency Y/Y 2019 FX Rates Change II Revenue $4,226 $4,162 $4,200 - $4,400 (1%) - 4% 1% - 6% Section Adjusted EBITDA $1,436 $1,417 $1,420 - $1,530 (1%) - 7% 0% - 8% Adjusted EPS $1.10 $1.09 $1.08 - $1.18 (2%) - 7% (1%) - 8% AFFO(2) $874 $861 $870 - $930 0% - 6% 1% - 8% III Section IV Section V Section VI Note: Section 2019 Guidance assumes: • Expected organic storage rental revenue growth of 1.75% - 2.5% and total organic revenue growth of 2% - 2.5% • Includes the impact of the adoption of lease accounting, which is expected to reduce Adjusted EBITDA by $10mm to $15mm • Interest expense is expected to be $425mm to $435mm and normalized cash taxes to be $55mm to $65mm VII • Expect structural tax rate of 18% to 20% Section • Assumes full-year weighted average shares outstanding of ~288mm • Real Estate and Non-Real Estate Recurring CapEx and Non-Real Estate Growth Investments expected to be $145mm to $155mm • Real Estate Growth Investment and Innovation of ~$175mm VIII • Business acquisitions are expected to be ~$150mm plus acquisitions of customer relationships and inducements are expected to be $90mm to $95mm Section • Data Center development capex expected to be ~$250mm IX Section X Section XI (1) Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such Section reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. (2) AFFO 2019 Guidance excludes capital expenditures associated with Significant Acquisitions. www.ironmountain.com Selected metric definitions are available in the Appendix 7

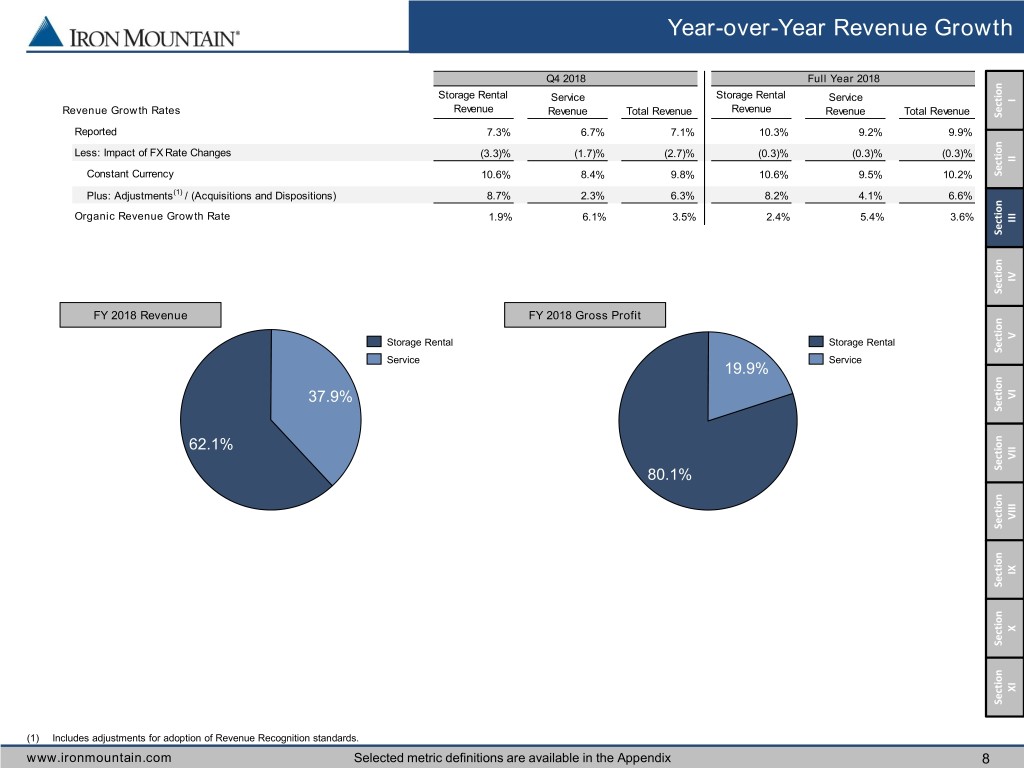

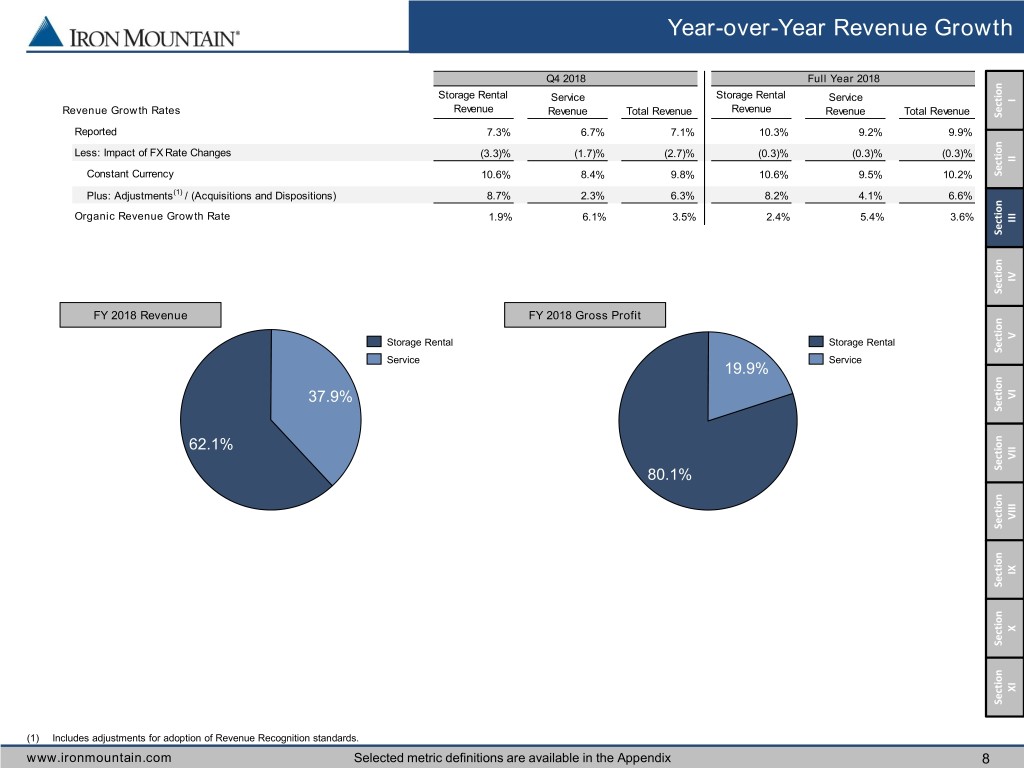

Year-over-Year Revenue Growth Q4 2018 Full Year 2018 Storage Rental Storage Rental Service Service I Revenue Growth Rates Revenue Revenue Total Revenue Revenue Revenue Total Revenue Section Reported 7.3% 6.7% 7.1% 10.3% 9.2% 9.9% Less: Impact of FX Rate Changes (3.3)% (1.7)% (2.7)% (0.3)% (0.3)% (0.3)% II Constant Currency 10.6% 8.4% 9.8% 10.6% 9.5% 10.2% Section Plus: Adjustments(1) / (Acquisitions and Dispositions) 8.7% 2.3% 6.3% 8.2% 4.1% 6.6% Organic Revenue Growth Rate 1.9% 6.1% 3.5% 2.4% 5.4% 3.6% III Section IV Section FY 2018 Revenue FY 2018 Gross Profit Storage Rental Storage Rental V Section Service Service 19.9% 37.9% VI Section 62.1% VII 80.1% Section VIII Section Section IX Section X Section XI Section (1) Includes adjustments for adoption of Revenue Recognition standards. www.ironmountain.com Selected metric definitions are available in the Appendix 8

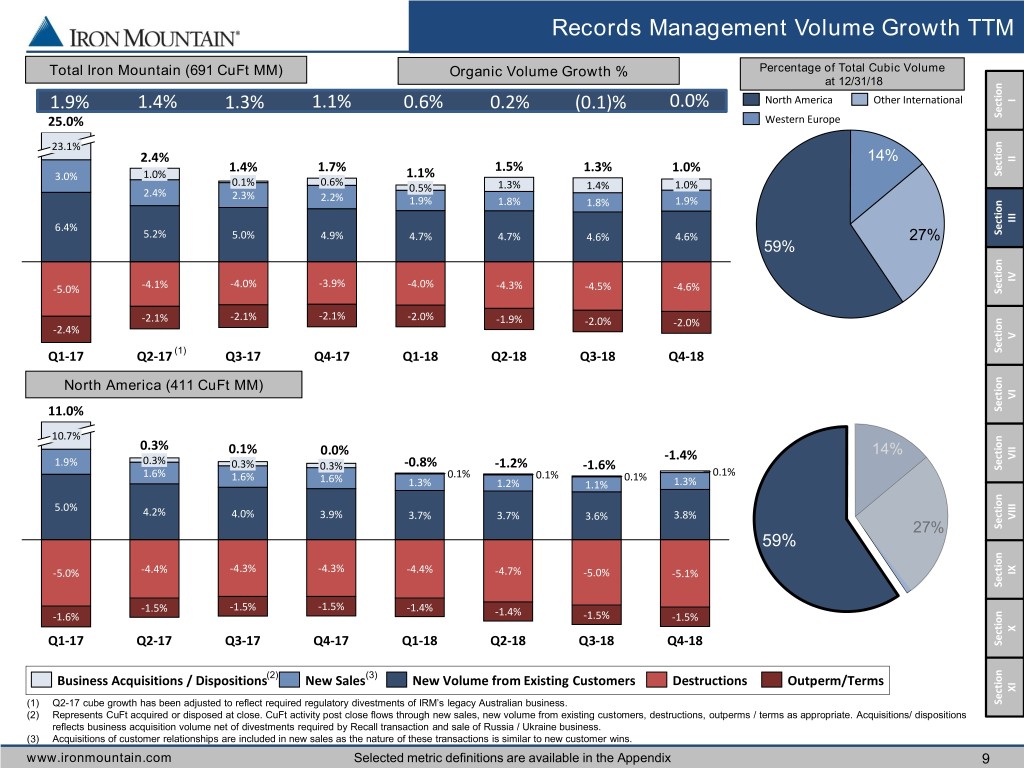

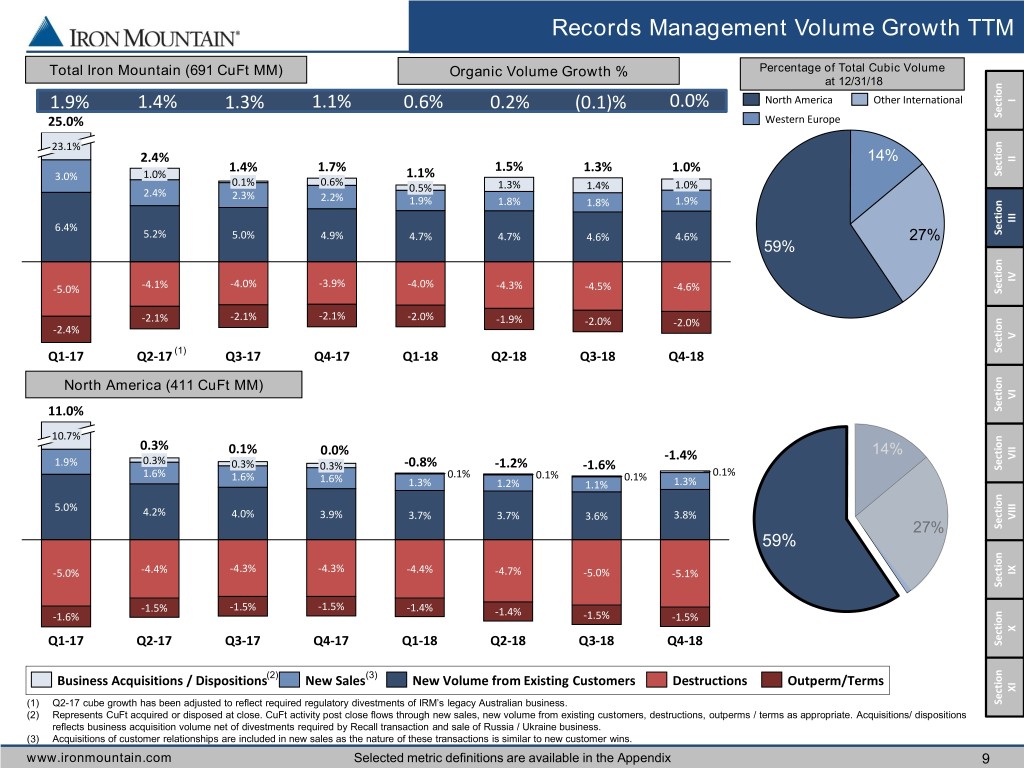

Records Management Volume Growth TTM Total Iron Mountain (691 CuFt MM) Organic Volume Growth % Percentage of Total Cubic Volume at 12/31/18 1.9% 1.4% 1.3% 1.1% 0.6% 0.2% (0.1)% 0.0% North America Other International I 25.0% Western Europe Section 23.1% 2.4% 14% II 1.4% 1.7% 1.5% 1.3% 1.0% 3.0% 1.0% 1.1% Section 0.1% 0.6% 0.5% 1.3% 1.4% 1.0% 2.4% 2.3% 2.2% 1.9% 1.8% 1.8% 1.9% III 6.4% 5.2% 5.0% 4.9% 4.7% 4.7% 4.6% 4.6% 27% Section 59% IV -4.1% -4.0% -3.9% -4.0% -4.3% -4.5% -4.6% -5.0% Section -2.1% -2.1% -2.0% -2.1% -1.9% -2.0% -2.0% -2.4% V Q1-17 Q2-17 (1) Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Section North America (411 CuFt MM) VI 11.0% Section 10.7% 0.3% 0.1% 0.0% 14% -1.4% VII 1.9% 0.3% -0.8% 0.3% 0.3% -1.2% Section -1.6% 0.1% 1.6% 1.6% 1.6% 0.1% 0.1% 0.1% 1.3% 1.2% 1.1% 1.3% 5.0% 4.2% 4.0% 3.9% 3.7% 3.7% 3.6% 3.8% VIII 27% Section 59% -5.0% -4.4% -4.3% -4.3% -4.4% -4.7% -5.0% -5.1% IX Section -1.5% -1.5% -1.5% -1.4% -1.6% -1.4% -1.5% -1.5% X Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Section Business Acquisitions / Dispositions(2) New Sales (3) New Volume from Existing Customers Destructions Outperm/Terms XI (1) Q2-17 cube growth has been adjusted to reflect required regulatory divestments of IRM’s legacy Australian business. Section (2) Represents CuFt acquired or disposed at close. CuFt activity post close flows through new sales, new volume from existing customers, destructions, outperms / terms as appropriate. Acquisitions/ dispositions reflects business acquisition volume net of divestments required by Recall transaction and sale of Russia / Ukraine business. (3) Acquisitions of customer relationships are included in new sales as the nature of these transactions is similar to new customer wins. www.ironmountain.com Selected metric definitions are available in the Appendix 9

Records Management Volume Growth TTM Percentage of Total Cubic Volume Western Europe (96 CuFt MM) at 12/31/18 49.2% I Section 11.7% 45.5% II 9.2% 14% 3.6% Section 2.0% 1.7% 5.7% 1.1% 0.5% 0.4% 0.8% 4.3% 4.0% III 3.9% 3.5% 3.1% 3.6% 3.2% Section 6.9% 5.1% 4.7% 27% 4.6% 4.4% 4.3% 4.1% 4.1% 59% IV -4.4% -4.0% -3.9% -4.2% -4.5% -4.6% -6.2% -4.8% Section -2.1% -2.3% -2.7% -2.8% -2.6% -2.4% -2.2% -2.6% V Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Section Other International (184 CuFt MM) 61.7% VI Section 54.6% 9.0% 9.0% 14% 5.4% 7.0% VII 6.0% Section 3.0% 4.3% 5.8% 5.2% 5.4% 1.8% 1.8% 3.8% 3.3% 3.0% 2.6% 2.4% 2.4% 2.5% 2.5% VIII 11.2% 27% Section 7.6% 7.8% 7.6% 7.3% 7.4% 7.2% 7.0% 59% -0.2% -1.4% IX -2.7% -2.8% -2.9% -3.1% -3.1% -3.2% -4.2% -2.8% Section -3.5% -3.2% -3.0% -2.9% -3.0% -3.1% -3.6% -5.3% X Q1-17 Q2-17 (1) Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Section Business Acquisitions/ Dispositions(2) New Sales (3) New Volume from Existing Customers Destructions Outperm/Terms XI (1) Q2-17 cube growth has been adjusted to reflect required regulatory divestments of IRM’s legacy Australian business. Section (2) Represents CuFt acquired or disposed at close. CuFt activity post close flows through new sales, new volume from existing customers, destructions, outperms / terms as appropriate. Acquisitions/ dispositions reflects business acquisition volume net of divestments required by Recall transaction and sale of Russia / Ukraine business. (3) Acquisitions of customer relationships are included in new sales as the nature of these transactions is similar to new customer wins. www.ironmountain.com Selected metric definitions are available in the Appendix 10

Quarterly Operating Performance(1) Q4 Results % Growth Impact of I Impact of FX Rate Constant Adjustments(1) and Organic Q4 2017 Q4 2018 Reported - = + = Section Changes Currency Acquisitions/ Growth By Reporting Segment Dispositions II NA Records and Information Management Business Section Storage Rental $309,322 $304,883 (1.4)% (0.3)% (1.1)% 1.9% 0.8% Service 210,263 227,372 8.1% (0.5)% 8.6% (0.3)% 8.3% Total Revenues $519,585 $532,255 2.4% (0.4)% 2.8% 1.1% 3.9% Adjusted EBITDA & Margin 228,978 44.1% 237,691 44.7% III NA Data Management Business Section Storage Rental $68,782 $67,360 (2.1)% (0.3)% (1.8)% 0.9% (0.9)% Service 31,117 29,161 (6.3)% (0.3)% (6.0)% (1.8)% (7.8)% Total Revenues $99,899 $96,521 (3.4)% (0.3)% (3.1)% 0.0% (3.1)% IV Adjusted EBITDA & Margin 56,173 56.2% 51,277 53.1% Section Western European Business (2) Storage Rental $79,091 $79,740 0.8% (3.0)% 3.8% (1.3)% 2.5% Service 49,665 47,945 (3.5)% (2.3)% (1.2)% 1.0% (0.2)% V Total Revenues $128,756 $127,685 (0.8)% (2.7)% 1.9% (0.5)% 1.4% Section Adjusted EBITDA & Margin 46,050 35.8% 48,793 38.2% Other International Business (2) Storage Rental $128,283 $126,080 (1.7)% (9.1)% 7.4% (3.3)% 4.1% VI Service 78,194 76,321 (2.4)% (10.1)% 7.7% (1.6)% 6.1% Section Total Revenues $206,477 $202,401 (2.0)% (9.5)% 7.5% (2.6)% 4.9% Adjusted EBITDA & Margin 55,675 27.0% 61,705 30.5% Global Data Center Business VII Storage Rental $12,289 $61,196 398.0% (4.8)% 402.8% (390.4)% 12.4% Section Service 573 2,909 407.7% (0.9)% 408.6% (408.1)% 0.5% Total Revenues $12,862 $64,105 398.4% (4.6)% 403.0% (391.1)% 11.9% Adjusted EBITDA & Margin 2,701 21.0% 26,584 41.5% Corporate and Other Business VIII Storage Rental $16,181 $19,634 21.3% (0.8)% 22.1% (16.3)% 5.8% Section Service 7,475 18,888 152.7% (3.0)% 155.7% (109.1)% 46.6% Total Revenues $23,656 $38,522 62.8% (2.1)% 64.9% (46.1)% 18.8% Adjusted EBITDA (63,033) (66,439) IX Total Section Storage Rental $613,948 $658,894 7.3% (2.6)% 9.9% (8.0)% 1.9% Service 377,288 402,595 6.7% (2.8)% 9.5% (3.4)% 6.1% Total Revenues $991,236 $1,061,489 7.1% (2.6)% 9.7% (6.2)% 3.5% X Adjusted EBITDA & Margin 326,544 32.9% 359,611 33.9% Section XI Section (1) Includes adjustments for adoption of Revenue Recognition standards. (2) Variances from Q4 2017 reported results due to reclassification of Information Governance and Digital Solutions business in Sweden from the Western European Business segment to the Other International Business segment. www.ironmountain.com Selected metric definitions are available in the Appendix 11

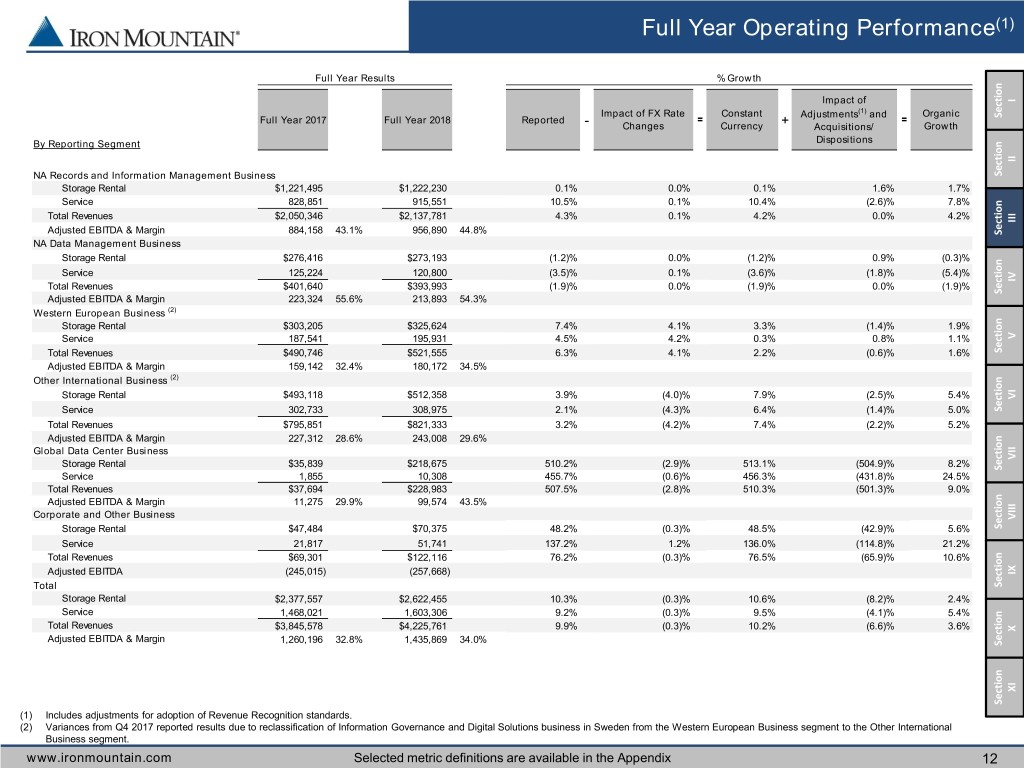

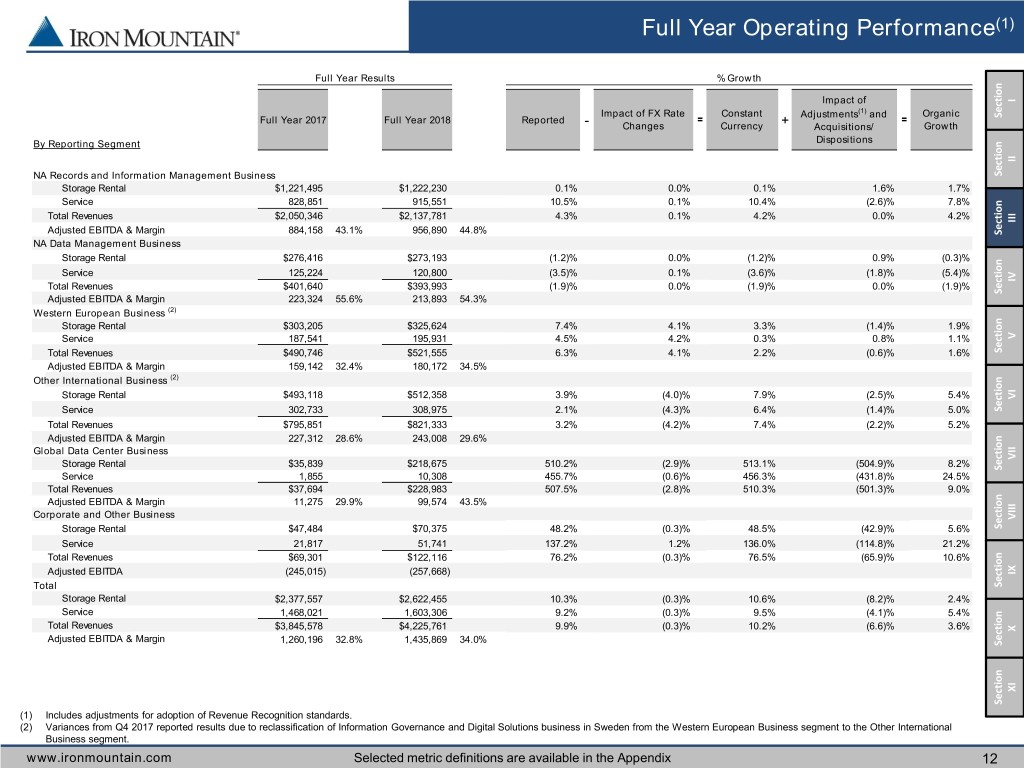

Full Year Operating Performance(1) Full Year Results % Growth Impact of I (1) Impact of FX Rate Constant Adjustments and Organic Section Full Year 2017 Full Year 2018 Reported = = - Changes Currency + Acquisitions/ Growth By Reporting Segment Dispositions II NA Records and Information Management Business Section Storage Rental $1,221,495 $1,222,230 0.1% 0.0% 0.1% 1.6% 1.7% Service 828,851 915,551 10.5% 0.1% 10.4% (2.6)% 7.8% Total Revenues $2,050,346 $2,137,781 4.3% 0.1% 4.2% 0.0% 4.2% III Adjusted EBITDA & Margin 884,158 43.1% 956,890 44.8% Section NA Data Management Business Storage Rental $276,416 $273,193 (1.2)% 0.0% (1.2)% 0.9% (0.3)% Service 125,224 120,800 (3.5)% 0.1% (3.6)% (1.8)% (5.4)% IV Total Revenues $401,640 $393,993 (1.9)% 0.0% (1.9)% 0.0% (1.9)% Section Adjusted EBITDA & Margin 223,324 55.6% 213,893 54.3% Western European Business (2) Storage Rental $303,205 $325,624 7.4% 4.1% 3.3% (1.4)% 1.9% Service 187,541 195,931 4.5% 4.2% 0.3% 0.8% 1.1% V Total Revenues $490,746 $521,555 6.3% 4.1% 2.2% (0.6)% 1.6% Section Adjusted EBITDA & Margin 159,142 32.4% 180,172 34.5% Other International Business (2) Storage Rental $493,118 $512,358 3.9% (4.0)% 7.9% (2.5)% 5.4% VI Service 302,733 308,975 2.1% (4.3)% 6.4% (1.4)% 5.0% Section Total Revenues $795,851 $821,333 3.2% (4.2)% 7.4% (2.2)% 5.2% Adjusted EBITDA & Margin 227,312 28.6% 243,008 29.6% Global Data Center Business Storage Rental $35,839 $218,675 510.2% (2.9)% 513.1% (504.9)% 8.2% VII Section Service 1,855 10,308 455.7% (0.6)% 456.3% (431.8)% 24.5% Total Revenues $37,694 $228,983 507.5% (2.8)% 510.3% (501.3)% 9.0% Adjusted EBITDA & Margin 11,275 29.9% 99,574 43.5% Corporate and Other Business VIII Storage Rental $47,484 $70,375 48.2% (0.3)% 48.5% (42.9)% 5.6% Section Service 21,817 51,741 137.2% 1.2% 136.0% (114.8)% 21.2% Total Revenues $69,301 $122,116 76.2% (0.3)% 76.5% (65.9)% 10.6% Adjusted EBITDA (245,015) (257,668) IX Total Section Storage Rental $2,377,557 $2,622,455 10.3% (0.3)% 10.6% (8.2)% 2.4% Service 1,468,021 1,603,306 9.2% (0.3)% 9.5% (4.1)% 5.4% Total Revenues $3,845,578 $4,225,761 9.9% (0.3)% 10.2% (6.6)% 3.6% X Adjusted EBITDA & Margin 1,260,196 32.8% 1,435,869 34.0% Section XI Section (1) Includes adjustments for adoption of Revenue Recognition standards. (2) Variances from Q4 2017 reported results due to reclassification of Information Governance and Digital Solutions business in Sweden from the Western European Business segment to the Other International Business segment. www.ironmountain.com Selected metric definitions are available in the Appendix 12

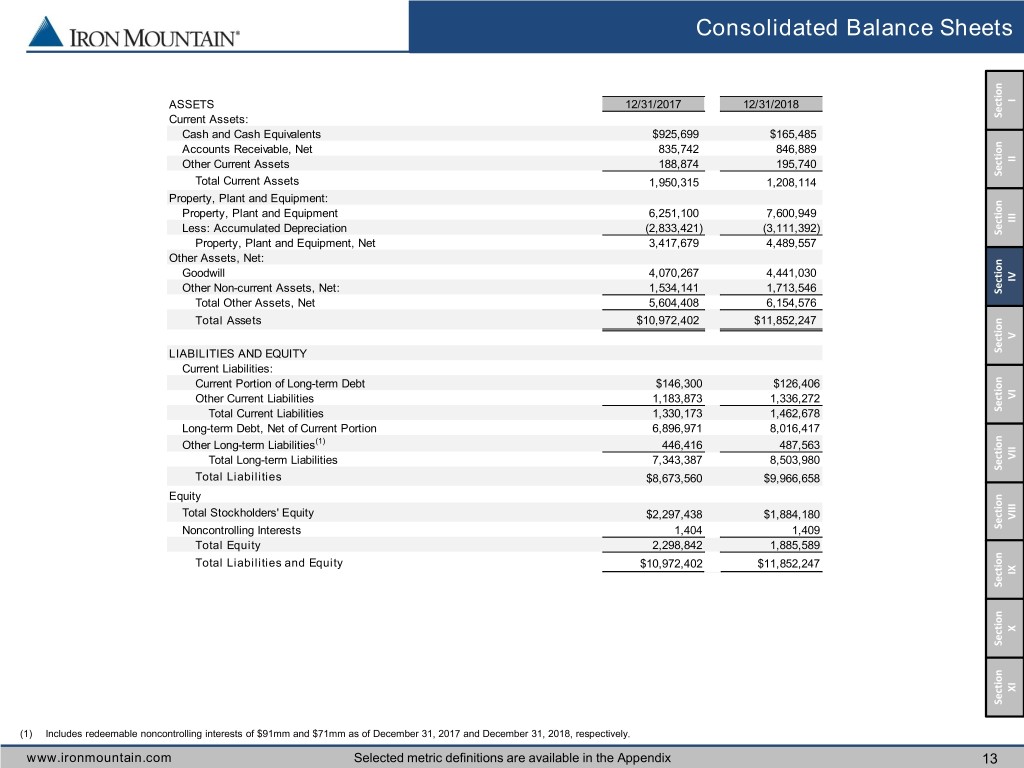

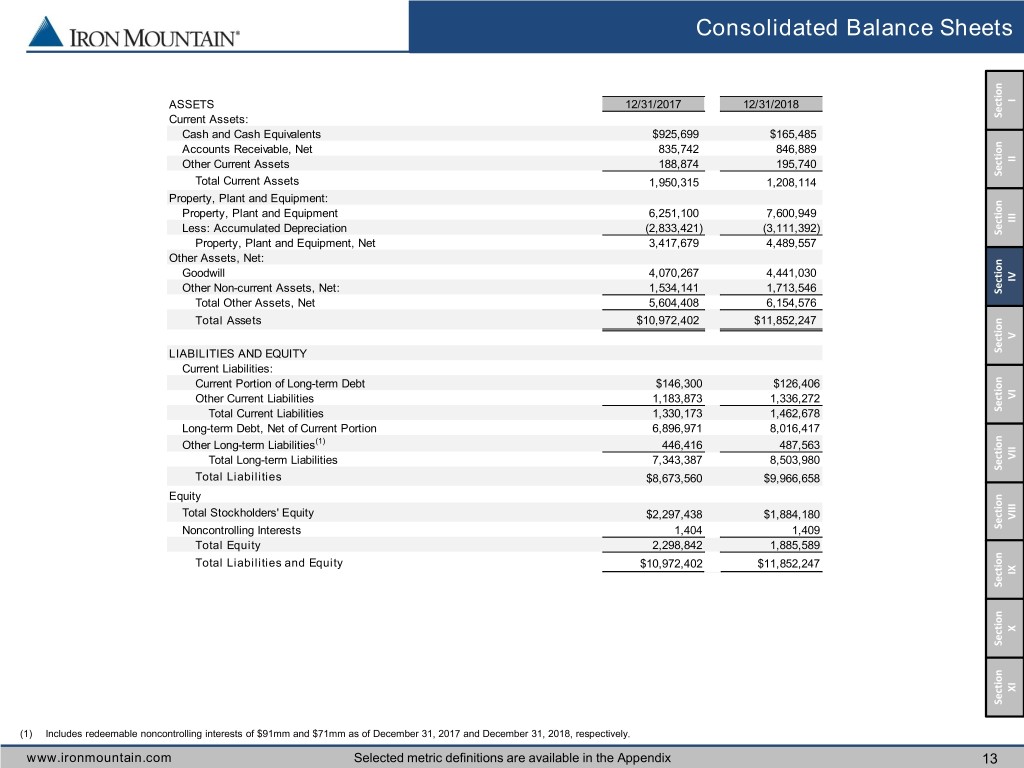

Consolidated Balance Sheets ASSETS 12/31/2017 12/31/2018 I Current Assets: Section Cash and Cash Equivalents $925,699 $165,485 Accounts Receivable, Net 835,742 846,889 Other Current Assets 188,874 195,740 II Section Total Current Assets 1,950,315 1,208,114 Property, Plant and Equipment: Property, Plant and Equipment 6,251,100 7,600,949 III Less: Accumulated Depreciation (2,833,421) (3,111,392) Section Property, Plant and Equipment, Net 3,417,679 4,489,557 Other Assets, Net: Goodwill 4,070,267 4,441,030 IV Other Non-current Assets, Net: 1,534,141 1,713,546 Section Total Other Assets, Net 5,604,408 6,154,576 Total Assets $10,972,402 $11,852,247 V LIABILITIES AND EQUITY Section Current Liabilities: Current Portion of Long-term Debt $146,300 $126,406 Other Current Liabilities 1,183,873 1,336,272 VI Total Current Liabilities 1,330,173 1,462,678 Section Long-term Debt, Net of Current Portion 6,896,971 8,016,417 Other Long-term Liabilities(1) 446,416 487,563 Total Long-term Liabilities 7,343,387 8,503,980 VII Section Total Liabilities $8,673,560 $9,966,658 Equity Total Stockholders' Equity $2,297,438 $1,884,180 VIII Noncontrolling Interests 1,404 1,409 Section Total Equity 2,298,842 1,885,589 Total Liabilities and Equity $10,972,402 $11,852,247 IX Section X Section XI Section (1) Includes redeemable noncontrolling interests of $91mm and $71mm as of December 31, 2017 and December 31, 2018, respectively. www.ironmountain.com Selected metric definitions are available in the Appendix 13

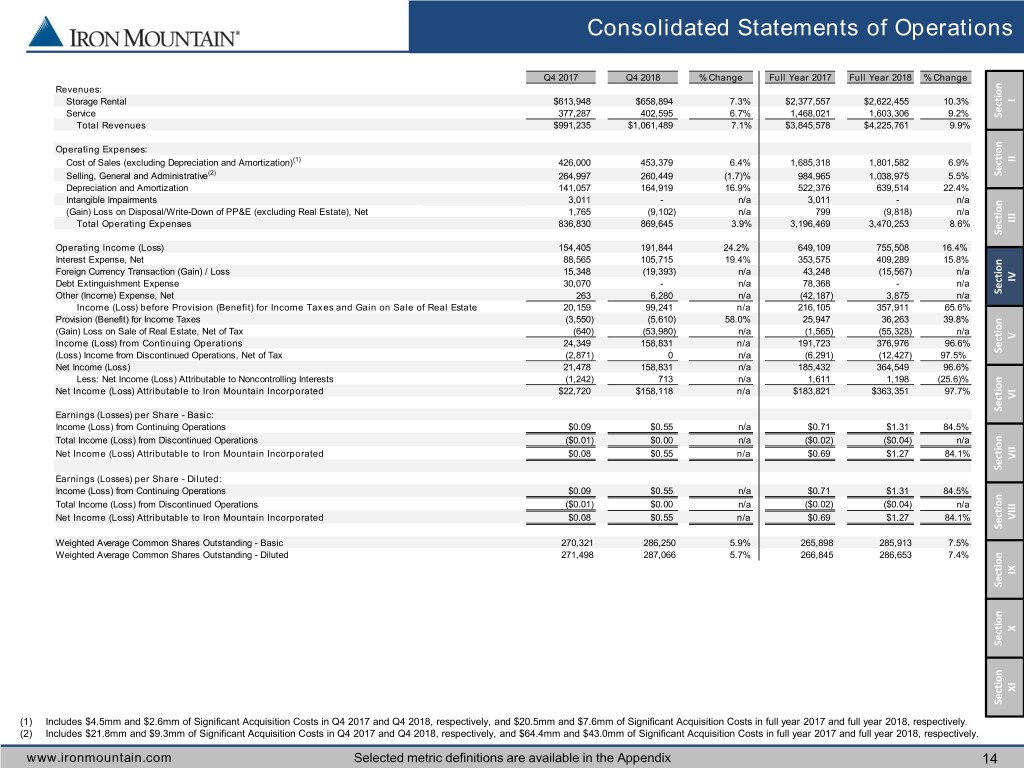

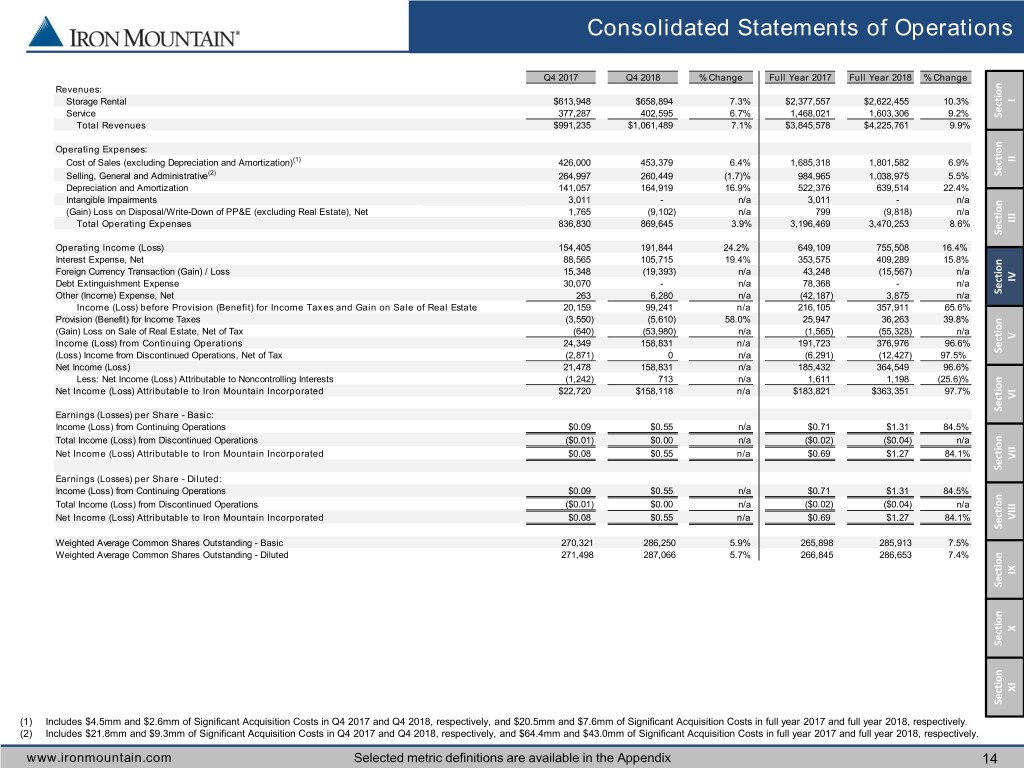

Consolidated Statements of Operations Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Revenues: Storage Rental $613,948 $658,894 7.3% $2,377,557 $2,622,455 10.3% I Service 377,287 402,595 6.7% 1,468,021 1,603,306 9.2% Section Total Revenues $991,235 $1,061,489 7.1% $3,845,578 $4,225,761 9.9% Operating Expenses: Cost of Sales (excluding Depreciation and Amortization)(1) 426,000 453,379 6.4% 1,685,318 1,801,582 6.9% II (2) Selling, General and Administrative 264,997 260,449 (1.7)% 984,965 1,038,975 5.5% Section Depreciation and Amortization 141,057 164,919 16.9% 522,376 639,514 22.4% Intangible Impairments 3,011 - n/a 3,011 - n/a (Gain) Loss on Disposal/Write-Down of PP&E (excluding Real Estate), Net 1,765 (9,102) n/a 799 (9,818) n/a Total Operating Expenses 836,830 869,645 3.9% 3,196,469 3,470,253 8.6% III Section Operating Income (Loss) 154,405 191,844 24.2% 649,109 755,508 16.4% Interest Expense, Net 88,565 105,715 19.4% 353,575 409,289 15.8% Foreign Currency Transaction (Gain) / Loss 15,348 (19,393) n/a 43,248 (15,567) n/a Debt Extinguishment Expense 30,070 - n/a 78,368 - n/a IV Other (Income) Expense, Net 263 6,280 n/a (42,187) 3,875 n/a Section Income (Loss) before Provision (Benefit) for Income Taxes and Gain on Sale of Real Estate 20,159 99,241 n/a 216,105 357,911 65.6% Provision (Benefit) for Income Taxes (3,550) (5,610) 58.0% 25,947 36,263 39.8% (Gain) Loss on Sale of Real Estate, Net of Tax (640) (53,980) n/a (1,565) (55,328) n/a V Income (Loss) from Continuing Operations 24,349 158,831 n/a 191,723 376,976 96.6% (Loss) Income from Discontinued Operations, Net of Tax (2,871) 0 n/a (6,291) (12,427) 97.5% Section Net Income (Loss) 21,478 158,831 n/a 185,432 364,549 96.6% Less: Net Income (Loss) Attributable to Noncontrolling Interests (1,242) 713 n/a 1,611 1,198 (25.6)% Net Income (Loss) Attributable to Iron Mountain Incorporated $22,720 $158,118 n/a $183,821 $363,351 97.7% VI Earnings (Losses) per Share - Basic: Section Income (Loss) from Continuing Operations $0.09 $0.55 n/a $0.71 $1.31 84.5% Total Income (Loss) from Discontinued Operations ($0.01) $0.00 n/a ($0.02) ($0.04) n/a Net Income (Loss) Attributable to Iron Mountain Incorporated $0.08 $0.55 n/a $0.69 $1.27 84.1% VII Section Earnings (Losses) per Share - Diluted: Income (Loss) from Continuing Operations $0.09 $0.55 n/a $0.71 $1.31 84.5% Total Income (Loss) from Discontinued Operations ($0.01) $0.00 n/a ($0.02) ($0.04) n/a Net Income (Loss) Attributable to Iron Mountain Incorporated $0.08 $0.55 n/a $0.69 $1.27 84.1% VIII Section Section Weighted Average Common Shares Outstanding - Basic 270,321 286,250 5.9% 265,898 285,913 7.5% Weighted Average Common Shares Outstanding - Diluted 271,498 287,066 5.7% 266,845 286,653 7.4% IX Section X Section XI Section (1) Includes $4.5mm and $2.6mm of Significant Acquisition Costs in Q4 2017 and Q4 2018, respectively, and $20.5mm and $7.6mm of Significant Acquisition Costs in full year 2017 and full year 2018, respectively. (2) Includes $21.8mm and $9.3mm of Significant Acquisition Costs in Q4 2017 and Q4 2018, respectively, and $64.4mm and $43.0mm of Significant Acquisition Costs in full year 2017 and full year 2018, respectively. www.ironmountain.com Selected metric definitions are available in the Appendix 14

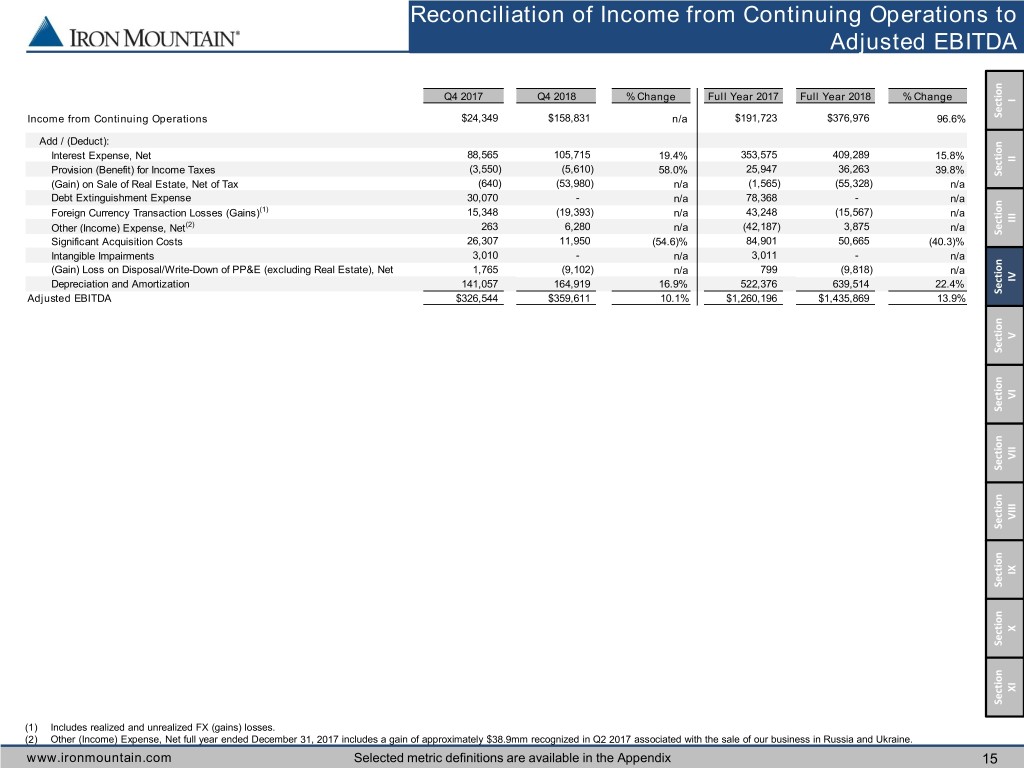

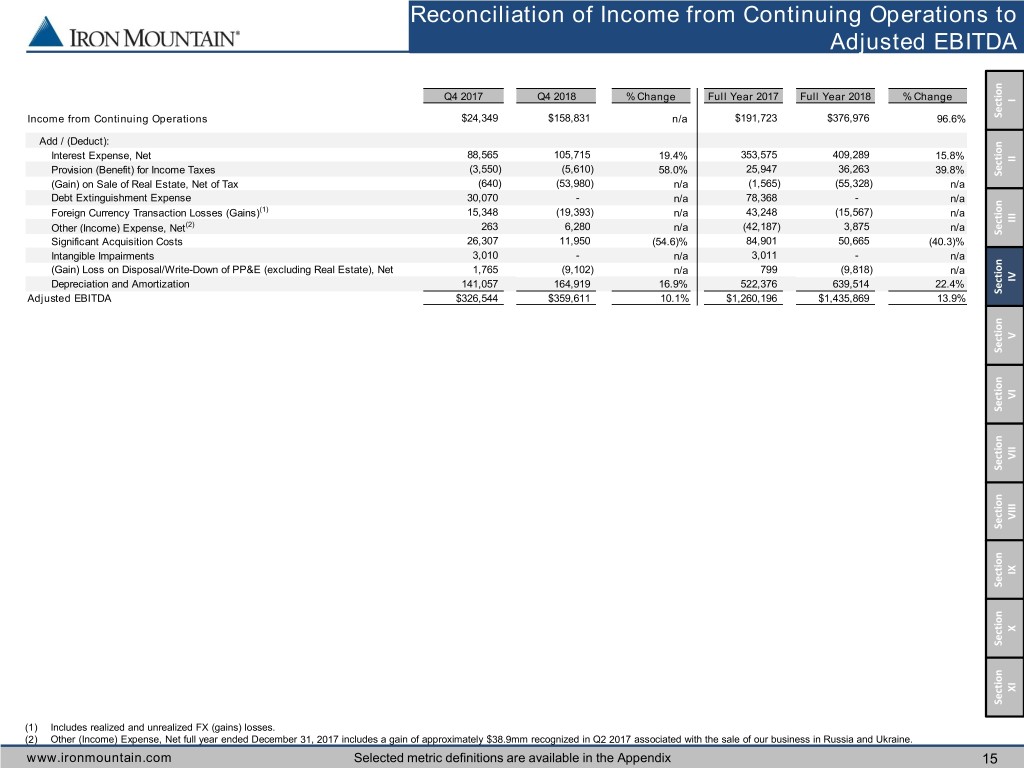

Reconciliation of Income from Continuing Operations to Adjusted EBITDA Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change I Income from Continuing Operations $24,349 $158,831 n/a $191,723 $376,976 96.6% Section Add / (Deduct): Interest Expense, Net 88,565 105,715 19.4% 353,575 409,289 15.8% II Provision (Benefit) for Income Taxes (3,550) (5,610) 58.0% 25,947 36,263 39.8% Section (Gain) on Sale of Real Estate, Net of Tax (640) (53,980) n/a (1,565) (55,328) n/a Debt Extinguishment Expense 30,070 - n/a 78,368 - n/a Foreign Currency Transaction Losses (Gains)(1) 15,348 (19,393) n/a 43,248 (15,567) n/a III Other (Income) Expense, Net(2) 263 6,280 n/a (42,187) 3,875 n/a Section SignificantRecall Costs Acquisition Costs 26,307 11,950 (54.6)% 84,901 50,665 (40.3)% Intangible Impairments 3,010 - n/a 3,011 - n/a (Gain) Loss on Disposal/Write-Down of PP&E (excluding Real Estate), Net 1,765 (9,102) n/a 799 (9,818) n/a Depreciation and Amortization 141,057 164,919 16.9% 522,376 639,514 22.4% IV Adjusted EBITDA $326,544 $359,611 10.1% $1,260,196 $1,435,869 13.9% Section V Section VI Section VII Section VIII Section Section IX Section X Section XI Section (1) Includes realized and unrealized FX (gains) losses. (2) Other (Income) Expense, Net full year ended December 31, 2017 includes a gain of approximately $38.9mm recognized in Q2 2017 associated with the sale of our business in Russia and Ukraine. www.ironmountain.com Selected metric definitions are available in the Appendix 15

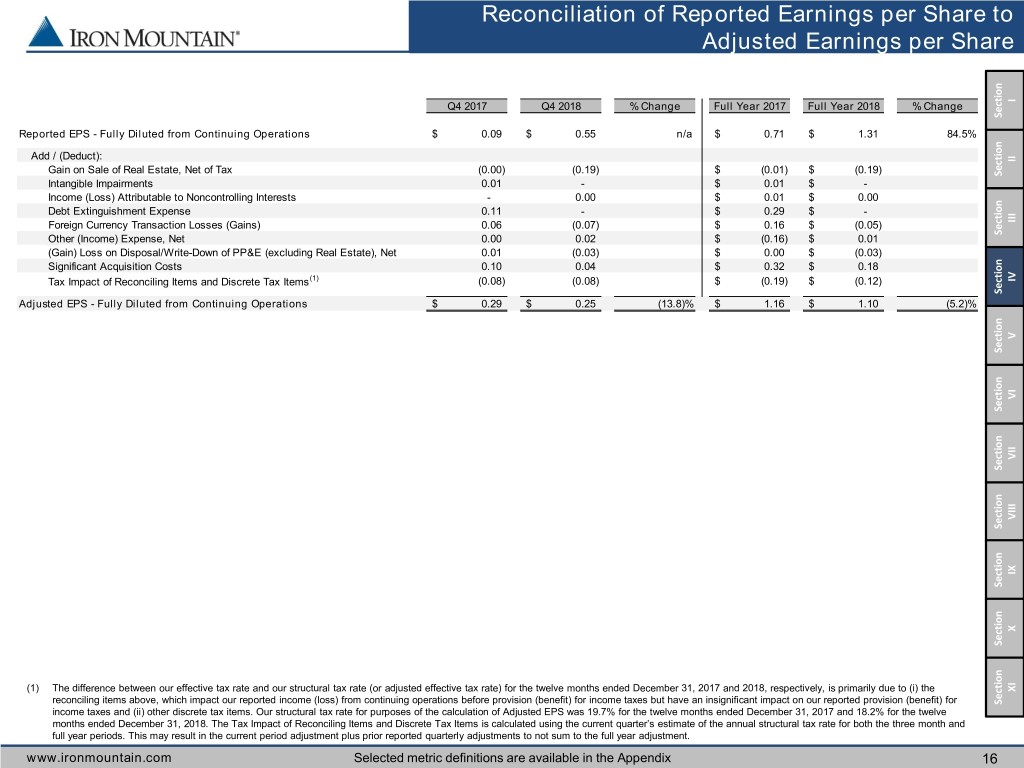

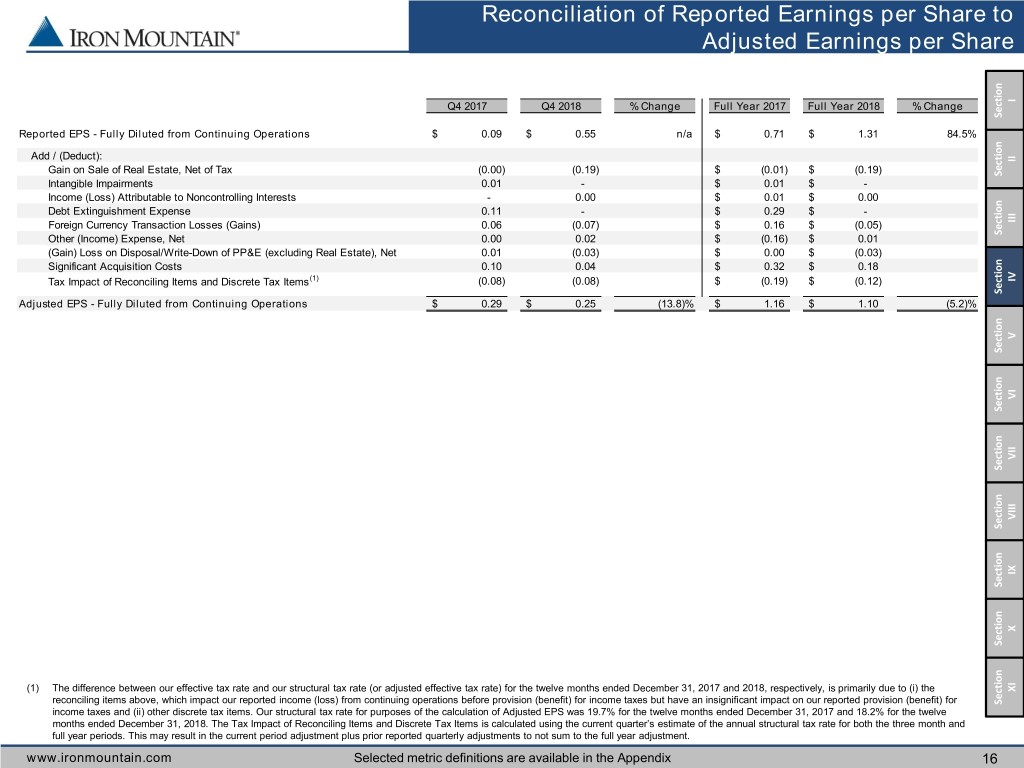

Reconciliation of Reported Earnings per Share to Adjusted Earnings per Share Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change I Section Reported EPS - Fully Diluted from Continuing Operations $ 0.09 $ 0.55 n/a $ 0.71 $ 1.31 84.5% Add / (Deduct): II Gain on Sale of Real Estate, Net of Tax (0.00) (0.19) $ (0.01) $ (0.19) Section Intangible Impairments 0.01 - $ 0.01 $ - Income (Loss) Attributable to Noncontrolling Interests - 0.00 $ 0.01 $ 0.00 Debt Extinguishment Expense 0.11 - $ 0.29 $ - Foreign Currency Transaction Losses (Gains) 0.06 (0.07) $ 0.16 $ (0.05) III Other (Income) Expense, Net 0.00 0.02 $ (0.16) $ 0.01 Section (Gain) Loss on Disposal/Write-Down of PP&E (excluding Real Estate), Net 0.01 (0.03) $ 0.00 $ (0.03) Significant Acquisition Costs 0.10 0.04 $ 0.32 $ 0.18 Tax Impact of Reconciling Items and Discrete Tax Items(1) (0.08) (0.08) $ (0.19) $ (0.12) IV Section Adjusted EPS - Fully Diluted from Continuing Operations $ 0.29 $ 0.25 (13.8)% $ 1.16 $ 1.10 (5.2)% V Section VI Section VII Section VIII Section Section IX Section X Section (1) The difference between our effective tax rate and our structural tax rate (or adjusted effective tax rate) for the twelve months ended December 31, 2017 and 2018, respectively, is primarily due to (i) the XI reconciling items above, which impact our reported income (loss) from continuing operations before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for Section income taxes and (ii) other discrete tax items. Our structural tax rate for purposes of the calculation of Adjusted EPS was 19.7% for the twelve months ended December 31, 2017 and 18.2% for the twelve months ended December 31, 2018. The Tax Impact of Reconciling Items and Discrete Tax Items is calculated using the current quarter’s estimate of the annual structural tax rate for both the three month and full year periods. This may result in the current period adjustment plus prior reported quarterly adjustments to not sum to the full year adjustment. www.ironmountain.com Selected metric definitions are available in the Appendix 16

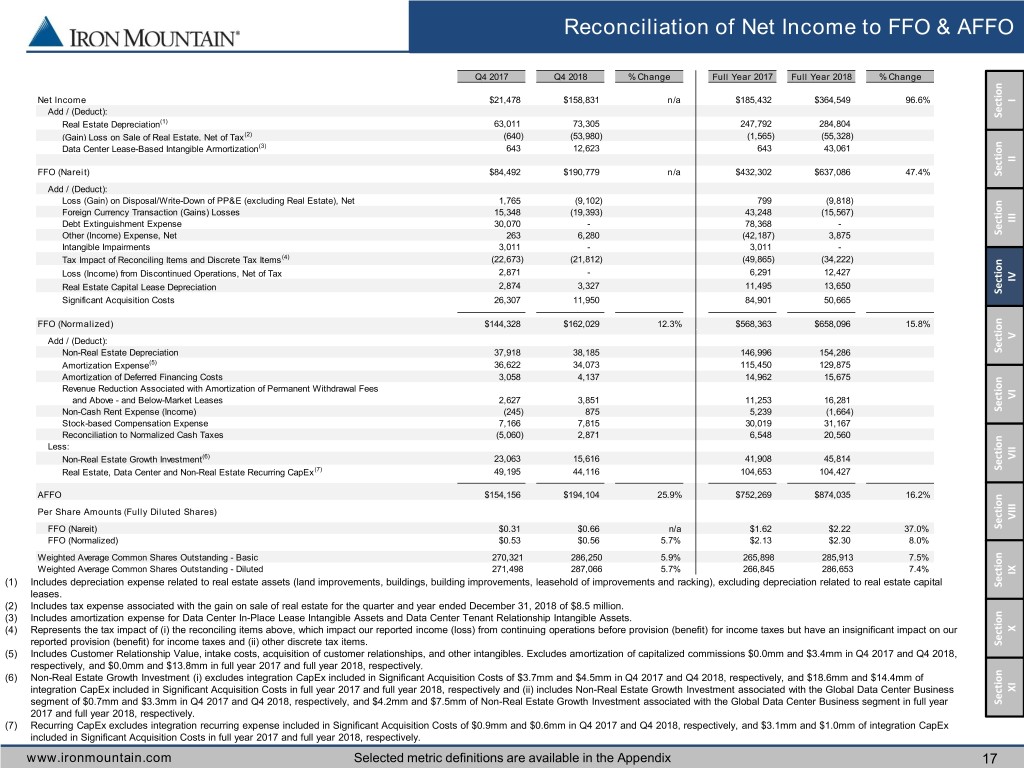

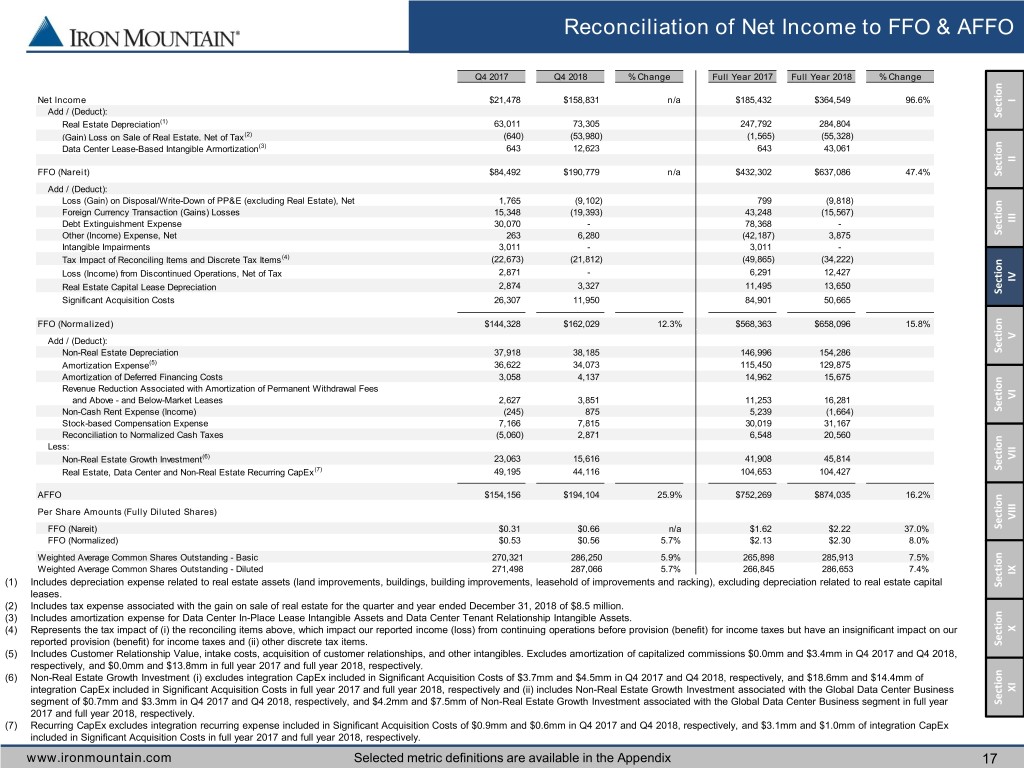

Reconciliation of Net Income to FFO & AFFO Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Net Income $21,478 $158,831 n/a $185,432 $364,549 96.6% I Add / (Deduct): Section Real Estate Depreciation(1) 63,011 73,305 247,792 284,804 (Gain) Loss on Sale of Real Estate, Net of Tax(2) (640) (53,980) (1,565) (55,328) Data Center Lease-Based Intangible Armortization(3) 643 12,623 643 43,061 II FFO (Nareit) $84,492 $190,779 n/a $432,302 $637,086 47.4% Section Add / (Deduct): Loss (Gain) on Disposal/Write-Down of PP&E (excluding Real Estate), Net 1,765 (9,102) 799 (9,818) Foreign Currency Transaction (Gains) Losses 15,348 (19,393) 43,248 (15,567) Debt Extinguishment Expense 30,070 - 78,368 - III Other (Income) Expense, Net 263 6,280 (42,187) 3,875 Section Intangible Impairments 3,011 - 3,011 - Tax Impact of Reconciling Items and Discrete Tax Items (4) (22,673) (21,812) (49,865) (34,222) Loss (Income) from Discontinued Operations, Net of Tax 2,871 - 6,291 12,427 IV Real Estate Capital Lease Depreciation 2,874 3,327 11,495 13,650 Section Significant Acquisition Costs 26,307 11,950 84,901 50,665 FFO (Normalized) $144,328 $162,029 12.3% $568,363 $658,096 15.8% Add / (Deduct): V Non-Real Estate Depreciation 37,918 38,185 146,996 154,286 Section Amortization Expense(5) 36,622 34,073 115,450 129,875 Amortization of Deferred Financing Costs 3,058 4,137 14,962 15,675 Revenue Reduction Associated with Amortization of Permanent Withdrawal Fees and Above - and Below-Market Leases 2,627 3,851 11,253 16,281 VI Non-Cash Rent Expense (Income) (245) 875 5,239 (1,664) Section Stock-based Compensation Expense 7,166 7,815 30,019 31,167 Reconciliation to Normalized Cash Taxes (5,060) 2,871 6,548 20,560 Less: Non-Real Estate Growth Investment(6) 23,063 15,616 41,908 45,814 VII Real Estate, Data Center and Non-Real Estate Recurring CapEx (7) 49,195 44,116 104,653 104,427 Section AFFO $154,156 $194,104 25.9% $752,269 $874,035 16.2% Per Share Amounts (Fully Diluted Shares) VIII FFO (Nareit) $0.31 $0.66 n/a $1.62 $2.22 37.0% Section FFO (Normalized) $0.53 $0.56 5.7% $2.13 $2.30 8.0% Weighted Average Common Shares Outstanding - Basic 270,321 286,250 5.9% 265,898 285,913 7.5% Weighted Average Common Shares Outstanding - Diluted 271,498 287,066 5.7% 266,845 286,653 7.4% IX (1) Includes depreciation expense related to real estate assets (land improvements, buildings, building improvements, leasehold of improvements and racking), excluding depreciation related to real estate capital Section leases. (2) Includes tax expense associated with the gain on sale of real estate for the quarter and year ended December 31, 2018 of $8.5 million. (3) Includes amortization expense for Data Center In-Place Lease Intangible Assets and Data Center Tenant Relationship Intangible Assets. (4) Represents the tax impact of (i) the reconciling items above, which impact our reported income (loss) from continuing operations before provision (benefit) for income taxes but have an insignificant impact on our X reported provision (benefit) for income taxes and (ii) other discrete tax items. Section (5) Includes Customer Relationship Value, intake costs, acquisition of customer relationships, and other intangibles. Excludes amortization of capitalized commissions $0.0mm and $3.4mm in Q4 2017 and Q4 2018, respectively, and $0.0mm and $13.8mm in full year 2017 and full year 2018, respectively. (6) Non-Real Estate Growth Investment (i) excludes integration CapEx included in Significant Acquisition Costs of $3.7mm and $4.5mm in Q4 2017 and Q4 2018, respectively, and $18.6mm and $14.4mm of integration CapEx included in Significant Acquisition Costs in full year 2017 and full year 2018, respectively and (ii) includes Non-Real Estate Growth Investment associated with the Global Data Center Business XI segment of $0.7mm and $3.3mm in Q4 2017 and Q4 2018, respectively, and $4.2mm and $7.5mm of Non-Real Estate Growth Investment associated with the Global Data Center Business segment in full year Section 2017 and full year 2018, respectively. (7) Recurring CapEx excludes integration recurring expense included in Significant Acquisition Costs of $0.9mm and $0.6mm in Q4 2017 and Q4 2018, respectively, and $3.1mm and $1.0mm of integration CapEx included in Significant Acquisition Costs in full year 2017 and full year 2018, respectively. www.ironmountain.com Selected metric definitions are available in the Appendix 17

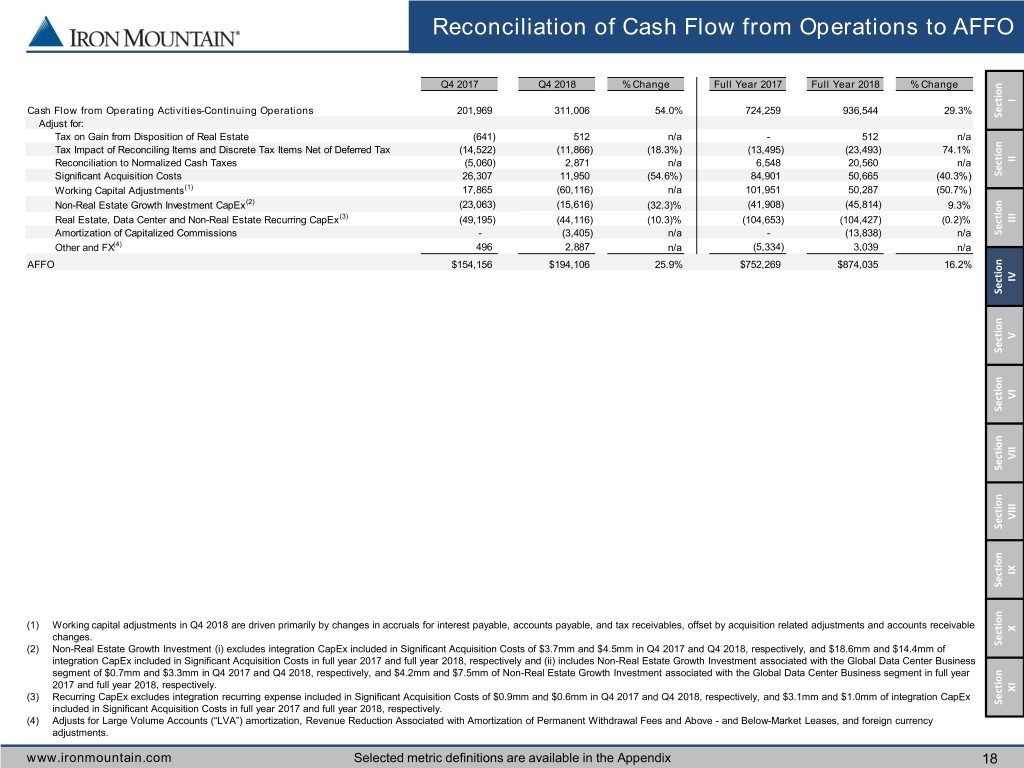

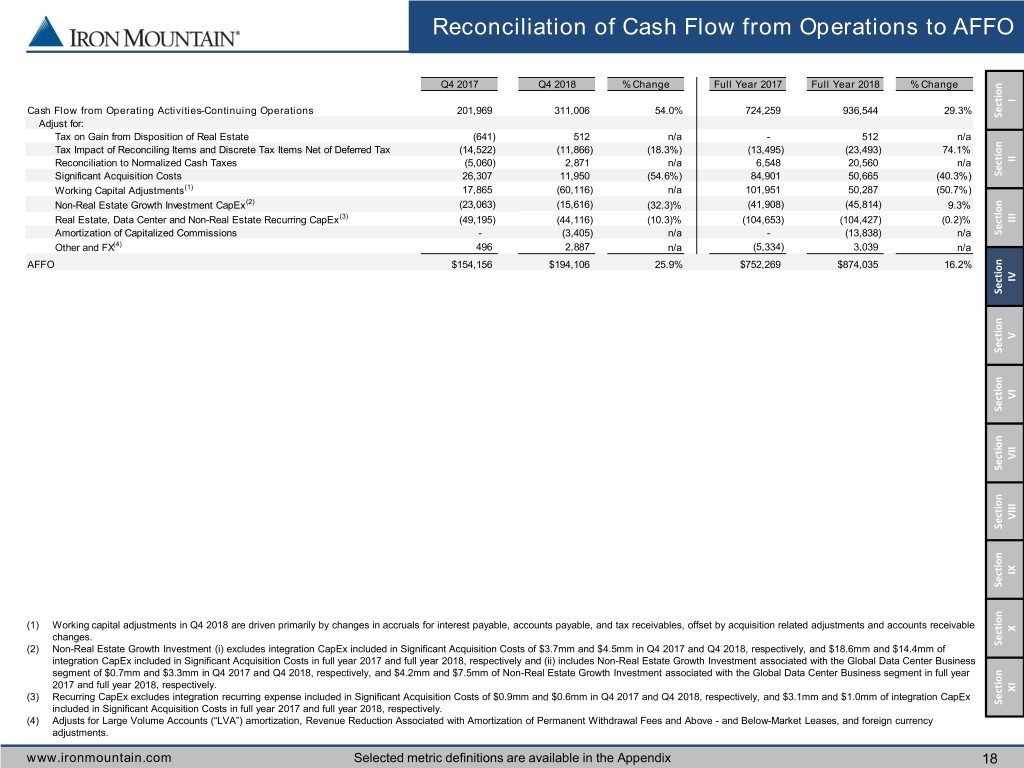

Reconciliation of Cash Flow from Operations to AFFO Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change I Cash Flow from Operating Activities-Continuing Operations 201,969 311,006 54.0% 724,259 936,544 29.3% Section Adjust for: Tax on Gain from Disposition of Real Estate (641) 512 n/a - 512 n/a Tax Impact of Reconciling Items and Discrete Tax Items Net of Deferred Tax (14,522) (11,866) (18.3%) (13,495) (23,493) 74.1% Reconciliation to Normalized Cash Taxes (5,060) 2,871 n/a 6,548 20,560 n/a II Significant Acquisition Costs 26,307 11,950 (54.6%) 84,901 50,665 (40.3%) Section Working Capital Adjustments(1) 17,865 (60,116) n/a 101,951 50,287 (50.7%) Non-Real Estate Growth Investment CapEx(2) (23,063) (15,616) (32.3)% (41,908) (45,814) 9.3% (3) Real Estate, Data Center and Non-Real Estate Recurring CapEx (49,195) (44,116) (10.3)% (104,653) (104,427) (0.2)% III Amortization of Capitalized Commissions - (3,405) n/a - (13,838) n/a Section Other and FX(4) 496 2,887 n/a (5,334) 3,039 n/a AFFO $154,156 $194,106 25.9% $752,269 $874,035 16.2% IV Section V Section VI Section VII Section VIII Section Section IX Section (1) Working capital adjustments in Q4 2018 are driven primarily by changes in accruals for interest payable, accounts payable, and tax receivables, offset by acquisition related adjustments and accounts receivable X changes. (2) Non-Real Estate Growth Investment (i) excludes integration CapEx included in Significant Acquisition Costs of $3.7mm and $4.5mm in Q4 2017 and Q4 2018, respectively, and $18.6mm and $14.4mm of Section integration CapEx included in Significant Acquisition Costs in full year 2017 and full year 2018, respectively and (ii) includes Non-Real Estate Growth Investment associated with the Global Data Center Business segment of $0.7mm and $3.3mm in Q4 2017 and Q4 2018, respectively, and $4.2mm and $7.5mm of Non-Real Estate Growth Investment associated with the Global Data Center Business segment in full year 2017 and full year 2018, respectively. XI (3) Recurring CapEx excludes integration recurring expense included in Significant Acquisition Costs of $0.9mm and $0.6mm in Q4 2017 and Q4 2018, respectively, and $3.1mm and $1.0mm of integration CapEx included in Significant Acquisition Costs in full year 2017 and full year 2018, respectively. Section (4) Adjusts for Large Volume Accounts (“LVA”) amortization, Revenue Reduction Associated with Amortization of Permanent Withdrawal Fees and Above - and Below-Market Leases, and foreign currency adjustments. www.ironmountain.com Selected metric definitions are available in the Appendix 18

Storage and Service Reconciliation(1) Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change I Total Storage Revenue $613,948 $658,894 7.3% $2,377,557 $2,622,455 10.3% Section Add: Permanent Withdraw al Fees 6,537 7,578 15.9% 24,238 26,958 11.2% Adjusted Storage Revenue $620,485 $666,472 7.4% $2,401,795 $2,649,413 10.3% II Section Total Service Revenue $377,287 $402,596 6.7% $1,468,021 $1,603,306 9.2% Less: Permanent Withdraw al Fees (6,537) (7,578) 15.9% (24,238) (26,958) 11.2% Adjusted Service Revenue $370,750 $395,018 6.5% $1,443,783 $1,576,348 9.2% III Section Storage Cost of Sales (COS) Storage COS Excluding Rent 76,439 94,822 24.0% 299,317 365,295 22.0% IV Storage Rent 73,949 78,289 5.9% 294,707 309,612 5.1% Section Total Storage COS 150,388 173,111 15.1% 594,024 674,907 13.6% Service Cost of Sales (COS) Service COS Excluding Rent 267,954 274,322 2.4% 1,058,018 1,104,654 4.4% V Section Service Rent 3,185 3,332 4.6% 12,783 14,393 12.6% Total Service COS 271,139 277,654 2.4% 1,070,801 1,119,047 4.5% VI Significant Acquisition Costs Included in Cost of Sales 4,474 2,614 (41.6%) 20,493 7,628 (62.8%) Section Total COS $426,001 $453,379 6.4% $1,685,318 $1,801,582 6.9% VII SG&A Costs Section Storage Overhead 37,626 35,706 (5.1%) 134,586 153,237 13.9% Service Overhead 24,907 26,216 5.3% 90,816 110,527 21.7% Corporate Overhead 114,393 123,326 7.8% 442,038 474,868 7.4% VIII Significant Acquisition Costs Included in SG&A 21,833 9,336 (57.2%) 64,408 43,037 (33.2%) Section Sales and Marketing 66,238 65,865 (0.6%) 253,117 257,306 1.7% Total SG&A $264,997 $260,449 (1.7%) $984,965 $1,038,975 5.5% IX Section Adjusted EBITDA Total Storage Adjusted EBITDA 432,471 457,655 5.8% 1,673,185 1,821,269 8.9% Total Service Adjusted EBITDA 74,704 91,148 22.0% 282,166 346,774 22.9% X Less: Corporate Overhead and Sales and Marketing (180,631) (189,191) 4.7% (695,155) (732,174) 5.3% Section Total Adjusted EBITDA $326,544 $359,612 10.1% $1,260,196 $1,435,869 13.9% XI (1) As a result of our adoption of a new accounting standard pertaining to revenue recognition, which we adopted as of January 1, 2018 (i) our Storage and Service Revenues and Adjusted Storage and Service Section EBITDA margins for Q4 2018 reflect a net reclassification of $6.0mm and (ii) our Storage and Service Revenues and Adjusted Storage and Service EBITDA margins for full year 2018 reflect a net reclassification of $25.1mm of Storage Rental Revenues and Storage Adjusted EBITDA into Service Revenues and Service Adjusted EBITDA. Our revenues for Q4 2017 and full year 2017 do not reflect this revenue reclassification as this new accounting standard was adopted on a modified retrospective basis, whereby prior period results were not restated. www.ironmountain.com Selected metric definitions are available in the Appendix 19

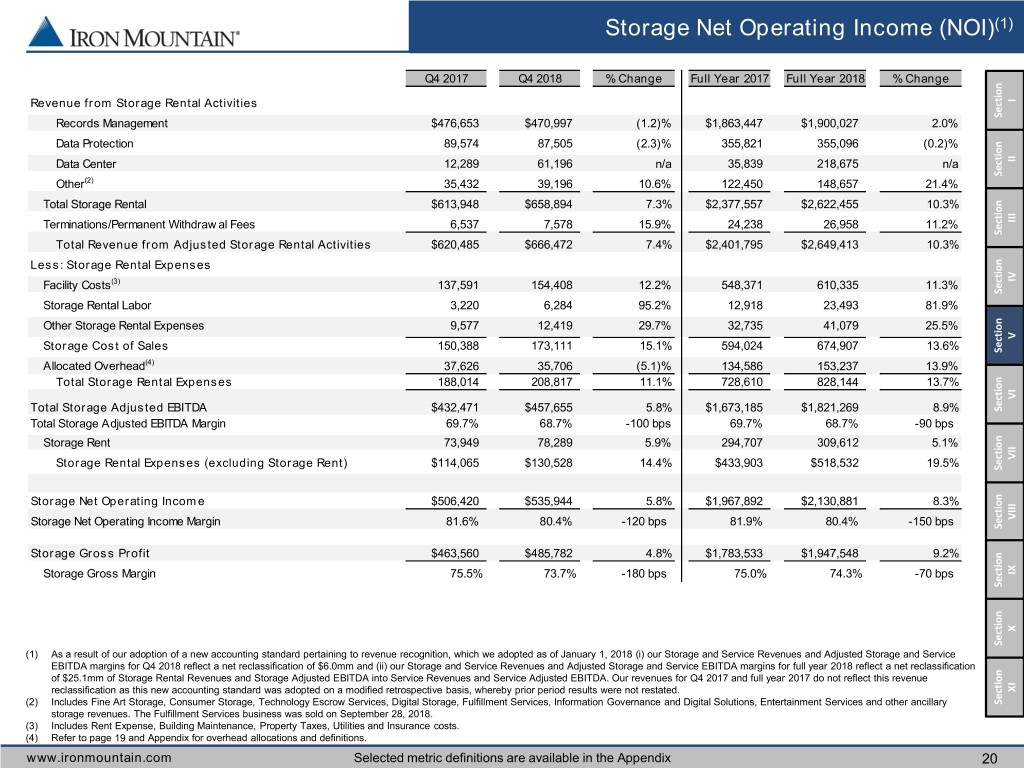

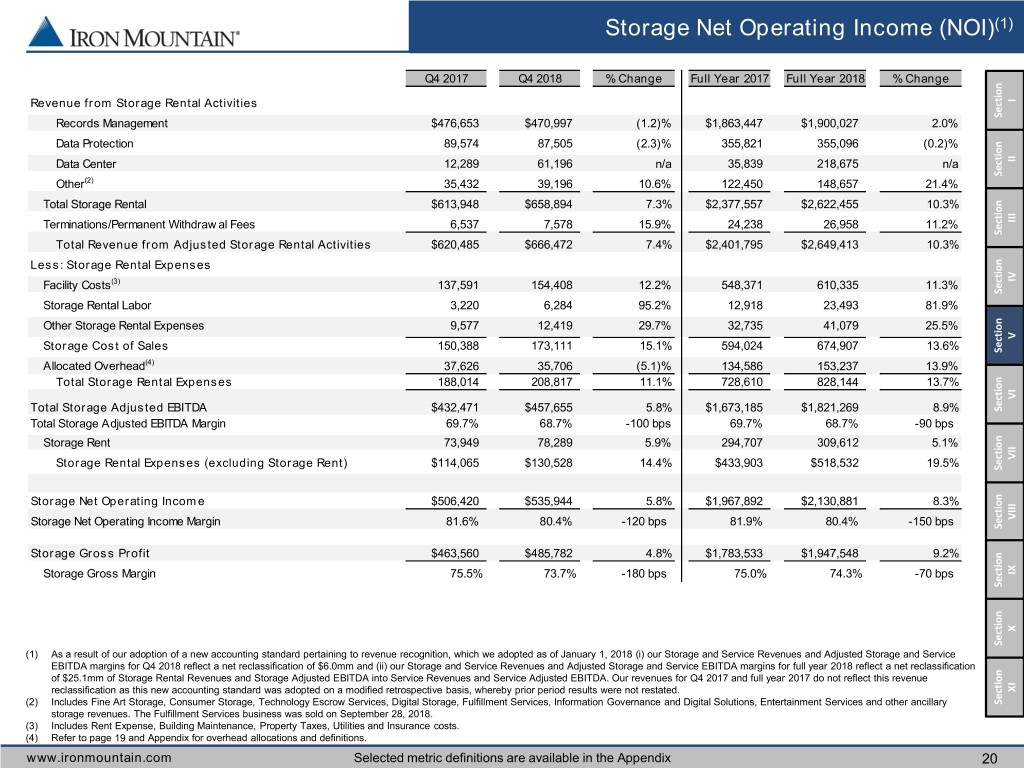

Storage Net Operating Income (NOI)(1) Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Revenue from Storage Rental Activities I Section Records Management $476,653 $470,997 (1.2)% $1,863,447 $1,900,027 2.0% Data Protection 89,574 87,505 (2.3)% 355,821 355,096 (0.2)% Data Center 12,289 61,196 n/a 35,839 218,675 n/a II Section Other(2) 35,432 39,196 10.6% 122,450 148,657 21.4% Total Storage Rental $613,948 $658,894 7.3% $2,377,557 $2,622,455 10.3% Terminations/Permanent Withdraw al Fees 6,537 7,578 15.9% 24,238 26,958 11.2% III Section Total Revenue from Adjusted Storage Rental Activities $620,485 $666,472 7.4% $2,401,795 $2,649,413 10.3% Less: Storage Rental Expenses Facility Costs(3) 137,591 154,408 12.2% 548,371 610,335 11.3% IV Section Storage Rental Labor 3,220 6,284 95.2% 12,918 23,493 81.9% Other Storage Rental Expenses 9,577 12,419 29.7% 32,735 41,079 25.5% V Storage Cost of Sales 150,388 173,111 15.1% 594,024 674,907 13.6% Section Allocated Overhead(4) 37,626 35,706 (5.1)% 134,586 153,237 13.9% Total Storage Rental Expenses 188,014 208,817 11.1% 728,610 828,144 13.7% VI Total Storage Adjusted EBITDA $432,471 $457,655 5.8% $1,673,185 $1,821,269 8.9% Section Total Storage Adjusted EBITDA Margin 69.7% 68.7% -100 bps 69.7% 68.7% -90 bps Storage Rent 73,949 78,289 5.9% 294,707 309,612 5.1% Storage Rental Expenses (excluding Storage Rent) $114,065 $130,528 14.4% $433,903 $518,532 19.5% VII Section Storage Net Operating Income $506,420 $535,944 5.8% $1,967,892 $2,130,881 8.3% Storage Net Operating Income Margin 81.6% 80.4% -120 bps 81.9% 80.4% -150 bps VIII Section Section Storage Gross Profit $463,560 $485,782 4.8% $1,783,533 $1,947,548 9.2% Storage Gross Margin 75.5% 73.7% -180 bps 75.0% 74.3% -70 bps IX Section X Section (1) As a result of our adoption of a new accounting standard pertaining to revenue recognition, which we adopted as of January 1, 2018 (i) our Storage and Service Revenues and Adjusted Storage and Service EBITDA margins for Q4 2018 reflect a net reclassification of $6.0mm and (ii) our Storage and Service Revenues and Adjusted Storage and Service EBITDA margins for full year 2018 reflect a net reclassification of $25.1mm of Storage Rental Revenues and Storage Adjusted EBITDA into Service Revenues and Service Adjusted EBITDA. Our revenues for Q4 2017 and full year 2017 do not reflect this revenue reclassification as this new accounting standard was adopted on a modified retrospective basis, whereby prior period results were not restated. XI (2) Includes Fine Art Storage, Consumer Storage, Technology Escrow Services, Digital Storage, Fulfillment Services, Information Governance and Digital Solutions, Entertainment Services and other ancillary Section storage revenues. The Fulfillment Services business was sold on September 28, 2018. (3) Includes Rent Expense, Building Maintenance, Property Taxes, Utilities and Insurance costs. (4) Refer to page 19 and Appendix for overhead allocations and definitions. www.ironmountain.com Selected metric definitions are available in the Appendix 20

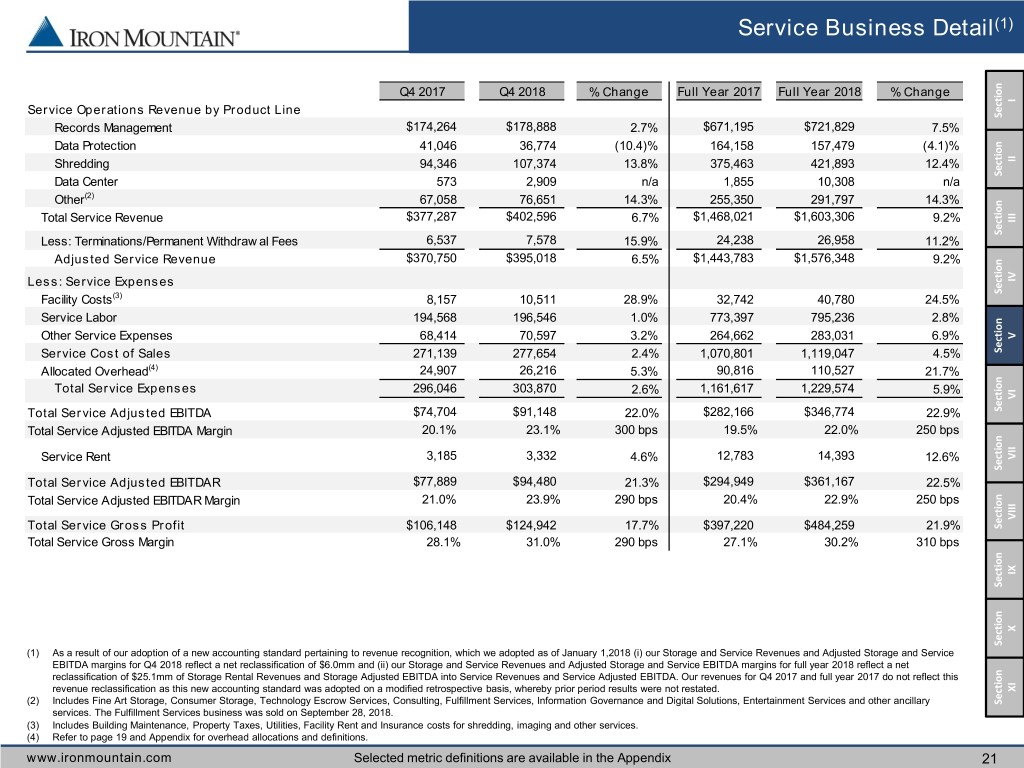

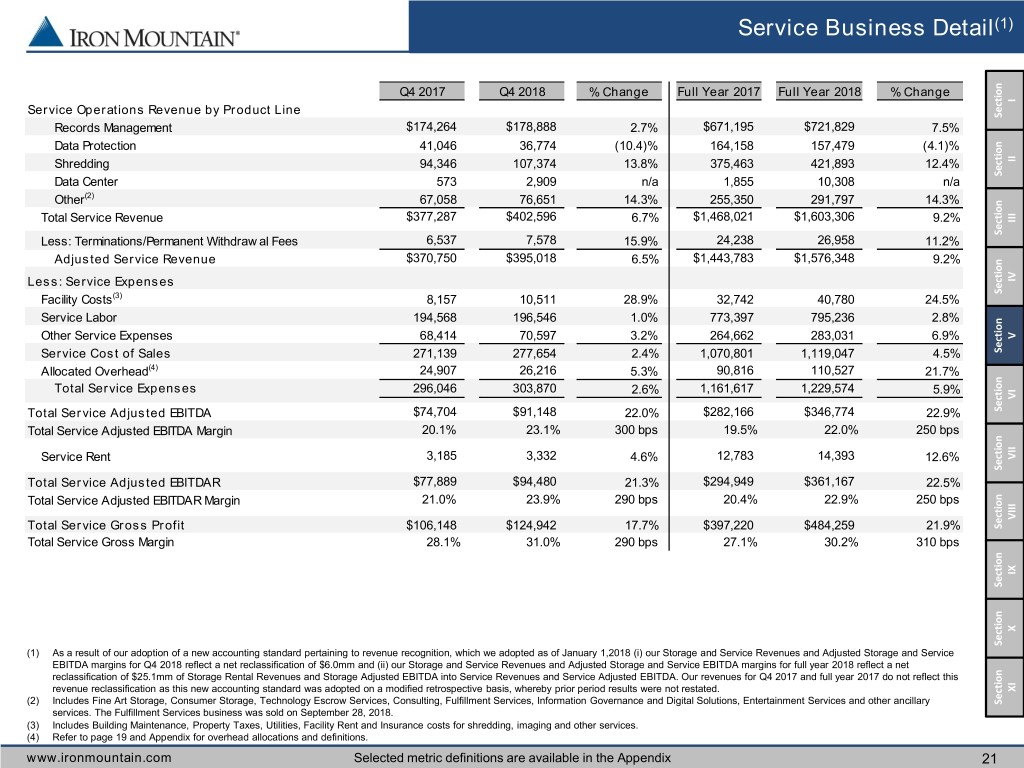

Service Business Detail(1) Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change I Service Operations Revenue by Product Line Section Records Management $174,264 $178,888 2.7% $671,195 $721,829 7.5% Data Protection 41,046 36,774 (10.4)% 164,158 157,479 (4.1)% Shredding 94,346 107,374 13.8% 375,463 421,893 12.4% II Data Center 573 2,909 n/a 1,855 10,308 n/a Section Other(2) 67,058 76,651 14.3% 255,350 291,797 14.3% Total Service Revenue $377,287 $402,596 6.7% $1,468,021 $1,603,306 9.2% III Section Less: Terminations/Permanent Withdraw al Fees 6,537 7,578 15.9% 24,238 26,958 11.2% Adjusted Service Revenue $370,750 $395,018 6.5% $1,443,783 $1,576,348 9.2% Less: Service Expenses IV Facility Costs(3) 8,157 10,511 28.9% 32,742 40,780 24.5% Section Service Labor 194,568 196,546 1.0% 773,397 795,236 2.8% Other Service Expenses 68,414 70,597 3.2% 264,662 283,031 6.9% V Service Cost of Sales 271,139 277,654 2.4% 1,070,801 1,119,047 4.5% Section Allocated Overhead(4) 24,907 26,216 5.3% 90,816 110,527 21.7% Total Service Expenses 296,046 303,870 2.6% 1,161,617 1,229,574 5.9% VI Total Service Adjusted EBITDA $74,704 $91,148 22.0% $282,166 $346,774 22.9% Section Total Service Adjusted EBITDA Margin 20.1% 23.1% 300 bps 19.5% 22.0% 250 bps Service Rent 3,185 3,332 4.6% 12,783 14,393 12.6% VII Section Total Service Adjusted EBITDAR $77,889 $94,480 21.3% $294,949 $361,167 22.5% Total Service Adjusted EBITDAR Margin 21.0% 23.9% 290 bps 20.4% 22.9% 250 bps VIII Total Service Gross Profit $106,148 $124,942 17.7% $397,220 $484,259 21.9% Section Total Service Gross Margin 28.1% 31.0% 290 bps 27.1% 30.2% 310 bps IX Section X Section (1) As a result of our adoption of a new accounting standard pertaining to revenue recognition, which we adopted as of January 1,2018 (i) our Storage and Service Revenues and Adjusted Storage and Service EBITDA margins for Q4 2018 reflect a net reclassification of $6.0mm and (ii) our Storage and Service Revenues and Adjusted Storage and Service EBITDA margins for full year 2018 reflect a net reclassification of $25.1mm of Storage Rental Revenues and Storage Adjusted EBITDA into Service Revenues and Service Adjusted EBITDA. Our revenues for Q4 2017 and full year 2017 do not reflect this revenue reclassification as this new accounting standard was adopted on a modified retrospective basis, whereby prior period results were not restated. XI (2) Includes Fine Art Storage, Consumer Storage, Technology Escrow Services, Consulting, Fulfillment Services, Information Governance and Digital Solutions, Entertainment Services and other ancillary Section services. The Fulfillment Services business was sold on September 28, 2018. (3) Includes Building Maintenance, Property Taxes, Utilities, Facility Rent and Insurance costs for shredding, imaging and other services. (4) Refer to page 19 and Appendix for overhead allocations and definitions. www.ironmountain.com Selected metric definitions are available in the Appendix 21

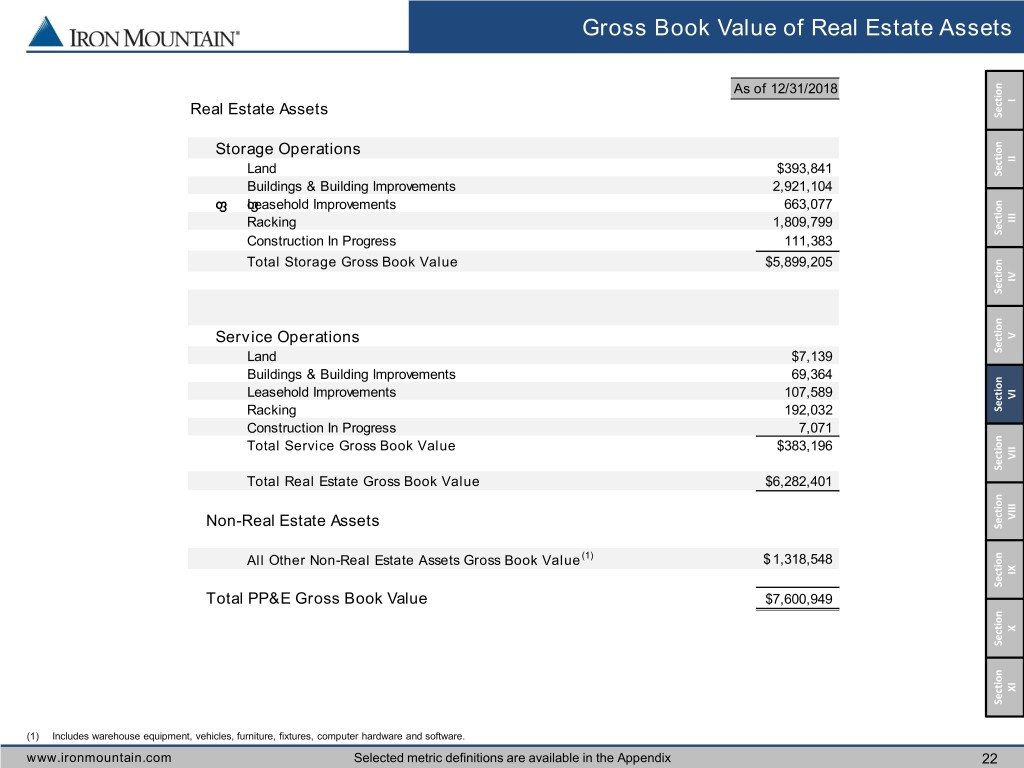

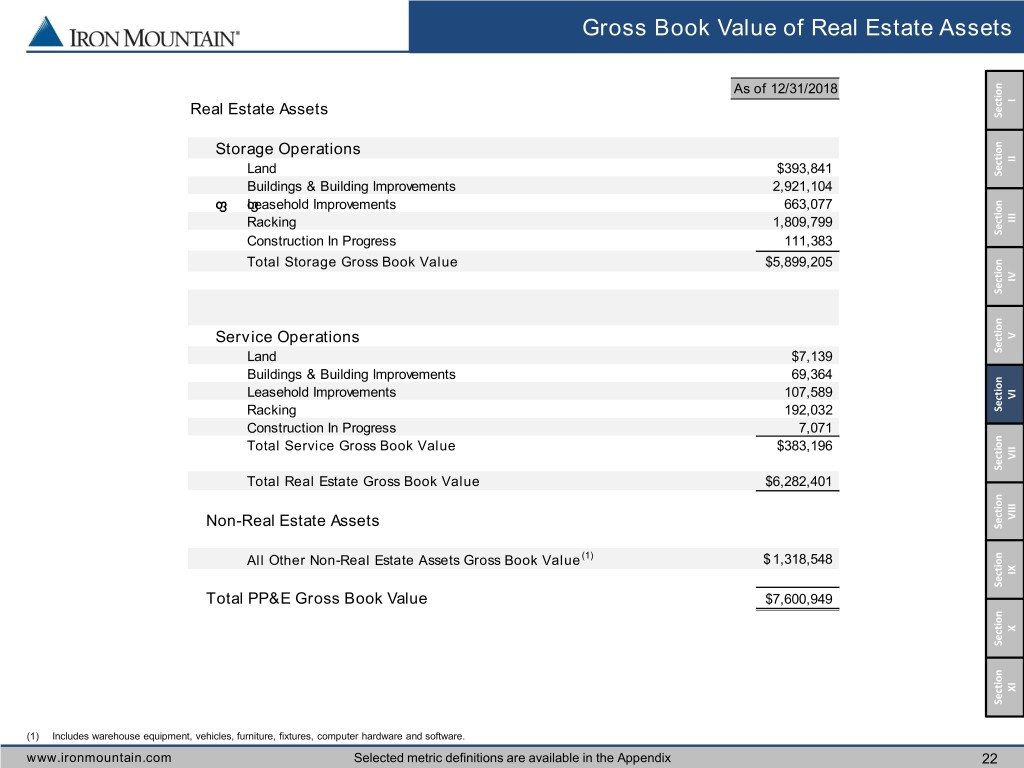

Gross Book Value of Real Estate Assets As of 12/31/2018 Real Estate Assets I Section Storage Operations II Land $393,841 Section Buildings & Building Improvements 2,921,104 Leasehold Improvements 663,077 Racking 1,809,799 III Construction In Progress 111,383 Section Total Storage Gross Book Value $5,899,205 IV Section Service Operations V Land $7,139 Section Buildings & Building Improvements 69,364 Leasehold Improvements 107,589 VI Racking 192,032 Section Construction In Progress 7,071 Total Service Gross Book Value $383,196 VII Section Total Real Estate Gross Book Value $6,282,401 VIII Non-Real Estate Assets Section All Other Non-Real Estate Assets Gross Book Value (1) $ 1,318,548 IX Section Total PP&E Gross Book Value $7,600,949 X Section XI Section (1) Includes warehouse equipment, vehicles, furniture, fixtures, computer hardware and software. www.ironmountain.com Selected metric definitions are available in the Appendix 22

Lease Obligations(1) Facility Lease Expirations I (% of total square feet subject to lease) Section 12/31/2018 Assuming Exercise of All Extension Options II Section III Section IV Section V Section 53.1% VI Section VII Section 7.1% 5.6% 5.1% 4.8% 4.4% 4.0% 3.3% 4.0% VIII 2.8% 2.9% 2.8% Section 2019(2) 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter IX Section Weighted Average Remaining Lease Obligations: 11.6 years X Section XI Section (1) Includes capital and operating lease obligations. (2) Reflects month to month leases and predominantly short term occupancies. www.ironmountain.com Selected metric definitions are available in the Appendix 23

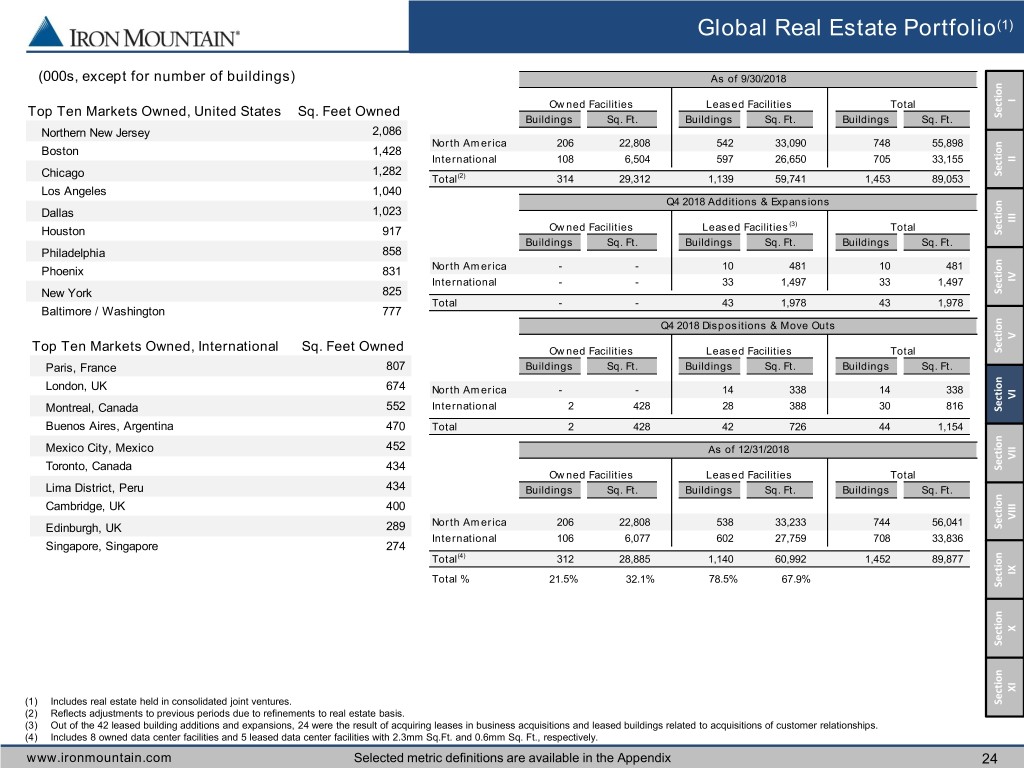

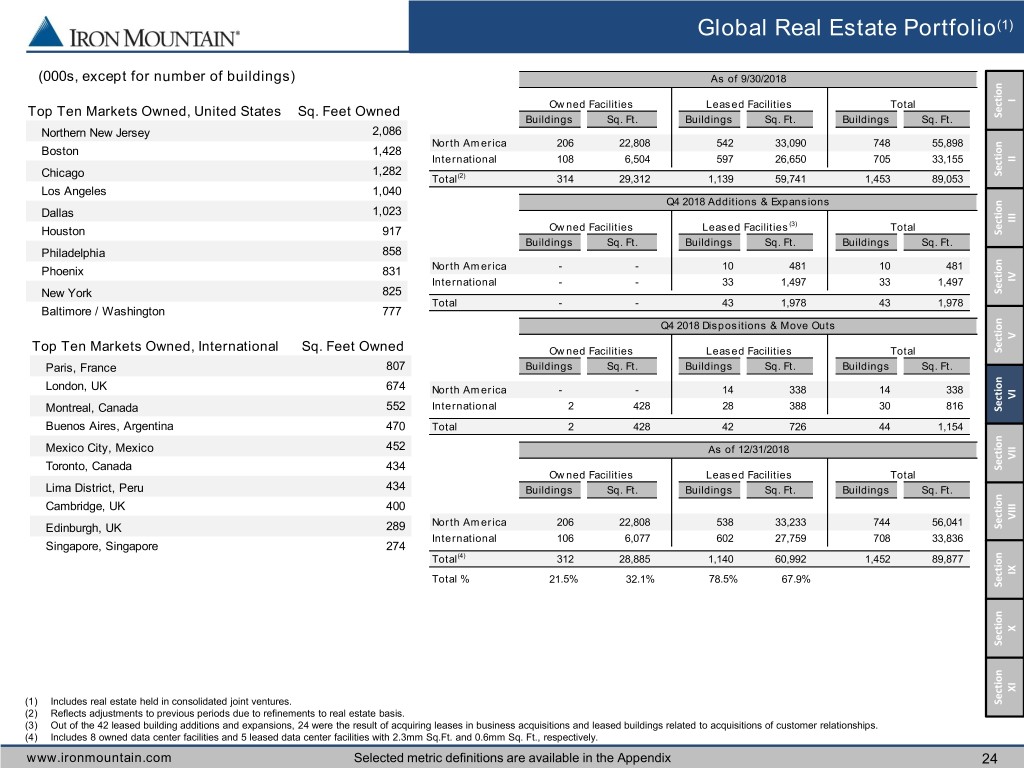

Global Real Estate Portfolio(1) (000s, except for number of buildings) As of 9/30/2018 Ow ned Facilities Leased Facilities Total I Top Ten Markets Owned, United States Sq. Feet Owned Section Buildings Sq. Ft. Buildings Sq. Ft. Buildings Sq. Ft. Northern New Jersey 2,086 North America 206 22,808 542 33,090 748 55,898 Boston 1,428 International x 108 6,504 597 26,650 705 33,155 II Chicago 1,282 (2) Section Total 314 29,312 1,139 59,741 1,453 89,053 Los Angeles 1,040 Q4 2018 Additions & Expansions Dallas 1,023 III Ow ned Facilities Leased Facilities (3) Total Houston 917 Section Buildings Sq. Ft. Buildings Sq. Ft. Buildings Sq. Ft. Philadelphia 858 Phoenix 831 North America - - 10 481 10 481 International x - - 33 1,497 33 1,497 IV New York 825 Section Total - - 43 1,978 43 1,978 Baltimore / Washington 777 Q4 2018 Dispositions & Move Outs V Top Ten Markets Owned, International Sq. Feet Owned Ow ned Facilities Leased Facilities Total Section Paris, France 807 Buildings Sq. Ft. Buildings Sq. Ft. Buildings Sq. Ft. London, UK 674 North America - - 14 338 14 338 VI Montreal, Canada 552 International x 2 428 28 388 30 816 Section Buenos Aires, Argentina 470 Total 2 428 42 726 44 1,154 Mexico City, Mexico 452 As of 12/31/2018 VII Toronto, Canada 434 Section Ow ned Facilities Leased Facilities Total Lima District, Peru 434 Buildings Sq. Ft. Buildings Sq. Ft. Buildings Sq. Ft. Cambridge, UK 400 North America 206 22,808 538 33,233 744 56,041 VIII Edinburgh, UK 289 Section International x 106 6,077 602 27,759 708 33,836 Singapore, Singapore 274 Total(4) 312 28,885 1,140 60,992 1,452 89,877 Total % 21.5% 32.1% 78.5% 67.9% IX Section X Section XI (1) Includes real estate held in consolidated joint ventures. Section (2) Reflects adjustments to previous periods due to refinements to real estate basis. (3) Out of the 42 leased building additions and expansions, 24 were the result of acquiring leases in business acquisitions and leased buildings related to acquisitions of customer relationships. (4) Includes 8 owned data center facilities and 5 leased data center facilities with 2.3mm Sq.Ft. and 0.6mm Sq. Ft., respectively. www.ironmountain.com Selected metric definitions are available in the Appendix 24

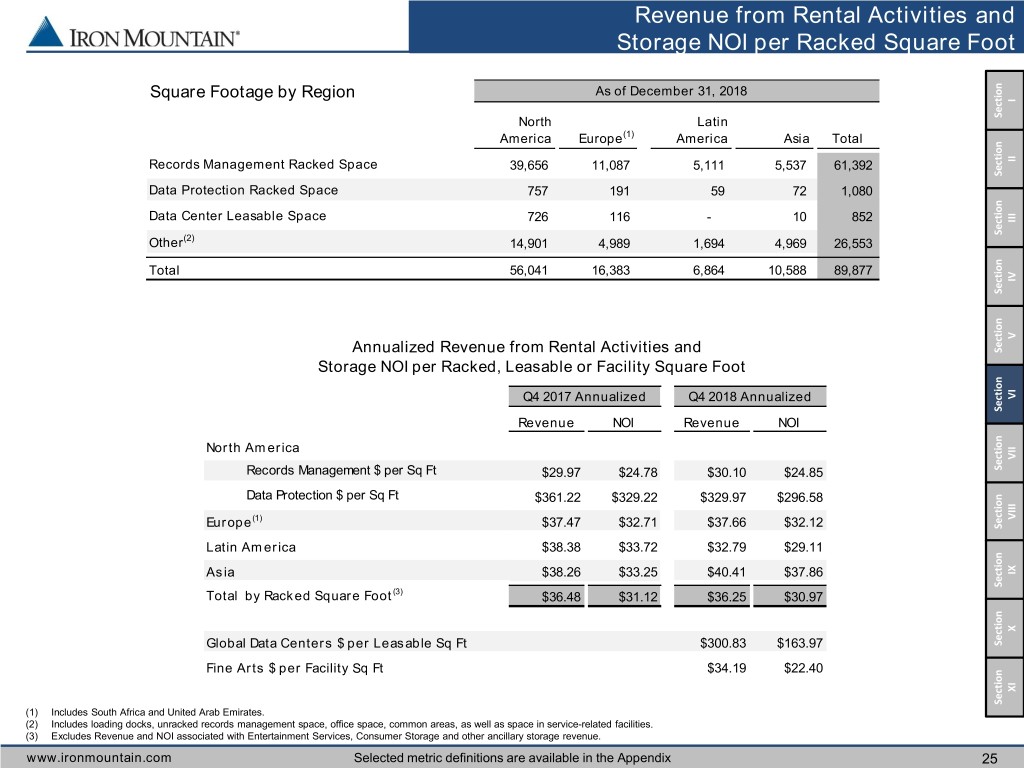

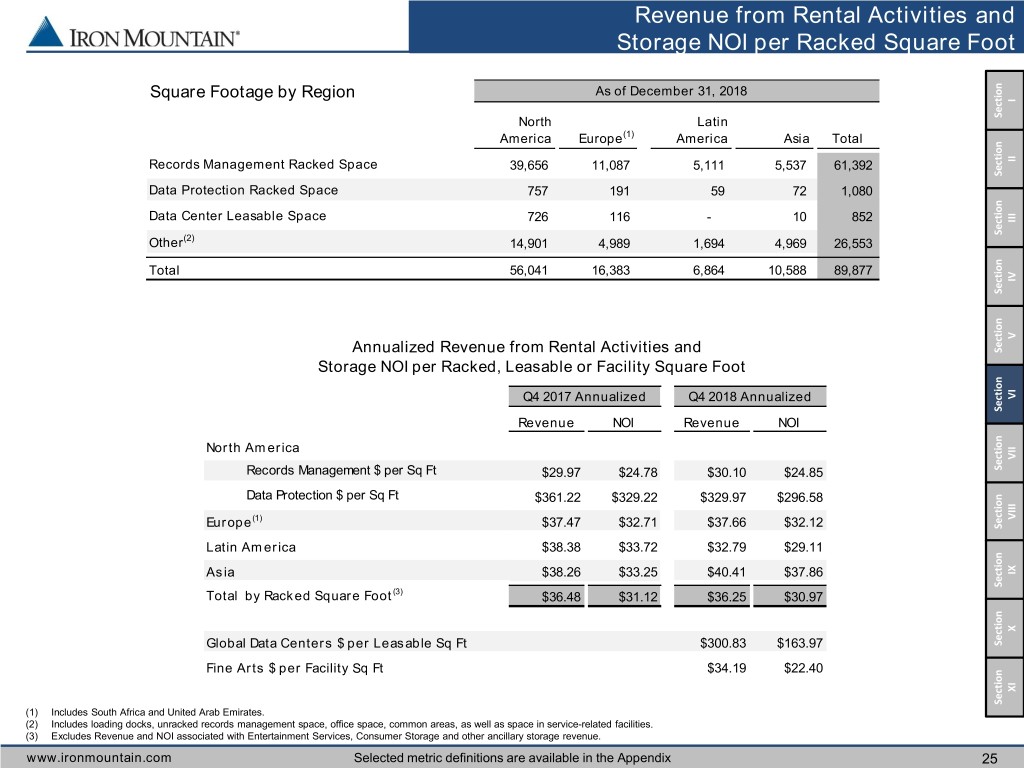

Revenue from Rental Activities and Storage NOI per Racked Square Foot Square Footage by Region As of December 31, 2018 I North Latin Section America Europe(1) America Asia Total Records Management Racked Space 39,656 11,087 5,111 5,537 61,392 II Section Data Protection Racked Space 757 191 59 72 1,080 Data Center Leasable Space 726 116 - 10 852 III Section Other(2) 14,901 4,989 1,694 4,969 26,553 Total 56,041 16,383 6,864 10,588 89,877 IV Section V Annualized Revenue from Rental Activities and Section Storage NOI per Racked, Leasable or Facility Square Foot Q4 2017 Annualized Q4 2018 Annualized VI Section Revenue NOI Revenue NOI North America VII Records Management $ per Sq Ft $29.97 $24.78 $30.10 $24.85 Section Data Protection $ per Sq Ft $361.22 $329.22 $329.97 $296.58 (1) VIII Europe $37.47 $32.71 $37.66 $32.12 Section Latin America $38.38 $33.72 $32.79 $29.11 Asia $38.26 $33.25 $40.41 $37.86 IX Section Total by Racked Square Foot(3) $36.48 $31.12 $36.25 $30.97 X Global Data Centers $ per Leasable Sq Ft $300.83 $163.97 Section Fine Arts $ per Facility Sq Ft $34.19 $22.40 XI Section (1) Includes South Africa and United Arab Emirates. (2) Includes loading docks, unracked records management space, office space, common areas, as well as space in service-related facilities. (3) Excludes Revenue and NOI associated with Entertainment Services, Consumer Storage and other ancillary storage revenue. www.ironmountain.com Selected metric definitions are available in the Appendix 25

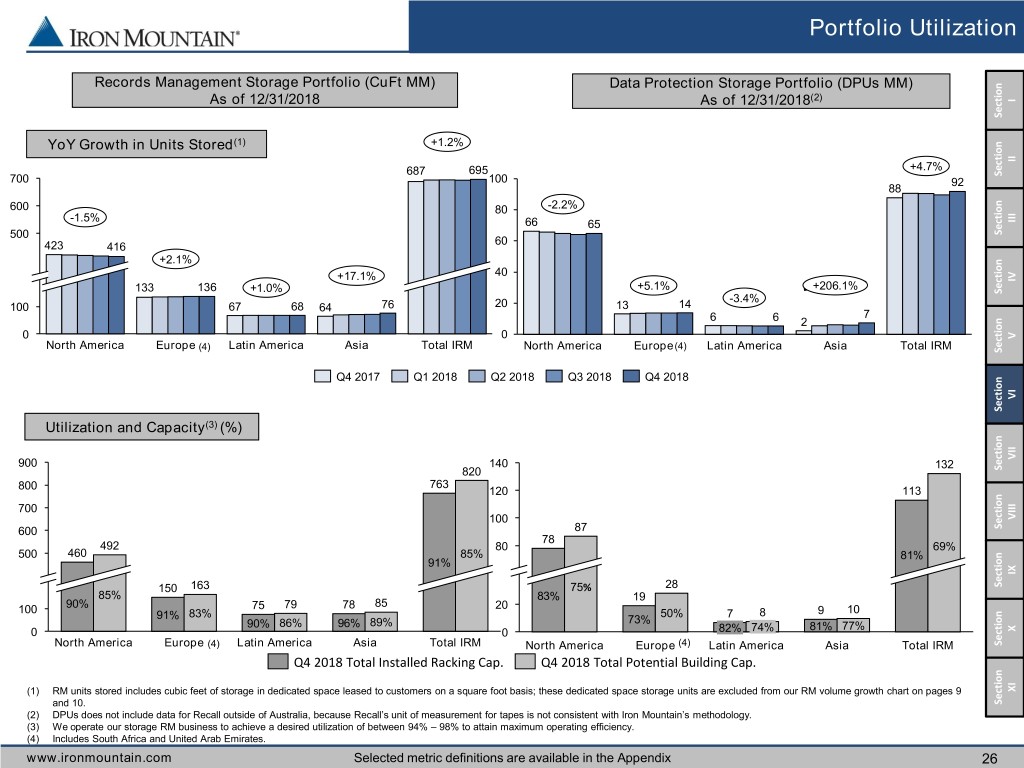

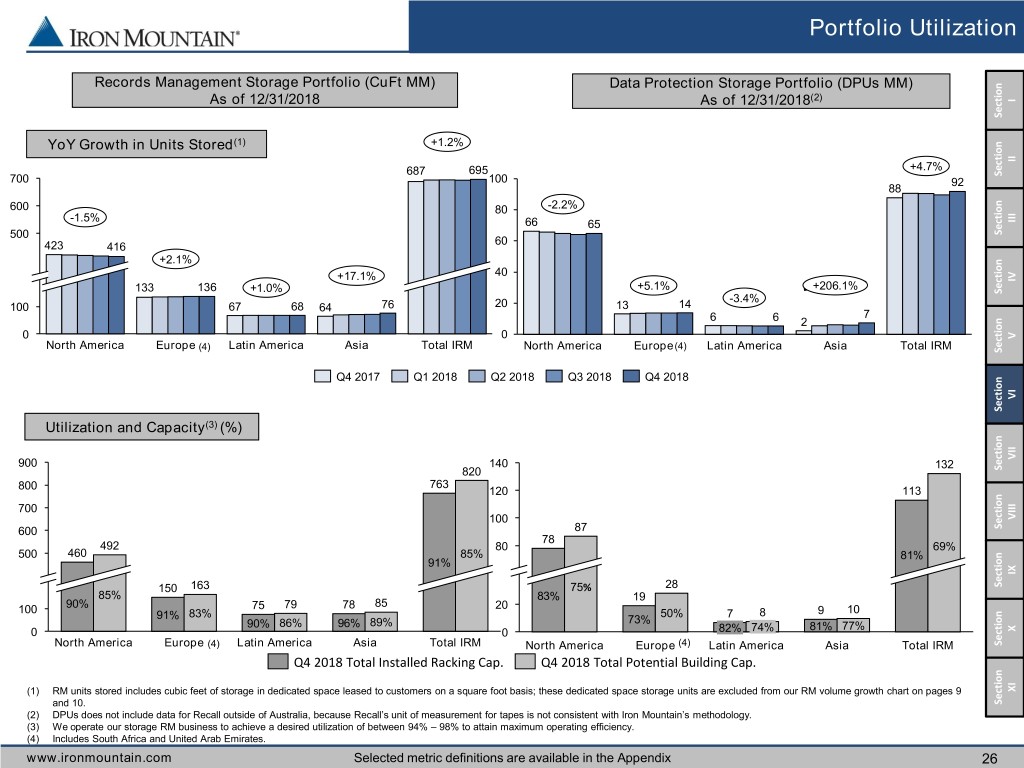

Portfolio Utilization Records Management Storage Portfolio (CuFt MM) Data Protection Storage Portfolio (DPUs MM) As of 12/31/2018 As of 12/31/2018(2) I Section YoY Growth in Units Stored(1) +1.2% +4.7% II 687 695 Section 700 100 92 88 600 80 -2.2% -1.5% III 66 65 500 Section 60 423 416 +2.1% 40 +17.1% IV 133 136 +5.1% +206.1% +1.0% Section -3.4% 100 67 68 64 76 20 13 14 7 6 6 2 0 0 V North America Europe (4) Latin America Asia Total IRM North America Europe(4) Latin America Asia Total IRM Section Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 VI Section Utilization and Capacity(3) (%) 900 140 VII 132 Section 820 763 800 120 113 700 100 VIII 600 87 Section 78 492 80 69% 500 460 85% 81% 91% IX 150 163 75% 28 Section 85% 83% 19 90% 75 79 78 85 20 100 91% 83% 50% 7 8 9 10 90% 86% 96% 89% 73% 81% 77% X 0 0 82% 74% North America Europe (4) Latin America Asia Total IRM North America Europe (4) Latin America Asia Total IRM Section Q4 2018 Total Installed Racking Cap. Q4 2018 Total Potential Building Cap. (1) RM units stored includes cubic feet of storage in dedicated space leased to customers on a square foot basis; these dedicated space storage units are excluded from our RM volume growth chart on pages 9 XI and 10. Section (2) DPUs does not include data for Recall outside of Australia, because Recall’s unit of measurement for tapes is not consistent with Iron Mountain’s methodology. (3) We operate our storage RM business to achieve a desired utilization of between 94% – 98% to attain maximum operating efficiency. (4) Includes South Africa and United Arab Emirates. www.ironmountain.com Selected metric definitions are available in the Appendix 26

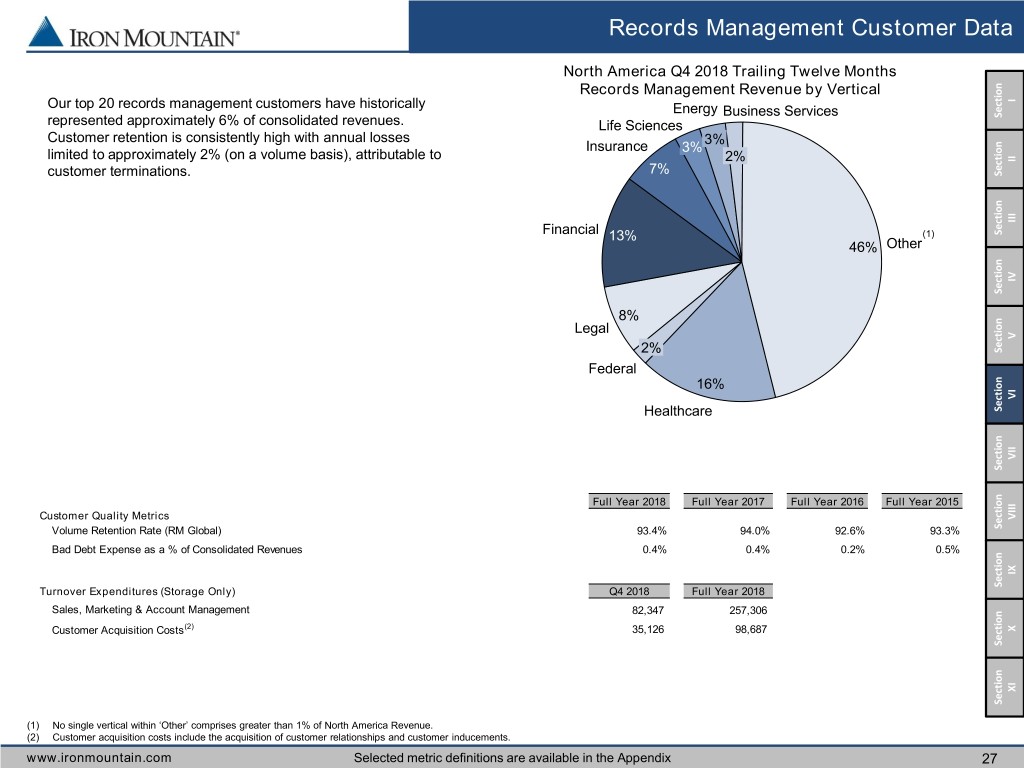

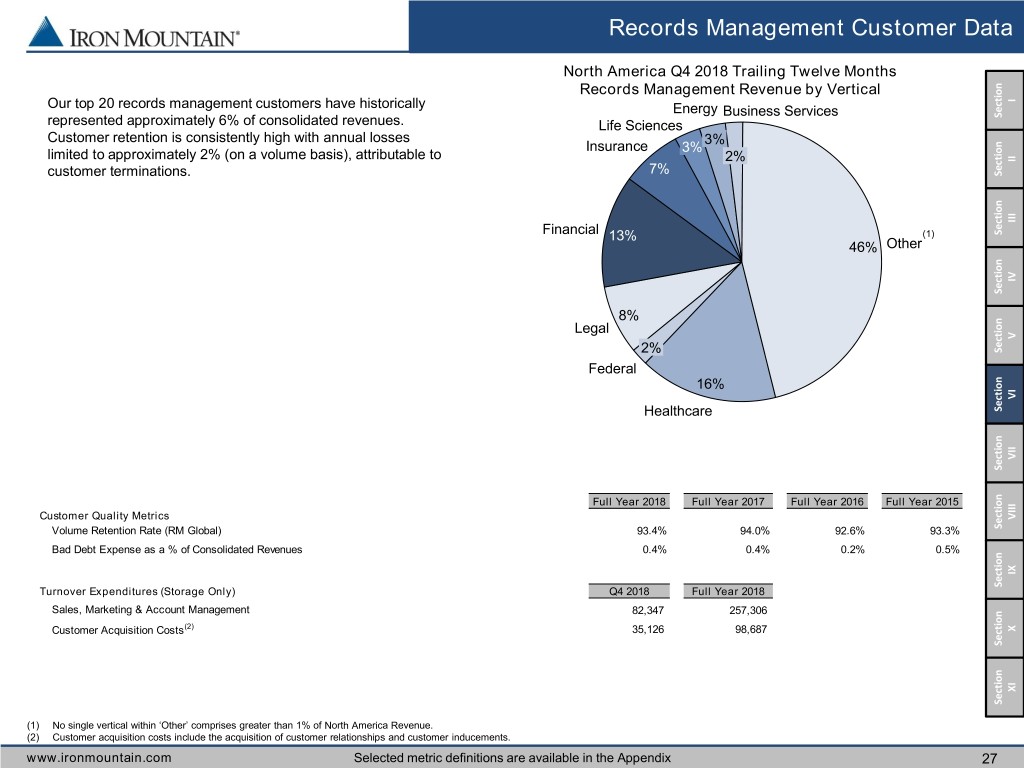

Records Management Customer Data North America Q4 2018 Trailing Twelve Months Records Management Revenue by Vertical I Our top 20 records management customers have historically Energy Business Services Section represented approximately 6% of consolidated revenues. Life Sciences Customer retention is consistently high with annual losses 3% Insurance 3% limited to approximately 2% (on a volume basis), attributable to 2% II customer terminations. 7% Section III Financial 13% (1) Section 46% Other IV Section 8% Legal V 2% Section Federal 16% VI Healthcare Section VII Section Full Year 2018 Full Year 2017 Full Year 2016 Full Year 2015 Customer Quality Metrics VIII Volume Retention Rate (RM Global) 93.4% 94.0% 92.6% 93.3% Section Bad Debt Expense as a % of Consolidated Revenues 0.4% 0.4% 0.2% 0.5% IX Turnover Expenditures (Storage Only) Q4 2018 Full Year 2018 Section Sales, Marketing & Account Management 82,347 257,306 (2) Customer Acquisition Costs 35,126 98,687 X Section XI Section (1) No single vertical within ‘Other’ comprises greater than 1% of North America Revenue. (2) Customer acquisition costs include the acquisition of customer relationships and customer inducements. www.ironmountain.com Selected metric definitions are available in the Appendix 27

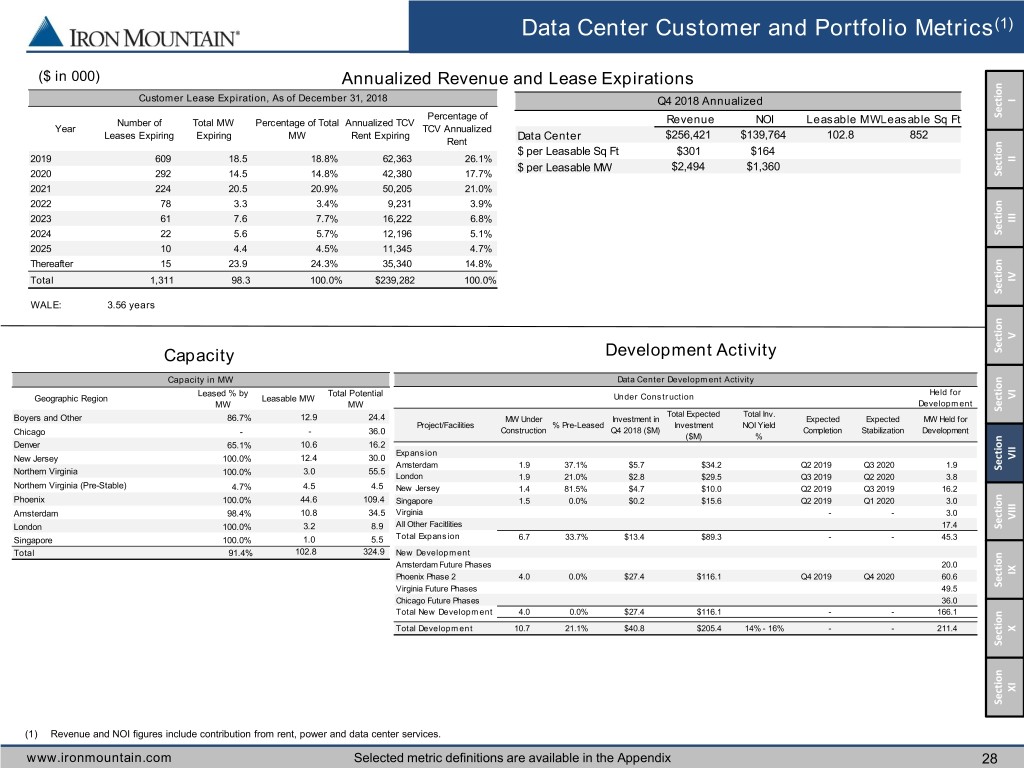

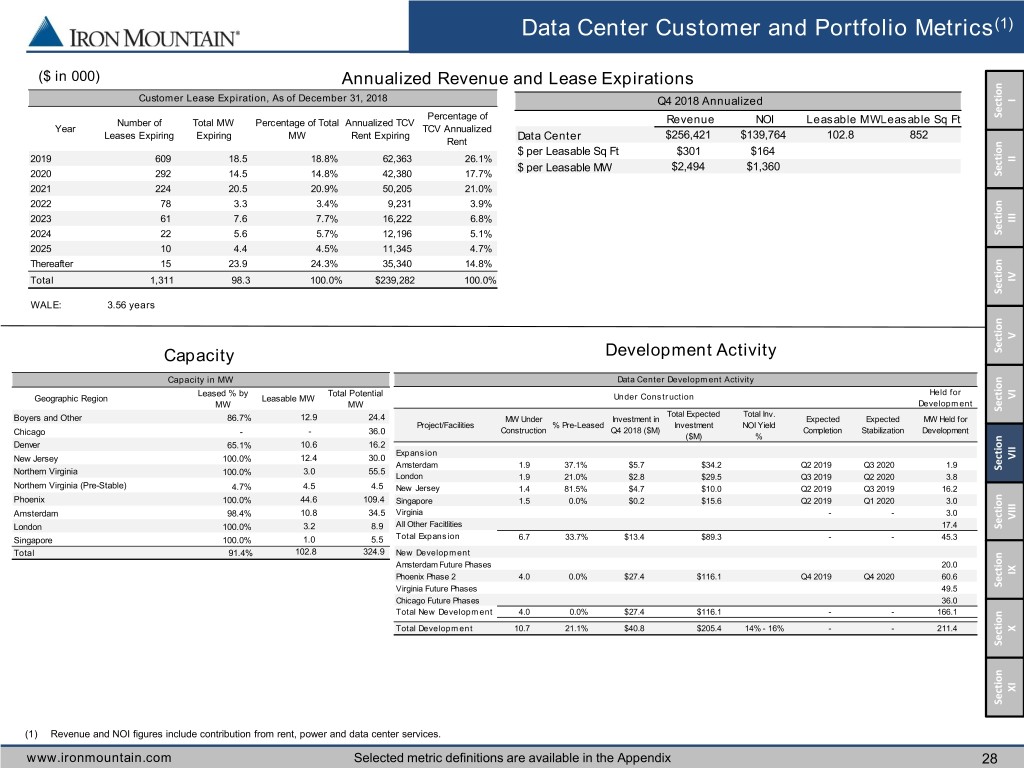

Data Center Customer and Portfolio Metrics(1) ($ in 000) Annualized Revenue and Lease Expirations Customer Lease Expiration, As of December 31, 2018 Q4 2018 Annualized I Percentage of Section Number of Total MW Percentage of Total Annualized TCV Revenue NOI Leasable MWLeasable Sq Ft Year TCV Annualized Leases Expiring Expiring MW Rent Expiring Data Center $256,421 $139,764 102.8 852 Rent $ per Leasable Sq Ft $301 $164 2019 609 18.5 18.8% 62,363 26.1% II $ per Leasable MW $2,494 $1,360 2020 292 14.5 14.8% 42,380 17.7% Section 2021 224 20.5 20.9% 50,205 21.0% 2022 78 3.3 3.4% 9,231 3.9% 2023 61 7.6 7.7% 16,222 6.8% III 2024 22 5.6 5.7% 12,196 5.1% Section 2025 10 4.4 4.5% 11,345 4.7% Thereafter 15 23.9 24.3% 35,340 14.8% Total 1,311 98.3 100.0% $239,282 100.0% IV Section WALE: 3.56 years V Capacity Development Activity Section Capacity in MW Data Center Development Activity Leased % by Total Potential Held for Geographic Region Leasable MW Under Construction VI MW MW Development Total Expected Total Inv. Section Boyers and Other 86.7% 12.9 24.4 MW Under Investment in Expected Expected MW Held for Project/Facilities % Pre-Leased Investment NOI Yield Chicago - - 36.0 Construction Q4 2018 ($M) Completion Stabilization Development ($M) % Denver 65.1% 10.6 16.2 Expansion New Jersey 100.0% 12.4 30.0 VII Amsterdam 1.9 37.1% $5.7 $34.2 Q2 2019 Q3 2020 1.9 Northern Virginia 100.0% 3.0 55.5 Section London 1.9 21.0% $2.8 $29.5 Q3 2019 Q2 2020 3.8 Northern Virginia (Pre-Stable) 4.7% 4.5 4.5 New Jersey 1.4 81.5% $4.7 $10.0 Q2 2019 Q3 2019 16.2 Phoenix 100.0% 44.6 109.4 Singapore 1.5 0.0% $0.2 $15.6 Q2 2019 Q1 2020 3.0 Amsterdam 98.4% 10.8 34.5 Virginia - - 3.0 VIII All Other Facitlities London 100.0% 3.2 8.9 17.4 Section Singapore 100.0% 1.0 5.5 Total Expansion 6.7 33.7% $13.4 $89.3 - - 45.3 Total 91.4% 102.8 324.9 New Development Amsterdam Future Phases 20.0 Phoenix Phase 2 4.0 0.0% $27.4 $116.1 Q4 2019 Q4 2020 60.6 IX Virginia Future Phases 49.5 Section Chicago Future Phases 36.0 Total New Development 4.0 0.0% $27.4 $116.1 - - 166.1 Total Development 10.7 21.1% $40.8 $205.4 14% - 16% - - 211.4 X Section XI Section (1) Revenue and NOI figures include contribution from rent, power and data center services. www.ironmountain.com Selected metric definitions are available in the Appendix 28

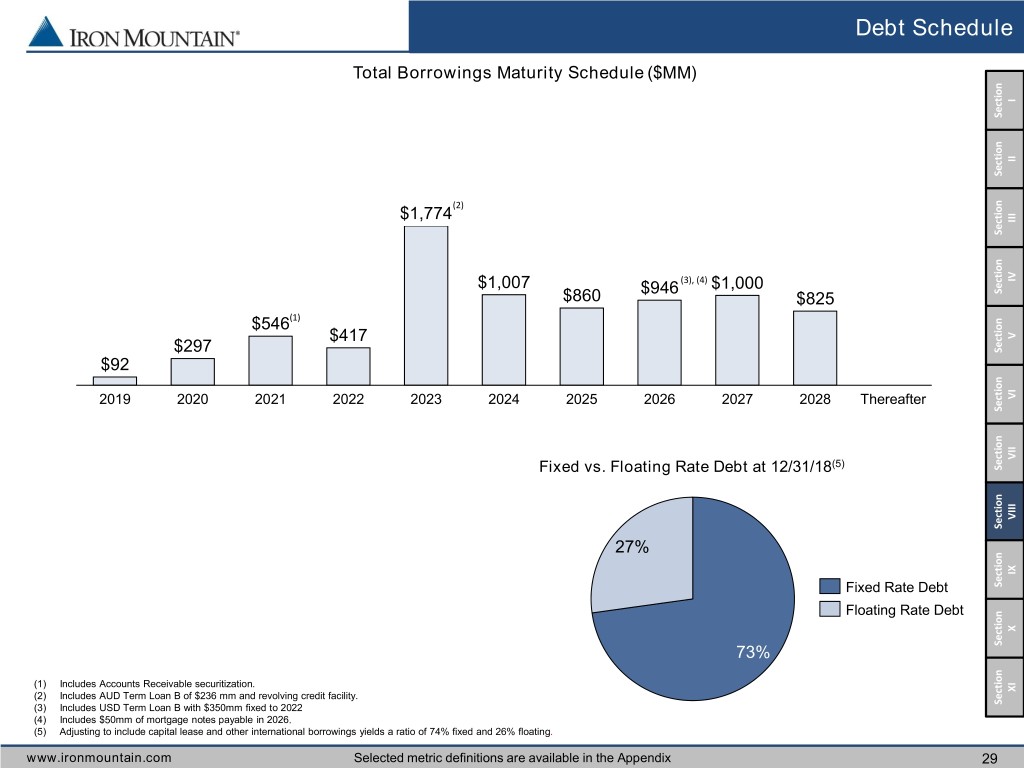

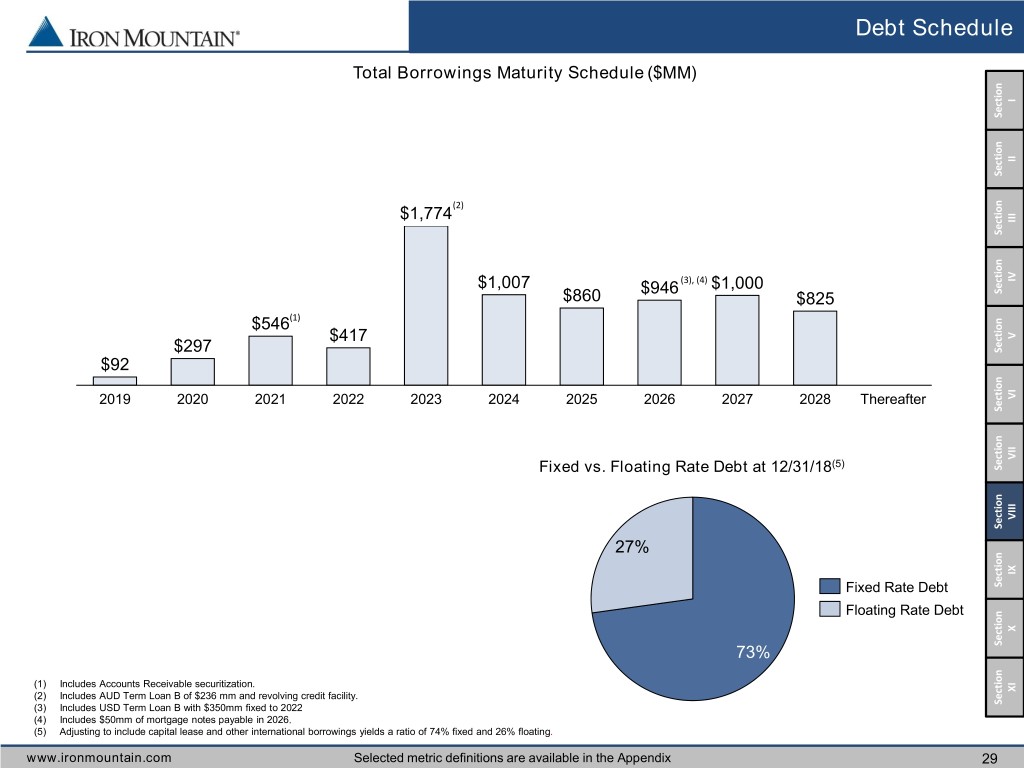

Debt Schedule Total Borrowings Maturity Schedule ($MM) I Section II Section (2) $1,774 III Section $1,007 (3), (4) $1,000 IV $946 Section $860 $825 $546(1) $417 V $297 Section $92 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 Thereafter VI Section (5) VII Fixed vs. Floating Rate Debt at 12/31/18 Section VIII Section Section 27% IX Fixed Rate Debt Section Floating Rate Debt X 73% Section (1) Includes Accounts Receivable securitization. (2) Includes AUD Term Loan B of $236 mm and revolving credit facility. XI (3) Includes USD Term Loan B with $350mm fixed to 2022 Section (4) Includes $50mm of mortgage notes payable in 2026. (5) Adjusting to include capital lease and other international borrowings yields a ratio of 74% fixed and 26% floating. www.ironmountain.com Selected metric definitions are available in the Appendix 29

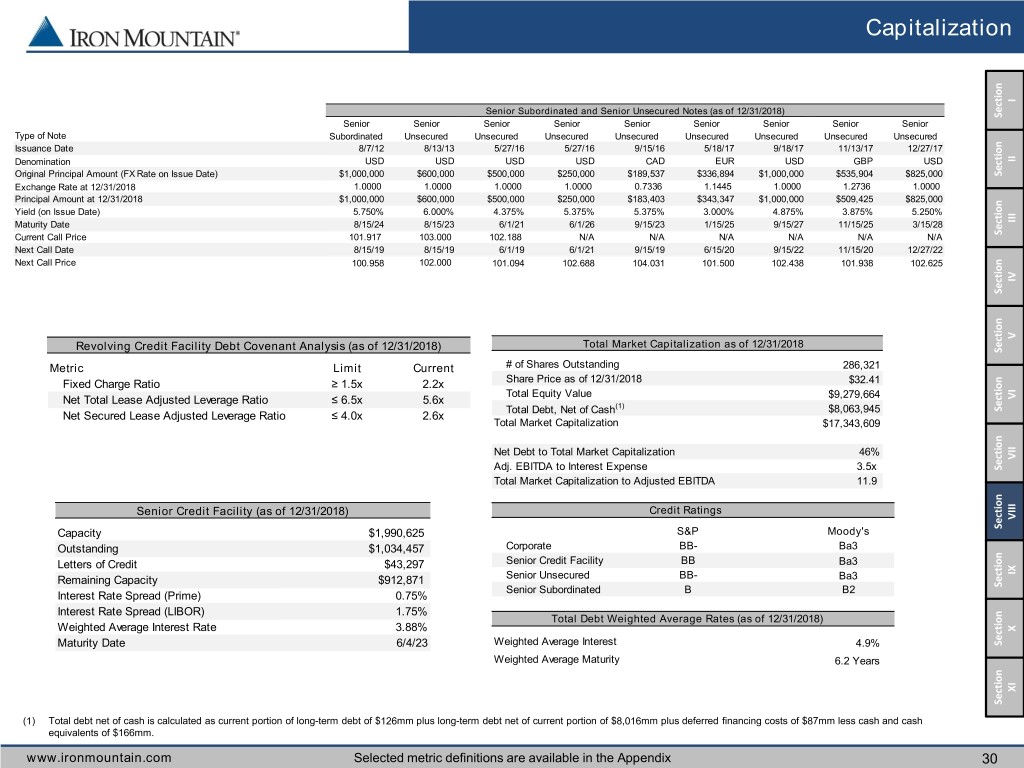

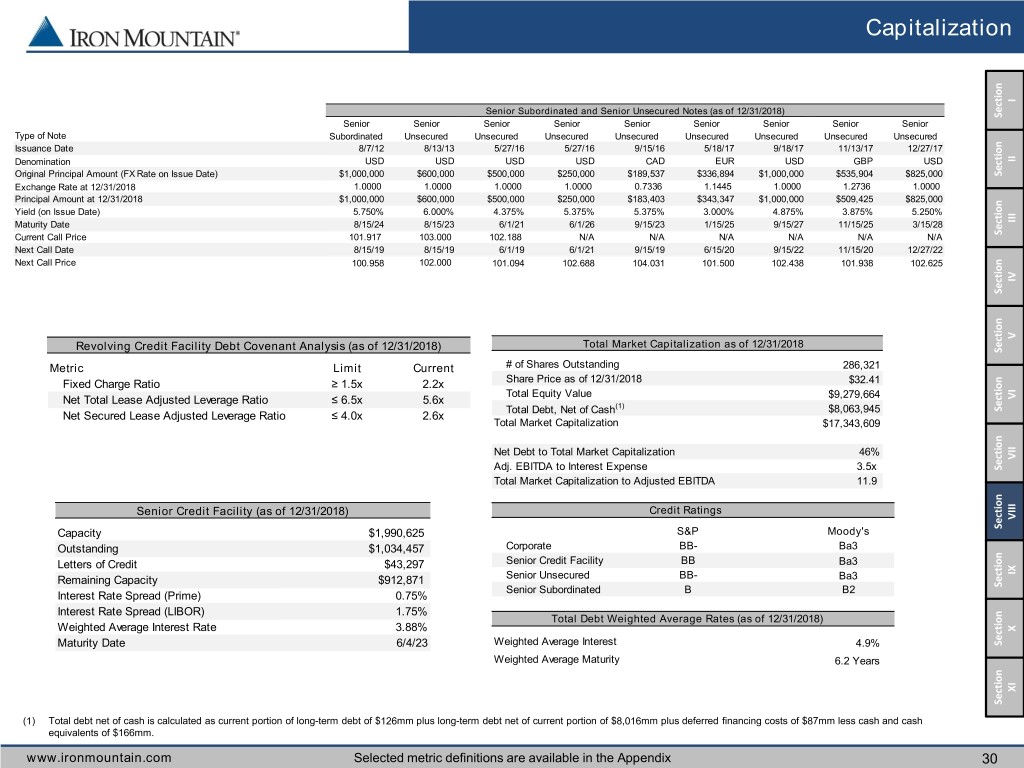

Capitalization I Senior Subordinated and Senior Unsecured Notes (as of 12/31/2018) Section Senior Senior Senior Senior Senior Senior Senior Senior Senior Type of Note Subordinated Unsecured Unsecured Unsecured Unsecured Unsecured Unsecured Unsecured Unsecured Issuance Date 8/7/12 8/13/13 5/27/16 5/27/16 9/15/16 5/18/17 9/18/17 11/13/17 12/27/17 Denomination USD USD USD USD CAD EUR USD GBP USD II Original Principal Amount (FX Rate on Issue Date) $1,000,000 $600,000 $500,000 $250,000 $189,537 $336,894 $1,000,000 $535,904 $825,000 Section Exchange Rate at 12/31/2018 1.0000 1.0000 1.0000 1.0000 0.7336 1.1445 1.0000 1.2736 1.0000 Principal Amount at 12/31/2018 $1,000,000 $600,000 $500,000 $250,000 $183,403 $343,347 $1,000,000 $509,425 $825,000 Yield (on Issue Date) 5.750% 6.000% 4.375% 5.375% 5.375% 3.000% 4.875% 3.875% 5.250% Maturity Date 8/15/24 8/15/23 6/1/21 6/1/26 9/15/23 1/15/25 9/15/27 11/15/25 3/15/28 III Current Call Price 101.917 103.000 102.188 N/A N/A N/A N/A N/A N/A Section Next Call Date 8/15/19 8/15/19 6/1/19 6/1/21 9/15/19 6/15/20 9/15/22 11/15/20 12/27/22 Next Call Price 100.958 102.000 101.094 102.688 104.031 101.500 102.438 101.938 102.625 IV Section V Revolving Credit Facility Debt Covenant Analysis (as of 12/31/2018) Total Market Capitalization as of 12/31/2018 Section Metric Limit Current # of Shares Outstanding 286,321 Fixed Charge Ratio ≥ 1.5x 2.2x Share Price as of 12/31/2018 $32.41 Total Equity Value $9,279,664 VI Net Total Lease Adjusted Leverage Ratio ≤ 6.5x 5.6x (1) Total Debt, Net of Cash $8,063,945 Section Net Secured Lease Adjusted Leverage Ratio ≤ 4.0x 2.6x Total Market Capitalization $17,343,609 Net Debt to Total Market Capitalization 46% VII Adj. EBITDA to Interest Expense 3.5x Section Total Market Capitalization to Adjusted EBITDA 11.9 Senior Credit Facility (as of 12/31/2018) CreditSenior Ratings Credit Facility Debt Covenant Analysis (as of 12/31/2018) VIII Capacity $1,990,625 S&P Moody's Section Data Table for ThinkCell Chart Outstanding $1,034,457 Corporate BB- Ba3 Letters of Credit $43,297 Senior Credit Facility BB Ba3 IX Remaining Capacity $912,871 Senior Unsecured BB- Ba3 Senior Subordinated B B2 Section Interest Rate Spread (Prime) 0.75% Interest Rate Spread (LIBOR) 1.75% Total Debt Weighted Average Rates (as of 12/31/2018) Weighted Average Interest Rate 3.88% X Maturity Date 6/4/23 Weighted Average Interest 4.9% Section Weighted Average Maturity 6.2 Years XI Section (1) Total debt net of cash is calculated as current portion of long-term debt of $126mm plus long-term debt net of current portion of $8,016mm plus deferred financing costs of $87mm less cash and cash equivalents of $166mm. www.ironmountain.com Selected metric definitions are available in the Appendix 30

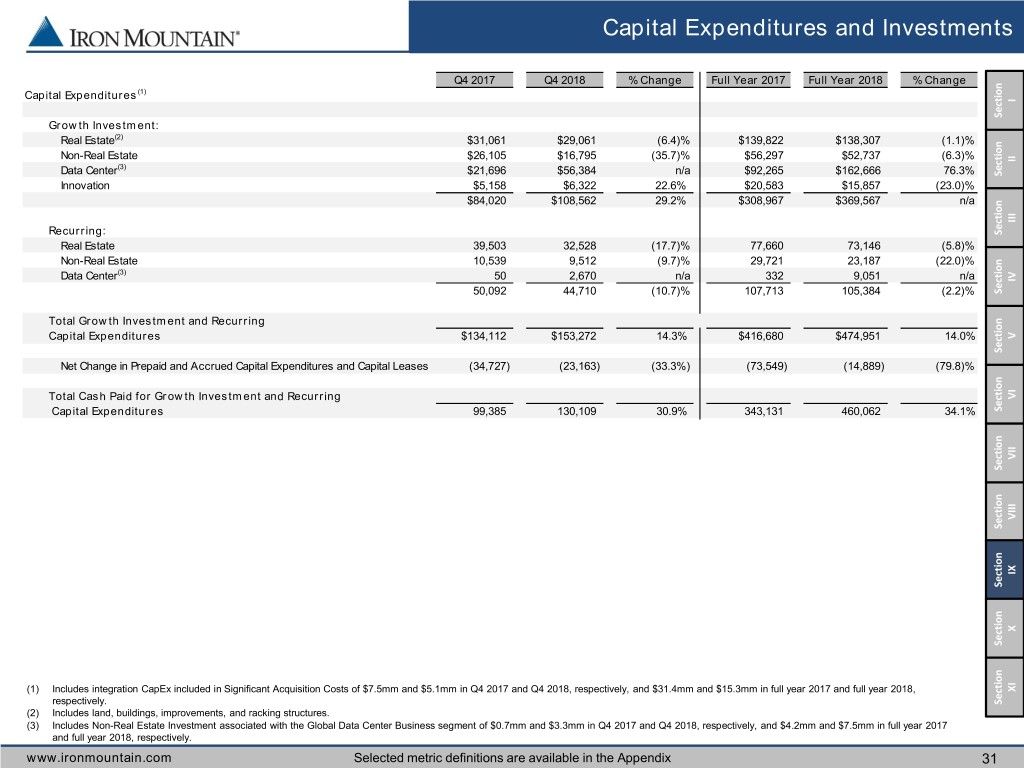

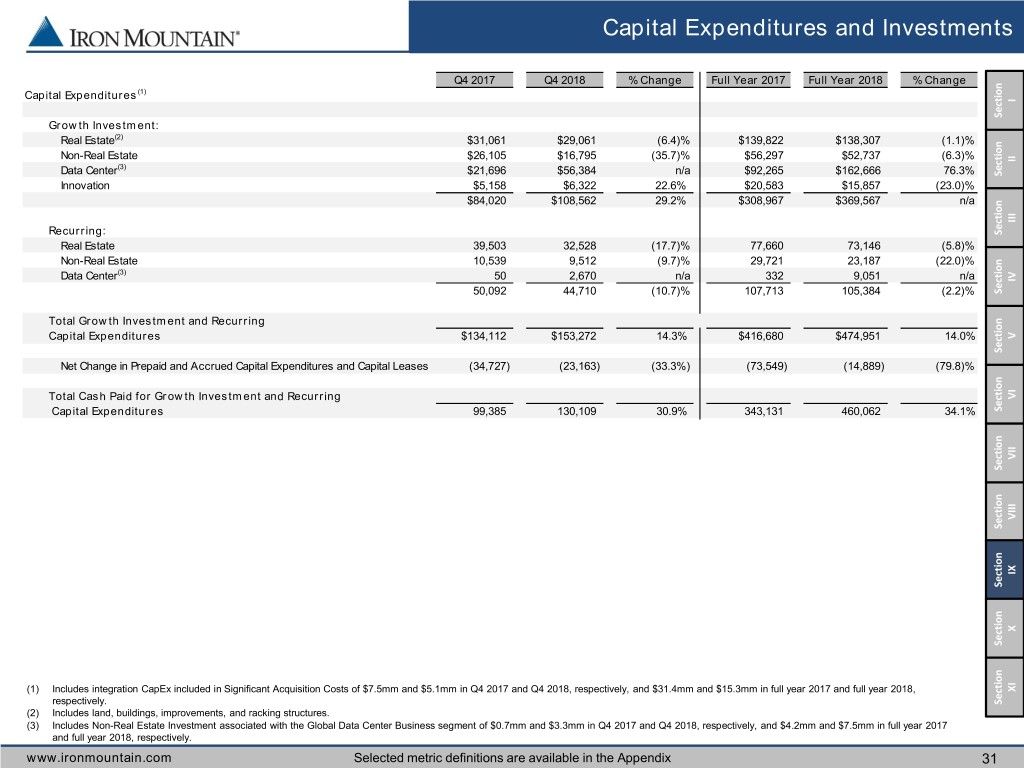

Capital Expenditures and Investments Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Capital Expenditures (1) I Section Growth Investment: Real Estate(2) $31,061 $29,061 (6.4)% $139,822 $138,307 (1.1)% Non-Real Estate $26,105 $16,795 (35.7)% $56,297 $52,737 (6.3)% II (3) Data Center $21,696 $56,384 n/a $92,265 $162,666 76.3% Section Innovation $5,158 $6,322 22.6% $20,583 $15,857 (23.0)% $84,020 $108,562 29.2% $308,967 $369,567 n/a III Recurring: Section Real Estate 39,503 32,528 (17.7)% 77,660 73,146 (5.8)% Non-Real Estate 10,539 9,512 (9.7)% 29,721 23,187 (22.0)% (3) Data Center 50 2,670 n/a 332 9,051 n/a IV 50,092 44,710 (10.7)% 107,713 105,384 (2.2)% Section Total Growth Investment and Recurring Capital Expenditures $134,112 $153,272 14.3% $416,680 $474,951 14.0% V Section Net Change in Prepaid and Accrued Capital Expenditures and Capital Leases (34,727) (23,163) (33.3%) (73,549) (14,889) (79.8)% Total Cash Paid for Growth Investment and Recurring VI Capital Expenditures 99,385 130,109 30.9% 343,131 460,062 34.1% Section VII Section VIII Section Section IX Section X Section (1) Includes integration CapEx included in Significant Acquisition Costs of $7.5mm and $5.1mm in Q4 2017 and Q4 2018, respectively, and $31.4mm and $15.3mm in full year 2017 and full year 2018, XI respectively. Section (2) Includes land, buildings, improvements, and racking structures. (3) Includes Non-Real Estate Investment associated with the Global Data Center Business segment of $0.7mm and $3.3mm in Q4 2017 and Q4 2018, respectively, and $4.2mm and $7.5mm in full year 2017 and full year 2018, respectively. www.ironmountain.com Selected metric definitions are available in the Appendix 31

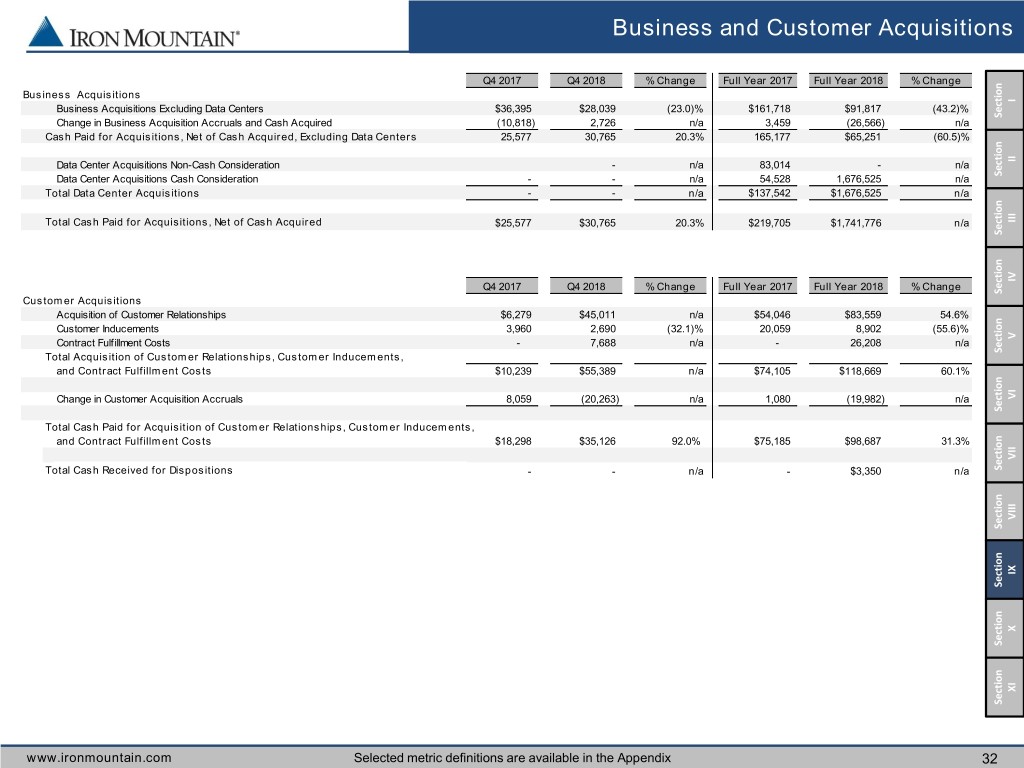

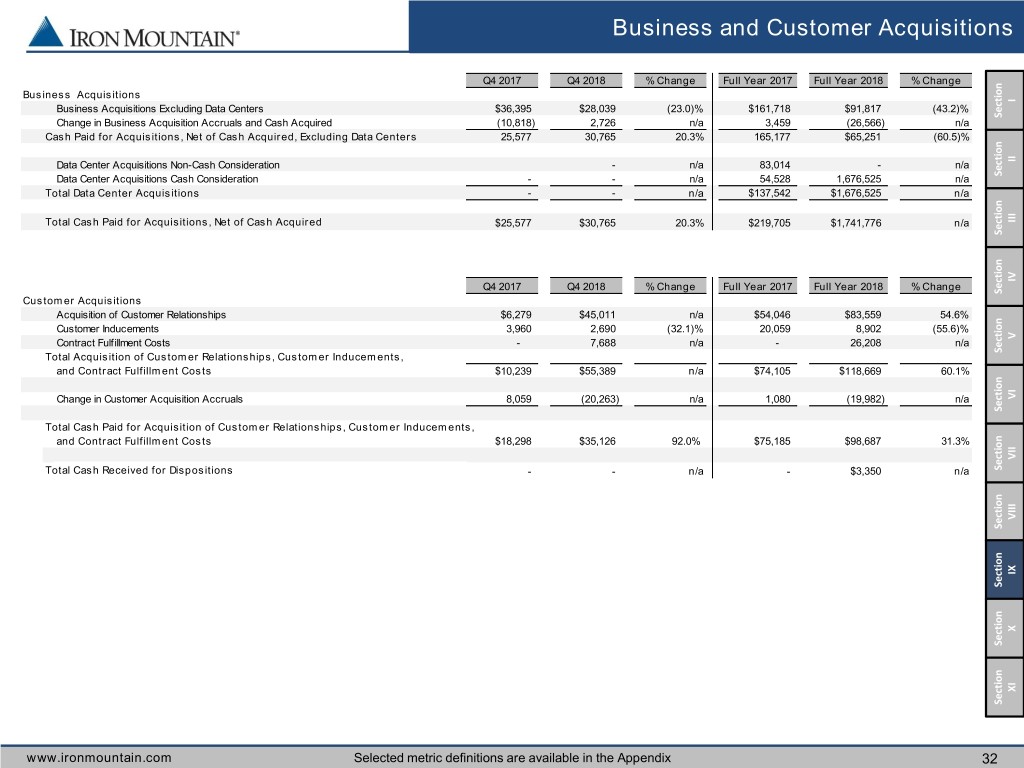

Business and Customer Acquisitions Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Business Acquisitions I Business Acquisitions Excluding Data Centers $36,395 $28,039 (23.0)% $161,718 $91,817 (43.2)% Section Change in Business Acquisition Accruals and Cash Acquired (10,818) 2,726 n/a 3,459 (26,566) n/a Cash Paid for Acquisitions, Net of Cash Acquired, Excluding Data Centers 25,577 30,765 20.3% 165,177 $65,251 (60.5)% Data Center Acquisitions Non-Cash Consideration - n/a 83,014 - n/a II Data Center Acquisitions Cash Consideration - - n/a 54,528 1,676,525 n/a Section Total Data Center Acquisitions - - n/a $137,542 $1,676,525 n/a Total Cash Paid for Acquisitions, Net of Cash Acquired $25,577 $30,765 20.3% $219,705 $1,741,776 n/a III Section IV Q4 2017 Q4 2018 % Change Full Year 2017 Full Year 2018 % Change Section Customer Acquisitions Acquisition of Customer Relationships $6,279 $45,011 n/a $54,046 $83,559 54.6% Customer Inducements 3,960 2,690 (32.1)% 20,059 8,902 (55.6)% Contract Fulfillment Costs - 7,688 n/a - 26,208 n/a V Total Acquisition of Customer Relationships, Customer Inducements, Section and Contract Fulfillment Costs $10,239 $55,389 n/a $74,105 $118,669 60.1% Change in Customer Acquisition Accruals 8,059 (20,263) n/a 1,080 (19,982) n/a VI Section Total Cash Paid for Acquisition of Customer Relationships, Customer Inducements, Customerand Contract Inducements Fulfillment Costs $18,298 $35,126 92.0% $75,185 $98,687 31.3% VII Total Cash Received for Dispositions x - - n/a - $3,350 n/a Section VIII Section Section IX Section X Section XI Section www.ironmountain.com Selected metric definitions are available in the Appendix 32

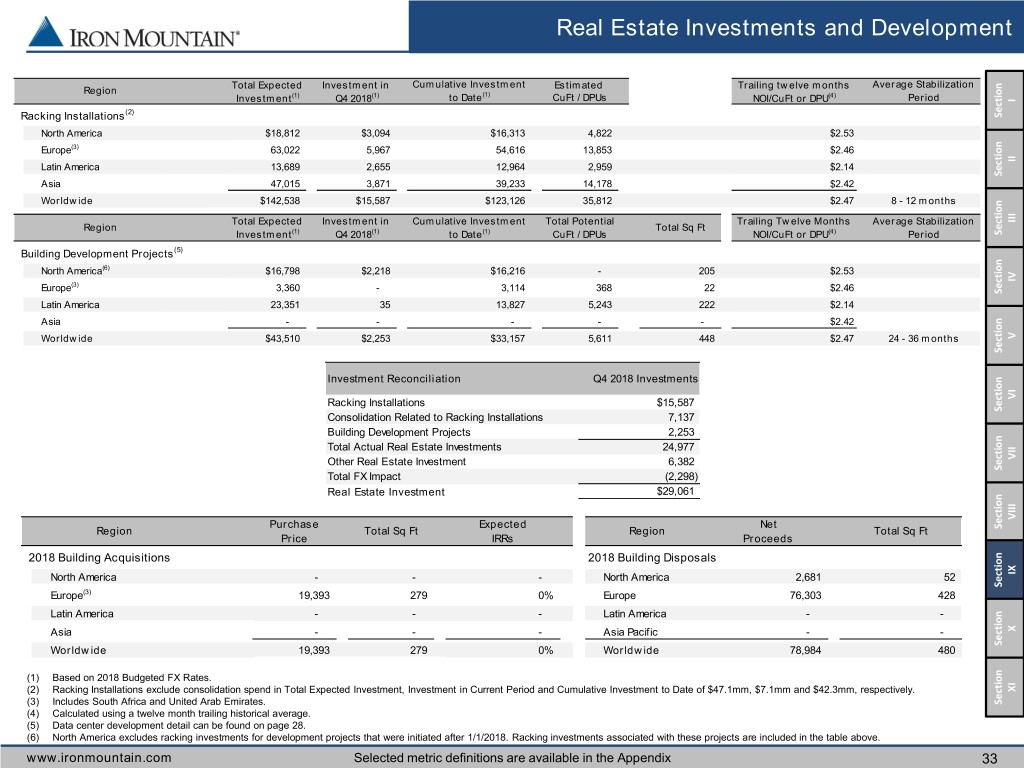

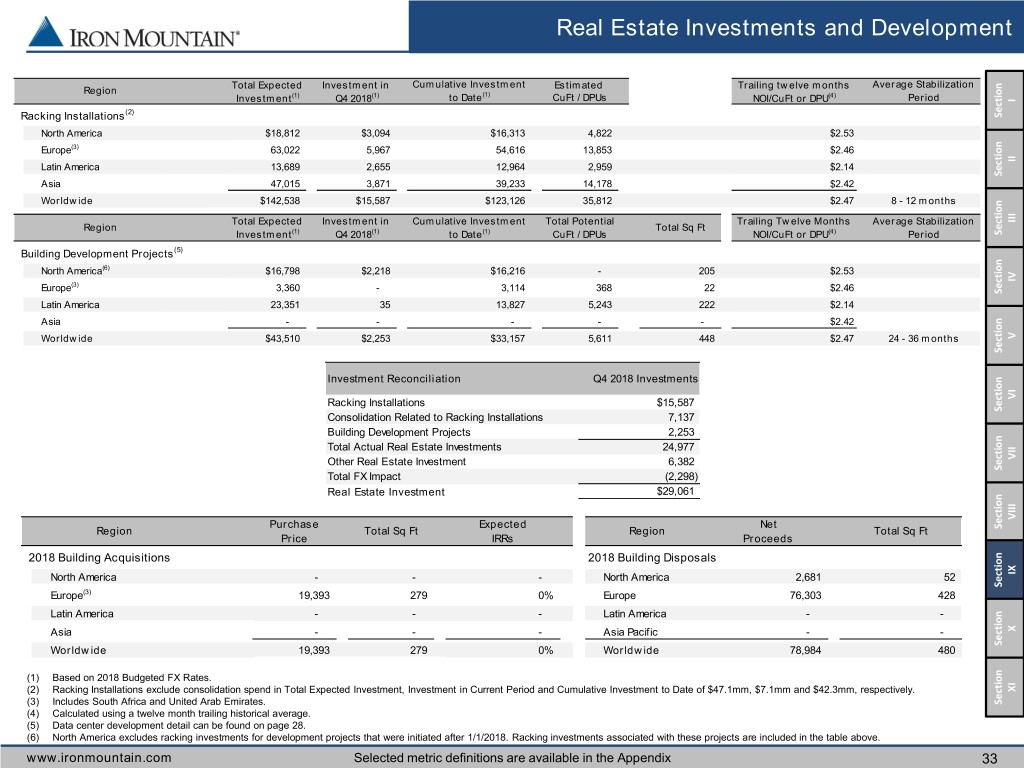

Real Estate Investments and Development Total Expected Investment in Cumulative Investment Estimated Trailing twelve months Average Stabilization Region (1) (1) (1) (4) Investment Q4 2018 to Date CuFt / DPUs NOI/CuFt or DPU Period I (2) Racking Installations Section North America $18,812 $3,094 $16,313 4,822 $2.53 Europe(3) 63,022 5,967 54,616 13,853 $2.46 II Latin America 13,689 2,655 12,964 2,959 $2.14 Section Asia 47,015 3,871 39,233 14,178 $2.42 Worldwide $142,538 $15,587 $123,126 35,812 $2.47 8 - 12 months Total Expected Investment in Cumulative Investment Total Potential Trailing Twelve Months Average Stabilization III Region (1) (1) (1) Total Sq Ft (4) Investment Q4 2018 to Date CuFt / DPUs NOI/CuFt or DPU Period Section Building Development Projects(5) North America(6) $16,798 $2,218 $16,216 - 205 $2.53 IV Europe(3) 3,360 - 3,114 368 22 $2.46 Section Latin America 23,351 35 13,827 5,243 222 $2.14 Asia - - - - - $2.42 Worldwide $43,510 $2,253 $33,157 5,611 448 $2.47 24 - 36 months V Section Investment Reconciliation Q4 2018 Investments Racking Installations $15,587 VI Section Consolidation Related to Racking Installations 7,137 Building Development Projects 2,253 Total Actual Real Estate Investments 24,977 Other Real Estate Investment 6,382 VII Section Total FX Impact (2,298) Real Estate Investment $29,061 VIII Purchase Expected Net Section Region Total Sq Ft Region Total Sq Ft Price IRRs Proceeds 2018 Building Acquisitions 2018 Building Disposals North America - - - North America 2,681 52 IX Section Europe(3) 19,393 279 0% Europe 76,303 428 Latin America - - - Latin America - - Asia - - - Asia Pacific - - X Worldwide 19,393 279 0% Worldwide 78,984 480 Section (1) Based on 2018 Budgeted FX Rates. (2) Racking Installations exclude consolidation spend in Total Expected Investment, Investment in Current Period and Cumulative Investment to Date of $47.1mm, $7.1mm and $42.3mm, respectively. XI (3) Includes South Africa and United Arab Emirates. Section (4) Calculated using a twelve month trailing historical average. (5) Data center development detail can be found on page 28. (6) North America excludes racking investments for development projects that were initiated after 1/1/2018. Racking investments associated with these projects are included in the table above. www.ironmountain.com Selected metric definitions are available in the Appendix 33

Components of Value Q4 2018 Annualized Components I NOI Section North America Records Management $985,360 II Data Protection 224,596 Section Other 73,020 Europe (1) 387,192 III Latin America 149,596 Section Asia 184,248 Global Data Center 139,764 Total Portfolio Storage NOI $ 2,143,776 IV Section V Section Q4 2018 Service Adjusted EBITDAR (2) Service Adjusted EBITDAR $377,920 VI Section Balance at 12/31/2018 VII Section Cash, Cash Equivalents & Other Tangible Assets(3) $1,208,114 Quarterly Building & Racking Investment, not reflected in NOI 17,840 VIII Data Center Investment, not reflected in NOI 40,850 Section Customer Acquisition Consideration 45,011 Less: Debt, Gross Book Value(4) $8,142,822 IX Section Non-Controlling Interests 1,409 Annualized Rental Expense 326,484 Estimated Tax Liability 80,385 X Section XI (1) Includes South Africa and United Arab Emirates. Section (2) Q4 2018 annualized. (3) Includes Cash, Cash Equivalents, Restricted Cash, Accounts Receivable, Other Tangible Current Assets and Prepaid Expenses. (4) Calculated as current portion of Long-Term Debt of $126mm plus Long-Term Debt Net of Current Portion of $8,016mm. www.ironmountain.com Selected metric definitions are available in the Appendix 34

Appendix Non-GAAP Measures and Definitions I Non-GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be Section important for investors to consider when evaluating our financial performance. These non-GAAP measures should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating II Section activities from continuing operations (as determined in accordance with GAAP). Adjusted Earnings Per Share, or Adjusted EPS III Section Adjusted EPS is defined as reported earnings per share fully diluted from continuing operations excluding: (i) (gain) loss on disposal/write-down of property, plant and equipment (excluding real estate), net; (ii) gain on sale of real estate, net of tax; (iii) intangible impairments; (iv) other (income) IV expense, net; (v) Significant Acquisition Costs (as defined below); and (vi) the tax impact of reconciling items and discrete tax items. Adjusted EPS Section includes income (loss) attributable to noncontrolling interests. We do not believe these excluded items to be indicative of our ongoing operating results, and they are not considered when we are forecasting our future results. We believe Adjusted EPS is of value to our current and potential V investors when comparing our results from past, present and future periods. Section Adjusted EBITDA and Adjusted EBITDA Margin VI Section Adjusted EBITDA is defined as income (loss) from continuing operations before interest expense, net, provision (benefit) for income taxes, depreciation and amortization, and also excludes certain items that we believe are not indicative of our core operating results, specifically: (i) (gain) loss on disposal/write-down of property, plant and equipment (excluding real estate), net; (ii) intangible impairments; (iii) other (income) expense, net; VII Section (iv) gain on sale of real estate, net of tax; and (v) Significant Acquisition Costs. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by total revenues. We use multiples of current or projected Adjusted EBITDA in conjunction with our discounted cash flow models to determine our estimated overall enterprise valuation and to evaluate acquisition targets. We believe Adjusted EBITDA and Adjusted EBITDA Margin provide our VIII Section Section current and potential investors with relevant and useful information regarding our ability to generate cash flow to support business investment. These measures are an integral part of the internal reporting system we use to assess and evaluate the operating performance of our business. IX Adjusted EBITDA excludes both interest expense, net and the provision (benefit) for income taxes. These expenses are associated with our Section capitalization and tax structures, which we do not consider when evaluating the operating profitability of our core operations. Finally, Adjusted EBITDA does not include depreciation and amortization expenses, in order to eliminate the impact of capital investments, which we evaluate by X comparing capital expenditures to incremental revenue generated and as a percentage of total revenues. Adjusted EBITDA and Adjusted EBITDA Section Margin should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing XI operations (as determined in accordance with GAAP). Section www.ironmountain.com Selected metric definitions are available in the Appendix 35

Appendix Non-GAAP Measures and Definitions (continued) Adjusted Funds From Operations, or AFFO I Section AFFO is defined as FFO (Normalized) excluding non-cash rent expense or income, plus depreciation on non-real estate assets, amortization expense of customer relationship value (CRV), intake costs, acquisition of customer relationships, other intangibles, deferred financing costs and II permanent withdrawal fees, stock-based compensation expense and the impact of reconciling to normalized cash taxes, less recurring capital Section expenditures and non-real estate growth investments, excluding Significant Acquisition Capital Expenditures. We believe AFFO is a useful measure in determining our ability to generate excess cash that may be used for reinvestment in the business, discretionary deployment in investments such III as real estate or acquisition opportunities, returning capital to our stockholders and voluntary prepayments of indebtedness. Additionally AFFO is Section reconciled to cash flow from operations to adjust for real estate and REIT tax adjustments, Significant Acquisition Costs and other non-cash expenses. AFFO does not include adjustments for customer inducements, acquisition of customer relationships and investment in innovation as we IV consider these expenditures to be growth related. Section Funds From Operations, or FFO (Nareit), and FFO (Normalized) V Section Funds from operations (“FFO”) is defined by the National Association of Real Estate Investment Trusts ("Nareit") and us as net income (loss) excluding depreciation on real estate assets, gains on sale of real estate, net of tax and amortization of data center leased-based intangibles ("FFO VI (Nareit)"). FFO (Nareit) does not give effect to real estate depreciation because these amounts are computed, under GAAP, to allocate the cost of a Section property over its useful life. Because values for well-maintained real estate assets have historically increased or decreased based upon prevailing market conditions, we believe that FFO (Nareit) provides investors with a clearer view of our operating performance. Our most directly comparable VII GAAP measure to FFO (Nareit) is net income (loss). Although Nareit has published a definition of FFO, modifications to FFO (Nareit) are common Section among REITs as companies seek to provide financial measures that most meaningfully reflect their particular business. Our definition of FFO (Normalized) excludes certain items included in FFO (Nareit) that we believe are not indicative of our core operating results, specifically: (i) (gain) VIII loss on disposal/write-down of property, plant and equipment (excluding real estate), net; (ii) intangible impairments; (iii) other expense (income), net; Section (iv) real estate capital lease depreciation; (v) Significant Acquisition Costs; (vi) REIT Costs; (vii) the tax impact of reconciling items and discrete tax items; (viii) loss (income) from discontinued operations, net of tax; and (ix) loss (gain) on sale of discontinued operations, net of tax. IX Section FFO (Normalized) per share X Section FFO (Normalized) divided by weighted average fully-diluted shares outstanding. XI Section www.ironmountain.com Selected metric definitions are available in the Appendix 36

Appendix Non-GAAP Measures and Definitions (continued) Service Adjusted EBITDA I Section Service Adjusted EBITDA is calculated by taking service revenues excluding terminations and permanent withdrawals less direct expenses and overhead allocated to the service business. Terminations and permanent withdrawals are excluded from this calculation as they are included in the II Storage NOI calculation. Section Service Adjusted EBITDAR III Section Service Adjusted EBITDA as defined above, excluding rent expense associated with the service business. This is provided to enable valuation of Service Adjusted EBITDA irrespective of whether the company’s properties are leased or owned. Related rent expense is provided in the Components of Value slide. IV Section Storage Adjusted EBITDA V Storage Adjusted EBITDA is calculated by taking storage revenues including terminations and permanent withdrawal fees less direct expenses and Section overhead allocated to the storage business. VI Section VII Section VIII Section Section IX Section X Section XI Section www.ironmountain.com Selected metric definitions are available in the Appendix 37