Supplemental Financial Information Fourth Quarter 2020 investors.ironmountain.com

Table of Contents Section I - Q4 Earnings Press Release 3 Q4 Earnings Press Release Section II - Company Profile 7 Section III - Financial Highlights and Guidance Financial and Operating Highlights 8 2021 Guidance 9 Organic Revenue Growth 10 Section IV - Operational Metrics Worldwide Storage Volume 11 Quarterly and Year-to-Date Operating Performance 12 Section V - Balance Sheets, Statements of Operations and Reconciliations Consolidated Balance Sheets 13 Consolidated Statements of Operations 14 Reconciliation of Income from Continuing Operations to Adjusted EBITDA 16 Reported Earnings per Share to Adjusted Earnings per Share 17 Reconciliation of Net Income to FFO and AFFO 18 Reconciliation of Net Income to FFO and AFFO Full Year 20 Section VI - Storage and Service Reconciliation 22 Storage and Service Business Detail Section VII - Real Estate Metrics 24 Global Real Estate Portfolio and Lease Obligations Facility Lease Expirations Section VIII - Data Center Customer and Portfolio Metrics Data Center Customer Lease Expiration and Leasing Activity Summary 25 Data Center Operating Portfolio 26 Data Center Expansion and Development Activity 27 Section IX - Capitalization and Debt Maturity Profile 28 Capitalization Debt Maturity Profile Section X - Capital Expenditures and Acquisitions Capital Expenditures and Investments 29 Business and Customer Acquisitions 31 Section XI - Appendix and Definitions 33 All figures except per share, megawatts (MW), kilowatts (kW), and facility counts in 000s unless noted All figures in reported dollars unless noted Figures may not foot due to rounding All figures for the quarter ended December 31, 2020 unless noted Unaudited investors.ironmountain.com Q4 2020 Supplemental Financial Information 2

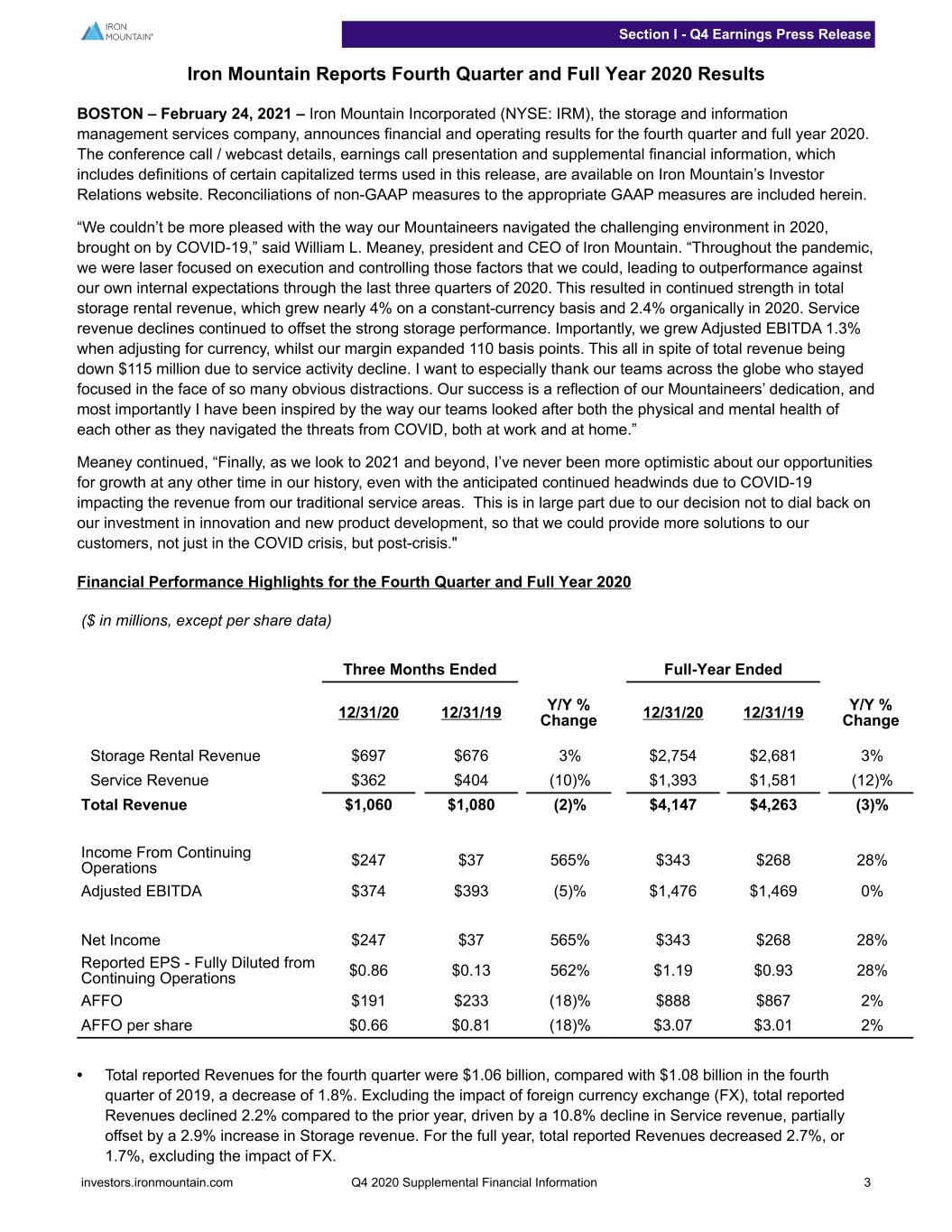

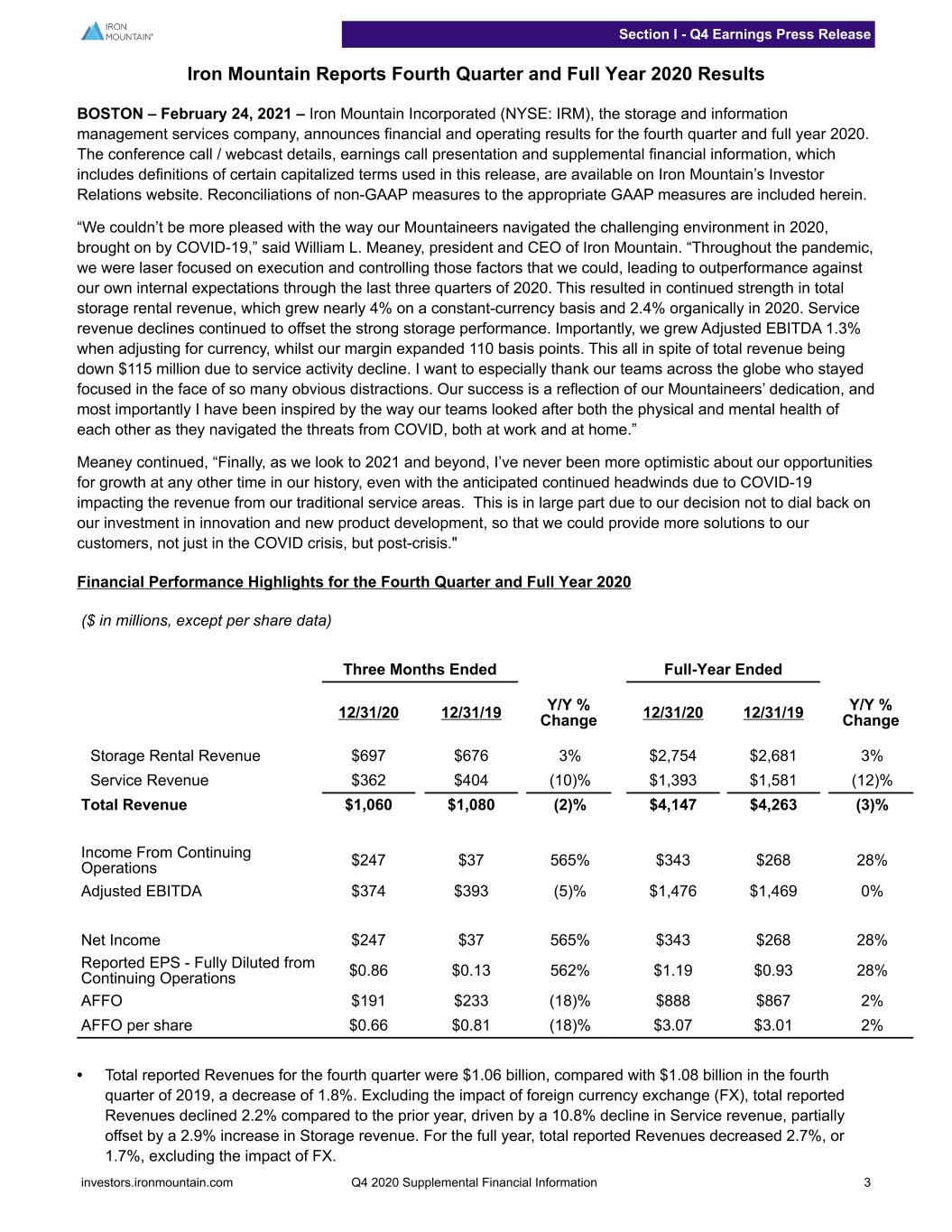

Iron Mountain Reports Fourth Quarter and Full Year 2020 Results BOSTON – February 24, 2021 – Iron Mountain Incorporated (NYSE: IRM), the storage and information management services company, announces financial and operating results for the fourth quarter and full year 2020. The conference call / webcast details, earnings call presentation and supplemental financial information, which includes definitions of certain capitalized terms used in this release, are available on Iron Mountain’s Investor Relations website. Reconciliations of non-GAAP measures to the appropriate GAAP measures are included herein. “We couldn’t be more pleased with the way our Mountaineers navigated the challenging environment in 2020, brought on by COVID-19,” said William L. Meaney, president and CEO of Iron Mountain. “Throughout the pandemic, we were laser focused on execution and controlling those factors that we could, leading to outperformance against our own internal expectations through the last three quarters of 2020. This resulted in continued strength in total storage rental revenue, which grew nearly 4% on a constant-currency basis and 2.4% organically in 2020. Service revenue declines continued to offset the strong storage performance. Importantly, we grew Adjusted EBITDA 1.3% when adjusting for currency, whilst our margin expanded 110 basis points. This all in spite of total revenue being down $115 million due to service activity decline. I want to especially thank our teams across the globe who stayed focused in the face of so many obvious distractions. Our success is a reflection of our Mountaineers’ dedication, and most importantly I have been inspired by the way our teams looked after both the physical and mental health of each other as they navigated the threats from COVID, both at work and at home.” Meaney continued, “Finally, as we look to 2021 and beyond, I’ve never been more optimistic about our opportunities for growth at any other time in our history, even with the anticipated continued headwinds due to COVID-19 impacting the revenue from our traditional service areas. This is in large part due to our decision not to dial back on our investment in innovation and new product development, so that we could provide more solutions to our customers, not just in the COVID crisis, but post-crisis." Financial Performance Highlights for the Fourth Quarter and Full Year 2020 ($ in millions, except per share data) Three Months Ended Full-Year Ended 12/31/20 12/31/19 Y/Y % Change 12/31/20 12/31/19 Y/Y % Change Storage Rental Revenue $697 $676 3% $2,754 $2,681 3% Service Revenue $362 $404 (10)% $1,393 $1,581 (12)% Total Revenue $1,060 $1,080 (2)% $4,147 $4,263 (3)% Income From Continuing Operations $247 $37 565% $343 $268 28% Adjusted EBITDA $374 $393 (5)% $1,476 $1,469 0% Net Income $247 $37 565% $343 $268 28% Reported EPS - Fully Diluted from Continuing Operations $0.86 $0.13 562% $1.19 $0.93 28% AFFO $191 $233 (18)% $888 $867 2% AFFO per share $0.66 $0.81 (18)% $3.07 $3.01 2% • Total reported Revenues for the fourth quarter were $1.06 billion, compared with $1.08 billion in the fourth quarter of 2019, a decrease of 1.8%. Excluding the impact of foreign currency exchange (FX), total reported Revenues declined 2.2% compared to the prior year, driven by a 10.8% decline in Service revenue, partially offset by a 2.9% increase in Storage revenue. For the full year, total reported Revenues decreased 2.7%, or 1.7%, excluding the impact of FX. Section I - Q4 Earnings Press Release investors.ironmountain.com Q4 2020 Supplemental Financial Information 3

• Income from Continuing Operations for the fourth quarter was $246.8 million, compared with $37.1 million in the fourth quarter of 2019. The following items were included in the fourth quarters of 2020 and 2019, respectively: ◦ Restructuring Charges of $65.7 million associated with the implementation of Project Summit compared to $48.6 million. ◦ Significant Acquisition Costs of $4.7 million in the fourth quarter of 2019. ◦ Gain on Disposal/Write-Down of PP&E, Net of $285.4 million compared to $46.7 million, primarily related to the company's capital recycling program. For the full year, Income from Continuing Operations was $343.1 million, compared with $268.2 million in 2019. The following items were included in the full year ended 2020 and 2019, respectively: ◦ Restructuring Charges of $194.4 million compared to $48.6 million. ◦ Significant Acquisition Costs of $13.3 million in 2019. ◦ Gain on Disposal/Write-Down of PP&E, Net of $363.5 million compared to $63.8 million, primarily related to the company's capital recycling program. ◦ Intangible Impairment charge of $23.0 million related to the writedown of goodwill associated with the Fine Arts business in 2020. ◦ Debt extinguishment charge of $68.3 million related to the early extinguishment of several of the company's Notes in 2020. • Adjusted EBITDA for the fourth quarter was $374.2 million, compared with $393.1 million in the fourth quarter of 2019, a decrease of 4.8%. On a constant currency basis, Adjusted EBITDA decreased by 5.3%, driven in part by the aforementioned decline in Service revenue, partially offset by the benefits of Project Summit and the flow through from revenue management. For the full year, Adjusted EBITDA was $1.48 billion, compared with $1.47 billion in 2019, an increase of 0.5%, and excludes $9.3 million of direct and incremental costs related to COVID-19 incurred in the second quarter, as previously disclosed. Excluding the impact of FX, Adjusted EBITDA increased 1.3% for the full year. • Reported EPS - Fully Diluted from Continuing Operations for the fourth quarter was $0.86, compared with $0.13 in the fourth quarter of 2019. For the full year, Reported EPS - Fully Diluted from Continuing Operations was $1.19, compared with $0.93 in 2019. • Adjusted EPS for the fourth quarter was $0.29, compared with $0.33 in the fourth quarter of 2019. For the full year, Adjusted EPS was $1.19, compared with $1.11 in 2019. Adjusted EPS reflects a structural tax rate of 15.1% in 2020 and 17.6% in 2019. • Net Income for the fourth quarter was $246.8 million compared with $37.1 million in the fourth quarter of 2019. For the full year, Net Income was $343.1 million compared with $268.3 million in 2019. Net Income in the fourth quarters and full years of 2020 and 2019 included the aforementioned items that impacted Income from Continuing Operations. • FFO (Normalized) per share was $0.60 for the fourth quarter, compared with $0.67 in the fourth quarter of 2019, or a decrease of 10.4%. For the full year, FFO (Normalized) per share was $2.42, compared with $2.38 in 2019, an increase of 1.5%. • AFFO was $190.8 million for the fourth quarter, compared with $233.1 million in the fourth quarter of 2019, a decrease of 18.2%. For the full year, AFFO was $887.5 million, compared with $867.0 million in 2019, an increase of 2.4%. • AFFO per share was $0.66 for the fourth quarter, compared with $0.81 in the fourth quarter of 2019, or a decrease of 18.5%. For the full year, AFFO per share was $3.07, compared with $3.01 in 2019, an increase of 2.0%. Section I - Q4 Earnings Press Release investors.ironmountain.com Q4 2020 Supplemental Financial Information 4

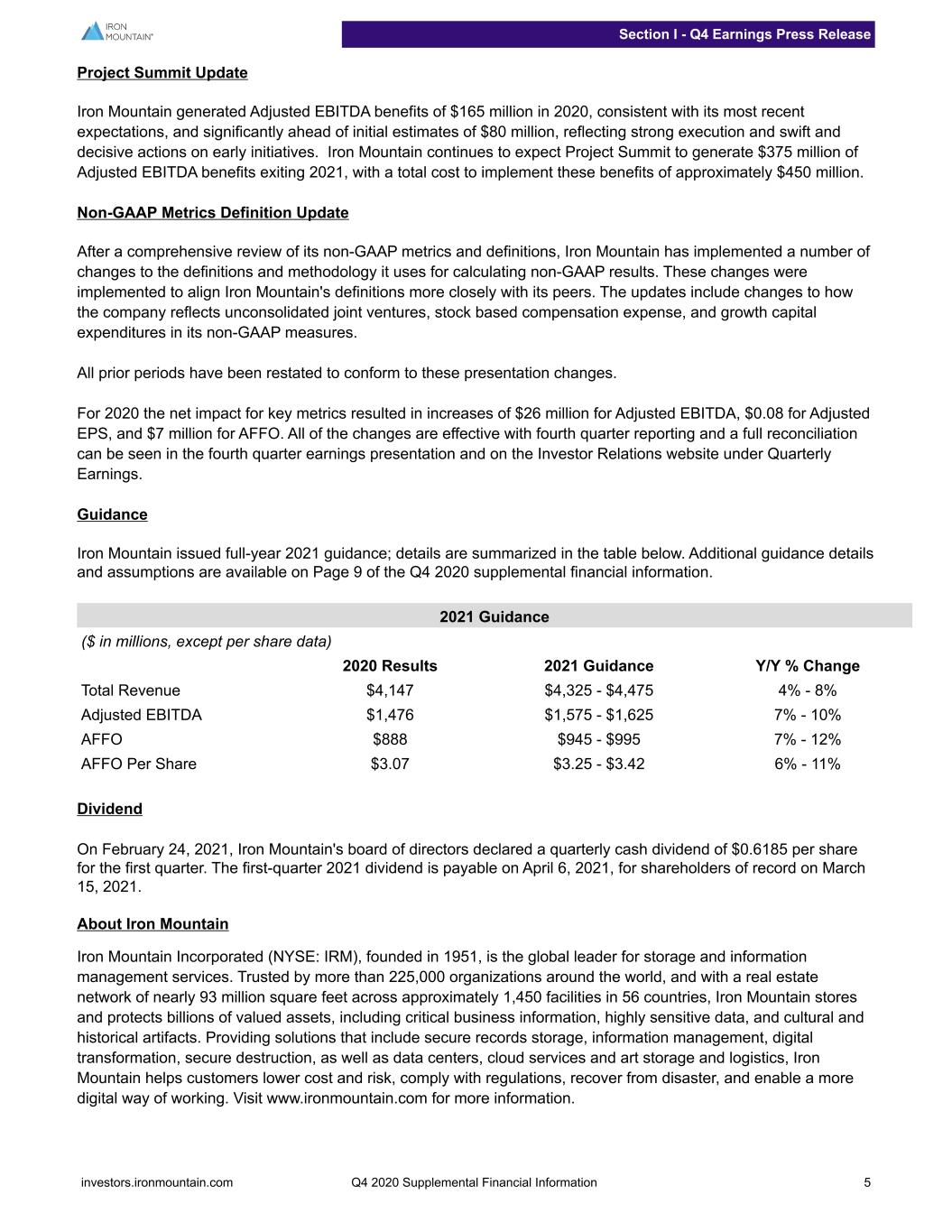

Project Summit Update Iron Mountain generated Adjusted EBITDA benefits of $165 million in 2020, consistent with its most recent expectations, and significantly ahead of initial estimates of $80 million, reflecting strong execution and swift and decisive actions on early initiatives. Iron Mountain continues to expect Project Summit to generate $375 million of Adjusted EBITDA benefits exiting 2021, with a total cost to implement these benefits of approximately $450 million. Non-GAAP Metrics Definition Update After a comprehensive review of its non-GAAP metrics and definitions, Iron Mountain has implemented a number of changes to the definitions and methodology it uses for calculating non-GAAP results. These changes were implemented to align Iron Mountain's definitions more closely with its peers. The updates include changes to how the company reflects unconsolidated joint ventures, stock based compensation expense, and growth capital expenditures in its non-GAAP measures. All prior periods have been restated to conform to these presentation changes. For 2020 the net impact for key metrics resulted in increases of $26 million for Adjusted EBITDA, $0.08 for Adjusted EPS, and $7 million for AFFO. All of the changes are effective with fourth quarter reporting and a full reconciliation can be seen in the fourth quarter earnings presentation and on the Investor Relations website under Quarterly Earnings. Guidance Iron Mountain issued full-year 2021 guidance; details are summarized in the table below. Additional guidance details and assumptions are available on Page 9 of the Q4 2020 supplemental financial information. 2021 Guidance ($ in millions, except per share data) 2020 Results 2021 Guidance Y/Y % Change Total Revenue $4,147 $4,325 - $4,475 4% - 8% Adjusted EBITDA $1,476 $1,575 - $1,625 7% - 10% AFFO $888 $945 - $995 7% - 12% AFFO Per Share $3.07 $3.25 - $3.42 6% - 11% Dividend On February 24, 2021, Iron Mountain's board of directors declared a quarterly cash dividend of $0.6185 per share for the first quarter. The first-quarter 2021 dividend is payable on April 6, 2021, for shareholders of record on March 15, 2021. About Iron Mountain Iron Mountain Incorporated (NYSE: IRM), founded in 1951, is the global leader for storage and information management services. Trusted by more than 225,000 organizations around the world, and with a real estate network of nearly 93 million square feet across approximately 1,450 facilities in 56 countries, Iron Mountain stores and protects billions of valued assets, including critical business information, highly sensitive data, and cultural and historical artifacts. Providing solutions that include secure records storage, information management, digital transformation, secure destruction, as well as data centers, cloud services and art storage and logistics, Iron Mountain helps customers lower cost and risk, comply with regulations, recover from disaster, and enable a more digital way of working. Visit www.ironmountain.com for more information. Section I - Q4 Earnings Press Release investors.ironmountain.com Q4 2020 Supplemental Financial Information 5

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: We have made statements in this presentation that constitute "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward-looking statements concern our operations, economic performance, financial condition, goals, beliefs, future growth strategies, investment objectives, plans and current expectations, such as our (1) 2021 guidance as well as our expectations for growth, including growth opportunities and growth rates for revenue by segment, organic revenue, organic volume and other metrics, (2) expectations and assumptions regarding the impact from the COVID-19 pandemic on us and our customers, including on our businesses, financial position, results of operations and cash flows, (3) expected benefits, costs and actions related to, and timing of, Project Summit, (4) expectations as to our capital allocation strategy, including our future investments, leverage ratio, dividend payments and possible funding sources (including real estate monetization) and capital expenditures, (5) expectations regarding the closing of pending acquisitions and investments, and (6) other forward-looking statements related to our business, results of operations and financial condition. These forward-looking statements are subject to various known and unknown risks, uncertainties and other factors, and you should not rely upon them except as statements of our present intentions and of our present expectations, which may or may not occur. When we use words such as "believes," "expects," "anticipates," "estimates," “plans” or similar expressions, we are making forward-looking statements. Although we believe that our forward-looking statements are based on reasonable assumptions, our expected results may not be achieved, and actual results may differ materially from our expectations. In addition, important factors that could cause actual results to differ from expectations include, among others: (i) the severity and duration of the COVID-19 pandemic and its effects on the global economy, including its effects on us, the markets we serve and our customers and the third parties with whom we do business within those markets; (ii) our ability to execute on Project Summit and the potential impacts of Project Summit on our ability to retain and recruit employees; (iii) our ability to remain qualified for taxation as a real estate investment trust for United States federal income tax purposes; (iv) changes in customer preferences and demand for our storage and information management services, including as a result of the shift from paper and tape storage to alternative technologies that require less physical space; (v) our ability or inability to execute our strategic growth plan, including our ability to invest according to plan, incorporate new digital information technologies into our offerings, achieve satisfactory returns on new product offerings, continue our revenue management, expand internationally, complete acquisitions on satisfactory terms, integrate acquired companies efficiently and grow our business through joint ventures; (vi) changes in the amount of our capital expenditures; (vii) our ability to raise debt or equity capital and changes in the cost of our debt; (viii) the cost and our ability to comply with laws, regulations and customer demands, including those relating to data security and privacy issues, as well as fire and safety and environmental standards; (ix) the impact of litigation or disputes that may arise in connection with incidents in which we fail to protect our customers' information or our internal records or information technology systems and the impact of such incidents on our reputation and ability to compete; (x) changes in the price for our storage and information management services relative to the cost of providing such storage and information management services; (xi) changes in the political and economic environments in the countries in which our international subsidiaries operate and changes in the global political climate, particularly as we consolidate operations and move records and data across borders; (xii) our ability to comply with our existing debt obligations and restrictions in our debt instruments; (xiii) the impact of service interruptions or equipment damage and the cost of power on our data center operations; (xiv) the cost or potential liabilities associated with real estate necessary for our business; (xv) failures in our adoption of new IT systems; (xvi) other trends in competitive or economic conditions affecting our financial condition or results of operations not presently contemplated; and (xvii) the other risks described in our periodic reports filed with the SEC, including under the caption “Risk Factors” in Part I, Item 1A of our Annual Report. Except as required by law, we undertake no obligation to update any forward-looking statements appearing in this report. Reconciliation of Non-GAAP Measures: Throughout this release, Iron Mountain discusses (1) Adjusted EBITDA, (2) Adjusted Earnings per Share (“Adjusted EPS”), (3) Funds from Operations (“FFO Nareit”), (4) FFO (Normalized) and (5) Adjusted Funds from Operations (“AFFO”). These measures do not conform to accounting principles generally accepted in the United States (“GAAP”). These non-GAAP measures are supplemental metrics designed to enhance our disclosure and to provide additional information that we believe to be important for investors to consider in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) attributable to Iron Mountain Incorporated or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). The reconciliation of these measures to the appropriate GAAP measure, as required by Regulation G under the Securities Exchange Act of 1934, as amended, and their definitions are included later in this release. Investor Relations Contacts: Greer Aviv, 617-535-2887 Nathan McCurren, 617-535-2997 Senior Vice President, Investor Relations Director, Investor Relations greer.aviv@ironmountain.com nathan.mccurren@ironmountain.com Section I - Q4 Earnings Press Release investors.ironmountain.com Q4 2020 Supplemental Financial Information 6

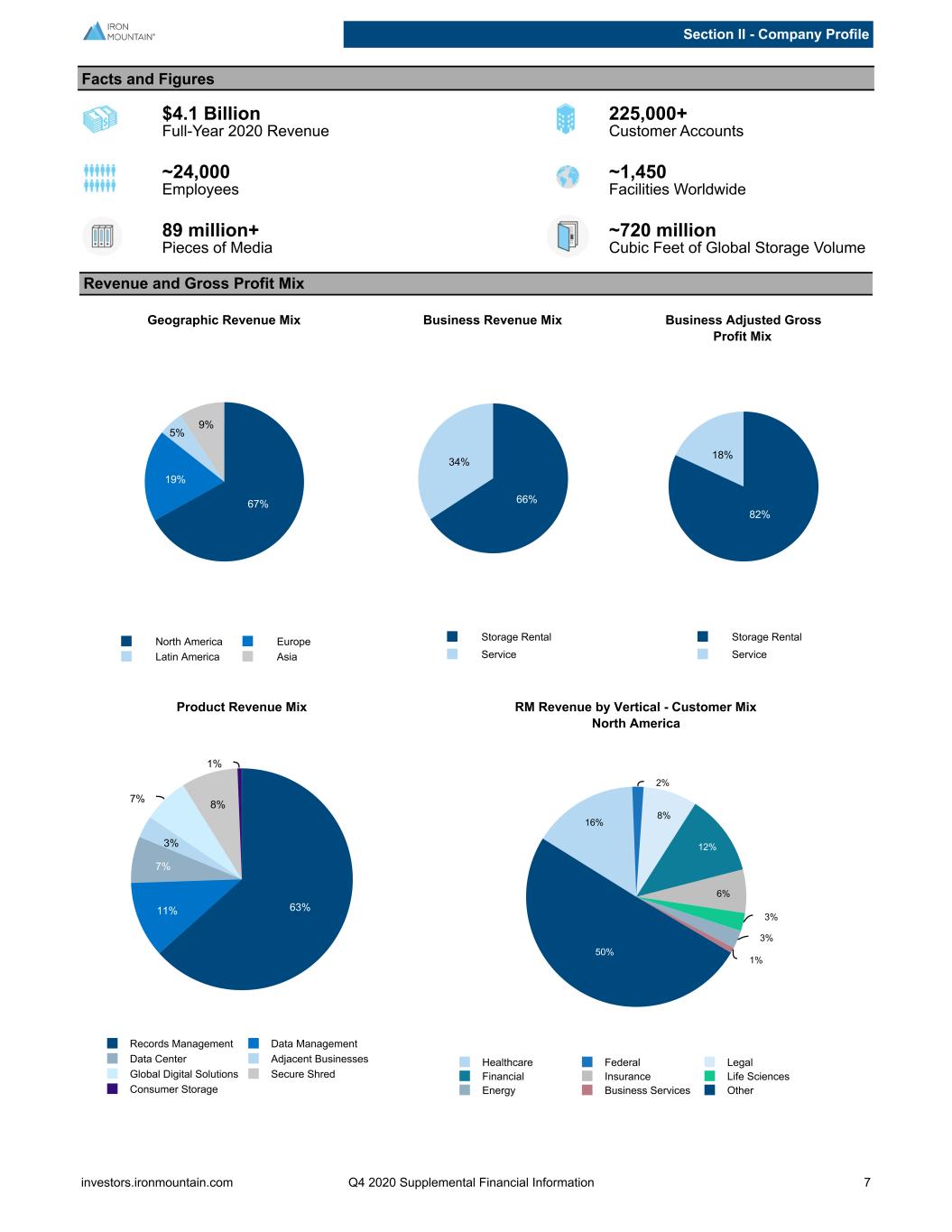

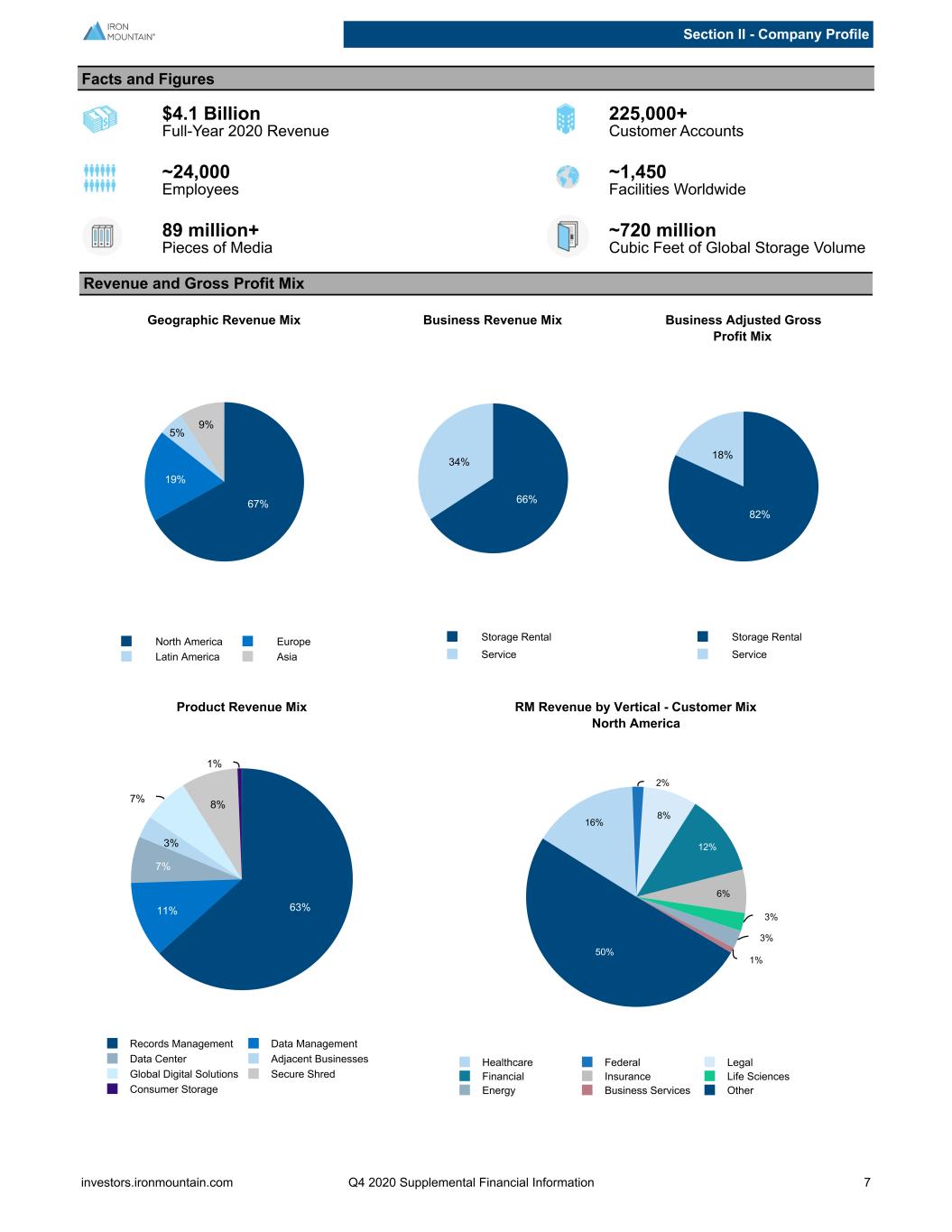

Facts and Figures $4.1 Billion Full-Year 2020 Revenue 225,000+ Customer Accounts ~24,000 Employees ~1,450 Facilities Worldwide 89 million+ Pieces of Media ~720 million Cubic Feet of Global Storage Volume Revenue and Gross Profit Mix Geographic Revenue Mix 67% 19% 5% 9% North America Europe Latin America Asia Business Revenue Mix 66% 34% Storage Rental Service Business Adjusted Gross Profit Mix 82% 18% Storage Rental Service Product Revenue Mix 63%11% 7% 3% 7% 8% 1% Records Management Data Management Data Center Adjacent Businesses Global Digital Solutions Secure Shred Consumer Storage RM Revenue by Vertical - Customer Mix North America 16% 2% 8% 12% 6% 3% 3% 1% 50% Healthcare Federal Legal Financial Insurance Life Sciences Energy Business Services Other Section II - Company Profile investors.ironmountain.com Q4 2020 Supplemental Financial Information 7

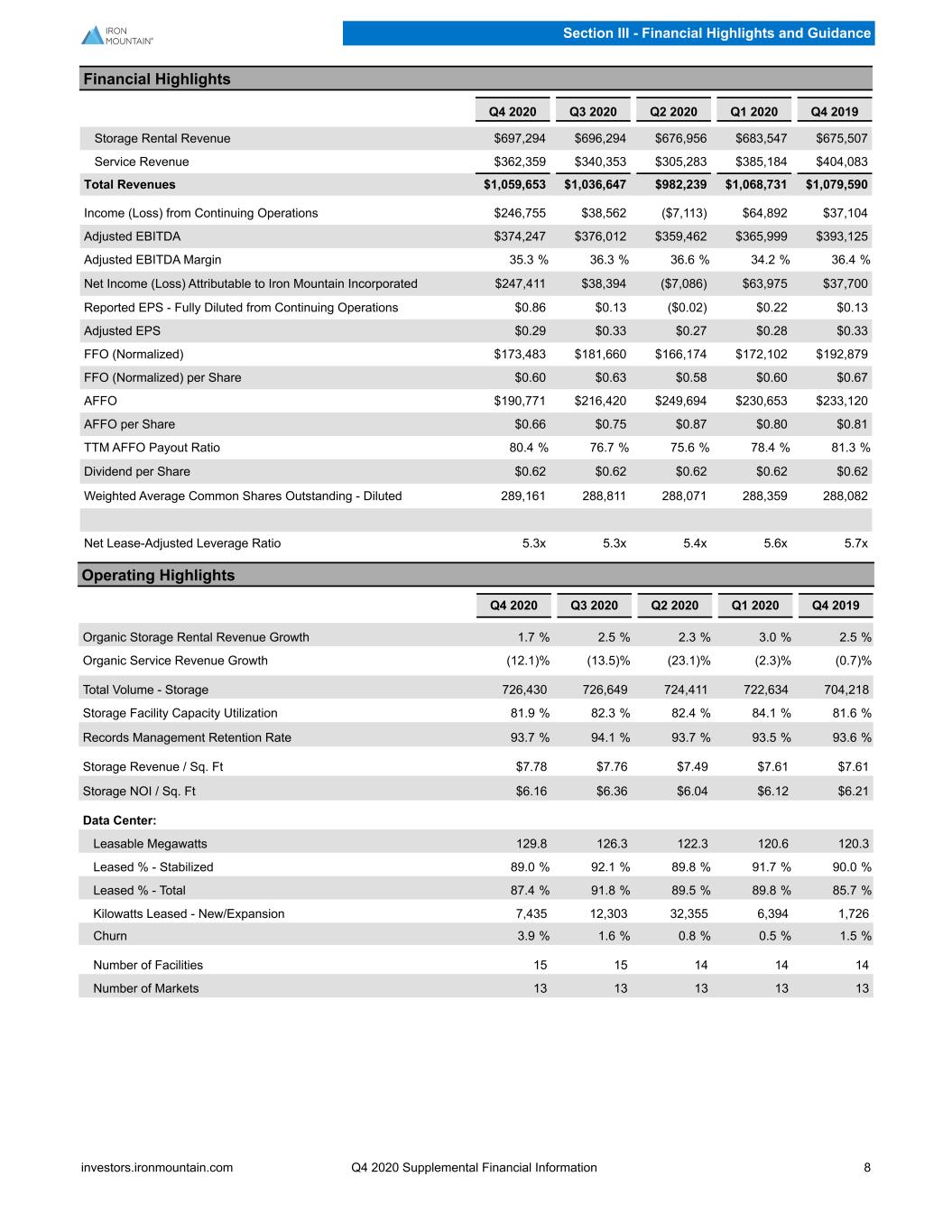

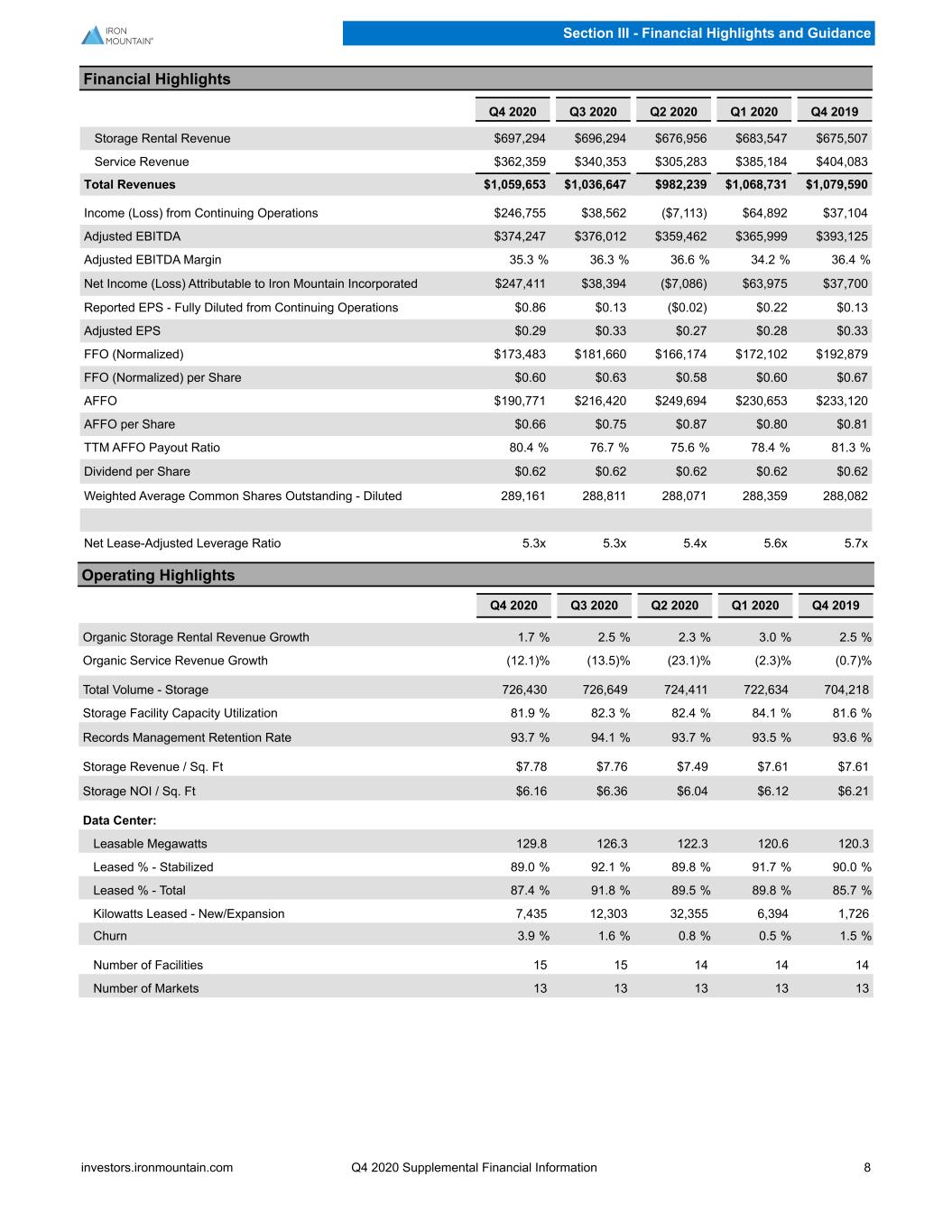

Financial Highlights Q4 2020 Q3 2020 Q2 2020 Q1 2020 Q4 2019 Storage Rental Revenue $697,294 $696,294 $676,956 $683,547 $675,507 Service Revenue $362,359 $340,353 $305,283 $385,184 $404,083 Total Revenues $1,059,653 $1,036,647 $982,239 $1,068,731 $1,079,590 Income (Loss) from Continuing Operations $246,755 $38,562 ($7,113) $64,892 $37,104 Adjusted EBITDA $374,247 $376,012 $359,462 $365,999 $393,125 Adjusted EBITDA Margin 35.3 % 36.3 % 36.6 % 34.2 % 36.4 % Net Income (Loss) Attributable to Iron Mountain Incorporated $247,411 $38,394 ($7,086) $63,975 $37,700 Reported EPS - Fully Diluted from Continuing Operations $0.86 $0.13 ($0.02) $0.22 $0.13 Adjusted EPS $0.29 $0.33 $0.27 $0.28 $0.33 FFO (Normalized) $173,483 $181,660 $166,174 $172,102 $192,879 FFO (Normalized) per Share $0.60 $0.63 $0.58 $0.60 $0.67 AFFO $190,771 $216,420 $249,694 $230,653 $233,120 AFFO per Share $0.66 $0.75 $0.87 $0.80 $0.81 TTM AFFO Payout Ratio 80.4 % 76.7 % 75.6 % 78.4 % 81.3 % Dividend per Share $0.62 $0.62 $0.62 $0.62 $0.62 Weighted Average Common Shares Outstanding - Diluted 289,161 288,811 288,071 288,359 288,082 Net Lease-Adjusted Leverage Ratio 5.3x 5.3x 5.4x 5.6x 5.7x Operating Highlights Q4 2020 Q3 2020 Q2 2020 Q1 2020 Q4 2019 Organic Storage Rental Revenue Growth 1.7 % 2.5 % 2.3 % 3.0 % 2.5 % Organic Service Revenue Growth (12.1) % (13.5) % (23.1) % (2.3) % (0.7) % Total Volume - Storage 726,430 726,649 724,411 722,634 704,218 Storage Facility Capacity Utilization 81.9 % 82.3 % 82.4 % 84.1 % 81.6 % Records Management Retention Rate 93.7 % 94.1 % 93.7 % 93.5 % 93.6 % Storage Revenue / Sq. Ft $7.78 $7.76 $7.49 $7.61 $7.61 Storage NOI / Sq. Ft $6.16 $6.36 $6.04 $6.12 $6.21 Data Center: Leasable Megawatts 129.8 126.3 122.3 120.6 120.3 Leased % - Stabilized 89.0 % 92.1 % 89.8 % 91.7 % 90.0 % Leased % - Total 87.4 % 91.8 % 89.5 % 89.8 % 85.7 % Kilowatts Leased - New/Expansion 7,435 12,303 32,355 6,394 1,726 Churn 3.9 % 1.6 % 0.8 % 0.5 % 1.5 % Number of Facilities 15 15 14 14 14 Number of Markets 13 13 13 13 13 Section III - Financial Highlights and Guidance investors.ironmountain.com Q4 2020 Supplemental Financial Information 8

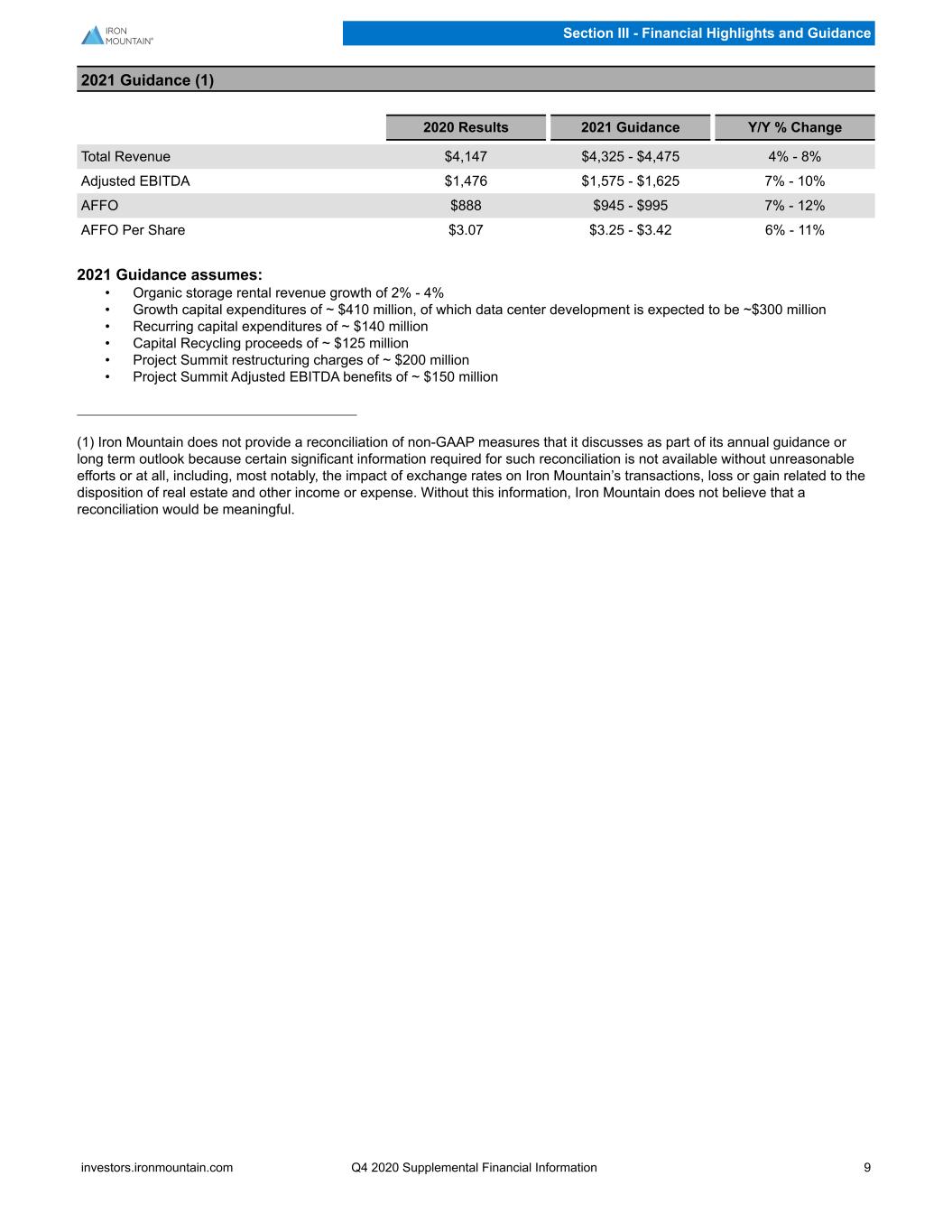

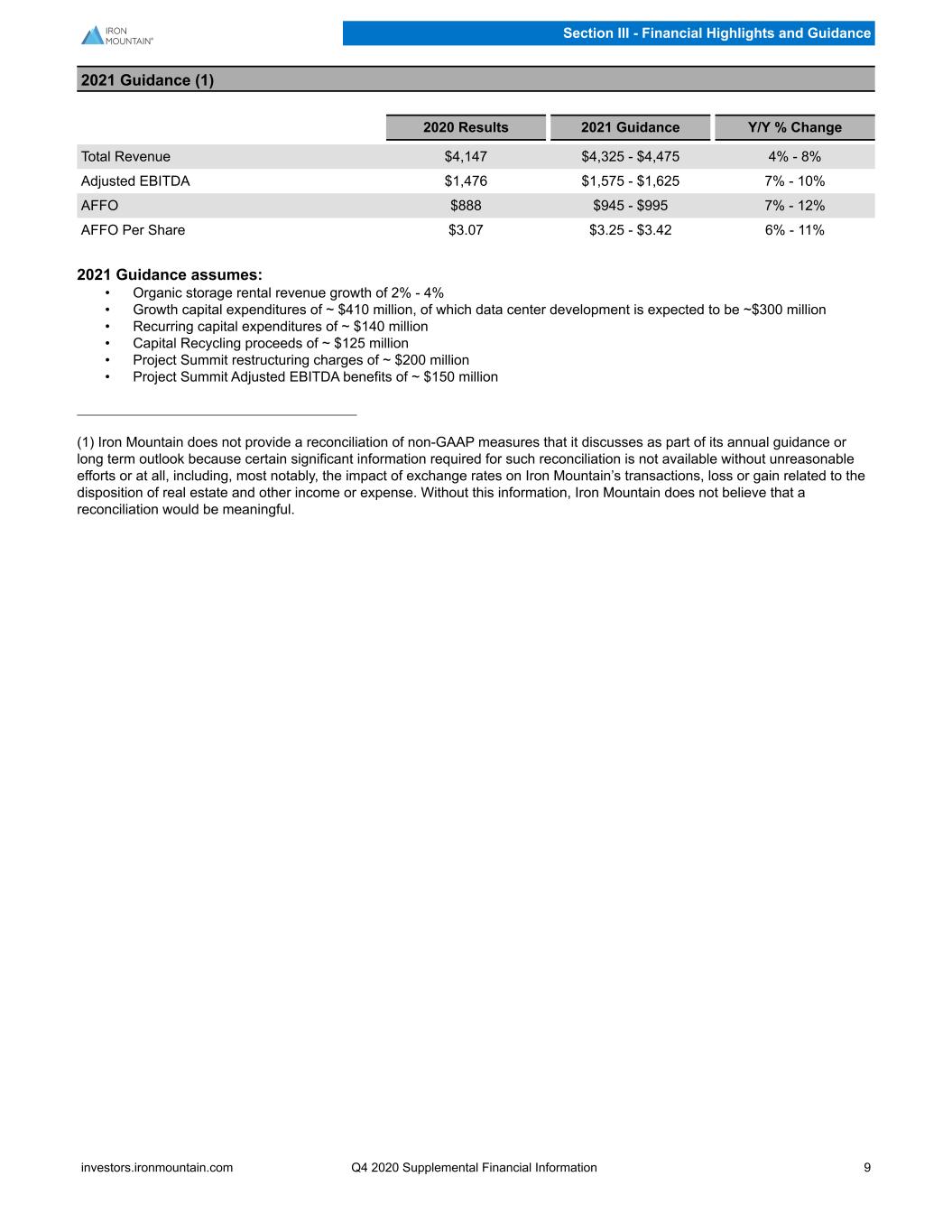

2021 Guidance (1) 2020 Results 2021 Guidance Y/Y % Change Total Revenue $4,147 $4,325 - $4,475 4% - 8% Adjusted EBITDA $1,476 $1,575 - $1,625 7% - 10% AFFO $888 $945 - $995 7% - 12% AFFO Per Share $3.07 $3.25 - $3.42 6% - 11% 2021 Guidance assumes: • Organic storage rental revenue growth of 2% - 4% • Growth capital expenditures of ~ $410 million, of which data center development is expected to be ~$300 million • Recurring capital expenditures of ~ $140 million • Capital Recycling proceeds of ~ $125 million • Project Summit restructuring charges of ~ $200 million • Project Summit Adjusted EBITDA benefits of ~ $150 million (1) Iron Mountain does not provide a reconciliation of non-GAAP measures that it discusses as part of its annual guidance or long term outlook because certain significant information required for such reconciliation is not available without unreasonable efforts or at all, including, most notably, the impact of exchange rates on Iron Mountain’s transactions, loss or gain related to the disposition of real estate and other income or expense. Without this information, Iron Mountain does not believe that a reconciliation would be meaningful. Section III - Financial Highlights and Guidance investors.ironmountain.com Q4 2020 Supplemental Financial Information 9

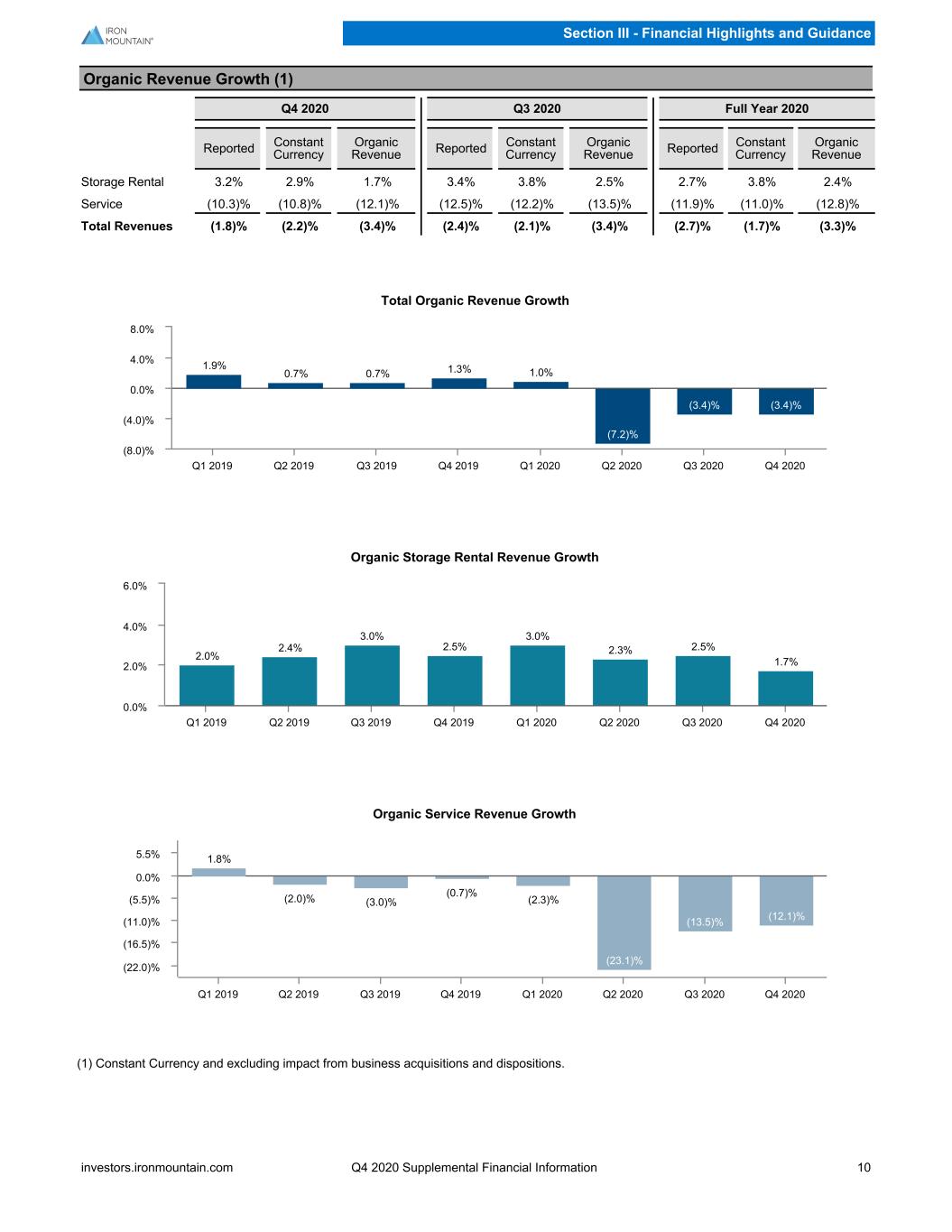

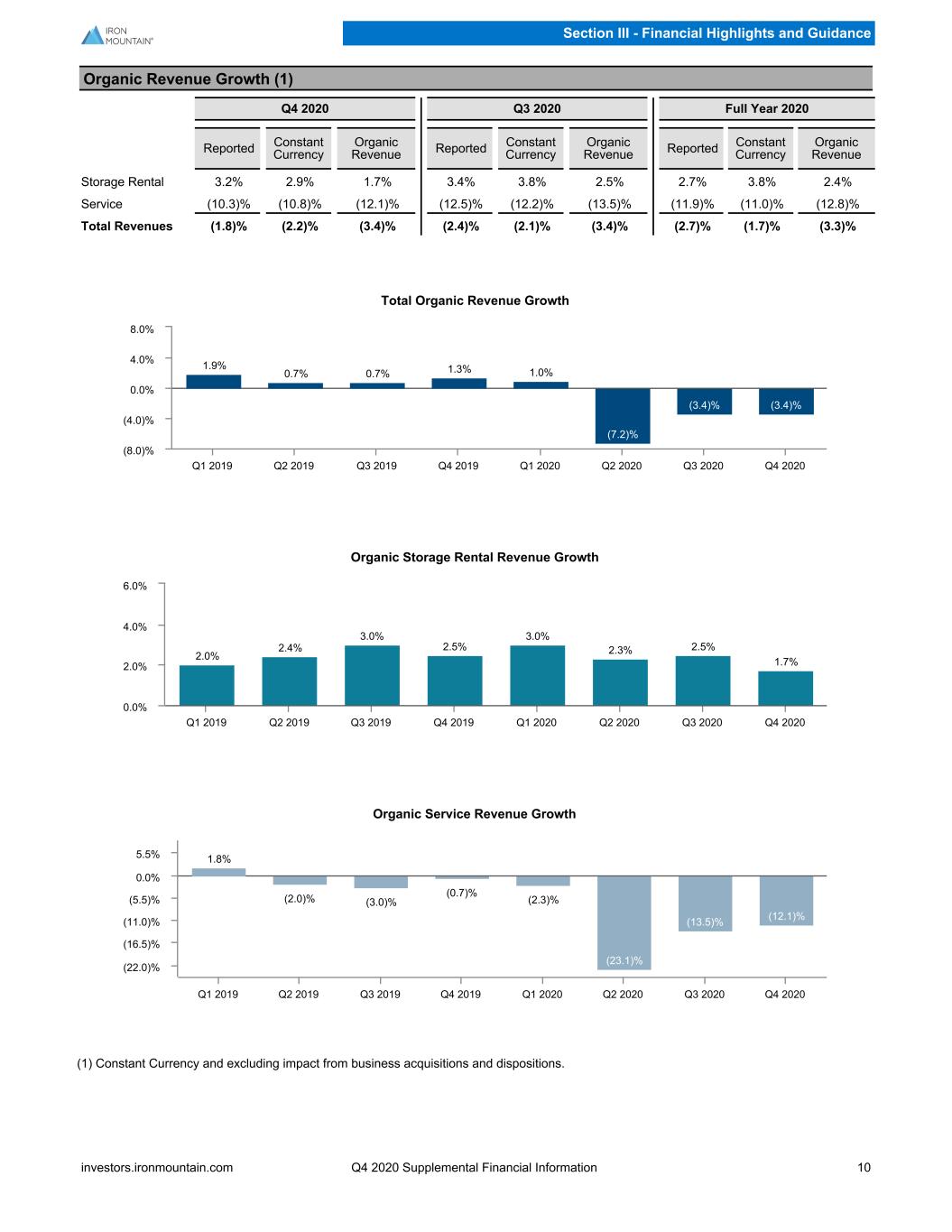

Organic Revenue Growth (1) Q4 2020 Q3 2020 Full Year 2020 Reported Constant Currency Organic Revenue Reported Constant Currency Organic Revenue Reported Constant Currency Organic Revenue Storage Rental 3.2% 2.9% 1.7% 3.4% 3.8% 2.5% 2.7% 3.8% 2.4% Service (10.3)% (10.8)% (12.1)% (12.5)% (12.2)% (13.5)% (11.9)% (11.0)% (12.8)% Total Revenues (1.8)% (2.2)% (3.4)% (2.4)% (2.1)% (3.4)% (2.7)% (1.7)% (3.3)% Total Organic Revenue Growth 1.9% 0.7% 0.7% 1.3% 1.0% (7.2)% (3.4)% (3.4)% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 (8.0)% (4.0)% 0.0% 4.0% 8.0% Organic Storage Rental Revenue Growth 2.0% 2.4% 3.0% 2.5% 3.0% 2.3% 2.5% 1.7% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 0.0% 2.0% 4.0% 6.0% Organic Service Revenue Growth 1.8% (2.0)% (3.0)% (0.7)% (2.3)% (23.1)% (13.5)% (12.1)% Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 (22.0)% (16.5)% (11.0)% (5.5)% 0.0% 5.5% (1) Constant Currency and excluding impact from business acquisitions and dispositions. Section III - Financial Highlights and Guidance investors.ironmountain.com Q4 2020 Supplemental Financial Information 10

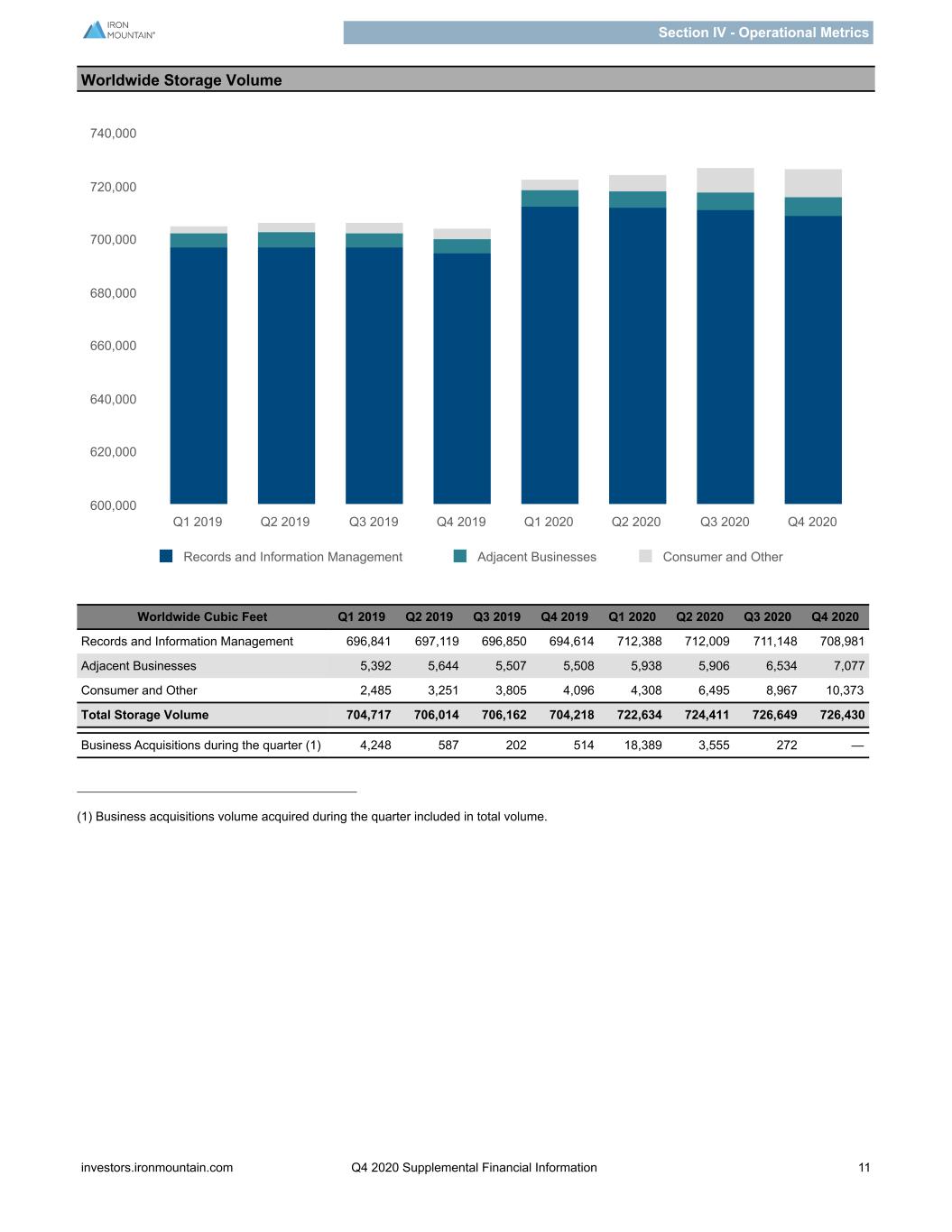

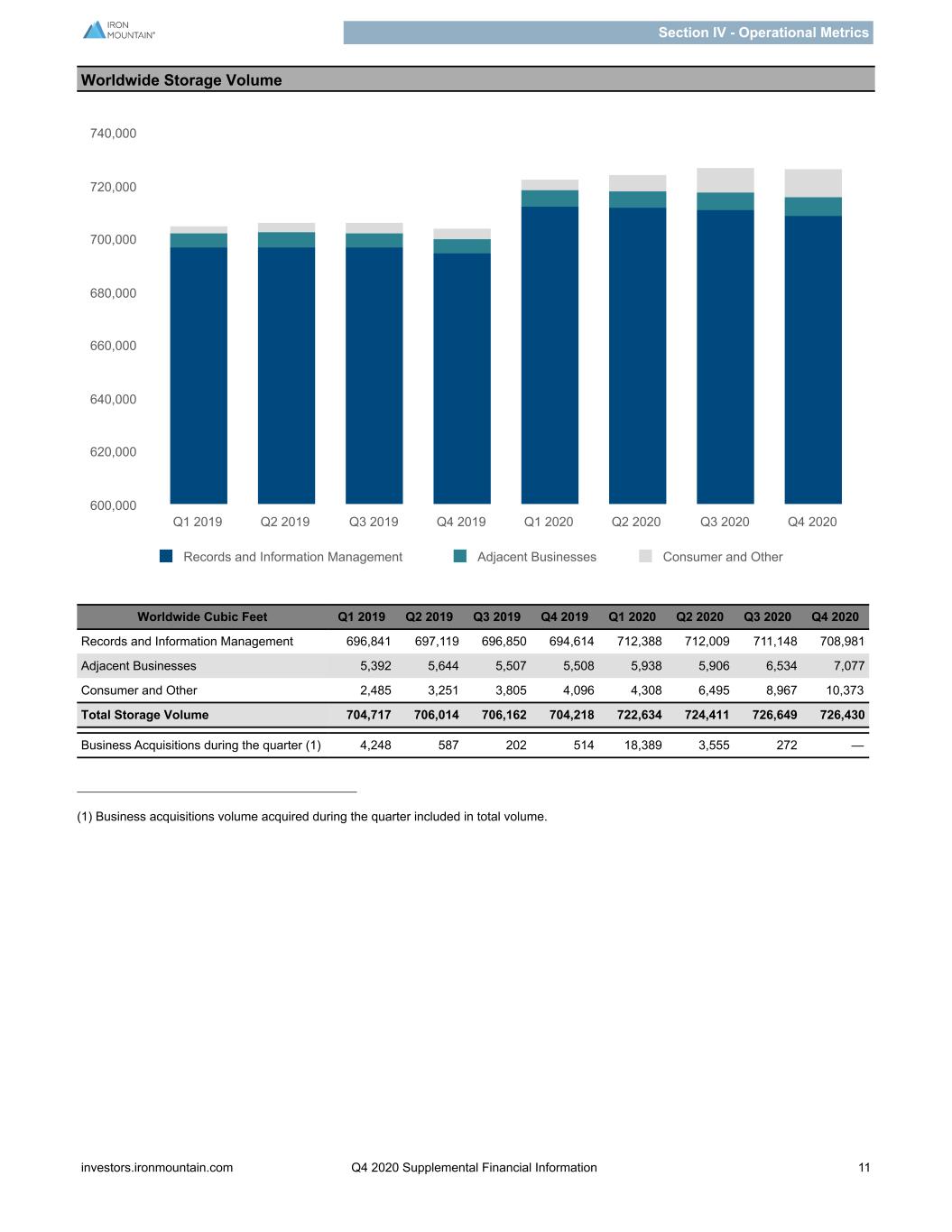

Worldwide Storage Volume Records and Information Management Adjacent Businesses Consumer and Other Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 600,000 620,000 640,000 660,000 680,000 700,000 720,000 740,000 Worldwide Cubic Feet Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Records and Information Management 696,841 697,119 696,850 694,614 712,388 712,009 711,148 708,981 Adjacent Businesses 5,392 5,644 5,507 5,508 5,938 5,906 6,534 7,077 Consumer and Other 2,485 3,251 3,805 4,096 4,308 6,495 8,967 10,373 Total Storage Volume 704,717 706,014 706,162 704,218 722,634 724,411 726,649 726,430 Business Acquisitions during the quarter (1) 4,248 587 202 514 18,389 3,555 272 — (1) Business acquisitions volume acquired during the quarter included in total volume. Section IV - Operational Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 11

Fourth Quarter 2020 Y/Y % Change Q4 2020 Q3 2020 Q4 2019 Reported Constant Currency Organic Growth (2) Global RIM Business Storage Rental $600,419 $598,949 $581,884 3.2% 3.0% 1.6% Service 343,568 322,824 380,245 (9.6)% (10.1)% (11.4)% Total Revenues $943,987 $921,773 $962,129 (1.9)% (2.2)% (3.6)% Adjusted EBITDA $404,398 $393,883 $407,697 Adjusted EBITDA Margin 42.8 % 42.7 % 42.4 % Global Data Center Business Data Center Revenue (1) $72,373 $72,814 $68,906 5.0% 3.9% 3.9% Adjusted EBITDA $31,764 $33,359 $35,603 Adjusted EBITDA Margin 43.9 % 45.8 % 51.7 % Corporate and Other Business Storage Rental $30,003 $28,929 $28,999 3.5% 2.9% 3.0% Service 13,290 13,131 19,556 (32.0)% (33.4)% (33.0)% Total Revenues $43,293 $42,060 $48,555 (10.8)% (11.8)% (11.5)% Adjusted EBITDA $(61,916) $(51,230) $(50,176) Total Consolidated Storage Rental $697,294 $696,294 $675,507 3.2% 2.9% 1.7% Service 362,359 340,353 404,083 (10.3)% (10.8)% (12.1)% Total Revenues $1,059,653 $1,036,647 $1,079,590 (1.8)% (2.2)% (3.4)% Adjusted EBITDA $374,247 $376,012 $393,125 Adjusted EBITDA Margin 35.3 % 36.3 % 36.4 % Full Year 2020 Y/Y % Change Full Year 2020 Full Year 2019 Reported Constant Currency Organic Growth (2) Global RIM Business Storage Rental $2,373,783 $2,320,076 2.3% 3.6% 1.9% Service 1,325,497 1,492,357 (11.2)% (10.2)% (12.1)% Total Revenues $3,699,280 $3,812,433 (3.0)% (1.8)% (3.6)% Adjusted EBITDA $1,574,069 $1,566,065 Adjusted EBITDA Margin 42.6 % 41.1 % Global Data Center Business Data Center Revenue (1) $279,312 $257,151 8.6% 8.3% 8.3% Adjusted EBITDA $126,576 $121,517 Adjusted EBITDA Margin 45.3 % 47.3 % Corporate and Other Business Storage Rental $116,613 $114,086 2.2% 2.1% 3.2% Service 52,065 78,914 (34.0)% (34.1)% (34.4)% Total Revenues $168,678 $193,000 (12.6)% (12.7)% (12.2)% Adjusted EBITDA $(224,924) $(218,573) Total Consolidated Storage Rental $2,754,091 $2,681,087 2.7% 3.8% 2.4% Service 1,393,179 1,581,497 (11.9)% (11.0)% (12.8)% Total Revenues $4,147,270 $4,262,584 (2.7)% (1.7)% (3.3)% Adjusted EBITDA $1,475,721 $1,469,009 Adjusted EBITDA Margin 35.6 % 34.5 % (1) Includes Global Data Center service revenue of $5.5M, $4.4M, and $4.3M in Q4 2020, Q3 2020, and Q4 2019, respectively, and $15.6M and $10.2M in Full Year 2020 and Full Year 2019, respectively. (2) Constant Currency and excluding impact from business acquisitions and dispositions. Section IV - Operational Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 12

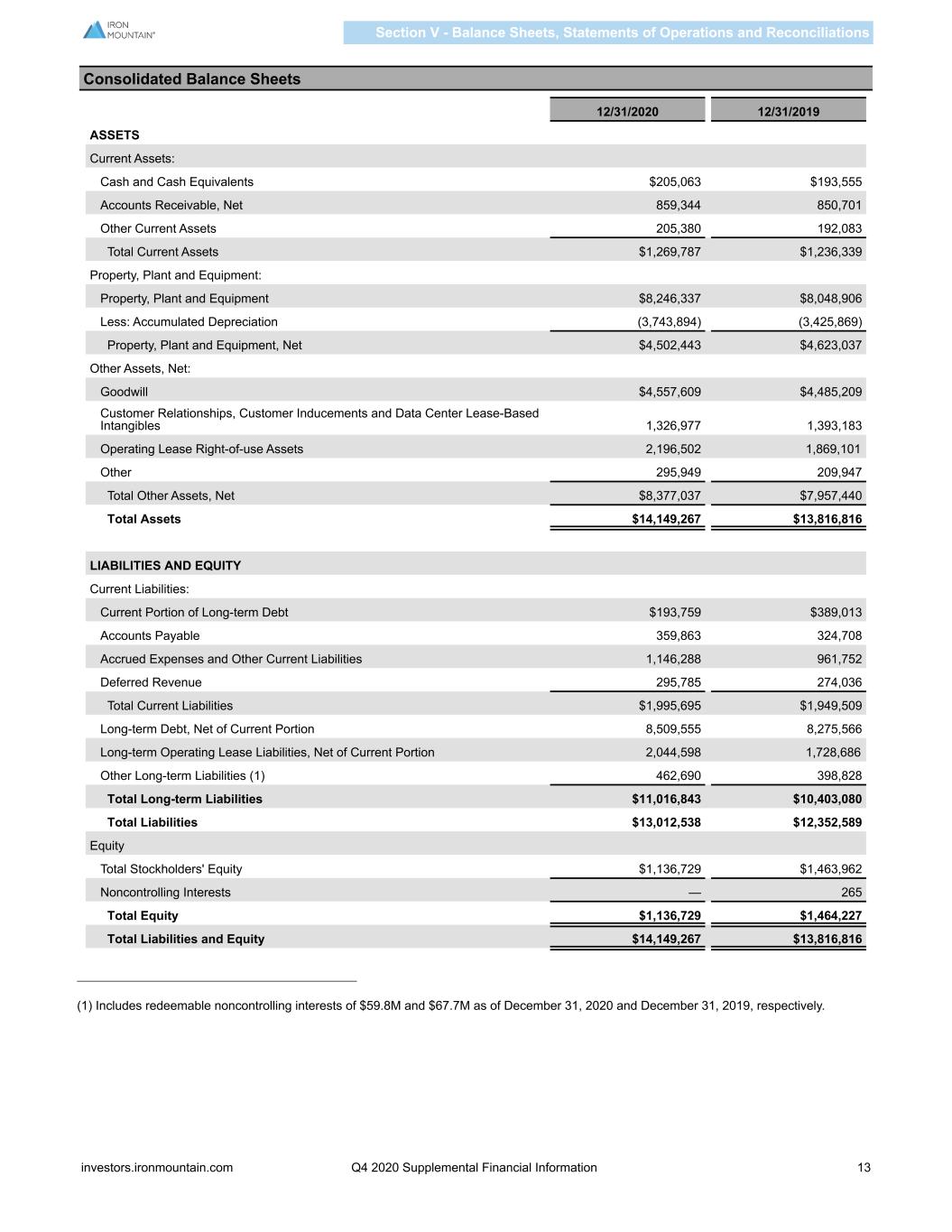

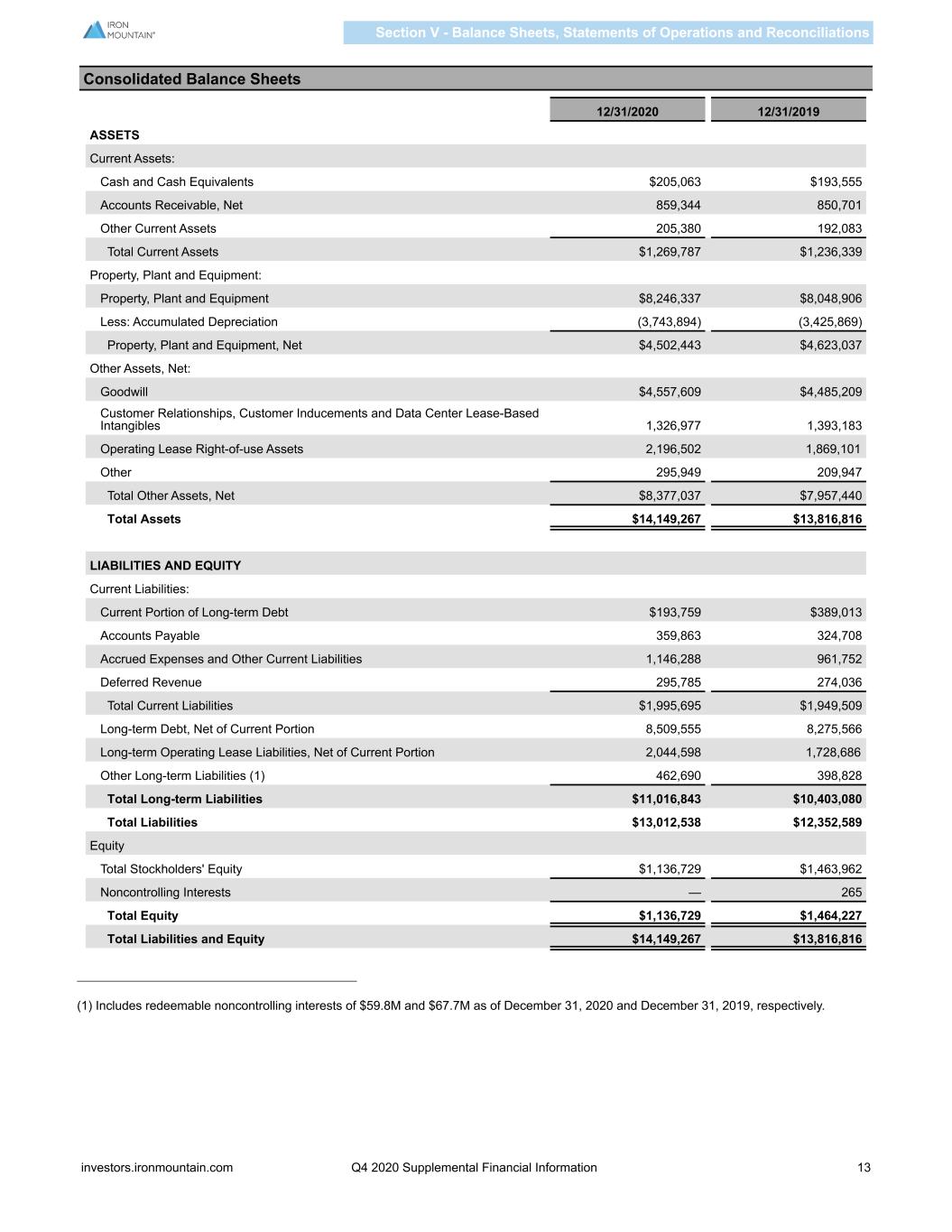

Consolidated Balance Sheets 12/31/2020 12/31/2019 ASSETS Current Assets: Cash and Cash Equivalents $205,063 $193,555 Accounts Receivable, Net 859,344 850,701 Other Current Assets 205,380 192,083 Total Current Assets $1,269,787 $1,236,339 Property, Plant and Equipment: Property, Plant and Equipment $8,246,337 $8,048,906 Less: Accumulated Depreciation (3,743,894) (3,425,869) Property, Plant and Equipment, Net $4,502,443 $4,623,037 Other Assets, Net: Goodwill $4,557,609 $4,485,209 Customer Relationships, Customer Inducements and Data Center Lease-Based Intangibles 1,326,977 1,393,183 Operating Lease Right-of-use Assets 2,196,502 1,869,101 Other 295,949 209,947 Total Other Assets, Net $8,377,037 $7,957,440 Total Assets $14,149,267 $13,816,816 LIABILITIES AND EQUITY Current Liabilities: Current Portion of Long-term Debt $193,759 $389,013 Accounts Payable 359,863 324,708 Accrued Expenses and Other Current Liabilities 1,146,288 961,752 Deferred Revenue 295,785 274,036 Total Current Liabilities $1,995,695 $1,949,509 Long-term Debt, Net of Current Portion 8,509,555 8,275,566 Long-term Operating Lease Liabilities, Net of Current Portion 2,044,598 1,728,686 Other Long-term Liabilities (1) 462,690 398,828 Total Long-term Liabilities $11,016,843 $10,403,080 Total Liabilities $13,012,538 $12,352,589 Equity Total Stockholders' Equity $1,136,729 $1,463,962 Noncontrolling Interests — 265 Total Equity $1,136,729 $1,464,227 Total Liabilities and Equity $14,149,267 $13,816,816 (1) Includes redeemable noncontrolling interests of $59.8M and $67.7M as of December 31, 2020 and December 31, 2019, respectively. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 13

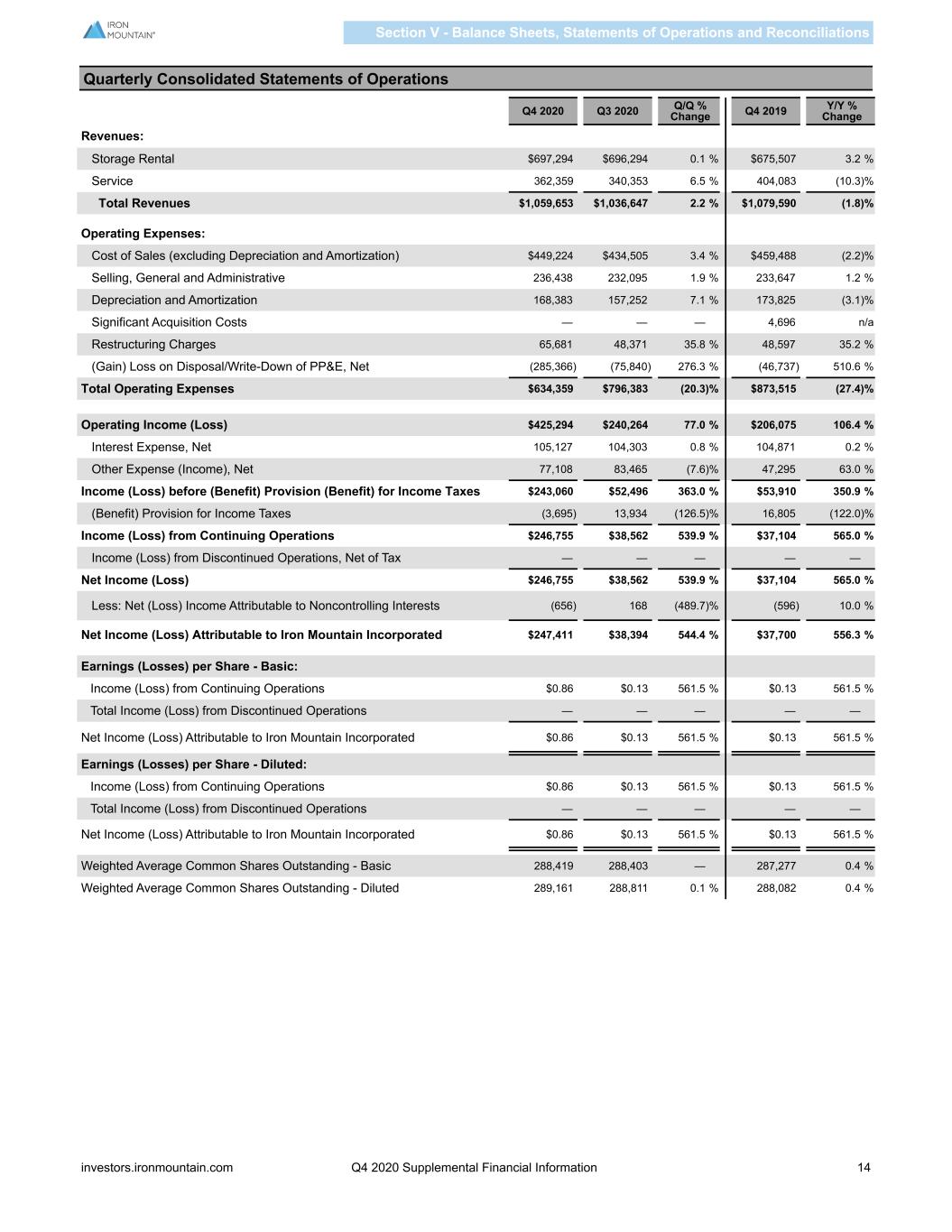

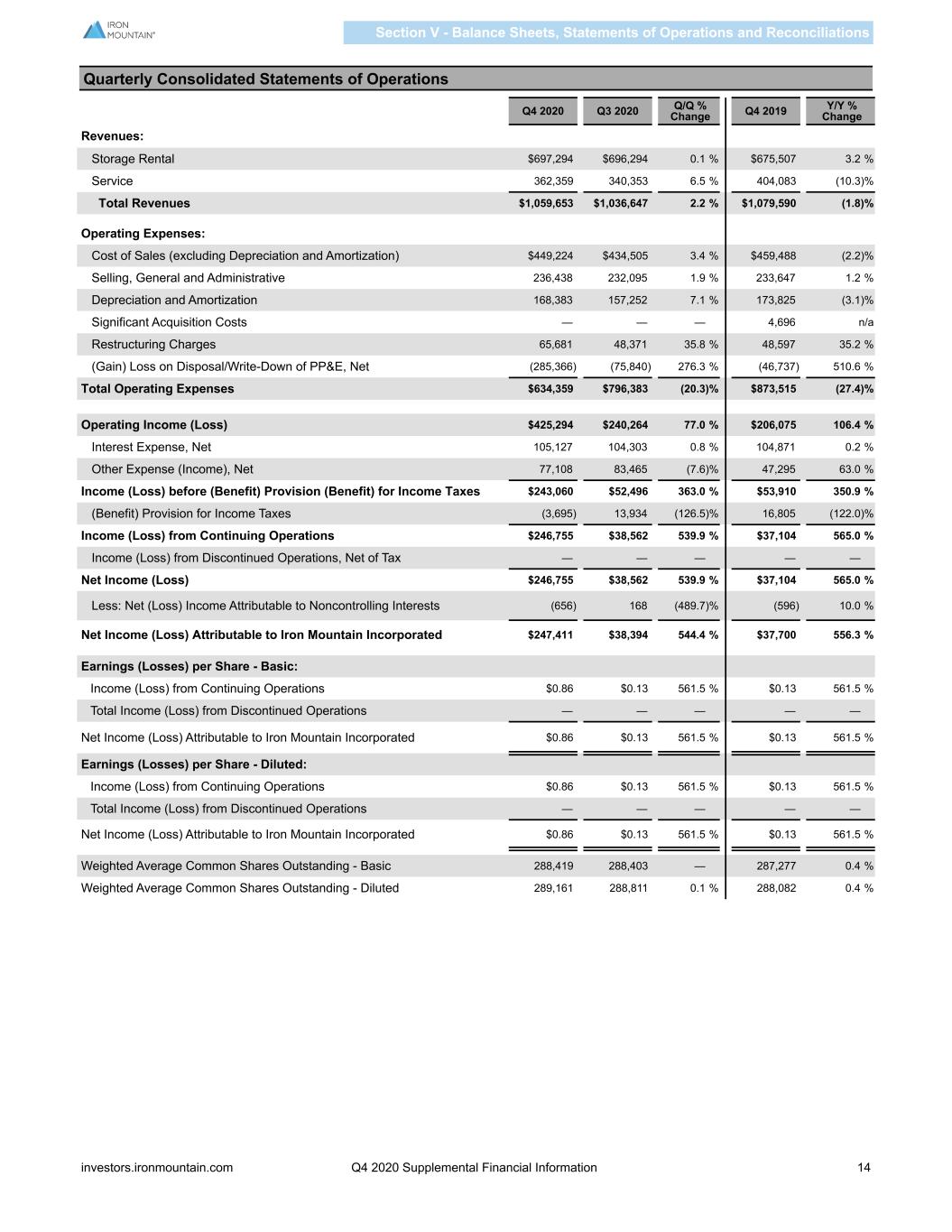

Quarterly Consolidated Statements of Operations Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Revenues: Storage Rental $697,294 $696,294 0.1 % $675,507 3.2 % Service 362,359 340,353 6.5 % 404,083 (10.3) % Total Revenues $1,059,653 $1,036,647 2.2 % $1,079,590 (1.8) % Operating Expenses: Cost of Sales (excluding Depreciation and Amortization) $449,224 $434,505 3.4 % $459,488 (2.2) % Selling, General and Administrative 236,438 232,095 1.9 % 233,647 1.2 % Depreciation and Amortization 168,383 157,252 7.1 % 173,825 (3.1) % Significant Acquisition Costs — — — 4,696 n/a Restructuring Charges 65,681 48,371 35.8 % 48,597 35.2 % (Gain) Loss on Disposal/Write-Down of PP&E, Net (285,366) (75,840) 276.3 % (46,737) 510.6 % Total Operating Expenses $634,359 $796,383 (20.3) % $873,515 (27.4) % Operating Income (Loss) $425,294 $240,264 77.0 % $206,075 106.4 % Interest Expense, Net 105,127 104,303 0.8 % 104,871 0.2 % Other Expense (Income), Net 77,108 83,465 (7.6) % 47,295 63.0 % Income (Loss) before (Benefit) Provision (Benefit) for Income Taxes $243,060 $52,496 363.0 % $53,910 350.9 % (Benefit) Provision for Income Taxes (3,695) 13,934 (126.5) % 16,805 (122.0) % Income (Loss) from Continuing Operations $246,755 $38,562 539.9 % $37,104 565.0 % Income (Loss) from Discontinued Operations, Net of Tax — — — — — Net Income (Loss) $246,755 $38,562 539.9 % $37,104 565.0 % Less: Net (Loss) Income Attributable to Noncontrolling Interests (656) 168 (489.7) % (596) 10.0 % Net Income (Loss) Attributable to Iron Mountain Incorporated $247,411 $38,394 544.4 % $37,700 556.3 % Earnings (Losses) per Share - Basic: Income (Loss) from Continuing Operations $0.86 $0.13 561.5 % $0.13 561.5 % Total Income (Loss) from Discontinued Operations — — — — — Net Income (Loss) Attributable to Iron Mountain Incorporated $0.86 $0.13 561.5 % $0.13 561.5 % Earnings (Losses) per Share - Diluted: Income (Loss) from Continuing Operations $0.86 $0.13 561.5 % $0.13 561.5 % Total Income (Loss) from Discontinued Operations — — — — — Net Income (Loss) Attributable to Iron Mountain Incorporated $0.86 $0.13 561.5 % $0.13 561.5 % Weighted Average Common Shares Outstanding - Basic 288,419 288,403 — 287,277 0.4 % Weighted Average Common Shares Outstanding - Diluted 289,161 288,811 0.1 % 288,082 0.4 % Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 14

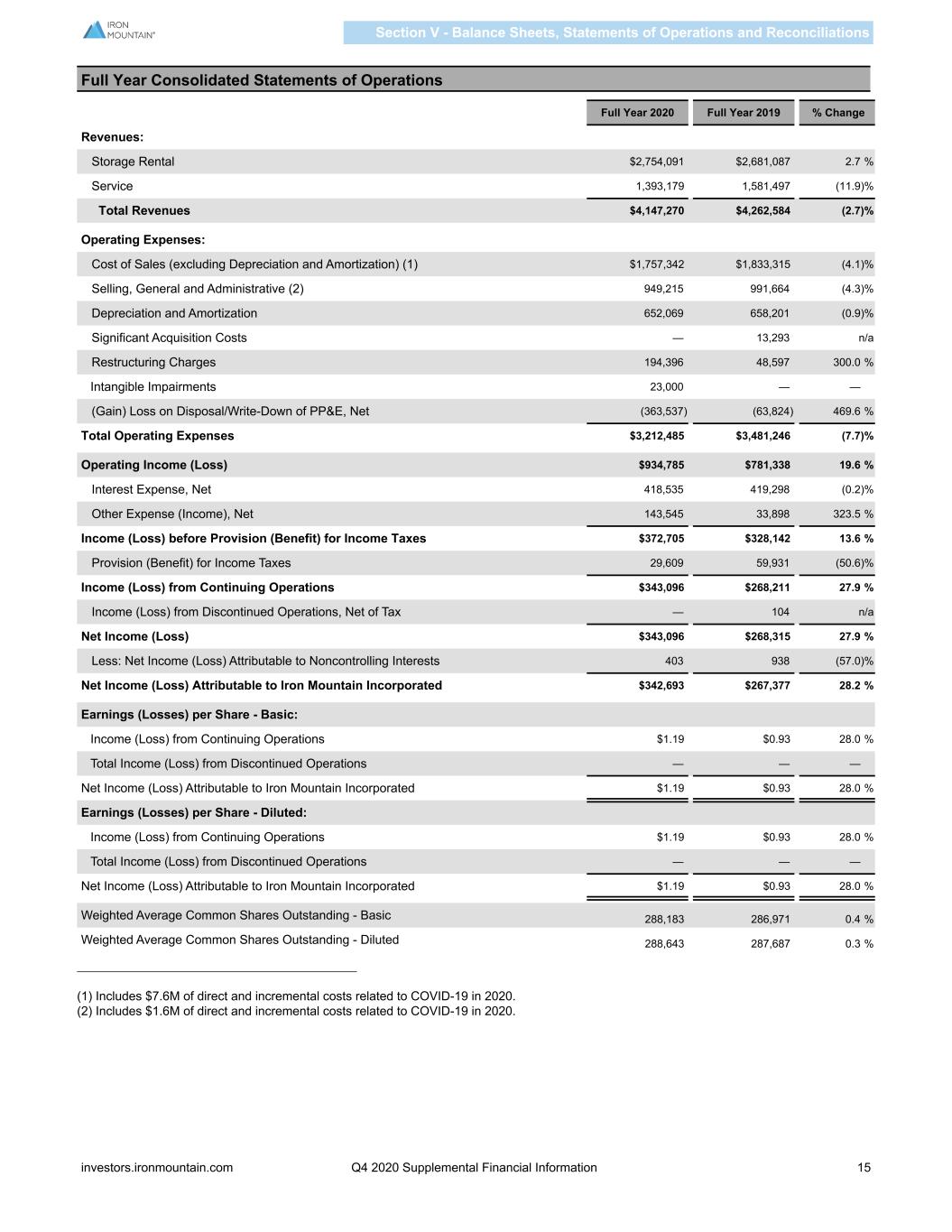

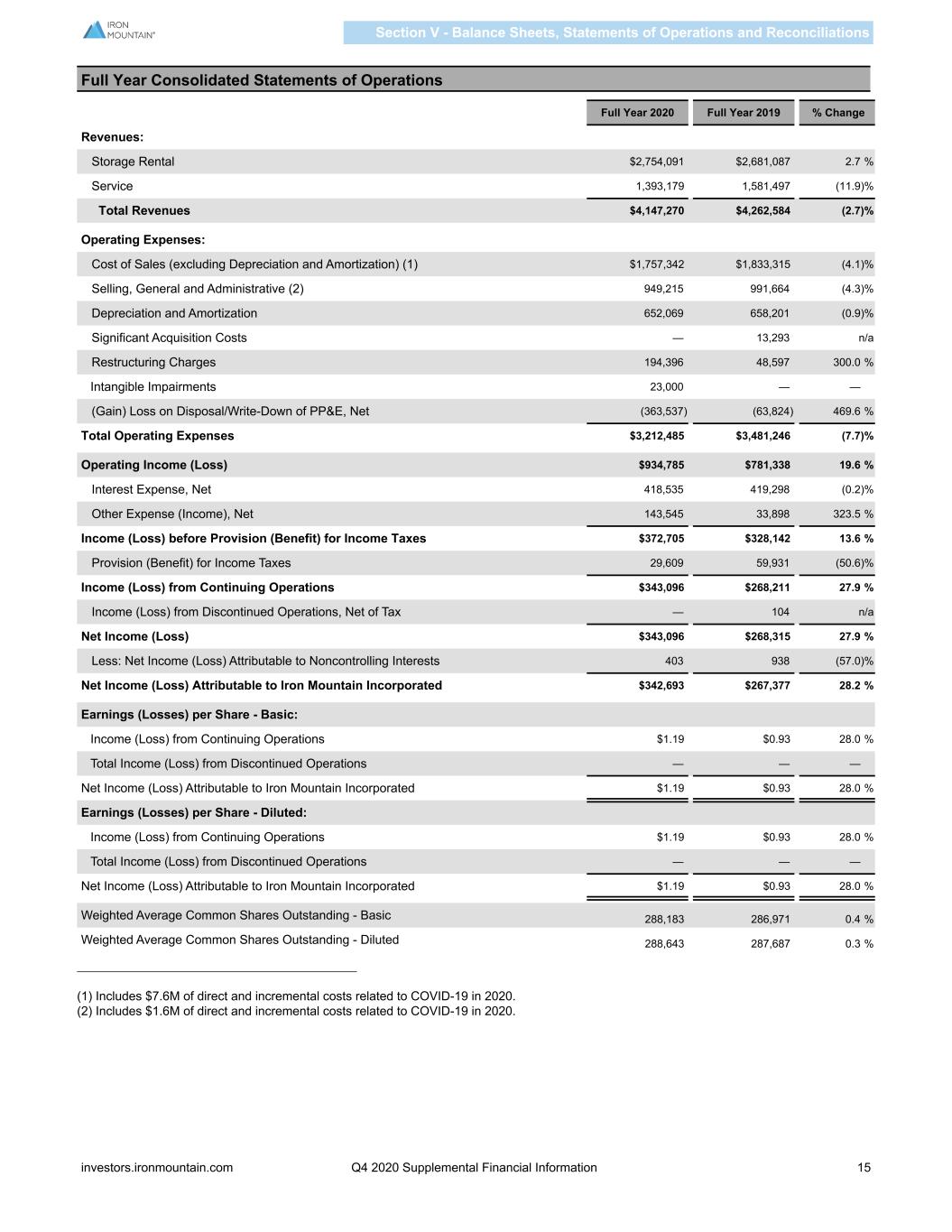

Full Year Consolidated Statements of Operations Full Year 2020 Full Year 2019 % Change Revenues: Storage Rental $2,754,091 $2,681,087 2.7 % Service 1,393,179 1,581,497 (11.9) % Total Revenues $4,147,270 $4,262,584 (2.7) % Operating Expenses: Cost of Sales (excluding Depreciation and Amortization) (1) $1,757,342 $1,833,315 (4.1) % Selling, General and Administrative (2) 949,215 991,664 (4.3) % Depreciation and Amortization 652,069 658,201 (0.9) % Significant Acquisition Costs — 13,293 n/a Restructuring Charges 194,396 48,597 300.0 % Intangible Impairments 23,000 — — (Gain) Loss on Disposal/Write-Down of PP&E, Net (363,537) (63,824) 469.6 % Total Operating Expenses $3,212,485 $3,481,246 (7.7) % Operating Income (Loss) $934,785 $781,338 19.6 % Interest Expense, Net 418,535 419,298 (0.2) % Other Expense (Income), Net 143,545 33,898 323.5 % Income (Loss) before Provision (Benefit) for Income Taxes $372,705 $328,142 13.6 % Provision (Benefit) for Income Taxes 29,609 59,931 (50.6) % Income (Loss) from Continuing Operations $343,096 $268,211 27.9 % Income (Loss) from Discontinued Operations, Net of Tax — 104 n/a Net Income (Loss) $343,096 $268,315 27.9 % Less: Net Income (Loss) Attributable to Noncontrolling Interests 403 938 (57.0) % Net Income (Loss) Attributable to Iron Mountain Incorporated $342,693 $267,377 28.2 % Earnings (Losses) per Share - Basic: Income (Loss) from Continuing Operations $1.19 $0.93 28.0 % Total Income (Loss) from Discontinued Operations — — — Net Income (Loss) Attributable to Iron Mountain Incorporated $1.19 $0.93 28.0 % Earnings (Losses) per Share - Diluted: Income (Loss) from Continuing Operations $1.19 $0.93 28.0 % Total Income (Loss) from Discontinued Operations — — — Net Income (Loss) Attributable to Iron Mountain Incorporated $1.19 $0.93 28.0 % Weighted Average Common Shares Outstanding - Basic 288,183 286,971 0.4 % Weighted Average Common Shares Outstanding - Diluted 288,643 287,687 0.3 % (1) Includes $7.6M of direct and incremental costs related to COVID-19 in 2020. (2) Includes $1.6M of direct and incremental costs related to COVID-19 in 2020. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 15

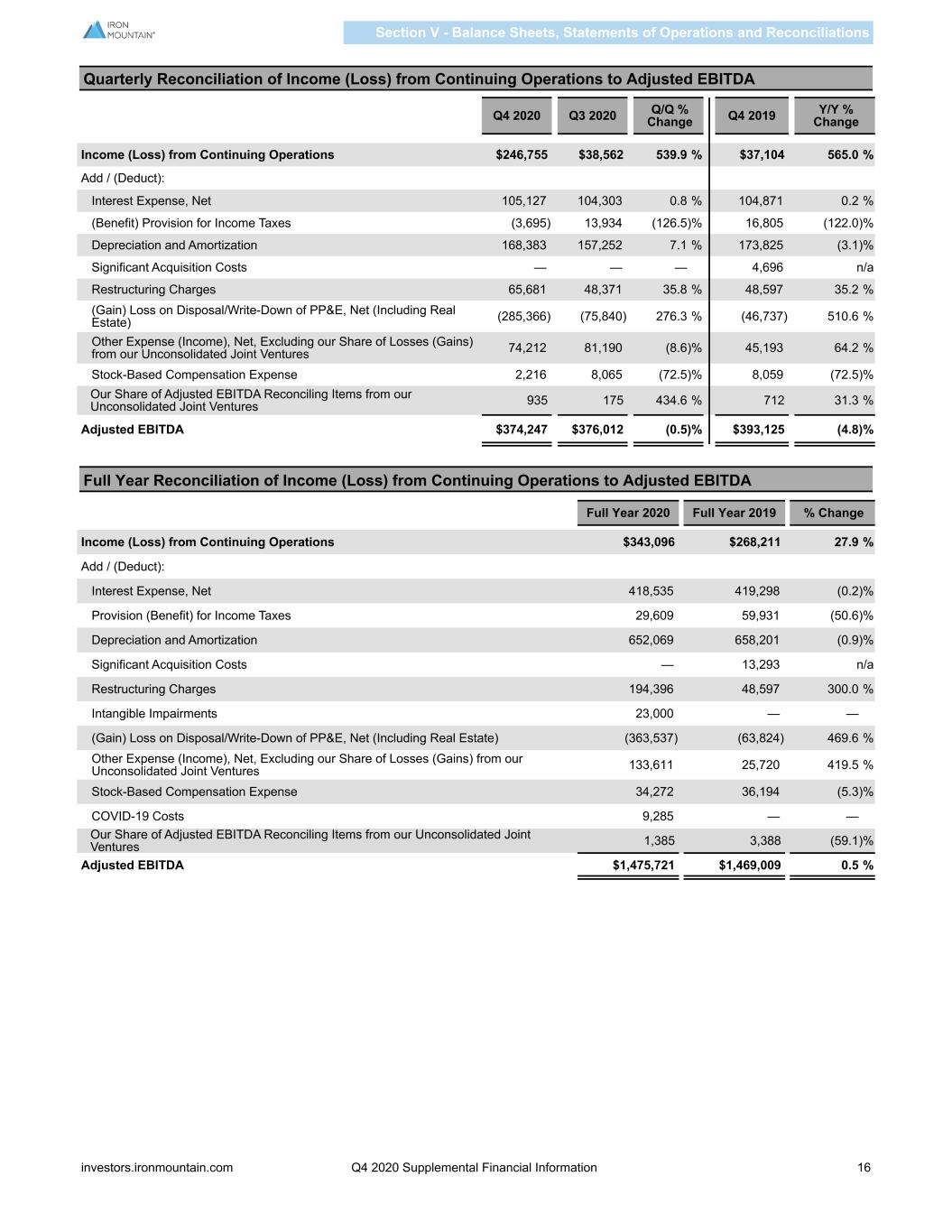

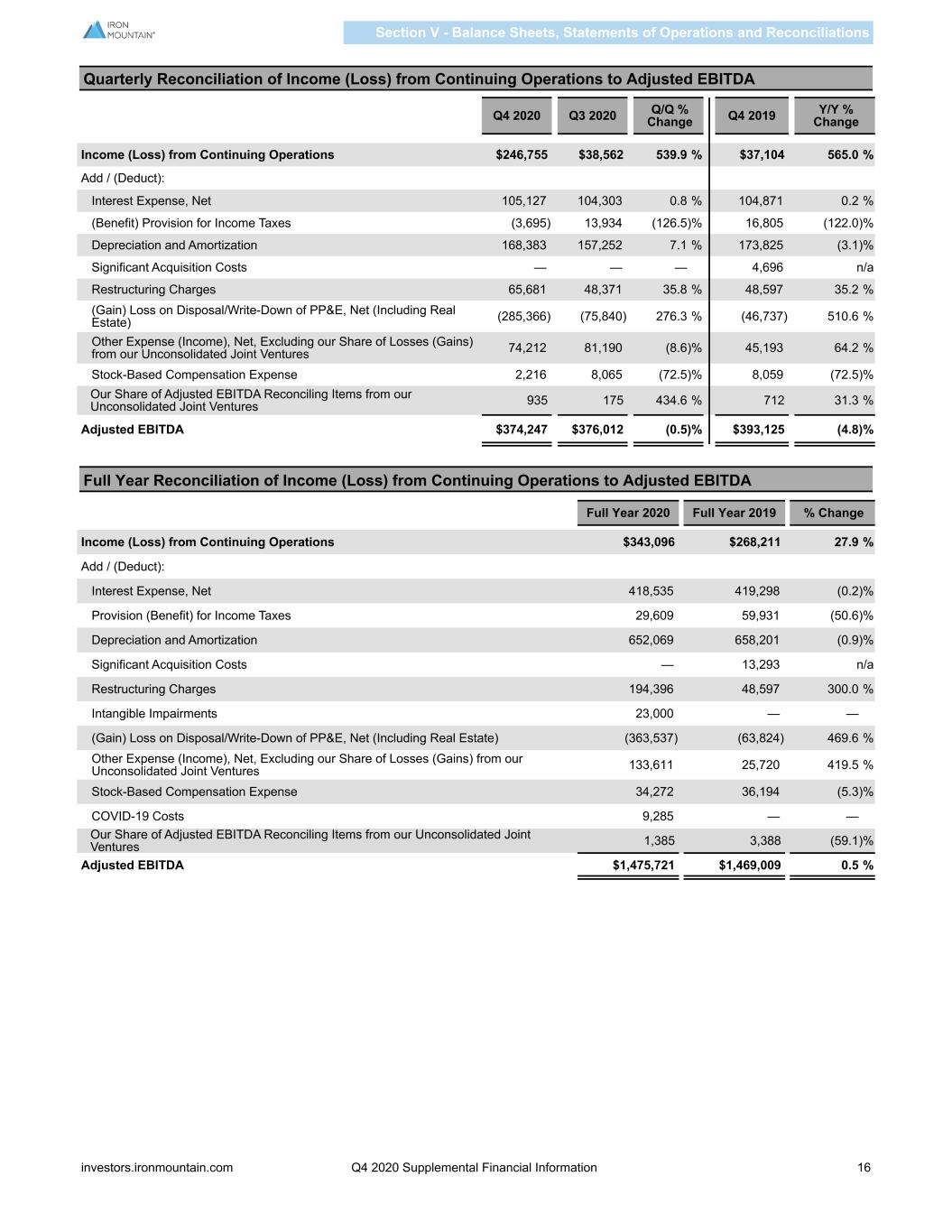

Quarterly Reconciliation of Income (Loss) from Continuing Operations to Adjusted EBITDA Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Income (Loss) from Continuing Operations $246,755 $38,562 539.9 % $37,104 565.0 % Add / (Deduct): Interest Expense, Net 105,127 104,303 0.8 % 104,871 0.2 % (Benefit) Provision for Income Taxes (3,695) 13,934 (126.5) % 16,805 (122.0) % Depreciation and Amortization 168,383 157,252 7.1 % 173,825 (3.1) % Significant Acquisition Costs — — — 4,696 n/a Restructuring Charges 65,681 48,371 35.8 % 48,597 35.2 % (Gain) Loss on Disposal/Write-Down of PP&E, Net (Including Real Estate) (285,366) (75,840) 276.3 % (46,737) 510.6 % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 74,212 81,190 (8.6) % 45,193 64.2 % Stock-Based Compensation Expense 2,216 8,065 (72.5) % 8,059 (72.5) % Our Share of Adjusted EBITDA Reconciling Items from our Unconsolidated Joint Ventures 935 175 434.6 % 712 31.3 % Adjusted EBITDA $374,247 $376,012 (0.5) % $393,125 (4.8) % Full Year Reconciliation of Income (Loss) from Continuing Operations to Adjusted EBITDA Full Year 2020 Full Year 2019 % Change Income (Loss) from Continuing Operations $343,096 $268,211 27.9 % Add / (Deduct): Interest Expense, Net 418,535 419,298 (0.2) % Provision (Benefit) for Income Taxes 29,609 59,931 (50.6) % Depreciation and Amortization 652,069 658,201 (0.9) % Significant Acquisition Costs — 13,293 n/a Restructuring Charges 194,396 48,597 300.0 % Intangible Impairments 23,000 — — (Gain) Loss on Disposal/Write-Down of PP&E, Net (Including Real Estate) (363,537) (63,824) 469.6 % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 133,611 25,720 419.5 % Stock-Based Compensation Expense 34,272 36,194 (5.3) % COVID-19 Costs 9,285 — — Our Share of Adjusted EBITDA Reconciling Items from our Unconsolidated Joint Ventures 1,385 3,388 (59.1) % Adjusted EBITDA $1,475,721 $1,469,009 0.5 % Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 16

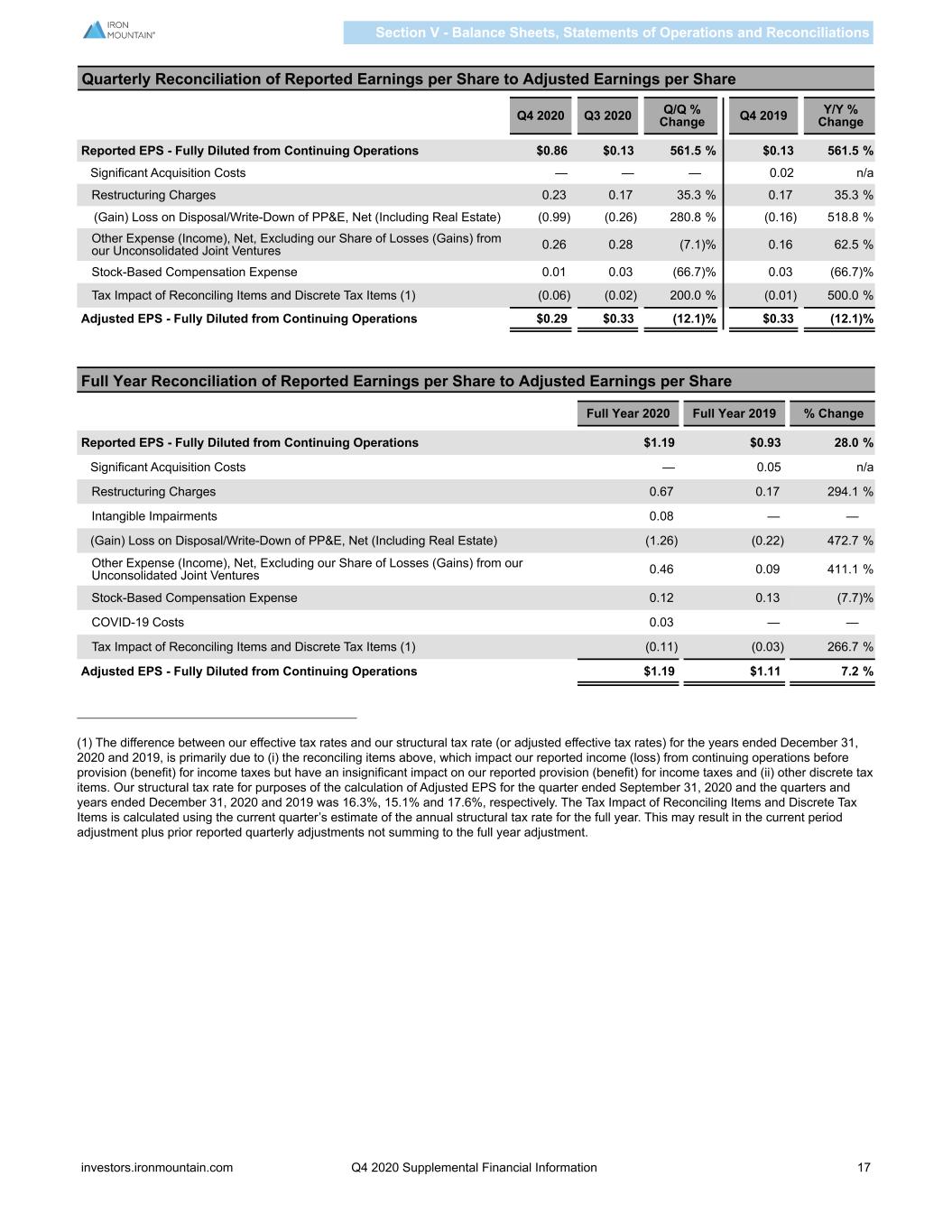

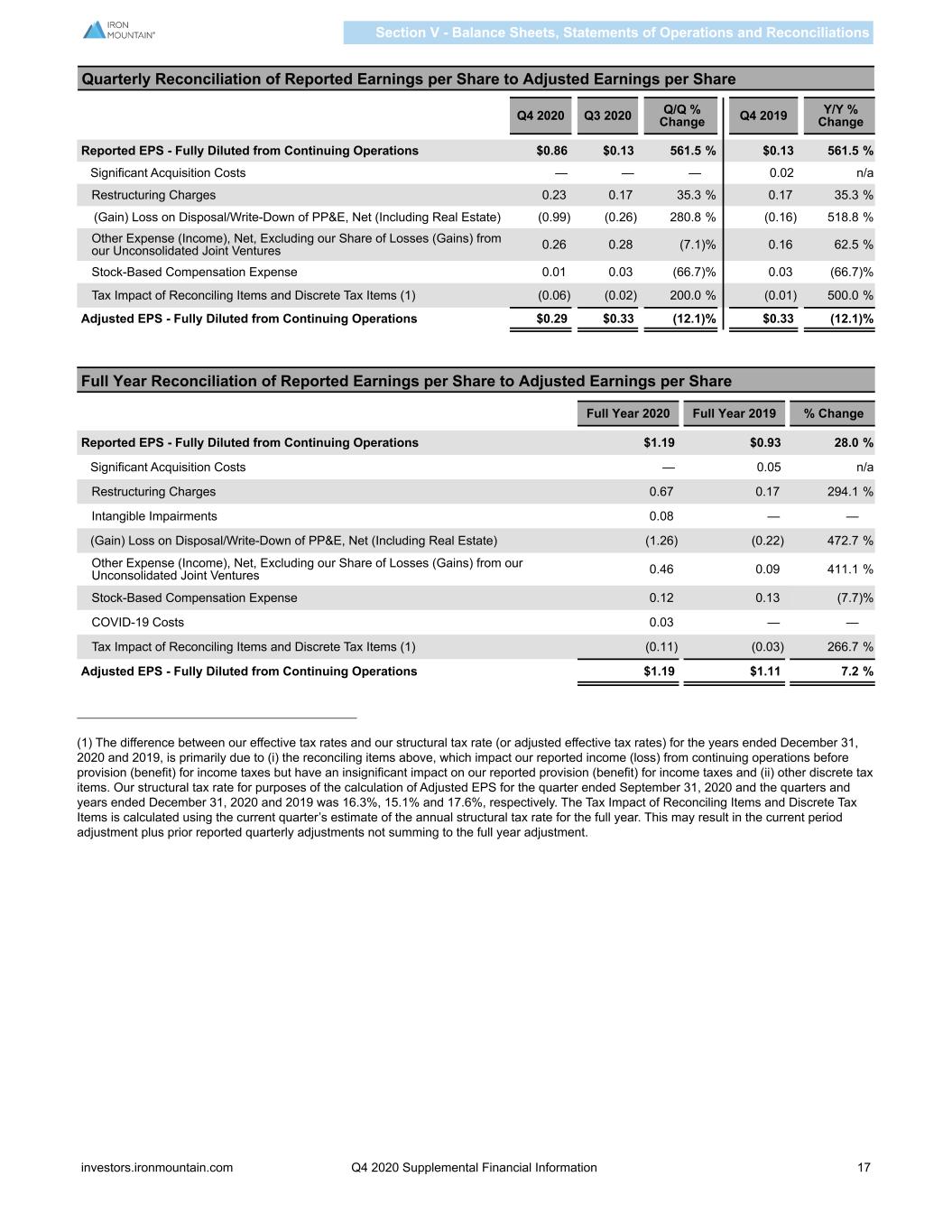

Quarterly Reconciliation of Reported Earnings per Share to Adjusted Earnings per Share Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Reported EPS - Fully Diluted from Continuing Operations $0.86 $0.13 561.5 % $0.13 561.5 % Significant Acquisition Costs — — — 0.02 n/a Restructuring Charges 0.23 0.17 35.3 % 0.17 35.3 % (Gain) Loss on Disposal/Write-Down of PP&E, Net (Including Real Estate) (0.99) (0.26) 280.8 % (0.16) 518.8 % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 0.26 0.28 (7.1) % 0.16 62.5 % Stock-Based Compensation Expense 0.01 0.03 (66.7) % 0.03 (66.7) % Tax Impact of Reconciling Items and Discrete Tax Items (1) (0.06) (0.02) 200.0 % (0.01) 500.0 % Adjusted EPS - Fully Diluted from Continuing Operations $0.29 $0.33 (12.1) % $0.33 (12.1) % Full Year Reconciliation of Reported Earnings per Share to Adjusted Earnings per Share Full Year 2020 Full Year 2019 % Change Reported EPS - Fully Diluted from Continuing Operations $1.19 $0.93 28.0 % Significant Acquisition Costs — 0.05 n/a Restructuring Charges 0.67 0.17 294.1 % Intangible Impairments 0.08 — — (Gain) Loss on Disposal/Write-Down of PP&E, Net (Including Real Estate) (1.26) (0.22) 472.7 % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 0.46 0.09 411.1 % Stock-Based Compensation Expense 0.12 0.13 (7.7) % COVID-19 Costs 0.03 — — Tax Impact of Reconciling Items and Discrete Tax Items (1) (0.11) (0.03) 266.7 % Adjusted EPS - Fully Diluted from Continuing Operations $1.19 $1.11 7.2 % (1) The difference between our effective tax rates and our structural tax rate (or adjusted effective tax rates) for the years ended December 31, 2020 and 2019, is primarily due to (i) the reconciling items above, which impact our reported income (loss) from continuing operations before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for income taxes and (ii) other discrete tax items. Our structural tax rate for purposes of the calculation of Adjusted EPS for the quarter ended September 31, 2020 and the quarters and years ended December 31, 2020 and 2019 was 16.3%, 15.1% and 17.6%, respectively. The Tax Impact of Reconciling Items and Discrete Tax Items is calculated using the current quarter’s estimate of the annual structural tax rate for the full year. This may result in the current period adjustment plus prior reported quarterly adjustments not summing to the full year adjustment. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 17

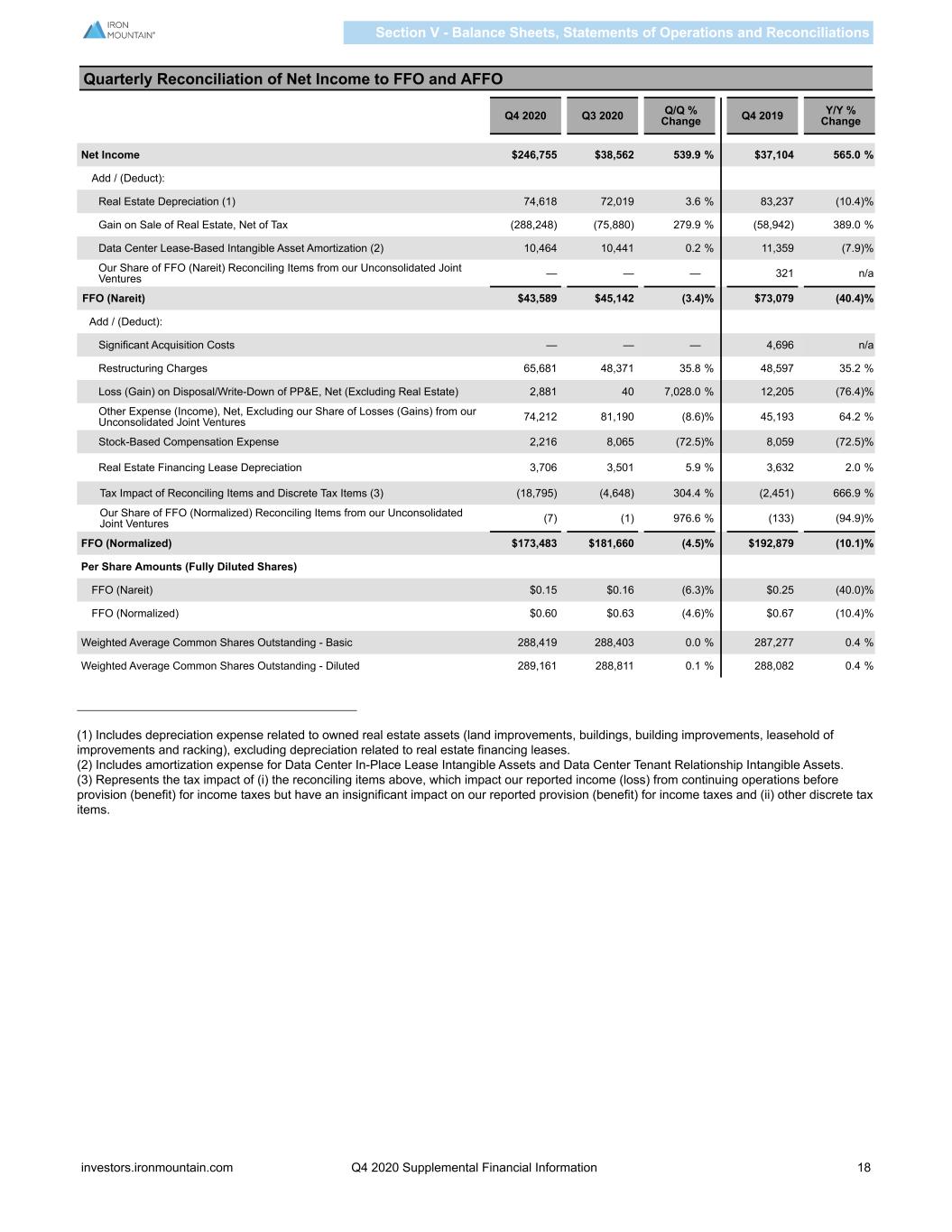

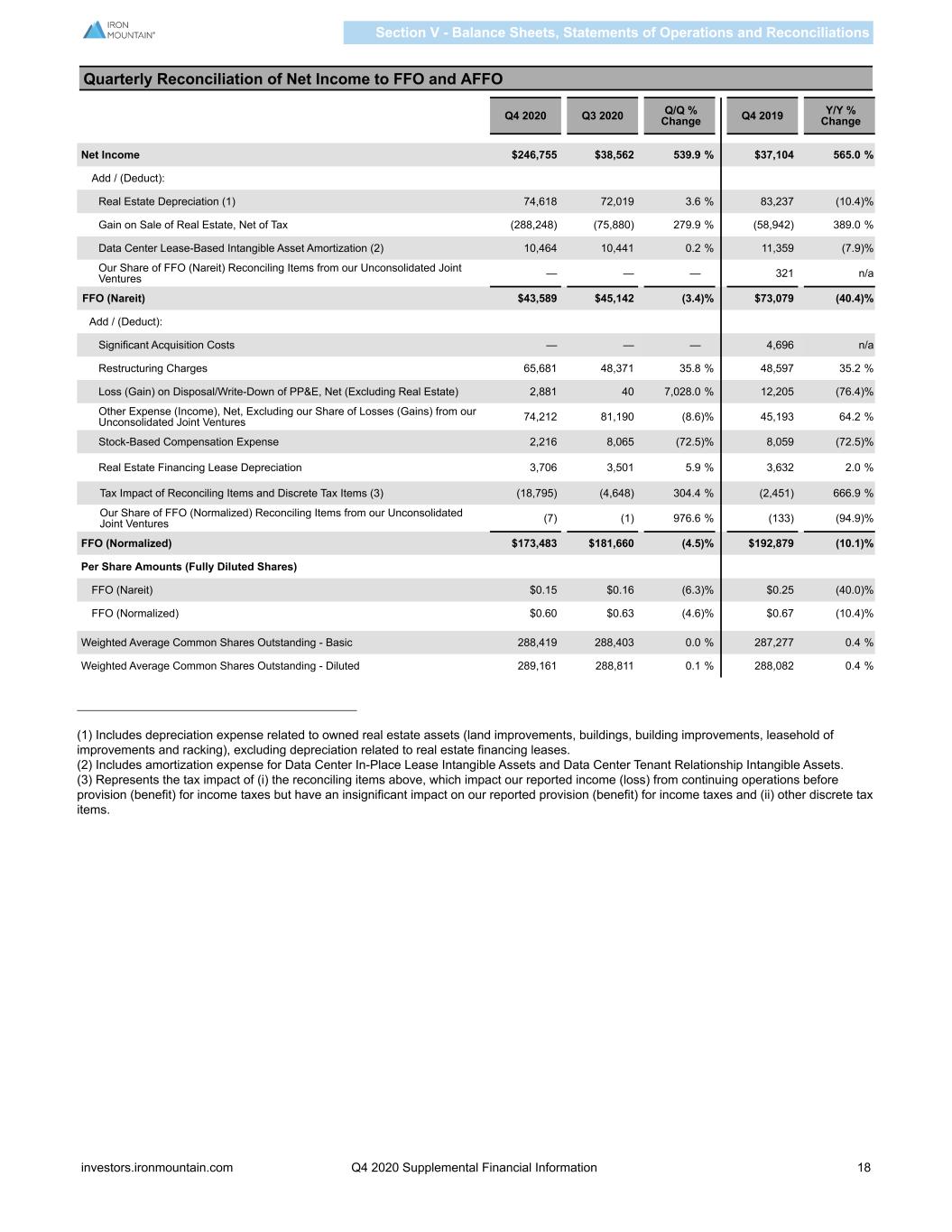

Quarterly Reconciliation of Net Income to FFO and AFFO Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Net Income $246,755 $38,562 539.9 % $37,104 565.0 % Add / (Deduct): Real Estate Depreciation (1) 74,618 72,019 3.6 % 83,237 (10.4) % Gain on Sale of Real Estate, Net of Tax (288,248) (75,880) 279.9 % (58,942) 389.0 % Data Center Lease-Based Intangible Asset Amortization (2) 10,464 10,441 0.2 % 11,359 (7.9) % Our Share of FFO (Nareit) Reconciling Items from our Unconsolidated Joint Ventures — — — 321 n/a FFO (Nareit) $43,589 $45,142 (3.4) % $73,079 (40.4) % Add / (Deduct): Significant Acquisition Costs — — — 4,696 n/a Restructuring Charges 65,681 48,371 35.8 % 48,597 35.2 % Loss (Gain) on Disposal/Write-Down of PP&E, Net (Excluding Real Estate) 2,881 40 7,028.0 % 12,205 (76.4) % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 74,212 81,190 (8.6) % 45,193 64.2 % Stock-Based Compensation Expense 2,216 8,065 (72.5) % 8,059 (72.5) % Real Estate Financing Lease Depreciation 3,706 3,501 5.9 % 3,632 2.0 % Tax Impact of Reconciling Items and Discrete Tax Items (3) (18,795) (4,648) 304.4 % (2,451) 666.9 % Our Share of FFO (Normalized) Reconciling Items from our Unconsolidated Joint Ventures (7) (1) 976.6 % (133) (94.9) % FFO (Normalized) $173,483 $181,660 (4.5) % $192,879 (10.1) % Per Share Amounts (Fully Diluted Shares) FFO (Nareit) $0.15 $0.16 (6.3) % $0.25 (40.0) % FFO (Normalized) $0.60 $0.63 (4.6) % $0.67 (10.4) % Weighted Average Common Shares Outstanding - Basic 288,419 288,403 0.0 % 287,277 0.4 % Weighted Average Common Shares Outstanding - Diluted 289,161 288,811 0.1 % 288,082 0.4 % (1) Includes depreciation expense related to owned real estate assets (land improvements, buildings, building improvements, leasehold of improvements and racking), excluding depreciation related to real estate financing leases. (2) Includes amortization expense for Data Center In-Place Lease Intangible Assets and Data Center Tenant Relationship Intangible Assets. (3) Represents the tax impact of (i) the reconciling items above, which impact our reported income (loss) from continuing operations before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for income taxes and (ii) other discrete tax items. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 18

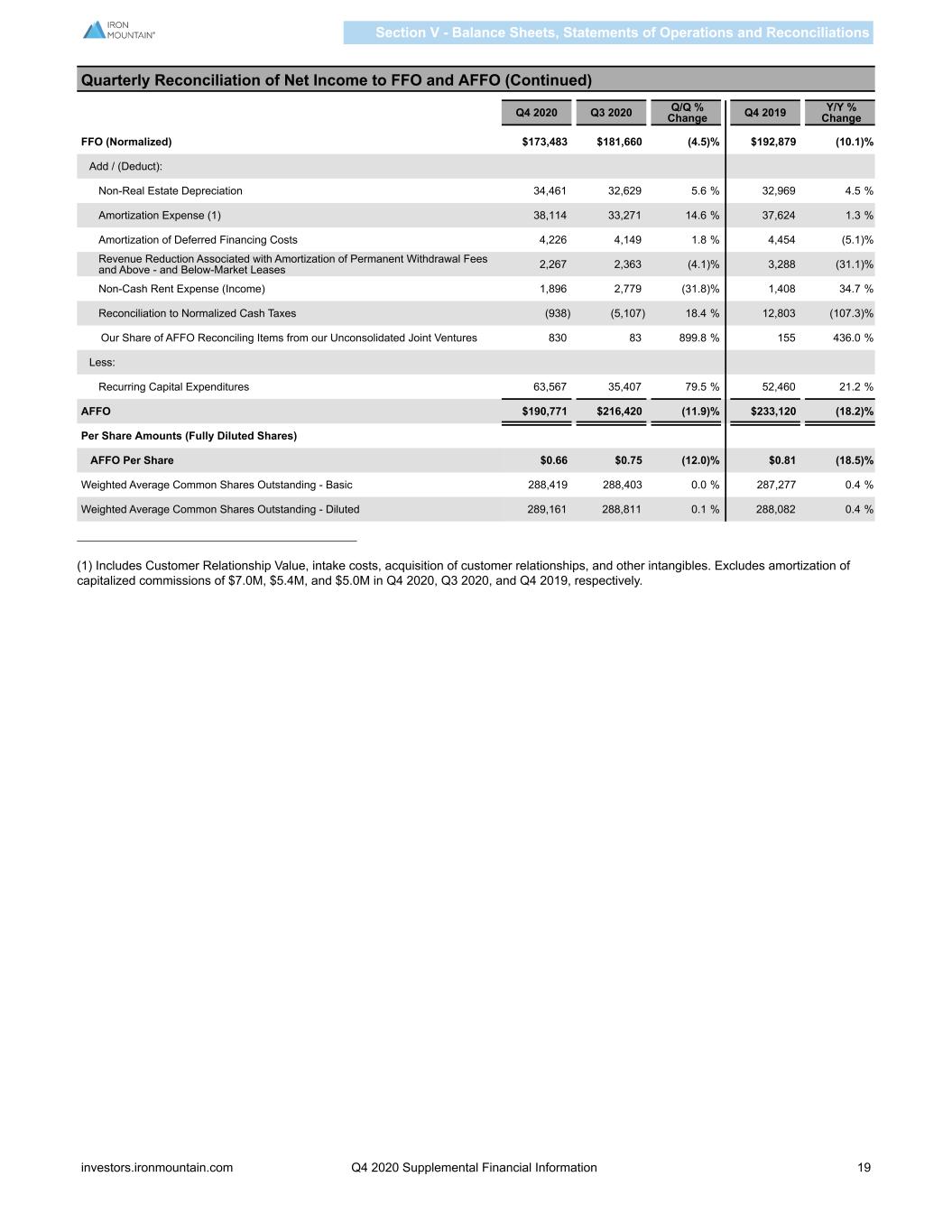

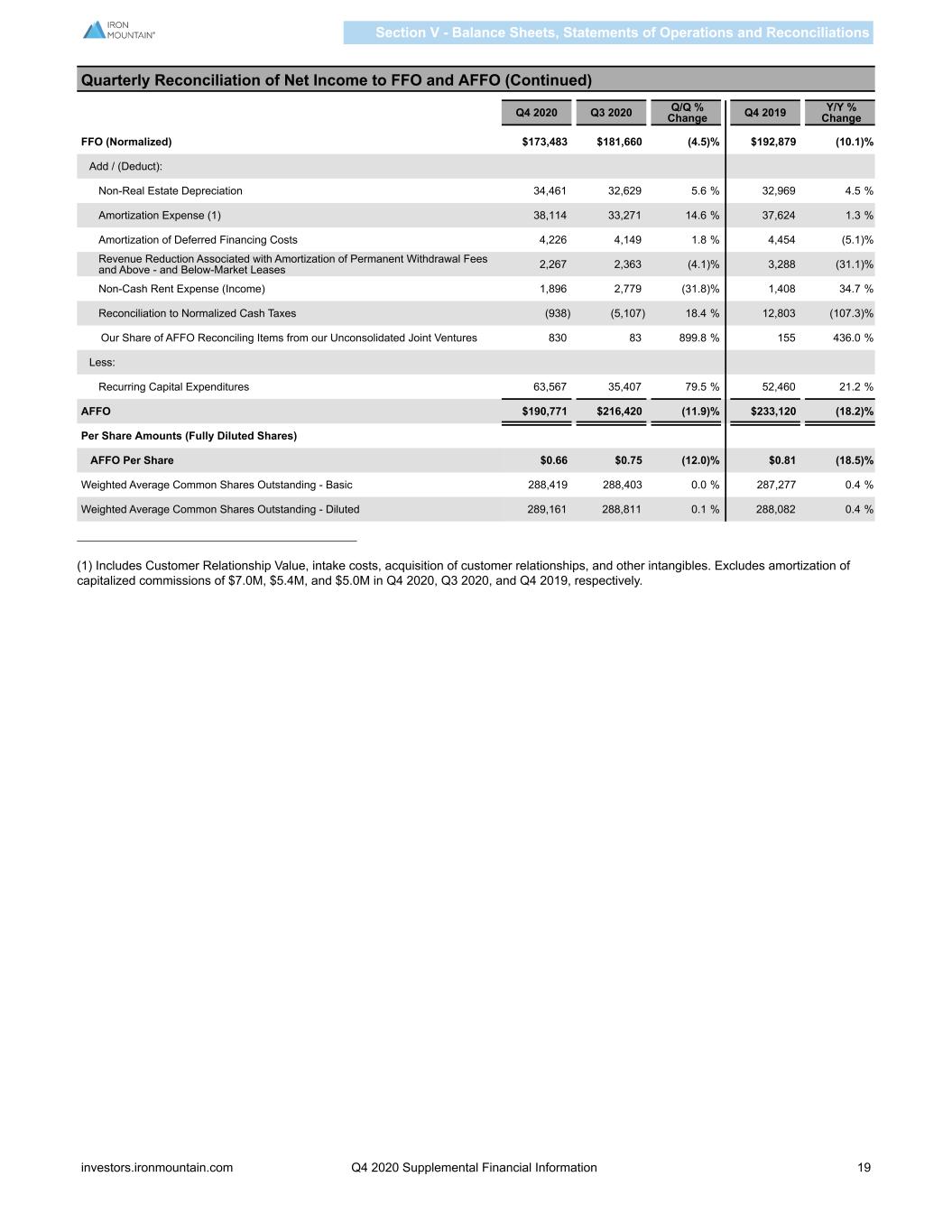

Quarterly Reconciliation of Net Income to FFO and AFFO (Continued) Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change FFO (Normalized) $173,483 $181,660 (4.5) % $192,879 (10.1) % Add / (Deduct): Non-Real Estate Depreciation 34,461 32,629 5.6 % 32,969 4.5 % Amortization Expense (1) 38,114 33,271 14.6 % 37,624 1.3 % Amortization of Deferred Financing Costs 4,226 4,149 1.8 % 4,454 (5.1) % Revenue Reduction Associated with Amortization of Permanent Withdrawal Fees and Above - and Below-Market Leases 2,267 2,363 (4.1) % 3,288 (31.1) % Non-Cash Rent Expense (Income) 1,896 2,779 (31.8) % 1,408 34.7 % Reconciliation to Normalized Cash Taxes (938) (5,107) 18.4 % 12,803 (107.3) % Our Share of AFFO Reconciling Items from our Unconsolidated Joint Ventures 830 83 899.8 % 155 436.0 % Less: Recurring Capital Expenditures 63,567 35,407 79.5 % 52,460 21.2 % AFFO $190,771 $216,420 (11.9) % $233,120 (18.2) % Per Share Amounts (Fully Diluted Shares) AFFO Per Share $0.66 $0.75 (12.0) % $0.81 (18.5) % Weighted Average Common Shares Outstanding - Basic 288,419 288,403 0.0 % 287,277 0.4 % Weighted Average Common Shares Outstanding - Diluted 289,161 288,811 0.1 % 288,082 0.4 % (1) Includes Customer Relationship Value, intake costs, acquisition of customer relationships, and other intangibles. Excludes amortization of capitalized commissions of $7.0M, $5.4M, and $5.0M in Q4 2020, Q3 2020, and Q4 2019, respectively. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 19

Full Year Reconciliation of Net Income to FFO and AFFO Full Year 2020 Full Year 2019 % Change Net Income $343,096 $268,315 27.9 % Add / (Deduct): Real Estate Depreciation (1) 298,943 303,415 (1.5) % Gain on Sale of Real Estate, Net of Tax (365,709) (99,194) 268.7 % Data Center Lease-Based Intangible Asset Amortization (2) 42,637 46,696 (8.7) % Our Share of FFO (Nareit) Reconciling Items from our Unconsolidated Joint Ventures — 1,284 n/a FFO (Nareit) $318,967 $520,516 (38.7) % Add / (Deduct): Significant Acquisition Costs — 13,293 n/a Restructuring Charges 194,396 48,597 300.0 % Intangible Impairments 23,000 — — Loss (Gain) on Disposal/Write-Down of PP&E, Net (Excluding Real Estate) 2,523 40,763 (93.8) % Other Expense (Income), Net, Excluding our Share of Losses (Gains) from our Unconsolidated Joint Ventures 133,611 25,720 419.5 % Stock-Based Compensation Expense 34,272 36,194 (5.3) % COVID-19 Costs 9,285 — — Real Estate Financing Lease Depreciation 13,801 13,364 3.3 % Tax Impact of Reconciling Items and Discrete Tax Items (3) (31,825) (13,095) 143.0 % (Income) Loss from Discontinued Operations, Net of Tax — (104) n/a Our Share of FFO (Normalized) Reconciling Items from our Unconsolidated Joint Ventures (38) 148 (125.5) % FFO (Normalized) $697,992 $685,396 1.8 % Per Share Amounts (Fully Diluted Shares) FFO (Nareit) $1.11 $1.81 (38.7) % FFO (Normalized) $2.42 $2.38 1.5 % Weighted Average Common Shares Outstanding - Basic 288,183 286,971 0.4 % Weighted Average Common Shares Outstanding - Diluted 288,643 287,687 0.3 % (1) Includes depreciation expense related to owned real estate assets (land improvements, buildings, building improvements, leasehold of improvements and racking), excluding depreciation related to real estate financing leases. (2) Includes amortization expense for Data Center In-Place Lease Intangible Assets and Data Center Tenant Relationship Intangible Assets. (3) Represents the tax impact of (i) the reconciling items above, which impact our reported income (loss) from continuing operations before provision (benefit) for income taxes but have an insignificant impact on our reported provision (benefit) for income taxes and (ii) other discrete tax items. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 20

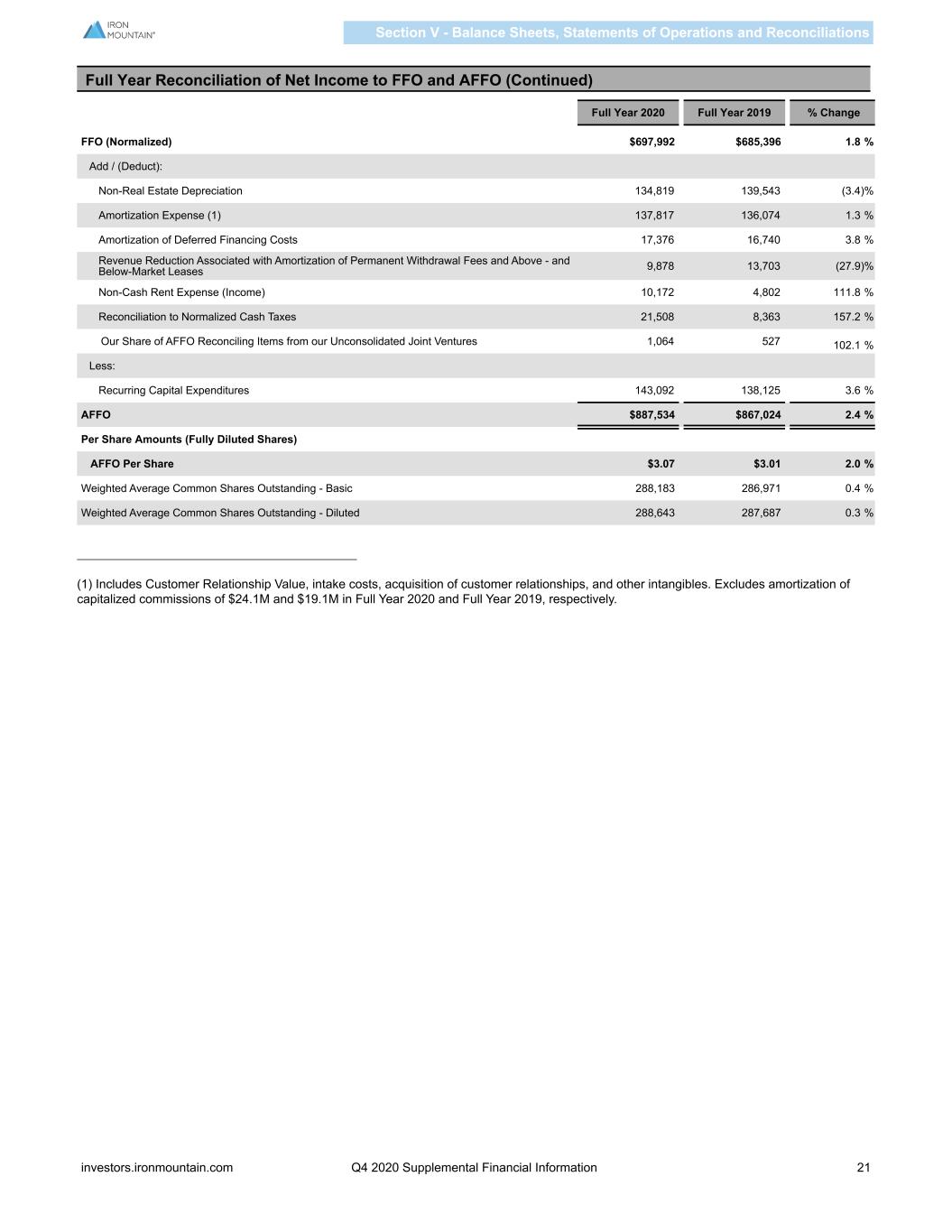

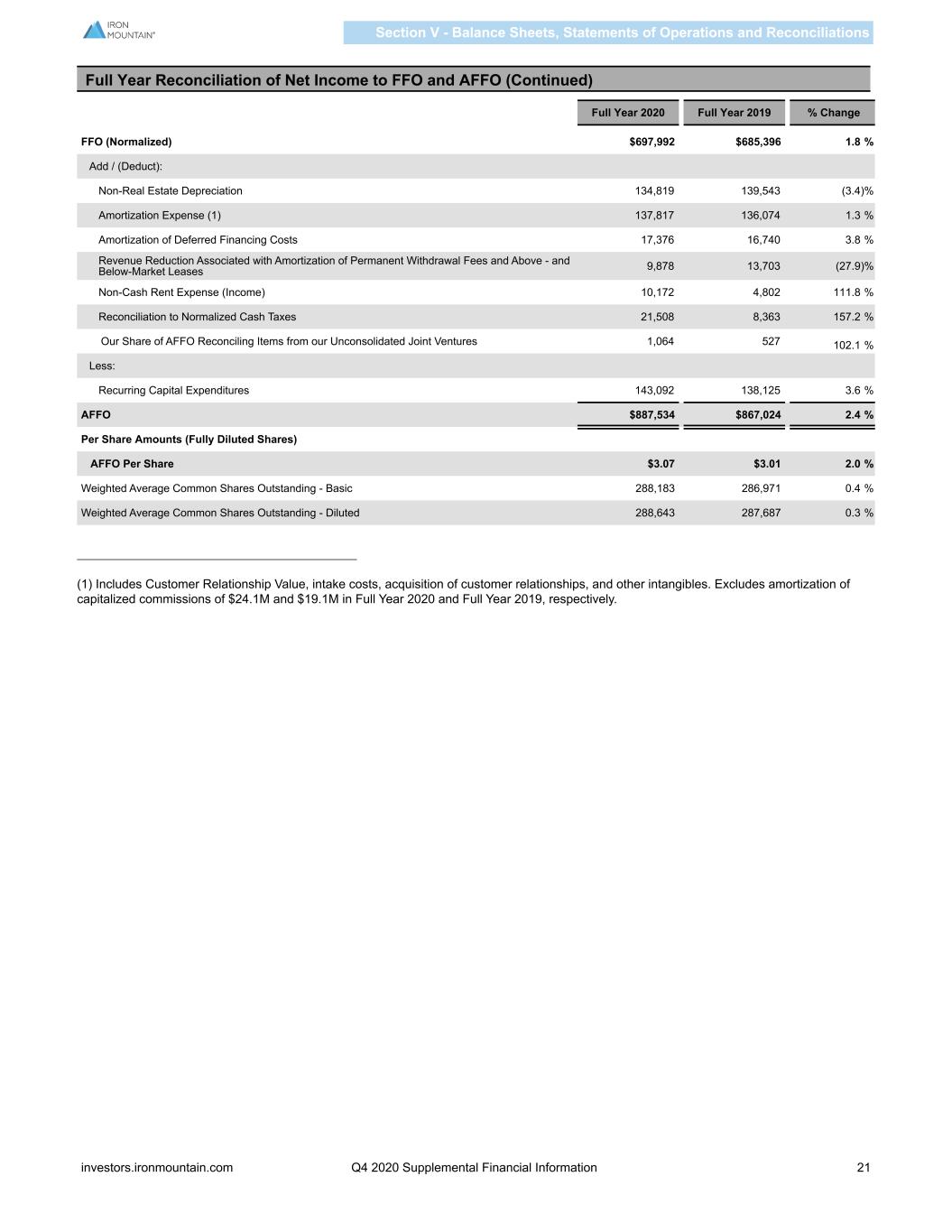

Full Year Reconciliation of Net Income to FFO and AFFO (Continued) Full Year 2020 Full Year 2019 % Change FFO (Normalized) $697,992 $685,396 1.8 % Add / (Deduct): Non-Real Estate Depreciation 134,819 139,543 (3.4) % Amortization Expense (1) 137,817 136,074 1.3 % Amortization of Deferred Financing Costs 17,376 16,740 3.8 % Revenue Reduction Associated with Amortization of Permanent Withdrawal Fees and Above - and Below-Market Leases 9,878 13,703 (27.9) % Non-Cash Rent Expense (Income) 10,172 4,802 111.8 % Reconciliation to Normalized Cash Taxes 21,508 8,363 157.2 % Our Share of AFFO Reconciling Items from our Unconsolidated Joint Ventures 1,064 527 102.1 % Less: Recurring Capital Expenditures 143,092 138,125 3.6 % AFFO $887,534 $867,024 2.4 % Per Share Amounts (Fully Diluted Shares) AFFO Per Share $3.07 $3.01 2.0 % Weighted Average Common Shares Outstanding - Basic 288,183 286,971 0.4 % Weighted Average Common Shares Outstanding - Diluted 288,643 287,687 0.3 % (1) Includes Customer Relationship Value, intake costs, acquisition of customer relationships, and other intangibles. Excludes amortization of capitalized commissions of $24.1M and $19.1M in Full Year 2020 and Full Year 2019, respectively. Section V - Balance Sheets, Statements of Operations and Reconciliations investors.ironmountain.com Q4 2020 Supplemental Financial Information 21

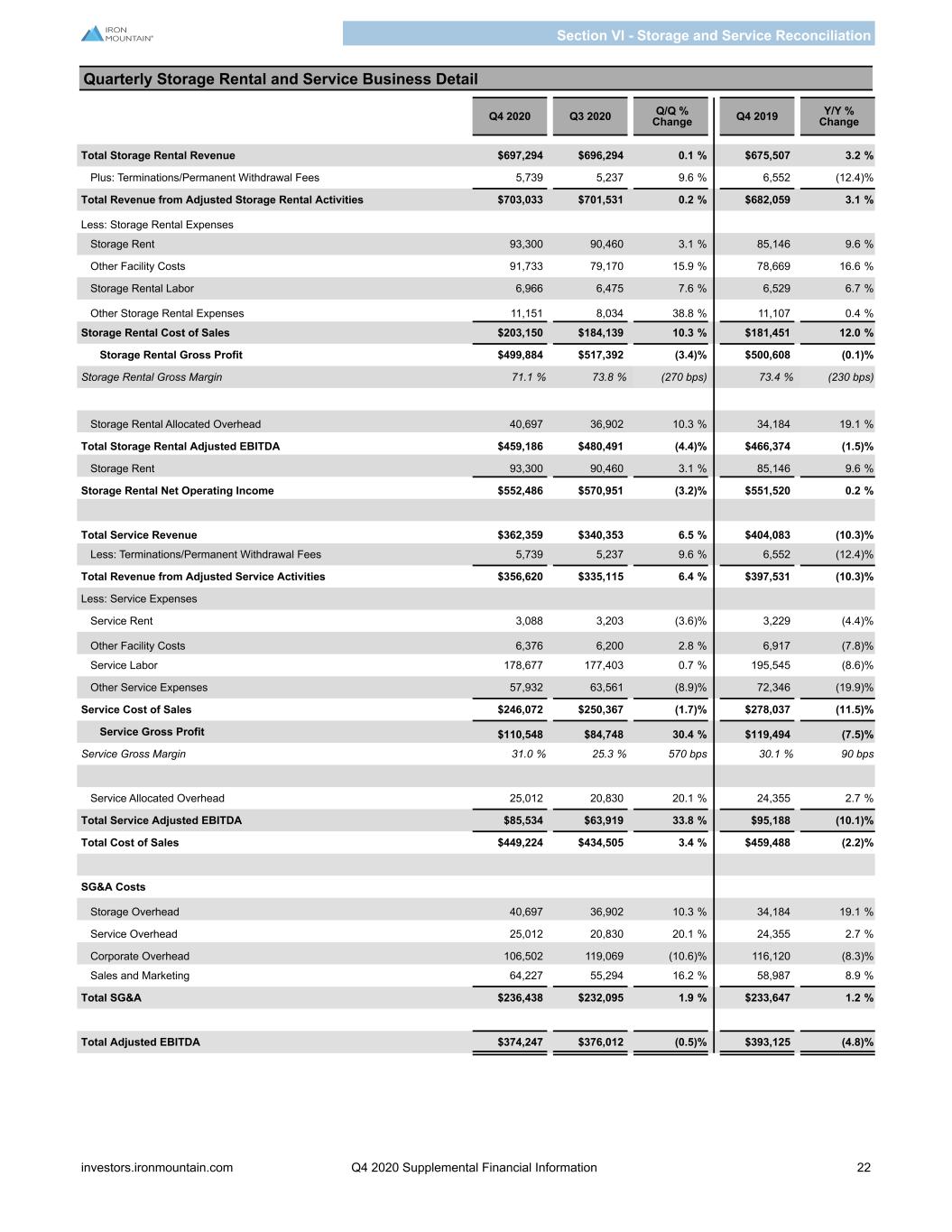

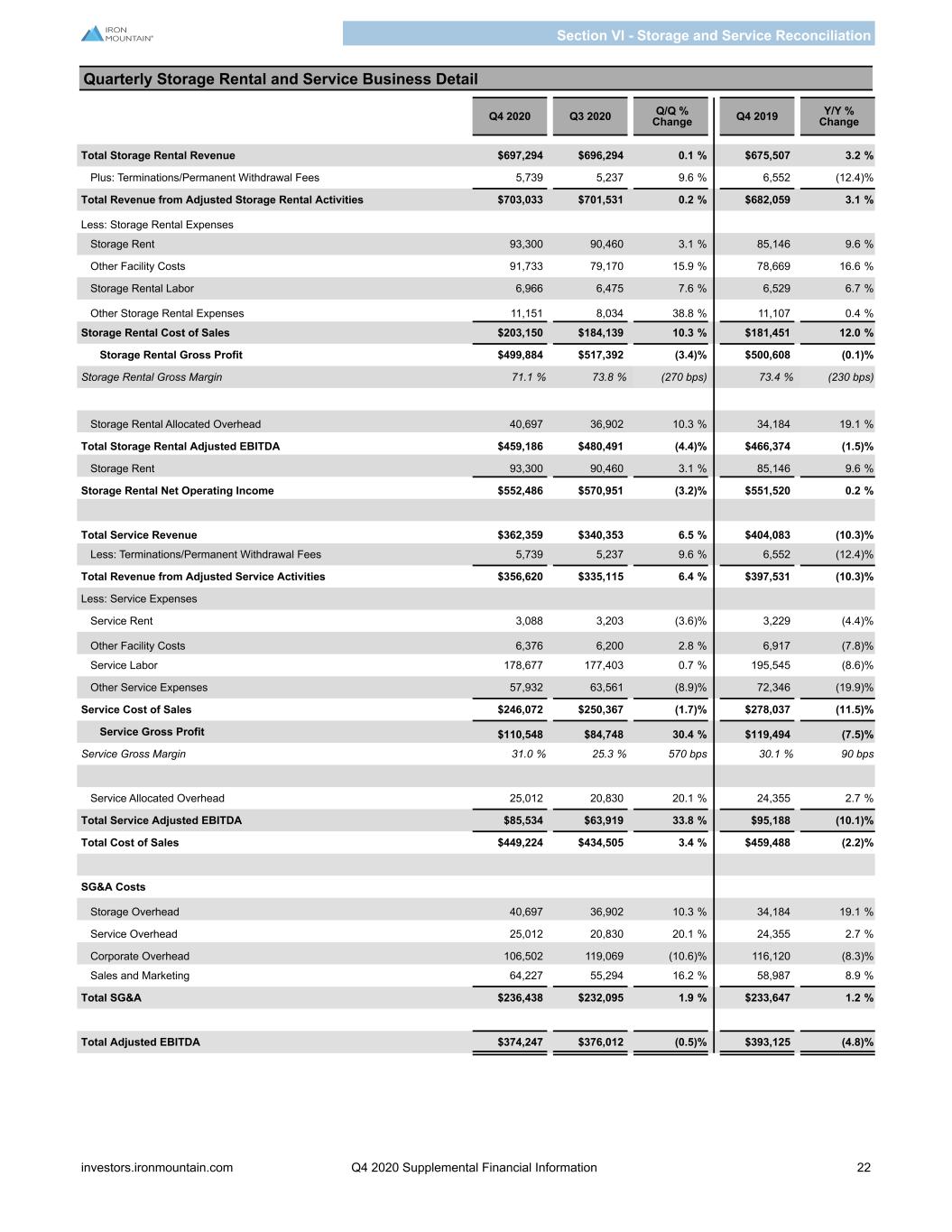

Quarterly Storage Rental and Service Business Detail Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Total Storage Rental Revenue $697,294 $696,294 0.1 % $675,507 3.2 % Plus: Terminations/Permanent Withdrawal Fees 5,739 5,237 9.6 % 6,552 (12.4) % Total Revenue from Adjusted Storage Rental Activities $703,033 $701,531 0.2 % $682,059 3.1 % Less: Storage Rental Expenses Storage Rent 93,300 90,460 3.1 % 85,146 9.6 % Other Facility Costs 91,733 79,170 15.9 % 78,669 16.6 % Storage Rental Labor 6,966 6,475 7.6 % 6,529 6.7 % Other Storage Rental Expenses 11,151 8,034 38.8 % 11,107 0.4 % Storage Rental Cost of Sales $203,150 $184,139 10.3 % $181,451 12.0 % Storage Rental Gross Profit $499,884 $517,392 (3.4) % $500,608 (0.1) % Storage Rental Gross Margin 71.1 % 73.8 % (270 bps) 73.4 % (230 bps) Storage Rental Allocated Overhead 40,697 36,902 10.3 % 34,184 19.1 % Total Storage Rental Adjusted EBITDA $459,186 $480,491 (4.4) % $466,374 (1.5) % Storage Rent 93,300 90,460 3.1 % 85,146 9.6 % Storage Rental Net Operating Income $552,486 $570,951 (3.2) % $551,520 0.2 % Total Service Revenue $362,359 $340,353 6.5 % $404,083 (10.3) % Less: Terminations/Permanent Withdrawal Fees 5,739 5,237 9.6 % 6,552 (12.4) % Total Revenue from Adjusted Service Activities $356,620 $335,115 6.4 % $397,531 (10.3) % Less: Service Expenses Service Rent 3,088 3,203 (3.6) % 3,229 (4.4) % Other Facility Costs 6,376 6,200 2.8 % 6,917 (7.8) % Service Labor 178,677 177,403 0.7 % 195,545 (8.6) % Other Service Expenses 57,932 63,561 (8.9) % 72,346 (19.9) % Service Cost of Sales $246,072 $250,367 (1.7) % $278,037 (11.5) % Service Gross Profit $110,548 $84,748 30.4 % $119,494 (7.5) % Service Gross Margin 31.0 % 25.3 % 570 bps 30.1 % 90 bps Service Allocated Overhead 25,012 20,830 20.1 % 24,355 2.7 % Total Service Adjusted EBITDA $85,534 $63,919 33.8 % $95,188 (10.1) % Total Cost of Sales $449,224 $434,505 3.4 % $459,488 (2.2) % SG&A Costs Storage Overhead 40,697 36,902 10.3 % 34,184 19.1 % Service Overhead 25,012 20,830 20.1 % 24,355 2.7 % Corporate Overhead 106,502 119,069 (10.6) % 116,120 (8.3) % Sales and Marketing 64,227 55,294 16.2 % 58,987 8.9 % Total SG&A $236,438 $232,095 1.9 % $233,647 1.2 % Total Adjusted EBITDA $374,247 $376,012 (0.5) % $393,125 (4.8) % Section VI - Storage and Service Reconciliation investors.ironmountain.com Q4 2020 Supplemental Financial Information 22

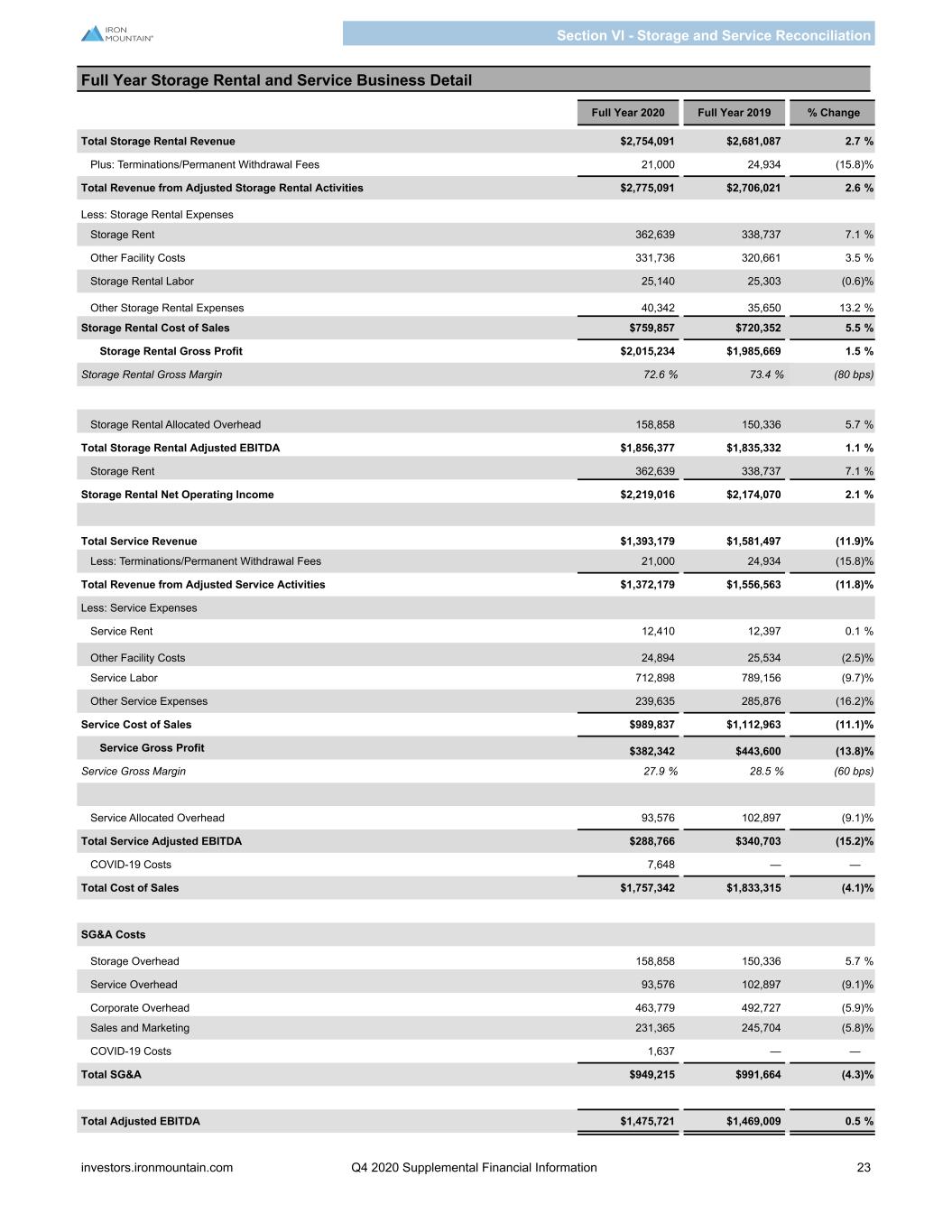

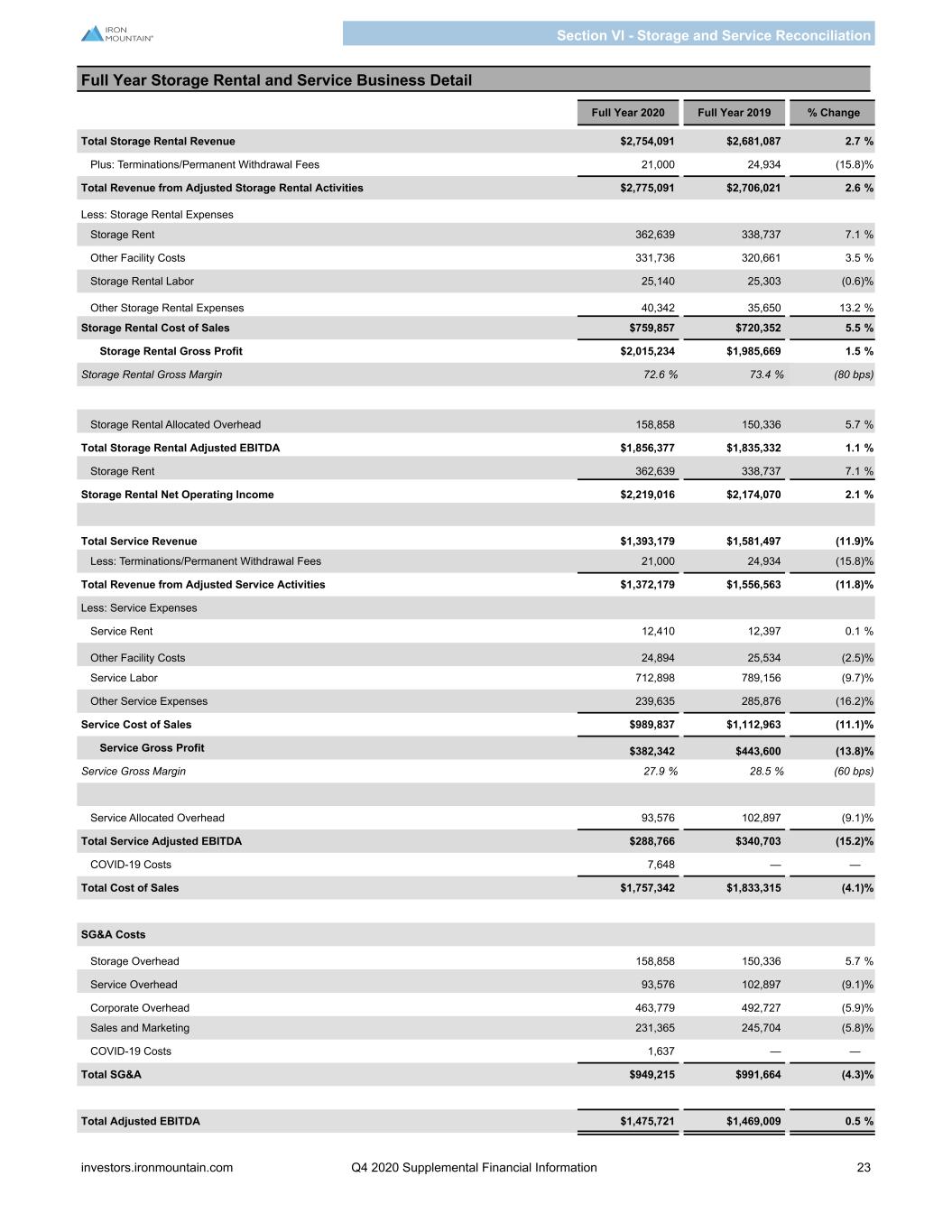

Full Year Storage Rental and Service Business Detail Full Year 2020 Full Year 2019 % Change Total Storage Rental Revenue $2,754,091 $2,681,087 2.7 % Plus: Terminations/Permanent Withdrawal Fees 21,000 24,934 (15.8) % Total Revenue from Adjusted Storage Rental Activities $2,775,091 $2,706,021 2.6 % Less: Storage Rental Expenses Storage Rent 362,639 338,737 7.1 % Other Facility Costs 331,736 320,661 3.5 % Storage Rental Labor 25,140 25,303 (0.6) % Other Storage Rental Expenses 40,342 35,650 13.2 % Storage Rental Cost of Sales $759,857 $720,352 5.5 % Storage Rental Gross Profit $2,015,234 $1,985,669 1.5 % Storage Rental Gross Margin 72.6 % 73.4 % (80 bps) Storage Rental Allocated Overhead 158,858 150,336 5.7 % Total Storage Rental Adjusted EBITDA $1,856,377 $1,835,332 1.1 % Storage Rent 362,639 338,737 7.1 % Storage Rental Net Operating Income $2,219,016 $2,174,070 2.1 % Total Service Revenue $1,393,179 $1,581,497 (11.9) % Less: Terminations/Permanent Withdrawal Fees 21,000 24,934 (15.8) % Total Revenue from Adjusted Service Activities $1,372,179 $1,556,563 (11.8) % Less: Service Expenses Service Rent 12,410 12,397 0.1 % Other Facility Costs 24,894 25,534 (2.5) % Service Labor 712,898 789,156 (9.7) % Other Service Expenses 239,635 285,876 (16.2) % Service Cost of Sales $989,837 $1,112,963 (11.1) % Service Gross Profit $382,342 $443,600 (13.8) % Service Gross Margin 27.9 % 28.5 % (60 bps) Service Allocated Overhead 93,576 102,897 (9.1) % Total Service Adjusted EBITDA $288,766 $340,703 (15.2) % COVID-19 Costs 7,648 — — Total Cost of Sales $1,757,342 $1,833,315 (4.1) % SG&A Costs Storage Overhead 158,858 150,336 5.7 % Service Overhead 93,576 102,897 (9.1) % Corporate Overhead 463,779 492,727 (5.9) % Sales and Marketing 231,365 245,704 (5.8) % COVID-19 Costs 1,637 — — Total SG&A $949,215 $991,664 (4.3) % Total Adjusted EBITDA $1,475,721 $1,469,009 0.5 % Section VI - Storage and Service Reconciliation investors.ironmountain.com Q4 2020 Supplemental Financial Information 23

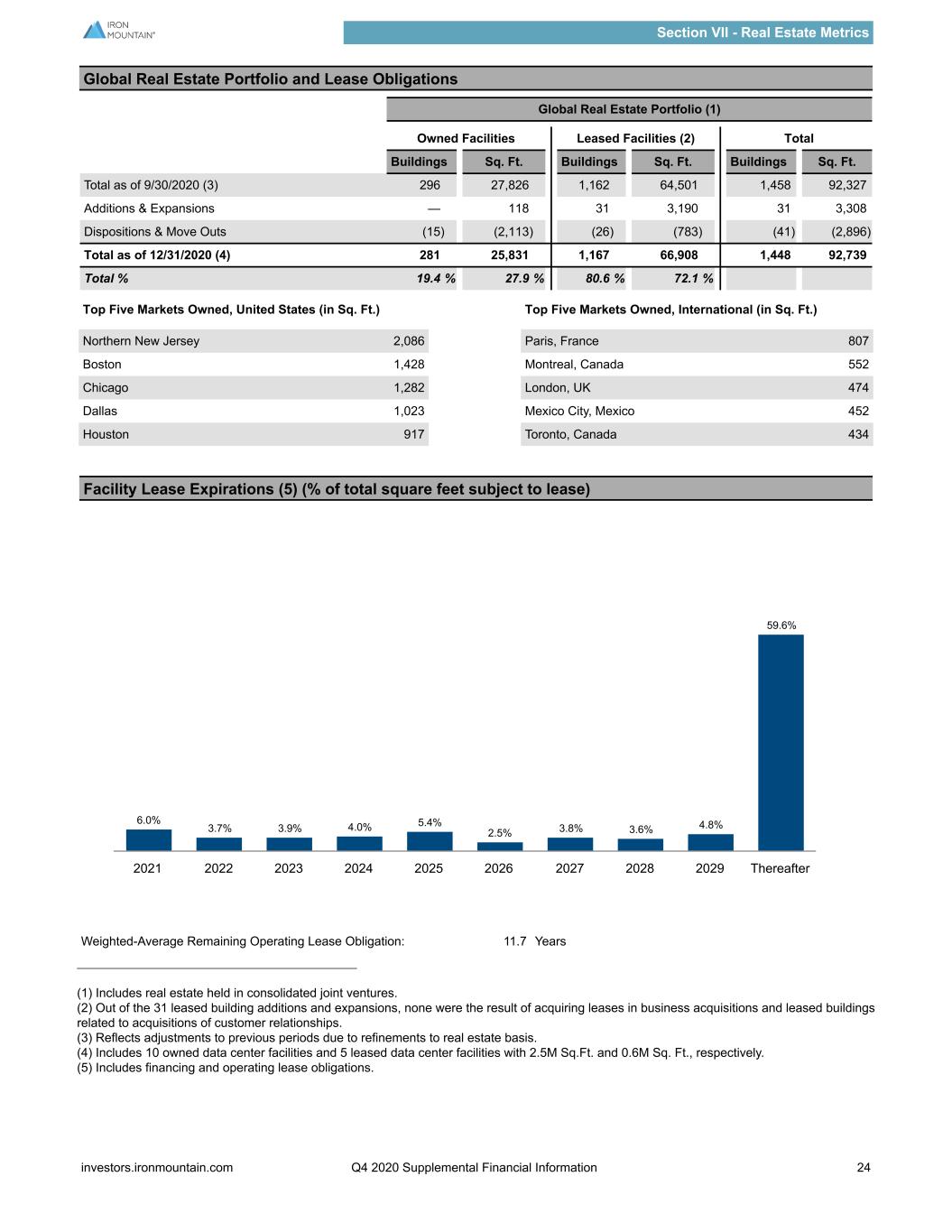

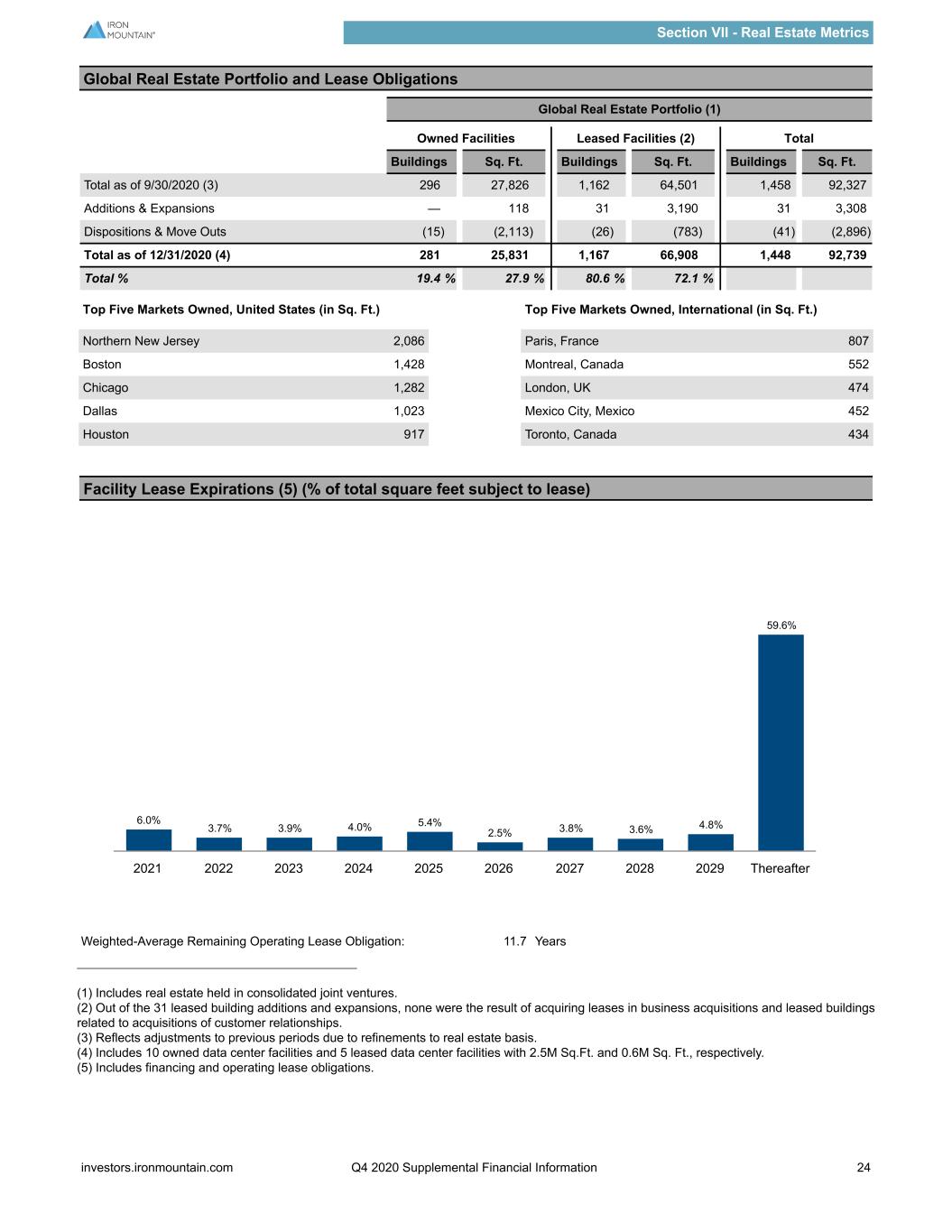

Global Real Estate Portfolio and Lease Obligations Global Real Estate Portfolio (1) Owned Facilities Leased Facilities (2) Total Buildings Sq. Ft. Buildings Sq. Ft. Buildings Sq. Ft. Total as of 9/30/2020 (3) 296 27,826 1,162 64,501 1,458 92,327 Additions & Expansions — 118 31 3,190 31 3,308 Dispositions & Move Outs (15) (2,113) (26) (783) (41) (2,896) Total as of 12/31/2020 (4) 281 25,831 1,167 66,908 1,448 92,739 Total % 19.4 % 27.9 % 80.6 % 72.1 % Top Five Markets Owned, United States (in Sq. Ft.) Top Five Markets Owned, International (in Sq. Ft.) Northern New Jersey 2,086 Paris, France 807 Boston 1,428 Montreal, Canada 552 Chicago 1,282 London, UK 474 Dallas 1,023 Mexico City, Mexico 452 Houston 917 Toronto, Canada 434 Facility Lease Expirations (5) (% of total square feet subject to lease) 6.0% 3.7% 3.9% 4.0% 5.4% 2.5% 3.8% 3.6% 4.8% 59.6% 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter Weighted-Average Remaining Operating Lease Obligation: 11.7 Years (1) Includes real estate held in consolidated joint ventures. (2) Out of the 31 leased building additions and expansions, none were the result of acquiring leases in business acquisitions and leased buildings related to acquisitions of customer relationships. (3) Reflects adjustments to previous periods due to refinements to real estate basis. (4) Includes 10 owned data center facilities and 5 leased data center facilities with 2.5M Sq.Ft. and 0.6M Sq. Ft., respectively. (5) Includes financing and operating lease obligations. Section VII - Real Estate Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 24

Data Center Customer Lease Expiration Year Number of Leases Expiring Total MW Expiring Percentage of Total MW Annualized GAAP TCV Rent Expiring Percentage of TCV Annualized Rent 2021 594 18.1 13.9% $57,614 20.2% 2022 320 17.6 13.5% 46,544 16.3% 2023 261 18.7 14.4% 50,762 17.8% 2024 81 8.9 6.8% 22,497 7.9% 2025 48 11.6 8.9% 25,593 9.0% 2026 14 7.6 5.8% 15,683 5.5% 2027 3 6.8 5.2% 6,944 2.4% Thereafter 19 41.1 31.5% 59,851 20.9% Total 1,340 130.4 100.0% $285,488 100.0% WALE: 3.8 years Data Center Leasing Activity Summary Q4 2020 Full Year 2020 Transaction Count GAAP MRR kW $ / kW / Month Transaction Count GAAP MRR kW $ / kW / Month New/expansion leases signed 64 $859 7,435 $115 252 $5,245 (1) 58,487 $93 (1) Commenced leases 96 398 1,579 252 372 2,180 13,075 167 Renewed leases 57 461 1,541 299 325 4,625 20,423 226 Churn 3.9% 6.8% Cash Mark to Market 4.2% (3.9)% GAAP Mark to Market 6.2% (2.0)% New VA-2 Data Center in Manassas VA (1) GAAP MRR includes contractual payments related to reserved dedicated expansion space, which is excluded from the rate. Section VIII - Data Center Customer and Portfolio Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 25

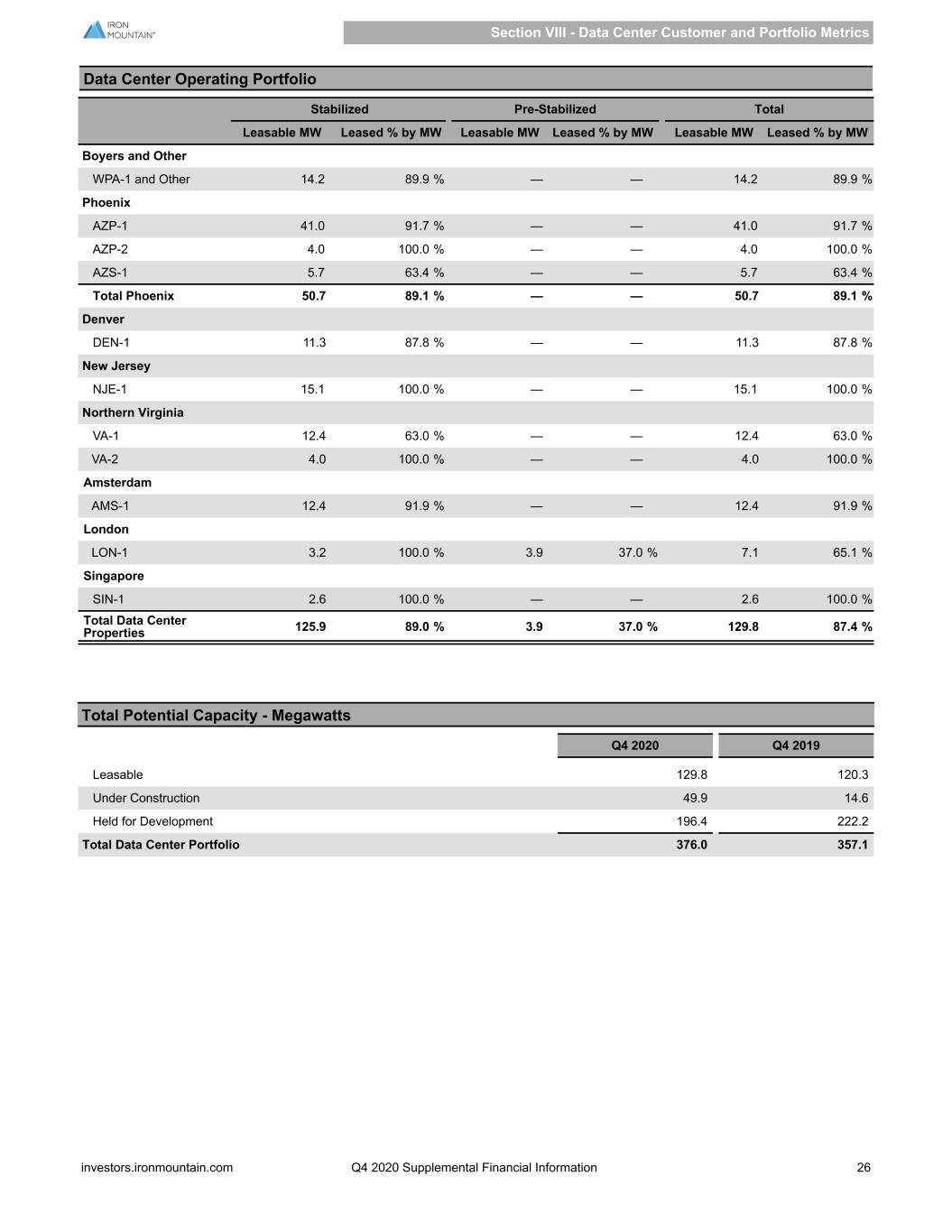

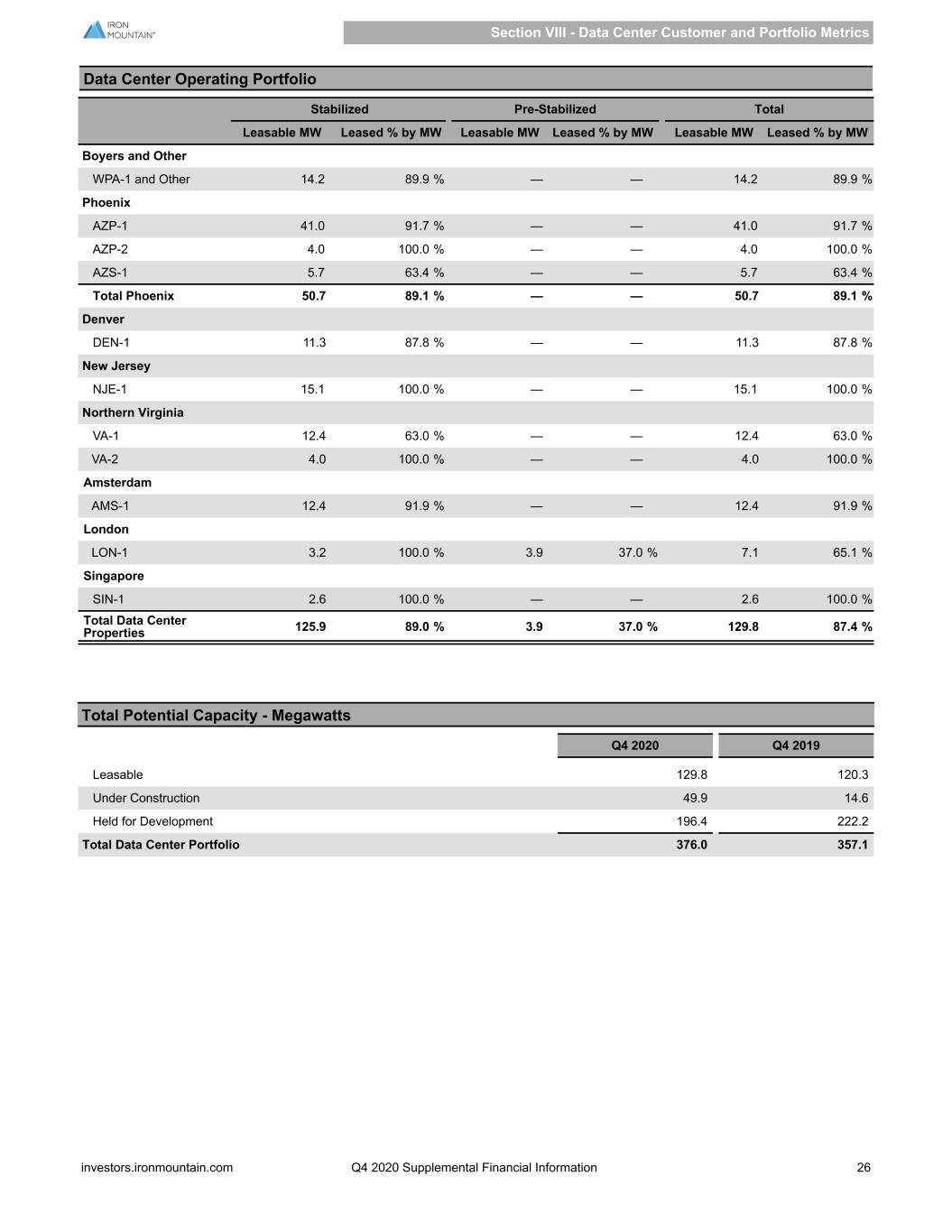

Data Center Operating Portfolio Stabilized Pre-Stabilized Total Leasable MW Leased % by MW Leasable MW Leased % by MW Leasable MW Leased % by MW Boyers and Other WPA-1 and Other 14.2 89.9 % — — 14.2 89.9 % Phoenix AZP-1 41.0 91.7 % — — 41.0 91.7 % AZP-2 4.0 100.0 % — — 4.0 100.0 % AZS-1 5.7 63.4 % — — 5.7 63.4 % Total Phoenix 50.7 89.1 % — — 50.7 89.1 % Denver DEN-1 11.3 87.8 % — — 11.3 87.8 % New Jersey NJE-1 15.1 100.0 % — — 15.1 100.0 % Northern Virginia VA-1 12.4 63.0 % — — 12.4 63.0 % VA-2 4.0 100.0 % — — 4.0 100.0 % Amsterdam AMS-1 12.4 91.9 % — — 12.4 91.9 % London LON-1 3.2 100.0 % 3.9 37.0 % 7.1 65.1 % Singapore SIN-1 2.6 100.0 % — — 2.6 100.0 % Total Data Center Properties 125.9 89.0 % 3.9 37.0 % 129.8 87.4 % Total Potential Capacity - Megawatts Q4 2020 Q4 2019 Leasable 129.8 120.3 Under Construction 49.9 14.6 Held for Development 196.4 222.2 Total Data Center Portfolio 376.0 357.1 Section VIII - Data Center Customer and Portfolio Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 26

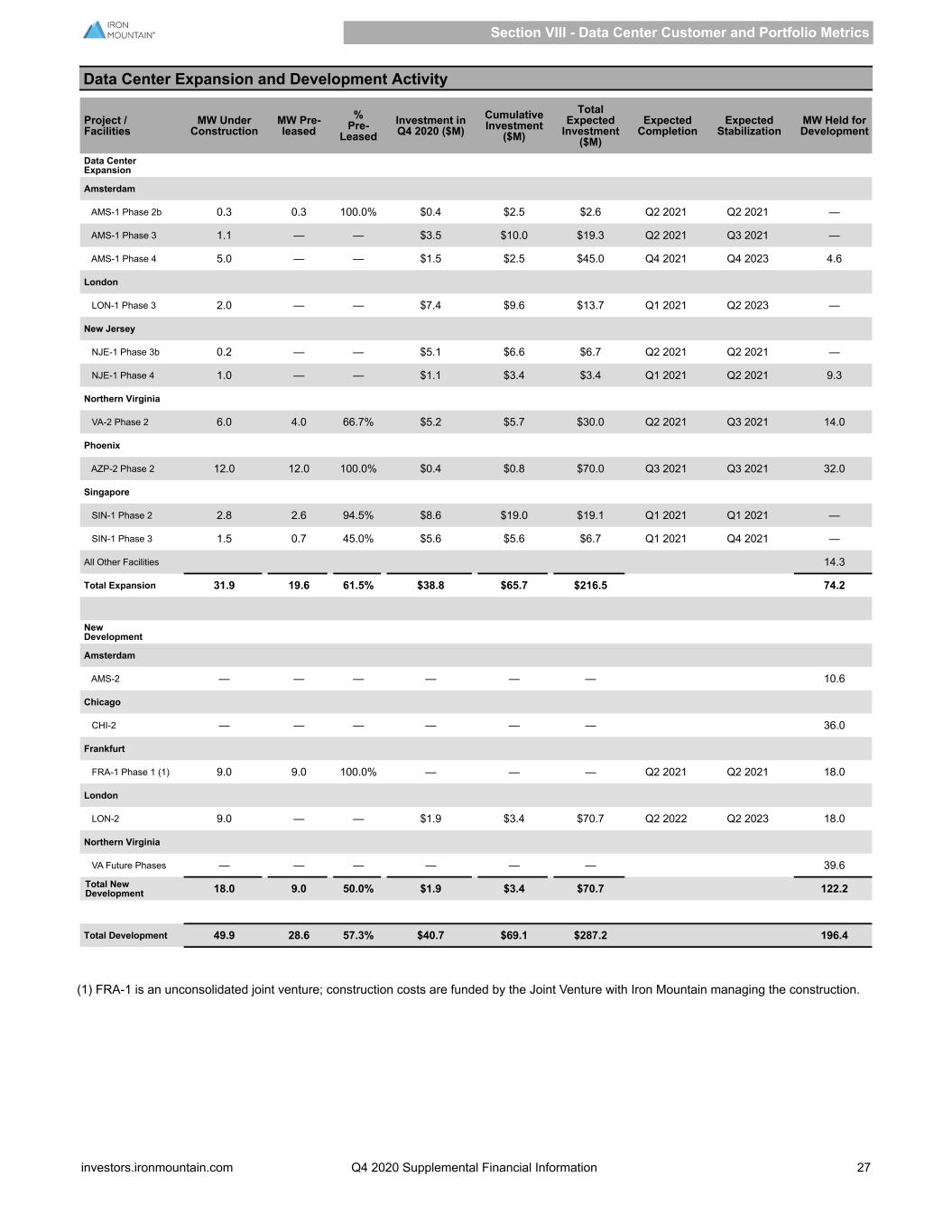

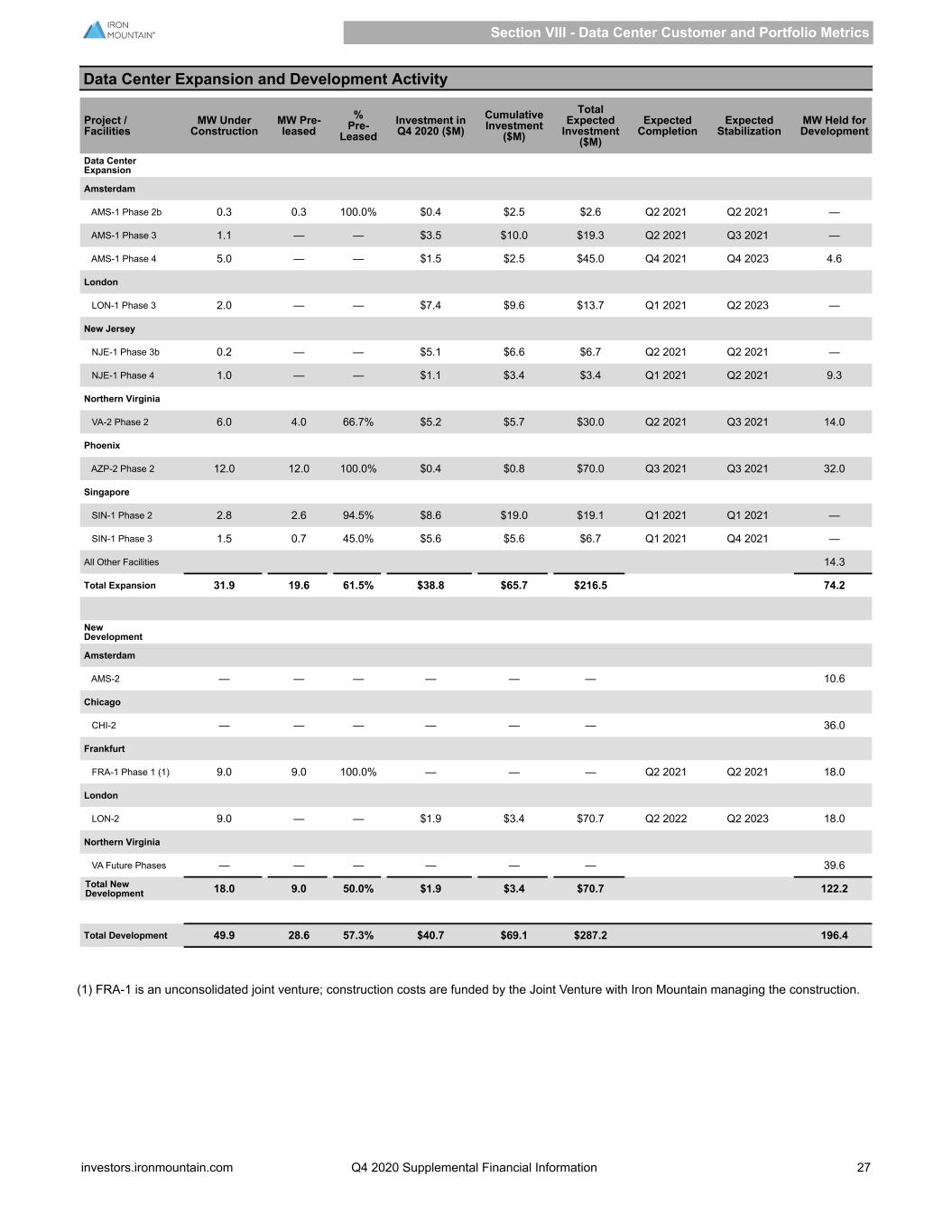

Data Center Expansion and Development Activity Project / Facilities MW Under Construction MW Pre- leased % Pre- Leased Investment in Q4 2020 ($M) Cumulative Investment ($M) Total Expected Investment ($M) Expected Completion Expected Stabilization MW Held for Development Data Center Expansion Amsterdam AMS-1 Phase 2b 0.3 0.3 100.0% $0.4 $2.5 $2.6 Q2 2021 Q2 2021 — AMS-1 Phase 3 1.1 — — $3.5 $10.0 $19.3 Q2 2021 Q3 2021 — AMS-1 Phase 4 5.0 — — $1.5 $2.5 $45.0 Q4 2021 Q4 2023 4.6 London LON-1 Phase 3 2.0 — — $7.4 $9.6 $13.7 Q1 2021 Q2 2023 — New Jersey NJE-1 Phase 3b 0.2 — — $5.1 $6.6 $6.7 Q2 2021 Q2 2021 — NJE-1 Phase 4 1.0 — — $1.1 $3.4 $3.4 Q1 2021 Q2 2021 9.3 Northern Virginia VA-2 Phase 2 6.0 4.0 66.7% $5.2 $5.7 $30.0 Q2 2021 Q3 2021 14.0 Phoenix AZP-2 Phase 2 12.0 12.0 100.0% $0.4 $0.8 $70.0 Q3 2021 Q3 2021 32.0 Singapore SIN-1 Phase 2 2.8 2.6 94.5% $8.6 $19.0 $19.1 Q1 2021 Q1 2021 — SIN-1 Phase 3 1.5 0.7 45.0% $5.6 $5.6 $6.7 Q1 2021 Q4 2021 — All Other Facilities 14.3 Total Expansion 31.9 19.6 61.5% $38.8 $65.7 $216.5 74.2 New Development Amsterdam AMS-2 — — — — — — 10.6 Chicago CHI-2 — — — — — — 36.0 Frankfurt FRA-1 Phase 1 (1) 9.0 9.0 100.0% — — — Q2 2021 Q2 2021 18.0 London LON-2 9.0 — — $1.9 $3.4 $70.7 Q2 2022 Q2 2023 18.0 Northern Virginia VA Future Phases — — — — — — 39.6 Total New Development 18.0 9.0 50.0% $1.9 $3.4 $70.7 122.2 Total Development 49.9 28.6 57.3% $40.7 $69.1 $287.2 196.4 (1) FRA-1 is an unconsolidated joint venture; construction costs are funded by the Joint Venture with Iron Mountain managing the construction. Section VIII - Data Center Customer and Portfolio Metrics investors.ironmountain.com Q4 2020 Supplemental Financial Information 27

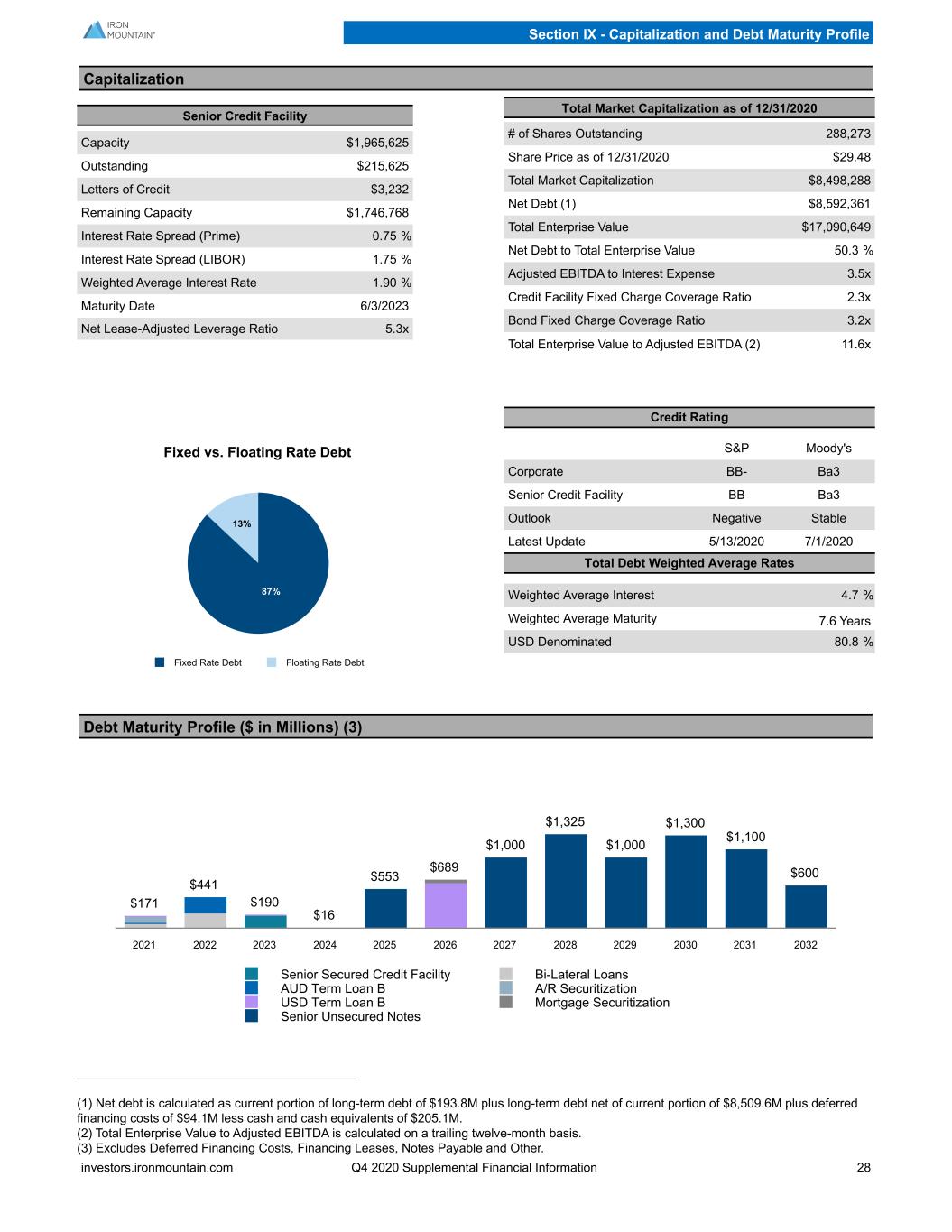

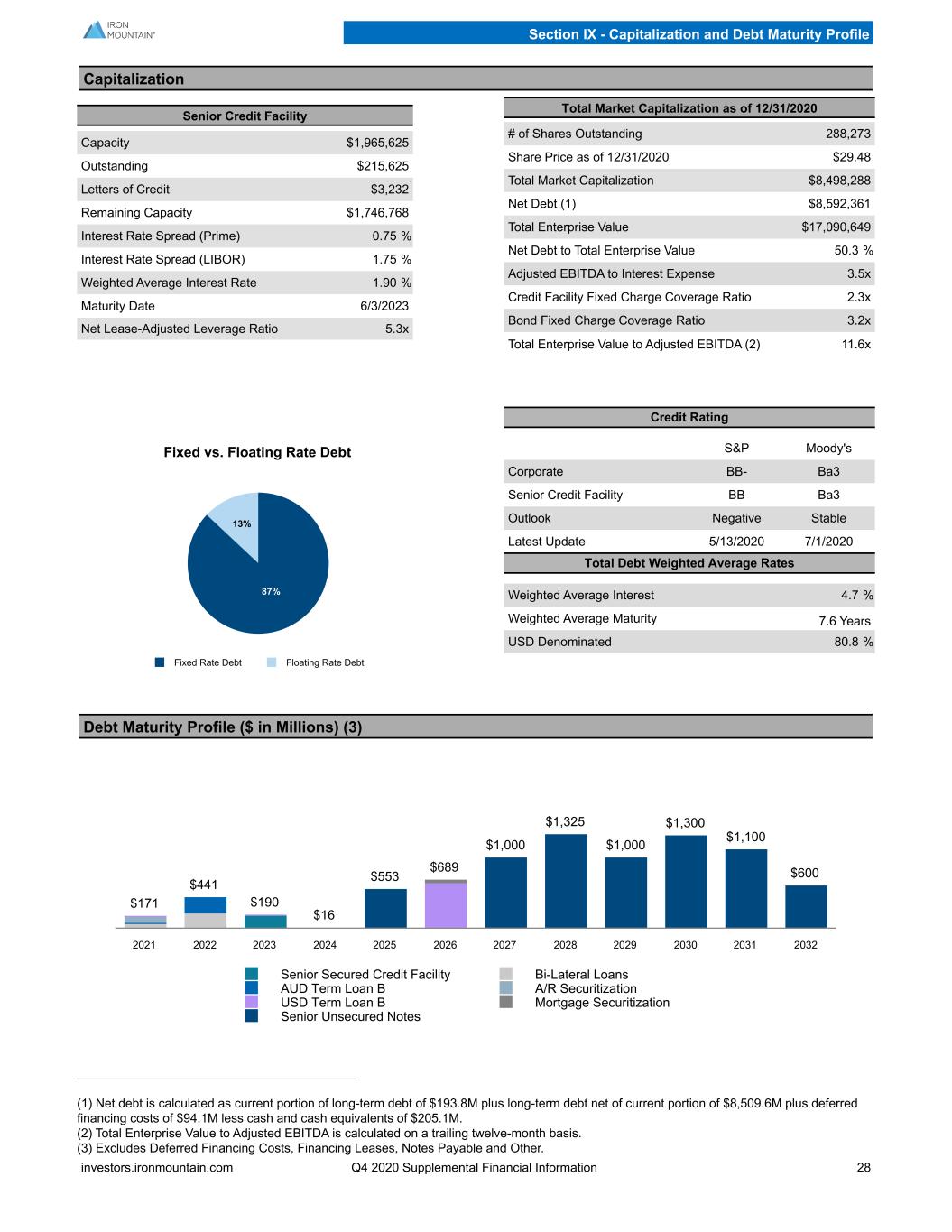

Capitalization Senior Credit Facility Capacity $1,965,625 Outstanding $215,625 Letters of Credit $3,232 Remaining Capacity $1,746,768 Interest Rate Spread (Prime) 0.75 % Interest Rate Spread (LIBOR) 1.75 % Weighted Average Interest Rate 1.90 % Maturity Date 6/3/2023 Net Lease-Adjusted Leverage Ratio 5.3x Total Market Capitalization as of 12/31/2020 # of Shares Outstanding 288,273 Share Price as of 12/31/2020 $29.48 Total Market Capitalization $8,498,288 Net Debt (1) $8,592,361 Total Enterprise Value $17,090,649 Net Debt to Total Enterprise Value 50.3 % Adjusted EBITDA to Interest Expense 3.5x Credit Facility Fixed Charge Coverage Ratio 2.3x Bond Fixed Charge Coverage Ratio 3.2x Total Enterprise Value to Adjusted EBITDA (2) 11.6x Fixed vs. Floating Rate Debt 87% 13% Fixed Rate Debt Floating Rate Debt Credit Rating S&P Moody's Corporate BB- Ba3 Senior Credit Facility BB Ba3 Outlook Negative Stable Latest Update 5/13/2020 7/1/2020 Total Debt Weighted Average Rates Weighted Average Interest 4.7 % Weighted Average Maturity 7.6 Years USD Denominated 80.8 % Debt Maturity Profile ($ in Millions) (3) $171 $441 $190 $16 $553 $689 $1,000 $1,325 $1,000 $1,300 $1,100 $600 Senior Secured Credit Facility Bi-Lateral Loans AUD Term Loan B A/R Securitization USD Term Loan B Mortgage Securitization Senior Unsecured Notes 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 (1) Net debt is calculated as current portion of long-term debt of $193.8M plus long-term debt net of current portion of $8,509.6M plus deferred financing costs of $94.1M less cash and cash equivalents of $205.1M. (2) Total Enterprise Value to Adjusted EBITDA is calculated on a trailing twelve-month basis. (3) Excludes Deferred Financing Costs, Financing Leases, Notes Payable and Other. Section IX - Capitalization and Debt Maturity Profile investors.ironmountain.com Q4 2020 Supplemental Financial Information 28

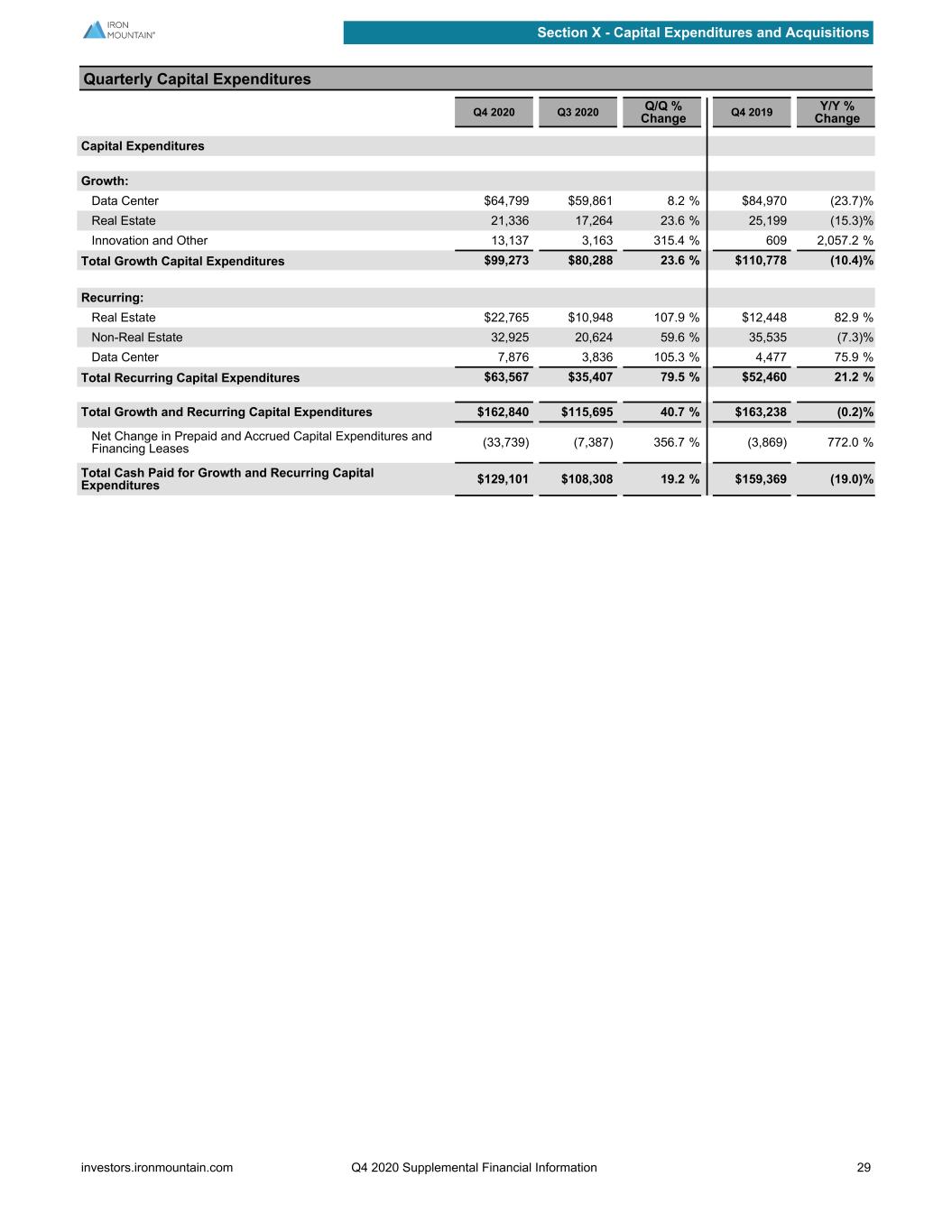

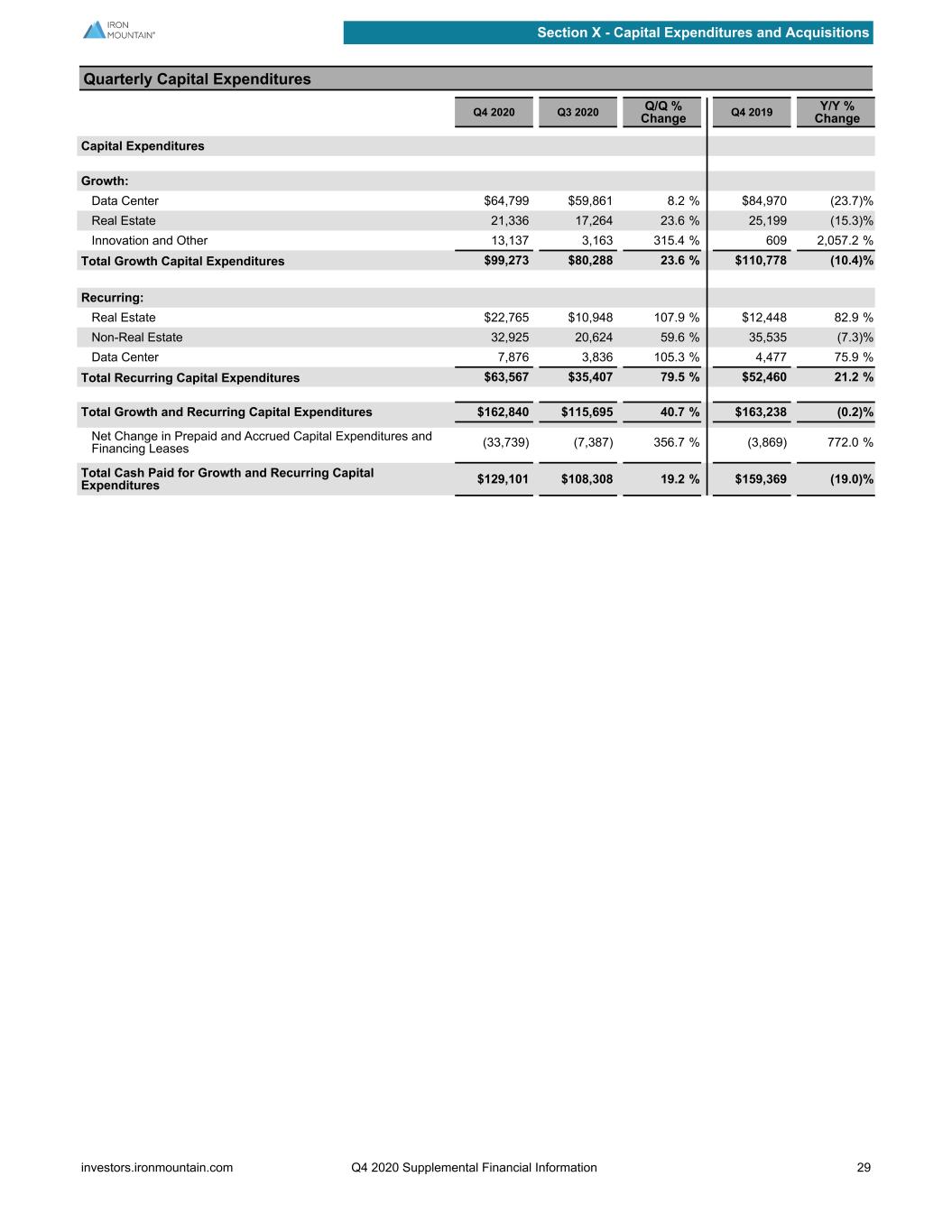

Quarterly Capital Expenditures Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Capital Expenditures Growth: Data Center $64,799 $59,861 8.2 % $84,970 (23.7) % Real Estate 21,336 17,264 23.6 % 25,199 (15.3) % Innovation and Other 13,137 3,163 315.4 % 609 2,057.2 % Total Growth Capital Expenditures $99,273 $80,288 23.6 % $110,778 (10.4) % Recurring: Real Estate $22,765 $10,948 107.9 % $12,448 82.9 % Non-Real Estate 32,925 20,624 59.6 % 35,535 (7.3) % Data Center 7,876 3,836 105.3 % 4,477 75.9 % Total Recurring Capital Expenditures $63,567 $35,407 79.5 % $52,460 21.2 % Total Growth and Recurring Capital Expenditures $162,840 $115,695 40.7 % $163,238 (0.2) % Net Change in Prepaid and Accrued Capital Expenditures and Financing Leases (33,739) (7,387) 356.7 % (3,869) 772.0 % Total Cash Paid for Growth and Recurring Capital Expenditures $129,101 $108,308 19.2 % $159,369 (19.0) % Section X - Capital Expenditures and Acquisitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 29

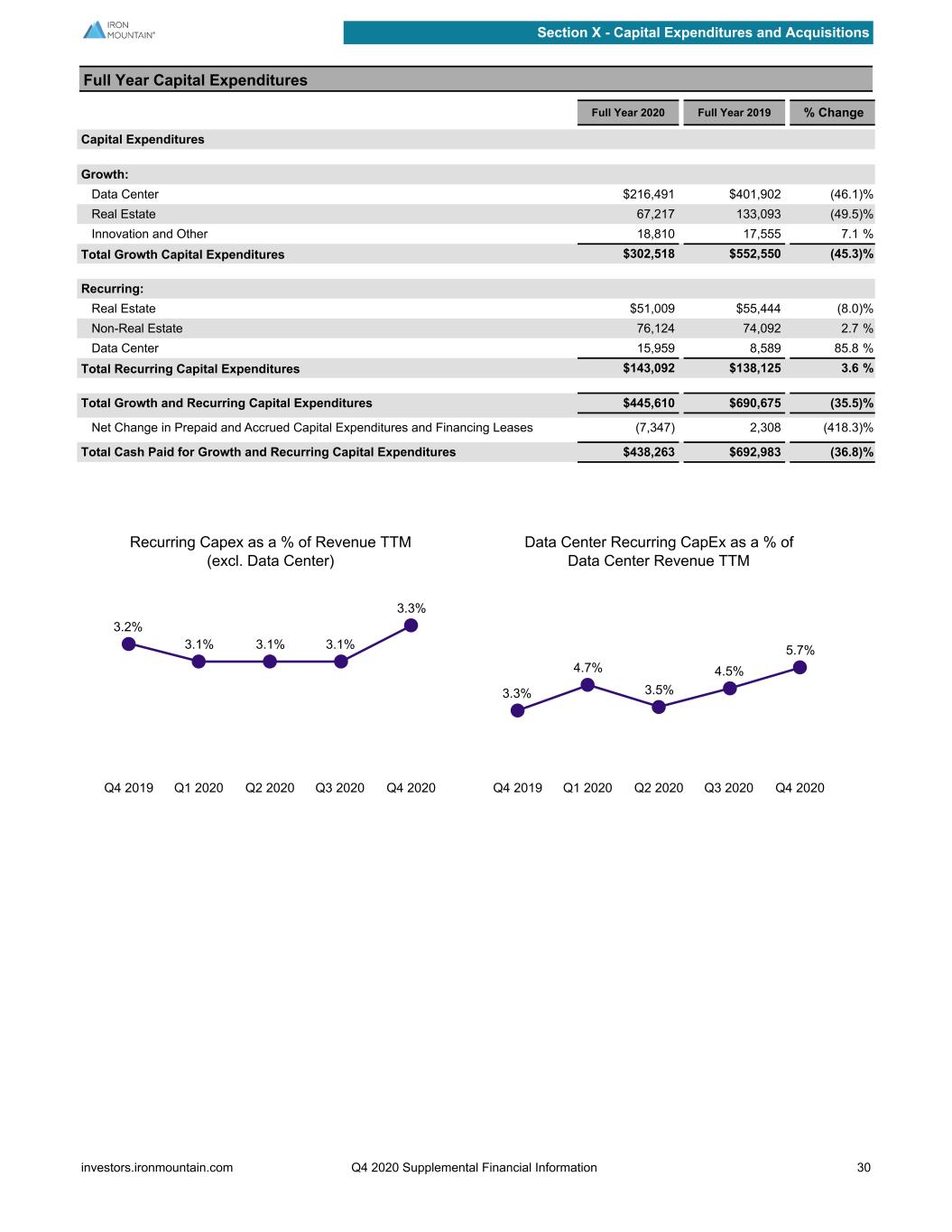

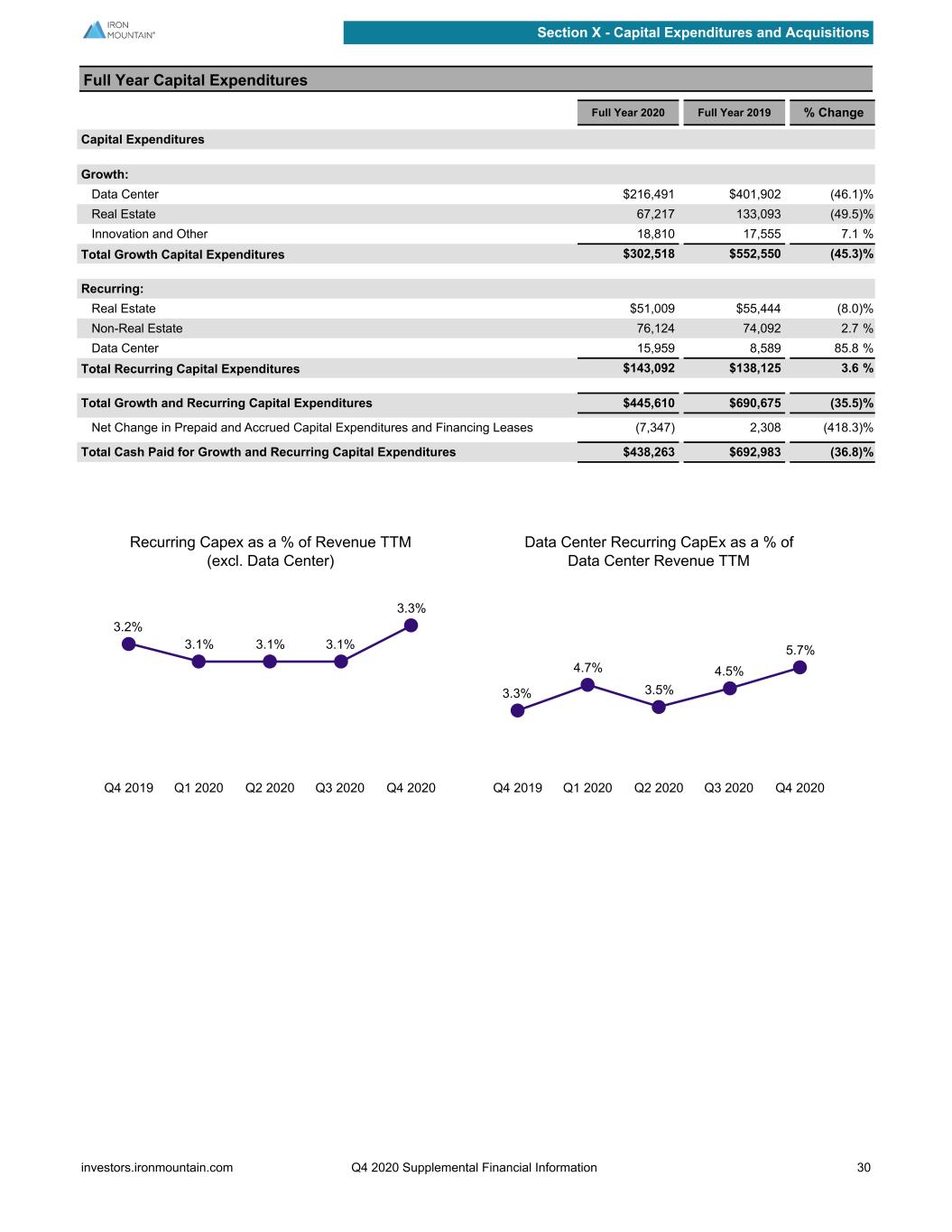

Full Year Capital Expenditures Full Year 2020 Full Year 2019 % Change Capital Expenditures Growth: Data Center $216,491 $401,902 (46.1) % Real Estate 67,217 133,093 (49.5) % Innovation and Other 18,810 17,555 7.1 % Total Growth Capital Expenditures $302,518 $552,550 (45.3) % Recurring: Real Estate $51,009 $55,444 (8.0) % Non-Real Estate 76,124 74,092 2.7 % Data Center 15,959 8,589 85.8 % Total Recurring Capital Expenditures $143,092 $138,125 3.6 % Total Growth and Recurring Capital Expenditures $445,610 $690,675 (35.5) % Net Change in Prepaid and Accrued Capital Expenditures and Financing Leases (7,347) 2,308 (418.3) % Total Cash Paid for Growth and Recurring Capital Expenditures $438,263 $692,983 (36.8) % Recurring Capex as a % of Revenue TTM (excl. Data Center) 3.2% 3.1% 3.1% 3.1% 3.3% Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Data Center Recurring CapEx as a % of Data Center Revenue TTM 3.3% 4.7% 3.5% 4.5% 5.7% Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Section X - Capital Expenditures and Acquisitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 30

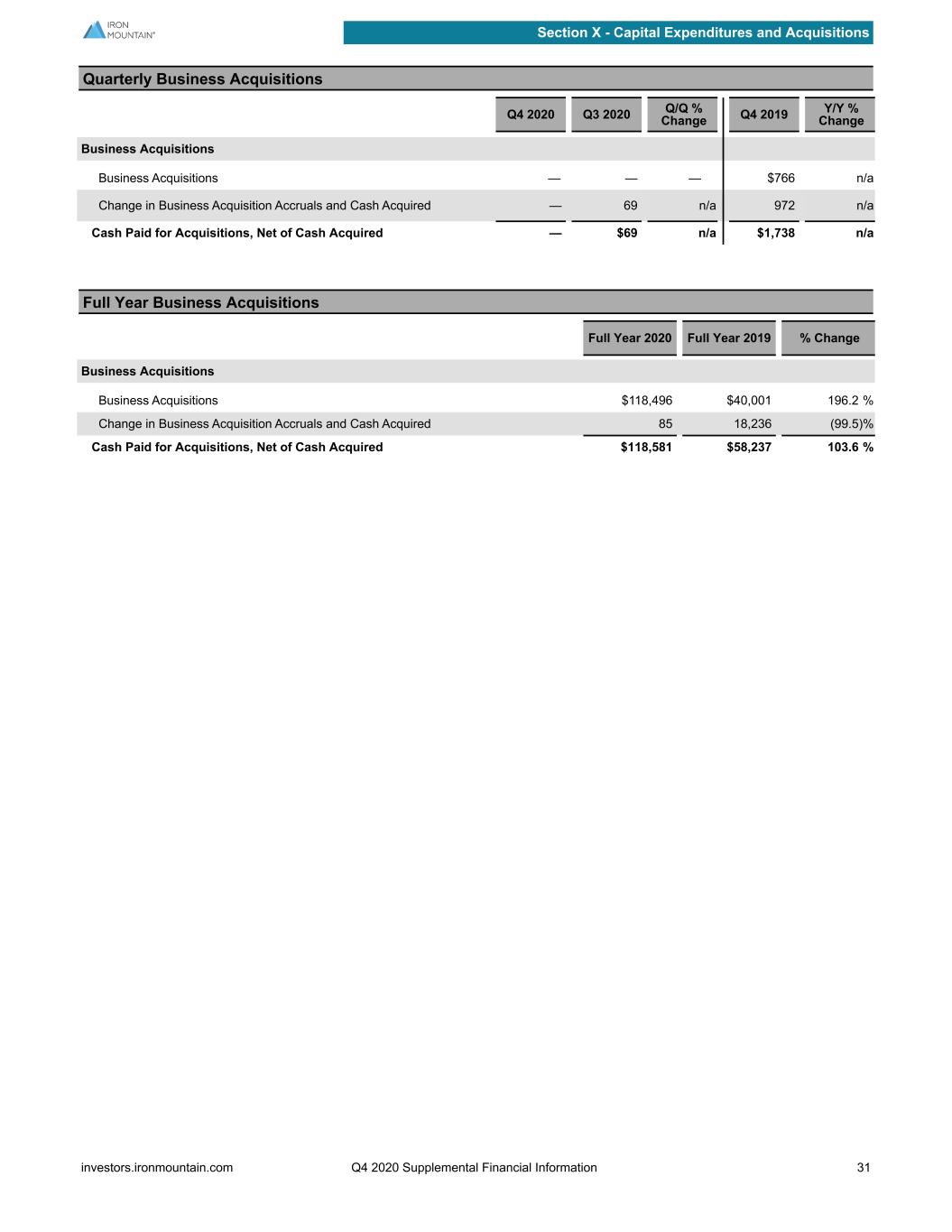

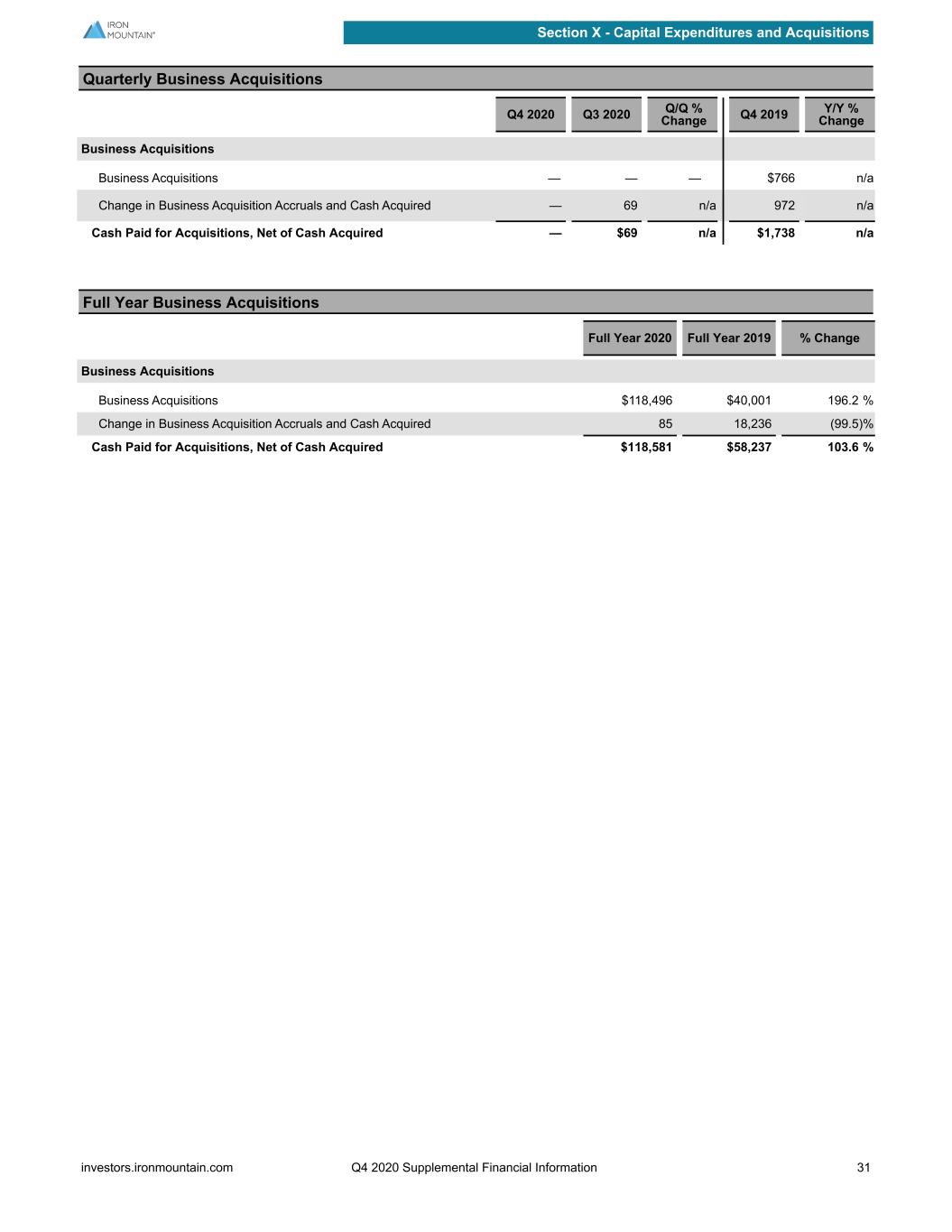

Quarterly Business Acquisitions Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Business Acquisitions Business Acquisitions — — — $766 n/a Change in Business Acquisition Accruals and Cash Acquired — 69 n/a 972 n/a Cash Paid for Acquisitions, Net of Cash Acquired — $69 n/a $1,738 n/a Full Year Business Acquisitions Full Year 2020 Full Year 2019 % Change Business Acquisitions Business Acquisitions $118,496 $40,001 196.2 % Change in Business Acquisition Accruals and Cash Acquired 85 18,236 (99.5) % Cash Paid for Acquisitions, Net of Cash Acquired $118,581 $58,237 103.6 % Section X - Capital Expenditures and Acquisitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 31

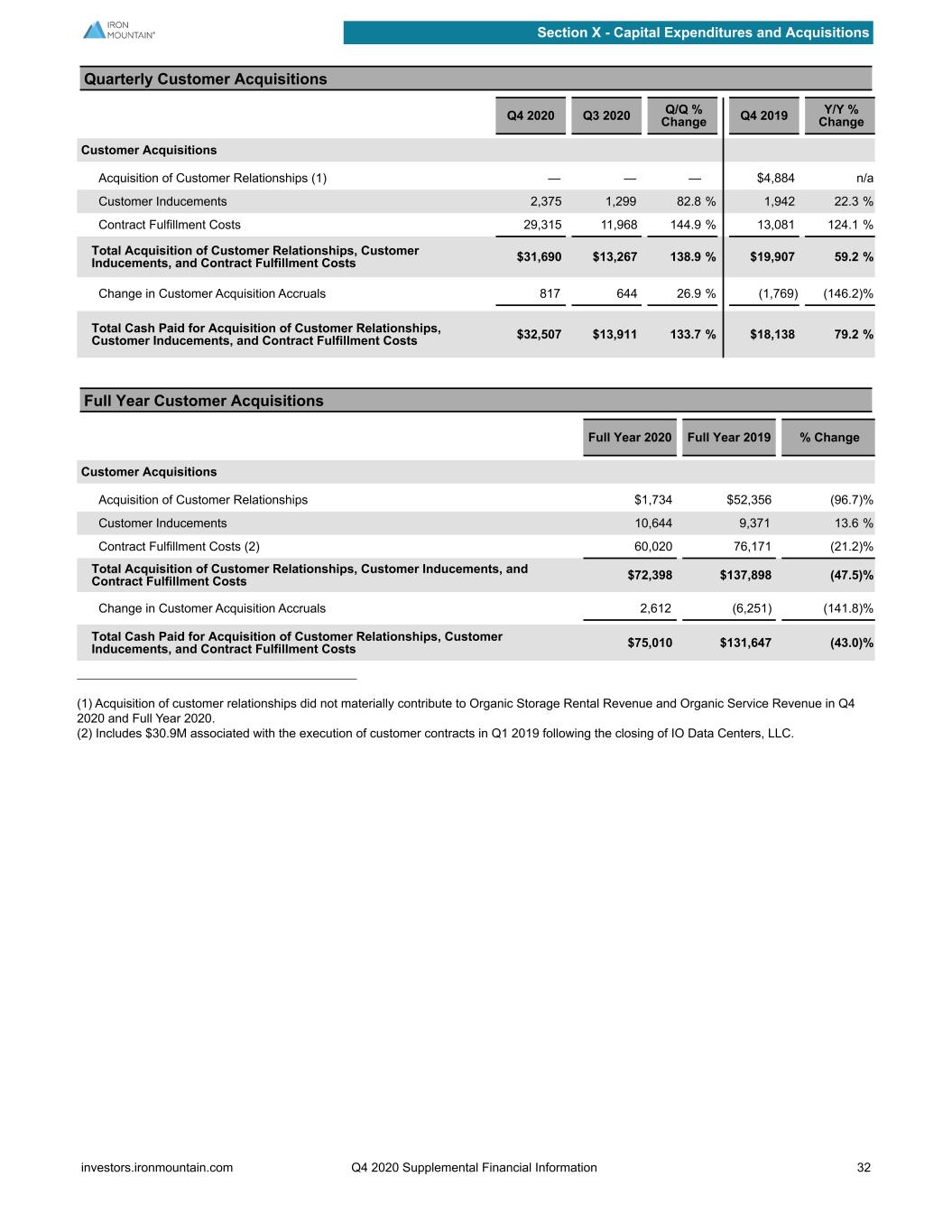

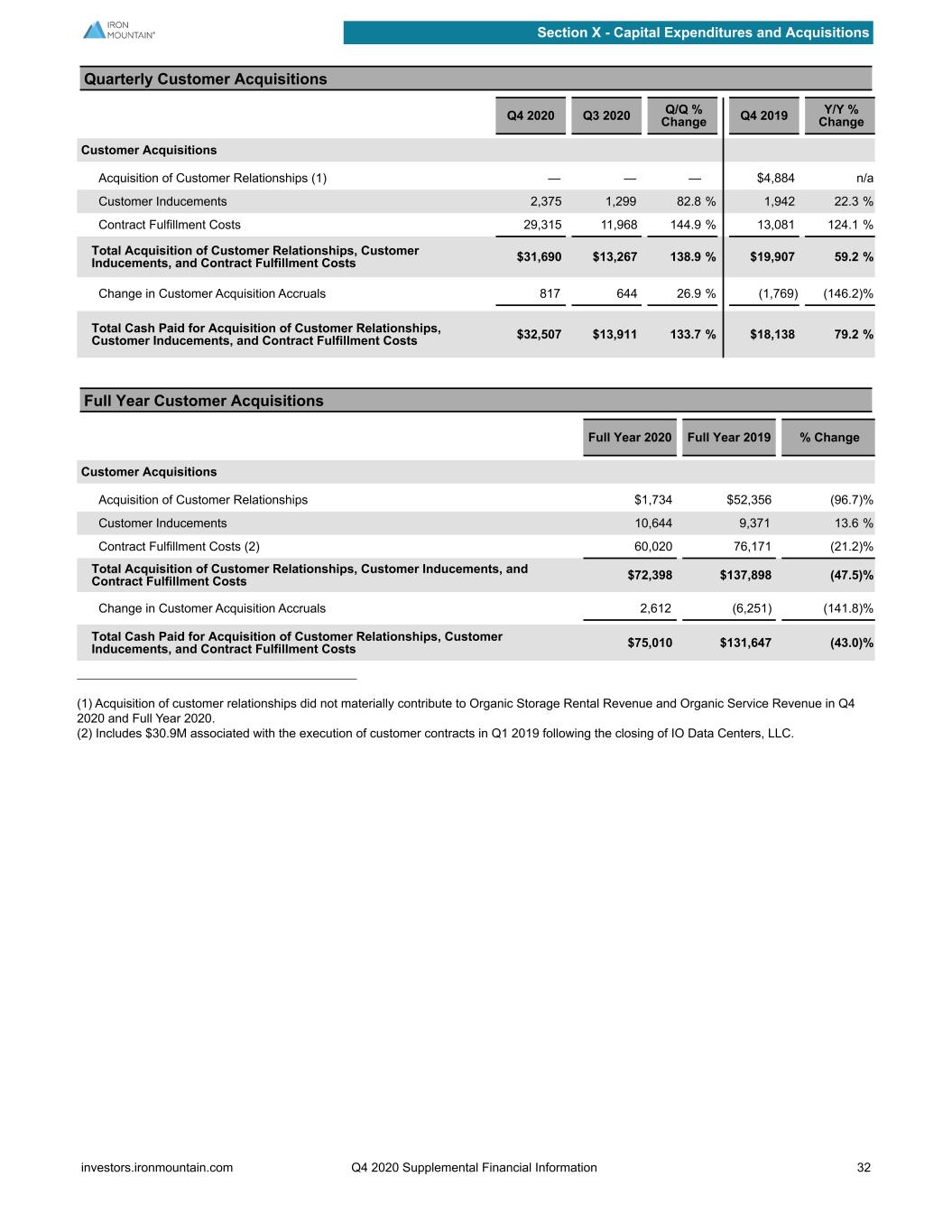

Quarterly Customer Acquisitions Q4 2020 Q3 2020 Q/Q % Change Q4 2019 Y/Y % Change Customer Acquisitions Acquisition of Customer Relationships (1) — — — $4,884 n/a Customer Inducements 2,375 1,299 82.8 % 1,942 22.3 % Contract Fulfillment Costs 29,315 11,968 144.9 % 13,081 124.1 % Total Acquisition of Customer Relationships, Customer Inducements, and Contract Fulfillment Costs $31,690 $13,267 138.9 % $19,907 59.2 % Change in Customer Acquisition Accruals 817 644 26.9 % (1,769) (146.2) % Total Cash Paid for Acquisition of Customer Relationships, Customer Inducements, and Contract Fulfillment Costs $32,507 $13,911 133.7 % $18,138 79.2 % Full Year Customer Acquisitions Full Year 2020 Full Year 2019 % Change Customer Acquisitions Acquisition of Customer Relationships $1,734 $52,356 (96.7) % Customer Inducements 10,644 9,371 13.6 % Contract Fulfillment Costs (2) 60,020 76,171 (21.2) % Total Acquisition of Customer Relationships, Customer Inducements, and Contract Fulfillment Costs $72,398 $137,898 (47.5) % Change in Customer Acquisition Accruals 2,612 (6,251) (141.8) % Total Cash Paid for Acquisition of Customer Relationships, Customer Inducements, and Contract Fulfillment Costs $75,010 $131,647 (43.0) % (1) Acquisition of customer relationships did not materially contribute to Organic Storage Rental Revenue and Organic Service Revenue in Q4 2020 and Full Year 2020. (2) Includes $30.9M associated with the execution of customer contracts in Q1 2019 following the closing of IO Data Centers, LLC. Section X - Capital Expenditures and Acquisitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 32

Non-GAAP Measures and Definitions Non-GAAP measures are supplemental metrics designed to enhance our disclosures and to provide additional information that we believe to be important for investors to consider when evaluating our financial performance. These non-GAAP measures should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such as operating income, (loss) income from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). Adjusted Earnings Per Share, or Adjusted EPS During the fourth quarter of 2020, we changed our definition of Adjusted EPS to (a) exclude stock-based compensation expense and (b) include our share of adjusted losses (gains) from our unconsolidated joint ventures. We now define Adjusted EPS as reported earnings per share fully diluted from continuing operations (inclusive of our share of adjusted losses (gains) from our unconsolidated joint ventures) and excluding certain items, specifically: (i) Significant Acquisition Costs; (ii) Restructuring Charges; (iii) Intangible impairments; (iv) (Gain) loss on disposal/write-down of property, plant and equipment, net (including real estate); (v) Other expense (income), net, (Other expense (income), net is inclusive of debt extinguishment expense, foreign currency gains/losses and Other, net); (vi) Stock-based compensation expense; (vii) COVID-19 Costs; and (viii) Tax impact of reconciling items and discrete tax items. We do not believe these excluded items to be indicative of our ongoing operating results, and they are not considered when we are forecasting our future results. We believe Adjusted EPS is of value to our current and potential investors when comparing our results from past, present and future periods. Adjusted EBITDA and Adjusted EBITDA Margin During the fourth quarter of 2020, we changed our definition of Adjusted EBITDA to (a) exclude stock-based compensation expense and (b) include our share of Adjusted EBITDA from our unconsolidated joint ventures. We now define Adjusted EBITDA as income (loss) from continuing operations before interest expense, net, provision (benefit) for income taxes, depreciation and amortization (inclusive of our share of Adjusted EBITDA from our unconsolidated joint ventures), and excluding certain items we do not believe to be indicative of our core operating results, specifically: (i) Significant Acquisition Costs; (ii) Restructuring Charges; (iii) Intangible impairments; (iv) (Gain) loss on disposal/write-down of property, plant and equipment, net (including real estate); (v) Other expense (income), net, (Other expense (income), net is inclusive of debt extinguishment expense, foreign currency gains/losses and Other, net); (vi) Stock-based compensation expense; and (vii) COVID-19 Costs (as defined below). Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by total revenues. We also show Adjusted EBITDA and Adjusted EBITDA Margin for each of our reportable operating segments under “Results of Operations – Segment Analysis” in the 10K. Adjusted EBITDA excludes both interest expense, net and the provision (benefit) for income taxes. These expenses are associated with our capitalization and tax structures, which we do not consider when evaluating the operating profitability of our core operations. Adjusted EBITDA also does not include depreciation and amortization expenses, in order to eliminate the impact of capital investments, which we evaluate by comparing capital expenditures to incremental revenue generated and as a percentage of total revenues. Adjusted EBITDA and Adjusted EBITDA Margin should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States of America (“GAAP”), such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). Adjusted Funds From Operations, or AFFO During the fourth quarter of 2020, we changed our definition of adjusted funds from operations (“AFFO”) to exclude our share of reconciling items from our unconsolidated joint ventures. AFFO is defined as FFO (Normalized) (1) excluding (i) non-cash rent expense (income), (ii) depreciation on non-real estate assets, (iii) amortization expense associated with customer relationship value (CRV), intake costs, acquisitions of customer relationships and other intangibles, (other than capitalized internal commissions), (iv) amortization of deferred financing costs [and debt discount/ premium], (v) revenue reduction associated with amortization of permanent withdrawal fees and above-and below-market data center leases, and (vi) the impact of reconciling to normalized cash taxes, and (2) including recurring capital expenditures. We also adjust for these items to the extent attributable to our portion of unconsolidated ventures. We believe that AFFO, as a widely recognized measure of operations of REITs, is helpful to investors as a meaningful supplemental comparative performance measure to other REITs, including on a per share basis. AFFO should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as operating income, income (loss) from continuing operations, net income (loss) or cash flows from operating activities from continuing operations (as determined in accordance with GAAP). AFFO per share AFFO divided by weighted-average fully-diluted shares outstanding Funds From Operations, or FFO (Nareit), and FFO (Normalized) Funds from operations ("FFO") is defined by the National Association of Real Estate Investment Trusts (“Nareit”) as net income (loss) excluding depreciation on real estate assets, gains on sale of real estate, net of tax, and amortization of data center leased based intangibles. Consistent with Nareit's definition of FFO, during the fourth quarter of 2020, we began adjusting for our share of reconciling items from our unconsolidated joint ventures from FFO ("FFO (Nareit)"). FFO (Nareit) does not give effect to real estate depreciation because these amounts are computed, under GAAP, to allocate the cost of a property over its useful life. Because values for well-maintained real estate assets have historically increased or decreased based upon prevailing market conditions, we believe that FFO (Nareit) provides investors with a clearer view of our operating performance. Our most directly comparable GAAP measure to FFO (Nareit) is net income (loss). Although Nareit has published a definition of FFO, we modify FFO (Nareit), as is common among REITs seeking to provide financial measures that most meaningfully reflect their particular business ("FFO (Normalized)"). During the fourth quarter of 2020, we changed our definition of FFO (Normalized) to exclude stock-based compensation expense and adjust for our share of FFO (Normalized) reconciling items from our unconsolidated joint ventures. Our definition of FFO (Normalized) excludes certain items included in FFO (Nareit) that we believe are not indicative of our core operating results, specifically: (i) Significant Acquisition Costs; (ii) Restructuring Charges; (iii) Intangible impairments; (iv) Loss (gain) on disposal/write-down of property, plant and equipment, net (excluding real estate); (v) Other expense (income), net, (Other expense (income), net is inclusive of debt extinguishment expense, foreign currency gains/losses and Other, net); (vi) Stock-based compensation expense; (vii) COVID-19 Costs; (viii) Real estate financing lease depreciation; (ix) Tax impact of reconciling items and discrete tax items; and (x) (Income) loss from discontinued operations, net of tax. Section XI - Appendix and Definitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 33

FFO (Normalized) per share FFO (Normalized) divided by weighted-average fully-diluted shares outstanding. Service Adjusted EBITDA Service Adjusted EBITDA is calculated by taking service revenues excluding terminations and permanent withdrawals less direct expenses and overhead allocated to the service business. Terminations and permanent withdrawals are excluded from this calculation as they are included in the Storage NOI calculation. Storage Adjusted EBITDA Storage Adjusted EBITDA is calculated by taking storage revenues including terminations and permanent withdrawal fees less direct expenses and overhead allocated to the storage business. Constant Currency Adjusts results for normalized FX impacts in prior period. Other Definitions Business Segments Global Record and Information Management ("Global RIM") Business: provides (i) storage of physical records and healthcare information services, vital records services, courier operations, and the collection, handling and disposal of sensitive documents (collectively, “Records Management”) for customers in 56 countries around the globe, (ii) storage and rotation of backup computer media as part of corporate disaster recovery plans, including service and courier operations (“Data Protection & Recovery”); server and computer backup services; and related services offerings, (collectively, “Data Management”), (iii) Global Digital Solutions (“GDS”), which develops, implements and supports comprehensive storage and information management solutions for the complete lifecycle of our customers’ information, including the management of physical records, conversion of documents to digital formats and digital storage of information, primarily in the United States and Canada, (iv) Secure Shredding, which includes the scheduled pick-up of office records that customers accumulate in specially designed secure containers we provide and is a natural extension of our hardcopy records management operations, completing the lifecycle of a record. Complementary to our shredding operations is the sale of the resultant waste paper to third-party recyclers. Through a combination of shredding facilities and mobile shredding units consisting of custom-built trucks, we are able to offer secure shredding services to our customers throughout the United States, Canada and South Africa, and (v) on-demand, valet storage for consumers (“Consumer Storage”) across 31 markets in North America through a strategic partnership (the “MakeSpace JV”) with MakeSpace Labs, Inc., a consumer storage provider (“MakeSpace”), formed in March 2019. The MakeSpace JV utilizes data analytics and machine learning to provide effective customer acquisition and a convenient and seamless consumer storage experience. Global Data Center Business: provides enterprise-class data center facilities and hyperscale-ready capacity to protect mission-critical assets and ensure the continued operation of our customers’ IT infrastructure, with secure, reliable and flexible data center options. The world’s most heavily regulated organizations have trusted us with their data centers for over 15 years, and five of the top 10 global cloud providers were Iron Mountain Data Center customers. Our Global Data Center Business footprint spans nine markets in the United States: Denver, Colorado; Kansas City, Missouri; Boston, Massachusetts; Boyers, Pennsylvania; Manassas, Virginia; Edison, New Jersey; Columbus, Ohio; and Phoenix and Scottsdale, Arizona and four international markets: Amsterdam, London, Singapore and, through an unconsolidated joint venture, Frankfurt. Corporate and Other Business: consists primarily of Adjacent Businesses and other corporate items. Adjacent Businesses is comprised of (i) entertainment and media which helps industry clients store, safeguard and deliver physical media of all types, and provides digital content repository systems that house, distribute, and archive key media assets, throughout the United States, Canada, France, China - Hong Kong S.A.R., the Netherlands and the United Kingdom (“Entertainment Services”) and (ii) technical expertise in the handling, installation and storing of art in the United States, Canada and Europe (“Fine Arts”). Our Corporate and Other Business segment also includes costs related to executive and staff functions, including finance, human resources and IT, which benefit the enterprise as a whole. Capital Expenditures and Investments – Our business requires capital expenditures to support our expected storage rental revenue and service revenue growth and ongoing operations, new products and services and increased profitability. The majority of our capital goes to support business line growth and our ongoing operations. Additionally, we invest capital to acquire or construct real estate. We also expend capital to support the development and improvement of products and services and projects designed to increase our profitability. These expenditures are generally relatively small and discretionary in nature. We categorize our capital expenditures as follows: Growth Investment: Data Center - Expenditures primarily related to investments in new construction of data center facilities (including the acquisition of land and development of facilities) or capacity expansion in existing buildings. Real Estate - Expenditures primarily related to investments in land, buildings, building improvements, leasehold improvements and racking structures to grow our revenues or achieve operational efficiencies. Innovation & Other - Discretionary capital expenditures for significant new products and services, restructuring (including Project Summit), and integration of acquisitions. Section XI - Appendix and Definitions investors.ironmountain.com Q4 2020 Supplemental Financial Information 34