UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 20F

£

ANNUAL REPORT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

T

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

£

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

£

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Not Applicable

For the transition period from

to

Commission File Number001-32670

MINCO GOLD CORPORATION

(formerly “Minco Mining & Metals Corporation”)

(Exact name of registrant as specified in its charter)

A CORPORATION FORMED UNDER THE LAWS OF BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada,V6E 3P3

(Address of principal executive offices)

Paul Zhang, CFO and VP Finance, (604) 688-8002 Ext. 109, (604) 688-8030,paul@mincomining.ca, Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, B6E 3P3

(Name, Telephone, Facsimile number, E-mail, and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| |

Common Shares | NYSE Amex Equities |

Title of each class | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

1

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 48,157,782

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes£

No T

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YesT

No£

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YesT

No£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “Accelerated filer and large accelerated file” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer: £

Accelerated file: £

Non-accelerated filer: T

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP£

International Financial Reporting Standards as issued

OtherT

By the International Accounting Standards Board£

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

TItem 17

£Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes£

No T

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes£

No£

Not Applicable

2

| TABLE OF CONTENTS | | |

| | | | | PAGE |

| INTRODUCTION AND USE OF CERTAIN TERMS | | 5 |

| FORWARD-LOOKING STATEMENTS | | 5 |

| GLOSSARY OF MINING TERMS | | 5 |

| PART I | | | | |

| ITEM 1. | | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | | 10 |

| ITEM 2. | | OFFER STATISTICS AND EXPECTED TIMETABLE | | 10 |

| ITEM 3. | | KEY INFORMATION | | 11 |

| ITEM 4. | | INFORMATION ON THE COMPANY | | 18 |

| ITEM 5. | | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 50 |

| ITEM 6. | | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | 58 |

| ITEM 7. | | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 69 |

| ITEM 8. | | FINANCIAL INFORMATION | | 71 |

| ITEM 9. | | THE OFFER AND LISTING | | 71 |

| ITEM 10. | | ADDITIONAL INFORMATION | | 73 |

| ITEM 11. | | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT | | |

| | | MARKET RISK | | 84 |

| ITEM 12. | | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | | 85 |

| PART II | | | | |

| ITEM 13. | | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | | 86 |

| ITEM 14. | | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY | | |

| | | HOLDERS AND USE OF PROCEEDS | | 86 |

| ITEM 15. | | CONTROLS AND PROCEDURES | | 86 |

| ITEM 16A. | | AUDIT COMMITTEE FINANCIAL EXPERT | | 87 |

| ITEM 16B. | | CODE OF ETHICS | | 87 |

| ITEM 16C. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES | | 89 |

| ITEM 16D. | | EXEMPTIONS FROM THE LISTING STANDARDS134 | | |

| | | FOR AUDIT COMMITTEES | | 89 |

3

| ITEM 16E. | | PURCHASES OF EQUITY SECURITIES BY THE ISSUER | | |

| | | AND AFFILIATE PURCHASERS | | 89 |

| ITEM 16F. | | CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | | 89 |

| ITEM 16G. | | CORPORATE GOVERNANCE | | 89 |

| PART III | | | | |

| ITEM 17. | | FINANCIAL STATEMENTS MINCO GOLD | | 91 |

| ITEM 18. | | FINANCIAL STATEMENTS MINCO SILVER | | 131 |

| SIGNATURES | | | | 165 |

| ITEM 19. | | EXHIBITS | | 166 |

4

INTRODUCTION AND USE OF CERTAIN TERMS

Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”) is incorporated under the laws of the province of British Columbia, Canada. In this document, the term “Company” refers to Minco Gold Corporation and its consolidated subsidiaries. Where required, the term “Minco Gold” refers to Minco Gold Corporation as a standalone entity. The Company's consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles ("GAAP") and are presented in Canadian dollars. Unless otherwise indicated, references to dollar amounts in this Annual Report relate to Canadian dollars. Minco Gold Corporation files reports and other information with the Securities and Exchange Commission ("SEC") located at Judiciary Plaza, 100 F St. NE, Washington, D.C. 20549. Copies of the Company's filings with the SEC may be obtained by accessing the SEC's website loc ated atwww.sec.gov. Further, the Company also files reports under Canadian regulatory requirements on SEDAR. Copies of the Company's reports filed on SEDAR can be obtained by accessing SEDAR's website atwww.sedar.com. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada,V6E 3P3, Tel: 604-688-8002, Fax: 604-688-8030, email addressinfo@mincomining.ca and websitewww.mincomining.ca.

FORWARD-LOOKING STATEMENTS

The following discussion contains forward-looking statements regarding events and financial trends which may affect the Company's future operating results and financial position. Such statements are subject to risks and uncertainties that could cause the Company's actual results and financial position to differ materially from those anticipated in forward looking statements. These risk factors include, but are not limited to, the fact that the Company is in the exploration stage, will need additional financing to develop its properties and will be subject to certain risks since its prospects are located in China, all of which factors are set forth in more detail in the section entitled “Risk Factors” in Item 3.D. and “Operating and Financial Review and Prospects” at Item 5.

GLOSSARY OF TERMS

| |

“757 Team” | means the No. 757 Geo-Exploration Team, an entity owned and controlled by the Guangdong Geological Bureau (“GGB”) of the PRC government. |

“757 Transfer Agreement” | means the agreement dated November 19, 2004 between 757 Team and Minco China pursuant to which 757 Team agreed to transfer and sell to Minco China the Original Fuwan Silver Permit. |

“Additional Permits” | means collectively the Luoke-Jilinggang Permit, the Guyegang-Sanyatang Permit, the Guanhuatang Permitand the Dadinggang Property. |

“alteration” | chemical and mineralogical changes in a rock mass resulting from reaction with hydrothermal fluids or changes in pressure and temperature. |

“Amending Contract” | means the contract dated January 10, 2006 between Minco Silver Corporation and GGB. |

“anomalous” | adjective describing a sample, location or area at which either (i) the concentration of an element(s) or (ii) a geophysical measurement is significantly different from (generally higher than) the average background concentrations in an area. Though it may not constitute mineralization, an anomalous sample or area may be used as a guide to the possible location of mineralization. |

“anomaly” | an area defined by one or more anomalous points. |

“antimony” | A trivalent and pentavalent metalloid element that is commonly metallic silvery white, crystalline, and brittle yet rather soft. |

“assay” | an analysis of the contents of metals in mineralized rocks. |

“Assignment Agreement” | means the assignment agreement dated August 20, 2004 between the Minco Gold, Minco Silver Corporation, Minco China and Minco BVI. |

5

“Au” | Gold. |

“Baojiang” | means Foshan Baojiang Nonferrous Metals Corporation. |

“breccia” | a coarse grained rock composed of large, >2mm angular rock fragments that have been cemented together in a fine grained matrix. |

“Changkeng JV Agreement” | means the formal joint venture agreement dated September 28, 2004 between the Company, GGB, Zhenjie, Baojiang and GD Gold. |

“Changkeng Permit” | means the reconnaissance survey exploration permit (#T01120080102000011) which expires on September 10, 2011 in respect of the 1.19 km2Changkeng gold property in Gaoyao City of Guangdong Province in southern China. |

“Changkeng Property” | means the 1.19 km2Changkeng gold property in Gaoyao City of Guangdong Province in southern China which adjoins the property underlying the Fuwan Silver Permit. |

“CIM” | Canadian Institute of Mining, Metallurgy and Petroleum. |

“Company” or “Minco” | means Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”). |

“concentrates” | to separate ore or metal from its containing rock or earth. |

“Dadinggang Property” | means the small area within the Luoke-Jilinggang Permit, about 0.395 km2. This area was extended from the original Luoke-Jilinggang Permit in late 2006. |

“deposit” | a mineralized body which has been physically delineated by drilling, trenching and/or underground work and may contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body until final technical, legal and economic factors have been resolved. |

“diamond drill holes” | a drilling method whereby rock is drilled with a diamond impregnated, hollow drilling bit which produces a continuous, in-situ record of the rock mass intersected in the form of solid cylinders of rock which are referred to as core. |

“fault” or “block fault” | a fracture in a rock across which there has been displacement. Block faults are usually steep, and break the earth's crust into “blocks” that are displaced vertically and/or laterally relative to each other. |

“First Confirmation Agreement” | means the confirmation agreement dated May 2, 2005 between the Company, Minco China and Minco Silver Corporation. |

“Fuwan JV Agreement” | means the formal joint venture agreement dated September 28, 2004 between Minco Silver Corporation and GGB. |

“Fuwan Permits” | means, collectively, the Fuwan Silver Permit and the Additional Permits. |

“Fuwan Property” | means the Fuwan silver property which is located in Guangdong Province in southern China beside the Xijiang River consisting of the following three components: (i) the properties which are the subject of the Fuwan Silver Permit; (ii) the properties which are the subject of the Luoke-Jilinggang Permit and the Guyegang-Sanyatang Permit; (iii) the Guanhuatang permit ; and (iv) Minco Gold's interests in the silver mineralization located on the Changkeng Property. |

6

“Fuwan Silver Permit” | means the reconnaissance survey exploration permit (# 0100000730293) in respect of the 0.79 km2Fuwan silver property in Gaomong Region, Foshan City of Guangdong Province issued to Minco China and initially having validity from August 20, 2007 to July 20, 2009. The Fuwan Silver Permit was transferred to FoShan Minco, a subsidiary of Minco Silver, before the permit's original expiry date in conjunction with the combination of the Fuwan Silver Permit and the “Luoke-Jilinggang Permit” as one permit, under a new expiry date of the permit of July 20, 2011. |

“g/t” | unit of grade expressed in grams/tonne. |

“gangue” | the non economic portion of ore. |

“GD Gold” | means Guangdong Gold Corporation. |

“geophysical” | the use of geophysical instruments and methods to determine subsurface conditions by analysis of such properties as specific gravity, electrical conductivity, and magnetic susceptibility. |

“GGB” | means Guangdong Geological Bureau, an entity owned and controlled by the Guangdong Geological Bureau of the PRC government. |

“gouge” | a thin layer of soft earthy putty-like rock material along the containing wall of a mineral vein. |

“grade” | the amount of valuable mineral in each tone of ore, expressed as ounces per ton or grams per tonne for precious metal and as a percentage by weight for other metals. |

“Guanhuatang Permit” | means the reconnaissance survey exploration permit (# T011200805020004910100000510045) in respect of the 37.29 km2Guanhuatang silver and multi-metals property in Foshan City of Guangdong Province issued to Minco China and having validity from April 7, 2005 to April 7, 2008. The new expiry date of the permit is on April 07, 2010. |

“Guyegang-Sanyatang Permit” | means the reconnaissance survey exploration permit (# 0100000510047) in respect of the 91.91 km2Guyegang-Sanyatang silver and multi-metals property in Gaoming Region, Foshan City of Guangdong Province issued to Minco China and having validity from April 7, 2005 to April 7, 2008. The new expiry date of the permit is on April 07, 2010. |

“hydrothermal” | of or pertaining to heated water, to the action of heated water, or to the products of the action of heated water. |

“JVs” | means Joint Venture established with Chinese partners. The Company owns controlling interests of over 50% in all JVs in China. Joint Venture as used in reference to “Chinese joint venture”, “co-operative joint venture”, “equity joint venture”, “Sino-foreign co-operative joint venture” does not refer to a joint venture as contemplated by US or Canadian GAAP. The term reflects the nomenclature of the related agreements. |

“limestone” | A sedimentary rock consisting of chiefly >50% calcium carbonate. |

“Luoke-Jilinggang Permit” | means the reconnaissance survey exploration permit (#T01120080402000336) in respect of the 76.62 km2Luoke-Jilinggang silver and multi-metals property in Gaoyao City, Zhaoqing City of Guangdong Province issued to Minco China and having validity from September 26, 2008 to July 20, 2011 |

“Minco Base Metals” | means Minco Base Metals Corporation |

“Minco BVI” | means Minco Silver Ltd. |

“Minco China” | means Minco Mining (China) Corporation. |

“Minco Gold” | means Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”). |

7

“Minco Silver” | means Minco Silver Corporation. |

“mineral reserve” | the economically mineable part of a measured mineral resource or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting minerals and allowances for losses that may occur when the material is mined. |

“mineral resource” | a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

“mineralization”

“MOLAR” | the process or processes by which a mineral or minerals are introduced into a rock, resulting in an economically valuable or potentially valuable deposit. Means the Ministry of Land and Resources |

“Original Fuwan Silver Permit” | means the reconnaissance survey exploration permit (# 440000040093) in respect of the 0.79 km2Fuwan silver property in Gaoming Region, Foshan City of Guangdong Province, legally conferred to 757 Team by Guangdong Department of Land and Resources on September 12, 2003. |

“outcrop” | an exposure on the surface of the underlying rock. |

“oz” | Troy ounce consisting of 31.1035 grams. |

“Pb” | Lead. |

“Preliminary Changkeng JV Agreement” | means the preliminary joint venture agreement dated April 16, 2004 between Minco Gold, GGB, Zhenjie and Baojiang. |

“Preliminary Fuwan JV Agreement” | means the preliminary Fuwan joint venture agreement dated April 16, 2004 and amended August 18, 2004 between Minco BVI and GGB |

“pyrite” | A sulphide mineral of iron and sulphur. |

“Pyroclastic” | refers to a sedimentary rock composed or airborne volcanic material from a volcanic eruption. |

“Qualified Person” | an individual who is an engineer or geoscientist with at least five years experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of an approved self-regulating organization. |

“quartz” | A common rock-forming mineral comprised of silicon and oxygen (SiO2). |

“RMB” | means the Chinese currency Renminbi. |

“sample” | a sample of selected rock chips from within an area of interest. |

“sandstone” | A medium grained clastic sedimentary rock. |

“Sb” | Antimony. |

“Second Confirmation Agreement” | means the confirmation agreement dated August 24, 2006 between Minco Gold, Minco China and Minco Silver. |

8

“sedimentary rock” | A rock that has been formed by the consolidation of loose sediment that has accumulated in layers. |

“sedimentary” | formed by the deposition of solid fragmented material that originates from weathering of rocks and is transported from a source to a site of disposition. |

“State” | means the central government of China |

“strike” | the direction or trend that a structural surface takes as it intersects the horizontal. |

“sulphide” | a class of minerals commonly combining various elements in varying ratios with sulphur. |

“tonne” | metric unit of weight consisting of 1,000 kilograms. |

“Transfer Confirmation Agreement” | means the confirmation agreement dated November 19, 2004 between 757 Team, GGB and Minco China. |

“Triassic” | the period of geological time from 225 to 195 million years before present. |

“vein” | A tabular mineral deposit formed in or adjacent to faults or fractures by the deposition of minerals from hydrothermal fluids. |

“veinlet” | A small vein; the distinction between vein and veinlet tends to be subjective. |

“volcanic” | pertaining to the activity, structures or rock types of a volcano. |

“Zhenjie” | means Zhuhai Zhenjie Development Ltd. |

| “JVs” | means Joint Venture established with Chinese partners. The Company owns controlling interests of over 50% in all JVs in China. Joint Venture as used in reference to “Chinese joint venture,” “co-operative joint venture,” “equity joint venture,” “Sino-foreign joint venture” and “Sino-foreign co-operative joint venture” does not refer to a joint venture as contemplated by US or Canadian GAAP. The term reflects the nomenclature of the related agreements. |

| “ZhongJia” | means a subsidiary, Zhongjia Minco in China |

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are Canadian geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards.

In this Annual Report references to “Canadian National Instrument 43-101” are references to National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators and references to “CIM Standards” are references to Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council on August 20, 2000 as may be amended from time to time by the CIM.

| |

| Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources and Indicated Mineral Resources. |

| This Annual Report uses the terms “Measured Mineral Resource” and “Indicated Mineral Resource.” We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves. |

9

PART 1

ITEM 1.

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A.

DIRECTORS AND SENIOR MANAGEMENT

The following table sets forth as of May 12, 2010, the names, business addresses and functions of the Company's directors and senior management.

| | |

Name | Business Address | Position |

Ken Cai | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada,V6E 3P3 | President, Chief Executive Officer and Director |

Robert M. Callander | 43 Delhi Avenue North York, Ontario, Canada M5M 3B8 | Director |

Michael Doggett | Vancouver, British Columbia, Canada | Director |

Malcolm F. Clay | West Vancouver, British Columbia, Canada | Director |

Dwayne Melrose | Suite 1200, Kunxun Tower, 9 Zhichun Road, Haidian District, Beijing, China, 100191 | VP Exploration and Director |

Paul Zhang | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada,V6E 3P3 | Chief Financial Officer and VP Finance |

B.

ADVISERS

The Company's registrar and transfer agent for its common shares is Computershare Trust Company of Canada, located at 510 Burrard Street, Vancouver, British Columbia, V6C 3B9, Canada, telephone: 604-661-0224, fax: 604-661-9401, internet:www.computershare.com. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada,V6E 3P3, Tel: 604-688-8002, Fax: 604-688-8030, email addressinfo@mincomining.ca and websitewww.mincomining.ca. The Company's legal advisors are Salley Bowes Harwardt, located at 1185 West Georgia Street, Suite 1750, Vancouver, British Columbia, Canada, V6E 4E6 and US legal advisors are Bullivant, Houser, Bailey PC (formerly “Bartel Eng & Schroder”), located at 1415 L Street, Suite 1000, Sacramento, Califor nia, 95814..

C.

AUDITORS

The Company's auditors arePricewaterhouseCoopers, LLP, Chartered Accountants, located at 250 Howe Street, Suite 700, Vancouver, British Columbia, Canada, V6C 3S7.

ITEM 2.

OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

10

ITEM 3.

KEY INFORMATION

A.

SELECTED FINANCIAL DATA

The following selected financial information for the fiscal years ended December 31, 2009, 2008, 2007, 2006 and 2005 are derived from the financial statements of the Company and should be read in conjunction with the financial statements and the notes attached to this Annual Report. The Company's financial statements are prepared in accordance with Canadian generally accepted accounting principles (“GAAP”). Over the period reviewed, there have been significant differences between Canadian GAAP and United States GAAP.

Canadian GAAP

| | | | | | | | | | |

| December 31, 2009 | December 31, 2008 | December 31, 2007 | December 31, 2006 | December 31, 2005 |

Operations | | | | | |

Interest and sundry income | $ 123,052 | $ 363,361 | $ 299,354 | $ 673,570 | $ 475,554 |

Exploration expense | 241,236 | 10,193,279 | 1,845,250 | 2,535,281 | 2,666,958 |

Loss from continuing operations | (756,504) | (14,117,717) | (6,717,499) | (1,529,160) | (939,153) |

Loss for year | (200,900) | (13,264,305) | (7,580,231) | (1,589,324) | (1,013,541) |

Loss per Common share from continuing operations | | | | | |

(basic and diluted) | $ (0.00) | $ (0.31) | $ (0.18) | $ (0.04) | $ (0.03) |

Common shares used in calculations | 43,148,525 | 42,970,813 | 42,908,809 | 41,193,591 | 34,501,784 |

| | | | | |

Consolidated Balance Sheet Data | | | | | |

Total assets | 14,595,566 | 10,558,425 | 16,747,109 | 19,584,528 | 18,643,798 |

Total liabilities | 5,203,844 | 8,688.807 | 2,819,893 | 501,128 | 1,365,105 |

Non-controlling interest | 2,493,427 | - | 82,685 | - | - |

Net assets | 6,898,295 | 1,869,618 | 13,844,531 | 19,083,400 | 17,278,693 |

Share capital | $ 38,553,755 | $ 34,021,922 | $33,941,510 | $33,809,903 | $ 8,187,245 |

Shares outstanding – basic | 48,157,782 | 42,989,051 | 42,928,385 | 42,865,219 | 38,633,992 |

United States GAAP

| | | | | |

| December 31, 2009 | December 31, 2008 | December 31, 2007 | December 31, 2006 | December 31, 2005 |

Operations | | | | | |

Interest and sundry income | $ 123,052 | $ 363,361 | $ 299,354 | $ 673,570 | $ 475,554 |

Exploration expense | 241,236 | 10,193,279 | 1,845,250 | 2,535,281 | 2,666,958 |

Loss for year | (962,138) | (16,893,597) | (7,582,231) | (6,802,234) | (5,427,996) |

| | | | | |

Income (loss) per common share | | | | | |

From continuing operations | | | | | |

(basic and diluted) | $ (0.02) | $ (0.39) | $ (0.18) | $ (0.17) | $ (0.16) |

Common shares used in calculations | 43,148,525 | 42,970,813 | 42,908,809 | 41,193,591 | 34,501,784 |

| | | | | |

Consolidated Balance Sheet Data | | | | | |

Total assets | 11,696,990 | 8,397,987 | 16,747,109 | 19,838,955 | 18,643,798 |

Total liabilities | 5,203,844 | 8,688,807 | 2,819,893 | 501,128 | 1,365,105 |

Net assets | 6,493,146 | (290,820) | 13,844,531 | 19,337,827 | 17,278,693 |

Share capital | $ 38,553,755 | $ 34,021,922 | $36,757,166 | $36,625,559 | $31,002,901 |

Common shares outstanding | 48,157,782 | 42,989,051 | 42,928,385 | 42,865,219 | 38,633,992 |

11

Exchange Rates

The following table sets forth information as to the average period end, high and low exchange rate for Canadian dollars and US dollars for the periods indicated based on the daily average Interbank rate (USD to CAD) in Canadian dollars as certified for customs purposes by OANDA (US$1.00 = S/B C$1.019 as at March 31, 2010 ).

| | | | |

Year Ended December 31 | Average | Period End | High | Low |

2009 2008 | 1.14 1.07 | 1.05 1.22 | 1.31 1.30 | 1.02 0.97 |

2007 | 1.07 | 0.99 | 1.19 | 0.92 |

2006 | 1.13 | 1.16 | 1.17 | 1.10 |

2005 | 1.22 | 1.14 | 1.27 | 1.14 |

The following table sets out the high and low exchange rate for each month during the previous 12 months:

| | |

Month | High | Low |

March 2010 February 2010 January 2010 December 2009 November 2009 October 2009 September 2009 August 2009 July 2009 June 2009 | $1.057 1.078 1.070 1.075 1.087 1.096 1.110 1.112 1.172 1.163 | $1.006 1.037 1.022 1.037 1.042 1.021 1.059 1.063 1.075 1.078 |

May 2009 | 1.205 | 1.089 |

April 2009 | $1.271 | $1.198 |

| | |

B.

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and indebtedness as of December 31, 2009 and December 31, 2008 in accordance with Canadian GAAP. This section should be read in conjunction with the consolidated financial statements and related notes contained elsewhere in this Annual Report.

| | | |

| | As of December 31, 2009 | As of December 31, 2008 |

Shareholders' equity | | |

| Common shares, unlimited number of common shares without par value: | | |

| 48,157,782 (2008 – 42,989,051) issued and outstanding shares | $38,553,755 | $34,021,922 |

| Contributed surplus | 5,627,841 | 4,930,097 |

| Deficit | (37,283,301) | (37,082,401) |

Total capitalization and indebtedness | $6,898,295 | $1,869,618 |

C.

REASONS FOR THE OFFER AND USE OF PROCEEDS

NOT APPLICABLE

12

D.

RISK FACTORS

In addition to the other information presented in this Annual Report, you should consider the following carefully in evaluating the Company and its business. This Annual Report contains forward-looking statements that involve risks and uncertainties. The Company's actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report.

Limited Operating History

The Company has no history of earnings and there are no known commercial quantities of mineral reserves on the Company's property. Accordingly it is not possible to predict when, if at all, the Company will generate revenues or income from its operations.

Exploration and Development is a Speculative Business

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production.

The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, the availability of mining equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital.

All of the properties in which the Company has an interest or a right to acquire an interest are in the exploration stages only and are without a known body of commercial ore. Development of the subject mineral properties would follow only if favourable exploration results are obtained. The business of exploration for minerals and mining involves a high degree of risk. Few properties that are explored are ultimately developed into producing mines.

There is no assurance that the Company's mineral exploration and development activities will result in any discoveries of commercial bodies of ore. The long-term profitability of the Company's operations will in part be directly related to the costs and success of its exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis.

No Assurance of Production

Mineral exploration is highly speculative in nature, involves many risks, and frequently does not lead to the discovery of commercial reserves of minerals. While the rewards can be substantial if commercial reserves of minerals are found, there can be no assurance that the Company's past or future exploration efforts will be successful, that any production there from will be obtained, or that any such production which is attempted will be profitable.

Industry Specific Risks

The exploration, development, and production of minerals are capital-intensive businesses, subject to the normal risks and capital expenditure requirements associated with mining operations, which even a combination of experience, knowledge and careful evaluation may not be able to overcome.

13

Factors Beyond Company's Control

Discovery, location and development of mineral deposits depend upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The exploration and development of mineral properties and the marketability of any minerals contained in such properties will also be affected by numerous factors beyond the control of the Company. These factors include government regulation, high levels of volatility in market prices, availability of markets, availability of adequate transportation and refining facilities and the imposition of new or amendments to existing taxes and royalties. The effect of these factors cannot be accurately predicted.

Uninsured Risks

The Company's mining activities are subject to the risks normally inherent in mineral exploration, including but not limited to environmental hazards, industrial accident, flooding, periodic or seasonal interruptions due to climate and hazardous weather conditions, and unusual or unexpected formations. Such risks could result in damage to or destruction of mineral properties or production facilities, personal injury, environmental damage, delay in mining and possible legal liability.

The Company may become subject to liability for pollution and other hazards against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. The payment for such liabilities would reduce the funds available for exploration and mining activities and may have a material impact on the Company's financial position.

Currency Exchange Rates

The Company maintains its accounts in US dollar, Canadian dollar and Chinese Renminbi (“RMB”) denominations. The government of the People's Republic of China (“PRC” or “China”) maintained the exchange rate between the RMB and the US dollar as a constant until July 2005 and thus exchange rates between the Canadian dollar and the RMB fluctuated in tandem with the changing exchange rates between the US and Canadian dollars. Since July 2005, the value of the RMB has been tied to a basket of currencies of China's largest trading partners.Given that most of Minco Gold's expenditures are currently and are anticipated to be incurred in Canadian dollars and RMB, Minco Gold is subject to foreign currency fluctuations which may materially affect its financial position and operating results. The Company does not currently have a formal hedging program to mitigate foreign currency exchange risks.

Competition

The precious metal minerals exploration industry and mining business are intensely competitive. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mining properties. Many of these competitors have substantially greater technical and financial resources than the Company. Competition could adversely affect the Company's ability to acquire suitable properties or prospects in the future.

Future Financing

The Company has limited financial resources and has no assurance that additional funding will be available to it for further exploration and development of its projects. There can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Uncertainty of Estimates

Resource and reserve estimates of minerals are inherently imprecise and depend to some extent on statistical inferences drawn from limited drilling, which may prove unreliable. Although estimated recoveries are based upon test results, actual recovery may vary with different rock types or formations in a way which could adversely affect operations.

14

Management and Directors

The success of the Company is currently largely dependent on the performance of its officers. The loss of the services of these persons will have a materially adverse effect on the Company's business and prospects. There is no assurance the Company can maintain the services of its officers or other qualified personnel required to operate its business. Failure to do so could have a material adverse affect on the Company and its prospects. The Company has not purchased any “key-man” insurance with respect to any of its directors or officers to the date hereof. The loss of any key officer of the Company could have an adverse impact on the Company, its business and its financial position.

Potential Conflicts of Interest

None of the Company's officers and directors devotes their full-time efforts to the Company. Certain members of the Company's board and officers of the Company also serve as officers or directors of other companies involved in natural resource exploration and development. Consequently, there exists the possibility that those directors and officers may be in a position of conflict. In particular, Ken Z. Cai serves as Director and CEO in each of the Company, Minco Silver and Minco Base Metals. In addition, Paul Zhang serves as Chief Financial Officer and Vice President Finance and Dwayne Melrose serves as Vice President, Exploration of the Company, and Minco Silver and as a Director of Minco Gold and Minco Base Metals. Any decision made by those directors and officers will be made in accordance with their duties and obligations to deal fairly and in good faith with the Company and such other companies. In addition, such directors and officers will declare, and refrain from voting on, any matter in which such directors or officers may have a conflict of interest. Nevertheless, there remains the possibility that the best interests of the Company will not be served because its directors and officers have other commitments.

Fluctuating Mineral Prices

Factors beyond the control of the Company may affect the marketability of metals discovered, if any. Metal prices have fluctuated widely, particularly in recent years. The effect of these factors cannot be predicted.

The Mining Industry Is Highly Speculative

The Company is engaged in the exploration for minerals which involves a high degree of geological, technical and economic uncertainty because of the inability to predict future mineral prices, as well as the difficulty of determining the extent of a mineral deposit and the feasibility of extracting it without the expenditure of considerable money.

Penny Stock Rules May Make It More Difficult to Trade the Company's Common Shares

The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price, as defined, less than US$5.00 per share or an exercise price of less than US$5.00 per share, subject to certain exceptions. The Company's securities may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors such as institutions with assets in excess of US$5,000,000 or an individual with net worth in excess of US$1,000,000 or annual income exceeding US$200,000 or US$300,000 jointly with his or her spouse. For transactions covered by this rule, the broker-dealers must make a special suitability determination for the purchase and receive the purchaser's written agreement of the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell the Company's securit ies and also affect the ability of the Company's investors to sell their shares in the secondary market.

15

The Company is Not a Passive Foreign Investment Company for United State Federal Income Tax Purposes

The Company believes that it is not a passive foreign investment company (“PFIC”) for United States Federal income tax purposes because it does not earn 75% or more of its gross income from passive sources, or more than 50% of the value of its assets during the year is attributable to assets that produce or are held for the production of passive income. See Item 10.E. “Taxation - United States Tax Consequences - Passive Foreign Investment Companies.”

Risks Related to Doing Business in China

PRC Political and Economic Considerations

The business operations of the Company will be located in, and the revenues of the Company derived from activities in, the PRC. Likewise, the Company's operations in the PRC are currently conducted through and with the assistance of Minco China, a Chinese company. Accordingly, the business, financial condition and results of operations of the Company could be significantly and adversely affected by economic, political and social changes in the PRC. The economy of the PRC has traditionally been a planned economy, subject to five-year and annual plans adopted by the state, which set down national economic development goals. Since 1978, the PRC has been moving the economy from a planned economy to a more open, market-oriented system.

The economic development of the PRC is following a model of market economy under socialism. Under this direction, it is expected that the PRC will continue to strengthen its economic and trading relationships with foreign countries and that business development in the PRC will follow market forces and the rules of market economics. However, the Chinese government continues to play a significant role in regulating industry by imposing industrial policies. In addition, there is no guarantee that a major turnover of senior political decision makers will not occur, or that the existing economic policy of the PRC will not be changed. A change in policies by the PRC could adversely affect the Company's interests in China by changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports and sources of supplies, or the expropriation of private enterprises.

In order to conduct exploration and development of mineral deposits in the PRC, resource companies are required to obtain licenses and permits from the relevant authorities in the PRC, including a business license which authorizes companies to carry on business in the PRC. The business license of Minco China is subject to an annual review process pursuant to which it must pass annual inspections of the Administration for Industry and Commerce in the PRC. As a result, if Minco China does not pass its annual review it will not be authorized to carry on business in the PRC which may adversely affect the Company's interests in its properties. The Company believes that it and Minco China are operating in compliance with all applicable rules and regulations.

The purpose set out in Minco China's articles of association includes, among other things, the application of advances and appropriate exploration and mining technology and scientific methods to develop mine exploration and development software and technology, improve exploration precision and accuracy, and to reduce exploration risks. Minco China's scope of business according to its articles of association includes, among others, the exploration of mineral deposits, development of exploration technology, and the development of software for mine exploration and development. However, Minco China's approved business scope contained in its business licence does not clearly state that Minco China is approved to conduct exploration and mining business because Minco China has not obtained the approval from the Ministry of Commerce for its exploration and mining business. Minco China has applied to amend the scope of its business to more clearly include mining e xploration and development. Minco China's application has been approved by the Beijing Metropolitan Department of Commerce and is subject to the final approval of the Ministry of Commerce. While Minco China expects that its business scope application will be approved, no guarantee can be given that the Ministry of Commerce approval will ultimately be obtained.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of companies engaged in mineral resource exploration and development, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties. The Company's various property interests and potential property rights in the PRC involve various Chinese state-sector entities, including the GGB and 757 Team, whose actions and priorities may be dictated by government policies, instead of purely commercial considerations. Additionally, companies (such as Minco China) with a foreign ownership component operating in the PRC may be required to work within a framework which is different to that imposed on domestic Chinese companies. The Chinese government is opening up opportunities for foreign investment in mining projects and this process is expected to continue. However, if the Chinese government shoul d reverse this trend and impose greater restrictions on foreign companies, the Company's business and future earnings could be negatively affected.

16

PRC Legal System and Enforcement

Most of the material agreements to which the Company or its affiliates are party or will be party in the future with respect to mining assets in the PRC are expected to be governed by Chinese law and some may be with Chinese governmental entities. The PRC legal system embodies uncertainties that could limit the legal protection available to the Company and its shareholders. The outcome of any litigation may be more uncertain than usual because: (i) the experience of the PRC judiciary is relatively limited, and (ii) the interpretation of PRC laws may be subject to policy changes reflecting domestic political changes. The laws that do exist are relatively recent and their interpretation and enforcement involve uncertainties, which could limit the available legal protections. Even where adequate law exists in the PRC, it may be impossible to obtain swift and equitable enforcement of such law or to obtain enforcement of judgments by a court of another jurisdiction. The i nability to enforce or obtain a remedy under such agreements would have a material adverse impact on the Company.

Many tax rules are not published in the PRC, and those that are published can be ambiguous and contradictory, leaving a considerable amount of discretion to local tax authorities. PRC currently offers tax and other preferential incentives to encourage foreign investment. However, the tax regime of the PRC is undergoing review and there is no assurance that such tax and other incentives will continue to be available. There is also no guarantee that the pursuit of economic reforms by the State will be consistent or effective and as a result, changes in the rate or method of taxation, reduction in tariff protection and other import restrictions, and changes in state policies affecting the mining industry may have a negative effect on its operating results and financial condition.

Environmental Considerations

Although the PRC has enacted environmental protection legislation to regulate the mining industry, due to the very short history of this legislation, national and local environmental protection standards are still in the process of being formulated and implemented. The legislation provides for penalties and other liabilities for the violation of such standards and establishes, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are being or have been conducted. The Company believes that there are no outstanding notices, orders or directives from central or local environmental protection agencies or local government authorities alleging any breach of national or local environmental quality standards by Minco China, GGB, the 757 Team or any other party in respect of the Company's properties in China. Although the Company intends to fully comply with all environmental regulations, there is a risk that permis sion to conduct exploration and development activities could be withdrawn temporarily or permanently where there is evidence of serious breaches of such standards.

17

Reliability of Information

While the information contained herein regarding the PRC has been obtained from a variety of sources, including government and private publications, independent verification of this information is not available and there can be no assurance that the sources from which it is taken or on which it is based are wholly reliable.

Ownership and Regulation of Mineral Resources is subject to extensive government regulation

Ownership of land in China remains with the State, and governments at the national, regional and local levels, are extensively involved in the regulation of exploration and mining activities. Transfers of exploration and mining rights are also subject to governmental approval. Failure or delays in obtaining necessary approvals could have a materially adverse affect on the financial condition and results of operations of the Company. Nearly all mining projects in the PRC require government approval. There can be no certainty that any such approvals will be granted (directly or indirectly) to Minco China in a timely manner, or at all.

ITEM 4.

INFORMATION ON THE COMPANY

Cautionary Note to U.S. Investors

We describe our properties utilizing mining terminology such as "measured resources" and "indicated resources" that are required by Canadian regulations but are not recognized by the SEC. U.S. investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into reserves.

A.

HISTORY AND DEVELOPMENT OF THE COMPANY

The Company is a British Columbia corporation whose common shares trade on the Toronto Stock Exchange (“TSX”) under the trading symbol MMM. The Company's common shares were also listed in the United Stated on the Over the Counter (“OTC”) market under the symbol MMAXF. On November 11, 2005 the Company received listing approval from NYSE Amex Equities (“AMEX”). The Company began trading on the AMEX on November 22, 2005 with its trading symbol on the AMEX as “MMK”. On February 1, 2006 the Company began trading its shares on the TSX and AMEX under its new name Minco Gold Corporation. The symbol on the TSX remains unchanged and the new symbol on the AMEX is now MGH. On May 9, 2007 the Company began trading on the Frankfurt Stock Exchange under the ticket symbol MI5 and the German securities code is (WKN) A0MKB6.

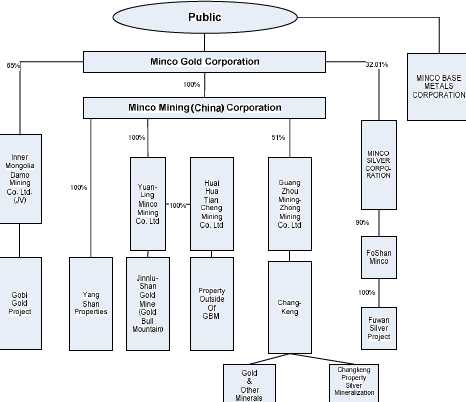

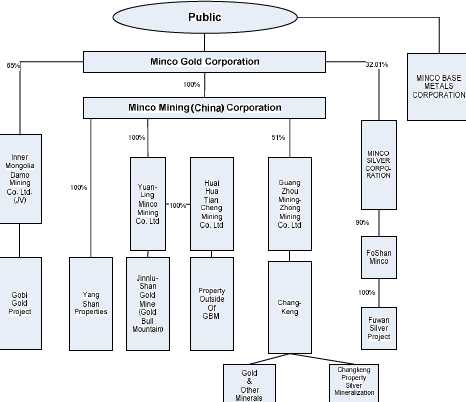

The Company was incorporated under the laws of the Province of British Columbia on November 5, 1982, under the name “Caprock Energy Ltd.” On September 14, 1989 Caprock Energy Ltd. changed its name to Consolidated Caprock Resources Ltd. On February 8, 1993 Consolidated Caprock Resources Ltd. changed its name to Minco Mining & Metals Corporation. On January 29, 2007 the Company changed its name to Minco Gold Corporation. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada,V6E 2E9, telephone 604-688-8002. Through joint ventures with Chinese governmental entities, and others, the Company is engaged in the acquisition, exploration and development of precious and base metal mineral projects in the People's Republic of China. The Company has subsidiaries which are also engaged in the acquisition and exploration of mineral projects in China. See Item 4. C - "Organizational Structure." The Company has no affiliation with 3M Corporation, which company's trading symbol in the United States is MMM.

At present, all of the Company's properties are in the exploration stage and further exploration will be required before final evaluations as to the economic and legal feasibility can be determined. None of the Company's properties has a known body of commercial ore, nor are any such properties at the commercial development or production stage. No assurance can be given that commercially viable mineral deposits exist on any of the Company's properties. Further, the Company's interest in joint ventures, which own properties, will be subject to dilution if the Company fails to expend further funds on the projects. The Company has not generated cash flows from operations. These facts increase the uncertainty and risks faced by investors in the Company. For more information see Item 3. D. - "Risk Factors."

18

On November 15, 2008 the Company completed its intended Plan of Arrangement and spun off the White Silver Mountain Project to Minco Base Metals Corporation (“Minco Base Metals”) with the intention to build a strong base metals company. The Plan of Arrangement resulted in the shareholders of the Company receiving one common share of Minco Base Metals for every five common share of the Company held on the record date, which was November 15, 2007. The Company now holds no shares of Minco Base Metals.

The Company believes that separating its assets into two companies, with Shareholders holding proportionate interests in each company provides a significant opportunity to increase overall shareholder value, with increased flexibility to utilize and exploit their respective assets.

B.

BUSINESS OVERVIEW

Background

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards. U.S. investors in particular are advised to read carefully the definitions of these terms as well as the explanatory and cautionary notes in the Glossary, and the cautionary notes below, regarding use of these terms.

The Company is engaged in the exploration and acquisition of gold properties in China. The Company is an exploration stage company and none of the properties are currently beyond the advanced exploration stage. There is no assurance that a commercially viable mineral deposit exists on any of our properties and further exploration work may be required before a final evaluation as to the economic and legal feasibility is determined. For further information, see Item 3.D – “Risk Factors”. Since the signing of the Company's first co-operation agreement on the Chapuzi Project in China in 1995, the Company has been active in mineral exploration and property evaluations in China. The Company intends, through its subsidiaries, to build a portfolio of precious metal properties in China.

The Company currently holds interest in a number of sino-foreign co-operative joint ventures with Chinese mining organizations, holding mineral rights in China, located in Inner Mongolia, Guangdong, Hunan and Gansu provinces. The Company spun-out its Silver and Base Metals properties to Minco Silver Corporation and Minco Base Metals Corporation respectively and retains its gold projects (Gobi Gold, Gold Bull Mountain, Longnan, and Changkeng). The equity markets for junior mineral exploration companies are unpredictable. The Company also entered into cost sharing arrangements through joint venture agreements. While management believes that the quality of the concessions now held by the Company will attract joint venture partners in the short-term and medium-term, there is no guarantee that the terms would be as favorable as management would like. For detailed property descriptions please refer to section D – “Description of Property&# 148;.

Financial (Canadian GAAP)

Year Ended December 31, 2009

In 2009, the Company used cash of $2,003,349 to support operating activities compared to $10,655,802 in 2008. The net loss from continuing operations in 2009 was $756,504. In order to reconcile the loss to cash flows, it is necessary to eliminate non-cash expenses, such as amortization of $190,111, stock-based compensation of $750,510, an unrecognized gain on marketable securities of $23,100, equity loss on investment in Minco Silver of $1,659,280 and a dilution gain of $3,479,000. It's also necessary to consider cash used or generated by non-cash working capital items. In aggregate, non-cash working capital cash of $664,147 was used. Cash flow generated by discontinued operations in 2009 was $319,502 compared to $169,430 in 2008.

19

In 2009, the Company generated cash of $4,479,067 from financing activities, compared to $2,927,676 in 2008. The 2009 financing consists primarily of issuance of common shares in Minco Gold through a private placement of 5,000,000 shares in October 2009 with the balance generated from the exercise of stock options. Cash flows from the financing activities of discontinued operations were $Nil in 2009 (2008: $213,942).

In 2009, the Company used cash of $1,571,213 to support investing activities compared to generating $8,847,319 from investing activities in 2008. The 2009 cash used in investing activities consists of the purchase of $1,553,377 in short-term investments and the acquisition of new equipment for $62,707. Cash flows from investing activities of discontinued operations were $44,871 (2008: $288).

Year Ended December 31, 2008

In 2008, the Company used cash of $10,655,802 to support operating activities compared to $4,882,736 in 2007. The net loss from continuing operations in 2008 was $14,117,717. In order to reconcile the loss to cash flows, it is necessary to eliminate non-cash expenses, such as amortization of $95,905, stock-based compensation of $1,242,953, write down of mineral interest of $358,500 and equity loss on investment in Minco Silver of $948,750. In addition, certain other operating items did not generate cash including a dilution gain of $1,544,454, the write down of short-term investments of $75,600, the gain on the sale of exploration permit of $425,632 and foreign exchange loss of $1,015,022. It's also necessary to consider cash used or generated by non-cash working capital items. In aggregate, non-cash working capital generated cash of $1,525,841. Cash flow generated by discontinued operations in 2008 was $169,430 compared to $618,515 in 2007.

In 2008, the Company generated cash of $2,927,676 from financing activities, compared to $573,485 in 2007. The 2008 financing consists of issuance of common shares in Minco Gold through the exercise of stock options, which generated $46,439, and the increase in loan payable of $2,667,295. Cash flow generated from financing activities of discontinued operations was $213,942 in 2008 compared to $99,325 in 2007.

In 2008, the Company generated cash of $8,847,031 from investing activities compared to generating $5,885,151 from investing activities in 2007. The 2009 cash used in investing activities consists primarily of the sale of $5,138,285 in short-term investments and the receipt of amounts due from Minco Silver of $3,393,506. Cash flows from the investing activities of discontinued operations were insignificant in 2008 compared to cash used of $40,699 on 2007.

Year Ended December 31, 2007

In 2007, the Company used cash of $4,882,736 to support operating activities compared to $5,176,195 in 2006. The net loss in 2007 was $7,540,635. In order to reconcile the loss to cash flows, it is necessary to eliminate non-cash expenses, such as amortization of $52,588, stock-based compensation of $2,022,850, a gain on sale of Minco Silver shares of $2,978,034 and equity loss on investment in Minco Silver of $3,239,898. In addition, certain other operating items did not generate cash including a dilution gain of $191,000, write down of short-term investments of $232,546 and the minority non-controlling interest in the loss of $761,770. It's also necessary to consider cash used or generated by non-cash working capital items. In aggregate, non-cash working capital generated cash of $807,206. Cash flow generated from discontinued operations in 2007 was $618,515 compared to $NIL cash in 2006.

In 2007, the Company generated cash of $573,485 from financing activities, compared to $4,940,333 in 2006. The 2007 financing included issuance of common shares in Minco Gold through the exercise of stock options, which generated $105,808, the contribution of cash from non-controlling interests of $412,803, offset by the cost of a share buyback program of $44,451.

In 2007, the Company generated cash of $5,844,452 from investing activities compared to using cash of $176,704 in 2006. The 2007 cash used in investing activities consists primarily of the sale of $4,745,616 in short-term investments and the sale of shares of Minco Silver of $3,248,416 offset by advances made to Minco Silver in the amount of $1,903,602.

20

Agreements

The Fuwan Joint Venture

On August 20, 2004, the Company, Minco Silver, Minco China and Minco BVI entered into an assignment agreement (the “Assignment Agreement”) whereby Minco Gold, Minco BVI and Minco China assigned to Minco Silver their respective interests in each of the following:

a)

the preliminary Fuwan Joint Venture agreement dated April 16, 2004 and amended August 18, 2004 between Minco BVI and GGB;

b)

the right to earn the 51% interest in the silver mineralization to be acquired by Minco Gold pursuant to the Changkeng JV Agreement; and

c)

certain additional exploration permits identified by and to be acquired by Minco China, namely the Additional Permits.

In consideration for the assignment of the foregoing interests, Minco Silver issued 14,000,000 common shares to the Company.

The Company holds 13,000,000 common shares of Minco Silver which, as of December 31, 2009, represents an ownership interest of 32.01% of Minco Silver. During December 2007, the Company sold 1,000,000 common shares of Minco Silver at a gross price of $3.25 per share. This transaction resulted in a gain of $2,978,034.

The Changkeng Joint Venture

On April 16, 2004, Minco Gold, GGB, Zhenjie and Baojiang entered into a preliminary joint venture agreement to explore and develop the mineral property underlying the Changkeng Permit. The target mineral on the Changkeng Property is gold but the property is known to also contain silver mineralization.

On August 20, 2004, Minco Silver, Minco Gold, Minco China and Minco BVI entered into the Assignment Agreement whereby Minco Gold, Minco BVI and Minco China assigned to Minco Silver their respective interests in, among other things noted above, Minco Gold's right to earn up to a 51% interest in the Changkeng Property's silver mineralization pursuant to the Preliminary Changkeng JV Agreement.

The Preliminary Changkeng JV Agreement was superseded by a formal joint venture agreement dated September 28, 2004 made among the original four parties to the preliminary joint venture agreement and a fifth company, GD Gold. The Changkeng JV Agreement provides for the establishment of a Sino-foreign joint venture with limited liability to be named Guangdong Minco-Jinli Mining Co., Ltd. (the “Changkeng JV”) to explore and develop non-ferrous and precious metals resources. The Changkeng JV Agreement provides that the total investment of the Changkeng JV (the “Changkeng Total Investment”) will be 100 million RMB and that the registered capital of the Changkeng JV will be 50 million RMB.

On February 8, 2007, Minco China replaced Minco Gold as the controlling shareholder in Mingzhong by signing a joint venture agreement with the JV partners to form Guangzhou Mingzhong Mining Co., Ltd (“Mingzhong”); GD Gold chose not to participate in the new agreement. This agreement superseded the previous JV agreement on September 28, 2004. The contribution proportions of the parties to the Changkeng JV Agreement are as follows: Minco China - 51%; GGB 21%; Zhenjie - 18%; Baojiang - 10%. A business license was granted in 2007 to Mingzhong, a co-operative joint venture established among Minco China, GGB, and two private Chinese companies to jointly explore and develop the Changkeng Property.

On November 28, 2009, all the shareholders of Mingzhong signed a shareholder solution, and the contribution proportions of the parties to the Changkeng JV Agreement are as follows: Minco China - 51%; GGB - 5.7%; Zhenjie - 18%; Baojiang - 10%; GD Gold - 2%; 757 Team – 13.3%.

21

Under the terms of the agreement, Minco China had the right to earn a 51% equity interest in Mingzhong with a total contribution of RMB 51 million (approx. US $7.1 million). The other shareholders will contribute RMB 49 million (approx. US $6.8 million) for their 49% equity interest in Mingzhong.

The original Changkeng Permit has been renewed each year since 2004 and is currently in good standing until September 10, 2011.

Mingzhong has signed a purchase agreement to buy a 100% interest in the Changkeng Exploration Permit on the Changkeng Property from the 757 Team. The total purchase price (the “Purchase Price”) is RMB 49 million (approx. US $6.8 million), payable in three instalments within two years. The Ministry of Lands and Resources has approved the Purchase Price and the transfer of the Changkeng Exploration Permit from 757 Team to Mingzhong. The first instalment of RMB 19 million was made in December 2008.

The Silver Standard Agreement

The Company, Minco Gold and Silver Standard Resources Inc. (“Silver Standard”) entered into a strategic alliance agreement dated October 4, 2004 (the “Silver Standard Agreement”) for the purpose of jointly investigating and acquiring silver dominant properties in China. The Silver Standard Agreement also obligated Minco Gold and Silver Standard, as shareholders of Minco Silver, to voting their shares jointly to elect directors and provides Silver Standard the right to participated in future financings to maintain its interest in Minco Silver. On March 4, 2009 by the mutual agreement of Minco Silver, Minco Gold and Silver Standard terminated the Silver Standard Agreement. Silver Standard subsequently sold 100% of its shares in Minco Silver. As the date of this Annual Information Form the Silver Standard Agreement has no force or effect.

BACKGROUND TO MINING IN CHINA

Gold has been produced in China for over 4,000 years. In the past ten years China has grown into the world's fourth largest gold producer. In 2003, gold production was over 200 tonnes. It is presumed that early Chinese production was from placer deposits, and placer reserves still account for over 15% of China's total gold production. The primary gold producing provinces in China are Shandong, Henan, Hebei, Shaanxi, Heilongjiang, Liaoning and Inner Mongolia. In 2003, there were 800 gold mines in China with stable production capacity of 150 tonnes per year.

The Chinese mining industry has traditionally been closed to foreign participation. However, a change in the mineral resources law implemented by China's central government permits foreign participation. The regulation of mining, including gold mining, in China is in a state of evolution from a totally planned, state-controlled condition to free market conditions, as experienced in developed and most developing countries. The Ministry of Lands and Mineral Resources (“MLR”) administers geological exploration and also carries out exploration through its own personnel. The following is a general description of China's foreign investment in China and the history of gold mining therein.

General Background

China is the world's fourth-largest country, after Russia, Canada and the United States, with an area of over 9,596,960 square kilometers and the population of China is estimated at approximately 1.3 billion people. Industry is the most important sector of the economy of the China, accounting for 48.6 percent of its gross domestic product (“GDP”) in 2008. The mining industry accounted for an estimated 5.3 percent of the national industrial output in 2008. Services accounted for 40.5 percent and agriculture accounted for the remaining 10.9 percent of GDP in 2008. In 2008, agriculture accounted for 39.5 percent of employment, while industry employed 27.2 percent and services 33.2 percent. Since 1978, China has been moving from a planned economy to a more open, market-oriented system, with the result that the economic influence of privately owned enterprises and foreign investors has been steadily increasing. The result of this ec onomic development has been the quadrupling of GDP since 1978.

Agricultural output doubled in the 1980s, and industry has posted major gains, especially in coastal provinces, where foreign investment has helped spur output of both domestic and export goods. Growth has not been without setbacks, as issues such as inflation, excessive capital investment, inefficient state owned enterprises and banks, and deterioration in the environment have periodically caused the State to backtrack, re-tightening central controls from time to time.

22

The Chinese legal system is comprised of written statutes and the interpretation of these statutes by the People's Supreme Court. TheGeneral Principles of the Civil Law of the PRChas been in effect since January 1, 1987. Continuing efforts are being made to improve civil, administrative, criminal and commercial law especially since China's accession into the WTO. This includes the development of laws governing foreign investment in China, including a regime for Sino-foreign co-operative joint ventures and increased foreign participation in mineral resource exploration and mining.

Foreign Investment

Direct foreign investment in China usually takes the form of equity joint ventures (“EJVs”), co-operative joint ventures (“CJVs”) and wholly foreign-owned enterprises (“WFOEs”). These investment vehicles are collectively referred to as foreign investment enterprises (“FIEs”).

An EJV is a Chinese legal person and consists of at least one foreign party and at least one Chinese party. The EJV generally takes the form of a limited liability company. It is required to have a registered capital to which each party to the EJV subscribes. Each party to the EJV is liable to the EJV up to the amount of the registered capital subscribed by it. The profits, losses and risks of the EJV are shared by the parties in proportion to their respective contributions to the registered capital. There are also rules and regulations governing specific aspects of EJVs or FIEs, including capital contribution requirements, debt-equity ratio, foreign exchange control, labour management, land use and taxation. Unlike an EJV, a CJV may be, but need not be, incorporated as a separate legal entity. The relationship between the parties is contractual in nature. The rights, liabilities and obligations of the parties are governed by the CJV contract, as is each party's share of the goods produced or profits generated. A CJV is considered a legal person with limited liability if it is incorporated as a separate legal entity.

The establishment of FIEs requires the approval of various Chinese government authorities. Generally, the approval authority is determined on the basis of the total amount of investment involved and the location of the project in question. The State Council must approve restricted foreign invested projects having an investment of US$100 million or more, encouraged and permitted foreign investment projects having an investment of US$500 million or more. Subject to the above, the State Development and Reform Commission and the Ministry of Commerce are authorized by the State Council to approve foreign investment projects under restricted catalogue having an investment of US$50 million or more, and foreign investment projects under the encouraged or permitted catalogue having an investment of US$100 million or more. Provincial authorities are authorized to approve projects less than the above thresholds under various catalogues. However, companies which conduct ex ploration or mining will be required to obtain the approval of the Ministry of Commerce as required by doc. 70 issued by the State of Council in 2000.

Co-operative Joint Ventures

Co-operative joint ventures (“CJVs”) are a form of foreign direct investment in China and are governed by theLaw of the PRC on Sino-foreign Co-operative Joint Ventures(implemented in 1988 and revised in 2000) and thePRC Sino-foreign Co-operative Joint Venture Law Implementing Rules (implemented in 1995) (collectively the “CJV Law”). Foreign investment in mining in China may also take the form of Sino-foreign equity joint ventures or wholly foreign owned enterprises. The CJV Law permits a CJV to choose to operate as a “legal person” by forming a limited liability company, subject to approval by relevant governmental authorities. In that case, the limited liability company owns all of the CJV's assets, and the liabilities of the investor are limited as provided in the co-operative joint venture contract entered into between them. The CJV Law requires investors in a CJV to make an investment or other contr ibution, which may take the form of cash, material, technology, land use rights, or other property rights. Investors must satisfy their contribution obligations within the time frame prescribed by their joint venture contract subject to applicable PRC regulations. Failure to satisfy contribution obligations by investors may lead to penalty and even to the business license being revoked by the governmental authorities. Profits of a CJV are distributed as agreed by investors in the CJV contract and distributions need not be proportionate to each investor's contributions. The CJV contract also determines how liquidation proceeds are to be distributed when the CJV contract is terminated.

23

Ownership and Regulation of Mineral Resources

Exploration for and exploitation of mineral resources in China is governed by theMineral Resources Law of the PRC of 1986, amended effective January 1, 1997, and theImplementation Rules for the Mineral Resources Law of the PRC, effective March 26, 1994. In order to further implement these laws, on February 12, 1998, the State Council issued three sets of regulations: (i)Regulation for Registering to Explore Mineral Resources Using the Block System, (ii)Regulation for Registering to Mine Mineral Resources, and (iii)Regulation for Transferring Exploration and Mining Rights (together with the mineral resources law and implementation rules being referred to herein as the “Mineral Resources Law”). Under the Mineral Resources Law, the Ministry of Land and Resources (“MOLAR”) is charged with supervision nationwide of mineral resources prospecting and development.