UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 20F

| T | ANNUAL REPORT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| £ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011 |

OR

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| £ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report: Not Applicable

For the transition period from _________________________________to______________________________

Commission File Number 001-32670

MINCO GOLD CORPORATION

(Exact name of registrant as specified in its charter)

A CORPORATION FORMED UNDER THE LAWS OF BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, V6E 3P3

(Address of principal executive offices)

Jennifer Trevitt, (604) 688-8002 Ext. 107 , (604) 688-8030, Suite 2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, B6E 3P3

(Name, Telephone, Facsimile number and/or E-mail, and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Common Shares | NYSE Amex Equities |

| Title of each class | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares, no par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 50,348,215 common shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes £ No T

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes £ No T

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes T No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “Accelerated filer and large accelerated file” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer: £ | Accelerated file: £ | Non-accelerated filer: T |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP £ | International Financial Reporting Standards as issued | Other £ |

| | By the International Accounting Standards Board T | |

If “other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

£ Item 17 £ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No T

| TABLE OF CONTENTS |

| | | |

| INTRODUCTION AND USE OF CERTAIN TERMS | 1 |

| FORWARD-LOOKING STATEMENTS 1 |

| GLOSSARY OF TERMS | 1 |

| PART 1 | | 6 |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 6 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 6 |

| ITEM 3. | KEY INFORMATION | 7 |

| ITEM 4. | INFORMATION ON THE COMPANY | 15 |

| ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 38 |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 45 |

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 54 |

| ITEM 8. | FINANCIAL INFORMATION | 57 |

| ITEM 9. | THE OFFER AND LISTING | 57 |

| ITEM 10. | ADDITIONAL INFORMATION | 58 |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 67 |

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 69 |

| | |

| PART II | 69 |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 69 |

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDER AND USE OF PROCEEDS | 69 |

| ITEM 15. | CONTROLS AND PROCEDURES | 69 |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | 70 |

| ITEM 16B. | CODE OF ETHICS - BOARD OF DIRECTORS AND OFFICERS | 70 |

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 71 |

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS | 71 |

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATE PURCHASERS | 71 |

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | 71 |

| ITEM 16G. | CORPORATE GOVERNANCE | 71 |

| ITEM 16H. | MINE SAFETY | 71 |

| | |

| PART III | 72 |

| ITEM 17. | FINANCIAL STATEMENTS | 72 |

| ITEM 18. | FINANCIAL STATEMENTS | 72 |

| ITEM 19. | EXHIBITS | 73 |

INTRODUCTION AND USE OF CERTAIN TERMS

Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”) is incorporated under the laws of the province of British Columbia, Canada. In this document, the term “Company” refers to Minco Gold Corporation and its consolidated subsidiaries. Where required, the term “Minco Gold” refers to Minco Gold Corporation as a standalone entity. The Company’s consolidated financial statements are prepared in accordance with International Financial Reporting Standards as issued by International Accounting Standards Board ("IFRS") and are presented in Canadian dollars. Unless otherwise indicated, references to dollar amounts in this Annual Report relate to Canadian dollars. Minco Gold Corporation files reports and other information with the Securities and Exchange Commission ("SEC") located at 100 F St. NE, Washington, D.C. 20549. Copies of the Company’s filings with the SEC may be obtained by accessing the SEC’s website located at www.sec.gov. Further, the Company also files reports under Canadian regulatory requirements on SEDAR. Copies of the Company’s reports filed on SEDAR can be obtained by accessing SEDAR’s website at www.sedar.com. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, V6E 3P3, Tel: 604-688-8002, Fax: 604-688-8030, email address info@mincomining.ca and website www.mincomining.ca.

FORWARD-LOOKING STATEMENTS

This document contains certain forward-looking information and statements, including statements relating to matters that are not historical facts and statements of our beliefs, intentions and expectations about developments, results and events which will or may occur in the future, which constitute "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995, collectively referred to as "forward-looking statements". Forward-looking statements are typically identified by words such as "anticipate", "could", "should", "expect", "seek", "may", "intend", "likely", "will", "plan", "estimate", "believe" and similar expressions suggesting future outcomes or statements regarding an outlook. Such statements are subject to risks and uncertainties that could cause the Company’s actual results and financial position to differ materially from those anticipated in forward looking statements. These risk factors include, but are not limited to, the fact that the Company is in the exploration stage, will need additional financing to develop its properties and will be subject to certain risks since its prospects are located in China, all of which factors are set forth in more detail in the section entitled “Risk Factors” in Item 3.D. and “Operating and Financial Review and Prospects” at Item 5.

GLOSSARY OF TERMS

“757 Team” | means the No. 757 Geo-Exploration Team, an entity owned and controlled by the Guangdong Geological Bureau (“GGB”) of the PRC government. |

“Additional Permits” | means collectively the Guyegang-Sanyatang Permit, the Guanhuatang Permit and the Hecun Permit Property. |

“alteration” | chemical and mineralogical changes in a rock mass resulting from reaction with hydrothermal fluids or changes in pressure and temperature. |

“Amending Contract” | means the contract dated January 10, 2006 between Minco Silver Corporation and GGB. |

“anomalous” | adjective describing a sample, location or area at which either (i) the concentration of an element(s) or (ii) a geophysical measurement is significantly different from (generally higher than) the average background concentrations in an area. Though it may not constitute mineralization, an anomalous sample or area may be used as a guide to the possible location of mineralization. |

“anomaly” | an area defined by one or more anomalous points. |

“antimony” | A trivalent and pentavalent metalloid element that is commonly metallic silvery white, crystalline, and brittle yet rather soft. |

“assay” | an analysis of the contents of metals in mineralized rocks. |

“Au” | Gold. |

“Baojiang” | means Foshan Baojiang Nonferrous Metals Corporation. |

“breccia” | a coarse grained rock composed of large, >2mm angular rock fragments that have been cemented together in a fine grained matrix. |

“Changkeng JV Agreement” | means the formal joint venture agreement dated September 28, 2004 between the Company, GGB, Zhenjie, Baojiang and GD Gold. |

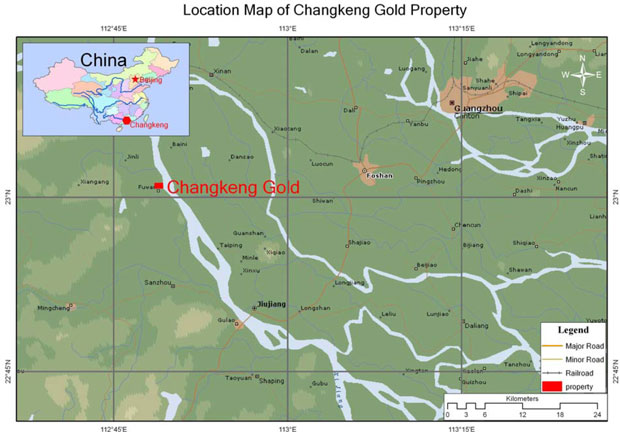

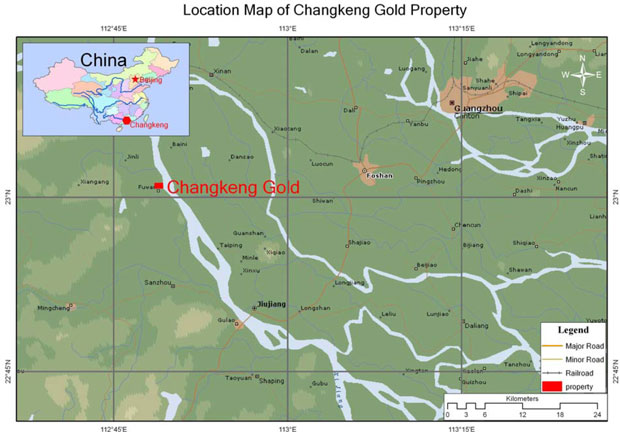

“Changkeng Permit” | means the reconnaissance survey exploration permit (#T01120080102000011) which expires on October 13, 2013 in respect of the 1.18 km2 Changkeng gold property in Gaoyao City of Guangdong Province in southern China. |

“Changkeng Property” | means the 1.18 km2 Changkeng gold property in Gaoyao City of Guangdong Province in southern China which adjoins the property underlying the Fuwan Silver Permit. |

“CIM” | Canadian Institute of Mining, Metallurgy and Petroleum. |

“Company” or “Minco” | means Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”). |

“concentrates” | to separate ore or metal from its containing rock or earth. |

“deposit” | a mineralized body which has been physically delineated by drilling, trenching and/or underground work and may contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures; such a deposit does not qualify as a commercially mineable ore body until final technical, legal and economic factors have been resolved. |

“diamond drill holes” | a drilling method whereby rock is drilled with a diamond impregnated, hollow drilling bit which produces a continuous, in-situ record of the rock mass intersected in the form of solid cylinders of rock which are referred to as core. |

“fault” or “block fault” | a fracture in a rock across which there has been displacement. Block faults are usually steep, and break the earth’s crust into “blocks” that are displaced vertically and/or laterally relative to each other. |

“Fuwan Permits” | means, collectively, the Fuwan Silver Permit and the Additional Permits. |

“Fuwan Property” | means the Fuwan silver property which is located in Guangdong Province in southern China beside the Xijiang River consisting of the following three components: (i) the properties which are the subject of the Fuwan Silver Permit; (ii) the properties which are the subject of the Luoke-Jilinggang Permit and the Guyegang-Sanyatang Permit; (iii) the Guanhuatang permit; and (iv) Minco Gold’s interests in the silver mineralization located on the Changkeng Property. |

“Fuwan Silver Permit” | means the reconnaissance survey exploration permit (# 0100000730293) in respect of the 0.79 km2 Fuwan silver property in Gaomong Region, Foshan City of Guangdong Province issued to Minco China and initially having validity from August 20, 2007 to July 20, 2009. The Fuwan Silver Permit was transferred to Foshan Minco, a subsidiary of Minco Silver, before the permit’s original expiry date in conjunction with the combination of the Fuwan Silver Permit and the “Luoke-Jilinggang Permit” as one permit having validity from July 20, 2011 to July 20, 2013. |

“g/t” | unit of grade expressed in grams/tonne. |

“GD Gold” | means Guangdong Gold Corporation. |

“geophysical” | the use of geophysical instruments and methods to determine subsurface conditions by analysis of such properties as specific gravity, electrical conductivity, and magnetic susceptibility. |

“GGB” | means Guangdong Geological Bureau, an entity owned and controlled by the Guangdong Geological Bureau of the PRC government. |

“gouge” | a thin layer of soft earthy putty-like rock material along the containing wall of a mineral vein. |

“grade” | the amount of valuable mineral in each tone of ore, expressed as ounces per ton or grams per tonne for precious metal and as a percentage by weight for other metals. |

“Guanhuatang Permit” | means the reconnaissance survey exploration permit (#T01120080502000491) in respect of the 37.29 km2 Guanhuatang silver and multi-metals property in Foshan City of Guangdong Province held by Minco China in trust for Foshan Minco. |

“Guyegang-Sanyatang Permit” | means the reconnaissance survey exploration permit (#T01120080402000421) in respect of the 74.74km2 silver and multi-metals property in Gaoming Region, Foshan city of Guangdong Province issued to Minco China in trust for Foshan Minco. |

"Hecun Permit" | means the reconnaissance survey exploration permit (#T01120080402000422) in respect of the 16.96km2 lead-zinc property in Gaoming region, Foshan City of Guangdong province held by Minco China in trust for Foshan Minco. |

“hydrothermal” | of or pertaining to heated water, to the action of heated water, or to the products of the action of heated water. |

“JVs” | means Joint Venture established with Chinese partners. The Company owns controlling interests of over 50% in all JVs in China. Joint Venture as used in reference to “Chinese joint venture”, “co-operative joint venture”, “equity joint venture”, “Sino-foreign co-operative joint venture” does not refer to a joint venture as contemplated by US or Canadian GAAP. The term reflects the nomenclature of the related agreements. |

“limestone” | A sedimentary rock consisting of chiefly >50% calcium carbonate. |

“Luoke-Jilinggang Permit” | means the reconnaissance survey exploration permit (#T01120080402000336) in respect of the 76.62 km2 Luoke-Jilinggang silver and multi-metals property in Gaoyao City and Gaomin City of Guangdong Province issued to Foshan Minco and having validity from July 20, 2011 to July 20, 2013, incorporating the original Fuwan permit and original Luoke-Jilinggang permits) |

“Minco Base Metals” | means Minco Base Metals Corporation |

“Minco BVI” | means Minco Silver Ltd. |

“Minco China” | means Minco Mining (China) Corporation. |

“Minco Gold” | means Minco Gold Corporation (formerly “Minco Mining & Metals Corporation”). |

“Minco Silver” | means Minco Silver Corporation. |

“mineral reserve” | the economically mineable part of a measured mineral resource or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting minerals and allowances for losses that may occur when the material is mined. |

“mineral resource” | a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. |

“mineralization” | the process or processes by which a mineral or minerals are introduced into a rock, resulting in an economically valuable or potentially valuable deposit. |

“MOLAR” | Means the Ministry of Land and Resources |

“outcrop” | an exposure on the surface of the underlying rock. |

“oz” | Troy ounce consisting of 31.1035 grams. |

“Pb” | Lead. |

"PRC" | Means the People's Republic of China. |

“Preliminary Changkeng JV Agreement” | means the preliminary joint venture agreement dated April 16, 2004 between Minco Gold, GGB, Zhenjie and Baojiang. |

“pyrite” | A sulphide mineral of iron and sulphur. |

“Pyroclastic” | refers to a sedimentary rock composed or airborne volcanic material from a volcanic eruption. |

“Qualified Person” | an individual who is an engineer or geoscientist with at least five yeas experience in mineral exploration, mine development, production activities and project assessment, or any combination thereof, including experience relevant to the subject matter of the project or report and is a member in good standing of an approved self-regulating organization. |

“quartz” | A common rock-forming mineral comprised of silicon and oxygen (SiO2). |

“RMB” | means the Chinese currency Renminbi. |

| “sample” | a sample of selected rock chips from within an area of interest. |

“sandstone” | A medium grained clastic sedimentary rock. |

“Sb” | Antimony. |

“Second Confirmation Agreement” | means the confirmation agreement dated August 24, 2006 between Minco Gold, Minco China and Minco Silver. |

“sedimentary rock” | A rock that has been formed by the consolidation of loose sediment that has accumulated in layers. |

“sedimentary” | formed by the deposition of solid fragmented material that originates from weathering of rocks and is transported from a source to a site of disposition. |

“State” | means the central government of China |

“strike” | the direction or trend that a structural surface takes as it intersects the horizontal. |

“sulphide” | a class of minerals commonly combining various elements in varying ratios with sulphur. |

“tonne” | metric unit of weight consisting of 1,000 kilograms. |

“Transfer Confirmation Agreement” | means the confirmation agreement dated November 19, 2004 between 757 Team, GGB and Minco China. |

“Triassic” | the period of geological time from 225 to 195 million years before present. |

“vein” | A tabular mineral deposit formed in or adjacent to faults or fractures by the deposition of minerals from hydrothermal fluids. |

“veinlet” | A small vein; the distinction between vein and veinlet tends to be subjective. |

“volcanic” | pertaining to the activity, structures or rock types of a volcano. |

| “Zhenjie” | means Zhuhai Zhenjie Development Ltd. |

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are Canadian geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards.

In this Annual Report references to “Canadian National Instrument 43-101” are references to National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators and references to “CIM Standards” are references to Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on December 11, 2005 as may be amended from time to time by the CIM.

Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources and Indicated Mineral Resources.

This Annual Report uses the terms “Measured Mineral Resource” and “Indicated Mineral Resource.” We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves.

PART 1

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. DIRECTORS AND SENIOR MANAGEMENT

The following table sets forth as of April 20, 2012, the names, business addresses and functions of the Company’s directors and senior management.

| Name | Business Address | Position |

| Ken Cai | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3 | President, Chief Executive Officer and Director |

Robert M. Callander | 43 Delhi Avenue North York, Ontario, Canada M5M 3B8 | Director |

| Michael Doggett | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3 | Director |

| Malcolm F. Clay | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3 | Director |

| Ellen Wei | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3 | Interim Chief Financial Officer and Controller |

| Ute Koessler | Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3 | Vice President Corporate Communications |

B. ADVISERS

The Company's registrar and transfer agent for its common shares is Computershare Trust Company of Canada, located at 510 Burrard Street, Vancouver, British Columbia, V6C 3B9, Canada, telephone: 604-661-0224, fax: 604-661-9401, internet: www.computershare.com. The principal executive office of the Company is located at Suite #2772, 1055 West Georgia Street, PO Box 11176, Vancouver, British Columbia, Canada, V6E 3P3, Tel: 604-688-8002, Fax: 604-688-8030, email address info@mincomining.ca and website www.mincomining.ca. The Company's legal advisors are Sangra Moller LLP, located at 925 West Georgia Street, Suite 1000, Vancouver, British Columbia, Canada. V6C 3L2

C. AUDITORS

The Company's auditors are PricewaterhouseCoopers, LLP, Chartered Accountants, located at 250 Howe Street, Suite 700, Vancouver, British Columbia, Canada, V6C 3S7.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

NOT APPLICABLE.

ITEM 3. KEY INFORMATION

A. SELECTED FINANCIAL DATA

The following selected financial information for the fiscal years ended December 31, 2011 and 2010 are derived from the financial statements of the Company and should be read in conjunction with the financial statements and the notes attached to this Annual Report. The Company’s financial statements are prepared in accordance with International Financial Reporting Standards as issued by International Accounting Standards Board ("IFRS"). Over the period reviewed, there have been significant differences between IFRS and United States GAAP.

IFRS

| | | December 31, 2011 | | | December 31, 2010 | |

| Operations | | | | | | |

| Finance and other income | | $ | 238,218 | | | $ | 59,709 | |

| Exploration expense | | | 1,963,874 | | | | 1,467,641 | |

| Loss from continuing operations | | | 862,446 | | | | (2,058,649 | ) |

| Net Income (loss) | | | (862,446 | ) | | | (451,348 | ) |

Loss per Common share from continuing operations | | | | | | |

| (basic and diluted) | | $ | 0.02 | | | $ | (0.01 | ) |

| Common shares used in calculations | | | | | | | | |

| Basic | | | 50,228,592 | | | | 48,582,347 | |

| Diluted | | | 51,580,329 | | | | 48,582,347 | |

| | | | | | | | | |

| Consolidated Balance Sheet Data | | | | | | | | |

| Total assets | | | 22,176,773 | | | | 23,700,260 | |

| Total liabilities | | | 7,715,102 | | | | 13,469,839 | |

| Non-controlling interest | | | 2,415,029 | | | | 2,444,005 | |

| Net assets | | | 14,461,671 | | | | 10,230421 | |

| Share capital | | $ | 41,758,037 | | | $ | 40,335,033 | |

| Dividends | | | 0 | | | | 0 | |

Exchange Rates

The following table sets forth information as to the average period end, high and low exchange rate for Canadian dollars and US dollars for the periods indicated based on the exchange rates posted by the Board of Governors of the Federal Reserve System (USD to CAD) in Canadian dollars (USD$1.00 = CAD$ 0.9927 as at March 30, 2012 ).

Year Ended December 31 | | Average | | Period End | | High | | Low |

2011 2010 | | 0.9886 1.0297 | | 1.0168 1.0009 | | 1.0605 1.0776 | | 0.9448 0.9960 |

| 2009 | | 1.1411 | | 1.0461 | | 1.2995 | | 1.0289 |

| 2008 | | 1.0659 | | 1.2240 | | 1.2971 | | 0.9717 |

| 2007 | | 1.0734 | | 0.9818 | | 1.1852 | | 0.9168 |

B. CAPITALIZATION AND INDEBTEDNESS

NOT APPLICABLE.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

NOT APPLICABLE

D. RISK FACTORS

An investment in our securities should be considered highly speculative and involves a high degree of financial risk due to the nature of our activities and the current status of our operations. A prospective investor should carefully consider the risks summarized below and all other information contained in this Annual Report before making an investment decision relating to our shares. Some statements in this Annual Report (including some of the following risk factors) are forward-looking statements. Please refer to the discussion of forward-looking statements in the introduction to this Annual Report. Any one or more of these risks could have a material adverse effect on the value of any investment in our Company and the business, financial position or operating results of our Company and should be taken into account in assessing our activities. The risks noted below do not necessarily comprise all those faced by us.

Risks Relating to the Company

Title to Properties

To the knowledge of the Company, none of its property interests have been surveyed to establish boundaries. There can be no assurance that any governmental authority in the PRC could not significantly alter the conditions of or revoke the applicable exploration or mining authorizations held by the Company or that the Company's interest in such properties will not be challenged or impugned by third parties or governmental authorities.

In addition, there can be no assurance that the properties or other assets in which the Company has an interest are not subject to prior unregistered agreements, transfers, pledges, mortgages or claims and title may be affected by undetected defects as it is difficult to verify that no agreements, transfers, claims, mortgages, pledges or other encumbrances exist given the state of the legal and administrative systems in the PRC.

China Political and Economic Considerations

The business operations of the Company will be located in, and the revenues of the Company derived from activities in the PRC. Likewise, the Company's operations in the PRC are currently conducted through and with the assistance of Minco China, a WFOE. Accordingly, the business, financial condition and results of operations of the Company could be significantly and adversely affected by economic, political and social changes in the PRC. The economy of the PRC has traditionally been a planned economy, subject to five-year and annual plans adopted by the state, which set national economic development goals. Since 1978, the PRC has been moving the economy from a planned economy to a more open, market-oriented system. The economic development of the PRC is following a model of market economy under socialism. Under this direction, it is expected that the PRC will continue to strengthen its economic and trading relationships with foreign countries and that business development in the PRC will follow market forces and the rules of market economics.

However, the Chinese government continues to play a significant role in regulating industry by imposing industrial policies. In addition, there is no guarantee that a major turnover of senior political decision makers will not occur, or that the existing economic policy of the PRC will not be changed. A change in policies by the PRC could adversely affect the Company's interests in China by changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports and sources of supplies, or the expropriation of private enterprises. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permits governing operations and activities of companies engaged in mineral resource exploration and development, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties. Companies with a foreign ownership component operating in the PRC may be required to work within a framework which is different to that imposed on domestic Chinese companies. The Chinese government is opening up opportunities for foreign investment in mining projects and this process is expected to continue. However, if the Chinese government should reverse this trend and impose greater restrictions on foreign companies, the Company's business and future earnings could be negatively affected.

Peoples Republic of China Legal System and Enforcement

Most of the material agreements to which the Company or its affiliates are party or will be party in the future with respect to mining assets in the PRC are expected to be governed by Chinese law and some may be with Chinese governmental entities. The PRC legal system embodies uncertainties that could limit the legal protection available to the Company and its shareholders. The outcome of any litigation may be more uncertain than usual because: (i) the experience of the PRC judiciary is relatively limited, and (ii) the interpretation of PRC laws may be subject to policy changes reflecting domestic political changes. The laws that do exist are relatively recent and their interpretation and enforcement involve uncertainties, which could limit the available legal protections. Even where adequate law exists in the PRC, it may be impossible to obtain swift and equitable enforcement of such law or to obtain enforcement of judgments by a court of another jurisdiction. The inability to enforce or obtain a remedy under such agreements could have a material adverse impact on the Company. Many tax rules are not published in the PRC, and those that are published can be ambiguous and contradictory, leaving a considerable amount of discretion to local tax authorities. The PRC currently offers tax and other preferential incentives to encourage foreign investment. However, the tax regime of the PRC is undergoing review and there is no assurance that such tax and other incentives will continue to be available. There is also no guarantee that the pursuit of economic reforms by the State will be consistent or effective and as a result, changes in the rate or method of taxation, reduction in tariff protection and other import restrictions, and changes in state policies affecting the mining industry may have a negative effect on its operating results and financial condition.

Government Regulation of Mineral Resources and Ownership

Ownership of land in China remains with the States, and the State, at the national, regional and local levels, is extensively involved in the regulation of exploration and mining activities. Transfers and issuances of exploration and mining rights are also subject to governmental approval. Failure or delays in obtaining necessary approvals could have a materially adverse effect on the financial condition and results of operations of the Company. Nearly all mining projects in the PRC require government approval. There can be no certainty that any such approvals will be granted (directly or indirectly) to the Company in a timely manner, or at all.

Exploration and Development is a Speculative Business

Resource exploration and development is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits that, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, the availability of mining equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection, the combination of which factors may result in the Company not receiving an adequate return of investment capital. The long-term profitability of the Company's operations will in part be directly related to the costs and success of its exploration programs, which may be affected by a number of factors. Substantial expenditures are required to establish reserves through drilling and to develop the mining and processing facilities and infrastructure at any site chosen for mining. If our exploration costs are greater than anticipated, we will have fewer funds for our exploration activities and for our general and administrative expenses, which in turn will adversely affect our financial condition and ability to pursue our exploration programs. Although substantial benefits may be derived from the discovery of a major mineralized deposit, no assurance can be given that minerals will be discovered in sufficient quantities to justify commercial operations that commercially viable mineral deposits exist on our properties or that funds required for development can be obtained on a timely basis.

Future Financing

The Company currently has limited financial resources and there is no assurance that additional funding will be available to it for further exploration and development of its projects. There can be no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Joint Venture Agreement

There is no guarantee that Minco Gold and its other joint venture partners will be able to fund the Changkeng joint venture. Mingzhong, the entity that holds the Changkeng Permit, is owned in part by certain state-owned entities which require government approvals before they are able to increase their investment in Mingzhong. It is unclear when these approvals will be forthcoming, if at all.

Industry Specific Risks

The exploration, development, and production of minerals are capital-intensive businesses, subject to the normal risks and capital expenditure requirements associated with mining operations, which even a combination of experience, knowledge and careful evaluation may not be able to overcome.

Operations that we undertake will be subject to hazardous risks incidental to exploration and test mining, including, but not limited to work stoppages, date to property and possible environmental damage. Liabilities resulting from such events may result in us being forced to incur significant costs that could have a material adverse effect on our financial condition and business prospects.

Limited Experience with Development-Stage Mining Operations

The Company has limited experience in placing resource properties into production, and its ability to do so will be dependent upon using the services of appropriately experienced personnel or entering into agreements with other major resource companies that can provide such expertise. There can be no assurance that the Company will have available to it the necessary expertise if the Company places its resource properties into production.

Factors Beyond Company's Control

Discovery, location and development of mineral deposits depend upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The exploration and development of mineral properties and the marketability of any minerals contained in such properties will also be affected by numerous factors beyond the control of the Company. These factors include government regulation, high levels of volatility in market prices, availability of markets, availability of adequate transportation and refining facilities and the imposition of new, or amendments to existing, taxes and royalties. The effect of these factors cannot be accurately predicted.

Potential Conflicts of Interest

Certain members of the Company's board and officers of the Company also serve as officers or directors of other companies involved in natural resource exploration and development. Consequently, there exists the possibility that those directors and officers may be in a position of conflict. In particular, Ken Z. Cai is a director of and serves in management in each of the Company, Minco Silver and Minco Base Metals.

In addition, Ellen Wei serves as Interim Chief Financial Officer and Controller and Jennifer Trevitt serves as Corporate Secretary, respectively, of the Company, Minco Silver and Minco Base Metals. Any decision made by such directors and officers will be made in accordance with their duties and obligations to deal fairly and in good faith with the Company and such other companies. In addition, such directors and officers will declare, and refrain from voting on any matter in which such directors or officers may have a conflict of interest. Nevertheless, there remains the possibility that the best interests of the Company will not be served because its directors and officers have other commitments. Matters between the Company and Minco Silver which put any of the directors or officers of the Company in a position of conflict are approved by the audit committee of the board of directors which is comprised of solely independent directors.

In addition to the potential conflicts described above, some of the directors of the Company are also directors or officers of other reporting and in non-reporting issuers who are engaged in other industry sectors. Accordingly, conflicts of interest may arise which could influence the decisions or actions of directors or officers acting on behalf of the Company.

Scope of Business

In China companies are granted a business license which specifies the scope of activities that they are permitted to undertake. Although Minco China has taken steps to ensure that all of its business activities are within the scope of its business license, there is no assurance that the relevant Chinese authorities will agree with such assessment. If Minco China is determined to have exceeded the scope of its business license it could be subject to penalties or other sanctions.

Uninsured Risks

The Company's mining activities are subject to the risks normally inherent in mineral exploration, including, but not limited to, environmental hazards, industrial accidents, flooding, periodic or seasonal interruptions due to climate and hazardous weather conditions, and unusual or unexpected formations. Such risks could result in damage to or destruction of mineral properties or production facilities, personal injury, environmental damage, delay in mining and possible legal liability. The Company may become subject to liability for pollution and other hazards against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. The payment for such liabilities would reduce the funds available for exploration and mining activities and may have a material impact on the Company's financial position.

Currency Exchange Rates

The Company maintains its accounts Canadian dollars and RMB denominations. Given that most of Minco Gold's expenditures are currently and are anticipated to be incurred in RMB, Minco Gold is subject to foreign currency fluctuations which may affect its financial position and operating results. The Company does not currently have a formal hedging program to mitigate foreign currency exchange risks.

Repatriation of Capital Located in China

The Company may face delays repatriating funds held in China if at any time the Company needs additional resources to enable it to undertake projects elsewhere in the world. There are certain restrictions on the repatriation of funds held in China as more particularly described below.

Under Chinese law, repatriation of funds in China falls under several categories: (1) profit repatriation, (2) capital repatriation, (3) liquidation, and (4) overseas loan repayment. The major requirements for each of the repatriation methods is as follows:

| 1. | Profit repatriation – A WFOE may repatriate its after-tax profits out of China with few restrictions. Minco China is classified as a WFOE. Profit repatriation can only be undertaken once a year. |

| 2. | Capital repatriation – Under Chinese law, capital repatriation can only be made under the following circumstances: |

| (a) | Share/Equity Interest Sale – In the event that a foreign investor, as an assignor, intends to sell its equity interest in the WFOE to any other foreign or domestic entities/individuals, as an assignee, the approval from the original approving authority, such as the local Department of Commerce ("DOC") is required. Such governmental approval for an equity sale is not difficult to obtain in normal circumstances and it would normally take one to two months after all of the required documents have been submitted, subject to local practice. Once the governmental approval is obtained, the assignee is obliged to apply to the local State Administration for Foreign Exchange ("SAFE"), for the approval of mailing the payment of the transfer price to the assignor, which can normally be done within 20 business days after all of the required documents have been submitted. |

| (b) | Capital Decrease – Generally, a WFOE must not decrease its registered capital during its operating term, however, if its registered capital needs to be decreased due to the change of the total investment amount or operation scale or for other reasons, such decrease could be done after approval from the original approval authority has been obtained. The procedures for capital decrease are as follows: |

| (i) | The WFOE would apply to the local DOC for a preliminary approval of a capital decrease; |

| (ii) | After receiving the preliminary reply, the WFOE would notify all of its creditors in writing for such capital decrease and the WFOE would publically disclose such capital decrease in provincial newspapers at least three times; |

| (iii) | The creditors may require the WFOE to pay off all debts or provide corresponding guarantees to pay any outstanding debts; |

| (iv) | After the WFOE has made at least three public notices in provincial newspapers, it would apply to the local DOC for formal approval of the capital decrease; |

| (v) | Once the DOC has approved the decrease of the registered capital, the WFOE would conduct the registration change at the local Administration for Industry and Commerce ("AIC"); and |

| (vi) | Upon completion of the above procedures, if the then contributed capital of the WFOE exceeds the registered capital after the decrease, the WFOE would apply for the capital repatriation approval of the decreased capital to its investor(s) at the local SAFE. Once approval is received, the bank can remit the exceeded capital. |

The above process takes around six months to complete.

| 3. | Liquidation – The investor may also voluntarily liquidate the WFOE in accordance with relevant Chinese law and the articles of association of the WFOE. The procedures for the liquidation of a foreign investment are as follows: |

| (a) | A resolution to liquidate the WFOE is adopted; |

| (b) | The WFOE applies to the local DOC for approval of the liquidation; |

| (c) | The WFOE sets up a liquidation committee to conduct the liquidation; |

| (d) | The notices to creditors and the public announcements about the liquidation must be made; |

| (e) | The liquidation committee would handle the sale of the assets of the WFOE and the distribution of the liquidation proceeds and submit a distribution report to the local DOC; and |

| (f) | The deregistration of the WFOE must be conducted with the local AIC and local tax, customs, foreign exchange and other authorities. |

| (g) | Upon completion of the above procedures, the investor would apply to the local SAFE for repatriation of the liquidated proceeds. Once approval is received, the bank can remit the liquidated proceeds. |

The above process takes approximately six months to complete.

| 4. | Overseas Loan Repayment - Under Chinese law, a WFOE may borrow overseas loans from its investors or other overseas companies or financial institutions, provided that the overseas loan amount shall not exceed the balance between the total investment amount and the registered capital of the WFOE. The procedures for registration and repayment of such overseas loans are as follows: |

| (a) | The WFOE would register the overseas loan with the local SAFE and obtain loan registration certificates issued by the local SAFE; |

| (b) | After registration, the WFOE would open a special foreign exchange cash account with domestic banks to receive the overseas loan; |

| (c) | When the WFOE repays the overseas loan, it would apply to the local SAFE for the repayment approval; and |

| (d) | Upon the issuance of the repayment approval of the local SAFE, the WFOE would submit the overseas loan registration certificate and the repayment approval issued by the local SAFE to the banks and the banks would conduct payment operations through the WFOE's special foreign exchange cash account for the overseas loan or the special foreign exchange cash account for the overseas loan repayment. |

Competition

The precious metal minerals exploration industry and mining business are intensely competitive. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mining properties. Many of these competitors have substantially greater technical and financial resources than the Company. Competition could adversely affect the Company's ability to acquire suitable properties or prospects in the future.

Uncertainty of Estimates

Resource and reserve estimates of minerals are inherently imprecise and depend to some extent on statistical inferences drawn from limited drilling, which may prove unreliable. Although estimated recoveries are based upon test results, actual recovery may vary with different rock types or formations in a way which could adversely affect operations.

Reliance on Management and Directors

The success of the Company is currently largely dependent on the performance of its officers. The loss of the services of these persons will have a materially adverse effect on the Company's business and prospects. There is no assurance the Company can maintain the services of its officers or other qualified personnel required to operate its business.

Failure to do so could have a material adverse effect on the Company and its prospects. The Company has not purchased any "key-man" insurance with respect to any of its directors or officers to the date hereof. The loss of any key officer of the Company could have an adverse impact on the Company, its business and its financial position.

Fluctuating Mineral Prices

Factors beyond the control of the Company may affect the marketability of metals discovered, if any. Metal prices have fluctuated widely, particularly in recent years. The effect of these factors cannot be predicted. Fluctuations in the price of gold may also adversely affect our ability to obtain future financing to fund our planned exploration programs.

The Mining Industry Is Highly Speculative

The Company is engaged in the exploration for minerals which involves a high degree of geological, technical and economic uncertainty because of the inability to predict future mineral prices, as well as the difficulty of determining the extent of a mineral deposit and the feasibility of extracting it without the expenditure of considerable money.

Environmental Considerations

Although the PRC has enacted environmental protection legislation to regulate the mining industry, due to the very short history of this legislation, national and local environmental protection standards are still in the process of being formulated and implemented. The legislation provides for penalties and other liabilities for the violation of such standards and establishes, in certain circumstances, obligations to rehabilitate current and former facilities and locations where operations are being or have been conducted.

Although the Company intends to fully comply with all environmental regulations, there is a risk that permission to conduct exploration and development activities could be withdrawn temporarily or permanently where there is evidence of serious breaches of such standards.

The following risk factors apply to the business of Minco Silver and as such could affect the Company's investment therein:

Permitting Requirements

The ability of Minco Silver to carry out successful mining activities will depend on a number of factors. One of the most critical factors will be the ability of the Company to obtain mining licences and permits in China. Although the Company, through Foshan Minco, has applied for and obtained various permits for the Fuwan Project, additional permits and licenses will also be required in order to put the deposit into commercial production. These include permits and licenses pertaining to environmental matters, land use rights, water and forestry matters and, ultimately, a mining license. While applications for the additional required permits and licences have been, and will be, made by Foshan Minco to the relevant Chinese government authorities, there is no assurance that such permits or licenses will be issued in a timely manner, or at all.

Many of the required licences and permits are, or will be, subject to conditions imposed by the PRC government as well as mining legislation of the PRC. No assurances can be given that all necessary permits, licenses or tenures will be granted to the Company through Foshan Minco, or, if they are granted, that the Company, through Foshan Minco, will be in a position to comply with all conditions and legal requirements that are imposed. For example, the business licenses of Minco China and Foshan Minco restrict the activities that may be carried on by these companies and in particular, Foshan Minco is not permitted under its business license to conduct exploration activities. To date, exploration activities conducted at the Fuwan Project have been conducted by Minco China. As the Fuwan Project is currently at development stage, Foshan Minco, as the operating company, has to obtain mining licence and other permits required for commercial production on the project. There is no certainty that such approvals will be obtained in a timely manner or at all. Furthermore, each of Minco China and Foshan Minco is subject to an annual review process pursuant to which it must pass annual inspections of the Administration for Industry and Commerce in the PRC. As a result, if Foshan Minco does not pass its annual review it will not be authorized to carry on business in the PRC which may adversely affect the Company's interests in the Fuwan Project. The Company believes that it and Minco China and/or Foshan Minco are operating in material compliance with all applicable rules and regulations.

Management of Minco Silver also believe that reasonable measures have been taken to ensure that the permits for the Fuwan Project have been duly approved by and registered with all relevant authorities in the People's Republic of China in accordance with the laws and regulations in effect and that Minco China and Foshan Minco are the registered owners of such permits. However, no legal opinion has been obtained to date concerning the land, assets, permits and licenses relating to the properties over which the Company, through Minco China and Foshan Minco, has or may acquire an interest.

The Luoke-Jilinggang permit held by Foshan Minco, one of the four permits comprising the Fuwan Project, has been renewed until July 20, 2013. The other three permits, the Guanhuatang, Guyegang and Hecun permits held by Minco China, expire on April 7, 2013.

Failure to comply with applicable laws, regulations, and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Capital Costs, Operating Costs and Production and Economic Returns

The capital costs to take the Company's Fuwan Project into production may be significantly higher than estimated in the feasibility study technical report on the Fuwan project (the "Fuwan Technical Report"). The pre-production capital costs set out in the Fuwan Technical Report were estimated at US$73.1 million and pricing and quantity data was considered to be reasonable as at the date of the estimates. Changes in metal prices, exchanges rates and other factors since the date of the Fuwan Technical Report may result in greater costs than those estimated, which may have an adverse impact on the Company's ability and timing to bring the Fuwan Project into production.

The Fuwan Project does not have an operating history upon which the Company can base estimates of future operating costs. Decisions about the development of the Fuwan Project and other mineral properties will ultimately be based upon feasibility studies. Feasibility studies derive estimates of cash operating costs based upon, among other things:

| · | anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed; |

| · | anticipated recovery rates of silver and other metals from the ore; |

| · | cash operating costs of comparable facilities and equipment; and |

| · | anticipated climatic conditions. |

Cash operating costs, production and economic returns, and other estimates contained in studies or estimates prepared by or for the Minco Silver, including the Fuwan Technical Report or other feasibility studies, if prepared, may differ significantly from those anticipated, and there can be no assurance that the Company's actual operating costs will not be higher than currently anticipated.

Future Financing

The funds raised by the public offering completed by Minco Silver in 2011 will not be sufficient to meet all of the its ongoing financial requirements relating to the exploration, development or operation of the Fuwan Project. Although it has received a conditional commitment of a project debt facility in the amount of RMB 300 million (approximately US$44.17 million) from the Guangdong Branch of ICBC for the Fuwan Project, this commitment represents only a portion of the funds required to construct the Fuwan silver mine and the facility is subject to certain conditions including receipt by the Company of the mining license.

Minco Silver currently has limited financial resources and there is no assurance that additional funding will be available to it for further exploration and development of its projects. There can be no assurance that it will be able to obtain adequate financing in the future or that the terms of such financing will be favourable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of its projects with the possible loss of such properties.

Currency Exchange Rates

The Company maintains its accounts in US dollar, Canadian dollar and RMB denominations. The government of the PRC maintained the exchange rate between the RMB and the US dollar as a constant until July 2005 and thus exchange rates between the Canadian dollar and the RMB fluctuated in tandem with the changing exchange rates between the US and Canadian dollars. Since July 2005, the value of the RMB has been tied to a basket of currencies of China's largest trading partners. Given that most of Minco Silver's expenditures are currently and are anticipated to be incurred in U.S. dollars and RMB, Minco Silver is subject to foreign currency fluctuations which may materially affect its financial position and operating results. The Company does not currently have a formal hedging program to mitigate foreign currency exchange risks.

ITEM 4. INFORMATION ON THE COMPANY

Cautionary Note to U.S. Investors

We describe our properties utilizing mining terminology such as "measured resources" and "indicated resources" that are required by Canadian regulations but are not recognized by the SEC. U.S. investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into reserves.

A. HISTORY AND DEVELOPMENT OF THE COMPANY

Name, Address and Incorporation

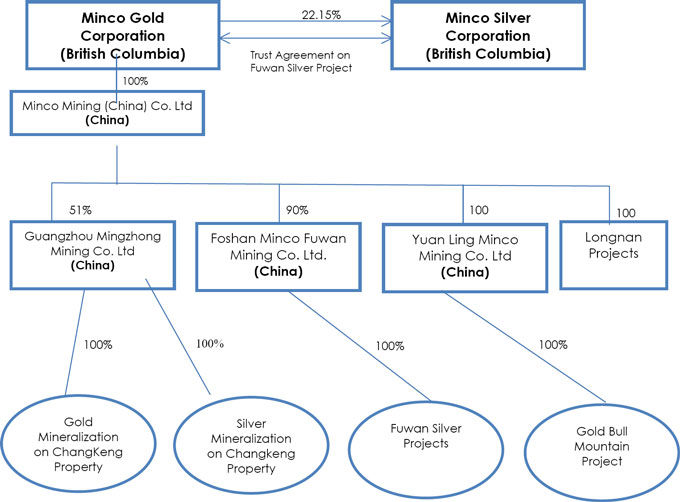

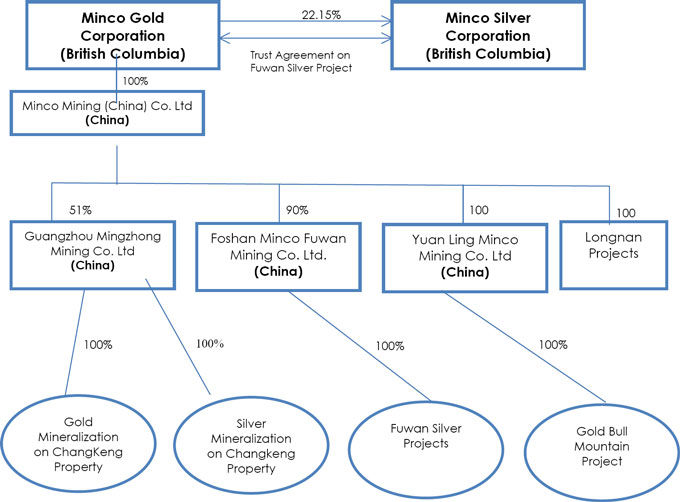

Minco Gold Corporation was incorporated under the Business Corporations Act (British Columbia) on November 5, 1982, under the name "Caprock Energy Ltd." The Company changed its name to Minco Gold Corporation on January 29, 2007. The Company has subsidiaries which are also engaged in the acquisition and exploration of mineral projects in China. See "Organizational Chart"

The principal executive office and registered office of the Company is located at Suite #2772, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 3P3, telephone number 604-688-8002, fax number 604-688-8030 and email address info@mincomining.ca. The Company's shares trade on the Toronto Stock Exchange (the "TSX") under the trading symbol MMM. The Company began trading on the NYSE AMEX on November 22, 2005 with its trading symbol on the AMEX as "MMK". On February 1, 2007 the trading symbol on the AMEX was changed from MMK to MGH.

On November 15, 2008 the Company completed its intended Plan of Arrangement and spun off the White Silver Mountain Project to Minco Base Metals Corporation (“Minco Base Metals”) with the intention to build a strong base metals company. The Plan of Arrangement resulted in the shareholders of the Company receiving one common share of Minco Base Metals for every five common share of the Company held on the record date, which was November 15, 2007. The Company now holds no shares of Minco Base Metals.

The table below breaks out the Corporation's exploration expenditures, by property, over the past two financial years.

| Year ended December 31, | | 2011 IFRS | | | 2010 IFRS | |

| | | $ | | | | $ | | |

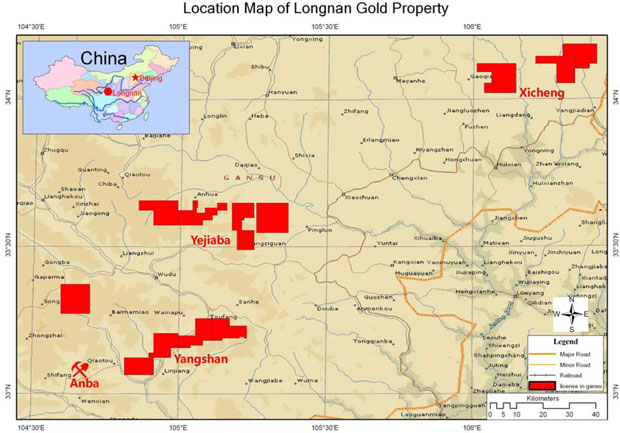

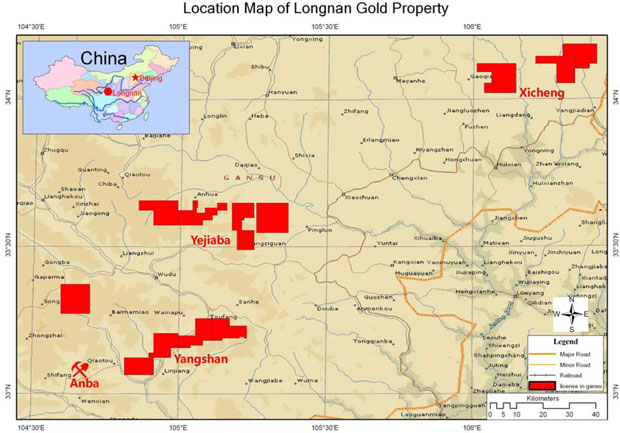

Gansu - Longnan | | | 1,870,486 | | | | 1,330,745 | |

Guangdong - Changkeng | | | 66,522 | | | | 135,727 | |

Hunan - Gold Bull Mountain | | | 26,866 | | | | 1,169 | |

| Total | | | 1,963,874 | | | | 1,467,641 | |

Inter-corporate Relationships

The Company has two significant investments in two companies with current or planned business operations, which were created for the exploration and acquisition of mineral projects in China as described below:

| · | Minco Silver, incorporated on August 20, 2004, under the laws of British Columbia. This company was incorporated to acquire and develop silver projects in China and is currently involved with the development of the Fuwan Silver Property, Guangdong Province, China, described under "Description of Mineral Properties." The Company owns a 22.15% interest in Minco Silver; and |

| · | Minco China, incorporated in China on May 12, 2004, for the purposes of managing the Company's projects in China, enhancing the Company's management team in China, and to expand upon certain mining activities (such as staking) in China. |

B. BUSINESS OVERVIEW

Background

All disclosure about our material exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards. U.S. investors in particular are advised to read carefully the definitions of these terms as well as the explanatory and cautionary notes in the Glossary, and the cautionary notes below, regarding use of these terms.

Three Year History

The Company's business has been focused on exploring its gold projects. As outlined in greater detail below, the focus of the Company's activities over the past three years has been the exploration of its Longnan and the Changkeng Gold Project in China. See "Description of Properties" for more detailed descriptions of these properties.

The Company signed a 30-year joint venture contract with four other Chinese companies for the exploration and development of the Changkeng Gold Project in late 2004. A business license was granted on March 30, 2007 to Mingzhong, a joint venture company established for pursuing the Changkeng Gold Project and a subsidiary of the Company. In January 2009, MOLAR approved the transfer of the Changkeng Exploration Permit from the 757 Exploration Team to Mingzhong. Between late 2007 and the end of 2008, the Company completed a comprehensive exploration program on the Changkeng Gold Project which consisted of the drilling of 66 diamond holes, an extensive hydrological study as well as a geotechnical survey. In March 2009, a resource estimate was prepared by P&E Mining Consultants Inc. ("P&E") for the Changkeng Gold Project utilizing diamond drill data from a total of 127 drill holes and 13 surface trenches. See "Description of Properties – Changkeng Gold Property".

Minco China entered into a Joint Venture Agreement in December 2010 (the "JV Agreement") with the 208 Exploration Team (the "208 Team"), a subsidiary of China National Nuclear Corporation (the "CNNC"), to acquire a 51% equity interest in the Tugurige Gold Project located in Inner Mongolia, China. To secure the project, Minco China provided RMB 60 million (approximately $9 million) in the form of a secured short-term loan to the Tugurige Gold Mine. The loan was repaid on March 25, 2011 in full with interest. As at December 31, 2011, the 208 Team has not complied with certain of its obligations under the JV agreement, including its obligation to set up a new entity (the "JV Co") and transfer its 100% interest in the Tugurige Gold Project to the JV Co. The Company is proactively engaged in resolving this dispute with the 208 Team.

Over the past a few years, the Company reviewed its portfolio of mineral properties and sold several projects, including BYC, Gobi Gold, and Xiaoshan Projects, which are not core holdings with less exploration potential. The Company recovered the exploration costs on those projects with some profits.

In the Longnan region, the 2011 field program commenced at the beginning of March and was focused on Yejiaba sub-project where Minco discovered zones of significant mineralization in 2010. The program resulted in the discovery of the Baimashi gold-antimony zone on the boundary between the Weiziping-Baimashi and Shajinba-Yangjiagou permits, Yejiaba sub-project. In the second half of 2011, the Company completed a drilling program at the Shajinba Zone, Yejiaba sub-project. The program targeted two zones of mineralization: (a) a zone of gold mineralization at the south-east corner of the Shajinba Zone, and (b) a zone of poly-metallic mineralization at the north-west corner of the area. The drill program returned lower gold values than the surface trenching program conducted in 2009 and 2010 but allowed the Company to verify structural interpretation and provided several significant mineralized intersections at depth. A limited trenching program was undertaken at the Shajinba Zone at the end of 2011. Although the program failed to uncover significant anomalies, the Company believes there is high potential for better discoveries on the surface and at depth.

The Company has a significant ownership interest (22.15%) in Minco Silver, a related party engaged in developing the Fuwan Silver Deposit, located in Guangdong Province, China. Minco Silver has made significant progress in permitting on the Fuwan Silver Deposit, including the following:

| · | The Mining Area Permit was approved by MOLAR in 2009. The Mining Area Permit covers approximately 0.79 km2, defines the mining limits of the Fuwan deposit and restricts the use of this land to mining activities. The permit was renewed by MOLAR and expires on April 4, 2014; |

| · | Minco Silver has made significant progress on the Environmental Impact Assessment ("EIA"). New water guidelines (the "Guidelines") issued by the Ministry of Environmental Protection of China, became effective on June 1, 2011, which all applicants for the EIA are subject to. Minco Silver signed an agreement with General Station for Geo-Environmental Monitoring of Guangdong Province to provide a water monitoring study to comply with the Guidelines. The field work for the water monitoring study has been completed and the results will be used to prepare a comprehensive water monitoring report for the project. The revised EIA is expected to be resubmitted to the Chinese Environmental Protection Authority for approval in the first half of 2012; |

| · | The exploration permits for the Fuwan Silver Project were renewed by MOLAR in July 2011, and expires in July 2013; and |

| · | The preliminary mine design, carried out by the Nanching Engineering & Research Institute of Nonferrous Metals ("NERIN"), has been completed. The design is subject to final revision upon the approval of the regulatory EIA before the final report of the design will be released to Minco Silver. |

BACKGROUND TO MINING IN CHINA

General Background

Industry is the most important sector of the economy of the China, accounting for 52.9% of its gross domestic product ("GDP") in 2004. The mining industry accounted for an estimated 6 percent of the national industrial output in 2004. In 2003, the mining industry employed more than 20 million people. Since 1978, China has been moving from a planned economy to a more open, market-oriented system, with the result that the economic influence of privately owned enterprises and foreign investors has been steadily increasing. The result of this economic development has been the quadrupling of GDP since 1978.

Agricultural output doubled in the 1980s, and industry has posted major gains, especially in coastal provinces, where foreign investment has helped spur output of both domestic and export goods. Growth has not been without setbacks, as issues such as inflation, excessive capital investment, inefficient state owned enterprises and banks, and deterioration in the environment have periodically caused the State to backtrack, re-tightening central controls from time to time.

The Chinese legal system is comprised of written statutes and the interpretation of these statutes by the People's Supreme Court. Continuing efforts are being made to improve civil, administrative, criminal and commercial law, especially since China's accession into the WTO. This effort includes the development of laws governing foreign investment in China, including a regime for Sino-foreign cooperative joint ventures and increased foreign participation in mineral resource exploration and mining.

Foreign Investment

Direct foreign investment in China usually takes the form of equity joint ventures ("EJVs"), cooperative joint ventures ("CJVs") and WFOEs. These investment vehicles are collectively referred to as foreign investment enterprises ("FIEs"). An EJV is a Chinese legal person and consists of at least one foreign party and at least one Chinese party. The EJV generally takes the form of a limited liability company. It is required to have registered capital to which each party to the EJV subscribes. Each party to the EJV is liable to the EJV up to the amount of the registered capital subscribed by it.

The profits, losses and risks of the EJV are shared by the parties in proportion to their respective contributions to the registered capital. There are also rules and regulations governing specific aspects of EJVs or FIEs, including capital contribution requirements, debt equity ratio, foreign exchange control, labour management, land use and taxation. Unlike an EJV, a CJV may be, but need not be, incorporated as a separate legal entity. The relationship between the parties is contractual in nature. The rights, liabilities and obligations of the parties are governed by the CJV contract, as is each party's share of the goods produced or profits generated. A CJV is considered a legal person with limited liability if it is incorporated as a separate legal entity.

The establishment of FIEs requires the approval of various Chinese government authorities. Generally, the approval authority is determined on the basis of the total amount of investment involved and the location of the project in question. The State Council must approve restricted foreign invested projects having an investment of US$100 million or more and encouraged and permitted foreign investment projects having an investment of US$500 million or more. Subject to the above, the State Development and Reform Commission and the Ministry of Commerce are authorized by the State Council to approve foreign investment projects under restricted catalogue having an investment of US$50 million or more, and foreign investment projects under the encouraged or permitted catalogue having an investment of US$100 million or more.

Provincial authorities are authorized to approve projects less than the above thresholds under various catalogues. However, companies which conduct exploration or mining are required to obtain the approval of the Ministry of Commerce as required by doc. 70 issued by the State of Council in 2000.

Cooperative Joint Ventures

CJVs are a form of foreign direct investment in China and are governed by the Law of the PRC on Sino-foreign Cooperative Joint Ventures (implemented in 1988 and revised in 2000) and the PRC Sinoforeign Cooperative Joint Venture Law Implementing Rules (implemented in 1995) (collectively the "CJV Law"). Foreign investment in mining in China may also take the form of Sino-foreign equity joint ventures or WFOEs. The CJV Law permits a CJV to choose to operate as a "legal person" by forming a limited liability company, subject to approval by relevant governmental authorities.

A limited liability company would own all of the CJV's assets, and the liabilities of the investor are limited as provided in the CJV contract entered into between them. The CJV Law requires investors in a CJV to make an investment or other contribution, which may take the form of cash, material, technology, land use rights, or other property rights. Investors must satisfy their contribution obligations within the time frame prescribed by their CJV subject to applicable Chinese regulations.

Failure to satisfy contribution obligations by investors may lead to penalties and even to the business license being revoked by the governmental authorities. Profits of a CJV are distributed as agreed by investors in the CJV contract and distributions need not be proportionate to each investor's contributions. The CJV contract also determines how liquidation proceeds are to be distributed when the CJV contract is terminated.

Government Regulations of Mineral Resources and Ownership

Exploration for and exploitation of mineral resources in China are governed by the Mineral Resources Law of the PRC of 1986, amended effective January 1, 1997, and the Implementation Rules for the Mineral Resources Law of the PRC, effective March 26, 1994. In order to further implement these laws, on February 12, 1998, the State Council issued three sets of regulations: (i) Regulation for Registering to Explore Mineral Resources Using the Block System, (ii) Regulation for Registering to Mine Mineral Resources, and (iii) Regulation for Transferring Exploration and Mining Rights (together with the mineral resources law and implementation rules being referred to herein as the "Mineral Resources Law"). Under the Mineral Resources Law, MOLAR is charged with supervision nationwide of mineral resources prospecting and development.

The mineral resources administration authorities of provinces, autonomous regions and municipalities, under the jurisdiction of the State, are charged with supervision of mineral resources prospecting and development in their respective administration areas. The people's governments of provinces, autonomous regions and municipalities, under the jurisdiction of the State, are charged with coordinating the supervision by the mineral resources administration authorities on the same level. The Mineral Resources Law, together with the Constitution of the PRC, provides that mineral resources are owned by the State. The State Council, the highest executive body of the State, regulates mineral resources on behalf of the State. The ownership rights of the State include: (i) occupy, (ii) use, (iii) earn, and (iv) dispose of, mineral resources, regardless of the rights of owners or users of the land under which the mineral resources are located. Therefore, the State is free to authorize third parties to enjoy its rights to legally occupy and use mineral resources and may collect resource taxes and royalties pursuant to its right to earn. In this way, the State can direct and regulate the development and use of the mineral resources of PRC.

Mineral Resources Permits

The Provisions in Guiding Foreign Investment and the Industrial Catalogue in Guiding Foreign Investment, which was updated on April 1, 2002, January 1, 2005 and October 31, 2007 (collectively the "Investment Guiding Regulations") govern foreign investment in PRC and categorize industries into four types where foreign investment is: (i) encouraged, (ii) permitted, (iii) restricted, or (iv) prohibited.

The Provisions in Guiding Foreign Investment and the Industrial Catalogue in Guiding Foreign Investment, which was updated on April 1, 2002, January 1, 2005 and October 31, 2007 (collectively the "Investment Guiding Regulations") govern foreign investment in PRC and categorize industries into four types where foreign investment is: (i) encouraged, (ii) permitted, (iii) restricted, or (iv) prohibited.

In mining industries, "encouraged" projects include the exploration and mining of coal (and its derived resources), iron, manganese, copper and zinc minerals, etc. "Restricted" projects include the exploration and mining of the minerals of tin, antimony and other noble metals including gold and silver, etc. "Prohibited" projects include the exploration and mining of radioactive minerals and rare earth. Foreign investment is "permitted" if the exploration and mining of the minerals is not included in the other three categories. Subject to the Investment Guiding Regulations, foreign investment in the exploration and mining of minerals is generally encouraged, in particular in relation to minerals in the western region of China.

Until January 2000, the production, purchasing, distributing, manufacturing, using, recycling, import and export of silver was strictly regulated by the Regulations of the PRC on the Control of Gold and Silver. Since then, China's silver market has been fully opened and silver is now treated as a commodity not subject to any special control or restrictive regulation by the State. However, foreign investment in the exploration and mining of silver remains restricted. China has adopted, under the Mineral Resources Law, a licensing system for the exploration and exploitation of mineral resources. MOLAR and its authorized provincial or local departments are responsible for approving applications for exploration permits and mining permits. The approval of MOLAR is also required to transfer those rights.