UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE YEAR ENDED DECEMBER 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12317

NATIONAL OILWELL VARCO, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 76-0475815 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

7909 Parkwood Circle Drive, Houston, Texas 77036-6565

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Common Stock, par value $.01 | | New York Stock Exchange |

| (Title of Class) | | (Exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | x | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller Reporting Company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2015 was $18.7 billion. As of February 12, 2016, there were 375,800,956 shares of the Company’s common stock ($0.01 par value) outstanding.

Documents Incorporated by Reference

Portions of the Proxy Statement in connection with the 2016 Annual Meeting of Stockholders are incorporated in Part III of this report.

FORM 10-K

PART I

General

National Oilwell Varco, Inc. (“NOV” or the “Company”), a Delaware corporation incorporated in 1995, is a leading worldwide provider in the design, manufacture and sale of equipment and components used in oil and gas drilling, completion and production operations, and the provision of oilfield services to the upstream oil and gas industry. The Company conducts operations in approximately 835 locations across six continents.

The Company’s principal executive offices are located at 7909 Parkwood Circle Drive, Houston, Texas 77036, its telephone number is (713) 346-7500. Further information about the Company’s products and services can be found on its website at:http://www.nov.com . The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and all amendments thereto, are available free of charge on its Internet website. These reports are posted on the website as soon as reasonably practicable after they are electronically filed with the Securities and Exchange Commission (“SEC”). The Company’s Code of Ethics is also posted on its website.

The Company has a long tradition of pioneering innovations which improve the cost-effectiveness, efficiency, safety and environmental impact of oil and gas operations. The Company’s common stock is traded on the New York Stock Exchange under the symbol “NOV”. The Company operates through four reporting segments: Rig Systems, Rig Aftermarket, Wellbore Technologies and Completion & Production Solutions.

On May 30, 2014, the Company completed the spin-off of its distribution business into an independent public company named NOW Inc., which trades on the New York Stock Exchange under the symbol “DNOW”. After the close of the New York Stock Exchange on May 30, 2014, stockholders of record as of May 22, 2014 (the “Record Date”) received one share of NOW Inc. common stock for every four NOV common shares they held as of the Record Date. No fractional shares of NOW Inc. common stock were distributed. The transfer agent aggregated any fractional shares into whole shares, sold those whole shares in the open market at prevailing rates and distributed the net cash proceeds, after deducting any taxes required to be withheld and brokerage charges and commissions, pro rata to each holder who would otherwise have been entitled to receive fractional shares in the distribution. Our operating segments were realigned upon separation of NOW Inc., and as a result, all prior periods are presented on this basis. Results of operations related to NOW Inc. have been classified as discontinued operations in all periods presented on Form 10-K.

Rig Systems

The Company’s Rig Systems segment makes and supports the capital equipment and integrated systems needed to drill oil and gas wells on land and offshore. The segment designs, manufactures and sells land rigs, offshore drilling equipment packages, including installation and commissioning services, and drilling rig components that mechanize and automate the drilling process and rig functionality.

Equipment and technologies in Rig Systems include: substructures, derricks, and masts; cranes; pipe lifting, racking, rotating, and assembly systems; fluid transfer technologies, such as mud pumps; pressure control equipment, including blowout preventers; power transmission systems, including drives and generators; and rig instrumentation and control systems.

Rig Systems supports land and offshore drillers. Demand for the segment’s products depends on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig construction and refurbishment.

1

Rig Aftermarket

The Company’s Rig Aftermarket segment provides comprehensive aftermarket products and services to support land and offshore rigs, and drilling rig components manufactured by the Company’s Rig Systems segment.

The segment provides spare parts, repair, and rentals as well as technical support, field service and first well support, field engineering, and customer training through a network of aftermarket service and repair facilities strategically located in major areas of drilling operations.

Rig Aftermarket supports land and offshore drillers. Demand for the segment’s products and services depends on overall levels of oilfield drilling activity, which drives demand for spare parts, service, and repair for Rig Systems’ large installed base of equipment; and secondarily on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig refurbishments and re-certifications.

Wellbore Technologies

The Company’s Wellbore Technologies segment designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance, including: solids control and waste management equipment and services; drilling fluids; portable power generation; premium drill pipe; wired pipe; drilling optimization and automation services; tubular inspection, repair and coating services; rope access inspection; instrumentation; measuring and monitoring; downhole and fishing tools; steerable technologies; hole openers; and drill bits.

Wellbore Technologies focuses on oil and gas companies and supports drilling contractors, oilfield service companies, and oilfield equipment rental companies. Demand for the segment’s products and services depends on the level of oilfield drilling activity by oil and gas companies, drilling contractors, and oilfield service companies.

Completion & Production Solutions

The Company’s Completion & Production Solutions segment integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic fracture stimulation, including pressure pumping trucks and pumps, blenders, sanders, hydration units, injection units, flowline, manifolds and wellheads; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; onshore production, including composite pipe, surface transfer and progressive cavity pumps, and artificial lift systems; and, offshore production, including floating production systems and subsea production technologies.

Completion & Production Solutions supports service companies and oil and gas companies. Demand for the segment’s products depends on the level of oilfield completions and workover activity by oilfield service companies and drilling contractors, and capital spending plans by oil and gas companies and oilfield service companies.

The following table sets forth the contribution to our total revenue of our four reporting segments (in millions):

| | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2015 | | | 2014 | | | 2013 | |

Revenue: | | | | | | | | | | | | |

Rig Systems | | $ | 6,964 | | | $ | 9,848 | | | $ | 8,450 | |

Rig Aftermarket | | | 2,515 | | | | 3,222 | | | | 2,692 | |

Wellbore Technologies | | | 3,718 | | | | 5,722 | | | | 5,211 | |

Completion & Production Solutions | | | 3,365 | | | | 4,645 | | | | 4,309 | |

Eliminations | | | (1,805 | ) | | | (1,997 | ) | | | (1,441 | ) |

| | | | | | | | | | | | |

Total Revenue | | $ | 14,757 | | | $ | 21,440 | | | $ | 19,221 | |

| | | | | | | | | | | | |

2

Sales from one segment to another generally are priced at estimated equivalent commercial selling prices; however, segments originating an external sale are credited with the full profit to the Company. Eliminations include intercompany transactions conducted between the four reporting segments that are eliminated in consolidation. Intercompany transactions within each reporting segment are eliminated within each reporting segment.

See Note 15 to our Consolidated Financial Statements included in this Annual Report on Form 10-K for financial information by segment and a geographical breakout of revenues and long-lived assets. We have also included a glossary of oilfield terms at the end of Item 1. “Business” of this Annual Report.

Influence of Oil and Gas Activity Levels on the Company’s Business

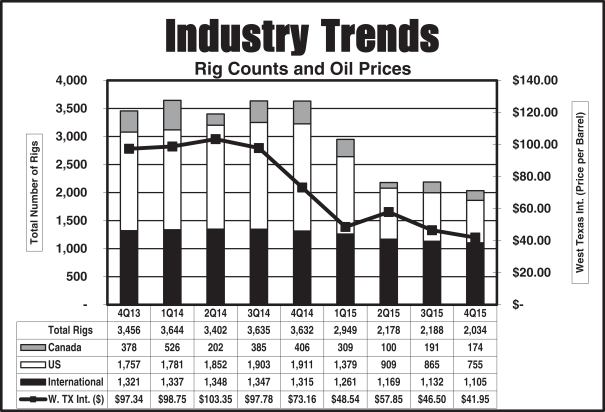

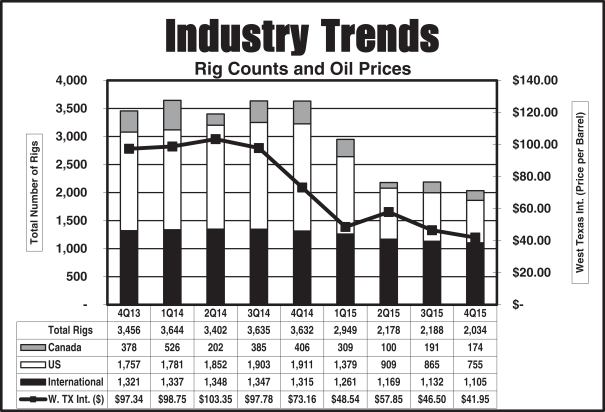

The oil and gas industry has historically experienced significant volatility. Demand for the Company’s products and services depends primarily upon the general level of activity in the oil and gas industry worldwide, including the number of drilling rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions and the level of well remediation activity. Oil and gas activity is in turn heavily influenced by, among other factors, oil and gas prices worldwide. High levels of drilling and well remediation generally spurs demand for the Company’s products and services. Additionally, high levels of oil and gas activity increase cash flows available for oil and gas companies, drilling contractors, oilfield service companies, and manufacturers of oil country tubular goods (“OCTG”) to invest in capital equipment that the Company sells.

In 2010, as the financial crisis of the preceding three years eased and oil prices recovered, order rates began to improve across a broad array of rig equipment, with a particular focus on continued build out of the deepwater fleet. Each year 2011, 2012 and 2013 saw a further improvement in order rates as commodity prices remained at levels supporting sustained capital spending by our customers. Global rig count increased 5% in 2014 compared to 2013, after falling by 3% in 2013 compared to 2012. During the second half of 2014 and through 2015 the global oil and gas industry experienced a cyclical decline causing the Company to experience a decline in new orders. Backlog for Rig Systems at December 31, 2015, 2014 and 2013, was $6.1 billion, $12.5 billion and $15.0 billion, respectively. Backlog for Completion & Production Solutions at December 31, 2015, 2014 and 2013 was $1.0 billion, $1.8 billion and $1.6 billion, respectively.

The willingness of oil and gas operators to make capital investments to explore for and produce oil and natural gas will continue to be influenced by numerous factors over which the Company has no control, including but not limited to: prices for oil and gas; supply and demand for oil and natural gas; the ability or willingness of members of the Organization of Petroleum Exporting Countries (“OPEC”) to maintain oil price stability through voluntary production limits; the level of oil production by non-OPEC countries; general economic and political conditions; costs of exploration and production; the availability of new leases and concessions; access to external financing; and governmental regulations regarding, among other things, environmental protection, climate change, taxation, price controls and product allocations. The willingness of drilling contractors and well servicing companies to make capital expenditures for the type of specialized equipment the Company provides is also influenced by numerous factors over which the Company has no control, including: the general level of oil and gas well drilling and servicing; rig day-rates; access to external financing; outlook for future increases in well drilling and well remediation activity; steel prices and fabrication costs; and government regulations regarding, among other things, environmental protection, climate change, taxation, and price controls.

See additional discussion on the current worldwide economic environment and related oil and gas activity levels in Item 1A. Risk Factors and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Overview of Oil and Gas Well Construction Processes

Oil and gas wells are usually drilled by drilling contractors using a drilling rig. A bit is attached to the end of a drill stem, which is assembled by the drilling rig and its crew from 30 or 45-foot joints of drill pipe and specialized drilling components known as downhole tools. Using the conventional rotary drilling method, the

3

drill stem is turned from the rotary table of the drilling rig by torque applied to the kelly, which is screwed into the top of the drill stem. Increasingly, drilling is performed using a drilling motor, which is attached to the bottom of the drill stem and provides rotational force directly to the bit, or a top drive, a device suspended from the derrick that turns the entire drill stem, rather than such force being supplied by the rotary table. The use of drilling motors and top drives permits the drilling contractor to drill directionally, including horizontally. The Company sells and rents drilling motors, agitators, drill bits, downhole tools and drill pipe through Wellbore Technologies, and sells top drives through Rig Systems.

Heavy drilling fluids, or “drilling muds”, are pumped down the drill stem and forced out through jets in the bit. The drilling mud returns to the surface through the space between the borehole wall and the drill stem, carrying with it the rock cuttings drilled out by the bit. The cuttings are removed from the mud by a solids control system (which can include shakers, centrifuges and other specialized equipment) and disposed of in an environmentally sound manner. The solids control system permits the mud, which is often comprised of expensive chemicals, to be continuously reused and re-circulated back into the hole.

Rig Systems sells the large “mud pumps” that are used to pump drilling mud through the drill stem, down and back up the hole. Wellbore Technologies sells and rents solids control equipment; and provides solids control, waste management and drilling fluids services. Many operators internally coat the drill stem to improve its hydraulic efficiency and protect it from corrosive fluids sometimes encountered during drilling; have hardfacing alloys applied to drill pipe joints, collars and other components to protect tool joints and casing against wear; and inspect and assess the integrity of the drill pipe from time to time. Wellbore Technologies manufactures and sells drill pipe and provides coating, “hard-banding”, and drill pipe inspection and repair.

As the hole depth increases, the kelly must be removed frequently so that additional joints of drill pipe can be added to the drill stem. When the bit becomes dull or the equipment at the bottom of the drill stem—including the drilling motors—otherwise requires servicing, the entire drill stem is pulled out of the hole and disassembled by disconnecting the joints of drill pipe. These are set aside or “racked”, the old bit is replaced or service is performed, and the drill stem is reassembled and lowered back into the hole (a process called “tripping”). During drilling and tripping operations, joints of drill pipe must be screwed together and tightened (“made up”), and loosened and unscrewed (“spun out”). Rig Systems provides drilling equipment to manipulate and maneuver the drill pipe in this manner. When the hole has reached certain depths, all of the drill pipe is pulled out of the hole and larger diameter pipe known as casing is lowered into the hole and permanently cemented in place in order to protect against collapse and contamination of the hole. The casing is typically inspected before it is lowered into the hole, another service provided by Wellbore Technologies. Wellbore Technologies drilling optimization and automation maximizes bit performance in the wellbore by mitigating vibrations, dynamic and impact loading, and stick slip which ensures longer bit runs, reducing trips. Hole openers from Wellbore Technologies, that mount above the drill bits in the drill stem, opens the tolerance of the hole to allow for easier and faster casing installation. Completion & Production Solutions manufactures pressure pumping equipment that is used to cement the casing in place. The rig’s hoisting system raises and lowers the drill stem while drilling or tripping, and lowers casing into the wellbore. A conventional hoisting system is a block and tackle mechanism that works within the drilling rig’s derrick. The mechanism is lifted by a series of pulleys that are attached to the drawworks at the base of the derrick. Rig Systems sells and installs drawworks and pipe hoisting systems.

During the course of normal drilling operations, the drill stem passes through different geological formations which exhibit varying pressure characteristics. If this pressure is not contained, oil, gas and/or water would flow out of these formations to the surface. Containing reservoir pressures is accomplished primarily by the circulation of heavy drilling muds and secondarily by blowout preventers (“BOPs”), should the mud prove inadequate in an emergency situation. Rig Systems sells blowout preventers. Drilling muds are carefully designed to exhibit certain qualities that optimize the drilling process. In addition to containing formation pressure, they must provide power to the drilling motor; carry drilled solids to the surface; protect the drilled formations from being damaged; and, cool the drill bit. Achieving these objectives often requires a formulation specific to a given well, requires a high level of cleanliness for better bottom hole assembly performance and can involve the use of

4

expensive chemicals as well as natural materials, such as certain types of clay. The fluid itself is often oil, or more expensive synthetic mud. Given the cost, it is highly desirable to reuse as much of the drilling mud as possible. Solids control equipment such as shale shakers, centrifuges, cuttings dryers, and mud cleaners help accomplish this objective. Wellbore Technologies rents, sells, operates and services this equipment. Drilling muds are formulated based on expected drilling conditions. However, as the hole is drilled, the drill stem may encounter a high pressure zone where the mud density is inadequate to maintain sufficient pressure. Should efforts to “weight up” the mud in order to contain such a pressure kick fail, a blowout could result, whereby reservoir fluids would flow uncontrolled into the well. A series of high-pressure valves known as blowout preventers are positioned at the top of the well and, when activated, form tight seals that prevent the escape of fluids to the surface. When closed, conventional BOPs prevent normal rig operations so the BOPs are activated only if drilling mud and normal well control procedures cannot safely contain the pressure.

The operations of the rig and the condition of the drilling mud are closely monitored by various sensors, which measure operating parameters such as the weight on the rig’s hook, the incidence of pressure kicks, the operation of the drilling mud pumps, etc. Wellbore Technologies sells and rents drilling rig instrumentation packages that perform these monitoring functions. Monitoring can be done at the well or remotely from selected centralized operation centers.

During drilling operations the drilling rig and related equipment and tools are subject to severe stresses, pressures and temperatures, as well as a corrosive environment, and require regular repair and maintenance. Rig Aftermarket supplies spare parts and can dispatch field service engineers with the expertise to quickly repair and maintain equipment, minimizing down time.

After the well has reached its total depth and the final section of casing has been set, the drilling rig is moved off and the well is prepared to begin producing oil or gas in a process known as “well completion.” Well completion usually involves installing production tubing concentrically in the casing. Due to the corrosive nature of many produced fluids, production tubing is often inspected and coated, services offered by Wellbore Technologies. Sometimes operators choose to use corrosion resistant composite materials or alloys, sold by Completion & Production Solutions.

From time to time, a producing well may undergo workover procedures to extend its life and/or increase its production rate. Workover rigs are used to disassemble the wellhead, tubing and other completion components of an existing well in order to stimulate or remediate the well. Workover rigs are similar to drilling rigs in their capabilities to handle tubing, but are usually smaller and somewhat less sophisticated. The Company offers a comprehensive range of workover rigs through Rig Systems. Tubing and sucker rods removed from a well during a well remediation operation are often inspected to determine their suitability to be reused in the well, a service Wellbore Technologies provides.

Frequently, coiled tubing units or wireline units are used to accomplish certain well remediation operations or well completions. Coiled tubing consists of a continuous length of reeled steel tubing which can be injected concentrically into the production tubing all the way to the bottom of most wells. It permits many operations to be performed without disassembling the production tubing, and without curtailing the production of the well. Wireline winch units are devices that utilize single-strand or multi-strand wires to perform well remediation operations, such as lowering tools and transmitting data to the surface. The Completion & Production Solutions segment manufactures and sells various types of coiled tubing and wireline equipment and tools.

Rig Systems

The Company’s Rig Systems segment makes and supports the capital equipment and integrated systems needed to drill oil and gas wells on land and offshore. The segment designs, manufactures, and sells land rigs, complete offshore drilling equipment packages, and drilling rig components that mechanize and automate many complex rig processes.

5

Equipment and technologies in Rig Systems include: power transmission systems, like drives and generators; substructures, derricks, and masts; pipe lifting, racking, rotating, and assembly systems; pressure control equipment, including blowout preventers; cranes; and rig instrumentation and control systems.

Top Drives. The TDS™ Top Drive Drilling System, originally introduced by the Company in 1982, significantly altered the traditional drilling process. The TDS rotates the drill stem from its top, rather than by the rotary table, with a large electric motor affixed to rails installed in the derrick that traverses the length of the derrick to the rig floor, eliminating the conventional rotary table for drilling. Components of the TDS also are used to connect additional joints of drill pipe to the drill stem during drilling operations, enabling the use of three or four pre-connected joints of drill pipe at a time, compared to traditional drilling with one joint of drill pipe. Additionally, the TDS facilitates horizontal and extended reach drilling.

Electric Rig Motors. The Company has helped lead the application of AC motor technology in the oilfield industry. The Company buys motors from third parties and builds them in its own facilities and is further developing motor technology, including the introduction of permanent magnet drilling motors for use in top drives, cranes, mud pumps, winches, and drawworks.

Rotary Equipment. The alternative to using a TDS to rotate the drill stem is to use a rotary table, which rotates the pipe at the floor of the rig. Rig Systems produces rotary tables as well as kelly and master bushings. In 1998, the Company introduced the Rotary Support Table for use on rigs with a TDS. The Rotary Support Table is used in concert with the TDS to completely eliminate the need for the larger conventional rotary table.

Pipe Handling Systems. Pipe racking systems are used to handle drill pipe, casing and tubing on a drilling rig. Vertical pipe racking systems move drill pipe and casing between the well and a storage (“racking”) area on the rig floor. Horizontal racking systems are used to handle tubulars while stored horizontally (for example, on the pipe deck of an offshore rig) and transport tubulars up to the rig floor and into a vertical position for use in the drilling process.

Vertical pipe racking systems are used predominantly on offshore rigs and are found on almost all floating rigs. Mechanical vertical pipe racking systems greatly reduce the manual effort involved in pipe handling. Pipe racking systems, introduced by the Company in 1985, provide a fully automated mechanism for handling and racking drill pipe during drilling and tripping operations, spinning and torquing drill pipe, and automatic hoisting and racking of disconnected joints of drill pipe. These functions can be integrated via computer controlled sequencing, and operated by a driller from an environmentally secure cabin. An important element of this system is the Iron Roughneck, which was originally introduced by the Company in 1976 and is an automated device that makes pipe connections on the rig floor and requires less direct involvement of rig floor personnel in potentially dangerous operations. The Automated Roughneck is a microprocessor-controlled version of the Iron Roughneck.

Horizontal pipe transfer systems were introduced by the Company in 1993. They include the Pipe Deck Machine (“PDM”), which is used to manipulate and move stored tubulars; the Pipe Transfer Conveyor (“PTC”), which transports sections of pipe to the rig floor; and a Pickup Laydown System (“PLS”), which raises the pipe to a vertical position for transfer to a vertical racking system. These components may be employed separately, or incorporated together to form a complete horizontal racking system, known as the Pipe Transfer System (“PTS”).

Pipe Handling Tools. The Company’s pipe handling tools are designed to enhance the safety, efficiency and reliability of pipe handling operations. Many of these tools have provided innovative methods of performing the designated task through mechanization of functions previously performed manually. Rig Systems manufactures various tools used to grip, hold, raise, and lower pipe, and in the making up and breaking out of drill pipe, workstrings, casing and production tubulars including spinning wrenches, manual tongs, torque wrenches and kelly spinners.

6

Mud Pumps. Mud pumps are high pressure pumps located on the rig that force drilling mud down the drill pipe, through the drill bit, and up the space between the drill pipe and the drilled formation (the “annulus”) back to the surface. These pumps, which generate pressures of up to 7,500 psi, must therefore be capable of displacing drilling fluids thousands of feet down and back up the well bore. The conventional mud pump design, known as the triplex pump, uses three reciprocating pistons oriented horizontally. The Company has introduced the HEX™ Pump, which uses six pumping cylinders, versus the three used in the triplex pump. Along with other design features, the greater number of cylinders reduces pulsations (or surges) and increases the output available from a given footprint. Reduced pulsation is desirable where downhole measurement equipment is being used during the drilling process, as is often the case in directional drilling.

Hoisting Systems. Hoisting systems are used to raise or lower the drill stem while drilling or tripping, and to lower casing into the wellbore. The drawworks, the heart of the hoisting system, is a large winch that spools off or takes in the drilling line, which is in turn connected to the drill stem at the top of the derrick. The drawworks also plays an important role in keeping the weight on the drill bit at a desired level. This task is particularly challenging on offshore drilling rigs, which are subject to wave motion. To address this, the Company has introduced the AHD™ Active Heave Drilling Drawworks which uses computer-controlled motors to compensate for the motion experienced in offshore drilling operations.

Cranes. The Company provides a comprehensive range of crane solutions, with purpose-built products for all segments of the oil and gas industry as well as many other markets. The Company has a broad collection of crane brand names with international recognition, and a large staff of engineers specializing in the design of cranes and related equipment. The product range extends from small cargo-handling cranes to the world’s largest marine cranes. In all, the Company provides over twenty crane product lines that include standard model configurations as well as custom-engineered and specialty cranes.

Motion Compensation Systems. Traditionally, motion compensation equipment is located on top of the drilling rig and serves to stabilize the bit on the bottom of the hole, increasing drilling effectiveness of floating offshore rigs by compensating for wave and wind action. The AHD Drawworks, discussed above, was introduced to eliminate weight and improve safety, removing the compensator from the top of the rig and integrating it into the drawworks system. In addition to the AHD Drawworks, the Company has introduced an Active Heave Compensation (“AHC”) System that goes beyond the capabilities of the AHD Drawworks to handle the most severe weather. Additionally, the Company’s tensioning systems provide continuous axial tension to the marine riser pipe (larger diameter pipe which connects floating drilling rigs to the well on the ocean floor) and guide lines on floating drilling rigs, tension leg platforms and jack-up drilling rigs.

Blowout Preventers. BOPs are devices used to seal the space between the drill pipe and the borehole and, if necessary, to also shear the drill pipe itself to prevent blowouts (uncontrolled flows of formation fluids and gases to the surface). Rig Systems manufactures a wide array of BOPs used in various applications from deepwater offshore vessels to land rigs. Ram and annular BOPs are back-up devices that are activated only if other techniques for controlling pressure in the wellbore are inadequate. When closed, these devices prevent normal drilling operations. Ram BOPs seal the wellbore by hydraulically closing rams (thick heavy blocks of steel) against each other across the wellbore. Specially designed packers seal around specific sizes of pipe in the wellbore, shear pipe in the wellbore or close off an open hole. Annular BOPs seal the wellbore by hydraulically closing a rubber packing unit around the drill pipe or kelly or by sealing against itself if nothing is in the hole.

In 1998, the Company introduced the NXT TM ram type BOP which eliminates door bolts, providing significant weight, rig-time, and space savings. Its unique features make subsea operation more efficient through faster ram configuration changes. In 2004, the Company introduced the LXT TM ram type of BOP, which features many of the design elements of the NXT TM, but is targeted at the land market. Over the past five years considerable focus has been placed on robustness and reliability in the fundamental design of the equipment with extensive testing being performed in an R&D facility opened in 2012. In 2013, the Company acquired the T3 BOP product line, further expanding its market offering of reliable, field proven designs for land based drilling applications.

7

The ShearMaxTM line of low force BOP shear rams released in 2010 add substantial tubular shearing capability to the Company’s line of pressure control equipment, including the capability to shear large drill pipe tool joints, previously unheard of in the industry. This innovative shear blade design utilizes patented “Puncture Technology” to reduce the shearing pressures 50% or more and in some cases as much as five times lower. The ShearMax Blind shear provides a shear-and-seal design for drill pipe, while the Casing and TJC shears address casing up to 16” OD and most tool joints up to 2” wall thickness, respectively.

Derricks and Substructures. Drilling activities are carried out from a drilling rig. A drilling rig consists of one or two derricks; the substructure that supports the derrick(s); and the rig package, which consists of the various pieces of equipment discussed above. Rig Systems designs, fabricates and services derricks used in both onshore and offshore applications, and substructures used in onshore applications. Rig Systems also works with shipyards in the fabrication of substructures for offshore drilling rigs.

Land Rig Packages. The Company designs, manufactures, assembles, upgrades, and supplies equipment sets to a variety of land drilling rigs, including those specifically designed to operate in harsh environments such as the Arctic Circle and the desert. Our key land rig product names include the Ideal Rig™, Drake Rig™,and Rapid Rig TM. The Company’s recent rig packages are designed to be safer and fast moving, to utilize AC technology, and to reduce manpower required to operate a rig.

Offshore Drilling Equipment Packages. Rig Systems also provides the above major pieces of equipment in fully integrated equipment packages for offshore drilling rigs. By purchasing an entire drilling equipment package customers reap the benefits of Rig Systems’ integrated package engineering and installation and commissioning expertise, alleviating many of the potential problems of sourcing complex equipment that must work together from multiple vendors.

Customers and Competition. Rig Systems sells directly to drilling contractors, rig fabricators, well servicing companies, pressure pumping companies, national oil companies, major and independent oil and gas companies, and also through distribution companies. Demand for its products is strongly dependent upon capital spending plans by oil and gas companies and drilling contractors, and the level of oil and gas well drilling activity.

The products of Rig Systems are sold in highly competitive markets and its sales and earnings can be affected by competitive actions such as price changes, new product development, or improved availability and delivery. The segment’s primary competitors are MHWirth; Aker Solutions; American Electric Technologies; American Block; AXON Energy Products; Bentec; Bomco; Canrig (a division of Nabors Industries); Cavins Oil Well Tools; Cameron International; Den-Con Tool Company; Forum Energy Technologies; General Electric; Hitec Products; Honghua; Huisman; Liebherr; Parveen Industries; Omron Corporation; Rolls Royce; Siemens; Stewart & Stevenson; Soilmec and Drillmec (a part of the Trevi Group); Seatrax; Tesco Corporation; Wärtsilä and Weatherford International. Management believes that the principal competitive factors affecting Rig Systems are performance, quality, reputation, customer service, availability of spare parts and consumables, breadth of product line and price.

Rig Aftermarket

The Company’s Rig Aftermarket segment provides comprehensive aftermarket products and services to support a large installed base of land and offshore rigs, and drilling rig components manufactured by the Company’s Rig Systems segment. The segment provides spare parts, repair, and rentals as well as technical support, field service and first well support, field engineering, and customer training through a network of aftermarket service and repair facilities strategically located in major areas of drilling operations.

Spare Parts. Rig Aftermarket maintains an inventory of spare parts, the majority manufactured by Rig Systems, across a global network of aftermarket service and repair facilities.

8

Technical Support. Rig Aftermarket’s Technical Support Centers troubleshoot and resolve equipment needs for customers. Cross-disciplinary teams work together with field service technicians and subject matter experts to keep customers’ rigs in operation and utilize web-based applications to record, manage, and resolve issues.

Field Service. Field service engineers actively support rig equipment and technologies on location. Based across a global network of aftermarket service and repair facilities, field service engineers can be deployed to operating sites worldwide to resolve equipment issues, whether structural, mechanical, electrical, or software-related.

Repair. Rig Aftermarket overhauls, repairs, rebuilds, and recertifies equipment to quality assurance and OEM specifications using only OEM parts.

eHawk Remote Support. A subscription service available to customers, eHawk Support Centers provide fast issue response times. Using satellite and computer technology, eHawk Support Centers can diagnose equipment status and work to handle issues remotely, reducing service personnel visits to the field. eHawk utilizes web-based applications to record, manage, and resolve issues.

Field Engineering. Rig Aftermarket Field Engineering supports customers by providing rig-specific designs, modifications, and solutions as needed. Services include rig surveys, proposal and design drawings, service manuals, and equipment installation.

Training Centers and Technical Colleges. Rig Aftermarket Training Centers offering training for all equipment and technologies designed and manufactured by Rig Systems. Training centers offer a varied curriculum that incorporates hands-on experience, use of equipment simulators, automated classrooms, and enhanced animations with cross-sectional cutouts.

Customers and Competition. Rig Aftermarket supports land and offshore drillers. Demand for the segment’s products and services depends on overall levels of oilfield drilling activity, which drives demand for spare parts, service, and repair for Rig System’s large installed base of equipment; and secondarily on drilling contractors’ and oil and gas companies’ capital spending plans, specifically capital expenditures on rig refurbishments andre-certifications.

The products of Rig Aftermarket are sold in highly competitive markets and its sales and earnings can be affected by competitive actions such as price changes, new product development, or improved availability and delivery. The segment’s primary competitors are MHWirth; American Electric Technologies; American Block; AXON Energy Products; Bentec; Bomco; Canrig (a division of Nabors Industries); Cavins Oil Well Tools; Cameron International; Den-Con Tool Company; Forum Energy Technologies; General Electric; Hitec Products; Honghua; Huisman Liebherr; Parveen Industries; Omron Corporation; Rolls Royce; Siemens; Stewart & Stevenson; Soilmec and Drillmec (a part of the Trevi Group); Seatrax; Sparrows Offshore; Subsea Solutions; Tesco Corporation; Wärtsilä and Weatherford International. Management believes that the principal competitive factors affecting Rig Aftermarket are performance, quality, reputation, customer service, availability of spare parts and consumables, breadth of product line and price.

Wellbore Technologies

The Company’s Wellbore Technologies segment designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance, including: solids control and waste management equipment and services; drilling fluids; portable power generation; premium drill pipe; wired pipe; drilling optimization and automation services; tubular inspection, repair and coating services; rope access inspection; instrumentation; measuring and monitoring; downhole and fishing tools; steerable technologies; hole openers; and drill bits.

The Wellbore Technologies segment focuses on oil and gas companies and supports drilling contractors, oilfield service companies, and oilfield rental companies. Demand for Wellbore Technologies’ products and services primarily depends on the level of oilfield drilling activity by oil and gas companies, drilling contractors, and oilfield service companies.

9

Drill Pipe Products. The Company designs, manufactures, and sells a full range of proprietary premium and API drill stem products used for the drilling of oil and gas wells. A drilling rig typically carries an inventory of 10,000 to 30,000 feet of drill pipe, which is consumed over time by the drilling process.

During the drilling process, motors mounted on the rig rotate the drill pipe, bottom-hole assembly, and drill bit. In addition to driving the drill bit, drill pipe serves as the conduit for drilling fluids. The Company offers a broad line of premium drilling products designed for the drilling of extended reach, directional, horizontal, deepwater, and ultra-deep wells in both international and domestic markets.

Voest-Alpine Tubulars (“VAT”). VAT is a joint venture between the Company and the Austrian based Voest-Alpine Group. The Company has a 50.01% investment in the joint venture which is located in Kindberg, Austria. VAT owns a tubular mill with an annual capacity of approximately 380,000 metric tons and is the primary supplier of green tubes for our U.S. based production. VAT is accounted for under the equity-method of accounting due to the minority owner having substantive participating rights.

Tubular Coating. The Company develops, manufactures and applies its proprietary tubular coatings, known as Tube-Kote® coatings, to new and used downhole tubulars and line pipe. Tubular coatings help prevent corrosion, which extends the life of tubular assets, and reduces expensive interruptions in production. In addition, coatings are designed to increase the fluid flow rate up to 25%. In addition, the Company offers a mechanical fit connection that is very quick to field install and combined with internal coatings provides a continuous internal surface of coatings thru the connection. The Company also offers other corrosion solutions such as fiberglass lined tubing that also services our customers as it relates to wells that are injection or enhance oil recovery wells.

Tubular Inspection. Newly manufactured pipe may have serious defects that are not detected at the mill, and pipe can be damaged during handling prior to use at the well site. Exploration and production companies have new tubulars inspected before they are placed in service to reduce the risk of tubular failures during drilling, completion, or production. Used tubulars are inspected to detect service-induced flaws. In addition to our Tubular Inspection product line, we have a Specialty Inspection group that performs rig inspections, drop surveys, lift gear inspections and derrick building services via rope access with locations around the world to service the land and offshore contractors.

Tubular inspection techniques include electromagnetic, ultrasonic, magnetic flux leakage and gamma ray. Inspection services are provided by mobile units at the wellhead as used tubing is removed from a well, and at fixed site locations.

Mill Systems and Sales. The Company engineers and fabricates inspection equipment for steel mills, which it sells and rents. The equipment is used for quality control purposes to detect defects in the pipe during the high-speed manufacturing process. Each piece of mill inspection equipment is designed to customer specifications and is installed and serviced by the Company.

Machining, Repair and Services. The Company offers a variety of machining services including: thread repair, tool joint rebuilding and sub manufacturing, providing a “one-stop-shop” concept for its drill pipe customers.

Drilling & Intervention. The Company combines a wide array of drilling and intervention tools with drilling, coring, borehole enlargement and other services. The broad spectrum of bottom hole assembly (“BHA”) components offered is the result of the strategic consolidation of key acquisitions.

The Company manufactures fixed cutter and roller cone drill bits and services its customer base in virtually every significant oil and gas producing region of the world.

The Company designs, manufacturers and services a wide array of downhole motors which are capable of achieving higher rotary velocities than can generally be achieved using conventional surface rotary equipment. The AGITATOR™ friction reduction tool delivers improved drilling efficiency along with extending the reach of horizontal drilling applications.

10

The Company manufactures an extensive range of hole-opening solutions, borehole enlargement, which produce enlarged wellbores in numerous applications and operate in demanding environments around the world.

The Company manufactures steerable technologies that allow for borehole directional control, enabling our customers to drill more efficiently in challenging environments globally.

Through its Coring Services business line, the Company enables the extraction of actual rock samples from a drilled well bore and allows geologists to examine the formations at the surface.

The Company is well positioned to address intervention and well workovers with a comprehensive offering of leading fishing and thru-tubing tools. We sell and rent tools to perform retrieval of stuck tools and remove debris, mill bridge plugs and other devices and manipulate well flow control.

Dynamic Drilling Solutions. The Company’s Dynamic Drilling Solutions combines product lines that are focused on instrumentation, eTools for measuring, data-driven solutions used for monitoring, managed pressure drilling, and drilling automation and optimization. Dynamic Drilling Solutions generates, collects, aggregates, communicates, and analyzes drilling data to provide our customers effective solutions for their well environments.

Instrumentation. The Company’s Instrumentation business provides drilling rig operators real time measurement and monitoring of critical parameters required to improve rig safety and efficiency. The Company’s measurement and monitoring systems combine leading hardware and software technologies (both at the surface and in the wellbore) into an integrated drilling rig package. Access of drilling data is provided to offsite locations, enabling company personnel to monitor drilling operations through a secure link.

Directional Sensors, Steering Tools, Magnetic Multi-shot Tools and Electromagnetic Measurement-While-Drilling Systems are offered by the Company. These directional eTools provide measurements and store the data in memory or use a telemetry pathway to transmit downhole data to the surface. At the surface this data is analyzed to optimize well trajectory and improve the drilling rate-of-penetration.

Managed Pressure Drilling equipment and support services enable improved kick detection and help manage wellbore pressures during drilling to permit accessing reserves in certain areas using chokes, manifolds, rotating control devices, continuous circulation systems, downhole sensors and optimized control systems.

Solids Control and Waste Management. The Company offers highly-engineered equipment, and services to separate and manage drill cuttings produced by the drilling process (“Solids Control”). Drill cuttings are usually contaminated with petroleum or drilling fluids, and must be disposed of in an environmentally sound manner. Wellsite Services manufactures state-of-the-art patented solids control equipment. Upon the separation of the drill cuttings Wellsite Services provides waste management (both onsite and at centralized locations), including transport and storage.

Fluids Services. The Company is engaged in the provision of drilling fluid systems, drilling fluid products, completion fluids and other related services. Drilling fluids are used to maintain well bore stability while drilling, control downhole pressure, lubricate and cool the drill bit, suspend and release cuttings, and transmit hydraulic energy to drilling tools and bits. Wellsite Services provides water and oil based drilling fluids

Portable Power Generation. The Portable Power division provides rental generators, lighting and other accessories for use in the upstream oil and gas industry, refinery and petrochemical operations, construction sites, events, disaster relief and other industries.

NOV IntelliServ. NOV IntelliServ is a joint venture between the Company and Schlumberger, Ltd. in which the Company holds a 55% interest and maintains operational control. NOV IntelliServ manufactures wellbore data transmission products used to deliver high-speed communication up and down the drill string.

11

Customers and Competition. Customers for Wellbore Technologies include major and independent oil and gas companies, national oil companies, drilling and workover contractors, oilfield equipment and product distributors and other manufacturers, oilfield service companies, steel mills, rental companies, and other industrial companies. The Company’s competitors include: Baker Hughes; Drill Pipe Masters; Frank’s International; Future Pipe; Halliburton; Hanwei; Hilong; Patterson Tubular Services; Precision Tube; ShawCor; Schlumberger; Superior Energy Services; Texas Steel Conversion; Vallourec & Mannesmann and Weatherford International, along with a number of smaller regional competitors.

Completion & Production Solutions

The Company’s Completion & Production Solutions segment integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic fracture stimulation, including pressure pumping trucks, blenders, sanders, hydration units, injection units, flowline, manifolds and wellheads; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; offshore production, including composite pipe, process equipment, floating production systems and subsea production technologies; and, onshore production including surface transfer and progressive cavity pumps, positive displacement reciprocating pumps, pressure vessels, and artificial lift systems.

Completion & Production Solutions supports service companies and oil and gas companies. Demand for Completion & Production Solutions’ products depends on the level of oilfield completions and workover activity by oilfield service companies and drilling contractors and capital spending plans by oil and gas companies and oilfield service companies.

Coiled Tubing Equipment. Coiled tubing consists of flexible steel tubing manufactured in a continuous string and spooled on a reel. It can often extend over twenty thousand feet in length and is run in and out of the wellbore at a high rate of speed by a hydraulically operated coiled tubing unit. A coiled tubing unit is typically mounted on a truck, semi-trailer or skid (steel frames on which portable equipment is mounted to facilitate handling with cranes for offshore use) and consists of a hydraulically operated tubing reel or drum, an injector head which pushes or pulls the tubing in or out of the wellbore, and various power and control systems. Coiled tubing is typically used with sophisticated pressure control equipment which permits the operator to perform workover operations on a live well. The Completion & Production Solutions segment manufactures and sells both coiled tubing units and the ancillary pressure control equipment used in these operations. Currently, most coiled tubing units are used in well remediation and completion applications. The Company believes that advances in the manufacturing process of coiled tubing, tubing fatigue protection and the capability to manufacture larger diameter and increased wall thickness coiled tubing strings have resulted in increased uses and applications for these products. For example, some well operators are now using coiled tubing in drilling applications such as slim-hole re-entries of existing wells.

Wireline Equipment. The Company’s wireline products include wireline drum units, which consist of a spool or drum of wireline cable, mounted in a mobile vehicle or skid, which works in conjunction with a source of power (an engine mounted in the vehicle or within a separate “power pack” skid). The wireline drum unit is used to spool wireline cable into or out of a well, in order to perform surveys inside the well, sample fluids from the bottom of the well, retrieve or replace components from inside the well, or to perform other well remediation or survey operations. The wireline used may be “slick line”, which is conventional single-strand steel cable used to convey tools in or out of the well, or “electric line”, which contains an imbedded single-conductor or multi-conductor electrical line which permits communication between the surface and electronic instruments attached to the end of the wireline at the bottom of the well. Wireline units are usually used in conjunction with a variety of pressure control equipment which permits safe access into wells while they are flowing and under pressure at the surface. The Company engineers and manufactures a broad range of pressure control equipment for wireline operations, including wireline blowout preventers, strippers, packers, lubricators and grease injection units. Additionally, the Company makes wireline rigging equipment such as mast trucks, and skidded masts for offshore rig-up.

12

Stimulation Equipment. The Company’s stimulation products include fracturing pumpers, acid units, frac blenders, frac control systems, sand handling systems, combo units, hydration and chemical additive systems as well as services and parts. Additionally, the Company sells, services, and rents wellheads, frac trees, portable flow line, and well testing equipment.

Turret Mooring Systems. The Company designs and manufacturers Turret Mooring Systems and Spread Moored Systems, and other products for Floating Production, Storage and Offloading (“FPSOs”) and other offshore vessels and terminals. A turret mooring system consists of a geostatic part attached to the seabed and a rotating part integrated in the hull of the FPSO, which are connected and allow the ship to weathervane (rotate) around the turret during production.

Flexible Pipe Systems. The Company designs and manufactures flexible pipe products and systems for the offshore oil and gas industry, including products associated with FPSO’s and other offshore production platforms, as well as subsea production systems including flexible risers, flowlines and jumpers. The product range consists of flexible pipe solutions from 2” – 16”, designed to operate under very demanding offshore conditions in all parts of the world. The products remain flexible even under very high working pressure, up to 1,000 bars, and at the same time they are able to withstand working temperatures from minus 50° centigrade up to +130° centigrade. Flexible pipe systems are superior to other pipe solutions in respect of flexibility, ability to withstand different design conditions and capability to convey challenging mixtures of liquid and gaseous fluids. The Company’s products are qualified for use in water depths down to 2,000 meters. The Company also supplies a wide range of additional equipment such as accessories and steel structures required in a given system configuration.

Fiberglass & Composite Tubulars. The Company designs, manufactures and markets filament-wound and molded fiberglass pipe and fittings as well as spoolable fiberglass pipe. These products are used by a wide range of petroleum, petrochemical and other industrial fluid and gas processing industries; for service station piping systems; aboard marine vessels, FPSOs and offshore oil platforms; and, are marketed as an alternative to metallic piping systems which can fail under corrosive operating conditions. The Company’s Fiberspar™ business, manufactures and sells fiberglass-reinforced spoolable pipe to the oil and gas industry which provides a reliable, corrosion-resistant, cost-effective solution for the production and transportation of oil and gas.

XL Systems. The Company’s XL Systems product line offers the customer an integrated package of large-bore tubular products and services for offshore or deep onshore wells. This product line includes the Company’s proprietary line of wedge thread connections on large-bore tubulars and related engineering and design services. The Company provides this product line for drive pipe, jet strings and conductor casing. The Company produces large-bore tubulars with a high-strength, high-fatigue Viper™ weld-on connector for use in deep-water and other environments where an extremely robust connector is needed. The Company also offers service personnel in connection with the installation of all of these products.

Process and Flow Technologies. The Company serves its customers in various industrial and oil and gas markets by designing, manufacturing and distributing key products including pumping technologies (reciprocating, multistage surface, and progressive cavity pumps), process equipment (dynamic oil recovery, water treatment, sand handling, separation and crude / gas handling), artificial lift solutions (stuffing boxes, drive heads, PCP, control boxes, polished rod accessories, and hydraulic pumping units), mixing and agitation equipment, heat exchangers, pipeline products (closures, expanding gate valves, and plug valves) and general oilfield products (critical service hookups, pumping tees, and production BOP’s). These products are used by a highly diversified customer base with presence in oil and gas and industrial markets, which include waste water treatment, mining, chemical processing, paper and pulp, agriculture, food and beverage, among others. The group supports its international market and customer base through a mixed channel to market model, which includes both direct sales and separate partnership relationships.

Pumps & Expendables. The Company designs, manufactures, and sells pumps and expendables that are used in oil and gas drilling operations, well service operations, production applications, as well as industrial applications.

13

These pumps include reciprocating positive displacement piston and plunger pumps and high pressure mud pumps. These pumps are sold as individual units and unitized packages with drivers, controls and piping. The Company also manufactures fluid end expendables (liners, valves, pistons, and plungers). The Company offers popular industry brand names including: Wheatley, Gaso, National, Oilwell, MSW, and Omega reciprocating pumps.

Customers and Competition. The primary customers for the products and services offered by the Completion & Productions Solutions segment include well servicing companies, oil and gas companies, and fabricators, as well as distributors in select markets. Competitors include: Cameron International; Circor International; Corpro (a division of ALS); Dover; Drilquip; FMC Technologies; Forum Energy Technologies; GE Oil & Gas; Modec; SBM Offshore; Stewart & Stevenson; Technip; Roper Industries; Weir Group; and a number of regional competitors. Management believes that on-site support is becoming a more important competitive element in this market, and other competitive factors affecting the business are performance, quality, reputation, customer service, product availability and technology, breadth of product line and price.

2015 Acquisitions and Other Investments

During 2015, the Company completed a total of seven acquisitions and other investments for an aggregate investment of $86 million, net of cash acquired.

2015 Realignment

From time to time the Company realigns the structure of its organization to achieve business goals, including enhanced efficiency and cost reduction. In November, certain of the Company’s subsidiaries completed restructuring transactions intended to achieve these goals, through a strategic realignment of certain business units. These restructuring activities include: (a) a division of National Oilwell Varco, L.P. (“NOV LP”) allocating certain assets and liabilities associated with the Chemineer and Process & Flow Technologies business units to Chemineer, Inc. and NOV Process & Flow Technologies US, Inc., respectively; (b) realignment of the structure of Robbins & Myers, Inc. (“R&M”) and distribution of R&M’s equity ownership in certain subsidiaries to Grant Prideco, Inc. (“Grant Prideco”), a direct subsidiary of the Company; (c) realignment of business units of Ameron International Corporation (“Ameron”) including (i) the contribution of certain assets and liabilities corresponding to two divisions (respectively, the water transmission and pole products divisions) into separate subsidiaries of Ameron, and (ii) the distribution by Ameron of all of the outstanding membership interest in Tubo-FGS, LLC (a fiberglass pipe business unit) and certain intangible intellectual property assets to its parent Grant Prideco for strategic realignment with Grant Prideco’s fiberglass pipe division; (d) distribution of certain intangible intellectual property assets from subsidiaries to a holding company subsidiary; (e) realignment of the ownership structure of National Oilwell DHT; and (f) elimination of certain intercompany balances between subsidiaries through distribution, setoff or assignment, including without limitation intercompany balances between NOV LP and certain divisions of Fiber Glass Systems, L.P., as obligors, and Ameron, as obligee.

Seasonal Nature of the Company’s Business

Historically, activity levels of some of the Company’s segments have followed seasonal trends to some degree.

In Canada, Wellbore Technologies and Completion & Production Solutions typically realized high first quarter activity levels, as operators take advantage of the winter freeze to gain access to remote drilling and production areas. In past years, certain Canadian businesses within Wellbore Technologies and Completion & Production Solutions have declined during the second quarter due to warming weather conditions which resulted in thawing, softer ground, difficulty accessing drill sites, and road bans that curtailed drilling activity (“Canadian Breakup”). However, these segments have typically rebounded in the third and fourth quarter. Wellbore Technologies and Completion & Production Solutions activity in the U.S. sometimes increases during the third quarter and then

14

peaks in the fourth quarter as operators spend the remaining drilling and/or production capital budgets for that year. Wellbore Technologies and Completion & Production Solutions revenues in the Rocky Mountain region sometimes decline in the late fourth quarter or early first quarter due to harsh winter weather. The Company’s fiberglass and composite tubulars business in China has typically declined in the first quarter due to the impact of weather on manufacturing and installation operations, and due to business slowdowns associated with the Chinese New Year. In general, Rig Systems and Rig Aftermarket have not experienced significant seasonal fluctuation, although orders for new equipment and aftermarket spare parts may be modestly affected by holiday schedules. There can be no guarantee that seasonal effects will not influence future sales in these segments.

The Company anticipates that the seasonal trends described above will continue. However, there can be no guarantee that spending by the Company’s customers will continue to follow patterns seen in the past.

Marketing and Distribution Network

Substantially all of Rig Systems’ capital equipment and Rig Aftermarket’s spare parts sales, and a large portion of our smaller pumps and parts sales, are made through our direct sales force and distribution service centers. Sales to foreign oil companies are often made with or through representative arrangements. Products within Wellbore Technologies and Completion & Production Solutions are rented and sold worldwide through our own sales force and through commissioned representatives.

Completion & Production Solutions’ customers are predominantly service companies and oil and gas companies. Demand for the Company’s Completion & Production Solutions segment products depends on the level of oilfield completions and workover activity by oilfield service companies and drilling contractors and capital spending plans by oil and gas companies and oilfield service companies.

The Company’s foreign operations, which include significant operations in Canada, Europe, Russia, the Far East, the Middle East, Africa and Latin America, are subject to the risks normally associated with conducting business in foreign countries, including foreign currency exchange risks and uncertain political and economic environments, which may limit or disrupt markets, restrict the movement of funds or result in the deprivation of contract rights or the taking of property without fair compensation. Government-owned petroleum companies located in some of the countries in which the Company operates have adopted policies (or are subject to governmental policies) giving preference to the purchase of goods and services from companies that are majority-owned by local nationals. As a result of such policies, the Company relies on joint ventures, license arrangements and other business combinations with local nationals in these countries. In addition, political considerations may disrupt the commercial relationship between the Company and such government-owned petroleum companies. Although the Company has not experienced any material problems in foreign countries arising from nationalistic policies, political instability, economic instability or currency restrictions, there can be no assurance that such a problem will not arise in the future. See Note 15 to the Consolidated Financial Statements for information regarding geographic revenue information.

Research and New Product Development and Intellectual Property

The Company believes that it has been a leader in the development of new technology and equipment to enhance the safety and productivity of drilling and well servicing processes and that its sales and earnings have been dependent, in part, upon the successful introduction of new or improved products. Through its internal development programs and certain acquisitions, the Company has assembled an extensive array of technologies protected by a substantial number of trade and service marks, patents, trade secrets, and other proprietary rights.

As of December 31, 2015, the Company held a substantial number of United States patents and had additional patent applications pending. As of this date, the Company also had foreign patents and patent applications pending relating to inventions covered by the United States patents. Additionally, the Company maintains a substantial number of trade and service marks and maintains a number of trade secrets. Expiration dates of such patents range from 2016 to 2035.

15

Although the Company believes that this intellectual property has value, competitive products with different designs have been successfully developed and marketed by others. The Company considers the quality and timely delivery of its products, the service it provides to its customers and the technical knowledge and skills of its personnel to be as important as its intellectual property in its ability to compete. While the Company stresses the importance of its research and development programs, the technical challenges and market uncertainties associated with the development and successful introduction of new products are such that there can be no assurance that the Company will realize future revenue from new products.

Manufacturing and Service Locations

The manufacturing processes for the Company’s products generally consist of machining, welding and fabrication, heat treating, assembly of manufactured and purchased components and testing. Most equipment is manufactured primarily from alloy steel. The availability and price of alloy steel castings, forgings, purchased components and bar stock is critical to the production and timing of shipments.

Rig Systems provides drilling rig components, as well as complete land drilling rigs, and offshore drilling equipment packages. The primary manufacturing facilities are located in Houston, Texas; Orange, California; and Ulsan, South Korea.

Rig Aftermarket provides comprehensive aftermarket products and services to support land rigs and offshore rigs, and drilling rig components manufactured by Rig Systems. Primary facilities are located in Houston, Texas; New Iberia, Louisiana; Aberdeen, Scotland; Singapore; and Dubai, UAE.

Wellbore Technologies designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance, including: solids control and waste management equipment and services, drilling fluids, premium drill pipe, wired pipe, drilling optimization services, tubular inspection and coating services, instrumentation, downhole tools, and drill bits. Primary facilities are located in Houston, Conroe, Navasota, Cedar Park, Texas; Veracruz, Mexico; and Dubai, UAE.

Completion & Production Solutions integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic fracture stimulation, including pressure pumping trucks and pumps, blenders, sanders, hydration units, injection units, flowline, manifolds and wellheads; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; onshore production, including composite pipe, surface transfer and progressive cavity pumps, and artificial lift systems; and, offshore production, including floating production systems and subsea production technologies. Primary facilities are located in Houston, Fort Worth, Texas; Tulsa, Oklahoma; Senai, Malaysia; Kalundborg, Denmark; Superporto du Acu, Brazil; and Manchester, England.

Raw Materials

The Company believes that materials and components used in its operations are generally available from multiple sources. The prices paid by the Company for its raw materials may be affected by, among other things, energy, steel and other commodity prices; tariffs and duties on imported materials; and foreign currency exchange rates. The Company has experienced rising, declining and stable prices for mild steel and standard grades in line with broader economic activity and has generally seen specialty alloy prices continue to rise, driven primarily by escalation in the price of the alloying agents. The Company has generally been successful in its effort to mitigate the financial impact of higher raw materials costs on its operations by applying surcharges to, and adjusting prices on, the products it sells. Higher prices and lower availability of steel and other raw materials the Company uses in its business may adversely impact future periods.

Backlog

The Company monitors its backlog of orders within its Rig Systems and Completion & Production Solutions segments to guide its planning. Backlog includes orders which typically require more than three months to manufacture and deliver.

16

Backlog measurements are made on the basis of written orders which are firm, but may be defaulted upon by the customer in some instances. Most require reimbursement to the Company for costs incurred in such an event. There can be no assurance that the backlog amounts will ultimately be realized as revenue, or that the Company will earn a profit on backlog work. Backlog for Rig Systems at December 31, 2015, 2014 and 2013, was $6.1 billion, $12.5 billion and $15.0 billion, respectively. Backlog for Completion & Production Solutions at December 31, 2015, 2014 and 2013 was $1.0 billion, $1.8 billion and $1.6 billion, respectively.

Employees

At December 31, 2015, the Company had a total of 50,197 employees, of which 5,871 were temporary employees. Approximately 470 employees in the U.S. are subject to collective bargaining agreements. Additionally, certain of the Company’s employees in various foreign locations are subject to collective bargaining agreements. The Company believes its relationship with its employees is good.

17

You should carefully consider the risks described below, in addition to other information contained or incorporated by reference herein. Realization of any of the following risks could have a material adverse effect on our business, financial condition, cash flows and results of operations.

We are dependent upon the level of activity in the oil and gas industry, which is volatile.

The oil and gas industry historically has experienced significant volatility. Demand for our products and services depends primarily upon the number of oil rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions, capital expenditures of other oilfield service companies and the level of workover activity. Drilling and workover activity can fluctuate significantly in a short period of time, particularly in the United States and Canada. The willingness of oil and gas operators to make capital expenditures to explore for and produce oil and natural gas and the willingness of oilfield service companies to invest in capital equipment will continue to be influenced by numerous factors over which we have no control, including:

| | • | | the current and anticipated future prices for oil and natural gas; |

| | • | | the ability or willingness of the members of the Organization of Petroleum Exporting Countries, or OPEC, to maintain price stability through voluntary production limits; |

| | • | | the level of production by non-OPEC countries; |

| | • | | level of excess production capacity; |

| | • | | cost of exploring for and producing oil and gas; |

| | • | | level of drilling activity and drilling rig dayrates; |

| | • | | worldwide economic activity and associated demand for oil and gas; |

| | • | | availability and access to potential hydrocarbon resources; |

| | • | | national government political requirements; |

| | • | | development of alternate energy sources; and |

| | • | | environmental regulations. |

The current significant oil and gas industry downturn has resulted in reduced demand for oilfield services, which has had, and may continue to have, a significant adverse impact on our financial results. If these conditions worsen or oil and gas prices do not improve, further reductions in spending by the oil and gas industry could have a material adverse effect on our financial condition, results of operations and cash flows.

Volatile oil and gas prices affect demand for our products.

Expectations for future oil and gas prices cause many shifts in the strategies and expenditure levels of oil and gas companies and drilling contractors, particularly with respect to decisions to purchase major capital equipment of the type we manufacture. Oil and gas prices, which are determined by the marketplace, may fall below a range that is acceptable to our customers, which could reduce demand for our products.

There are risks associated with certain contracts for our equipment.