UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE YEAR ENDED DECEMBER 31, 2018

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12317

NATIONAL OILWELL VARCO, INC.

(Exact name of registrant as specified in its charter)

Delaware | | 76-0475815 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

7909 Parkwood Circle Drive

Houston, Texas 77036-6565

(Address of principal executive offices)

(713) 346-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, par value $.01 | | New York Stock Exchange |

(Title of Class) | | (Exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes☒ No☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes☐ No☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes☒ No☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller Reporting Company | ☐ |

| | Emerging growth company | ☐ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(1) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes☐ No☒

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2018 was $16.6 billion. As of February 8, 2019, there were 383,433,346 shares of the Company’s common stock ($0.01 par value) outstanding.

Documents Incorporated by Reference

Portions of the Proxy Statement in connection with the 2019 Annual Meeting of Stockholders are incorporated in Part III of this report.

1

FORM 10-K

PART I

General

National Oilwell Varco, Inc. (“NOV” or the “Company”), a Delaware corporation incorporated in 1995, is a leading independent provider of equipment and technology to the upstream oil and gas industry. Over the course of its 156-year history, NOV and its predecessor companies have helped transform the way the industry develops oil and gas fields and improved the cost-effectiveness, efficiency, safety, and environmental impact of global oil and gas operations. Over the past few decades, the Company pioneered and refined key technologies that helped make frontier resources, such as unconventional and deepwater oil and gas, economically viable.

NOV owns an extensive proprietary technology portfolio, which the Company uses to support the industry’s full-field drilling, completion, and production needs. By leveraging its unmatched cross-segment capabilities, scope, and scale, NOV continues to develop and introduce technologies that further enhance oilfield economics, with particular focus on those technologies related to drilling automation, multistage completions, predictive analytics and condition-based maintenance, and improved deepwater project economics. Given the breadth and depth of the Company’s technology and product offerings, most oil and gas wells around the world see at least some piece of NOV equipment over the course of their lifetime.

NOV serves major-diversified, national, and independent service companies; contractors; and oil and gas operators in 65 countries around the world. The Company currently operates under three segments: Wellbore Technologies, Completion & Production Solutions, and Rig Technologies.

Business Strategy and Competitive Strengths

NOV’s primary business objective is to further enhance its position in the marketplace as a leading independent provider of technology and equipment to the upstream oil and gas industry. The Company intends to advance this objective and generate above-average returns on its capital over the long term by delivering technologies, equipment, and services that help lower the marginal cost of developing and producing oil and gas resources and by executing the following strategies that leverage the Company’s competitive strengths:

Leverage NOV’s advantages of size, scope, scale, and position in the market

NOV’s position as a leading independent provider of technology and equipment to the upstream oil and gas industry affords the Company several competitive advantages, as follows:

Economies of scale in procurement and manufacturing. NOV’s market leadership and global footprint, which spans almost every major oilfield market, provides the Company with economies of scale. NOV’s scope and scale have enabled it to develop a unique global supply chain, which provides the Company with the ability to procure materials from the lowest-cost sources of supply around the world. The Company’s global manufacturing footprint and flexibility to produce a diverse array of products also enables NOV to rapidly adapt to changes in demand, efficiently leverage manufacturing capacity that is near high-demand areas, and manufacture goods in the lowest-cost jurisdictions. The geographic diversity of NOV’s footprint also reduces potential volatility in the Company’s revenues from shifts in location of oilfield activity around the world, regional differences in hydrocarbon prices, and adverse weather and other events.

Scope and scale for distribution and marketing. As a leading independent provider of technology and equipment to the oilfield and with operations in 65 countries, NOV has developed an efficient global distribution network and relationships with virtually every oil and gas operator, service company, and contractor in the world. NOV uses its customer relationships and distribution capabilities to accelerate the commercialization of new products and technologies. NOV routinely develops technologies for use in the global marketplace. NOV’s infrastructure allows the Company to quickly penetrate the global marketplace and can create a first-mover advantage as customers prefer to standardize operations around certain products.

2

Reputation, experience, and benefits of fleet standardization. NOV’s reputation and experience make its products a lower-risk purchasing decision for customers. The Company benefits from customer efforts to standardize training, maintenance, and spare parts. Standardized fleets of equipment are easier for customers to operate and maintain, resulting in reduced downtime, lower training costs, better safety, and reduced inventory stocking requirements. Customers may prefer to standardize on equipment from a well-capitalized market leader such as NOV. NOV has entered into long-term service agreements with several large offshore drilling contractors whereby NOV will employ big data analytics and condition monitoring to maximize uptime and reduce the customer’s total cost of ownership for drill floor equipment.

Large installed base of equipment. As a leading original equipment manufacturer (“OEM”) in the oilfield, NOV is in an excellent position to provide aftermarket support for the industry’s largest installed base of equipment. Most oilfield services customers prefer OEM aftermarket support of their equipment, and many of their E&P customers demand it. Customers frequently encounter higher risk and cost when they purchase and use potentially incompatible products from different vendors, particularly where products must interact through complex interfaces, which are common sources of failures and unplanned costs. Additionally, certain past industry events increased the industry’s risk profile with government regulatory bodies, who have shown a strong preference for service contractors maintaining critical equipment through the OEM.

Digital products and technologies. NOV’s size and scale also provides for inherent competitive advantages in the areas of technology and innovation. NOV often develops technologies and solutions that involve multiple segments and businesses within the Company. Many such solutions could not be developed by smaller, less-diverse organizations, as an appropriate return on the cost of investment to develop certain technologies could not be achieved when applied to a more limited product offering. NOV’s efforts in big data, predictive analytics, and associated sensor technologies is an example of one such area. NOV has invested considerable time and resources to develop its MaxTM industrial platform, which enables large-scale collection, aggregation, and analytics of real-time equipment data. While the initial application of this platform was a predictive analytics and condition-based monitoring solution for subsea blowout preventers, the platform was designed to be the backbone of all big data products and services offered by the Company and to be used to monitor, analyze, and optimize many of the Company’s own manufacturing operations.

Employ a capital-light business model with the ability to quickly scale operations

NOV’s manufacturing operations are capital light and have low fixed-asset intensity. The Company’s facilities require relatively low investment and maintenance expenditures versus the sales they enable. NOV manufactures a diverse array of products across its manufacturing infrastructure and drives efficiency improvements by shifting production runs to facilities where demand is highest—lowering shipping costs—or to facilities that have the lowest-cost operations. The Company also realizes the benefit of serving a customer base that requires technically complex equipment used in extremely harsh environments. Placing sophisticated tools in a bottomhole assembly at the end of drillpipe to precisely place a wellbore several miles into the earth, and then physically cracking open reservoir rock using large volumes of highly abrasive fluids pumped at extremely high pressures, is incredibly hard on equipment. This harsh operating environment creates recurring sales opportunities for replacement equipment and aftermarket sales and service.

NOV has organized its infrastructure to take advantage of the oil and gas industry’s cyclicality. As commodity prices rise, the oilfield typically enters an expansionary phase where large amounts of capital are deployed quickly and equipment orders increase in line. NOV maintains the ability to ramp up manufacturing capacity quickly to capture the value generated by up-cycles while meeting the demands of its customer base. During industry down-cycles, the Company focuses on improving internal efficiencies and advancing technological offerings. NOV’s ability to continue, if not accelerate, pursuit of its technological initiatives throughout industry cycles enhances the Company’s ability to drive long-term customer and shareholder value. The Company also outsources non-critical machining operations with lower tolerance requirements during times of increased activity levels and brings the machining operations back into Company-owned facilities during down-cycles to improve asset utilization and lower costs.

3

Capitalize on and drive end-market fragmentation

A key tenet of NOV’s business model is to make its technologies and products available to all industry participants. To the extent NOV can provide equipment and technology that is as good, if not better than, products developed by service providers, it will prevent any one organization from having a proprietary advantage and therefore drive fragmentation. This fragmentation expands NOV’s customer base and permits the Company to avoid customer concentration in most of its businesses. NOV has resisted the recent trend toward vertical integration, which has left the Company in an attractive and unique position in the marketplace as the only large-cap independent provider of technology and equipment to the oilfield service space. In the international markets, many countries are pursuing initiatives that drive local content and greater local employment in oilfield activity. These actions will likely prompt more local startup enterprises, further expanding the number of customers for NOV’s equipment.

Develop proprietary technologies and solutions that assist oil and gas operators in reducing their marginal cost of supply

NOV strives to further develop its substantial technology portfolio and has a reputation for rapidly developing innovative solutions that assist its customers’ pursuit of productivity gains. The Company is well positioned to leverage resources and introduce new breakthrough technologies, including digital products that enhance efficiencies and address industry needs, while generating strong returns. The Company’s unmatched cross-business-unit capabilities and expertise uniquely position NOV to pioneer proprietary technologies across its business lines. For example, NOV’s Wellbore Technologies and Rig Technologies segments jointly introduced closed-loop drilling technologies, which link data from the bottom of the well to the software controls of the drilling rig and use machine learning to drive greater efficiency. NOV works closely with customers to identify needs and its technical experts utilize internal research and development capabilities to develop value-added technologies.

Employ a conservative capital structure with ample liquidity to capitalize on volatility associated with the oil and gas industry

NOV maintains a conservative capital structure, with an investment grade credit rating and ample liquidity. The Company carefully manages its capital structure by continuously monitoring cash flow, capital spending, and debt capacity. Maintaining financial strength inspires confidence from customers who provide NOV with large purchase commitments that the Company delivers over multi-year timeframes. This provides NOV with the flexibility to execute its strategy, including advancing technological offerings, through industry volatility and commodity price cycles. The Company intends to maintain a conservative approach to managing its balance sheet to preserve operational and strategic flexibility.

Business Segment Overview

Wellbore Technologies provides the critical technologies, equipment, and services required to maximize customer efficiencies and economics associated with oil and gas wells. The segment’s offerings are provided through the following business units:

| • | ReedHycalog is a market-leading designer and manufacturer of drill-bit technology, a provider of borehole enlargement systems, and an independent supplier of directional drilling tools and optimization software and services. Distinguished by its industry-leading cutter technology, ReedHycalog’s drill-bit offering features both fixed-cutter and roller-cone bits designed to improve drilling times and overall well efficiencies. ReedHycalog also manufactures tools that enable the precise placement of the wellbore within the desired reservoir location, including measurement-while-drilling tools and dynamic rotary steerable systems. ReedHycalog harnesses NOV’s unique ability to link downhole tools and services with surface equipment to provide the world’s first closed-loop drilling automation and optimization system, combining heuristic functions and machine-learning capabilities to transform drilling performance and operations. |

| • | Downhole is a leading independent equipment supplier in the drilling and intervention segment of the industry, with engineering teams, manufacturing facilities, supply hubs and service centers situated in regions of oil and gas activity. With a constantly-evolving product portfolio that includes downhole drilling motors, agitator systems, as well as fishing and thrutubing tools, the Downhole business unit’s offerings enable its customers to achieve significant increases in efficiency, whether in drilling, workover or intervention operations. |

4

| • | WellSite Services is a leading provider of solids control and waste management equipment and services, drilling and completion fluids, data acquisition and analytics, water management solutions, managed-pressure-drilling systems, and wellsite logistics solutions. WellSite Services manufactures, sells, and rents highly engineered solids control equipment and provides field services that improve customers’ bottom lines by efficiently separating solids and reclaiming drilling fluids for re-use. After separating drill cuttings, WellSite Services provides waste management (both onsite and at centralized locations), including transport and storage. Additionally, WellSite Services provides high-performance drilling fluid and water management solutions with a network of experts that safely work at the wellsite to ensure that operators have the support they need to bring their wells in on-time and on-budget. MD Totco delivers real-time measurement and monitoring of critical parameters required to improve rig safety and efficiency. Access to data and analytics are provided to offsite locations and mobile applications, enabling company personnel to monitor drilling operations through a secure link. WellSite Services offers a diversified range of resources to help manage the full lifecycle of the wellsite from initial preparation to worksite abandonment, including generators, temperature-control equipment, portable lighting, and other wellsite accessories. |

| • | Tuboscope is a leader in tubular coating and inspection services, servicing drill pipe and other oil country tubular goods (“OCTG”) such as casing, production tubing, and line pipe. Backed by an 80-year track record, Tuboscope offers a fully integrated inspection, coating, and repair process that enables customers to be confident that their critical OCTG will behave as they should when needed. In addition, Tuboscope offers artificial lift rod solutions, line-pipe connection systems, and RFID technology for complete drillpipe lifecycle management. |

| • | Grant Prideco is a leading manufacturer of premium drill-stem tubulars. With an integrated supply chain and a strong position in the competitive premium drillpipe connections, Grant Prideco offers one stop shopping for all drill stem needs. Armed with a product portfolio that ranges from the needs of the simplest vertical land well to the challenging needs of deepwater, extended-reach, high-pressure/high-temperature, and factory-drilling applications, Grant Prideco innovates with advanced metallurgical grades and connection technologies. |

| • | IntelliServ is the only independent commercial provider of wired drillpipe complete with an associated telemetry network that utilizes real-time broadband data transmission to enable instantaneous two-way communication between the bottomhole assembly and surface control system. IntelliServTM wired pipe enables significant rig time savings as surveys, downlinks, slide orientations, and other data-driven activities are performed in a matter of seconds versus minutes with conventional telemetry. |

Completion & Production Solutions provides the critical technologies necessary to optimize the well completion process and production phase of a well’s life cycle. Completion & Production Solutions business units include:

| • | Intervention and Stimulation Equipment (“ISE”) engineers and manufactures capital equipment and consumables and provides aftermarket service and repair to oilfield pressure pumpers, coiled tubing operators, wireline service companies, and providers of well testing and flowback services. ISE manufactures and assembles all equipment used to execute hydraulic fracturing jobs with particularly strong positions in the higher-valued technologies and complex process equipment, such as hydration units, chemical additive systems, blenders, and control systems. In addition, the business unit produces essential consumable components that support pressure pumping spreads, including centrifugal pumps, fluid ends, valves, seats, and flowline equipment. The business unit also designs and manufactures equipment used to pump, mix, transport, and store cement used in the well construction process. ISE is a leading provider of coiled tubing units, control systems, pressure control equipment, injector heads, and coiled tubing itself. ISE also provides nitrogen equipment and snubbing units. The business unit designs and manufactures wireline products for electric and slickline line applications, including critical pressure control equipment like wireline lubricators. Additionally, ISE designs and manufatures equipment for |

5

| | surface well-test and flowback operations. ISE supports its equipment offering by providing comprehensive repair, recertification and other support services through an unmatched global network of aftermarket service and repair facilities. |

| • | Fiber Glass Systems is a market leader in the design, manufacture, and delivery of high-end composite piping systems, pressure vessels, and structures engineered to deliver customers with solutions to both corrosion and weight challenges across a wide array of applications. With manufacturing facilities spanning five continents and a sales and distribution network covering 40 countries, Fiber Glass Systems serves customers in the oil and gas, chemical, industrial, marine, offshore, subsea, fuel handling, and mining industries. |

| • | Process and Flow Technologies provides integrated processing, production, and pumping equipment to customers in the oil and gas and industrial markets. For the production space they manufacture pumping technologies, including reciprocating, multistage, and progressive cavity pumps, as well as artificial lift support systems. For the midstream space they manufacture closures, transfer pumps, and valves. In the fluid processing space they design and manufacture integrated systems that provide water treatment, separation, sand management, hydrate inhibition, and gas processing for use both on and offshore. In the Industrial market they manufacture pumping, mixing, agitation equipment, and heat exchangers for general use in industrial end-markets. This equipment is supported by a global aftermarket service organization. |

| • | Subsea Production Systems strives to improve subsea infrastructure through technical innovation that improves customer productivity and reduces cost. The business unit is one of only three global manufacturers of flexible subsea pipe systems, which are designed to operate under demanding offshore conditions around the world. Flexible pipes are highly engineered, complex structures that are helically wound and comprised of multiple unbonded layers of steel and composites, which allow them to withstand the demanding pressures and tensile loads required in deepwater production while remaining resistant to the fatigue induced by wave and tidal action. Subsea Production Systems also provides an assortment of critical equipment necessary for subsea production, such as subsea water injection systems, tie-in connector systems, subsea storage units, and other related equipment. |

| • | Floating Production Systems offers a comprehensive technology suite geared towards improving offshore economics by providing cost-effective ways for operators to get their projects to first oil faster. Floating Production Systems offers turret mooring systems and topside process modules that are designed to minimize execution risk and maximize operability and crew safety. Floating Production Systems has the capability to partner with the operator from concept to redeployment as well as to simply operate as the equipment provider. NOV, along with alliance partners, offers complete technology, engineering, and product delivery capabilities to supply comprehensive topside solutions for FPSO projects. |

| • | XL Systems provides integral and weld-on connectors for oil and gas applications, including conductor strings, surface casing, and liners, in sizes ranging from 16 to 72 inches in diameter. XL Systems is the sole provider of a proprietary line of wedge thread connections on large-bore pipe. In addition, XL Systems supplies connector products in which the threads are machined on high-strength forging material and then welded to pipe. |

| • | Completion Tools offers a portfolio of differentiated completion tool products and solutions that address the most pressing needs of the global completions marketplace. The Completion Tools business’ product portfolio is highlighted by proprietary technology like the Bulldog Frac Sleeve, which utilizes a coiled tubing annular frac system to isolate and stimulate stages while being lighter and easier to handle than other sleeves on the market. Other proprietary technologies include the BPSTM (Burst Port System) Multistage, the BullmastiffTM Frac System, and i-Frac CEMTM ball-drop-activated multistage frac sleeve. The portfolio also includes liner hanger systems, sub-surface safety valves, and a variety of bridge plugs. |

6

Rig Technologies is the global leader in the engineering, manufacturing, and support of advanced drilling equipment packages and related capital equipment necessary to drill oil and gas wells anywhere in the world. Rig Technologies includes:

| • | Rig Equipment designs, manufactures, and sells land rigs, complete offshore drilling packages, and drilling rig components designed to mechanize and automate many complex drilling rig processes. Rig Equipment’s product portfolio includes many equipment designs that changed the way rigs are operated, including the TDS top drive drilling system and automated roughneck. As the oil and gas industry has pushed the boundaries of geology and engineering with the move into the ultra-deepwater and onshore unconventional plays, the Rig Equipment unit has met the increasing challenges of its customer base with constant improvements to both its land and offshore rig equipment offerings. An example of this is the recently introduced NOVOSTM control system that offers drilling process automation, which enables dramatic improvements in drilling efficiency, reliability, and performance. The business unit also provides comprehensive aftermarket products and services to maximize its customers’ rig fleets’ drilling uptime. Aftermarket offerings include spare parts, repair, and rentals as well as comprehensive remote equipment monitoring, technical support, field service, and customer training through an extensive network of aftermarket service and repair facilities strategically located in major areas of drilling operations around the world. |

| • | Marine Construction designs, engineers, and manufactures heavy-lift cranes; a large range of knuckle-boom and lattice boom cranes, including active heave options; mooring, anchor, and deck handling machinery; a full range and models of jacking systems; and pipelay and construction systems. Marine Construction serves the oil and gas industry as well as other marine-based end markets. |

See Note 15 to the Consolidated Financial Statements for financial information by segment and a geographical breakout of revenues and long-lived assets. We have also included a glossary of oilfield terms at the end of Item 1. “Business” of this Annual Report.

Overview of Oil and Gas Well-Construction Processes

The well-construction process starts with an operator and its contractors designating a suitable drilling site and placing a drilling rig at the location. The rig’s crew assembles the drill stem, which consists of drillpipe joints, specialized drilling components known as downhole tools, and a drill bit at the end. Modern rigs typically power the drill bit through a drilling motor, which is attached to the bottom of the drill stem and provides rotational force directly to the bit, or a top drive, a device suspended from the derrick that turns the entire drill stem. The evolution of drilling motors and top drives has facilitated operators’ abilities to drill directionally and horizontally as opposed to being limited to the traditional vertical trajectory. The Company sells and rents drilling motors, agitators, drill bits, downhole tools and drill pipe through Wellbore Technologies, and sells top drives through Rig Technologies.

Heavy drilling fluids, or “drilling muds,” are pumped down the drill stem and forced out through jets in the bit. The drilling mud returns to the surface through the space between the borehole wall and the drill stem, carrying with it the rock cuttings drilled out by the bit. The cuttings are removed from the mud by a solids control system (which can include shakers, centrifuges, and other specialized equipment) and disposed of in an environmentally sound manner. The solids control system permits the mud, which is often comprised of expensive compounds, to be continuously reused and re-circulated back into the hole. Rig Technologies sells the large “mud pumps” that are used to pump drilling mud through the drill stem, down, and back up the hole. Wellbore Technologies sells and rents solids control equipment and provides solids control, waste management and drilling fluids services.

7

Many operators internally coat the drill stem to improve its hydraulic efficiency and protect it from the corrosive fluids sometimes encountered during drilling; have hard-facing alloys applied to drillpipe joints, collars, and other components to protect tool joints and casing against wear; and inspect and assess the integrity of the drillpipe from time to time. Wellbore Technologies manufactures and sells drillpipe and provides coating, “hardfacing,” and drillpipe inspection and repair. As hole depth increases, additional joints of drillpipe are continuously added to the drill stem. When the bit becomes dull or the equipment at the bottom of the drill stem – including the drilling motors – otherwise requires servicing, the entire drill stem is pulled out of the hole and disassembled by disconnecting the joints of drillpipe. These are set aside or “racked,” the old bit is replaced or service is performed, and the drill stem is reassembled and lowered back into the hole (a process called “tripping”). During drilling and tripping operations, joints of drillpipe must be screwed together and tightened (“made up”), and loosened and unscrewed (“spun out”), a process that can create a considerable amount of stress on the pipe connections while also being quite time consuming. Rig Technologies provides drilling equipment to manipulate and maneuver the drillpipe in an efficient and safe manner, and Wellbore Technologies manufactures premium connections that are designed to reduce failure downhole and improve the rate of connection on the rig floor. When the hole has reached a specified depth, all the drillpipe is pulled out of the hole, and larger-diameter pipe known as casing is lowered into the hole and permanently cemented in place in order to protect against collapse and contamination of the hole. The casing is typically inspected before it is lowered into the hole, another service provided by Wellbore Technologies. Hole openers from Wellbore Technologies, which mount above the drill bits in the drill stem, open the tolerance of the hole to allow for easier and faster casing installation. Completion & Production Solutions manufactures cement mixing and pumping equipment that is used to cement the casing in place. The rig’s hoisting system raises and lowers the drill stem while drilling or tripping, and lowers casing into the wellbore. A conventional hoisting system is a block-and-tackle mechanism that works within the drilling rig’s derrick. The mechanism is lifted by a series of pulleys that are attached to the drawworks at the base of the derrick. Rig Technologies sells and installs drawworks and pipe hoisting-systems.

During the course of normal drilling operations, the drill stem passes through different geological formations that exhibit varying pressure characteristics. If this pressure is not contained, oil, gas, and/or water would flow out of these formations to the surface. Containing reservoir pressures is accomplished primarily by the circulation of heavy drilling muds and secondarily by blowout preventers (“BOPs”), should the mud prove inadequate. Drilling muds are carefully designed to exhibit certain qualities that optimize the drilling process. In addition to containing formation pressure, they must provide power to the drilling motor; carry drilled solids to the surface; protect the drilled formations from being damaged; and cool the drill bit. Achieving these objectives often requires a formulation specific to a given well, requires a high level of cleanliness for better bottomhole assembly, and can involve the use of expensive chemicals as well as natural materials, such as certain types of clay. The fluid itself is often oil or more expensive synthetic mud. Given the cost, it is highly desirable to reuse as much of the drilling mud as possible. Solids control equipment such as shale shakers, centrifuges, cuttings dryers, and mud cleaners help accomplish this objective. Wellbore Technologies provides drilling fluids and rents, sells, operates, and services solids control equipment. Rig Technologies manufactures pumps that power the flow of the mud and fluid downhole and back to the surface. Drilling muds are formulated based on expected drilling conditions. However, as the hole is drilled, the drill stem may encounter a high-pressure zone where the mud density is inadequate to maintain sufficient pressure. Should efforts to “weight up” the mud to contain such a pressure kick fail, a blowout could result, whereby reservoir fluids would flow uncontrolled into the well. A series of BOPs are positioned at the top of the well and, when activated, form tight seals that prevent the escape of fluids to the surface. Conventional BOPs prevent normal rig operations when closed so the BOPs are activated only if drilling mud and normal well control procedures cannot safely contain the pressure. Rig Technologies engineers and manufactures BOPs.

The operations of the rig and the condition of the drilling mud are closely monitored by various sensors, which measure operating parameters such as the weight on the rig’s hook, the incidence of pressure kicks, the operation of the drilling mud pumps, weight on bit, etc. Wellbore Technologies sells and rents drilling rig instrumentation packages that perform these monitoring functions as well as additional sensors that continuously collect downhole data that can be transmitted back to the surface via wired drill pipe. Wellbore Technologies’ also offers drilling optimization and automation software and services that utilize this downhole data to maximize drilling performance by mitigating vibrations, dynamic and impact loading, and stick-slip, which ensures longer bit runs, and reduces the number of necessary trips.

8

During drilling operations, the drilling rig and related equipment and tools are subject to severe stresses, pressures, and temperatures, as well as a corrosive environment, and require regular repair and maintenance. Rig Technologies supplies spare parts and can dispatch field service engineers with the expertise to quickly repair and maintain equipment, minimizing down time.

Once a well has been drilled, cased, and cemented, and the operator determines hydrocarbons are present in commercial quantities, the well is then completed, and sometimes stimulated. After the casing is cemented in place, the well undergoes one of several completion processes to open the bottom of the wellbore and allow hydrocarbons to flow from the reservoir and up the well to the surface. The most commonly used technique is known as perforation. The perforating process entails lowering a string of shaped charges to the desired depth in the well using an electric wireline unit and firing the charges to perforate the casing or liner. Wireline units are also used to perform logging operations and other intervention services. At this point, the operator may decide, based on well design and flow rate, to further enhance production by stimulating the well. Unconventional wells almost always require stimulation through multi-stage hydraulic fracturing, a process by which a fluid or slurry is pumped down the well by large pumping units. This causes the underground formation to crack or fracture, opening up space for hydrocarbons to flow more freely out of tight rock formations. A proppant is suspended in the fluid and lodges in the cracks, propping them open and allowing hydrocarbons to flow after the fluid is gone. A coiled tubing unit is often used to drill out bridge plugs that isolate the many stages needed to stimulate a horizontal well. A coiled tubing unit utilizes a large continuous length of steel tubing to enter and traverse long laterals and perform completion and well remediation operations. As drilling laterals have lengthened in recent years, many operators are electing to use larger high-specification well service rigs to assist in several phases of the completion phase by conveying tools downhole and drilling out completion plugs. Workover rigs are similar to drilling rigs in their capabilities to handle tubing but are usually smaller and somewhat less sophisticated. Completion & Production Solutions provides the essential equipment necessary for the entirety of the completion and stimulation process, designing and manufacturing coiled tubing units, wireline units, pressure pumping equipment, completion tools, snubbing units, nitrogen units, and treating iron. In addition, the well completion process creates a large amount of wear and tear on the equipment used, which creates healthy demand for Completion & Production Solutions’ aftermarket services. The use of coiled tubing and wireline equipment typically requires the use of a BOP to ensure safety during operations. Completion & Production Solutions manufactures this well control equipment. Due to the corrosive nature of many produced fluids, production tubing is often inspected and coated, services offered by Wellbore Technologies. Increasingly, operators choose to use corrosion-resistant composite materials or alloys in the process, which are also sold by Completion & Production Solutions.

Once the well has been stimulated, it is usually ready to be capped with a production wellhead and linked up to a gathering system where it can begin producing and generating cash flow for the operator. This process is significantly more involved offshore, where pipes are often required to reach thousands of feet from the wellhead back to the surface, contending with tides, debris, and weather. The development of flexible pipe solved many of the issues associated with linking offshore wells back to their respective floating production, storage, and offloading vessels (“FPSOs”), which serve as gathering hubs, sometimes in some of the most remote areas of the world. Completion & Production Solutions is one of only three global manufacturers of flexible subsea pipe in addition to offering turret mooring systems and topside process modules for FPSOs.

Natural decline rates set in as a well ages, and workover procedures and other services may be necessary to extend its life and increase its production rate. Over time, downhole equipment, casing, or tubing may need to be serviced or replaced. When producing wells require anything from routine maintenance to major modifications and repair, a well servicing rig is typically needed. Workover rigs are used to disassemble the wellhead, tubing and other completion components of an existing well in order to stimulate or remediate the well. As a well continues to mature, its natural reservoir pressure may no longer be enough to force fluids to the surface. Artificial lift equipment is then typically installed, which adds energy to the fluid column in a wellbore using one of several types of pumps. In addition to reduced pressure, the water cut of a well’s production tends to increase as the well ages, which typically requires the addition of water treatment and separation equipment. The Company offers a comprehensive range of workover rigs through Rig Technologies. Tubing and sucker rods removed from a well during a well remediation operation are often inspected to determine their suitability to be reused in the well, a service Wellbore Technologies provides. Completion & Production Solutions offers several types of artificial lift and related support systems as well as integrated systems that provide water treatment, separation, hydrate inhibition, and gas processing.

9

Markets and Competition

The Company’s customers are predominantly service companies and oil and gas companies. Products within Wellbore Technologies and Completion & Production Solutions are sold and rented worldwide through NOV’s sales force and through commissioned representatives. Substantially all of Rig Technologies’ capital equipment and spare parts sales, and a large portion of smaller pumps and parts sales, are made through NOV’s direct sales force and distribution service centers. Sales to foreign oil companies are often made with or through representative arrangements.

The Company’s competition consists primarily of publicly traded oilfield service and equipment companies and smaller independent equipment manufacturers.

The Company’s foreign operations, which include significant operations in the Middle East, Africa and Latin America, Russia, the Far East, Canada and Europe are subject to the risks normally associated with conducting business in foreign countries, including foreign currency exchange risks and uncertain political and economic environments, which may limit or disrupt markets, restrict the movement of funds or result in the deprivation of contract rights or the taking of property without fair compensation. Government-owned petroleum companies located in some of the countries in which the Company operates have adopted policies (or are subject to governmental policies) giving preference to the purchase of goods and services from companies that are majority-owned by local nationals. As a result of such policies, the Company relies on joint ventures, license arrangements, and other business combinations with local nationals in these countries. See Note 15 to the Consolidated Financial Statements for information regarding geographic revenue information.

2018 Acquisitions and Other Investments

During 2018, the Company completed a total of eight acquisitions and other investments for an aggregate cash investment of $280 million, net of cash acquired.

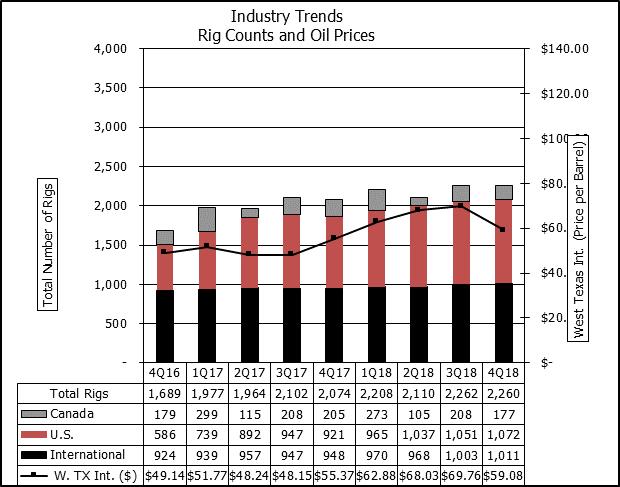

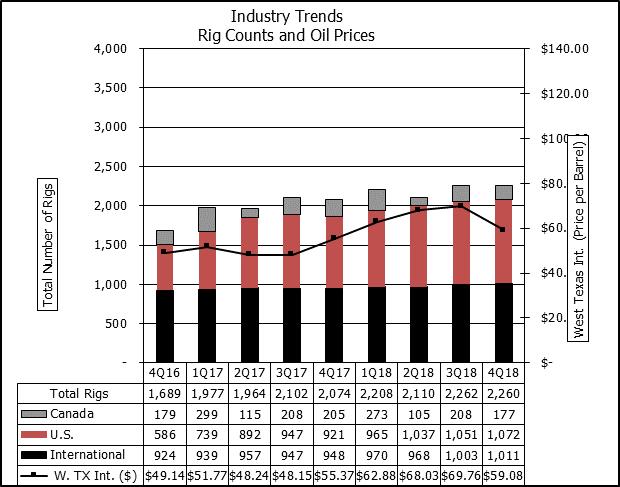

Influence of Oil and Gas Activity Levels on the Company’s Business

The oil and gas industry has historically experienced significant volatility. Demand for the Company’s products and services depends primarily upon the general level of activity in the oil and gas industry worldwide. Oil and gas activity is in turn heavily influenced by, among other factors, oil and gas prices worldwide. High levels of drilling and well remediation generally spurs demand for the Company’s products and services. Additionally, high levels of oil and gas activity increase cash flows available for oil and gas companies, drilling contractors, oilfield service companies, and manufacturers of OCTG to invest in equipment that the Company sells.

See additional discussion on the current worldwide economic environment and related oil and gas activity levels in Item 1A. “Risk Factors” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Seasonal Nature of the Company’s Business

Historically, activity levels of some of the Company’s segments have followed seasonal trends to some degree. Extremely harsh winter weather can reduce oilfield operations in far northern or high-altitude locations, including parts of Colorado, Canada, Russia and China, and the annual thaw (or “breakup”) in Canada makes some unimproved roads inaccessible to heavy equipment during part of each second quarter. Both situations temporarily reduce demand for the Company’s products and services in the effected geographic area, although revenues generally recover once conditions improve. Fluctuations in customer’s activity levels caused by national or customary holiday seasons and annual budgetary cycles can also affect their spending levels with the Company, leading to both temporary local decreases and increases in sales. The Company anticipates that the seasonal trends described above will continue, however, there can be no guarantee that spending by the Company’s customers will continue to follow patterns seen in the past.

10

Research and New Product Development and Intellectual Property

The Company believes that it has been a leader in the development of new technology and equipment to enhance the safety and productivity of drilling and well servicing processes and that its sales and earnings have been dependent, in part, upon the successful introduction of new or improved products. Through its internal development programs and certain acquisitions, the Company has assembled an extensive array of technologies protected by a substantial number of trademarks, for both goods and services, patents, trade secrets, and other proprietary rights.

As of December 31, 2018, the Company held a substantial number of granted patents and pending patent applications worldwide, including US patents and US patent applications as well as patents and patent applications in a variety of other countries. Expiration dates of such patents range from 2020 to 2039. Additionally, the Company maintains a substantial number of trademarks for both goods and services and maintains a number of trade secrets.

Although the Company believes that this intellectual property has value, competitive products with different designs have been successfully developed and marketed by others. The Company considers the quality and timely delivery of its products, the service it provides to its customers, and the technical knowledge and skills of its personnel to be as important as its intellectual property in its ability to compete. While the Company stresses the importance of its research and development programs, the technical challenges and market uncertainties associated with the development and successful introduction of new products are such that there can be no assurance that the Company will realize future revenue from new products.

Manufacturing and Service Locations

The manufacturing processes for the Company’s products generally consist of machining, welding and fabrication, heat treating, assembly of manufactured and purchased components, and testing. Most equipment is manufactured primarily from alloy steel. The availability and price of alloy steel castings, forgings, purchased components, and bar stock is critical to the production and timing of shipments.

Wellbore Technologies designs, manufactures, rents, and sells a variety of equipment and technologies used to perform drilling operations, and offers services that optimize their performance, including: solids control and waste management equipment and services, drilling fluids, premium drillpipe, wired pipe, drilling optimization services, tubular inspection and coating services, instrumentation, downhole tools, and drill bits. Primary facilities are located in Houston, Conroe, Navasota, and Cedar Park, Texas; Veracruz, Mexico; and Dubai, UAE.

Completion & Production Solutions integrates technologies for well completions and oil and gas production. The segment designs, manufactures, and sells equipment and technologies needed for hydraulic fracture stimulation, including pressure pumping trucks, blenders, sanders, hydration units, injection units, flowline, and manifolds; well intervention, including coiled tubing units, coiled tubing, and wireline units and tools; cementing products for pumping, mixing, transport, and storage; onshore production, including fluid processing, composite pipe, surface transfer and progressive cavity pumps, and artificial lift systems; and offshore production, including floating production systems and subsea production technologies. Primary facilities are located in Houston, and Fort Worth, Texas; Tulsa, Oklahoma; Senai, Malaysia; Qingdau, Shandong, China; Kalundborg, Denmark; Superporto du Acu, Brazil; Manchester, England; and Aberdeenshire, Scotland, UK.

Rig Technologies provides drilling rig components, complete land drilling rigs, and offshore drilling equipment packages. Primary manufacturing facilities are located in Houston, Texas; Orange, California; New Iberia, Louisiana; Singapore; and Dubai, UAE.

Raw Materials

The Company believes that materials and components used in its operations are generally available from multiple sources. The prices paid by the Company for its raw materials may be affected by, among other things, energy, steel, and other commodity prices; tariffs and duties on imported materials; and foreign currency exchange rates. The Company has experienced rising, declining, and stable prices for milled steel and standard grades in line with broader economic activity and has generally seen specialty alloy prices continue to rise, driven primarily by escalation in the price of the alloying agents. The Company has generally been successful in its effort to mitigate the financial impact of higher raw materials costs on its operations by applying surcharges to, and adjusting prices on, the products it sells.

11

Higher prices and lower availability of steel and other raw materials the Company uses in its business may adversely impact future periods.

Backlog

The Company monitors its backlog of orders within its Completion & Production Solutions and Rig Technologies segments to guide its planning. Backlog includes orders which typically require more than three months to manufacture and deliver.

Backlog measurements are made on the basis of written orders that are firm, but may be defaulted upon by the customer in some instances. Most require reimbursement to the Company for costs incurred in such an event. There can be no assurance that the backlog amounts will ultimately be realized as revenue, or that the Company will earn a profit on backlog work. Backlog for Completion & Production Solutions at December 31, 2018, 2017 and 2016 was $0.9 billion, $1.1 billion and $0.8 billion, respectively. Backlog for Rig Technologies at December 31, 2018, 2017 and 2016, was $3.1 billion, $1.9 billion and $2.5 billion, respectively.

Employees

At December 31, 2018, the Company had a total of 35,063 employees, of which 843 were temporary employees and 294 were subject to collective bargaining agreements in the U.S. Additionally, certain employees in various foreign locations are subject to collective bargaining agreements. Based upon the geographical diversification of these employees, we do not believe any risk of loss from employee strikes or other collective actions would be material to the conduct of our operations taken as a whole.

Available Information

The Company’s principal executive offices are located at 7909 Parkwood Circle Drive, Houston, Texas 77036. Its telephone number is (713) 346-7500. Further information about the Company’s products and services can be found on its website at: http://www.nov.com. The Company’s common stock is traded on the New York Stock Exchange under the symbol “NOV”. The Company’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all related amendments are available free of charge on the Investor Relations portion of the Company’s website, www.nov.com/investor, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The Company’s Code of Ethics is also posted on its website.

ITEM 1A.RISK FACTORS

You should carefully consider the risks described below, in addition to other information contained or incorporated by reference herein. Realization of any of the following risks could have a material adverse effect on our business, financial condition, cash flows and results of operations.

We are dependent upon the level of activity in the oil and gas industry, which is volatile and has caused, and may cause future, fluctuations in our operating results.

The oil and gas industry historically has experienced significant volatility. Demand for our products and services depends primarily upon the number of oil rigs in operation, the number of oil and gas wells being drilled, the depth and drilling conditions of these wells, the volume of production, the number of well completions, capital expenditures of other oilfield service companies and the level of workover activity. Drilling and workover activity can fluctuate significantly in a short period, particularly in the United States and Canada. The willingness of oil and gas operators to make capital expenditures to explore for and produce oil and natural gas and the willingness of oilfield service companies to invest in capital equipment will continue to be influenced by numerous factors over which we have no control, including the:

| • | current and anticipated future prices for oil and natural gas; |

| • | volatility of prices for oil and natural gas; |

12

| • | ability or willingness of the members of the Organization of Petroleum Exporting Countries (“OPEC”) and other countries, such as Russia, to maintain or influence price stability through voluntary production limits; |

| • | Sanctions and other restrictions placed on certain oil producing countries, such as Russia, Iran, and Venezuela; |

| • | level of production by non-OPEC countries including production from U.S. shale plays; |

| • | level of excess production capacity; |

| • | cost of exploring for and producing oil and gas; |

| • | level of drilling activity and drilling rig dayrates; |

| • | worldwide economic activity and associated demand for oil and gas; |

| • | availability and access to potential hydrocarbon resources; |

| • | national government political requirements; |

| • | fluctuations in political conditions in the United States and abroad; |

| • | currency exchange rate fluctuations and devaluations; |

| • | development of alternate energy sources; and, |

| • | environmental regulations. |

Expectations for future oil and gas prices cause many shifts in the strategies and expenditure levels of oil and gas companies, drilling contractors, and other service companies, particularly with respect to decisions to purchase major capital equipment of the type we manufacture. Oil and gas prices, which are determined by the marketplace, may remain below a range that is acceptable to certain of our customers, which could continue the reduced demand for our products and have a material adverse effect on our financial condition, results of operations and cash flows.

There are risks associated with certain contracts for our equipment.

As of December 31, 2018, we had a backlog of capital equipment to be manufactured, assembled, tested and delivered by Completion & Production Solutions and Rig Technologies in the amount of $0.9 billion and $3.1 billion, respectively. The following factors, in addition to others not listed, could reduce our margins on these contracts, adversely impact completion of these contracts, adversely affect our position in the market or subject us to contractual penalties:

| • | financial challenges for consumers of our capital equipment; |

| • | credit market conditions for consumers of our capital equipment; |

| • | our failure to adequately estimate costs for making this equipment; |

| • | our inability to deliver equipment that meets contracted technical requirements; |

| • | our inability to maintain our quality standards during the design and manufacturing process; |

| • | our inability to secure parts made by third party vendors at reasonable costs and within required timeframes; |

| • | unexpected increases in the costs of raw materials; |

| • | our inability to manage unexpected delays due to weather, shipyard access, labor shortages or other factors beyond our control; and, |

| • | the imposition of tariffs or duties between countries, which could materially affect our global supply chain. For example, section 232 tariffs on steel may increase our costs, reduce margins or otherwise adversely affect the Company. |

13

The Company’s existing contracts for rig and production equipment generally carry significant down payment and progress billing terms favorable to the ultimate completion of these projects and the majority do not allow customers to cancel projects for convenience. However, unfavorable market conditions or financial difficulties experienced by our customers may result in cancellation of contracts or the delay or abandonment of projects. Any such developments could have a material adverse effect on our operating results and financial condition.

Competition in our industry, including the introduction of new products and technologies by our competitors, as well as the expiration of the intellectual property rights protecting our products and technologies, could ultimately lead to lower revenue and earnings.

The oilfield products and services industry is highly competitive. We compete with national, regional and foreign competitors in each of our current major product lines. Certain of these competitors may have greater financial, technical, manufacturing and marketing resources than us, and may be in a better competitive position. The following can each affect our revenue and earnings:

| • | improvements in the availability and delivery of products and services by our competitors; |

| • | the introduction of new products and technologies by our competitors; and, |

| • | the expiration of intellectual property rights protecting our products and technologies. |

We are a leader in the development of new technology and equipment to enhance the safety and productivity of drilling and well servicing processes. If we are unable to maintain our technology leadership position, it could adversely affect our competitive advantage for certain products and services. Our revenues and operating results have been dependent, in part, upon the successful introduction of new or improved products. Through our internal development programs and acquisitions, we have assembled an extensive array of technologies protected by a substantial number of trade and service marks, patents, trade secrets, and other proprietary rights, some of which expire in the near future. The expiration of these rights could have a material adverse effect on our operating results. Furthermore, while the Company stresses the importance of its research and development programs, the technical challenges and market uncertainties associated with the development and successful introduction of new products are such that there can be no assurance that the Company will realize future revenue from new products.

The tools, techniques, methodologies, programs and components we use to provide our services may infringe upon the intellectual property rights of others. Infringement claims generally result in significant legal and other costs and may distract management from running our core business. Royalty payments under licenses from third parties, if available, would increase our costs. Additionally, developing non-infringing technologies would increase our costs. If a license were not available, we might not be able to continue providing a particular service or product, which could adversely affect our financial condition, results of operations and cash flows.

In addition, certain foreign jurisdictions and government-owned petroleum companies located in some of the countries in which we operate have adopted policies or regulations which may give local nationals in these countries competitive advantages. Actions taken by our competitors and changes in local policies, preferences or regulations could impact our ability to compete in certain markets and adversely affect our financial results.

A significant portion of our revenue is derived from our non-United States operations, which exposes us to risks inherent in doing business in each of the over 65 countries in which we operate.

Approximately 60% of our revenues in 2018 were derived from operations outside the United States (based on revenue destination). Our foreign operations include significant operations in every oil producing region in the world. Our revenues and operations are subject to the risks normally associated with conducting business in foreign countries, including:

| • | uncertain political, social and economic environments; |

| • | social unrest, acts of terrorism, war and other armed conflict; |

14

| • | trade and economic sanctions and other restrictions imposed by the United States, European Union or other countries; |

| • | restrictions under the United States Foreign Corrupt Practices Act (“FCPA”) or similar legislation, as well as foreign anti-bribery and anti-corruption laws; |

| • | confiscatory taxation, tax duties, complex and everchanging tax regimes or other adverse tax policies; |

| • | exposure to expropriation of our assets and other actions by foreign governments; |

| • | deprivation of contract rights; |

| • | restrictions on the repatriation of income or capital; |

| • | currency exchange rate fluctuations and devaluations. |

Our failure to comply with complex U.S. and foreign laws and regulations could have a material adverse effect on our business and our results of operations.

Our ability to comply with various complex U.S. and foreign laws and regulations, such as the FCPA, the U.K. Bribery Act and other foreign anti-bribery and anti-corruption laws, as well as various trade control regulations, is dependent on the success of our ongoing compliance program, including our ability to continue to effectively supervise and train our employees to deter prohibited practices. These various laws and regulations can change frequently and significantly. We may become involved in a governmental investigation even if the Company has complied with these laws. If we fail to comply with applicable laws and regulation, we could be subject to investigations, sanctions and civil and criminal prosecution as well as fines and penalties, which could have a material adverse effect on our reputation and our business, financial condition, results of operations and cash flows. In addition, government disruptions could negatively impact our ability to conduct our business.

We are also required to comply with various complex U.S. and foreign tax laws, regulations and treaties. These laws, regulations and treaties can change frequently and significantly and it is reasonable to expect changes in the future. If we fail to comply with any of these tax laws, regulations or treaties, we could be subject to, among other things, civil and criminal prosecution, fines, penalties and confiscation of our assets, which could disrupt our ability to provide our products and services to our customers. Any of these events could have a material adverse effect on our business, financial condition, results of operations and cash flows.

Further, in some instances, direct or indirect consumers of our products and services, entities providing financing for purchases of our products and services or members of the supply chain for our products and services may become involved in governmental investigations, internal investigations, political or other enforcement matters. In such circumstances, such investigations may adversely impact the ability of consumers of our products, entities providing financial support to such consumers or entities in the supply chain to timely perform their business plans or to timely perform under agreements with us. The Company could also become involved in investigations of consumers of our products at significant cost to the Company.

We could be adversely affected if we fail to comply with any of the numerous federal, state and local laws, regulations and policies that govern environmental protection, zoning and other matters applicable to our businesses.

Our businesses are subject to numerous federal, state and local laws, regulations and policies governing environmental protection, zoning and other matters. These laws and regulations have changed frequently in the past and it is reasonable to expect additional changes in the future. If existing regulatory requirements change, we may be required to make significant unanticipated capital and operating expenditures. We cannot assure you that our operations will continue to comply with future laws and regulations. Governmental authorities may seek to impose fines and penalties on us or to revoke or deny the issuance or renewal of operating permits for failure to comply with applicable laws and regulations. Under these circumstances, we might be required to reduce or cease operations or conduct site remediation or other corrective action which could adversely impact our operations and financial condition.

15

Our businesses expose us to potential environmental, product or personal injury liability.

Our businesses expose us to the risk that harmful substances may escape into the environment or a product could fail to perform or cause personal injury, which could result in:

| • | personal injury or loss of life; |

| • | severe damage to or destruction of property; or, |

| • | environmental damage and suspension of operations. |

Our current and past activities, as well as the activities of our former divisions and subsidiaries, could result in our facing substantial environmental, regulatory and other litigation and liabilities. These could include the costs of cleanup of contaminated sites and site closure obligations. These liabilities could also be imposed on the basis of one or more of the following theories:

| • | breach of contract with customers; or, |

| • | as a result of our contractual agreement to indemnify our customers in the normal course of business, which is normally the case. |

We may not have adequate insurance for potential environmental, product or personal injury liabilities.

While we maintain liability insurance, this insurance is subject to coverage limits. In addition, certain policies do not provide coverage for damages resulting from environmental contamination or may exclude coverage for other reasons. We face the following risks with respect to our insurance coverage:

| • | we may not be able to continue to obtain insurance on commercially reasonable terms; |

| • | we may be faced with types of liabilities that will not be covered by our insurance; |

| • | our insurance carriers may not be able to meet their obligations under the policies; or, |

| • | the dollar amount of any liabilities may exceed our policy limits. |

Even a partially uninsured claim, if successful and of significant size, could have a material adverse effect on our consolidated financial statements.

The adoption of climate change legislation, restrictions on emissions of greenhouse gases, or other environmental regulations could increase our operating costs or reduce demand for our products.

Environmental advocacy groups and regulatory agencies in the United States and other countries have been focusing considerable attention on the emissions of carbon dioxide, methane and other greenhouse gases and their potential role in climate change. The adoption of laws and regulations to implement controls of greenhouse gases, including the imposition of fees or taxes, could adversely impact our operations and financial condition. The U.S. Congress and other governments routinely consider legislation to control and reduce emissions of greenhouse gasses and other climate change related legislation, which could require significant reductions in emissions from oil and gas related operations. Additionally, recent concerns regarding the potential impact of hydraulic stimulation, or “fracking”, activities have resulted in government officials promulgating regulations to impose certain operational restrictions and disclosure requirements on oil and gas companies. Changes in the legal and regulatory environment could reduce oil and natural gas drilling activity and result in a corresponding decline in the demand for our products and services, which could adversely impact our operating results and financial condition.

Cybersecurity risks and threats could adversely affect our business.

We rely heavily on information systems to conduct our business. Any failure, interruption or breach in security of our information systems could result in failures or disruptions in our customer relationship management, general ledger systems and other systems. While we have policies and procedures designed to prevent or limit the effect of the failure, interruption or security breach of our information systems, there can be no assurance that any such failures, interruptions or security breaches will not occur or, if they do occur, that any breach or interruption will be sufficiently

16

limited. The occurrence of any failures, interruptions or security breaches of our information systems could damage our reputation, result in a loss of our intellectual property or other proprietary information, including customer data, result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability, any of which could have a material adverse effect on our financial position or results of operations.

Local content requirements imposed in certain jurisdictions may increase the complexity of our operations and impact the demand for our services.

A growing number of nations are requiring equipment providers and contractors to meet local content requirements or other local standards. To meet many of these local content and other requirements, we are required to attract and retain qualified local personnel. If we are unable to do so because the supply of qualified local personnel is constrained for any reason, the growth and profitability of our business may be adversely affected. In addition, our ability to work in certain jurisdictions is sometimes subject to our ability to successfully negotiate and agree upon acceptable joint venture agreements. The failure to reach acceptable agreements could adversely impact the Company’s operations in certain countries. Additionally, we may share control of joint ventures with unaffiliated third parties. Differences in views, and disagreements, among joint venture parties may result in delayed decision making and disputes on important issues. In some instances, we could suffer a material adverse effect to the results of our joint ventures and our consolidated results of operations.

Our ability to hire and retain qualified personnel at competitive cost could materially affect our operations and growth potential.

Many of the products we sell, and related services that we provide, are complex and technologically advanced, which enable them to perform in challenging conditions. Our ability to succeed is, in part, dependent on our success in attracting and retaining qualified personnel to provide service and to design, manufacture, use, install and commission our products. A significant increase in wages paid by competitors, both within and outside the energy industry, for such highly skilled personnel could result in insufficient availability of skilled labor or increase our labor costs, or both. If the supply of skilled labor is constrained or our costs increase, our margins could decrease and our growth potential could be impaired.

Severe weather conditions may adversely affect our operations.

Our business may be materially affected by severe weather conditions in areas where we operate. This may entail the evacuation of personnel and stoppage of services. In addition, if particularly severe weather affects platforms or structures, this may result in a suspension of activities. Any of these events could adversely affect our financial condition, results of operations and cash flows.

An impairment of goodwill or other indefinite lived intangible assets could reduce our earnings.

The Company has approximately $6.3 billion of goodwill and $0.4 billion of other intangible assets with indefinite lives as of December 31, 2018. Generally accepted accounting principles require the Company to test goodwill and other indefinite lived intangible assets for impairment on an annual basis or whenever events or circumstances indicate they might be impaired. Events or circumstances which could indicate a potential impairment include (but are not limited to) a significant sustained reduction in worldwide oil and gas prices or drilling; a significant sustained reduction in profitability or cash flow of oil and gas companies or drilling contractors; a significant sustained reduction in capital investment by other oilfield service companies; or a significant increase in worldwide inventories of oil or gas. The timing and magnitude of any goodwill impairment charge, which could be material, would depend on the timing and severity of the event or events triggering the charge and would require a high degree of management judgment. If we were to determine that any of our remaining balance of goodwill or other indefinite lived intangible assets was impaired, we would record an immediate charge to earnings with a corresponding reduction in stockholders’ equity; resulting in a possible increase in balance sheet leverage as measured by debt to total capitalization.

See additional discussion on “Goodwill and Other Indefinite – Lived Intangible Assets” in Critical Accounting Estimates of Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

17

We have expanded and grown our businesses through acquisitions and continue to pursue a growth strategy but we cannot assure that attractive acquisitions will be available to us at reasonable prices or at all.

We cannot assure that we will successfully integrate the operations and assets of any acquired business with our own or that our management will be able to manage effectively any new lines of business. Any inability on the part of management to integrate and manage acquired businesses and their assumed liabilities could adversely affect our business and financial performance. In addition, we may need to incur substantial indebtedness to finance future acquisitions. We cannot assure that we will be able to obtain this financing on terms acceptable to us or at all. Future acquisitions may result in increased depreciation and amortization expense, increased interest expense, increased financial leverage or decreased operating income for the Company, any of which could cause our business to suffer.

GLOSSARY OF OILFIELD TERMS

| | (Sources: Company management; “A Dictionary for the Petroleum Industry,” The University of Texas at Austin, 2001.) |

| |

API | | Abbr: American Petroleum Institute |

| |

Annular Blowout Preventer | | A large valve, usually installed above the ram blowout preventers, that forms a seal in the annular space between the pipe and the wellbore or, if no pipe is present, in the wellbore itself. |

| |

Annulus | | The open space around pipe in a wellbore through which fluids may pass. |

| |

Automatic Pipe Handling Systems (Automatic Pipe Racker) | | A device used on a drilling rig to automatically remove and insert drill stem components from and into the hole. It replaces the need for a person to be in the derrick or mast when tripping pipe into or out of the hole. |

| |

Automatic Roughneck | | A large, self-contained pipe-handling machine used by drilling crew members to make up and break out tubulars. The device combines a spinning wrench, torque wrench, and backup wrenches. |

| |

Beam pump | | Surface pump that raise and lowers sucker rods continually, so as to operate a downhole pump. |

| |

Bit | | The cutting or boring element used in drilling oil and gas wells. The bit consists of a cutting element and a circulating element. The cutting element is steel teeth, tungsten carbide buttons, industrial diamonds, or polycrystalline diamonds (“PDCs”). These teeth, buttons, or diamonds penetrate and gouge or scrape the formation to remove it. The circulating element permits the passage of drilling fluid and utilizes the hydraulic force of the fluid stream to improve drilling rates. In rotary drilling, several drill collars are joined to the bottom end of the drill pipe column, and the bit is attached to the end of the drill collars. Drill collars provide weight on the bit to keep it in firm contact with the bottom of the hole. |

| |

Blowout | | An uncontrolled flow of gas, oil or other well fluids into the atmosphere. A blowout, or gusher, occurs when formation pressure exceeds the pressure applied to it by the column of drilling fluid. A kick warns of an impending blowout. |

| |