Item 8: Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable.

Item 9: Proxy Disclosures for Open-End Management Investment Companies.

Not applicable.

Item 10: Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Not applicable. The Trustees’ Fees and Expenses are included in the financial statements filed under Item 7 of this Form.

Item 11: Statement Regarding Basis for Approval of Investment Advisory Contracts.

Trustees Approve Advisory Arrangements – Corporate Bond Index Funds

The board of trustees of Vanguard Short-Term Corporate Bond Index Fund, Vanguard Intermediate-Term Corporate Bond Index Fund, and Vanguard Long-Term Corporate Bond Index Fund has renewed each fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Fixed Income Group. The board determined that continuing each fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about each fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of each fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Fixed Income Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of each advisory arrangement.

Investment performance

The board considered the short- and long-term performance of each fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that each fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that each fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that each fund’s arrangement with Vanguard ensures that the funds will realize economies of scale as they grow, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

Trustees Approve Advisory Arrangements – Treasury Index Funds

The board of trustees of Vanguard Short-Term Treasury Index Fund, Vanguard Intermediate-Term Treasury Index Fund, and Vanguard Long-Term Treasury Index Fund has renewed each fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Fixed Income Group. The board determined that continuing each fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decisions upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about each fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangements. Rather, it was the totality of the circumstances that drove the board’s decisions.

Nature, extent, and quality of services

The board reviewed the quality of each fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Fixed Income Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of each advisory arrangement.

Investment performance

The board considered the short- and long-term performance of each fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that each advisory arrangement should continue.

Cost

The board concluded that each fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that each fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that each fund’s arrangement with Vanguard ensures that the funds will realize economies of scale as they grow, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangements again after a one-year period.

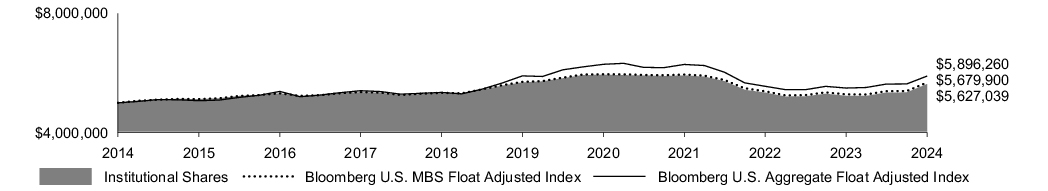

Trustees Approve Advisory Arrangement – Mortgage-Backed Securities Index Fund

The board of trustees of Vanguard Mortgage-Backed Securities Index Fund has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Fixed Income Group. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year through advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the fund’s investment management services over both the short and long term, and took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Fixed Income Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short- and long-term performance of the fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the fund’s expense ratio was below the average expense ratio charged by funds in its peer group and that the fund’s advisory expenses were also below the peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that the fund’s arrangement with Vanguard ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

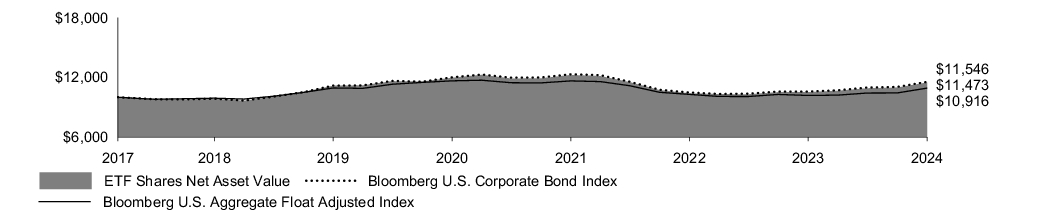

Trustees Approve Advisory Arrangement – Total Corporate Bond ETF

The board of trustees of Vanguard Total Corporate Bond ETF has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Fixed Income Group. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board reviewed the quality of the investment management services provided to the fund since its inception in 2017; it also took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Fixed Income Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the performance of the fund since its inception in 2017, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the fund’s acquired fund fees and expenses were below the average expense ratio charged by funds in its peer group. The fund does not incur advisory expenses directly; however, the board noted that each of the underlying funds in which the fund invests has advisory expenses below the relevant peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that Vanguard’s arrangement with the Total Corporate Bond ETF and its underlying funds ensures that the fund will realize economies of scale as it grows, with the cost to shareholders declining as fund assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.

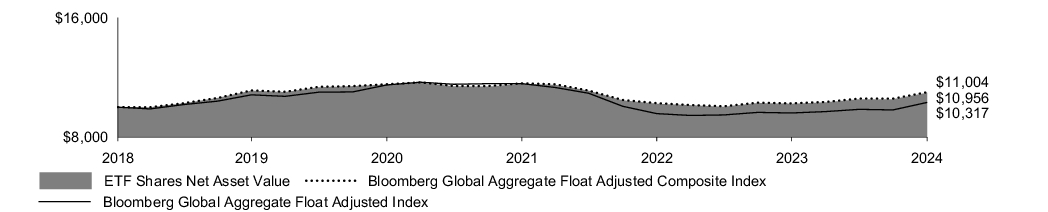

Trustees Approve Advisory Arrangement – Total World Bond ETF

The board of trustees of Vanguard Total World Bond ETF has renewed the fund’s investment advisory arrangement with The Vanguard Group, Inc. (Vanguard), through its Fixed Income Group. The board determined that continuing the fund’s internalized management structure was in the best interests of the fund and its shareholders.

The board based its decision upon an evaluation of the advisor’s investment staff, portfolio management process, and performance. This evaluation included information provided to the board by Vanguard’s Portfolio Review Department, which is responsible for fund and advisor oversight and product management. The Portfolio Review Department met regularly with the advisor and made presentations to the board during the fiscal year that directed the board’s focus to relevant information and topics.

The board, or an investment committee made up of board members, also received information throughout the year during advisor presentations conducted by the Portfolio Review Department. For each advisor presentation, the board was provided with letters and reports that included information about, among other things, the advisory firm and the advisor’s assessment of the investment environment, portfolio performance, and portfolio characteristics.

In addition, the board received periodic reports throughout the year, which included information about the fund’s performance relative to its peers and benchmark, as applicable, and updates, as needed, on the Portfolio Review Department’s ongoing assessment of the advisor.

Prior to their meeting, the trustees were provided with a memo and materials that summarized the information they received over the course of the year. They also considered the factors discussed below, among others. However, no single factor determined whether the board approved the arrangement. Rather, it was the totality of the circumstances that drove the board’s decision.

Nature, extent, and quality of services

The board considered the quality of the investment management services provided to the fund since its inception in 2018; it also took into account the organizational depth and stability of the advisor. The board considered that Vanguard has been managing investments for more than four decades. The Fixed Income Group adheres to a sound, disciplined investment management process; the team has considerable experience, stability, and depth.

The board concluded that Vanguard’s experience, stability, depth, and performance, among other factors, warranted continuation of the advisory arrangement.

Investment performance

The board considered the short-term and since-inception performance of the fund, including any periods of outperformance or underperformance compared with its target index and peer group. The board concluded that the performance was such that the advisory arrangement should continue.

Cost

The board concluded that the fund’s acquired fund fees and expenses were below the average expense ratio charged by funds in its peer group. The fund does not incur advisory expenses directly; however, the board noted that each of the underlying funds in which the fund invests has advisory expenses below the relevant peer-group average.

The board does not conduct a profitability analysis of Vanguard because of Vanguard’s unique structure. Unlike most other mutual fund management companies, Vanguard is owned by the funds it oversees.

The benefit of economies of scale

The board concluded that Vanguard’s arrangement with the Total World Bond ETF and its underlying funds ensures the fund will realize economies of scale as the assets of the underlying funds grow, with the cost to shareholders declining as assets increase.

The board will consider whether to renew the advisory arrangement again after a one-year period.