UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-07851

_Franklin Templeton Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices)(Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: _12/31/13

Item 1. Reports to Stockholders.

| Contents | |||||||

| Shareholder Letter | 1 | Annual Report | Franklin Templeton | Report of Independent | |||

| Growth Allocation Fund | 25 | Registered Public | |||||

| Economic and Market Overview | 3 | Accounting Firm | 78 | ||||

| Franklin Templeton | Financial Highlights and | ||||||

| Conservative Allocation Fund | 5 | Statements of Investments | 35 | Tax Information | 79 | ||

| Financial Statements | 56 | Board Members and Officers | 82 | ||||

| Franklin Templeton | |||||||

| Moderate Allocation Fund | 15 | Notes to Financial Statements | 61 | Shareholder Information | 87 | ||

| 1

Annual Report

Economic and Market Overview

The 12 months under review were characterized by reinvigorated policy support and an economic recovery in developed markets. However, differences in global economic trends corresponded with increasingly divergent monetary policies, and growth in emerging market economies tended to slow. The central banks of key developed markets generally reaffirmed their accommodative monetary stances while some emerging market counterparts tightened policy rates as they sought to control inflation and currency depreciation.

In the U.S., economic growth and employment trends generally exceeded expectations, underpinned by consumer and business spending and rising inventories. Historically low mortgage rates and improving sentiment aided the housing market recovery, evidenced by solid new and existing home sales, rising home prices, low inventories and multi-year lows in new foreclosures. The U.S. Federal Reserve Board (Fed) expanded its asset purchase program to $85 billion per month from $40 billion early in the year. After encouraging economic and employment reports, the Fed announced in December it would reduce its monthly bond purchases by $10 billion beginning in January 2014; however, the Fed committed to keeping interest rates low. In October, the federal government temporarily shut down after Congress failed to authorize routine federal funding amid a disagreement over a new health care law. However, Congress subsequently agreed to fund the government through early 2014 and later passed a two-year budget deal that could ease automatic spending cuts and lower the risk of another shutdown.

Outside the U.S., the eurozone emerged from its longest recession on record during the second half of 2013 and Japan’s growth moderated. The European Central Bank reduced its policy rate to a record low and pledged to maintain systemic support following political turmoil in Greece, Spain, Portugal and Italy. Germany’s re-election of Chancellor Angela Merkel was largely perceived as a vote of support for ongoing eurozone reform measures. In Asia, the Bank of Japan set an explicit inflation target and pledged to double bond purchases in an unprecedented wave of policy reform. The U.S. dollar fell versus the euro but rose versus the Japanese yen in 2013.

Growth in many emerging markets moderated based on lower domestic demand, falling exports and weakening commodity prices. Political turmoil in certain emerging markets, the Fed’s potential tapering of its asset purchase program and the Chinese central bank’s effort to tighten liquidity to curb real estate and credit speculation led to a sell-off in emerging market equities and

Annual Report | 3

a sharp depreciation in regional currencies against the U.S. dollar. Central banks in Brazil, India and Indonesia raised interest rates in the second half of 2013 as they sought to curb inflation.

The stock market rally in developed markets accelerated during 2013 amid redoubled central bank commitments, continued corporate earnings strength and increasing signs of economic progress. Emerging market stocks rebounded toward period-end, although Latin American stocks trailed their emerging market peers. Oil prices rallied in the third quarter and rose for the year mainly owing to supply concerns related to geopolitical turmoil, but gold posted its largest annual price decline in more than three decades. Increasingly divergent economic and political circumstances during the period resulted in declining market correlations, which many bottom-up investors perceived as more favorable.

The foregoing information reflects our analysis and opinions as of December 31, 2013. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

4 | Annual Report

Franklin Templeton Conservative Allocation Fund

Your Fund’s Goal and Main Investments: Franklin Templeton Conservative Allocation

Fund seeks the highest level of long-term total return consistent with a lower level of risk.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or

implied performance or portfolio composition, which may change on a continuous basis.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

SOI, which begins on page 40.

Annual Report | 5

| Top 10 Fund Holdings | ||

| Franklin Templeton | ||

| Conservative Allocation Fund | ||

| 12/31/13 | ||

| % of Total | ||

| Net Assets | ||

| Templeton Global Total Return Fund – | ||

| Class R6 | 17.3 | % |

| Franklin U.S. Government Securities | ||

| Fund – Class R6 | 11.5 | % |

| Franklin Low Duration Total Return | ||

| Fund – Class R6 | 9.8 | % |

| Franklin Growth Fund – Class R6 | 9.5 | % |

| Franklin Rising Dividends Fund – | ||

| Class R6 | 6.5 | % |

| Franklin Strategic Income Fund – | ||

| Class R6 | 5.6 | % |

| iShares Intermediate Credit Bond, ETF | 4.8 | % |

| Franklin DynaTech Fund – Class R6 | 4.2 | % |

| Templeton Foreign Fund – Class R6 | 4.0 | % |

| Mutual European Fund – Class R6 | 3.8 | % |

Australasia, Far East (EAFE) Index, which measures global stock performance for developed markets excluding the U.S. and Canada, produced total returns of +32.39% and +23.29%.2 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Index, which tracks U.S. investment-grade bonds, had a -2.02% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 8.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes, and when selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed mainly to its allocation among equities and fixed income securities and to the actual performance of the fund investments.

At period-end, Franklin Templeton Conservative Allocation Fund allocated 51.9% of total net assets to fixed income and 44.2% of total net assets to equity. Domestic fixed income exposure was 60.9% of the total fixed income weighting, with the balance represented by foreign fixed income. Templeton Global Total Return Fund – Class R6, representing 17.3% of the Fund’s total net assets, was our largest fixed income fund weighting at period-end. On the equity side, domestic exposure was 68.6% of the Fund’s total equity weighting, with the balance represented by foreign equity. The portfolio was diversified across capitalization sizes and investment styles, and on December 31, 2013,

2. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

6 | Annual Report

we held shares in large-, mid- and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6 was our largest equity fund weighting at 9.5% of total net assets.

During the 12-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, and our largest domestic value fund holding, Franklin Rising Dividends Fund – Class R6, underperformed the S&P 500. Our largest foreign equity fund holding, Templeton Foreign Fund – Class R6, outperformed the MSCI EAFE Index. On the fixed income side, Templeton Global Total Return Fund – Class R6 outperformed the Barclays U.S. Aggregate Index while Franklin U.S. Government Securities Fund – Class R6 performed better than the index.

Thank you for your continued participation in Franklin Templeton Conservative Allocation Fund. We look forward to serving your future investment needs.

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2013, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 7

Performance Summary as of 12/31/13

Franklin Templeton Conservative Allocation Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Price and Distribution Information | ||||||||

| Class A (Symbol: FTCIX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 0.59 | $ | 14.65 | $ | 14.06 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.3235 | ||||||

| Long-Term Capital Gain | $ | 0.5190 | ||||||

| Total | $ | 0.8425 | ||||||

| Class C (Symbol: FTCCX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 0.57 | $ | 14.40 | $ | 13.83 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2186 | ||||||

| Long-Term Capital Gain | $ | 0.5190 | ||||||

| Total | $ | 0.7376 | ||||||

| Class R (Symbol: FTCRX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 0.59 | $ | 14.60 | $ | 14.01 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2857 | ||||||

| Long-Term Capital Gain | $ | 0.5190 | ||||||

| Total | $ | 0.8047 | ||||||

| Class R6 (Symbol: n/a) | Change | 12/31/13 | �� | 5/1/13 | ||||

| Net Asset Value (NAV) | +$ | 0.01 | $ | 14.63 | $ | 14.62 | ||

| Distributions (5/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.3288 | ||||||

| Long-Term Capital Gain | $ | 0.5190 | ||||||

| Total | $ | 0.8478 | ||||||

| Advisor Class (Symbol: FTCZX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 0.59 | $ | 14.64 | $ | 14.05 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.3598 | ||||||

| Long-Term Capital Gain | $ | 0.5190 | ||||||

| Total | $ | 0.8788 | ||||||

8 | Annual Report

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

| Class A | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 10.39 | % | + | 55.80 | % | + | 77.35 | % |

| Average Annual Total Return3 | + | 4.02 | % | + | 7.98 | % | + | 5.27 | % |

| Value of $10,000 Investment4 | $ | 10,402 | $ | 14,679 | $ | 16,711 | |||

| Total Annual Operating Expenses5 | 1.14% (with waiver) | 1.15% (without waiver) | |||||||

| Class C | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 9.61 | % | + | 50.12 | % | + | 64.57 | % |

| Average Annual Total Return3 | + | 8.61 | % | + | 8.46 | % | + | 5.11 | % |

| Value of $10,000 Investment4 | $ | 10,861 | $ | 15,012 | $ | 16,457 | |||

| Total Annual Operating Expenses5 | 1.89% (with waiver) | 1.90% (without waiver) | |||||||

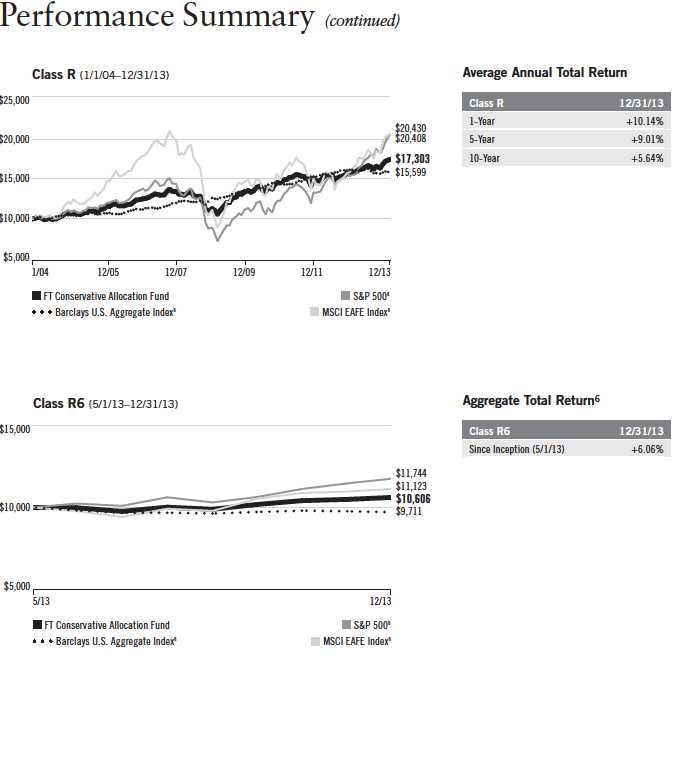

| Class R | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 10.14 | % | + | 53.93 | % | + | 73.03 | % |

| Average Annual Total Return3 | + | 10.14 | % | + | 9.01 | % | + | 5.64 | % |

| Value of $10,000 Investment4 | $ | 11,014 | $ | 15,393 | $ | 17,303 | |||

| Total Annual Operating Expenses5 | 1.39% (with waiver) | 1.40% (without waiver) | |||||||

| Class R6 | Inception (5/1/13) | ||||||||

| Cumulative Total Return2 | + | 6.06 | % | ||||||

| Aggregate Total Return6 | + | 6.06 | % | ||||||

| Value of $10,000 Investment4 | $ | 10,606 | |||||||

| Total Annual Operating Expenses5 | 0.77% (with waiver) | 0.78% (without waiver) | |||||||

| Advisor Class7 | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 10.67 | % | + | 57.76 | % | + | 80.90 | % |

| Average Annual Total Return3 | + | 10.67 | % | + | 9.55 | % | + | 6.11 | % |

| Value of $10,000 Investment4 | $ | 11,067 | $ | 15,776 | $ | 18,090 | |||

| Total Annual Operating Expenses5 | 0.89% (with waiver) | 0.90% (without waiver) | |||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 9

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

10 | Annual Report

Annual Report | 11

While an asset allocation plan can be a valuable tool to help reduce overall volatility, all investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, which may engage in a variety of investment strategies involving certain risks, the Fund is subject to those same risks. Typically, the more aggressive the investment, or the greater the potential return, the more risk involved. Generally, investors should be comfortable with some fluctuation in the value of their investments, especially over the short term. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. These risks are described in the Fund’s prospectus. Investors should consult their financial advisors for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Class R6: Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 4/30/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 20%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

7. Effective 12/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 12/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 12/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 12/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +61.21% and +6.09%.

8. Source: © 2014 Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The MSCI EAFE Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets excluding the U.S. and Canada. The Barclays U.S. Aggregate Index is a market capitalization-weighted index representing the U.S. investment-grade, fixed-rate, taxable bond market with index components for government and corporate, mortgage pass-through and asset-backed securities. All issues included are SEC registered, taxable, dollar denominated and nonconvertible, must have at least one year to final maturity and must be rated investment grade (Baa3/BBB-/BBB- or higher) using the middle rating of Moody’s, Standard & Poor’s and Fitch, respectively.

12 | Annual Report

Your Fund’s Expenses

Franklin Templeton Conservative Allocation Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 13

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| Beginning | Ending | Expenses Paid | Expenses Paid | |||||

| Account Value | Account Value | During Period* | During Period** | |||||

| Class A | 7/1/13 | 12/31/13 | 7/1/13–12/31/13 | 7/1/13–12/31/13 | ||||

| Actual | $ | 1,000 | $ | 1,084.10 | $ | 3.31 | $ | 6.36 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.03 | $ | 3.21 | $ | 6.16 |

| Class C | ||||||||

| Actual | $ | 1,000 | $ | 1,080.00 | $ | 7.23 | $ | 10.28 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.25 | $ | 7.02 | $ | 9.96 |

| Class R | ||||||||

| Actual | $ | 1,000 | $ | 1,083.00 | $ | 4.62 | $ | 7.67 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.77 | $ | 4.48 | $ | 7.43 |

| Class R6 | ||||||||

| Actual | $ | 1,000 | $ | 1,086.20 | $ | 1.47 | $ | 4.52 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.79 | $ | 1.43 | $ | 4.38 |

| Advisor Class | ||||||||

| Actual | $ | 1,000 | $ | 1,085.50 | $ | 2.00 | $ | 5.05 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.29 | $ | 1.94 | $ | 4.89 |

14 | Annual Report

*Expenses are calculated using the most recent six-month expense ratio excluding expenses of the fund investments, net of expense waivers,

annualized for each class (A: 0.63%; C: 1.38%; R: 0.88%; R6: 0.28%; and Advisor: 0.38%), multiplied by the average account value over the

period, multiplied by 184/365 to reflect the one-half year period.

**Expenses are calculated using the most recent six-month expense ratio including expenses of the fund investments, net of expense waivers,

annualized for each class (A: 1.21%; C: 1.96%; R: 1.46%; R6: 0.86%; and Advisor: 0.96%), multiplied by the average account value over the

period, multiplied by 184/365 to reflect the one-half year period.

Franklin Templeton Moderate Allocation Fund

Your Fund’s Goal and Main Investments: Franklin Templeton Moderate Allocation Fund

seeks the highest level of long-term total return consistent with a moderate level of risk.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

This annual report for Franklin Templeton Moderate Allocation Fund covers

the fiscal year ended December 31, 2013.

Performance Overview

Franklin Templeton Moderate Allocation Fund – Class A delivered a +14.35%

cumulative total return for the 12 months under review. By comparison, the

Fund’s equity benchmarks, the Standard & Poor’s 500 Index (S&P 500), a

broad measure of U.S. stock performance, and MSCI Europe, Australasia, Far

East (EAFE) Index, which measures global stock performance for developed

markets excluding the U.S. and Canada, produced total returns of +32.39%

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or

implied performance or portfolio composition, which may change on a continuous basis.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

SOI, which begins on page 47.

Annual Report | 15

| Top 10 Fund Holdings | ||

| Franklin Templeton | ||

| Moderate Allocation Fund | ||

| 12/31/13 | ||

| % of Total | ||

| Net Assets | ||

| Franklin Growth Fund – Class R6 | 12.7 | % |

| Templeton Global Total Return Fund – | ||

| Class R6 | 12.1 | % |

| Franklin Rising Dividends Fund – | ||

| Class R6 | 8.4 | % |

| Franklin U.S. Government Securities | ||

| Fund – Class R6 | 8.2 | % |

| Franklin Low Duration Total Return | ||

| Fund – Class R6 | 7.2 | % |

| Templeton Foreign Fund – Class R6 | 5.3 | % |

| Franklin DynaTech Fund – Class R6 | 5.2 | % |

| Mutual European Fund – Class R6 | 5.0 | % |

| Franklin Strategic Income Fund – | ||

| Class R6 | 4.0 | % |

| Franklin Utilities Fund – Class R6 | 3.7 | % |

and +23.29%.2 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Index, which tracks U.S. investment-grade bonds, had a -2.02% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 18.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes, and when selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed mainly to its allocation among equities and fixed income securities and to the actual performance of the fund investments.

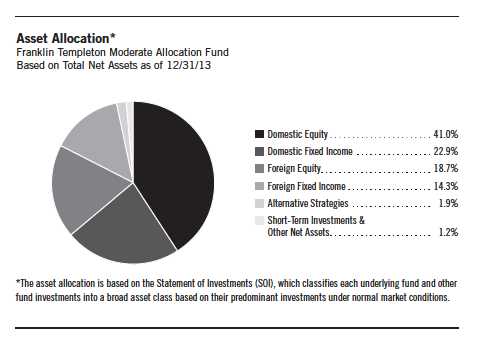

At period-end, Franklin Templeton Moderate Allocation Fund allocated 59.7% of total net assets to equity and 37.2% to fixed income. Domestic equity exposure was 68.7% of the total equity weighting, with the balance represented by foreign equity. The portfolio was diversified across capitalization sizes and investment styles, and on December 31, 2013, we held shares in large-, mid-and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6, representing 12.7% of the Fund’s total net assets, was our largest equity fund weighting at period-end. On the fixed income side, domestic exposure was 61.6% of the Fund’s total income weighting, with the balance represented by foreign fixed income. Templeton Global Total Return Fund – Class R6 was our largest fixed income fund weighting at 12.1% of total net assets.

2. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

16 | Annual Report

During the 12-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, and our largest domestic value fund holding, Franklin Rising Dividends Fund – Class R6, underperformed the S&P 500. Our largest foreign equity fund holding, Templeton Foreign Fund – Class R6, outperformed the MSCI EAFE Index. On the fixed income side, Templeton Global Total Return Fund – Class R6 outperformed the Barclays U.S. Aggregate Index while Franklin U.S. Government Securities Fund – Class R6 performed better than the index.

Thank you for your continued participation in Franklin Templeton Moderate Allocation Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2013, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 17

Performance Summary as of 12/31/13

Franklin Templeton Moderate Allocation Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Price and Distribution Information | ||||||||

| Class A (Symbol: FMTIX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 1.19 | $ | 15.78 | $ | 14.59 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2960 | ||||||

| Short-Term Capital Gain | $ | 0.0034 | ||||||

| Long-Term Capital Gain | $ | 0.5557 | ||||||

| Total | $ | 0.8551 | ||||||

| Class C (Symbol: FTMTX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 1.14 | $ | 15.42 | $ | 14.28 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.1853 | ||||||

| Short-Term Capital Gain | $ | 0.0034 | ||||||

| Long-Term Capital Gain | $ | 0.5557 | ||||||

| Total | $ | 0.7444 | ||||||

| Class R (Symbol: FTMRX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 1.18 | $ | 15.73 | $ | 14.55 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2569 | ||||||

| Short-Term Capital Gain | $ | 0.0034 | ||||||

| Long-Term Capital Gain | $ | 0.5557 | ||||||

| Total | $ | 0.8160 | ||||||

| Class R6 (Symbol: n/a) | Change | 12/31/13 | 5/1/13 | |||||

| Net Asset Value (NAV) | +$ | 0.46 | $ | 15.79 | $ | 15.33 | ||

| Distributions (5/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.3101 | ||||||

| Short-Term Capital Gain | $ | 0.0034 | ||||||

| Long-Term Capital Gain | $ | 0.5557 | ||||||

| Total | $ | 0.8692 | ||||||

18 | Annual Report

| Performance Summary (continued) | ||||||

| Price and Distribution Information (continued) | ||||||

| Advisor Class (Symbol: FMTZX) | Change | 12/31/13 | 12/31/12 | |||

| Net Asset Value (NAV) | +$ | 1.19 | $ | 15.79 | $ | 14.60 |

| Distributions (1/1/13–12/31/13) | ||||||

| Dividend Income | $ | 0.3347 | ||||

| Short-Term Capital Gain | $ | 0.0034 | ||||

| Long-Term Capital Gain | $ | 0.5557 | ||||

| Total | $ | 0.8938 | ||||

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

| Class A | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 14.35 | % | + | 71.96 | % | + | 92.06 | % |

| Average Annual Total Return3 | + | 7.78 | % | + | 10.14 | % | + | 6.11 | % |

| Value of $10,000 Investment4 | $ | 10,778 | $ | 16,208 | $ | 18,097 | |||

| Total Annual Operating Expenses5 | 1.20% (with waiver) | 1.22% (without waiver) | |||||||

| Class C | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 13.41 | % | + | 65.63 | % | + | 78.09 | % |

| Average Annual Total Return3 | + | 12.41 | % | + | 10.62 | % | + | 5.94 | % |

| Value of $10,000 Investment4 | $ | 11,241 | $ | 16,563 | $ | 17,809 | |||

| Total Annual Operating Expenses5 | 1.95% (with waiver) | 1.97% (without waiver) | |||||||

| Class R | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 13.97 | % | + | 69.82 | % | + | 87.24 | % |

| Average Annual Total Return3 | + | 13.97 | % | + | 11.17 | % | + | 6.47 | % |

| Value of $10,000 Investment4 | $ | 11,397 | $ | 16,982 | $ | 18,724 | |||

| Total Annual Operating Expenses5 | 1.45% (with waiver) | 1.47% (without waiver) | |||||||

| Class R6 | Inception (5/1/13) | ||||||||

| Cumulative Total Return2 | + | 8.93 | % | ||||||

| Aggregate Total Return6 | + | 8.93 | % | ||||||

| Value of $10,000 Investment4 | $ | 10,893 | |||||||

| Total Annual Operating Expenses5 | 0.81% (with waiver) | 0.83% (without waiver) | |||||||

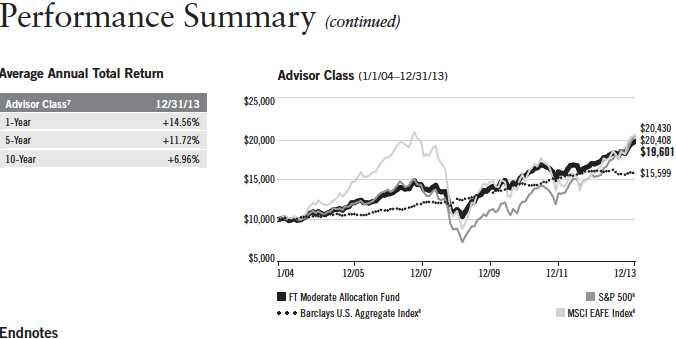

| Advisor Class7 | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 14.56 | % | + | 74.06 | % | + | 96.01 | % |

| Average Annual Total Return3 | + | 14.56 | % | + | 11.72 | % | + | 6.96 | % |

| Value of $10,000 Investment4 | $ | 11,456 | $ | 17,406 | $ | 19,601 | |||

| Total Annual Operating Expenses5 | 0.95% (with waiver) | 0.97% (without waiver) | |||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 19

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

20 | Annual Report

Annual Report | 21

While an asset allocation plan can be a valuable tool to help reduce overall volatility, all investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, which may engage in a variety of investment strategies involving certain risks, the Fund is subject to those same risks. Typically, the more aggressive the investment, or the greater the potential return, the more risk involved. Generally, investors should be comfortable with some fluctuation in the value of their investments, especially over the short term. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. These risks are described in the Fund’s prospectus. Investors should consult their financial advisors for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

Class C: Class R: | These shares have higher annual fees and expenses than Class A shares. Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares. |

Class R6: Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has an expense reduction contractually guaranteed through at least 4/30/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction and fee waiver, to the extent applicable; without these reductions, the results would have been lower. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 10%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual fund operating expenses to become higher than the figures shown.

6. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

7. Effective 12/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 12/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 12/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 12/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +69.79% and +6.77%.

8. Source: © 2014 Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The MSCI EAFE Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets excluding the U.S. and Canada. The Barclays U.S. Aggregate Index is a market capitalization-weighted index representing the U.S. investment-grade, fixed-rate, taxable bond market with index components for government and corporate, mortgage pass-through and asset-backed securities. All issues included are SEC registered, taxable, dollar denominated and nonconvertible, must have at least one year to final maturity and must be rated investment grade (Baa3/BBB-/BBB- or higher) using the middle rating of Moody’s, Standard & Poor’s and Fitch, respectively.

22 | Annual Report

Your Fund’s Expenses

Franklin Templeton Moderate Allocation Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 23

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| Beginning | Ending | Expenses Paid | Expenses Paid | |||||

| Account Value | Account Value | During Period* | During Period** | |||||

| Class A | 7/1/13 | 12/31/13 | 7/1/13–12/31/13 | 7/1/13–12/31/13 | ||||

| Actual | $ | 1,000 | $ | 1,107.50 | $ | 3.29 | $ | 6.48 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.08 | $ | 3.16 | $ | 6.21 |

| Class C | ||||||||

| Actual | $ | 1,000 | $ | 1,102.30 | $ | 7.26 | $ | 10.44 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.30 | $ | 6.97 | $ | 10.01 |

| Class R | ||||||||

| Actual | $ | 1,000 | $ | 1,105.00 | $ | 4.62 | $ | 7.80 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.82 | $ | 4.43 | $ | 7.48 |

| Class R6 | ||||||||

| Actual | $ | 1,000 | $ | 1,108.90 | $ | 1.38 | $ | 4.57 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.89 | $ | 1.33 | $ | 4.38 |

| Advisor Class | ||||||||

| Actual | $ | 1,000 | $ | 1,108.20 | $ | 1.97 | $ | 5.15 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.34 | $ | 1.89 | $ | 4.94 |

*Expenses are calculated using the most recent six-month expense ratio excluding expenses of the fund investments, net of expense waivers, annualized for each class (A: 0.62%; C: 1.37%; R: 0.87%; R6: 0.26%; and Advisor: 0.37%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

**Expenses are calculated using the most recent six-month expense ratio including expenses of the fund investments, net of expense waivers, annualized for each class (A: 1.22%; C: 1.97%; R: 1.47%; R6: 0.86%; and Advisor: 0.97%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

24 | Annual Report

Franklin Templeton Growth Allocation Fund

Your Fund’s Goal and Main Investments: Franklin Templeton Growth Allocation Fund seeks the highest level of long-term total return consistent with a higher level of risk.1

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

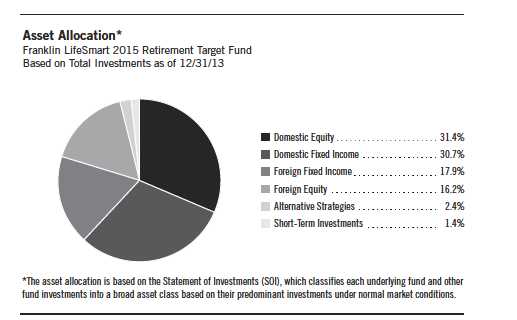

| Asset Allocation* | |

| Franklin Templeton | |

| Growth Allocation Fund | |

| Based on Total Net Assets as of 12/31/13 | |

| Domestic Equity | 56.9% |

| Foreign Equity | 27.5% |

| Domestic Fixed Income | 8.2% |

| Foreign Fixed Income | 5.0% |

| Alternative Strategies | 0.8% |

| Short-Term Investments & Other Net Assets | 1.6% |

| *The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying | |

| fund and other fund investments into a broad asset class based on their predominant | |

| investments under normal market conditions. | |

This annual report for Franklin Templeton Growth Allocation Fund covers the fiscal year ended December 31, 2013.

Performance Overview

Franklin Templeton Growth Allocation Fund – Class A delivered a +20.98% cumulative total return for the 12 months under review. By comparison, the Fund’s equity benchmarks, the Standard & Poor’s 500 Index (S&P 500), a broad measure of U.S. stock performance, and MSCI Europe, Australasia, Far East (EAFE) Index, which measures global stock performance for developed markets excluding the U.S. and Canada, produced total returns of +32.39% and +23.29%.2 The Fund’s fixed income benchmark, the Barclays U.S. Aggregate Index, which tracks U.S. investment-grade bonds, had a -2.02% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 28.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes, and

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or implied performance or portfolio composition, which may change on a continuous basis.

2. Source: © 2014 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. The indexes are unmanaged and include reinvestment of any income or distributions. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s SOI, which begins on page 54.

Annual Report | 25

| Top 10 Fund Holdings | ||

| Franklin Templeton | ||

| Growth Allocation Fund | ||

| 12/31/13 | ||

| % of Total | ||

| Net Assets | ||

| Franklin Growth Fund – Class R6 | 16.9 | % |

| Franklin Rising Dividends Fund – | ||

| Class R6 | 11.7 | % |

| Templeton Foreign Fund – Class R6 | 7.6 | % |

| Franklin DynaTech Fund – Class R6 | 7.4 | % |

| Mutual European Fund – Class R6 | 7.0 | % |

| Franklin International Small Cap Growth | ||

| Fund – Class R6 | 5.2 | % |

| Franklin Utilities Fund – Class R6 | 4.9 | % |

| Franklin Flex Cap Growth Fund – | ||

| Class R6 | 4.3 | % |

| Templeton Global Total Return Fund – | ||

| Class R6 | 4.2 | % |

| Templeton Frontier Markets Fund – | ||

| Class R6 | 3.6 | % |

when selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed mainly to its allocation among equities and fixed income securities and to the actual performance of the fund investments.

At period-end, Franklin Templeton Growth Allocation Fund allocated 84.4% of total net assets to equity and 13.2% to fixed income. Domestic equity exposure was 67.4% of the total equity weighting, with the balance represented by foreign equity. The portfolio was diversified across capitalization sizes and investment styles, and on December 31, 2013, we held shares in large-, mid-and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6, representing 16.9% of the Fund’s total net assets, was our largest equity fund weighting at period-end. On the fixed income side, domestic exposure was 62.1% of the Fund’s total income weighting, with the balance represented by foreign fixed income. Templeton Global Total Return Fund – Class R6 was our largest fixed income fund weighting at 4.2% of total net assets.

During the 12-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, and our largest domestic value fund holding, Franklin Rising Dividends Fund – Class R6, underperformed the S&P 500. Our largest foreign equity fund holding, Templeton Foreign Fund – Class R6, outperformed the MSCI EAFE Index. On the fixed income side, Templeton Global Total Return Fund – Class R6 outperformed the Barclays U.S. Aggregate Index.

26 | Annual Report

Thank you for your continued participation in Franklin Templeton Growth Allocation Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2013, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Annual Report | 27

Performance Summary as of 12/31/13

Franklin Templeton Growth Allocation Fund

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Price and Distribution Information | ||||||||

| Class A (Symbol: FGTIX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 2.59 | $ | 18.40 | $ | 15.81 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2473 | ||||||

| Long-Term Capital Gain | $ | 0.4420 | ||||||

| Total | $ | 0.6893 | ||||||

| Class C (Symbol: FTGTX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 2.50 | $ | 18.00 | $ | 15.50 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.1289 | ||||||

| Long-Term Capital Gain | $ | 0.4420 | ||||||

| Total | $ | 0.5709 | ||||||

| Class R (Symbol: FGTRX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 2.55 | $ | 18.18 | $ | 15.63 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2021 | ||||||

| Long-Term Capital Gain | $ | 0.4420 | ||||||

| Total | $ | 0.6441 | ||||||

| Class R6 (Symbol: n/a) | Change | 12/31/13 | 5/1/13 | |||||

| Net Asset Value (NAV) | +$ | 1.56 | $ | 18.44 | $ | 16.88 | ||

| Distributions (5/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.3040 | ||||||

| Long-Term Capital Gain | $ | 0.4420 | ||||||

| Total | $ | 0.7460 | ||||||

| Advisor Class (Symbol: FGTZX) | Change | 12/31/13 | 12/31/12 | |||||

| Net Asset Value (NAV) | +$ | 2.60 | $ | 18.45 | $ | 15.85 | ||

| Distributions (1/1/13–12/31/13) | ||||||||

| Dividend Income | $ | 0.2898 | ||||||

| Long-Term Capital Gain | $ | 0.4420 | ||||||

| Total | $ | 0.7318 | ||||||

28 | Annual Report

Performance Summary (continued)

Performance1

Cumulative total return excludes sales charges. Aggregate and average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only; Class R/R6/Advisor Class: no sales charges.

| Class A | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 20.98 | % | + | 94.04 | % | + | 104.29 | % |

| Average Annual Total Return3 | + | 14.06 | % | + | 12.83 | % | + | 6.77 | % |

| Value of $10,000 Investment4 | $ | 11,406 | $ | 18,287 | $ | 19,249 | |||

| Total Annual Operating Expenses5 | 1.25% (with waiver) | 1.32% (without waiver) | |||||||

| Class C | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 20.04 | % | + | 86.89 | % | + | 89.49 | % |

| Average Annual Total Return3 | + | 19.04 | % | + | 13.32 | % | + | 6.60 | % |

| Value of $10,000 Investment4 | $ | 11,904 | $ | 18,689 | $ | 18,949 | |||

| Total Annual Operating Expenses5 | 2.00% (with waiver) | 2.07% (without waiver) | |||||||

| Class R | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 20.67 | % | + | 91.73 | % | + | 99.31 | % |

| Average Annual Total Return3 | + | 20.67 | % | + | 13.90 | % | + | 7.14 | % |

| Value of $10,000 Investment4 | $ | 12,067 | $ | 19,173 | $ | 19,931 | |||

| Total Annual Operating Expenses5 | 1.50% (with waiver) | 1.57% (without waiver) | |||||||

| Class R6 | Inception (5/1/13) | ||||||||

| Cumulative Total Return2 | + | 13.88 | % | ||||||

| Aggregate Total Return6 | + | 13.88 | % | ||||||

| Value of $10,000 Investment4 | $ | 11,388 | |||||||

| Total Annual Operating Expenses5 | 0.82% (with waiver) | 0.89% (without waiver) | |||||||

| Advisor Class7 | 1-Year | 5-Year | 10-Year | ||||||

| Cumulative Total Return2 | + | 21.26 | % | + | 96.57 | % | + | 108.60 | % |

| Average Annual Total Return3 | + | 21.26 | % | + | 14.47 | % | + | 7.63 | % |

| Value of $10,000 Investment4 | $ | 12,126 | $ | 19,657 | $ | 20,860 | |||

| Total Annual Operating Expenses5 | 1.00% (with waiver) | 1.07% (without waiver) | |||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Annual Report | 29

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged indexes include reinvestment of any income or distributions. They differ from the Fund in composition and do not pay management fees or expenses. One cannot invest directly in an index.

30 | Annual Report

Annual Report | 31

While an asset allocation plan can be a valuable tool to help reduce overall volatility, all investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, which may engage in a variety of investment strategies involving certain risks, the Fund is subject to those same risks. Typically, the more aggressive the investment, or the greater the potential return, the more risk involved. Generally, investors should be comfortable with some fluctuation in the value of their investments, especially over the short term. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks that are heightened in developing countries. These risks are described in the Fund’s prospectus. Investors should consult their financial advisors for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and

expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has an expense reduction contractually guaranteed through at least 4/30/14 and a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year end. Fund investment results reflect the expense reduction, without which the results would have been lower. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 5%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. 4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

6. Aggregate total return represents the change in value of an investment for the period indicated. Since Class R6 shares have existed for less than one year, average annual total return is not available.

7. Effective 12/1/05, the Fund began offering Advisor Class shares, which do not have sales charges or a Rule 12b-1 plan. Performance quotations for this class reflect the following methods of calculation: (a) For periods prior to 12/1/05, a restated figure is used based upon the Fund’s Class A performance, excluding the effect of Class A’s maximum initial sales charge, but reflecting the effect of the Class A Rule 12b-1 fees; and (b) for periods after 12/1/05, actual Advisor Class performance is used reflecting all charges and fees applicable to that class. Since 12/1/05 (commencement of sales), the cumulative and average annual total returns of Advisor Class shares were +73.73% and +7.07%.

8. Source: © 2014 Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance. The MSCI EAFE Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets excluding the U.S. and Canada. The Barclays U.S. Aggregate Index is a market capitalization-weighted index representing the U.S. investment-grade, fixed-rate, taxable bond market with index components for government and corporate, mortgage pass-through and asset-backed securities. All issues included are SEC registered, taxable, dollar denominated and nonconvertible, must have at least one year to final maturity and must be rated investment grade (Baa3/BBB-/BBB- or higher) using the middle rating of Moody’s, Standard & Poor’s and Fitch, respectively.

32 | Annual Report

Your Fund’s Expenses

Franklin Templeton Growth Allocation Fund

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 33

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

| Beginning | Ending | Expenses Paid | Expenses Paid | |||||

| Account Value | Account Value | During Period* | During Period** | |||||

| Class A | 7/1/13 | 12/31/13 | 7/1/13–12/31/13 | 7/1/13–12/31/13 | ||||

| Actual | $ | 1,000 | $ | 1,146.00 | $ | 3.35 | $ | 6.76 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.08 | $ | 3.16 | $ | 6.36 |

| Class C | ||||||||

| Actual | $ | 1,000 | $ | 1,141.50 | $ | 7.39 | $ | 10.80 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.30 | $ | 6.97 | $ | 10.16 |

| Class R | ||||||||

| Actual | $ | 1,000 | $ | 1,144.50 | $ | 4.70 | $ | 8.11 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.82 | $ | 4.43 | $ | 7.63 |

| Class R6 | ||||||||

| Actual | $ | 1,000 | $ | 1,147.80 | $ | 1.19 | $ | 4.60 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,024.15 | $ | 1.12 | $ | 4.33 |

| Advisor Class | ||||||||

| Actual | $ | 1,000 | $ | 1,147.40 | $ | 2.00 | $ | 5.41 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,023.34 | $ | 1.89 | $ | 5.09 |

*Expenses are calculated using the most recent six-month expense ratio excluding expenses of the fund investments, net of expense waivers, annualized for each class (A: 0.62%; C: 1.37%; R: 0.87%; R6: 0.22%; and Advisor: 0.37%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

**Expenses are calculated using the most recent six-month expense ratio including expenses of the fund investments, net of expense waivers, annualized for each class (A: 1.25%; C: 2.00%; R: 1.50%; R6: 0.85%; and Advisor: 1.00%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

34 | Annual Report

Franklin Templeton Fund Allocator Series

Financial Highlights

| Franklin Templeton Conservative Allocation Fund | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| Class A | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 14.06 | $ | 13.33 | $ | 13.74 | $ | 12.72 | $ | 10.92 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb,c | 0.31 | 0.27 | 0.30 | 0.29 | 0.25 | ||||||||||

| Net realized and unrealized gains (losses) | 1.12 | 0.79 | (0.40 | ) | 0.97 | 1.87 | |||||||||

| Total from investment operations | 1.43 | 1.06 | (0.10 | ) | 1.26 | 2.12 | |||||||||

| Less distributions from: | �� | ||||||||||||||

| Net investment income | (0.32 | ) | (0.30 | ) | (0.31 | ) | (0.24 | ) | (0.24 | ) | |||||

| Net realized gains | (0.52 | ) | (0.03 | ) | — | — | (0.08 | ) | |||||||

| Total distributions | (0.84 | ) | (0.33 | ) | (0.31 | ) | (0.24 | ) | (0.32 | ) | |||||

| Net asset value, end of year | $ | 14.65 | $ | 14.06 | $ | 13.33 | $ | 13.74 | $ | 12.72 | |||||

| Total returnd | 10.39 | % | 7.99 | % | (0.71 | )% | 10.00 | % | 19.67 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expenses before waiver and payments by affiliatese | 0.60 | % | 0.53 | % | 0.52 | % | 0.52 | % | 0.56 | % | |||||

| Expenses net of waiver and payments by affiliatese | 0.59 | % | 0.50 | % | 0.50 | % | 0.50 | % | 0.50 | % | |||||

| Net investment incomec | 2.11 | % | 1.98 | % | 2.17 | % | 2.25 | % | 2.15 | % | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 871,541 | $ | 794,429 | $ | 725,675 | $ | 612,828 | $ | 443,376 | |||||

| Portfolio turnover rate | 57.59 | % | 25.82 | % | 18.67 | % | 10.51 | % | 11.48 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eDoes not include expenses of the Underlying Funds and exchange traded funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds and

exchange traded funds was 0.62% for the year ended December 31, 2013.

Annual Report | The accompanying notes are an integral part of these financial statements. | 35

Franklin Templeton Fund Allocator Series

Financial Highlights (continued)

| Franklin Templeton Conservative Allocation Fund | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| Class C | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 13.83 | $ | 13.13 | $ | 13.53 | $ | 12.54 | $ | 10.77 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb,c | 0.20 | 0.17 | 0.19 | 0.19 | 0.16 | ||||||||||

| Net realized and unrealized gains (losses) | 1.11 | 0.76 | (0.38 | ) | 0.95 | 1.85 | |||||||||

| Total from investment operations | 1.31 | 0.93 | (0.19 | ) | 1.14 | 2.01 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.22 | ) | (0.20 | ) | (0.21 | ) | (0.15 | ) | (0.16 | ) | |||||

| Net realized gains | (0.52 | ) | (0.03 | ) | — | — | (0.08 | ) | |||||||

| Total distributions | (0.74 | ) | (0.23 | ) | (0.21 | ) | (0.15 | ) | (0.24 | ) | |||||

| Net asset value, end of year | $ | 14.40 | $ | 13.83 | $ | 13.13 | $ | 13.53 | $ | 12.54 | |||||

| Total returnd | 9.61 | % | 7.09 | % | (1.38 | )% | 9.12 | % | 18.84 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expenses before waiver and payments by affiliatese | 1.35 | % | 1.28 | % | 1.27 | % | 1.27 | % | 1.30 | % | |||||

| Expenses net of waiver and payments by affiliatese | 1.34 | % | 1.25 | % | 1.25 | % | 1.25 | % | 1.24 | % | |||||

| Net investment incomec | 1.36 | % | 1.23 | % | 1.42 | % | 1.50 | % | 1.41 | % | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 524,756 | $ | 452,211 | $ | 426,775 | $ | 366,892 | $ | 253,622 | |||||

| Portfolio turnover rate | 57.59 | % | 25.82 | % | 18.67 | % | 10.51 | % | 11.48 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eDoes not include expenses of the Underlying Funds and exchange traded funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds and

exchange traded funds was 0.62% for the year ended December 31, 2013.

36 | The accompanying notes are an integral part of these financial statements. | Annual Report

Franklin Templeton Fund Allocator Series

Financial Highlights (continued)

| Franklin Templeton Conservative Allocation Fund | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| Class R | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 14.01 | $ | 13.29 | $ | 13.70 | $ | 12.69 | $ | 10.89 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb,c | 0.26 | 0.24 | 0.27 | 0.27 | 0.23 | ||||||||||

| Net realized and unrealized gains (losses) | 1.14 | 0.78 | (0.40 | ) | 0.95 | 1.86 | |||||||||

| Total from investment operations | 1.40 | 1.02 | (0.13 | ) | 1.22 | 2.09 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.29 | ) | (0.27 | ) | (0.28 | ) | (0.21 | ) | (0.21 | ) | |||||

| Net realized gains | (0.52 | ) | (0.03 | ) | — | — | (0.08 | ) | |||||||

| Total distributions | (0.81 | ) | (0.30 | ) | (0.28 | ) | (0.21 | ) | (0.29 | ) | |||||

| Net asset value, end of year | $ | 14.60 | $ | 14.01 | $ | 13.29 | $ | 13.70 | $ | 12.69 | |||||

| Total return | 10.14 | % | 7.68 | % | (0.95 | )% | 9.69 | % | 19.45 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expenses before waiver and payments by affiliatesd | 0.85 | % | 0.78 | % | 0.77 | % | 0.77 | % | 0.81 | % | |||||

| Expenses net of waiver and payments by affiliatesd | 0.84 | % | 0.75 | % | 0.75 | % | 0.75 | % | 0.75 | % | |||||

| Net investment incomec | 1.86 | % | 1.73 | % | 1.92 | % | 2.00 | % | 1.90 | % | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 166,927 | $ | 178,520 | $ | 149,761 | $ | 109,077 | $ | 59,184 | |||||