UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (650) 312-2000

Date of fiscal year end: 5/31

Date of reporting period: 11/30/16

Item 1. Reports to Stockholders.

| |

| Contents | |

| |

| Semiannual Report | |

| Economic and Market Overview | 2 |

| Franklin Payout 2017 Fund | 3 |

| Franklin Payout 2018 Fund | 8 |

| Franklin Payout 2019 Fund | 13 |

| Franklin Payout 2020 Fund | 18 |

| Franklin Payout 2021 Fund | 23 |

| Financial Highlights and Statements of Investments | 28 |

| Financial Statements | 51 |

| Notes to Financial Statements | 58 |

| Shareholder Information | 66 |

Not FDIC Insured | May Lose Value | No Bank Guarantee

1

Semiannual Report

Economic and Market Overview

The U.S. economy strengthened during the six months under review. The economy grew at a faster pace in 2016’s third quarter than in the second quarter, mainly due to personal consumption expenditures, exports, private inventory investment, federal government spending and nonresidential fixed investment. Manufacturing conditions remained volatile but generally expanded, and the services sector continued to grow. The unemployment rate declined from 4.7% in May to 4.6% at period-end.1 Monthly retail sales were volatile, but grew during most of the review period. Inflation, as measured by the Consumer Price Index, remained relatively subdued for most of the period, but rose during the second half.

The U.S. Federal Reserve (Fed) kept its target interest rate at 0.25–0.50% at its November meeting, while setting the stage for an interest rate hike in December. The Fed members generally agreed that it would be appropriate to raise the federal funds rate in the near term, as long as data continue to provide evidence of economic resilience.

The 10-year Treasury yield, which moves inversely to price, shifted throughout the period. It rose from 1.84% on May 31, 2016, to a period high of 2.37% on Nov 30, 2016. However, negative interest rates in Japan and Europe and central banks’ purchases of government bonds pushed down the Treasury yield. The U.K.’s historic referendum to leave the European Union in June 2016 (also known as “Brexit”) also boosted safe haven buying by investors. The Treasury yield reached a period low of 1.37% in early July. The yield rose in October, due to positive economic data and signals from the Fed on the possibility of an increase in interest rates in the near term. Additionally, in November, the U.S. Treasury yield further increased, amid a bond market selloff, based on investor expectations that possible expansionary fiscal policies under the new U.S. President Donald Trump could lead to a stronger economy and higher inflation.

The foregoing information reflects our analysis and opinions as of November 30, 2016. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

2 Semiannual Report

Franklin Payout 2017 Fund

We are pleased to bring you Franklin Payout 2017 Fund’s semiannual report for the period ended November 30, 2016.

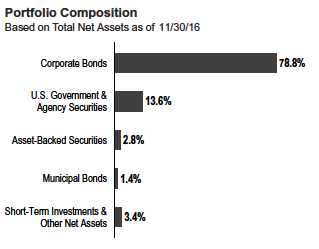

Your Fund’s Goals and Main Investments

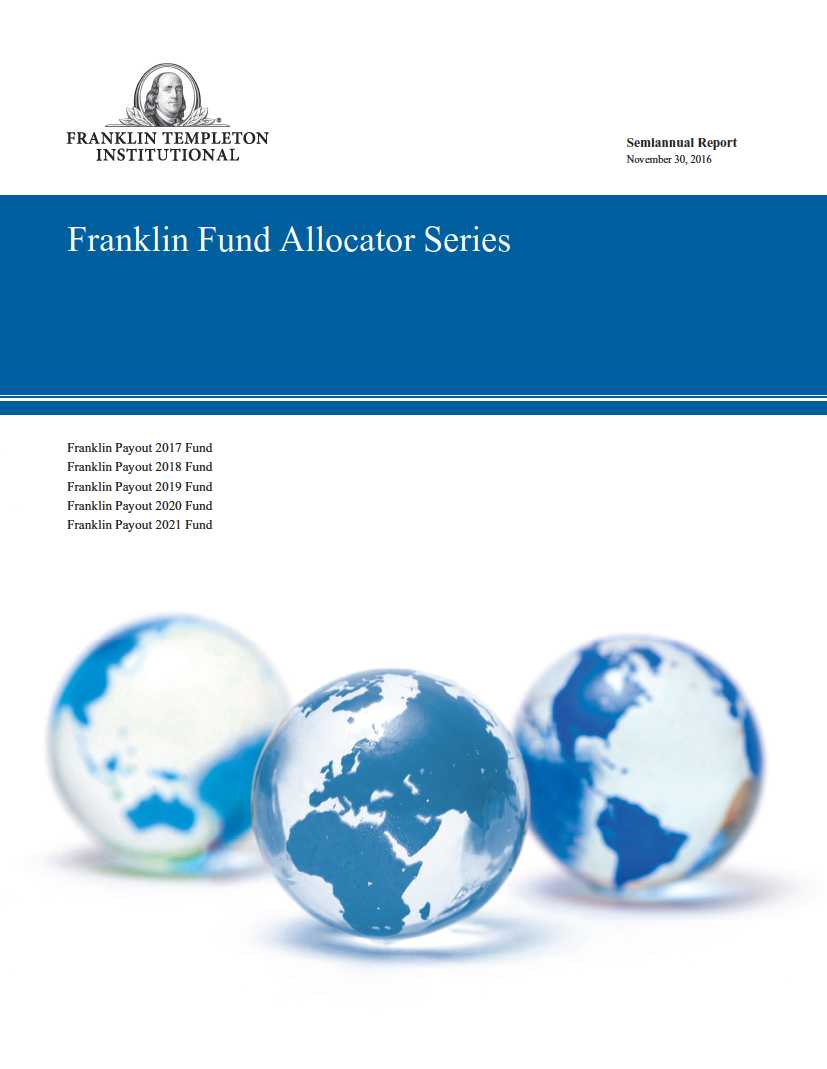

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a +0.60% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2017 Maturity Index, returned +0.40%.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2017. You can find more of the Fund’s performance data in the Performance Summary beginning on page 5.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

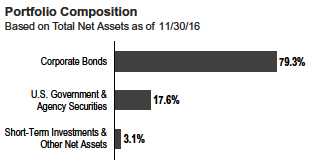

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of broad economic trends, combined with a bottom-up fundamental analysis of market sectors, industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2017. Over time, the Fund’s duration and weighted average maturity will decline as 2017 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2017, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays U.S. Government/Credit 2017 Maturity Index was enhanced primarily by our overweighted allocation to the investment-grade corporate credit sector, with security selection within the sector slightly benefiting results. In addition, our modestly longer duration

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 30.

Semiannual Report 3

| | |

| FRANKLIN PAYOUT 2017 FUND | | |

| |

| |

| |

| Maturity | | |

| 11/30/16 | | |

| | % of Total | |

| | Market Value | |

| 0 to 1 Year | 47.4 | % |

| 1 to 2 Years | 49.8 | % |

| 3 to 4 Years | 2.8 | % |

| |

| Top 10 Holdings* | | |

| 11/30/16 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| Federal Home Loan Bank (FHLB) | 8.7 | % |

| Federal National Mortgage Association (FNMA) | 4.9 | % |

| Morgan Stanley | 3.0 | % |

| Pacific Gas & Electric Co. | 2.9 | % |

| Wells Fargo & Co. | 2.9 | % |

| General Electric Co. | 2.9 | % |

| The Bear Stearns Cos. LLC | 2.9 | % |

| Bank of America Corp. | 2.9 | % |

| The Goldman Sachs Group Inc. | 2.9 | % |

| EOG Resources Inc. | 2.9 | % |

*Securities are listed by issuer, which may appear by another name in the SOI.

positioning compared with the index and security selection within our foreign holdings aided relative performance. In contrast, security selection in the U.S. agency sector detracted slightly from results.

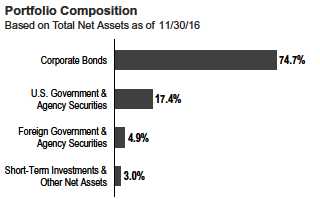

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the benchmark. We favored the sector based on our belief that its overall valuations remained relatively attractive on a longer term basis and the sector offered relatively higher earnings potential. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained an overweighted position in the agency sector. Finally, we maintained a modestly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2017 Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

4 Semiannual Report

FRANKLIN PAYOUT 2017 FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| Advisor | | | | |

| 6-Month | +0.60 | % | +0.60 | % |

| 1-Year | +1.50 | % | +1.50 | % |

| Since Inception (6/1/15) | +1.71 | % | +1.14 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 6 for Performance Summary footnotes.

Semiannual Report 5

| | | | |

| FRANKLIN PAYOUT 2017 FUND | | | | |

| PERFORMANCE SUMMARY | | | | |

| |

| Total Annual Operating Expenses4 | | | |

| Share Class | With Waiver | | Without Waiver | |

| Advisor | 0.44 | % | 4.25 | % |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its

value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of

bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s

distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on

floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they

will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17. The Fund also has a fee waiver associated with any investments it makes in a Franklin

Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through its current fiscal year-end. Fund investment results reflect the expense reduction

and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2017 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| |

| R6 | $ | 1,000 | $ | 1,006.00 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

| Advisor | $ | 1,000 | $ | 1,006.00 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Semiannual Report 7

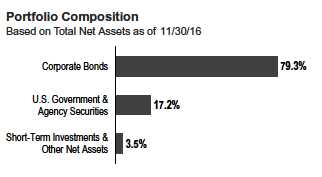

Franklin Payout 2018 Fund

We are pleased to bring you Franklin Payout 2018 Fund’s semiannual report for the period ended November 30, 2016.

Your Fund’s Goals and Main Investments

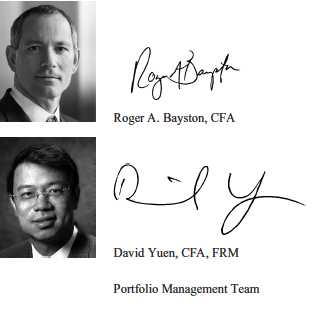

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a +0.50% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2018 Maturity Index, returned +0.37%.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2018. You can find more of the Fund’s performance data in the Performance Summary beginning on page 10.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

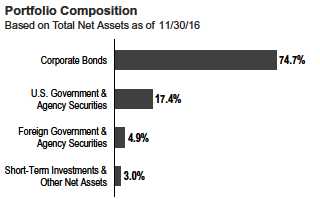

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of broad economic trends, combined with a bottom-up fundamental analysis of market sectors,

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2018. Over time, the Fund’s duration and weighted average maturity will decline as 2018 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2018, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

| | |

| Maturity | | |

| 11/30/16 | | |

| | % of Total | |

| | Market Value | |

| 0 to 1 Year | 2.9 | % |

| 1 to 2 Years | 56.9 | % |

| 2 to 3 Years | 40.2 | % |

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 35.

8 Semiannual Report

FRANKLIN PAYOUT 2018 FUND

| | |

| Top 10 Holdings* | | |

| 11/30/16 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| U.S. Treasury Note | 8.6 | % |

| Federal National Mortgage Association (FNMA) | 4.9 | % |

| Federal Home Loan Bank (FHLB) | 3.7 | % |

| Caterpillar Inc. | 3.1 | % |

| Pacific Gas & Electric Co. | 3.1 | % |

| Duke Energy Carolinas LLC | 3.1 | % |

| Raytheon Co. | 3.1 | % |

| Bank of America Corp. | 3.1 | % |

| HSBC USA Inc. | 2.8 | % |

| Citigroup Inc. | 2.8 | % |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays U.S. Government/Credit 2018 Maturity Index was enhanced primarily by our overweighted allocation to the investment-grade corporate credit sector, with security selection within the sector also benefiting results. In addition, security selection within our foreign holdings aided performance. In contrast, our longer duration positioning compared with the index was the primary detractor from relative performance.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We favored the sector based on our belief that its overall valuations remained relatively attractive on a longer term basis and the sector offered relatively higher earnings potential. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained a slightly underweighted position in the agency sector. Finally, we maintained a modestly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2018 Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report 9

FRANKLIN PAYOUT 2018 FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| Advisor | | | | |

| 6-Month | +0.50 | % | +0.50 | % |

| 1-Year | +1.88 | % | +1.88 | % |

| Since Inception (6/1/15) | +2.28 | % | +1.52 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 11 for Performance Summary footnotes.

| | | | | |

| | | | | | FRANKLIN PAYOUT 2018 FUND |

| | | | | | PERFORMANCE SUMMARY |

| |

| Total Annual Operating Expenses4 | | | | |

| Share Class | With Waiver | | Without Waiver | | |

| Advisor | 0.44 | % | 4.17 | % | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its

value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of

bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s

distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on

floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they

will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17. The Fund also has a fee waiver associated with any investments it makes in a Franklin

Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through its current fiscal year-end. Fund investment results reflect the expense reduction

and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report 11

FRANKLIN PAYOUT 2018 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| |

| R6 | $ | 1,000 | $ | 1,005.00 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

| Advisor | $ | 1,000 | $ | 1,005.00 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

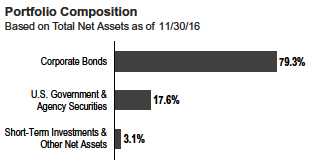

Franklin Payout 2019 Fund

We are pleased to bring you Franklin Payout 2019 Fund’s semiannual report for the period ended November 30, 2016.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a +0.39% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2019 Maturity Index, returned +0.14%.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2019. You can find more of the Fund’s performance data in the Performance Summary beginning on page 15.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of broad economic trends, combined with a bottom-up fundamental analysis of market sectors,

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2019. Over time, the Fund’s duration and weighted average maturity will decline as 2019 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2019, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

| | |

| Maturity | | |

| 11/30/16 | | |

| | % of Total | |

| | Market Value | |

| 0 to 1 Year | 2.5 | % |

| 2 to 3 Years | 59.7 | % |

| 3 to 4 Years | 37.8 | % |

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 39.

Semiannual Report 13

| | |

| FRANKLIN PAYOUT 2019 FUND | | |

| |

| |

| |

| Top 10 Holdings* | | |

| 11/30/16 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| Federal Home Loan Bank (FHLB) | 9.0 | % |

| Federal National Mortgage Association (FNMA) | 4.9 | % |

| Federal Farm Credit Bank (FFCB) | 3.7 | % |

| Anheuser-Busch InBev Worldwide Inc. | 2.8 | % |

| Morgan Stanley | 2.6 | % |

| Emerson Electric Co. | 2.6 | % |

| Boeing Capital Corp. | 2.6 | % |

| Westpac Banking Corp. | 2.6 | % |

| Deere & Co. | 2.6 | % |

| Lockheed Martin Corp. | 2.6 | % |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays U.S. Government/Credit 2019 Maturity Index was enhanced primarily by our overweighted allocations to the high yield and investment-grade corporate credit sectors, although security selection within the investment-grade corporate credit sector detracted from returns. In addition, security selection within the high yield corporate credit sector contributed to performance, and allocation and security selection in the U.S. agency sector contributed slightly. In contrast, our longer duration positioning compared with the index was the primary detractor from relative performance. Our foreign exposure weighed slightly on returns, although security selection within our foreign positions helped slightly.

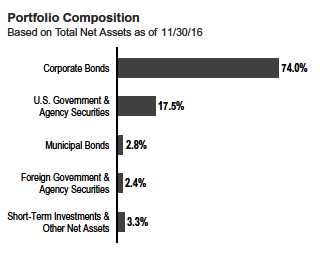

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We favored the sector based on our belief that its overall valuations remained relatively attractive on a longer term basis and the sector offered relatively higher earnings potential. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained an overweighted position in the agency sector. Finally, we maintained a modestly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2019 Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2019 FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| Advisor | | | | |

| 6-Month | +0.39 | % | +0.39 | % |

| 1-Year | +2.64 | % | +2.64 | % |

| Since Inception (6/1/15) | +3.26 | % | +2.16 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 16 for Performance Summary footnotes.

Semiannual Report 15

| | | | |

| FRANKLIN PAYOUT 2019 FUND | | | | |

| PERFORMANCE SUMMARY | | | | |

| |

| Total Annual Operating Expenses4 | | | |

| Share Class | With Waiver | | Without Waiver | |

| Advisor | 0.44 | % | 3.71 | % |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its

value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of

bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s

distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on

floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they

will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17. The Fund also has a fee waiver associated with any investments it makes in a Franklin

Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through its current fiscal year-end. Fund investment results reflect the expense reduction

and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2019 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| |

| R6 | $ | 1,000 | $ | 1,003.90 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

| Advisor | $ | 1,000 | $ | 1,003.90 | $ | 1.46 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Semiannual Report 17

Franklin Payout 2020 Fund

This semiannual report for Franklin Payout 2020 Fund covers the period ended November 30, 2016.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a 0.00% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2020 Maturity Index, returned -0.21%.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2020. You can find more of the Fund’s performance data in the Performance Summary beginning on page 20.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of broad economic trends, combined with a bottom-up fundamental analysis of market sectors,

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2020. Over time, the Fund’s duration and weighted average maturity will decline as 2020 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2020, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays U.S. Government/Credit 2020 Maturity Index was enhanced primarily by our overweighted allocations to the high yield and investment-grade corporate credit sectors, with security selection within the

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 43.

FRANKLIN PAYOUT 2020 FUND

| | |

| Maturity | | |

| 11/30/16 | | |

| | % of Total | |

| | Market Value | |

| 0 to 1 Year | 2.3 | % |

| 3 to 4 Years | 75.5 | % |

| 4 to 5 Years | 22.2 | % |

| |

| Top 10 Holdings* | | |

| 11/30/16 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| U.S. Treasury Note | 12.3 | % |

| Federal Home Loan Bank (FHLB) | 5.1 | % |

| AEGON Funding Co. LLC | 2.7 | % |

| Morgan Stanley | 2.7 | % |

| Emerson Electric Co. | 2.6 | % |

| Hershey Co. | 2.6 | % |

| JPMorgan Chase & Co. | 2.6 | % |

| Travelers Cos. Inc. | 2.6 | % |

| UnitedHealth Group Inc. | 2.6 | % |

| Aetna Inc. | 2.5 | % |

*Securities are listed by issuer, which may appear by another name in the SOI.

high yield corporate credit sector also helping results. However, security selection within the investment-grade corporate credit sector weighed on returns. Security selection within our foreign holdings contributed to performance, although this positive effect was partially offset by the negative effect of sector allocation. In contrast, our longer duration positioning compared with the index was the primary detractor from relative performance. Security selection in the U.S. agency sector weighed slightly on performance over the period.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We favored the sector based on our belief that valuations remained relatively attractive on a longer term basis and the sector offered higher earnings potential. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained an overweighted position in the agency sector. Finally, we maintained a modestly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2020 Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

Semiannual Report 19

FRANKLIN PAYOUT 2020 FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| Advisor | | | | |

| 6-Month | 0.00 | % | 0.00 | % |

| 1-Year | +2.69 | % | +2.69 | % |

| Since Inception (6/1/15) | +3.10 | % | +2.06 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 21 for Performance Summary footnotes.

| | | | | |

| | | | | | FRANKLIN PAYOUT 2020 FUND |

| | | | | | PERFORMANCE SUMMARY |

| |

| Total Annual Operating Expenses4 | | | | |

| Share Class | With Waiver | | Without Waiver | | |

| Advisor | 0.44 | % | 3.73 | % | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its

value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of

bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s

distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on

floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they

will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17. The Fund also has a fee waiver associated with any investments it makes in a Franklin

Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through its current fiscal year-end. Fund investment results reflect the expense reduction

and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

Semiannual Report 21

FRANKLIN PAYOUT 2020 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| |

| R6 | $ | 1,000 | $ | 1,000.00 | $ | 1.45 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

| Advisor | $ | 1,000 | $ | 1,000.00 | $ | 1.45 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Franklin Payout 2021 Fund

This semiannual report for Franklin Payout 2021 Fund covers the period ended November 30, 2016.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a -0.49% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2021 Maturity Index, returned -0.62%.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2021.You can find more of the Fund’s performance data in the Performance Summary beginning on page 25.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

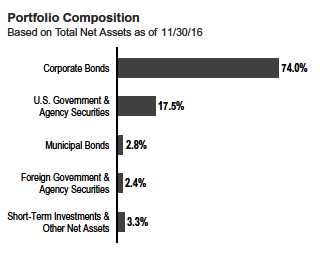

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of broad economic trends, combined with a bottom-up fundamental analysis of market sectors,

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2021. Over time, the Fund’s duration and weighted average maturity will decline as 2021 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2021, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

What is duration?

Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays U.S. Government/Credit

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an

index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 48.

Semiannual Report 23

| | |

| FRANKLIN PAYOUT 2021 FUND | | |

| |

| |

| |

| Maturity | | |

| 11/30/16 | | |

| | % of Total | |

| | Market Value | |

| 0 to 1 Year | 2.7 | % |

| 4 to 5 Years | 63.0 | % |

| 5 to 6 Years | 34.3 | % |

| |

| Top 10 Holdings* | | |

| 11/30/16 | | |

| | % of Total | |

| Issue/Issuer | Net Assets | |

| U.S. Treasury Note | 7.7 | % |

| Federal Home Loan Bank (FHLB) | 5.0 | % |

| Federal Farm Credit Bank (FFCB) | 4.8 | % |

| California State General Obligation (GO) | 2.8 | % |

| Thomas & Betts Corp. | 2.7 | % |

| General Electric Co. | 2.6 | % |

| Telstra Corp. Ltd. | 2.6 | % |

| Gilead Sciences Inc. | 2.6 | % |

| Total Capital SA | 2.6 | % |

| Simon Property Group LP | 2.6 | % |

*Securities are listed by issuer, which may appear by another name in the SOI.

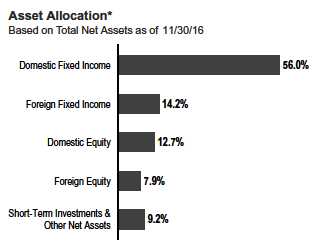

2021 Maturity Index was enhanced primarily by our overweighted allocations to the investment-grade and high yield corporate credit sectors, although security selection within the investment-grade corporate credit sector weighed on performance. Our allocations to the U.S. agency and municipal bond sectors also aided performance, but security selection within both sectors detracted. Security selection within our foreign holdings contributed to performance, but our allocation to the sector detracted slightly. In contrast, our longer duration positioning compared with the index was the primary detractor from relative performance over the period.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We favored the sector based on our belief that overall valuations remained relatively attractive on a longer term basis and the sector offered higher earnings potential. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained an overweighted position in the agency sector. Finally, we maintained a modestly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2021 Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2016, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2021 FUND

Performance Summary as of November 30, 2016

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

Performance as of 11/30/161

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| | Cumulative | | Average Annual | |

| Share Class | Total Return2 | | Total Return3 | |

| Advisor | | | | |

| 6-Month | -0.49 | % | -0.49 | % |

| 1-Year | +3.11 | % | +3.11 | % |

| Since Inception (6/1/15) | +4.04 | % | +2.68 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 26 for Performance Summary footnotes.

Semiannual Report 25

| | | | |

| FRANKLIN PAYOUT 2021 FUND | | | | |

| PERFORMANCE SUMMARY | | | | |

| |

| Total Annual Operating Expenses4 | | | |

| Share Class | With Waiver | | Without Waiver | |

| Advisor | 0.44 | % | 3.70 | % |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its

value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of

bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s

distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on

floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they

will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction contractually guaranteed through 9/30/17. The Fund also has a fee waiver associated with any investments it makes in a Franklin

Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through its current fiscal year-end. Fund investment results reflect the expense reduction

and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the period indicated.

3. Average annual total return represents the change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this

report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2021 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | (actual return after expenses) | | (5% annual return before expenses) | | |

| |

| | | | | | | Expenses | | | | Expenses | Net | |

| | | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized | |

| Share | | Account | | Account | | Period | | Account | | Period | Expense | |

| Class | | Value 6/1/16 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | | Value 11/30/16 | | 6/1/16–11/30/161,2 | Ratio2 | |

| |

| R6 | $ | 1,000 | $ | 995.10 | $ | 1.45 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

| Advisor | $ | 1,000 | $ | 995.10 | $ | 1.45 | $ | 1,023.61 | $ | 1.47 | 0.29 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above–in the far right column–multiplied by the simple average account value

over the period indicated, and then multiplied by 183/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.