UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(650)312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/24

Item 1. Reports to Stockholders.

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

| Not Applicable. |

| | |

Franklin Emerging Market Core Equity (IU) Fund | |

Class A true |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin Emerging Market Core Equity (IU) Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $0 | 0.00% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin Emerging Market Core Equity (IU) Fund returned 10.67%. The Fund compares its performance to the MSCI Emerging Markets Index, which returned 6.68% for the same period.

| |

Top contributors to performance: |

| Stock selection within: |

| ↑ | The financials sector and overweight positions in banking companies, including Shinhan Financials Group, Hana Financial Group and KB Financials Group |

| ↑ | The industrials sector and underweight positions in electrical equipment companies, including Ecopro, LG Energy Solutions and POSCO Future M |

| ↑ | The materials sector including an underweight position in chemicals company LG Chem |

| |

Top detractors from performance: |

| Stock selection within: |

| ↓ | The consumer discretionary sector, notably overweight positions in automobile companies Li Auto and Yadea Group |

| ↓ | The health care sector and overweight positions in pharmaceuticals companies, including CSPC Pharmaceutical Group |

| ↓ | The information technology sector, notably underweight positions in semiconductor companies MediaTek and SK Hynix |

| Franklin Emerging Market Core Equity (IU) Fund | PAGE 1 | 0924 |

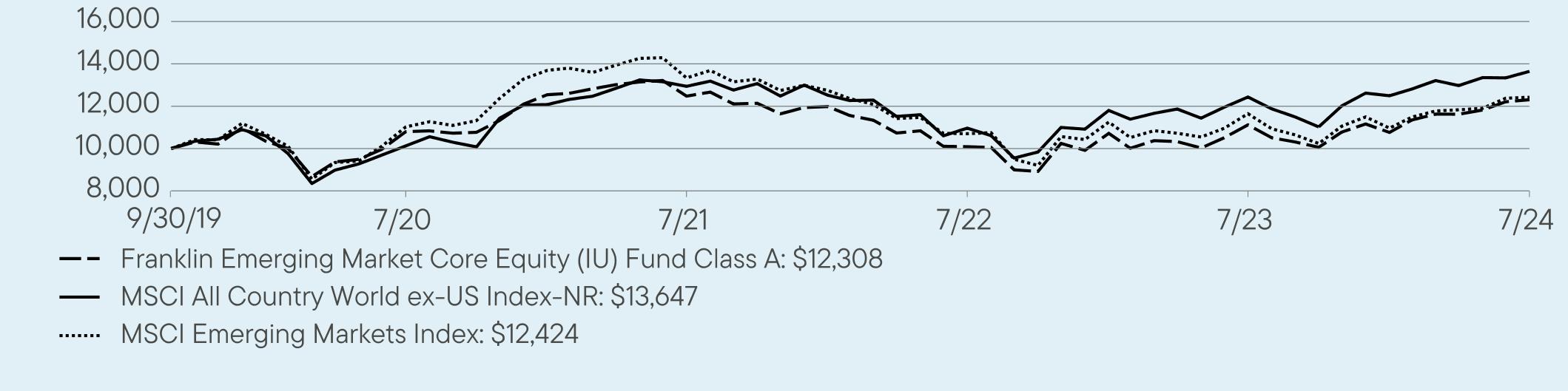

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class A 9/30/2019 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | |

| | 1 Year | Since Inception

(9/30/2019) |

Class A | 10.67 | 4.39 |

MSCI All Country World ex-US Index-NR | 9.75 | 6.64 |

MSCI Emerging Markets Index | 6.68 | 4.59 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $139,280,741 |

Total Number of Portfolio Holdings* | 221 |

Total Management Fee Paid | $0 |

Portfolio Turnover Rate | 69.43% |

| * | Does not include derivatives, except purchased options, if any. |

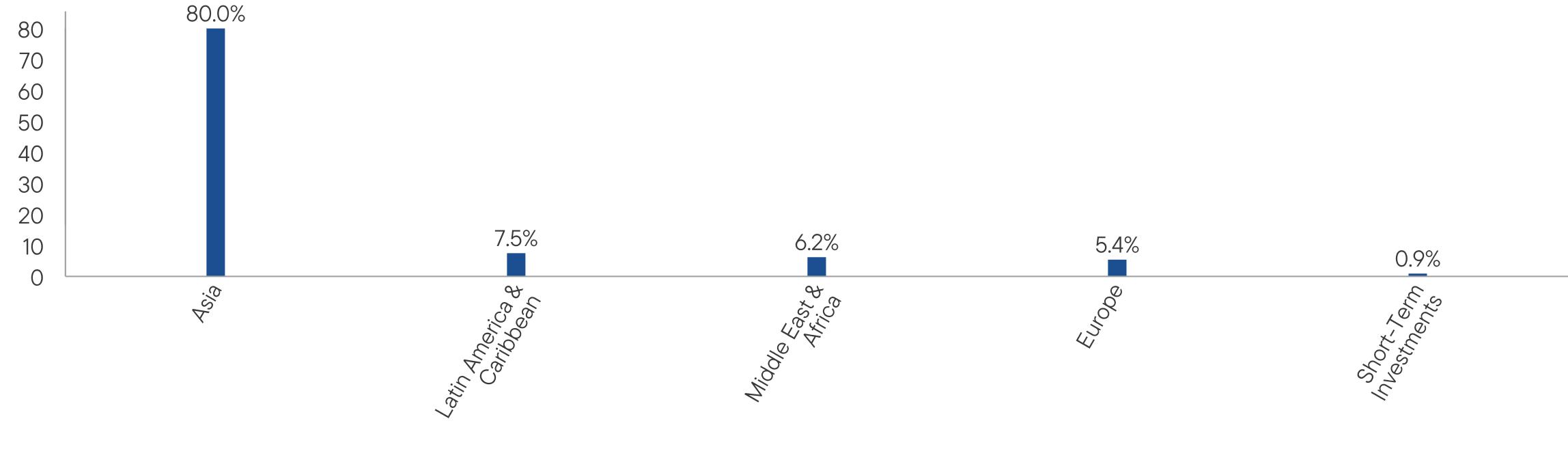

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin Emerging Market Core Equity (IU) Fund | PAGE 2 | 0924 |

HOW HAS THE FUND CHANGED?

Todd Brighton was removed as a portfolio manager of the Fund effective December 1, 2023, and Christopher W. Floyd was added as a portfolio manager of the Fund effective June 3, 2024.

This is a summary of certain changes to the Fund since August 1, 2023.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-internalusefunds-documents, including its: |

| • proxy voting information • financial information • holdings • tax information |

| Franklin Emerging Market Core Equity (IU) Fund | PAGE 3 | 0924 |

10796124771008811121123081012612940109651243513647110231333810702116461242480.07.56.25.40.9

| | |

Franklin International Core Equity (IU) Fund | |

Class A true |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin International Core Equity (IU) Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $0 | 0.00% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin International Core Equity (IU) Fund returned 14.79%. The Fund compares its performance to the MSCI EAFE Index, which returned 11.76% for the same period.

| |

Top contributors to performance: |

| Stock selection and overweight positions in: |

| ↑ | Banking stocks, including UniCredit, Sumitomo Mitsui Financial Group and Banco Bilbao Vizcaya Argentaria within the financials sector |

| ↑ | Electrical, machinery and industrial stocks, including Hitachi, Wartsila Oyj and Atlas Copco within the industrials sector |

| ↑ | Pharmaceuticals stocks Novo Nordisk and Otsuka Holdings within the health care sector |

| |

Top detractors from performance: |

| Stock selection in: |

| ↓ | Information technology, notably overweight positions in semiconductor stocks STMicroelectronics and SCREEN Holdings |

| ↓ | Materials, notably overweight positions in metals & mining stocks, including Pilbara Minerals, ArcelorMittal and Fortescue |

| ↓ | Underweight allocation to stocks within the financials sector |

| Franklin International Core Equity (IU) Fund | PAGE 1 | 0924 |

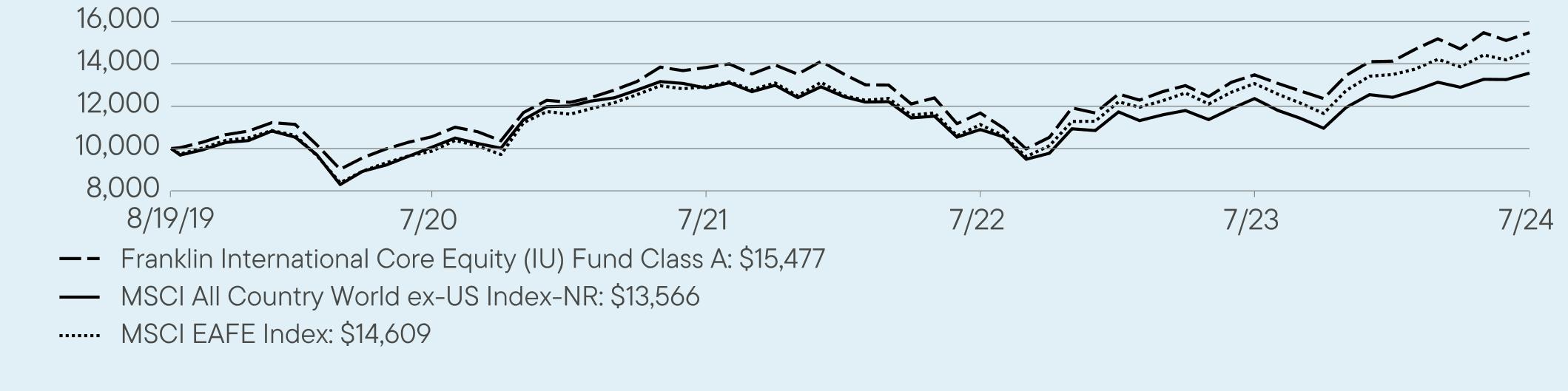

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class A 8/19/2019 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | |

| | 1 Year | Since Inception

(8/19/2019) |

Class A | 14.79 | 9.22 |

MSCI All Country World ex-US Index-NR | 9.75 | 7.21 |

MSCI EAFE Index | 11.76 | 8.71 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $941,318,260 |

Total Number of Portfolio Holdings* | 201 |

Total Management Fee Paid | $0 |

Portfolio Turnover Rate | 59.10% |

| * | Does not include derivatives, except purchased options, if any. |

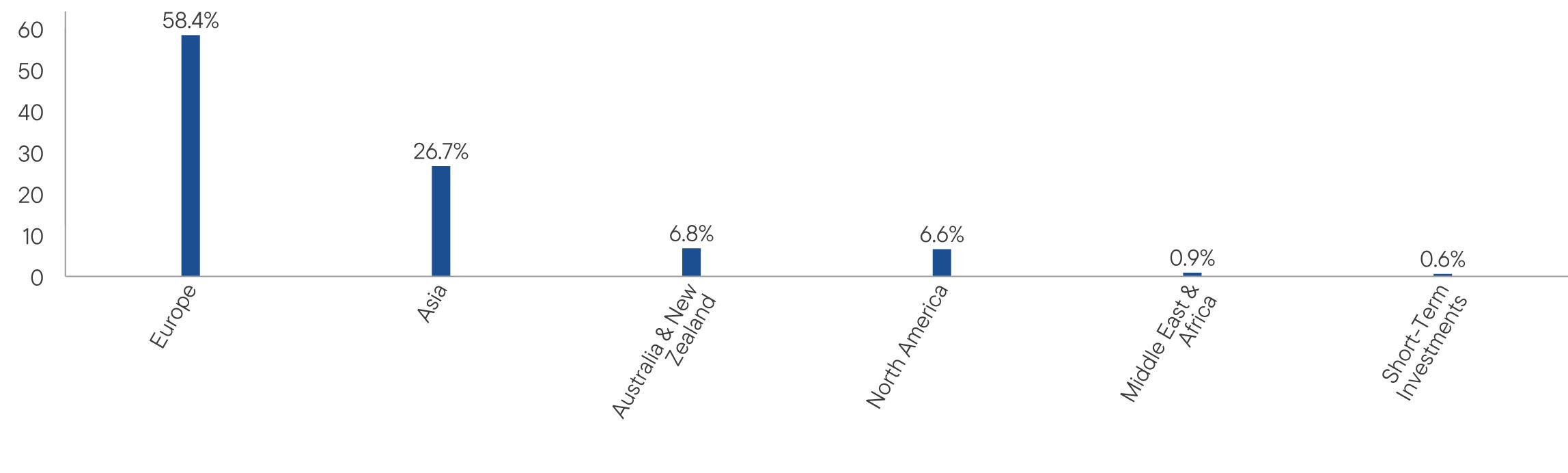

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin International Core Equity (IU) Fund | PAGE 2 | 0924 |

HOW HAS THE FUND CHANGED?

Todd Brighton was removed as a portfolio manager of the Fund effective December 1, 2023, and Christopher W. Floyd was added as a portfolio manager of the Fund effective June 3, 2024.

This is a summary of certain changes to the Fund since August 1, 2023.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-internalusefunds-documents, including its: |

| • proxy voting information • financial information • holdings • tax information |

| Franklin International Core Equity (IU) Fund | PAGE 3 | 0924 |

1055813831116801348315477100661286310899123611356698761292311132130711460958.426.76.86.60.90.6

| | |

Franklin U.S. Core Equity (IU) Fund | |

Class A true |

| Annual Shareholder Report | July 31, 2024 |

|

This annual shareholder report contains important information about Franklin U.S. Core Equity (IU) Fund for the period August 1, 2023, to July 31, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-internalusefunds-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment* |

| Class A | $0 | 0.00% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

For the twelve months ended July 31, 2024, Class A shares of Franklin U.S. Core Equity (IU) Fund returned 26.88%. The Fund compares its performance to the S&P 500 Index, which returned 22.15% for the same period.

| |

Top contributors to performance: |

| Stock selection within: |

| ↑ | Information technology sector, notably semiconductor companies NVIDA, Applied Materials and KLA |

| ↑ | Consumer discretionary sector, notably an underweight allocation to select companies within the hospitality sector, including McDonald’s and Starbucks as well as an underweight position in Nike, a sporting goods retailer |

| ↑ | Health care sector, notably underweight positions in certain pharmaceutical companies, including Johnson & Johnson, Pfizer and Bristol-Myers Squibb |

| |

Top detractors from performance: |

| Stock selection within: |

| ↓ | Financials sector, notably underweight positions in banking companies, including Citigroup, Goldman Sachs and Wells Fargo |

| ↓ | Materials sector, notably overweight positions in chemicals companies, including CF Industries |

| ↓ | An overweight allocation to cash |

| Franklin U.S. Core Equity (IU) Fund | PAGE 1 | 0924 |

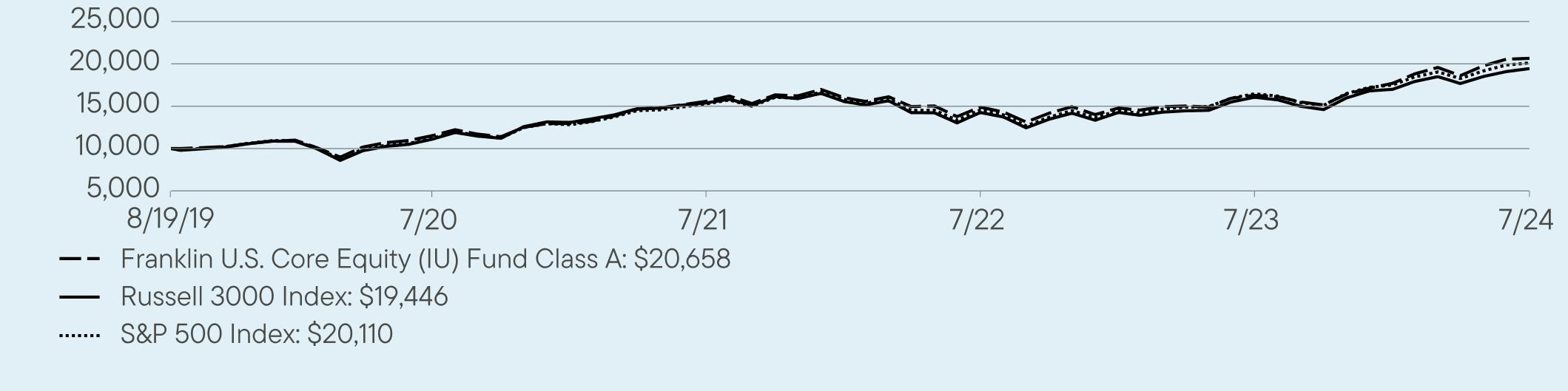

HOW DID THE FUND PERFORM OVER THE LAST 10 YEARS?

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

VALUE OF A $10,000 INVESTMENT – Class A 8/19/2019 — 7/31/2024

AVERAGE ANNUAL TOTAL RETURNS (%) Period Ended July 31, 2024

| | |

| | 1 Year | Since Inception

(8/19/2019) |

Class A | 26.88 | 15.78 |

Russell 3000 Index | 21.07 | 14.87 |

S&P 500 Index | 22.15 | 15.57 |

Fund performance figures may reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

For current month-end performance, please call Franklin Templeton at (800) DIAL BEN/342-5236.

Important data provider notices and terms available at www.franklintempletondatasources.com.

KEY FUND STATISTICS (as of July 31, 2024)

| |

Total Net Assets | $2,022,210,724 |

Total Number of Portfolio Holdings* | 182 |

Total Management Fee Paid | $0 |

Portfolio Turnover Rate | 76.33% |

| * | Does not include derivatives, except purchased options, if any. |

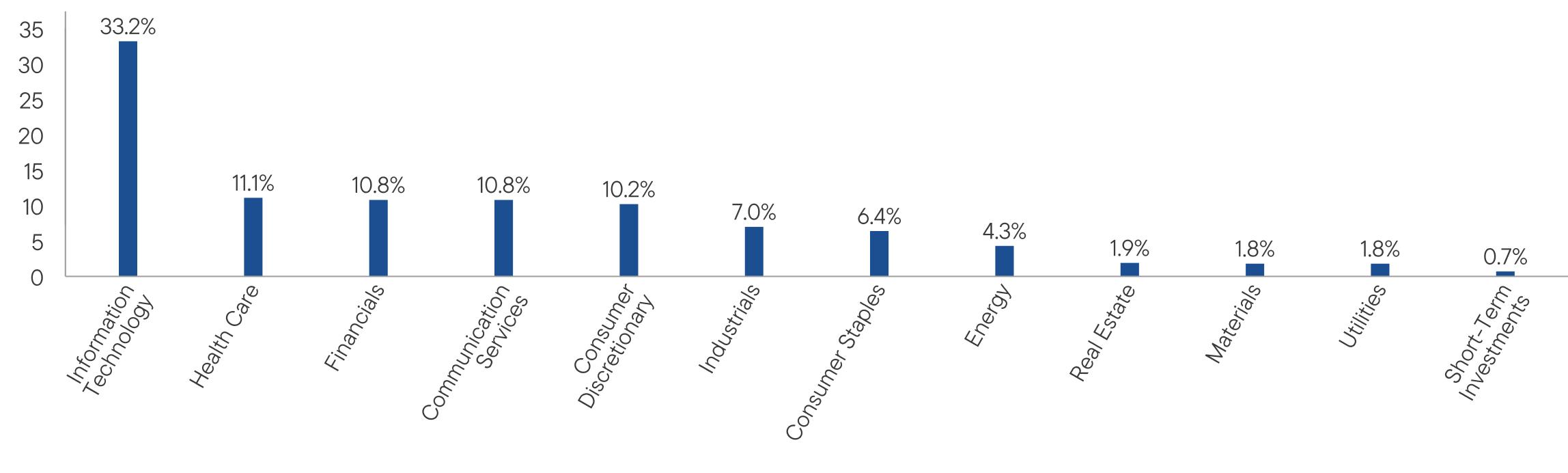

WHAT DID THE FUND INVEST IN? (as of July 31, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| Franklin U.S. Core Equity (IU) Fund | PAGE 2 | 0924 |

HOW HAS THE FUND CHANGED?

Todd Brighton was removed as a portfolio manager of the Fund effective December 1, 2023, and Christopher W. Floyd was added as a portfolio manager of the Fund effective June 3, 2024.

This is a summary of certain changes to the Fund since August 1, 2023.

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-internalusefunds-documents, including its: |

| • proxy voting information • financial information • holdings • tax information |

| Franklin U.S. Core Equity (IU) Fund | PAGE 3 | 0924 |

11509155821489416281206581109315389142571606119446111961527614567164632011033.211.110.810.810.27.06.44.31.91.81.80.7

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

(c) N/A

(d) N/A

(f) Pursuant to Item 19(a)(1), the Registrant is attaching as an exhibit a copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Mary C. Choksi, and she is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $122,429 for the fiscal year ended July 31, 2024, and $113,572 for the fiscal year ended July 31, 2023.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

There were no fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning.

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant for tax compliance, tax advice and tax planning were $140,000 for the fiscal year ended July 31, 2024, and $70,000 for the fiscal year ended July 31, 2023. The services for which these fees were paid included global access to tax platform International Tax View.

(d) All Other Fees

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant not reported in paragraphs (a)-(c) of Item 4 were $0 for the fiscal year ended July 31, 2024, and $1,399 for the fiscal year ended July 31, 2023. The services for which these fees were paid included review of materials provided to the fund Board in connection with the investment management contract renewal process.

The aggregate fees paid to the principal accountant for products and services rendered by the principal accountant to the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant not reported in paragraphs (a)-(c) of Item 4 were $163,638 for the fiscal year ended July 31, 2024 and $94,715 for the fiscal year ended July 31, 2023. The services for which these fees were paid included professional fees in connection with SOC 1 Reports,

professional services relating to the readiness assessment over Greenhouse Gas Emissions and Energy, professional fees relating to security counts and fees in connection with license for accounting and business knowledge platform Viewpoint.

(e) (1) The registrant’s audit committee is directly responsible for approving the services to be provided by the auditors, including:

| (i) | pre-approval of all audit and audit related services; |

| (ii) | pre-approval of all non-audit related services to be provided to the Fund by the auditors; |

(iii) pre-approval of all non-audit related services to be provided to the registrant by the auditors to the registrant’s investment adviser or to any entity that controls, is controlled by or is under common control with the registrant’s investment adviser and that provides ongoing services to the registrant where the non-audit services relate directly to the operations or financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or appropriate, as an alternative to committee pre-approval of services to be provided by the auditors, as required by paragraphs (ii) and (iii) above, of policies and procedures to permit such services to be pre-approved by other means, such as through establishment of guidelines or by action of a designated member or members of the committee; provided the policies and procedures are detailed as to the particular service and the committee is informed of each service and such policies and procedures do not include delegation of audit committee responsibilities, as contemplated under the Securities Exchange Act of 1934, to management; subject, in the case of (ii) through (iv), to any waivers, exceptions or exemptions that may be available under applicable law or rules.

(e) (2) None of the services provided to the registrant described in paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

(f) No disclosures are required by this Item 4(f).

(g) The aggregate non-audit fees paid to the principal accountant for services rendered by the principal accountant to the registrant and the registrant’s investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant were $303,638 for the fiscal year ended July 31, 2024, and $166,114 for the fiscal year ended July 31, 2023.

(h) The registrant’s audit committee of the board has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

(i) N/A

(j) N/A

| Item 5. Audit Committee of Listed Registrants. N/A | |

Item 6. Schedule of Investments.

(a) Please see schedule of investments contained in the Financial Statements and Financial Highlights included under Item 7 of this Form N-CSR.

(b) N/A

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Franklin

Fund

Allocator

Series

Financial

Statements

and

Other

Important

Information

Annual

|

July 31, 2024

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

Franklin

International

Core

Equity

(IU)

Fund

Franklin

U.S.

Core

Equity

(IU)

Fund

Financial

Statements

and

Other

Important

Information—Annual

Financial

Highlights

and

Schedules

of

Investments

2

Financial

Statements

27

Notes

to

Financial

Statements

31

Report

of

Independent

Registered

Public

Accounting

Firm

43

Tax

Information

44

Changes

In

and

Disagreements

with

Accountants

45

Results

of

Meeting(s)

of

Shareholders

45

Remuneration

Paid

to

Directors,

Officers

and

Others

45

Board

Approval

of

Management

and

Subadvisory

Agreements

45

Franklin

Fund

Allocator

Series

Financial

Highlights

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Year

Ended

July

31,

Year

Ended

July

31,

2020

a

2024

2023

2022

2021

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$9.77

$9.23

$11.83

$10.57

$10.00

Income

from

investment

operations

b

:

Net

investment

income

c

.........................

0.31

0.36

0.35

0.28

0.33

Net

realized

and

unrealized

gains

(losses)

...........

0.68

0.55

(2.58)

1.34

0.45

Total

from

investment

operations

....................

0.99

0.91

(2.23)

1.62

0.78

Less

distributions

from:

Net

investment

income

..........................

(0.39)

(0.37)

(0.37)

(0.36)

(0.21)

Net

realized

gains

.............................

—

—

—

—

(—)

d

Total

distributions

...............................

(0.39)

(0.37)

(0.37)

(0.36)

(0.21)

Net

asset

value,

end

of

year

.......................

$10.37

$9.77

$9.23

$11.83

$10.57

Total

return

e

...................................

10.67%

10.24%

(19.15)%

15.57%

7.96%

Ratios

to

average

net

assets

f

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

...............................

0.17%

0.15%

0.17%

0.14%

0.17%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

—%

—%

—%

—%

0.01%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

...............................

—%

—%

—%

g

—%

g

—%

Net

investment

income

...........................

3.25%

3.92%

3.27%

2.41%

3.44%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$139,281

$126,226

$109,129

$116,643

$138,590

Portfolio

turnover

rate

............................

69.43%

108.11%

125.41%

108.13%

102.39%

a

For

the

period

August

19,

2019

(effective

date)

to

July

31,

2020.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Amount

rounds

to

less

than

$0.01

per

share.

e

Total

return

is

not

annualized

for

periods

less

than

one

year.

f

Ratios

are

annualized

for

periods

less

than

one

year,

except

for

non-recurring

expenses,

if

any.

g

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Fund

Allocator

Series

Schedule

of

Investments,

July

31,

2024

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

97.3%

Aerospace

&

Defense

0.5%

Hanwha

Aerospace

Co.

Ltd.

...........................

South

Korea

3,283

$

692,373

Air

Freight

&

Logistics

0.2%

a,b,c

JD

Logistics,

Inc.

,

144A

,

Reg

S

.........................

China

243,300

250,239

Automobile

Components

0.7%

Fuyao

Glass

Industry

Group

Co.

Ltd.

,

A

...................

China

23,800

148,376

Hankook

Tire

&

Technology

Co.

Ltd.

.....................

South

Korea

10,387

340,926

Hyundai

Mobis

Co.

Ltd.

...............................

South

Korea

2,716

441,665

930,967

Automobiles

3.5%

BYD

Co.

Ltd.

,

A

.....................................

China

16,300

557,849

BYD

Co.

Ltd.

,

H

....................................

China

39,000

1,154,594

Geely

Automobile

Holdings

Ltd.

.........................

China

1,098,000

1,115,638

a,c

Li

Auto,

Inc.

,

A

......................................

China

104,500

1,022,248

a

Seres

Group

Co.

Ltd.

,

A

..............................

China

17,000

187,900

Tata

Motors

Ltd.

,

A

..................................

India

51,468

489,181

b

Yadea

Group

Holdings

Ltd.

,

144A

,

Reg

S

.................

China

242,000

326,144

4,853,554

Banks

14.4%

Abu

Dhabi

Islamic

Bank

PJSC

.........................

United

Arab

Emirates

152,534

509,146

Akbank

TAS

.......................................

Turkiye

472,656

883,285

Arab

National

Bank

..................................

Saudi

Arabia

32,530

186,063

Axis

Bank

Ltd.

......................................

India

32,622

455,735

Banco

de

Chile

.....................................

Chile

4,304,046

512,606

b

Banco

del

Bajio

SA

,

144A

,

Reg

S

.......................

Mexico

130,474

388,834

Bancolombia

SA

....................................

Colombia

19,273

173,747

Bank

Central

Asia

Tbk.

PT

............................

Indonesia

1,696,500

1,072,050

Bank

of

Beijing

Co.

Ltd.

,

A

.............................

China

230,795

170,371

Bank

of

Shanghai

Co.

Ltd.

,

A

...........................

China

161,100

162,649

Bank

Polska

Kasa

Opieki

SA

...........................

Poland

23,016

932,463

BDO

Unibank,

Inc.

..................................

Philippines

58,152

136,886

China

Construction

Bank

Corp.

,

H

.......................

China

1,696,000

1,184,301

China

Merchants

Bank

Co.

Ltd.

,

H

.......................

China

212,000

878,709

Commercial

International

Bank

-

Egypt

(CIB)

...............

Egypt

71,691

122,964

Emirates

NBD

Bank

PJSC

............................

United

Arab

Emirates

48,552

252,479

Haci

Omer

Sabanci

Holding

A/S

........................

Turkiye

107,452

322,290

Hana

Financial

Group,

Inc.

............................

South

Korea

32,681

1,556,264

ICICI

Bank

Ltd.

.....................................

India

53,591

781,217

KB

Financial

Group,

Inc.

..............................

South

Korea

16,246

1,055,600

Komercni

Banka

A/S

.................................

Czech

Republic

14,116

487,704

Metropolitan

Bank

&

Trust

Co.

..........................

Philippines

153,170

180,362

b

Moneta

Money

Bank

A/S

,

144A

,

Reg

S

...................

Czech

Republic

33,303

152,570

Nedbank

Group

Ltd.

.................................

South

Africa

49,530

758,593

OTP

Bank

Nyrt.

.....................................

Hungary

33,112

1,697,292

Ping

An

Bank

Co.

Ltd.

,

A

..............................

China

97,200

138,396

Santander

Bank

Polska

SA

............................

Poland

4,945

651,685

SCB

X

PCL

........................................

Thailand

139,500

404,327

Shinhan

Financial

Group

Co.

Ltd.

.......................

South

Korea

44,529

1,968,421

TMBThanachart

Bank

PCL

............................

Thailand

5,006,700

238,190

Woori

Financial

Group,

Inc.

............................

South

Korea

98,169

1,135,713

Yapi

ve

Kredi

Bankasi

A/S

.............................

Turkiye

518,550

472,784

20,023,696

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Beverages

1.8%

Arca

Continental

SAB

de

CV

...........................

Mexico

82,400

$

810,915

b

Nongfu

Spring

Co.

Ltd.

,

H

,

144A

,

Reg

S

..................

China

206,000

800,245

United

Spirits

Ltd.

...................................

India

40,324

682,139

Varun

Beverages

Ltd.

................................

India

13,712

258,716

2,552,015

Biotechnology

0.3%

a,b

Akeso,

Inc.

,

144A

,

Reg

S

.............................

China

82,000

444,089

Broadline

Retail

3.5%

c

Alibaba

Group

Holding

Ltd.

............................

China

218,800

2,153,055

a,c

PDD

Holdings,

Inc.

,

ADR

..............................

China

9,900

1,276,011

c

Vipshop

Holdings

Ltd.

,

ADR

...........................

China

65,467

892,970

Woolworths

Holdings

Ltd.

.............................

South

Africa

163,689

541,103

4,863,139

Capital

Markets

0.8%

b

HDFC

Asset

Management

Co.

Ltd.

,

144A

,

Reg

S

...........

India

14,709

723,876

Korea

Investment

Holdings

Co.

Ltd.

.....................

South

Korea

8,068

435,676

1,159,552

Chemicals

2.9%

Asian

Paints

Ltd.

....................................

India

27,546

1,016,727

Kumho

Petrochemical

Co.

Ltd.

.........................

South

Korea

1,586

161,692

a,b,d,e

PhosAgro

PJSC

,

GDR

,

Reg

S

..........................

Russia

32,310

—

PI

Industries

Ltd.

....................................

India

12,146

643,726

Pidilite

Industries

Ltd.

................................

India

5,586

212,728

Sahara

International

Petrochemical

Co.

...................

Saudi

Arabia

60,016

456,700

Saudi

Aramco

Base

Oil

Co.

............................

Saudi

Arabia

3,243

112,455

Solar

Industries

India

Ltd.

.............................

India

5,080

656,884

Supreme

Industries

Ltd.

..............................

India

11,846

759,199

4,020,111

Communications

Equipment

0.1%

ZTE

Corp.

,

A

.......................................

China

46,900

178,772

Construction

&

Engineering

0.1%

Larsen

&

Toubro

Ltd.

.................................

India

3,902

178,205

Construction

Materials

0.3%

Cemex

SAB

de

CV

..................................

Mexico

161,800

104,567

Shree

Cement

Ltd.

..................................

India

972

322,537

427,104

Consumer

Finance

0.4%

Krungthai

Card

PCL

.................................

Thailand

100,600

110,535

Muthoot

Finance

Ltd.

................................

India

21,232

466,835

577,370

Consumer

Staples

Distribution

&

Retail

1.3%

Bid

Corp.

Ltd.

......................................

South

Africa

18,381

457,539

Nahdi

Medical

Co.

...................................

Saudi

Arabia

6,305

223,238

President

Chain

Store

Corp.

...........................

Taiwan

18,000

153,135

Sumber

Alfaria

Trijaya

Tbk.

PT

.........................

Indonesia

2,816,200

491,882

Wal-Mart

de

Mexico

SAB

de

CV

........................

Mexico

132,400

440,342

1,766,136

Diversified

Consumer

Services

0.2%

a,c

TAL

Education

Group

,

ADR

............................

China

24,500

245,490

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Diversified

REITs

0.1%

Fibra

Uno

Administracion

SA

de

CV

.....................

Mexico

92,200

$

117,193

Diversified

Telecommunication

Services

1.0%

a

Indus

Towers

Ltd.

...................................

India

153,728

796,948

LG

Uplus

Corp.

.....................................

South

Korea

38,424

282,470

Telekom

Malaysia

Bhd.

...............................

Malaysia

215,000

326,512

1,405,930

Electric

Utilities

0.6%

d,e

Inter

RAO

UES

PJSC

................................

Russia

8,656,700

—

Public

Power

Corp.

SA

...............................

Greece

29,167

371,568

Tata

Power

Co.

Ltd.

(The)

.............................

India

42,014

228,173

Tenaga

Nasional

Bhd.

................................

Malaysia

76,800

235,356

835,097

Electrical

Equipment

3.3%

ABB

India

Ltd.

......................................

India

5,120

483,900

CG

Power

&

Industrial

Solutions

Ltd.

.....................

India

105,423

929,147

Fortune

Electric

Co.

Ltd.

..............................

Taiwan

11,000

235,784

Havells

India

Ltd.

...................................

India

34,457

762,113

HD

Hyundai

Electric

Co.

Ltd.

...........................

South

Korea

3,638

827,451

NARI

Technology

Co.

Ltd.

,

A

...........................

China

39,760

132,236

Polycab

India

Ltd.

...................................

India

7,367

605,293

Voltronic

Power

Technology

Corp.

.......................

Taiwan

10,000

571,656

4,547,580

Electronic

Equipment,

Instruments

&

Components

3.4%

AAC

Technologies

Holdings,

Inc.

........................

China

134,500

492,340

Delta

Electronics,

Inc.

................................

Taiwan

42,000

541,814

a

Foxconn

Industrial

Internet

Co.

Ltd.

,

A

....................

China

111,400

374,623

Hon

Hai

Precision

Industry

Co.

Ltd.

......................

Taiwan

326,000

2,008,784

Largan

Precision

Co.

Ltd.

.............................

Taiwan

10,000

871,421

WPG

Holdings

Ltd.

..................................

Taiwan

4,000

10,587

Zhen

Ding

Technology

Holding

Ltd.

......................

Taiwan

119,000

504,083

4,803,652

Energy

Equipment

&

Services

0.1%

China

Oilfield

Services

Ltd.

,

H

..........................

China

236,000

207,892

Entertainment

1.4%

c

NetEase,

Inc.

......................................

China

81,700

1,506,850

c

Tencent

Music

Entertainment

Group

,

ADR

.................

China

28,400

402,712

1,909,562

Financial

Services

1.3%

Bajaj

Holdings

&

Investment

Ltd.

........................

India

1,730

199,077

Meritz

Financial

Group,

Inc.

............................

South

Korea

15,542

962,832

Power

Finance

Corp.

Ltd.

.............................

India

97,394

650,159

1,812,068

Food

Products

1.6%

a

Britannia

Industries

Ltd.

...............................

India

17,802

1,231,037

Nestle

India

Ltd.

....................................

India

11,871

348,863

Orion

Corp.

........................................

South

Korea

4,201

270,581

QL

Resources

Bhd.

..................................

Malaysia

205,700

299,339

a

Savola

Group

(The)

.................................

Saudi

Arabia

11,763

143,087

2,292,907

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Gas

Utilities

0.1%

Kunlun

Energy

Co.

Ltd.

...............................

China

168,000

$

162,859

Ground

Transportation

0.1%

Container

Corp.

of

India

Ltd.

...........................

India

10,241

127,657

Health

Care

Equipment

&

Supplies

0.2%

Shandong

Weigao

Group

Medical

Polymer

Co.

Ltd.

,

H

.......

China

223,600

113,462

Shenzhen

Mindray

Bio-Medical

Electronics

Co.

Ltd.

,

A

........

China

3,500

124,758

238,220

Health

Care

Providers

&

Services

0.6%

Bumrungrad

Hospital

PCL

.............................

Thailand

56,800

393,221

Dr.

Sulaiman

Al

Habib

Medical

Services

Group

Co.

..........

Saudi

Arabia

1,787

137,172

Sinopharm

Group

Co.

Ltd.

,

H

..........................

China

124,800

292,726

823,119

Hotels,

Restaurants

&

Leisure

2.0%

Indian

Hotels

Co.

Ltd.

(The)

,

A

..........................

India

120,597

926,808

a,b

Meituan

Dianping

,

B

,

144A

,

Reg

S

......................

China

67,710

937,564

OPAP

SA

.........................................

Greece

11,068

192,971

a

Zomato

Ltd.

.......................................

India

287,029

789,381

2,846,724

Household

Durables

0.3%

Gree

Electric

Appliances,

Inc.

of

Zhuhai

,

A

.................

China

29,200

161,881

Haier

Smart

Home

Co.

Ltd.

,

A

..........................

China

56,200

212,477

374,358

Household

Products

0.1%

Kimberly-Clark

de

Mexico

SAB

de

CV

,

A

..................

Mexico

67,200

119,540

Independent

Power

and

Renewable

Electricity

Producers

0.7%

a

Adani

Power

Ltd.

...................................

India

85,582

753,069

NTPC

Ltd.

.........................................

India

57,212

284,918

1,037,987

Industrial

Conglomerates

1.0%

Alfa

SAB

de

CV

,

A

...................................

Mexico

603,400

346,885

KOC

Holding

A/S

...................................

Turkiye

131,128

851,532

a

SK

Square

Co.

Ltd.

..................................

South

Korea

2,140

136,431

1,334,848

Insurance

3.0%

Caixa

Seguridade

Participacoes

SA

.....................

Brazil

112,600

287,105

Cathay

Financial

Holding

Co.

Ltd.

.......................

Taiwan

99,000

190,402

DB

Insurance

Co.

Ltd.

................................

South

Korea

9,034

733,646

OUTsurance

Group

Ltd.

..............................

South

Africa

153,310

406,613

Ping

An

Insurance

Group

Co.

of

China

Ltd.

,

H

..............

China

224,500

974,925

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

................

South

Korea

2,129

581,892

Samsung

Life

Insurance

Co.

Ltd.

........................

South

Korea

13,361

947,772

4,122,355

Interactive

Media

&

Services

4.5%

c

Autohome,

Inc.

,

ADR

.................................

China

12,200

304,268

a,c

Baidu,

Inc.

,

A

.......................................

China

13,050

144,694

c

Kanzhun

Ltd.

,

ADR

..................................

China

8,400

114,072

a,b,c

Kuaishou

Technology

,

144A

,

Reg

S

......................

China

112,000

627,282

c

Tencent

Holdings

Ltd.

................................

China

110,200

5,085,372

6,275,688

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

IT

Services

2.8%

Elm

Co.

..........................................

Saudi

Arabia

1,864

$

454,583

HCL

Technologies

Ltd.

...............................

India

11,674

229,723

Infosys

Ltd.

........................................

India

31,503

698,617

Samsung

SDS

Co.

Ltd.

...............................

South

Korea

2,973

323,353

Tata

Consultancy

Services

Ltd.

.........................

India

43,172

2,267,134

3,973,410

Life

Sciences

Tools

&

Services

0.4%

Divi's

Laboratories

Ltd.

...............................

India

2,754

162,130

WuXi

AppTec

Co.

Ltd.

,

A

..............................

China

24,700

145,380

b

WuXi

AppTec

Co.

Ltd.

,

H

,

144A

,

Reg

S

...................

China

53,840

220,245

527,755

Machinery

0.8%

a

China

CSSC

Holdings

Ltd.

,

A

..........................

China

49,900

283,525

Doosan

Bobcat,

Inc.

.................................

South

Korea

10,575

321,677

Sinotruk

Hong

Kong

Ltd.

..............................

China

127,000

334,048

Weichai

Power

Co.

Ltd.

,

A

.............................

China

78,300

149,939

1,089,189

Metals

&

Mining

3.8%

China

Hongqiao

Group

Ltd.

............................

China

268,000

333,824

Cia

de

Minas

Buenaventura

SAA

,

ADR

...................

Peru

20,400

316,200

CMOC

Group

Ltd.

,

H

.................................

China

177,000

141,169

d,e

GMK

Norilskiy

Nickel

PAO

.............................

Russia

316,400

—

Gold

Fields

Ltd.

.....................................

South

Africa

1,269

22,095

Harmony

Gold

Mining

Co.

Ltd.

.........................

South

Africa

97,835

959,405

Hindalco

Industries

Ltd.

...............................

India

63,460

509,078

Kumba

Iron

Ore

Ltd.

.................................

South

Africa

11,735

256,009

NMDC

Ltd.

........................................

India

186,588

540,281

d,e

Novolipetsk

Steel

PJSC

..............................

Russia

347,890

—

d,e

Severstal

PAO

.....................................

Russia

48,409

—

Vale

SA

...........................................

Brazil

94,200

1,026,549

Vedanta

Ltd.

.......................................

India

213,330

1,150,876

5,255,486

Multi-Utilities

0.7%

YTL

Corp.

Bhd.

.....................................

Malaysia

623,700

463,882

YTL

Power

International

Bhd.

..........................

Malaysia

453,200

460,809

924,691

Oil,

Gas

&

Consumable

Fuels

3.9%

Adaro

Energy

Indonesia

Tbk.

PT

........................

Indonesia

2,543,900

503,773

China

Petroleum

&

Chemical

Corp.

,

A

....................

China

260,900

234,414

Empresas

Copec

SA

.................................

Chile

46,162

321,413

Exxaro

Resources

Ltd.

...............................

South

Africa

21,010

225,121

Inner

Mongolia

Yitai

Coal

Co.

Ltd.

,

B

.....................

China

212,451

385,174

PetroChina

Co.

Ltd.

,

H

...............................

China

270,000

234,463

Petroleo

Brasileiro

SA

................................

Brazil

121,200

870,092

Reliance

Industries

Ltd.

...............................

India

49,402

1,781,174

b

Saudi

Arabian

Oil

Co.

,

144A

,

Reg

S

.....................

Saudi

Arabia

13,573

99,854

Turkiye

Petrol

Rafinerileri

A/S

..........................

Turkiye

45,237

223,021

Ultrapar

Participacoes

SA

.............................

Brazil

136,900

537,636

5,416,135

Passenger

Airlines

0.4%

a,b

InterGlobe

Aviation

Ltd.

,

144A

,

Reg

S

....................

India

10,385

555,383

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Personal

Care

Products

0.9%

Colgate-Palmolive

India

Ltd.

...........................

India

24,804

$

1,012,322

b

Giant

Biogene

Holding

Co.

Ltd.

,

144A

,

Reg

S

..............

China

49,000

254,004

1,266,326

Pharmaceuticals

2.0%

Aurobindo

Pharma

Ltd.

...............................

India

21,694

372,297

CSPC

Pharmaceutical

Group

Ltd.

.......................

China

1,291,600

960,757

Dr

Reddy's

Laboratories

Ltd.

...........................

India

5,561

449,076

Lupin

Ltd.

.........................................

India

42,623

975,420

2,757,550

Real

Estate

Management

&

Development

1.2%

Barwa

Real

Estate

Co.

...............................

Qatar

181,387

138,177

Emaar

Properties

PJSC

..............................

United

Arab

Emirates

544,789

1,280,042

NEPI

Rockcastle

NV

.................................

Romania

39,733

300,477

1,718,696

Semiconductors

&

Semiconductor

Equipment

12.8%

eMemory

Technology,

Inc.

.............................

Taiwan

5,000

356,739

Global

Unichip

Corp.

.................................

Taiwan

5,000

180,767

MediaTek,

Inc.

.....................................

Taiwan

28,000

1,071,076

Novatek

Microelectronics

Corp.

.........................

Taiwan

82,000

1,328,279

SK

Hynix,

Inc.

......................................

South

Korea

6,115

881,511

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

.............

Taiwan

438,000

12,833,256

United

Microelectronics

Corp.

..........................

Taiwan

772,000

1,235,279

17,886,907

Software

0.1%

Tata

Elxsi

Ltd.

......................................

India

1,706

142,614

Specialty

Retail

1.9%

b

Pop

Mart

International

Group

Ltd.

,

144A

,

Reg

S

............

China

87,600

464,768

b

Topsports

International

Holdings

Ltd.

,

144A

,

Reg

S

..........

China

338,000

150,553

Trent

Ltd.

.........................................

India

25,237

1,763,887

Vibra

Energia

SA

....................................

Brazil

61,900

253,493

2,632,701

Technology

Hardware,

Storage

&

Peripherals

5.8%

Asustek

Computer,

Inc.

...............................

Taiwan

37,000

521,159

Pegatron

Corp.

.....................................

Taiwan

363,000

1,126,286

Samsung

Electronics

Co.

Ltd.

..........................

South

Korea

90,195

5,590,010

Wistron

Corp.

......................................

Taiwan

301,000

909,648

8,147,103

Textiles,

Apparel

&

Luxury

Goods

1.2%

ANTA

Sports

Products

Ltd.

............................

China

88,600

793,050

Bosideng

International

Holdings

Ltd.

.....................

China

686,000

343,316

Pou

Chen

Corp.

....................................

Taiwan

425,000

471,190

1,607,556

Transportation

Infrastructure

1.0%

International

Container

Terminal

Services,

Inc.

..............

Philippines

135,780

828,622

Malaysia

Airports

Holdings

Bhd.

........................

Malaysia

168,900

376,612

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

.......

Mexico

18,075

169,769

1,375,003

Wireless

Telecommunication

Services

1.2%

Bharti

Airtel

Ltd.

....................................

India

11,475

205,001

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

See

Abbreviations

on

page

42

.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

(continued)

Wireless

Telecommunication

Services

(continued)

Etihad

Etisalat

Co.

..................................

Saudi

Arabia

64,426

$

894,901

SK

Telecom

Co.

Ltd.

.................................

South

Korea

5,718

227,410

TIM

SA

...........................................

Brazil

106,700

329,983

1,657,295

Total

Common

Stocks

(Cost

$

113,486,444

)

...................................

135,491,848

Preferred

Stocks

2.5%

Banks

1.6%

f

Itau

Unibanco

Holding

SA

,

6.92

%

.......................

Brazil

144,700

866,859

f

Itausa

SA

,

2.95

%

...................................

Brazil

772,666

1,389,471

2,256,330

Electric

Utilities

0.4%

f

Cia

Energetica

de

Minas

Gerais

,

9.94

%

...................

Brazil

274,190

526,524

Metals

&

Mining

0.5%

f

Gerdau

SA

,

6.1

%

...................................

Brazil

209,734

677,184

Total

Preferred

Stocks

(Cost

$

3,101,788

)

.....................................

3,460,038

Total

Long

Term

Investments

(Cost

$

116,588,232

)

.............................

138,951,886

a

Short

Term

Investments

0.9%

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Money

Market

Funds

0.9%

g,h

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio

,

5.002

%

..

United

States

1,306,790

1,306,790

Total

Money

Market

Funds

(Cost

$

1,306,790

)

.................................

1,306,790

Total

Short

Term

Investments

(Cost

$

1,306,790

)

...............................

1,306,790

a

Total

Investments

(Cost

$

117,895,022

)

100.7

%

................................

$140,258,676

Other

Assets,

less

Liabilities

(

0.7

)

%

.........................................

(977,935)

Net

Assets

100.0%

.........................................................

$139,280,741

a

a

a

a

Non-income

producing.

b

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

July

31,

2024,

the

aggregate

value

of

these

securities

was

$6,395,650,

representing

4.6%

of

net

assets.

c

Variable

interest

entity

(VIE).

See

Note

6

regarding

investments

made

through

a

VIE

structure.

At

July

31,

2024,

the

aggregate

value

of

these

securities

was

$14,025,263,

representing

10.1%

of

net

assets.

d

Fair

valued

using

significant

unobservable

inputs.

See

Note

7

regarding

fair

value

measurements.

e

See

Note

6

regarding

investments

in

Russian

securities.

f

Variable

rate

security.

The

rate

shown

represents

the

yield

at

period

end.

Franklin

Fund

Allocator

Series

Schedule

of

Investments

Franklin

Emerging

Market

Core

Equity

(IU)

Fund

(continued)

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

g

See

Note

3(d)

regarding

investments

in

affiliated

management

investment

companies.

h

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

Franklin

Fund

Allocator

Series

Financial

Highlights

Franklin

International

Core

Equity

(IU)

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Annual

Report

a

Year

Ended

July

31,

Year

Ended

July

31,

2020

a

2024

2023

2022

2021

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

year)

Net

asset

value,

beginning

of

year

...................

$11.33

$10.18

$13.09

$10.31

$10.00

Income

from

investment

operations

b

:

Net

investment

income

c

.........................

0.34

0.37

0.34

0.35

0.25

Net

realized

and

unrealized

gains

(losses)

...........

1.28

1.16

(2.26)

2.80

0.30

Total

from

investment

operations

....................

1.62

1.53

(1.92)

3.15

0.55

Less

distributions

from:

Net

investment

income

..........................

(0.45)

(0.38)

(0.42)

(0.37)

(0.24)

Net

realized

gains

.............................

—

—

(0.57)

—

—

Total

distributions

...............................

(0.45)

(0.38)

(0.99)

(0.37)

(0.24)

Net

asset

value,

end

of

year

.......................

$12.50

$11.33

$10.18

$13.09

$10.31

Total

return

d

...................................

14.79%

15.44%

(15.56)%

31.00%

5.58%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

and

expense

reduction

...............................

0.02%

0.03%

0.04%

0.04%

0.08%

Expenses

net

of

waiver

and

payments

by

affiliates

.......

—%

—%

—%

—%

0.01%

Expenses

net

of

waiver

and

payments

by

affiliates

and

expense

reduction

...............................

—%

—%

f

—%

—%

f

—%

Net

investment

income

...........................

2.91%

3.62%

2.94%

2.93%

2.57%

Supplemental

data

Net

assets,

end

of

year

(000’s)

.....................

$941,318

$944,165

$800,757

$360,375

$281,150

Portfolio

turnover

rate

............................

59.10%

101.79%

125.21%

103.80%

94.98%

a

For

the

period

August

19,

2019

(effective

date)

to

July

31,

2020.

b

The

amount

shown

for

a

share

outstanding

throughout

the

period

may

not

correlate

with

the

Statement

of

Operations

for

the

period

due

to

the

timing

of

sales

and

repurchases

of

the

Fund’s

shares

in

relation

to

income

earned

and/or

fluctuating

fair

value

of

the

investments

of

the

Fund.

c

Based

on

average

daily

shares

outstanding.

d

Total

return

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year,

except

for

non-recurring

expenses,

if

any.

f

Benefit

of

expense

reduction

rounds

to

less

than

0.01%.

Franklin

Fund

Allocator

Series

Schedule

of

Investments,

July

31,

2024

Franklin

International

Core

Equity

(IU)

Fund

Annual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Country

Shares

a

Value

a

a

a

a

a

a

Common

Stocks

98.3%

Aerospace

&

Defense

1.7%

BAE

Systems

plc

...................................

United

Kingdom

678,020

$

11,306,335

Kongsberg

Gruppen

ASA

.............................

Norway

27,911

2,806,942

Leonardo

SpA

......................................

Italy

36,687

874,082

Saab

AB

,

B

........................................

Sweden

22,472

519,071

Safran

SA

.........................................

France

4,130

907,331

16,413,761

Air

Freight

&

Logistics

0.5%

DSV

A/S

..........................................

Denmark

10,438

1,914,810

a

InPost

SA

.........................................

Poland

52,278

905,745

Nippon

Express

Holdings,

Inc.

..........................

Japan

38,200

1,890,170

4,710,725

Automobile

Components

0.5%

Cie

Generale

des

Etablissements

Michelin

SCA

............

France

84,928

3,362,204

Continental

AG

.....................................

Germany

20,707

1,269,419

4,631,623

Automobiles

3.2%

Bayerische

Motoren

Werke

AG

.........................

Germany

45,590

4,228,434

Mazda

Motor

Corp.

..................................

Japan

295,100

2,545,360

a

Polestar

Automotive

Holding

UK

plc

,

SDR

.................

Hong

Kong

75,517

55,528

Stellantis

NV

.......................................

United

States

409,014

6,815,840

Subaru

Corp.

......................................

Japan

340,700

6,550,468

Toyota

Motor

Corp.

..................................

Japan

443,600

8,521,893

a

Volvo

Car

AB

,

B

....................................

Sweden

352,413

1,000,243

29,717,766

Banks

9.8%

b

ABN

AMRO

Bank

NV

,

CVA

,

144A

,

Reg

S

.................

Netherlands

387,575

6,765,840

AIB

Group

plc

......................................

Ireland

945,969

5,426,159

Banco

Bilbao

Vizcaya

Argentaria

SA

.....................

Spain

1,014,025

10,628,216

Commonwealth

Bank

of

Australia