UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORMN-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: 650312-2000

Date of fiscal year end:5/31

Date of reporting period:11/30/19

Item 1. Reports to Stockholders.

| | | | | | |

Franklin Payout 2019 Fund | | | | Franklin Payout 2021 Fund | | |

Franklin Payout 2020 Fund | | | | Franklin Payout 2022 Fund | | |

Internet Delivery of Fund Reports Unless You Request Paper Copies:Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800)321-8563 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800)321-8563 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

|

Not FDIC Insured| May Lose Value| No Bank Guarantee |

| | | | |

| | | |

| | Not part of the semiannual report | | 1 |

SEMIANNUAL REPORT

Economic and Market Overview

The U.S. economy expanded during the six months ended November 30, 2019. After moderating in 2019’s second quarter, the economy grew faster in the third quarter, aided by consumer spending, housing investment, government spending and exports. The manufacturing sector expanded at the start of the period, but contracted during the last four months, while the services sector expanded throughout the period. The unemployment rate decreased slightly from 3.6% in May 2019 to 3.5% atperiod-end.1 The annual inflation rate, as measured by the Consumer Price Index, increased from 1.8% in May 2019 to 2.1% atperiod-end.1

At its July 2019 meeting, the U.S. Federal Reserve (Fed) lowered its target range for the federal funds rate for the first time since December 2008, to 2.00%–2.25%, citing muted inflation pressures and the potential effects of global trade tensions on economic growth. Furthermore, the Fed ended its balance sheet normalization program earlier than previously indicated. The Fed further lowered the federal funds target rate range by 0.25% at its September and October meetings, to 1.50%–1.75%, reiterating the rationale cited at the July meeting.

The10-year Treasury yield, which moves inversely to its price, decreased during the period, falling to multi-year lows in 2019’s third quarter before beginning to recover in October. U.S. political uncertainties (including the impeachment inquiry into President Donald Trump), geopolitical tensions in certain regions (including political unrest in Hong Kong that led to the U.S. legislation supportingpro-democracy protesters), U.S. trade disputes with China and other trading partners, slower domestic and global economic growth, and the Fed’s more accommodative monetary policy stance weighed on the Treasury yield at certain points during the period. However, several better-than-expected U.S. economic reports and periods of optimism about a potential U.S.-China trade agreement supported the yield. The10-year yield fell persistently below certain short-term yields during most of the period, but rose above all short-term Treasury yields beginning inmid-October amid investor optimism following the announcement of a potential phase one of the U.S.-China trade agreement.

Overall, the10-year Treasury yield declined from 2.14% at the beginning of the period to 1.78% atperiod-end.

The foregoing information reflects our analysis and opinions as of November 30, 2019. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

Franklin Payout 2019 Fund

This semiannual report for Franklin Payout 2019 Fund covers the period ended November 30, 2019. As previously communicated, the Fund is scheduled to liquidate on or about January 10, 2020. In preparation for the Fund’s liquidation, the Fund closed to all investors at the close of market on December 19, 2019, and made its final distribution on December 27, 2019.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares posted a +1.00% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2019 Maturity Index, posted a +1.07% total return.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2019. You can find more of the Fund’s performance data in the Performance Summary beginning on page 5.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in

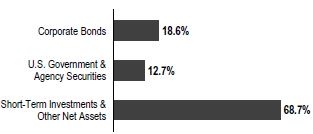

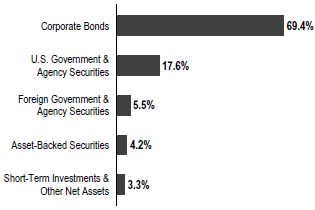

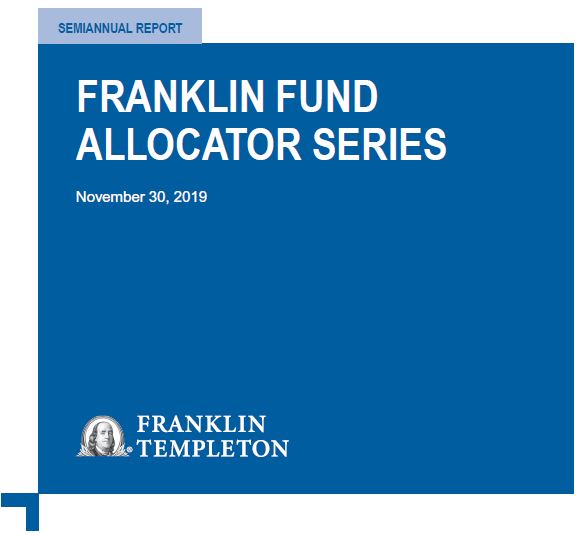

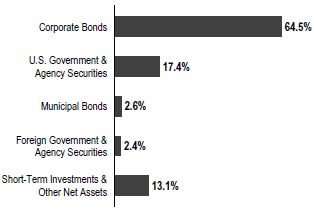

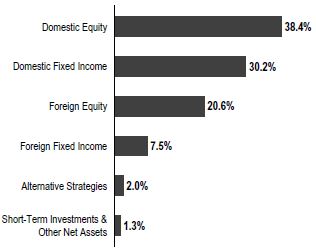

Portfolio Composition

Based on Total Net Assets as of 11/30/19

U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use atop-down analysis of macroeconomic trends, combined with abottom-up fundamental analysis of market sectors, industries and issuers, to try to take advantage of varying sector reactions to economic events.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2019. Over time, the Fund’s duration and weighted average maturity declined as 2019 approached. In the later months of operation, when the debt securities held by the Fund matured, the proceeds from such securities were held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2019, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund was not designed for long-term capital appreciation and did not provide a complete solution for a shareholder’s retirement income needs. The Fund did not guarantee a level of dividends,

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 25.

FRANKLIN PAYOUT 2019 FUND

income or principal at or before its target maturity date. The Fund liquidated as scheduled in January 2020.

Maturity

11/30/19

| | | | |

| | | % of Total Market Value | |

0 to 1 Year | | | 100.0% | |

Top 10 Holdings*

11/30/19

| | | | |

| Issue/Issuer | | % of Total

Net Assets | |

Federal Home Loan Bank (FHLB) | | | 9.0% | |

Federal Farm Credit Bank (FFCB) | | | 3.7% | |

UnitedHealth Group Inc. | | | 2.5% | |

Johnson & Johnson | | | 2.5% | |

Caterpillar Financial Services Corp. | | | 2.4% | |

Georgia Power Co. | | | 2.4% | |

General Electric Co. | | | 2.4% | |

Costco Wholesale Corp. | | | 2.4% | |

Kinder Morgan Inc. | | | 1.2% | |

Progress Energy Inc. | | | 1.2% | |

* Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s exposure to investment-grade corporate securities was the primary contributor to returns. In contrast, our yield curve positioning detracted from performance.

Atperiod-end, we remained overweighted and focused on investment-grade corporate credit exposures in the portfolio. This focus is based on our belief that valuations remained relatively attractive on a longer-term basis as well as the increased earnings potential available from this sector. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained a slightly overweighted position to the agency sector. Finally, we maintained an underweighted duration position in the portfolio compared with the index, driven largely by the maturity of our holdings heading into the Fund’s predetermined maturity date.

Thank you for your trust and participation in Franklin Payout 2019 Fund. It has been our privilege to serve you.

| | |

| |  |

| | David Yuen, CFA, FRM |

| | Co-Lead Portfolio Manager |

| |

| | |

| |

|

| | Tina Chou Co-Lead Portfolio Manager |

| |

| | Thomas Runkel, CFA Co-Lead Portfolio Manager |

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

FRANKLIN PAYOUT 2019 FUND

Performance Summary as of November 30, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 11/30/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%.Advisor Class:no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at(800)321-8563.

| | | | |

Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

Advisor | | | | |

6-Month | | +1.00% | | +1.00% |

1-Year | | +2.62% | | +2.62% |

3-Year | | +5.07% | | +1.66% |

Since Inception (6/1/15) | | +8.49% | | +1.83% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

See page 6 for Performance Summary footnotes.

FRANKLIN PAYOUT 2019 FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses4

| | | | | | | | | | |

| Share Class | | With Fee

Waiver | | | | | Without Fee

Waiver | |

Advisor | | | 0.46% | | | | | | 3.05% | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/20. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2019 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual | | Hypothetical | | |

| | | | | | | (actual return after expenses) | | | | (5% annual return before expenses) | | | | |

| | | | | | | | | Expenses | | | | | | Expenses | | | | Net |

| | | Beginning | | | | Ending | | Paid During | | | | Ending | | Paid During | | | | Annualized |

| Share | | Account | | | | Account | | Period | | | | Account | | Period | | | | Expense |

| Class | | Value 6/1/19 | | | | Value 11/30/19 | | 6/1/19–11/30/191, 2 | | | | Value 11/30/19 | | 6/1/19–11/30/191, 2 | | | | Ratio2 |

| | | | | | | | | | | | |

| R6 | | $1,000 | | | | $1,010.00 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

| Advisor | | $1,000 | | | | $1,010.00 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 183/366 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Franklin Payout 2020 Fund

This semiannual report for Franklin Payout 2020 Fund covers the period ended November 30, 2019.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares posted a +1.39% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2020 Maturity Index, posted a +1.43% total return.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2020. You can find more of the Fund’s performance data in the Performance Summary beginning on page 10.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

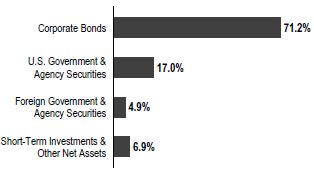

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use atop-down analysis of

Portfolio Composition

Based on Total Net Assets as of 11/30/19

macroeconomic trends, combined with abottom-up fundamental analysis of market sectors, industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2020. Over time, the Fund’s duration and weighted average maturity will decline as 2020 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2020, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is not designed for long-term capital appreciation and does not provide a complete solution for a shareholder’s retirement income needs. The Fund does not guarantee a level of dividends, income or principal at or before its target maturity date.

| | |

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. | | |

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 29.

FRANKLIN PAYOUT 2020 FUND

Maturity

11/30/19

| | |

| | | % of Total Market Value |

| |

0 to 1 Year | | 80.3% |

1 to 2 Years | | 19.7% |

Top 10 Holdings*

11/30/19

| | |

| Issue/Issuer | | % of Total Net Assets |

U.S. Treasury Note | | 12.0% |

Federal Home Loan Bank (FHLB) | | 4.9% |

Morgan Stanley | | 2.5% |

Emerson Electric Co. | | 2.5% |

Hershey Co. | | 2.5% |

JPMorgan Chase & Co. | | 2.5% |

Travelers Cos. Inc. | | 2.5% |

TransCanada PipeLines Ltd. | | 2.5% |

Northern Trust Corp. | | 2.4% |

Coca Cola Co. | | 2.4% |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s exposure to investment-grade corporate credit was the primary contributor to returns. In contrast, security selection within the high yield corporate credit sector detracted from performance. Duration positioning also weighed slightly on returns.

Atperiod-end, we remained overweighted and focused on investment-grade corporate credit exposures in the portfolio. This focus is based on our belief that valuations remained relatively attractive on a longer-term basis as well as the increased earnings potential available from this sector. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive to us. Additionally, we maintained a slight overweighted allocation to the agency sector. Finally, we maintained a slight duration overweight in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2020 Fund. We look forward to serving your future investment needs.

| | |

| |

David Yuen, CFA, FRM Co-Lead Portfolio Manager |

| | |

| |

Tina Chou Co-Lead Portfolio Manager |

| | Thomas Runkel, CFA Co-Lead Portfolio Manager |

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2020 FUND

Performance Summary as of November 30, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 11/30/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%.Advisor Class:no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at(800)321-8563.

| | | | |

| Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

| | |

Advisor | | | | |

6-Month | | +1.39% | | +1.39% |

1-Year | | +3.93% | | +3.93% |

3-Year | | +6.34% | | +2.07% |

Since Inception (6/1/15) | | +9.64% | | +2.07% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

See page 11 for Performance Summary footnotes.

FRANKLIN PAYOUT 2020 FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses4

| | | | |

| Share Class | | With Fee Waiver | | Without Fee Waiver |

Advisor | | 0.46% | | 3.25% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/20. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2020 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | | | | | | |

Share Class | | Beginning Account Value 6/1/19 | | | | Ending Account Value 11/30/19 | | Expenses Paid During Period 6/1/19–11/30/191, 2 | | | | Ending Account Value 11/30/19 | | Expenses Paid During Period 6/1/19–11/30/191, 2 | | | | Net Annualized Expense Ratio2 |

| | | | | | | | | | | | |

| R6 | | $1,000 | | | | $1,013.90 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

| Advisor | | $1,000 | | | | $1,013.90 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 183/366 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Franklin Payout 2021 Fund

This semiannual report for Franklin Payout 2021 Fund covers the period ended November 30, 2019.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares posted a +1.78% cumulative total return for the six months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2021 Maturity Index, posted a +1.60% total return.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2021. You can find more of the Fund’s performance data in the Performance Summary beginning on page 15.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use atop-down analysis of

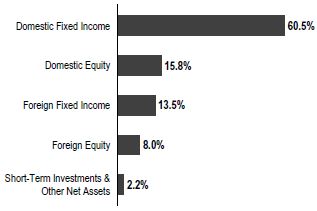

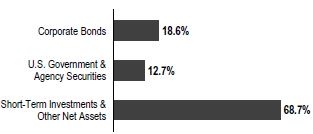

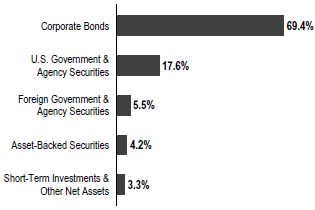

Portfolio Composition

Based on Total Net Assets as of 11/30/19

macroeconomic trends, combined with abottom-up fundamental analysis of market sectors, industries and issuers, to try to take advantage of varying sector reactions to economic events.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2021. Over time, the Fund’s duration and weighted average maturity will decline as 2021 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2021, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is not designed for long-term capital appreciation and does not provide a complete solution for a shareholder’s retirement income needs. The Fund does not guarantee a level of dividends, income or principal at or before its target maturity date.

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 34.

FRANKLIN PAYOUT 2021 FUND

Maturity

11/30/19

| | |

| | | % of Total Market Value |

0 to 1 Year | | 13.0% |

1 to 2 Years | | 56.4% |

2 to 3 Years | | 30.6% |

Top 10 Holdings*

11/30/19

| | |

| Issue/Issuer | | % of Total Net Assets |

U.S. Treasury Note | | 7.7% |

Federal Home Loan Bank (FHLB) | | 4.9% |

Federal Farm Credit Bank (FFCB) | | 4.8% |

California State GO | | 2.6% |

Total Capital SA | | 2.5% |

Telstra Corp. Ltd. | | 2.5% |

General Electric Co. | | 2.5% |

Gilead Sciences Inc. | | 2.5% |

Berkshire Hathaway Inc. | | 2.5% |

BP Capital Markets PLC | | 2.4% |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s exposure to investment-grade corporate securities was the primary contributor to returns, while allocation and security selection within the high yield sector also lifted returns. In contrast, duration positioning detracted from performance.

Atperiod-end, we remained overweighted and focused on investment-grade corporate credit exposures in the portfolio. This focus is based on our belief that valuations remained relatively attractive on a longer-term basis as well as the increased earnings potential available from this sector. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive, in our opinion. Additionally, we maintained a slight overweighted position to the agency sector. Finally, we maintained a slight duration overweight in the portfolio driven largely by our focus on final maturity dates closer toyear-end as compared with the index.

Thank you for your participation in Franklin Payout 2021 Fund. We look forward to serving your future investment needs.

| | |

| |

David Yuen, CFA, FRM Co-Lead Portfolio Manager |

| |

| |

Tina Chou Co-Lead Portfolio Manager |

| |

| | | Thomas Runkel, CFA Co-Lead Portfolio Manager |

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2021 FUND

Performance Summary as of November 30, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 11/30/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%.Advisor Class:no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at(800)321-8563.

| | | | |

| Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

Advisor | | | | |

6-Month | | +1.78% | | +1.78% |

1-Year | | +5.76% | | +5.76% |

3-Year | | +7.58% | | +2.46% |

Since Inception (6/1/15) | | +11.92% | | +2.54% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

See page 16 for Performance Summary footnotes.

FRANKLIN PAYOUT 2021 FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses4

| | | | |

| Share Class | | With Fee Waiver | | Without Fee Waiver |

Advisor | | 0.46% | | 3.07% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2021 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | Hypothetical (5% annual return before expenses) | | | | |

| | | | | | | | | | | | | | |

Share Class | | Beginning Account Value 6/1/19 | | | | Ending Account Value 11/30/19 | | Expenses Paid During Period 6/1/19–11/30/191, 2 | | | | Ending Account Value 11/30/19 | | Expenses Paid During Period 6/1/19–11/30/191, 2 | | | | Net Annualized Expense Ratio2 |

| | | | | | | | | | | | |

| R6 | | $1,000 | | | | $1,017.80 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

| Advisor | | $1,000 | | | | $1,017.80 | | $1.46 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 183/366 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Franklin Payout 2022 Fund

This semiannual report for Franklin Payout 2022 Fund covers the period ended November 30, 2019.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in U.S. dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares posted a +2.25% cumulative total return for the period under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays U.S. Government/Credit 2022 Maturity Index, posted a +2.01% total return.1 The index includes investment-grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2022. You can find more of the Fund’s performance data in the Performance Summary beginning on page 20.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

Investment Strategy

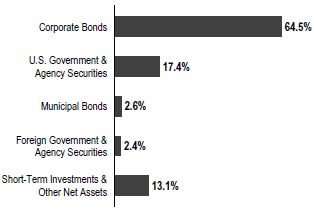

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in U.S. dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use atop-down analysis of

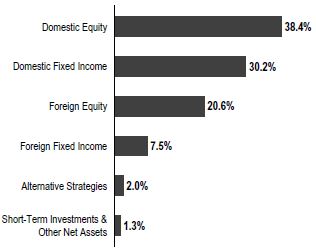

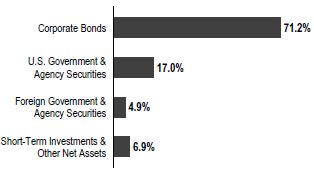

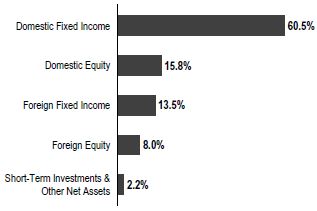

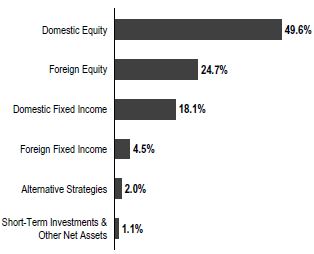

Portfolio Composition

Based on Total Net Assets as of 11/30/19

macroeconomic trends, combined with abottom-up fundamental analysis of market sectors, industries and issuers, to try to take advantage of varying sector reactions to economic events.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2022. Over time, the Fund’s duration and weighted average maturity will decline as 2022 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2022, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is not designed for long-term capital appreciation and does not provide a complete solution for a shareholder’s retirement income needs. The Fund does not guarantee a level of dividends, income or principal at or before its target maturity date.

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 39.

FRANKLIN PAYOUT 2022 FUND

Maturity

11/30/19

| | |

| | | % of Total Market Value |

0 to 1 Year | | 3.5% |

2 to 3 Years | | 61.3% |

3 to 4 Years | | 31.1% |

5 to 6 Years | | 4.1% |

Top 10 Holdings*

11/30/19

| | |

| Issue/Issuer | | % of Total

Net Assets |

U.S. Treasury Note | | 9.3% |

Federal Home Loan Bank (FHLB) | | 8.3% |

Metlife Inc. | | 2.8% |

JPMorgan Chase & Co. | | 2.8% |

International Business Machines Corp. | | 2.8% |

Caterpillar Financial Services Corp. | | 2.8% |

American Express Co. | | 2.8% |

Swiss Re Treasury U.S. Corp. | | 2.8% |

Massmutual Global Funding II | | 2.8% |

Bank of Montreal | | 2.8% |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s exposure to investment-grade corporate securities was the primary contributor to returns, although security selection within the sector detracted somewhat. Additionally, an overweighted duration positioning also contributed to performance. There were no material detractors from performance over the period.

Atperiod-end, we remained overweighted and focused on investment-grade corporate credit exposures in the portfolio. This focus is based on our belief that valuations remained relatively attractive on a longer-term basis as well as the increased earnings potential available from this sector. Conversely, we maintained an underweighted allocation to the U.S. Treasury sector as valuations and income levels remained unattractive, in our opinion. Additionally, we maintained a slight overweighted position to the agency sector. Finally, we maintained a slight duration overweight in the portfolio driven largely by our focus on final maturity dates closer toyear-end as compared with the index.

Thank you for your participation in Franklin Payout 2022 Fund. We look forward to serving your future investment needs.

| | |

| |

David Yuen, CFA, FRM Co-Lead Portfolio Manager |

| |

| |

Tina Chou Co-Lead Portfolio Manager |

| |

| | Thomas Runkel, CFA Co-Lead Portfolio Manager |

The foregoing information reflects our analysis, opinions and portfolio holdings as of November 30, 2019, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2022 FUND

Performance Summary as of November 30, 2019

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 11/30/191

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%.Advisor Class:no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at(800)321-8563.

| | | | |

| Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

Advisor | | | | |

6-Month | | +2.25% | | +2.25% |

1-Year | | +7.64% | | +7.64% |

Since Inception (1/23/18) | | +7.21% | | +3.83% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recentmonth-end performance, call a Franklin Templeton Institutional Services representative at (800)321-8563.

See page 21 for Performance Summary footnotes.

FRANKLIN PAYOUT 2022 FUND

PERFORMANCE SUMMARY

Total Annual Operating Expenses4

| | | | |

| Share Class | | With Fee

Waiver | | Without Fee

Waiver |

Advisor | | 0.44% | | 3.46% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/20. Fund investment results reflect the fee waiver; without this waiver, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

FRANKLIN PAYOUT 2022 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service(12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share Class | | Beginning Account

Value | | | | Ending Account Value 11/30/19 | | Expenses Paid During Period 1/23/18–11/30/191, 2 | | | | Ending Account

Value 11/30/19 | | Expenses Paid During Period 6/1/19–11/30/191, 2 | | | | Net Annualized Expense Ratio2 |

| | | | | | | | | | | | |

R6 | | $1,000 | | | �� | $1,022.50 | | $1.47 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

Advisor | | $1,000 | | | | $1,022.50 | | $1.47 | | | | $1,023.55 | | $1.47 | | | | 0.29% |

1. Expenses are equal to the annualized expense ratio for thesix-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 183/366 to reflect theone-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

FRANKLIN FUND ALLOCATOR SERIES

Financial Highlights

Franklin Payout 2019 Fund

| | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

November 30, 2019 | | | Year Ended May 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016a | |

| | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of period | | | $10.04 | | | | $ 9.99 | | | | $10.13 | | | | $10.16 | | | | $10.00 | |

| | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomec | | | 0.09 | | | | 0.19 | | | | 0.19 | | | | 0.18 | | | | 0.18 | |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.01 | | | | 0.05 | | | | (0.15 | ) | | | (0.03 | ) | | | 0.10 | |

| | | | | |

Total from investment operations | | | 0.10 | | | | 0.24 | | | | 0.04 | | | | 0.15 | | | | 0.28 | |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | — | | | | (0.19 | ) | | | (0.18 | ) | | | (0.18 | ) | | | (0.12 | ) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (— | )d | | | — | | | | — | |

| | | | | |

Total distributions | | | — | | | | (0.19 | ) | | | (0.18 | ) | | | (0.18 | ) | | | (0.12 | ) |

| | | | | |

Net asset value, end of period | | | $10.14 | | | | $10.04 | | | | $ 9.99 | | | | $10.13 | | | | $10.16 | |

| | | | | |

Total returne | | | 1.00% | | | | 2.44% | | | | 0.45% | | | | 1.52% | | | | 2.85% | |

| | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 2.04% | | | | 3.03% | | | | 2.60% | | | | 2.66% | | | | 3.57% | |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.29% | | | | 0.29% | g | | | 0.30% | | | | 0.30% | | | | 0.29% | |

| | | | | |

Net investment income | �� | | 1.71% | | | | 1.86% | | | | 1.88% | | | | 1.81% | | | | 1.80% | |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (000’s) | | | $2,054 | | | | $2,032 | | | | $2,022 | | | | $2,051 | | | | $2,057 | |

| | | | | |

Portfolio turnover rate | | | —% | | | | 2.60% | | | | 1.29% | | | | —% | | | | —% | h |

aFor the year June 1, 2015 (commencement of operations) to May 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hRounds to less than 0.01%.

| | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 23 |

FRANKLIN FUND ALLOCATOR SERIES

FINANCIAL HIGHLIGHTS

Franklin Payout 2019 Fund(continued)

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended November 30, 2019 | | | Year Ended May 31, |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016a |

| | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of period | | | $10.04 | | | | $ 9.99 | | | | $10.13 | | | | $10.16 | | | $10.00 |

| | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomec | | | 0.09 | | | | 0.19 | | | | 0.19 | | | | 0.18 | | | 0.18 |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.01 | | | | 0.05 | | | | (0.15 | ) | | | (0.03 | ) | | 0.10 |

| | | | | |

Total from investment operations | | | 0.10 | | | | 0.24 | | | | 0.04 | | | | 0.15 | | | 0.28 |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | — | | | | (0.19 | ) | | | (0.18 | ) | | | (0.18 | ) | | (0.12) |

| | | | | |

Net realized gains | | | — | | | | — | | | | (— | )d | | | — | | | — |

| | | | | |

Total distributions | | | — | | | | (0.19 | ) | | | (0.18 | ) | | | (0.18 | ) | | (0.12) |

| | | | | |

Net asset value, end of period | | | $10.14 | | | | $10.04 | | | | $ 9.99 | | | | $10.13 | | | $10.16 |

| | | | | |

Total returne | | | 1.00% | | | | 2.42% | | | | 0.44% | | | | 1.52% | | | 2.85% |

| | | | | |

Ratios to average net assetsf | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 2.04% | | | | 3.03% | | | | 2.60% | | | | 2.66% | | | 3.57% |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.29% | | | | 0.30% | g | | | 0.31% | | | | 0.30% | | | 0.29% |

| | | | | |

Net investment income | | | 1.71% | | | | 1.85% | | | | 1.87% | | | | 1.81% | | | 1.80% |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (000’s) | | | $2,054 | | | | $2,032 | | | | $2,022 | | | | $2,051 | | | $2,057 |

| | | | | |

Portfolio turnover rate | | | —% | | | | 2.60% | | | | 1.29% | | | | —% | | | —%h |

aFor the year June 1, 2015 (commencement of operations) to May 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dAmount rounds to less than $0.01 per share.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gBenefit of expense reduction rounds to less than 0.01%.

hRounds to less than 0.01%.

| | | | |

| | | |

24 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN FUND ALLOCATOR SERIES

Statement of Investments, November 30, 2019 (unaudited)

Franklin Payout 2019 Fund

| | | | | | | | | | | | | | | | |

| | | Country | | | Principal Amount | | | Value | |

| | | | |

Corporate Bonds 18.6% | | | | | | | | | | | | | | | | |

| | | | |

Capital Goods 4.9% | | | | | | | | | | | | | | | | |

Caterpillar Financial Services Corp., senior note, 2.25%, 12/01/19 | | | United States | | | $ | 100,000 | | | | | | | $ | 100,000 | |

General Electric Co., senior secured note, first lien, 2.10%, 12/11/19 | | | United States | | | | 100,000 | | | | | | | | 99,997 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | 199,997 | |

| | | | | | | | | | | | | | | | |

| | | | |

Energy 1.2% | | | | | | | | | | | | | | | | |

Kinder Morgan Inc., senior note, 3.05%, 12/01/19 | | | United States | | | | 50,000 | | | | | | | | 50,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Food & Staples Retailing 2.4% | | | | | | | | | | | | | | | | |

Costco Wholesale Corp., senior note, 1.70%, 12/15/19 | | | United States | | | | 100,000 | | | | | | | | 99,993 | |

| | | | | | | | | | | | | | | | |

| | | | |

Health Care Equipment & Services 2.8% | | | | | | | | | | | | | | | | |

Becton Dickinson and Co., senior note, 2.675%, 12/15/19 | | | United States | | | | 14,000 | | | | | | | | 14,003 | |

UnitedHealth Group Inc., senior note, 2.30%, 12/15/19 | | | United States | | | | 100,000 | | | | | | | | 100,013 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 114,016 | |

| | | | | | | | | | | | | | | | |

| | | | |

Pharmaceuticals, Biotechnology & Life Sciences 2.4% | | | | | | | | | | | | | | | | |

Johnson & Johnson, senior note, 1.875%, 12/05/19 | | | United States | | | | 100,000 | | | | | | | | 100,002 | |

| | | | | | | | | | | | | | | | |

| | | | |

Utilities 4.9% | | | | | | | | | | | | | | | | |

DTE Energy Co., senior note, 2.40%, 12/01/19 | | | United States | | | | 50,000 | | | | | | | | 50,000 | |

Georgia Power Co., senior note, 4.25%, 12/01/19 | | | United States | | | | 100,000 | | | | | | | | 100,000 | |

Progress Energy Inc., senior bond, 4.875%, 12/01/19 | | | United States | | | | 50,000 | | | | | | | | 50,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | | | | | | | | | | 200,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Corporate Bonds (Cost $764,013) | | | | | | | | | | | | | | | 764,008 | |

| | | | | | | | | | | | | | | | |

| | | | |

U.S. Government and Agency Securities 12.7% | | | | | | | | | | | | | | | | |

FFCB, 1.95%, 12/17/19 | | | United States | | | | 150,000 | | | | | | | | 150,031 | |

FHLB, | | | | | | | | | | | | | | | | |

1.25%, 12/13/19 | | | United States | | | | 160,000 | | | | | | | | 159,975 | |

2.375%, 12/13/19 | | | United States | | | | 210,000 | | | | | | | | 210,060 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total U.S. Government and Agency Securities

(Cost $520,046) | | | | | | | | | | | | | | | 520,066 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments before Short Term Investments (Cost $1,284,059) | | | | | | | | | | | | | | | 1,284,074 | |

| | | | | | | | | | | | | | | | |

FRANKLIN FUND ALLOCATOR SERIES

STATEMENT OF INVESTMENTS (UNAUDITED)

Franklin Payout 2019 Fund(continued)

| | | | | | | | | | | | | | | | |

| | | Country | | | Shares | | | Value | |

| | | | |

Short Term Investments (Cost $2,761,777) 67.2% | | | | | | | | | | | | | | | | |

| | | | |

Money Market Funds 67.2% | | | | | | | | | | | | | | | | |

a,bInstitutional Fiduciary Trust Money Market Portfolio, 1.35% | | | United States | | | | 2,761,777 | | | | | | | $ | 2,761,777 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments (Cost $4,045,836) 98.5% | | | | | | | | | | | | | | | 4,045,851 | |

| | | | |

Other Assets, less Liabilities 1.5% | | | | | | | | | | | | | | | 61,986 | |

| | | | | | | | | | | | | | | | |

| | | | |

Net Assets 100.0% | | | | | | | | | | | | | | $ | 4,107,837 | |

| | | | | | | | | | | | | | | | |

See Abbreviations on page 52.

aSee Note 3(d) regarding investments in affiliated management investment companies.

bThe rate shown is the annualizedseven-day effective yield at period end.

| | | | |

| | | |

26 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | |

FRANKLIN FUND ALLOCATOR SERIES

Financial Highlights

Franklin Payout 2020 Fund

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended November 30, 2019 | | | Year Ended May 31, |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016a |

| | | | | |

Class R6 | | | | | | | | | | | | | | | | | | |

| | | | | |

Per share operating performance (for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | |

| | | | | |

Net asset value, beginning of period | | | $10.04 | | | | $ 9.95 | | | | $10.17 | | | | $10.17 | | | $10.00 |

| | | | | |

Income from investment operationsb: | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment incomec | | | 0.10 | | | | 0.21 | | | | 0.20 | | | | 0.21 | | | 0.20 |

| | | | | |

Net realized and unrealized gains (losses) | | | 0.04 | | | | 0.09 | | | | (0.22 | ) | | | (0.01 | ) | | 0.11 |

| | | | | |

Total from investment operations | | | 0.14 | | | | 0.30 | | | | (0.02 | ) | | | 0.20 | | | 0.31 |

| | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income | | | — | | | | (0.21 | ) | | | (0.20 | ) | | | (0.20 | ) | | (0.14) |

| | | | | |

Net asset value, end of period | | | $10.18 | | | | $10.04 | | | | $ 9.95 | | | | $10.17 | | | $10.17 |

| | | | | |

Total returnd | | | 1.39% | | | | 3.03% | | | | (0.18)% | | | | 1.99% | | | 3.10% |

| | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses before waiver and payments by affiliates | | | 3.23% | | | | 3.23% | | | | 2.74% | | | | 2.72% | | | 3.59% |

| | | | | |

Expenses net of waiver and payments by affiliates | | | 0.29% | | | | 0.29% | | | | 0.30% | | | | 0.30% | | | 0.29% |

| | | | | |

Net investment income | | | 2.02% | | | | 2.07% | | | | 2.03% | | | | 2.02% | | | 2.01% |

| | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of period (000’s) | | | $2,064 | | | | $2,037 | | | | $2,018 | | | | $2,062 | | | $2,061 |

| | | | | |

Portfolio turnover rate | | | —% | | | | 6.50% | | | | —% | | | | 1.28% | | | 4.23% |

aFor the year June 1, 2015 (commencement of operations) to May 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

| | | | |

| | | |

| | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 27 |

FRANKLIN FUND ALLOCATOR SERIES

FINANCIAL HIGHLIGHTS

Franklin Payout 2020 Fund(continued)

| | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

November 30, 2019 | | | Year Ended May 31, |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016a |

| | | | | |

Advisor Class | | | | | | | | | | | | | | | | | | |

| | | | | |