UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/20

Item 1. Reports to Stockholders.

| | |

Franklin Conservative Allocation Fund | | Franklin Growth Allocation Fund |

| |

Franklin Moderate Allocation Fund | | |

Sign up for electronic delivery at franklintempleton.com/edelivery

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

SHAREHOLDER LETTER

Dear Shareholder:

During the six months ended June 30, 2020, global economies were impacted by government restrictions to limit the novel coronavirus (COVID-19) pandemic, and the U.S. economy contracted in 2020’s first and second quarters. Given these economic risks, the U.S. Federal Reserve lowered its key rate by 0.50% on March 3 and further by 1.00% on March 15, decreasing the rate during the period from 1.75% to 0.25%. In its efforts to support U.S. economic activity, the Fed also announced broad quantitative easing measures to aid credit markets.

Concerns about the pandemic caused many equity investors to shift to government bonds and cash during the period. Nevertheless, global equities partially recovered by June 30, 2020, given optimism about reopening economies and potential COVID-19 treatments. In this environment, the prices of U.S. stocks, as measured by the Standard & Poor’s® 500 Index (S&P 500®), returned -4.04% (the index decreasing from 3,230.78 to 3,100.29).1,3 The prices of stocks in global developed markets, as measured by the MSCI World Index, returned -6.64% (the index decreasing from 2,358.468 to 2,201.788).2,3 Investment-grade bonds, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index (Bloomberg Index), posted a +6.14% total return (an index increase from 2,225.000 to 2,361.51), which includes reinvestment of income and distributions.4

We are committed to our long-term perspective and disciplined investment approach as we conduct a rigorous, fundamental analysis of securities with a regular emphasis on investment risk management.

We believe active, professional investment management serves investors well. We also recognize the important role of financial advisors in today’s markets and encourage investors to continue to seek their advice. Amid changing markets and economic conditions, we are confident investors with a well-diversified portfolio and a patient, long-term outlook should be well-positioned for the years ahead.

In addition, Franklin Fund Allocator Series’ semiannual report includes more detail about prevailing conditions and a discussion about investment decisions during the period. As you know, all securities markets fluctuate, as do mutual fund share prices.

We thank you for investing with Franklin, welcome your questions and comments, and look forward to assisting your future investment plans.

Sincerely,

Rupert H. Johnson, Jr.

Chairman

Franklin Fund Allocator Series

This letter reflects our analysis and opinions as of June 30, 2020, unless otherwise indicated. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Copyright © 2020, S&P Dow Jones Indices LLC. All rights reserved.

2. Source: MSCI.

3. Source: Morningstar. The changes in index prices shown for the S&P 500 and MSCI World Index do not include reinvestments of income and distributions, which are included in their total returns, which were: S&P 500 -3.08% (index total return resulting in a decrease from 6,553.57 to 6,351.67) and MSCI World Index -5.48% (index total return resulting in a decrease from 9,979.034 to 9,432.107).

4. Sources: Morningstar and Bloomberg Barclays indexes. For the Bloomberg Index, only total return as shown is available, not price change without the inclusion of reinvested income and distributions.

See www.franklintempletondatasources.com for additional data provider information.

|

Not FDIC Insured | May Lose Value | No Bank Guarantee |

| | | | |

franklintempleton.com | | Not part of the semiannual report | | 1 |

Contents

| | | | |

Semiannual Report | | | | |

| |

Economic and Market Overview | | | 3 | |

| |

Franklin Conservative Allocation Fund | | | 4 | |

| |

Franklin Moderate Allocation Fund | | | 9 | |

| |

Franklin Growth Allocation Fund | | | 14 | |

| |

Financial Highlights and Statements of Investments | | | 19 | |

| |

Financial Statements | | | 40 | |

| |

Notes to Financial Statements | | | 45 | |

| |

Shareholder Information | | | 59 | |

|

| Visit franklintempleton.com for fund updates, to access your account, or to find helpful financial planning tools. |

| | | | |

| | | |

2 | | Semiannual Report | | franklintempleton.com |

SEMIANNUAL REPORT

Economic and Market Overview

Global developed and emerging market equities, as measured by the MSCI All Country World Index (USD), posted a -5.99% total return during the six months under review.1 Stocks fell sharply in early 2020 as countries around the world implemented lockdown measures in an effort to slow the spread of the novel coronavirus (COVID-19). Global supply chain disruptions, business and personal restrictions, and subdued consumer spending drove many investors to sell equity holdings in favor of perceived safe investments such as government bonds and cash. While global equities, notably in the U.S., rebounded in April and May amid optimism about easing lockdown restrictions, concerns about a second wave of infections hindered equities in June, as investors weighed the possibility of renewed restrictions.

In the U.S., government mandates to mitigate the COVID-19 pandemic severely impacted the economy beginning in March 2020. As a result, the unemployment rate surged to 14.7% in April, as many businesses, particularly those involved in hospitality, retail and travel, announced mass layoffs.2 According to the National Bureau of Economic Research, the longest U.S. economic expansion in history ended in February 2020 as the country slipped into a severe recession. Nonetheless, near period-end, there were signs that a recovery was underway, as jobless claims fell considerably from their peak in early April, retail sales rose sharply in May, and the unemployment rate fell to 11.1% in June.2 Along with optimism about improved treatments and potential vaccines for COVID-19, the positive economic signals contributed to a significant equity rebound in April and May. However, an increase in COVID-19 infections in many states throughout June pressured U.S. stocks.

The U.S. Federal Reserve (Fed) made significant efforts to support the U.S. economy. In March 2020, as the pandemic began to severely impact the economy and financial markets, the Fed implemented two emergency rate cuts, lowering the federal funds target rate to a range of 0.00%–0.25%, and announced sweeping quantitative easing measures aimed at ensuring credit flow to borrowers and supporting credit markets with unlimited amounts of bond purchasing.

In the eurozone, some analysts forecasted a significant contraction in 2020, particularly in southern European

countries, as the magnitude of the economic disruption caused by the pandemic became apparent. European developed market equities, as measured by the MSCI Europe Index (USD), posted a -12.43% total return for the period.1 To stimulate growth, the European Central Bank implemented a broad bond-buying program, and many countries passed fiscal stimulus measures.

Asian developed and emerging market equities, as measured by the MSCI All Country Asia Index (USD), posted a -5.51% total return during the six-month period.1 The onset of the pandemic brought dramatically slower economic activity in Asia, as businesses halted operations and manufacturing and export activity declined sharply in the region’s major economies. Asian markets generally advanced toward period-end, bolstered by fiscal stimulus measures and economies reopening throughout the region.

Emerging market stocks, as measured by the MSCI Emerging Markets Index (USD), posted a -9.67% total return due primarily to the COVID-19 pandemic.1 A sharp decrease in prices for oil and other natural resources also hurt emerging market economies reliant on these exports. In the last quarter of the reporting period, however, investor optimism led to a stock rally, particularly in emerging market countries that had successfully lowered infection rates.

The foregoing information reflects our analysis and opinions as of June 30, 2020. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Morningstar.

2. Source: U.S. Bureau of Labor Statistics.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

franklintempleton.com | | Semiannual Report | | 3 |

Franklin Conservative Allocation Fund

This semiannual report for Franklin Conservative Allocation Fund covers the period ended June 30, 2020.

Your Fund’s Goal and Main Investments

The Fund seeks the highest level of long-term total return consistent with an acceptable level of risk.1

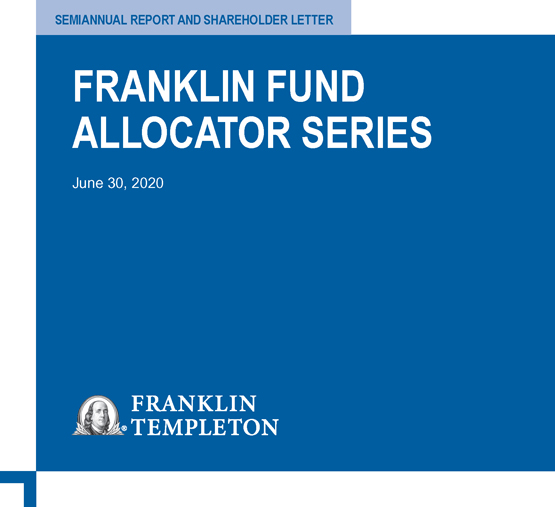

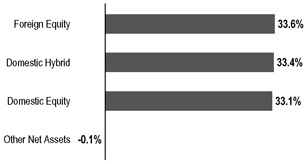

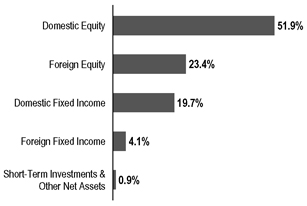

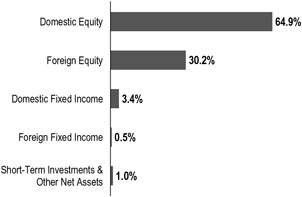

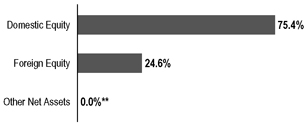

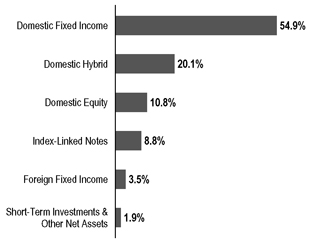

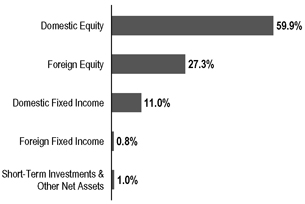

Asset Allocation*

Based on Total Net Assets as of 6/30/20

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund and other fund investments into a broad asset class based on its predominant investments under normal market conditions.

Performance Overview

The Fund’s Class A shares posted a -0.29% cumulative total return for the six months under review. In comparison, the Custom Franklin Conservative Allocation Fund Index (Blended Benchmark) posted a -0.60% cumulative total return.2 The Fund’s equity benchmark, the MSCI All Country World Index (ACWI), which measures equity market performance in global developed and emerging markets, posted a -5.99% total return.3 The Fund’s fixed income benchmark, the Bloomberg Barclays Multiverse Index, a broad-based measure of the global fixed income bond market, posted a +2.53% total return.3 You can find the

Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes of equity and fixed-income investments by investing primarily in a distinctly-weighted combination of underlying funds, based on each underlying fund’s predominant asset class. When selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed to its allocation among equity and fixed income securities and to the actual performance of the fund investments.

At period-end, Franklin Conservative Allocation Fund allocated 58.8% of total net assets to fixed income and 40.4% to equity. Domestic fixed income exposure was 82.1% of the total fixed income weighting, with the balance

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or implied performance or portfolio composition, which may change on a continuous basis.

2. Source: FactSet. The Fund’s Blended Benchmark was calculated internally. Effective January 1, 2015, the Blended Benchmark changed to 40% MSCI ACWI and 60% Bloomberg Barclays Multiverse Index. From January 1, 2013 to December 31, 2014, the Blended Benchmark was composed of 28% Standard & Poor’s 500 Index (S&P 500), 12% MSCI Europe, Australasia, Far East (EAFE) Index and 60% Bloomberg Barclays U.S. Aggregate Bond Index. Prior to January 1, 2013, the Blended Benchmark was composed of 28% S&P 500, 12% MSCI EAFE Index, 40% Bloomberg Barclays U.S. Aggregate Bond Index and 20% Payden & Rygel 90 Day T-Bill Index.

3. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s SOI which begins on page 24.

| | | | |

| | | |

4 | | Semiannual Report | | franklintempleton.com |

FRANKLIN CONSERVATIVE ALLOCATION FUND

Top 10 Fund Holdings

6/30/20

| | |

| | | % of Total |

| | | Net Assets |

Franklin Liberty U.S. Core Bond ETF | | 25.7% |

Franklin Growth Fund – Class R6 | | 9.4% |

Franklin U.S. Core Equity (IU) Fund | | 8.7% |

iShares Core U.S. Aggregate Bond ETF | | 6.8% |

Franklin LibertyQ U.S. Equity ETF | | 5.3% |

Franklin Liberty U.S. Treasury Bond ETF | | 5.2% |

Franklin Liberty International Aggregate Bond ETF | | 5.1% |

Franklin Low Duration Total Return Fund – Class R6 | | 5.0% |

Franklin Rising Dividends Fund – Class R6 | | 4.7% |

Templeton Global Total Return Fund – Class R6 | | 3.4% |

represented by foreign fixed income. Franklin Liberty U.S. Core Bond ETF was our largest fixed income fund weighting at 25.7% of the Fund’s total net assets. On the equity side, domestic exposure was 77.2% of the Fund’s total equity weighting, with the balance represented by foreign equity. The Portfolio was diversified across capitalization sizes and investment styles, and on June 30, 2020, we held shares in large-, mid- and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6 was our largest equity fund weighting at 9.4% of total net assets.

During the six-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, outperformed the MSCI ACWI, while our largest domestic value fund holding, Franklin LibertyQ U.S. Equity ETF, and our largest foreign equity fund holding, Franklin International Core Equity (IU) Fund, underperformed the index. On the fixed income side, our largest domestic fixed income fund holding, Franklin Liberty U.S. Core Bond ETF, outperformed the Bloomberg Barclays Multiverse Index, while our largest foreign fixed income holding, Franklin Liberty International Aggregate Bond ETF, underperformed the index.

Thank you for your continued participation in Franklin Conservative Allocation Fund. We look forward to serving your future investment needs.

Thomas A. Nelson, CFA

Co-Lead Portfolio Manager

May Tong, CFA

Co-Lead Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

| | | | |

franklintempleton.com | | Semiannual Report | | 5 |

FRANKLIN CONSERVATIVE ALLOCATION FUND

Performance Summary as of June 30, 2020

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 6/30/201

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| | | Cumulative | | | | Average Annual | |

Share Class | | | Total Return | 2 | | | Total Return | 3 |

| |

A4 | | | | | | | | |

6-Month | | | -0.29% | | | | -5.78% | |

| |

1-Year | | | +3.24% | | | | -2.44% | |

| |

5-Year | | | +21.33% | | | | +2.77% | |

| |

10-Year | | | +66.28% | | | | +4.63% | |

| |

| | |

Advisor | | | | | | | | |

6-Month | | | -0.17% | | | | -0.17% | |

| |

1-Year | | | +3.50% | | | | +3.50% | |

| |

5-Year | | | +22.94% | | | | +4.22% | |

| |

10-Year | | | +70.60% | | | | +5.49% | |

| |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 7 for Performance Summary footnotes.

| | | | |

| | | |

6 | | Semiannual Report | | franklintempleton.com |

FRANKLIN CONSERVATIVE ALLOCATION FUND

PERFORMANCE SUMMARY

Distributions (1/1/20–6/30/20)

| | | | | | |

| Share Class | | Net Investment

Income | | Short-Term

Capital Gain | | Total |

A | | $0.0949 | | $0.1676 | | $0.2625 |

C | | $0.0468 | | $0.1676 | | $0.2144 |

R | | $0.0785 | | $0.1676 | | $0.2461 |

R6 | | $0.1157 | | $0.1676 | | $0.2833 |

Advisor | | $0.1104 | | $0.1676 | | $0.2780 |

Total Annual Operating Expenses5

| | |

| Share Class | | |

A | | 0.88% |

Advisor | | 0.63% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, it is subject to the same risks, and indirectly bears the fees and expenses, of the underlying funds. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks which are heightened in developing countries. Investors should consult their financial advisor for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. The Fund’s prospectus also includes a description of the main investment risks.

1. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 20%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus, including the effect of acquired fund fees and expenses, and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

franklintempleton.com | | Semiannual Report | | 7 |

FRANKLIN CONSERVATIVE ALLOCATION FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | | | | |

A | | $1,000 | | | | $997.10 | | $3.13 | | | | $1,021.73 | | $3.17 | | | | 0.63% |

C | | $1,000 | | | | $994.10 | | $6.84 | | | | $1,018.00 | | $6.92 | | | | 1.38% |

R | | $1,000 | | | | $996.60 | | $4.37 | | | | $1,020.49 | | $4.42 | | | | 0.88% |

R6 | | $1,000 | | | | $999.40 | | $1.49 | | | | $1,023.37 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $998.30 | | $1.89 | | | | $1,022.97 | | $1.91 | | | | 0.38% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements, for Class R6. Does not include acquired fund fees and expenses.

| | | | |

| | | |

8 | | Semiannual Report | | franklintempleton.com |

Franklin Moderate Allocation Fund

This semiannual report for Franklin Moderate Allocation Fund covers the period ended June 30, 2020.

Your Fund’s Goal and Main Investments

The Fund seeks the highest level of long-term total return consistent with an acceptable level of risk.1

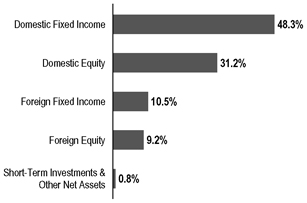

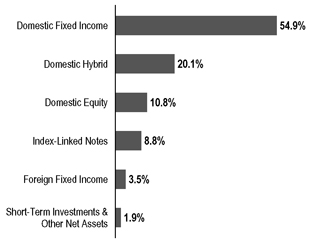

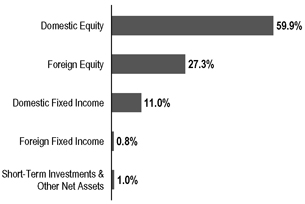

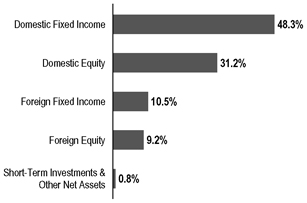

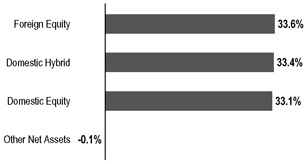

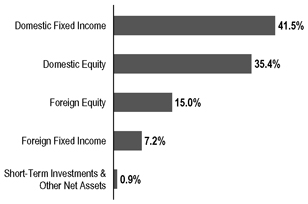

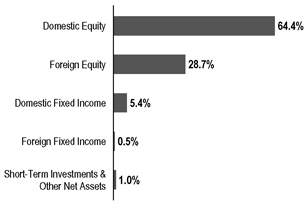

Asset Allocation*

Based on Total Net Assets as of 6/30/20

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund and other fund investments into a broad asset class based on its predominant investments under normal market conditions.

Performance Overview

The Fund’s Class A shares posted a -1.01% cumulative total return for the six months under review. In comparison, the Custom Franklin Moderate Allocation Fund Index (Blended Benchmark) posted a -2.31% cumulative total return.2 The Fund’s equity benchmark, the MSCI All Country World Index (ACWI), which measures equity market performance in global developed and emerging markets, posted a -5.99% total return.3 The Fund’s fixed income benchmark, the Bloomberg Barclays Multiverse Index, a broad-based measure of the global fixed income bond market, posted a +2.53% total return.3 You can find the Fund’s long-term

performance data in the Performance Summary beginning on page 11.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes of equity and fixed-income investments by investing primarily in a distinctly-weighted combination of underlying funds, based on each underlying fund’s predominant asset class. When selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed to its allocation among equity and fixed income securities and to the actual performance of the fund investments.

At period-end, Franklin Moderate Allocation Fund allocated 60.5% of total net assets to equity and 38.8% to fixed income. Domestic equity exposure was 75.7% of the Fund’s total equity weighting, with the balance represented by

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or implied performance or portfolio composition, which may change on a continuous basis.

2. Source: The Fund’s Blended Benchmark was calculated internally. Effective January 1, 2015, the Blended Benchmark changed to 60% MSCI ACWI and 40% Bloomberg Barclays Multiverse Index. From January 1, 2013 to December 31, 2014, the Blended Benchmark was composed of 38.5% Standard & Poor’s 500 Index (S&P 500), 16.5% MSCI Europe, Australasia, Far East (EAFE) Index and 45% Bloomberg Barclays U.S. Aggregate Bond Index. Prior to January 1, 2013, the Blended Benchmark was composed of 38.5% S&P 500, 16.5% MSCI EAFE Index, 35% Bloomberg Barclays U.S. Aggregate Bond Index and 10% Payden & Rygel 90 Day T-Bill Index.

3. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s SOI, which begins on page 31.

| | | | |

franklintempleton.com | | Semiannual Report | | 9 |

FRANKLIN MODERATE ALLOCATION FUND

Top 10 Fund Holdings

6/30/20

| | |

| | | % of Total |

| | | Net Assets |

Franklin Liberty U.S. Core Bond ETF | | 19.2% |

Franklin Growth Fund – Class R6 | | 13.8% |

Franklin U.S. Core Equity (IU) Fund | | 12.8% |

Franklin LibertyQ U.S. Equity ETF | | 7.8% |

Franklin Rising Dividends Fund – Class R6 | | 6.9% |

Franklin International Core Equity (IU) Fund | | 5.0% |

Invesco QQQ Trust Series 1 ETF | | 4.6% |

iShares Core U.S. Aggregate Bond ETF | | 3.7% |

Franklin Low Duration Total Return Fund – Class R6 | | 3.3% |

Franklin Liberty International Aggregate Bond ETF | | 3.3% |

foreign equity. The Portfolio was diversified across capitalization sizes and investment styles, and on June 30, 2020, we held shares in large-, mid- and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6 was our largest equity fund weighting at 13.8% of total net assets. On the fixed income side, domestic exposure was 82.0% of the Fund’s total fixed income weighting, with the balance represented by foreign fixed income. Franklin Liberty U.S. Core Bond ETF was our largest fixed income fund weighting at 19.2% of the Fund’s total net assets.

During the six-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, outperformed the MSCI ACWI, while our largest domestic value fund holding, Franklin LibertyQ U.S. Equity ETF, and our largest foreign equity fund holding, Franklin International Core Equity (IU) Fund, underperformed the index. On the fixed income side, our largest domestic fixed income fund holding, Franklin Liberty U.S. Core Bond ETF, outperformed the Bloomberg Barclays Multiverse Index, while our largest foreign fixed income holding, Franklin Liberty International Aggregate Bond ETF, underperformed the index.

Thank you for your continued participation in Franklin Moderate Allocation Fund. We look forward to serving your future investment needs.

Thomas A. Nelson, CFA

Co-Lead Portfolio Manager

May Tong, CFA

Co-Lead Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

| | | |

10 | | Semiannual Report | | franklintempleton.com |

FRANKLIN MODERATE ALLOCATION FUND

Performance Summary as of June 30, 2020

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 6/30/201

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| | | Cumulative | | | | Average Annual | |

Share Class | | | Total Return | 2 | | | Total Return | 3 |

| |

A4 | | | | | | | | |

6-Month | | | -1.01% | | | | -6.47% | |

| |

1-Year | | | +3.78% | | | | -1.94% | |

| |

| 5-Year | | | +28.56% | | | | +3.98% | |

| |

10-Year | | | +90.56% | | | | +6.06% | |

| |

| | |

Advisor | | | | | | | | |

6-Month | | | -0.89% | | | | -0.89% | |

| |

| 1-Year | | | +4.04% | | | | +4.04% | |

| |

5-Year | | | +30.17% | | | | +5.41% | |

| |

| 10-Year | | | +95.42% | | | | +6.93% | |

| |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 12 for Performance Summary footnotes.

| | | | |

franklintempleton.com | | Semiannual Report | | 11 |

FRANKLIN MODERATE ALLOCATION FUND

PERFORMANCE SUMMARY

Distributions (1/1/20–6/30/20)

| | | | | | |

| Share Class | | Net Investment

Income | | Short-Term

Capital Gain | | Total |

A | | $0.0716 | | $0.3556 | | $0.4272 |

C | | $0.0218 | | $0.3556 | | $0.3774 |

R | | $0.0540 | | $0.3556 | | $0.4096 |

R6 | | $0.0941 | | $0.3556 | | $0.4497 |

Advisor | | $0.0881 | | $0.3556 | | $0.4437 |

Total Annual Operating Expenses5

| | |

| Share Class | | |

A | | 0.88% |

Advisor | | 0.63% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, it is subject to the same risks, and indirectly bears the fees and expenses, of the underlying funds. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Smaller or relatively new or unseasoned companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks which are heightened in developing countries. Investors should consult their financial advisor for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. The Fund’s prospectus also includes a description of the main investment risks

1. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 20%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus, including the effect of acquired fund fees and expenses, and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

| | | |

12 | | Semiannual Report | | franklintempleton.com |

FRANKLIN MODERATE ALLOCATION FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201,2 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201,2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | | | | |

A | | $1,000 | | | | $989.90 | | $3.17 | | | | $1,021.68 | | $3.22 | | | | 0.64% |

C | | $1,000 | | | | $985.90 | | $6.86 | | | | $1,017.95 | | $6.97 | | | | 1.39% |

R | | $1,000 | | | | $988.60 | | $4.40 | | | | $1,020.44 | | $4.47 | | | | 0.89% |

R6 | | $1,000 | | | | $990.80 | | $1.48 | | | | $1,023.37 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $991.10 | | $1.93 | | | | $1,022.92 | | $1.96 | | | | 0.39% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements, for Class R6. Does not include acquired fund fees and expenses.

| | | | |

franklintempleton.com | | Semiannual Report | | 13 |

Franklin Growth Allocation Fund

This semiannual report for Franklin Growth Allocation Fund covers the period ended June 30, 2020.

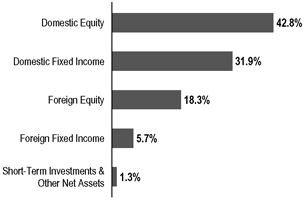

Your Fund’s Goal and Main Investments

The Fund seeks the highest level of long-term total return consistent with an acceptable level of risk.1

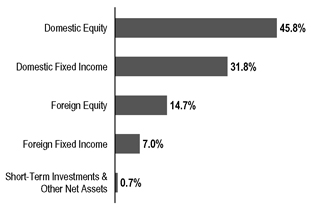

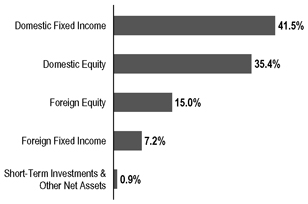

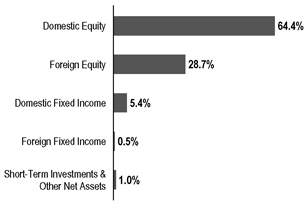

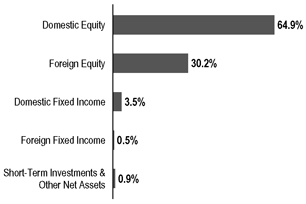

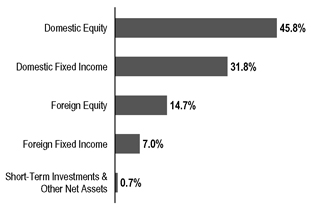

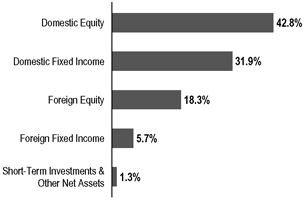

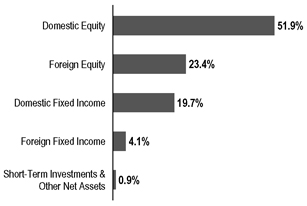

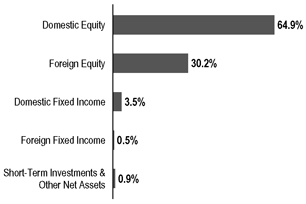

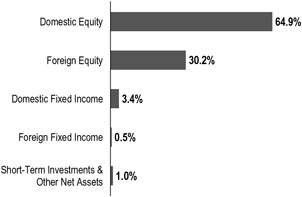

Asset Allocation*

Based on Total Net Assets as of 6/30/20

*The asset allocation is based on the Statement of Investments (SOI), which classifies each underlying fund and other fund investments into a broad asset class based on its predominant investments under normal market conditions.

Performance Overview

The Fund’s Class A shares posted a -2.60% cumulative total return for the six months under review. In comparison, the Custom Franklin Growth Allocation Fund Index (Blended Benchmark) posted a -4.10% cumulative total return.2 The Fund’s equity benchmark, the MSCI All Country World Index (ACWI), which measures equity market performance in global developed and emerging markets, posted a -5.99% total return.3 The Fund’s fixed income benchmark, the Bloomberg Barclays Multiverse Index, a broad-based measure of the global fixed income bond market, posted a +2.53% total return.3 You can find the Fund’s long-term

performance data in the Performance Summary beginning on page 16.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Investment Strategy

Whenever possible, we attempt to hold the same underlying Franklin Templeton funds and other fund investments (collectively, “fund investments”) in each Allocation Fund’s portfolio and will vary the allocation percentages of the fund investments based upon each Allocation Fund’s risk/return level. Maintaining similarity of the fund investments across the Conservative, Moderate and Growth Allocation Funds is intended to increase the consistency of their results relative to one another. We allocate the Fund’s assets among the broad asset classes of equity and fixed-income investments by investing primarily in a distinctly-weighted combination of underlying funds, based on each underlying fund’s predominant asset class. When selecting equity funds, we consider the fund investments’ foreign and domestic exposure, market capitalization ranges and investment styles (growth versus value). When selecting fixed income funds, we focus primarily on maximizing income appropriate to the Fund’s risk profile.

Manager’s Discussion

The Fund’s performance can be attributed to its allocation among equity and fixed income securities and to the actual performance of the fund investments.

At period-end, Franklin Growth Allocation Fund allocated 80.6% of total net assets to equity and 18.8% to fixed income. Domestic equity exposure was 73.7% of the Fund’s total equity weighting, with the balance represented by

1. The risk/reward potential is based on the Fund’s goal and level of risk. It is not indicative of the Fund’s actual or implied performance or portfolio composition, which may change on a continuous basis.

2. Source: FactSet. The Fund’s Blended Benchmark was calculated internally. Effective January 1, 2015, the Blended Benchmark changed to 80% MSCI ACWI and 20% Bloomberg Barclays Multiverse Index. From January 1, 2013 to December 31, 2014, the Blended Benchmark was composed of 56% Standard & Poor’s Index (S&P 500), 24% MSCI Europe, Australasia, Far East (EAFE) Index and 20% Bloomberg Barclays U.S. Aggregate Bond Index. Prior to January 1, 2013, the Blended Benchmark was composed of 56% S&P 500, 24% MSCI EAFE Index, 15% Bloomberg Barclays U.S. Aggregate Bond Index and 5% Payden & Rygel 90 Day T-Bill Index.

3. Source: Morningstar.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s SOI which begins on page 38.

| | | | |

| | | |

14 | | Semiannual Report | | franklintempleton.com |

FRANKLIN GROWTH ALLOCATION FUND

Top 10 Fund Holdings

6/30/20

| | |

| | | % of Total

Net Assets |

Franklin Growth Fund – Class R6 | | 17.8% |

Franklin U.S. Core Equity (IU) Fund | | 16.6% |

Franklin LibertyQ U.S. Equity ETF | | 10.1% |

Franklin Rising Dividends Fund – Class R6 | | 8.9% |

Franklin Liberty U.S. Core Bond ETF | | 8.3% |

Franklin International Core Equity (IU) Fund | | 7.0% |

Invesco QQQ Trust Series 1 ETF | | 6.0% |

Franklin Emerging Market Core Equity (IU) Fund | | 3.4% |

Templeton Foreign Fund – Class R6 | | 3.1% |

iShares Core U.S. Aggregate Bond ETF | | 2.9% |

foreign equity. The Portfolio was diversified across capitalization sizes and investment styles, and on June 30, 2020, we held shares in large-, mid- and small-capitalization equity funds, representing both growth and value styles. Franklin Growth Fund – Class R6 was our largest equity fund weighting at 17.8% of total net assets. On the fixed income side, domestic exposure was 81.9% of the Fund’s total fixed income weighting, with the balance represented by foreign fixed income. Franklin Liberty U.S. Core Bond ETF was our largest fixed income fund weighting at 8.3% of the Fund’s total net assets.

During the six-month reporting period, our largest domestic growth fund holding, Franklin Growth Fund – Class R6, outperformed the MSCI ACWI, while our largest domestic value fund holding, Franklin LibertyQ U.S. Equity ETF, and our largest foreign equity fund holding, Franklin Emerging Market Core Equity (IU) Fund, underperformed the index. On the fixed income side, our largest domestic fixed income fund holding, Franklin Liberty U.S. Core Bond ETF, outperformed the Bloomberg Barclays Multiverse Index, while our largest foreign fixed income holding, Franklin Liberty International Aggregate Bond ETF, underperformed the index.

Thank you for your continued participation in Franklin Growth Allocation Fund. We look forward to serving your future investment needs.

Thomas A. Nelson, CFA

Co-Lead Portfolio Manager

May Tong, CFA

Co-Lead Portfolio Manager

The foregoing information reflects our analysis, opinions and portfolio holdings as of June 30, 2020, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

| | | | |

franklintempleton.com | | Semiannual Report | | 15 |

FRANKLIN GROWTH ALLOCATION FUND

Performance Summary as of June 30, 2020

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 6/30/201

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| | | | | | | | |

| | | Cumulative | | | | Average Annual | |

Share Class | | | Total Return | 2 | | | Total Return | 3 |

| |

A4 | | | | | | | | |

6-Month | | | -2.60% | | | | -7.98% | |

| |

1-Year | | | +3.59% | | | | -2.13% | |

| |

5-Year | | | +34.17% | | | | +4.86% | |

| |

10-Year | | | +121.86% | | | | +7.68% | |

| |

| | |

Advisor | | | | | | | | |

6-Month | | | -2.48% | | | | -2.48% | |

| |

1-Year | | | +3.88% | | | | +3.88% | |

| |

5-Year | | | +35.88% | | | | +6.32% | |

| |

10-Year | | | +127.66% | | | | +8.57% | |

| |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 17 for Performance Summary footnotes.

| | | | |

| | | |

16 | | Semiannual Report | | franklintempleton.com |

FRANKLIN GROWTH ALLOCATION FUND

PERFORMANCE SUMMARY

Distributions (1/1/20–6/30/20)

| | | | | | |

| Share Class | | Net Investment

Income | | Short-Term

Capital Gain | | Total |

A | | $0.0529 | | $0.5612 | | $0.6141 |

C | | $0.0188 | | $0.5612 | | $0.5800 |

R | | $0.0310 | | $0.5612 | | $0.5922 |

R6 | | $0.0820 | | $0.5612 | | $0.6432 |

Advisor | | $0.0722 | | $0.5612 | | $0.6334 |

Total Annual Operating Expenses5

| | |

| Share Class | | |

A | | 0.94% |

Advisor | | 0.69% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Because this Fund invests in underlying funds, it is subject to the same risks, and indirectly bears the fees and expenses, of the underlying funds. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in a fund adjust to a rise in interest rates, that fund’s share price may decline. Foreign investing carries additional risks such as currency and market volatility and political or social instability, risks which are heightened in developing countries. Growth stock prices reflect projections of future earnings or revenues, and can therefore fall dramatically if the company fails to meet those projections. Value securities may not increase in price as anticipated or may decline further in value. Investors should consult their financial advisor for help selecting the appropriate fund of funds, or fund combination, based on an evaluation of their investment objectives and risk tolerance. Unexpected events and their aftermaths, such as the spread of deadly diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. The Fund’s prospectus also includes a description of the main investment risks.

1. As of 1/1/13, the Fund changed its target allocation, with short-term investments (formerly a targeted allocation of 20%) combined into the fixed income allocations; such a change can impact performance.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns (with sales charges) would have differed. Average annual total returns (with sales charges) have been restated to reflect the current maximum initial sales charge of 5.50%.

5. Figures are as stated in the Fund’s current prospectus, including the effect of acquired fund fees and expenses, and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

| | | | |

franklintempleton.com | | Semiannual Report | | 17 |

FRANKLIN GROWTH ALLOCATION FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 1/1/20 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Ending

Account

Value 6/30/20 | | Expenses

Paid During

Period

1/1/20–6/30/201, 2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | | | | |

A | | $1,000 | | | | $974.00 | | $ 3.24 | | | | $1,021.58 | | $ 3.32 | | | | 0.66% |

C | | $1,000 | | | | $970.70 | | $ 6.91 | | | | $1,017.85 | | $ 7.07 | | | | 1.41% |

R | | $1,000 | | | | $972.90 | | $ 4.46 | | | | $1,020.34 | | $ 4.57 | | | | 0.91% |

R6 | | $1,000 | | | | $976.30 | | $ 1.42 | | | | $1,023.42 | | $ 1.46 | | | | 0.29% |

Advisor | | $1,000 | | | | $975.20 | | $ 2.01 | | | | $1,022.82 | | $ 2.06 | | | | 0.41% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/366 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | |

| | | |

18 | | Semiannual Report | | franklintempleton.com |

FRANKLIN FUND ALLOCATOR SERIES

Financial Highlights

Franklin Conservative Allocation Fund

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $14.08 | | | | $13.33 | | | | $14.86 | | | | $13.74 | | | | $13.40 | | | | $14.53 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb,c | | | 0.09 | | | | 0.32 | | | | 0.39 | | | | 0.20 | | | | 0.14 | | | | 0.28 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.14 | ) | | | 1.43 | | | | (0.90 | ) | | | 1.25 | | | | 0.45 | | | | (0.60 | ) |

| | | | | | |

Total from investment operations | | | (0.05 | ) | | | 1.75 | | | | (0.51 | ) | | | 1.45 | | | | 0.59 | | | | (0.32 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income and short term gains received from Underlying Funds and exchange traded funds | | | (0.09 | ) | | | (0.33 | ) | | | (0.38 | ) | | | (0.24 | ) | | | (0.15 | ) | | | (0.28 | ) |

| | | | | | |

Net realized gains | | | (0.17 | ) | | | (0.67 | ) | | | (0.64 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.53 | ) |

| | | | | | |

Total distributions | | | (0.26 | ) | | | (1.00 | ) | | | (1.02 | ) | | | (0.33 | ) | | | (0.25 | ) | | | (0.81 | ) |

| | | | | | |

Net asset value, end of period | | | $13.77 | | | | $14.08 | | | | $13.33 | | | | $14.86 | | | | $13.74 | | | | $13.40 | |

| | | | | | |

Total returnd | | | (0.29)% | | | | 13.25% | | | | (3.44)% | | | | 10.58% | | | | 4.39% | | | | (2.26)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expensesf,g | | | 0.63% | h | | | 0.63% | h | | | 0.63% | h | | | 0.63% | | | | 0.63% | | | | 0.62% | |

| | | | | | |

Net investment incomec | | | 1.35% | | | | 2.25% | | | | 2.57% | | | | 1.37% | | | | 1.01% | | | | 1.97% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $829,442 | | | | $839,134 | | | | $778,221 | | | | $800,141 | | | | $809,039 | | | | $905,537 | |

| | | | | | |

Portfolio turnover rate | | | 32.77% | | | | 86.76% | | | | 30.70% | | | | 17.99% | | | | 34.83% | | | | 17.69% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fDoes not include expenses of the Underlying Funds and exchange traded funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds and exchange traded funds was 0.24% for the period ended June 30, 2020.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

hBenefit of expense reduction rounds to less than 0.01%.

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 19 |

FRANKLIN FUND ALLOCATOR SERIES

FINANCIAL HIGHLIGHTS

Franklin Conservative Allocation Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $13.77 | | | | $13.06 | | | | $14.57 | | | | $13.47 | | | | $13.15 | | | | $14.27 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb,c | | | 0.04 | | | | 0.20 | | | | 0.24 | | | | 0.09 | | | | 0.04 | | | | 0.17 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.12 | ) | | | 1.40 | | | | (0.84 | ) | | | 1.23 | | | | 0.43 | | | | (0.58 | ) |

| | | | | | |

Total from investment operations | | | (0.08 | ) | | | 1.60 | | | | (0.60 | ) | | | 1.32 | | | | 0.47 | | | | (0.41 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income and short term gains received from Underlying Funds and exchange traded funds | | | (0.05 | ) | | | (0.22 | ) | | | (0.27 | ) | | | (0.13 | ) | | | (0.05 | ) | | | (0.18 | ) |

| | | | | | |

Net realized gains | | | (0.17 | ) | | | (0.67 | ) | | | (0.64 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.53 | ) |

| | | | | | |

Total distributions | | | (0.22 | ) | | | (0.89 | ) | | | (0.91 | ) | | | (0.22 | ) | | | (0.15 | ) | | | (0.71 | ) |

| | | | | | |

Net asset value, end of period | | | $13.47 | | | | $13.77 | | | | $13.06 | | | | $14.57 | | | | $13.47 | | | | $13.15 | |

| | | | | | |

Total returnd | | | (0.59)% | | | | 12.35% | | | | (4.14)% | | | | 9.80% | | | | 3.55% | | | | (2.96)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expensesf,g | | | 1.38% | h | | | 1.38% | h | | | 1.38% | h | | | 1.38% | | | | 1.37% | | | | 1.37% | |

| | | | | | |

Net investment incomec | | | 0.60% | | | | 1.50% | | | | 1.82% | | | | 0.62% | | | | 0.27% | | | | 1.22% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $220,177 | | | | $252,407 | | | | $285,547 | | | | $423,890 | | | | $470,582 | | | | $536,548 | |

| | | | | | |

Portfolio turnover rate | | | 32.77% | | | | 86.76% | | | | 30.70% | | | | 17.99% | | | | 34.83% | | | | 17.69% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fDoes not include expenses of the Underlying Funds and exchange traded funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds and exchange traded funds was 0.24% for the period ended June 30, 2020.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

hBenefit of expense reduction rounds to less than 0.01%.

| | | | |

| | | |

20 | | Semiannual Report | The accompanying notes are an integral part of these financial statements. | | franklintempleton.com |

FRANKLIN FUND ALLOCATOR SERIES

FINANCIAL HIGHLIGHTS

Franklin Conservative Allocation Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class R | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $14.02 | | | | $13.28 | | | | $14.80 | | | | $13.69 | | | | $13.35 | | | | $14.48 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb,c | | | 0.07 | | | | 0.28 | | | | 0.33 | | | | 0.16 | | | | 0.10 | | | | 0.24 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.13 | ) | | | 1.42 | | | | (0.87 | ) | | | 1.24 | | | | 0.45 | | | | (0.59 | ) |

| | | | | | |

Total from investment operations | | | (0.06 | ) | | | 1.70 | | | | (0.54 | ) | | | 1.40 | | | | 0.55 | | | | (0.35 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income and short term gains received from Underlying Funds and exchange traded funds | | | (0.08 | ) | | | (0.29 | ) | | | (0.34 | ) | | | (0.20 | ) | | | (0.11 | ) | | | (0.25 | ) |

| | | | | | |

Net realized gains | | | (0.17 | ) | | | (0.67 | ) | | | (0.64 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.53 | ) |

| | | | | | |

Total distributions | | | (0.25 | ) | | | (0.96 | ) | | | (0.98 | ) | | | (0.29 | ) | | | (0.21 | ) | | | (0.78 | ) |

| | | | | | |

Net asset value, end of period | | | $13.71 | | | | $14.02 | | | | $13.28 | | | | $14.80 | | | | $13.69 | | | | $13.35 | |

| | | | | | |

Total returnd | | | (0.34)% | | | | 12.93% | | | | (3.64)% | | | | 10.25% | | | | 4.15% | | | | (2.52)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expensesf,g | | | 0.88% | h | | | 0.88% | h | | | 0.88% | h | | | 0.88% | | | | 0.88% | | | | 0.87% | |

| | | | | | |

Net investment incomec | | | 1.10% | | | | 2.00% | | | | 2.32% | | | | 1.12% | | | | 0.76% | | | | 1.72% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net assets, end of period (000’s) | | | $65,177 | | | | $71,153 | | | | $80,338 | | | | $103,629 | | | | $124,018 | | | | $139,592 | |

| | | | | | |

Portfolio turnover rate | | | 32.77% | | | | 86.76% | | | | 30.70% | | | | 17.99% | | | | 34.83% | | | | 17.69% | |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cRecognition of net investment income by the Fund is affected by the timing of declaration of dividends by the Underlying Funds and exchange traded funds in which the Fund invests.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fDoes not include expenses of the Underlying Funds and exchange traded funds in which the Fund invests. The weighted average indirect expenses of the Underlying Funds and exchange traded funds was 0.24% for the period ended June 30, 2020.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

hBenefit of expense reduction rounds to less than 0.01%.

| | | | |

franklintempleton.com | | The accompanying notes are an integral part of these financial statements. | Semiannual Report | | 21 |

FRANKLIN FUND ALLOCATOR SERIES

FINANCIAL HIGHLIGHTS

Franklin Conservative Allocation Fund (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six Months Ended

June 30, 2020 | | | Year Ended December 31, | |

| | | (unaudited) | | | 2019 | | | 2018 | | | 2017 | | | 2016 | | | 2015 | |

| | | | | | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Per share operating performance | | | | | | | | | | | | | | | | | | | | | | | | |

(for a share outstanding throughout the period) | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net asset value, beginning of period | | | $14.06 | | | | $13.31 | | | | $14.84 | | | | $13.72 | | | | $13.39 | | | | $14.52 | |

| | | | | | |

Income from investment operationsa: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment incomeb,c | | | 0.11 | | | | 0.36 | | | | 0.44 | | | | 0.25 | | | | 0.18 | | | | 0.36 | |

| | | | | | |

Net realized and unrealized gains (losses) | | | (0.13 | ) | | | 1.44 | | | | (0.90 | ) | | | 1.25 | | | | 0.44 | | | | (0.63 | ) |

| | | | | | |

Total from investment operations | | | (0.02 | ) | | | 1.80 | | | | (0.46 | ) | | | 1.50 | | | | 0.62 | | | | (0.27 | ) |

| | | | | | |

Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net investment income and short term gains received from Underlying Funds and exchange traded funds | | | (0.12 | ) | | | (0.38 | ) | | | (0.43 | ) | | | (0.29 | ) | | | (0.19 | ) | | | (0.33 | ) |

| | | | | | |

Net realized gains | | | (0.17 | ) | | | (0.67 | ) | | | (0.64 | ) | | | (0.09 | ) | | | (0.10 | ) | | | (0.53 | ) |

| | | | | | |

Total distributions | | | (0.29 | ) | | | (1.05 | ) | | | (1.07 | ) | | | (0.38 | ) | | | (0.29 | ) | | | (0.86 | ) |

| | | | | | |

Net asset value, end of period | | | $13.75 | | | | $14.06 | | | | $13.31 | | | | $14.84 | | | | $13.72 | | | | $13.39 | |

| | | | | | |

Total returnd | | | (0.06)% | | | | 13.64% | | | | (3.11)% | | | | 10.99% | | | | 4.69% | | | | (1.93)% | |

| | | | | | |

Ratios to average net assetse | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Expenses before waiver and payments by affiliatesf | | | 0.41% | | | | 0.42% | | | | 0.40% | | | | 0.32% | | | | 0.30% | | | | 0.29% | |

| | | | | | |

Expenses net of waiver and payments by affiliatesf | | | 0.30% | g | | | 0.31% | g | | | 0.29% | g | | | 0.28% | | | | 0.28% | | | | 0.28% | |

| | | | | | |

Net investment incomec | | | 1.68% | | | | 2.57% | | | | 2.91% | | | | 1.72% | | | | 1.36% | | | | 2.31% | |

| | | | | | |

Supplemental data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |