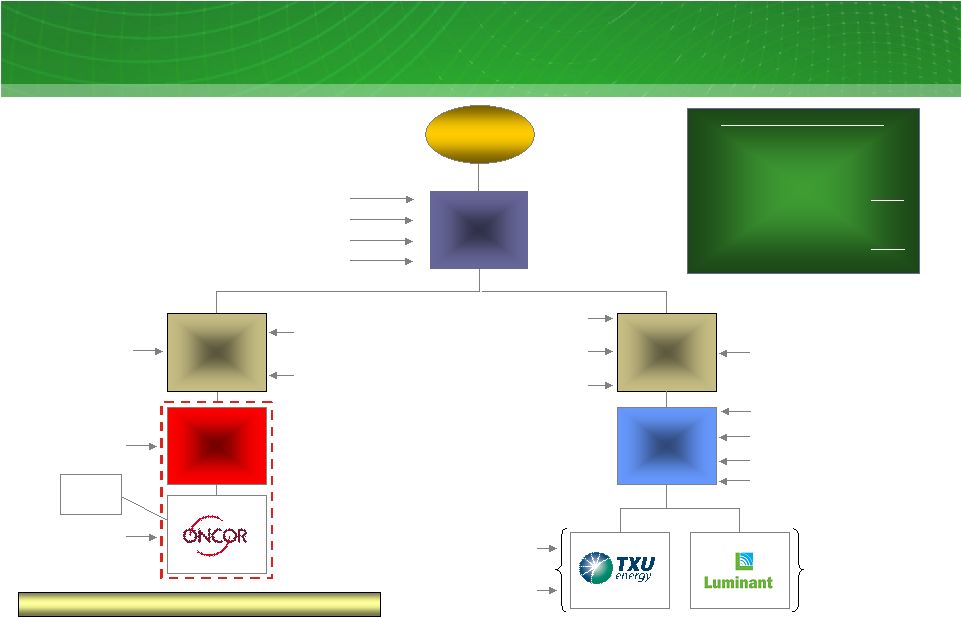

10 EFH Corp. Debt Structure 1 Summary diagram includes unamortized discounts and premiums and excludes subsidiaries of EFH that are not subsidiaries of Energy Future Intermediate Holding Company or Energy Future Competitive Holdings Company, including TXU Receivables Company, which buys receivables from TXU Energy and sells undivided interests in such receivables under the TXU receivables program. 2 March 31, 2010 balances adjusted to include the effects of a debt repurchase and debt exchanges in April 2010 that resulted in the issuance of an additional $66 million of EFH Corp. 10% Senior Secured Notes and acquisition of $5 million of EFH Corp. 10.875% Notes, $75 million of EFH Corp. 11.25/12.00% PIK Toggle Notes and $17 million of TCEH 10.50/11.25% PIK Toggle Notes. 3 Excludes short term borrowings related to the accounts receivables program. 4 Other debt includes a financing lease of an indirect subsidiary of EFH as well as a capital lease for IT equipment at EFH. 5 Includes securitization bonds issued by Oncor Electric Delivery Transmission Bond Company LLC and Oncor’s Revolving Credit Facility that had a balance of $756 million as of March 31, 2010. 6 Cash and cash equivalents and restricted cash (non regulated) as of March 31, 2010. Investor Group EFH $1.9 billion Pre-Merger Notes Guarantor of $0.7 billion EFH Senior Secured Notes $5.8 billion of debt 5 Energy Future Intermediate Holding Company Energy Future Competitive Holdings Company TCEH Oncor Electric Delivery Holdings Ring-fenced entities Guarantor of $6.8 billion TCEH Cash Pay/PIK Toggle Notes and $4.5 billion EFH Cash Pay/PIK Toggle Notes Guarantor of TCEH Sr. Secured Facilities and Commodity Collateral Posting Facility (CCP) $0.1 billion of Pre-Merger Notes Guarantors of $6.8 billion TCEH Cash Pay/PIK Toggle Notes Guarantors of TCEH Sr. Secured Facilities and CCP $6.8 billion TCEH Cash Pay/PIK Toggle Notes $21.6 billion Sr. Secured Facilities ~20% Minority Investor $4.5 billion EFH Cash Pay/PIK Toggle Notes $1.5 billion of other debt $0.0 billion of CCP Debt Outstanding ($ billions) As of 3/31/10 Pro-forma 2 EFH $ 7.2 EFIH 0.2 EFCH 0.1 TCEH 3 29.9 Total debt (non regulated) 37.4 Cash and cash equivalents 6 (1.3) Restricted cash 6 (1.2) Net debt (non regulated) $34.9 EFH Corp. debt structure 1 As of 3/31/10 Pro-forma 2 ; $ billions As of March 31, 2010, the EFH Corp. leverage ratio was 9.1x $0.7 billion EFH Senior Secured Notes $0.2 billion Senior Secured Notes Guarantor of $4.5 billion EFH Cash Pay/ PIK Toggle Notes Guarantor of $0.7 billion EFH Senior Secured Notes $0.09 Other debt 4 |