UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07831

FMI Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Ted D. Kellner

Fiduciary Management, Inc.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, WI 53202

(Name and address of agent for service)

(414) 226-4555

Registrant's telephone number, including area code:

Date of fiscal year end: September 30

Date of reporting period: September 30, 2007

Item 1. Reports to Stockholders.

ANNUAL REPORT

September 30, 2007

FMI

Focus Fund

A NO-LOAD

MUTUAL FUND

Ted D. Kellner, CFA

President

October 23, 2007

Dear Fellow Shareholders:

During the first half of 2007, many market pundits commented at the lack of volatility in the various market indices over the prior 18 months. That certainly changed in the third quarter! The markets were buffeted by a number of factors: turmoil in the credit markets, stemming initially from the significant downturn in the housing market and spilling over into the financing of private equity transactions; the perception of an economy that will most likely be slowing as we enter 2008; and the realization that the long string of double digit corporate earnings increases may finally come to a halt in this year’s third quarter. In response to these conditions, the Federal Reserve Board first lowered the discount rate by 50 basis points in August, and an additional 50 in September, when they also dropped the Federal Funds Rate by 50 basis points. Against this backdrop, volatility increased dramatically, and as detailed in Rick and Glenn’s report, the FMI Focus Fund sustained a decline in the third quarter, although at this writing it remains comfortably in positive territory, year-to-date. As we have discussed in past letters, we believe we are in the later stages of this economic expansion, and the likelihood of a more muted economic environment in the ensuing 12 months appears at hand. We continue to believe that in this environment, it is prudent to reduce excessive risk, and your portfolio is populated with well-financed, solid companies that we believe will perform well over a longer time frame. It is also an environment wherein we expect to have the opportunity to add to existing and new stocks at attractive prices.

As always, we thank all of our fellow shareholders for your continued support and investment in the FMI Focus Fund.

Sincerely,

Ted D. Kellner, CFA

President

100 E. Wisconsin Ave., Suite 2200 • Milwaukee, WI 53202 • 414-226-4555

www.fmifunds.com

|  | |

| Richard E. Lane | Glenn W. Primack | |

| Portfolio | Portfolio Manager | |

October 15, 2007

Dear Fellow Shareholders,

The FMI Focus Fund was down 4.68% for the final quarter of our fiscal year (third calendar-quarter). This compares to a loss of 3.09% for the Russell 2000 Index, and a flat 0.02% gain for the Russell 2000 Growth Index. No question, this was a tough quarter as outlined below.

The stock price of Manpower Inc. (MAN), one of our largest holdings, fell from the mid-nineties to the low-sixties on recession concerns. ValueClick, Inc. (VCLK), another large position fell from around $30 per share to the low twenties on disappointment that it didn’t get bought out, followed quickly by a Federal Trade Commission (FTC) investigation into one of its segment’s business practices. Our low-end consumer discretionary holdings, Family Dollar Stores, Inc. (FDO) and Rent-A-Center, Inc. (RCII), fell on recession fears and concern that high food and energy prices would squeeze their modest-income customers. Last, but certainly not least, our housing and mortgage-finance related

THE VALUE OF A $10,000 INVESTMENT IN THE FMI FOCUS FUND FROM

ITS INCEPTION (12/16/96) TO 9/30/07 AS COMPARED TO THE

RUSSELL 2000 AND THE RUSSELL 2000 GROWTH

FMI Focus Fund

$72,293

Russell 2000(1)

$26,309

Russell 2000 Growth(2)

$17,934

Results From Fund Inception (12/16/96) Through 9/30/07

| | | | Annualized Total | Annualized Total | Annualized Total Return* |

| | Total Return* | Total Return* For the | Return* For the 5 | Return* For the 10 | Through 9/30/07 From |

| | Last 3 Months | Year Ended 9/30/07 | Years Ended 9/30/07 | Years Ended 9/30/07 | Fund Inception 12/16/96 |

| FMI Focus Fund | -4.68% | 14.87% | 17.44% | 15.72% | 20.12% |

| Russell 2000 | -3.09% | 12.34% | 18.75% | 7.22% | 9.38% |

| Russell 2000 Growth | 0.02% | 18.94% | 18.70% | 3.65% | 5.56% |

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index which comprises the 3,000 largest U.S. companies based on total market capitalization. |

| (2) | The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. |

| * | Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fmifunds.com. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

investments: MGIC Investment Corp. (MTG), RAM Holdings Ltd. (RAMR), Central Garden & Pet Co. (CENT), Interline Brands, Inc. (IBI), Associated Banc-Corp (ASBC), and Beacon Roofing Supply, Inc. (BECN), were hurt by the well documented downturn in the U.S. housing market.

Throw in the general panic in small-cap value companies (the Russell 2000 Value Index was down 6.26% in the quarter), of which we have some exposure, and you have the makings of a “perfect storm.” Fortunately, ninety days of performance is a very short measurement period and is not terribly meaningful long-term. Many of the companies mentioned above have subsequently bounced back nicely. The vast majority of the companies outlined are solid, well-managed companies with bright futures. Later on in this letter, we detail two of the more important positions, Manpower and ValueClick. We will illustrate why we are still confident in their prospects. However, there are several holdings whose near-term outlooks will be challenging, including two of our perennial favorites, MGIC, and Central Garden & Pet. Each is going through a “perfect storm” of its own. We recently sold the entire Central Garden & Pet position and about half of the MGIC position to offset some gains in the portfolio. We will be patient in buying them back as we observe how they fare in the current housing downturn.

Even though we described our particular perfect storm, nothing happens in a vacuum. Consider what transpired during the third calendar quarter. Mounting evidence of a slowing U.S. economy and a true financial panic brought on by sub-prime mortgage lending and leveraged buyout (LBO) financing caused the Federal Reserve to reverse course and lower short-term interest rates by one-half of one percent. In the wake of this turmoil, equity prices fell generally by eight-to-ten percent, but economically sensitive and smaller-capitalization companies fell considerably more.

While most equity markets have indeed bounced back nicely, the jury is still out. The credit scare was a long time in coming. In previous shareholder letters, we outlined our concerns on lax underwriting standards across the board, but particularly in the home mortgage lending and leverage buyout arenas. The fallout in terms of losses to financial institutions and investors is still difficult to quantify. We believe it will play out over the next twelve-to-fifteen months. Obviously, the Fed was sufficiently concerned about the situation to lower interest rates in the face of mounting evidence of inflation. Of course, the Fed’s action in and of itself is potentially inflationary because lower interest rates in the United States makes the dollar less attractive. As the dollar falls in value, import prices go up and, so it follows, domestic producers are also able to increase prices in a less competitive environment.

So, where does all of this leave us? We still believe we are in the later stages of an economic cycle. The falling dollar, while maybe sowing the seeds of inflation and the inevitable end to the current economic cycle, will certainly help domestic exporters over the near term. Companies in our portfolio that benefit directly (or indirectly through a customer base comprised of exporters) include our energy, industrial and capital goods producers: Airgas, Inc. (ARG), Joy Global Inc. (JOYG), Kennametal Inc. (KMT), Cytec Industries Inc. (CYT), Dresser-Rand Group, Inc. (DRC), Exterran Holdings Inc. (EXH), Rowan Companies, Inc. (RDC), Kadant Inc. (KAI), and W.W. Grainger, Inc. (GWW). Also benefiting are our extensive technology holdings, due to their significant international sales. Companies with extensive foreign operations (as opposed to pure exports) also may benefit from strong overseas economies and currency translation gains. Portfolio companies falling into this last category include Manpower, Rockwood Holdings Inc. (ROC) and Celanese Corp. (CE).

From the above discussion, we feel a significant part of the portfolio should fare well in what we deem to be the later phase of the economic cycle. Consumer and financial companies may face tougher sledding and we have limited our exposure to companies that have unique niches, like Family Dollar Stores, Inc. and Jos. A. Bank Clothiers, Inc. (JOSB), or whose stocks have fallen to very low, and thus attractive, valuations like Liz Claiborne, Inc. (LIZ). Note that as the financial fallout from the lax lending will no doubt lead to some attractive opportunities in the financial arena, we believe investors will initially overreact to the negative news flow and give us a better entry point down the road. Having said that, we are doing extensive research, particularly in regional banks, and are excited about the potential here, but only if the above scenario plays out, investors panic, and lay the stocks at our feet. Regional banks tend to be good franchises and, in a consolidating industry, offer a lot of buyout opportunities.Manpower Inc. (MAN)

We have held Manpower in the portfolio for a number of years. This has been a rewarding investment. Jeff Joerres and company have been excellent stewards of shareholder capital. Recall from previous write-ups how Jeff brought a return of capital discipline (i.e. pricing discipline) to an industry that had none. Through that discipline, the staffing industry has thrived, earning improved margins and strong equity prices! Recall as well another linchpin to our Manpower investment, exposure to faster growing economies outside of the United States. Less than 20% of Manpower’s earnings are derived from its home base. Both the return-on-investment focus and international diversification have driven earnings nicely. So, what happened to the stock price in the third calendar quarter? Several things: The August financial panic caused investors to fear a recession was imminent and Manpower’s staffing business would certainly suffer under such a scenario. As luck would have it, several of Manpower’s largest investors were hedge funds that suffered from investor panic and liquidation in August and September. As the hedge funds redeemed unhappy investors, they were forced to dump millions of shares of Manpower onto an already skittish market. On top of that, the French government rescinded a tax subsidy to the staffing industry that was worth some fifty cents per share to Manpower. All of those issues combined to clobber the stock.

We had been trimming the stock on the way up, but clearly missed exiting the remaining position. As the stock fell, we took advantage of the decline to rebuild the stake. Manpower is an outstanding staffing franchise, but the business is indeed cyclical. We like the stock in the mid-sixties for the balance of this economic cycle but anticipate exiting prior to the next recession.

ValueClick, Inc. (VCLK)

ValueClick has been one of our most intriguing, yet volatile, positions. The stock performed well early in the year, increasing from $24 to $35. Aquantive’s purchase by Microsoft Corp. (MSFT), and Google Inc.’s (GOOG) purchase of DoubleClick for enormous premiums, fueled takeover speculation. We sold stock at those levels, as we felt our investment had gotten a bit ahead of itself. However, we felt that ValueClick was a unique asset in a consolidating industry. We decided that the investment could still have considerable upside in an acquisition, again, as suggested by the premiums paid for Aquantive and DoubleClick. Unfortunately, just as things were heating up, the FTC began an investigation into non-promotional lead generation in the online industry, one of ValueClick’s many lucrative markets. Advertisers pay companies to deliver leads, which they do by offering prizes or coupons in exchange for contact information from interested consumers. In the second quarter, ValueClick’s advertisers sharply pulled back spending in this medium pending the investigation. Consequently, 2nd Quarter earnings were somewhat weaker than expected and estimates for 2007 came down.

Through the turmoil, we re-examined our thesis on ValueClick, and our conviction remained unchanged. ValueClick is the second largest independent ad network, the largest independent ad server, and the largest manager of affiliate marketing. There isn’t another asset in our universe of Internet advertising stocks that has that scale, revenue base, and franchise strength. The scarcity of the asset is complimented by the willingness of management to generate shareholder value as well. While they will continue to manage ValueClick for the long term, we believe management would consider any alternative to increase shareholder value. More quickly than we had anticipated, ValueClick has again risen on unconfirmed takeout speculation. The volatility of this sector is severe, but we still consider ValueClick undervalued fundamentally (although less so than before), and extremely undervalued in a take out.

Of course, we continue to remind investors of the underlying thesis for our enthusiasm for Internet advertising plays. The Internet now accounts for approximately 20% of the advertising “eyeballs.” However, it only accounts for about 8% of advertising spending, which is growing 20-30% per year. Ad spending on the Internet will continue to take share from the traditional mediums, such as television, radio and newspapers and there simply are not many ways to play it. Incidentally, our Sapient Corp. (SAPE) holding is another based on this theme.

Bemis Company, Inc. (BMS)

Unfortunately, Bemis Company has been a frustrating holding. The company has two businesses, flexible packaging and pressure sensitive. Its flexible packaging business supplies plastic packaging solutions to consumerpackaged goods companies such as Kraft and Oscar Mayer. Bemis is known for its innovative design and materials expertise. Within its pressure sensitive business, Bemis has developed barrier plastics that keep food fresher for longer and EZ peel technology that allows containers to be opened more easily.

We originally became interested in Bemis when raw material (plastic resins) price increases compressed margins in flexible packaging by several percentage points. We believed that a more moderate raw material environment would allow margins to recover. Further, Bemis was increasing the percentage of higher value packaging solutions while running older, more commodity packaging solutions for cash; and trying to restructure its European business which had low margins and disappointing revenue growth. As it stands now, we believe Bemis’ footprint in Europe may simply be too small for the company to earn the return its shareholders require and raw material prices have shown no sign of abating. The company recently reduced guidance as its largest flexible business, meat and cheese packaging, had lower than expected volume growth. So much for the bear case, here is why we still like the investment.

After spending much time with management, we are satisfied that the issues in meat and cheese are most likely temporary. Food costs, like energy costs, have been rising quickly. We believe the increase in cost to the consumer, which also appears to be weakening, has forced many consumers to cut down on waste and be more cost conscious in their purchases of groceries (less waste in the refrigerator versus simply eating less). We also think management will take a hard look at the European business and decide whether or not it fits within the portfolio of the company. As well, ongoing consolidation in the European flexible packaging industry seems likely to improve pricing even in the absence of a Bemis divestiture. The stock is extremely cheap, at 13.5 times 2008 earnings, and we believe those earnings are depressed. If flexible packaging margins recover, Bemis could easily earn $2.70 per share, which does not include any upside in new products.

Bemis has two exciting new opportunities in flexible packaging. First, Bemis has a new case ready solution, which allows the meat producers to ship individual containers to the grocery store instead of shipping larger sides of beef that a butcher would traditionally carve. Grocery stores benefit from a reduction in the labor costs and convenience. Bemis’ solution keeps the meat fresh over twice as long as the only other currently available solution. We believe this could be a catalyst for the company. This market is about $300 million and Bemis could have the best solution on the market for several years. Second, Bemis has redesigned its bacon packaging for Oscar Mayer by replacing the bag with a rigid container that makes resealing and storage vastly more convenient for the consumer. Although Bemis has 80% of the market share in bacon packaging, Oscar Mayer is a new customer.

All in all, Bemis has an excellent franchise, is cheap even on the currently depressed level of earnings due to a number of temporary factors, and has a bevy of new products on its way. While near-term results may continue to be “punky,” patient investors should be well rewarded.

NEW ADDITIONS

AMN Healthcare Services, Inc. (AHS)

One of our new investments is AMN Healthcare Services. This company provides travel nurse staffing to hospitals. Most hospitals are constantly hiring nurses and are chronically short on qualified nurses, especially if the hospital’s population fluctuates. To account for this undersupply, hospitals will often hire travel nurses for 3-6 month assignments. These nurses provide the hospital with more consistent aid than temps. AMN recruits and matches a population of nurses with hiring hospitals, locates housing for the nurses and provides benefits. AMN Healthcare Services recruits doctors for temporary assignments as well. We believe the travel nursing industry is growing in the high single digits, although that growth can be somewhat volatile. The locum tenens (temporary physician staffing) business industry is growing more quickly in the low double digits. AMN Healthcare is the market leader in both of these services.

We believe AMN’s market-leading franchise is undervalued by many investors on the street. The company lowered its guidance in July because of a slowdown in California, which provided an attractive entry point for long-term investors. We believe this issue is temporary as several larger hospitals were a bit more aggressive in recruiting nurses through incentive bonuses. These hospitals have attempted this strategy in the past and many of these nurses leave as soon as their 6 month or 1 year commitment is up. We believe the company will see the California demand improve by the fourth quarter. Also, AMN’s margins are temporarily depressed from costs associated with its international nurse staffing business. This business has suffered due to Congressional delays in visa approval for international nurses. Although we should see relief of this issue by next year, the company has already taken steps to cut costs in this business to improve profitability. We believe margins in 2008 should also improve through management’s efforts.

Ross Stores, Inc. (ROST)

Our most recent Consumer position is Ross Stores, which operates a chain of nearly 800 off-price closeout stores providing branded apparel, accessories and footwear for savings of 20% to 60% from regular department and specialty store prices. The off-price channel has historically navigated through difficult consumer spending environments with better relative sales, making the business model quite defensive. Furthermore, Ross has significant room to expand operating margins as they ramp up the implementation of several infrastructure initiatives that have hurt margins for over two years. Unlike its principal competitor, TJ Maxx (owned by The TJX Companies, Inc. – TJX), with which it operates in a near duopoly, Ross Stores has significant long-term square-footage growth potential, as they operate at less than half of the footprint of TJ Maxx. Although management has delivered four quarters of year-over-year margin improvement, the company is still well below their recent peak in 2004. We like the company’s prospects and the current price puts it on the bargain basement table.

United Natural Foods, Inc. (UNFI)

United Natural Foods is the largest distributor in the natural and organic foods sector. This segment of the food industry is attractive because it has grown at ten-percent per year as consumers increasingly embrace organic/healthy diets. The supplier base is highly fragmented with Hain Celestial representing a little less than eight percent of total purchases. The competitor base is fragmented as well. This makes United interesting with respect to scarcity value. There simply are not many publicly held ways to invest in this growth industry.

The stock came under pressure earlier this year as its largest customer, Whole Foods (30% of sales) acquired Wild Oats (almost 9% of sales). The company has a seven-year distribution agreement with Whole Foods that was finalized last fall. Supermarket chains (14%) and mom-&-pop organic stores (46%) represent the other two major customer classifications. We believe the company can grow faster than the industry and has opportunities to improve gross and operating margins.

We hope the company reviews and strategic outlook yield helpful insights during a challenging quarter.

Our Board of Directors has declared distributions on October 30, 2007 of $0.13406 per share from short-term capital gains, which will be treated as ordinary income and $1.93499 per share from net long-term capital gains, payable October 31, 2007, to shareholders of record on October 29, 2007.

As usual, we thank our fellow shareholders for their patience and perseverance. Hang in there!

Sincerely,

|  |

| Richard E. Lane, CFA | Glenn W. Primack |

| Portfolio Manager | Portfolio Manager |

COST DISCUSSION

As a shareholder of the Fund you incur ongoing costs, including management fees and other Fund expenses. You do not incur transaction costs such as sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees because the Fund does not charge these fees. This example is intended to help you understand your ongoing costs (in dollars) of investing in FMI Focus Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

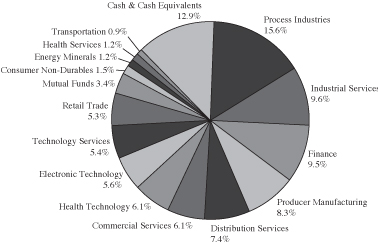

Industry Sectors as of September 30, 2007

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2007 through September 30, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

In addition to the costs highlighted and described below, the only Fund transaction costs you might currently incur would be wire fees ($15 per wire), if you choose to have proceeds from a redemption wired to your bank account instead of receiving a check. Additionally, U.S. Bank charges an annual processing fee ($15) if you maintain an IRA account with the Fund. To determine your total costs of investing in the Fund, you would need to add any applicable wire or IRA processing fees you’ve incurred during the period to the costs provided in the example at the end of this article.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account | Account | During Period* |

| | Value 4/01/07 | Value 9/30/07 | 4/01/07-9/30/07 |

| FMI Focus Fund Actual | $1,000.00 | $1,038.80 | $7.72 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.50 | $7.64 |

| * | Expenses are equal to the Fund’s annualized expense ratio of 1.51%, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period between April 1, 2007 and September 30, 2007). |

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

Mid-cap stocks continued to offer better opportunities for our Five Pillars investment philosophy while small-cap stocks were looking fully valued. Low interest rates and an absence of risk aversion propelled leverage buyouts (LBO) into new sectors. This proved to be a benefit to the Fund as companies, which we invest in, tend to exhibit characteristics, which LBOs find appealing. As such, we had several companies bought out over the last year, including eCollege, Guitar Center, aQuantive, Laidlaw, Digitas, and Biomet. High oil prices over the last year continued to push energy and related stocks higher. Indeed, the Energy sector was the top contributor to Fund performance over the last year. Fiscal 2007 was not without its share of trials. In the first quarter, we voiced our concern that consumers were overly dependent on using their home equity which buoyed the retail sectors and led us to believe a soft landing was possible. By the summer, the housing sales slump combined with higher interest rates lead to a sub-prime mortgage downturn. Performance was directly impacted by the steep decline in MGIC Investment Corp., as well as other housing and financial related holdings. Top performers for fiscal 2007 were Celanese Corp., Juniper Networks Inc., and Dresser-Rand Group Inc.

| |

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN |

FMI Focus Fund, Russell 2000 Index(1) and Russell 2000 Growth Index(2) |

| | |

|

| | | |

| | | |

AVERAGE ANNUAL TOTAL RETURN |

1-Year | 5-Year | 10-Year |

| +14.87% | +17.44% | +15.72% |

| | | |

| | Past performance does not predict future performance. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | |

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index which comprises the 3,000 largest U.S. companies based on total market capitalization. | |

| (2) | The Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. | |

| | | |

FMI Focus Fund

STATEMENT OF NET ASSETS

September 30, 2007

Shares | | | | Cost | | | Value | |

LONG-TERM INVESTMENTS — 87.1% (a) | | | | | | |

| | | | | | | |

COMMON STOCKS — 83.7% (a) | | | | | | |

| | | | | | | |

COMMERCIAL SERVICES SECTOR — 6.1% | | | | | | |

| | | Advertising/Marketing Services — 2.2% | | | | | | |

| | 892,700 | | ValueClick, Inc.* | | $ | 15,465,866 | | | $ | 20,050,042 | |

| | | | | | | | | | | | |

| | | | Personnel Services — 3.9% | | | | | | | | |

| | 246,900 | | AMN Healthcare Services, Inc.* | | | 4,662,244 | | | | 4,624,437 | |

| | 369,100 | | Manpower Inc. | | | 21,208,575 | | | | 23,751,585 | |

| | 693,200 | | MPS Group, Inc.* | | | 9,357,674 | | | | 7,729,180 | |

| | | | | | | 35,228,493 | | | | 36,105,202 | |

CONSUMER NON-DURABLES SECTOR — 1.5% | | | | | | | | |

| | | | Apparel/Footwear — 1.5% | | | | | | | | |

| | 403,100 | | Liz Claiborne, Inc. | | | 15,359,763 | | | | 13,838,423 | |

| | | | | | | | | |

DISTRIBUTION SERVICES SECTOR — 7.4% | | | | | | | | |

| | | | Electronics Distributors — 3.6% | | | | | | | | |

| | 554,600 | | Arrow Electronics, Inc.* | | | 15,847,193 | | | | 23,581,592 | |

| | 499,000 | | Ingram Micro Inc.* | | | 6,290,852 | | | | 9,785,390 | |

| | | | | | | 22,138,045 | | | | 33,366,982 | |

| | | | Food Distributors — 0.7% | | | | | | | | |

| | 225,500 | | United Natural Foods, Inc.* | | | 5,903,486 | | | | 6,138,110 | |

| | | | | | | | | | | | |

| | | | Wholesale Distributors — 3.1% | | | | | | | | |

| | 195,900 | | Grainger (W.W.), Inc. | | | 9,833,748 | | | | 17,864,121 | |

| | 459,200 | | Interline Brands, Inc.* | | | 7,883,289 | | | | 10,557,008 | |

| | | | | | | 17,717,037 | | | | 28,421,129 | |

ELECTRONIC TECHNOLOGY SECTOR — 5.6% | | | | | | | | |

| | | | Computer Communications — 1.5% | | | | | | | | |

| | 384,300 | | Juniper Networks, Inc.* | | | 5,529,114 | | | | 14,069,223 | |

| | | | | | | | | | | | |

| | | | Electronic Production Equipment — 1.8% | | | | | | | | |

| | 428,400 | | Asyst Technologies, Inc.* | | | 2,237,032 | | | | 2,266,236 | |

| | 653,100 | | Entegris Inc.* | | | 6,725,096 | | | | 5,668,908 | |

| | 432,200 | | MKS Instruments, Inc.* | | | 7,479,734 | | | | 8,220,444 | |

| | | | | | | 16,441,862 | | | | 16,155,588 | |

| | | | Semiconductors — 2.3% | | | | | | | | |

| | 878,100 | | Altera Corp. | | | 16,363,057 | | | | 21,144,648 | |

| | | | | | | | | |

ENERGY MINERALS SECTOR — 1.2% | | | | | | | | |

| | | | Oil & Gas Production — 1.2% | | | | | | | | |

| | 160,000 | | Noble Energy, Inc. | | | 3,165,113 | | | | 11,206,400 | |

| | | | | | | | | |

FINANCE SECTOR — 9.5% | | | | | | | | |

| | | | Finance/Rental/Leasing — 4.3% | | | | | | | | |

| | 256,700 | | Advance America Cash Advance Centers Inc. | | | 3,959,310 | | | | 2,738,989 | |

| | 402,600 | | Assured Guaranty Ltd. | | | 9,172,166 | | | | 10,938,642 | |

| | 832,100 | | RAM Holdings Ltd.* | | | 9,676,731 | | | | 7,738,530 | |

STATEMENT OF NET ASSETS (Continued)

September 30, 2007

Shares | | | | Cost | | | Value | |

LONG-TERM INVESTMENTS — 87.1% (a) (Continued) | | | | | | |

| | | | | | | |

COMMON STOCKS — 83.7% (a) (Continued) | | | | | | |

| | | | | | | |

FINANCE SECTOR — 9.5% (Continued) | | | | | |

| | | Finance/Rental/Leasing — 4.3% (Continued) | | | | | | |

| | 1,008,600 | | Rent-A-Center, Inc.* | | $ | 20,768,486 | | | $ | 18,285,918 | |

| | | | | | | 43,576,693 | | | | 39,702,079 | |

| | | | Insurance Brokers/Services — 1.3% | | | | | | | | |

| | 400,000 | | Arthur J. Gallagher & Co. | | | 10,847,892 | | | | 11,588,000 | |

| | | | | | | | | | | | |

| | | | Multi-Line Insurance — 1.2% | | | | | | | | |

| | 143,600 | | PartnerRe Ltd. | | | 6,556,754 | | | | 11,342,964 | |

| | | | | | | | | | | | |

| | | | Regional Banks — 2.1% | | | | | | | | |

| | 486,325 | | Associated Banc-Corp | | | 12,277,565 | | | | 14,409,810 | |

| | 44,200 | | Cullen/Frost Bankers, Inc. | | | 2,244,025 | | | | 2,215,304 | |

| | 96,600 | | Midwest Banc Holdings, Inc. | | | 2,028,600 | | | | 1,426,782 | |

| | 117,900 | | Nexity Financial Corp.* | | | 1,886,400 | | | | 978,570 | |

| | | | | | | 18,436,590 | | | | 19,030,466 | |

| | | | Specialty Insurance — 0.6% | | | | | | | | |

| | 170,500 | | MGIC Investment Corp. | | | 9,969,761 | | | | 5,508,855 | |

| | | | | | | | | |

HEALTH SERVICES SECTOR — 1.2% | | | | | | | | |

| | | | Health Industry Services — 1.2% | | | | | | | | |

| | 303,200 | | Pharmaceutical Product Development, Inc. | | | 10,371,276 | | | | 10,745,408 | |

| | | | | | | | | |

HEALTH TECHNOLOGY SECTOR — 6.1% | | | | | | | | |

| | | | Biotechnology — 2.4% | | | | | | | | |

| | 390,000 | | Charles River Laboratories International, Inc.* | | | 17,587,444 | | | | 21,898,500 | |

| | | | | | | | | | | | |

| | | | Medical Specialties — 3.7% | | | | | | | | |

| | 302,300 | | Beckman Coulter, Inc. | | | 16,221,073 | | | | 22,297,648 | |

| | 136,500 | | PerkinElmer, Inc. | | | 2,254,530 | | | | 3,987,165 | |

| | 276,500 | | Wright Medical Group, Inc.* | | | 5,727,426 | | | | 7,415,730 | |

| | | | | | | 24,203,029 | | | | 33,700,543 | |

INDUSTRIAL SERVICES SECTOR — 9.6% | | | | | | | | |

| | | | Contract Drilling — 1.9% | | | | | | | | |

| | 195,000 | | Pride International, Inc.* | | | 2,480,990 | | | | 7,127,250 | |

| | 286,100 | | Rowan Companies, Inc. | | | 8,868,459 | | | | 10,465,538 | |

| | | | | | | 11,349,449 | | | | 17,592,788 | |

| | | | Environmental Services — 3.2% | | | | | | | | |

| | 791,882 | | Casella Waste Systems, Inc.* | | | 6,970,182 | | | | 9,930,200 | |

| | 598,200 | | Republic Services, Inc. | | | 7,834,347 | | | | 19,567,122 | |

| | | | | | | 14,804,529 | | | | 29,497,322 | |

| | | | Oilfield Services/Equipment — 4.5% | | | | | | | | |

| | 650,400 | | Dresser-Rand Group, Inc.* | | | 14,840,464 | | | | 27,778,584 | |

| | 170,121 | | Exterran Holdings Inc.* | | | 7,963,030 | | | | 13,667,521 | |

| | | | | | | 22,803,494 | | | | 41,446,105 | |

STATEMENT OF NET ASSETS (Continued)

September 30, 2007

Shares | | | | Cost | | | Value | |

LONG-TERM INVESTMENTS — 87.1% (a) (Continued) | | | | | | |

| | | | | | | |

COMMON STOCKS — 83.7% (a) (Continued) | | | | | | |

| | | | | | | |

PROCESS INDUSTRIES SECTOR — 15.6% | | | | | | |

| | | Chemicals: Major Diversified — 2.6% | | | | | | |

| | 614,900 | | Celanese Corp. | | $ | 10,069,737 | | | $ | 23,968,802 | |

| | | | | | | | | | | | |

| | | | Chemicals: Specialty — 7.6% | | | | | | | | |

| | 261,200 | | Airgas, Inc. | | | 2,587,150 | | | | 13,485,756 | |

| | 824,700 | | Cambrex Corp. | | | 9,575,635 | | | | 8,980,983 | |

| | 315,381 | | Cytec Industries Inc. | �� | | 18,355,279 | | | | 21,568,907 | |

| | 415,400 | | Rockwood Holdings Inc.* | | | 8,133,269 | | | | 14,883,782 | |

| | 219,800 | | Sigma-Aldrich Corp. | | | 7,122,778 | | | | 10,713,052 | |

| | | | | | | 45,774,111 | | | | 69,632,480 | |

| | | | Containers/Packaging — 4.5% | | | | | | | | |

| | 644,600 | | Bemis Company, Inc. | | | 17,719,457 | | | | 18,764,306 | |

| | 500,000 | | Packaging Corp of America | | | 10,502,766 | | | | 14,535,000 | |

| | 728,600 | | Smurfit-Stone Container Corp.* | | | 9,024,121 | | | | 8,510,048 | |

| | | | | | | 37,246,344 | | | | 41,809,354 | |

| | | | Industrial Specialties — 0.9% | | | | | | | | |

| | 393,700 | | Ferro Corp. | | | 6,047,272 | | | | 7,866,126 | |

| | | | | | | | | |

PRODUCER MANUFACTURING SECTOR — 8.3% | | | | | | | | |

| | | | Electrical Products — 2.0% | | | | | | | | |

| | 723,800 | | Molex Inc. Cl A | | | 19,437,035 | | | | 18,355,568 | |

| | | | | | | | | | | | |

| | | | Industrial Machinery — 3.5% | | | | | | | | |

| | 140,000 | | Kadant Inc.* | | | 2,105,453 | | | | 3,920,000 | |

| | 334,100 | | Kennametal Inc. | | | 11,551,709 | | | | 28,057,718 | |

| | | | | | | 13,657,162 | | | | 31,977,718 | |

| | | | Miscellaneous Manufacturing — 1.2% | | | | | | | | |

| | 318,300 | | Brady Corp. | | | 10,813,520 | | | | 11,420,604 | |

| | | | | | | | | | | | |

| | | | Trucks/Construction/Farm Machinery — 1.6% | | | | | | | | |

| | 19,800 | | Federal Signal Corp. | | | 310,969 | | | | 304,128 | |

| | 288,300 | | Joy Global Inc. | | | 13,914,469 | | | | 14,662,938 | |

| | | | | | | 14,225,438 | | | | 14,967,066 | |

RETAIL TRADE SECTOR — 5.3% | | | | | | | | |

| | | | Apparel/Footwear Retail — 2.1% | | | | | | | | |

| | 310,000 | | Jos. A. Bank Clothiers, Inc.* | | | 8,730,997 | | | | 10,360,200 | |

| | 330,400 | | Ross Stores, Inc. | | | 9,088,731 | | | | 8,471,456 | |

| | | | | | | 17,819,728 | | | | 18,831,656 | |

| | | | Discount Stores — 2.3% | | | | | | | | |

| | 805,400 | | Family Dollar Stores, Inc. | | | 17,284,136 | | | | 21,391,424 | |

| | | | | | | | | | | | |

| | | | Specialty Stores — 0.9% | | | | | | | | |

| | 262,800 | | PetSmart, Inc. | | | 6,834,139 | | | | 8,383,320 | |

STATEMENT OF NET ASSETS (Continued)

September 30, 2007

Shares or Principal Amount | | Cost | | | Value | |

LONG-TERM INVESTMENTS — 87.1% (a) (Continued) | | | | | | |

| | | | | | | |

COMMON STOCKS — 83.7% (a) (Continued) | | | | | | |

| | | | | | | |

TECHNOLOGY SERVICES SECTOR — 5.4% | | | | | | |

| | | Data Processing Services — 1.2% | | | | | | |

| | 319,000 | | Hewitt Associates, Inc.* | | $ | 8,826,705 | | | $ | 11,180,950 | |

| | | | | | | | | | | | |

| | | | Information Technology Services — 2.5% | | | | | | | | |

| | 972,300 | | CIBER, Inc.* | | | 7,287,328 | | | | 7,593,663 | |

| | 363,400 | | JDA Software Group, Inc.* | | | 3,454,241 | | | | 7,507,844 | |

| | 1,121,500 | | Sapient Corp.* | | | 8,347,380 | | | | 7,525,265 | |

| | | | | | | 19,088,949 | | | | 22,626,772 | |

| | | | Packaged Software — 1.7% | | | | | | | | |

| | 908,100 | | Parametric Technology Corp.* | | | 9,346,736 | | | | 15,819,102 | |

| | | | | | | | | |

TRANSPORTATION SECTOR — 0.9% | | | | | | | | |

| | | | Trucking — 0.9% | | | | | | | | |

| | 470,400 | | Werner Enterprises, Inc. | | | 9,134,883 | | | | 8,067,360 | |

| | | | Total common stocks | | | 589,424,642 | | | | 768,847,079 | |

| | | | | | | | | | | | |

MUTUAL FUNDS — 3.4% (a) | | | | | | | | |

| | 454,900 | | iShares S&P SmallCap 600 Index Fund | | | 20,818,221 | | | | 31,720,177 | |

| | | | Total long-term investments | | | 610,242,863 | | | | 800,567,256 | |

| | | | | | | | | | | | |

SHORT-TERM INVESTMENTS — 12.1% (a) | | | | | | | | |

| | | | Commercial Paper — 0.9% | | | | | | | | |

| $ | 8,000,000 | | General Electric Capital Corp., 4.60%, due 10/01/07 | | | 8,000,000 | | | | 8,000,000 | |

| | | | | | | | | | | | |

| | | | U.S. Treasury Securities — 8.2% | | | | | | | | |

| | 58,000,000 | | U.S. Treasury Bills, 3.26%, due 10/04/07 | | | 57,984,243 | | | | 57,984,243 | |

| | 17,000,000 | | U.S. Treasury Bills, 2.70%, due 10/11/07 | | | 16,987,250 | | | | 16,987,250 | |

| | | | Total U.S. treasury securities | | | 74,971,493 | | | | 74,971,493 | |

| | | | | | | | | | | | |

| | | | Variable Rate Demand Note — 3.0% | | | | | | | | |

| | 27,927,502 | | U.S. Bank, N.A., 4.88% | | | 27,927,502 | | | | 27,927,502 | |

| | | | Total short-term investments | | | 110,898,995 | | | | 110,898,995 | |

| | | | Total investments | | $ | 721,141,858 | | | | 911,466,251 | |

| | | | Cash and receivables, less Liabilities — 0.8% (a) | | | | | | | 7,389,716 | |

| | | | Net Assets | | | | | | $ | 918,855,967 | |

| | | | Net Asset Value Per Share ($0.0001 par value, 100,000,000 | | | | | | | | |

| | | | shares authorized), offering and redemption price | | | | | | | | |

| | | | ($918,855,967 ÷ 26,384,375 shares outstanding) | | | | | | $ | 34.83 | |

| * | Non-income producing security. |

| (a) | Percentages for the various classifications relate to net assets. |

The accompanying notes to financial statements are an integral part of this statement.

STATEMENT OF OPERATIONS

For the Year Ended September 30, 2007

INCOME: | | | |

| Dividends | | $ | 7,269,231 | |

| Interest | | | 5,343,660 | |

| Total income | | | 12,612,891 | |

EXPENSES: | | | | |

| Management fees | | | 11,727,251 | |

| Transfer agent fees | | | 1,274,683 | |

| Administrative and accounting services | | | 554,400 | |

| Printing and postage expense | | | 279,232 | |

| Custodian fees | | | 200,311 | |

| Professional fees | | | 47,996 | |

| Registration fees | | | 44,587 | |

| Insurance expense | | | 36,696 | |

| Board of Directors fees | | | 36,000 | |

| Other expenses | | | 30,184 | |

| Total expenses | | | 14,231,340 | |

NET INVESTMENT LOSS | | | (1,618,449 | ) |

NET REALIZED GAIN ON INVESTMENTS | | | 76,871,435 | |

NET INCREASE IN UNREALIZED APPRECIATION ON INVESTMENTS | | | 53,775,675 | |

NET GAIN ON INVESTMENTS | | | 130,647,110 | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 129,028,661 | |

STATEMENTS OF CHANGES IN NET ASSETS

For the Years Ended September 30, 2007 and 2006

| | | 2007 | | | 2006 | |

OPERATIONS: | | | | | | |

| Net investment loss | | $ | (1,618,449 | ) | | $ | (3,745,038 | ) |

| Net realized gain on investments | | | 76,871,435 | | | | 119,676,250 | |

| Net increase (decrease) in unrealized appreciation on investments | | | 53,775,675 | | | | (42,853,197 | ) |

| Net increase in net assets from operations | | | 129,028,661 | | | | 73,078,015 | |

| | | | | | | | | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Distributions from net realized gains | | | | | | | | |

| ($4.2996 and $3.7158 per share, respectively) | | | (113,038,704 | )* | | | (109,117,313 | )* |

| | | | | | | | | |

FUND SHARE ACTIVITIES: | | | | | | | | |

| Proceeds from shares issued (1,552,719 and 3,080,518 shares, respectively) | | | 52,759,060 | | | | 103,892,465 | |

| Net asset value of shares issued in distributions reinvested | | | | | | | | |

| (3,385,251 and 3,415,461 shares, respectively) | | | 109,645,434 | | | | 105,420,981 | |

| Cost of shares redeemed (4,781,083 and 9,665,838 shares, respectively) | | | (162,184,744 | ) | | | (324,064,867 | ) |

| Net increase (decrease) in net assets derived from Fund share activities | | | 219,750 | | | | (114,751,421 | ) |

| TOTAL INCREASE (DECREASE) | | | 16,209,707 | | | | (150,790,719 | ) |

| NET ASSETS AT THE BEGINNING OF THE YEAR | | | 902,646,260 | | | | 1,053,436,979 | |

| NET ASSETS AT THE END OF THE YEAR (Includes undistributed | | | | | | | | |

| net investment income of $0 and $0, respectively) | | $ | 918,855,967 | | | $ | 902,646,260 | |

The accompanying notes to financial statements are an integral part of these statements.

FMI Focus Fund

FINANCIAL HIGHLIGHTS

(Selected data for each share of the Fund outstanding throughout each year)

| | | Years Ended September 30, | |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

PER SHARE OPERATING PERFORMANCE: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 34.42 | | | $ | 35.83 | | | $ | 32.14 | | | $ | 29.35 | | | $ | 20.81 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | | (0.06 | ) | | | (0.13 | ) | | | (0.21 | ) | | | (0.29 | ) | | | (0.18 | ) |

| Net realized and unrealized gains on investments | | | 4.77 | | | | 2.44 | | | | 5.44 | | | | 3.08 | | | | 8.72 | |

| Total from investment operations | | | 4.71 | | | | 2.31 | | | | 5.23 | | | | 2.79 | | | | 8.54 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Distributions from net investment income | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized gains | | | (4.30 | ) | | | (3.72 | ) | | | (1.54 | ) | | | — | | | | — | |

| Total from distributions | | | (4.30 | ) | | | (3.72 | ) | | | (1.54 | ) | | | — | | | | — | |

| Net asset value, end of year | | $ | 34.83 | | | $ | 34.42 | | | $ | 35.83 | | | $ | 32.14 | | | $ | 29.35 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN | | | 14.87% | | | | 7.75% | | | | 16.83% | | | | 9.51% | | | | 41.04% | |

| | | | | | | | | | | | | | | | | | | | | |

RATIOS/SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s $) | | | 918,856 | | | | 902,646 | | | | 1,053,437 | | | | 1,063,995 | | | | 948,471 | |

| Ratio of expenses to average net assets | | | 1.52% | | | | 1.50% | | | | 1.48% | | | | 1.43% | | | | 1.47% | |

| Ratio of net investment loss to average net assets | | | (0.17% | ) | | | (0.38% | ) | | | (0.61% | ) | | | (0.87% | ) | | | (0.71% | ) |

| Portfolio turnover rate | | | 40.9% | | | | 49.0% | | | | 63.1% | | | | 63.8% | | | | 52.6% | |

The accompanying notes to financial statements are an integral part of this statement.

NOTES TO FINANCIAL STATEMENTS

September 30, 2007

| (1) | Summary of Significant Accounting Policies — |

The following is a summary of significant accounting policies of the FMI Focus Fund (the “Fund”), a portfolio of FMI Funds, Inc. (the “Company”) which is registered as a diversified, open-end management investment company under the Investment Company Act of 1940, as amended. The Company was incorporated under the laws of Maryland on September 5, 1996 and the Fund commenced operations on December 16, 1996. The assets and liabilities of each Fund in the Company are segregated as a shareholder’s interest is limited to the Fund in which the shareholder owns shares. The investment objective of the Fund is to seek capital appreciation principally through investing in common stocks and warrants, engaging in short sales, investing in foreign securities and effecting transactions in stock index futures contracts, options on stock index futures contracts, and options on securities and stock indexes.

| | (a) | Each security, excluding short-term investments, is valued at the last sale price reported by the principal security exchange on which the issue is traded. Securities that are traded on the Nasdaq Markets are valued at the Nasdaq Official Closing Price or if no sale is reported, at the latest bid price. Securities which are traded over-the-counter are valued at the latest bid price. Securities sold short which are listed on a national securities exchange or the Nasdaq Stock Market but which were not traded on the valuation date are valued at the most recent ask price. Unlisted equity securities for which market quotations are readily available are valued at the most recent bid price. Options purchased or written by the Fund are valued at the average of the most recent bid and ask prices. Securities for which quotations are not readily available are valued at fair value as determined by the investment adviser under the supervision of the Board of Directors. The fair value of a security is the amount which the Fund might reasonably expect to receive upon a current sale. The fair value of a security may differ from the last quoted price and the Fund may not be able to sell a security at the fair value. Market quotations may not be available, for example, if trading in particular securities was halted during the day and not resumed prior to the close of trading on the New York Stock Exchange. Short-term investments with maturities of 60 days or less are valued at amortized cost which approximates value. For financial reporting purposes, investment transactions are recorded on the trade date. |

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2007

| (1) | Summary of Significant Accounting Policies — (Continued) |

| | | In September 2006, the Financial Accounting Standards Board (“FASB”) issued Statement of Financial Accounting Standards (“SFAS”) No. 157, “Fair Value Measurements.” This standard establishes a single authoritative definition of fair value, sets out a framework for measuring fair value and requires additional disclosures about fair value measurements. SFAS No. 157 applies to fair value measurements already required or permitted by existing standards. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods within those fiscal years. The changes to current generally accepted accounting principles from the application of this standard relate to the definition of fair value, the methods used to measure fair value, and the expanded disclosures about fair value measurements. The Fund does not believe the adoption of SFAS No. 157 will impact the financial statement amounts; however, additional disclosures may be required about the inputs used to develop the measurements and the effect of certain of the measurements included within the Statement of Operations for the period. |

| | | |

| | (b) | Net realized gains and losses on sales of securities are computed on the identified cost basis. |

| | | |

| | (c) | Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. |

| | | |

| | (d) | The Fund has investments in short-term variable rate demand notes, which are unsecured instruments. The Fund may be susceptible to credit risk with respect to these notes to the extent the issuer defaults on its payment obligation. The Fund’s policy is to monitor the creditworthiness of the issuer and nonperformance by these issuers is not anticipated. |

| | | |

| | (e) | Accounting principles generally accepted in the United States of America (“GAAP”) require that permanent differences between income for financial reporting and tax purposes be reclassified in the capital accounts. |

| | | |

| | (f) | The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates. |

| | | |

| | (g) | The Fund may sell securities short. For financial statement purposes, an amount equal to the settlement amount would be included in the statement of net assets as a liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short position. Subsequent fluctuations in the market prices of securities sold, but not yet purchased, may require purchasing the securities at prices which may differ from the market value reflected on the statement of net assets. The Fund is liable for any dividends payable on securities while those securities are in a short position. Under the 1940 Act, the Fund is required to maintain collateral for its short positions consisting of liquid securities. The collateral is required to be adjusted daily to reflect changes in the value of the securities sold short. |

| | | |

| | (h) | The Fund may own certain securities that are restricted. Restricted securities include Section 4(2) commercial paper, securities issued in a private placement, or securities eligible for resale pursuant to Rule 144A under the Securities Act of 1933. A restricted security cannot be resold to the general public without prior registration under the Securities Act of 1933 (the “Act”) or pursuant to the resale limitations provided by Rule 144A under the Act, or an exemption from the registration requirements of the Act. |

| | | |

| | (i) | No provision has been made for Federal income taxes since the Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all net investment company taxable income and net capital gains to its shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| | | |

| | | On July 13, 2006, the FASB released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax return to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. Recent SEC guidance allows funds to delay implementing FIN 48 into NAV calculations until the fund’s last NAV calculations in the first required financial statement reporting period. As a result, the Fund must begin to incorporate FIN 48 into its NAV calculations by March 31, 2008. At this time, management is continuing to evaluate the implications of FIN 48 and does not expect the adoption of FIN 48 will have a significant impact on the net assets or results of operations of the Fund. |

FMI Focus Fund

NOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2007

| (2) | Investment Adviser and Management Agreement and Transactions With Related Parties — |

The Fund has a management agreement with Fiduciary Management, Inc. (“FMI”), with whom certain officers and directors of the Fund are affiliated, to serve as investment adviser and manager. Under the terms of the agreement, the Fund will pay FMI a monthly management fee at an annual rate of 1.25% of the daily net assets. The Fund has an administrative agreement with FMI to supervise all aspects of the Fund’s operations except those performed by FMI pursuant to the management agreement. Under the terms of the agreement, the Fund will pay FMI a monthly administrative fee at the annual rate of 0.2% of the daily net assets up to and including $30,000,000, 0.1% on the next $70,000,000 and 0.05% of the daily net assets of the Fund in excess of $100,000,000.

FMI entered into a sub-advisory agreement with Broadview Advisors, LLC, to assist it in the day-to-day management of the Fund. Broadview Advisors, LLC, determines which securities will be purchased, retained or sold for the Fund. FMI pays Broadview Advisors, LLC 76% of the Fund’s management fee of 1.25% of the daily net assets.

Under the management agreement, FMI will reimburse the Fund for expenses over 2.75% of the daily net assets of the Fund. No such reimbursements were required for the year ended September 30, 2007.

The Fund has entered into a Distribution Plan (the “Plan”), pursuant to Rule 12b-1 under the Investment Company Act of 1940. The Plan provides that the Fund may incur certain costs which may not exceed the lesser of a monthly amount equal to 0.25% of the Fund’s daily net assets or the actual distribution costs incurred during the year. Amounts payable under the Plan are paid monthly for any activities or expenses primarily intended to result in the sale of shares of the Fund. For the year ended September 30, 2007, no such expenses were incurred.

In the normal course of business the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

U.S. Bank, N.A. has made available to the Fund a $60,000,000 credit facility pursuant to a Credit Agreement (“Agreement”) dated November 18, 2002 for the purpose of having cash available to satisfy redemption requests and to purchase portfolio securities. Principal and interest of such loan under the Agreement are due not more than 31 days after the date of the loan. Amounts under the credit facility bear interest at a rate per annum equal to the current prime rate minus one on the amount borrowed. Advances will be collateralized by securities owned by the Fund. During the year ended September 30, 2007, the Fund did not borrow against the Agreement. The Credit Agreement expires on June 5, 2008.

| (4) | Distribution to Shareholders — |

Net investment income and net realized gains, if any, are distributed to shareholders at least annually. On October 30, 2007, the Fund will distribute $3,507,465 from net short-term realized gains ($0.13406 per share) and $50,627,727 from long-term realized gains ($1.93499 per share). The distributions will be paid on October 31, 2007 to shareholders of record on October 29, 2007.

| (5) | Investment Transactions — |

For the year ended September 30, 2007, purchases and proceeds of sales of investment securities (excluding short-term investments) were $337,424,534 and $500,828,176, respectively.

| (6) | Accounts Payable and Accrued Liabilities — |

As of September 30, 2007, liabilities of the Fund included the following:

| Payable to FMI for management and administrative fees | | $ | 980,055 | |

| Due to custodian | | | 285,877 | |

| Payable to shareholders for redemptions | | | 124,168 | |

| Other liabilities | | | 357,003 | |

| (7) | Sources of Net Assets — |

As of September 30, 2007, the sources of net assets were as follows:

| Fund shares issued and outstanding | | $ | 679,448,129 | |

| Net unrealized appreciation on investments | | | 190,324,393 | |

| Accumulated net realized gains on investments | | | 49,083,445 | |

| | | $ | 918,855,967 | |

FMI Focus FundNOTES TO FINANCIAL STATEMENTS (Continued)

September 30, 2007

| (8) | Income Tax Information — |

The following information for the Fund is presented on an income tax basis as of September 30, 2007:

| | | Gross | Gross | Net Unrealized | Distributable | Distributable |

| | Cost of | Unrealized | Unrealized | Appreciation | Ordinary | Long-Term |

| | Investments | Appreciation | Depreciation | on Investments | Income | Capital Gains |

| | $726,193,605 | $210,560,109 | $25,287,463 | $185,272,646 | $3,507,465 | $50,627,727 |

The difference between the cost amount for financial statement and federal income tax purposes is due primarily to timing differences in recognizing certain gains and losses in security transactions.

The tax components of dividends paid during the years ended September 30, 2007 and 2006, capital loss carryovers, which may be used to offset future capital gains, subject to Internal Revenue Code limitations, as of September 30, 2007, and tax basis post-October losses as of September 30, 2007, which are not recognized for tax purposes until the first day of the following fiscal year are:

September 30, 2007 | | September 30, 2006 |

Ordinary | Long-Term | Net Capital | | | Ordinary | Long-Term |

Income | Capital Gains | Loss | Post-October | | Income | Capital Gains |

Distributions | Distributions | Carryovers | Losses | | Distributions | Distributions |

| $22,364,961 | $90,673,743 | $ — | $ — | | $44,245,543 | $64,871,770 |

For corporate shareholders of the Fund, the percentage of dividend income distributed for the year ended September 30, 2007 which is designated as qualifying for the dividends received deduction is 45% (unaudited).

For all shareholders of the Fund, the percentage of dividend income under the Jobs and Growth Tax Relief Act of 2003, is 45% (unaudited).

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

September 30, 2007

To the Board of Directors and Shareholders of FMI Focus Fund

In our opinion, the accompanying statement of net assets and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of FMI Focus Fund (the “Fund” a series of FMI Funds, Inc.) at September 30, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at September 30, 2007 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

Milwaukee, Wisconsin

October 30, 2007

DIRECTORS AND OFFICERS

| | | Term of | Principal | # of Funds | Other |

| | Position | Office and | Occupation(s) | in Complex | Directorships |

Name, Age | Held with | Length of | During Past | Overseen | Held by |

and Address | the Fund | Time Served | Five Years | by Director | Director or Officer |

| | | | | | |

Non-Interested Directors | | | | | |

| | | | | | |

| Barry K. Allen, 59 | Director | Indefinite Term | Mr. Allen is President of Allen | 4 | Harley-Davidson, |

| c/o Fiduciary | | Since 1996 | Enterprises, LLC (Brookfield, WI) a | | Inc., FMI Common, |

| Management, Inc. | | | private equity investments management | | Stock Fund, Inc. and |

| 100 E. Wisconsin Ave. | | | company, and Senior Advisor for | | FMI Mutual Funds, |

| Suite 2200 | | | Providence Equity Partners (Providence, | | Inc. |

| Milwaukee, WI 53202 | | | RI) since September 2007. He was | | |

| | | | Executive Vice President of Qwest | | |

| | | | Communications International, Inc. | | |

| | | | (Denver, CO) from September 2002 to | | |

| | | | June 2007. | | |

| | | | | | |

| George D. Dalton, 79 | Director | Indefinite Term | Mr. Dalton is Chairman and Chief | 4 | FMI Common |

| c/o Fiduciary | | Since 1997 | Executive Officer of NOVO1 | | Stock Fund, Inc., and |

| Management, Inc. | | | (Waukesha, WI) a privately held company | | FMI Mutual |

| 100 E. Wisconsin Ave. | | | specializing in teleservices call centers | | Funds, Inc. |

| Suite 2200 | | | since January 2000. | | |

| Milwaukee, WI | | | | | |

| | | | | | |

| Gordon H. | Director | Indefinite Term | Mr. Gunnlaugsson retired from M&I | 4 | Renaissance Learning |

| Gunnlaugsson, 63 | | Since 2001 | Corporation (Milwaukee, WI) in | | Systems, Inc., FMI |

| c/o Fiduciary | | | December 2000. | | Common Stock Fund, |

| Management, Inc. | | | | | Inc. and FMI Mutual |

| 100 E. Wisconsin Ave. | | | | | Funds, Inc. |

| Suite 2200 | | | | | |

| Milwaukee, WI 53202 | | | | | |

| | | | | | |

| Paul S. Shain, 44 | Director | Indefinite Term | Mr. Shain is Senior Vice President of | 4 | FMI Common Stock |

| c/o Fiduciary | | Since October | CDW Corporation (Vernon Hills, IL) and | | Fund, Inc. and FMI |

| Management, Inc. | | 2001 | Chief Executive Officer of CDW Berbee | | Mutual Funds, Inc. |

| 100 E. Wisconsin Ave. | | | (f/k/a/ Berbee Information Networks | | |

| Suite 2200 | | | Corporation), a strategic business unit of | | |

| Milwaukee, WI 53202 | | | CDW Corporation. CDW Berbee is a | | |

| | | | leading provider of Information Technology Services including unified | | |

| | | | communications, infrastructure integration, | | |

| | | | and hosting and managed services. He | | |

| | | | has been employed by such firm in various | | |

| | | | capacities since January 2000. | | |

Interested Directors | | | | | |

| | | | | | |

| Patrick J. English,* 46 | Director | Indefinite Term | Mr. English is President of Fiduciary | 3 | FMI Common Stock |

| c/o Fiduciary | | Since 1996 | Management, Inc. and has been employed | | Fund, Inc. |

| Management, Inc. | Vice | One Year Term | by the Adviser in various capacities | | |

| 100 E. Wisconsin Ave. | President | Since 1996 | since December, 1986. | | |

| Suite 2200 | | | | | |

| Milwaukee, WI 53202 | | | | | |

DIRECTORS AND OFFICERS (Continued)

| | | Term of | Principal | # of Funds | Other |

| | Position | Office and | Occupation(s) | in Complex | Directorships |

Name, Age | Held with | Length of | During Past | Overseen | Held by |

and Address | the Fund | Time Served | Five Years | by Director | Director or Officer |

| | | | | | |

Interested Directors (continued) | | | | | |

| | | | | | |

| Ted D. Kellner,* 61 | Director | Indefinite Term | Mr. Kellner is Chairman of the Board | 3 | Marshall & Ilsley |

| c/o Fiduciary | | Since 1996 | and Chief Executive Officer of Fiduciary | | Corporation and |

| Management, Inc. | President | One Year Term | Management, Inc. which he co-founded | | FMI Common Stock |

| 100 E. Wisconsin Ave. | and | Since 1996 | in 1980. | | Fund, Inc. |

| Suite 2200 | Treasurer | | | | |

| Milwaukee, WI 53202 | | | | | |

| | | | | | |

| Richard E. Lane*, 51 | Director | Indefinite Term | Mr. Lane is President of Broadview | 2 | None |

| 100 E. Wisconsin Ave. | | Since 2001 | Advisors, LLC, the sub-adviser to the | | |

| Suite 2250 | | | Fund. | | |

| Milwaukee, WI 53202 | | | | | |

| | | | | | |

Other Officers | | | | | |

| | | | | | |

| Kathleen M. Lauters, 55 | Chief | At Discretion | Ms. Lauters is the Fund’s Chief | N/A | None |

| c/o Fiduciary | Compliance | of Board | Compliance Officer since September 2004. | | |

| Management, Inc. | Officer | Since 2004 | From June 1995 to September 2004 Ms. | | |

| 100 E. Wisconsin Ave. | | | Lauters was employed by Strong Capital | | |

| Suite 2200 | | | Management, most recently as Senior | | |

| Milwaukee, WI 53202 | | | Compliance Analyst. | | |

| | | | | | |

| Camille F. Wildes, 55 | Vice | One Year Term | Ms. Wildes is a Vice-President of | N/A | None |

| c/o Fiduciary | President | Since 1999 | Fiduciary Management, Inc. and has | | |

| Management, Inc. | and | | been employed by the Adviser in various | | |

| 100 E. Wisconsin Ave. | Assistant | | capacities since December, 1982. | | |

| Suite 2200 | Treasurer | | | | |

| Milwaukee, WI 53202 | | | | | |

| | | | | | |

| Donald S. Wilson, 64 | Vice | One Year Term | Mr. Wilson is Vice Chairman, Treasurer | N/A | FMI Common Stock |

| c/o Fiduciary | President | Since 1996 | and Chief Compliance Officer of | | Fund, Inc. and FMI |

| Management, Inc. | and | | Fiduciary Management, Inc. | | Mutual Funds, Inc. |

| 100 E. Wisconsin Ave. | Secretary | | which he co-founded in 1980. | | |

| Suite 2200 | | | | | |

| Milwaukee, WI 53202 | | | | | |

| * | Messrs. English and Kellner are interested directors of the Fund because they are officers of the Fund and the Adviser. Mr. Lane is an interested director of the Fund because he is an officer of the Fund’s sub-adviser. |

For additional information about the Directors and Officers or for a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, please call (800) 811-5311 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission (the “Commission”) at http://www.sec.gov. Information on how the Fund voted proxies relating to portfolio securities is available on the Fund’s website at http://www.fmifunds.com or the website of the Commission no later than August 31 for the prior 12 months ending June 30. The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available on the Commission’s website. The Fund’s Form N-Q may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C., and that information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

FMI Focus Fund

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

www.fmifunds.com

414-226-4555

BOARD OF DIRECTORS

BARRY K. ALLEN

GEORGE D. DALTON

PATRICK J. ENGLISH

GORDON H. GUNNLAUGSSON

TED D. KELLNER

RICHARD E. LANE

PAUL S. SHAIN

INVESTMENT ADVISER

AND ADMINISTRATOR

FIDUCIARY MANAGEMENT, INC.

100 East Wisconsin Avenue, Suite 2200

Milwaukee, Wisconsin 53202

PORTFOLIO MANAGER

BROADVIEW ADVISORS, LLC

100 East Wisconsin Avenue, Suite 2250

Milwaukee, Wisconsin 53202

TRANSFER AGENT AND

DIVIDEND DISBURSING AGENT

U.S. BANCORP FUND SERVICES, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

800-811-5311 or 414-765-4124

CUSTODIAN

U.S. BANK, N.A.

1555 North RiverCenter Drive, Suite 302

Milwaukee, Wisconsin 53212

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PRICEWATERHOUSECOOPERS LLP

100 East Wisconsin Avenue, Suite 1800

Milwaukee, Wisconsin 53202

LEGAL COUNSEL

FOLEY & LARDNER LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of FMI Focus Fund unless accompanied or preceded by the Fund’s current prospectus.

ANNUAL REPORT

September 30, 2007

FMI

Large Cap

Fund

A NO-LOAD

MUTUAL FUND

FMI

Large Cap

Fund

October 1, 2007

Dear Fellow Shareholders:

The September quarter was difficult for the FMI Large Cap Fund as it declined 1.34% in the quarter compared to a gain of 2.03% for the benchmark Standard & Poor’s 500. Calendar year-to-date, the Fund was up 6.52%, while the S&P 500 was up 9.13%.

A number of factors impacted the third quarter. In response to turbulent credit conditions and perhaps a weakening economy, the Federal Reserve Board first lowered the discount rate by 50 basis points in August, then another 50 in September, when they also dropped the federal funds rate by 50 basis points. The thought of 1998 and the Long Term Capital Management crisis likely weighed heavily on their decision. The Fed’s action was a booster shot for growth stocks nine years ago and it has been recently, too. Most of the growth stock indices were strong in September, continuing a move away from value stocks this year. While this relative movement was a factor in our third quarter results, we also simply had more than our share of poorly performing stocks.

We are confident that the underperforming companies in the Fund will improve, but there is no way to gauge how long the market will favor growth. It is déjà vu to see investors bidding up the stocks of companies that are “hitting their numbers” even though the multiples in many cases are already very high. It is reminiscent of the 1995-1999 period, and it remains to be seen whether there will be significant fund flows from value pools to growth pools. After the mortgage debacle and credit scare in July and August, it is amazing, and somewhat frustrating, to observe that the market seems little concerned about these warning shots across the bow. Perhaps faith in Bernanke (rates) and the government (borrower bailouts) is enough to justify this attitude. Even the derivative difficulties seemed to have passed without a lot of damage. So far.

We still believe in Economics 101. Excesses and imbalances tend to swing the other way over time. We are beginning to see the pendulum swing back in the housing and mortgage markets. Credit quality may also be on the verge of meaningfully deteriorating. The dollar has been extremely weak. Last quarter’s letter articulates our position on some of these issues in more detail, but suffice it to say, we remain somewhat cautious about a few of the macro issues, as well as the overall stock market. Valuations also do not appear to incorporate much bad news. The companies in the FMI Large Cap Fund, on the other hand, are sound, well-financed all-terrain vehicles that we feel will perform nicely, at least on a relative basis, over a long-term time frame. They are not Ferraris, however, so if we are entering a growth and momentum environment, the Fund is likely to underperform.

Before delving into a couple of relatively new holdings, a sentence or two about the difficult stocks in the quarter is appropriate. Two stocks that have been pretty strong over the past couple of years, Accenture Ltd. and Cardinal Health, Inc., pulled back in the quarter. Both of these were trimmed in July, but with perfect hindsight, not enough. Today, with more attractive valuations and solid long-term fundamentals, the 3-4 year investment outlook is positive.

Time Warner Inc. declined on fears of a slowdown in cable and AOL. While the large regional Bell companies pose a threat with new video offerings, we think this is manageable. Cable remains attractive, particularly in the “triple play” (video, broadband internet and telephone) scenario, where cable’s gain in telephony outweighs the losses in video. AOL remains in a very positive transition from a dial-up subscription model to an advertising-supported one. The valuation of Time Warner is quite attractive.

Tyco International Ltd. and its post-spin new brethren, Covidien and Tyco Electronics, underperformed in the period. We underestimated the costs and challenges in this endeavor. We think each company and stock has a promising long-term outlook. Finally, Sprint Nextel Corp. fell in the quarter as net additions are lagging and costs remain too high. Sprint’s efforts to improve and integrate their networks is showing positive results, but the churn and the cost to service customers in this transition period have been too high. We were early with our bet, but we still have confidence they can pull it off, and the stock is very inexpensive. Our custom is to address macroeconomic and other broader topical issues following the December and June quarters, and discuss individual companies in more detail following the March and September quarters.

BEST BUY CO., INC.

Description

Best Buy (BBY) is the leading retailer of consumer electronics, home office products, entertainment software, appliances and related services. It is a category-dominant retailer, with industry-leading growth and margins. The company operates 822 domestic Best Buy superstores (20% market share), along with 121 stores in Canada, 135 in China, and a handful of specialty stores in the United States.

Good Business

| | • | Despite operating in a competitive industry, Best Buy has established a powerful brand (the familiar yellow tag) and a coveted “destination” shopping experience. |

| | | |

| | • | New technology and “must have” gadgets drive an evergreen demand curve. |

| | | |

| | • | Unadjusted ROIC (return on invested capital) runs approximately 20%. Adjusted for operating leases, it is roughly 14-15%. |

| | | |

| | • | Best Buy is essentially vendor neutral, thereby enabling investors to capture the growth in new technology without taking inventor’s risk. |

| | | |

| | • | The business is easy to understand. |

| | | |