QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant /x/

|

| Filed by a party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

GOLF TRUST OF AMERICA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

GOLF TRUST OF AMERICA, INC.

NOTICE OF 2001 ANNUAL MEETING OF STOCKHOLDERS

October 18, 2001

Charleston, South Carolina

Notice is hereby given that the 2001 Annual Meeting of Stockholders (the "Annual Meeting") of Golf Trust of America, Inc. (the "Company") will be held at the Charleston Place Hotel, 205 Meeting Street, Charleston, South Carolina, on November 15, 2001 at 8:30 a.m. for the following purposes:

- 1.

- to elect two directors to the Company's Board of Directors; and

- 2.

- to transact such other business as may properly be brought before the Annual Meeting or any adjournments or postponements thereof.

The close of business on October 4, 2001 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. Only holders of record of the Company's sole class of common stock at such time will be entitled to vote.

You are cordially invited to attend the Annual Meeting in person. Even if you plan to attend the Annual Meeting, please promptly sign, date and return the enclosed proxy card in the enclosed self-addressed, postage prepaid envelope. It will assist us in keeping down the expenses of the Annual Meeting if all stockholders, whether you own a few shares or many shares, return your signed proxies promptly.

A majority of the outstanding shares of common stock entitled to vote at the Annual Meeting must be represented at the Annual Meeting, in person or by proxy, in order to constitute a quorum. Please return your proxy card in order to ensure that a quorum is obtained and to avoid the additional costs to the Company of adjourning the Annual Meeting and resoliciting proxies. If you attend the Annual Meeting, you may vote your shares of common stock in person if you wish, even if you have previously returned your proxy card.

YOUR VOTE IS IMPORTANT.

| | | By Order of the Board of Directors, |

| | |  |

| | | Scott D. Peters

Secretary |

PROXY STATEMENT

This Proxy Statement is furnished as of October 18, 2001 in connection with the solicitation of proxies by the Board of Directors of Golf Trust of America, Inc. (the "Company") for use at the 2001 Annual Meeting of Stockholders, which will be held on November 15, 2001 (the "Annual Meeting").

The Company's principal executive offices are located at 14 North Adger's Wharf, Charleston, South Carolina 29401. This Proxy Statement and accompanying proxy card will be first mailed to stockholders on or about October 18, 2001. The Company will provide a copy of the Company's Annual Report on Form 10-K, as filed earlier this year with the Securities and Exchange Commission, without charge to any stockholder who so requests in writing to Golf Trust of America, Inc., 14 North Adger's Wharf, Charleston, South Carolina 29401, Attention: Investor Relations.

Voting Procedures

A proxy card is enclosed for your use. You are solicited on behalf of the Board of Directors to sign, date and return the proxy card in the accompanying envelope, which is postage prepaid if mailed in the United States.

You have three choices regarding the election of directors at the upcoming Annual Meeting. You may:

- 1.

- vote for all of the director nominees;

- 2.

- withhold authority to vote for all of the director nominees; or

- 3.

- vote for one or more of the director nominees and withhold authority to vote for one or more of the other director nominees.

Stockholders may vote by completing and returning the enclosed proxy card prior to the Annual Meeting, by voting in person at the Annual Meeting or by submitting a signed proxy card at the Annual Meeting.

YOUR VOTE IS IMPORTANT.

ACCORDINGLY, YOU ARE URGED TO SIGN AND RETURN THE ACCOMPANYING

PROXY CARD REGARDLESS OF HOW MANY OR FEW SHARES YOU OWN AND

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

You may revoke your proxy at any time before it is actually voted at the Annual Meeting by: (a) delivering written notice of your revocation to the Secretary of the Company at 14 North Adger's Wharf, Charleston, South Carolina 29401; (b) submitting a later dated proxy; or (c) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting will not, by itself, constitute revocation of the proxy. You may also be represented by another person present at the Annual Meeting by executing a form of proxy designating such person to act on your behalf.

Each unrevoked proxy card properly signed and received prior to the close of the Annual Meeting will be voted as indicated. Unless otherwise specified on the proxy, the shares represented by a signed proxy card will be voted FOR each director nominee named in Proposal 1 on the proxy card and will be voted in the discretion of the persons named as proxies on the other business that may properly come before the Annual Meeting.

The presence at the Annual Meeting, in person or by proxy, of a majority of the shares of the Company's sole class of common stock ("Common Stock") issued and outstanding as of October 4, 2001, will constitute a quorum. A quorum is necessary for the transaction of business at the Annual Meeting. The Company will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as not voting for purposes of determining the approval of any matter submitted to the stockholders for a vote. If a broker indicates on the enclosed proxy or its substitute that it does not have discretionary voting authority as to certain shares to vote

1

on a particular matter ("broker non-votes"), those shares will be treated as abstentions with respect to that matter.

Votes cast at the Annual Meeting will be tabulated by the person appointed by the Company to act as inspector of election for the Annual Meeting.

Shares Entitled to Vote and Required Vote

Holders of record of the Company's sole class of Common Stock at the close of business on October 4, 2001 are entitled to vote at the Annual Meeting. On October 4, 2001, 7,778,103 shares of Common Stock were outstanding. The presence in person or by proxy of stockholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting constitutes a quorum. A majority of the votes cast at the Annual Meeting, duly called and at which a quorum is present, is sufficient to take or authorize action upon any matter that may properly come before the Annual Meeting. A plurality of all the votes cast at the Annual Meeting, duly called and at which a quorum is present, is sufficient to elect a director. Each share of Common Stock is entitled to one vote.

PROPOSAL 1:

ELECTION OF DIRECTORS

The Company's Articles of Incorporation, as amended (the "Charter"), provide for the six members of the Company's Board of Directors to be divided into three classes serving staggered terms. The terms of the two Class III directors are ending this year, on the date of the upcoming Annual Meeting. The terms of the Class I and Class II directors will end on the dates of the annual meetings to be held in the years 2003 and 2002, respectively. In addition, directors serve until their successors have been duly elected and qualified or until the directors resign, become disqualified or disabled, or are otherwise removed.

This Year's Nominees

The Nominating Committee of the Company's Board of Directors has nominated the current two Class III directors, whose terms are expiring, to stand for re-election at the upcoming Annual Meeting. These directors are Mr. Scott D. Peters and Mr. Roy C. Chapman. If re-elected, such directors will serve until the 2004 Annual Meeting and until their successors are elected and qualified.

Directors of the Company are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Messrs. Peters and Chapman. If any of such nominees unexpectedly becomes unavailable for election, proxies will be voted for the election of persons selected as nominees in their place by the Board of Directors.

Certain information about Messrs. Peters and Chapman is set forth below.

Name

| | Age

| | Position

|

|---|

| Scott D. Peters | | 43 | | Director, Chief Financial Officer, Senior Vice President and Secretary |

Roy C. Chapman |

|

60 |

|

Independent Director(1)(2)(3) |

- (1)

- Compensation Committee Member

- (2)

- Nominating Committee Member

- (3)

- Audit Committee Member

2

Biographical Information

Scott D. Peters is a Director, Chief Financial Officer, Senior Vice President and Secretary of the Company. Prior to Mr. Peters' election to the Board by the stockholders in May 2000, Mr. Peters served as an interim director, appointed by the Board to fill the vacancy created by Mr. David D. Joseph's resignation in late 1999. From 1992 through 1996, Mr. Peters served as Senior Vice President and Chief Financial Officer of the Pacific Holding Company in Los Angeles, where he participated in the management of a 4,000 acre real estate portfolio consisting of residential, commercial and country club properties focusing on master-planned golf communities. From 1988 to 1992, Mr. Peters served as Senior Vice President and Chief Financial Officer of Castle & Cooke Homes, Inc; and from time to time during 1990 and 1991 lectured on Real Estate Finance and Asset Management at California State University at Bakersfield. Mr. Peters became a Certified Public Accountant and worked with Arthur Andersen & Co. and Laventhol & Horwath from 1981 to 1985. From 1986 to 1988, Mr. Peters worked with a general partnership that managed the construction of the Scottsdale Princess Resort. He received a Bachelor of Arts degree in Accounting and Finance with honors from Kent State University and a Masters in Taxation degree from the University of Akron, Ohio.

Roy C. Chapman is an Independent Director. Mr. Chapman currently is Chairman, Chief Executive Officer and principal stockholder of Human Capital Resources, Inc., which was formed to assist students to finance higher education. He is also serving as Executive Vice President of Corporate Development of Lombard Technologies, Inc., a privately held company involved in the consolidation of the metal surface finishing industry. From 1987 until his retirement in February 1993, Mr. Chapman was Chairman and Chief Executive Officer of Cache, Inc., the owner and operator of a nationwide chain of upscale women's apparel stores. He has served as the Chief Financial and Administrative Officer of Brooks Fashion Stores and was a partner in the international accounting and consulting firm of PriceWaterhouseCoopers LLP. Mr. Chapman has also served as a member of the staff of the Division of Market Regulation of the Securities and Exchange Commission and acted as a consultant to the Special Task Force to Overhaul the Securities Investors Protection Act. Mr. Chapman earned a Bachelors degree in Business Administration from Pace University.

Recommendation of the Board of Directors on Proposal 1:

The Board of Directors recommends that the stockholders vote for the election of Messrs. Peters and Chapman to serve as directors of the company until the 2004 annual meeting and until such time as their successors are elected and qualified.

OTHER MATTERS AT THE MEETING

The Board of Directors does not know of any matters to be presented at the Annual Meeting other than those mentioned in this Proxy Statement. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

THE BOARD OF DIRECTORS

The Company is managed by a Board of Directors composed of six members, a majority of whom are independent of the Company's management ("Independent Directors"). The Board met 15 times in 2000 and acted by unanimous consent on 2 other occasions; the Audit Committee met 3 times; the Compensation Committee acted by unanimous consent once; the Nominating Committee acted by unanimous consent once; the Strategic Alternatives Working Committee met four times; and the Independent Committee met once. Each of the directors either attended or participated by telephone in at least 75% of the total number of meetings of the Board of Directors and of the committees of the Company of which he was a member.

3

Committees

Audit Committee. The Board of Directors has established an audit committee consisting of three Independent Directors (the "Audit Committee"). Mr. Jones is currently the chairman of the Audit Committee. The Audit Committee's role is to make recommendations concerning the engagement of independent public accountants, review with the independent public accountants the plans and results of the audit engagement, approve professional services provided by the independent public accountants, review the independence of the independent public accountants, consider the range of audit and non-audit fees and review the adequacy of the Company's internal accounting controls. The Audit Committee report is set forth within this document.

Compensation Committee. The Board of Directors has established a compensation committee consisting of three Independent Directors (the "Compensation Committee") to determine compensation, including awards under the Company's stock incentive plans, for the Company's executive officers. The current chairman is Mr. Chapman. The Compensation Committee report is set forth within this document.

Nominating Committee. The Board of Directors has established a nominating committee (the "Nominating Committee") to nominate individuals for election to the Board of Directors. The Nominating Committee consists of two Independent Directors and Mr. Blair. The current chairman is Mr. Blair. The Nominating Committee will consider nominees recommended by stockholders. (A stockholder wishing to recommend a nominee should contact the Secretary of the Company, Scott D. Peters, at (843) 723-4653.)

Other Committees. The Board of Directors may from time to time form other committees as circumstances warrant. Such committees will have such authority and responsibility as may be delegated by the Board of Directors, to the extent permitted by Maryland law. During the year 2000, the Board had two such committees. The Strategic Alternatives Working Committee, composed of Messrs. Blair and Wax, was created to work with the Company's financial advisor to consider the Company's strategic alternatives. The Independent Committee, composed of the four Independent Directors, Messrs. Chapman, Jones, Reams and Wax, was created to review and make a recommendation regarding the Legends agreement, pursuant to which the Company sold 6.5 golf courses on July 31, 2001.

Compensation of Directors

The Company pays its Independent Directors fees for their services as directors. Directors receive annual compensation of $10,000 plus a fee of $1,000 for attendance at each meeting of the Board of Directors (whether in person or telephonically) and $500 for attending committee meetings. Directors who are not Independent Directors are not paid any director fees. The Company reimburses directors for their reasonable and documented out-of-pocket travel expenses. As described below, the four Independent Directors receive automatic annual grants of options to purchase 5,000 shares of Common Stock at the stock's fair market value on the date of grant.

Directors' Stock Option Plan

On January 28, 1997 the Company's sole stockholder approved the Board of Directors' adoption of the Golf Trust of America 1997 Non-Employee Directors' Plan (the "Directors' Plan").

Share Authorization. A maximum of 100,000 shares of Common Stock may be issued under the Directors' Plan except that the share limitation and terms of outstanding awards may be adjusted, as the Compensation Committee deems appropriate, in the event of a stock dividend, stock split, combination, reclassification, recapitalization or other similar event. Through the date hereof, the Company has awarded grants relating to 100,000 shares (such that no shares remain available for grant) under the Directors' Plan.

4

Eligibility. The Directors' Plan provides for the grant of options to purchase Common Stock to each eligible director of the Company. No director who is an employee of the Company or an owner who contributes a golf course to the Company and receives OP Units is eligible to participate in the Directors' Plan. Consequently, only the Independent Directors are eligible to participate in the Directors' Plan.

Options. Pursuant to the Directors' Plan each eligible director was awarded non-qualified options to purchase 5,000 shares of Common Stock in connection with the Company's initial public offering ("IPO"). Such initial grants are exercisable at the IPO price of $21.00 per share. Each subsequently elected eligible director received non-qualified options to purchase 5,000 shares of Common Stock on the date such director was first elected or appointed to the Board of Directors. The Directors' Plan also provides for an automatic annual grant to each eligible director of options to purchase 5,000 shares of Common Stock on the anniversary of the IPO, beginning in 1998. Accordingly, each eligible director was awarded non-qualified options to purchase 5,000 options at $29.00 per share on February 7, 1998, non-qualified options to purchase 5,000 shares at $24.50 per share on February 6, 1999, non-qualified options to purchase shares at $17.938 on February 6, 2000 and non-qualified options to purchase shares at $7.85 on February 5, 2001. The exercise price of all option grants under the Directors' Plan is 100% of the fair market value of the Common Stock on the date of grant. All awards under the Directors' Plan vest immediately upon grant. The exercise price may be paid in cash, cash equivalents, Common Stock or a combination thereof acceptable to the Compensation Committee. Options granted under the Directors' Plan are exercisable for 10 years from the date of grant.

Certain Federal Income Tax Consequences Relating to Options. Generally, an eligible director does not recognize any taxable income, and the Company is not entitled to a deduction, upon the grant of an option. Upon the exercise of an option the eligible director recognizes ordinary income equal to the excess of the fair market value of the shares acquired over the option exercise price, if any. Special rules may apply as a result of Section 16 of the Exchange Act. The Company is generally entitled to a deduction equal to the compensation taxable to the eligible director as ordinary income. Eligible directors may be subject to backup withholding requirements for federal income tax.

Amendment and Termination. The Directors' Plan provides that the Board may amend or terminate the Directors' Plan, but the terms relating to the amount, price and timing of awards may not be amended more than once every six months other than to comport with changes in the tax code, or the rules and regulations thereunder. An amendment will not become effective without stockholder approval if the amendment materially (i) increases the number of shares that may be issued under the Directors' Plan; (ii) changes the eligibility requirements; or (iii) increases the benefits that may be provided under the Directors' Plan. No options may be granted under the Directors' Plan after December 31, 2006.

Directors and Officers Insurance

The Company maintains directors and officers liability insurance. Directors and officers liability insurance insures the officers and directors of the Company from any claim arising out of an alleged wrongful act by such persons while acting as directors and officers of the Company, and the Company to the extent that it has indemnified the directors and officers for such loss.

Indemnification

The Charter provides that the Company shall indemnify its officers and directors against certain liabilities to the fullest extent permitted under applicable law. The Charter also provides that the directors and officers of the Company be exculpated from monetary damages to the fullest extent permitted under applicable law.

5

DIRECTORS AND OFFICERS

The Company's Board of Directors consists of six members (prior to Larry D. Young's resignation from the Board in May 2001, the Board consisted of seven members; however, as of the date of this Proxy Statement, the Board has elected not to appoint another director to replace Mr. Young). The directors include W. Bradley Blair II, Chief Executive Officer, President and Chairman of the Board of the Company and Scott D. Peters, Chief Financial Officer, Senior Vice President and Secretary of the Company. The remaining directors are Independent Directors who are not employees of the Company. Subject to severance compensation rights pursuant to any employment agreements, officers of the Company serve at the pleasure of the Board of Directors.

Set forth below is information with respect to the Company's directors and executive officers.

Name

| | Age

| | Position

| | Year First

Elected to

Board

| | Current

Term

Expires

|

|---|

| W. Bradley Blair, II(1) | | 58 | | Chief Executive Officer, President and Chairman of the Board of Directors | | 1997 | | 2002 |

Scott D. Peters |

|

43 |

|

Chief Financial Officer, Senior Vice President, Secretary and Director |

|

1999 |

(2) |

2001 |

Roy C. Chapman(1)(3)(4) |

|

60 |

|

Independent Director |

|

1997 |

|

2001 |

Raymond V. Jones(3) |

|

53 |

|

Independent Director |

|

1997 |

|

2002 |

Fred W. Reams(1)(4) |

|

58 |

|

Independent Director |

|

1997 |

|

2003 |

Edward L. Wax(3)(4) |

|

64 |

|

Independent Director |

|

1997 |

|

2003 |

- (1)

- Nominating Committee Member

- (2)

- Elected by the Board of Directors to fill the vacancy created by Mr. Joseph's resignation. Mr. Peters was elected at the 2000 annual meeting of stockholders to serve the remainder of Mr. Joseph's original term, which expires on the date of the upcoming 2001 Annual Meeting.

- (3)

- Audit Committee Member

- (4)

- Compensation Committee Member

Biographical Information

W. Bradley Blair, II is Chief Executive Officer, President, and Chairman of the Board of Directors of the Company. From 1993 until the Company's IPO, Mr. Blair served as Executive Vice President, Chief Operating Officer and General Counsel for The Legends Group. As an officer of Legends Group Ltd., Mr. Blair was responsible for all aspects of operations, including acquisitions, development and marketing. From 1978 to 1993, Mr. Blair was the managing partner at Blair, Conaway Bograd & Martin, P.A., a law firm, specializing in real estate, finance, taxation and acquisitions. Mr. Blair earned a Bachelor of Science degree in Business from Indiana University and a Juris Doctorate degree from the University of North Carolina at Chapel Hill Law School.

Raymond V. Jones is an Independent Director. From 1984 to 1994 he was Managing Partner of Summit Properties Limited Partnership before such entity went public in 1994. From 1994 until retiring in March 1998, Mr. Jones was Executive Vice President of Summit Properties Inc. ("Summit"). Summit is a publicly-traded REIT listed on the New York Stock Exchange and is one of the largest developers and operators of luxury garden multifamily apartment communities in the southeastern United States.

6

While at Summit, Mr. Jones oversaw the development of 26 multifamily apartment communities comprising nearly 6,500 apartment homes in Georgia, North Carolina, South Carolina and Ohio. Prior to 1984, Mr. Jones served as General Operations Manager for both the Charlotte and Houston divisions of Ryan Homes, Inc. Mr. Jones earned a Bachelor of Arts degree in Political Science from George Washington University.

Fred W. Reams is an Independent Director. Since 1981 Mr. Reams has served as the President of Reams Asset Management Company, LLC ("Reams Management"), an independent private investment firm which he co-founded. Reams Management employs a staff of 25 persons and manages approximately $6 billion in assets. In addition, Mr. Reams has served as President of the Board of Directors of the Otter Creek Golf Course since 1981. Otter Creek located in Indiana and rated in the top 25 public courses by Golf Digest in 1990, recently expanded to 27 holes and has hosted several noteworthy tournaments, including multiple U.S. Open and U.S. Senior Open Qualifiers, four American Junior Golf Association Championships, the National Public Links Championship and over 20 state amateur championships. Mr. Reams holds a Bachelor of Arts degree and a Master of Arts degree in Economics from Western Michigan University.

Edward L. Wax is an Independent Director. Mr. Wax is currently Chairman Emeritus of Saatchi & Saatchi, a worldwide advertising and ideas company. From 1992 until his appointment to his current position in 1997, Mr. Wax served as Chairman and Chief Executive Officer of Saatchi & Saatchi. Mr. Wax has been responsible at Saatchi for the operations of 143 offices, in 87 countries. Mr. Wax has been employed by Saatchi & Saatchi since 1982. Mr. Wax was formerly Chairman of the American Association of Advertising Agencies as well as a director of both the Ad Council and the Advertising Educational Foundation. Mr. Wax also serves on the Board of Directors of Dollar Thrifty Automotive Group. Mr. Wax holds a Bachelor of Science degree in Chemical Engineering from Northeastern University and a Masters in Business Administration degree from the Wharton Graduate School of Business.

Biographical information for Messrs. Peters and Chapman appears on page 3 above.

Executive Compensation

The Company currently has two executive officers, Mr. Blair and Mr. Peters (the "Named Executive Officers"). The following table sets forth for the fiscal years ended December 31, 2000, 1999, and 1998, compensation awarded or paid to, or earned by, each of the Named Executive Officers.

Summary Compensation Table

| |

| | Annual Compensation

| | Long Term Compensation

| |

|---|

Name and Principal Position

| | Fiscal Year

| | Salary

| | Bonus(1)

| | Restricted

Stock

Awards(2)

| | Securities

Underlying

Options(3)

| |

|---|

W. Bradley Blair, II

Chief Executive Officer, President and Chairman of the Board of Directors | | 2000

1999

1998 | | $

$

$ | 338,910

330,000

300,000 | | $

$

$ | 0

247,500

328,929 | | $

$

$ | 0

603,400

275,703 | | 0

85,000

155,000 |

(4)

(4) |

Scott D. Peters

Chief Financial Officer, Senior Vice President, Secretary and Director |

|

2000

1999

1998 |

|

$

$

$ |

180,752

176,000

160,000 |

|

$

$

$ |

0

132,000

173,014 |

|

$

$

$ |

0

344,800

423,391 |

|

0

60,000

85,000 |

(5)

(5) |

- (1)

- Listed bonuses in 1998 and 1999 include performance related bonuses earned in 1998 and 1999 but paid in 1999 and 2000, respectively. Not included in these amounts are car allowances paid to Messrs. Blair and Peters of $12,000 and $7,200, respectively, for 1998, 1999 and 2000.

7

- (2)

- On January 1, 1998, Messrs. Blair and Peters were awarded 9,507 and 3,623 shares of restricted stock, respectively, for the shares' par value when the stock price was $29.00. Such grants vest in four equal annual installments on the anniversary of the date of grant. On March 10, 1999, pursuant to the 1998 Stock-Based Incentive Plan, Messrs. Blair and Peters were awarded 20,000 and 14,000 shares of restricted stock, respectively, for the shares' par value when the stock price was $22.75. Such shares will vest in five equal annual installments on the anniversary of the date of grant. On January 30, 2000, pursuant to the 1998 Stock-Based Incentive Plan, Messrs. Blair and Peters were awarded 35,000 and 20,000 shares of restricted stock, respectively, for the shares par value when the stock price was $17.25. Such shares will vest in three equal annual installments on the anniversary of the date of grant. On February 25, 2001, all of Messrs. Blair and Peters' restricted stock vested, pursuant to their amended employment agreements, upon the Board of Directors' approval of the Company's plan of liquidation. The amounts shown are the fair market value of the entire award (regardless of vesting) on the date of grant (based on the closing price on the date of grant), less the purchase price paid by each Named Executive Officer. Under the applicable option plan, dividends are payable on all restricted stock awards prior to vesting.

- (3)

- Listed options for 1999 include option grants made on January 30, 2000 in respect of the Named Executive Officer's performance in 1999.

- (4)

- On November 11, 1998, Mr. Blair was granted options to purchase 155,000 shares at $25.063 per share. This grant vests in five equal annual installments beginning one year from the date of grant. On January 30, 2000, Mr. Blair was granted options to purchase 85,000 shares at $17.25 per share. This grant vests in three equal annual installments beginning one year from the date of grant. On February 25, 2001, all of Mr. Blair's options vested, pursuant to his amended employment agreement, upon the Board of Directors' approval of the Company's plan of liquidation.

- (5)

- On November 11, 1998 Mr. Peters was granted options to purchase 85,000 shares at $25.063 per share. This grant vests in five equal annual installments beginning one year from the date of grant. On January 30, 2000, Mr. Peters was granted options to purchase 60,000 shares at $17.25 per share. This grant vests in three equal annual installments beginning one year from the date of grant. On February 25, 2001, all of Mr. Peter's options vested, pursuant to his amended employment agreement, upon the Board of Directors' approval of the Company's plan of liquidation.

Option Exercises in 2000 and Year-End Option Values

There were no option exercises during the fiscal year ended December 31, 2000 by any of the Named Executive Officers. The following table describes the exercisable and unexercisable options held by each of the Named Executive Officers as of December 31, 2000. The "Value of Unexercised In-the-Money Options at December 31, 2000" is based on a value of $7.25 per share, the closing price of the Company's Common Stock on the American Stock Exchange on December 31, 2000, less the per share exercise price, multiplied by the number of shares issued upon exercise of the option.

2000 Option Exercises Year-End Holdings

| |

| |

| |

| |

| | Value of Unexercised

In-The-Money

Options at

December 31, 2000(1)

|

|---|

| |

| |

| | Number of Securities

Underlying Unexercised Options

at December 31, 2000

|

|---|

| | Shares

Acquired

on

Exercise

| |

|

|---|

Name

| | Value

Received

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| W. Bradley Blair, II | | — | | — | | 462,000 | | 178,000 | | — | | — |

Scott D. Peters |

|

— |

|

— |

|

174,000 |

|

111,000 |

|

— |

|

— |

- (1)

- None of the options included in the table above were in-the-money on December 31, 2000.

8

Employment Agreements

The Company entered into written employment agreements with Messrs. Blair and Peters at the time of the Company's IPO, which have been amended since then, most recently as of February 25, 2001. The term of Mr. Blair's employment will expire four years after the Board of Directors delivers to him a notice of non-renewal; similarly, the term of Mr. Peters' employment will expire three years after the Board of Directors delivers to him a notice of non-renewal. The Board of Directors retains the right to terminate their employment earlier, subject to an obligation to pay severance benefits unless the termination is for "good reason," as defined below. The employment agreements provide for an annual base salary of $360,000 for Mr. Blair and $200,000 for Mr. Peters in 2001, with automatic annual cost of living increases based on the increase, if any, in the consumer price index. The employment agreements also provide that following the stockholders' adoption of the Company's plan of liquidation on May 22, 2001, the executives are no longer eligible for further stock-based awards or performance bonuses. Instead, they received a retention bonus upon the effective date of the amended agreements equal to $1,233,907 for Mr. Blair and $660,921 for Mr. Peters, as well as accelerated vesting of all previously granted stock-based compensation. Such acceleration occurred on February 25, 2001 and such payments were made shortly thereafter. In addition, on that date, all of the Company's outstanding loans to the executives, in the amount of $2,163,738 for Mr. Blair and $683,118 for Mr. Peters, were forgiven as required by the terms of their existing promissory notes, see "Certain Relationships and Related Transactions—Indebtedness of Management."

Under the employment agreements, each of Messrs. Blair and Peters, or their estates, would receive severance payments upon their death or disability, or upon the termination of their employment by the Board of Directors without "good reason" or upon their resignation with "good cause." The Board of Directors will have "good reason" to terminate their employment if they engage in gross negligence, willful misconduct, fraud or materially breach their employment agreements. Each executive will have "good cause" to resign in the event of any material reduction in his compensation or benefits, material breach or material default by the Company under his employment agreement or following a change in control of the Company, as defined in the employment agreements. The severance payments of Messrs. Blair and Peters would be equal to base salary plus bonus, with the bonus equal to the greater of the executive's then most recent annual bonus or his average annual bonus for the years 1997 through 1999. The severance payments would be made for either the balance of the employment term or three years, whichever is longer.

Also under their employment agreements, the executives are entitled to milestone payments of $1,645,210 for Mr. Blair and $881,228 for Mr. Peters upon repayment of all of the Company's unsecured debt. The executives are entitled to a final milestone payment of $1,233,907 for Mr. Blair and $660,921 for Mr. Peters upon the later of February 25, 2002, which is the one-year anniversary of the Board of Directors' approval of the Company's plan of liquidation, and repayment of all of the Company's unsecured debt. Any severance payments otherwise payable under the employment agreements will be reduced by the amount of the retention bonus and any milestone payments that the Company makes. The Company is obligated to make non-recourse loans to the executives, secured by an equivalent amount of stock, to allow them to fund their personal income tax liability arising from certain non-cash benefits payable to them, including the accelerated vesting and debt forgiveness. The amended employment agreements of Messrs. Blair and Peters, as currently in effect, were filed as exhibits to the Company's Current Report on Form 8-K, filed March 14, 2001.

Change of Control Agreements

The amended employment agreements of Messrs. Blair and Peters provide that each executive will have good cause to resign upon a change of control and, in that case, the executive would be entitled to severance payments, minus the previously paid retention bonus and any milestone payments in connection with the Company's plan of liquidation, as described under "Directors and Officers—Employment Agreements," above.

9

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Company's Compensation Committee was at any time since the Company's formation an officer or employee of the Company. None of the Company's executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company's Board of Directors or Compensation Committee.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The following report should not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed under such Acts.

Responsibilities of the Company's Compensation Committee. The Company's executive compensation program is administered under the direction of the Compensation Committee of the Board of Directors of the Company, which is comprised of three Independent Directors. The specific responsibilities of the Compensation Committee are to:

- 1.

- administer the Company's executive compensation program;

- 2.

- review and approve compensation awarded to the executive officers pursuant to the executive compensation program;

- 3.

- monitor the performance of the Company in relation to the performance of the executive officers;

- 4.

- monitor performance of the executive officers in view of the Board of Directors' strategic objectives;

- 5.

- monitor compensation awarded to the executive officers in comparison to compensation received by executive officers of other similar companies; and

- 6.

- develop procedures to help assure executive retention and succession.

Compensation determinations pursuant to the executive compensation program are generally made at or shortly after the end of the fiscal year. At the end of the fiscal year, incentive cash and non-cash bonuses are calculated pursuant to the funds from operations ("FFO") growth criteria which is contained in the respective Company incentive compensation plan approved by the Compensation Committee prior to or at the beginning of the fiscal year. Payment of bonuses are subject to audited confirmation of the Company's financial performance, which occurs immediately after the end of the fiscal year.

In fulfilling its responsibilities, the Compensation Committee takes into account recommendations from management as well as the specific factors enumerated herein for specific elements of compensation. The Compensation Committee periodically reviews comparative compensation data.

Philosophy of the Compensation Committee. The philosophy of the Compensation Committee as reflected in the specific compensation plans included in the executive compensation program is to:

- 1.

- attract, retain and reward experienced, highly motivated executive officers who are capable of effectively leading and continuing the growth of the Company;

- 2.

- place more emphasis on short and long-term incentive compensation which is dependent upon both Company and individual performance rather than on base salary;

10

- 3.

- reward and encourage executive officer activity that results in enhanced value for stockholders; and

- 4.

- link both short and long-term incentive compensation as much as possible to the achievement of specific individual and Company goals.

Elements of Compensation. The Compensation Committee believes that the above-stated philosophy can best be implemented through three separate components of executive compensation with each component designed to reward different performance goals, yet have all three components work together to satisfy the ultimate goal of enhancing stockholder value. The three elements of executive compensation are:

- 1.

- salary, which compensates the executive for performing the basic job description through the performance of assigned responsibilities;

- 2.

- cash and non-cash bonuses, which reward the executive for commendable performance of special designated tasks or outstanding performance of assigned responsibilities during the fiscal year; and

- 3.

- stock options and/or stock grants, which provide long-term rewards to the executive in a manner directly related to FFO growth and to the enhancement of stockholder value.

In administering each element of compensation, the Compensation Committee considers the integration of that element not only with the other two elements of compensation, but also with additional benefits available to the executive such as the 1997 Employee Stock Purchase Plan, insurance benefits provided by the Company and the retirement savings plan sponsored by the Company.

The elements of compensation for year 2000 are discussed next.

Base Salary. As required by their employment agreements, the base salaries of Messrs. Blair and Peters were increased for the year 2000 over the year 1999 by the rise in the consumer price index as a cost of living adjustment.

Cash and Non-Cash Bonuses and Stock Options/Grants. In early 2000, the Compensation Committee approved an incentive compensation plan for the year establishing, among other things, the specific per share FFO growth criteria, requisite financial returns on acquisitions, and internal growth of asset performance and balance sheet management upon which executive officers' bonuses were dependent. Due to a variety of causes, particularly the adverse industry and economic trends facing the Company in 2000, none of the quantitative performance goals was met in year 2000. Accordingly, no cash or stock bonus was awarded to the Company's executives for year 2000.

Recent Events. During the latter half of the year 2000, the Compensation Committee undertook its planning responsibilities in a context which differed from prior years. Notable differences included the ongoing strategic alternatives analysis process, and extrinsic factors such as the eroding golf course industry economics, the continued constriction on capital availability to the Company and the continuing problems being realized by the small-cap, triple net lease sector of the real estate investment trust community. These factors presented a challenge to the Compensation Committee as it sought to balance the objectives of fair compensation in the face of an eroding stock price, particularly in the context of the need for management continuity with respect to the strategic alternatives analysis process. Consequently, the Compensation Committee deferred much of their deliberations as to this coming year's incentive compensation arrangements until greater certainty regarding the Company's strategic direction was achieved.

When the Board was nearing a conclusion that it might adopt a plan of liquidation for submission to the stockholders, the Compensation Committee determined that modifications to Messrs. Blair and Peters' employment agreements should be made. In particular, the Compensation Committee believed

11

that the "change of control" definition, which had been in place in their initial employment agreements executed in February 1997 (the time of the company's IPO), should be modified for the benefit of stockholders in the context of the possible adoption of a plan of liquidation.

As written, the employment agreements between the Company and Messrs. Blair and Peters provided that adoption by the Board of Directors of the Company's plan of liquidation would constitute a "change of control," upon which Messrs. Blair and Peters would have had the right to resign and receive their full severance package, comprised of full vesting of all stock options and restricted stock, severance pay and a gross-up for any excise taxes they may owe, whether or not stockholders ultimately approved the plan of liquidation. The executives were also obligors on promissory notes to the Company that, according to their terms, would be forgiven following a "change of control," which was again defined to include adoption by the Board of Directors of the Company's plan of liquidation. Unless these agreements were amended, all of these benefits would have arisen upon the Board of Directors' approval of the Company's plan of liquidation. Accordingly, the Compensation Committee determined and advised the Board of Directors that the Company faced a substantial risk that its key executives would resign before the plan of liquidation was completed, in which case all of the above benefits would be paideven if the Company's stockholders did not approve the plan of liquidation. After negotiations between the executives and the Compensation Committee, the executives agreed to amend their employment agreements to provide for the principal terms as described under "Directors and Officers—Employment Agreements," above.

| | Respectfully submitted, |

|

By: |

|

The Compensation Committee |

|

Members: |

|

Roy C. Chapman

Fred W. Reams

Edward L. Wax |

12

ANNUAL REPORT OF THE AUDIT COMMITTEE

The following report should not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that the Company specifically incorporates this information by reference and shall not otherwise be deemed filed under such Acts.

In accordance with its written charter (Exhibit A), the Company's Audit Committee recommends to the Board of Directors the selection of the Company's independent accountants. The Audit Committee is also responsible for assisting the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company.

In this context, the Audit Committee has met and held discussions with management and the independent accountants. Management represented to the Audit Committee that the Company's consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

The Company's independent accountants also provided to the Audit Committee the written disclosures and letter required by Independent Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants that firm's independence.

Based upon the Audit Committee's discussion with management and the independent accountants and the Audit Committee's review of the representation of management and the report of the independent accountants to the Audit Committee, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company's Annual Report on Form 10-K for the year ended December 31, 2000, filed with the Securities and Exchange Commission.

| | Respectfully submitted, |

|

By: |

|

The Audit Committee |

|

Members: |

|

Raymond V. Jones

Roy C. Chapman

Edward L. Wax |

13

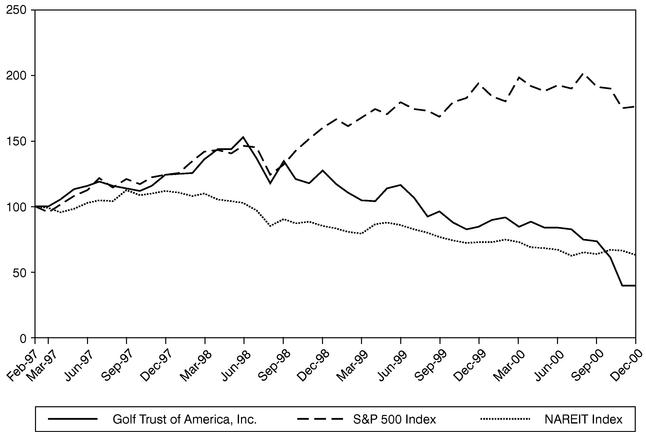

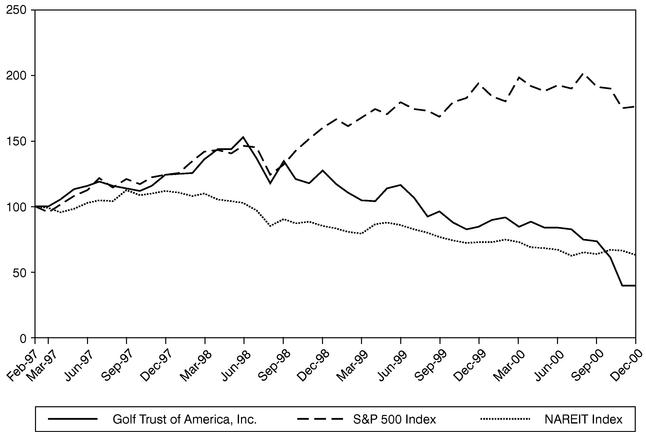

STOCK PERFORMANCE CHART

The following graph charts the Company's stock price since the Company's inception in February 1997 compared to both the S&P 500 and the NAREIT Index:

Note: The stock price performance shown on the graph above is not necessarily indicative of future price performance.

INDEPENDENT PUBLIC ACCOUNTANTS

Since February 28, 1997, the Company has engaged BDO Seidman, LLP ("BDO Seidman") as its principal accountants and such firm is expected to be retained as its principal accountants in 2001. BDO Seidman audited the Company's financial statements for the periods ending December 31, 1997, 1998, 1999 and 2000. A representative from BDO Seidman will be present at the Annual Meeting, and is expected to be available to respond to appropriate questions.

Fees billed to the Company by BDO Seidman during the fiscal year ending December 31, 2000 include the following:

Audit Fees: Audit fees billed to the Company by BDO Seidman during the fiscal year ending December 31, 2000 for review of the Company's annual financial statement and those financial statements included in the Company's quarterly reports on Form 10-Q totaled $134,187.

Financial Information Systems Design and Implementation Fees: The Company did not engage BDO Seidman to provide advice to the Company regarding financial information systems design and implementation during the fiscal year ended December 31, 2000.

All other fees: Fees billed to the Company by BDO Seidman during the fiscal year ended December 31, 2000 for all other non-audit services rendered to the Company, including services related to income taxes and implementation of the plan of liquidation, totaled $397,291.

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table describes, as of September 15, 2001, the beneficial ownership of Common Stock and common OP Units (which are common units of limited partnership interest in Golf Trust of America, L.P., the operating partnership through which the Company owns its golf course interests (the "Operating Partnership")) by each director, by each Named Executive Officer of the Company, by all directors and officers of the Company as a group and by each person known to the Company to be the beneficial owner of 5% or more of the outstanding Common Stock. This table shows beneficial ownership in accordance with the rules of the Securities and Exchange Commission to include securities that a named person has the right to acquire within 60 days. Each person named in the table has sole voting and investment/disposition power with respect to all of the shares of Common Stock or OP Units shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. Unless otherwise noted, the address of each person in the table is c/o Golf Trust of America, Inc., 14 North Adger's Wharf, Charleston, South Carolina 29401.

| | Common Stock

| | Common OP Units

| |

|---|

Name and Address of Beneficial Owner

| | Number of

Shares of

Common Stock

| | Percentage of

Shares of

Common Stock

Outstanding(1)

| | Number of

OP Units

| | Percentage

Interest in

Operating

Partnership(2)

| |

|---|

| W. Bradley Blair, II | | 808,932 | (3) | 9.61 | % | 12,500 | | * | |

| Scott D. Peters | | 340,625 | (4) | 4.22 | % | — | | — | |

| Roy C. Chapman | | 25,500 | (5) | * | | — | | — | |

| Raymond V. Jones | | 26,000 | (5) | * | | — | | — | |

| Fred W. Reams | | 65,000 | (5) | * | | — | | — | |

| Edward L. Wax | | 26,250 | (5) | * | | — | | — | |

| Directors and officers as a group (6 persons) | | 1,292,307 | (6) | 14.81 | % | 12,500 | | 27.1 | % |

| AEW Capital Management, L.P. | | 961,704 | (7) | 11.00 | %(8) | — | | — | |

| FMR Corp. | | 1,094,100 | (9) | 14.06 | %(10) | — | | — | |

- *

- Less than 1%

- (1)

- Based on 7,778,103 shares of Common Stock outstanding as of September 15, 2001. In accordance with SEC rules, each person's percentage interest is calculated by dividing such person's beneficially owned shares by the sum of the total number of common shares outstanding plus the number of shares such person has the right to acquire (including, for example, upon exercise of vested options, but excluding upon conversion of the separately shown OP Units) within 60 days of September 15, 2001.

- (2)

- Based on 8,076,993 common OP Units outstanding (including the 7,778,103 common OP Units held by the Company's subsidiaries). Under the partnership agreement of the Operating Partnership, the holders of OP Units (other than the Company's subsidiaries) have the right to tender them for redemption at any time. Upon such a tender, either the Operating Partnership must redeem the OP Units for cash or the Company must acquire the OP Units for shares of Common Stock, on a one-for-one basis.

- (3)

- Mr. Blair's beneficial ownership includes options to purchase 640,000 shares of Common Stock, all of which have vested and are exercisable as of September 15, 2001.

- (4)

- Mr. Peters' beneficial ownership includes options to purchase 285,000 shares of Common Stock, all of which have vested and are exercisable as of September 15, 2001.

- (5)

- Each of the Independent Directors' beneficial ownership includes options to purchase 25,000 shares of Common Stock, all of which have vested and are exercisable as of September 15, 2001.

15

- (6)

- Includes options to purchase 1,025,000 shares of Common Stock, all of which have vested and are exercisable as of September 15, 2001. Excludes 36,452 shares held by Mr. David Joseph, who resigned as the Company's executive vice president in late 1999, which are pledged to the Operating Partnership to secure a promissory note from Mr. Joseph to the Company. Mr. Joseph has agreed to vote all pledged shares as recommended by the Board of Directors.

- (7)

- Amounts shown for AEW Capital Management, L.P. include 800,000 shares of the Company's Series A Convertible Cumulative Preferred Stock held by its affiliate AEW Targeted Securities Fund, L.P., which shares are convertible into an aggregate of 761,905 shares of the Company's Common Stock. AEW Capital Management, L.P. beneficially owns an additional 199,800 shares of the Company's Common Stock. These entities' address is c/o AEW Capital Management, Inc., 225 Franklin Street, Boston, MA 02110. Information about AEW Capital Management, L.P. is included in reliance on its Schedule 13G filed with the Security and Exchange Commission ("SEC") on April 16, 1999.

- (8)

- In order to preserve the Company's REIT status, among other reasons, the Company's charter limits the number of shares that my be owned by a single person or "group," as defined under federal securities laws, to 9.8% of each class of outstanding equity. This restriction is referred to as the Company's "ownership limit." However, in cases where violation of the ownership limit would not jeopardize the Company's REIT status, the Company's charter allows the Board of Directors to grant a waiver of the ownership limit. In connection with AEW's investment in the Company's Series A Preferred Stock, the Board of Directors granted them a limited waiver from the ownership limit on April 2, 1999.

- (9)

- FMR Corp.'s address is 82 Devonshire Street, Boston, MA 02109. FMR Corp. reports that it has sole power to vote or to direct the vote of 735,100 shares, shared power to vote or to direct the vote of 0 shares, sole power to dispose or to direct the disposition of 1,094,100 shares and shared power to dispose or to direct the disposition of 0 shares (but see note 10 below). Information about FMR Corp. is included in reliance on the Schedule 13G/A filed with the SEC on February 14, 2001 by FMR Corp.

- (10)

- The Company has contact FMR Corp. to discuss the possibility of granting them a waiver to the ownership limit (see note 8 above). In the absence of a waiver, the shares beneficially held by FMR Corp. in excess of the ownership limit become "shares-in-trust" under terms of the Company's charter and must be surrendered to a trustee of a charitable trust named by the Company. The trustee has the authority to direct the voting and disposition of the shares and would proceed to dispose of the shares to a permitted transferee on an orderly basis.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Certain Business Relationships

W. Bradley Blair, II, Chief Executive Officer, President and Chairman of the Board of the Company, is an inactive equity holder in Blair Conaway Bograd & Martin, P.A., a law firm engaged by the Company on a limited basis to provide real estate, corporate and labor law services to the Company.

Indebtedness of Management

The Compensation Committee of the Board of Directors has authorized the Company from time to time to make loans to its officers to help them pay their personal income tax liability arising in connection with their non-cash compensation and benefit arrangements and to assist them to acquire Common Stock of the Company on the open market. In 2000, the Company made loans to Mr. Blair in the amount of $75,000 and to Mr. Peters in the amount of $50,000 for the payment of personal income

16

taxes arising from the vesting of restricted stock grants. These loans were evidenced by promissory notes and secured by Common Stock of the Company and OP Units of the Operating Partnership. The loans carried interest rates equal to the applicable federal rate on the date of the loan with an average interest rate of 6.25%. Under the terms of the promissory notes, the interest accrued and became due and payable annually in arrears unless and until the Company reduced its common dividend by more than 30% (which reduction occurred on December 26, 2000). All interest that would otherwise have been due and payable after such date was not due but instead was added to principal. The largest aggregate amount of indebtedness outstanding at any point during the year was at December 31, 2000, when Mr. Blair owed the Company a total of $2,082,000 at a weighted average annual interest rate of 5.45% and Mr. Peters owed the Company a total of $643,000 at a weighted average annual interest rate of 5.35%. These loans were forgiven pursuant to the terms of the related promissory notes upon the Board of Directors' approval of the Company's plan of liquidation.

Pursuant to the terms of Messrs. Blair and Peters' employment agreements, as amended on February 25, 2001, the Company made new loans of $1,595,000 to the executive officers on February 25, 2001 for the payment of personal income taxes arising from the acceleration of their restricted stock grants and the forgiveness of their outstanding debt to the Company that occurred on such date. These new loans are evidenced by promissory notes and secured by Common Stock of the Company. Interest accrues on these loans at an annual rate of 5.06% (the applicable federal rate on the date of the loan) and is due at maturity. These loans mature at the earliest of the following times: (i) February 25, 2006, (ii) three years following termination of the borrower's employment with the Company or (iii) the date of the final distribution under the Company's plan of liquidation. At any time when the loan is oversecured, the borrower has the right to sell the stock securing the loan, provided that all proceeds of the sale are first applied to the loan. All distributions (including any liquidating distributions) on the stock securing the loan are applied against the loan. The related promissory notes are non-recourse to the borrower.

COST OF SOLICITATION

The expense of soliciting proxies and the cost of preparing, assembling and mailing material in connection with the solicitation of proxies will be paid by the Company. In addition to the use of mails, certain directors, officers or employees of the Company and its subsidiaries, who receive no compensation for their services other than their regular salaries, may solicit personally or by telephone and tabulate the proxies. The Company will also request persons, firms and corporations holding shares in their names or in the names of their nominees, which are beneficially owned by others, to send proxy materials to and obtain proxies from such beneficial owners. The Company will reimburse such holders for their reasonable expenses.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's officers and directors, and persons who own more than 10% of a registered class of the Company's equity securities, to file initial reports of ownership and changes in ownership with the Securities and Exchange Commission ("SEC") and American Stock Exchange. Officers, directors and stockholders owning more than 10% of the Common Stock of the Company are required by SEC regulations to furnish the Company with copies of all reports filed pursuant to Section 16(a).

Based solely on review of copies of such reports required by Section 16(a) and filed by or on behalf of the Company's officers and directors or written representations that no such reports were required, the Company believes that during 2000 all of its officers and directors, and stockholders owning greater than 10% of the Common Stock of the Company complied with all applicable Section 16(a) filing requirements.

17

STOCKHOLDER PROPOSALS FOR THE 2002 ANNUAL MEETING

Any stockholder who meets the requirements of the proxy rules under the Securities Exchange Act of 1934 may submit to the Board of Directors proposals to be considered for inclusion in the proxy statement to be submitted to the Company's stockholders at the 2002 Annual Meeting of Stockholders. Any such proposal must be submitted in writing by notice delivered or mailed by first-class United States mail, postage prepaid, to the Secretary of the Company, Golf Trust of America, Inc., 14 North Adger's Wharf, Charleston, South Carolina 29401. Any such notice must be received by Wednesday, January 23, 2002.

Stockholders wishing to present a proposal at the 2002 Annual Meeting of Stockholders but not wishing to submit such proposal for inclusion in the proxy statement must provide the Company written notice no later than Friday, February 22, 2002. Any proposal received after such date shall be considered untimely. Such written notice must be delivered or mailed by first-class United States mail, postage prepaid to the Secretary of the Company, Golf Trust of America, Inc., 14 North Adger's Wharf, Charleston, South Carolina 29401. The proposal must set forth the name and address of the stockholder, the text to be introduced, the number of shares held and the date of their acquisition, and a representation that the stockholder intends to appear in person or by proxy to introduce the proposal specified in the notice. The chairman of the meeting may refuse to acknowledge the introduction of any stockholder proposal not made in compliance with the foregoing procedures.

| | | By Order of the Board of Directors, |

|

|

GOLF TRUST OF AMERICA, INC. |

| | |  |

| | | By: Scott D. Peters,Secretary |

18

CHARTER OF THE AUDIT COMMITTEE

Golf Trust of America, Inc.

- I.

- Introduction

- 1.01

- The Audit Committee (the "Committee") of the Board of Directors (the "Board") of Golf Trust of America, Inc. (the "Company") has been established to:

- (a)

- Providence assistance to the entire Board in fulfilling their responsibilities related to oversight of the integrity of the Company's internal controls, audit process and financial reporting,

- (b)

- Serve as a liaison between the Board and the Company's independent auditors,

- (c)

- Monitor the independence and performance of the Company's independent auditors and Chief Financial Officer, and

- (d)

- Provide an avenue of communication among the independent auditors, management, the Chief Financial Officer and the Board.

- II.

- Members

- 2.01

- Members of the Committee will be appointed from the Board annually and will meet the requirements of the American Stock Exchange.

- 2.02

- The Committee must meet the following membership requirements:

- (a)

- Minimum of three independent directors.

- (b)

- All members must be able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement or will become able to do so within a reasonable period of time after his or her appointment to the audit committee.

- (c)

- At least one member must have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

- 2.03

- The definition of an independent director prohibits:

- (a)

- A director being employed by the Company or any of its affiliates for the current year or any of the past three years.

- (b)

- A director accepting any compensation from the Company or any of its affiliates in excess of $60,000 during the previous fiscal year, other than compensation for board service, benefits under a tax-qualified retirement plan or non-discretionary compensation.

A–1

- (c)

- A director being a member of the immediate family of an individual who is, or has been in any of the past three years, employed by the Company or any of its affiliates as an executive officer.

- (d)

- A director being a partner in, or a controlling shareholder or an executive officer of, any for-profit business organization to which the Company made or from which the corporation received, payments (other than those arising solely from investments in the Company's securities) that exceed five percent of the Company's or business' consolidated gross revenues for that year, or $200,000, whichever is more, in any of the past three years.

- (e)

- A director being employed as an executive of another entity where any of the Company's executives serves on that corporation's compensation committee. A director who has one or more of these relationships may be appointed to the Committee, if the Board, under exceptional and limited circumstances determines that membership on the Committee is required by the best interests of the Company and its shareholders and the Board discloses, in its next annual proxy statement subsequent to such determination, the nature of the relationship and the reason for the determination.

- III.

- Functions

- 3.01

- The Committee will act for the Board in overseeing the integrity of the Company's internal controls, audit process and financial reporting. In performing this function, the Committee will have direct access to the Company's Chief Executive Officer, Chief Financial Officer, internal auditors, independent auditors and outside counsel. In addition, the Committee may meet with other members of management and employees when in the judgement of the Committee such meetings are warranted.

- 3.02

- The Committee will meet periodically with the independent auditors and will review and assess the performance of the independent auditors. It will make recommendations to the full Board annually as to the appointment of independent auditors and will, in appropriate circumstances, review any proposed non-audit services provided by the independent auditors. The Committee will consider the possible effect of providing such services on the independent auditor's independence and will review the range of fees of the independent auditors for both audit and non-audit services, having responsibility for approving the terms of the independent auditors' engagement.

- 3.03

- The Committee shall receive from the independent auditors a written statement no less often than annually, delineating any relationship between the independent auditor and the Company, wherein:

- (a)

- The independent auditor has accepted any compensation from the Company or its affiliates other than compensation for its services to the Company as approved by the Committee, or

- (b)

- The independent auditor is controlled by, or under common control with, any person who is, or has been in any of the past three years, employed by the Company or any of its affiliates as an executive officer, or

- (c)

- The independent auditor or any partner or controlling shareholder thereof, is a partner in or a controlling shareholder or an executive officer of any business organization to which the Company made, or from which the Company received, payments that are or have been significant to the Company or business organization in any of the past three years.

A–2

- 3.04

- The Committee shall discuss with the independent auditor any disclosed relationships that in the Committee's estimation could impact the objectivity and independence of the independent auditor and take, or recommend that the full Board take, appropriate action, if necessary, to ensure the independence of the independent auditor.

- 3.05

- The Committee will require that the outside auditor discuss not just the acceptability, and compliance of the Company's accounting principles, but also the quality thereof and report such findings to the full Board.

- 3.06

- The Committee, as representative of the Board has the ultimate authority and responsibility to select, evaluate, and replace the independent auditor or to nominate an independent auditor to be proposed for shareholder approval in any proxy statement.

- 3.07

- The Committee will review with the independent auditors the overall audit plan and the scope and results of the annual audit. It will assess the Company's internal controls and the adequacy of such procedures and controls. It will review with the independent auditors accounting principles employed in the Company's financial reports and any proposed changes therein (including any significant accounting and reporting issues, recent professional and regulatory pronouncements and the impact of these issues and pronouncements on the financial statements).

- 3.08

- The Committee will review with the Company's management and the independent auditors the Company's annual operating results and annual audited financial statements. The Committee will also review the management letter issued by the independent auditors and management's responses to any reports or recommendations of the independent auditors.

- 3.09

- The Committee will also review the Company's annual report on Form 10-K, particularly "Management's Discussion and Analysis of Financial Condition and Results of Operations."

- 3.10

- The Committee will also review the financial data to be included in the Company's quarterly financial reporting on Form 10-Q particularly "Management's Discussion and Analysis of Financial Condition and Results of Operations." ' Such review shall consist of a discussion between the Company's outside auditor, the Committee (the chairman or his designee from the Committee may represent the Committee), and either the chief executive officer, chief operating officer or chief financial officer of the Company. Such review discussion shall occur in person or by telephone conference call and shall cover matters including but not limited to significant adjustments, management judgements and accounting estimates, significant new accounting policies and disagreements with management if any.

- 3.11

- The Committee will review with the Company's management and the independent auditors the Company's internal controls over and compliance with the specific regulations governing the Company's continued status as a Real Estate Investment Trust for income tax reporting purposes.

- 3.12

- The Committee will review, with the Company's counsel, any legal matters that could have a significant impact of the Company's financial statements and any findings of any examinations by regulatory agencies, such as the Securities and Exchange Commission.

- 3.13

- The Committee will direct and supervise investigations into any matters within its scope, including the integrity of reported facts and figures, ethical conduct and appropriate disclosure. The Committee is authorized to retain outside counsel if necessary, but will normally work through the Company's management, the internal auditors and the independent auditors.

A–3

- 3.14

- The Committee will make recommendations or reports on matters that, in its judgement, should receive the attention of the Board and perform such other oversight functions as the Board may request.

- 3.15

- The Committee will include a letter in the annual report to shareholders and Form 10-K annual report, disclosing:

- (a)

- that the Company management has reviewed the audited financial statements of the Company with the Committee, including a discussion of the quality of the accounting principles applied to the statements, and significant judgements affecting the statements;

- (b)

- that the independent auditors have discussed with the Committee the outside auditor's judgements of the qualities of the accounting principles applied and the judgements referenced in (a) above; and

- (c)

- that the members of the Committee have discussed among themselves without management or the outside auditor present, the information disclosed to the Committee in (a) and (b) above.

- 3.16

- The Committee will disclose its charter at least every third year in the annual report or proxy, unless such charter is significantly amended, in which case the amended charter will be disclosed in the next annual report or proxy thereafter.

- IV.

- Meetings

- 4.01

- The Committee will meet periodically, at least twice a year, but as frequently as its members may deem appropriate to perform its functions. Typically, meetings will be held:

- (a)

- prior to the annual audit, and

- (b)

- subsequent to completion of the audit and before financial statements or earnings reports are issued.

- 4.02

- Meetings of the Committee will consist in part of private meetings between the Committee and independent auditors, and the Company's management, as appropriate.

- 4.03

- The Chairman of the Committee will endeavor to circulate an agenda or otherwise discuss with members of the Committee the matters to be reviewed in advance of the meeting, and the Chairman or any Secretary pro tem appointed by him or her will keep minutes of the meetings.

- 4.04

- The Committee also will report its findings and deliberations to the full board at the next meeting of the Board following its meetings.

- 4.05

- In addition to the generalized reviews described above, matters for review at the Committee's separate meetings with the independent auditors should include:

- (a)

- limitations, if any, imposed by management on the scope of the audit and disagreements, if any, between the independent auditors and management in the preparation of the Company's financial statements;

- (b)

- major changes in and other questions regarding appropriate accounting and auditing principles and procedures, including financial, regulatory and tax policy issues; and

A–4

- (c)

- the independent auditors plan to handle their responsibilities under the Private Securities Litigation Reform Act of 1995, including informing the Committee of any illegal acts that may come to their attention, and whether established procedures for reporting have been followed in the preceding period.

- V.

- Review and Reassessment

- 5.01

- The Committee will review and reassess this charter for adequacy on an annual basis.

- VI.

- Compensation

- 6.01