QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

GOLF TRUST OF AMERICA, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

October 18, 2004

Charleston, South Carolina

To the Common Stockholders of Golf Trust of America, Inc.:

Notice is hereby given that the 2004 Annual Meeting of Stockholders of Golf Trust of America, Inc. will be held at the Harbour Club, 35 Prioleau Street, Charleston, South Carolina, on November 19, 2004 at 9:30 a.m. for the following purposes:

- 1.

- to elect one director to Golf Trust's board of directors; and

- 2.

- to transact such other business as may properly be brought before the annual meeting or any adjournments or postponements thereof.

The close of business on October 8, 2004 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting and any adjournment thereof. Only holders of record of our common stock at that time will be entitled to vote.

You are cordially invited to attend the annual meeting in person. Even if you plan to attend the annual meeting, please promptly sign, date and return the enclosed proxy card in the enclosed self-addressed, postage prepaid envelope. A majority of the outstanding shares of common stock entitled to vote at the annual meeting must be represented at the annual meeting, in person or by proxy, in order to constitute a quorum. Please return your proxy card in order to ensure that a quorum is obtained. It will assist us in keeping down the expenses of the annual meeting if all stockholders, whether you own a few shares or many shares, return your signed proxies promptly. If you hold through a broker, you might also have the option of voting by phone or internet.

If you are a holder of record and attend the annual meeting, you may vote your shares of common stock in person if you wish, even if you have previously returned your proxy card. If you hold our stock through a broker (or other nominee) and you wish to vote in person at the meeting, you must first obtain from your broker (or other nominee) a proxy issued in your name.

YOUR VOTE IS IMPORTANT. Please return your proxy card today.

| | | By Order of the Board of Directors

of Golf Trust of America, Inc., |

|

|

|

| | | Scott D. Peters

Secretary |

PROXY STATEMENT

This proxy statement dated October 18, 2004, is furnished in connection with the solicitation of proxies by the board of directors of our company, Golf Trust of America, Inc., for use at our 2004 annual meeting of stockholders, which will be held on Friday, November 19, 2004. This proxy statement and the accompanying proxy card will be first mailed to stockholders on or about October 20, 2004.

Table of Contents

| Voting Procedures | | 2 |

Proposal 1: Election of Directors |

|

3 |

Other Matters at the Meeting |

|

4 |

The Board of Directors |

|

4 |

Directors and Officers |

|

8 |

Report of the Compensation Committee on Executive Compensation |

|

14 |

Annual Report of the Audit Committee |

|

17 |

Stock Performance Chart |

|

18 |

Registered Independent Public Accounting Firm |

|

19 |

Security Ownership of Management and Five-Percent Stockholders |

|

20 |

Certain Relationships and Related Transactions |

|

22 |

Cost of Solicitation |

|

22 |

Section 16(a) Beneficial Ownership Reporting Compliance |

|

22 |

Stockholder Proposals for the 2005 Annual Meeting |

|

23 |

Appendix: Charter of the Audit Committee |

|

A-1 |

Our principal executive offices are located at 10 North Adger's Wharf, Charleston, South Carolina 29401. We will provide a copy of our company's annual report on Form 10-K, as filed earlier this year with the Securities and Exchange Commission and previously mailed to stockholders, without charge to any stockholder who so requests in writing to Golf Trust of America, Inc., 10 North Adger's Wharf, Charleston, South Carolina 29401, Attention: Investor Relations.

1

VOTING PROCEDURES

You have two choices regarding the election of directors at the upcoming annual meeting. You may:

- •

- vote for the director nominee; or

- •

- withhold authority to vote for the director nominee.

A proxy card is enclosed for your use. You are solicited on behalf of the board of directors to sign, date and return the proxy card in the accompanying envelope, which is postage prepaid if mailed in the United States. If you hold your shares through a broker, you might also have the opportunity to vote by phone or over the internet; please refer to the separate instructions enclosed by your broker. Stockholders of record may vote by completing and returning the enclosed proxy card prior to the annual meeting, by voting in person at the annual meeting or by submitting a signed proxy card at the annual meeting.

YOUR VOTE IS IMPORTANT. You are urged to sign and return the accompanying proxy card regardless of how many or few shares you own and whether or not you plan to attend the meeting.

You may revoke your proxy at any time before it is actually voted at the annual meeting by:

- •

- delivering written notice of your revocation to the Secretary of Golf Trust of America, Inc., at 10 North Adger's Wharf, Charleston, South Carolina 29401;

- •

- submitting a later dated proxy; or

- •

- attending the annual meeting and voting in person.

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the meeting, you must obtain from the record holder a proxy issued in your name.

Attendance at the annual meeting will not, by itself, constitute revocation of the proxy. You may also be represented by another person present at the annual meeting by executing a form of proxy designating such person to act on your behalf.

Each unrevoked proxy card properly signed and received prior to the close of the annual meeting will be voted as indicated. Unless otherwise specified on the proxy, the shares represented by a signed proxy card will be voted FOR the director nominee named in Proposal 1 on the proxy card and will be voted in the discretion of the persons named as proxies on any other business that may properly come before the annual meeting.

Shares Entitled to Vote and Required Vote

The presence at the annual meeting, in person or by proxy, of a majority of the shares of our company's sole class of common stock issued and outstanding as of October 8, 2004 will constitute a quorum. On October 8, 2004, 7,372,788 shares of common stock were outstanding. A quorum is necessary for the transaction of business at the annual meeting. A majority of the votes cast at the annual meeting, assuming a quorum is present, is sufficient to take or authorize action upon any matter that may properly come before the annual meeting (unless a supermajority is required by law, the terms of our charter or the terms of the proposal). A plurality of all the votes cast at the annual meeting, assuming a quorum is present, is sufficient to elect a director. Each share of common stock is entitled to one vote.

We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as not voting for purposes of determining the approval of any matter submitted to the stockholders for a vote. If a broker indicates on the enclosed proxy or its

2

substitute that it does not have discretionary voting authority as to certain shares to vote on a particular matter (which is known as a "broker non-vote"), those shares will be treated as abstentions with respect to that matter. Votes cast at the annual meeting will be tabulated by the representative of our transfer agent who we will appoint to act as inspector of election for the annual meeting.

PROPOSAL 1:

ELECTION OF DIRECTORS

Our company's charter provides for the five members of our board of directors to be divided into three classes serving staggered terms. The term of the one Class III director is ending this year on the date of the upcoming annual meeting. The terms of the Class II and Class I directors will end on the dates of the annual meetings to be held in the years 2005 and 2006, respectively. In addition, directors serve until their successors have been duly elected and qualified or until the directors resign, become disqualified or disabled, or are otherwise removed.

This Year's Nominee

The nominating committee of our board of directors has nominated the current Class III director, whose term is expiring, to stand for re-election at the upcoming annual meeting. This director is Mr. Scott D. Peters. If re-elected, this director will serve until the 2007 annual meeting and until his successor is elected and qualified (or until the earlier dissolution of our company pursuant to our ongoing plan of liquidation).

Mr. Roy C. Chapman, our other Class III director, died unexpectedly on July 6, 2004. While the board of directors remains fixed at six (6), at this time the board of directors has decided not to fill the vacancy resulting from Mr. Chapman's death. You may not vote your proxy for more than one nominee for director.

Directors will be elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the annual meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of Mr. Peters. If Mr. Peters unexpectedly becomes unavailable for election, proxies will be voted for the election of a person selected as a nominee in his place by the board of directors.

Information about Mr. Peters is set forth below.

Name

| | Age

| | Position

| | Year First

Elected to

Board

|

|---|

| Scott D. Peters | | 46 | | Chief Financial Officer, Senior Vice President, Secretary and Director | | 1999 |

Biographical Information

Scott D. Peters is our Chief Financial Officer, Senior Vice President and Secretary. He has been an officer of our company since our initial public offering in 1997. Mr. Peters was appointed by the Board to fill a vacancy created by a board member's resignation in late 1999. A stockholder vote confirmed Mr. Peter's appointment at the 2000 annual meeting and re-elected him to a three-year term at the 2001 annual meeting. In September 2004, Mr. Peters accepted a position as the Executive Vice President and Chief Financial Officer at Triple Net Properties in Santa Ana, California. Mr. Peters also serves as a member of the Board of Managers of Triple Net Properties. As part of his duties at Triple Net Properties, Mr. Peters serves as Chief Financial Officer of three real estate investment trusts: A REIT, G REIT and T REIT. In addition, Mr. Peters continues to serve as our company's Chief Financial Officer, Senior Vice President and Secretary through March 31, 2005 pursuant to the terms

3

of his amended and restated employment agreement. From 1992 through 1996, Mr. Peters served as Senior Vice President and Chief Financial Officer of the Pacific Holding Company in Los Angeles, where he participated in the management of a 4,000 acre real estate portfolio consisting of residential, commercial and country club properties focusing on master planned golf communities. From 1988 to 1992, Mr. Peters served as Senior Vice President and Chief Financial Officer of Castle & Cooke Homes, Inc. From 1986 to 1988, Mr. Peters worked with a general partnership that managed the construction of the Scottsdale Princess Resort. Mr. Peters is a Certified Public Accountant who worked with Arthur Andersen & Co. and Laventhol & Horwath from 1981 to 1985. He received a Bachelor of Arts degree in Accounting and Finance with honors from Kent State University.

Recommendation of our Board of Directors on Proposal 1:

Our board of directors recommends that stockholders vote FOR the election of Mr. Peters to serve as a director of our company.

OTHER MATTERS AT THE MEETING

Our board of directors does not know of any matters to be presented at the annual meeting other than those mentioned in this proxy statement. If any other matters are properly brought before the annual meeting, the persons named in the accompanying proxy intend to vote on such matters in accordance with their best judgment.

THE BOARD OF DIRECTORS

Our board of directors was composed of seven directors from the time of our initial public offering in February 1997 until February 2001, when Mr. Larry D. Young resigned as expected in connection with our plan of liquidation. Following Mr. Young's departure, our board of directors formally reduced the size of our board from seven to six members. On July 6, 2004, Mr. Chapman, a member of our board of directors, died unexpectedly. We currently have five members on our board of directors.

Three of our five directors are independent under Rule 121(A) of the rules of the American Stock Exchange, or Amex, and receive no compensation, directly or indirectly, from our company other than for their services as directors. We refer to these three directors as our independent directors. The board met eighteen times in 2003; the audit committee met twelve times; the compensation committee met one time; and the nominating committee met one time. Each of the directors either attended or participated by telephone in at least 75% of the total number of meetings of the board of directors and of the committees of the board of which he was a member.

Committees

Audit Committee. The board of directors has established an audit committee to oversee our financial reporting process on behalf of the board of directors. Mr. Jones is the chairman of the audit committee. The audit committee consists of Messrs. Wax, Reams and Jones, each of whom is independent under the rules of the Amex. Each member of our audit committee also meets the criteria for independence set forth in Rule 10A-3(b)(1) under the Exchange Act of 1934, as amended. None of the members of our audit committee has participated in the preparation of our financial statements or those of our subsidiaries during the past three years, and all are able to read and understand fundamental financial statements. The audit committee's role is to select the independent public accountants, to review with the independent public accountants the plans and results of the audit engagement, to approve professional services provided by the independent public accountants, to review the independence of the independent public accountants, to consider the range of audit and non-audit fees and to review the adequacy of our company's internal accounting controls. Management has the primary responsibility for the financial statements and the reporting process including the systems of

4

internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements. The audit committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards. While financially literate under the applicable rules of the Amex, the members of the audit committee are not currently professionally engaged in the practices of accounting or auditing and are not all experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the audit committee rely without independent verification on the information provided to them and on the representations made by management and our auditors, BDO Seidman, LLP. Accordingly, the audit committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The audit committee's reviews, considerations and discussions do not provide assurance that BDO Seidman's audit of our financial statements was carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America or that our public accountants are in fact "independent."

Our "audit committee financial expert," as defined by the rules of the Securities and Exchange Commission, was the late Mr. Roy C. Chapman. Following Mr. Chapman's death, Mr. Fred W. Reams became our new "audit committee financial expert." As required by the rules of the Securities and Exchange Commission, the audit committee members supplied a report regarding its recommendation that we include our audited 2003 financial statements in our Form 10-K. The report appears elsewhere in this proxy statement. The audit committee operates pursuant to a written amended and restated charter approved by our board of directors. The charter appears as an appendix to this proxy statement.

The immediately preceding paragraph is not proxy soliciting material and shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act, or the Exchange Act.

�� Compensation Committee. The board of directors has established a compensation committee to determine compensation, including granting awards under our stock incentive plans, for our officers. However, we do not intend to make any further option awards to our executives or to any other person. The compensation committee consists of Messrs. Wax, Reams and Jones, each of whom is independent under the rules of the Amex. The chairman of the compensation committee is Mr. Wax (who replaced Mr. Chapman upon his death in July 2004).

Nominating Committee. The board of directors has established a nominating committee to nominate individuals for election to the board of directors. The nominating committee consists of Messrs. Wax, Reams and Jones, each of whom is independent under the rules of the Amex. The chairman of the nominating committee is Mr. Reams. The nominating committee does not have a charter.

Criteria for Board Membership. In selecting candidates for appointment or re-election to our board of directors, our nominating committee considers the appropriate balance of experience, skills and characteristics required of our board of directors, and seeks to insure that at least a majority of

5

our directors are independent under the rules of the Amex, that members of our audit committee meet the financial literacy and sophistication requirements under the rules of the Amex and that at least one of them qualifies as an "audit committee financial expert" under the rules of the Securities and Exchange Commission. Nominees for director are selected on the basis of their depth and breadth of experience, integrity, leadership, ability to make sound business judgments, ability to read and understand basic financial statements, understanding of our business environment, and willingness to devote adequate time to board duties. Other factors considered in evaluating nominees for director include whether the nominee will complement our board's existing strengths, with particular emphasis placed on skills relating to our expected activities, including the efficient completion of our liquidation.

Stockholder Nominees. Our nominating committee will consider nominees recommended by security holders. Any such nominations should be submitted to the chairman of our nominating committee, Mr. Reams, c/o Scott D. Peters at the address of our principal executive offices and should include the following information: (a) the name, address and phone number of the stockholder making the nomination and a statement of the number of shares of our common stock beneficially owned by the stockholder making the nomination during the year preceding the date of nomination; (b) the nominee's name, address and phone number; and (c) a statement of the nominee's qualifications for board membership, and should be submitted in the time frame described in our bylaws and under the caption "Stockholder Proposals for the 2005 Annual Meeting" below.

Process for Identifying and Evaluating Nominees. Our nominating committee believes we are well served by our current directors. Our nominating committee will consider the re-nomination of incumbent directors who are willing to continue as directors based on their continuing qualification under the criteria for board membership. In addition, our nominating committee will assess each incumbent director's performance during his term, the number of meetings attended, his level of participation and overall contribution, the number of other company boards on which the individual serves, the individual's effect on the composition of our board of directors, and any changed circumstances affecting the individual director which may bear on his ability to continue to serve on our board of directors. Although re-nomination of incumbent directors is not automatic, incumbent directors may have an advantage if they have demonstrated during their term a keen understanding of our business and an ability to function well with our board of directors and management. Potential nominees may also come to our nominating committee's attention from the following sources, among others: third-party search firms; stockholder suggestions; and our management. After reviewing appropriate biographical information and qualifications of all candidates, the best qualified first-time candidates will be interviewed by at least one member of our nominating committee and by our chief executive officer. Our nominating committee will consider the chief executive officer's opinion regarding the candidate, but shall not give it dispositive weight. Our nominating committee will then select the potential candidates to be recommended to our board of directors for nomination at the annual meeting. Our board of directors is expected, but not required, to select its official nominees only from candidates recommended by our nominating committee. The rules of the Amex require our board's ultimate nominees to be selected either from our nominating committee's list or by a majority of the independent directors.

Board Nominee for the 2004 Annual Meeting. The nominee listed in this proxy statement, Scott D. Peters, is a current director standing for re-election.

Other Committees. The board of directors may, from time to time, form other committees as circumstances warrant. Any additional committees will have authority and responsibility as may be delegated by the board of directors, to the extent permitted by Maryland law. During 2001, the board had two such committees, the strategic alternatives working committee, comprised of Messrs. Blair and Wax, which was created to work with our financial advisor, and an independent committee, composed of the four independent directors, which was created to review and make a recommendation regarding

6

the Legends transaction and agreement. During 2002 and 2003, these two committees did not meet and no other committees were created.

Compensation of Directors

We pay our independent directors fees for their services as directors. Independent directors receive annual compensation of $10,000, plus a fee of $1,000 for attendance at each meeting of the board of directors (whether in person or telephonically), and $500 for attending each committee meeting. Directors who are not independent directors are not paid any director fees. We reimburse directors for their reasonable and documented out-of-pocket travel expenses. Under our non-employee directors' stock option plan, at the time of our initial public offering and on the first four anniversaries of our initial public offering, our three independent directors received automatic annual grants of options to purchase 5,000 shares of our common stock at the stock's fair market value on the date of grant. All grants to our independent directors were fully vested on the grant date and expire ten years from the date of grant. Upon the February 2001 grant, the shares available under our non-employee directors' stock option plan were exhausted and no options have been granted to our independent directors since that time.

Directors and Officers Insurance

We maintain directors and officers liability insurance. Directors and officers liability insurance insures our officers and directors from claims arising out of an alleged wrongful act by such persons while acting as directors and officers of our company, and it insures our company to the extent that we have indemnified the directors and officers for such loss.

Indemnification

Our charter provides that we shall indemnify our officers and directors against certain liabilities to the fullest extent permitted under applicable law. The charter also provides that our directors and officers shall be exculpated from monetary damages to us to the fullest extent permitted under applicable law.

Communications with Directors

Our stockholders or other interested parties may communicate with any director or committee of our board of directors by contacting Scott D. Peters at Golf Trust of America, Inc., 10 North Adger's Wharf, Charleston, South Carolina 29401. Communications directed to the full board will be distributed to each director, communications directed to a specific director will be forwarded to that director and communications to the "independent" or non-employee directors (or words of similar effect) shall be forwarded to the chair of our audit committee.

We have a policy of encouraging all directors to attend our annual stockholders' meetings. All of our directors attended the 2003 annual meeting.

7

DIRECTORS AND OFFICERS

Set forth below is information regarding our directors and executive officers. Subject to severance compensation rights under their employment agreements, officers serve at the pleasure of the board of directors.

Name

| | Age

| | Position

| | Year First

Elected to

Board

| | Current

Term

Expires

|

|---|

W. Bradley Blair, II |

|

61 |

|

Chief Executive Officer, President and Chairman of the Board of Directors |

|

1997 |

|

2005 |

Scott D. Peters |

|

46 |

|

Chief Financial Officer, Senior Vice President, Secretary and Director |

|

1999 |

|

2004 |

Raymond V. Jones(1)(2)(3) |

|

56 |

|

Independent Director |

|

1997 |

|

2005 |

Fred W. Reams (1)(2)(3) |

|

61 |

|

Independent Director |

|

1997 |

|

2006 |

Edward L. Wax (1)(2)(3) |

|

67 |

|

Independent Director |

|

1997 |

|

2006 |

- (1)

- Nominating Committee Member

- (2)

- Audit Committee Member

- (3)

- Compensation Committee Member

Biographical Information

W. Bradley Blair, II is our Chief Executive Officer, President, and Chairman of the board of directors. He has been an officer of our company since our initial public offering in 1997. From 1993 until our initial public offering in February 1997, Mr. Blair served as Executive Vice President, Chief Operating Officer and General Counsel for The Legends Group. As an officer of The Legends Group, Mr. Blair was responsible for all aspects of operations, including acquisitions, development and marketing. From 1978 to 1993, Mr. Blair was the managing partner at Blair Conaway Bograd & Martin, P.A., a law firm specializing in real estate, finance, taxation and acquisitions. Mr. Blair earned a Bachelor of Science degree in Business from Indiana University and a Juris Doctorate degree from the University of North Carolina at Chapel Hill Law School.

Raymond V. Jones is an independent director under the rules of the Amex. From 1984 to 1994 he was Managing Partner of Summit Properties Limited Partnership before it went public in 1994. From 1994 until retiring in March 1998, Mr. Jones was the Executive Vice President of Summit Properties Inc. Summit is a publicly traded REIT listed on the New York Stock Exchange and is one of the largest developers and operators of luxury garden multifamily apartment communities in the Southeastern United States. While at Summit, Mr. Jones oversaw the development of 26 communities comprising nearly 6,500 apartment homes in Georgia, North Carolina, South Carolina and Ohio. Prior to 1984, Mr. Jones served as General Operations Manager for both the Charlotte and Houston divisions of Ryan Homes, Inc. Mr. Jones earned a Bachelor of Arts degree in Political Science from George Washington University.

Fred W. Reams is an independent director under the rules of the Amex. From 1981 until his retirement on March 31, 2004, Mr. Reams served as the Chairman or President and Chief Investment Officer of Reams Asset Management Company, LLC, an independent private investment firm which he co-founded. From 1967 to 1981, Mr. Reams was employed in various investment management positions

8

with the First National Bank of Michigan, Irwin Management Company, and Cummins, Inc. In addition, Mr. Reams served as President of the board of directors of the Otter Creek Golf Course from 1981 through 2003. Mr. Reams holds a Bachelor of Arts degree and a Master of Arts degree in Economics from Western Michigan University.

Edward L. Wax is an independent director under the rules of the Amex. Mr. Wax is currently Chairman Emeritus of Saatchi & Saatchi, a worldwide advertising and ideas company. From 1992 until his appointment to his current position in 1997, Mr. Wax served as Chairman and Chief Executive Officer of Saatchi & Saatchi. Mr. Wax had been responsible at Saatchi for the operations of 143 offices in 87 countries. Mr. Wax's employment by Saatchi & Saatchi began in 1982. Mr. Wax was formerly Chairman of The American Association of Advertising Agencies as well as a director of both the Ad Council and the Advertising Educational Foundation. Mr. Wax also serves on the board of directors of Dollar Thrifty Automotive Group. Mr. Wax holds a Bachelor of Science degree in Chemical Engineering from Northeastern University and a Masters in Business Administration degree from the Wharton Graduate School of Business.

Biographical information for Mr. Peters appears on page 3 above.

Executive Compensation

We currently have two executive officers, Messrs. Blair and Peters, whom we sometimes refer to as our named executive officers. The following table sets forth for the fiscal years ended December 31, 2003, 2002, and 2001, compensation awarded or paid to, or earned by, each of the named executive officers.

Summary Compensation Table

| |

| | Annual Compensation

| | Long Term Compensation

| |

| |

|---|

Name and Principal Position

| | Fiscal

Year

| | Salary(1)

| | Bonus

| | Other Annual

Compensation

| | Restricted

Stock

Awards

| | Securities

Underlying

Options

| | All Other

Compensation

| |

|---|

W. Bradley Blair, II

Chief Executive Officer, and Chairman of the Board | | 2003

2002

2001 | | $

$

$ | 374,538

365,760

359,583 | | $

| —

—

— | | $

| —

—

— | | —

—

— | | —

—

— | | $

$ | 1,815,523

—

3,397,645 | (2)

(2) |

Scott D. Peters

Chief Financial Officer, Senior Vice President and Secretary |

|

2003

2002

2001 |

|

$

$

$ |

190,586

203,200

197,826 |

|

|

—

—

— |

|

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

$

$ |

1,156,680

—

1,344,039 |

(2)

(2) |

- (1)

- Amounts shown for all years exclude car allowances paid to Mr. Blair in the amount of $12,000 per year. Amounts shown for all years exclude car allowances paid to Mr. Peters in the amount of $7,200 per year in 2001 and 2002, and $5,400 per year in 2003.

- (2)

- We entered into written employment agreements with W. Bradley Blair, II and Scott D. Peters at the time of our initial public offering. On February 25, 2001, the employment agreements were amended and restated to provide that when the stockholders adopted a plan of liquidation, the executives became ineligible for further stock based awards or compensation committee determined performance bonuses. Instead of being eligible for stock-based awards or performance bonuses, the executives received retention bonuses upon the effective date of the amended employment agreements equal to $1,233,907 for Mr. Blair and $660,921 for Mr. Peters, as well as accelerated vesting of all previously granted stock based compensation both also became eligible for two additional bonuses upon our achievement of predefined performance milestones. Such acceleration occurred on February 25, 2001 and we paid the retention bonuses shortly thereafter. In addition, on February 25, 2001, as a result of the board's adoption of the plan of liquidation, all of our outstanding loans to our executives, $2,163,738 for Mr. Blair and $683,118 for Mr. Peters, were forgiven pursuant to the terms of their existing promissory notes as discussed under the heading "Employment Agreements" below. Under the

9

then-existing amended and restated employment agreements, performance milestone payments aggregating approximately $2,526,000 were paid to our executives upon our repayment of our obligations under our secured credit facility led by Bank of America, N.A. One fourth of the remaining earned milestone payment of $165,230 plus accrued interest due to Mr. Peters was paid on September 30, 2003 pursuant to his fourth amended and restated employment agreement. In his fourth amended and restated employment agreement, Mr. Peters agreed to accept delayed payment of the remaining milestone payments to correspond with net cash proceeds that we received from sales of our assets. An additional one fourth of the remaining earned milestone payment plus accrued interest was due on August 26, 2004 when we sold golf course assets resulting in more than $1,200,000 of net cash proceeds. The remaining half of the remaining earned milestone payment plus accrued interest was due to Mr. Peters on September 24, 2004 when we sold golf course assets resulting in more than $2,500,000 of net cash proceeds. We have paid Mr. Peters only $330,460 of the remaining earned milestone payment since September 30, 2003, and the remaining $165,230 will be paid to Mr. Peters in due course. On October 1, 2003, interest began to accrue on the unpaid portion of Mr. Peters' remaining earned milestone payment at 5% per annum. This interest continues to accrue. Mr. Blair is also entitled to an additional performance milestone payment of approximately $1,234,000, plus accrued interest, due to the repayment of the outstanding balance under our credit facility. Such payment will be made to Mr. Blair in due course. All conditions to payment are satisfied. Any severance payments otherwise payable under the amended and restated employment agreements will be reduced by the amount of the performance milestone payments discussed above that we have made.

Option Grants in 2003

We did not grant any options to our named executive officers in 2003. Our only option grants since January 1, 2001 were the automatic grants of 5,000 options to each of our four independent directors in February 2001. Following those grants, our non-employee directors' option plan was exhausted and it will not be renewed. We do not expect to make any further option awards to our directors, officers or any other person.

Option Exercises in 2003 and Year-End Option Values

There were no option exercises during the fiscal year ended December 31, 2003 by any of our executive officers or any of our independent directors. The following table describes the exercisable and unexercisable options held by each of the named executive officers as of December 31, 2003. The value of unexercised in-the-money options at December 31, 2003 is based on a value of $2.48 per share, the prior closing price of our common stock on the Amex on December 31, 2003.

2003 Option Exercises and Year-End Holdings

| |

| |

| |

| |

| | Value of Unexercised

In-The-Money

Options at

December 31, 2003(1)

|

|---|

| |

| |

| | Number of Securities Underlying Unexercised

Options at

December 31, 2003

|

|---|

| | Shares

Acquired

On

Exercise

| |

|

|---|

Name

| | Value

Received

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| W. Bradley Blair, II | | — | | — | | 640,000 | | — | | — | | — |

Scott D. Peters |

|

— |

|

— |

|

285,000 |

|

— |

|

— |

|

— |

Employment Agreements

We entered into written employment agreements with W. Bradley Blair, II and Scott D. Peters at the time of our initial public offering. Both agreements have been amended and restated. The amended and restated employment agreement of Mr. Blair was included as an exhibit to our current report on Form 8-K filed March 12, 2001. Mr. Blair's employment agreement was amended further by that certain letter agreement included as exhibit 10.16.3 to our annual report on Form 10-K filed March 31, 2004. The employment agreement of Mr. Peters that is currently in effect was included as an exhibit to

10

our current report on Form 8-K, filed October 9, 2003. The employment agreements of Messrs. Blair and Peters, as amended through the date of this proxy statement, include the following provisions:

Salary. The amended employment agreement for Mr. Blair executed on February 25, 2001 provides for an annual base salary of $360,000, with automatic annual cost of living increases based on the increase, if any, in the consumer price index. However, we entered into a letter agreement with Mr. Blair on March 22, 2004 which provides for Mr. Blair to receive a reduced base salary from us as of April 1, 2004 and for a corresponding reduction in the amount of time he is required to devote to us. As a result, effective April 1, 2004, Mr. Blair will receive an annual salary of $286,241, or seventy-five percent of his current base salary of $381,654. In addition, effective January 1, 2005, Mr. Blair will receive a further reduced annual base salary of $190,827.

In addition, the fourth amended and restated employment agreement for Mr. Peters provides for quarterly compensation of $12,000 plus additional compensation at a rate of $150 per hour for hours worked that exceed eighty hours per quarter. Also pursuant to this agreement, Mr. Peters agreed to accept delayed payment of the remaining milestone payments to correspond with net cash proceeds that we received from sales of our golf course assets. Commencing October 1, 2003, interest is accruing on the unpaid portion of Mr. Peters' remaining earned milestone payment at five percent per annum.

Bonuses. Under the employment agreements, as amended in 2001, the eligibility of our named executives for normal performance bonuses and stock based awards terminated upon the approval of the plan of liquidation by our stockholders. Upon such approval of the plan of liquidation, the applicable amended employment contracts provided for Retention Bonuses and Forgiveness of Indebtedness and Performance Milestone Bonuses, each as described below:

- •

- Retention Bonuses and Forgiveness of Indebtedness. The Retention Bonuses were designed to recognize services rendered by the named executives (including, without limitation, services rendered in assisting in the creation of the plan of liquidation, negotiating the agreements with Legends and our Series A preferred stock holder, and seeking to achieve resolutions of various issues with our lenders). Pursuant to their amended and restated employment agreements, Messrs. Blair and Peters received Retention Bonuses of $1,233,907 and $660,921, respectively, on February 25, 2001. In addition, in recognition of their services and pursuant to their amended and restated employment agreements, their options and restricted stock awards immediately vested in full at that time. All of the options that became fully vested are at the present time "out of the money." Pursuant to the terms of the executives' existing promissory notes, which were not modified, the named executives' debt to us, in the amount of $2,163,738 for Mr. Blair and $683,118 for Mr. Peters, was automatically forgiven upon board adoption of the plan of liquidation on February 25, 2001.

- •

- Performance Milestone Bonuses. As a result of our achievement of all milestones stated below, Messrs. Blair and Peters have earned and are entitled to payment of the additional cash Performance Milestone Bonuses shown below:

| | Bonus Payment*

|

|---|

Performance Milestone

| | Blair

| | Peters

|

|---|

| Stockholder approval of plan of liquidation and repayment of all our debt** | | $ | 1,645,210 | | $ | 881,228 |

| Later of (a) repayment of all our debt** and (b) February 25, 2002, i.e., 12 months after board approval of the plan of liquidation | | $ | 1,233,907 | | $ | 660,921 |

- *

- Plus interest from the date of stockholder approval of the plan of liquidation.

- **

- Including debt of our operating partnership, but excluding routine trade creditor debt not yet due and excluding debt that we have agreed to keep outstanding for the benefit of limited partners.

11

Performance milestone bonus amounts, which include accrued interest, were paid to our named executives as follows: (i) $1,815,523 to Mr. Blair on June 19, 2003; (ii) $972,453 to Mr. Peters on June 19, 2003; (iii) $184,227 to Mr. Peters on September 30, 2003; (iv) $191,649 to Mr. Peters on August 27, 2004; and (v) $191,794 to Mr. Peters on September 27, 2004. The amounts remaining to be paid are $1,233,907, plus accrued interest, to Mr. Blair and $165,230, plus accrued interest, to Mr. Peters.

Term. Pursuant to Mr. Blair's amended and restated employment agreement, our board has the right, upon 45 days notice, to terminate him without good reason and without any obligation to pay further severance payments following the date on which the final milestone payment is made. Prior to such time, if we terminate Mr. Blair without "good reason" or if he resigns for "good cause" we would be required to make additional payments to him pursuant to his amended and restated employment agreement. We would have "good reason" to terminate an executive's employment if he engaged in gross negligence, willful misconduct, fraud or material breach of his employment agreement. Each executive would have "good cause" to resign in the event of any material reduction in his compensation or benefits, material breach or material default by us under the applicable employment agreement or following a change in control of our company. The additional payment at this point in time would be an amount equivalent to the earned but unpaid Performance Milestone Bonus.

Extension of Non-Recourse Tax Loans Secured by Stock. Upon each non-cash benefit payment (i.e., debt forgiveness and stock award acceleration) occurring concurrently with the board's adoption of the plan of liquidation, our executives incurred tax liability, but were unable to fund such liability by selling our common stock because of federal securities law restrictions and other concerns. Pursuant to the amended and restated employment agreements, we extended to each executive a non-recourse loan in the amount necessary to cover such personal income tax liability. On the date it was made, each loan was secured by a number of shares of our stock with a then-current market value equal to the amount of the loan. Interest accrues at the applicable federal rate and is added to principal. Any distributions on the pledged shares prior to maturity are applied to loan service. Each executive has the right, prior to maturity, if the loan is then over-secured, to sell the pledged stock on the open market, provided that the proceeds are first applied to outstanding principal and interest on the loan. These loans are more fully described below under the caption "Certain Relationships and Related Transactions—Indebtedness of Management."

As a result of the letter agreement that we entered into with Mr. Blair on March 22, 2004, Mr. Blair agreed to irrevocably assign to us the shares of our common stock which secure the above-mentioned non-recourse loan previously made to Mr. Blair in the amount of $1,150,320 and we agreed to cancel such loan.

Covenants Not to Compete

In Mr. Blair's applicable amended and restated employment agreement, he has agreed not to engage in any competitive businesses. He also agreed not to compete directly with us or in a business similar to ours during his employment. However, Mr. Blair may continue to invest in certain residential real estate developments and resort operations.

Under Mr. Peters' applicable amended and restated employment agreement, he was required to devote substantially all of his full working time to our business only until September 30, 2003. However, while he remains employed by us, and for one year after his termination or resignation, Mr. Peters may not:

- •

- compete directly with us in a similar business;

- •

- compete directly or indirectly with us, our subsidiaries, partners, potential golf course buyers, potential buyers (and/or their affiliates), potential buyers of our preferred stock or debt (or any of their affiliates) with respect to any acquisition or development of any real estate project

12

Notwithstanding the above limitations, Mr. Peters may be employed by a business that competes with us so long as he does not have direct or indirect responsibility for any interaction with, or analysis of, our company and is wholly screened-off from such interaction and analysis by the competitive business.

Change of Control Agreements

Mr. Blair's amended and restated employment agreement provides that he will have "good cause" to resign upon a change of control and, in that case, all of his stock options and restricted stock would vest in full and he would be entitled to severance payments, minus the previously paid retention bonus and any milestone payments in connection with the plan of liquidation described above. The amended and restated employment agreements of our named executive officers provide that if any payment by or on behalf of our company or our operating partnership to either executive qualifies as an excess parachute payment under the tax code, we shall make additional payments in cash to the executive (so called gross-up payments) so that the executive is put in the same after-tax position as he would have been had no excise tax been imposed by the tax code.

Compensation Committee Interlocks and Insider Participation

During fiscal year 2003, our compensation committee members were Roy C. Chapman, Fred W. Reams and Edward L. Wax. During 2003, Raymond V. Jones also routinely attended compensation committee meetings by invitation, and he became a member of the compensation committee in 2004. During fiscal year 2003 and fiscal year 2004 to date, our compensation committee has been comprised solely of directors who are independent under the rules of the Amex.

None of the members of our compensation committee was at any time since our formation an officer or employee of our company. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

13

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act or the Exchange Act. The following report describes our executive officers' compensation for the 2003 fiscal year, including the changes to the executives' compensation arrangements implemented in connection with the plan of liquidation.

Responsibilities of the Company's Compensation Committee. Our executive compensation program is administered under the direction of the compensation committee of our board of directors, which is comprised of three independent directors. The specific responsibilities of the compensation committee are to:

- 1.

- administer our executive compensation program;

- 2.

- review and approve compensation awarded to the executive officers pursuant to the executive compensation program;

- 3.

- monitor our performance in relation to the performance of the executive officers;

- 4.

- monitor performance of the executive officers in view of the board of directors' strategic objectives;

- 5.

- monitor compensation awarded to the executive officers in comparison to compensation received by executive officers of other similar companies; and

- 6.

- develop procedures to help assure executive retention and succession.

Philosophy of the Compensation Committee. The philosophy of the compensation committee as reflected in the specific compensation plans included in the executive compensation program is to:

- 1.

- retain (to the extent necessary) and reward experienced, highly motivated executive officers who are capable of effectively leading our liquidation of the company pursuant to the plan of liquidation; and

- 2.

- reward and encourage executive officer activity that results in enhanced value for stockholders pursuant to the plan of liquidation.

Elements of Compensation. The compensation committee believes that the above philosophy can best be implemented through two separate components of executive compensation with each component designed to reward different performance goals, yet have the two components work together to satisfy the ultimate goal of enhancing stockholder value in the context of the plan of liquidation. The two elements of executive compensation are:

- 1.

- salary, which compensates the executive for performing the basic job description through the performance of assigned responsibilities; and

- 2.

- cash bonuses, which reward the executive for commendable performance of special designated tasks or outstanding performance of assigned responsibilities during the fiscal year pertaining to the plan of liquidation exceeding the compensation committee's expectations.

These elements for the year 2003 are discussed next.

Base Salary. As required by his amended and restated employment agreement, the base salary of Mr. Blair increased for the year 2003 over 2002 by the increase in the consumer price index as a cost of living adjustment. Based on the reduction of duties in his amended and restated employment agreement, Mr. Peters' base salary for 2003 was reduced from his base salary for 2002.

14

Cash Bonuses. During early 2001, the compensation committee undertook its planning responsibilities in a context which differed from prior years. Notable differences included the ongoing strategic alternatives analysis process, and extrinsic factors such as eroding golf course industry economics, the continued constriction of capital availability and the continuing problems being realized by the small-cap, triple net lease sector of the REIT community. These factors presented a challenge to the compensation committee as we sought to balance the objectives of fair compensation in the face of an eroding stock price, particularly in the context of the need for management continuity with respect to the strategic alternatives analysis process and the plan of liquidation.

When the Board was nearing a conclusion that it might adopt a plan of liquidation for submission to the stockholders, the compensation committee determined that modifications to the employment agreements of Messrs. Blair and Peters should be made. In particular, the compensation committee believed that the change of control definition, which had been in place in their original employment agreements executed in February 1997 (the time of our initial public offering), should be modified for the benefit of stockholders in the context of the possible Board adoption of a plan of liquidation.

Pursuant to the amended and restated employment agreements, the executives' right to performance bonuses and stock based awards terminated upon stockholder approval of the plan of liquidation. Instead, the amended and restated employment agreements provided for a retention bonus, which was paid when our board adopted the plan of liquidation, and two performance milestones to be paid if and when the remaining milestones were met. As described below, both milestones were met in mid-2003. The performance milestones are as follows:

- •

- stockholder approval of the plan of liquidation;

- •

- continued employment with the company for 12 months following board approval of the plan of liquidation; and

- •

- repayment of all company debt.

With the economic downturn, our implementation of the plan of liquidation is still ongoing. Both milestone bonus payments became payable on June 19, 2003, the date on which all of our bank debt was repaid. As described elsewhere in this proxy statement, we made a portion of the milestone payments shortly thereafter and we expect to pay the remainder in due course.

Following the disposition of our Sandpiper property and the corresponding reduction in demands on Mr. Peters' time, the compensation committee determined that management should seek to negotiate a reduced time commitment and a reduced salary arrangement with Mr. Peters. Accordingly, a further amended and restated employment agreement with Mr. Peters was executed on August 29, 2003. Under this amended and restated employment agreement, Mr. Peters is expected to devote a substantially reduced number of hours per calendar quarter to our company. Correspondingly, we will pay him a salary of $12,000 per quarter. To the extent that we require more of Mr. Peters' time, we will pay him on an hourly basis, up to a capped amount per diem. This arrangement was extended by mutual agreement until March 31, 2005.

In anticipation of the reduction of our asset base, the conclusion of the Innisbrook Resort settlement negotiations, our assumption of the ownership of the Innisbrook Resort and the corresponding reduction in demands on Mr. Blair's time, the compensation committee determined that management should seek to negotiate a reduced time commitment and a reduced salary arrangement with Mr. Blair. Accordingly, a further amended and restated employment agreement with Mr. Blair was executed on March 22, 2004. Under this amended and restated employment agreement, Mr. Blair is expected to devote a substantially reduced number of hours per calendar quarter to our company. Correspondingly, we will pay him an annual salary of $286,241 for 2004 and $190,827 for 2005.

15

Because our executives' right to receive their milestone performance bonuses has now vested, we face the risk that our executives might resign, even though the plan of liquidation has not yet been completed. The resignation or incapacitation of Mr. Blair poses a relatively greater risk at this time in light of the reduced time commitments to our company by Mr. Peters resulting from his commitments to additional employers. Notwithstanding Mr. Peters' concurrent employment with unaffiliated real estate companies in California, we have reached an arrangement with Mr. Peters which we believe will enable him to continue to fulfill his responsibilities as chief financial officer of our company. If Mr. Blair or Mr. Peters were to resign, we might request the remaining named executive to increase his time commitment to our company or seek to hire a replacement. We face the risk that the remaining named executive might be unwilling or unable to return to full time employment with our company due to other commitments or for other reasons. Our cost to hire a replacement would likely depend upon the experience and skills required of such an individual in light of our financial condition, our assets remaining to be liquidated, and the complexity of any issues bearing on our company and the liquidation at that time. Now that substantially more of the issues surrounding the Innisbrook Resort (our last significant asset in liquidation) are resolved, our need for a full-time executive is less significant. The compensation committee will continue to evaluate the staffing alternatives available to it as our company's liquidation progresses.

| | Respectfully submitted, |

|

By: |

|

The Compensation Committee |

|

Members: |

|

Edward L. Wax

Fred W. Reams

Raymond V. Jones

|

16

ANNUAL REPORT OF THE AUDIT COMMITTEE

The information contained in this report shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act or the Exchange Act.

In accordance with its written charter (which appears as an appendix to this proxy statement), the company's audit committee selects the company's independent accountants. The audit committee is also responsible for assisting the board of directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the company.

In this context, the audit committee has met and held discussions with management and the independent accountants to discuss our audited financial statements. Management represented to the audit committee that the company's consolidated financial statements were prepared in accordance with generally accepted accounting principles in the United States of America and according to the liquidation basis of accounting for periods subsequent to May 22, 2001, and the audit committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The audit committee discussed with the independent accountants matters required to be discussed by Statements on Auditing Standards Nos. 61 and 90 (Communication with Audit Committees), as amended.

The company's independent accountants also provided to the audit committee the written disclosures and letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as amended, and the audit committee discussed with the independent accountants that firm's independence.

Based upon the audit committee's review and discussions referred to above, the audit committee recommended that the board of directors include the audited consolidated financial statements in the company's annual report on Form 10-K for the year ended December 31, 2003, filed with the Securities and Exchange Commission.

| | Respectfully submitted, |

|

By: |

|

The Audit Committee |

|

Members: |

|

Raymond V. Jones

Edward L. Wax

Fred W. Reams

|

17

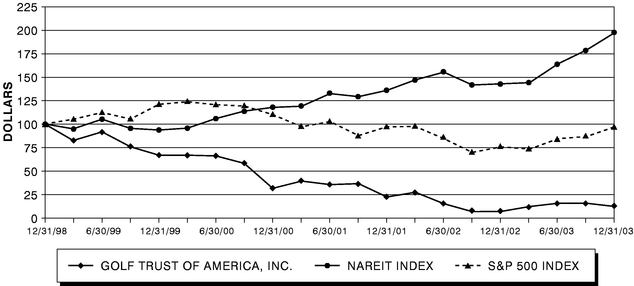

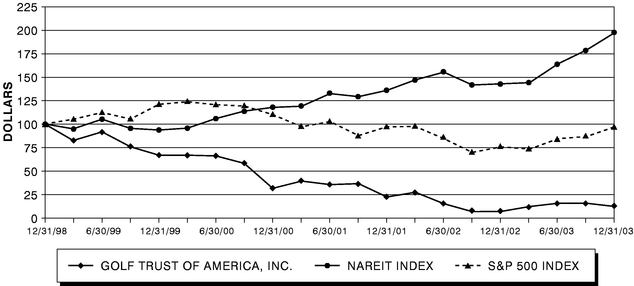

STOCK PERFORMANCE CHART

The information contained in this chart shall not be deemed to be "soliciting material" or "filed" or incorporated by reference in future filings with the Securities and Exchange Commission, or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act, or the Exchange Act.

The following graph shows the five-year cumulative total return resulting from a hypothetical $100 investment in our common stock at its closing price on December 31, 1998 through December 31, 2003, compared to the same amount invested in the Standard & Poor's, or S&P, 500 Index and the National Associate of Real Estate Investment Trusts Index, or NAREIT over the same period (in each case, assuming reinvestment of dividends). This graph is presented as required by SEC rules. The stock price performance shown on the graph is not necessarily indicative of future price performance.

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG GOLF TRUST OF AMERICA, INC.,

S&P 500 INDEX AND NAREIT INDEX

ASSUMES $100 INVESTED ON DEC. 31, 1998

ASSUMES DIVIDEND REINVESTED

18

REGISTERED INDEPENDENT PUBLIC ACCOUNTING FIRM

Since February 28, 1997, we have engaged BDO Seidman, LLP ("BDO Seidman") as our principal accountants and we expect to retain them as our principal accountants in 2004. BDO Seidman has audited our financial statements for each fiscal year beginning with fiscal year ending December 31, 1997. A representative from BDO Seidman will be present at our annual meeting, will have the opportunity to make a statement and is expected to be available to respond to appropriate questions.

Fees billed to us by BDO Seidman during each of the last two fiscal years ending December 31, 2003 and 2002, respectively, include the following:

- •

- Audit Fees: Audit fees and related expenses billed to us by BDO Seidman during each of the fiscal years ended December 31, 2003 and 2002 for audits of our annual financial statement and for reviews of financial statements included in our quarterly reports on Form 10-Q totaled $181,038 and $202,847 respectively.

- •

- Audit-Related Fees: Audit-related expenses billed to us by BDO Seidman during each of the fiscal years ended December 31, 2003 and 2002 for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, primarily advising on accounting and financial reporting matters, and are not included above totaled $13,928 and $24,357, respectively.

- •

- Tax Fees: Fees and expenses billed to us by BDO Seidman during each of the fiscal years ended December 31, 2003 and 2002 for tax services, including preparation of income tax returns and general tax consulting, totaled $92,933 and $201,990, respectively.

- •

- Other Fees: We did not have any other fees billed to us by BDO Seidman during either of the fiscal years ended December 31, 2003 and 2002.

The audit committee of our board of directors is required to pre-approve the audit and non-audit services performed by our independent auditor in order to assure that the provision of such services do not impair the auditor's independence. Prior to the beginning of our fiscal year, our audit committee pre-approves certain general audit and non-audit services up to specified cost levels. Any audit or non-audit services that are not pre-approved in this manner require specific pre-approval by our audit committee. While our audit committee may delegate pre-approval authority to one or more of its members, the member or members to whom such authority is delegated must report any pre-approval decisions to the audit committee at its next scheduled meeting. Our audit committee does not delegate its responsibilities to pre-approve services performed by the independent auditor to management.

All of the services described above were approved by the audit committee pursuant to Regulation S-X.

19

SECURITY OWNERSHIP OF MANAGEMENT AND FIVE-PERCENT STOCKHOLDERS

The following table describes, as of October 1, 2004, the beneficial ownership of common stock and common OP units held by each of our directors, by each of our executive officers, by all of our directors and executive officers as a group and by each person known to us to be the beneficial owner of 5% or more of our outstanding common stock. OP units represent limited partnership interests in Golf Trust of America, L.P., our operating partnership, and are convertible into shares of our common stock on a one-for-one basis. This table shows beneficial ownership in accordance with the rules of the Securities and Exchange Commission to include securities that a named person has the right to acquire within 60 days. However, for the sake of clarity, the table does not report beneficial ownership of OP units as beneficial ownership of common stock (even though all OP units are currently convertible into common stock) but instead, reports holdings of stock and OP units separately. Each person named in the table has sole voting and investment/disposition power with respect to all of the shares of common stock or OP units shown as beneficially owned by such person, except as otherwise set forth in the notes to the table. Unless otherwise noted, the address of each person in the table is c/o Golf Trust of America, Inc., 10 North Adger's Wharf, Charleston, South Carolina 29401.

| | Common Stock

| | Common OP Units

|

|---|

Name of Beneficial Owner

| | Number of shares

of Common Stock

| | Percentage

of Class(1)

| | Number of

OP Units

| | Percentage

of Class(2)

|

|---|

| W. Bradley Blair, II(3) | | 677,642 | | 8.46 | % | — | | — |

| Scott D. Peters(4) | | 340,625 | | 4.45 | % | — | | — |

| Raymond V. Jones(5) | | 26,000 | | * | | — | | — |

| Fred W. Reams(5) | | 25,000 | | * | | — | | — |

| Edward L. Wax(5) | | 26,250 | | * | | — | | — |

| AEW Capital Management, L.P.(6)(7) | | 761,904 | | 9.37 | % | — | | — |

| Jan H. Loeb(8) | | 561,300 | | 7.61 | % | — | | — |

| QVT Financial(9) | | 544,400 | | 7.38 | % | | | |

| DB Advisors, L.L.C. (formerly listed as Taunus Corporation)(10) | | 645,300 | | 8.75 | % | — | | — |

| Directors and officers as a group (5 persons)(11) | | 1,121,017 | | 13.35 | % | — | | — |

- *

- Less than 1%

- (1)

- Based on 7,372,788 common shares outstanding. In accordance with the rules of the Securities and Exchange Commission, each person's percentage interest is calculated by dividing such person's beneficially owned common shares by the sum of the total number of common shares outstanding plus the number of currently unissued common shares such person has the right to acquire (including upon exercise of vested options and upon conversion of preferred stock, but excluding upon conversion of the separately shown OP units) within 60 days of October 1, 2004.

- (2)

- Based on 7,408,582 common OP units outstanding (including the 7,372,788 common OP units held by GTA's subsidiaries). Under the operating partnership agreement, the holder(s) of OP units (other than GTA's subsidiaries) has the right to tender them for redemption at any time. Upon such a tender, either the operating partnership must redeem the OP units for cash or GTA must acquire the OP units for shares of common stock, on a one-for-one basis.

- (3)

- Mr. Blair's beneficial ownership includes options to purchase 640,000 shares of common stock, all of which have vested and are exercisable as of October 1, 2004; however, none of these options were in the money as of this date.

- (4)

- Mr. Peters' beneficial ownership includes options to purchase 285,000 shares of common stock, all of which have vested and are exercisable as of October 1, 2004; however, none of these options were in the money as of this date.

20

- (5)

- Includes options to purchase 25,000 shares of our common stock all of which are vested and are exercisable as of October 1, 2004; however, none of these options were in the money as of this date.

- (6)

- Amounts shown for AEW Capital Management, L.P. include 800,000 shares of our company's Series A convertible cumulative preferred stock held by its affiliate AEW Targeted Securities Fund, L.P., which shares are convertible into an aggregate of 761,904 shares of our company's common stock. AEW Capital Management, L.P. reports that it has the sole power to vote or direct the vote of 761,904 shares and the sole power to dispose of or direct the disposition of 761,904 shares. These entities' address is c/o AEW Capital Management, Inc., 225 Franklin Street, Boston, MA 02110. Information about AEW Capital Management, L.P. is included in reliance on its Schedule 13G filed with the SEC on April 16, 1999 as updated by correspondence with AEW Capital Management, L.P. in March 2004.

- (7)

- Our charter limits the number of our shares that may be owned by a single person or group, as defined under federal securities laws, to 9.8% of each class of outstanding equity. We refer to this restriction as our ownership limit. However, in cases where violation of the ownership limit would not have jeopardized our REIT status, our charter allowed our board to grant a waiver of the ownership limit. In connection with AEW's investment in our Series A preferred stock, we granted them a limited waiver from the ownership limit on April 2, 1999.

- (8)

- Mr. Loeb's address is 6610 Cross Country Boulevard, Baltimore, Maryland 21215. Mr. Loeb reports that he has sole power to vote or to direct the vote of 540,600 shares, shared power to vote or to direct the vote of 20,700 shares, sole power to dispose or to direct the disposition of 540,600 shares and shared power to dispose or to direct the disposition of 20,700 shares. Information about Mr. Loeb is included in reliance on the Schedule 13D filed with the SEC on January 16, 2003.

- (9)

- QVT Financial's address is 527 Madison Avenue, 8th Floor, New York, New York 10022. QVT Financial reports that it is the investment manager for QVT Fund LP (the "Fund") which beneficially owns 430,628 shares. QVT Financial also reports that it is the investment manager for a separate discretionary account managed for Deutsche Bank AG (the "Separate Account") which holds 113,772 shares. QVT Financial has the power to direct the vote and disposition of the common stock held by each of the Fund and the Separate Account. Accordingly, QVT Financial may be deemed to be the beneficial owner of an aggregate amount of 544,400 shares of common stock, consisting of the shares owned by the Fund and the shares held in the Separate Account. QVT Financial reports that it has sole power to vote or to direct the vote of 0 shares, shared power to vote or to direct the vote of 544,400 shares, sole power to dispose or to direct the disposition of 0 shares and shared power to dispose or to direct the disposition of 544,400 shares. Information about QVT Financial is included in reliance on the Schedule 13G filed with the SEC on May 13, 2004.

- (10)

- The Schedule 13G filed on February 14, 2002 by Taunus Corporation, a wholly owned subsidiary of Deutsche Bank AG, was amended most recently by a Schedule 13G filed by Deutsche Bank AG on February 6, 2004. Deutsche Bank AG's address is Taunusanlage 12, D-60325, Frankfurt am Main, Federal Republic of Germany. Deutsche Bank AG reports that its subsidiary DB Advisors, L.L.C. has sole power to vote or to direct the vote of 645,300 shares, shared power to vote or to direct the vote of 0 shares, sole power to dispose or to direct the disposition of 645,300 shares and shared power to dispose or to direct the disposition of 0 shares. Information about DB Advisors, L.L.C. is included in reliance on the Schedule 13G filed with the SEC on February 6, 2004 by Deutsche Bank AG, of which DB Advisors, L.L.C. is a wholly owned subsidiary.

- (11)

- Includes options to purchase 1,025,000 shares of common stock, all of which have vested and are exercisable as of October 1, 2004; however, none of these options were in the money as of this date.

21

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Indebtedness of Management

Pursuant to the terms of our executive officers' amended and restated employment agreements dated as of February 25, 2001, we made non-recourse loans of $1,595,000 to our executive officers ($1,150,000 to Mr. Blair and $445,000 to Mr. Peters) for the payment of personal income taxes arising from the acceleration of their restricted stock grants and the forgiveness of their outstanding debt to us as of such date. These new loans were evidenced by promissory notes from the executives and secured by their total holdings of 199,415 shares (143,790 of which were owned by Mr. Blair and 55,625 of which were owned by Mr. Peters) of our common stock valued at $8 per share at the time of the issuance of these loans. Interest accrues on these loans at 5.06% per annum (the applicable federal rate on the date of the loan) and is due at maturity. Effective July 1, 2002, we discontinued accruing interest on these loans because the total outstanding balance of each loan exceeded the value of the collateral, common stock, computed based on the current net assets available to common stockholders. The outstanding balance of these loans at June 30, 2002, principal and interest, was $1,655,000. For the years ended December 31, 2003 and 2002, we recorded an allowance for doubtful accounts against this receivable in the aggregate amounts of $497,000 and $400,000, respectively, which approximated the difference in the pledged value of $8 per share and the computed value based on the net assets in liquidation at December 31, 2003 and 2002, respectively.

As a result of the letter agreement that we entered into with Mr. Blair on March 22, 2004, Mr. Blair agreed to, among other things, irrevocably assign to us the shares of our common stock which secure the above mentioned $1,150,000 non-recourse loan previously made to Mr. Blair in exchange for our agreement to cancel such loan.

Mr. Peters' loan matures at the earliest of the following times: (i) February 25, 2006; (ii) three years following termination of his employment with us; or (iii) the date of the final distribution under the plan of liquidation. At any time when the loan is over-secured, Mr. Peters has the right to sell such common stock securing the loan, provided that all proceeds of the sale are first applied to the then outstanding balance of the loan. All distributions (including any liquidating distributions) on the stock securing the loan are applied against the loan. The related promissory note is non-recourse to Mr. Peters.

The largest aggregate amounts of indebtedness under our loans to Messrs. Blair and Peters during our 2003 fiscal year were $1,150,000, and $445,000, respectively, plus accrued interest. Due to the cancellation of Mr. Blair's loan on March 22, 2004, there was no outstanding balance due from Mr. Blair at October 1, 2004. The outstanding balance of the loan to Mr. Peters at October 1, 2004 was $445,000 plus accrued interest.

COST OF SOLICITATION