Filed by Enterprise Financial Services Corp pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities and Exchange Act of 1934, as amended Subject Company: First Choice Bancorp Commission File No: 001-38476 Welcome to Enterprise Bank & Trust ____________________________ April 26, 2021

2 Table of Contents I. Message from Leadership 3 II. Forward Looking Statements 4 III. Frequently Asked Questions 6 IV. Key Highlights 14 V. A Little More About Us 15 VI. Benefits Information 16 VII. Executive Biographies 19

3 Message from Leadership April 26, 2021 Dear First Choice Bank Associates, We are excited to announce that First Choice Bank (First Choice) is planning to join Enterprise Bank & Trust (Enterprise). The boards of directors of First Choice Bancorp (FCBP) and Enterprise Financial Services Corp (EFSC), our respective parent companies, approved a definitive agreement to merge our two companies. Pending closing, First Choice will join the Enterprise team. As with any agreement like this one, there will be three major milestones: 1. Public Announcement (occurring today) 2. Legal Close (when, among other things, First Choice legally merges with Enterprise) 3. System Integration (when we migrate associates and clients to common systems) Certainly, you have many questions about what lies ahead, and Enterprise has provided the enclosed materials with some initial information. We are committed to transparent communication throughout this process, and we will provide you with ongoing updates throughout the legal close and system integration process. Our intention is to partner with you every step of the way. Enterprise, based in Missouri, may not be a name you recognize, so to begin, we want to tell you a little more about the company. Enterprise was founded in St. Louis, Missouri in 1988. Primarily through organic growth and strategic mergers, Enterprise has become the largest publicly traded community bank headquartered in St. Louis. Today, Enterprise is a $10.2 billion bank with 39 locations spanning Arizona, Nevada, California, Kansas, Missouri and northern New Mexico with specialized banking solutions that are delivered throughout the country. Together, Enterprise and First Choice will be better positioned to provide opportunities for talented team members. We envision that the combined strength of our companies will allow us to offer a wider array of services and a better overall banking experience. Enterprise’s benefits strategy is designed to attract, retain and motivate the best talent by providing highly valued healthcare, wellness, financial and work/life balance benefits for associates and their families. But don’t take our word for it. Take a moment to listen to what Enterprise associates say about their bank in this video. You can also learn more about us in this overview. As we prepare to combine our organizations, rest assured that we will remain true to the principles on which both of our companies were founded. The way you conduct business, your established processes and the way you work with clients at First Choice will not change. We will honor and preserve the First Choice legacy as we create our new organization together. We are excited about our partnership and look forward to continuing to deliver on our promises to clients, together with you. Regards, Jim Lally Robert Franko President & CEO President, CEO & CFO Enterprise Financial Services Corp First Choice Bancorp

4 Forward‐Looking Statements Certain statements contained in this document may be considered forward‐looking statements regarding Enterprise Financial Services Corp (EFSC), including its wholly‐owned subsidiary Enterprise Bank & Trust (Enterprise), First Choice Bancorp (FCBP), including its wholly‐owned subsidiary First Choice Bank (First Choice), and EFSC’s proposed acquisition of FCBP and First Choice. These forward‐ looking statements may include: statements regarding the acquisition, the consideration payable in connection with the acquisition, and the ability of the parties to consummate the acquisition. Forward‐ looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward‐looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward‐looking statements speak only as of the date they are made. Because forward‐looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that EFSC or FCBP anticipated in their forward‐looking statements and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, the possibility: that expected benefits of the acquisition may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the acquisition may not be timely completed, if at all; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive transaction agreement; the outcome of any legal proceedings that may be instituted against EFSC or FCBP; that prior to the completion of the acquisition or thereafter, EFSC’s and FCBP’s respective businesses may not perform as expected due to transaction‐related uncertainty or other factors; that the parties are unable to successfully implement integration strategies; that required regulatory, EFSC shareholder or FCBP shareholder or other approvals are not obtained or other closing conditions are not satisfied in a timely manner or at all; that adverse regulatory conditions may be imposed in connection with regulatory approvals of the acquisition; reputational risks and the reaction of the companies’ employees or customers to the transaction; diversion of management time on acquisition‐related issues; that the COVID‐19 pandemic, including uncertainty and volatility in financial, commodities and other markets, and disruptions to banking and other financial activity, could harm Enterprise and FCBP’s business, financial position and results of operations, and could adversely affect the timing and anticipated benefits of the proposed acquisition; and those factors and risks referenced from time to time in EFSC’s or FCBP’s filings with the SEC, including in their Annual Reports on Form 10‐K for the fiscal year ended December 31, 2020, and their other filings with the SEC. For any forward‐ looking statements made in this press release or in any documents, EFSC and FCBP claim the protection of the safe harbor for forward‐looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Except to the extent required by applicable law or regulation, each of EFSC and FCBP disclaims any obligation to revise or publicly release any revision or update to any of the forward‐looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made. Additional Information About the Merger and Where to Find It In connection with the proposed acquisition transaction, along with other relevant documents, a registration statement on Form S‐4 will be filed with the SEC that will include a joint proxy statement/prospectus to be distributed to the shareholders of EFSC and FCBP in connection with their votes on the acquisition. SHAREHOLDERS OF EFSC AND FCBP CHOICE ARE URGED TO READ THE

5 REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION AND RELATED MATTERS. FREE COPIES OF THESE DOCUMENTS MAY BE OBTAINED AS DESCRIBED BELOW. The final joint proxy statement/prospectus will be mailed to shareholders of EFSC and FCBP. Investors and security holders will be able to obtain the documents, and any other documents EFSC has filed with the SEC, free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by EFSC in connection with the proposed acquisition will be available free of charge by (1) accessing EFSC’s website at www.enterprisebank.com under the “Investor Relations” link, (2) writing EFSC at 150 North Meramec, Clayton, Missouri 63105, Attention: Investor Relations, (3) accessing FCBP’s website at https://investors.firstchoicebankca.com under the “SEC Filings” tab, or (4) writing FCBP at 17785 Center Court Drive, N Suite 750, Cerritos, CA 90703, Attention: General Counsel. Participants in Solicitation FCBP and certain of their directors and executive officers, and EFSC and certain of their directors, executive officers and other certain members of management and employees, may be deemed to be participants in the solicitation of proxies from the shareholders of FSBP and the shareholders of EFSC in connection with the Merger. Information about the directors and executive officers of EFSC is set forth in the proxy statement for EFSC’s 2021 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 17, 2021. Information about the directors and officers of FCBP will be set forth in the Form‐10‐K/A, to be filed with the SEC on or about April 27, 2021 and in the proxy statement of FCBP to be filed on Schedule 14A during the third quarter of 2021. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed acquisition when it becomes available. Free copies of this document, once filed, may be obtained as described in the preceding paragraph.

6 Frequently Asked Questions WHO IS ENTERPRISE BANK & TRUST? Enterprise may not be a name you’re familiar with, so here’s a little more information about us. Enterprise was founded as a startup in St. Louis in 1988. We have grown organically and through acquisitions to become the largest publicly traded community bank based in St. Louis. Today, we have 39 locations spanning the St. Louis, Kansas City, Phoenix, San Diego, Las Vegas and northern New Mexico metropolitan areas. Our activities as a financial services partner fall into three main categories, all related to growth. We: ● Empower privately held businesses to improve their ability to compete; ● Help families to secure their financial futures; and ● Invest in our communities to advance quality of life. WHY IS FIRST CHOICE MERGING WITH ENTERPRISE? Over the next few days, you may read headlines that say, “First Choice Bancorp to Sell to Enterprise Financial Services Corp” or “First Choice Bank to be Acquired by Enterprise Bank & Trust.” While those headlines may be technically correct, they don’t convey the true spirit of the transaction. We think that now is the right time to join forces because there is a huge opportunity to combine our strengths and be better together than each organization is separately. This transaction can help us both achieve our long‐term strategic goals, which do not change, sooner than if we remained independent. Here’s how: ● The combined company will have an attractive blend of both specialized and commercial lending with the ability to add low‐cost core deposits that are not dependent on a traditional branch network. ● First Choice’s SBA program further enhances Enterprise’s SBA expertise, in addition to our strong community bank profile in the markets we serve. ● On a combined basis, Enterprise Financial Services Corp (EFSC) will hold approximately $12.7 billion in assets, with what will be enhanced earning power and scale, as well as a materially stronger position in all markets that we serve. Ultimately, the combined company will be an even more compelling value proposition for associates, clients, communities and shareholders. ● The acquisition will enhance Enterprise’s expansion into Southwestern markets, with capacity to attract national specialty deposits in higher growth markets. ● One of the many values from this partnership will be that, if all goes according to plan and expectations, each of our companies will get to where we want to be in terms of a balanced business mix much sooner than if we were to remain two independent companies. Merging provides opportunities to accelerate growth potential and vault the combined company into a strong leadership position across our footprint. Enterprise has great respect for the bank you have built and taken to market, for your incredible team, and for your culture. Whether you have been here for five years or five weeks or five days, the company you joined was the right one, and will continue to be the right one. The common thread that links Enterprise to First Choice is one that may be the reason you decided to work at First Choice originally. Both companies’ mission, vision and cultures are aligned at their core. WHAT CAN I DO TO HELP CLIENTS DURING THIS PROCESS? Just as you have helped people through changes in the past, you can make a tremendous difference by maintaining an enthusiastic, positive attitude. Your clients' perception of this event is highly influenced by your reaction to it. This is a big change for everyone and your positive attitude is the best way to

7 assure clients that they can expect to receive the same fast, efficient, personalized service you have always provided. Throughout this journey, we are committed to doing everything we can to provide you with information and relevant updates so you can feel confident when discussing the acquisition with your clients. WHAT DOES ENTERPRISE DO TO SUPPORT ITS COMMUNITIES? One of Enterprise’s Guiding Principles is Corporate Citizenship: We are committed to managing our business and community relationships in ways that positively impact our associates, clients, and the diverse communities where we live and work. Individually, associates are offered Voluntary Time Off (VTO) and have the opportunity to participate in a corporate matching program for financial donations to personally selected nonprofits. Throughout the year, various volunteer opportunities, charitable drives and fundraising events are promoted internally. These events are either organized by individual branches/units for local activities or at the corporate level for regional events, and even national events which occur in all of our markets. As an organization, we also contribute to the strength and health of our communities through the Enterprise Bank & Trust Foundation. WHEN WILL FIRST CHOICE ASSOCIATES KNOW THE TIMELINE OF THE TRANSITION? WHEN WILL THE ACQUISITION CLOSE? The acquisition is subject to customary closing conditions, including requisite regulatory approvals and EFSC and FCBP shareholder approval, with an anticipated closing in the third quarter of this year. As more information becomes available, plans are finalized and decisions are made, we are committed to being as transparent as possible while complying with applicable laws. WILL YOU BE KEEPING ALL FIRST CHOICE LOCATIONS? In the coming months, we will be evaluating our branch footprint, which we do regularly. While no decisions have been made, there are First Choice branch locations that are in close proximity to existing Enterprise locations. Importantly, any changes in our branch footprint are communicated well in advance, are made in a fashion to not disrupt clients, and location closings don’t necessarily mean a reduction in team members or other impacts. Following systems integration, First Choice clients will be able to conduct business at 39 branch offices currently operated by Enterprise in Arizona, California, Kansas, Missouri, Nevada and New Mexico, and a limited network of loan production offices and deposit production offices. WILL ANY OF OUR LEADERSHIP TEAM BE RETAINED? In addition to certain key executives whom we have spoken with about staying on in various roles, we expect to maintain other essential management and business line leaders to ensure the continued success of the combined organization.

8 First Choice Associate FAQs WHEN WILL MEETINGS WITH THE ENTERPRISE MANAGEMENT TEAM BEGIN? Meetings between the Enterprise team and the First Choice team will take place promptly following the public announcement of the proposed acquisition and will continue as we work together as part of the acquisition process. In addition, plans are underway to have follow‐up Town Hall meetings to let all associates know about Enterprise, timelines relative to transaction close, eventual system integration and other information. WHAT IS ENTERPRISE’S ASSOCIATE EXPERIENCE LIKE? We take great effort and pride in creating a strong culture for our associates. This begins with referring to our “clients” as people or clients, and our “employees” as associates. Additionally, we have a set of Guiding Principles that describe our commitment to defining the character and culture of our company in all circumstances, irrespective of changes in goals, strategies, type of work or top management. Our principles focus on Integrity, Client Success, Accountability, Teamwork & Diversity, Continuous Improvement, Balance and Corporate Citizenship. We work to exemplify these Principles through everyday behaviors, management practices, and organizational norms. Voted a “Best Bank to Work For” by American Banker, we offer our associates an array of benefits and the opportunity to chart their own career path with us. We offer many exciting opportunities for our associates, ranging from free or discounted banking services, tuition reimbursement, an Employee Assistance Program (EAP) for associates and family members, wellness program, discounted tickets for community events and encouragement for our associates to focus on their own learning and development. HOW HAS ENTERPRISE HANDLED COVID‐19? Associate and client safety, while maintaining continued operational functionality, is our top priority. Our approach to addressing COVID‐19 and minimizing its impact on our business included forming a Task Force and Oversight Committee to closely monitor current conditions and guidelines from the CDC and federal, state and local authorities. We transitioned to remote work for associates not classified as on‐site essential. We have been operating largely on a remote basis since mid‐March 2020 while maintaining excellent productivity and client relationships. Recently, the majority of our branches have returned to full service with open lobbies and signs requiring masks visibly posted for clients. Associates are also wearing masks on‐site and maintaining social distancing. Lobbies have protective shields and directions to help clients and employees adhere to CDC guidelines. We also have a network of available Video Teller Machines (VTMs) available to serve clients safely with extended hours in most markets. We continue to follow CDC guidance and comply with applicable federal, state and local governmental requirements. We anticipate continuing to use a balanced, conservative phased‐in approach in returning to the office in‐person for all non‐branch associates based on data from our markets. We also consider business impact and the health and safety of our associates and the communities in which we operate in making determinations regarding returning to work and re‐opening branches and locations for in‐person services. HOW DO WE PREPARE FOR CONVERSATIONS WITH THE MANAGERS AND HUMAN RESOURCE REPRESENTATIVES FROM ENTERPRISE? DO WE NEED TO UPDATE OUR RESUMES AND/OR CONDUCT JOB INTERVIEWS? In preparation for the integration process, we will be in collective discussions about personnel and staffing decisions for the combined organization. This collaboration will begin shortly after

9 announcement and will include all associates. HOW WILL TRAINING FOR ASSOCIATES BE ACCOMPLISHED? One of Enterprise’s past approaches that has proven to be effective is what we call the "partner branch" approach. Each First Choice branch and department will be assigned to an Enterprise partner branch or department, and the assigned managers and staff will work with and support one another throughout the transition process. A comprehensive training plan will also be created to ensure a well‐coordinated approach to training across the combined organization. More details will be communicated at the appropriate time. WILL DEPARTMENTS BE MOVING TO DIFFERENT LOCATIONS? As part of any acquisition, there will be ongoing assessments of both companies to determine how the combined company will be most effectively organized. Currently, we have associates who joined Enterprise as part of prior mergers. A majority of those associates remained in, and continue to work from, the same geographic area they were previously in, while working in a variety of roles within our organization, including within our operations and other support teams. Our plan today reflects a similar expectation. As we get closer to the closing, we expect to communicate these findings, with the goal of minimizing disruption for associates and clients. WILL CERTAIN DEPARTMENTS BE ASKED TO STAY ON ONLY THROUGH SYSTEM INTEGRATION? Future staffing needs will be assessed on an ongoing basis, and decisions regarding individuals, teams and departments will be made and communicated within several days following legal closing of the transaction. IS THE DRESS CODE FOR ENTERPRISE DIFFERENT FROM OUR CURRENT ONE? We do not anticipate significant changes to First Choice’s dress code, as the current dress code affords a range of appropriate dress guidelines including casual attire to business attire, and varies by function, season and occasion. Casual Fridays will continue as usual, unless notified otherwise.

10 Benefit FAQs IF AN ASSOCIATE CONTINUES WITH THE COMBINED COMPANY, WILL THEIR YEARS OF SERVICE “COUNT” IN THE NEW ORGANIZATION? Yes. Years of service with First Choice will be counted for associates who continue in positions with the combined company. Continuous service time, which considers all time worked since the original hire date, will be used to determine time off accrual rates and most other benefit eligibility decisions. WILL THE BENEFIT PLAN OPTIONS (MEDICAL, PHARMACY, DENTAL, VISION) CHANGE FROM THE CURRENT FIRST CHOICE OPTIONS? Enterprise and First Choice both currently provide competitive health insurance options through a similar network of providers, and Enterprise will thoughtfully consider the First Choice benefits and plan design in determining its next set of open enrollment options. Our integration plan will encompass an analysis of benefit plans with a goal of maintaining a competitive plan for former First Choice associates. It is possible no changes will be made to medical benefits for the calendar year 2021. If a change occurs prior to January 1, 2022, Enterprise will provide credit to its deductible for employee progress to relevant First Choice plan deductibles as they convert to the Enterprise competitive benefit offerings. WHAT ABOUT TIME OFF, DISABILITY, AND OTHER SUCH PROGRAMS? Final decisions about the combined organization's time‐off programs, including how and when to transition associates from their current programs to Enterprise programs, will be determined at a later date. Payroll conversion is expected to take place no later than Jan. 1, 2022, at which point you will be eligible for Enterprise’s PTO plan. .Any necessary education/training will be provided prior to implementation. In the meantime, current program guidelines will be followed, and associates should continue to follow current processes regarding requesting and gaining approval for future time off. WILL ALL ASSOCIATES WHO ARE NOT RETAINED RECEIVE SEVERANCE? All associates whose positions are eliminated as a result of the acquisition and who do not find another position within the combined company will be offered a competitive severance package. WILL STAFF BE ABLE TO DRAW UNEMPLOYMENT? WILL COBRA BE OFFERED? Any associate whose employment is terminated directly as a result of the consummation of the acquisition will be able to apply for unemployment compensation. All COBRA laws and regulations and federal guidelines will be followed. In addition, the current practice is to pay 90 days of the employer portion of COBRA as part of the severance package. HOW WILL OUR 401(K) BE HANDLED, AND WHAT IS THE ASSOCIATED TIMING? DO WE HAVE THE OPTION TO REVIEW THE NEW 401(K) OPTIONS PRIOR TO BEING AUTO‐ENROLLED IN THE PLAN? We will carefully prepare for the transition from the current 401(k) plan to the combined company's plan and will communicate and support associates as needed throughout the process. The transition process will include education about all program options and the timing of transfer of 401(k) balances into the Enterprise 401(k) plan. It is important to note that Enterprise offers a competitive 401(k) plan that provides a 100% match of the first 6% of eligible compensation. DOES ENTERPRISE HAVE AN EMPLOYEE STOCK PURCHASE PLAN (ESPP)? Yes. The Employee Stock Purchase Plan (ESPP) is a benefit which extends the ability for associates to

11 have a financial stake in Enterprise and gives associates a way to share in the future of our company. Under Enterprise’s ESPP, eligible associates may contribute up to 15% of their compensation, subject to IRS limits, to purchase Enterprise common stock on a discounted basis. The ESPP has two six‐month offering periods per calendar year: June 1 to November 30 and December 1 to May 31. More information regarding Enterprise’s ESPP (including information on how to enroll) will be provided at a later date. WILL STAFF SALARIES BE AFFECTED? Currently, Enterprise does not have plans to change annual base salary or wage levels for associates continuing in similar roles with the combined organization immediately following closing. In the normal course of our operations, we regularly assess compensation for roles to ensure market competitiveness and organizational alignment. We anticipate incorporating positions continuing with Enterprise into this process beginning in 2022.

12 First Choice Client FAQs WILL ACCOUNT NUMBERS CHANGE? While we cannot guarantee account numbers will remain the same, there is no need for you or our clients to change any current practices at this time. For now, it’s business as usual, and you may do your banking as you’ve always done. As we prepare to finalize our partnership, we will be evaluating accounts and planning to integrate our systems. We pledge to communicate any necessary changes in a clear and timely manner. WILL BRANCH HOURS CHANGE? Enterprise does not intend to change hours, as they have been set by the current management team based on client need. This is an analysis Enterprise performs periodically to ensure client expectations are being met. WILL LOCAL BANKERS HAVE THE AUTHORITY TO MAKE DECISIONS? Our philosophy is to keep the decision process close to the client. Similar to First Choice’s current processes, we treat each Branch/Department as its own business and the applicable manager can run their business and guide clients to ensure they are fully benefiting from all Enterprise has to offer. DOES ENTERPRISE OFFER ADVANTAGES FOR MY BUSINESS CLIENTS? Following the acquisition, former clients of First Choice will have access to a full suite of sophisticated Treasury Management solutions from Enterprise that will allow them to seamlessly manage cash on a daily basis. This includes the ability to speed up cash flow, automate receivables, invest excess funds, efficiently administer payables and assist with fraud prevention, as well as provide the online tools required from a reconciliation and information reporting perspective. Our Treasury Management professionals will also work with clients on an ongoing basis to help configure and refine their product set into a powerful, effective program for managing cash resources as their business grows and evolves. WILL CLIENT ACCOUNTS STAY THE SAME? WILL THE CHANGE OF OWNERSHIP AFFECT CLIENTS’ DIRECT DEPOSITS? Each bank will remain independent until the transaction is formally approved by regulators as well as FCBP and EFSC shareholders, and the transaction has legally closed. After closing, First Choice clients will not be able to transact business at Enterprise branches (and vice versa) until computer systems have been converted and integrated, which is anticipated to occur in late 2021. Once the integration is complete, Enterprise and First Choice clients will be able to transact business at any of the combined organization’s branches. Both organizations are committed to making the transaction for clients as seamless as possible, including offering a competitive suite of products and services that embraces a “best of both” perspective. WHAT PRODUCTS WILL BE OFFERED? WHAT HAPPENS TO OUR ASSOCIATE ACCOUNTS? Enterprise is currently mapping all product features and benefits to determine the appropriate product set. Decisions about products and accounts will be communicated to associates at the appropriate time. WILL DEBIT CARDS REMAIN THE SAME OR WILL THEY BE REISSUED? Multiple options are being investigated to provide the greatest benefits and features to clients with as little impact as possible.

13 HOW WILL CURRENT FIRST CHOICE TIME DEPOSIT ACCOUNTS CHANGE ONCE THE BANKS HAVE MERGED AND AFTER SYSTEM INTEGRATIONS? These accounts should see no change. Clients will receive notice upon maturity to contact the bank for current rates. WILL DEPOSITS CONTINUE TO BE INSURED BY THE FDIC? Deposits will continue to be insured by the FDIC up to the maximum amount allowed by law. WILL THE NEWLY COMBINED BANK OFFER NEW PRODUCTS? The combined organization will offer First Choice’s clients a broader array of products and services, including expanded Treasury Management services, business products and more. Disclaimers: The questions and answers in the foregoing FAQs are intended to provide a brief summary only. If there is any inconsistency between this FAQ and any plan documents, the plan documents will govern. Further, Enterprise and EFSC reserve the right to amend and terminate any benefit plans, programs or arrangements at any time.

14 Key Highlights We want you to feel comfortable and confident sharing information with friends, family and clients about our proposed acquisition. We’ve provided you with highlights to use when speaking with them. As always, when you have questions, we encourage you to ask your manager or email us at ask@enterprisebank.com. ● Subject to approval by First Choice Bancorp (FCBP) and Enterprise Financial Services Corp (EFSC) shareholders and applicable banking regulators, we plan to merge FCBP with and into EFSC, with EFSC as the surviving institution, and soon thereafter merge First Choice Bank (First Choice) with and into Enterprise Bank & Trust (Enterprise), with Enterprise surviving. ● Enterprise has significant experience in acquisitions, having successfully completed many transactions in the last decade. The Enterprise and First Choice leadership teams are wholly committed to making this transition as seamless as possible — and to keeping our clients informed and involved in the progress along the way. ● With this combination, EFSC will hold approximately $12.7 billion in assets, providing financial strength and the ability to continue our focus on providing exceptional service. ● The planned combination of First Choice and Enterprise represents an alliance between two well‐respected and like‐minded companies. ● First Choice clients will continue to enjoy the same personal attention and exceptional service they have come to expect. Over time, greater size and scale will afford clients access to enhanced products and services. ● We expect this union will generate tremendous growth: growing value for shareholders, growing choices and benefits for clients, economic advantages for clients and opportunities for associates. ● We believe the combination will add talented new associates at all levels, as well as valuable new ideas and clients of all types in retail and commercial banking, specialized banking, wealth management and private banking. ● First Choice can access Enterprise University, the 90‐minute virtual courses Enterprise offers that are offered at no cost to people in the communities we serve and cover a wide range of business topics taught by experts in their fields. ● Enterprise will invite members of the First Choice team to participate in our Engagement & Inclusion Ambassador Program. This group works to create an inclusive work environment where the unique qualities of our associates are celebrated for better understanding of the needs of our diverse clients and our communities. ● With the addition of First Choice, Enterprise’s efforts to foster innovation for improved client engagement also grow. We will advance this effort through our continued emphasis on an incubator focused on creating, supporting and encouraging internal innovation targeting the client experience. ● Your clients don’t need to do anything at this time. Products you offer and accounts remain the same as before. ● Enterprise is incredibly proud to be named to the list of America’s “Best Banks to Work For,” a coveted list of banks identified by American Banker, for the third straight year. ● This acquisition provides the opportunity to help both companies achieve our long‐term strategic goals, which do not change, sooner than if we remained independent. The way you conduct business, your established processes and the way you work with clients at First Choice will not change as a result of this acquisition.

15 A Little More About Us At Enterprise Bank & Trust (Enterprise), our mission is guiding people to a lifetime of financial success. Our mission speaks to who we are and what we do. We’re committed to supporting dreams, securing financial futures and delivering for all people. Here’s a look at some of the ways we’re recognized for our differentiation both locally, and nationally: Enterprise is different from other banks in three ways: 1. Providing specialized expertise through our people (talent). ● We’re incredibly proud to be named to the list of “America’s Best Banks to Work For,” a coveted list of banks identified by American Banker for the third straight year. ● Our net promoter score (NPS) is 71 – well above the industry average. Our NPS is up there with brands like Apple, Nordstrom and Zappos. ● We offer a wide range of specialized expertise that other banks don’t have, including aircraft financing, sponsor finance, tax credit services, specialized legal services and life insurance premium finance. ● The average tenure of associates with the bank is seven years. 2. Offering financial stability and a networking ecosystem that spurs opportunity and action (strength). ● At $10.2 billion in assets, we are at a distinctive size – and we’re in a sweet spot. We believe we can bank anyone in town, but we retain the intimacy community banks offer. ● We have an investment grade rating through Kroll, a ratings agency that identifies the strongest banks in the country based on liquidity, asset quality, capital adequacy and earnings. ● We provide easy access to local decision‐makers, quick turnaround delivered with flexibility and expertise and knowledge of your business. ● We regularly rank among the top 50 banks in our size range based on financial performance (S&P Global Market Intelligence's annual Top 50 Ranking). 3. Empowering people and communities (passion). ● In 2020, 385 nonprofit organizations received charitable contributions from Enterprise. ● Through Enterprise University, our highly acclaimed business education program, we are educating thousands of people (more than 25,000 total) at no cost to them. ● We offer a reciprocal mentoring program that pairs executives with mid‐level associates of color and/or women as well as other career acceleration programs to develop high‐potential associates for a career in banking.

16 Benefits Information Enterprise’s benefits strategy is designed to attract, retain and motivate the best talent by providing highly‐valued healthcare, wellness, financial and work‐life balance benefits for our associates and their families. ELIGIBILITY The effective date for First Choice associates to become eligible for Enterprise benefit plan participation will be immediately following the ceasing of First Choice benefit offerings. The timing of this transition from First Choice benefit plans to Enterprise benefit plans will be determined and communicated at a later date. Associates will be given credit for service/time employed at First Choice. KEEPING ASSOCIATES AND FAMILIES HEALTHY Enterprise is committed to providing associates with a benefits program that is both comprehensive and competitive. Our benefits program offers health care coverage and income protection to our associates and their families. Associates working at least 20 hours per week are eligible to participate in our benefit programs. We offer: ● Health insurance plans, which include wellness incentives, prescription drug coverage and 100% coverage for preventative care ● Dental insurance ● Vision insurance ● Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) ● Company‐paid life insurance and accidental death and dismemberment (AD&D) insurance ○ Voluntary supplemental life and AD&D may be purchased ● Company‐paid long‐term and short‐term disability insurance coverage ● Voluntary accident, critical illness and hospital indemnity coverage may be purchased PREPARING FOR THE FUTURE EFSC 401(k) Plan ● All associates 21 years of age and older are eligible to participate immediately upon hire ● Automatic enrollment with 3% initial deferral rate, with 1% rate increases each year (up to 10% of compensation); associates may opt out or change their deferral rate at any time ● Enterprise provides 100% per‐pay‐period match of the first 6% contributed by associate ● Enterprise contributions vest over three years (33% after year one, 66% after year two, fully vested after three years) ● After‐tax Roth contributions may also be made Employee Stock Purchase Plan ● Associates can elect to deduct 1% to 15% of eligible pay (after tax) per paycheck ● Contributions are limited to $25,000 each calendar year, under applicable IRS regulations ● Purchase price per share will equal 85% of the closing price on either the first business day of the offering period or the last business day of the offering period, whichever is lower ● Purchase dates are May 31 and November 30 ● Enterprise pays for purchase‐related commission fees on share purchases Educational Assistance ● Full‐time associates who have completed six months of continuous employment are eligible

17 ● Applies to education directly related to associate’s present job, that enhances associate’s current job/future potential at the company or contributes to completion of approved business degree (subject to manager approval) ● Reimbursement is 50% of the cost of tuition as long as associate receives grade of B‐ or better for graduate‐level courses and a grade of C or better for undergraduate‐level courses ● Employment at Enterprise must continue three years beyond course and/or degree completion or associate will be required to reimburse Enterprise on a pro‐rated basis ● Enterprise may also pay expenses for position‐related professional certifications, training courses, seminars and conferences WORK‐LIFE BALANCE We’re proud to offer paid time off, holidays, volunteer time off and paid parental leave. Paid Time Off ● May be used for vacation, illness, appointments, bereavement not covered by bereavement policy, religious observances, Family and Medical Leaves not covered by Disability, and inclement weather ● Calculated on a calendar year basis and accrues monthly based on years of service and Full Time Equivalency (FTE = average number of hours worked per week), as follows: FULL‐TIME ASSOCIATE FULL‐TIME OFFICER Years of Service PTO Accrual Rate Years of Service PTO Accrual Rate 0‐3 11.34 hours per month (17 days annually) 0‐6 14.67 hours per month (22 days annually) 4‐6 14.67 hours per month (22 days annually) 7+ 18 hours per month (27 days annually) 7+ 18 hours per month (27 days annually) Holidays ● New Year’s Day ● Memorial Day ● Independence Day ● Labor Day ● Thanksgiving Day ● Christmas Day ● All Federal Reserve holidays (birthday of Martin Luther King, Jr., Washington’s birthday, Columbus Day, Veterans Day) Volunteer Time Off

18 ● Full‐time associates may volunteer up to eight hours per calendar year and part‐time associates up to four hours per calendar year ● Organization must be an IRS‐classified 501(c)(3) nonprofit charity or any school of the associate’s choice ● More than one organization and/or school may be chosen ● Time may be taken in one‐hour increments and must be taken during normal working hours Parental Leave ● To qualify, an associate must have been employed by Enterprise for at least 12 months ● Available to both primary and secondary caregivers immediately following the birth or adoption of their child ● Primary caregivers receive up to 12 weeks of parental leave paid at 100% of base earnings (less all applicable taxes and withholdings) from the date of birth/adoption ● Secondary caregivers receive up to two weeks of parental leave paid at 100% of base earnings (less all applicable taxes and withholdings) from the date of birth/adoption

19 Executive Biographies JAMES B. LALLY, PRESIDENT & CEO Jim Lally is President and CEO of Enterprise Financial Services Corp (Nasdaq: EFSC). Throughout his career, Jim has helped EFSC achieve record financial results, increased market share, and industry‐leading client satisfaction. Before being named CEO in May of 2017, he served as President of EFSC, Director of Fee Businesses and Director of Commercial Banking for Enterprise Bank & Trust, the company’s principal subsidiary. Before joining EFSC, Jim worked in various commercial banking capacities with U.S. Bank and Commerce Bank. Jim serves on the Wallis Companies Board, SSM Health Cardinal Glennon Children’s Foundation Board of Governors, St. Joseph’s Academy Board, St. Louis Archdiocesan Finance Council, St. Louis Archdiocesan Property and Finance Committee, and is Trustee of the St. Louis Archdiocesan Fund. Currently, Jim is a member of the Regional Business Council of St. Louis and Jim’s past civic involvements include Friends of Scouting Campaign Chairman for the New Horizons District of the Boy Scouts of Greater St. Louis, Executive Leadership team of the St. Louis Chapter of the American Heart Association and Algonquin Golf Club. A native of St. Louis, Jim received his MBA from the University of Missouri–St. Louis and his Bachelor of Science degree in finance from Saint Louis University. In June of 2016, Jim completed The Executive Program at the Darden School of Business University of Virginia. KEENE TURNER, EVP & CHIEF FINANCIAL OFFICER Keene S. Turner is Executive Vice President and Chief Financial Officer of Enterprise Financial Services Corp (Nasdaq: EFSC). In his role, he has responsibility for developing, implementing and overseeing the strategy and planning process, asset and liability management, investment portfolio management and investor relations. Keene previously served at National Penn Bancshares, Inc. in Pennsylvania as Executive Vice President and Chief Accounting Officer. Prior to National Penn, Turner was a Vice President at the investment banking firm Griffin Financial Group, where he advised financial institutions on mergers, acquisitions and other strategic matters. He is a CPA, with public accounting experience at Ernst & Young, LLP. Throughout his experiences working at large accounting firms, he gained extensive skills in the areas of technical financial accounting consultations, mergers and acquisitions and securities offerings for global and national financial services clients. Keene was selected as a recipient of the Lehigh Valley Business 40 Under 40 award and was also recognized by the St. Louis Business Journal as CFO of the Year in recognition of helping the company grow beyond the bottom‐line. He is a summa cum laude graduate of Albright College in Reading, Pennsylvania with a Bachelor of Science degree in Economics, Accounting and Business Administration.

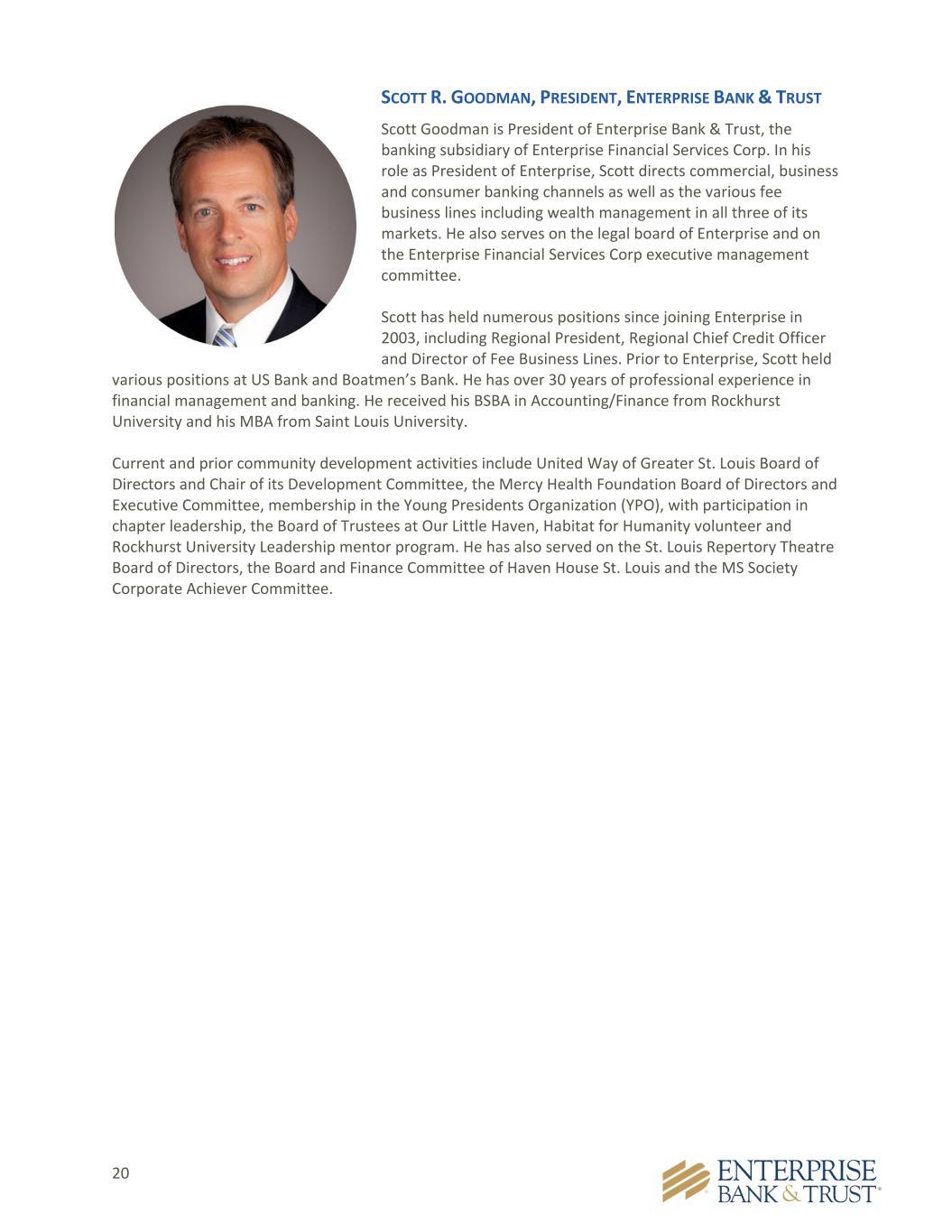

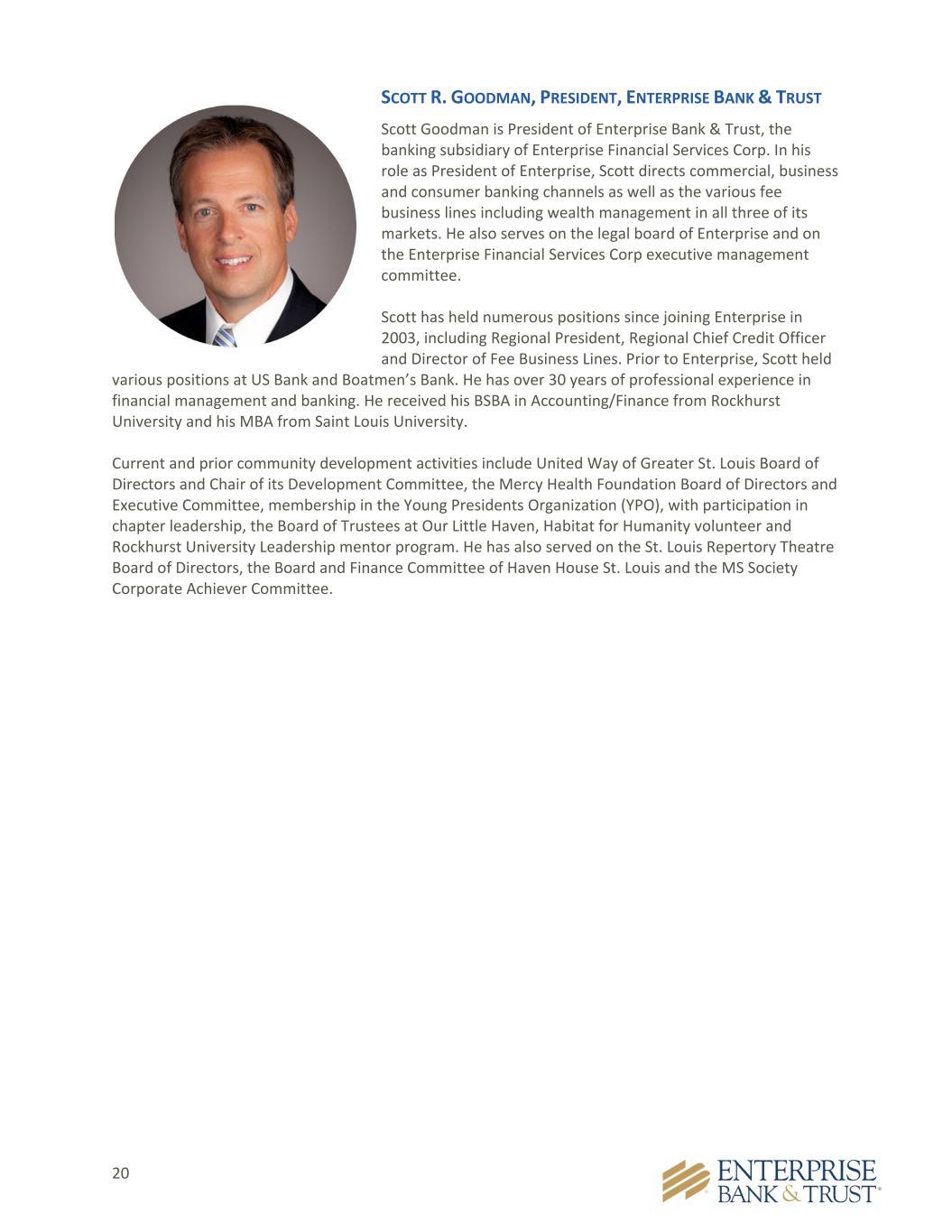

20 SCOTT R. GOODMAN, PRESIDENT, ENTERPRISE BANK & TRUST Scott Goodman is President of Enterprise Bank & Trust, the banking subsidiary of Enterprise Financial Services Corp. In his role as President of Enterprise, Scott directs commercial, business and consumer banking channels as well as the various fee business lines including wealth management in all three of its markets. He also serves on the legal board of Enterprise and on the Enterprise Financial Services Corp executive management committee. Scott has held numerous positions since joining Enterprise in 2003, including Regional President, Regional Chief Credit Officer and Director of Fee Business Lines. Prior to Enterprise, Scott held various positions at US Bank and Boatmen’s Bank. He has over 30 years of professional experience in financial management and banking. He received his BSBA in Accounting/Finance from Rockhurst University and his MBA from Saint Louis University. Current and prior community development activities include United Way of Greater St. Louis Board of Directors and Chair of its Development Committee, the Mercy Health Foundation Board of Directors and Executive Committee, membership in the Young Presidents Organization (YPO), with participation in chapter leadership, the Board of Trustees at Our Little Haven, Habitat for Humanity volunteer and Rockhurst University Leadership mentor program. He has also served on the St. Louis Repertory Theatre Board of Directors, the Board and Finance Committee of Haven House St. Louis and the MS Society Corporate Achiever Committee.

21 Key Enterprise Contacts SCOTT COUP DIRECTOR, COMMERCIAL SALES (913) 234‐6422 scoup@enterprisebank.com KENNY HITT PRESIDENT, CONSUMER BANKING (816) 289‐8254 khitt@enterprisebank.com DAKOTA DANESCU CORPORATE DEVELOPMENT SPECIALIST (586) 212‐5704 ddanescu@enterprisebank.com JADA RESSE SVP, HUMAN RESOURCES (314) 210‐0357 jreese@enterprisebank.com DOUG BAUCHE EVP, CHIEF CREDIT OFFICER (636) 399‐6045 dbauche@enterprisebank.com MARK PONDER EVP, CHIEF ADMINISTRATIVE OFFICER (314) 566‐9881 mponder@enterprisebank.com ERICA VASQUEZ SVP, OPERATIONS (314) 607‐4989 evasquez@enterprisebank.com NICOLE IANNACONE EVP, CHIEF RISK OFFICER & GENERAL COUNSEL (314) 810‐3773 niannacone@enterprisebank.com JASON SHINN CHIEF INFORMATION OFFICER (314) 565‐5223 jshinn@enterprisebank.com TROY DUMLAO SVP, CHIEF ACCOUNTING OFFICER (303) 549‐2654 tdumlao@enterprisebank.com JEREMY JAMESON DIRECTOR, CREDIT POLICY & ADMINISTRATION (515) 974‐9131 jjameson@enterprisebank.com