Enterprise: A Snapshot Guiding People to a Lifetime of Financial Success Filed by Enterprise Financial Services Corp pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed pursuant to Rule 14a-12 under the Securities and Exchange Act of 1934, as amended Subject Company: First Choice Bancorp Commission File No: 001-38476

Forward-Looking Statements Certain statements contained in this document may be considered forward-looking statements regarding Enterprise Financial Services Corp (EFSC), including its wholly-owned subsidiary Enterprise Bank & Trust (Enterprise), First Choice Bancorp (FCBP), including its wholly-owned subsidiary First Choice Bank (First Choice), and EFSC’s proposed acquisition of FCBP and First Choice. These forward-looking statements may include: statements regarding the acquisition, the consideration payable in connection with the acquisition, and the ability of the parties to consummate the acquisition. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those that EFSC or FCBP anticipated in their forward-looking statements and future results could differ materially from historical performance. Factors that could cause or contribute to such differences include, but are not limited to, the possibility: that expected benefits of the acquisition may not materialize in the timeframe expected or at all, or may be more costly to achieve; that the acquisition may not be timely completed, if at all; the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive transaction agreement; the outcome of any legal proceedings that may be instituted against EFSC or FCBP; that prior to the completion of the acquisition or thereafter, EFSC’s and FCBP’s respective businesses may not perform as expected due to transaction-related uncertainty or other factors; that the parties are unable to successfully implement integration strategies; that required regulatory, EFSC shareholder or FCBP shareholder or other approvals are not obtained or other closing conditions are not satisfied in a timely manner or at all; that adverse regulatory conditions may be imposed in connection with regulatory approvals of the acquisition; reputational risks and the reaction of the companies’ employees or customers to the transaction; diversion of management time on acquisition-related issues; that the COVID-19 pandemic, including uncertainty and volatility in financial, commodities and other markets, and disruptions to banking and other financial activity, could harm Enterprise and FCBP’s business, financial position and results of operations, and could adversely affect the timing and anticipated benefits of the proposed acquisition; and those factors and risks referenced from time to time in EFSC’s or FCBP’s filings with the SEC, including in their Annual Reports on Form 10-K for the fiscal year ended December 31, 2020, and their other filings with the SEC. For any forward-looking statements made in this press release or in any documents, EFSC and FCBP claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Except to the extent required by applicable law or regulation, each of EFSC and FCBP disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made.

3 Additional Information About the Merger and Where to Find It In connection with the proposed acquisition transaction, along with other relevant documents, a registration statement on Form S-4 will be filed with the SEC that will include a joint proxy statement/prospectus to be distributed to the shareholders of EFSC and FCBP in connection with their votes on the acquisition. SHAREHOLDERS OF EFSC AND FCBP ARE URGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE JOINT PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION AND RELATED MATTERS. FREE COPIES OF THESE DOCUMENTS MAY BE OBTAINED AS DESCRIBED BELOW. The final joint proxy statement/prospectus will be mailed to shareholders of EFSC and FCBP. Investors and security holders will be able to obtain the documents, and any other documents EFSC has filed with the SEC, free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by EFSC in connection with the proposed acquisition will be available free of charge by (1) accessing EFSC’s website at www.enterprisebank.com under the “Investor Relations” link, (2) writing EFSC at 150 North Meramec, Clayton, Missouri 63105, Attention: Investor Relations, (3) accessing FCBP’s website at https://investors.firstchoicebankca.com under the “SEC Filings” tab, or (4) writing FCBP at 17785 Center Court Drive, N Suite 750, Cerritos, CA 90703, Attention: General Counsel. Participants in Solicitation FCBP and certain of their directors and executive officers, and EFSC and certain of their directors, executive officers and other certain members of management and employees, may be deemed to be participants in the solicitation of proxies from the shareholders of FCBP and the shareholders of EFSC in connection with the Merger. Information about the directors and executive officers of EFSC is set forth in the proxy statement for EFSC’s 2021 annual meeting of shareholders, as filed with the SEC on a Schedule 14A on March 17, 2021. Information about the directors and officers of FCBP will be set forth in the Form-10-K/A, to be filed with the SEC on or about April 27, 2021 and in the proxy statement of FCBP to be filed on Schedule 14A during the third quarter of 2021. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed acquisition when it becomes available. Free copies of this document, once filed, may be obtained as described in the preceding paragraph.

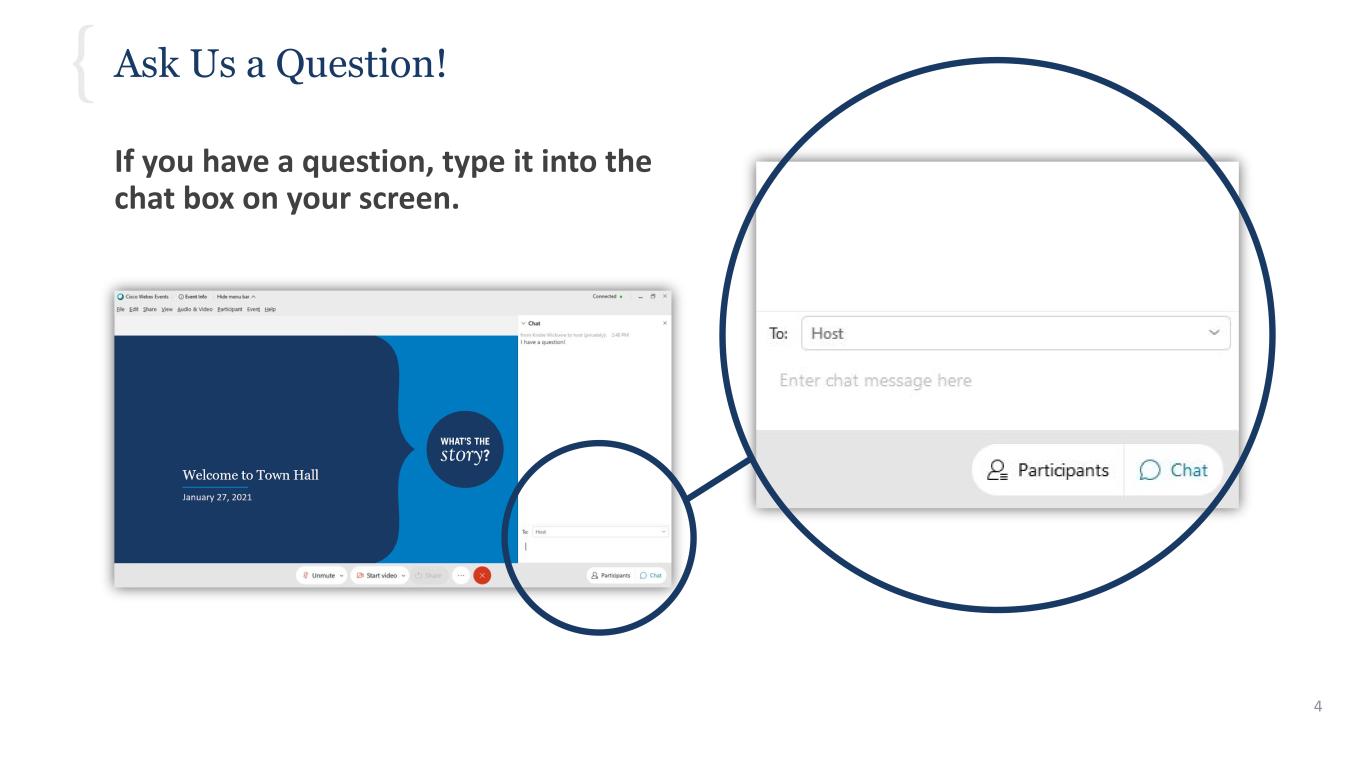

Ask Us a Question! If you have a question, type it into the chat box on your screen. 4

Executive Leadership Team JIM LALLY President & CEO Enterprise Financial Services Corp KEENE TURNER EVP, Chief Financial & Operating Officer Enterprise Financial Services Corp SCOTT GOODMAN President Enterprise Bank & Trust DOUG BAUCHE EVP, Chief Credit Officer Enterprise Bank & Trust MARK PONDER EVP, Chief Administrative Officer Enterprise Bank & Trust NICOLE IANNACONE EVP, Chief Risk Officer & General Counsel Enterprise Bank & Trust

2021 Strategic Priorities 6 ASSOCIATE EXPERIENCE CLIENT EXPERIENCE RELATIONSHIP GROWTH EXECUTE KEY GROWTH PROJECTS Enhance operational improvements, efficiencies and opportunities for associates Improve client experience with emphasis on digital capabilities Drive growth by attracting new and expanding existing relationships Execute key initiatives to facilitate growth and scale

Shared Mission and Vision TALENT, STRENGTH, PASSION together with SPEED, SERVICE, SOLUTIONS create a company that has: ●A customer-centric focus ●Highly skilled and experienced associates ●Specialized expertise ●Tailored solutions ●Strong investment ratings ●An innovative, entrepreneurial approach Prompt follow-up on requests 93% Ease of doing business 92% Provides advice to help grow business 83% Speed Service Solutions

8 By the Numbers TALENT STRENGTH PASSION 71 NPS $10.2B 25,000+ educated at no cost through Enterprise University IN ASSETS Net Promoter Score A- INVESTMENT KROLL RATING TOP 50 Voted a Best Bank to Work For by American Banker 2020 is the 4TH CONSECUTIVE YEAR of receiving a Greenwich Excellence Award for Middle Market Banking EXCLUSIVE SPECIALIZED EXPERTISE Sponsor Finance Community Association Property Management SBA

Enterprise Culture Regional Excellence Awards Communications from Leadership Community Focused Associate Matching Company Updates 2x Week Quarterly Town Halls Business Strategy Updates Why Associates Love Enterprise Entrepreneurial Spirit Diversity of Thought High-teaming Culture Guiding Principles Integrity TeamworkClient Success Accountability Diversity Continuous Improvement Balance Corporate Citizenship

Community Impact and ESG Reports 10

2020 Environmental, Social and Governance Highlights 11 ● There were no layoffs or pay reductions as a result of the pandemic, and on-site essential employees received premium wages for a period of time. ● 70% of employees worked remotely during the pandemic. ● In 2020, we invested over $1.5 billion in programs designed to promote small business and community development. ● Enterprise University, which provides no-cost training courses, has helped more than 25,000 professionals. Our Results Governance Pandemic Preparedness Climate Additional Policies Community Involvement Human Capital Our Framework

Key Integration Team TROY DUMLAO Finance KEENE TURNER Executive Sponsor JADA REESE Human Resources SCOTT COUP Commercial Banking MARK PONDER Administration NICOLE IANNACONE Legal JASON SHINN Information Technology BRIDGET HUFFMAN Risk JEREMY JAMESON Credit ERICA VASQUEZ Operations DAKOTA DANESCU Coordination KENNY HITT Consumer Banking

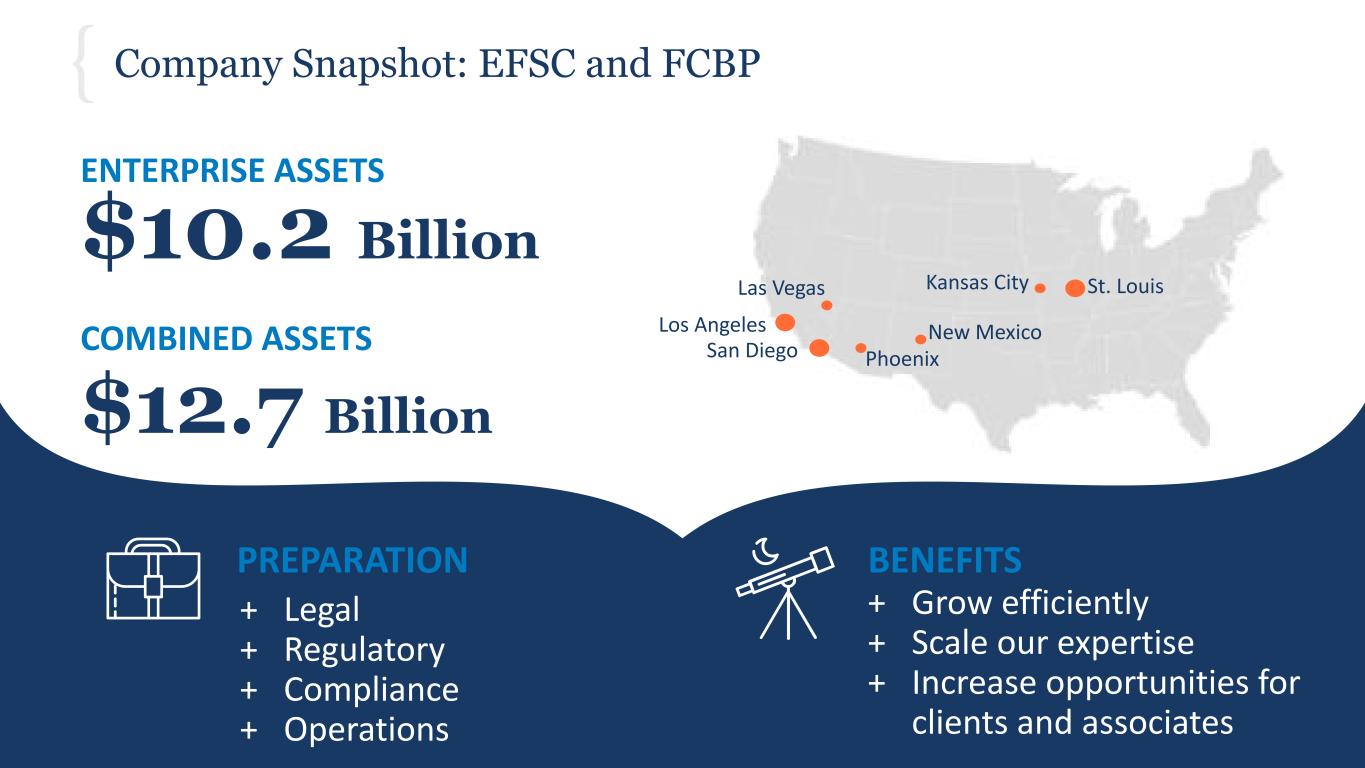

Company Snapshot: EFSC and FCBP 13 $10.2 Billion ENTERPRISE ASSETS $12.7 Billion COMBINED ASSETS St. LouisKansas City New Mexico Phoenix Las Vegas San Diego PREPARATION + Legal + Regulatory + Compliance + Operations + Grow efficiently + Scale our expertise + Increase opportunities for clients and associates BENEFITS Los Angeles

What to Expect 14 TEAMWORK ANSWERS COLLABORATION Group efforts with virtual and safe on-site meetings FAQs Welcome Packet Key Enterprise contacts ask@enterprisebank.com Open and honest participation and collaboration

15 Q&A TOGETHER, THERE’S NO STOPPING YOU.