UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07899 and 811-07885

| Name of Fund: | | BlackRock Index Funds, Inc. |

| | | iShares MSCI EAFE International Index Fund |

| | | iShares Russell 2000 Small-Cap Index Fund |

| | | Quantitative Master Series LLC |

| | | Master Small Cap Index Series |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Index Funds, Inc. and Quantitative Master Series LLC, 55 East 52nd Street, New York, NY 10055

Registrants’ telephone number, including area code: (800) 441-7762

Date of fiscal year end: 12/31/2021

Date of reporting period: 12/31/2021

Item 1 – Report to Stockholders

| | (a) | The Report to Shareholders is attached herewith. |

| | |

| | DECEMBER 31, 2021 |

BlackRock FundsSM

· iShares Municipal Bond Index Fund

· iShares Short-Term TIPS Bond Index Fund

BlackRock Index Funds, Inc.

· iShares MSCI EAFE International Index Fund

· iShares Russell 2000 Small-Cap Index Fund

|

Not FDIC Insured • May Lose Value • No Bank Guarantee |

The Markets in Review

Dear Shareholder,

The 12-month reporting period as of December 31, 2021 saw a continuation of the resurgent growth that followed the initial coronavirus (or “COVID-19”) pandemic reopening, albeit at a slower pace. The global economy weathered the emergence of several variant strains and the resulting peaks and troughs in infections amid optimism that increasing vaccinations and economic adaptation could help contain the pandemic’s disruptions. Continued growth meant that the U.S. economy regained and then surpassed its pre-pandemic output. However, a rapid rebound in consumer spending pushed up against supply constraints and led to elevated inflation.

Equity prices rose with the broader economy, as the implementation of mass vaccination campaigns and passage of an additional fiscal stimulus package and infrastructure bill further boosted stocks. In the United States, both large-and small-capitalization stocks posted a strong advance, and many equity indices neared or surpassed all-time highs late in the reporting period. International equities from developed markets also gained, although emerging market stocks declined, pressured by a strengthening U.S. dollar.

The 10-year U.S. Treasury yield (which is inversely related to bond prices) rose during the reporting period as the economy expanded rapidly and inflation reached its highest annualized reading in decades. In the corporate bond market, support from the U.S. Federal Reserve (the “Fed”) assuaged credit concerns and led to solid returns for high-yield corporate bonds, outpacing investment-grade corporate bonds, which declined.

The Fed maintained accommodative monetary policy during the reporting period by maintaining near-zero interest rates and by asserting that inflation could exceed its 2% target for a sustained period without triggering a rate increase. However, the Fed’s tone shifted late in the year, as it reduced its bond-buying program and used its market guidance to raise the prospect of higher rates in 2022.

Looking ahead, we believe that the global expansion will continue to broaden as Europe and other developed market economies gain momentum, although the Delta and Omicron variants of the coronavirus remain a threat, particularly in emerging markets. While we expect inflation to abate somewhat as supply bottlenecks are resolved, we anticipate that inflation will remain higher than the pre-COVID norm. The Fed is poised to raise interest rates next year in response, but the Fed’s policy shift means that tightening is likely to be less aggressive than what we’ve seen in previous cycles.

In this environment, we favor an overweight to equities, as we believe low interest rates and continued economic growth will support further gains, albeit likely more modest than what we saw in 2021. Sectors that are better poised to manage the transition to a lower-carbon world, such as technology and health care, are particularly attractive in the long term. U.S. and other developed-market equities have room for further growth, while we believe Chinese equities stand to gain from a more accommodative monetary and fiscal environment as the Chinese economy slows. We are underweight long-term credit, but inflation-protected U.S. Treasuries, Asian fixed income, and emerging market local-currency bonds offer potential opportunities. We believe that international diversification and a focus on sustainability can help provide portfolio resilience, and the disruption created by the coronavirus appears to be accelerating the shift toward sustainable investments.

In this environment, our view is that investors need to think globally, extend their scope across a broad array of asset classes, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

Total Returns as of December 31, 2021 |

| | | |

| | | 6-Month | | 12-Month |

| | |

U.S. large cap equities

(S&P 500® Index) | | 11.67% | | 28.71% |

| | |

U.S. small cap equities

(Russell 2000® Index) | | (2.31) | | 14.82 |

| | |

International equities

(MSCI Europe, Australasia, Far East Index) | | 2.24 | | 11.26 |

| | |

Emerging market equities

(MSCI Emerging Markets Index) | | (9.30) | | (2.54) |

| | |

3-month Treasury bills

(ICE BofA 3-Month U.S. Treasury Bill Index) | | 0.02 | | 0.05 |

| | |

U.S. Treasury securities

(ICE BofA 10-Year U.S. Treasury Index) | | 0.44 | | (3.68) |

| | |

U.S. investment grade bonds

(Bloomberg U.S. Aggregate Bond Index) | | 0.06 | | (1.54) |

| | |

Tax-exempt municipal bonds

(S&P Municipal Bond Index) | | 0.52 | | 1.77 |

| | |

U.S. high yield bonds

(Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 1.59 | | 5.26 |

|

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 2 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

| | |

| Fund Summary as of December 31, 2021 | | iShares Municipal Bond Index Fund |

Investment Objective

iShares Municipal Bond Index Fund’s (the “Fund”) investment objective is to seek to provide investment results that correspond to the total return performance of fixed-income securities in the aggregate, as represented by the ICE BofA US Municipal Securities Index (the “Underlying Index”).

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2021, the Fund’s Institutional Shares returned 1.54%, Investor A Shares returned 1.28%, Investor P Shares returned 1.29%, and Class K Shares returned 1.58%. The Fund’s benchmark, the ICE BofA US Municipal Securities Index, returned 1.83% for the same period.

Returns for the Fund’s respective share classes differ from the benchmark indexes based on individual share-class expenses.

Describe the market environment.

The global markets in 2021 began the process of recovery from the COVID-19 pandemic and geopolitical uncertainty. The year started with a positive tone for risk assets as vaccines were rolled out and signs of recovery emerged. The reopening of the economy, continued government stimulus and a dovish Fed contributed to a risk-on environment in the first half of the year. The Fed maintained its exceptionally accommodative stance through most of 2021 as the economy continued to recover with minor setbacks due to the COVID-19 Delta and, more recently, the COVID-19 Omicron variant. The U.S. unemployment rate trended downward throughout the year, beginning at 6.4% in January and ending the year at 3.9%.

As the economy showed continued signs of recovery and inflation remained elevated, the Fed began tapering its asset purchases in November 2021. The final Federal Open Market Committee (“FOMC”) meeting of the year, held in December 2021, announced a doubling in the pace of tapering. At the new pace, the Fund will wrap up its asset purchases in the middle of March 2022, and the expectation is that fed funds rate hikes will follow shortly thereafter. This was reflected in the December Summary of Economic Projections and “dot plot” that showed that FOMC participants anticipate that three increases in the Fed’s benchmark overnight lending rate will be appropriate in 2022. The 10-year U.S. Treasury yield rose by 59 basis points (0.59%) to 1.52% at year end.

Municipal bonds outperformed comparable-maturity U.S. Treasuries for the year on strong credit fundamentals and as U.S. Treasury yields were more directly impacted by the prospect of Fed tightening.

Describe recent portfolio activity.

During the period, the Fund maintained its objective of seeking to provide investment results that correspond to the total return performance of the Underlying Index by selecting securities in accordance with their relative proportion within the Underlying Index. Other factors considered in security selection included transaction costs and maturity.

Describe portfolio positioning at period end.

The Fund remained positioned to attempt to match the risk characteristics of the Underlying Index, irrespective of the market’s future direction.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 4 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares Municipal Bond Index Fund |

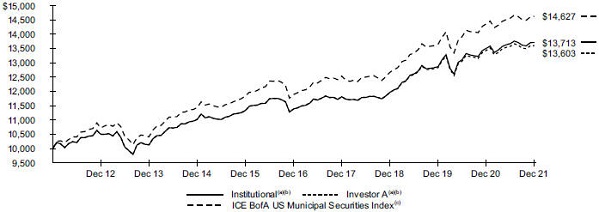

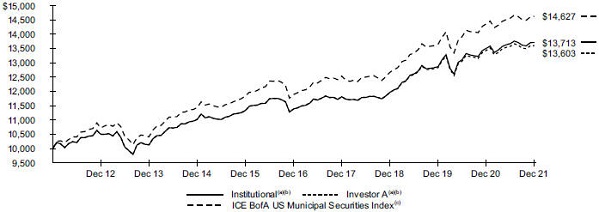

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| | (a) | Assuming transaction costs and other operating expenses, including administration fees, if any. On November 19, 2018, the Fund acquired all of the assets and assumed certain stated liabilities of the State Farm Tax Advantaged Bond Fund (the “Predecessor Fund”), a series of State Farm Mutual Fund Trust, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization; accordingly the Fund assumed the performance and financial history of the Predecessor Fund upon completion of the Reorganization. | |

| | (b) | The Fund generally invests at least 80% of its assets, plus the amount of any borrowings for investment purposes, in securities or other financial instruments that are components of or have economic characteristics similar to the securities in the Underlying Index. | |

| | (c) | An index that tracks the performance of U.S. dollar denominated investment grade tax-exempt debt publicly issued by U.S. states and territories, and their political subdivisions, in the U.S. domestic market. | |

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Average Annual Total Returns(a) | |

| | | | | | | | | | | | |

| | | | | |

| | | | | | | | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | | | |

| | | Standardized

30-Day Yields | | | Unsubsidized

30-Day Yields | | | Without Sales Charge | | | With Sales Charge | | | Without

Sales

Charge | | | With Sales Charge | | | Without

Sales

Charge | | | With Sales Charge | |

| | | | | | | | |

Institutional | | | 0.79 | % | | | 0.78 | % | | | 1.54 | % | | | N/A | | | | 3.79 | % | | | N/A | | | | 3.21 | % | | | N/A | |

Investor A | | | 0.53 | | | | 0.50 | | | | 1.28 | | | | N/A | | | | 3.62 | | | | N/A | | | | 3.13 | | | | N/A | |

Investor P | | | 0.52 | | | | 0.52 | | | | 1.29 | | | | (2.77 | )% | | | 3.62 | | | | 2.78 | % | | | 3.12 | | | | 2.70 | % |

Class K | | | 0.83 | | | | 0.77 | | | | 1.58 | | | | N/A | | | | 3.81 | | | | N/A | | | | 3.22 | | | | N/A | |

ICE BofA US Municipal Securities Index | | | — | | | | — | | | | 1.83 | | | | N/A | | | | 4.23 | | | | N/A | | | | 3.88 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. On November 19, 2018, the Fund acquired all of the assets and assumed certain stated liabilities of the State Farm Tax Advantaged Bond Fund (the “Predecessor Fund”), a series of State Farm Mutual Fund Trust, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization; accordingly the Fund assumed the performance and financial history of the Predecessor Fund upon completion of the Reorganization. | |

N/A — Not applicable as the share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | Hypothetical(a) | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | |

| | | Beginning | | | Ending | | | Expenses | | | | | Beginning | | | Ending | | | Expenses | | | Annualized | |

| | | Account Value | | | Account Value | | | Paid During | | | | | Account Value | | | Account Value | | | Paid During | | | Expense | |

| | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | Ratio | |

| | | | | | | | |

Institutional | | | $ 1,000.00 | | | | $ 1,003.20 | | | | $ 1.21 | | | | | | $ 1,000.00 | | | | $ 1,024.00 | | | | $ 1.22 | | | | 0.24 | % |

Investor A | | | 1,000.00 | | | | 1,001.90 | | | | 2.52 | | | | | | 1,000.00 | | | | 1,022.68 | | | | 2.55 | | | | 0.50 | |

Investor P | | | 1,000.00 | | | | 1,001.90 | | | | 2.47 | | | | | | 1,000.00 | | | | 1,022.74 | | | | 2.50 | | | | 0.49 | |

Class K | | | 1,000.00 | | | | 1,003.40 | | | | 1.01 | | | | | | 1,000.00 | | | | 1,024.20 | | | | 1.02 | | | | 0.20 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares Municipal Bond Index Fund |

Portfolio Information

| | | | |

| SECTOR ALLOCATION | |

| | |

| Sector(a)(b) | | Percent of Total Investments | |

| |

State | | | 31 | % |

| |

Transportation | | | 26 | |

| |

County/City/Special District/School District | | | 16 | |

| |

Utilities | | | 16 | |

| |

Health | | | 6 | |

| |

Education | | | 4 | |

| |

Tobacco | | | 1 | |

| | | | |

| CALL/MATURITY SCHEDULE | |

| | |

| Calendar Year Ended December 31,(a)(c) | | Percentage | |

| |

2022 | | | 8 | % |

| |

2023 | | | 9 | |

| |

2024 | | | 8 | |

| |

2025 | | | 11 | |

| |

2026 | | | 16 | |

| | | | |

| CREDIT QUALITY ALLOCATION | |

| | |

| Credit Rating(a)(d) | | Percent of Total Investments | |

| |

AAA/Aaa | | | 21 | % |

| |

AA/Aa | | | 55 | |

| |

A | | | 17 | |

| |

BBB/Baa | | | 6 | |

| |

N/R(e) | | | 1 | |

| (a) | Excludes short-term securities. |

| (b) | For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of December 31, 2021, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1% of the Fund’s total investments. |

| | |

| 6 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2021 | | iShares Short-Term TIPS Bond Index Fund |

Investment Objective

iShares Short-Term TIPS Bond Index Fund’s (the “Fund”) investment objective is to seek to track the investment results of an index composed of U.S. 0-5 Year Treasury Inflation-Protected Securities.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2021, the Fund’s Institutional Shares returned 5.18%, Investor A Shares returned 4.89%, and Class K Shares returned 5.19%. The Fund’s benchmark, the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L), the (“Underlying Index”), returned 5.34% for the same period.

On December 31, 2021, Bloomberg priced the Fund’s benchmark index at 1 pm EST while BlackRock funds priced at 4 pm EST. This event caused some pricing noise and underperformance across both the index and active books, including the iShares Short Term TIPS Index Fund, when looking at the official return. This effect was offset on January 3, 2022 as the benchmark reverted to 4 pm EST pricing.

What factors influenced performance?

Prices for Treasury inflation-protected securities (“TIPS”) are influenced by changes in inflation expectations as well as the direction of nominal U.S. Treasury yields. For the 12-month period, the Bloomberg US TIPS Index posted a return of 5.96% while the Fund’s benchmark, the Bloomberg U.S. TIPS 0-5 Years Index, returned 5.34%, with returns for both indexes limited by rising longer-term nominal U.S. Treasury yields.

The global markets in 2021 began the process of recovery from the COVID-19 pandemic and geopolitical uncertainty. The year started with a positive tone for risk assets as vaccines were rolled out and signs of recovery emerged. The reopening of the economy, continued government stimulus and a dovish Fed contributed to a risk-on environment in the first half of the year. The Fed maintained its exceptionally accommodative stance through most of 2021 as the economy continued to recover with minor setbacks due to the COVID-19 Delta variant and, more recently, the COVID-19 Omicron variant. The U.S. unemployment rate trended downward throughout the year, beginning at 6.4% in January and ending the year at 3.9%.

As the economy showed continued signs of recovery and inflation remained elevated, the Fed began tapering its asset purchases in November 2021. The final Federal Open Market Committee (“FOMC”) meeting of the year, held in December 2021, announced a doubling in the pace of tapering. At the new pace, the Fund will wrap up its asset purchases in the middle of March 2022, and the expectation is that fed funds rate hikes will follow shortly thereafter. This was reflected in the December Summary of Economic Projections and “dot plot” that showed that FOMC participants anticipate that three increases in the Fed’s benchmark overnight lending rate will be appropriate in 2022. The 10-year U.S. Treasury yield rose by 59 basis points (0.59%) over the 12 months to 1.52% at year end.

Describe recent portfolio activity.

During the period, the Fund maintained its objective of seeking to provide investment results that correspond to the total return performance of the Underlying Index by selecting securities in accordance with their relative proportion within the Underlying Index. Other factors considered in security selection included transaction costs and maturity.

Describe portfolio positioning at period end.

The Fund remains positioned to attempt to match the risk and return characteristics of the Underlying Index, irrespective of the future direction of inflation expectations.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares Short-Term TIPS Bond Index Fund |

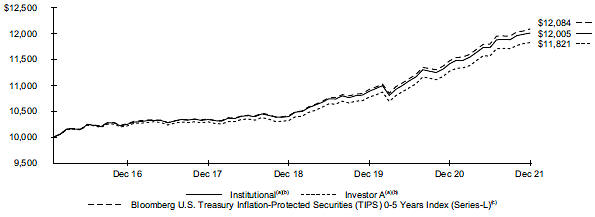

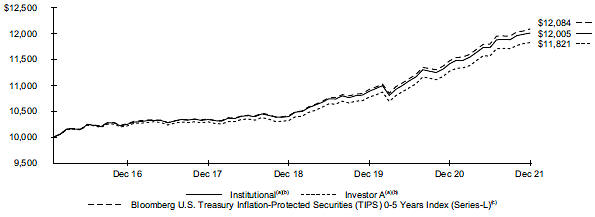

TOTAL RETURN BASED ON A $10,000 INVESTMENT

The Fund commenced operations on February 16, 2016.

| | (a) | Assuming transaction costs and other operating expenses, including investment advisory fees, if any. | |

| | (b) | The Fund generally invests at least 90% of its assets, plus the amount of any borrowing for investment purposes, in securities of the Underlying Index. From time to time when conditions warrant, however, the Fund may invest at least 80% of its assets in securities of the Underlying Index. The Fund may invest a portion of the remainder of its assets in securities not included in the Underlying Index, but which BlackRock Advisors, LLC believes will help the Fund track the Underlying Index. | |

| | (c) | Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L) (formerly Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L), an index that measures the performance of the inflation-protected public obligations of the U.S. Treasury that have a remaining maturity of less than five years. | |

Performance

| | | | | | | | | | | | |

| | | Average Annual Total Returns(a) | |

| | | |

| | | | 1 Year | | | | 5 Years | | |

| Since

Inception |

(b) |

| | | |

Institutional | | | 5.18 | % | | | 3.21 | % | | | 3.16 | % |

Investor A | | | 4.89 | | | | 2.96 | | | | 2.89 | |

Class K | | | 5.19 | | | | 3.23 | | | | 3.18 | |

Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Years Index (Series-L) | | | 5.34 | | | | 3.32 | | | | 3.28 | |

| | (a) | Average annual total returns reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related fees. | |

| | (b) | The Fund commenced operations on February 16, 2016. | |

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical(a) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | |

| Beginning

Account Value (07/01/21) |

| |

| Ending

Account Value (12/31/21) |

| |

| Expenses

Paid During the Period |

(b) | | | | | |

| Beginning

Account Value (07/01/21) |

| |

| Ending

Account Value (12/31/21) |

| |

| Expenses

Paid During the Period |

(b) | |

| Annualized

Expense Ratio |

|

| | | | | | | | |

Institutional | | | $ 1,000.00 | | | | $ 1,024.00 | | | | $ 0.36 | | | | | | | | $ 1,000.00 | | | | $ 1,024.85 | | | | $ 0.36 | | | | 0.07 | % |

Investor A | | | 1,000.00 | | | | 1,022.60 | | | | 1.84 | | | | | | | | 1,000.00 | | | | 1,023.39 | | | | 1.84 | | | | 0.36 | |

Class K | | | 1,000.00 | | | �� | 1,024.10 | | | | 0.31 | | | | | | | | 1,000.00 | | | | 1,024.90 | | | | 0.31 | | | | 0.06 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| 8 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares Short-Term TIPS Bond Index Fund |

Portfolio Information

ALLOCATION BY MATURITY

| | | | |

| | |

| Period | |

| Percent of

Total Investments |

(a) |

| |

0-1 Year | | | 13 | % |

| |

1-2 Years | | | 21 | |

| |

2-3 Years | | | 21 | |

| |

3-4 Years | | | 26 | |

| |

4-5 Years | | | 19 | |

| (a) | | Exclude short-term securities. |

FIVE LARGEST FUND HOLDINGS

| | | | |

| | |

| Holding | | Percent of

Total Investments | |

| |

U.S. Treasury Inflation Protected Security, 0.13%, 01/15/2023 | | | 8 | % |

| |

U.S. Treasury Inflation Protected Security, 0.13%, 10/15/2025 | | | 7 | |

| |

U.S. Treasury Inflation Protected Security, 0.38%, 07/15/2023 | | | 7 | |

| |

U.S. Treasury Inflation Protected Security, 0.25%, 01/15/2025 | | | 6 | |

| |

U.S. Treasury Inflation Protected Security, 0.38%, 07/15/2025 | | | 6 | |

| | |

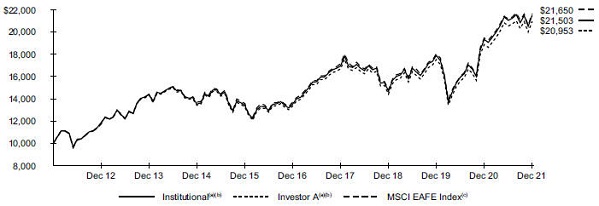

| Fund Summary as of December 31, 2021 | | iShares MSCI EAFE International Index Fund |

Investment Objective

iShares MSCI EAFE International Index Fund’s (the “Fund”) investment objective is to match the performance of the MSCI EAFE Index (Europe, Australasia, Far East) (the “MSCI EAFE Index”) in U.S. dollars with net dividends as closely as possible before the deduction of Fund expenses.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2021, the Fund’s Institutional Shares returned 11.28%, Investor A Shares returned 11.01%, Investor P Shares returned 11.05%, and Class K Shares returned 11.33%. The MSCI EAFE Index returned 11.26% for the same period.

Returns for the Fund’s respective share classes differ from the benchmark index based on individual share-class expenses.

Describe the market environment.

The vaccination rollout in developed markets during the first quarter of 2021 boosted optimism for a global economic recovery. However, the reappearance of high numbers of daily COVID-19 cases across Europe weighed down on the general sentiment, especially as social restrictions were tightened again across Europe.

After a relatively slow start in the second quarter of 2021, the vaccination rate across developed markets picked up, leading to more economic activities restarting. The prospect for strong growth, signaled by strong economic data, also boosted European equities over the quarter. Strong corporate earnings in Europe supported market performance as companies benefited from a combination of demand recovery and supply constraints. Services increased over the quarter, as the ease of COVID-19 restrictions helped fuel higher demand. However, despite the improving economic outlook, the European Central Bank policy makers signaled that it was still too soon to withdraw stimulus measures, while despite the Bank of England announcing its plans to slow its quantitative easing program.

In Japan, the consistent increase in COVID-19 cases led the government to extend the state of emergency until June 20, 2021. While market performance was initially weighed down by the slow vaccination campaign, the market began to rally in the second quarter of 2021 as the government rolled out mass vaccination efforts throughout the country. The Japanese equity market started to recover by the end of May, but investors’ concerns over the low vaccination rate persisted, resulting in slight negative performance for the quarter.

In the third quarter of 2021, the COVID-19 pandemic continued to have a negative impact on economic recovery, but to a lesser degree in developed countries as vaccination rates increased. However, concerns regarding inflation, supply chain disruption, and rising energy prices hindered developed markets’ performance.

In Europe, strong earnings reports and easing of restrictions boosted market performance, and many economies began to recover in the first two months of the third quarter. However, an increase in energy prices due to energy shortages, along with concerns of inflation and supply chain disruption, hindered market performance and gross domestic product growth.

In Asia, the concerns regarding the debt crisis of the Chinese property developer Evergrande dampened market performance, especially in Hong Kong. The Japanese market continued its recovery throughout the third quarter of 2021 despite the state of emergency implemented in Tokyo. Japanese equities were supported by strong earnings reports and increased hopes of stimulus and economic reopening, as COVID-19 cases declined.

During the fourth quarter of 2021, developed non-U.S. equity markets posted a gain in October on the back of strong corporate earnings reports and robust economic data. However, the emergence of the new COVID-19 Omicron variant dampened markets performance in November and put pressure on central banks as they faced rising inflation rates on the back of supply chain disruptions. In December, markets rebounded as the new variant was reported to be less severe than expected despite higher transmissibility.

In Europe, the market recovered in December 2021 after concerns regarding the Omicron variant were lessened. The European Central Bank committed to end the emergency bond buying program in March 2022 but promised to keep low borrowing costs over 2022 and to keep the door open for restarting emergency support in the event of turbulence. On the other hand, the Bank of England raised the policy interest rate in December from 0.10% to 0.25%, signaling that inflation risk outweighed the disruptions risk of the Omicron variant.

Asian developed markets finished the fourth quarter of 2021 in negative territory. The uncertainty of the impact of the Omicron variant and higher commodity prices weighed down on the performance of Asian markets. Japanese equities were the worst performer on the back of a weakened yen and renewed ambiguity regarding new mobility restrictions.

In the fourth quarter of 2021, from a sector perspective within the MSCI EAFE Index, materials (+8.80%), consumer staples (+6.96%) and real estate (+6.29%) were among the best performers. Communication services (-7.68%), energy (-7.37%), and financials (+2.08%) were among the worst performers.

Describe recent portfolio activity.

During the 12-month period, as changes were made to the composition of the MSCI EAFE Index, the Fund purchased and sold securities to maintain its objective of matching the risks and return of the benchmark index.

Describe portfolio positioning at period end.

The Fund remains positioned to match the risk characteristics of the benchmark index, irrespective of the market’s future direction.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 10 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares MSCI EAFE International Index Fund |

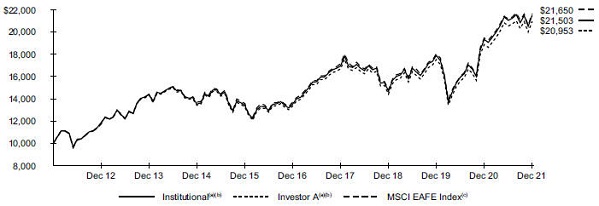

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| | (a) | Assuming transaction costs and other operating expenses, including administration fees, if any. | |

| | (b) | Prior to August 1, 2016, the Fund invested all of its assets in Master International Index Series, a series of Quantitative Master Series LLC. Master International Index Series invested in a statistically selected sample of equity securities included in the MSCI EAFE Index and in derivative instruments linked to the MSCI EAFE Index. On August 1, 2016, the Fund ceased to invest in the Master International Index Series as part of a “master/feeder” structure and instead began to operate as a stand-alone fund. | |

| | (c) | An equity index which captures large- and mid-cap representation across certain developed markets countries around the world, excluding the United States and Canada. The index covers approximately 85% of the free float adjusted market capitalization in each country. | |

Performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns(a) | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | |

| | | Without

Sales

Charge | | | With

Sales

Charge | | | Without

Sales

Charge | | | With

Sales

Charge | | | Without

Sales

Charge | | | With

Sales

Charge | |

| | | | | | |

Institutional | | | 11.28 | % | | | N/A | | | | 9.70 | % | | | N/A | | | | 7.96 | % | | | N/A | |

Investor A | | | 11.01 | | | | N/A | | | | 9.40 | | | | N/A | | | | 7.68 | | | | N/A | |

Investor P | | | 11.05 | | | | 5.22 | % | | | 9.42 | | | | 8.25 | % | | | 7.69 | | | | 7.11 | % |

Class K | | | 11.33 | | | | N/A | | | | 9.74 | | | | N/A | | | | 8.00 | | | | N/A | |

MSCI EAFE Index | | | 11.26 | | | | N/A | | | | 9.55 | | | | N/A | | | | 8.03 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

N/A — Not applicable as the share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical(a) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Beginning | | | | Ending | | | | Expenses | | | | | | | | Beginning | | | | Ending | | | | Expenses | | | | Annualized | |

| | | Account Value | | | | Account Value | | | | Paid During | | | | | | | | Account Value | | | | Account Value | | | | Paid During | | | | Expense | |

| | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | | | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | Ratio | |

| | | | | | | | |

Institutional | | | $ 1,000.00 | | | | $ 1,021.60 | | | | $ 0.46 | | | | | | | | $ 1,000.00 | | | | $ 1,024.75 | | | | $ 0.46 | | | | 0.09 | % |

Investor A | | | 1,000.00 | | | | 1,020.50 | | | | 1.73 | | | | | | | | 1,000.00 | | | | 1,023.49 | | | | 1.73 | | | | 0.34 | |

Investor P | | | 1,000.00 | | | | 1,020.60 | | | | 1.73 | | | | | | | | 1,000.00 | | | | 1,023.49 | | | | 1.73 | | | | 0.34 | |

Class K | | | 1,000.00 | | | | 1,021.50 | | | | 0.20 | | | | | | | | 1,000.00 | | | | 1,025.00 | | | | 0.20 | | | | 0.04 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares MSCI EAFE International Index Fund |

Portfolio Information

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security | | Percent of Net Assets | |

| |

Nestle SA, Registered Shares | | | 2 | % |

ASML Holding NV | | | 2 | |

Roche Holding AG | | | 2 | |

LVMH Moet Hennessy Louis Vuitton SE | | | 1 | |

Toyota Motor Corp. | | | 1 | |

Novartis AG, Registered Shares | | | 1 | |

Novo Nordisk A/S, Class B | | | 1 | |

AstraZeneca PLC | | | 1 | |

Sony Group Corp. | | | 1 | |

SAP SE | | | 1 | |

GEOGRAPHIC ALLOCATION

| | | | |

| | |

| Country/Geographic Region | | Percent of Net Assets | |

| |

Japan | | | 22 | % |

United Kingdom | | | 13 | |

France | | | 11 | |

Switzerland | | | 11 | |

Germany | | | 9 | |

Australia | | | 7 | |

Netherlands | | | 6 | |

Sweden | | | 4 | |

Denmark | | | 3 | |

Hong Kong | | | 2 | |

Spain | | | 2 | |

Italy | | | 2 | |

Finland | | | 1 | |

Singapore | | | 1 | |

Ireland | | | 1 | |

Belgium | | | 1 | |

Israel | | | 1 | |

Norway | | | 1 | |

United States | | | 1 | |

Other# | | | — | (a) |

Other Assets Less Liabilities | | | 1 | |

| (a) | Rounds to less than 1% of net assets. |

| # | Includes holdings within countries/geographic regions that are less than 1% of net assets. Please refer to the Schedule of Investments for such countries/geographic regions. |

| | |

| 12 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

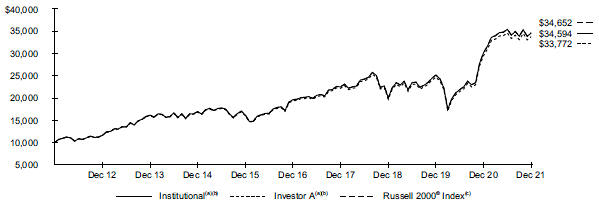

Fund Summary as of December 31, 2021 | | iShares Russell 2000 Small-Cap Index Fund |

Investment Objective

iShares Russell 2000 Small-Cap Index Fund’s (the “Fund”) investment objective is to match the performance of the Russell 2000® Index as closely as possible before the deduction of Fund expenses.

Portfolio Management Commentary

How did the Fund perform?

For the 12-month period ended December 31, 2021, the Fund’s Institutional Shares returned 14.73%, Investor A Shares returned 14.38%, Investor P Shares returned 14,42%, and Class K Shares returned 14.78%. The Russell 2000® Index returned 14.82% for the same period.

Returns for the Fund’s respective share classes differ from the benchmark index based on individual share-class expenses. The Fund invests all of its assets in Master Small Cap Index Series (the “Series”), a series of Quantitative Master Series LLC.

Describe the market environment.

In the first quarter of 2021, following the strong end to 2020, favorable conditions continued with signs of a sooner-than-expected economic activity restart. Monetary conditions remained supportive, as the Fed signaled a continuing environment of low interest rates. With both the Senate and Congress passing a new $1.9 trillion stimulus package, and the United States starting to lead in the vaccine rollout, optimism continued to rise for strong economic growth in the first quarter. Despite the heightened volatility at the beginning of the quarter related to retail trading activity, the positive news about the stimulus package and the potential infrastructure bill soothed the market and supported a positive return over the first quarter.

The U.S. equity market rallied in the second quarter of 2021 as the vaccination campaign continued to accelerate, and as more signs started to emerge for a sooner-than-expected economic activity restart. The U.S. Consumer Price Index increased by more than 4% (one-year as of April 2021), which raised questions on whether this surge was sparked by temporary factors at play. However, the inflation concerns and the Fed’s cautious optimism about the recovery muted the market rally in May. In June, the U.S. equity market extended its rally, supported by the prospect of more fiscal stimulus, as President Biden reached a bipartisan $1 trillion agreement for infrastructure spending.

In the third quarter of 2021, U.S. equities continued climbing in August on the back of strong economic data and quarterly earnings reports. The positive return in markets came despite the increase in COVID-19 Delta variant cases in the United States. The Fed announcement in August was in line with expectations, as Fed Chair Jerome Powell suggested that tapering may start before year end during his Jackson Hole speech.

The positive sentiment of July and August was offset in September amid concerns regarding potential contagion from the unfolding debt crisis at Chinese property developer, Evergrande. Concerns that higher inflation and supply chain issues would last longer than expected also weighed down on the market. Lastly, the continuing disagreement in Washington D.C. regarding the debt ceiling and the infrastructure bill dampened U.S. equity performance. However, Congress passed a bill, toward the end of the third quarter, extending government funding until December 3, 2021.

Following a strong earnings season in the fourth quarter of 2021 that boosted the positive sentiment early in the quarter, the emergence of the new COVID-19 Omicron variant and the concerns about higher inflation rates weighed down on U.S. market performance in November. However, preliminary data showed that the coronavirus vaccine was effective against the Omicron variant, and the Fed shared more clarity on next year’s policy path, leading to strong positive returns to end the fourth quarter. The falling unemployment rate and the $550 billion bipartisan infrastructure bill signed by President Biden supported market performance over the fourth quarter.

The Fed’s stance on monetary policy was at the forefront of market discussions over the fourth quarter of 2021. Fed Chair Jerome Powell conceded that inflation had been far stickier than initially anticipated. These inflation pressures have been exacerbated as consumer demand continued to increase with supply chain bottlenecks and labor shortages. The Fed brought forward the dates of tapering to Spring 2022.

In the fourth quarter of 2021, from a sector perspective within the Russell 2000® Index, utilities (+10.87%), real estate (+8.44%) and industrials (+7.71%) were among the best performers, while communication services (-9.99%), health care (-9.58%), and energy (-3.16%) were among the worst performers.

Describe recent portfolio activity.

During the 12-month period, as changes were made to the composition of the Russell 2000® Index, the Series purchased and sold securities to maintain its objective of matching the risks and return of the benchmark index.

The Series had slightly elevated cash positions at times during the period, which had no material impact on Fund performance.

Describe portfolio positioning at period end.

The Series remains positioned to match the risk characteristics of its benchmark index, irrespective of the market’s future direction.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| Fund Summary as of December 31, 2021 (continued) | | iShares Russell 2000 Small-Cap Index Fund |

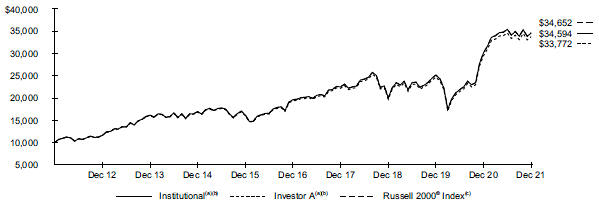

TOTAL RETURN BASED ON A $10,000 INVESTMENT

| | (a) | Assuming transaction costs and other operating expenses, including administration fees, if any. | |

| | (b) | The Fund invests all of its assets in the Series. The Series may invest in a statistically selected sample of the stocks included in the Russell 2000® Index and in derivative instruments linked to the Russell 2000® Index. | |

| | (c) | An index that measures the performance of the small-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. | |

Performance

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns(a) | |

| | | | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | | | | |

| | | Without

Sales

Charge | | | With

Sales

Charge | | | Without

Sales

Charge | | | With

Sales

Charge | | | Without

Sales

Charge | | | With

Sales

Charge | |

| | | | | | |

Institutional | | | 14.73 | % | | | N/A | | | | 12.00 | % | | | N/A | | | | 13.21 | % | | | N/A | |

Investor A | | | 14.38 | | | | N/A | | | | 11.72 | | | | N/A | | | | 12.94 | | | | N/A | |

Investor P | | | 14.42 | | | | 8.41 | % | | | 11.72 | | | | 10.52 | % | | | 12.93 | | | | 12.32 | % |

Class K | | | 14.78 | | | | N/A | | | | 12.06 | | | | N/A | | | | 13.28 | | | | N/A | |

Russell 2000® Index | | | 14.82 | | | | N/A | | | | 12.02 | | | | N/A | | | | 13.23 | | | | N/A | |

| | (a) | Assuming maximum sales charges, if any. Average annual total returns with and without sales charges reflect reductions for distribution and service fees. See “About Fund Performance” for a detailed description of share classes, including any related sales charges and fees, and how performance was calculated for certain share classes. | |

N/A — Not applicable as the share class and index do not have a sales charge.

Past performance is not an indication of future results.

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles.

Expense Example

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | | | | Hypothetical(a) | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | Beginning | | | | Ending | | | | Expenses | | | | | | | | Beginning | | | | Ending | | | | Expenses | | | | Annualized | |

| | | Account Value | | | | Account Value | | | | Paid During | | | | | | | | Account Value | | | | Account Value | | | | Paid During | | | | Expense | |

| | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | | | | | (07/01/21) | | | | (12/31/21) | | | | the Period | (b) | | | Ratio | |

| | | | | | | | |

Institutional | | | $ 1,000.00 | | | | $ 976.90 | | | | $ 0.60 | | | | | | | | $ 1,000.00 | | | | $ 1,024.60 | | | | $ 0.61 | | | | 0.12 | % |

Investor A | | | 1,000.00 | | | | 975.10 | | | | 1.84 | | | | | | | | 1,000.00 | | | | 1,023.34 | | | | 1.89 | | | | 0.37 | |

Investor P | | | 1,000.00 | | | | 975.30 | | | | 1.84 | | | | | | | | 1,000.00 | | | | 1,023.34 | | | | 1.89 | | | | 0.37 | |

Class K | | | 1,000.00 | | | | 977.10 | | | | 0.30 | | | | | | | | 1,000.00 | | | | 1,024.90 | | | | 0.31 | | | | 0.06 | |

| | (a) | Hypothetical 5% annual return before expenses is calculated by prorating the number of days in the most recent fiscal half year divided by 365. | |

| | (b) | For each class of the Fund, expenses are equal to the annualized expense ratio for the class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period shown). Because the Fund invests all of its assets in the Master Portfolio, the expense example reflects the net expenses of both the Fund and the Master Portfolio in which it invests. | |

See “Disclosure of Expenses” for further information on how expenses were calculated.

| | |

| 14 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

About Fund Performance

Institutional and Class K Shares are not subject to any sales charge. These shares bear no ongoing distribution or service fees and are available only to certain eligible investors.

On November 19, 2018, the iShares Municipal Bond Index Fund acquired all of the assets and assumed certain stated liabilities, of the State Farm Tax Advantaged Bond Fund (the “Predecessor Fund”), a series of State Farm Mutual Fund Trust, in a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization. Accordingly, information provided herein for periods prior to the Reorganization is that of the Predecessor Fund. See Note 1 of the Notes to Financial Statements for additional information regarding the Reorganization.

Institutional and Class K Shares performance of iShares Municipal Bond Index Fund shown prior to the Institutional and Class K Shares inception date of November 19, 2018 is that of Investor A Shares, which reflect the performance of Premier Shares of the Predecessor Fund. The performance of iShares Municipal Bond Index Fund’s Institutional and Class K Shares would be substantially similar to Investor A Shares because Institutional Shares, Class K Shares and Investor A Shares invest in the same portfolio of securities and performance would only differ to the extent that Institutional Shares, Class K Shares and Investor A Shares have different expenses. The actual returns of Institutional and Class K Shares would have been higher than those of the Investor A Shares because Institutional and Class K Shares have lower expenses than the Investor A Shares.

Investor A Shares are not subject to any sales charge and bear no ongoing distribution fee. These shares are subject to an ongoing service fee of 0.25% per year. These shares are generally available through financial intermediaries. Investor A Shares performance of iShares Municipal Bond Index Fund shown prior to the Reorganization is that of the Premier Shares of the Predecessor Fund.

Investor P Shares (available in iShares MSCI EAFE International Index Fund and iShares Russell 2000 Small-Cap Index Fund) are subject to a maximum initial sales charge (front-end load) of 5.25% and a service fee of 0.25% per year (but no distribution fee). These shares are only available to investors purchasing shares through registered representatives of an insurance company’s broker-dealer that has entered into an agreement with iShares MSCI EAFE International Index Fund and iShares Russell 2000 Small-Cap Index Fund’s distributor to offer such shares. Investor P Share performance of iShares MSCI EAFE International Index Fund and iShares Russell 2000 Small-Cap Index Fund shown prior to the Investor P Shares inception date of August 6, 2018 is that of Institutional Shares (which have no distribution or service fees) and was restated to reflect Investor P Shares fees.

Investor P Shares (available in iShares Municipal Bond Index Fund) are subject to a maximum initial sales charge (front-end load) of 4.00% and a service fee of 0.25% per year (but no distribution fee). Certain redemptions of these shares may be subject to a contingent deferred sales charge (“CDSC”) where no initial sales charge was paid at the time of purchase. These shares are only available to investors purchasing shares through registered representatives of an insurance company’s broker-dealer that has entered into an agreement with the Fund’s distributor to offer such shares. Investor P Shares performance shown prior to the Reorganization is that of the Premier Shares of the Predecessor Fund.

Past performance is not an indication of future results. Financial markets have experienced extreme volatility and trading in many instruments has been disrupted. These circumstances may continue for an extended period of time and may continue to affect adversely the value and liquidity of each Fund’s investments. As a result, current performance may be lower or higher than the performance data quoted. Refer to blackrock.com to obtain performance data current to the most recent month-end. Performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Figures shown in the performance table(s) assume reinvestment of all distributions, if any, at net asset value (“NAV”) on the ex-dividend date or payable date, as applicable. Investment return and principal value of shares will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Distributions paid to each class of shares will vary because of the different levels of service, distribution and transfer agency fees applicable to each class, which are deducted from the income available to be paid to shareholders.

BlackRock Advisors, LLC (the “Manager”), each Fund’s investment adviser, has contractually and/or voluntarily agreed to waive and/or reimburse a portion of each Fund’s expenses. Without such waiver(s) and/or reimbursement(s), each Fund’s performance would have been lower. With respect to each Fund’s voluntary waiver(s), if any, the Manager is under no obligation to waive and/or reimburse or to continue waiving and/or reimbursing its fees and such voluntary waiver(s) may be reduced or discontinued at any time. With respect to each Fund’s contractual waiver(s), if any, the Manager is under no obligation to continue waiving and/or reimbursing its fees after the applicable termination date of such agreement. See the Notes to Financial Statements for additional information on waivers and/or reimbursements.

The standardized 30-day yield includes the effects of any waivers and/or reimbursements. The unsubsidized 30-day yield excludes the effects of any waivers and/or reimbursements.

| | |

ABOUT FUND PERFORMANCE | | 15 |

Disclosure of Expenses

Shareholders of each Fund may incur the following charges: (a) transactional expenses, such as sales charges; and (b) operating expenses, including investment advisory fees, service and distribution fees, including 12b-1 fees, acquired fund fees and expenses, and other fund expenses. The expense examples shown (which are based on a hypothetical investment of $1,000 invested at the beginning of the period (or from the commencement of operations if less than 6 months) and held through the end of the period) are intended to assist shareholders both in calculating expenses based on an investment in each Fund and in comparing these expenses with similar costs of investing in other mutual funds.

The expense examples provide information about actual account values and actual expenses. Annualized expense ratios reflect contractual and voluntary fee waivers, if any. In order to estimate the expenses a shareholder paid during the period covered by this report, shareholders can divide their account value by $1,000 and then multiply the result by the number corresponding to their Fund and share class under the heading entitled “Expenses Paid During the Period.”

The expense examples also provide information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses. In order to assist shareholders in comparing the ongoing expenses of investing in these Funds and other funds, compare the 5% hypothetical examples with the 5% hypothetical examples that appear in shareholder reports of other funds.

The expenses shown in the expense examples are intended to highlight shareholders’ ongoing costs only and do not reflect transactional expenses, such as sales charges, if any. Therefore, the hypothetical examples are useful in comparing ongoing expenses only and will not help shareholders determine the relative total expenses of owning different funds. If these transactional expenses were included, shareholder expenses would have been higher.

Derivative Financial Instruments

The Funds may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. The Funds’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Fund can realize on an investment and/or may result in lower distributions paid to shareholders. The Funds’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 16 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments December 31, 2021 | | iShares Municipal Bond Index Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

Municipal Bonds | | | | | | | | |

| | |

| Alabama — 0.5% | | | | | | |

| | |

| State — 0.2% | | | | | | |

Alabama Public School and College Authority, Refunding RB, Series A, 4.00%, 11/01/38 | | $ | 395 | | | $ | 476,015 | |

| | | | | | | | |

| | |

| Transportation — 0.3% | | | | | | |

Alabama Federal Aid Highway Finance Authority, Refunding RB, Series B, 5.00%, 09/01/24(a) | | | 900 | | | | 1,010,363 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Alabama | | | | | | | 1,486,378 | |

| | | | | | | | |

| | |

| Arizona — 1.7% | | | | | | |

|

| County/City/Special District/School District — 0.2% | |

City of Phoenix, Refunding GO, 5.00%, 07/01/24 | | | 650 | | | | 723,944 | |

| | | | | | | | |

| | |

| Health — 0.3% | | | | | | |

Arizona Health Facilities Authority, Refunding RB, Series A, 4.00%, 01/01/23(b) | | | 1,000 | | | | 1,000,000 | |

| | | | | | | | |

| | |

| Transportation — 0.3% | | | | | | |

Arizona Department of Transportation State Highway Fund Revenue, Refunding RB, Sub-Series A, 5.00%, 07/01/22(b) | | | 1,000 | | | | 1,023,654 | |

| | | | | | | | |

| | |

| Utilities — 0.9% | | | | | | |

Salt River Project Agricultural Improvement & Power District, Refunding RB, Series A, 5.00%, 01/01/34 | | | 2,480 | | | | 2,975,039 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Arizona | | | | | | | 5,722,637 | |

| | | | | | | | |

| | |

| California — 21.0% | | | | | | |

|

| County/City/Special District/School District — 4.4% | |

Coast Community College District, Refunding GO, Series A, 4.00%, 08/01/23(b) | | | 1,000 | | | | 1,059,347 | |

Contra Costa Community College District, GO, Series A, 4.00%, 08/01/39 | | | 1,000 | | | | 1,083,398 | |

El Camino Community College District Foundation, GO, CAB, Series C, 0.00%, 08/01/38(c) | | | 680 | | | | 472,787 | |

Fremont Union High School District, Refunding GO, Series A, 5.00%, 08/01/44 | | | 1,350 | | | | 1,643,627 | |

Los Angeles Community College District, Refunding GO, Series A, 5.00%, 08/01/24(b) | | | 1,000 | | | | 1,118,720 | |

Los Angeles County Facilities Inc., RB, Series A, 4.00%, 12/01/48 | | | 1,000 | | | | 1,159,709 | |

Los Angeles Unified School District, GO, Series B-1, 5.00%, 07/01/33 | | | 1,500 | | | | 1,850,002 | |

Sacramento City Financing Authority, Refunding RB, Series E, (AMBAC), 5.25%, 12/01/30 | | | 250 | | | | 322,127 | |

San Diego Community College District, Refunding GO, 4.00%, 08/01/26(b) | | | 500 | | | | 578,563 | |

San Diego Unified School District, GO | | | | | | | | |

Series I, 5.00%, 07/01/41 | | | 1,000 | | | | 1,214,390 | |

Series I, 5.00%, 07/01/47 | | | 2,075 | | | | 2,503,820 | |

Series L, 4.00%, 07/01/49 | | | 1,000 | | | | 1,176,095 | |

San Marcos Unified School District, GO, CAB, Series B, 0.00%, 08/01/51(c) | | | 350 | | | | 168,378 | |

| | | | | | | | |

| | |

| | | | | | | 14,350,963 | |

| | |

| Education — 2.3% | | | | | | |

California Educational Facilities Authority, RB, Series U-6, 5.00%, 05/01/45 | | | 1,260 | | | | 1,957,899 | |

California State University, Refunding RB Series A, 4.00%, 11/01/35 | | | 500 | | | | 564,380 | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| Education (continued) | | | | | | |

California State University, Refunding RB (continued) | |

Series A, 4.00%, 11/01/38 | | $ | 500 | | | $ | 562,680 | |

Series A, 5.00%, 11/01/43 | | | 540 | | | | 625,750 | |

Series A, 5.00%, 11/01/48 | | | 1,030 | | | | 1,275,615 | |

University of California, Refunding RB | | | | | | | | |

Series AR, 5.00%, 05/15/41 | | | 605 | | | | 712,986 | |

Series AY, 5.00%, 05/15/32 | | | 500 | | | | 610,211 | |

Series AY, 5.00%, 05/15/36 | | | 1,000 | | | | 1,216,313 | |

| | | | | | | | |

| | |

| | | | | | | 7,525,834 | |

| | |

| Health — 1.1% | | | | | | |

California Health Facilities Financing Authority Refunding RB, 5.00%, 08/15/51 | | | 1,000 | | | | 1,284,424 | |

California Health Facilities Financing Authority, RB, Series A, 5.00%, 11/15/48 | | | 1,950 | | | | 2,377,871 | |

| | | | | | | | |

| | |

| | | | | | | 3,662,295 | |

| | |

| State — 5.8% | | | | | | |

California State Public Works Board, RB, Series A, 5.00%, 03/01/38 | | | 1,000 | | | | 1,050,563 | |

California State Public Works Board, Refunding RB | | | | | | | | |

Series B, 5.00%, 10/01/26 | | | 250 | | | | 300,588 | |

Series C, 4.00%, 11/01/32 | | | 500 | | | | 574,416 | |

Series C, 5.00%, 11/01/34 | | | 685 | | | | 818,475 | |

State of California, GO, 5.00%, 03/01/45 | | | 1,000 | | | | 1,123,816 | |

State of California, Refunding GO | | | | | | | | |

5.00%, 10/01/24 | | | 475 | | | | 534,826 | |

5.00%, 10/01/25 | | | 1,000 | | | | 1,166,631 | |

5.00%, 08/01/26 | | | 540 | | | | 626,800 | |

5.00%, 08/01/27 | | | 1,000 | | | | 1,198,265 | |

5.00%, 08/01/31 | | | 1,000 | | | | 1,188,301 | |

5.00%, 09/01/31 | | | 565 | | | | 673,314 | |

5.00%, 12/01/31 | | | 2,000 | | | | 2,171,749 | |

4.00%, 09/01/32 | | | 250 | | | | 286,496 | |

4.00%, 09/01/33 | | | 1,000 | | | | 1,144,834 | |

5.00%, 08/01/35 | | | 1,000 | | | | 1,221,756 | |

4.00%, 09/01/35 | | | 1,000 | | | | 1,143,023 | |

5.00%, 09/01/35 | | | 1,000 | | | | 1,189,181 | |

5.00%, 02/01/38 | | | 1,000 | | | | 1,048,495 | |

5.00%, 12/01/43 | | | 500 | | | | 542,737 | |

5.00%, 08/01/46 | | | 1,000 | | | | 1,177,453 | |

| | | | | | | | |

| | |

| | | | | | | 19,181,719 | |

| | |

| Tobacco — 0.9% | | | | | | |

Golden State Tobacco Securitization Corp., Refunding RB, Series A, (SAP), 5.00%, 06/01/25(b) | | | 2,400 | | | | 2,773,924 | |

| | | | | | | | |

| | |

| Transportation — 2.9% | | | | | | |

Bay Area Toll Authority, RB, Series F-1,

4.00%, 04/01/56 | | | 1,000 | | | | 1,145,682 | |

Bay Area Toll Authority, Refunding RB,

4.00%, 04/01/38 | | | 500 | | | | 577,548 | |

City of Long Beach California Harbor Revenue, Refunding ARB, Series C, 5.00%, 05/15/47 | | | 500 | | | | 600,019 | |

City of Los Angeles Department of Airports, ARB, Sub- Series B, 5.00%, 05/15/42 | | | 1,500 | | | | 1,817,035 | |

City of Los Angeles Department of Airports, Refunding RB, Series B, 5.00%, 05/15/35 | | | 400 | | | | 406,937 | |

Foothill-Eastern Transportation Corridor Agency, Refunding RB, CAB(c) | | | | | | | | |

Series A, (AGM), 0.00%, 01/15/36 | | | 500 | | | | 370,605 | |

Series A, (AGM), 0.00%, 01/15/37 | | | 1,000 | | | | 720,232 | |

| | |

FUND SCHEDULES OF INVESTMENTS | | 17 |

| | |

Schedule of Investments (continued) December 31, 2021 | | iShares Municipal Bond Index Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| Transportation (continued) | | | | | | |

Riverside County Transportation Commission Refunding RB, 4.00%, 06/01/37 | | $ | 1,154 | | | $ | 1,387,701 | |

San Francisco City & County Airport Comm-San Francisco International Airport, Refunding ARB | | | | | | | | |

Series E, 5.00%, 05/01/48 | | | 1,190 | | | | 1,459,510 | |

Series A, AMT, 4.00%, 05/01/49 | | | 1,000 | | | | 1,135,947 | |

| | | | | | | | |

| | |

| | | | | | | 9,621,216 | |

| | |

| Utilities — 3.6% | | | | | | |

City of San Francisco California Public Utilities Commission Water Revenue, Refunding RB, 5.00%, 11/01/35 | | | 1,305 | | | | 1,560,650 | |

East Bay Municipal Utility District Water System Revenue, Refunding RB, Series B, 5.00%, 06/01/33 | | | 1,435 | | | | 1,758,518 | |

Los Angeles Department of Water & Power Power System Revenue, RB, Series D, 5.00%, 07/01/44 | | | 1,500 | | | | 1,658,392 | |

Los Angeles Department of Water & Power Power System Revenue, Refunding RB | | | | | | | | |

Series A, 5.00%, 07/01/30 | | | 1,500 | | | | 1,697,841 | |

Series A, 5.00%, 07/01/37 | | | 1,000 | | | | 1,229,098 | |

Sacramento Municipal Utility District, RB, Series A, 5.00%, 08/15/41 | | | 575 | | | | 615,106 | |

San Diego Public Facilities Financing Authority, Refunding RB, Series A, Subordinate, 5.00%, 08/01/43 | | | 500 | | | | 619,312 | |

San Francisco City & County Public Utilities Commission Wastewater Revenue, Refunding RB, Series B, 4.00%, 10/01/42 | | | 1,500 | | | | 1,539,955 | |

State of California Department of Water Resources, Refunding RB, Series AW,

5.00%, 12/01/26(b) | | | 1,000 | | | | 1,214,843 | |

| | | | | | | | |

| | |

| | | | | | | 11,893,715 | |

| | | | | | | | |

| | |

Total Municipal Bonds in California | | | | | | | 69,009,666 | |

| | |

| Colorado — 1.9% | | | | | | |

|

| County/City/Special District/School District — 0.5% | |

City & County of Denver Colorado, Refunding RB, Series A, 4.00%, 08/01/46 | | | 1,500 | | | | 1,656,099 | |

| | | | | | | | |

| | |

| Health — 0.3% | | | | | | |

Colorado Health Facilities Authority, Refunding RB, Series A, 5.00%, 08/01/44 | | | 1,000 | | | | 1,227,991 | |

| | | | | | | | |

| | |

| State — 0.2% | | | | | | |

State of Colorado, COP, Series N,

4.00%, 03/15/43 | | | 500 | | | | 572,015 | |

| | | | | | | | |

| | |

| Transportation — 0.5% | | | | | | |

City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series A, AMT, 5.00%, 12/01/35 | | | 1,000 | | | | 1,230,694 | |

E-470 Public Highway Authority, Refunding RB, Series A, 5.00%, 09/01/40 | | | 400 | | | | 444,469 | |

| | | | | | | | |

| | |

| | | | | | | 1,675,163 | |

| | |

| Utilities — 0.4% | | | | | | |

Board of Water Commissioners City & County of Denver, RB, Series A, 4.00%, 12/15/26 | | | 1,230 | | | | 1,233,434 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Colorado | | | | | | | 6,364,702 | |

| | | | | | | | |

| | |

| Connecticut — 2.2% | | | | | | |

| | |

| Health — 0.4% | | | | | | |

Connecticut State Health & Educational Facilities Authority, Refunding RB, 5.00%, 12/01/45 | | | 1,000 | | | | 1,171,051 | |

| | | | | | | | |

| | | | | | | | |

| Security | | Par (000) | | | Value | |

| | |

| State — 1.8% | | | | | | |

State of Connecticut Special Tax Revenue, RB | | | | | | | | |

Series A, 5.00%, 09/01/24 | | $ | 400 | | | $ | 447,917 | |

Series A, 5.00%, 10/01/29 | | | 725 | | | | 782,509 | |

Series A, 4.00%, 05/01/36 | | | 1,000 | | | | 1,199,640 | |

Series A, 4.00%, 09/01/36 | | | 430 | | | | 484,470 | |

State of Connecticut, GO | | | | | | | | |

Series A, 5.00%, 10/15/23 | | | 850 | | | | 920,433 | |

Series A, 5.00%, 10/15/27 | | | 400 | | | | 432,178 | |

Series B, 5.00%, 06/15/28 | | | 400 | | | | 459,928 | |

Series B, 4.00%, 06/15/33 | | | 850 | | | | 939,553 | |

State of Connecticut, Refunding GO, Series B, 5.00%, 05/15/25 | | | 250 | | | | 287,399 | |

| | | | | | | | |

| | |

| | | | | | | 5,954,027 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Connecticut | | | | | | | 7,125,078 | |

| | |

| District of Columbia — 2.5% | | | | | | |

| | |

| State — 0.5% | | | | | | |

District of Columbia, GO | | | | | | | | |

Series D, 5.00%, 06/01/26 | | | 500 | | | | 596,732 | |

Series D, 4.00%, 06/01/34 | | | 1,000 | | | | 1,159,649 | |

| | | | | | | | |

| | |

| | | | | | | 1,756,381 | |

| | |

| Transportation — 1.1% | | | | | | |

Metropolitan Washington Airports Authority Aviation Revenue, Refunding RB, Series A, AMT,

4.00%, 10/01/51 | | | 1,500 | | | | 1,754,253 | |

Washington Metropolitan Area Transit Authority, RB, Series A, 4.00%, 07/15/45 | | | 1,500 | | | | 1,773,838 | |

| | | | | | | | |

| | |

| | | | | | | 3,528,091 | |

| | |

| Utilities — 0.9% | | | | | | |

District of Columbia Water & Sewer Authority, Refunding RB | | | | | | | | |

Sub-Series A, 5.00%, 10/01/45 | | | 1,510 | | | | 1,743,355 | |

Series C, Sub-Lien, 5.00%, 10/01/44 | | | 1,000 | | | | 1,111,704 | |

| | | | | | | | |

| | |

| | | | | | | 2,855,059 | |

| | | | | | | | |

| | |

Total Municipal Bonds in District of Columbia | | | | | | | 8,139,531 | |

| | |

| Florida — 2.7% | | | | | | |

|

| County/City/Special District/School District — 0.7% | |

County of Miami-Dade Florida Transit System, RB, Series A, 4.00%, 07/01/50 | | | 1,500 | | | | 1,743,718 | |

School Board of Miami-Dade County, Refunding COP, Series D, 5.00%, 02/01/27 | | | 500 | | | | 585,233 | |

| | | | | | | | |

| | |

| | | | | | | 2,328,951 | |

| | |

| State — 0.3% | | | | | | |

State of Florida, Refunding GO, Series A,

5.00%, 07/01/25 | | | 1,000 | | | | 1,157,363 | |

| | | | | | | | |

| | |

| Transportation — 1.7% | | | | | | |

Central Florida Expressway Authority, Refunding RB, Series B, Senior Lien,

5.00%, 07/01/33 | | | 1,000 | | | | 1,179,564 | |

County of Broward Florida Airport System Revenue, Refunding ARB, Series Q-1, 5.00%, 10/01/22(b) | | | 1,000 | | | | 1,036,039 | |

Greater Orlando Aviation Authority, ARB, Series A, AMT, 5.00%, 10/01/54 | | | 850 | | | | 1,035,460 | |

| | |

| 18 | | 2 0 2 1 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Schedule of Investments (continued) December 31, 2021 | | iShares Municipal Bond Index Fund (Percentages shown are based on Net Assets) |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| Transportation (continued) | | | | | | |

Miami-Dade County Expressway Authority, Refunding RB, Series B, 5.00%, 07/01/25 | | $ | 1,000 | | | $ | 1,111,119 | |

State of Florida Department of Transportation Turnpike System Revenue, RB, Series A, 4.00%, 07/01/48 | | | 1,000 | | | | 1,147,899 | |

| | | | | | | | |

| | |

| | | | | | | 5,510,081 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Florida | | | | | | | 8,996,395 | |

| | |

| Georgia — 2.0% | | | | | | |

|

| County/City/Special District/School District — 0.5% | |

Gwinnett County School District, GO, 5.00%, 02/01/40 | | | 400 | | | | 502,901 | |

Metropolitan Atlanta Rapid Transit Authority, Refunding RB, Series B, 5.00%, 07/01/35 | | | 1,000 | | | | 1,185,998 | |

| | | | | | | | |

| | |

| | | | | | | 1,688,899 | |

| | |

| State — 0.9% | | | | | | |

State of Georgia, GO, Series A, 5.00%, 02/01/29 | | | 650 | | | | 765,340 | |

State of Georgia, Refunding GO, Series C, 5.00%, 07/01/28 | | | 1,710 | | | | 2,105,850 | |

| | | | | | | | |

| | |

| | | | | | | 2,871,190 | |

| | |

| Transportation — 0.4% | | | | | | |

City of Atlanta Georgia Department of Aviation, Refunding RB, Series A, 5.00%, 07/01/29 | | | 1,000 | | | | 1,286,939 | |

| | | | | | | | |

| | |

| Utilities — 0.2% | | | | | | |

City of Atlanta Georgia Water & Wastewater Revenue, Refunding RB, 5.00%, 05/01/25(b) | | | 500 | | | | 575,270 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Georgia | | | | | | | 6,422,298 | |

| | | | | | | | |

| | |

| Hawaii — 0.2% | | | | | | |

| | |

| State — 0.2% | | | | | | |

State of Hawaii, Refunding GO, Series A, 5.00%, 11/01/22(b) | | | 500 | | | | 519,905 | |

| | | | | | | | |

| | |

| Illinois — 3.9% | | | | | | |

| | |

| Health — 0.4% | | | | | | |

Illinois Finance Authority, Refunding RB, 5.00%, 12/01/40 | | | 1,000 | | | | 1,172,225 | |

| | | | | | | | |

| | |

| State — 2.1% | | | | | | |

Metropolitan Pier & Exposition Authority, RB, (AGM), 0.00%, 06/15/46(c) | | | 1,105 | | | | 587,771 | |

State of Illinois, GO | | | | | | | | |

5.00%, 05/01/39 | | | 1,500 | | | | 1,638,257 | |

Series C, 5.00%, 11/01/29 | | | 1,000 | | | | 1,201,304 | |

Series D, 5.00%, 11/01/24 | | | 1,000 | | | | 1,120,962 | |

Series D, 5.00%, 11/01/26 | | | 500 | | | | 593,305 | |

State of Illinois, Refunding GO | | | | | | | | |

5.00%, 02/01/22 | | | 500 | | | | 501,802 | |

Series A, 5.00%, 10/01/25 | | | 500 | | | | 576,586 | |

Series A, 5.00%, 10/01/28 | | | 500 | | | | 615,790 | |

| | | | | | | | |

| | |

| | | | | | | 6,835,777 | |

| | |

| Transportation — 1.4% | | | | | | |

Chicago O’Hare International Airport, ARB, Series E, Senior Lien, 5.00%, 01/01/24 | | | 410 | | | | 447,340 | |

Chicago O’Hare International Airport, Refunding ARB | | | | | | | | |

Series B, Senior Lien, 4.00%, 01/01/44 | | | 1,000 | | | | 1,145,308 | |

Series B, Senior Lien, 5.00%, 01/01/48 | | | 1,000 | | | | 1,216,465 | |

| | | | | | | | |

| Security | | Par

(000) | | | Value | |

| | |

| Transportation (continued) | | | | | | |

Chicago Transit Authority Capital Grant Receipts Revenue Refunding RB, 5.00%, 06/01/28 | | $ | 190 | | | $ | 236,290 | |

Illinois State Toll Highway Authority, RB, Series B, 5.00%, 01/01/41 | | | 1,000 | | | | 1,169,463 | |

Illinois State Toll Highway Authority, Refunding RB | | | | | | | | |

Series A, 5.00%, 01/01/25 | | | 100 | | | | 113,285 | |

Series A, 5.00%, 01/01/30 | | | 250 | | | | 315,662 | |

| | | | | | | | |

| | |

| | | | | | | 4,643,813 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Illinois | | | | | | | 12,651,815 | |

| | |

| Indiana — 0.0% | | | | | | |

| | |

| State — 0.0% | | | | | | |

Indiana Finance Authority, Refunding RB, Series C, 5.00%, 12/01/24 | | | 100 | | | | 113,406 | |

| | | | | | | | |

| | |

| Kansas — 0.7% | | | | | | |

|

| County/City/Special District/School District — 0.1% | |

University of Kansas Hospital Authority Refunding RB, 5.00%, 03/01/27(b) | | | 155 | | | | 187,942 | |

| | | | | | | | |

| | |

| Health — 0.1% | | | | | | |

University of Kansas Hospital Authority Refunding RB, 5.00%, 03/01/47 | | | 425 | | | | 504,665 | |

| | | | | | | | |

| | |

| Transportation — 0.5% | | | | | | |

State of Kansas Department of Transportation, RB

5.00%, 09/01/27 | | | 1,000 | | | | 1,160,073 | |

5.00%, 09/01/34 | | | 500 | | | | 578,098 | |

| | | | | | | | |

| | |

| | | | | | | 1,738,171 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Kansas | | | | | | | 2,430,778 | |

| | |

| Louisiana(b) — 0.5% | | | | | | |

|

| County/City/Special District/School District — 0.3% | |

State of Louisiana Gasoline & Fuels Tax Revenue, Refunding RB, Series C-1, 2nd Lien, 5.00%, 05/01/23 | | | 925 | | | | 983,434 | |

| | | | | | | | |

| | |

| State — 0.2% | | | | | | |

State of Louisiana, Refunding GO, Series C, 5.00%, 07/15/22 | | | 500 | | | | 512,870 | |

| | | | | | | | |

| | |

Total Municipal Bonds in Louisiana | | | | | | | 1,496,304 | |

| | | | | | | | |

| | |

| Maryland — 1.0% | | | | | | |

| | |

| State — 0.7% | | | | | | |

State of Maryland, GO | | | | | | | | |

Series A, 5.00%, 03/15/28 | | | 450 | | | | 564,780 | |