Exhibit 99.1

| | |

| | News Release |

FOR IMMEDIATE RELEASE

November 7, 2013

MEDIA CONTACT: Lisa Gagnon

703-903-3385

INVESTOR CONTACT: Robin Phillips

571-382-4732

FREDDIE MAC REPORTS PRE-TAX INCOME OF $6.5 BILLION FOR THIRD QUARTER 2013

Release of Valuation Allowance on Deferred Tax Assets Adds $23.9 Billion to Net Income

Net Income of $30.5 Billion for Third Quarter 2013, Comprehensive Income of $30.4 Billion

Third Quarter 2013 Financial Results

| | — | | Pre-tax income was $6.5 billion, compared to $4.9 billion in the second quarter of 2013 – the eighth consecutive quarter of positive earnings and the second largest in company history |

| | — | | Net income was $30.5 billion, including the $23.9 billion impact of releasing the valuation allowance on deferred tax assets |

| | — | | Comprehensive income was $30.4 billion |

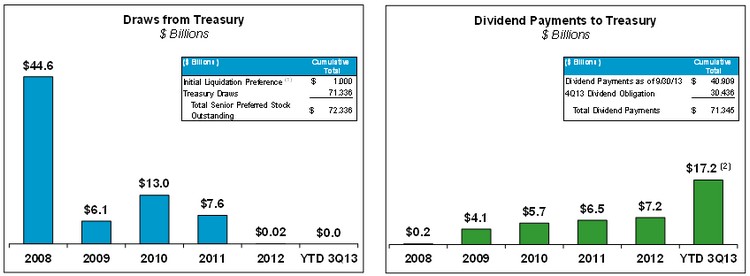

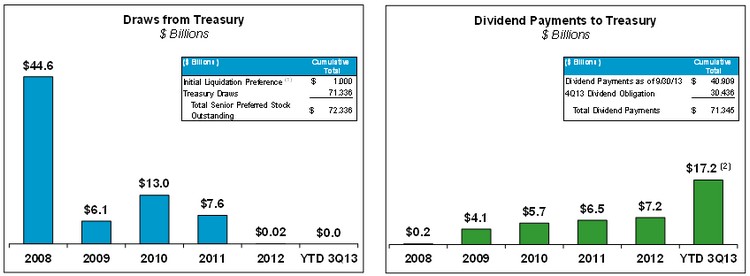

Treasury Draws and Dividend Payments at September 30, 2013

| | — | | Based on net worth of $33.4 billion, the company’s dividend obligation to Treasury will be $30.4 billion in December 2013 |

| | — | | Including the December dividend obligation, the company’s aggregate cash dividends paid to Treasury will total $71.345 billion, versus cumulative cash draws of $71.336 billion received from Treasury |

| | — | | Senior preferred stock held by Treasury remained $72.3 billion, as dividend payments do not reduce prior Treasury draws outstanding |

Housing Market Support Since January 1, 2009

| | — | | Provided $2.1 trillion of liquidity to the mortgage market that funded: |

¡ 7.5 million refinancings, including 1.4 million in the first nine months of 2013

¡ 1.9 million home purchases

¡ 1.5 million units of multifamily rental housing

| | — | | Helped approximately 913,000 borrowers to avoid foreclosure, including nearly 128,000 in the first nine months of 2013 |

Credit Quality at September 30, 2013

| | — | | Post-2008 book of business grew to 52 percent of single-family credit guarantee portfolio during third quarter, excluding relief refinance loans which grew to 21 percent |

| | — | | Delinquency rates continued to decline and remained below industry benchmarks |

¡ Single-family serious delinquency rate was 2.58 percent, down from 2.79 percent at June 30, 2013

¡ Multifamily delinquency rate was 0.05 percent, down from 0.09 percent at June 30, 2013

| | — | | Loan repurchase settlements with three of the company’s larger seller/servicers contributed $0.9 billion to pre-tax income in the third quarter |

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 2

McLean, VA — Freddie Mac (OTCQB: FMCC) today reported net income of $30.5 billion for the third quarter of 2013, compared to $5.0 billion for the second quarter of 2013. The company also reported comprehensive income of $30.4 billion for the third quarter of 2013, compared to $4.4 billion for the second quarter of 2013.

Summary Financial Results(1)

| | | | | | | | | | | | | | |

| | | | | Three Months Ended | |

| | | | | June 30, | | | September 30, | | | | |

| ($ Billions) | | 2013 | | | 2013 | | | Change | |

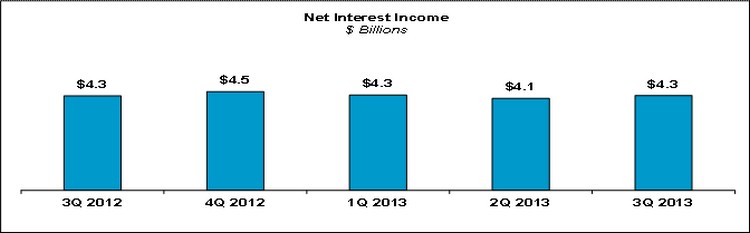

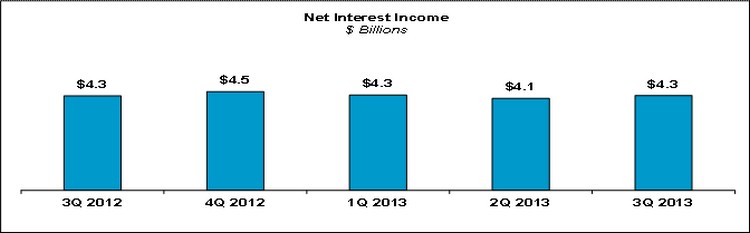

| 1 | | Net interest income | | $ | 4.1 | | | $ | 4.3 | | | $ | 0.1 | |

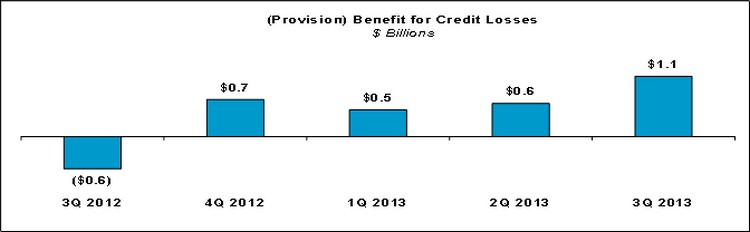

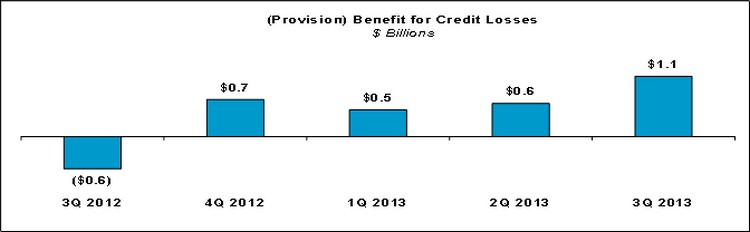

| 2 | | Benefit for credit losses | | | 0.6 | | | | 1.1 | | | | 0.5 | |

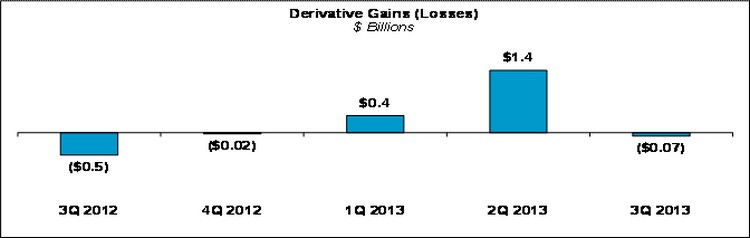

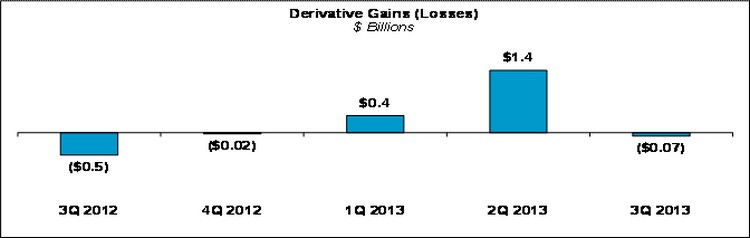

| 3 | | Derivative gains (losses) | | | 1.4 | | | | (0.1 | ) | | | (1.4 | ) |

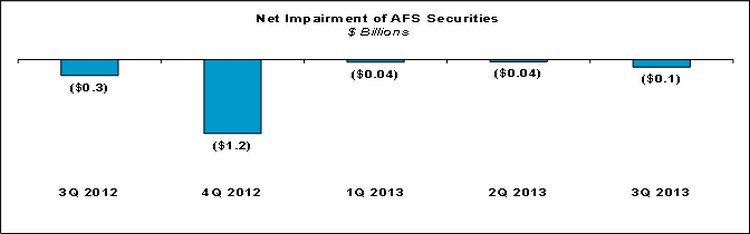

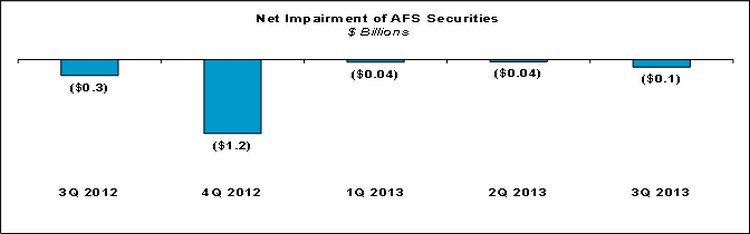

| 4 | | Net impairment | | | (0.0 | ) | | | (0.1 | ) | | | (0.1 | ) |

| 5 | | Other non-interest income (loss) | | | (0.6 | ) | | | 1.9 | | | | 2.5 | |

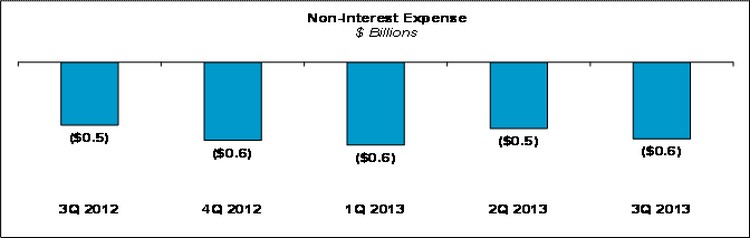

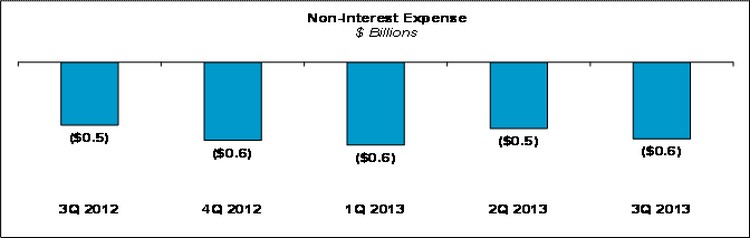

| 6 | | Non-interest expense | | | (0.5 | ) | | | (0.6 | ) | | | (0.1 | ) |

| | | | | | | | | | | | | | |

| 7 | | Pre-tax income | | $ | 4.9 | | | $ | 6.5 | | | $ | 1.6 | |

| 8 | | Income tax benefit | | | 0.0 | | | | 24.0 | | | | 23.9 | |

| | | | | | | | | | | | | | |

| 9 | | Net income | | $ | 5.0 | | | $ | 30.5 | | | $ | 25.5 | |

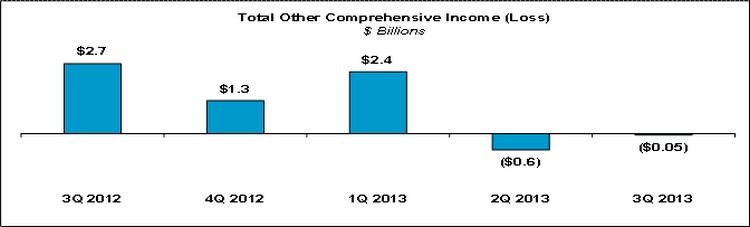

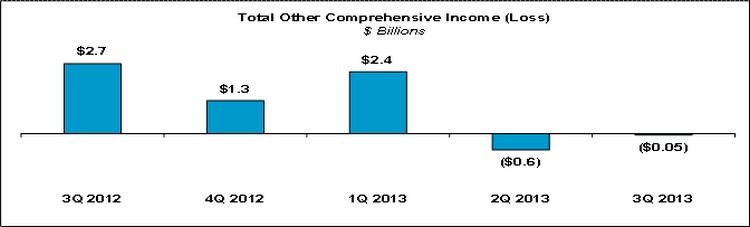

| 10 | | Total other comprehensive income (loss) | | | (0.6 | ) | | | (0.0 | ) | | | 0.6 | |

| | | | | | | | | | | | | | |

| 11 | | Comprehensive income | | $ | 4.4 | | | $ | 30.4 | | | $ | 26.1 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) | Columns may not add due to rounding. See “Appendix - Financial Results Discussion” section for additional information about the company’s financial results for the third quarter of 2013. |

Pre-Tax Income –Freddie Mac’s pre-tax income was $6.5 billion for the third quarter of 2013, up $1.6 billion from the second quarter of 2013. The increase primarily reflects higher other non-interest income, driven by gains on securities in the company’s mortgage-related investments portfolio, gains on multifamily mortgage loans and settlement proceeds related to private label securities litigation. These favorable impacts were partially offset by a shift from derivative gains in the second quarter to derivative losses in the third quarter.

Net Income –Freddie Mac’s net income was $30.5 billion for the third quarter of 2013, up $25.5 billion from the second quarter of 2013. The significant increase primarily reflects a benefit for federal income taxes of $23.9 billion that resulted from the company’s conclusion to release the valuation allowance against its net deferred tax assets.

Comprehensive Income –Freddie Mac’s comprehensive income was $30.4 billion for the third quarter of 2013, up $26.1 billion from the second quarter of 2013. The increase was primarily driven by higher quarterly net income due to the release of the deferred tax asset valuation allowance. Third quarter 2013 results also reflect improved fair values on the company’s agency and non-agency available-for-sale (AFS) securities. The fair value of Freddie Mac’s AFS securities may fluctuate considerably from quarter to quarter due to market conditions, which can lead to variability in the company’s comprehensive income results.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 3

Sustainability of Earnings –Freddie Mac’s level of earnings in recent periods is not sustainable over the long term. Freddie Mac’s recent financial results have benefited significantly from strong home-price appreciation, and the company expects home-price growth to moderate in future periods. Recent financial results have also included benefits related to settlements of both private label securities litigation and loan repurchase claims. In addition, declines in the size of the company’s mortgage-related investments portfolio, as required by the Federal Housing Finance Agency (FHFA) and the Purchase Agreement with Treasury, will reduce earnings over time. The company’s financial results will also continue to be affected by changes in interest rates and mortgage spreads, which can cause significant mark-to-market variability in its results.

Deferred Tax Asset Valuation Allowance –On a quarterly basis, Freddie Mac determines whether a valuation allowance is necessary on its net deferred tax asset. In doing so, the company considers all evidence available, both positive and negative, in determining whether it is more likely than not that the deferred tax assets will be realized. Freddie Mac established a valuation allowance against its deferred tax assets in 2008.

After weighing all available evidence at September 30, 2013, Freddie Mac concluded that it is more likely than not that the company’s deferred tax assets will be realized. As a result, the company released the valuation allowance against its net deferred tax assets, resulting in the recognition of a $23.9 billion federal income tax benefit in Freddie Mac’s net income in the third quarter of 2013.

In future quarters the company will continue to evaluate its ability to realize the net deferred tax asset. If evidence in future periods changes such that it is more likely than not that part or all of the net deferred tax asset will not be realized, the company will reestablish a valuation allowance at that time. For 2014 the company expects that its effective tax rate will approximate the corporate statutory rate which is currently 35 percent. See “MD&A - CONSOLIDATED BALANCE SHEETS ANALYSIS – Deferred Tax Assets and Liabilities” in the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 for additional information.

Settlements –During the third quarter of 2013, Freddie Mac entered into agreements with Wells Fargo Bank, N.A., certain affiliates of Citigroup Inc., and SunTrust Mortgage, Inc. to release specified loans from certain repurchase obligations in exchange for one-time cash payments. These agreements contributed $0.9 billion to the company’s pre-tax income in the third quarter of 2013.

In addition, in October 2013, Freddie Mac entered into agreements with JPMorgan Chase & Co. to settle certain single-family loan representation and warranty claims as well as litigation related to Freddie Mac’s investment in certain private label securities. Under the two agreements, Freddie Mac will be paid approximately $3.2 billion, which will be reflected in the company’s financial results for the fourth quarter of 2013.

About Freddie Mac’s Conservatorship

Purchase Agreement with Treasury – Freddie Mac has been operating under conservatorship, with FHFA as Conservator, since September 6, 2008. The support provided by Treasury pursuant to the Purchase Agreement enables the company to maintain access to the debt markets and have adequate liquidity to conduct its normal business operations. Based on Freddie Mac’s Net Worth Amount at September 30, 2013, the company’s net worth sweep dividend obligation to Treasury in December 2013 will be $30.4 billion. Freddie Mac experienced a significant non-cash increase in its net worth as of September 30, 2013 due to the release of the valuation allowance against net deferred tax assets. Including the December 2013

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 4

dividend obligation, Freddie Mac’s aggregate cash dividends paid to Treasury will total $71.345 billion, versus cumulative cash draws of $71.336 billion received from Treasury through September 30, 2013. Under the Purchase Agreement, the payment of dividends cannot be used to reduce prior Treasury draws. Accordingly, Treasury still maintains a liquidation preference of $72.3 billion on the company’s senior preferred stock as of September 30, 2013.

Treasury Draws and Dividend Payments

| (1) | The initial $1 billion liquidation preference of senior preferred stock was issued to Treasury in September 2008 as consideration for Treasury’s funding commitment. The company received no cash proceeds as a result of issuing this initial $1 billion liquidation preference of senior preferred stock. |

| (2) | Amount does not include the December 2013 dividend obligation of $30.4 billion. |

In August 2012, the terms governing the company’s dividend obligations on the senior preferred stock were amended. The amended Purchase Agreement does not allow the company to build a capital reserve over the long term. Beginning in 2013, the required senior preferred stock dividends each quarter equal the amount, if any, by which the company’s net worth as of the end of the preceding quarter exceeds an applicable capital reserve amount. The applicable capital reserve amount is $3.0 billion for each quarter of 2013 and will be reduced by $600 million annually thereafter until it reaches zero in 2018.

The amount of remaining funding available to Freddie Mac under the Purchase Agreement with Treasury is currently $140.5 billion, and will be reduced by any future draws.

Freddie Mac is not permitted to redeem the senior preferred stock prior to the termination of Treasury’s funding commitment under the Purchase Agreement. The limited circumstances under which Treasury’s funding commitment will terminate are described in “BUSINESS — Treasury Agreements” in the company’s Annual Report on Form 10-K for the year ended December 31, 2012.

Remittance of Guarantee Fees to Treasury - In September 2012, Freddie Mac began remitting proceeds to Treasury from the 10 basis point guarantee fee increase required by the Temporary Payroll Tax Cut Continuation Act of 2011. The guarantee fee expense related to this increase totaled $366 million for the first nine months of 2013.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 5

Housing Market Support

Freddie Mac continues to support the U.S. housing market by ensuring credit availability for new and refinanced mortgages as well as rental housing. The company also continues helping struggling homeowners avoid foreclosure and stabilizing communities nationwide. Since the beginning of 2009, Freddie Mac has helped nearly 10.9 million American families own or rent a home and approximately 913,000 avoid foreclosure. At the same time, the company is working with FHFA, its customers and the industry to build a stronger housing finance system for the nation.

Number of Families Helped

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Thousands) | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | YTD

9/30/2013 | | | Cumulative

Total | |

| 1 | | Number of families helped to own or rent a home | | | 2,480 | | | | 2,089 | | | | 1,830 | | | | 2,472 | | | | 2,011 | | | | 10,882 | |

| 2 | | Relief refinance borrowers (includes HARP)(1) | | | 169 | | | | 533 | | | | 453 | | | | 687 | | | | 531 | | | | 2,373 | |

| 3 | | Other refinance borrowers(1) | | | 1,595 | | | | 947 | | | | 740 | | | | 996 | | | | 841 | | | | 5,119 | |

| 4 | | Purchase borrowers(1) | | | 460 | | | | 378 | | | | 326 | | | | 353 | | | | 381 | | | | 1,898 | |

| 5 | | Multifamily rental units | | | 256 | | | | 231 | | | | 311 | | | | 436 | | | | 258 | | | | 1,492 | |

| 6 | | Number of single families helped to avoid foreclosure(2) | | | 133 | | | | 275 | | | | 208 | | | | 169 | | | | 128 | | | | 913 | |

| 7 | | Loan modifications | | | 65 | | | | 170 | | | | 109 | | | | 70 | | | | 60 | | | | 474 | |

| 8 | | Repayment plans | | | 34 | | | | 31 | | | | 33 | | | | 33 | | | | 22 | | | | 153 | |

| 9 | | Forbearance agreements | | | 15 | | | | 35 | | | | 20 | | | | 13 | | | | 9 | | | | 92 | |

| 10 | | Short sales & deed-in-lieu of foreclosure transactions | | | 19 | | | | 39 | | | | 46 | | | | 53 | | | | 37 | | | | 194 | |

| 11 | | Total (lines 1+6) | | | 2,613 | | | | 2,364 | | | | 2,038 | | | | 2,641 | | | | 2,139 | | | | 11,795 | |

| (1) | For the periods presented, a borrower may be counted more than once if the company purchased more than one loan (purchase or refinance mortgage) relating to the same borrower. |

| (2) | These categories are not mutually exclusive and a borrower in one category may also be included within another category in the same period. For the periods presented, a borrower may subsequently go into foreclosure. |

Providing Liquidity – Freddie Mac continues to provide access to affordable financing for new and refinanced mortgages and rental housing. Since the beginning of 2009, the company has provided $2.1 trillion in liquidity to the market through its purchases of loans and issuances of mortgage-related securities, including $382 billion during the first nine months of 2013.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 6

Market Liquidity Provided(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ Billions) | | 2009 | | | 2010 | | | 2011 | | | 2012 | | | YTD

9/30/2013 | | | Cumulative

Total | |

| 1 | | Single-family purchases or issuances(1) | | $ | 483 | | | $ | 390 | | | $ | 321 | | | $ | 427 | | | $ | 359 | | | $ | 1,980 | |

| 2 | | Relief refinance mortgages (includes HARP) | | | 35 | | | | 106 | | | | 82 | | | | 123 | | | | 87 | | | | 433 | |

| 3 | | Other refinance mortgages | | | 345 | | | | 200 | | | | 168 | | | | 228 | | | | 188 | | | | 1,129 | |

| 4 | | Purchase mortgages | | | 94 | | | | 78 | | | | 71 | | | | 76 | | | | 84 | | | | 403 | |

| 5 | | Other(2) | | | 9 | | | | 6 | | | | — | | | | — | | | | — | | | | 15 | |

| 6 | | Multifamily loan purchases or guarantees(1)(3) | | $ | 17 | | | $ | 16 | | | $ | 20 | | | $ | 29 | | | $ | 19 | | | $ | 101 | |

| 7 | | Other(4) | | $ | 46 | | | $ | — | | | $ | 8 | | | $ | — | | | $ | 4 | | | $ | 58 | |

| 8 | | Total (lines 1+6+7) | | $ | 546 | | | $ | 406 | | | $ | 349 | | | $ | 456 | | | $ | 382 | | | $ | 2,139 | |

| (1) | Based on unpaid principal balance (UPB). |

| (2) | Includes Ginnie Mae Certificates, HFA initiative-related guarantees, and Other Guarantee Transactions for which loan level data is not available. |

| (3) | In the first quarter of 2013, Freddie Mac made certain changes to more closely align the presentation of the company’s single-family and multifamily securitization activities. As a result, Multifamily issuances of K-deals are no longer included in line 6. All periods presented above have been revised. |

| (4) | Consists of non-Freddie Mac mortgage-related securities purchased for the company’s mortgage-related investments portfolio. |

Enabling Refinance Activity– Through purchasing refinance mortgages, Freddie Mac helps borrowers lower their payments and/or improve their mortgage terms. Refinance purchases of $274.9 billion accounted for 76 percent of the company’s single-family mortgage purchase volume during the first nine months of 2013. The company estimates that the homeowners who refinanced during the third quarter will reduce their mortgage interest payments by an average of $3,400 during the first 12 months. Since the beginning of 2009, the company has purchased or guaranteed $1.6 trillion of refinance mortgages, helping nearly 7.5 million homeowners.

The company’s relief refinance initiative, which includes the Home Affordable Refinance Program (HARP) for loans with loan-to-value (LTV) ratios above 80 percent, continues to help homeowners nationwide. During the first nine months of 2013, Freddie Mac purchased approximately 297,000 HARP loans, bringing the total to over 1.2 million since the program’s debut in 2009.

Preventing Foreclosures – Freddie Mac helps struggling borrowers retain their homes or otherwise avoid foreclosure. During the first nine months of 2013, the company completed approximately 128,000 single-family loan workouts, including over 60,000 loan modifications. This brings the total number of homeowners the company has helped to avoid foreclosure to approximately 913,000 since the beginning of 2009.

In addition, when foreclosure is unavoidable, Freddie Mac has further helped to stabilize communities by focusing its real estate owned (REO) home sales on owner-occupants, who made up approximately two–thirds of its purchasers since the beginning of 2009, and by promoting industry-leading standards for property preservation.

Building a Stronger Mortgage Market – Working with FHFA and the industry, Freddie Mac continues to devote resources to help develop a stronger, more efficient mortgage market. In October 2013, FHFA announced the formation of Common Securitization Solutions, LLCSM, which is equally-owned by Freddie Mac and Fannie Mae, that will execute the conservatorship goal of establishing a common securitization platform.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 7

The company also continues to make progress in transferring mortgage credit risk and attracting private capital back to the housing finance market. In the third quarter, the company successfully closed its first single-family risk sharing transaction with the issuance of $500 million of Structured Agency Credit Risk (STACRSM) notes and a second STACR transaction is scheduled to settle on November 12, 2013. In addition, Freddie Mac settled over $6 billion of K-deal transactions in the third quarter. These multifamily mortgage-backed securities transfer a significant portion of credit risk to private investors. Since 2009, Freddie Mac has settled nearly $64 billion of K-deal securities and has not realized any credit losses on the portion of these securities guaranteed by the company.

Credit Quality

Post-2008 Single-Family Books of Business – Since 2008, Freddie Mac has enhanced its credit and underwriting policies, purchased fewer loans with higher-risk characteristics and seen positive changes in the underwriting practices of lenders and mortgage insurers. These factors have contributed to the improved credit quality of loans purchased since 2008 (excluding relief refinance mortgages).

Single-Family Credit Guarantee Portfolio – Concentration of Credit Risk

| | | | | | |

| | | As of 9/30/2013 | | YTD 9/30/2013 |

| | | % of Portfolio | | Serious Delinquency

Rate | | % of Credit Losses |

Loans originated in 2009 - 2013 | | 73% | | 0.36% | | 8.6% |

HARP | | 13 | | 0.88% | | 5.6 |

Other relief refinance | | 8 | | 0.31% | | 0.5 |

All other loans | | 52 | | 0.25% | | 2.5 |

Loans originated in 2005 - 2008 | | 17 | | 9.15% | | 82.0 |

Loans originated in 2004 and prior | | 10 | | 3.29% | | 9.4 |

Total | | 100% | | 2.58% | | 100.0% |

At September 30, 2013, loans originated after 2008 accounted for 52 percent of the UPB of Freddie Mac’s single-family credit guarantee portfolio, excluding HARP loans and other relief refinance loans which represented 13 percent and 8 percent of the single-family credit guarantee portfolio, respectively. HARP loans generally reflect many of the credit risk attributes of the original loans, and thus generally present higher risk to the company than other refinance loans the company has purchased since 2009. However, in many cases, the borrowers’ payments are reduced through HARP refinancing, thereby strengthening the borrowers’ potential to make their mortgage payments.

2005 to 2008 Single-Family Books of Business – Loans originated in 2005 through 2008 account for the majority of the $73 billion in provision for credit losses the company has recorded since the beginning of 2008. These loans continue to represent a declining portion of the company’s single-family credit guarantee portfolio. At September 30, 2013, loans originated in 2005 through 2008 represented 17 percent of the company’s single-family credit guarantee portfolio (based on UPB), compared to 19 percent at June 30, 2013.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 8

Single-Family Credit Guarantee Portfolio Purchases – LTV Ratios and Credit Scores

| | | | | | | | | | |

| | | 2009 | | 2010 | | 2011 | | 2012 | | YTD

9/30/2013 |

Weighted Average Original LTV Ratio: | | | | | | | | | | |

Relief refinance (includes HARP) | | 80% | | 77% | | 77% | | 97% | | 91% |

All other | | 66% | | 67% | | 67% | | 68% | | 70% |

Total purchases | | 67% | | 70% | | 70% | | 76% | | 75% |

Weighted Average Credit Score: | | | | | | | | | | |

Relief refinance (includes HARP) | | 738 | | 747 | | 744 | | 740 | | 728 |

All other | | 757 | | 758 | | 759 | | 762 | | 757 |

Total purchases | | 756 | | 755 | | 755 | | 756 | | 750 |

Total single-family loans (including relief refinance loans) purchased by Freddie Mac in the first nine months of 2013 had a weighted average original LTV ratio of 75 percent and a weighted average FICO score of 750. The company’s 2012 and 2013 LTV ratios and FICO scores reflect increased purchases of HARP loans, which were driven by FHFA-directed enhancements made in 2012 that expanded eligibility to refinance borrowers whose mortgages have LTV ratios above 125 percent.

Single-family serious delinquency rate was 2.58 percent at September 30, 2013, compared to 2.79 percent at June 30, 2013. While the company’s single-family serious delinquency rate remains higher than the rate in years prior to 2009, it is substantially below the rate for the entire U.S. mortgage market. According to the Mortgage Bankers Association’s National Delinquency Survey, the serious delinquency rate on first-lien single-family loans in the U.S. mortgage market was 5.88 percent at June 30, 2013, which is the most recent date for which data is available.

Multifamily delinquency rate(based on loans 60 days or more past due or in the process of foreclosure) was 0.05 percent at September 30, 2013, compared to 0.09 percent at June 30, 2013, reflecting continued positive multifamily market fundamentals.

Additional Information

For more information, including that related to Freddie Mac’s financial results, conservatorship and related matters, see the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2013, and the company’s Consolidated Financial Statements and Financial Results Supplement. These documents are available on the Investor Relations page of the company’s Web site at www.FreddieMac.com/investors.

Additional information about Freddie Mac and its business is also set forth in the company’s filings with the SEC, which are available on the Investor Relations page of the company’s Web site at www.FreddieMac.com/investors and the SEC’s Web site at www.sec.gov. Freddie Mac encourages all investors and interested members of the public to review these materials for a more complete understanding of the company’s financial results and related disclosures.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 9

* * * *

This press release contains forward-looking statements, which may include statements pertaining to the conservatorship, the company’s current expectations and objectives for its efforts under the Making Home Affordable program, the servicing alignment initiative and other programs to assist the U.S. residential mortgage market, future business plans, liquidity, capital management, economic and market conditions and trends, market share, the effect of legislative and regulatory developments, implementation of new accounting guidance, credit losses, internal control remediation efforts, and results of operations and financial condition on a GAAP, Segment Earnings and fair value basis. Forward-looking statements involve known and unknown risks and uncertainties, some of which are beyond the company’s control. Management’s expectations for the company’s future necessarily involve a number of assumptions, judgments and estimates, and various factors, including changes in market conditions, liquidity, mortgage-to-debt option-adjusted spread, credit outlook, actions by FHFA, Treasury, the Federal Reserve, the SEC, HUD, other federal agencies, the Administration and Congress, and the impacts of legislation or regulations and new or amended accounting guidance, could cause actual results to differ materially from these expectations. These assumptions, judgments, estimates and factors are discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2012, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2013, June 30, 2013 and September 30, 2013 and Current Reports on Form 8-K, which are available on the Investor Relations page of the company’s Web site at www.FreddieMac.com/investors and the SEC’s Web site at www.sec.gov. The company undertakes no obligation to update forward-looking statements it makes to reflect events or circumstances after the date of this press release.

Freddie Mac was established by Congress in 1970 to provide liquidity, stability and affordability to the nation’s residential mortgage markets. Freddie Mac supports communities across the nation by providing mortgage capital to lenders. Today Freddie Mac is making home possible for one in four home borrowers and is one of the largest sources of financing for multifamily housing. For more information, visit www.FreddieMac.com.

# # #

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 10

Appendix - Financial Results Discussion

Summary Consolidated Statements of Comprehensive Income(1)

| | | | | | | | | | | | | | |

| | | | | Three Months Ended | |

| | | | | June 30, | | | September 30, | | | | |

| ($ Millions) | | 2013 | | | 2013 | | | Change | |

| 1 | | Net interest income | | $ | 4,144 | | | $ | 4,276 | | | $ | 132 | |

| 2 | | (Provision) benefit for credit losses | | | 623 | | | | 1,138 | | | | 515 | |

| 3 | | Derivative gains (losses) | | | 1,362 | | | | (74 | ) | | | (1,436 | ) |

| 4 | | Net impairments of AFS securities recognized in earnings | | | (44 | ) | | | (126 | ) | | | (82 | ) |

| 5 | | Other non-interest income (loss) | | | (640 | ) | | | 1,889 | | | | 2,529 | |

| | | | | | | | | | | | | | |

| 6 | | Non-interest income | | | 678 | | | | 1,689 | | | | 1,011 | |

| 7 | | Administrative expenses | | | (444 | ) | | | (455 | ) | | | (11 | ) |

| 8 | | REO operations income | | | 110 | | | | 79 | | | | (31 | ) |

| 9 | | Other non-interest expense | | | (164 | ) | | | (201 | ) | | | (37 | ) |

| | | | | | | | | | | | | | |

| 10 | | Non-interest expense | | | (498 | ) | | | (577 | ) | | | (79 | ) |

| 11 | | Pre-tax income | | | 4,947 | | | | 6,526 | | | | 1,579 | |

| 12 | | Income tax benefit | | | 41 | | | | 23,960 | | | | 23,919 | |

| | | | | | | | | | | | | | |

| 13 | | Net income | | $ | 4,988 | | | $ | 30,486 | | | $ | 25,498 | |

| 14 | | Total other comprehensive income (loss) | | | (631 | ) | | | (49 | ) | | | 582 | |

| | | | | | | | | | | | | | |

| 15 | | Comprehensive income | | $ | 4,357 | | | $ | 30,437 | | | $ | 26,080 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) | Columns may not add due to rounding. |

Net interest income was $4.3 billion for the third quarter of 2013, compared to $4.1 billion for the second quarter of 2013. Net interest yield was 86 basis points for the third quarter of 2013, compared to 83 basis points for the second quarter of 2013. The increases in both net interest income and net interest yield were mostly driven by lower funding costs, partially offset by lower yielding earning assets.

(Provision) benefit for credit losses was a benefit of $1.1 billion for the third quarter of 2013, compared to a benefit of $623 million for the second quarter of 2013. The benefit for credit losses for the third quarter of 2013

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 11

was driven by $0.9 billion of recoveries from counterparty settlements as well as continued improvement in national home prices.

The company’s loan loss reserves were $25.0 billion as of September 30, 2013, compared to $26.4 billion as of June 30, 2013.

Derivative gains (losses)was a loss of $74 million for the third quarter of 2013, compared to a gain of $1.4 billion for the second quarter of 2013. The shift to a loss in the third quarter of 2013 was due to long-term interest rates increasing less during the third quarter as compared to the second quarter.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 12

Net impairment of AFS securities recognized in earnings was $126 million for the third quarter of 2013, compared to $44 million for the second quarter of 2013. 2013 quarterly impairment results reflect continued improvement in forecasted home prices.

In the fourth quarter of 2012, Freddie Mac recognized $1.2 billion of net impairment expense mainly due to the implementation of a third-party model to project cash flows on the company’s single-family non-agency mortgage-related securities.

Other non-interest income (loss)was income of $1.9 billion for the third quarter of 2013, compared to a loss of $640 million for the second quarter of 2013. The improvement was mostly driven by higher gains of $1.1 billion on securities in the mortgage-related investments portfolio, higher gains of $0.7 billion on multifamily mortgage loans and higher settlement proceeds of $0.5 billion related to private label securities litigation.

Non-interest expense was $577 million for the third quarter of 2013, compared to $498 million for the second quarter of 2013. The increase in non-interest expense reflects lower REO operations income due to a decline in REO outflows.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 13

Income tax benefitwas $24.0 billion for the third quarter of 2013, compared to $41 million for the second quarter of 2013. The third quarter result includes a benefit for federal income taxes of $23.9 billion that resulted from the company’s conclusion to release the valuation allowance against its net deferred tax assets. See “MD&A - CONSOLIDATED BALANCE SHEETS ANALYSIS – Deferred Tax Assets and Liabilities” in the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 for additional information.

Total other comprehensive income (loss)was a loss of $49 million for the third quarter of 2013, compared to a loss of $631 million for the second quarter of 2013. The decrease was mostly driven by improved fair values on agency and non-agency AFS securities as long-term interest rates increased less in the third quarter compared to the second quarter.

Segment Financial Results – Freddie Mac’s operations consist of three reportable segments, which are based on the type of business activities each performs — Investments, Single-family Guarantee and Multifamily. Certain activities that are not part of a reportable segment are included in the All Other category. For the third quarter of 2013, the All Other category includes the impact of releasing the valuation allowance against net deferred tax assets.

Freddie Mac Third Quarter 2013 Financial Results

November 7, 2013

Page 14

Summary of Segment Earnings (Loss) and Comprehensive Income (Loss) (1)

| | | | | | | | | | | | | | |

| | | | | Three Months Ended | |

| | | | | June 30, | | | September 30, | | | | |

| ($ Billions) | | 2013 | | | 2013 | | | Change | |

| | Segment Earnings (loss), net of taxes | | | | | | | | | | | | |

| 1 | | Investments | | $ | 3.3 | | | $ | 3.7 | | | $ | 0.4 | |

| 2 | | Single-family Guarantee | | $ | 1.3 | | | $ | 2.0 | | | $ | 0.7 | |

| 3 | | Multifamily | | $ | 0.4 | | | $ | 0.8 | | | $ | 0.5 | |

| 4 | | All Other | | $ | — | | | $ | 23.9 | | | $ | 23.9 | |

| | | | | | | | | | | | | | |

| 5 | | Total Segment Earnings (loss), net of taxes | | $ | 5.0 | | | $ | 30.5 | | | $ | 25.5 | |

| | | | | | | | | | | | | | |

| | Comprehensive income (loss) of segments | | | | | | | | | | | | |

| 6 | | Investments | | $ | 2.9 | | | $ | 4.3 | | | $ | 1.4 | |

| 7 | | Single-family Guarantee | | $ | 1.3 | | | $ | 2.0 | | | $ | 0.7 | |

| 8 | | Multifamily | | $ | 0.1 | | | $ | 0.2 | | | $ | 0.0 | |

| 9 | | All Other | | $ | — | | | $ | 23.9 | | | $ | 23.9 | |

| | | | | | | | | | | | | | |

| 10 | | Comprehensive income (loss) of segments | | $ | 4.4 | | | $ | 30.4 | | | $ | 26.1 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| (1) | Columns may not add due to rounding. |

Investments segment earned $3.7 billion for the third quarter of 2013, compared to $3.3 billion for the second quarter of 2013. The increase was mostly driven by settlement proceeds related to private label securities litigation and gains on sales of AFS securities, partially offset by lower net gains on derivatives and other items recorded at fair value. Comprehensive income for the Investments segment was $4.3 billion for the third quarter of 2013, compared to $2.9 billion for the second quarter of 2013. The increase reflects improved fair values on agency and non-agency AFS securities.

Single-family Guarantee segment earned $2.0 billion for the third quarter of 2013, compared to $1.3 billion for the second quarter of 2013. The increase is primarily attributable to higher benefit for credit losses. Comprehensive income for the Single-family Guarantee segment approximated segment earnings for both the second and third quarter of 2013.

Multifamily segment earned $844 million for the third quarter of 2013, compared to $393 million for the second quarter of 2013. The increase primarily reflects higher gains on mortgage loans and higher gains on the sale of AFS securities. Comprehensive income for the Multifamily segment was $155 million for the third quarter of 2013, compared to $128 million for the second quarter of 2013. The increase is primarily attributable to higher segment earnings, partially offset by the reversal of unrealized gains associated with AFS securities that were sold during the third quarter.