UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07917

Wilshire Variable Insurance Trust

(Exact name of registrant as specified in charter)

Wilshire Variable Insurance Trust

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401-1085

(Address of principal executive offices) (Zip code)

Jason A. Schwarz

Wilshire Associates Incorporated

1299 Ocean Avenue, Suite 700

Santa Monica, CA 90401-1085

(Name and address of agent for service)

(310) 451-3051

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2020

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

(a) Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1).

Wilshire Variable Insurance Trust |

ANNUAL REPORT

Wilshire Global Allocation Fund |

December 31, 2020 |

Wilshire Variable Insurance Trust

Table of Contents |

|

Letter to Shareholders | 1 |

Commentary | 5 |

Disclosure of Fund Expenses | 9 |

Schedule of Investments | 11 |

Statement of Assets and Liabilities | 12 |

Statement of Operations | 13 |

Statements of Changes in Net Assets | 14 |

Financial Highlights | 15 |

Notes to Financial Statements | 16 |

Report of Independent Registered Public Accounting Firm | 25 |

Board Approval of Advisory Agreements | 27 |

Additional Fund Information | 36 |

Tax Information | 40 |

Shares of the Wilshire Global Allocation Fund are sold only as the underlying investment for variable annuity contracts issued by insurance companies. This report is authorized for use in connection with any offering of the Fund’s shares only if accompanied or preceded by the Fund’s current prospectus.

Shares of the Wilshire Variable Insurance Trust are distributed by Compass Distributors, LLC.

Wilshire Variable Insurance Trust

Letter to Shareholders (Unaudited) |

|

Dear Wilshire Variable Insurance Trust Shareholder:

We are pleased to present this annual report to all shareholders of the Wilshire Variable Insurance Trust. This report covers the period from January 1, 2020 to December 31, 2020 for the Global Allocation Fund (the “Fund”).

Market Environment

U.S. Equity Market

The U.S. stock market, represented by the Wilshire 5000 Total Market IndexSM, was up 14.47% for the fourth quarter of 2020 and 20.82% for the year. Although Coronavirus infections accelerated during the fourth quarter of the year and many cities re-imposed restrictions, both consumer and business surveys were moderating at encouraging levels. However, job growth has slowed dramatically, and initial jobless claims remained at what would normally be historic levels. The big news on the virus front was the commencement of vaccine distribution but that did not mean we were close to any normalization of everyday activities. Equity prices may appear to be elevated but are not necessarily expensive given very low government bond yields. A rebound in economic growth and earnings may be supportive of strong equity returns in 2021.

From both societal and investment perspectives, 2020 will be defined by the Coronavirus and its impact on severe economic restrictions and unprecedented government responses. As the virus spread to the U.S., the market sold-off quickly by -35% from February 19 to March 23. In turn, the Fed slashed its overnight rate from 1.5% to zero and the U.S. federal government passed a $2.2 trillion stimulus bill. In April alone, the economy shed more than 20 million jobs while Q1 real Gross Domestic Product(“GDP”) declined by -5%. The 2020 bear market was historically brief, however, bouncing off the lows on March 23rd and rallied to a new high by August 12. In evidence of its speed, the market’s recovery coincided with the U.S. Bureau of Economic Analysis reporting a -31% real GDP decline during Q2. While equities dipped below their previous high as confirmed cases reaccelerated, the Wilshire 5000 Index ended the year at another all-time high (up 20.82% for the year). Although the Coronavirus pandemic and its consequences will likely continue through much of 2021, images of vaccines being administered globally provide reason for hope.

Seven sectors ended the year in positive territory, with Consumer Discretionary (+46.99%) and Information Technology (+46.29%) representing the best performing sectors. There was significant dispersion among sectors, with the main laggard being Energy, down -32.87%. During 2020, large capitalization stocks outperformed small caps with the Wilshire U.S. Large-Cap IndexSM returning 21.17 % versus 17.42% for the Wilshire U.S. Small-Cap IndexSM. Over the same period, growth again outperformed value, with the Wilshire U.S. Large-Cap Growth IndexSM returning 35.36% versus 7.37% for the Wilshire U.S. Large-Cap Value IndexSM.

1

Wilshire Variable Insurance Trust

Letter to Shareholders (Unaudited) - (Continued) |

|

International Equity Market

Equity markets outside of the U.S. also enjoyed a strong fourth quarter, with emerging markets outperforming all developed markets. During 2020, the MSCI ACWl ex USA Index and MSCI Emerging Markets Index returned 10.65% and 18.31%, respectively. The U.K. was on a path to recovery, with Q3 GDP up a record +16.0%, but concerns about a new variant of the COVID-19 virus have led to renewed restrictions and the withdrawal of social accommodations granted for holiday gatherings. A second wave of infections is hindering other European countries as well, and the European Central Bank responded by expanding its money-printing program by hundreds of billions of euros. Among the largest countries within emerging markets, South Korea (+29%) and Brazil (+26%), in local currency terms, led the gains during the fourth quarter. China is the largest weighted country in the MSCI Emerging Markets Index (at 40%) and was up +11% during the same period. The Chinese economy is poised for growth this coming year, unlike most other countries, but that is driven by the People’s Republic of China’s traditional strengths, such as exports, while domestic demand is still weak.

Bond Market

The U.S. Treasury yield curve was up across most maturities during the fourth quarter after a dramatic drop earlier this year. Although the curve is down meaningfully for the year, the long-end managed to push above 1.50% by year-end. The 10-year Treasury yield ended the quarter at 0.93%, up 24 basis points from September. The Federal Open Market Committee met twice during the fourth quarter, as scheduled, with no change to the overnight rate, which the Committee expects will be near zero through at least 2023. The Committee reiterated its pledge to support the economic recovery, including an increase in its bond-buying activities. Credit spreads continued to tighten during the fourth quarter, boosting investment grade and high yield returns. During 2020, the Bloomberg Barclays U.S Aggregate Bond Index, Bloomberg Barclays U.S. Credit Index and Bloomberg Barclays U.S. Corporate High Yield Index returned 7.51%, 9.35% and 7.11%, respectively.

Fund Performance Review

The Wilshire Global Allocation Fund returned 11.93% in 2020, underperforming the Custom Benchmark return of 13.21% by -1.28%. Although the Fund underperformed its Custom Benchmark in 2020, we believe the Fund is well positioned for future growth.

As always, we sincerely appreciate your continued support and confidence in Wilshire Advisors.

Sincerely,

Jason Schwarz

President, Wilshire Variable Insurance Trust

2

Wilshire Variable Insurance Trust

Letter to Shareholders (Unaudited) - (Continued) |

|

Past performance does not guarantee future results. The performance data quoted represent past performance and current returns may be lower or higher. Share prices and investment returns fluctuate and an investor’s shares may be worth more or less than original cost upon redemption. For periods less than one year, performance is cumulative. For performance data current to the most recent month-end please call 1-866-591-1568.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transactions costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Investments in smaller companies typically exhibit higher volatility.

Investing involves risk including loss of principal. This report identifies each Portfolio’s investments on June 30, 2020. These holdings are subject to change. Not all investments in each Portfolio performed the same, nor is there any guarantee that these investments will perform as well in the future. Market forecasts provided in this report may not occur.

The MSCI ACWI ex USA Index is an equity index which captures large and mid cap representation across 22 of 23 Developed Markets countries (excluding the U.S) and 26 Emerging Markets countries. With 2,370 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The MSCI ACWI ex USA Investable Market Index is an equity index which captures large, mid and small cap representation across 22 of 23 Developed Markets countries (excluding the U.S.) and 26 Emerging Markets countries. With 6,434 constituents, the index covers approximately 99% of the global equity opportunity set outside the US.

MSCI Emerging Markets Index is an equity index which captures large and mid-cap representation across 26 Emerging Markets countries. With 1,385 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The Wilshire 5000 Total Market Index is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

3

Wilshire Variable Insurance Trust

Letter to Shareholders (Unaudited) - (Continued) |

|

The Wilshire US Large-Cap Index is a benchmark of the large-sized (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Index is a float-adjusted, market capitalization- weighted index of the issues ranked above 750 market capitalization of the Wilshire 5000 Total Market Index.

The Wilshire US Small-Cap Index is a benchmark of the small-sized (based on capitalization) companies in the U.S. equity market. The Wilshire US Small-Cap is a float-adjusted, market capitalization-weighted index of the issues ranked between 750 and 2,500 by market capitalization of the Wilshire 5000 Total Market Index.

The Wilshire US Large-Cap Growth Index is a benchmark of the large-sized growth (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Growth is a float-adjusted, market capitalization-weighted derivative index of the Wilshire US Large-Cap Index and by extension the Wilshire 5000 Total Market Index.

The Wilshire US Large-Cap Value Index is a benchmark of the large-sized value (based on capitalization) companies in the U.S. equity market. The Wilshire US Large-Cap Value is a float-adjusted, market capitalization-weighted derivative index of the Wilshire US Large-Cap Index and by extension the Wilshire 5000 Total Market Index.

Bloomberg Barclays U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Bloomberg Barclays U.S. Credit Index measures the investment grade, US dollar-denominated, fixed-rate, taxable corporate and government related bond markets.

The Bloomberg Barclays U.S. Corporate High Yield Index measures the US dollar-denominated, high yield, fixed-rate, corporate bond market.

A basis point is one hundredth of a percent or equivalently one percent of one percent

4

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary |

|

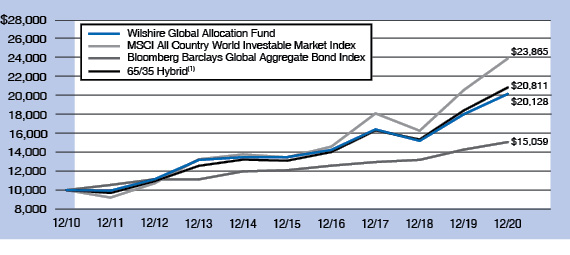

WILSHIRE GLOBAL ALLOCATION FUND

Average Annual Total Returns

One Year Ended 12/31/20 | 11.93% |

Five Years Ended 12/31/20 | 8.37% |

Ten Years Ended 12/31/20 | 7.25% |

MSCI ALL COUNTRY WORLD (ACWI) INVESTABLE MARKET (IMI)(1)

Average Annual Total Returns

One Year Ended 12/31/20 | 16.25% |

Five Years Ended 12/31/20 | 12.15% |

Ten Years Ended 12/31/20 | 9.09% |

BLOOMBERG BARCLAYS GLOBAL AGGREGATE BOND INDEX (HEDGED)(1)

Average Annual Total Returns

One Year Ended 12/31/20 | 5.58% |

Five Years Ended 12/31/20 | 4.49% |

Ten Years Ended 12/31/20 | 4.18% |

65/35 HYBRID INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/20 | 13.21% |

Five Years Ended 12/31/20 | 9.71% |

Ten Years Ended 12/31/20 | 7.60% |

5

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

COMPARATIVE PERFORMANCE

Comparison of Change in Value of a $10,000 Investment in the Wilshire Global Allocation Fund versus the following 2 indices and

a 65/35 Hybrid of the 2 indices: the MSCI ACWI IMI and the

Bloomberg Barclays Global Aggregate Index (Hedged) through 12/31/20.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Returns assume reinvestment of all distributions. Annuity contract fees are not reflected in returns. If these fees were included, returns would be lower. Recent performance can be found at your particular insurance company.

(1) | The MSCI ACW IMI captures large, mid and small cap representation across 23 Developed Markets and 26 Emerging Markets countries, covering approximately 99% of the global equity investment opportunity set. The Bloomberg Barclays Global Aggregate Index (Hedged) is a broad-based measure of the global investment grade fixed-rate debt markets from both developed and emerging markets issuers. 65/35 Hybrid is a blend of 65% MSCI All Country World (ACWI) Index and 35% Bloomberg Barclays Global Aggregate Index (Hedged). An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. |

During the ten years ended December 31, 2020, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, total returns would have been lower. For the year ended December 31, 2020, the investment adviser did not reduce its fees or reimburse expenses.

The Fund’s total expense ratio per the prospectus dated April 30, 2020, supplemented on 5/6/2020, 10/20/2020 and 1/12/2021 was 1.39% including Acquired Fund Fees and Expenses.

6

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

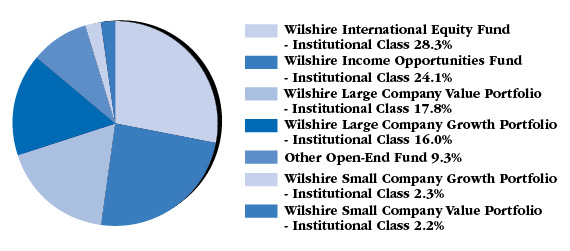

PORTFOLIO SECTOR WEIGHTING+

(As of December 31, 2020)

+ | Based on the percent of the Portfolio’s total investments in securities at value. |

The Wilshire 5000 Total Market IndexSM returned 20.82% for the year. US and global equities continued to stage a tremendous rally in the fourth quarter of 2020, benefiting primarily from optimism regarding the development and distribution of a COVID-19 vaccine. Real Gross Domestic Product (“GDP”) was up 33.4% during the third quarter of the year as the economy slowly recovered from COVID-19 restrictions. The largest contributor to growth was personal consumption, up 41.0% for the third quarter, which added 25.4% to the increase in real GDP. Residential investment was particularly strong during the fourth quarter while imports outpaced exports, acting as a drag on growth. The economy still contracted -3.4% from last year, and economic growth is likely to finish in negative territory for the calendar year of 2020.

Outside of the United States, equity performance lagged its U.S. counterpart, with the MSCI All Country World ex USA Index returning 10.65% and MSCI Emerging Markets Index returning 18.31% for year. Global equities continued to stage a tremendous rally in the fourth quarter, benefiting from optimism regarding the distribution of a COVID-19 vaccine. The economic recovery was aided by continued accommodative monetary policy including European Central Bank expanding and extending its bond buying programs.

Sector returns for the Wilshire 5000 Total Market Index were mixed for the year. Consumer Discretionary (+46.99%), and Information Technology (+46.29%) were the best performing sectors while Energy (-32.87%) was the largest detractor. For the year ended 2020, large capitalization stocks outperformed small capitalization stocks with the Wilshire U.S. Large-Cap IndexSM returning 21.17 % versus 17.42% for the Wilshire U.S. Small-Cap IndexSM. Growth stocks led value equities during the year, with Wilshire U.S. Large-Cap Growth IndexSM returning 35.36 % versus 7.37% for the Wilshire U.S. Large-Cap Value IndexSM.

7

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

Real estate securities were up during the fourth quarter in both the U.S. and abroad. Real estate sector performance was mixed with Hotel & Resort assets (+47%) and Retail REITs (+33%) leading the market while Industrials lagged. Commodity results were positive for the fourth quarter as crude oil was up 20.6% to $48.52 per barrel. Natural gas prices were up 0.5%, ending the quarter at $2.54 per million British thermal unit, as the U.S. exported a record amount of liquefied natural gas. Midstream energy surged during the fourth quarter while the broader infrastructure segment was also positive. Finally, gold prices were up 0.4% and finished at approximately $1,895 per troy ounce.

The Bloomberg Barclays US Aggregate Bond Index returned 7.51% for the year. During the fourth quarter, the U.S. 10-year Treasury yield rose approximately 0.30% and touched a near-term high of 1.15%, as nominal yields are only beginning to reflect the upside potential of future growth and inflation. Nevertheless, the U.S. Real 10-year yield remains near record low levels (-0.99%), indicating that nominal bonds are still priced irrationally relative to the expectations currently reflected in breakeven inflation rates. Real yields at these levels continue to signal signs of complacency, as investors appear to ignore the recovery in growth and inflation, particularly given the likelihood of additional government stimulus. In the Federal Open Market Committee’s communication that it intends to maintain its current policy through 2023 is, we believe, supporting a high degree of complacency among many investors.

The Global Allocation Fund returned 11.93% in 2020, underperforming the Custom Benchmark return of 13.21% by -1.28%. The lag in performance was largely driven by relative underperformance from the Wilshire Large Company Value Portfolio and the Wilshire Income Opportunities Fund. Overweight exposure to value stocks, despite their strong performance in the fourth quarter, detracted from relative performance on a one-year basis. Conversely, strong performance from the Wilshire International Equity Fund and Wilshire Large Company Growth Portfolio contributed to relative performance.

Although 2020 was a volatile year, we believe the Fund is well positioned going into 2021 as the market deals with ongoing pandemic, macroeconomic and geopolitical issues.

8

Wilshire Variable Insurance Trust

Disclosure of Fund Expenses (Unaudited) |

|

All mutual funds have operating expenses. As a shareholder of a mutual fund, you incur ongoing costs, which include costs for investment advisory services, administrative services, distribution and/or shareholder services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2020 and December 31, 2020.

The table below illustrates the Fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee reductions, that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return for the period, the “Expense Ratio” column shows the period’s annualized expense ratio, and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare the Fund’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return. It assumes that the Fund had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Variable Insurance Trust has no such charges or fees, but they may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds.

9

Wilshire Variable Insurance Trust

Disclosure of Fund Expenses (Unaudited) - (Continued) |

|

Beginning | Ending | Net | Expenses | |

Wilshire Global Allocation Fund | ||||

Actual Fund Return | $ 1,000.00 | $ 1,182.70 | 0.40% | $ 2.19 |

Hypothetical 5% Return | $ 1,000.00 | $ 1,023.13 | 0.40% | $ 2.03 |

(1) | Annualized, based on the Fund’s most recent fiscal half-year expenses. |

(2) | The expense ratio does not include the expenses of the underlying funds. |

(3) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 184/366 (to reflect one-half year period). |

(4) | Expenses shown do not include annuity contract fees. |

10

Wilshire Variable Insurance Trust

Schedule of Investments

December 31, 2020 |

|

Wilshire Global Allocation Fund |

Shares | Value | |||||||

AFFILIATED REGISTERED INVESTMENT COMPANIES — 90.7% | ||||||||

Wilshire Income Opportunities Fund - Institutional Class | 12,652,416 | $ | 130,699,455 | |||||

Wilshire International Equity Fund - Institutional Class | 12,576,285 | 153,430,673 | ||||||

Wilshire Large Company Growth Portfolio - Institutional Class | 1,731,065 | 86,864,850 | ||||||

Wilshire Large Company Value Portfolio - Institutional Class | 4,937,756 | 96,582,504 | ||||||

Wilshire Small Company Growth Portfolio - Institutional Class | 367,453 | 12,640,374 | ||||||

Wilshire Small Company Value Portfolio - Institutional Class | 529,300 | 11,639,314 | ||||||

Total Affiliated Registered Investment Companies (Cost $440,414,659) | $ | 491,857,170 | ||||||

OTHER OPEN-END FUND — 9.3% | ||||||||

Vanguard Total International Bond Index Fund - Institutional Shares | 1,438,376 | $ | 50,487,013 | |||||

Total Other Open-End Fund (Cost $48,842,112) | $ | 50,487,013 | ||||||

Shares | Value | |||||||

COMMON STOCK — 0.0% | ||||||||

BGP Holdings Ltd. (a)(b)(c) | 3,758 | $ | — | |||||

Total Common Stock (Cost $—) | $ | — | ||||||

Total Investments at Value — 100.0% (Cost $489,256,771) | $ | 542,344,183 | ||||||

Other Assets in Excess of Liabilities — (0.0)% (d) | 41,564 | |||||||

Net Assets — 100.0% | $ | 542,385,747 | ||||||

Percentages are stated as a percent of net assets.

(a) | Non-income producing security. |

(b) | Illiquid security. The total value of such securities is $0 as of December 31, 2020, representing 0.0% of net assets. |

(c) | Level 3 security. Security has been valued at fair value in accordance with procedures adopted by and under the general supervision of the Board of Trustees. The total value of such securities is $0 as of December 31, 2020, representing 0.0% of net assets. |

(d) | Percentage rounds to less than 0.1%. |

See Notes to Financial Statements.

11

Wilshire Variable Insurance Trust

Statement of Assets and Liabilities

December 31, 2020 |

|

WILSHIRE | ||||

ASSETS: | ||||

Unaffiliated investments, at value (Note 2) | $ | 50,487,013 | ||

Investments in affiliated registered investment companies, at value (Notes 2 and 5) | 491,857,170 | |||

Cash and cash equivalents | 606,171 | |||

Receivable for Fund shares sold | 749 | |||

Receivable for investment securities sold | 229,158 | |||

Dividends and interest receivable | 24 | |||

Other assets | 21,909 | |||

Total assets | 543,202,194 | |||

LIABILITIES: | ||||

Payable for Fund shares redeemed | 690,406 | |||

Investment advisory fees payable (Note 3) | 9,133 | |||

Distribution fees payable (Note 4) | 62,617 | |||

Administration fees payable (Note 3) | 6,264 | |||

Accrued expenses and other payables | 48,027 | |||

Total liabilities | 816,447 | |||

NET ASSETS | $ | 542,385,747 | ||

NET ASSETS consist of: | ||||

Paid-in capital | $ | 454,982,268 | ||

Accumulated earnings | 87,403,479 | |||

NET ASSETS | $ | 542,385,747 | ||

SHARES OUTSTANDING: | ||||

(Unlimited shares authorized) | 24,553,439 | |||

NET ASSET VALUE: | ||||

(Offering and redemption price per share) | $ | 22.09 | ||

Investments in unaffiliated funds, at cost (Note 2) | $ | 48,842,112 | ||

Investments in affiliated funds, at cost (Notes 2 and 5) | 440,414,659 | |||

See Notes to Financial Statements.

12

Wilshire Variable Insurance Trust

Statement of Operations

For the Year Ended December 31, 2020 |

|

WILSHIRE | ||||

INVESTMENT INCOME: | ||||

Income distributions from unaffiliated investments | $ | 553,543 | ||

Income distributions from affiliated registered investment companies (Note 5) | 7,860,875 | |||

Interest income | 1,203 | |||

Total income | 8,415,621 | |||

EXPENSES: | ||||

Distribution fees (Note 4) | 1,229,878 | |||

Investment advisory fees (Note 3) | 304,968 | |||

Professional expenses | 129,078 | |||

Trustees’ fees and expenses (Note 3) | 94,670 | |||

Administration fees (Note 3) | 56,113 | |||

Custodian fees | 48,101 | |||

Transfer agent fees | 40,275 | |||

Insurance expense | 38,553 | |||

Printing expenses | 29,910 | |||

Other | 2,027 | |||

Registration and filing fees | 449 | |||

Total expenses | 1,974,022 | |||

Net expenses | 1,974,022 | |||

Net investment income | 6,441,599 | |||

NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS (Notes 2 and 5): | ||||

Net realized gains (losses) from: | ||||

Sale of unaffiliated investments | (738,133 | ) | ||

Sale of affiliated registered investment companies (Note 5) | 8,045,646 | |||

Long-term capital gain distributions from unaffiliated registered investment companies | 77,062 | |||

Long-term capital gain distributions from affiliated registered investment companies (Note 5) | 23,404,073 | |||

Net change in unrealized appreciation (depreciation) of: | ||||

Unaffiliated investments | (857,834 | ) | ||

Investments in affiliated registered investment companies (Note 5) | 20,297,012 | |||

Net realized and unrealized gains on investments | 50,227,826 | |||

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 56,669,425 | ||

See Notes to Financial Statements.

13

Wilshire Variable Insurance Trust

Statements of Changes in Net Assets |

|

WILSHIRE GLOBAL | ||||||||

Year Ended | Year Ended | |||||||

OPERATIONS: | ||||||||

Net investment income | $ | 6,441,599 | $ | 9,347,853 | ||||

Net realized gains from investments | 7,307,513 | 9,744,551 | ||||||

Long-term capital gain distributions from registered investment companies | 23,481,135 | — | ||||||

Net change in unrealized appreciation of investments | 19,439,178 | 67,217,281 | ||||||

Net increase in net assets resulting from operations | 56,669,425 | 86,309,685 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS (Notes 2 and 10): | (19,223,585 | ) | (28,649,185 | ) | ||||

CAPITAL SHARE TRANSACTIONS: (DOLLARS) | ||||||||

Shares sold | 3,299,040 | 3,323,216 | ||||||

Shares issued as reinvestment of distributions | 19,223,585 | 28,649,185 | ||||||

Shares redeemed | (44,114,624 | ) | (52,105,756 | ) | ||||

Net decrease in net assets from capital share transactions | (21,591,999 | ) | (20,133,355 | ) | ||||

Net increase in net assets | 15,853,841 | 37,527,145 | ||||||

NET ASSETS: | ||||||||

Beginning of period | 526,531,906 | 489,004,761 | ||||||

End of period | $ | 542,385,747 | $ | 526,531,906 | ||||

CAPITAL SHARE TRANSACTIONS: | ||||||||

Shares sold | 168,525 | 165,004 | ||||||

Shares issued as reinvestment of distributions | 945,112 | 1,485,183 | ||||||

Shares redeemed | (2,235,427 | ) | (2,609,608 | ) | ||||

Net decrease in shares outstanding | (1,121,790 | ) | (959,421 | ) | ||||

Shares outstanding, beginning of period | 25,675,229 | 26,634,650 | ||||||

Shares outstanding, end of period | 24,553,439 | 25,675,229 | ||||||

See Notes to Financial Statements.

14

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Financial Highlights |

|

For a Fund Share Outstanding Throughout Each Period. | ||||||||||||||||||||

Investment Class Shares | ||||||||||||||||||||

Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

Net asset value, beginning of year | $ | 20.51 | $ | 18.36 | $ | 20.54 | $ | 18.49 | $ | 18.38 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income (a) | 0.26 | 0.36 | 0.36 | 0.37 | 0.46 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | 2.12 | 2.95 | (1.80 | ) | 2.43 | 0.57 | ||||||||||||||

Total from investment operations | 2.38 | 3.31 | (1.44 | ) | 2.80 | 1.03 | ||||||||||||||

Less distributions: | ||||||||||||||||||||

From net investment income | (0.39 | ) | (0.34 | ) | (0.39 | ) | (0.50 | ) | (0.31 | ) | ||||||||||

From realized capital gains | (0.41 | ) | (0.82 | ) | (0.35 | ) | (0.25 | ) | (0.61 | ) | ||||||||||

Total distributions | (0.80 | ) | (1.16 | ) | (0.74 | ) | (0.75 | ) | (0.92 | ) | ||||||||||

Net asset value, end of year | $ | 22.09 | $ | 20.51 | $ | 18.36 | $ | 20.54 | $ | 18.49 | ||||||||||

Total return (b) | 11.93 | % | 18.42 | % | (7.30 | )% | 15.16 | % | 5.62 | % | ||||||||||

Ratios to average net assets/supplemental data: | ||||||||||||||||||||

Net assets, end of period (in 000’s) | $ | 542,386 | $ | 526,532 | $ | 489,005 | $ | 411,016 | $ | 409,182 | ||||||||||

Operating expenses after fee reductions and expense reimbursements, recoupment of previously waived fees and excluding fees paid indirectly† | 0.40 | % | 0.44 | % | 0.49 | % | 0.50 | % | 0.51 | %(c) | ||||||||||

Operating expenses before fee reductions and expense reimbursements, recoupment of previously waived fees and excluding fees paid indirectly† | 0.40 | % | 0.44 | % | 0.45 | % | 0.41 | % | 0.53 | % | ||||||||||

Net investment income (a) | 1.31 | % | 1.82 | % | 1.78 | % | 1.80 | % | 2.44 | % | ||||||||||

Portfolio turnover rate | 12 | % | 11 | % | 29 | % | 15 | % | 65 | %(d) | ||||||||||

(a) | Net investment income per share was calculated using the average shares outstanding method for the period. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. The ratio of net investment income does not include net investment income of the investment companies in which the Fund invests. |

(b) | If you are an annuity contract owner, the total returns shown do not reflect the expenses that apply to the separate account or related insurance policies through which you invest in the Fund. The inclusion of these charges would reduce the total return figures for all periods shown. |

(c) | The ratio of expenses to average net assets includes interest expense, which is considered outside the expense limitation agreement. Had interest expense been excluded, the ratio would have been 0.50% for the year ended December 31, 2016. |

(d) | Includes the impact of in-kind transactions. |

† | These ratios do not include expenses of the underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

15

Wilshire Variable Insurance Trust

Notes to Financial Statements

December 31, 2020 |

|

1. Organization.

The Wilshire Variable Insurance Trust (the “Trust”) is an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently offers units of beneficial interest (shares) in the Wilshire Global Allocation Fund (the “Fund”). The Fund operates under a fund of funds structure and at this time invests substantially all of its assets in shares of certain underlying affiliated funds (the “Affiliated Funds”), which are mutual funds advised by Wilshire Advisors LLC, formerly known as Wilshire Associates Incorporated (the “Adviser”), and in shares of unaffiliated investment companies. Shares of the Fund may only be purchased by insurance company separate accounts for certain variable insurance contracts and by plan sponsors of qualified retirement plans.

The investment objective of the Fund is to realize a high long-term total rate of return consistent with prudent investment risks. Total rate of return consists of current income, which includes dividends, interest, discount accruals and capital appreciation.

2. Significant Accounting Policies.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946, “Financial Services – Investment Companies.”

Use of estimates — The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and those differences could be material.

Security valuation — A security listed or traded on a domestic exchange is valued at its last sales price on the exchange where it is principally traded. In the absence of a current quotation, the security is valued at the mean between the last bid and asked prices on the exchange. Securities traded on National Association of Securities Dealers Automatic Quotation (“NASDAQ”) System are valued at the NASDAQ official closing price. If there is no NASDAQ official closing price available, the most recent bid quotation is used. Securities traded over-the-counter (other than on NASDAQ) are valued at the last current sale price, and if there are no such sales, the most recent bid quotation is used. Investments representing shares of other open-end investment companies, are valued at their net asset value (“NAV”) as reported by such companies. Values of debt securities are generally reported at the last sales price if the security is actively traded. If a debt security is not actively traded, it is typically valued by an

16

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

independent pricing agent which employs methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. The independent pricing agent often utilizes proprietary models that are subjective and require the use of judgment and the application of various assumptions including, but not limited to, interest rates, repayment speeds, and default rate assumptions. Debt securities that have a remaining maturity of 60 days or less are valued at prices supplied by the Fund’s pricing agent for such securities, if available, and otherwise are valued at amortized cost if the Adviser’s Pricing Committee concludes it approximates fair value. When market quotations are not readily available, securities are valued according to procedures adopted by the Board of Trustees (the “Board”) or are valued at fair value as determined in good faith by the Adviser’s Pricing Committee, whose members include at least two representatives of the Adviser, one of whom is an officer of the Trust, or the Trust’s Valuation Committee which is composed of Trustees of the Trust. Securities whose market value using the procedures outlined above do not reflect fair value because a significant valuation event has occurred may be valued at fair value by the Adviser’s Pricing Committee or the Valuation Committee in accordance with the Trust’s valuation procedures. The value of fair valued securities may be different from the last sale price (or the mean between the last bid and asked prices), and there is no guarantee that a fair valued security will be sold at the price at which the Fund is carrying the security. Investments in open-end registered investment companies are valued at the end of day NAV per share as reported by the underlying funds.

In accordance with the authoritative guidance on fair value measurements and disclosures under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The guidance establishes three levels of the fair value hierarchy as follows:

● | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date; |

● | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

● | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

17

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. During the year ended December 31, 2020, there were no significant changes to the Fund’s fair value methodologies.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2020:

Wilshire Global Allocation Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Affiliated Registered Investment Companies | $ | 491,857,170 | $ | — | $ | — | $ | 491,857,170 | ||||||||

Other Open-End Fund | 50,487,013 | — | — | 50,487,013 | ||||||||||||

Common Stock | — | — | — | * | — | |||||||||||

Total | $ | 542,344,183 | $ | — | $ | — | $ | 542,344,183 | ||||||||

* | Includes securities that have been fair valued at $0. |

The Fund held a common stock that was measured at fair value on a recurring basis using significant unobservable inputs (Level 3) totaling $0. A reconciliation of Level 3 investments, including certain disclosures related to significant inputs used in valuing Level 3 investments, is only presented when the Fund has over 1% of Level 3 investments.

Cash and Cash Equivalents — Idle cash may be swept into various overnight demand deposits and is classified as Cash and Cash equivalents on the Statement of Assets and Liabilities. The Fund maintains cash in bank deposit accounts which, at times, may exceed United States federally insured limits. Amounts swept overnight are available on the next business day.

Investment transactions and investment income — Investment transactions are recorded on a trade date basis. Dividends, including distributions paid by affiliated and unaffiliated registered investment companies, are recorded on the ex-dividend date. The actual tax character of income, realized gains and return of capital distributions received from affiliated and unaffiliated registered investment companies may not be known until after the end of the fiscal year, at which time appropriate adjustments are recorded. Realized gains and losses on investments sold are determined on the basis of identified cost. Distributions received on securities that represent a return of capital or capital gain are reclassed as a reduction of cost of investments and/or as a realized gain.

Expense policy — Expenses that are attributable to both the Fund and the Wilshire Mutual Funds, Inc. (an affiliated investment company) are allocated across the Fund and the Wilshire Mutual Funds, Inc. based upon relative net assets or another reasonable basis.

Distributions to shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income, if any, are declared and paid annually. The Fund’s net realized capital gains, unless offset by any available capital

18

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

loss carryforward, are distributed to shareholders annually. Additional distributions of net investment income and net realized capital gains may be made at the discretion of the Board.

3. Investment Advisory and Other Services.

The Trust employs the Adviser to manage the investment and reinvestment of the assets of the Fund and to continuously review, oversee and administer the Fund’s investment program.

Under an Investment Advisory Agreement, the Fund pays to the Adviser a fee at the annual rate of 0.55% of the average daily net assets of the first $1 billion and 0.45% on the average daily net assets greater than $1 billion of the Fund, excluding assets invested in the Affiliated Funds.

The Adviser has entered into an expense limitation agreement with the Fund requiring it to reduce its management fee and/or reimburse expenses to limit annual operating expenses (excluding taxes, brokerage expenses, dividend expenses on short securities, acquired fund fees and expenses and extraordinary expenses) to 0.50% of average daily net assets of the Fund. The agreement to limit expenses continues through at least April 30, 2022. The Adviser may recoup the amount of any management fee reductions or expense reimbursements within three years after the day on which the fee reduction or expense reimbursement occurred if the recoupment does not cause the Fund’s expenses to exceed the expense limitation that was in place at the time of the fee reduction or expense reimbursement. There were no waivers or recoupments during the year ended December 31, 2020. There are no outstanding amounts that are subject to recoupment as of December 31, 2020.

Because the affiliated and unaffiliated registered investment companies have varied fee and expense levels and the Fund may own different proportions of the affiliated and unaffiliated registered investment companies at different times, the amount of fees and expenses incurred indirectly by the Fund will vary.

U.S. Bank N.A. serves as the Trust’s custodian. U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services, (the “Administrator”) serves as the Company’s administrator and accounting agent and also serves as the Trust’s transfer agent and dividend disbursing agent effective June 8, 2020. Compass Distributors, LLC, serves as the Company’s principal underwriter. Certain officers and an interested Trustee of the Trust may also be officers or employees of the Adviser, Administrator or their affiliates. They receive no fees for serving as officers or as an interested Trustee of the Trust.

DST Systems, Inc. served as the Company’s transfer agent until June 8, 2020.

19

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

Officers and Trustees’ expenses — The Fund and Wilshire Mutual Funds, Inc. together pay each Independent Trustee an annual retainer of $48,000, an annual additional retainer for each Committee chair of $12,000 and an annual additional retainer to the Board chair of $12,000. In addition, each Independent Trustee is compensated for Board and Committee meeting attendance in accordance with the following schedule: an in-person Board meeting fee of $6,000 for Independent Trustees and $7,000 for the Board chair; a telephonic Board meeting fee of $3,000 for Independent Trustees and $3,500 for the Board chair, and a telephonic Committee meeting fee of $500.

4. Distribution and Shareholder Services Plan.

The Fund has adopted a Rule 12b-1 distribution and shareholder services plan (the “Distribution Plan”). Pursuant to the Distribution Plan, the Distributor receives from the Fund a distribution and shareholder services fee computed at the annual rate of 0.25% of average daily net assets.

5. Security Transactions.

During the year ended December 31, 2020, the aggregate cost of purchases and proceeds from sales of investments, other than affiliated investments and short-term investments, totaled $1,532,490 and $17,928,485 respectively.

Information regarding the Fund’s investments in the Affiliated Funds during the year ended December 31, 2020 is provided in the table below:

Fund | Value as of | Cost of | Proceeds | Realized | ||||||||||||

Wilshire Income Opportunities Fund - Institutional Class | $ | 122,160,324 | $ | 31,523,139 | $ | (23,664,502 | ) | $ | 482,811 | |||||||

Wilshire International Equity Fund - Institutional Class | 180,927,511 | 15,779,484 | (55,182,416 | ) | 6,987,449 | |||||||||||

Wilshire Large Company Growth Portfolio - Institutional Class | 50,785,348 | 35,685,040 | (11,821,534 | ) | 2,888,028 | |||||||||||

Wilshire Large Company Value Portfolio - Institutional Class | 70,009,630 | 31,726,216 | (8,149,267 | ) | (950,061 | ) | ||||||||||

Wilshire Small Company Growth Portfolio - Institutional Class | 16,045,069 | 1,890,793 | (6,658,156 | ) | 218,709 | |||||||||||

Wilshire Small Company Value Portfolio - Institutional Class | 15,903,859 | 1,902,529 | (5,348,555 | ) | (1,581,290 | ) | ||||||||||

| $ | 455,831,741 | $ | 118,507,201 | $ | (110,824,430 | ) | $ | 8,045,646 | ||||||||

20

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

Fund | Change in | Value as of | Income | Capital | ||||||||||||

Wilshire Income Opportunities Fund - Institutional Class | $ | 197,683 | $ | 130,699,455 | $ | 4,881,654 | $ | — | ||||||||

Wilshire International Equity Fund - Institutional Class | 4,918,645 | 153,430,673 | 213,860 | 10,042,836 | ||||||||||||

Wilshire Large Company Growth Portfolio - Institutional Class | 9,327,968 | 86,864,850 | 2,765,361 | 10,899,769 | ||||||||||||

Wilshire Large Company Value Portfolio - Institutional Class | 3,945,986 | 96,582,504 | — | 969,246 | ||||||||||||

Wilshire Small Company Growth Portfolio - Institutional Class | 1,143,959 | 12,640,374 | — | 1,237,126 | ||||||||||||

Wilshire Small Company Value Portfolio - Institutional Class | 762,771 | 11,639,314 | — | 255,096 | ||||||||||||

| $ | 20,297,012 | $ | 491,857,170 | $ | 7,860,875 | $ | 23,404,073 | |||||||||

The Fund currently seeks to achieve its investment objective by investing a portion of its assets in Wilshire International Equity Fund, Wilshire Income Opportunities Fund, Wilshire Large Company Growth Portfolio, Wilshire Large Company Value Portfolio, Wilshire Small Company Growth Portfolio, and Wilshire Small Company Value Portfolio (the “Affiliated Funds”), registered open-end management investment companies. The Fund may redeem its investments from the Affiliated Funds at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so. The performance of the Fund is directly affected by the performance of the Affiliated Funds. As of December 31, 2020, the percentage of net assets invested in the Affiliated Funds was 90.7%. The Wilshire International Equity Fund represents 28.3% of the Fund’s net assets as of December 31, 2020. The latest shareholder report for the Wilshire Mutual Funds, Inc. can be found at www.sec.gov.

6. Significant Shareholders.

On December 31, 2020, 99% of the outstanding shares of the Fund, representing 1 omnibus shareholder, were held in the separate account of Horace Mann Life Insurance Co. through which shares of the Fund are sold.

7. Tax Information.

No provision for federal income taxes is required because the Fund has qualified, and intends to continue to qualify, as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and distributes to shareholders all of its taxable net investment income and net realized capital gains. Federal income tax regulations differ from U.S. GAAP; therefore, distributions determined in accordance with tax regulations may differ in amount or character from net investment income and

21

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial reporting records are not adjusted for temporary differences. The Fund is not aware of any tax positions for which it is reasonably likely that the total amounts of unrecognized tax benefits or expenses will materially change in the next twelve months. The Fund identifies its major tax jurisdiction as U.S. Federal.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing its tax returns to determine whether it is “more-likely than-not” (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities of returns filed within the past three years and on-going analysis of and changes to tax laws, regulations and interpretations thereof.

The federal tax cost and unrealized appreciation (depreciation) at December 31, 2020 for the Fund is as follows:

Tax cost of portfolio investments | $ | 492,729,378 | ||

Aggregate gross unrealized appreciation | $ | 56,152,009 | ||

Aggregate gross unrealized depreciation | (6,537,204 | ) | ||

Net unrealized appreciation | $ | 49,614,805 |

The difference between the book and tax-basis cost of portfolio investments for the Fund is attributable primarily to the tax deferral of losses on wash sales.

The tax character of distributions paid to shareholders for the year ended December 31, 2020 and 2019 was as follows:

December 31, | December 31, | |||||||

Ordinary income | $ | 9,731,947 | $ | 8,498,080 | ||||

Long-term capital gains | 9,491,638 | 20,151,105 | ||||||

Total | $ | 19,223,585 | $ | 28,649,185 | ||||

22

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

For the year ended December 31, 2020 there was no reclassification made on the Statement of Assets and Liabilities for the Fund as a result of book to tax differences.

At December 31, 2020, the components of accumulated deficit on a tax basis were as follows:

Undistributed ordinary income | $ | 7,253,436 | ||

Undistributed long-term gains | 30,535,238 | |||

Net unrealized appreciation on investments | 49,614,805 | |||

Total accumulated earnings | $ | 87,403,479 |

8. Indemnifications.

In the normal course of business, the Trust enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

9. Contingencies.

As a part of the merger of the Equity Fund and Socially Responsible Fund into the Fund on September 22, 2014, the Fund assumed all of the liabilities of the Equity Fund and Socially Responsible Fund, including, without limitation, contingencies relating to lawsuits. The Equity Fund and Socially Responsible Fund were named as defendants and putative members of a proposed defendant class of shareholders in lawsuits filed on December 7, 2010 in the U.S. Bankruptcy Court for the District of Delaware, and on March 6, 2012 in the District Court for the Southern District of New York, in connection with Tribune Company’s Chapter 11 bankruptcy proceeding. The 2010 lawsuit was brought by the Official Committee of Unsecured Creditors of the Tribune Company and the 2012 lawsuit was brought by Deutsche Bank, as trustee for senior noteholders of Tribune Company. Both lawsuits relate to a leveraged buyout transaction by which Tribune Company converted to a privately-held company in 2007 less than a year prior to Tribune Company’s bankruptcy filing. The putative defendant class is comprised of beneficial owners of shares of Tribune Company who meet certain jurisdictional requirements and received proceeds of the leveraged buyout. The plaintiffs seek to recover those proceeds, together with interest and attorneys’ fees and expenses, as fraudulent transfers under the Bankruptcy Act or various state laws. In 2013, the Complaint in the 2012 lawsuit was dismissed and the Second Circuit Court of Appeals affirmed the dismissal and the plaintiffs filed a petition for review by the Supreme Court. In April 2018, the Supreme Court deferred consideration of the petition to allow the Second Circuit to consider whether it would be appropriate to vacate the judgment in light of a 2018 Supreme Court decision in another case. On December 19, 2019, the Second Circuit issued an amended

23

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2020 |

|

opinion that again affirmed the dismissal. The Second Circuit in the Tribune proceeding denied a motion for a rehearing filed by the plaintiff on February 6, 2020. On July 6, 2020, the plaintiffs filed a petition for a writ of certiorari with the United States Supreme Court. The Supreme Court has not yet ruled on the petition for a writ of certiorari. The Adviser does not expect the Fund to be materially impacted by the lawsuits.

10. Other Risks

The global outbreak of coronavirus disease 2019 (“COVID-19”) has disrupted global economic markets and adversely affected individual companies and investment products. The prolonged economic impact of COVID-19 is uncertain. The operational and financial performance of the issuers of securities in which the Fund invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn impact the value of the Fund’s investments.

11. Subsequent Event Evaluation.

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based on this evaluation, no additional disclosures and/or adjustments were required to these financial statements.

The Board of Trustees approved a $75,000,000 umbrella line of credit (the “Line”) for the Wilshire Global Allocation Fund and the Wilshire Mutual Funds, Inc. on December 21, 2020. The Line, is uncommitted and senior secured with U.S. Bank N.A. The Line serves as a temporary liquidity service to meet redemption requests that otherwise might require the untimely disposition of securities. The Line became effective January 8, 2021 and has a one-year term. The interest rate is prime rate.

On September 30, 2020, the Adviser entered into an agreement with Monica HoldCo (US), Inc. (the “Acquirer”), under which the Acquirer, subject to satisfaction of certain conditions, acquired the Adviser (the “Transaction”). The Transaction closed on January 8, 2021. The Acquirer is a newly incorporated corporation under Delaware law. Through various holding company structures, the Acquirer is controlled by CC Capital Partners, LLC and Motive Capital Management, LLC (collectively, the “Buying Group”). On January 8, 2021, the Adviser changed its name to Wilshire Advisors LLC.

24

Wilshire Variable Insurance Trust

Report of Independent Registered Public Accounting Firm |

|

To the Shareholders of Wilshire Global Allocation Fund and

Board of Trustees of Wilshire Variable Insurance Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Wilshire Variable Insurance Trust comprising Wilshire Global Allocation Fund (the “Fund”) as of December 31, 2020, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the four years in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2020, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the four years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the year ended December 31, 2016, were audited by other auditors whose report dated February 28, 2017, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2020, by correspondence with the custodian and transfer agent. Our audits also included evaluating the accounting

25

Wilshire Variable Insurance Trust

Report of Independent Registered Public Accounting Firm - (Continued) |

|

principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

March 1, 2021

26

Wilshire Variable Insurance Trust

(the “Fund” and the series thereof, the “Portfolio”) |

|

On September 30, 2020 Wilshire Associates Incorporated (“Wilshire”), the investment adviser to the Portfolio, entered into an agreement with Monica HoldCo (US), Inc. (the “Acquirer”), under which the Acquirer, subject to satisfaction of certain conditions, acquired Wilshire (the “Transaction”). The Transaction closed on January 8, 2021. The Acquirer is a newly incorporated corporation under Delaware law. Through various holding company structures, the Acquirer is controlled by CC Capital Partners, LLC and Motive Capital Management, LLC (collectively, the “Buying Group”)

At meetings on August 24, 2020, September 23, 2020 and October 7, 2020 (the “Meetings”), the Board of Trustees (the “Board” and each trustee thereof, a “Board Member”) of the Fund discussed with representatives of Wilshire and, at the September 23, 2020 meeting, with certain representatives of the Buying Group the Transaction and the Buying Group’s plans and intentions regarding the Fund and Wilshire’s asset management business. The Board was advised that the Transaction, if completed, would constitute a change of control under the Investment Company Act of 1940, as amended, (the “1940 Act”) that would result in the termination of the investment advisory agreement between the Fund, on behalf of each Portfolio, and Wilshire (the “Current Advisory Agreement”). As a result, the Board was requested to approve a new investment advisory agreement between the Fund, on behalf of its Portfolio, and Wilshire (the “New Advisory Agreement”).

At its October 7, 2020 meeting, the Board, including a majority of the Board Members who are not “interested persons,” as defined in the 1940 Act (the “Independent Board Members”), approved the New Advisory Agreement between the Fund, on behalf of its Portfolio, and Wilshire. The Board’s evaluation of the New Advisory Agreement reflected the information provided specifically in connection with its review of the New Advisory Agreement, as well as, where relevant, information that was previously furnished to the Board in connection with the most recent renewal of the Current Advisory Agreement in November 2019 and at other Board meetings throughout the prior year. As part of their review process, the Independent Board Members were represented by independent legal counsel (“Independent Legal Counsel”), from whom the Independent Board Members received separate legal advice and with whom they met separately. Independent Legal Counsel reviewed and discussed with the Independent Board Members various key aspects of the Board Members’ legal responsibilities relating to the approval of the New Advisory Agreement and advised them of the relevant legal standards.

Information Requested and Received

At the direction of the Independent Board Members, Independent Legal Counsel sent a due diligence request list to Wilshire requesting information regarding the Transaction and the New Advisory Agreement to be provided to the Board in advance of the Meetings.

In response to the request for information, the Board Members received information from Wilshire regarding the factors underlying its recommendation to approve the New Advisory Agreement. In particular, the Board Members received information from Wilshire as to the Portfolio describing: (i) any anticipated changes in the nature, extent and quality

27

Wilshire Variable Insurance Trust

(the “Fund” and the series thereof, the “Portfolio”) |

|

of services to be provided as a result of the Transaction; (ii) information about the financial condition of Wilshire post-Transaction and its ability to provide the contracted-for services under the New Advisory Agreement; (iii) the investment performance of the Portfolio as provided by Wilshire based upon data gathered from the Morningstar Direct database (“Morningstar”); (iv) the costs of services provided and estimated profits realized by Wilshire; (v) the extent to which economies of scale are realized as the Portfolio grows; (vi) whether any economies of scale may be shared with the Portfolio’s shareholders as a result of the Transaction; (vii) comparisons of amounts paid by other registered investment companies as provided by Wilshire based upon data gathered from Morningstar; and (viii) fall-out benefits realized by Wilshire from its relationship with the Portfolio. The Board also requested and received information about the Buying Group and the Acquirer as well as the terms of the Transaction. The Independent Board Members also received a memorandum from Independent Legal Counsel describing their duties in connection with advisory contract proposals and with respect to the Transaction, and they were assisted in their review by Independent Legal Counsel.

Factors Considered

In connection with its deliberations regarding the New Advisory Agreement, the Board considered such information and factors as it believed to be relevant in the exercise of its business judgment. As described below, the Board considered the nature, extent and quality of the services to be performed by Wilshire under the New Advisory Agreement and performed by Wilshire under the Current Advisory Agreement; comparative fees as provided by Wilshire; the profits realized by Wilshire; the potential for economies of scale as a result of the Transaction; and whether any fall-out benefits are being realized by Wilshire or will be realized as a result of the Transaction. The Board was advised that the Portfolio would not bear the costs of obtaining shareholder approval of the New Advisory Agreement, including proxy solicitation costs, legal fees and the costs of printing and mailing the proxy statement, regardless of whether the Transaction was consummated. The Board considered that the terms of the New Advisory Agreement were substantially similar to the Current Advisory Agreement and that the Board had considered and approved the renewal of the Current Advisory Agreement in November 2019. The Board also considered that the Current Advisory Agreement were the product of multiple years of review and negotiation and information received and considered by the Board in the exercise of its business judgment during those years. The Board also took into account the various materials received from Wilshire, its discussions with management and representatives of the Buying Group and the guidance provided by Independent Legal Counsel in private sessions at which no representatives of Wilshire or the Buying Group were present.

Recognizing that the evaluation process with respect to the services provided by Wilshire is an ongoing one, the Board also considered information reviewed by the Board during the year at other Board and Board committee meetings. The Board considered

28

Wilshire Variable Insurance Trust

(the “Fund” and the series thereof, the “Portfolio”) |

|

the foregoing information and all materials provided in the context of its accumulated experience governing the Portfolio and weighed the factors and standards discussed with Independent Legal Counsel.

In deciding to approve the New Advisory Agreement, the Board did not identify any single factor as all-important or controlling and each Board Member, in the exercise of his or her business judgment, may attribute different weights to the various factors. The Board based its decision on the totality of the circumstances and relevant factors. This summary discusses the material factors and the conclusions with respect thereto that formed the basis for the Board’s approval and does not describe all of the matters considered. However, the Board concluded that each of the various factors referred to below favored such approval.

Based upon its evaluation of all materials provided, and its determination that it had received sufficient information to make an informed business decision with respect to the New Advisory Agreement, the Board concluded that it was in the best interests of the Portfolio to approve its New Advisory Agreement.

Nature, Extent and Quality of Services

With respect to the nature, extent and quality of services to be provided by Wilshire, the Board considered the functions currently performed by Wilshire, noting that Wilshire performs certain administrative functions on behalf of the Portfolio. The Board considered the experience and skills of the senior management leading Fund operations, the experience and skills of the key personnel performing the functions under the New Advisory Agreement and the resources made available to such personnel, including the compensation and retention plans for key executives and investment professionals. In evaluating the services provided by Wilshire for the Portfolio, the Board also took into account that the Portfolio operates under a fund-of-funds structure that pursues its investment objectives by investing in underlying funds. Thus, the Board considered the capabilities and expertise of Wilshire’s personnel responsible for implementing the Portfolio’s investment strategies and considered the information provided by Wilshire regarding investment oversight and risk management processes. The Board considered Wilshire’s representation that there were no planned or expected changes to key positions or investment personnel related to the Portfolio as a result of the Transaction.

The Board considered the compliance program established by Wilshire and the level of compliance maintained for the Portfolio. In addition, the Board considered the regular reports it receives from the Portfolio’s Chief Compliance Officer regarding compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board also considered Wilshire’s representation that there were no plans to change the manner in which the Portfolio was managed, operated, marketed or distributed, nor were there any planned changes to the Portfolio’s current compliance structure as a result of the Transaction.

29

Wilshire Variable Insurance Trust

(the “Fund” and the series thereof, the “Portfolio”) |

|

The Board considered Wilshire’s financial condition. The Board noted Wilshire’s statement that, while the operations of Wilshire are expected to continue with minimal change following the closing, Wilshire expects to benefit indirectly from the financial strength and significant information technology infrastructure resources of the Acquirer and the Buying Group. The Board also considered the financial support provided by Wilshire to the Portfolio pursuant to an expense limitation agreement. In this connection, the Board reviewed information regarding the firm’s business plans and the Acquirer’s proposed investment in the firm. The Board also noted Wilshire and the Acquirer’s commitment to ensuring that sufficient resources will continue to be available in the future for servicing the Portfolio.

In connection with its evaluation of the quality of services to be provided by Wilshire, the Board reviewed information on the performance of the Portfolio for the annualized one-, three-, five- and ten-year periods ended June 30, 2020, as applicable, in comparison to a peer group of funds determined by Wilshire based upon the Morningstar database for the same periods.

In general, the Board considered performance results in light of the Portfolio’s investment objective, strategies and risks, and the responsibilities of Wilshire, as disclosed in the Portfolio’s prospectus. As to Wilshire’s performance, the Board noted that the Portfolio’s performance exceeded its peer group median for all periods reviewed, ranking in the third quintile of its peer group for the one-year period and in the second quintile of its peer group for the three-, five- and ten-year periods (the first quintile being the best performers and the fifth quintile being the worst performers). In addition, the Portfolio’s annualized return for each period reviewed was below its benchmark performance.

In evaluating the Portfolio’s performance metrics, the Board took into account its discussions with management throughout the year regarding the factors that contributed to or detracted from performance, as the case may be, and considered Wilshire’s overall track record and reputation. After reviewing the foregoing and related factors, the Board concluded that the Portfolio’s performance was acceptable.

In addition, based on the foregoing, the Board concluded that Wilshire and its personnel were qualified to continue to serve the Portfolio in such capacity and that it was satisfied with the nature, extent and quality of the services provided by Wilshire to the Portfolio.

Comparative Fees

The Board compared the Portfolio’s actual management fee paid and total expense ratio to the applicable peer group of funds, as well as the Portfolio’s size relative to its peers. The Board considered that the Portfolio’s management fee would not change as a result of the Transaction and the currently applicable expense limitation arrangements would remain in effect following the closing of the Transaction. In considering the comparative fee and expense data provided by Wilshire, the Board noted that, although the Portfolio’s total expense ratio was above the peer group median, ranking in the fifth quintile (the

30

Wilshire Variable Insurance Trust

(the “Fund” and the series thereof, the “Portfolio”) |

|

first quintile being the lowest and the fifth quintile being the highest), the Portfolio’s actual management fee paid was below the peer group median and ranked in the first quintile of its peer group. The Board took into account the Portfolio’s fund-of-funds structure and noted that the management fee is applied to assets not invested in affiliated funds. The Board also considered that Wilshire has entered into an expense limitation agreement with respect to the Portfolio.

As part of its evaluation of the Portfolio’s management fee, the Board considered how such fee compared to funds with similar investment styles. With respect to the Portfolio, the Board noted that Wilshire sub-advises other asset allocation relationships and charges those sub-advised funds a lower fee. In this respect, the Board considered, among other things, the significant differences in the scope of services provided to the Portfolio and to such sub-advised funds. The Board concluded that the information it received demonstrated that the aggregate services provided to and specific circumstances of the Portfolio were sufficiently different from the services provided to and specific circumstances of the sub-advised funds to support the difference in fees.

Based upon all of the above, the Board concluded that the management fee for the Portfolio was reasonable.

Costs of Services Provided and Profitability to Wilshire