| OMB APPROVAL | |

OMB Number: 3235-0570

Expires: August 31, 2020

Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07917 |

| Wilshire Variable Insurance Trust |

| (Exact name of registrant as specified in charter) |

| 1299 Ocean Avenue, Suite 700 Santa Monica, CA | 90401-1085 |

| (Address of principal executive offices) | (Zip code) |

Jason A. Schwarz

| Wilshire Associates Incorporated, 1299 Ocean Avenue, Suite 700, Santa Monica, CA 90401-1085 |

| (Name and address of agent for service) |

| Registrant's telephone number, including area code: | (310) 451-3051 |

| Date of fiscal year end: | December 31 | |

| Date of reporting period: | December 31, 2018 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Wilshire Variable Insurance Trust

|

ANNUAL REPORT

Wilshire Global Allocation Fund

|

December 31, 2018 |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at 1-888-200-6796 or, if you own these shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at 1-888-200-6796. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Wilshire Variable Insurance Trust

Table of Contents

|

|

Letter to Shareholders | 1 |

Commentary | 3 |

Disclosure of Fund Expenses | 7 |

Schedule of Investments | 8 |

Statement of Assets and Liabilities | 9 |

Statement of Operations | 10 |

Statements of Changes in Net Assets | 11 |

Financial Highlights | 12 |

Notes to Financial Statements | 13 |

Report of Independent Registered Public Accounting Firm | 20 |

Board Approval of Advisory Agreements | 21 |

Additional Fund Information | 26 |

Tax Information | 29 |

Shares of the Wilshire Global Allocation Fund are sold only as the underlying investment for variable annuity contracts issued by insurance companies. This report is authorized for use in connection with any offering of the Fund’s shares only if accompanied or preceded by the Fund’s current prospectus.

Shares of the Wilshire Variable Insurance Trust are distributed by Ultimus Fund Distributors, LLC.

Wilshire Variable Insurance Trust

Letter To Shareholders (Unaudited)

|

|

Dear Wilshire Variable Insurance Trust Shareholder:

We are pleased to present this annual report to all shareholders of the Wilshire Variable Insurance Trust. This report covers the period from January 1, 2018 to December 31, 2018 for the Wilshire Global Allocation Fund.

Market Environment

U.S. Equity Market

The U.S. stock market, represented by the Wilshire 5000 Total Market IndexSM, was down -14.29% for the fourth quarter of 2018 and down -5.26% for the year. This marks the worst quarter for U.S. equities since 2011 and the first down year since the credit crisis sell-off of 2008. The Index had been down by double digits for the year in late December before gaining nearly 7% during the final few trading days. Concerns of an economic slowdown weighed on stock prices, as did fears that additional rate increases by the Federal Reserve could weaken future prospects for economic growth. Ongoing trade negotiations between China and the U.S. continued to be a factor affecting market activity during the quarter, and these issues remain unresolved entering the new year.

Eight of the eleven major sectors produced negative returns during 2018, with Energy (-19.39%) and Materials (-16.62%) down the most for the year. The best performing sectors were Health Care (+5.41%) and Utilities (+4.32%). Large capitalization stocks outperformed small caps with the Wilshire U.S. Large-Cap IndexSM returning -4.64% versus -10.84% for the Wilshire U.S. Small-Cap IndexSM. Growth stocks broadly trailed value stocks during the fourth quarter but outperformed overall during the twelve-month period.

International Equity Market

Equity markets outside of the U.S. were negative for 2018 in both developed and emerging markets, with double-digit losses across the major indices. The MSCI EAFE Index returned -13.79% for the year. Although the European Union began the year in sound economic condition, growth declined steadily throughout the year as gains in unemployment stalled and industrial production reversed course. News out of Japan was grim with a report showing a serious economic contraction during the third quarter that threatens to end Japan’s longest expansion since the 1980’s. Emerging markets underperformed nearly all of the major indices for 2018, with the MSCI Emerging Markets Index closing the year at -14.57%. This ended the two-year streak of positive annual gains for the index.

Bond Market

The U.S. Treasury yield curve fell across most maturities during the fourth quarter, with the biggest decreases occurring in the intermediate to longer segment of the curve. The bellwether 10-year Treasury yield ended the year at 2.69%, up 29 basis points from its 2017 finish of 2.40%. The Federal Open Market Committee increased its overnight rate four times in 2018, a total increase of 100 basis points, to a range of 2.25% to 2.50%. Credit spreads widened in the fourth quarter within both the investment grade and high yield markets. For the year, the Bloomberg Barclays U.S Aggregate Bond Index returned 0.01%, the Bloomberg Barclays U.S. TIPS Index returned -1.26%, and Bloomberg Barclays U.S. Corporate High Yield Index returned -2.08%.

Fund Performance Review

The Global Allocation Fund returned -7.30%, underperforming its custom benchmark by 1.88%. Despite the Fund’s underperformance versus its benchmark in 2018, we believe the Fund is well positioned for future growth.

As always, we sincerely appreciate your continued support and confidence in Wilshire Associates.

Sincerely,

Jason Schwarz

President, Wilshire Variable Insurance Trust

1

Wilshire Variable Insurance Trust

Letter To Shareholders (Unaudited) - (Continued)

|

|

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Annuity contract fees are not reflected in returns. If these fees were included, returns would be lower. Performance data current to the most recent month end may be obtained at http://advisor.wilshire.com.

Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. An individual cannot directly invest in any index.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the Funds or any stock in particular.

There are risks involved with investing, including the possible loss of principal. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic, or political instability in other nations. Investments in smaller companies typically exhibit higher volatility. The Funds operate under a fund of funds structure, pursuant to which the Funds invest in underlying affiliated funds (“Underlying Funds”) and unaffiliated investment companies and exchange-traded funds (“ETFs”). An investor in the Funds should understand that alternatively he or she could allocate investments directly to an Underlying Fund, unaffiliated investment company or ETF. By investing indirectly in an Underlying Fund, unaffiliated investment company or ETF through the Funds, an investor bears not only his or her proportionate share of certain expenses of the Funds (such as operating costs), but also, indirectly, similar expenses of an Underlying Fund, unaffiliated investment company or ETF. The management fee charged to the Funds is based on the average daily net assets not invested in the Underlying Funds.

There can be no assurance that a Fund will achieve its stated objectives. An investor may experience losses, at any time, including near, at or after the Fund’s target year, if applicable. In addition, there is no guarantee that an investor’s investment in a Fund will provide any income at or through the years following the Fund’s target year, if applicable, in amounts adequate to meet the investor’s goals or retirement needs.

The Bloomberg Barclays US Aggregate Bond Index is made up of the Bloomberg Barclays US Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, including securities that are of investment grade quality or better, have at least one year to maturity, and have an outstanding par value of at least $100 million.

The MSCI All Country World ex USA Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets, with the exception of U.S.-based companies.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets.

The Wilshire 5000 Total Market IndexSM is widely accepted as the definitive benchmark for the U.S. equity market, and measures performance of all U.S. equity securities with readily available price data.

2

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary |

|

WILSHIRE GLOBAL ALLOCATION FUND

Average Annual Total Returns

One Year Ended 12/31/18 | (7.30%) |

Five Years Ended 12/31/18 | 2.88% |

Ten Years Ended 12/31/18 | 7.11% |

65/35 HYBRID INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/18 | (5.42%) |

Five Years Ended 12/31/18 | 4.12% |

Ten Years Ended 12/31/18 | 7.71% |

MSCI ALL COUNTRY WORLD (ACWI) INDEX(1)

Average Annual Total Returns

One Year Ended 12/31/18 | (9.42%) |

Five Years Ended 12/31/18 | 4.26% |

Ten Years Ended 12/31/18 | 9.51% |

BLOOMBERG BARCLAYS GLOBAL AGGREGATE BOND INDEX (HEDGED)(1)

Average Annual Total Returns

One Year Ended 12/31/18 | 1.76% |

Five Years Ended 12/31/18 | 3.44% |

Ten Years Ended 12/31/18 | 3.77% |

3

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

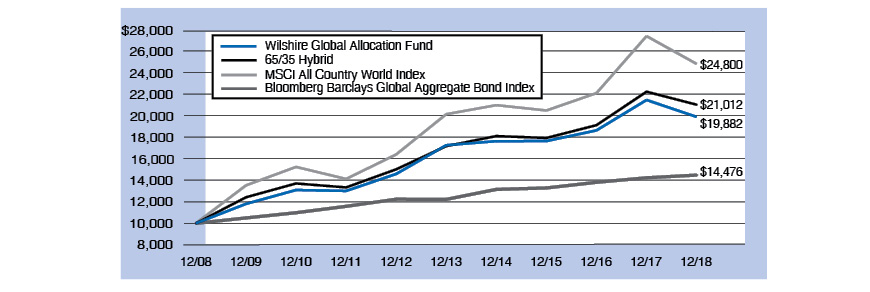

COMPARATIVE PERFORMANCE

Comparison of Change in Value of a $10,000 Investment in the Wilshire Global Allocation Fund versus the following 2 indices and a 65/35 Hybrid of the 2 indices: the MSCI ACWI and the Bloomberg Barclays Global Aggregate Index (Hedged) through 12/31/18.

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Returns assume reinvestment of all distributions. Annuity contract fees are not reflected in returns. If these fees were included, returns would be lower. Recent performance can be found at your particular insurance company.

(1) | 65/35 Hybrid is a blend of 65% MSCI All Country World (ACWI) Index and 35% Bloomberg Barclays Global Aggregate Index (Hedged). The MSCI ACWI Index is an unmanaged capitalization-weighted measure of stock markets of developed and emerging markets. The Bloomberg Barclays Global Aggregate Index (Hedged) is a broad-based measure of the global investment grade fixed-rate debt markets from both developed and emerging markets issuers. An individual cannot invest directly in an index. Index performance is presented for general comparative purposes. Unlike a mutual fund, the performance of an index assumes no transaction costs, management fees or other expenses. |

During the ten years ended December 31, 2018, certain fees and expenses were reduced or reimbursed. Without fee reductions and expense reimbursements, total returns would have been lower. For the year ended December 31, 2018, the investment adviser did not reduce its fees or reimburse expenses.

4

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

PORTFOLIO SECTOR WEIGHTING*

(As of December 31, 2018)

The Wilshire 5000 Total Market IndexSM was down -14.29% for the fourth quarter and -5.26% for the year, marking its first down year since the financial crisis. In 2018, the U.S. economy benefited from sizable tax cuts, particularly on the corporate side, which boosted earnings. Real gross domestic product (“GDP”) growth remained strong, growing at an annualized pace of 3.4% over the third quarter, and for the fourth quarter, the Federal Reserve Bank of Atlanta projects annualized GDP growth of 2.8%. At the end of November, the unemployment rate was 3.9%, a level not seen since 2000, while wage growth continued to trend up to 3.2%. The Consumer Price Index (“CPI”) was up 1.9% for the year; although December 2018 marked the first time that the trailing 12-month CPI had fallen below 2.0% since August 2017. Concerns around additional rate hikes and on-going trade negotiations increased, causing volatility to spike in the month of December. The CBOE S&P 500 Volatility Index® (“VIX”), which reflects a market estimate of future volatility, touched 36 on Monday December 24, 2018 before falling back to 17.66 at the end of the year.

Sector performance for the Wilshire 5000 Total Market Index was mostly negative for 2018. Health Care (+5.41%), Utilities (+4.32%) and Information Technology (+0.67%) were the best performing sectors while Energy (-19.39%) and Materials (-16.62%) were the biggest laggards. Utilities was the only sector that recorded a positive return for the fourth quarter. Large capitalization stocks outperformed small caps with the Wilshire U.S. Large-Cap IndexSM returning -4.64% versus -10.84% for the Wilshire U.S. Small-Cap IndexSM. Growth stocks broadly trailed value stocks in the fourth quarter but outperformed over the twelve-month period.

U.S. real estate securities were down for the year but slightly outperformed their international counterparts. Commodities were down for the one-year period as crude oil fell 24.8% to $45.41 per barrel, compared to $60.42 per barrel at the close of 2017. Natural gas prices ended 2018 at $2.94 per million BTUs (British thermal unit), marginally down from the 2017 close of $2.95 per million BTUs. Finally, gold prices ended 2018 at $1,281 per troy ounce, down approximately 2% from last year.

Equity markets outside of the U.S. continued to underperform relative to domestic equities, with the MSCI ACWI ex USA Index returning -14.20% during 2018. Political turmoil in Italy caused concern as the Italian government released its official budget for 2019 that included a deficit of 2.4% of GDP, which was above the 2% target set by the European Union and which worsened the country’s debt outlook. Japan provided a bright spot, as the Bank of Japan continued its stimulative policies. Trade tensions weighed heavily on foreign markets, particularly in emerging markets, with the MSCI Emerging Markets Index returning -14.57% for the year. Emerging markets entered a technical bear market during the fourth quarter, down -20% since late January. Much of the weakness came from securities domiciled in China, a cohort which now represents 30% of the MSCI Emerging Markets Index. While China-U.S. trade relations remain a significant variable, China’s central bank has also communicated a lack of desire to offer monetary stimulus, and liquidity issues have led to a number of corporate bond defaults.

* | Based on percent of the Fund’s total investments at value. |

5

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Commentary - (Continued) |

|

The U.S. fixed income market was slightly positive for 2018 with the Bloomberg Barclays U.S. Aggregate Bond Index returning 0.01%. The Federal Open Market Committee raised the fed funds rate four times in 2018 to a range of 2.25% to 2.50%. The committee adjusted its forecast for future rate hikes from three rate increases in 2019 to only two. Additionally, the central bank will continue to shrink its balance sheet by up to $50 billion per month. The U.S. Treasury curve continued to flatten over the year with the 10-year Treasury yield ending the year at 2.69%, up slightly from 2.46% at the beginning of the year. The yield curve differential between 2-year and 10 year-Treasuries ended the year at 21 basis points, compared to 54 basis points at the beginning of the year. Credit spreads, a measure used to gauge the risk of corporate debt, widened during the fourth quarter sell-off. The Bloomberg Barclays U.S. Universal Index and the Bloomberg Barclays U.S. Corporate High Yield Index returned -0.26% and -2.08%, respectively, for the year.

Globally, a strong U.S. dollar and geopolitical factors weighed on performance. The Citigroup World Global Bond Index (unhedged) returned -0.84% for the year. Emerging market bonds were heavily impacted by the geopolitical uncertainty, higher interest rates in the U.S., and concerns of trade war.

The Wilshire Global Allocation Fund returned -7.30% in 2018, underperforming its customized benchmark1 return of -5.42% by 1.88%. Relative performance was weighed down by relative underperformance from the Wilshire Large Company Value Portfolio and the Wilshire Small Company Value Portfolio, as well as a relative overweight to small cap. Conversely, strong performance from the Wilshire Small Company Growth Portfolio and the Wilshire International Equity Fund was contributive to relative performance.

Despite the Fund’s underperformance versus its benchmark, we believe the Fund is well positioned going into 2019 as the market deals with ongoing macroeconomic and geopolitical issues.

| 1 | Custom Benchmark: 1/1/14 – 5/31/14: 50% S&P 500 Index, 15% MSCI EAFE Index, 35% Bloomberg Barclays U.S. Aggregate Index; 6/1/14 to date: 65% MSCI All Country World Index, 35% Bloomberg Barclays Global-Aggregate Hedged Index |

6

Wilshire Variable Insurance Trust

Disclosure of Fund Expenses (Unaudited)

|

|

All mutual funds have operating expenses. As a shareholder of a mutual fund, you incur ongoing costs, which include costs for investment advisory services, administrative services, distribution and/or shareholder services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing fees (in dollars) of investing in the Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire period from July 1, 2018 to December 31, 2018.

The table below illustrates the Fund’s costs in two ways:

Actual Fund Return: This section helps you to estimate the actual expenses, after any applicable fee reductions, that you paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return for the period, the “Expense Ratio” column shows the period’s annualized expense ratio, and the “Expenses Paid During Period” column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund at the beginning of the period.

You may use the information here, together with your account value, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for the Fund in the first line under the heading entitled “Expenses Paid During Period.”

Hypothetical 5% Return: This section is intended to help you compare the Fund’s costs with those of other mutual funds. The “Ending Account Value” shown is derived from hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and assumed rate of return. It assumes that the Fund had an annual return of 5% before expenses, but that the expense ratio is unchanged. In this case, because the return used is not the Fund’s actual return, the results do not apply to your investment. This example is useful in making comparisons to other mutual funds because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on an assumed 5% annual return. You can assess the Fund’s ongoing costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees. Wilshire Variable Insurance Trust has no such charges or fees, but they may be present in other funds to which you compare this data. Therefore, the hypothetical portions of the table are useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds.

Beginning | Ending | Net Expense | Expenses Paid | |

Wilshire Global Allocation Fund | ||||

Actual Fund Return | $1,000.00 | $ 929.70 | 0.48% | $2.33 |

Hypothetical 5% Return | $1,000.00 | $ 1,022.79 | 0.48% | $2.45 |

(1) | Annualized, based on the Fund's most recent fiscal half-year expenses. |

(2) | The expense ratio does not include the expenses of the underlying funds. |

(3) | Expenses are equal to the Fund's annualized expense ratio multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

(4) | Expenses shown do not include annuity contract fees. |

7

Wilshire Variable Insurance Trust

Schedule of Investments

December 31, 2018 |

|

Wilshire Global Allocation Fund | ||||||||

Shares | Value | |||||||

AFFILIATED REGISTERED INVESTMENT COMPANIES — 85.2% | ||||||||

Wilshire Income Opportunities Fund - Institutional Class | 12,585,513 | $ | 123,715,597 | |||||

Wilshire International Equity Fund - Institutional Class | 17,180,311 | 157,887,061 | ||||||

Wilshire Large Company Growth Portfolio - Institutional Class | 1,236,493 | 45,020,717 | ||||||

Wilshire Large Company Value Portfolio - Institutional Class | 3,632,676 | 61,791,824 | ||||||

Wilshire Small Company Growth Portfolio - Institutional Class | 590,251 | 13,988,950 | ||||||

Wilshire Small Company Value Portfolio - Institutional Class | 761,255 | 14,106,063 | ||||||

Total Affiliated Registered Investment Companies | $ | 416,510,212 | ||||||

OTHER OPEN-END FUNDS — 14.9% | ||||||||

DFA Emerging Markets Core Equity Portfolio - Institutional Class | 1,173,065 | $ | 22,581,503 | |||||

Vanguard Short-Term Bond Index Fund - Institutional Class | 2,186,830 | 22,546,217 | ||||||

Vanguard Total International Bond Index Fund - Institutional Shares | 852,090 | 27,727,023 | ||||||

Total Other Open-End Funds | $ | 72,854,743 | ||||||

MONEY MARKET FUNDS — 0.0% (a) | ||||||||

Northern Trust Institutional Government Select Portfolio - Institutional Class, 2.25% (b) | 230,769 | $ | 230,769 | |||||

Total Investments at Value — 100.1% | $ | 489,595,724 | ||||||

Liabilities in Excess of Other Assets — (0.1%) | (590,963 | ) | ||||||

Net Assets — 100.0% | $ | 489,004,761 | ||||||

(a) | Percentage rounds to less than 0.1%. |

(b) | The rate shown is the 7-day effective yield as of December 31, 2018. |

See Notes to Financial Statements.

8

Wilshire Variable Insurance Trust

Statement of Assets and Liabilities

December 31, 2018 |

|

WILSHIRE | ||||

ASSETS: | ||||

Investments in unaffiliated funds, at value (Note 2) | $ | 73,085,512 | ||

Investments in affiliated funds, at value (Notes 2 and 5) | 416,510,212 | |||

Receivable for Fund shares sold | 37,204 | |||

Receivable for investment securities sold | 132,520 | |||

Dividends receivable | 50,058 | |||

Reclaims receivable | 1,871 | |||

Other assets | 21,357 | |||

Total assets | 489,838,734 | |||

LIABILITIES: | ||||

Payable for Fund shares redeemed | 631,707 | |||

Investment advisory fees payable (Note 3) | 40,545 | |||

Distribution fees payable (Note 4) | 55,532 | |||

Administration fees payable (Note 3) | 22,500 | |||

Accrued expenses and other payables | 83,689 | |||

Total liabilities | 833,973 | |||

NET ASSETS | $ | 489,004,761 | ||

NET ASSETS consist of: | ||||

Paid-in capital | $ | 496,707,622 | ||

Accumulated deficit | (7,702,861 | ) | ||

NET ASSETS | $ | 489,004,761 | ||

SHARES OUTSTANDING: | ||||

(Unlimited shares authorized) | 26,634,650 | |||

NET ASSET VALUE: | ||||

(Offering and redemption price per share) | $ | 18.36 | ||

Investments in unaffiliated funds, at cost (Note 2) | $ | 75,172,674 | ||

Investments in affiliated funds, at cost (Notes 2 and 5) | 447,991,919 | |||

See Notes to Financial Statements.

9

Wilshire Variable Insurance Trust

Statement of Operations

For the Year Ended December 31, 2018 |

|

WILSHIRE | ||||

INVESTMENT INCOME: | ||||

Dividend income from unaffiliated investments | $ | 1,517,183 | ||

Income distributions from affiliated funds (Note 5) | 7,592,202 | |||

Foreign taxes withheld | (41,154 | ) | ||

Total income | 9,068,231 | |||

EXPENSES: | ||||

Distribution fees (Note 4) | 999,905 | |||

Investment advisory fees (Note 3) | 300,121 | |||

Administration fees (Note 3) | 230,220 | |||

Professional expenses | 115,804 | |||

Trustees’ fees and expenses (Note 3) | 68,552 | |||

Insurance expense | 23,967 | |||

Printing expenses | 19,964 | |||

Custodian fees | 14,754 | |||

Transfer agent fees | 10,051 | |||

Registration and filing fees | 4,996 | |||

Chief Compliance Officer expenses | 2,987 | |||

Other | 24,238 | |||

Total expenses | 1,815,559 | |||

Previous investment advisory fee reductions and expense reimbursements recouped by the Adviser (Note 3) | 137,320 | |||

Net expenses | 1,952,879 | |||

Net investment income | 7,115,352 | |||

NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS (Notes 2 and 5): | ||||

Net realized gains (losses) from: | ||||

Sale of unaffiliated investments | (862,799 | ) | ||

Sale of affiliated investment company shares (Note 5) | 3,064,631 | |||

Capital gain distributions from affiliated investment companies (Note 5) | 17,685,765 | |||

Foreign currency transactions | 272 | |||

Net change in unrealized appreciation (depreciation) of: | ||||

Unaffiliated investments | (2,076,254 | ) | ||

Investments in affiliated funds (Note 5) | (55,270,757 | ) | ||

Foreign currency transactions and translation of other assets and liabilities denominated in foreign currencies | 1,313 | |||

Net realized and unrealized losses on investments | (37,457,829 | ) | ||

NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (30,342,477 | ) | |

See Notes to Financial Statements.

10

Wilshire Variable Insurance Trust

Statements of Changes in Net Assets |

|

WILSHIRE GLOBAL | ||||||||

Year Ended | Year Ended | |||||||

OPERATIONS: | ||||||||

Net investment income | $ | 7,115,352 | $ | 7,330,108 | ||||

Net realized gains from sale of unaffiliated investments, sale of affiliated investment company shares, capital gain distributions from affiliated investment companies | 19,887,869 | 5,885,022 | ||||||

Net change in unrealized appreciation (depreciation) of unaffiliated investments, investments in affiliated funds and foreign currency transactions and translation of other assets and liabilities denominated in foreign currencies | (57,345,698 | ) | 44,444,002 | |||||

Net increase (decrease) in net assets resulting from operations | (30,342,477 | ) | 57,659,132 | |||||

DISTRIBUTIONS TO SHAREHOLDERS (Notes 2 and 10) | (13,856,522 | ) | (14,675,152 | ) | ||||

CAPITAL SHARE TRANSACTIONS: (DOLLARS) | ||||||||

Net assets received in conjunction with fund merger (Note 1) | 148,648,667 | — | ||||||

Shares sold | 1,927,012 | 2,547,218 | ||||||

Shares issued as reinvestment of distributions | 13,856,522 | 14,675,151 | ||||||

Shares redeemed | (42,244,184 | ) | (58,372,924 | ) | ||||

Net increase (decrease) in net assets from capital share transactions | 122,188,017 | (41,150,555 | ) | |||||

Net increase in net assets | 77,989,018 | 1,833,425 | ||||||

NET ASSETS: | ||||||||

Beginning of year | 411,015,743 | 409,182,318 | ||||||

End of year | $ | 489,004,761 | $ | 411,015,743 | ||||

CAPITAL SHARE TRANSACTIONS: | �� | |||||||

Shares received in conjunction with fund merger (Note 1) | 7,920,164 | — | ||||||

Shares sold | 95,613 | 129,059 | ||||||

Shares issued as reinvestment of distributions | 689,036 | 710,066 | ||||||

Shares redeemed | (2,079,730 | ) | (2,959,450 | ) | ||||

Net increase (decrease) in shares outstanding | 6,625,083 | (2,120,325 | ) | |||||

Shares outstanding, beginning of year | 20,009,567 | 22,129,892 | ||||||

Shares outstanding, end of year | 26,634,650 | 20,009,567 | ||||||

(a) | The presentation of Distributions to Shareholders has been updated to reflect the changes prescribed in amendments to Regulation S-X, effective November 5, 2018 (Note 2). For the year ended December 31, 2017, distributions to shareholders were from net investment income of $9,868,254 and net realized capital gains of $4,806,898. As of December 31, 2017, accumulated net investment income was $7,328,636. |

See Notes to Financial Statements.

11

Wilshire Variable Insurance Trust

Wilshire Global Allocation Fund

Financial Highlights |

|

For a Fund Share Outstanding Throughout Each Year. | ||||||||||||||||||||

Year Ended | Year Ended | Year Ended | Year Ended | Year Ended | ||||||||||||||||

Net asset value, beginning of year | $ | 20.54 | $ | 18.49 | $ | 18.38 | $ | 19.75 | $ | 19.42 | ||||||||||

Income (loss) from investment operations: | ||||||||||||||||||||

Net investment income (a) | 0.36 | 0.37 | 0.46 | 0.30 | 0.23 | |||||||||||||||

Net realized and unrealized gains (losses) on investments | (1.80 | ) | 2.43 | 0.57 | (0.30 | ) | 0.19 | |||||||||||||

Total from investment operations | (1.44 | ) | 2.80 | 1.03 | 0.00 | 0.42 | ||||||||||||||

Less distributions: | ||||||||||||||||||||

From net investment income | (0.39 | ) | (0.50 | ) | (0.31 | ) | (0.37 | ) | (0.09 | ) | ||||||||||

From realized capital gains | (0.35 | ) | (0.25 | ) | (0.61 | ) | (1.00 | ) | — | |||||||||||

Total distributions | (0.74 | ) | (0.75 | ) | (0.92 | ) | (1.37 | ) | (0.09 | ) | ||||||||||

Net asset value, end of year | $ | 18.36 | $ | 20.54 | $ | 18.49 | $ | 18.38 | $ | 19.75 | ||||||||||

Total return (b) | (7.30 | %) | 15.16 | % | 5.62 | % | 0.04 | % | 2.17 | % | ||||||||||

Ratios to average net assets/supplemental data: | ||||||||||||||||||||

Net assets, end of year (in 000’s) | $ | 489,005 | $ | 411,016 | $ | 409,182 | $ | 432,239 | $ | 478,350 | ||||||||||

Operating expenses after fee reductions and expense reimbursements, recoupment of previously waived fees and excluding fees paid indirectly† | 0.49 | % | 0.50 | % | 0.51 | %(c) | 0.53 | %(c) | 0.52 | %(c) | ||||||||||

Operating expenses before fee reductions and expense reimbursements, recoupment of previously waived fees and excluding fees paid indirectly† | 0.45 | % | 0.41 | % | 0.53 | % | 0.63 | % | 0.57 | %(d) | ||||||||||

Net investment income (a) | 1.78 | % | 1.80 | % | 2.44 | % | 1.48 | % | 1.17 | % | ||||||||||

Portfolio turnover rate | 29 | % | 15 | % | 65 | %(e) | 29 | % | 83 | %(e) | ||||||||||

(a) | Net investment income was calculated using the average shares outstanding method for the period. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. The ratio does not include net investment income of the investment companies in which the Fund invests. |

(b) | If you are an annuity contract owner, the total returns shown do not reflect the expenses that apply to the separate account or related insurance policies through which you invest in the Fund. The inclusion of these charges would reduce the total return figures for all periods shown. |

(c) | The ratio of expenses to average net assets includes interest expense, which is considered outside the expense limitation agreement. Had interest expense been excluded, the ratio would have been 0.50%, 0.50% and 0.50% for the years ended December 31, 2016, 2015 and 2014, respectively. |

(d) | Had the ratio of operating expenses excluding fee reductions/expense reimbursements and excluding fees paid indirectly included these expense offsets, the ratio would have remained at 0.57%. |

(e) | Includes the impact of in-kind transactions. |

† | These ratios do not include expenses of the underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

12

Wilshire Variable Insurance Trust

Notes to Financial Statements

December 31, 2018 |

|

1. Organization.

The Wilshire Variable Insurance Trust (the “Trust”) is an open-end, diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust currently offers units of beneficial interest (shares) in the Wilshire Global Allocation Fund (the “Fund”). The Fund operates under a fund of funds structure and at this time invests substantially all of its assets in shares of certain underlying affiliated funds (the “Underlying Funds”), which are mutual funds advised by Wilshire Associates Incorporated (the “Adviser”), and in shares of unaffiliated investment companies. Shares of the Fund may only be purchased by insurance company separate accounts for certain variable insurance contracts and by plan sponsors of qualified retirement plans.

The investment objective of the Fund is to realize a high long-term total rate of return consistent with prudent investment risks. Total rate of return consists of current income, which includes dividends, interest, discount accruals and capital appreciation.

On December 7, 2018, the Fund consummated a tax-free merger with the Wilshire 2015 Fund (the “2015 Fund”), the Wilshire 2025 Fund (the “2025 Fund”) and the Wilshire 2035 Fund (the “2035 fund”) (collectively, the “Target Date Funds” and, each an “Aquired Fund”), previously each a portfolio offered by the Trust. The purpose of the transaction was to combine four portfolios with comparable investment objectives and strategies. Pursuant to the terms of the agreement governing the merger, each share of the Target Date Funds was converted into an equivalent dollar amount of shares of the Fund, based on the net asset value (“NAV”) of the Fund and the 2015 Fund, the 2025 Fund and the 2035 Fund as of December 7, 2018 ($18.77, $9.67, $10.33 and $10.22, respectively); this resulted in a conversion ratio of 0.515404 shares of the Fund for each share of the 2015 Fund, 0.550391 shares of the Fund for each share of the 2025 Fund, and 0.544611 shares of the Fund for each share of the 2035 Fund. The Fund issued 7,920,164 shares to shareholders valued at $148,648,667 of the Target Date Funds in connection with the merger. The basis of the assets transferred from the Target Date Funds reflected the historical basis of the assets as of the date of the tax-free merger. Net assets of the Fund, the 2015 Fund, the 2025 Fund and the 2035 Fund as of the merger date were $353,707,130, $20,616,196, $54,119,767 and $73,912,704, respectively, including total fair value of investments of $353,865,503, $20,633,284, $54,134,704 and $73,935,745, respectively, and unrealized appreciation (depreciation) on investments of ($160,117), $119,434, $729,182 and $1,202,089, respectively. The net assets of the 2015 Fund, the 2025 Fund and the 2035 Fund included accumulated realized capital losses of $10,161, $21,447 and $13,159, respectively. Total net assets of the Fund immediately after the merger were $502,355,797.

For financial statement purposes, assets received and shares issued by the Fund were calculated at fair value; however, the cost basis of the investments received from each Acquired Fund was carried forward to align ongoing reporting of the Fund’s realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. Expenses related to the merger were incurred by the Adviser.

Assuming the merger has been completed on January 1, 2018 (the beginning of the annual reporting period for the Fund), the Fund’s pro-forma results of operations for the year ended December 31, 2018 were as follows:

Net Investment Income | Net Realized Gains and Net Change in | Net Decrease in Net Assets |

$ 6,842,615 | $ (44,473,911) | $ (37,631,296) |

Because the combined investment portfolios have been managed as a single integrated portfolio since the merger was completed, it is not practical to separate the amounts of revenue and earnings of the Target Date Funds that have been included in the Fund’s Statement of Operations since December 7, 2018.

2. Significant Accounting Policies.

In August 2018, the SEC adopted regulations that eliminated or amended disclosure requirements that were redundant or outdated in light of changes in SEC requirements, accounting principles generally accepted in the United States of America (“U.S. GAAP”), International Financial Reporting Standards, or changes in technology or the business environment. These regulations were effective November 5, 2018, and the Fund is complying with them effective with these financial statements.

13

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with U.S. GAAP. The Fund follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.”

Use of estimates — The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and those differences could be material.

New Accounting Pronouncement — In August 2018, FASB issued Accounting Standards Update No. 2018-13 (“ASU 2018-13”), “Disclosure Framework – Changes to Disclosure Requirements for Fair Value Measurement,” which amends the fair value measurement disclosure requirements of ASC Topic 820 (“ASC 820”), “Fair Value Measurement.” ASU 2018-13 includes new, eliminated, and modified disclosure requirements for ASC 820. In addition, ASU 2018-13 clarifies that materiality is an appropriate consideration of entities when evaluating disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. Early adoption is permitted and the Fund has adopted ASU 2018-13 with these financial statements.

Security valuation — A security listed or traded on a domestic exchange is valued at its last sales price on the exchange where it is principally traded. In the absence of a current quotation, the security is valued at the mean between the last bid and asked prices on the exchange. Securities traded on National Association of Securities Dealers Automatic Quotation (“NASDAQ”) System are valued at the NASDAQ official closing price. If there is no NASDAQ official closing price available, the most recent bid quotation is used. Securities traded over-the-counter (other than on NASDAQ) are valued at the last current sale price, and if there are no such sales, the most recent bid quotation is used. Investments representing shares of other open-end investment companies, including money market funds, are valued at their net asset value (“NAV”) as reported by such companies. Values of debt securities are generally reported at the last sales price if the security is actively traded. If a debt security is not actively traded, it is typically valued by an independent pricing agent which employs methodologies that utilize actual market transactions, broker-supplied valuations, or other methodologies designed to identify the market value for such securities. The independent pricing agent often utilizes proprietary models that are subjective and require the use of judgment and the application of various assumptions including, but not limited to, interest rates, repayment speeds, and default rate assumptions. Debt securities that have a remaining maturity of 60 days or less are valued at prices supplied by the Fund’s pricing agent for such securities, if available, and otherwise are valued at amortized cost if the Pricing Committee concludes it approximates fair value. When market quotations are not readily available, securities are valued according to procedures adopted by the Board of Trustees (the “Board”) or are valued at fair value as determined in good faith by the Pricing Committee, whose members include at least two representatives of the Adviser, one of whom is an officer of the Trust, or the Trust’s Valuation Committee. Securities whose market value using the procedures outlined above do not reflect fair value because a significant valuation event has occurred may be valued at fair value by the Pricing Committee or the Valuation Committee in accordance with the Trust’s valuation procedures. The value of fair valued securities may be different from the last sale price (or the mean between the last bid and asked prices), and there is no guarantee that a fair valued security will be sold at the price at which the Fund is carrying the security. Investments in open-end registered investment companies are valued at the end of day NAV per share as reported by the underlying funds.

In accordance with the authoritative guidance on fair value measurements and disclosures under U.S. GAAP, the Fund discloses the fair value of its investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The guidance establishes three levels of the fair value hierarchy as follows:

● | Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

14

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

● | Level 2 – Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

● | Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. During the year ended December 31, 2018, there were no significant changes to the Fund’s fair value methodologies. During the year ended December 31, 2018, there were no Level 2 or Level 3 securities held by the Fund.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2018:

Wilshire Global Allocation Fund | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Affiliated Registered Investment Companies | $ | 416,510,212 | $ | — | $ | — | $ | 416,510,212 | ||||||||

Other Open-End Funds | 72,854,743 | — | — | 72,854,743 | ||||||||||||

Money Market Funds | 230,769 | — | — | 230,769 | ||||||||||||

Total | $ | 489,595,724 | $ | — | $ | — | $ | 489,595,724 | ||||||||

Investment transactions and investment income — Investment transactions are recorded on a trade date basis. Dividends, including distributions paid by Underlying Funds and unaffiliated investment companies, are recorded on the ex-dividend date. The actual tax character of income, realized gains and return of capital distributions received from Underlying Funds and unaffiliated investment companies may not be known until after the end of the fiscal year, at which time appropriate adjustments are recorded. Realized gains and losses on investments sold are determined on the basis of identified cost. Distributions received on securities that represent a return of capital or capital gain are reclassed as a reduction of cost of investments and/or as a realized gain.

Foreign currency transactions — The books and records of the Fund are maintained in U.S. dollars. Foreign currency transactions are translated into U.S. dollars on the following basis:

● | market value of investment securities, other assets and liabilities at the daily rates of exchange and |

● | purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. |

The portion of the results of operations caused by changes in foreign exchange rates on investments are not isolated from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments.

Net realized and unrealized gains (losses) from foreign currency related transactions include gains and losses arising from the sales of foreign currency and gains and losses between the ex-dividend and payment dates on dividends, interest and foreign withholding taxes. The effect of changes in foreign exchange rates on realized and unrealized gains or losses is reflected as a component of such gains or losses.

Expense policy — Expenses that are attributable to both the Fund and the Wilshire Mutual Funds, Inc. (an affiliated investment company) are allocated across the Fund and the Wilshire Mutual Funds, Inc. based upon relative net assets or another reasonable basis.

Distributions to shareholders — Distributions to shareholders are recorded on the ex-dividend date. Distributions from net investment income, if any, are declared and paid annually. The Fund’s net realized capital gains, unless offset by any available capital loss carryforward, are distributed to shareholders annually. Additional distributions of net investment income and net realized capital gains may be made at the discretion of the Board.

15

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

3. Investment Advisory and Other Services.

The Trust employs the Adviser to manage the investment and reinvestment of the assets of the Fund and to continuously review, oversee and administer the Fund’s investment program.

Under an Investment Advisory Agreement, the Fund pays to the Adviser a fee at the annual rate of 0.55% of the average daily net assets of the Fund, excluding assets invested in the Underlying Funds.

The Adviser has entered into an expense limitation agreement with the Fund requiring it to reduce its management fee and/or reimburse expenses to limit annual operating expenses (excluding taxes, brokerage expenses, dividend expenses on short securities, acquired fund fees and expenses and extraordinary expenses) to 0.50% of average daily net assets of the Fund. The agreement to limit expenses continues through at least April 30, 2019. The Adviser may recoup the amount of any management fee reductions or expense reimbursements within three years after the day on which the fee reduction or expense reimbursement occurred if the recoupment does not cause the Fund’s expenses to exceed the expense limitation that was in place at the time of the fee reduction or expense reimbursement.

During the year ended December 31, 2018, the Adviser recouped $137,320 of prior years’ fee reductions. No further amounts are subject to recoupment as of December 31, 2018.

Because the Underlying Funds and unaffiliated investment companies have varied fee and expense levels and the Fund may own different proportions of the Underlying Funds and unaffiliated investment companies at different times, the amount of fees and expenses incurred indirectly by the Fund will vary.

DST Systems, Inc. serves as the Fund’s transfer agent and dividend disbursing agent. The Northern Trust Company serves as the Trust’s custodian. Ultimus Fund Solutions, LLC (“Ultimus”) serves as the Fund’s administrator and accounting agent and Ultimus Fund Distributors LLC (the “Distributor”) serves as the Fund’s principal underwriter. Certain officers and interested Trustees of the Trust are also officers of the Adviser, Ultimus and/or of the Distributor.

Certain officers and an interested Trustee of the Trust may also be officers or employees of the Adviser, Ultimus, Distributor or their affiliates. They receive no fees for serving as officers or as an interested Trustee of the Trust.

Officers and Trustees’ expenses — Certain officers of the Trust are affiliated with and receive remuneration from the Adviser or Ultimus. The Trust does not pay any remuneration to its officers. The Fund and Wilshire Mutual Funds, Inc. together pay each Independent Trustee an annual retainer of $48,000, an annual additional retainer for each Committee chair of $12,000 and an annual additional retainer to the Board chair of $12,000. In addition, each Independent Trustee is compensated for Board and Committee meeting attendance in accordance with the following schedule: an in-person Board meeting fee of $3,000 for Independent Trustees and $4,000 for the Board chair; a telephonic Board meeting fee of $1,500 for Independent Trustees and $2,000 for the Board chair, and a telephonic Committee meeting fee of $500.

4. Distribution and Shareholder Services Plan.

The Fund has adopted a Rule 12b-1 distribution and shareholder services plan (the “Distribution Plan”). Pursuant to the Distribution Plan, the Distributor receives from the Fund a distribution and shareholder services fee computed at the annual rate of 0.25% of average daily net assets.

16

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

5. Security Transactions.

During the year ended December 31, 2018, the aggregate cost of purchases and proceeds from sales of investments, excluding the investments acquired in the merger, other than affiliated investments and short-term investments, totaled $36,880,545 and $34,937,669, respectively.

Information regarding the Fund’s investments in the Underlying Funds during the year ended December 31, 2018 is provided in the table below:

| Fund | Value as of December 31, 2017 | Cost of Purchases | Proceeds From Sales | Realized Gain (Loss) | Market Value Received with Merger | Change in Unrealized Appreciation (Depreciation) | Value as of December 31, 2018 | Income Distributions | Capital Gain Distributions | |||||||||||||||||||||||||||

| Wilshire Income Opportunities Fund - Institutional Class | $ | 100,323,497 | $ | 18,563,278 | $ | (19,399,490 | ) | $ | 414,692 | $ | 28,922,904 | $ | (5,109,284 | ) | $ | 123,715,597 | $ | 4,191,401 | $ | — | ||||||||||||||||

| Wilshire International Equity Fund - Institutional Class | 146,141,754 | 24,895,319 | (28,756,158 | ) | 3,653,353 | 39,982,168 | (28,029,375 | ) | 157,887,061 | 1,171,847 | 6,827,407 | |||||||||||||||||||||||||

| Wilshire Large Company Growth Portfolio - Institutional Class | 43,562,579 | 13,094,420 | (27,344,633 | ) | 1,295,260 | 21,834,999 | (7,421,908 | ) | 45,020,717 | 475,634 | 5,615,154 | |||||||||||||||||||||||||

| Wilshire Large Company Value Portfolio - Institutional Class | 44,381,480 | 16,675,403 | (15,118,277 | ) | (2,303,694 | ) | 27,714,839 | (9,557,927 | ) | 61,791,824 | 1,433,845 | 3,906,681 | ||||||||||||||||||||||||

| Wilshire Small Company Growth Portfolio - Institutional Class | 10,303,449 | 4,567,516 | (4,285,486 | ) | 244,568 | 5,646,695 | (2,487,792 | ) | 13,988,950 | 72,124 | 719,786 | |||||||||||||||||||||||||

| Wilshire Small Company Value Portfolio - Institutional Class | 10,381,600 | 3,395,425 | (2,892,125 | ) | (239,548 | ) | 6,125,182 | (2,664,471 | ) | 14,106,063 | 247,351 | 616,737 | ||||||||||||||||||||||||

| $ | 355,094,359 | $ | 81,191,361 | $ | (97,796,169 | ) | $ | 3,064,631 | $ | 130,226,787 | $ | (55,270,757 | ) | $ | 416,510,212 | $ | 7,592,202 | $ | 17,685,765 | |||||||||||||||||

The Fund currently seeks to achieve its investment objective by investing a portion of its assets in Wilshire International Equity Fund and Wilshire Income Opportunities Fund (the “Wilshire Funds”), both registered open-end management investment companies and Underlying Funds. The Fund may redeem its investments from the Wilshire Funds at any time if the Adviser determines that it is in the best interest of the Fund and its shareholders to do so. The performance of the Fund may be directly affected by the performance of the Wilshire Funds. As of December 31, 2018, the percentage of net assets invested in the Wilshire Funds was 57.5%. The latest shareholder report for the Wilshire Funds can be found at www.sec.gov.

6. Significant Shareholders.

On December 31, 2018, 99% of the outstanding shares of the Fund, representing 1 omnibus shareholder, were held in the separate account of Horace Mann Life Insurance Co. through which shares of the Fund are sold.

7. Tax Information.

No provision for federal income taxes is required because the Fund has qualified, and intends to continue to qualify, as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and distributes to shareholders all of its taxable net investment income and net realized capital gains. Federal income tax regulations differ from U.S. GAAP; therefore, distributions determined in accordance with tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character. Financial reporting records are not adjusted for temporary differences. The Fund is not aware of any tax positions for which it is reasonably likely that the total amounts of unrecognized tax benefits or expenses will materially change in the next twelve months. The Fund identifies its major tax jurisdiction as U.S. Federal.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing its tax returns to determine whether it is “more-likely than-not” (i.e., greater than 50%) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than-not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision

17

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities of returns filed within the past three years and on-going analysis of and changes to tax laws, regulations and interpretations thereof.

The federal tax cost and unrealized appreciation (depreciation) at December 31, 2018 for the Fund is as follows:

Tax cost of portfolio investments | $ | 525,944,235 | ||

Aggregate gross unrealized appreciation | $ | 964,214 | ||

Aggregate gross unrealized depreciation | (37,312,903 | ) | ||

Net unrealized depreciation | $ | (36,348,689 | ) |

The difference between the book and tax-basis cost of portfolio investments for the Fund is attributable primarily to the tax deferral of losses on wash sales.

The tax character of distributions paid to shareholders for the years ended December 31, 2018 and 2017 was as follows:

December 31, 2018 | December 31, 2017 | |||||||

Ordinary income | $ | 7,397,343 | $ | 12,484,912 | ||||

Long-term capital gains | 6,459,179 | 2,190,240 | ||||||

Total | $ | 13,856,522 | $ | 14,675,152 | ||||

For the year ended December 31, 2018, the following reclassification was made on the Statements of Assets and Liabilities for the Fund as a result of permanent differences in the recognition of capital gains or losses under income tax regulations and GAAP:

Paid-in-capital | $ | 46,481 | ||

Accumulated deficit | (46,481 | ) |

Such reclassification, the result of permanent differences between financial statement and income tax reporting requirements, has no effect on the Fund’s net assets or NAV per share.

At December 31, 2018, the components of accumulated deficit on a tax basis were as follows:

Undistributed ordinary income | $ | 7,165,394 | ||

Undistributed long-term gains | 21,480,434 | |||

Net unrealized depreciation on investments | (36,348,689 | ) | ||

Total accumulated deficit | $ | (7,702,861 | ) |

8. Indemnifications.

In the normal course of business, the Trust enters into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

9. Contingencies.

As a part of the merger of the Equity Fund and Socially Responsible Fund into the Fund on September 22, 2014, the Fund assumed all of the liabilities of the Equity Fund and Socially Responsible Fund, including, without limitation, contingencies relating to lawsuits. The Equity Fund and Socially Responsible Fund were named as defendants and putative members of a proposed defendant class of shareholders in lawsuits filed on December 7, 2010 in the U.S. Bankruptcy Court for the District of Delaware, and on March 6, 2012 in the District Court for the Southern District of New York, in connection with Tribune Company’s Chapter 11 bankruptcy proceeding. The 2010 lawsuit was brought by the Official Committee of

18

Wilshire Variable Insurance Trust

Notes to Financial Statements - (Continued)

December 31, 2018 |

|

Unsecured Creditors of the Tribune Company and the 2012 lawsuit was brought by Deutsche Bank, as trustee for senior noteholders of Tribune Company. Both lawsuits relate to a leveraged buyout transaction by which Tribune Company converted to a privately-held company in 2007 less than a year prior to Tribune Company’s bankruptcy filing. The putative defendant class is comprised of beneficial owners of shares of Tribune Company who meet certain jurisdictional requirements and received proceeds of the leveraged buyout. The plaintiffs seek to recover those proceeds, together with interest and attorneys’ fees and expenses, as fraudulent transfers under the Bankruptcy Act or various state laws. In 2013, the Complaint in the 2012 lawsuit was dismissed and the Second Circuit Court of Appeals recently affirmed the dismissal and the plaintiffs filed a petition for review by the Supreme Court. In April, 2018, the Supreme Court deferred consideration of the petition to allow the Second Circuit to consider whether it would be appropriate to vacate the judgment in light of a 2018 Supreme Court decision in another case. In May, 2018, the Second Circuit recalled its judgment mandate in anticipation of further panel review. The case remains pending before the Second Circuit. The District Court of New York has stayed the 2010 lawsuit pending a further decision by the Second Circuit in the 2012 lawsuit. The Adviser does not expect the Fund to be materially impacted by the lawsuits.

10. Subsequent Event Evaluation.

The Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based on this evaluation, no additional disclosures or adjustments were required to these financial statements.

19

Wilshire Variable Insurance Trust

Report Of Independent Registered Public Accounting Firm |

|

To the Shareholders of Wilshire Global Allocation Fund and

Board of Trustees of Wilshire Variable Insurance Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Wilshire Variable Insurance Trust comprising Wilshire Global Allocation Fund (the “Fund”) as of December 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets, and the financial highlights for each of the two years in the period then ended, including the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, the results of its operations for the year then ended, and the changes in its net assets and the financial highlights for each of the two years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

The Fund’s financial highlights for the years ended December 31, 2016, and prior, were audited by other auditors whose report dated February 28, 2017, expressed an unqualified opinion on those financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018, by correspondence with the custodian, transfer agent and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2017.

COHEN & COMPANY, LTD.

Cleveland, Ohio

February 28, 2019

20

Wilshire Variable Insurance Trust

Board Approval Of Advisory Agreements (Unaudited) |

|

Wilshire Variable Insurance Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end diversified management investment company, which was organized as a Delaware statutory trust under a Declaration of Trust dated November 7, 1996. The Declaration of Trust permits the Trust to offer separate series; the Trust presently consists of the following series:

● Wilshire 2015 Fund | ● Wilshire 2025 Fund |

● Wilshire 2035 Fund | ● Wilshire Global Allocation Fund |

(Wilshire 2015 Fund, Wilshire 2025 Fund and Wilshire 2035 Fund may be referred to herein collectively as the “Target Date Funds.” In addition, each of the Target Date Funds and Wilshire Global Allocation Fund (“Global Allocation Fund”) may be referred to herein as a “Fund” and collectively as the “Funds.”)

During the six months ended December 31, 2018, the Board of Trustees of the Trust (the “Board,” with the members of the Board referred to individually as the “Trustees”) approved the renewal for an additional one-year term of each of the investment advisory agreements between Wilshire Associates Incorporated (“Wilshire” or the “Adviser”), the investment adviser to each Fund, and the Trust, with respect to Global Allocation Fund and the Target Date Funds, respectively (each, an “Advisory Agreement” and collectively, the “Advisory Agreements”).

Each of the Advisory Agreements continues in effect from year to year provided that such continuance is specifically approved at least annually by (i) the Board or a majority of the outstanding voting securities (as defined in the 1940 Act) of each Fund, and, in either event, (ii) the vote of a majority of the Trustees who are not “interested persons,” as defined by the 1940 Act, of the Funds (the “Independent Trustees”) casting votes in person at a meeting called for such purpose.

The Board approved the renewal of each of the Advisory Agreements following an extensive process that concluded at the Board’s November 8-9, 2018 meeting (the “November Meeting”). As required by the 1940 Act, each approval was confirmed by the separate vote of the Independent Trustees, casting votes in person at a meeting called for such purpose. As part of their review process, the Independent Trustees were represented by independent legal counsel (“Independent Legal Counsel”), from whom the Independent Trustees received separate legal advice and with whom they met separately. Independent Legal Counsel reviewed and discussed with the Independent Trustees various key aspects of the Trustees’ legal responsibilities relating to the proposed renewal of the Advisory Agreements and advised them of the relevant legal standards.

In considering whether to approve the proposed renewal of the Target Date Funds’ Advisory Agreement, the Board took into account its August 28, 2018 approval of the mergers of each of the Target Date Funds into Global Allocation Fund, as well as its determination to recommend that shareholders of each Target Date Fund approve an Agreement and Plan of Reorganization (the “Plan”) providing for each merger at a special meeting of shareholders. In this connection, the Board—noting that the merger of one of the Target Date Funds into Global Allocation Fund is not contingent upon the approval of the Plan by the other Target Date Funds’ shareholders—considered the Adviser’s recommendation that the Board should renew the Advisory Agreement for the Target Date Funds in order to ensure the uninterrupted provision of advisory services to each Target Date Fund prior to the closing of the merger, if the Plan is approved by shareholders, or, if the Plan is not approved, for the duration of the renewal period.

Information Requested and Received

At the direction of the Independent Trustees, Independent Legal Counsel sent a memorandum to the Adviser requesting information regarding the Advisory Agreements to be provided to the Trustees in advance of the November Meeting.

In response to the request for information, the Trustees received information from the Adviser regarding the factors underlying its recommendation to approve each Advisory Agreement. In particular, the Trustees received information from the Adviser as to each Fund describing: (i) the nature, extent and quality of services provided; (ii) the financial condition of the Adviser and its ability to provide the contracted-for services under the applicable Advisory Agreement; (iii) the investment performance of the Fund as provided by the Adviser based upon data gathered from the Morningstar Direct database (“Morningstar”), along with a comparison to its benchmark index; (iv) the costs of services provided and estimated profits realized by the Adviser; (v) the extent to which economies of scale are realized as the Fund grows; (vi) whether

21

Wilshire Variable Insurance Trust

Board Approval Of Advisory Agreements (Unaudited) - (Continued) |

|

fee levels reflect any possible economies of scale for the benefit of Fund shareholders; (vii) comparisons of amounts paid by other registered investment companies as provided by Wilshire based upon data gathered from Morningstar; and (viii) fall-out benefits realized by the Adviser from its relationship with the Fund. The Independent Trustees also received a memorandum from Independent Legal Counsel describing their duties in connection with advisory contract proposals, and they were assisted in their review by Independent Legal Counsel.

Factors Considered

In connection with its deliberations regarding the proposed renewal of the Advisory Agreements, the Board considered such information and factors as it believed to be relevant in the exercise of its business judgement. As described below, the Board considered the nature, extent and quality of the services performed by the Adviser under the Advisory Agreements; comparative fees as provided by the Adviser; the profits realized by the Adviser; the extent to which the Adviser realizes economies of scale as a Fund grows; and whether any fall-out benefits are being realized by the Adviser. The Board also took into account the various materials received from the Adviser, its discussions with management and the guidance provided by Independent Legal Counsel in private sessions at which no representatives of the Adviser were present. In addition, as a part of its evaluation, the Board considered the assessment of performance made by the Investment Committee (which is comprised solely of Independent Trustees), which met on November 8, 2018 to review data on the Adviser’s performance. Recognizing that the evaluation process with respect to the services provided by the Adviser is an ongoing one, the Board also considered information reviewed by the Board during the year at other Board and Board committee meetings. The Board considered the foregoing information and all materials provided in the context of its accumulated experience governing the Funds and weighed the factors and standards discussed with Independent Legal Counsel.

In deciding to approve the renewal of each Advisory Agreement, the Board did not identify any single factor as all-important or controlling and each Trustee, in the exercise of his or her business judgment, may attribute different weights to the various factors. The Board based its decision on the totality of the circumstances and relevant factors. This summary discusses the material factors and the conclusions with respect thereto that formed the basis for the Board’s approval and does not describe all of the matters considered. However, the Board concluded that each of the various factors referred to below favored such approval.

Based upon its evaluation of all materials provided, and its determination that it had received sufficient information to make an informed business decision with respect to the Advisory Agreements, the Board concluded that it was in the best interests of each Fund to approve the renewal of its Advisory Agreement.

Nature, Extent and Quality of Services

With respect to the nature, extent and quality of services provided by the Adviser, the Board considered the functions currently performed by the Adviser, noting that the Adviser performs certain administrative functions on behalf of the Funds. The Board considered the experience and skills of the senior management leading Fund operations, the experience and skills of the key personnel performing the functions under the Advisory Agreements and the resources made available to such personnel. In evaluating the services provided by the Adviser, the Board also took into account that each Fund operates under a fund-of-funds structure that pursues its investment objectives by investing in underlying funds. Thus, the Board considered the capabilities and expertise of the Adviser’s personnel responsible for implementing each Fund’s asset allocation strategies and considered the information provided by the Adviser regarding its portfolio construction methodology, as well as the firm’s investment oversight and risk management processes.

The Board considered the compliance program established by the Adviser and the level of compliance maintained for the Funds. In addition, the Board considered the regular reports it receives from the Funds’ Chief Compliance Officer regarding compliance policies and procedures established pursuant to Rule 38a-1 under the 1940 Act. The Board also took into account information regarding the Adviser’s disaster recovery and contingency plans and data protection safeguards, among other things.

22

Wilshire Variable Insurance Trust

Board Approval Of Advisory Agreements (Unaudited) - (Continued) |

|

The Board considered the Adviser’s financial condition, and considered the financial support provided by the Adviser to the Funds pursuant to expense limitation agreements. In this connection, the Board reviewed, among other things, the Adviser’s audited consolidated financial statements as of December 31, 2017, as well as information regarding the firm’s business plans. The Board also noted the Adviser’s commitment to ensuring that sufficient resources will continue to be available in the future for servicing the Funds.