TABLE OF CONTENTS

CNI Charter Funds Semi-Annual Report

| | |

| | |

| 2 | Schedule of Investments |

| 56 | Statements of Assets and Liabilities |

| 60 | Statements of Operations |

| 64 | Statements of Changes in Net Assets |

| 70 | Financial Highlights |

| 74 | Notes to Financial Statements |

| 84 | Disclosure of Fund Expenses |

| 86 | Approval of Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Funds’ Form N-Q is available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q is also available on the Funds’ website at www.cnicharterfunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.cnicharterfunds.com, and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

CNI CHARTER FUNDS | PAGE 1

| schedule of investments |

March 31, 2011 (Unaudited) |

| Government Money Market Fund |

| | | | | | |

| U.S. Government Agency Obligations [77.2%] | | | | |

| FAMC | | | | | | |

| 5.500%, 07/15/11(A) | | $ | 15,000 | | | $ | 15,212 | |

| FAMC DN | | | | | | | | |

| 0.070%, 04/01/11(B) | | | 21,000 | | | | 21,000 | |

| 0.070%, 04/07/11(B) | | | 39,000 | | | | 38,999 | |

| FFCB | | | | | | | | |

| 0.181%, 04/14/11(C) | | | 50,000 | | | | 50,000 | |

| FFCB DN | | | | | | | | |

| 0.230%, 08/08/11(B) | | | 38,140 | | | | 38,108 | |

| 0.251%, 09/16/11(B) | | | 25,000 | | | | 24,971 | |

| FHLB | | | | | | | | |

| 0.210%, 04/01/11(C) | | | 30,000 | | | | 30,007 | |

| 0.210%, 04/01/11(C) | | | 25,000 | | | | 25,000 | |

| 0.110%, 04/01/11(C) | | | 65,000 | | | | 64,999 | |

| 0.205%, 04/15/11(C) | | | 50,000 | | | | 49,995 | |

| 0.218%, 04/26/11(C) | | | 50,000 | | | | 50,005 | |

| 0.184%, 04/27/11(C) | | | 40,000 | | | | 39,999 | |

| 0.153%, 04/28/11(C) | | | 25,000 | | | | 24,998 | |

| 0.200%, 08/03/11 | | | 25,000 | | | | 24,998 | |

| 0.230%, 10/21/11 | | | 47,000 | | | | 47,007 | |

| 0.350%, 11/07/11 | | | 50,000 | | | | 50,000 | |

| 0.300%, 11/08/11 | | | 50,000 | | | | 50,002 | |

| 0.260%, 11/23/11 | | | 50,000 | | | | 49,992 | |

| 0.750%, 12/21/11 | | | 30,000 | | | | 30,088 | |

| 0.470%, 03/16/12 | | | 25,000 | | | | 25,000 | |

| FHLB DN(B) | | | | | | | | |

| 0.056%, 04/01/11 | | | 444,843 | | | | 444,843 | |

| 0.040%, 04/04/11 | | | 75,000 | | | | 75,000 | |

| 0.127%, 04/06/11 | | | 77,000 | | | | 76,999 | |

| 0.020%, 04/07/11 | | | 100,000 | | | | 100,000 | |

| 0.020%, 04/21/11 | | | 75,000 | | | | 74,999 | |

| 0.100%, 04/25/11 | | | 31,000 | | | | 30,998 | |

| 0.170%, 05/06/11 | | | 50,000 | | | | 49,992 | |

| 0.170%, 05/13/11 | | | 25,697 | | | | 25,692 | |

| 0.250%, 07/15/11 | | | 50,000 | | | | 49,964 | |

| FHLMC DN(B) | | | | | | | | |

| 0.070%, 04/04/11 | | | 91,700 | | | | 91,700 | |

| 0.130%, 04/05/11 | | | 46,500 | | | | 46,499 | |

| 0.165%, 05/02/11 | | | 30,000 | | | | 29,996 | |

| 0.190%, 06/07/11 | | | 50,000 | | | | 49,982 | |

| 0.115%, 06/20/11 | | | 34,151 | | | | 34,142 | |

| 0.150%, 08/02/11 | | | 30,000 | | | | 29,985 | |

| 0.180%, 12/13/11 | | | 50,000 | | | | 49,936 | |

| FNMA | | | | | | | | |

| 5.125%, 04/15/11 | | $ | 25,000 | | | $ | 25,047 | |

| 0.875%, 01/12/12 | | | 25,000 | | | | 25,116 | |

| FNMA DN(B) | | | | | | | | |

| 0.230%, 04/26/11 | | | 25,000 | | | | 24,996 | |

| 0.210%, 05/16/11 | | | 50,000 | | | | 49,987 | |

| 0.220%, 07/18/11 | | | 50,000 | | | | 49,967 | |

| 0.160%, 09/01/11 | | | 50,000 | | | | 49,966 | |

| 0.190%, 12/01/11 | | | 50,000 | | | | 49,936 | |

Total U.S. Government Agency Obligations (Cost $2,286,122) | | | | | | | 2,286,122 | |

Other U.S. Government Related Securities [3.8%] | |

| Straight-A Funding | | | | | | | | |

| 0.250%, 04/11/11 | | | 12,626 | | | | 12,626 | |

| 0.250%, 04/18/11 | | | 30,000 | | | | 29,996 | |

| 0.240%, 06/14/11 | | | 50,093 | | | | 50,068 | |

| 0.200%, 04/01/11 | | | 18,795 | | | | 18,795 | |

Total Other U.S. Government Related Securities (Cost $111,485) | | | | 111,485 | |

Repurchase Agreements(D) [19.0%] | | | | | |

| Nomura | | | | | | | | |

| 0.120%, dated 03/31/11, repurchased on 04/01/11, repurchase price $275,000,917 (collateralized by various U.S. Government obligations, ranging in par value $1,000-$50,390,000, 0.000%-6.250%, 05/12/11-07/15/33; with total market value $280,503,955) | | | 275,000 | | | | 275,000 | |

| Bank of America | | | | | | | | |

| 0.090%, dated 03/31/11, repurchased on 04/01/11, repurchase price $175,000,438 (collateralized by various U.S. Government obligations, ranging in par value $6,189,000-$53,324,000, 0.000%-5.880%, 06/29/11-04/01/36; with total market value $178,500,936) | | | 175,000 | | | | 175,000 | |

| JPMorgan Chase | | | | | | | | |

| 0.080%, dated 03/31/11, repurchased on 04/01/11, repurchase price $50,000,111 (collateralized by a U.S. Treasury Note, par value $51,085,000, 0.375%, 08/31/12; with total market value $51,004,456) | | | 50,000 | | | | 50,000 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 2

| schedule of investments |

March 31, 2011 (Unaudited) |

Government Money Market Fund (concluded) |

| Barclays | | | | | | | | |

| 0.110%, dated 03/31/11, repurchased on 04/01/11, repurchase price $36,700,122 (collateralized by a U.S. Treasury Note, par value $37,700,112, 4.375%, 2/15/38; with total market value $37,434,002) | | $ | 36,700 | | | $ | 36,700 | |

| Deutsche Bank | | | | | | | | |

| 0.150%, dated 03/31/11, repurchased on 04/01/11, repurchase price $25,000,104 (collateralized by a FHLMC obligation, par value $24,943,000, 1.625%, 4/15/13; with a total market value $25,500,053) | | | 25,000 | | | | 25,000 | |

Total Repurchase Agreements (Cost $561,700) | | | | 561,700 | |

Total Investments [100.0%] (Cost $2,959,307) | | | $ | 2,959,307 | |

Percentages are based on Net Assets of $2,960,040 ($ Thousands).

| (A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2011, the value of these securities amounted to $15,212 (000), representing 0.5% of the net assets of the Fund. |

| (B) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

| (C) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

| (D) | Tri-Party Repurchase Agreement. |

DN — Discount Note

FAMC — Federal Agricultural Mortgage Corporation

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

As of March 31, 2011, all of the Fund’s investments are Level 2, in accordance with ASC 820.

For the period ended March 31, 2011, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 3

| schedule of investments |

March 31, 2011 (Unaudited) |

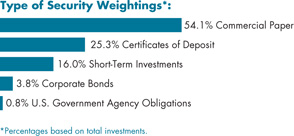

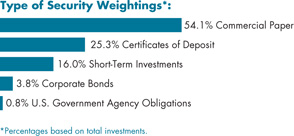

| Prime Money Market Fund |

| | | | | | |

| Commercial Paper [54.0%] | | | | | | |

| Banks [27.7%] | | | | | | |

| Abbey National North America | | | | | | |

| 0.330%, 05/09/11 | | $ | 14,000 | | | $ | 13,995 | |

| 0.280%, 04/01/11 | | | 25,000 | | | | 25,000 | |

| Banco Bilbao Vizcaya Argentaria (A) | | | | | | | | |

| 0.541%, 05/02/11 | | | 20,000 | | | | 19,991 | |

| 0.270%, 04/01/11 | | | 20,000 | | | | 20,000 | |

| Bank of America | | | | | | | | |

| 0.150%, 04/04/11 | | | 30,000 | | | | 30,000 | |

| Bank of Nova Scotia | | | | | | | | |

| 0.130%, 04/04/11 | | | 25,000 | | | | 25,000 | |

| Banque et Caisse d'Epargne de L'Etat | | | | | | | | |

| 0.300%, 05/04/11 | | | 20,000 | | | | 19,995 | |

| 0.250%, 06/30/11 | | | 20,000 | | | | 19,988 | |

| Bayerische Landesbank | | | | | | | | |

| 0.390%, 04/13/11 | | | 20,000 | | | | 19,997 | |

| Credit Agricole North America | | | | | | | | |

| 0.345%, 04/20/11 | | | 20,000 | | | | 19,996 | |

| Danske (A) | | | | | | | | |

| 0.320%, 05/03/11 | | | 25,000 | | | | 24,993 | |

| ING US Funding | | | | | | | | |

| 0.300%, 07/14/11 | | | 20,000 | | | | 19,983 | |

| Korea Development Bank | | | | | | | | |

| 0.501%, 05/09/11 | | | 20,000 | | | | 19,989 | |

| Landesbank Hessen-Thueringen (A) | | | | | | | | |

| 0.300%, 04/11/11 | | | 20,000 | | | | 19,998 | |

| Manhattan Asset Funding (A) | | | | | | | | |

| 0.280%, 04/01/11 | | | 25,000 | | | | 25,000 | |

| 0.270%, 04/06/11 | | | 16,000 | | | | 15,999 | |

| Societe Generale North America | | | | | | | | |

| 0.150%, 04/04/11 | | | 20,000 | | | | 20,000 | |

| | | | | | | 359,924 | |

| Financial Services [16.1%] | | | | | | |

| American Honda Finance | | | | | | |

| 0.220%, 04/04/11 | | $ | 25,000 | | | $ | 24,999 | |

| Arabella Finance (A) | | | | | | | | |

| 0.530%, 04/04/11 | | | 25,000 | | | | 24,999 | |

| General Electric Capital | | | | | | | | |

| 0.391%, 07/15/11 | | | 20,000 | | | | 19,977 | |

| Gotham Funding (A) | | | | | | | | |

| 0.260%, 04/27/11 | | | 30,749 | | | | 30,743 | |

| HSBC Finance | | | | | | | | |

| 0.351%, 07/25/11 | | | 20,000 | | | | 19,978 | |

| John Deere Credit (A) | | | | | | | | |

| 0.190%, 04/12/11 | | | 25,000 | | | | 24,999 | |

| MetLife Short Term Funding (A) | | | | | | | | |

| 0.280%, 04/11/11 | | | 24,000 | | | | 23,998 | |

| Natixis US Finance | | | | | | | | |

| 0.370%, 04/07/11 | | | 20,000 | | | | 19,999 | |

| Toyota Financial Services de Puerto Rico | | | | | | | | |

| 0.371%, 07/11/11 | | | 20,000 | | | | 19,979 | |

| | | | | | | 209,671 | |

| Investment Banker/Broker Dealer [2.7%] | | | | | |

| BNP Paribas Finance | | | | | | | | |

| 0.451%, 08/23/11 | | | 10,000 | | | | 9,982 | |

| 0.170%, 04/04/11 | | | 25,000 | | | | 24,999 | |

Total Investment Banker/Broker Dealer | | | | 34,981 | |

| Investment Companies [1.9%] | | | | | | | | |

| Royal Park Investments Funding (A) | | | | | | | | |

| | | 25,000 | | | | 24,999 | |

| Schools [1.2%] | | | | | | | | |

| University of California | | | | | | | | |

| | | 15,000 | | | | 15,000 | |

| Special Purpose Banks [4.4%] | | | | | | | | |

| Barton Capital (A) | | | | | | | | |

| 0.220%, 04/11/11 | | | 15,489 | | | | 15,488 | |

| 0.170%, 04/04/11 | | | 17,850 | | | | 17,850 | |

| Beethoven Funding (A) | | | | | | | | |

| 0.450%, 04/04/11 | | | 24,000 | | | | 23,999 | |

Total Special Purpose Banks | | | | | | | 57,337 | |

Total Commercial Paper (Cost $701,912) | | | | | | | 701,912 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 4

| schedule of investments |

March 31, 2011 (Unaudited) |

Prime Money Market Fund (continued) |

| Corporate Bonds [3.8%] | | | | | | | | |

| Banks [1.6%] | | | | | | | | |

| Westpac Banking, MTN | | | | | | | | |

| | $ | 20,500 | | | $ | 20,501 | |

| Financial Services [1.1%] | | | | | | | | |

| General Electric Capital | | | | | | | | |

| | | 13,845 | | | | 13,844 | |

| Security Brokers & Dealers [1.1%] | | | | | |

| Morgan Stanley, MTN | | | | | | | | |

| | | 15,000 | | | | 14,989 | |

Total Corporate Bonds (Cost $49,334) | | | | | | | 49,334 | |

| U.S. Government Agency Obligation [0.8%] | | | | | |

| FHLB | | | | | | | | |

| 0.184%, 10/27/11(B) | | | 10,000 | | | | 10,000 | |

Total U.S. Government Agency Obligation (Cost $10,000) | | | | | | | 10,000 | |

| Certificates of Deposit [25.4%] | | | | | | | | |

| Banco Del Estado De Chile | | | | | | | | |

| 0.260%, 04/05/11 | | | 25,000 | | | | 25,000 | |

| 0.460%, 04/18/11 | | | 20,000 | | | | 20,000 | |

| Bank of Montreal | | | | | | | | |

| 0.620%, 07/21/11 | | | 20,000 | | | | 20,015 | |

| Bank of Montreal Chicago | | | | | | | | |

| 0.338%, 10/31/11 | | | 25,000 | | | | 25,000 | |

| Barclays Bank | | | | | | | | |

| 0.690%, 05/10/11 | | | 25,000 | | | | 25,000 | |

| Bayerische Landesbank | | | | | | | | |

| 0.560%, 05/25/11 | | | 20,000 | | | | 20,000 | |

| Cooperatieve Centrale Raiffeisen-Boerenleenbank BA | | | | | | | | |

| 0.330%, 01/06/12 | | | 20,000 | | | | 20,000 | |

| Dexia Credit Local NY | | | | | | | | |

| 0.470%, 04/01/11 | | | 25,000 | | | | 25,000 | |

| 0.500%, 04/25/11 | | | 20,000 | | | | 20,000 | |

| Landesbank Hessen-Thueringen | | | | | | | | |

| 0.490%, 05/25/11 | | | 10,000 | | | | 10,000 | |

| Natixis NY | | | | | | | | |

| 0.570%, 08/11/11 | | | 10,200 | | | | 10,203 | |

| Norinchukin Bank | | | | | | | | |

| 0.280%, 04/05/11 | | | 20,000 | | | | 20,000 | |

| 0.330%, 05/09/11 | | | 20,000 | | | | 20,000 | |

| | | | | | |

| Skandinaviska Enskilda Banken NY | | | | | | |

| 0.390%, 04/07/11 | | $ | 20,000 | | | $ | 20,000 | |

| Societe Generale NY | | | | | | | | |

| 0.400%, 04/07/11 | | | 25,000 | | | | 25,000 | |

| UniCredit NY | | | | | | | | |

| 0.490%, 05/02/11 | | | 25,000 | | | | 25,000 | |

Total Certificates of Deposit (Cost $330,218) | | | | 330,218 | |

| Cash Equivalent [0.1%] | | | | | | | | |

| Goldman Sachs Financial Square Funds - Government Fund, 0.040%* | | | 1,262,078 | | | | 1,262 | |

Total Cash Equivalent (Cost $1,262) | | | | | | | 1,262 | |

| Repurchase Agreements(C) [15.9%] | | | | | | | | |

| Nomura | | | | | | | | |

| 0.120%, dated 03/31/11, repurchased on 04/01/11, repurchase price $75,000,250 (collateralized by a FHLB obligation and a FHLMC obligation, ranging in par value $21,540,000-$55,685,000, 1.000%-1.250% 02/25/13-12/12/24; with total market value $76,500,311) | | | 75,000 | | | | 75,000 | |

| Bank of America | | | | | | | | |

| 0.090%, dated 03/31/11, repurchased on 04/01/11, repurchase price $50,000,125 (collateralized by FHLB obligation, par value $51,020,000, 0.000%, 7/15/11; with total market value $51,000,612) | | | 50,000 | | | | 50,000 | |

| Deutsche Bank | | | | | | | | |

| 0.150%, dated 03/31/11, repurchased on 04/01/11, repurchase price $50,000,208 (collateralized by a FHLB obligation, par value $51,065,000, 1.000%, 03/21/13; with total market value $51,000,034) | | | 50,000 | | | | 50,000 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 5

| schedule of investments |

March 31, 2011 (Unaudited) |

Prime Money Market Fund (concluded) |

| | | | | | |

| Barclays | | | | | | |

| 0.110%, dated 03/31/11, repurchased on 04/01/11 repurchase price $39,900,094 (collateralized by U.S. Treasury Bond, par value $31,957,200, 4.375%, 02/15/38; with total market value $31,518,034) | | $ | 30,900 | | | $ | 30,900 | |

Total Repurchase Agreements (Cost $205,900) | | | | 205,900 | |

Total Investments [100.0%] (Cost $1,298,626) | | | $ | 1,298,626 | |

Percentages are based on Net Assets of $1,298,692 ($ Thousands).

| * | The rate reported is the 7-day effective yield as of March 31, 2011. |

| (A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2011, the value of these securities amounted to $333,557 (000), representing 25.7% of the net assets of the Fund. |

| (B) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

| (C) | Tri-Party Repurchase Agreement. |

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

MTN — Medium Term Note

The following is a summary of the inputs used as of March 31, 2011 in valuing the Fund’s investments carried at value ($ Thousands) in accordance with ASC 820:

| Investments in Securities | | | | | | | | | | | | |

| Commercial Paper | | $ | — | | | $ | 701,912 | | | $ | | | | $ | 701,912 | |

| Corporate Bonds | | | — | | | | 49,334 | | | | — | | | | 49,334 | |

| U.S. Government Agency Obligation | | | — | | | | 10,000 | | | | — | | | | 10,000 | |

| Certificates of Deposit | | | — | | | | 330,218 | | | | — | | | | 330,218 | |

| Cash Equivalent | | | 1,262 | | | | — | | | | — | | | | 1,262 | |

| Repurchase Agreements | | | — | | | | 205,900 | | | | — | | | | 205,900 | |

| Total Investments in Securities | | $ | 1,262 | | | $ | 1,297,364 | | | $ | — | | | $ | 1,298,626 | |

For the period ended March 31, 2011, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 6

| schedule of investments |

March 31, 2011 (Unaudited) |

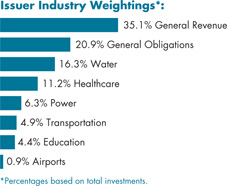

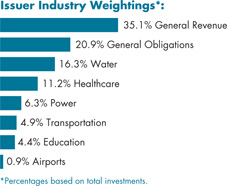

| California Tax Exempt Money Market Fund |

| | | | | | |

| Municipal Bonds [99.3%] | | | | | | |

| California [96.3%] | | | | | | |

| Bay Area Governments Association, SAB (A) | | | | | | |

| Pre-Refunded @ 102 | | | | | | |

| 6.200%, 09/02/11 | | $ | 1,950 | | | $ | 2,037 | |

| Bay Area Toll Authority, RB (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 4,000 | | | | 4,000 | |

| Bay Area Toll Authority, RB (B) (C) (D) | | | | | | | | |

| 0.150%, 04/07/11 | | | 7,000 | | | | 7,000 | |

| Bay Area Toll Authority, Ser C-1, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/07/11 | | | 10,000 | | | | 10,000 | |

| Bay Area Toll Authority, Ser C-1, RB (B) (C) (D) | | | | | | | | |

| 0.180%, 04/07/11 | | | 5,000 | | | | 5,000 | |

| Bay Area Toll Authority, Ser C-3, RB (B) (C) (D) | | | | | | | | |

| 0.160%, 04/07/11 | | | 1,000 | | | | 1,000 | |

| Bay Area Toll Authority, Ser C-4, RB (B) (C) (D) | | | | | | | | |

| 0.200%, 04/07/11 | | | 6,000 | | | | 6,000 | |

| Bay Area Toll Authority, Ser E-3, RB (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 5,000 | | | | 5,000 | |

| California Infrastructure & Economic Development Bank, RB (B) (D) | | | | | | | | |

| 0.180%, 04/01/11 | | | 6,740 | | | | 6,740 | |

| California State Department of Water Resources, Ser C-1, RB (B) (D) | | | | | | | | |

| 0.210%, 04/07/11 | | | 3,600 | | | | 3,600 | |

| California State, Department of Water Resource & Power, Ser C-9, RB (B) (D) | | | | | | | | |

| 0.220%, 04/07/11 | | | 6,000 | | | | 6,000 | |

| California State, Educational Facilities Authority, Stanford University Project, Ser L-4, RB (B) (D) | | | | | | | | |

| 0.170%, 04/06/11 | | $ | 515 | | | $ | 515 | |

| California State, Health Facilities Financing Authority, Luvile Salter Project, Ser B, RB (B) (D) | | | | | | | | |

| 0.210%, 04/07/11 | | | 11,700 | | | | 11,700 | |

| California State, Health Facilities Financing Authority, Ser B, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | | 22,250 | | | | 22,250 | |

| California State, Health Facilities Financing Authority, Ser C, RB (B) (C) (D) | | | | | | | | |

| 0.250%, 04/06/11 | | | 9,475 | | | | 9,475 | |

| California State, Health Facilities Financing Authority, Ser C, RB (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 18,400 | | | | 18,400 | |

| California State, Infrastructure & Economic Development Authority, J Paul Getty Trust Project, Ser B, RB (B) (D) | | | | | | | | |

| 0.150%, 04/01/11 | | | 11,915 | | | | 11,915 | |

| California State, Ser B, Sub-Ser B-3, GO (B) (C) (D) | | | | | | | | |

| 0.200%, 04/06/11 | | | 5,000 | | | | 5,000 | |

| California Statewide Communities Development Authority, Ser A, RB (B) (C) (D) | | | | | | | | |

| 0.160%, 04/01/11 | | | 12,525 | | | | 12,525 | |

| California Statewide Communities Development Authority, Ser B, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | | 12,800 | | | | 12,800 | |

| California Statewide, Communities Development Authority, Masters College Project, RB (B) (C) (D) | | | | | | | | |

| 0.230%, 04/07/11 | | | 3,000 | | | | 3,000 | |

| California Statewide, Communities Development Authority, Ser A, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | | 4,000 | | | | 4,000 | |

| East Bay Municipal Utility District, Ser A-2, RB (B) (D) | | | | | | | | |

| 0.180%, 04/06/11 | | | 15,000 | | | | 15,000 | |

| East Bay Municipal Utility District, Sub-Ser A-1, RB (B) (D) | | | | | | | | |

| 0.190%, 04/06/11 | | | 12,020 | | | | 12,020 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 7

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Money Market Fund (continued) |

| East Bay, Municipal Utilities District Water Authority, Sub-Ser B, RB, AGM (B) (D) | | | | | | | | |

| 0.300%, 04/06/11 | | $ | 10,000 | | | $ | 10,000 | |

| Eastern Municipal Water District, Ser B, COP (B) (D) | | | | | | | | |

| 0.200%, 04/06/11 | | | 10,600 | | | | 10,600 | |

| Elsinore Valley, Municipal Water District, Ser B, COP (B) (C) (D) | | | | | | | | |

| 0.230%, 04/07/11 | | | 15,000 | | | | 15,000 | |

| Glendale, Police Building Project, COP (B) (D) | | | | | | | | |

| 0.250%, 04/07/11 | | | 17,800 | | | | 17,800 | |

| Irvine Ranch, Water District #140-240-105-250, GO (B) (C) (D) | | | | | | | | |

| 0.170%, 04/01/11 | | | 5,800 | | | | 5,800 | |

| Irvine, Improvement Board, Act 1915 Project, District #05-21, Ser A, COP (B) (C) (D) | | | | | | | | |

| 0.240%, 04/01/11 | | | 10,000 | | | | 10,000 | |

| Irvine, Improvement Board, Act 1915 Project, District #93-14, SAB (B) (C) (D) | | | | | | | | |

| 0.200%, 04/01/11 | | | 2,300 | | | | 2,300 | |

| Irvine, Improvement Board, Act 1915 Project, District #97-16, COP (B) (C) (D) | | | | | | | | |

| 0.240%, 04/01/11 | | | 3,500 | | | | 3,500 | |

| Irvine, Improvement Board, Act 1915 Project, District #97-17, SAB (B) (C) (D) | | | | | | | | |

| 0.240%, 04/01/11 | | | 7,150 | | | | 7,150 | |

| Long Beach, TRAN | | | | | | | | |

| 2.000%, 09/30/11 | | | 2,000 | | | | 2,016 | |

| Los Angeles California, Sub-Ser B, RB (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 5,555 | | | | 5,555 | |

| Los Angeles Community College District, Ser A, GO, NATL-RE (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.500%, 08/01/11 | | | 2,500 | | | | 2,542 | |

| Los Angeles County, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 8,000 | | | | 8,022 | |

| Los Angeles County, Metropolitan Transportation Authority, RB (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 6,575 | | | | 6,575 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser A1, RB (B) (D) | | | | | | | | |

| 0.210%, 04/01/11 | | | 2,800 | | | | 2,800 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser A1, RB (B) (D) | | | | | | | | |

| 0.260%, 04/07/11 | | $ | 12,665 | | | $ | 12,665 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser A2, RB (B) (D) | | | | | | | | |

| 0.210%, 04/01/11 | | | 7,000 | | | | 7,000 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser A3, RB (B) (D) | | | | | | | | |

| 0.290%, 04/07/11 | | | 4,975 | | | | 4,975 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser C4, RB, FGIC (B) (C) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 2,000 | | | | 2,000 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-1, RB (B) (D) | | | | | | | | |

| 0.200%, 04/07/11 | | | 5,350 | | | | 5,350 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-2, RB (B) (D) | | | | | | | | |

| 0.200%, 04/01/11 | | | 15,700 | | | | 15,700 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-2, RB (B) (D) | | | | | | | | |

| 0.190%, 04/07/11 | | | 12,600 | | | | 12,600 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-3, RB (B) (D) | | | | | | | | |

| 0.230%, 04/01/11 | | | 5,900 | | | | 5,900 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-3, RB (B) (D) | | | | | | | | |

| 0.180%, 04/07/11 | | | 7,600 | | | | 7,600 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-4, RB (B) (D) | | | | | | | | |

| 0.240%, 04/07/11 | | | 6,400 | | | | 6,400 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-5, RB (B) (D) | | | | | | | | |

| 0.170%, 04/07/11 | | | 10,000 | | | | 10,000 | |

| Los Angeles, Unified School District, Administration Building III Project, Ser B, COP (B) (C) (D) | | | | | | | | |

| 0.240%, 04/06/11 | | | 10,060 | | | | 10,060 | |

| Los Angeles, Wastewater Systems Authority, Sub-Ser C, RB (B) (C) (D) | | | | | | | | |

| 0.180%, 04/07/11 | | | 11,195 | | | | 11,195 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 8

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Money Market Fund (continued) |

| Oakland-Alameda County, Coliseum Authority, Ser C-2, RB (B) (C) (D) | | | | | | | | |

| 0.210%, 04/06/11 | | $ | 3,500 | | | $ | 3,500 | |

| Oakland-Alameda County, Coliseum Project, Ser C-1, RB (B) (C) (D) | | | | | | | | |

| 0.230%, 04/06/11 | | | 14,400 | | | | 14,400 | |

| Orange County, Water District Authority, Ser A, COP (B) (D) | | | | | | | | |

| 0.200%, 04/06/11 | | | 10,850 | | | | 10,850 | |

| Pasadena, Public Financing Authority, Rose Bowl Refinancing & Improvement Project, RB (B) (C) (D) | | | | | | | | |

| 0.230%, 04/06/11 | | | 10,025 | | | | 10,025 | |

| Riverside County, Public Facilities Authority, Ser C, COP (B) (C) (D) | | | | | | | | |

| 0.240%, 04/06/11 | | | 9,600 | | | | 9,600 | |

| Sacramento County, Sanitation District Financing Authority, Sub-Ser D, RB (B) (C) (D) | | | | | | | | |

| 0.240%, 04/01/11 | | | 3,000 | | | | 3,000 | |

| Sacramento County, Sanitation District Financing Authority, Sub-Ser E, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | | 9,500 | | | | 9,500 | |

| Sacramento, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 3,500 | | | | 3,512 | |

| San Bernardino County, Ser A, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 5,000 | | | | 5,020 | |

| San Diego County, Regional Transportation Commission, Ser B, RB (B) (D) | | | | | | | | |

| 0.240%, 04/07/11 | | | 13,080 | | | | 13,080 | |

| San Diego County, Regional Transportation Commission, Ser C, RB (B) (D) | | | | | | | | |

| 0.300%, 04/07/11 | | | 6,890 | | | | 6,890 | |

| San Francisco City & County, Airports Commission, Ser 37C, RB, FSA (B) (D) | | | | | | | | |

| 0.320%, 04/06/11 | | | 7,000 | | | | 7,000 | |

| San Francisco, Unified School District, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 3,500 | | | | 3,513 | |

| Santa Barbara County, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 6,500 | | | | 6,526 | |

| Santa Clara County, Financing Authority, Multiple Facilities Projects, Ser M, RB (B) (C) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | | 10,105 | | | | 10,105 | |

| Santa Clara County, Financing Authority, VMC Facility Replacement Project, Ser B, RB (B) (D) | | | | | | | | |

| 0.220%, 04/06/11 | | $ | 13,475 | | | $ | 13,475 | |

| Santa Clara Valley, Transportation Authority, Ser C, RB (B) (D) | | | | | | | | |

| 0.250%, 04/07/11 | | | 12,000 | | | | 12,000 | |

| Santa Clara Valley, Transportation Authority, Ser D, RB (B) (D) | | | | | | | | |

| 0.250%, 04/07/11 | | | 17,300 | | | | 17,300 | |

| Santa Cruz County, TRAN | | | | | | | | |

| 2.000%, 06/30/11 | | | 8,400 | | | | 8,429 | |

| Southern California, Metropolitan Water District Authority, Ser C-1, RB (B) (D) | | | | | | | | |

| 0.120%, 04/01/11 | | | 19,200 | | | | 19,200 | |

| Southern California, Metropolitan Water District Authority, Water Works Authorization Project, Ser B, RB (B) (D) | | | | | | | | |

| 0.220%, 04/07/11 | | | 11,985 | | | | 11,985 | |

| State of California, GO (B) (C) (D) | | | | | | | | |

| 0.170%, 04/01/11 | | | 22,350 | | | | 22,350 | |

| State of California, GO (B) (C) (D) | | | | | | | | |

| 0.240%, 04/07/11 | | | 25,400 | | | | 25,400 | |

| State of California, GO (B) (C) (D) | | | | | | | | |

| 0.230%, 04/07/11 | | | 9,200 | | | | 9,200 | |

| State of California, Ser A-2, GO (B) (C) (D) | | | | | | | | |

| 0.200%, 04/01/11 | | | 4,275 | | | | 4,275 | |

| State of California, Ser B, GO (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 3.500%, 07/01/11 | | | 600 | | | | 605 | |

| State of California, Ser B-4, GO (B) (C) (D) | | | | | | | | |

| 0.240%, 04/06/11 | | | 15,000 | | | | 15,000 | |

| State of California, Ser C-11, GO (B) (C) (D) | | | | | | | | |

| 0.230%, 04/06/11 | | | 28,560 | | | | 28,560 | |

| State of California, Ser C-4, GO (B) (C) (D) | | | | | | | | |

| 0.170%, 04/01/11 | | | 3,000 | | | | 3,000 | |

| State of California, Sub-Ser A, GO (B) (C) (D) | | | | | | | | |

| 0.200%, 04/06/11 | | | 7,000 | | | | 7,000 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 9

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Money Market Fund (concluded) |

| State of California, Sub-Ser A, GO (B) (C) (D) | | | | | | | | |

| 0.200%, 04/06/11 | | $ | 5,000 | | | $ | 5,000 | |

| Turlock, Irrigation District, Capital Improvement & Refunding Project, COP (B) (C) (D) | | | | | | | | |

| 0.200%, 04/01/11 | | | 10,175 | | | | 10,175 | |

| Turlock, Irrigation District, RB | | | | | | | | |

| 0.750%, 08/12/11 | | | 6,000 | | | | 6,000 | |

| Tustin, Improvement Board Act, Reassessment District No. 95-2-A, Ser A, SAB (B) (C) (D) | | | | | | | | |

| 0.230%, 04/01/11 | | | 6,603 | | | | 6,603 | |

| | | | | | | 758,160 | |

| Texas [3.0%] | | | | | | | | |

| University of Texas, Ser B, RB (B) (D) | | | | | | | | |

| | | 23,430 | | | | 23,430 | |

Total Municipal Bonds (Cost $781,590) | | | | | | | 781,590 | |

Total Investments [99.3%] (Cost $781,590) | | | | | | $ | 781,590 | |

Percentages are based on Net Assets of $786,782 ($ Thousands).

| (A) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (B) | Put and Demand Feature — The date reported is the next reset or put date. |

| (C) | Securities are held in conjunction with a letter of credit from a major bank or financial institution. |

| (D) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

AGM — Assured Guarantee Municipal

COP — Certificate of Participation

FGIC — Financial Guaranty Insurance Company

FSA — Financial Security Assistance

GO — General Obligation

NATL-RE — National Public Finance Guarantee Corporation

RB — Revenue Bond

SAB — Special Assessment Board

Ser — Series

TRAN — Tax and Revenue Anticipation Note

As of March 31, 2011, all of the Fund’s investments are Level 2, in accordance with ASC 820.

For the period ended March 31, 2011, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 10

| schedule of investments |

March 31, 2011 (Unaudited) |

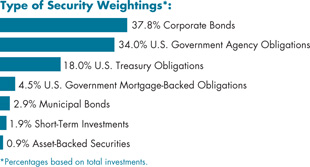

| Limited Maturity Fixed Income Fund |

| | | | | | |

| Corporate Bonds [37.6%] | | | | | | |

| Aerospace & Defense [1.6%] | | | | | | |

| Boeing | | | | | | |

| | $ | 625 | | | $ | 683 | |

| Banks [16.8%] | | | | | | | | |

| Ally Financial | | | | | | | | |

| 2.200%, 12/19/12 | | | 1,000 | | | | 1,025 | |

| ANZ National International | | | | | | | | |

| 6.200%, 07/19/13 | | | 625 | | | | 683 | |

| Bank of America | | | | | | | | |

| 4.875%, 01/15/13 | | | 150 | | | | 158 | |

| Bank of New York Mellon, MTN | | | | | | | | |

| 5.000%, 03/23/12 | | | 150 | | | | 156 | |

| Barclays Bank, MTN | | | | | | | | |

| 4.500%, 03/10/17(A) | | | 600 | | | | 580 | |

| Citibank | | | | | | | | |

| 1.500%, 07/12/11 | | | 300 | | | | 301 | |

| Citigroup | | | | | | | | |

| 6.375%, 08/12/14 | | | 600 | | | | 663 | |

| Credit Suisse NY, MTN | | | | | | | | |

| 5.000%, 05/15/13 | | | 600 | | | | 640 | |

| Goldman Sachs Group | | | | | | | | |

| 5.125%, 01/15/15 | | | 600 | | | | 641 | |

| JPMorgan Chase, MTN | | | | | | | | |

| 5.600%, 06/01/11 | | | 150 | | | | 151 | |

| 2.050%, 01/24/14 | | | 600 | | | | 599 | |

| Morgan Stanley | | | | | | | | |

| 5.375%, 10/15/15 | | | 600 | | | | 637 | |

| Wachovia, MTN | | | | | | | | |

| 5.500%, 05/01/13 | | | 600 | | | | 647 | |

| Wells Fargo | | | | | | | | |

| 5.300%, 08/26/11 | | | 150 | | | | 153 | |

| | | | | | | 7,034 | |

| Computer System Design & Services [3.0%] | | | | | |

| Hewlett-Packard | | | | | | | | |

| 6.125%, 03/01/14 | | | 600 | | | | 672 | |

| 4.250%, 02/24/12 | | | 150 | | | | 155 | |

| 2.950%, 08/15/12 | | | 120 | | | | 123 | |

| IBM | | | | | | | | |

| 4.750%, 11/29/12 | | $ | 165 | | | $ | 176 | |

| 2.100%, 05/06/13 | | | 140 | | | | 143 | |

Total Computer System Design & Services | | | | 1,269 | |

| Drugs [0.8%] | | | | | | | | |

| Abbott Laboratories | | | | | | | | |

| 5.600%, 05/15/11 | | | 145 | | | | 146 | |

| Pfizer | | | | | | | | |

| 4.450%, 03/15/12 | | | 170 | | | | 176 | |

| | | | | | | 322 | |

| Financial Services [6.8%] | | | | | | | | |

| Boeing Capital | | | | | | | | |

| 6.500%, 02/15/12 | | | 150 | | | | 158 | |

| Caterpillar Financial Services, MTN | | | | | | | | |

| 5.750%, 02/15/12 | | | 150 | | | | 157 | |

| CME Group | | | | | | | | |

| 5.400%, 08/01/13 | | | 625 | | | | 681 | |

| General Electric Capital, MTN | | | | | | | | |

| 2.000%, 09/28/12 | | | 1,000 | | | | 1,020 | |

| HSBC Finance | | | | | | | | |

| 5.500%, 01/19/16 | | | 600 | | | | 659 | |

| John Deere Capital, MTN | | | | | | | | |

| 5.250%, 10/01/12 | | | 150 | | | | 159 | |

| | | | | | | 2,834 | |

| Food, Beverage & Tobacco [0.6%] | | | | | |

| Coca-Cola Refreshments USA | | | | | | | | |

| 3.750%, 03/01/12 | | | 170 | | | | 175 | |

| PepsiCo | | | | | | | | |

| 5.150%, 05/15/12 | | | 60 | | | | 63 | |

Total Food, Beverage & Tobacco | | | | 238 | |

| Foreign Governments [1.8%] | | | | | | | | |

| Province of Ontario Canada | | | | | | | | |

| 4.100%, 06/16/14 | | | 600 | | | | 644 | |

| 1.875%, 11/19/12 | | | 125 | | | | 127 | |

Total Foreign Governments | | | | | | | 771 | |

| Investment Banker/Broker Dealer [4.6%] | | | | | |

| Citigroup Funding | | | | | | | | |

| 2.250%, 12/10/12 | | | 1,000 | | | | 1,025 | |

| Goldman Sachs Group | | | | | | | | |

| 6.600%, 01/15/12 | | | 115 | | | | 120 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 11

| schedule of investments |

March 31, 2011 (Unaudited) |

Limited Maturity Fixed Income Fund (continued) |

| Merrill Lynch, MTN | | | | | | | | |

| 5.000%, 01/15/15 | | $ | 600 | | | $ | 635 | |

| Morgan Stanley | | | | | | | | |

| 6.600%, 04/01/12 | | | 150 | | | | 159 | |

Total Investment Banker/Broker Dealer | | | | 1,939 | |

| Multi-Media [0.4%] | | | | | | | | |

| Walt Disney, MTN | | | | | | | | |

| | | 150 | | | | 152 | |

| Retail [0.4%] | | | | | | | | |

| Wal-Mart Stores | | | | | | | | |

| | | 170 | | | | 177 | |

| Telephones & Telecommunications [0.4%] | | | | | |

| AT&T | | | | | | | | |

| | | 150 | | | | 156 | |

| Transport-Rail [0.4%] | | | | | | | | |

| Canadian National Railway | | | | | | | | |

| | | 175 | | | | 181 | |

Total Corporate Bonds (Cost $15,510) | | | | | | | 15,756 | |

| U.S. Government Agency Obligations [33.8%] | |

| FHLB | | | | | | | | |

| 5.750%, 05/15/12 | | | 1,750 | | | | 1,854 | |

| FHLMC | | | | | | | | |

| 6.000%, 06/15/11 | | | 600 | | | | 607 | |

| 4.750%, 03/05/12 | | | 1,000 | | | | 1,041 | |

| 4.375%, 07/17/15 | | | 1,300 | | | | 1,422 | |

| 2.125%, 09/21/12 | | | 1,750 | | | | 1,789 | |

| 1.150%, 09/03/13 | | | 1,000 | | | | 995 | |

| FNMA | | | | | | | | |

| 6.125%, 03/15/12 | | | 600 | | | | 633 | |

| 5.375%, 11/15/11 | | | 1,000 | | | | 1,031 | |

| 5.250%, 08/01/12 | | | 1,000 | | | | 1,058 | |

| 5.000%, 03/15/16 | | | 600 | | | | 672 | |

| 5.000%, 02/13/17 | | | 1,000 | | | | 1,118 | |

| 3.000%, 07/28/14 | | | 925 | | | | 932 | |

| 1.750%, 02/22/13 | | | 1,000 | | | | 1,017 | |

Total U.S. Government Agency Obligations (Cost $14,179) | | | | | | | 14,169 | |

| U.S. Treasury Obligations [17.9%] | | | | | |

| U.S. Treasury Notes | | | | | | | | |

| 4.250%, 08/15/15 | | $ | 3,000 | | | $ | 3,293 | |

| 4.125%, 08/31/12 | | | 1,000 | | | | 1,051 | |

| 2.375%, 09/30/14 | | | 1,000 | | | | 1,029 | |

| 1.750%, 11/15/11 | | | 500 | | | | 505 | |

| 1.375%, 03/15/13 | | | 1,600 | | | | 1,618 | |

Total U.S. Treasury Obligations (Cost $7,393) | | | | 7,496 | |

| U.S. Government Mortgage-Backed Obligations [4.4%] | |

| FHLMC, Pool G12806 | | | | | | | | |

| 5.500%, 09/01/22 | | | 188 | | | | 203 | |

| FHLMC, Pool G18247 | | | | | | | | |

| 5.000%, 04/01/23 | | | 130 | | | | 138 | |

| FHLMC, Pool G18251 | | | | | | | | |

| 5.000%, 05/01/23 | | | 198 | | | | 210 | |

| FHLMC, Pool G18321 | | | | | | | | |

| 4.500%, 08/01/24 | | | 110 | | | | 116 | |

| FHLMC, Pool J04241 | | | | | | | | |

| 5.500%, 01/01/22 | | | 120 | | | | 130 | |

| FHLMC, Pool J04459 | | | | | | | | |

| 5.000%, 03/01/22 | | | 88 | | | | 94 | |

| FHLMC, Pool J04508 | | | | | | | | |

| 5.000%, 03/01/22 | | | 89 | | | | 96 | |

| FHLMC, Pool J07575 | | | | | | | | |

| 5.000%, 04/01/23 | | | 121 | | | | 129 | |

| FNMA, Pool 541946 | | | | | | | | |

| 7.500%, 07/01/30 | | | – | | | | 1 | |

| FNMA, Pool 837196 | | | | | | | | |

| 5.500%, 02/01/21 | | | 244 | | | | 264 | |

| FNMA, Pool 933915 | | | | | | | | |

| 4.500%, 06/01/23 | | | 236 | | | | 248 | |

| FNMA, Pool 961783 | | | | | | | | |

| 4.500%, 02/01/23 | | | 214 | | | | 225 | |

Total U.S. Government Mortgage-Backed Obligations (Cost $1,742) | | | | 1,854 | |

| Municipal Bonds [2.9%] | | | | | | | | |

| California [2.9%] | | | | | | | | |

| State of California, Ser A-2, RB | | | | | | | | |

| 3.000%, 06/28/11 | | | 600 | | | | 603 | |

| University of California, RB (A) | | | | | | | | |

| 1.988%, 05/15/50 | | | 600 | | | | 604 | |

| | | | | | | 1,207 | |

Total Municipal Bonds (Cost $1,202) | | | | | | | 1,207 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 12

| schedule of investments |

March 31, 2011 (Unaudited) |

Limited Maturity Fixed Income Fund (concluded) |

| | | | | | |

| Asset-Backed Securities [0.9%] | | | | | | |

| BMW Vehicle Lease Trust, Ser 2009-1, Cl A3 | | | | | | |

| 2.910%, 03/15/12 | | $ | 63 | | | $ | 63 | |

| Mercedes-Benz Auto Receivables Trust, Ser 2009-1, Cl A4 | | | | | | | | |

| 2.430%, 03/15/16 | | | 165 | | | | 169 | |

| USAA Auto Owner Trust, Ser 2009-2, Cl A4 | | | | | | | | |

| 2.530%, 07/15/15 | | | 135 | | | | 139 | |

Total Asset-Backed Securities (Cost $363) | | | | 371 | |

| Cash Equivalent [1.9%] | | | | | | | | |

| AIM STIT-Treasury Portfolio, 0.020%* | | | 794,779 | | | | 795 | |

Total Cash Equivalent (Cost $795) | | | | | | | 795 | |

Total Investments [99.4%] (Cost $41,184) | | | | | | $ | 41,648 | |

Percentages are based on Net Assets of $41,894 ($ Thousands).

| * | The rate reported is the 7-day current yield as of March 31, 2011. |

| (A) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

Cl — Class

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

MTN — Medium Term Note

RB — Revenue Bond

Ser — Series

Amounts designated as “—” are either $0 or have been rounded to $0.

The following is a summary of the inputs used as of March 31, 2011 in valuing the Fund’s investments carried at value ($ Thousands):

| Investments in Securities | | | | | | | | | | | | |

| Corporate Bonds | | $ | — | | | $ | 15,756 | | | $ | — | | | $ | 15,756 | |

| U.S. Government Agency Obligations | | | — | | | | 14,169 | | | | — | | | | 14,169 | |

| U.S. Treasury Obligations | | | — | | | | 7,496 | | | | — | | | | 7,496 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 1,854 | | | | — | | | | 1,854 | |

| Municipal Bonds | | | — | | | | 1,207 | | | | — | | | | 1,207 | |

| Asset-Backed Securities | | | — | | | | 371 | | | | — | | | | 371 | |

| Cash Equivalent | | | 795 | | | | — | | | | — | | | | 795 | |

| Total Investments in Securities | | $ | 795 | | | $ | 40,853 | | | $ | — | | | $ | 41,648 | |

For the period ended March 31, 2011, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 13

| schedule of investments |

March 31, 2011 (Unaudited) |

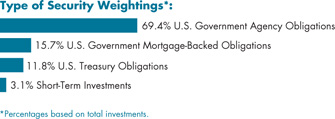

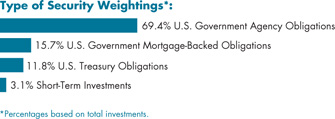

| Government Bond Fund |

| | | | | | |

| U.S. Government Agency Obligations [69.1%] | | | | |

| FAMC | | | | | | |

| 3.250%, 06/25/14 | | $ | 7,000 | | | $ | 7,368 | |

| FFCB | | | | | | | | |

| 3.600%, 03/22/17 | | | 5,000 | | | | 5,011 | |

| FHLB | | | | | | | | |

| 5.250%, 06/18/14 | | | 4,000 | | | | 4,462 | |

| 4.805%, 08/20/15 | | | 6,855 | | | | 7,327 | |

| 4.125%, 03/13/20 | | | 5,000 | | | | 5,160 | |

| 3.500%, 12/09/16 | | | 5,000 | | | | 5,162 | |

| 3.250%, 09/12/14 | | | 7,000 | | | | 7,362 | |

| 3.125%, 03/11/16 | | | 4,000 | | | | 4,137 | |

| 1.375%, 09/12/14 | | | 4,000 | | | | 3,960 | |

| 0.875%, 12/27/13 | | | 6,000 | | | | 5,926 | |

| FHLMC, MTN | | | | | | | | |

| 5.125%, 11/17/17 | | | 5,000 | | | | 5,632 | |

| 4.375%, 07/17/15 | | | 5,000 | | | | 5,468 | |

| 1.500%, 09/23/11(A) | | | 7,000 | | | | 6,960 | |

| FICO STRIP (B) | | | | | | | | |

| 3.942%, 11/02/18 | | | 8,000 | | | | 6,142 | |

| FNMA | | | | | | | | |

| 4.625%, 05/01/13 | | | 3,000 | | | | 3,196 | |

| 3.100%, 03/22/16 | | | 5,000 | | | | 5,084 | |

| 3.000%, 07/28/14 | | | 9,180 | | | | 9,248 | |

| 1.625%, 10/26/15 | | | 4,000 | | | | 3,892 | |

| 1.250%, 09/30/11(A) | | | 7,000 | | | | 6,919 | |

| Israel Government AID Bond (B) | | | | | | | | |

| 3.888%, 05/15/20 | | | 15,528 | | | | 10,872 | |

Total U.S. Government Agency Obligations (Cost $119,069) | | | | 119,288 | |

| U.S. Government Mortgage-Backed Obligations [15.6%] | |

| FHLMC REMIC, Ser 2005-R003, Cl AG | | | | | | | | |

| 5.125%, 10/15/15 | | | 385 | | | | 388 | |

| FHLMC REMIC, Ser 2006-R005, Cl AB | | | | | | | | |

| 5.500%, 12/15/18 | | | 2,321 | | | | 2,407 | |

| FHLMC REMIC, Ser 2006-R007, Cl AC | | | | | | | | |

| 5.875%, 05/15/16 | | | 78 | | | | 78 | |

| | | | | | |

| FHLMC REMIC, Ser 2007-R010, Cl AB | | | | | | |

| 5.500%, 12/15/19 | | $ | 3,839 | | | $ | 4,024 | |

| FHLMC REMIC, Ser 2007-R011, Cl AB | | | | | | | | |

| 5.500%, 12/15/20 | | | 5,974 | | | | 6,284 | |

| FHLMC REMIC, Ser 2007-R012, Cl AB | | | | | | | | |

| 5.500%, 12/15/20 | | | 2,298 | | | | 2,394 | |

| FHLMC REMIC, Ser 2007-R013, Cl AB | | | | | | | | |

| 6.000%, 12/15/21 | | | 303 | | | | 315 | |

| FHLMC REMIC, Ser 2008-R015, Cl AN, | | | | | | | | |

| 3.750%, 02/15/13 | | | 334 | | | | 334 | |

| FNMA ARM (C) | | | | | | | | |

| 4.202%, 03/01/34 | | | 325 | | | | 341 | |

| FNMA REMIC, Ser 2005-25, Cl VH, | | | | | | | | |

| 5.000%, 04/25/16 | | | 3,464 | | | | 3,664 | |

| FNMA REMIC, Ser 2006-R009, Cl AJ | | | | | | | | |

| 5.750%, 12/15/18 | | | 5,844 | | | | 6,095 | |

| GNMA | | | | | | | | |

| 8.000%, 08/15/22 | | | 10 | | | | 12 | |

| 7.500%, 06/15/24 | | | 3 | | | | 4 | |

| 7.500%, 05/15/26 | | | 3 | | | | 4 | |

| 6.000%, 01/15/29 | | | 12 | | | | 13 | |

| 7.000%, 12/15/16 | | | 9 | | | | 10 | |

| 7.500%, 04/15/32 | | | 30 | | | | 35 | |

| GNMA ARM (C) | | | | | | | | |

| 1.875%, 04/20/35 | | | 452 | | | | 466 | |

| 2.000%, 08/20/35 | | | 92 | | | | 95 | |

Total U.S. Government Mortgage-Backed Obligations (Cost $26,780) | | | | 26,963 | |

| U.S. Treasury Obligations [11.7%] | | | | | | | | |

| U.S. Treasury Note | | | | | | | | |

| 2.750%, 12/31/17 | | | 5,000 | | | | 4,977 | |

| 2.625%, 11/15/20 | | | 8,000 | | | | 7,465 | |

| 1.375%, 11/30/15 | | | 8,000 | | | | 7,747 | |

Total U.S. Treasury Obligations (Cost $20,461) | | | | 20,189 | |

| Cash Equivalent [1.3%] | | | | | | | | |

| Goldman Sachs Financial Square Funds - Government Fund, 0.040%* | | | 2,302,014 | | | | 2,302 | |

Total Cash Equivalent (Cost $2,302) | | | | | | | 2,302 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 14

| schedule of investments |

March 31, 2011 (Unaudited) |

Government Bond Fund (concluded) |

| | | | | | |

| Repurchase Agreement(D) [1.8%] | | | | | | |

| Barclays | | | | | | |

| 0.110%, dated 03/31/11, repurchased on 04/01/2011, repurchase price $3,100,009 (collateralized by a U.S. Treasury obligation, par value $3,158,848, 0.625%, 01/31/13; with total market value $3,162,072) | | $ | 3,100 | | | $ | 3,100 | |

Total Repurchase Agreement (Cost $3,100) | | | | 3,100 | |

Total Investments [99.5%] (Cost $171,712) | | | | | | $ | 171,842 | |

Percentages are based on Net Assets of $172,638 ($ Thousands).

| * | The rate reported is the 7-day effective yield as of March 31, 2011. |

| (A) | Step Bond — The rate reported is the rate in effect on March 31, 2011. The coupon on a step bond changes on a specific date. |

| (B) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

| (C) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

| (D) | Tri-Party Repurchase Agreement. |

AID — Agency for International Development

ARM — Adjustable Rate Mortgage

Cl — Class

FAMC — Federal Agriculture Mortgage Corporation

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FICO — Financing Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

MTN — Medium Term Note

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

STRIP — Separate trading of registered interest and principal of securities.

The following is a summary of the inputs used as of March 31, 2011 in valuing the Fund’s investments carried at value ($ Thousands) in accordance with ASC 820:

| Investments in Securities | | | | | | | | | | | | |

| U.S. Government Agency Obligations | | $ | — | | | $ | 119,288 | | | $ | — | | | $ | 119,288 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 26,963 | | | | — | | | | 26,963 | |

| U.S. Treasury Obligations | | | — | | | | 20,189 | | | | — | | | | 20,189 | |

| Cash Equivalent | | | 2,302 | | | | — | | | | — | | | | 2,302 | |

| Repurchase Agreement | | | — | | | | 3,100 | | | | — | | | | 3,100 | |

| Total Investments in Securities | | $ | 2,302 | | | $ | 169,540 | | | $ | — | | | $ | 171,842 | |

For the period ended March 31, 2010, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 15

| schedule of investments |

March 31, 2011 (Unaudited) |

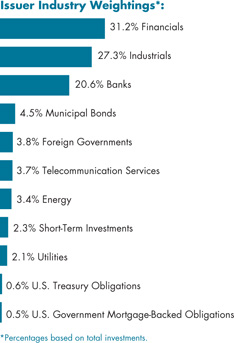

| Corporate Bond Fund |

| | | | | | |

| Corporate Bonds [91.7%] | | | | | | |

| Applications Software [1.7%] | | | | | | |

| Microsoft | | | | | | |

| | $ | 2,000 | | | $ | 2,077 | |

| Autoparts [0.9%] | | | | | | | | |

| Johnson Controls | | | | | | | | |

| | | 1,000 | | | | 1,050 | |

| Banks [18.3%] | | | | | | | | |

| ANZ National Int'l | | | | | | | | |

| 3.250%, 04/02/12(A) | | | 2,000 | | | | 2,051 | |

| Bank of America, FDIC Insured, MTN | | | | | | | | |

| 3.125%, 06/15/12 | | | 1,500 | | | | 1,547 | |

| Bank of Scotland | | | | | | | | |

| 5.000%, 11/21/11(A) | | | 1,000 | | | | 1,023 | |

| Barclays Bank | | | | | | | | |

| 6.050%, 12/04/17(A) | | | 1,000 | | | | 1,042 | |

| Barclays Bank, MTN | | | | | | | | |

| 4.500%, 03/10/17(B) | | | 1,950 | | | | 1,884 | |

| Citigroup Funding, FDIC Insured | | | | | | | | |

| 2.250%, 12/10/12 | | | 2,500 | | | | 2,563 | |

| Deutsche Bank | | | | | | | | |

| 7.250%, 10/15/11 | | | 500 | | | | 517 | |

| Deutsche Bank, MTN | | | | | | | | |

| 3.875%, 08/18/14 | | | 853 | | | | 890 | |

| JPMorgan Chase | | | | | | | | |

| 6.000%, 10/01/17 | | $ | 1,890 | | | $ | 2,067 | |

| JPMorgan Chase, FDIC Insured | | | | | | | | |

| 2.125%, 12/26/12 | | | 2,500 | | | | 2,561 | |

| US Bank, MTN | | | | | | | | |

| 6.375%, 08/01/11 | | | 1,485 | | | | 1,514 | |

| Wachovia Bank | | | | | | | | |

| 4.800%, 11/01/14 | | | 3,240 | | | | 3,450 | |

| Wells Fargo, FDIC Insured | | | | | | | | |

| 3.000%, 12/09/11 | | | 700 | | | | 713 | |

| | | | | | | 21,822 | |

| Chemicals [0.9%] | | | | | | | | |

| Dow Chemical | | | | | | | | |

| | | 1,135 | | | | 1,084 | |

| Communication & Media [3.2%] | | | | | |

| CBS | | | | | | | | |

| 8.875%, 05/15/19 | | | 1,000 | | | | 1,256 | |

| Comcast Cable Communications Holdings | | | | | | | | |

| 8.375%, 03/15/13 | | | 160 | | | | 180 | |

| Time Warner Entertainment | | | | | | | | |

| 8.375%, 03/15/23 | | | 775 | | | | 956 | |

| Walt Disney, MTN | | | | | | | | |

| 5.700%, 07/15/11 | | | 1,395 | | | | 1,417 | |

Total Communication & Media | | | | 3,809 | |

| Computer System Design & Services [6.7%] | | | | | |

| Cisco Systems | | | | | | | | |

| 5.500%, 02/22/16 | | | 1,250 | | | | 1,403 | |

| Dell | | | | | | | | |

| 5.875%, 06/15/19 | | | 1,865 | | | | 2,046 | |

| 5.625%, 04/15/14 | | | 1,000 | | | | 1,103 | |

| Hewlett-Packard | | | | | | | | |

| 6.125%, 03/01/14 | | | 1,470 | | | | 1,647 | |

| International Business Machines | | | | | | | | |

| 7.625%, 10/15/18 | | | 1,450 | | | | 1,815 | |

Total Computer System Design & Services | | | | 8,014 | |

| Diversified Operations [0.5%] | | | | | | | | |

| 3M, MTN | | | | | | | | |

| | | 500 | | | | 540 | |

| Electrical Services [2.1%] | | | | | | | | |

| Alabama Power | | | | | | | | |

| 4.850%, 12/15/12 | | | 1,380 | | | | 1,467 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 16

| schedule of investments |

March 31, 2011 (Unaudited) |

Corporate Bond Fund (continued) |

| American Electric Power | | | | | | | | |

| 5.250%, 06/01/15 | | $ | 986 | | | $ | 1,069 | |

Total Electrical Services | | | | | | | 2,536 | |

| Finance Auto Loans [0.8%] | | | | | |

| Harley-Davidson Financial Services, MTN | | | | | | | | |

| | | 1,000 | | | | 995 | |

| Financial Services [15.5%] | | | | | | | | |

| Ally Financial, FDIC Insured | | | | | | | | |

| 2.200%, 12/19/12 | | | 4,500 | | | | 4,610 | |

| Boeing Capital | | | | | | | | |

| 6.500%, 02/15/12 | | | 930 | | | | 977 | |

| Caisse Centrale Desjardins du Quebec | | | | | | | | |

| 2.650%, 09/16/15(A) | | | 3,000 | | | | 2,928 | |

| CME Group | | | | | | | | |

| 5.400%, 08/01/13 | | | 95 | | | | 103 | |

| Duke Capital | | | | | | | | |

| 5.500%, 03/01/14 | | | 615 | | | | 668 | |

| General Electric Capital, Ser A, MTN | | | | | | | | |

| 6.000%, 06/15/12 | | | 2,100 | | | | 2,224 | |

| General Electric Capital, FDIC Insured, MTN | | | | | | | | |

| 2.625%, 12/28/12 | | | 2,770 | | | | 2,859 | |

| HSBC Finance | | | | | | | | |

| 5.250%, 04/15/15 | | | 1,250 | | | | 1,346 | |

| Irish Life & Permanent Group Holdings | | | | | | | | |

| 3.600%, 01/14/13(A) | | | 2,000 | | | | 1,750 | |

| National Rural Utilities, Ser C, MTN | | | | | | | | |

| 7.250%, 03/01/12 | | | 1,000 | | | | 1,060 | |

| | | | | | | 18,525 | |

| Food, Beverage & Tobacco [3.6%] | | | | | |

| Anheuser-Busch | | | | | | | | |

| 7.500%, 03/15/12 | | | 665 | | | | 705 | |

| Bottling Group | | | | | | | | |

| 5.500%, 04/01/16 | | | 1,000 | | | | 1,127 | |

| 4.625%, 11/15/12 | | | 1,435 | | | | 1,520 | |

| Dr Pepper Snapple Group | | | | | | | | |

| 2.900%, 01/15/16 | | | 1,000 | | | | 991 | |

Total Food, Beverage & Tobacco | | | | 4,343 | |

| Foreign Governments [3.8%] | | | | | | | | |

| Kingdom of Denmark | | | | | | | | |

| 2.750%, 11/15/11 | | $ | 3,000 | | | $ | 3,041 | |

| Korea National Oil | | | | | | | | |

| 2.875%, 11/09/15 (A) | | | 1,000 | | | | 968 | |

| United Mexican States, MTN | | | | | | | | |

| 5.875%, 01/15/14 | | | 450 | | | | 495 | |

Total Foreign Governments | | | | | | | 4,504 | |

| Internet Security [0.8%] | | | | | | | | |

| Symantec | | | | | | | | |

| | | 1,000 | | | | 973 | |

| Investment Banker/Broker Dealer [12.4%] | | | | | |

| Citigroup | | | | | | | | |

| 5.850%, 08/02/16 | | | 980 | | | | 1,062 | |

| 5.500%, 02/15/17 | | | 250 | | | | 260 | |

| Credit Suisse | | | | | | | | |

| 5.500%, 08/15/13 | | | 1,250 | | | | 1,354 | |

| Goldman Sachs Group | | | | | | | | |

| 5.625%, 01/15/17 | | | 1,700 | | | | 1,791 | |

| Jefferies Group | | | | | | | | |

| 8.500%, 07/15/19 | | | 870 | | | | 1,026 | |

| Macquarie Group | | | | | | | | |

| 6.000%, 01/14/20(A) | | | 2,000 | | | | 2,013 | |

| Merrill Lynch | | | | | | | | |

| 6.050%, 05/16/16 | | | 2,025 | | | | 2,140 | |

| Morgan Stanley, MTN | | | | | | | | |

| 5.500%, 01/26/20 | | | 1,990 | | | | 1,999 | |

| Nomura Holdings, MTN | | | | | | | | |

| 4.125%, 01/19/16 | | | 1,200 | | | | 1,187 | |

| Societe Generale | | | | | | | | |

| 2.200%, 09/14/13(A) | | | 2,000 | | | | 1,998 | |

Total Investment Banker/Broker Dealer | | | | 14,830 | |

| Metals & Mining [0.9%] | | | | | | | | |

| Alcoa | | | | | | | | |

| | | 1,000 | | | | 1,057 | |

| Multi-line Insurance [1.5%] | | | | | | | | |

| MetLife | | | | | | | | |

| | | 1,430 | | | | 1,738 | |

| Petroleum & Fuel Products [5.0%] | | | | | |

| ConocoPhillips Canada Funding I | | | | | | | | |

| 5.625%, 10/15/16 | | | 2,000 | | | | 2,259 | |

| Kinder Morgan Energy Partners | | | | | | | | |

| 5.800%, 03/01/21 | | | 1,000 | | | | 1,074 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 17

| schedule of investments |

March 31, 2011 (Unaudited) |

Corporate Bond Fund (continued) |

| Shell International Finance | | | | | | | | |

| 3.250%, 09/22/15 | | $ | 1,500 | | | $ | 1,549 | |

| Transocean | | | | | | | | |

| 6.000%, 03/15/18 | | | 1,000 | | | | 1,079 | |

Total Petroleum & Fuel Products | | | | 5,961 | |

| Real Estate Investment Trusts [2.8%] | | | | | |

| HCP | | | | | | | | |

| 5.650%, 12/15/13 | | | 500 | | | | 542 | |

| 5.625%, 05/01/17 | | | 500 | | | | 529 | |

| Health Care REIT | | | | | | | | |

| 4.700%, 09/15/17 | | | 1,000 | | | | 1,003 | |

| Kimco Realty | | | | | | | | |

| 6.875%, 10/01/19 | | | 1,080 | | | | 1,260 | |

Total Real Estate Investment Trusts | | | | 3,334 | |

| Retail [4.0%] | | | | | | | | |

| CVS Caremark | | | | | | | | |

| 6.125%, 08/15/16 | | | 1,000 | | | | 1,126 | |

| Home Depot | | | | | | | | |

| 5.250%, 12/16/13 | | | 1,000 | | | | 1,091 | |

| Kroger | | | | | | | | |

| 5.500%, 02/01/13 | | | 450 | | | | 482 | |

| Target | | | | | | | | |

| 6.000%, 01/15/18 | | | 1,770 | | | | 2,026 | |

| | | | | | | 4,725 | |

| Special Purpose Banks [1.7%] | | | | | | | | |

| Dexia Credit Local | | | | | | | | |

| | | 2,000 | | | | 1,995 | |

| Telephones & Telecommunications [4.6%] | | | | | |

| Deutsche Telekom International Finance | | | | | | | | |

| 5.250%, 07/22/13 | | | 475 | | | | 514 | |

| Motorola Solutions | | | | | | | | |

| 6.000%, 11/15/17 | | | 1,000 | | | | 1,094 | |

| New Cingular Wireless Services | | | | | | | | |

| 8.125%, 05/01/12 | | | 345 | | | | 371 | |

| Telefonica Emisiones | | | | | | | | |

| 6.421%, 06/20/16 | | | 1,000 | | | | 1,111 | |

| Verizon Communications | | | | | | | | |

| 5.550%, 02/15/16 | | | 2,195 | | | | 2,438 | |

Total Telephones & Telecommunications | | | | 5,528 | |

Total Corporate Bonds (Cost $106,293) | | | | | | | 109,440 | |

| Municipal Bonds [4.5%] | | | | | | | | |

| California [3.6%] | | | | | | | | |

| California State, City of Industry, Sales Tax Project, RB, NATL-RE | | | | | | | | |

| 5.000%, 01/01/12 | | $ | 955 | | | $ | 966 | |

| Irvine Ranch, Water District Authority, RB (C) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 8.180%, 03/15/11 | | | 1,200 | | | | 1,242 | |

| Los Angeles County, Metropolitan Transportation Authority, RB | | | | | | | | |

| 4.280%, 06/01/21 | | | 2,000 | | | | 1,934 | |

| State of California, GO | | | | | | | | |

| 5.700%, 11/01/21 | | | 185 | | | | 188 | |

| | | | | | | 4,330 | |

| Wisconsin [0.9%] | | | | | | | | |

| De Pere, Unified School District, GO, FGIC (C) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| | | 995 | | | | 1,015 | |

Total Municipal Bonds (Cost $5,414) | | | | | | | 5,345 | |

| U.S. Government Mortgage-Backed Obligations [0.5%] | |

| FHLMC REMIC, Ser 2008-R015, Cl AN | | | | | | | | |

| 3.750%, 02/15/13 | | | 19 | | | | 19 | |

| FHLMC REMIC, Ser 2982, Cl NB | | | | | | | | |

| 5.500%, 02/15/29 | | | 134 | | | | 136 | |

| FNMA REMIC, Ser 2002-56, Cl MC | | | | | | | | |

| 5.500%, 09/25/17 | | | 381 | | | | 409 | |

| FNMA REMIC, Ser 2006-B1, Cl AB | | | | | | | | |

| 6.000%, 06/25/16 | | | 41 | | | | 41 | |

Total U.S. Government Mortgage-Backed Obligations (Cost $577) | | | | 605 | |

| U.S. Treasury Obligation [0.5%] | | | | | | | | |

| U.S. Treasury Inflation Protection Security | | | | | | | | |

| 2.000%, 01/15/14 | | | 596 | | | | 649 | |

Total U.S. Treasury Obligation (Cost $603) | | | | 649 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 18

| schedule of investments |

March 31, 2011 (Unaudited) |

Corporate Bond Fund (concluded) |

| | | | | | |

| Cash Equivalent [0.6%] | | | | | | |

| Goldman Sachs Financial Square Funds - Government Fund, 0.040%* | | | 758,346 | | | $ | 758 | |

Total Cash Equivalent (Cost $758) | | | | | | | 758 | |

| Repurchase Agreement(D) [1.7%] | | | | | | | | |

| Barclays | | | | | | | | |

| 0.110%, dated 03/31/11, repurchased on 04/01/11, repurchase price $2,000,006 (collateralized by a U.S. Treasury obligation, par value $2,037,973, 0.625%, 01/31/13; with total market value $2,040,053) | | $ | 2,000 | | | | 2,000 | |

Total Repurchase Agreement (Cost $2,000) | | | | 2,000 | |

Total Investments [99.5%] (Cost $115,645) | | | | | | $ | 118,797 | |

Percentages are based on Net Assets of $119,407 ($ Thousands).

| * | The rate reported is the 7-day effective yield as of March 31, 2011. |

| (A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2011, the value of these securities amounted to $16,763 (000), representing 14.1% of the net assets of the Fund. |

| (B) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2011. |

| (C) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

| (D) | Tri-Party Repurchase Agreement. |

FDIC Insured — Federal Depositary Insurance Corporation

FGIC — Financial Guaranty Insurance Company

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GO — General Obligation

MTN — Medium Term Note

NATL-RE — National Public Finance Guarantee Corporation

RB — Revenue Bond

REIT — Real Estate Investment Trust

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

The following is a summary of the inputs used as of March 31, 2011 in valuing the Fund’s investments carried at value ($ Thousands) in accordance with ASC 820:

| Investments in Securities | | | | | | | | | | | | |

| Corporate Bonds | | $ | — | | | $ | 109,440 | | | $ | — | | | $ | 109,440 | |

| Municipal Bonds | | | — | | | | 5,345 | | | | — | | | | 5,345 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 605 | | | | — | | | | 605 | |

| U.S. Treasury Obligation | | | — | | | | 649 | | | | — | | | | 649 | |

| Cash Equivalent | | | 758 | | | | — | | | | — | | | | 758 | |

| Repurchase Agreement | | | — | | | | 2,000 | | | | — | | | | 2,000 | |

| Total Investments in Securities | | $ | 758 | | | $ | 118,039 | | | $ | — | | | $ | 118,797 | |

For the period ended March 31, 2011, there have been no significant transfers between Level 1 and Level 2 assets and liabilities.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 19

| schedule of investments |

March 31, 2011 (Unaudited) |

| California Tax Exempt Bond Fund |

| | | | | | |

| Municipal Bonds [94.4%] | | | | | | |

| Arizona [1.6%] | | | | | | |

| Arizona State, School Facilities Board, Ser C, COP, AGM | | | | | | |

| Callable 09/01/14 @ 100 | | | | | | |

| | $ | 750 | | | $ | 800 | |

| California [81.9%] | | | | | | | | |

| Atwater, Elementary School District, Ser A, GO, NATL-RE FGIC | | | | | | | | |

| Callable 08/01/13 @ 100 | | | | | | | | |

| 5.000%, 08/01/22 | | | 660 | | | | 671 | |

| Azusa, Redevelopment Agency, Mortgage-Backed Securities Program, Ser A, RB, FNMA, ETM | | | | | | | | |

| 6.875%, 10/01/12 | | | 200 | | | | 219 | |

| Bay Area, Infrastructure Financing Authority, State Payment Acceleration Project, RB, NATL-RE FGIC | | | | | | | | |

| Callable 08/01/14 @ 100 | | | | | | | | |

| 5.000%, 08/01/17 | | | 360 | | | | 366 | |

| Burbank, Public Financing Authority, Golden State Redevelopment Project, Ser A, TA, AMBAC (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.250%, 12/01/13 | | | 75 | | | | 84 | |

| California State Public Works Board, Ser C, RB, NATL-RE FGIC | | | | | | | | |

| 5.000%, 09/01/20 | | | 750 | | | | 824 | |

| California State Public Works Board, Ser C-1, RB | | | | | | | | |

| Callable 03/01/20 @ 100 | | | | | | | | |

| 5.000%, 03/01/21 | | $ | 600 | | | $ | 651 | |

| California State, Department of Water Resources, Power Supply Project, Ser H-PWR, RB, AGM | | | | | | | | |

| Callable 05/01/18 @ 100 | | | | | | | | |

| 5.000%, 05/01/21 | | | 1,000 | | | | 1,078 | |

| California State, Department of Water Resources, Water Systems Project, Ser J-2, RB | | | | | | | | |

| 7.000%, 12/01/12 | | | 500 | | | | 553 | |

| California State, Department of Water Resources, Water Systems Project, Ser Y, RB, NATL-RE FGIC | | | | | | | | |

| Callable 06/01/13 @ 100 | | | | | | | | |

| 5.250%, 12/01/19 | | | 515 | | | | 559 | |

| California State, Economic Recovery Authority, Ser A, GO, NATL-RE | | | | | | | | |

| Callable 07/01/14 @ 100 | | | | | | | | |

| 5.000%, 07/01/15 | | | 900 | | | | 981 | |

| California State, Educational Facilities Authority, Stanford University Project, Ser T-4, RB | | | | | | | | |

| 5.000%, 03/15/14 | | | 350 | | | | 391 | |

| California State, GO | | | | | | | | |

| Callable 02/01/12 @ 100 | | | | | | | | |

| 5.000%, 02/01/18 | | | 175 | | | | 179 | |

| California State, Infrastructure & Economic Authority, Bay Area Toll Bridges Project, Ser A, RB, AGM (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.250%, 07/01/13 | | | 125 | | | | 138 | |

| California State, Public Works Board Lease, Department of Corrections-Administration Project, Ser A, RB, AMBAC | | | | | | | | |

| Callable 03/01/12 @ 100 | | | | | | | | |

| 5.250%, 03/01/18 | | | 155 | | | | 158 | |

| California State, Public Works Board Lease, Department of Mental Health Project, Ser A, RB | | | | | | | | |

| 5.250%, 06/01/13 | | | 200 | | | | 211 | |

| California State, Public Works Board, Ser B-1, RB | | | | | | | | |

| 5.000%, 03/01/19 | | | 500 | | | | 522 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 20

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Bond Fund (continued) |

| California Statewide Communities Development Authority, Ser A, RB | | | | | | | | |

| 5.000%, 04/01/19 | | $ | 150 | | | $ | 159 | |

| Carlsbad, Public Financing Authority, Municipal Golf Course Project, Ser A, RB, AMBAC | | | | | | | | |

| 4.500%, 09/01/16 | | | 350 | | | | 385 | |

| Castaic Lake Water Agency, Ser A, COP, AMBAC | | | | | | | | |

| Callable 08/01/16 @ 100 | | | | | | | | |

| 5.000%, 08/01/22 | | | 275 | | | | 286 | |

| Castaic Lake, Water Agency, Water Systems Improvement Project, Ser A, COP, NATL-RE | | | | | | | | |

| 7.000%, 08/01/13 | | | 300 | | | | 338 | |

| City & County of San Francisco California, Ser B, COP | | | | | | | | |

| Callable 04/01/19 @ 100 | | | | | | | | |

| 5.000%, 04/01/22 | | | 735 | | | | 766 | |

| Clovis, Public Financing Authority, Ser A, TA, NATL-RE | | | | | | | | |

| 3.250%, 08/01/13 | | | 400 | | | | 393 | |

| Dry Creek, Joint Elementary School District, Ser A, GO, AGM (B) | | | | | | | | |

| 3.212%, 08/01/11 | | | 200 | | | | 199 | |

| El Camino Hospital District, GO, NATL-RE | | | | | | | | |

| Callable 02/01/17 @ 100 | | | | | | | | |

| 5.000%, 08/01/20 | | | 500 | | | | 525 | |

| Escondido, Union School District, Refunding & Financing Project, COP, NATL-RE | | | | | | | | |

| 4.750%, 07/01/19 | | | 735 | | | | 799 | |

| Fresno, Unified School District, Election 2001 Project, Ser D, GO, NATL-RE (A) | | | | | | | | |

| Pre-Refunded @ 102 | | | | | | | | |

| 5.000%, 08/01/13 | | | 200 | | | | 224 | |

| Gilroy, Unified School District, GO (B) | | | | | | | | |

| 3.448%, 04/01/13 | | | 500 | | | | 474 | |

| Gilroy, Unified School District, GO, NATL-RE FGIC | | | | | | | | |

| Callable 08/01/13 @ 100 | | | | | | | | |

| 5.250%, 08/01/19 | | | 800 | | | | 836 | |

| Golden State, Tobacco Settlement, Ser A, RB, AMBAC | | | | | | | | |

| Callable 04/27/11 @ 100 | | | | | | | | |

| 5.000%, 06/01/20 | | $ | 500 | | | $ | 495 | |

| Golden State, Tobacco Settlement, Ser A-1, RB (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 6.750%, 06/01/13 | | | 920 | | | | 1,033 | |

| Jefferson, Unified High School District, Ser A, GO, NATL-RE FGIC | | | | | | | | |

| 5.000%, 08/01/14 | | | 200 | | | | 218 | |

| Kern, High School District, GO, ETM | | | | | | | | |

| 7.100%, 08/01/12 | | | 290 | | | | 315 | |

| Long Beach, Community College District, Ser A, GO | | | | | | | | |

| 9.850%, 01/15/13 | | | 500 | | | | 577 | |

| Los Angeles County, Metropolitan Transportation Authority, Proposition C, Ser A, RB, NATL-RE | | | | | | | | |

| Callable 07/01/14 @ 100 | | | | | | | | |

| 5.000%, 07/01/16 | | | 200 | | | | 221 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser B, RB, AGM | | | | | | | | |

| Callable 07/01/11 @ 101 | | | | | | | | |

| 5.250%, 07/01/15 | | | 250 | | | | 255 | |

| Los Angeles County, Public Works Financing Authority, SAB, AGM | | | | | | | | |

| 5.250%, 10/01/18 | | | 750 | | | | 852 | |

| Los Angeles County, Sanitation Districts Financing Authority, Capital Projects (District #14), Sub-Ser B, RB, NATL-RE FGIC | | | | | | | | |

| 3.750%, 10/01/14 | | | 175 | | | | 184 | |

| Los Angeles Municipal Improvement, Ser E, RB | | | | | | | | |

| 5.000%, 09/01/15 | | | 200 | | | | 219 | |

| Los Angeles, Department of Water & Power, Power Systems Project, Ser A Sub-Ser-Ser A-1, RB, NATL-RE | | | | | | | | |

| 5.000%, 07/01/12 | | | 665 | | | | 701 | |

| Los Angeles, Department of Water & Power, Sub-Ser A-2, RB, AGM | | | | | | | | |

| Callable 07/01/15 @ 100 | | | | | | | | |

| 5.000%, 07/01/25 | | | 1,000 | | | | 1,033 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 21

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Bond Fund (continued) |

| Los Angeles, Municipal Improvement Authority, Central Library Project, Ser A, RB, NATL-RE | | | | | | | | |

| Callable 06/01/12 @ 100 | | | | | | | | |

| 5.500%, 06/01/18 | | $ | 500 | | | $ | 520 | |

| Los Angeles, Municipal Improvement Authority, Central Library Project, Ser A, RB, NATL-RE | | | | | | | | |

| 5.250%, 06/01/12 | | | 300 | | | | 315 | |

| Los Angeles, Ser A, GO, AGM | | | | | | | | |

| Callable 09/01/12 @ 100 | | | | | | | | |

| 5.000%, 09/01/20 | | | 750 | | | | 781 | |

| Los Angeles, Unified School District, COP, AMBAC | | | | | | | | |

| 5.000%, 10/01/12 | | | 750 | | | | 786 | |

| Los Angeles, Unified School District, Ser A-1, GO, NATL-RE | | | | | | | | |

| Callable 07/01/14 @ 100 | | | | | | | | |

| 5.000%, 07/01/17 | | | 125 | | | | 134 | |

| Los Angeles, Wastewater Systems Authority, Ser A, RB | | | | | | | | |

| 5.000%, 06/01/14 | | | 825 | | | | 913 | |

| Mount San Antonio, Community College District, GO (B) | | | | | | | | |

| 3.787%, 05/01/15 | | | 500 | | | | 440 | |

| North Orange County, Community College District, Ser A, GO, NATL-RE (A) | | | | | | | | |

| Pre-Refunded @ 101 | | | | | | | | |

| 5.375%, 08/01/12 | | | 525 | | | | 563 | |

| Oakley, Civic Center Project, COP | | | | | | | | |

| 4.000%, 05/01/12 | | | 230 | | | | 236 | |

| Orange County, Public Financing Authority, RB, NATL-RE | | | | | | | | |

| 5.000%, 07/01/17 | | | 1,050 | | | | 1,171 | |

| Orange County, Sanitation District, Ser A, COP | | | | | | | | |

| 3.000%, 02/01/17 | | | 500 | | | | 506 | |

| Oxnard, School District, Election 2006 Project, Ser A, GO, CIFG | | | | | | | | |

| 6.750%, 08/01/11 | | | 300 | | | | 306 | |

| Pinole, Redevelopment Agency, Pinole Vista Redevelopment Project, TA, AGM | | | | | | | | |

| Callable 05/05/11 @ 100 | | | | | | | | |

| 5.250%, 08/01/14 | | | 100 | | | | 101 | |

| Port of Oakland, Ser B, RB, NATL-RE | | | | | | | | |

| Callable 11/01/17 @ 100 | | | | | | | | |

| 5.000%, 11/01/23 | | $ | 500 | | | $ | 497 | |

| Port of Oakland, Ser C, RB, NATL-RE | | | | | | | | |

| 5.000%, 11/01/15 | | | 450 | | | | 492 | |

| Sacramento, City Financing Authority, EPA Building Project, Ser A, RB, AMBAC | | | | | | | | |

| Callable 05/12/11 @ 100 | | | | | | | | |

| 4.750%, 05/01/17 | | | 525 | | | | 525 | |

| Sacramento, Municipal Utility District, Ser T, RB, NATL-RE FGIC | | | | | | | | |

| Callable 05/15/14 @ 100 | | | | | | | | |

| 5.250%, 05/15/22 | | | 805 | | | | 836 | |

| Sacramento, Unified School District, GO, NATL-RE | | | | | | | | |

| Callable 07/01/15 @ 100 | | | | | | | | |

| 5.000%, 07/01/18 | | | 300 | | | | 321 | |

| San Diego, Public Facilities Financing Authority, Ser B, RB | | | | | | | | |

| 5.000%, 05/15/14 | | | 750 | | | | 825 | |

| San Diego, Unified School District, Election 1998 Project, Ser E, GO, AGM | | | | | | | | |

| Callable 07/01/13 @ 101 | | | | | | | | |

| 5.250%, 07/01/16 | | | 100 | | | | 109 | |

| San Francisco City & County Airports Commission, Ser B, RB | | | | | | | | |

| 5.000%, 05/01/17 | | | 495 | | | | 542 | |

| San Francisco City & County Redevelopment Agency, Ser B, TA, NATL-RE FGIC | | | | | | | | |

| 5.250%, 08/01/13 | | | 500 | | | | 521 | |

| San Francisco City & County, Redevelopment Agency, Ser B, TA | | | | | | | | |

| 5.000%, 08/01/17 | | | 540 | | | | 550 | |

| San Francisco City & County, Redevelopment Agency, Ser B, TA, NATL-RE | | | | | | | | |

| 5.000%, 08/01/15 | | | 300 | | | | 312 | |

| San Francisco City & County, Redevelopment Agency, Ser B, TA, NATL-RE FGIC | | | | | | | | |

| Callable 08/01/13 @ 100 | | | | | | | | |

| 5.250%, 08/01/18 | | | 600 | | | | 609 | |

See accompanying notes to financial statements.

CNI CHARTER FUNDS | PAGE 22

| schedule of investments |

March 31, 2011 (Unaudited) |

California Tax Exempt Bond Fund (continued) |

| San Francisco, Bay Area Transit Financing Authority, Ser A, RB, NATL-RE | | | | | | | | |

| Callable 07/01/15 @ 100 | | | | | | | | |

| 5.000%, 07/01/24 | | $ | 550 | | | $ | 572 | |

| San Jose, Redevelopment Agency, Ser A, TA, NATL-RE | | | | | | | | |

| Callable 08/01/15 @ 100 | | | | | | | | |

| 5.000%, 08/01/17 | | | 795 | | | | 758 | |

| Santa Margarita, Dana Point Authority, Ser A, RB, AMBAC | | | | | | | | |

| Callable 08/01/14 @ 100 | | | | | | | | |

| 5.000%, 08/01/15 | | | 165 | | | | 181 | |

| Solano County, COP, NATL-RE (A) | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.250%, 11/01/12 | | | 100 | | | | 107 | |

| Southern California Public Power Authority, Sub-Ser, RB | | | | | | | | |

| 5.000%, 07/01/17 | | | 1,200 | | | | 1,356 | |

| Southern California, Metropolitan Water District Authority, Ser A, RB | | | | | | | | |

| 5.750%, 07/01/21 | | | 280 | | | | 326 | |

| State of California, GO | | | | | | | | |

| Callable 11/01/20 @ 100 | | | | | | | | |

| 5.000%, 11/01/22 | | | 1,025 | | | | 1,074 | |

| State of California, Ser A, GO, NATL-RE FGIC | | | | | | | | |

| Callable 07/01/11 @ 100 | | | | | | | | |

| 5.000%, 07/01/17 | | | 500 | | | | 505 | |

| State of California, Ser A-2, RB | | | | | | | | |

| 3.000%, 06/28/11 | | | 1,000 | | | | 1,006 | |