| | City National Rochdale Funds Semi-Annual Report |

| | |

| 2 | Letter to Our Shareholders |

| 4 | Schedule of Investments/Consolidated Schedule of Investments |

| 96 | Statements of Assets and Liabilities/Consolidated Statement of Assets and Liabilities |

| 100 | Statements of Operations/Consolidated Statement of Operations |

| 104 | Statements of Changes in Net Assets/Consolidated Statement of Changes in Net Assets |

| 110 | Financial Highlights/Consolidated Financial Highlights |

| 115 | Notes to Financial Statements/Consolidated Notes to Financial Statements |

| 129 | Disclosure of Fund Expenses |

| 132 | Shareholder Voting Results |

| 133 | Board Approval of Advisory and Sub-Advisory Agreements |

The Funds file their complete schedules of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within 60 days after the end of the period. The Funds’ Form N-Q filings are available on the Commission’s website at http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. The most current Form N-Q filing is also available on the Funds’ website at www. citynationalrochdalefunds.com and without charge, upon request, by calling 1-888-889-0799.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to the Funds’ portfolio securities, and information on how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ending June 30 is available (1) without charge, upon request, by calling 1-888-889-0799, (2) on the Funds’ website at www.citynationalrochdalefunds.com, and (3) on the Securities and Exchange Commission’s website at www.sec.gov.

CITY NATIONAL ROCHDALE FUNDS | PAGE 1

letter to our shareholders

March 31, 2014 (Unaudited)

Dear Shareholders,

This semi-annual report covers the six-month period ended March 31, 2014. Calendar year 2013 ended on a high note for most risk assets, with the S&P 500 Index delivering almost an 11% return during the final quarter of the year. From an investment standpoint, there was little competition for domestic stocks from other asset classes. Growth stocks generally outpaced their value-oriented counterparts, as investor optimism and improving economic fundamentals helped support expectations of continued expansion in corporate earnings. Within fixed income markets, investors willing to assume higher levels of credit risk were rewarded, whereas securities more sensitive to interest rate movement struggled.

Through the first quarter of the year, equity markets generally treaded water, finishing either slightly ahead or slightly behind where they started, depending on their respective geographies. Volatility in emerging markets led to a sharp sell-off in risk assets during the month of January, as investor concerns surrounding China’s slowing growth and tension in Ukraine heavily influenced market sentiment around the world. Bond investors benefited from a modest decline in interest rates, with the 10-year Treasury note rallying from a 3.03% to 2.72% yield during the quarter. Severe winter weather experienced by most of the country pressured a number of economic indicators, though market participants seem willing to look beyond some of the short-term softness in hopes of fundamental resurgence as we move into the second quarter.

Our bullish positioning over the last six months has generally been well rewarded by the market, and though valuations have expanded we are still finding opportunities for continued upside. Below is a summary of the asset classes in which the City National Rochdale Funds are invested for the six months ended March 31, 2014. Please note the inclusion of our newly added City National Rochdale Municipal High Income Fund to the family as a result of our investment team’s identification of what we believe to be a compelling opportunity within the municipal bond space.

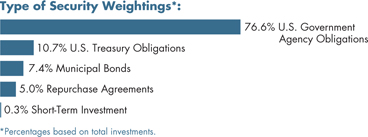

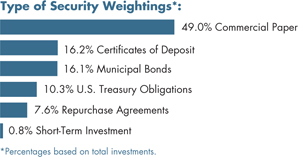

MONEY MARKET FUNDS

With short term interest rates steadily hovering near zero, we remain committed to helping our clients preserve positive returns by waiving a substantial portion of our fees. The three City National Rochdale money market funds all delivered either flat or positive absolute performance for the six-month period ending with the close of the first quarter. The Federal Reserve’s stated policy of continuing to maintain extremely low interest rates will likely keep a lid on yields for the foreseeable future, although the much-anticipated tapering agenda has recently become a reality. Though tapering is not tightening, if the economy continues to show improvement it is not unreasonable to expect an eventual rise in interest rates sometime in the late 2015 or early 2016 time frame.

BOND FUNDS

Our newest addition to the City National Rochdale fixed income offerings started off 2014 on solid footing. The City National Rochdale Municipal High Income Fund was launched on December 30, 2013, and thus far has demonstrated respectable performance and commendable asset growth. We continue to optimize investment strategies housed within our City National Rochdale Fixed Income Opportunities Fund, with recent enhancements designed to broaden credit exposure while insulating against impending interest rate risk.

U.S. core fixed income markets delivered positive performance for the six-month period ended March 31, 2014, with corporate credit leading the way in terms of return attribution. Given the low yield environment, investors have increasingly gravitated towards high yield bonds and other spread products in order to capture reasonable levels of income, relatively speaking. The Barclays U.S. Corporate High Yield Index posted a 6.7% return over the six-month period, outpacing nearly all segments of the domestic fixed income market. Domestic bank loans also generated an attractive six month print, with a return of 3.2% as measured by the Credit Suisse Leveraged Loan Index. The Barclays U.S. Aggregate Bond Index, which contains securities more susceptible to interest rate movements, delivered a 1.7% return.

CITY NATIONAL ROCHDALE FUNDS | PAGE 2

Fixed income strategies remain an important component within broadly diversified investment portfolios. By offering our clients access to unique and differentiated sources of risk premia within the space, we believe that we can preserve expectations for future positive absolute returns without incurring undue levels of interest rate risk.

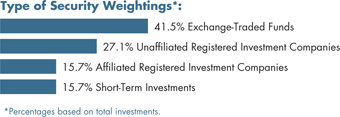

ABSOLUTE RETURN FUND

Our City National Rochdale Multi-Asset Fund, designed to deliver positive absolute performance in excess of inflation irrespective of the market environment, generated an attractive return pattern during the trailing six-month period, with only two months finishing in the red. The strategy held up particularly well during the month of January, when risk assets traded off significantly. We believe this flexible, “go-anywhere” type of strategy should continue to serve investors well going forward, as our ability to invest across a wide range of asset classes within a well-defined, conservative risk framework offers valuable diversification benefits.

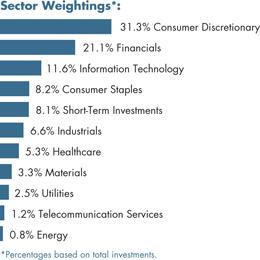

EQUITY FUNDS

As mentioned in the introduction, equity markets were the place to be over the trailing six-month period. Domestic stocks generated returns in the low teens, with international developed and emerging markets equities posting returns in the mid and low single digit ranges, respectively. Investment teams for our equity strategies continue to scour the globe for attractive opportunities, while maintaining a strong focus on quality and valuation. Given the run up we’ve experienced in equity markets over the last five years, it is not unreasonable to expect a correction of some sort in the coming quarters. Sticking to our knitting and not falling victim to attitudes of complacency that often surface in the latter stages of a bull market are as important as ever at this point in time.

We thank you for your trust and confidence in our abilities to continue to serve you well through your investment in the City National Rochdale Funds. We will continue to work hard to ensure that we maintain your confidence and respect as stewards of your capital.

Sincerely,

Bruce Simon

Chief Investment Officer

City National Rochdale Funds

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index.

Past performance is no guarantee of future results. Certain shareholders may be subject to the Alternative Minimum Tax (AMT). Federal income tax rules apply to any capital gain distributions.

Investing involves risk, including the loss of principal.

Fund expenses have been waived during the period on which the performance is based. Without waivers, performance would be lower.

This information must be preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing.

City National Rochdale Funds do not generally accept investments by non-U.S. persons and may not be available in all states.

The Barclays U.S. Corporate High Yield Index covers the U.S.-dollar denominated, non-investment grade, fixed rate, taxable corporate bond market and includes securities with ratings by Moody’s, Fitch, and S&P of Bal/BB+/BB+ or below.

The Credit Suisse Leveraged Loan Index is designed to mirror the investible universe of the U.S.-dollar denominated leveraged loan market.

The Barclays U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market.

CITY NATIONAL ROCHDALE FUNDS | PAGE 3

schedule of investments

March 31, 2014 (Unaudited)

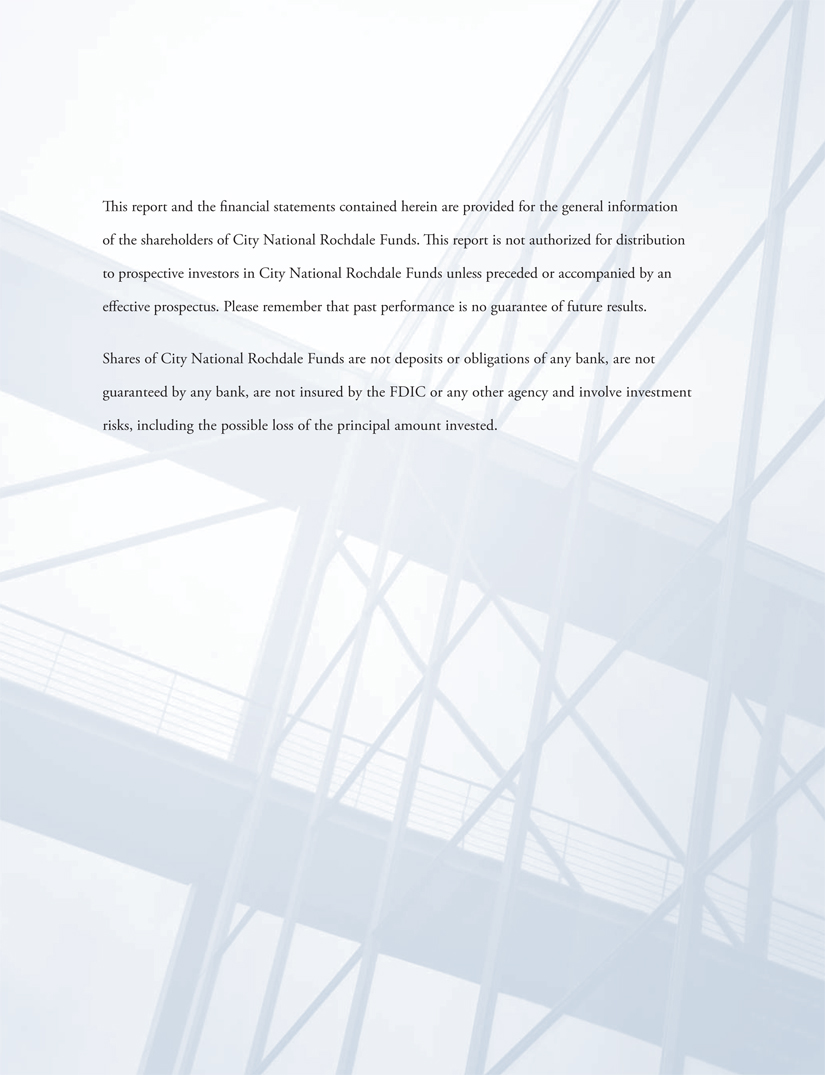

City National Rochdale Government Money Market Fund

| | | | | |

| U.S. Government Agency Obligations [76.5%] | |

| FAMC, MTN | | | | | | |

| 3.250%, 06/25/14 | | $ | 3,500 | | | $ | 3,524 | |

| FAMC DN (A) | | | | | | | | |

| 0.109%, 04/01/13 | | | 55,000 | | | | 55,000 | |

| 0.025%, 04/02/14 | | | 60,000 | | | | 60,000 | |

| 0.050%, 04/24/14 | | | 8,000 | | | | 8,000 | |

| 0.070%, 05/01/14 | | | 25,000 | | | | 24,999 | |

| 0.070%, 05/02/14 | | | 25,000 | | | | 24,998 | |

| 0.100%, 05/06/14 | | | 16,839 | | | | 16,837 | |

| 0.065%, 05/15/14 | | | 50,000 | | | | 49,996 | |

| 0.100%, 07/25/14 | | | 25,000 | | | | 24,992 | |

| FFCB | | | | | | | | |

| 0.221%, 04/01/14(B) | | | 31,690 | | | | 31,690 | |

| 0.186%, 04/13/14(B) | | | 12,300 | | | | 12,308 | |

| 0.175%, 04/23/14(B) | | | 26,500 | | | | 26,517 | |

| 0.200%, 05/13/14 | | | 20,000 | | | | 20,001 | |

| 0.250%, 05/21/14(B) | | | 21,000 | | | | 21,003 | |

| FFCB DN | | | | | | | | |

| 0.160%, 04/15/14(A) | | | 19,095 | | | | 19,094 | |

| 0.140%, 08/08/14(A) | | | 10,000 | | | | 9,995 | |

| 0.090%, 09/03/14(A) | | | 25,000 | | | | 24,991 | |

| FHLB | | | | | | | | |

| 0.104%, 04/08/14(B) | | | 40,000 | | | | 40,000 | |

| 0.109%, 04/09/14(B) | | | 40,000 | | | | 40,000 | |

| 0.119%, 04/10/14(B) | | | 50,000 | | | | 50,004 | |

| 0.125%, 04/11/14 | | | 8,800 | | | | 8,800 | |

| 0.106%, 04/14/14(B) | | | 15,000 | | | | 15,001 | |

| 0.135%, 04/15/14(B) | | | 50,000 | | | | 50,009 | |

| 0.115%, 04/16/14(B) | | | 50,000 | | | | 50,004 | |

| 0.125%, 04/17/14 | | | 51,765 | | | | 51,764 | |

| 0.106%, 04/19/14(B) | | | 50,000 | | | | 50,002 | |

| 0.094%, 04/25/14(B) | | | 50,000 | | | | 49,997 | |

| 0.125%, 05/02/14 | | | 9,350 | | | | 9,350 | |

| 0.054%, 06/12/14(B) | | | 20,000 | | | | 20,000 | |

| 5.250%, 06/18/14 | | | 10,000 | | | | 10,110 | |

| 0.125%, 06/18/14 | | | 31,040 | | | | 31,038 | |

| 0.110%, 06/23/14 | | | 40,000 | | | | 39,998 | |

| 0.120%, 07/14/14 | | | 50,000 | | | | 50,001 | |

| 0.100%, 07/15/14 | | | 50,000 | | | | 49,999 | |

| 0.125%, 09/03/14 | | | 25,000 | | | | 24,994 | |

| Face Amount (000) | | | | |

| 0.130%, 10/30/14 | | $ | 50,000 | | | $ | 49,997 | |

| 0.250%, 01/16/15 | | | 25,000 | | | | 25,021 | |

| 0.250%, 02/20/15 | | | 14,435 | | | | 14,447 | |

| FHLB DN (A) | | | | | | | | |

| 0.040%, 04/01/14 | | | 50,000 | | | | 50,000 | |

| 0.100%, 04/02/14 | | | 25,000 | | | | 25,000 | |

| 0.077%, 04/04/14 | | | 150,000 | | | | 149,999 | |

| 0.061%, 04/09/14 | | | 97,350 | | | | 97,349 | |

| 0.050%, 04/14/14 | | | 40,000 | | | | 39,999 | |

| 0.062%, 04/16/14 | | | 100,000 | | | | 99,997 | |

| 0.056%, 04/21/14 | | | 55,725 | | | | 55,723 | |

| 0.061%, 04/23/14 | | | 45,550 | | | | 45,548 | |

| 0.078%, 04/25/14 | | | 66,500 | | | | 66,497 | |

| 0.075%, 04/30/14(C) | | | 5,095 | | | | 5,095 | |

| 0.053%, 05/02/14 | | | 62,365 | | | | 62,362 | |

| 0.070%, 05/07/14 | | | 35,000 | | | | 34,998 | |

| 0.070%, 05/16/14 | | | 26,000 | | | | 25,998 | |

| 0.071%, 05/21/14 | | | 50,000 | | | | 49,995 | |

| 0.060%, 05/28/14 | | | 51,686 | | | | 51,681 | |

| 0.085%, 06/06/14 | | | 24,500 | | | | 24,496 | |

| 0.091%, 07/09/14 | | | 96,550 | | | | 96,526 | |

| 0.135%, 08/15/14 | | | 25,000 | | | | 24,987 | |

| 0.095%, 09/05/14 | | | 44,799 | | | | 44,780 | |

| 0.095%, 09/12/14 | | | 97,294 | | | | 97,252 | |

| FHLMC | | | | | | | | |

| 0.135%, 04/16/14(B) | | | 50,000 | | | | 50,010 | |

| 1.000%, 08/20/14 | | | 13,903 | | | | 13,949 | |

| 0.320%, 12/03/14 | | | 47,004 | | | | 47,056 | |

| FHLMC DN | | | | | | | | |

| 0.110%, 07/07/14(A) (C) | | | 50,000 | | | | 49,985 | |

| FNMA | | | | | | | | |

| 0.137%, 04/11/14(B) | | | 9,000 | | | | 9,002 | |

| 4.125%, 04/15/14 | | | 5,540 | | | | 5,549 | |

| 2.500%, 05/15/14 | | | 21,026 | | | | 21,086 | |

| 0.360%, 06/23/14(B) | | | 29,000 | | | | 29,013 | |

| 1.150%, 11/18/14 | | | 10,000 | | | | 10,065 | |

| FNMA DN (A) | | | | | | | | |

| 1.125%, 06/27/14 | | | 50,368 | | | | 50,491 | |

| Tennessee Valley Authority DN | | | | | | | | |

| 0.010%, 04/02/14(A) | | | 65,000 | | | | 65,000 | |

| | | | | | | | | |

| Total U.S. Government Agency Obligations | | | | | |

| (Cost $2,663,969) | | | | 2,663,969 | |

| | | | | | | | | |

| U.S. Treasury Obligations [10.7%] | |

| U.S. Treasury Bill | | | | | | | | |

| 0.001%, 04/03/14(A) | | | 40,000 | | | | 40,000 | |

| U.S. Treasury Notes | | | | | | | | |

| 0.090%, 04/01/14(B) | | | 30,000 | | | | 29,993 | |

| 1.250%, 04/15/14 | | | 50,000 | | | | 50,022 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 4

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Government Money Market Fund (continued)

| Face Amount (000) | | | | |

| 1.875%, 04/30/14 | | $ | 50,000 | | | $ | 50,072 | |

| 0.250%, 04/30/14 | | | 50,000 | | | | 50,006 | |

| 2.250%, 05/31/14 | | | 50,000 | | | | 50,177 | |

| 2.625%, 06/30/14 | | | 50,000 | | | | 50,313 | |

| 0.625%, 07/15/14 | | | 50,000 | | | | 50,080 | |

| | | | | | | | | |

| Total U.S. Treasury Obligations | |

| (Cost $370,663) | | | | 370,663 | |

| | | | | | | | | |

| Municipal Bonds [7.4%] | |

| California [1.9%] | |

| ABAG Finance Authority for Nonprofit, Miramar Apartments Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/03/14(B) (D) | | | 15,000 | | | | 15,000 | |

| Anaheim, Housing Authority, Sea Wind Apartments Project, Ser C, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/03/14(B) (D) | | | 6,300 | | | | 6,300 | |

| California Statewide, Communities Development Authority, Fairway Family Apartments Project, Ser PP, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/03/14(B) (D) | | | 8,000 | | | | 8,000 | |

| Los Angeles, Community Redevelopment Agency, Hollywood and Vine Apartments Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/03/14(B) (D) | | | 28,450 | | | | 28,450 | |

| Sacramento County Housing Authority, Ashford Heights Apartments Project, Ser H, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/03/14(B) (D) | | | 9,000 | | | | 9,000 | |

| | | | | | | | | |

| Total California | | | | 66,750 | |

| | | | | | | | | |

| New York [4.2%] | |

| New York State, Housing Finance Agency, 11th Avenue Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.050%, 04/02/14(B) (D) | | | 19,000 | | | | 19,000 | |

| New York State, Housing Finance Agency, 345 East 94th Street Project, Ser A, RB, FHLMC, AMT | | | | | | | | |

| 0.070%, 04/02/14(B) (D) | | | 13,200 | | | | 13,200 | |

| Face Amount (000) | | | | |

| New York State, Housing Finance Agency, 360 West 43rd Street Project, Ser A, RB, FNMA, AMT | | | | | | |

| 0.050%, 04/02/14(B) (D) | | $ | 14,100 | | | $ | 14,100 | |

| New York State, Housing Finance Agency, 360 West 43rd Street Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.050%, 04/02/14(B) (D) | | | 23,800 | | | | 23,800 | |

| New York State, Housing Finance Agency, 750 6th Avenue Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.050%, 04/02/14(B) (D) | | | 7,500 | | | | 7,500 | |

| New York State, Housing Finance Agency, RB | | | | | | | | |

| 0.050%, 04/02/14(B) (D) (E) | | | 25,200 | | | | 25,200 | |

| New York State, Housing Finance Agency, Victory Housing Project, Ser 2004-A, RB, FHLMC, AMT | | | | | | | | |

| 0.050%, 04/02/14(B) (D) | | | 25,500 | | | | 25,500 | |

| New York State, Housing Finance Agency, West 38th Street Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.070%, 04/02/14(B) (D) | | | 20,000 | | | | 20,000 | |

| | | | | | | | | |

| Total New York | | | | 148,300 | |

| | | | | | | | | |

| Texas [0.8%] | |

| Houston, Housing Finance, Regency Park Apartments Project, RB, FNMA, AMT | | | | | | | | |

| 0.090%, 04/02/14(B) (D) | | | 13,595 | | | | 13,595 | |

| Texas Department of Housing & Community Affairs, Idlewilde Apartments Project, RB, FNMA, AMT | | | | | | | | |

| 0.090%, 04/03/14(B) (D) | | | 13,610 | | | | 13,610 | |

| | | | | | | | | |

| Total Texas | | | | 27,205 | |

| | | | | | | | | |

| Washington [0.5%] | |

| Washington State, Housing Finance Commission, Vintage Spokane Project, Ser A, RB, FNMA, AMT | | | | | | | | |

| 0.090%, 04/03/14(B) (D) | | | 16,295 | | | | 16,295 | |

| | | | | | | | | |

| Total Municipal Bonds | |

| (Cost $258,550) | | | | 258,550 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 5

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Government Money Market Fund (concluded)

| Face Amount (000) | | | | |

| Repurchase Agreements (F) [5.0%] | |

| Bank of America | | | | | | |

| 0.050%, dated 03/31/14, repurchased on 04/01/14, repurchase price $37,000,051 (collateralized by various U.S. Government obligations, par values ranging from $11,900,000 to $30,900,000, 0.000%, 07/01/14 to 01/15/21; with a total market value $37,700,000) | | $ | 37,000 | | | $ | 37,000 | |

| Barclays | | | | | | | | |

| 0.060%, dated 03/31/14, repurchased on 04/01/14, repurchase price $28,000,047 (collateralized by a U.S. Treasury Note, par value $28,800,000, 2.000%, 11/30/20; with a total market value $28,600,000) | | | 28,000 | | | | 28,000 | |

| Deutsche Bank | | | | | | | | |

| 0.050%, dated 03/31/14, repurchased on 04/01/14, repurchase price $25,000,035 (collateralized by various U.S. Treasury Notes, par values ranging from $1,400 to $22,500,000, 0.000% - 8.750%, 05/15/14 to 05/15/23; with a total market value $25,539,088) | | | 25,000 | | | | 25,000 | |

| Deutsche Bank | | | | | | | | |

| 0.080%, dated 03/31/14, repurchased on 04/01/14, repurchase price $25,000,056 (collateralized by various U.S. Government obligations, par values ranging from $1,000 to $4,602,000, 0.000% - 6.625%, 07/15/14 to 07/15/37; with a total market value $25,502,997) | | | 25,000 | | | | 25,000 | |

| Goldman Sachs | | | | | | | | |

| 0.070%, dated 03/31/14, repurchased on 04/01/14, repurchase price $60,000,117 (collateralized by various U.S. Government obligations, par values ranging from $4.859.000 to $55,900,000, 0.500% - 4.375%, 10/15/15 to 05/13/16; with a total market value $61,151,600) | | | 60,000 | | | | 60,000 | |

| | | | | | | | | |

| Total Repurchase Agreements | |

| (Cost $175,000) | | | | 175,000 | |

| | | | | | |

| Short-Term Investment [0.3%] | |

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, 0.050%* | | | 10,219,370 | | | $ | 10,219 | |

| | | | | | | | | |

| Total Short-Term Investment | |

| (Cost $10,219) | | | | 10,219 | |

| | | | | | | | | |

| Total Investments [99.9%] | |

| (Cost $3,478,401) | | | $ | 3,478,401 | |

Percentages are based on Net Assets of $3,480,431 (000).

| * | The rate reported is the 7-day effective yield as of March 31, 2014. |

| (A) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

| (B) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2014. |

| (C) | The rate reported is the effective yield at time of purchase. |

| (D) | Put and Demand Feature — The date reported is the next reset or put date. |

| (E) | Securities are held in conjunction with a letter of credit from a major bank or financial institution. |

| (F) | Tri-Party Repurchase Agreement. |

ABAG — Association of Bay Area Governments

AMT — Alternative Minimum Tax (subject to)

DN — Discount Note

FAMC — Federal Agriculture Mortgage Corporation

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

MTN — Medium Term Note

RB — Revenue Bond

Ser — Series

The following is a list of the inputs used as of March 31, 2014 in valuing the Fund’s investments carried at value (000):

| Investments in Securities | | | | | | | | | | | | |

| U.S. Government Agency Obligations | | $ | — | | | $ | 2,663,969 | | | $ | — | | | $ | 2,663,969 | |

| U.S. Treasury Obligations | | | — | | | | 370,663 | | | | — | | | | 370,663 | |

| Municipal Bonds | | | — | | | | 258,550 | | | | — | | | | 258,550 | |

| Repurchase Agreements | | | — | | | | 175,000 | | | | — | | | | 175,000 | |

| Short-Term Investment | | | 10,219 | | | | — | | | | — | | | | 10,219 | |

| Total Investments in Securities | | $ | 10,219 | | | $ | 3,468,182 | | | $ | — | | | $ | 3,478,401 | |

For the period ended March 31, 2014, there have been no transfers between Level 1 and Level 2 assets and liabilities. Transfers between Levels are recognized at period end.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 6

schedule of investments

March 31, 2014 (Unaudited)

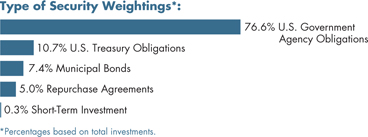

City National Rochdale Prime Money Market Fund

| | | | | |

| Commercial Paper [49.1%] | |

| Banks [28.7%] | |

| Australia and New Zealand Banking Group (A) | | | | | | |

| 0.200%, 07/08/14 | | $ | 20,000 | | | $ | 19,989 | |

| Bank of Tokyo- Mitsubishi UFJ NY | | | | | | | | |

| 0.220%, 04/23/14 | | | 15,000 | | | | 14,998 | |

| 0.190%, 04/21/14 | | | 10,000 | | | | 9,999 | |

| BNP Paribas Finance | | | | | | | | |

| 0.310%, 04/24/14 | | | 10,000 | | | | 9,998 | |

| Commonwealth Bank of Australia (A) | | | | | | | | |

| 0.165%, 06/30/14 | | | 35,000 | | | | 34,986 | |

| Credit Suisse NY | | | | | | | | |

| 0.260%, 09/09/14 | | | 10,000 | | | | 9,988 | |

| Deutsche Bank Financial | | | | | | | | |

| 0.300%, 08/25/14 | | | 10,000 | | | | 9,988 | |

| HSBC USA | | | | | | | | |

| 0.230%, 08/25/14 | | | 5,000 | | | | 4,995 | |

| 0.230%, 08/13/14 | | | 5,305 | | | | 5,300 | |

| Korea Development Bank NY | | | | | | | | |

| 0.190%, 04/14/14 | | | 25,000 | | | | 24,998 | |

| Macquarie Bank (A) | | | | | | | | |

| 0.200%, 05/08/14 | | | 35,000 | | | | 34,993 | |

| National Australia Funding Delaware (A) | | | | | | | | |

| 0.250%, 05/23/14 | | | 20,000 | | | | 19,993 | |

| 0.163%, 05/05/14 | | | 22,400 | | | | 22,397 | |

| Natixis US Finance | | | | | | | | |

| 0.330%, 07/01/14 | | | 15,000 | | | | 14,988 | |

| 0.150%, 05/05/14 | | | 10,000 | | | | 9,999 | |

| Skandinaviska Enskilda Banken (A) | | | | | | | | |

| 0.235%, 04/21/14 | | | 15,000 | | | | 14,998 | |

| Societe Generale North America | | | | | | | | |

| 0.300%, 05/02/14 | | | 15,000 | | | | 14,996 | |

| Standard Chartered Bank (A) | | | | | | | | |

| 0.250%, 09/04/14 | | | 10,000 | | | | 9,989 | |

| Sumitomo Mitsui Banking (A) | | | | | | | | |

| 0.200%, 04/21/14 | | | 5,000 | | | | 4,999 | |

| | | | | |

| Sumitomo Mitsui Trust Bank Limited (A) | | | | | | |

| 0.200%, 04/01/14 | | $ | 20,000 | | | $ | 20,000 | |

| Westpac Securities NZ (A) | | | | | | | | |

| 0.200%, 09/26/14 | | | 25,000 | | | | 24,975 | |

| | | | | | | | | |

| Total Banks | | | | 337,566 | |

| | | | | | | | | |

| Financial Services [16.0%] | |

| AllianceBernstein (A) | | | | | | | | |

| 0.190%, 04/09/14 | | | 10,000 | | | | 10,000 | |

| 0.150%, 04/11/14 | | | 10,000 | | | | 10,000 | |

| 0.120%, 04/01/14 | | | 15,000 | | | | 15,000 | |

| Allianz Finance (A) | | | | | | | | |

| 0.270%, 04/28/14 | | | 10,000 | | | | 9,998 | |

| Caisse Centrale Desjardins (A) | | | | | | | | |

| 0.170%, 04/28/14 | | | 15,000 | | | | 14,998 | |

| 0.110%, 04/03/14 | | | 10,000 | | | | 10,000 | |

| Collateralized Commercial Paper | | | | | | | | |

| 0.150%, 04/25/14 | | | 10,000 | | | | 9,999 | |

| Liberty Street Funding (A) | | | | | | | | |

| 0.180%, 05/29/14 | | | 7,700 | | | | 7,698 | |

| 0.130%, 04/01/14 | | | 30,000 | | | | 30,000 | |

| Mizuho Funding (A) | | | | | | | | |

| 0.195%, 06/02/14 | | | 20,000 | | | | 19,993 | |

| 0.175%, 05/21/14 | | | 15,000 | | | | 14,996 | |

| Toyota Financial Services de Puerto Rico | | | | | | | | |

| 0.200%, 04/04/14 | | | 10,000 | | | | 10,000 | |

| Toyota Motor Credit | | | | | | | | |

| 0.110%, 04/08/14 | | | 25,000 | | | | 24,999 | |

| | | | | | | | | |

| Total Financial Services | | | | 187,681 | |

| | | | | | | | | |

| Food, Beverage & Tobacco [1.0%] | |

| Coca-Cola (A) | | | | | | | | |

| 0.070%, 04/11/14 | | | 12,200 | | | | 12,200 | |

| | | | | | | | | |

| Import/Export [2.1%] | |

| Sumitomo Corp of America | | | | | | | | |

| 0.210%, 05/07/14 | | | 25,000 | | | | 24,995 | |

| | | | | | | | | |

| Schools [1.3%] | |

| University of California | | | | | | | | |

| 0.150%, 07/07/14 | | | 15,000 | | | | 14,994 | |

| | | | | | | | | |

| Total Commercial Paper | |

| (Cost $577,436) | | | | 577,436 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 7

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Prime Money Market Fund (continued)

| | | | | |

| Certificates of Deposit [16.1%] | |

| Banco Del Estado De Chile | | | | | | |

| 0.230%, 04/08/14 | | $ | 10,000 | | | $ | 10,000 | |

| 0.210%, 04/11/14 | | | 15,000 | | | | 15,000 | |

| 0.260%, 07/08/14 | | | 15,000 | | | | 15,000 | |

| Bank of America | | | | | | | | |

| 0.230%, 07/07/14 | | | 25,000 | | | | 25,000 | |

| 0.250%, 09/08/14 | | | 10,000 | | | | 10,000 | |

| Bank of Montreal IL | | | | | | | | |

| 0.210%, 09/08/14 | | | 25,000 | | | | 25,000 | |

| Bank of Tokyo-Mitsubishi UFJ NY | | | | | | | | |

| 0.220%, 08/22/14 | | | 15,000 | | | | 15,000 | |

| Korea Development Bank NY | | | | | | | | |

| 0.210%, 04/16/14 | | | 15,000 | | | | 15,000 | |

| Norinchukin Bank | | | | | | | | |

| 0.210%, 05/13/14 | | | 15,000 | | | | 15,000 | |

| 0.210%, 06/16/14 | | | 20,000 | | | | 20,000 | |

| Skandinaviska Enskilda Banken NY | | | | | | | | |

| 0.250%, 08/25/14 | | | 15,000 | | | | 15,000 | |

| Sumitomo Mitsui Banking | | | | | | | | |

| 0.210%, 04/16/14 | | | 10,000 | | | | 10,000 | |

| | | | | | | | | |

| Total Certificates of Deposit | |

| (Cost $190,000) | | | | 190,000 | |

| | | | | | | | | |

| Municipal Bonds [16.0%] | |

| California [8.7%] | |

| California State, Health Facilities Financing Authority, St. Joseph Health System Project, Ser B, RB | | | | | | | | |

| 0.060%, 04/01/14(B) (C) (D) | | | 29,000 | | | | 29,000 | |

| California State, Pollution Control Financing Authority, Pacific Gas & Electric Project, Ser C, RB | | | | | | | | |

| 0.030%, 04/01/14(B) (C) (D) | | | 5,000 | | | | 5,000 | |

| California State, Ser A-2, RAN | | | | | | | | |

| 2.000%, 06/23/14 | | | 15,000 | | | | 15,060 | |

| Los Angeles, Department of Water & Power, Ser B-3, RB | | | | | | | | |

| 0.040%, 04/01/14(C) (D) | | | 13,000 | | | | 13,000 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-1, RB | | | | | | | | |

| 0.050%, 04/03/14(C) (D) | | | 25,000 | | | | 25,000 | |

| | | | | |

| Southern California, Metropolitan Water District, Ser B-3, RB | | | | | | |

| 0.020%, 04/01/14(C) (D) | | $ | 15,000 | | | $ | 15,000 | |

| | | | | | | | | |

| Total California | | | | 102,060 | |

| | | | | | | | | |

| Illinois [1.1%] | |

| Chicago, Midway Airport Authority, Ser B, RB, AMT | | | | | | | | |

| 0.060%, 04/01/14(B) (C) (D) | | | 12,600 | | | | 12,600 | |

| | | | | | | | | |

| North Carolina [1.3%] | |

| Charlotte, Water and Sewer System, Ser B, RB | | | | | | | | |

| 0.060%, 04/03/14(C) (D) | | | 15,900 | | | | 15,900 | |

| | | | | | | | | |

| Ohio [1.5%] | |

| Ohio State, Higher Educational Facility Commission, Cleveland Clinic Project, Ser B-4, RB | | | | | | | | |

| 0.040%, 04/01/14(C) (D) | | | 17,485 | | | | 17,485 | |

| | | | | | | | | |

| Texas [3.4%] | |

| Lower Neches Valley Authority Industrial Development, Exxon-Mobil Project, RB | | | | | | | | |

| 0.040%, 04/01/14(C) (D) | | | 24,102 | | | | 24,102 | |

| Lower Neches Valley, Industrial Development Authority, Exxon Mobil Project, RB | | | | | | | | |

| 0.040%, 04/01/14(C) (D) | | | 16,700 | | | | 16,700 | |

| | | | | | | | | |

| Total Texas | | | | 40,802 | |

| | | | | | | | | |

| Total Municipal Bonds | |

| (Cost $188,847) | | | | 188,847 | |

| | | | | | | | | |

| U.S. Treasury Obligations [10.3%] | |

| U.S. Treasury Bill | | | | | | | | |

| 0.001%, 04/03/14(E) | | | 60,000 | | | | 60,000 | |

| U.S. Treasury Note | | | | | | | | |

| 4.250%, 08/15/14 | | | 30,000 | | | | 30,464 | |

| 4.250%, 11/15/14 | | | 30,000 | | | | 30,771 | |

| | | | | | | | | |

| Total U.S. Treasury Obligations | |

| (Cost $121,235) | | | | 121,235 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 8

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Prime Money Market Fund (concluded)

| | | | | |

| Repurchase Agreements (F) [7.6%] | |

| Bank of America | | | | | | |

| 0.050%, dated 03/31/14, repurchased on 04/01/14, repurchase price $21,000,029 (collateralized by various U.S. Government obligations, par values ranging from $5,294,000 to $20,000,000, 0.000% - 3.000%, 01/15/21 to 03/01/28; with a total market value $21,414,254) | | $ | 21,000 | | | $ | 21,000 | |

| Barclays | | | | | | | | |

| 0.060%, dated 03/31/14, repurchased on 04/01/14, repurchase price $18,000,030 (collateralized by a U.S. Treasury Note, par value $18,500,000, 1.375%, 09/30/18; with a total market value $18,400,000) | | | 18,000 | | | | 18,000 | |

| Deutsche Bank | | | | | | | | |

| 0.050%, dated 03/31/14, repurchased on 04/01/14, repurchase price $25,000,035 (collateralized by various U.S. Treasury Notes, par values ranging from $5,162,500 to $11,000,000 0.000% - 1.750%, 07/10/14 to 05/15/23; with a total market value $25,545,532) | | | 25,000 | | | | 25,000 | |

| Deutsche Bank | | | | | | | | |

| 0.080%, dated 03/31/14, repurchased on 04/01/14, repurchase price $25,000,056 (collateralized by various U.S. Government obligations, par values ranging from $1,000 to $11,300,000, 0.000% - 1.625%, 11/06/14 to 10/15/20; with a total market value $25,504,867) | | | 25,000 | | | | 25,000 | |

| | | | | | | | | |

| Total Repurchase Agreements | |

| (Cost $89,000) | | | | 89,000 | |

| | | | | | |

| Short-Term Investment [0.8%] | |

| SEI Daily Income Trust, Prime Obligation Fund, Cl A, 0.010%* | | | 9,662,678 | | | $ | 9,663 | |

| | | | | | | | | |

| Total Short-Term Investment | |

| (Cost $9,663) | | | | 9,663 | |

| | | | | | | | | |

| Total Investments [99.9%] | |

| (Cost $1,176,181) | | | $ | 1,176,181 | |

Percentages are based on Net Assets of $1,176,835 (000).

| * | The rate reported is the 7-day effective yield as of March 31, 2014. |

| (A) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2014, the value of these securities amounted to $362,202 (000), representing 30.8% of the net assets of the Fund. |

| (B) | Securities are held in conjunction with a letter of credit from a major bank or financial institution. |

| (C) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2014. |

| (D) | Put and Demand Feature — The date reported is the next reset date or put date. |

| (E) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

| (F) | Tri-Party Repurchase Agreement. |

AMT — Alternative Minimum Tax (subject to)

Cl — Class

NY — New York

NZ — New Zealand

RAN — Revenue Anticipation Note

RB — Revenue Bond

Ser — Series

The following is a summary of the inputs used as of March 31, 2014 in valuing the Fund’s investments carried at value (000).

| Investments in Securities | | | | | | | | | | | | |

| Commercial Paper | | $ | — | | | $ | 577,436 | | | $ | — | | | $ | 577,436 | |

| Certificates of Deposit | | | — | | | | 190,000 | | | | — | | | | 190,000 | |

| Municipal Bonds | | | — | | | | 188,847 | | | | — | | | | 188,847 | |

| U.S. Treasury Obligations | | | — | | | | 121,235 | | | | — | | | | 121,235 | |

| Repurchase Agreements | | | — | | | | 89,000 | | | | — | | | | 89,000 | |

| Short-Term Investment | | | 9,663 | | | | — | | | | — | | | | 9,663 | |

| Total Investments in Securities | | $ | 9,663 | | | $ | 1,166,518 | | | $ | — | | | $ | 1,176,181 | |

For the period ended March 31, 2014, there have been no transfers between Level 1 and Level 2 assets and liabilities. Transfers between Levels are recognized at period end.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 9

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale California Tax Exempt Money Market Fund

| | | | | |

| Municipal Bonds [81.9%] | |

| California [75.7%] | |

| Bay Area Toll Authority, Ser A-2, RB | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | $ | 16,700 | | | $ | 16,700 | |

| Bay Area Toll Authority, Ser C-1, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | | 14,445 | | | | 14,445 | |

| Bay Area Toll Authority, Ser C-2, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | | 4,190 | | | | 4,190 | |

| California State University, Ser A, RB, AGM | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.000%, 05/01/14(D) | | | 3,800 | | | | 3,815 | |

| California State, GO | | | | | | | | |

| 5.250%, 04/01/14 | | | 1,000 | | | | 1,000 | |

| California State, Health Facilities Financing Authority, Adventis Health System Project, Ser A, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | | 2,600 | | | | 2,600 | |

| California State, Health Facilities Financing Authority, Adventis Health System Project, Ser B, RB | | | | | | | | |

| 0.030%, 04/01/14(A) (B) (C) | | | 8,380 | | | | 8,380 | |

| California State, Health Facilities Financing Authority, Health Facility Catholic Project, Ser B, RB | | | | | | | | |

| 0.050%, 04/02/14(A) (B) (C) | | | 2,450 | | | | 2,450 | |

| California State, Health Facilities Financing Authority, Health Facility Catholic Project, Ser I, RB | | | | | | | | |

| 0.050%, 04/02/14(A) (B) (C) | | | 3,900 | | | | 3,900 | |

| | | | | |

| California State, Health Facilities Financing Authority, Scripps Health Project, Ser A, RB | | | | | | |

| 0.050%, 04/02/14(A) (B) (C) | | $ | 2,085 | | | $ | 2,085 | |

| California State, Health Facilities Financing Authority, Scripps Health Project, Ser C, RB | | | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | | 8,650 | | | | 8,650 | |

| California State, Kindergarten Project, Ser A-1, GO | | | | | | | | |

| 0.030%, 04/01/14(A) (B) (C) | | | 1,540 | | | | 1,540 | |

| California State, Kindergarten Project, Ser A-2, GO | | | | | | | | |

| 0.040%, 04/01/14(A) (B) (C) | | | 19,085 | | | | 19,085 | |

| California State, Kindergarten Project, Ser A-3, GO | | | | | | | | |

| 0.050%, 04/01/14(A) (B) (C) | | | 16,360 | | | | 16,360 | |

| California State, Kindergarten Project, Ser A-8, GO | | | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | | 15,400 | | | | 15,400 | |

| California State, Kindergarten Project, Ser B-1, GO | | | | | | | | |

| 0.030%, 04/01/14(A) (B) (C) | | | 3,100 | | | | 3,100 | |

| California State, Kindergarten Project, Ser B-2, GO | | | | | | | | |

| 0.070%, 04/01/14(A) (B) (C) | | | 5,800 | | | | 5,800 | |

| California State, Municipal Finance Authority, Chevron USA Recovery Zone Project, RB | | | | | | | | |

| 0.050%, 04/01/14(A) (C) | | | 10,100 | | | | 10,100 | |

| California State, Public Works Board, Department of Mental Health Project, Ser A, RB | | | | | | | | |

| Pre-Refunded @ 100 | | | | | | | | |

| 5.500%, 06/01/14(D) | | | 2,600 | | | | 2,624 | |

| California State, Public Works Board, University of California Research Project, Ser L, RB, NATL-RE, ETM | | | | | | | | |

| 5.250%, 11/01/14 | | | 1,000 | | | | 1,030 | |

| California State, Ser A-1, RAN | | | | | | | | |

| 2.000%, 05/28/14 | | | 5,500 | | | | 5,516 | |

| California State, Ser A-2, RAN | | | | | | | | |

| 2.000%, 06/23/14 | | | 23,500 | | | | 23,594 | |

| California State, Ser B-4, GO | | | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | | 1,900 | | | | 1,900 | |

| California State, Sub-Ser A-1, GO | | | | | | | | |

| 0.050%, 04/02/14(A) (B) (C) | | | 7,500 | | | | 7,500 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 10

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale California Tax Exempt Money Market Fund (continued)

| | | | | |

| California State, Sub-Ser A-2, GO | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | $ | 1,500 | | | $ | 1,500 | |

| California Statewide, Communities Development Authority, Kaiser Permanente Project, Ser D, RB | | | | | | | | |

| 0.040%, 04/02/14(A) (C) | | | 25,000 | | | | 25,000 | |

| California Statewide, Communities Development Authority, Masters College Project, Ser A, RB | | | | | | | | |

| 0.080%, 04/03/14(A) (B) (C) | | | 3,000 | | | | 3,000 | |

| East Bay, Municipal Utility District, Ser A-3, RB | | | | | | | | |

| 0.050%, 04/02/14(A) (C) | | | 10,000 | | | | 10,000 | |

| East Bay, Municipal Utility District, Sub-Ser C, RB | | | | | | | | |

| 0.060%, 04/02/14(A) (C) | | | 7,000 | | | | 7,000 | |

| Eastern Municipal Water District, Ser C, COP | | | | | | | | |

| 0.060%, 04/02/14(A) (C) | | | 26,475 | | | | 26,475 | |

| Eastern Municipal Water District, Ser D, COP | | | | | | | | |

| 0.060%, 04/02/14(A) (C) | | | 13,200 | | | | 13,200 | |

| Elsinore Valley, Municipal Water District, Ser A, COP | | | | | | | | |

| 0.070%, 04/02/14(A) (B) (C) | | | 3,240 | | | | 3,240 | |

| Elsinore Valley, Municipal Water District, Ser B, COP | | | | | | | | |

| 0.070%, 04/02/14(A) (B) (C) | | | 2,500 | | | | 2,500 | |

| Fresno County, TRAN | | | | | | | | |

| 1.250%, 06/30/14 | | | 5,000 | | | | 5,013 | |

| Irvine Ranch, Water District, SAB | | | | | | | | |

| 0.060%, 04/03/14(A) (B) (C) | | | 4,600 | | | | 4,600 | |

| Irvine Ranch, Water District, Ser B, SAB | | | | | | | | |

| 0.070%, 04/01/14(A) (B) (C) | | | 4,725 | | | | 4,725 | |

| Irvine, California, Ser A, SAB | | | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | | 5,000 | | | | 5,000 | |

| Los Angeles County, Metropolitan Transportation Authority, Ser A1, RB | | | | | | | | |

| 0.060%, 04/03/14(A) (C) | | | 36,180 | | | | 36,180 | |

| Los Angeles, Department of Water & Power, Ser A-5, RB | | | | | | | | |

| 0.040%, 04/03/14(A) (C) | | | 5,000 | | | | 5,000 | |

| Los Angeles, Department of Water & Power, Sub-Ser A-3, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 2,500 | | | | 2,500 | |

| | | | | |

| Los Angeles, Department of Water & Power, Sub-Ser A-8, RB | | | | | | |

| 0.060%, 04/03/14(A) (C) | | $ | 3,000 | | | $ | 3,000 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-1, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 7,250 | | | | 7,250 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-2, RB | | | | | | | | |

| 0.070%, 04/01/14(A) (C) | | | 34,900 | | | | 34,900 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-4, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 4,075 | | | | 4,075 | |

| Los Angeles, Department of Water & Power, Sub-Ser B-6, RB | | | | | | | | |

| 0.070%, 04/01/14(A) (C) | | | 23,200 | | | | 23,200 | |

| Metropolitan Water District of Southern California, Ser A-1, RB | | | | | | | | |

| 0.080%, 04/03/14(A) (C) | | | 10,000 | | | | 10,000 | |

| Metropolitan Water District of Southern California, Ser A-1, RB | | | | | | | | |

| 0.040%, 04/03/14(A) (C) | | | 1,520 | | | | 1,520 | |

| Metropolitan Water District of Southern California, Ser A-2, RB | | | | | | | | |

| 0.070%, 04/03/14(A) (C) | | | 11,000 | | | | 11,000 | |

| Metropolitan Water District of Southern California, Ser A-3, RB | | | | | | | | |

| 0.080%, 04/03/14(A) (C) | | | 11,000 | | | | 11,000 | |

| Metropolitan Water District of Southern California, Ser D, RB | | | | | | | | |

| 0.040%, 04/03/14(A) (C) | | | 3,800 | | | | 3,800 | |

| Orange County, Apartment Development Authority, Riverbend Apartments Project, Ser B, RB | | | | | | | | |

| 0.060%, 04/03/14(A) (C) | | | 10,000 | | | | 10,000 | |

| Orange County, Water District Authority, Ser A, COP | | | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | | 25,350 | | | | 25,350 | |

| Riverside County, Public Facilities Authority, Ser C, COP | | | | | | | | |

| 0.050%, 04/02/14(A) (B) (C) | | | 3,200 | | | | 3,200 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 11

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale California Tax Exempt Money Market Fund (continued)

| | | | | |

| Riverside County, Water Authority, Ser A, RB | | | | | | |

| 0.080%, 04/03/14(A) (C) | | $ | 33,140 | | | $ | 33,140 | |

| San Diego County, Regional Transportation Commission, Ser B, RB | | | | | | | | |

| 0.070%, 04/03/14(A) (C) | | | 9,180 | | | | 9,180 | |

| San Diego County, Regional Transportation Commission, Ser D, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 12,390 | | | | 12,390 | |

| San Diego County, School District, Ser A, TRAN | | | | | | | | |

| 2.000%, 06/30/14 | | | 2,500 | | | | 2,511 | |

| San Francisco City & County, Airports Commission, Ser 37C, RB | | | | | | | | |

| 0.060%, 04/02/14(A) (B) (C) | | | 15,900 | | | | 15,900 | |

| San Francisco City & County, Finance Authority, Moscone Center Project, Ser 2008-1, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (B) (C) | | | 2,810 | | | | 2,810 | |

| San Francisco, Bay Area Rapid Transit District, Election 2004, Ser C, GO | | | | | | | | |

| 2.000%, 08/01/14 | | | 4,455 | | | | 4,483 | |

| Santa Barbara County, Ser A, TRAN | | | | | | | | |

| 2.000%, 06/30/14 | | | 5,000 | | | | 5,022 | |

| Santa Clara County, Financing Authority, VMC Facility Replacement Project, Ser B, RB | | | | | | | | |

| 0.060%, 04/02/14(A) (C) | | | 13,820 | | | | 13,820 | |

| Santa Clara Valley, Transportation Authority, Ser C, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 24,300 | | | | 24,300 | |

| Santa Clara Valley, Transportation Authority, Ser C, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 995 | | | | 995 | |

| Santa Clara Valley, Transportation Authority, Ser D, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 14,000 | | | | 14,000 | |

| Southern California, Public Power Authority, Magnolia Power Project, Ser A-1, RB | | | | | | | | |

| 0.070%, 04/02/14(A) (B) (C) | | | 19,300 | | | | 19,300 | |

| | | | | |

| Southern California, Public Power Authority, Southern Transmission Project, Ser A, RB, AGM | | | | | | |

| 0.060%, 04/02/14(A) (C) | | $ | 35,000 | | | $ | 35,000 | |

| University of California, Ser AL-2, RB | | | | | | | | |

| 0.050%, 04/03/14(A) (C) | | | 5,000 | | | | 5,000 | |

| | | | | | | | | |

| Total California | | | | 682,843 | |

| | | | | | | | | |

| New York [3.4%] | |

| New York City, Municipal Water Finance Authority, RB | | | | | | | | |

| 0.040%, 04/01/14(A) (C) | | | 10,000 | | | | 10,000 | |

| New York City, Municipal Water Finance Authority, Ser DD-1, RB | | | | | | | | |

| 0.040%, 04/01/14(A) (C) | | | 5,010 | | | | 5,010 | |

| New York, New York, Ser A-5, GO | | | | | | | | |

| 0.060%, 04/01/14(A) (C) | | | 16,160 | | | | 16,160 | |

| | | | | | | | | |

| Total New York | | | | 31,170 | |

| | | | | | | | | |

| Texas [2.8%] | |

| Lower Neches Valley, Industrial Development Authority, Exxon Mobil Project, RB | | | | | | | | |

| 0.050%, 04/01/14(A) (C) | | | 13,385 | | | | 13,385 | |

| Lower Neches Valley, Industrial Development Authority, Exxon Mobil Project, RB | | | | | | | | |

| 0.040%, 04/01/14(A) (C) | | | 11,600 | | | | 11,600 | |

| | | | | | | | | |

| Total Texas | | | | 24,985 | |

| | | | | | | | | |

| Total Municipal Bonds | |

| (Cost $738,998) | | | | 738,998 | |

| | | | | | | | | |

| Commercial Paper [18.0%] | |

| California [18.0%] | |

| California State | | | | | | | | |

| 0.080%, 06/03/14 | | | 10,000 | | | | 10,000 | |

| 0.070%, 05/20/14 | | | 5,000 | | | | 5,000 | |

| California State University | | | | | | | | |

| 0.060%, 06/03/14 | | | 5,000 | | | | 5,000 | |

| California State, Department of Water | | | | | | | | |

| 0.080%, 07/03/14 | | | 2,838 | | | | 2,838 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 12

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale California Tax Exempt Money Market Fund (concluded)

| | | | | |

| California State, Educational Facilities Authority | | | | | | |

| 0.130%, 10/16/14 | | $ | 25,000 | | | $ | 25,000 | |

| 0.080%, 05/16/14 | | | 8,121 | | | | 8,121 | |

| California State, Health Facilities Financing Authority, Stanford Hospital Project, Ser B-2, RB | | | | | | | | |

| 0.130%, 06/04/14 | | | 18,550 | | | | 18,550 | |

| Sacramento, Municipal Utility District | | | | | | | | |

| 0.090%, 05/08/14 | | | 10,500 | | | | 10,500 | |

| 0.070%, 07/03/14 | | | 20,000 | | | | 20,000 | |

| San Diego, Water Authority | | | | | | | | |

| 0.090%, 04/03/14 | | | 13,100 | | | | 13,100 | |

| 0.090%, 06/04/14 | | | 10,000 | | | | 10,000 | |

| San Francisco City & County | | | | | | | | |

| 0.080%, 07/02/14 | | | 15,245 | | | | 15,245 | |

| San Francisco City & County, Airport Commission | | | | | | | | |

| 0.070%, 07/09/14 | | | 5,000 | | | | 5,000 | |

| Santa Clara Valley Water District | | | | | | | | |

| 0.070%, 06/02/14 | | | 13,865 | | | | 13,865 | |

| | | | | | | | | |

| Total California | | | | 162,219 | |

| | | | | | | | | |

| Total Commercial Paper | |

| (Cost $162,219) | | | | 162,219 | |

| | | | | | | | | |

| Total Investments [99.9%] | |

| (Cost $901,217) | | | $ | 901,217 | |

Percentages are based on Net Assets of $902,004 (000).

| (A) | Put and Demand Feature — The date reported is the next reset or put date. |

| (B) | Securities are held in conjunction with a letter of credit from a major bank or financial institution. |

| (C) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2014. |

| (D) | Pre-Refunded Security — The maturity date shown is the pre-refunded date. |

AGM — Assured Guarantee Municipal

COP — Certificate of Participation

ETM — Escrowed to Maturity

GO — General Obligation

NATL-RE — National Public Finance Guarantee Corporation

RAN — Revenue Anticipation Note

RB — Revenue Bond

SAB — Special Assessment Board

Ser — Series

TRAN — Tax and Revenue Anticipation Note

As of March 31, 2014, all of the Fund’s investments are Level 2, in accordance with the authoritative guidance on the fair value measurements and disclosure under U.S. GAAP.

For the period ended March 31, 2014, there have been no transfers between Level 1 and Level 2 assets and liabilities. Transfers between Levels are recognized at period end.

For more information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 13

schedule of investments

March 31, 2014 (Unaudited)

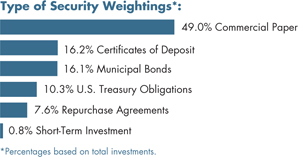

City National Rochdale Limited Maturity Fixed Income Fund

| | | | | |

| Corporate Bonds [45.9%] | |

| Banks [20.8%] | |

| Barclays Bank, MTN | | | | | | |

| 2.638%, 01/10/14(A) | | $ | 545 | | | $ | 545 | |

| Citigroup | | | | | | | | |

| 5.850%, 08/02/16 | | | 975 | | | | 1,076 | |

| Deutsche Bank | | | | | | | | |

| 3.250%, 01/11/16 | | | 900 | | | | 937 | |

| Goldman Sachs Group | | | | | | | | |

| 5.125%, 01/15/15 | | | 900 | | | | 932 | |

| Korea Development Bank | | | | | | | | |

| 3.250%, 03/09/16 | | | 575 | | | | 599 | |

| Morgan Stanley | | | | | | | | |

| 5.375%, 10/15/15 | | | 900 | | | | 959 | |

| Wachovia | | | | | | | | |

| 5.750%, 06/15/17 | | | 900 | | | | 1,023 | |

| | | | | | | | | |

| Total Banks | | | | 6,071 | |

| | | | | | | | | |

| Diversified Operations [3.4%] | |

| Glencore Funding | | | | | | | | |

| 1.700%, 05/27/16(B) | | | 1,000 | | | | 1,003 | |

| | | | | | | | | |

| Financial Services [3.4%] | |

| General Electric Capital, MTN | | | | | | | | |

| 2.950%, 05/09/16 | | | 950 | | | | 990 | |

| | | | | | | | | |

| Investment Banker/Broker Dealer [3.7%] | |

| Merrill Lynch, MTN | | | | | | | | |

| 6.400%, 08/28/17 | | | 940 | | | | 1,079 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels [3.4%] | |

| ConocoPhillips Canada Funding I | | | | | | | | |

| 5.625%, 10/15/16 | | | 900 | | | | 1,005 | |

| | | | | |

| Petroleum & Fuel Products [3.3%] | |

| Occidental Petroleum | | | | | | |

| 1.750%, 02/15/17 | | $ | 940 | | | $ | 953 | |

| | | | | | | | | |

| Telephones & Telecommunications [7.9%] | |

| America Movil | | | | | | | | |

| 1.234%, 03/12/14(A) | | | 1,000 | | | | 1,011 | |

| AT&T | | | | | | | | |

| 2.400%, 08/15/16 | | | 1,000 | | | | 1,030 | |

| Verizon Communications | | | | | | | | |

| 1.763%, 03/17/14(A) | | | 250 | | | | 257 | |

| | | | | | | | | |

| Total Telephones & Telecommunications | | | | 2,298 | |

| | | | | | | | | |

| Total Corporate Bonds | |

| (Cost $13,254) | | | | 13,399 | |

| | | | | | | | | |

| U.S. Government Agency Obligations [25.4%] | |

| FHLB | | | | | | | | |

| 0.500%, 11/20/15 | | | 580 | | | | 581 | |

| FHLMC | | | | | | | | |

| 4.375%, 07/17/15 | | | 1,800 | | | | 1,896 | |

| FNMA | | | | | | | | |

| 5.000%, 03/15/16 | | | 1,175 | | | | 1,279 | |

| 0.500%, 07/02/15 | | | 1,500 | | | | 1,506 | |

| 0.500%, 03/30/16 | | | 1,200 | | | | 1,201 | |

| 0.175%, 01/16/14(A) | | | 940 | | | | 940 | |

| | | | | | | | | |

| Total U.S. Government Agency Obligations | | | | | |

| (Cost $7,375) | | | | 7,403 | |

| | | | | | | | | |

| U.S. Treasury Obligations [10.1%] | |

| U.S. Treasury Note | | | | | | | | |

| 4.250%, 08/15/15 | | | 560 | | | | 591 | |

| 3.125%, 10/31/16 | | | 625 | | | | 664 | |

| 2.000%, 01/31/16 | | | 750 | | | | 772 | |

| 1.000%, 08/31/16 | | | 900 | | | | 908 | |

| | | | | | | | | |

| Total U.S. Treasury Obligations | |

| (Cost $2,919) | | | | 2,935 | |

| | | | | | | | | |

| U.S. Government Mortgage-Backed Obligations [4.7%] | |

| FHLMC, Pool G12806 | | | | | | | | |

| 5.500%, 09/01/22 | | | 59 | | | | 64 | |

| FHLMC, Pool G18247 | | | | | | | | |

| 5.000%, 04/01/23 | | | 36 | | | | 39 | |

| FHLMC, Pool G18251 | | | | | | | | |

| 5.000%, 05/01/23 | | | 55 | | | | 60 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 14

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Limited Maturity Fixed Income Fund (continued)

| | | | | |

| FHLMC, Pool G18321 | | | | | | |

| 4.500%, 08/01/24 | | $ | 28 | | | $ | 30 | |

| FHLMC, Pool J04241 | | | | | | | | |

| 5.500%, 01/01/22 | | | 27 | | | | 29 | |

| FHLMC, Pool J04459 | | | | | | | | |

| 5.000%, 03/01/22 | | | 29 | | | | 31 | |

| FHLMC, Pool J04508 | | | | | | | | |

| 5.000%, 03/01/22 | | | 31 | | | | 33 | |

| FHLMC, Pool J07575 | | | | | | | | |

| 5.000%, 04/01/23 | | | 27 | | | | 29 | |

| FHLMC REMIC, Ser 2011-3877, Cl ND, | | | | | | | | |

| 3.000%, 02/15/25 | | | 479 | | | | 499 | |

| FNMA, Pool 837196 | | | | | | | | |

| 5.500%, 02/01/21 | | | 59 | | | | 64 | |

| FNMA, Pool 933915 | | | | | | | | |

| 4.500%, 06/01/23 | | | 39 | | | | 42 | |

| FNMA, Pool 961783 | | | | | | | | |

| 4.500%, 02/01/23 | | | 58 | | | | 61 | |

| FNMA REMIC, Ser 2010-39, Cl PD, | | | | | | | | |

| 3.000%, 06/25/38 | | | 371 | | | | 380 | |

| | | | | | | | | |

| Total U.S. Government Mortgage-Backed Obligations | | | | | |

| (Cost $1,299) | | | | 1,361 | |

| | | | | | | | | |

| Municipal Bonds [5.6%] | |

| California [2.4%] | |

| Southern California, Public Power Authority, Sub-Ser B, RB, AGM, ETM | | | | | | | | |

| 6.930%, 05/15/17 | | | 595 | | | | 688 | |

| | | | | | | | | |

| Florida [3.2%] | |

| Florida State, Hurricane Catastrophe Fund Finance, Ser A, RB | | | | | | | | |

| 2.107%, 07/01/18 | | | 930 | | | | 935 | |

| | | | | | | | | |

| Total Municipal Bonds | |

| (Cost $1,607) | | | | 1,623 | |

| | | | | | | | | |

| Sovereign Debt [3.3%] | |

| Province of Ontario, Canada | | | | | | | | |

| 1.600%, 09/21/16 | | | 950 | | | | 967 | |

| | | | | | | | | |

| Total Sovereign Debt | |

| (Cost $962) | | | | 967 | |

| | | | | |

| Asset-Backed Security [3.1%] | |

| Hyundai Auto Receivables Trust, Ser 2013-B, Cl A2 | | | | | | |

| 0.530%, 03/15/16 | | $ | 896 | | | $ | 897 | |

| | | | | | | | | |

| Total Asset-Backed Security | |

| (Cost $896) | | | | 897 | |

| | | | | | | | | |

| Short-Term Investments [1.5%] | |

| City National Rochdale Government Money Market Fund, 0.010%*† | | | 219,880 | | | | 220 | |

| SEI Daily Income Trust Government Fund, Cl A, 0.010%* | | | 219,880 | | | | 220 | |

| | | | | | | | | |

| Total Short-Term Investments | |

| (Cost $440) | | | | 440 | |

| | | | | | | | | |

| Total Investments [99.6%] | |

| (Cost $28,752) | | | $ | 29,025 | |

Percentages are based on Net Assets of $29,156 (000).

| * | The rate reported is the 7-day effective yield as of March 31, 2014. |

| † | Investment in Affiliate. |

| (A) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2014. |

| (B) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutions. On March 31, 2014, the value of these securities amounted to $1,003 (000), representing 3.4% of the net assets of the Fund. |

AGM — Assured Guarantee Municipal

Cl — Class

ETM — Escrowed to Maturity

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

MTN — Medium Term Note

RB — Revenue Bond

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 15

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Limited Maturity Fixed Income Fund (concluded)

The following is a list of the inputs used as of March 31, 2014 in valuing the Fund’s investments carried at value (000):

| Investments in Securities | | | | | | | | | | | | |

| Corporate Bonds | | $ | — | | | $ | 13,399 | | | $ | — | | | $ | 13,399 | |

| U.S. Government Agency Obligations | | | — | | | | 7,403 | | | | — | | | | 7,403 | |

| U.S. Treasury Obligations | | | — | | | | 2,935 | | | | — | | | | 2,935 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 1,361 | | | | — | | | | 1,361 | |

| Municipal Bonds | | | — | | | | 1,623 | | | | — | | | | 1,623 | |

| Sovereign Debt | | | — | | | | 967 | | | | — | | | | 967 | |

| Asset-Backed Security | | | — | | | | 897 | | | | — | | | | 897 | |

| Short-Term Investments | | | 440 | | | | — | | | | — | | | | 440 | |

| Total Investments in Securities | | $ | 440 | | | $ | 28,585 | | | $ | — | | | $ | 29,025 | |

For the period ended March 31, 2014, there have been no transfers between any of the fair value hierarchy levels. Transfers between Levels are recognized at period end.

For information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 16

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Government Bond Fund

| | | | | |

| U.S. Government Agency Obligations [74.5%] | |

| Egypt Government AID Bond | | | | | | |

| 4.450%, 09/15/15 | | $ | 8,000 | | | $ | 8,472 | |

| FFCB | | | | | | | | |

| 0.239%, 01/26/14(A) | | | 10,000 | | | | 9,983 | |

| FHLB | | | | | | | | |

| 3.250%, 09/12/14 | | | 3,000 | | | | 3,043 | |

| 1.150%, 07/25/18 | | | 1,520 | | | | 1,475 | |

| 1.000%, 06/09/17 | | | 6,675 | | | | 6,654 | |

| 0.683%, 01/08/14(A) | | | 8,000 | | | | 8,001 | |

| 0.500%, 11/20/15 | | | 4,930 | | | | 4,939 | |

| FHLMC | | | | | | | | |

| 1.250%, 05/12/17 | | | 2,350 | | | | 2,368 | |

| 1.000%, 06/29/17 | | | 4,000 | | | | 3,986 | |

| 1.000%, 09/29/17 | | | 4,325 | | | | 4,290 | |

| FNMA | | | | | | | | |

| 5.000%, 03/15/16 | | | 5,475 | | | | 5,961 | |

| 5.000%, 02/13/17 | | | 5,395 | | | | 6,021 | |

| 4.875%, 12/15/16 | | | 5,000 | | | | 5,544 | |

| 2.375%, 04/11/16 | | | 5,000 | | | | 5,189 | |

| 1.875%, 02/19/19 | | | 445 | | | | 447 | |

| 1.625%, 11/27/18 | | | 5,000 | | | | 4,980 | |

| 1.000%, 10/16/17 | | | 7,000 | | | | 6,911 | |

| 0.875%, 05/21/18 | | | 4,500 | | | | 4,378 | |

| 0.625%, 08/26/16 | | | 5,000 | | | | 4,997 | |

| 0.175%, 01/15/14(A) | | | 10,000 | | | | 10,000 | |

| Israel Government AID Bond | | | | | | | | |

| 3.815%, 05/15/20(B) | | | 15,528 | | | | 13,326 | |

| Tennessee Valley Authority, Ser E | | | | | | | | |

| 6.250%, 12/15/17 | | | 8,000 | | | | 9,388 | |

| | | | | | | | | |

| Total U.S. Government Agency Obligations | | | | | |

| (Cost $129,180) | | | | 130,353 | |

| | | | | | | | | |

| U.S. Treasury Obligations [22.1%] | |

| U.S. Treasury Bond | | | | | | | | |

| 2.625%, 02/29/16 | | | 5,000 | | | | 5,212 | |

| U.S. Treasury Notes | | | | | | | | |

| 3.250%, 05/31/16 | | | 5,000 | | | | 5,298 | |

| 3.000%, 02/28/17 | | | 2,415 | | | | 2,563 | |

| 2.875%, 03/31/18 | | | 5,000 | | | | 5,295 | |

| | | | | |

| 2.750%, 02/28/18 | | $ | 5,000 | | | $ | 5,271 | |

| 1.375%, 11/30/15 to 09/30/18 | | | 10,500 | | | | 10,553 | |

| 0.875%, 02/28/17 | | | 4,500 | | | | 4,500 | |

| | | | | | | | | |

| Total U.S. Treasury Obligations | |

| (Cost $38,800) | | | | 38,692 | |

| | | | | | | | | |

| U.S. Government Mortgage-Backed Obligations [2.0%] | |

| FHLMC REMIC, Ser 2011-3877, Cl ND, | | | | | | | | |

| 3.000%, 02/15/25 | | | 1,902 | | | | 1,980 | |

| FNMA ARM, Pool 766620 | | | | | | | | |

| 2.419%, 01/01/14(A) | | | 214 | | | | 229 | |

| FNMA REMIC, Ser 2011-144, Cl CE, | | | | | | | | |

| 1.250%, 06/25/35 | | | 780 | | | | 782 | |

| GNMA, Pool 329656 | | | | | | | | |

| 8.000%, 08/15/22 | | | 5 | | | | 5 | |

| GNMA, Pool 376533 | | | | | | | | |

| 7.500%, 06/15/24 | | | 2 | | | | 2 | |

| GNMA, Pool 398660 | | | | | | | | |

| 7.500%, 05/15/26 | | | 2 | | | | 2 | |

| GNMA, Pool 497411 | | | | | | | | |

| 6.000%, 01/15/29 | | | 5 | | | | 5 | |

| GNMA, Pool 571376 | | | | | | | | |

| 7.000%, 12/15/16 | | | 4 | | | | 4 | |

| GNMA, Pool 584992 | | | | | | | | |

| 7.500%, 04/15/32 | | | 28 | | | | 31 | |

| GNMA ARM, Pool G2 81318 | | | | | | | | |

| 1.625%, 01/01/14(A) | | | 291 | | | | 303 | |

| GNMA ARM, Pool G2 81447 | | | | | | | | |

| 1.625%, 01/01/14(A) | | | 60 | | | | 63 | |

| | | | | | | | | |

| Total U.S. Government Mortgage-Backed Obligations | | | | | |

| (Cost $3,291) | | | | 3,406 | |

| | | | | | | | | |

| Short-Term Investments [0.9%] | |

| City National Rochdale Government Money Market Fund, 0.010%*† | | | 800,857 | | | | 801 | |

| SEI Daily Income Trust Government Fund, Cl A, 0.010%* | | | 800,857 | | | | 801 | |

| | | | | | | | | |

| Total Short-Term Investments | |

| (Cost $1,602) | | | | 1,602 | |

| | | | | | | | | |

| Total Investments [99.5%] | |

| (Cost $172,873) | | | $ | 174,053 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 17

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Government Bond Fund (concluded)

Percentages are based on Net Assets of $174,937 (000).

| * | The rate reported is the 7-day effective yield as of March 31, 2014. |

| † | Investment in Affiliate. |

| (A) | Floating Rate Security — The rate reported is the rate in effect on March 31, 2014. |

| (B) | Zero coupon security. The rate reported is the effective yield at time of purchase. |

AID — Agency for International Development

ARM — Adjustable Rate Mortgage

Cl — Class

FFCB — Federal Farm Credit Bank

FHLB — Federal Home Loan Bank

FHLMC — Federal Home Loan Mortgage Corporation

FNMA — Federal National Mortgage Association

GNMA — Government National Mortgage Association

REMIC — Real Estate Mortgage Investment Conduit

Ser — Series

The following is a list of the inputs used as of March 31, 2014 in valuing the Fund’s investments carried at value (000):

| Investments in Securities | | | | | | | | | | | | |

| U.S. Government Agency Obligations | | $ | — | | | $ | 130,353 | | | $ | — | | | $ | 130,353 | |

| U.S. Treasury Obligations | | | — | | | | 38,692 | | | | — | | | | 38,692 | |

| U.S. Government Mortgage-Backed Obligations | | | — | | | | 3,406 | | | | — | | | | 3,406 | |

| Short-Term Investments | | | 1,602 | | | | — | | | | — | | | | 1,602 | |

| Total Investments in Securities | | $ | 1,602 | | | $ | 172,451 | | | $ | — | | | $ | 174,053 | |

For the period ended March 31, 2014, there have been no transfers between any of the fair value hierarchy levels. Transfers between Levels are recognized at period end.

For information on valuation inputs, see Note 2 — Significant Accounting Policies in the Notes to Financial Statements.

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 18

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Corporate Bond Fund

| | | | | |

| Corporate Bonds [89.8%] | |

| Banks [10.9%] | |

| Bank of America, MTN | | | | | | |

| 6.400%, 08/28/17 | | $ | 400 | | | $ | 459 | |

| Barclays Bank, MTN | | | | | | | | |

| 2.638%, 01/10/14(A) | | | 1,950 | | | | 1,950 | |

| Citigroup | | | | | | | | |

| 5.850%, 08/02/16 | | | 980 | | | | 1,082 | |

| 5.500%, 02/15/17 | | | 250 | | | | 276 | |

| Countrywide Financial | | | | | | | | |

| 6.250%, 05/15/16 | | | 1,200 | | | | 1,316 | |

| HSBC Finance | | | | | | | | |

| 5.250%, 04/15/15 | | | 1,250 | | | | 1,306 | |

| JPMorgan Chase | | | | | | | | |

| 6.300%, 04/23/19 | | | 2,000 | | | | 2,351 | |

| 6.000%, 01/15/18 | | | 405 | | | | 465 | |

| National Australia Bank, MTN | | | | | | | | |

| 2.750%, 03/09/17 | | | 480 | | | | 500 | |

| Nordea Bank | | | | | | | | |

| 2.250%, 03/20/15(B) | | | 500 | | | | 509 | |

| UBS, MTN | | | | | | | | |

| 5.875%, 12/20/17 | | | 2,000 | | | | 2,291 | |

| Wells Fargo Bank | | | | | | | | |

| 5.750%, 05/16/16 | | | 2,400 | | | | 2,639 | |

| | | | | | | | | |

| Total Banks | | | | 15,144 | |

| | | | | |

| Broadcasting & Cable [1.6%] | |

| Time Warner Cable | | | | | | |

| 5.000%, 02/01/20 | | $ | 2,000 | | | $ | 2,184 | |

| | | | | | | | | |

| Coatings/Paint [1.1%] | |

| Sherwin-Williams | | | | | | | | |

| 3.125%, 12/15/14 | | | 1,450 | | | | 1,476 | |

| | | | | | | | | |

| Computers-Memory Devices [0.8%] | |

| NetApp | | | | | | | | |

| 2.000%, 12/15/17 | | | 1,000 | | | | 1,011 | |

| | | | | | | | | |

| Diversified Metals & Mining [1.8%] | |

| Rio Tinto | | | | | | | | |

| 2.250%, 09/20/16 | | | 2,500 | | | | 2,570 | |

| | | | | | | | | |

| Diversified Minerals [3.5%] | |

| BHP Billiton | | | | | | | | |

| 5.250%, 12/15/15 | | | 2,377 | | | | 2,567 | |

| Teck Resources | | | | | | | | |

| 3.150%, 01/15/17 | | | 1,250 | | | | 1,296 | |

| 2.500%, 02/01/18 | | | 1,000 | | | | 1,004 | |

| | | | | | | | | |

| Total Diversified Minerals | | | | 4,867 | |

| | | | | | | | | |

| Diversified Operations [2.7%] | |

| Glencore Funding | | | | | | | | |

| 1.700%, 05/27/16(B) | | | 1,500 | | | | 1,505 | |

| Siemens Finc | | | | | | | | |

| 5.750%, 10/17/16(B) | | | 2,000 | | | | 2,235 | |

| | | | | | | | | |

| Total Diversified Operations | | | | 3,740 | |

| | | | | | | | | |

| Drugs [2.9%] | |

| AbbVie | | | | | | | | |

| 1.200%, 11/06/15 | | | 1,000 | | | | 1,009 | |

| GlaxoSmithKline Capital | | | | | | | | |

| 5.650%, 05/15/18 | | | 405 | | | | 465 | |

| Wyeth | | | | | | | | |

| 5.500%, 02/15/16 | | | 2,000 | | | | 2,180 | |

| 5.450%, 04/01/17 | | | 330 | | | | 370 | |

| | | | | | | | | |

| Total Drugs | | | | 4,024 | |

| | | | | | | | | |

| Electric Utilities [3.4%] | |

| American Electric Power | | | | | | | | |

| 1.650%, 12/15/17 | | | 1,000 | | | | 994 | |

| Commonwealth Edison | | | | | | | | |

| 6.950%, 07/15/18 | | | 1,000 | | | | 1,171 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 19

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Corporate Bond Fund (continued)

| | | | | |

| Exelon | | | | | | |

| 4.900%, 06/15/15 | | $ | 1,138 | | | $ | 1,190 | |

| Exelon Generation | | | | | | | | |

| 6.200%, 10/01/17 | | | 1,200 | | | | 1,356 | |

| | | | | | | | | |

| Total Electric Utilities | | | | 4,711 | |

| | | | | | | | | |

| Financial Services [16.1%] | |

| American Honda Finance | | | | | | | | |

| 1.600%, 02/16/18(B) | | | 1,000 | | | | 990 | |

| Caisse Centrale Desjardins du Quebec | | | | | | | | |

| 2.650%, 09/16/15(B) | | | 3,000 | | | | 3,085 | |

| Daimler Finance North America | | | | | | | | |

| 2.300%, 01/09/15(B) | | | 1,350 | | | | 1,367 | |

| 1.875%, 09/15/14(B) | | | 1,000 | | | | 1,006 | |

| Ford Motor Credit | | | | | | | | |

| 8.000%, 12/15/16 | | | 1,000 | | | | 1,170 | |

| 2.375%, 01/16/18 | | | 1,000 | | | | 1,008 | |

| General Electric Capital | | | | | | | | |

| 5.300%, 02/11/21 | | | 2,500 | | | | 2,812 | |

| General Electric Capital, MTN | | | | | | | | |

| 2.950%, 05/09/16 | | | 50 | | | | 52 | |

| Harley-Davidson Financial Services, MTN | | | | | | | | |

| 3.875%, 03/15/16(B) | | | 1,000 | | | | 1,053 | |

| Nissan Motor Acceptance, MTN | | | | | | | | |

| 1.950%, 09/12/17(B) | | | 2,000 | | | | 2,009 | |

| PACCAR Financial, MTN | | | | | | | | |

| 0.800%, 02/08/16 | | | 1,500 | | | | 1,501 | |

| Toyota Motor Credit, MTN | | | | | | | | |

| 2.050%, 01/12/17 | | | 2,000 | | | | 2,053 | |

| VW Credit, MTN | | | | | | | | |

| 1.875%, 10/13/16 | | | 3,000 | | | | 3,057 | |

| Western Union | | | | | | | | |

| 5.930%, 10/01/16 | | | 1,000 | | | | 1,107 | |

| | | | | | | | | |

| Total Financial Services | | | | 22,270 | |

| | | | | | | | | |

| Food, Beverage & Tobacco [1.6%] | |

| Anheuser-Busch InBev Worldwide | | | | | | | | |

| 5.375%, 11/15/14 | | | 1,195 | | | | 1,231 | |

| Dr Pepper Snapple Group | | | | | | | | |

| 2.900%, 01/15/16 | | | 1,000 | | | | 1,037 | |

| | | | | | | | | |

| Total Food, Beverage & Tobacco | | | | 2,268 | |

| | | | | |

| Home Decoration Products [0.3%] | |

| Newell Rubbermaid | | | | | | |

| 2.000%, 06/15/15 | | $ | 500 | | | $ | 506 | |

| | | | | | | | | |

| Insurance [4.2%] | |

| Aflac | | | | | | | | |

| 8.500%, 05/15/19 | | | 1,100 | | | | 1,414 | |

| Genworth Financial | | | | | | | | |

| 7.700%, 06/15/20 | | | 1,400 | | | | 1,706 | |

| Metropolitan Life Global Funding I, MTN | | | | | | | | |

| 1.875%, 06/22/18(B) | | | 2,700 | | | | 2,689 | |

| | | | | | | | | |

| Total Insurance | | | | 5,809 | |

| | | | | | | | | |

| Investment Banker/Broker Dealer [8.4%] | |

| Deutsche Bank | | | | | | | | |

| 1.400%, 02/13/17 | | | 2,500 | | | | 2,500 | |

| Goldman Sachs Group | | | | | | | | |

| 5.625%, 01/15/17 | | | 1,700 | | | | 1,877 | |

| 2.625%, 01/31/19 | | | 500 | | | | 499 | |

| Jefferies Group | | | | | | | | |

| 8.500%, 07/15/19 | | | 1,370 | | | | 1,684 | |

| Macquarie Group | | | | | | | | |

| 6.000%, 01/14/20(B) | | | 2,000 | | | | 2,218 | |

| Morgan Stanley, MTN | | | | | | | | |

| 6.250%, 08/28/17 | | | 2,000 | | | | 2,289 | |

| 5.950%, 12/28/17 | | | 465 | | | | 531 | |

| | | | | | | | | |

| Total Investment Banker/Broker Dealer | | | | 11,598 | |

| | | | | | | | | |

| Machinery [0.1%] | |

| Caterpillar Financial Services, MTN | | | | | | | | |

| 1.625%, 06/01/17 | | | 215 | | | | 217 | |

| | | | | | | | | |

| Medical Products & Services [1.9%] | |

| Genentech | | | | | | | | |

| 4.750%, 07/15/15 | | | 2,500 | | | | 2,633 | |

| | | | | | | | | |

| Medical-HMO [0.9%] | |

| UnitedHealth Group | | | | | | | | |

| 4.875%, 03/15/15 | | | 1,205 | | | | 1,256 | |

| | | | | | | | | |

| Metal-Copper [0.7%] | |

| Freeport-McMoRan Copper & Gold | | | | | | | | |

| 1.400%, 02/13/15 | | | 1,000 | | | | 1,006 | |

See accompanying notes to financial statements.

CITY NATIONAL ROCHDALE FUNDS | PAGE 20

schedule of investments

March 31, 2014 (Unaudited)

City National Rochdale Corporate Bond Fund (continued)

| | | | | |

| Petroleum & Fuel Products [8.2%] | |

| BP Capital Markets | | | | | | |

| 1.375%, 05/10/18 | | $ | 2,800 | | | $ | 2,741 | |

| Kinder Morgan Energy Partners | | | | | | | | |

| 6.000%, 02/01/17 | | | 1,000 | | | | 1,114 | |

| Shell International Finance | | | | | | | | |

| 3.250%, 09/22/15 | | | 2,500 | | | | 2,611 | |

| Sunoco Logistics Partners Operations | | | | | | | | |

| 4.650%, 02/15/22 | | | 1,300 | | | | 1,359 | |

| Total Capital International | | | | | | | | |

| 1.550%, 06/28/17 | | | 425 | | | | 429 | |

| 1.500%, 02/17/17 | | | 2,980 | | | | 3,025 | |

| | | | | | | | | |

| Total Petroleum & Fuel Products | | | | 11,279 | |

| | | | | | | | | |

| Real Estate Investment Trusts [5.1%] | |

| American Tower | | | | | | | | |

| 7.250%, 05/15/19 | | | 1,200 | | | | 1,427 | |

| HCP | | | | | | | | |

| 5.625%, 05/01/17 | | | 1,000 | | | | 1,120 | |

| Health Care REIT | | | | | | | | |

| 4.700%, 09/15/17 | | | 1,000 | | | | 1,093 | |

| Kimco Realty | | | | | | | | |

| 6.875%, 10/01/19 | | | 1,080 | | | | 1,286 | |

| Simon Property Group | | | | | | | | |

| 6.100%, 05/01/16 | | | 2,000 | | | | 2,189 | |

| | | | | | | | | |

| Total Real Estate Investment Trusts | | | | 7,115 | |

| | | | | | | | | |

| Regional Authority [1.0%] | |

| Province of Ontario Canada | | | | | | | | |

| 1.600%, 09/21/16 | | | 1,360 | | | | 1,385 | |

| | | | | | | | | |

| Retail [4.0%] | |

| Lowe’s | | | | | | | | |

| 6.100%, 09/15/17 | | | 3,000 | | | | 3,451 | |

| Wal-Mart Stores | | | | | | | | |

| 2.875%, 04/01/15 | | | 2,000 | | | | 2,050 | |

| | | | | | | | | |

| Total Retail | | | | 5,501 | |

| | | | | | | | | |

| Telephones & Telecommunications [7.7%] | |

| America Movil | | | | | | | | |

| 1.234%, 03/12/14(A) | | | 2,750 | | | | 2,781 | |

| AT&T | | | | | | | | |

| 5.100%, 09/15/14 | | | 2,000 | | | | 2,042 | |

| 2.950%, 05/15/16 | | | 2,600 | | | | 2,707 | |

| | | | | |

| Motorola Solutions | | | | | | |

| 6.000%, 11/15/17 | | $ | 1,000 | | | $ | 1,143 | |

| Telefonica Emisiones SAU | | | | | | | | |

| 6.421%, 06/20/16 | | | 1,000 | | | | 1,107 | |

| Verizon Communications | | | | | | | | |

| 2.550%, 06/17/19 | | | 1,000 | | | | 1,006 | |

| | | | | | | | | |

| Total Telephones & Telecommunications | | | | 10,786 | |

| | | | | | | | | |

| Trucking & Leasing [0.9%] | |

| Penske Truck Leasing | | | | | | | | |

| 3.750%, 05/11/17(B) | | | 750 | | | | 796 | |

| 3.125%, 05/11/15(B) | | | 500 | | | | 512 | |

| | | | | | | | | |

| Total Trucking & Leasing | | | | 1,308 | |

| | | | | | | | | |

| Total Corporate Bonds | |

| (Cost $122,323) | | | | 124,664 | |

| | | | | | | | | |

| Municipal Bonds [3.1%] | |

| California [0.1%] | |

| California State, GO | | | | | | | | |

| 5.700%, 11/01/21 | | | 185 | | | | 216 | |

| | | | | | | | | |

| Florida [3.0%] | |

| Florida State, Hurricane Catastrophe Fund Finance, Ser A, RB | | | | | | | | |

| 2.107%, 07/01/18 | | | 4,130 | | | | 4,150 | |

| | | | | | | | | |