Proxy Materials

PLEASE CAST YOUR VOTE NOW!

City National Rochdale Socially Responsible Equity Fund

(a series of City National Rochdale Funds)

Dear Shareholder:

I am writing to let you know that a special meeting of shareholders of the City National Rochdale Socially Responsible Equity Fund (the "Fund") will be held on December 7, 2015 (the "Special Meeting"). The purpose of the Special Meeting is to seek your approval for a proposed reorganization of the Fund. The Fund currently is organized as a series of City National Rochdale Funds (the “Trust”), a registered investment company with its principal offices at 400 North Roxbury Drive, Beverly Hills, California 90210. After completion of the proposed reorganization, the Fund would be a series of Forum Funds II, a registered investment company with its principal offices at Three Canal Plaza, Suite 600, Portland, Maine 04101. This proposed reorganization will result in a change in the investment adviser to the Fund from City National Rochdale, LLC to SKBA Capital Management, LLC (“SKBA”), currently the sub-adviser to the Fund, and no change to the Fund's investment objective or strategies. The Fund's principal risks and investment limitations will also be materially the same and its expenses are not expected to increase as a result of the reorganization. This package contains a Proxy Statement, other information regarding the proposal, and the materials to use when casting your vote.

Please read the enclosed materials and cast your vote on the proxy card(s). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. After its careful review of the proposal, the Board of Trustees of the Trust recommends that you vote FOR the proposal.

The questions and answers on the next few pages are provided to assist you in understanding the proposal. The proposal is described in greater detail in the enclosed proxy statement.

Voting is quick and easy. Everything you need is enclosed. To cast your vote, simply complete the proxy card(s) enclosed in this package. Be sure to sign each card before mailing it in the postage-paid envelope. You may also vote your shares by touch-tone telephone or through the internet. Simply call the toll-free number or visit the web site indicated on your proxy card(s), enter the control number found on the card(s), and follow the recorded or online instructions.

If you have any questions before you vote, please call the Fund at 1 (888) 889-0799. Thank you for your participation in this important initiative.

Sincerely,

Garrett R. D’Alessandro

President and Chief Executive Officer

City National Rochdale Funds

Important information to help you understand and vote on the proposal

While you are encouraged to read the full text of the enclosed Proxy Statement, here is a brief overview of the proposed reorganization of the City National Rochdale Socially Responsible Equity Fund (the "Target Fund"), which affects you as a shareholder of the Fund and requires your vote.

| Proposed Reorganization |

Target Fund City National Rochdale Socially Responsible Equity Fund (a series of City National Rochdale Funds (the "Trust")) | ≥ | Acquiring Fund Baywood SociallyResponsible Fund (a series of Forum Funds II ("Forum")) |

Q & A: QUESTIONS AND ANSWERS

| Q. | What is this document and why are we sending it to you? |

A. The attached document is a proxy statement (the "Proxy Statement"), and is being provided to you by the Target Fund in connection with the solicitation of proxies to vote to approve the proposed reorganization (the "Reorganization") at a special meeting of shareholders (the "Special Meeting"). The Proxy Statement contains the information that shareholders of the Target Fund should know before voting on the Reorganization.

| Q. | What will happen to the Fund? |

A. Subject to your approval, the Target Fund will be reorganized into the Acquiring Fund, a newly-created series of Forum. All of the assets and liabilities of the Target Fund will be transferred to the Acquiring Fund, and you, as a shareholder of the Target Fund, will receive shares of the Acquiring Fund having equivalent value to your shares of the Target Fund on the date of the Reorganization. Shareholders of Institutional Class shares of the Target Fund will receive Institutional Class shares of the Acquiring Fund and shareholders of Class N shares of the Target Fund will receive Investor Class shares of the Acquiring Fund. Subsequently, the Target Fund will be terminated. The Reorganization requires approval by the Target Fund's shareholders.

The total value of the Acquiring Fund shares that you receive in the Reorganization will be the same as the total value of the shares of the Target Fund that you held immediately before the Reorganization.

| Q. | Why is the Target Fund reorganizing into the Acquiring Fund? |

A. Based on the recommendation of City National Rochdale, LLC (“CNR”), the Target Fund’s investment adviser, and SKBA Capital Management, LLC (“SKBA”), the sub-adviser to the Target Fund, the Board of Trustees of the Trust considered and approved the Reorganization. In considering the Reorganization, the Board noted that after the closure of another series of the Trust (which took place in September 2015), the Target Fund will be the last open series of a fund family sponsored by the American Hospital Association that reorganized into the Trust in 2005; the Target Fund’s investor base is largely made up of religious hospital retirement plans the investment mandates of which include investing in socially responsible companies; and because the Trust has not historically focused on this market segment, the asset growth of the Target Fund has been primarily a result of inflows principally from these retirement plans and the promotional efforts of SKBA. CNR and SKBA believe that the reorganization of the Target Fund out of the Trust into Forum, with SKBA assuming the role of investment adviser, would be beneficial to the Target Fund’s shareholders in part because the Fund’s investment strategy and the management of the Fund would be a core focus of SKBA’s fund team, rather than one of multiple fund product offerings. Furthermore, SKBA currently manages another mutual fund as part of Forum, and expects that it can provide direct investment advisory services to the Acquiring Fund more efficiently than it does with respect to the Target Fund as its sub-adviser. The annual advisory fee for the Acquiring Fund would be reduced by five basis points compared to the annual advisory fee of the Target Fund.

The total expenses that are paid by shareholders are not expected to change as a result of the Reorganization. As a condition to the Reorganization, SKBA will agree, for a two-year period following the closing of the Reorganization, to continue to waive its advisory fees and/or reimburse the Acquiring Fund for its expenses to the extent necessary to maintain the Acquiring Fund’s net annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) at 1.14% for Investor Class Shares and 0.89% for Institutional Class Shares (the “Expense Cap”), which are the levels of the Target Fund’s current voluntary expense caps. However, some of the third party service arrangement fees may be lower for the Acquiring Fund than for the Target Fund.

| Q. | What should I know about the Acquiring Fund? |

A. SKBA will become the investment adviser to the Acquiring Fund. The Acquiring Fund will have the same investment objective as the Target Fund. The Acquiring Fund will also have materially the same investment strategies, principal risks and investment limitations as the Target Fund. The investment advisory fee for the Acquiring Fund will be 0.05% lower than the current advisory fee for the Target Fund on an annual basis. The cost of investing in the Acquiring Fund is expected to be the same for at least two years following the closing of the Reorganization, which is the term of the Expense Cap. There can be no guarantee, however, that the expenses and costs of the Acquiring Fund will remain the same as or lower than those of the Target Fund after the expiration of the Expense Cap.

The Acquiring Fund is a newly created fund which will operate as a series of Forum. The primary differences between the Target Fund and the Acquiring Fund will be (1) the Acquiring Fund will have a different investment adviser; (2) the investment advisory fee for the Acquiring Fund will be lower than the current advisory fee for the Target Fund; (3) the Acquiring Fund will have different service providers that provide Third Party Service Arrangements, as defined below (i.e., custody, administration, transfer agency, distribution and other general support services) than the Target Fund; (4) the Acquiring Fund will be a series of Forum instead of the Trust; and (5) the Acquiring Fund will have a different Board of Trustees than the Target Fund. You will receive Acquiring Fund shares on a class-by-class basis equal in value as of the Reorganization closing date to shares of the Target Fund you hold as of such date. The Reorganization will not affect the value of your investment at the time of Reorganization and your interest in the Target Fund will not be diluted.

As a series of the Trust, the Target Fund retains various service providers which provide an array of services to all series of the Trust. These services include custody, administration, accounting, transfer agency, distribution and compliance (together, “Third Party Service Arrangements”). Currently, Third Party Service Arrangements are provided to the Trust by SEI Investments Global Fund Services (administration and fund accounting), U.S. Bancorp Fund Services, LLC ("USBFS") (transfer agency), U.S. Bank National Association (custody), SEI Investments Distribution Company (distribution) and City National Rochdale, LLC (compliance). Third Party Service Arrangements are provided to Forum by Atlantic Fund Administration, LLC ("Atlantic") (administration, compliance, fund accounting and transfer agency), Union Bank, N.A. (custody) and Foreside Fund Services, LLC (distribution).

| Q. | What are the federal income tax consequences of the Reorganization? |

A. The Reorganization is intended to qualify as a tax-free “reorganization” for U.S. federal income tax purposes and will not take place unless the Target Fund and the Acquiring Fund receive a satisfactory opinion of counsel to the effect that the Reorganization will be a “reorganization,” as described in more detail in the section entitled “Federal Income Tax Consequences” (although there can be no assurance that the Internal Revenue Service will agree with such opinion). Accordingly, no gain or loss is expected to be recognized by the Target Fund or its shareholders as a direct result of the Reorganization. In addition, the tax basis and holding period of a shareholder’s Target Fund shares of each class are expected to carry over to the Acquiring Fund shares of the corresponding class that the shareholder receives as a result of the Reorganization. At any time prior to the consummation of the Reorganization, Target Fund shareholders may redeem their Target Fund shares, generally resulting in the recognition of gain or loss to such shareholders for U.S. federal income tax purposes.

For more detailed information about the tax consequences of the Reorganization please refer to the “Federal Income Tax Consequences” section below.

| Q. | What happens if the Reorganization is not approved? |

A. If shareholders of the Target Fund fail to approve the Reorganization, the Target Fund will not be reorganized into the Acquiring Fund and the Board will consider what action to take.

| Q. | After the Reorganization will I be able to purchase and redeem shares and receive distributions the same way? |

A. The Reorganization will not affect your right to purchase and redeem shares and to receive distributions.

| Q. | What action has the Board taken? |

A. After careful consideration, the Board approved the proposed Reorganization and authorized the solicitation by the Target Fund of proxies. The Board recommends that shareholders vote FOR the Reorganization.

| Q. | Who bears the expenses associated with the Reorganization? |

A. City National Rochdale, LLC and SKBA, or their affiliates, will bear the expenses associated with the Reorganization. The expenses include, but are not limited to, costs relating to preparation, printing and distribution of this Proxy Statement and the registration statement, legal fees and accounting fees with respect to the Reorganization and Proxy Statement and expenses of holding the shareholder meeting and soliciting shareholder votes. The Target Fund will not incur any expenses in connection with the Reorganization.

| Q. | Who is Broadridge Financial Solutions, Inc.? |

A. Broadridge Financial Solutions, Inc. is a third party proxy vendor that City National Rochdale, LLC has engaged (at its expense) to contact shareholders and record proxy votes. In order to hold a shareholder meeting, a quorum must be reached. If a quorum is not attained, the meeting must adjourn to a future date. Voting your shares immediately will help to prevent the need to call you to solicit your vote.

| Q. | Who is eligible to vote? |

A. Shareholders of record of the Target Fund as of the close of business on September 30, 2015 (the "Record Date"), are entitled to be present and to vote at the Special Meeting or any adjournment thereof. Shareholders of record of the Target Fund at the close of business on the Record Date will be entitled to cast one vote for each full share and a fractional vote for each fractional share they hold on each proposal presented at the Special Meeting.

| Q. | I own a small interest in the Target Fund. Why should I bother to vote? |

A. Your vote is needed to ensure that a quorum is present at the Special Meeting so that the proposal can be acted upon. Your immediate response on the enclosed Proxy Card will help prevent the need for any further solicitations for a shareholder vote. We encourage all shareholders to participate, including investors with small interests. If other shareholders like you fail to vote, the Target Fund may not receive enough votes to go forward with the Special Meeting. If this happens, the Reorganization would be delayed, and we may need to solicit votes again.

| Q. | How do I place my vote and whom do I call for more information? |

A. You may vote your shares by any of the following methods: (1) call the telephone number provided on the proxy card attached to this Proxy Statement; (2) log on to the Internet as directed on the proxy card and vote electronically; (3) if you are unable to vote by telephone or on the Internet, fill out your proxy card and return it to us; or (4) attend the Special Meeting on December 7, 2015, and vote in person. Please refer to your Proxy Card for further instructions on how to vote.

| Q. | Is additional information about the Target Fund available? |

| A. | Yes, additional information about the Target Fund is available in the following documents: |

| • | Prospectus for the Target Fund and for the Acquiring Fund (a copy of the Acquiring Fund’s preliminary prospectus accompanies this Proxy, but is subject to completion, as discussed below); |

| • | Annual and Semi-Annual Reports to Shareholders of the Target Fund; and |

| • | Statement of Additional Information (SAI) for the Target Fund and a preliminary SAI for the Acquiring Fund. |

These documents are on file with the U.S. Securities and Exchange Commission (the “SEC”).

A preliminary prospectus for the Acquiring Fund, the shares of which you would own after the Reorganization, accompanies this Proxy. The preliminary prospectus for the Acquiring Fund is also available at www.proxyvote.com. The information in this preliminary prospectus is not complete and may be changed. The Acquiring Fund may not sell its securities until the registration statement filed with the SEC is effective. The preliminary prospectus is not an offer to sell the Acquiring Fund’s securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. The prospectus and the most recent annual and semi-annual reports to shareholders of the Target Fund have been previously mailed to shareholders.

Copies of all of these documents are available upon request without charge by writing to or calling:

Forum Funds II Three Canal Plaza, Suite 600 Portland, Maine 04101 (207) 347-2000 | City National Rochdale Funds c/o SEI Investments Distribution Co. One Freedom Valley Drive

Oaks, Pennsylvania 19456 1 (888) 889-0799 |

You also may view or obtain these documents from the SEC:

In Person: At the SEC’s Public Reference Room in Washington, D.C.

By Phone: (202) 551-8090

| By Mail: | Public Reference Room |

U.S. Securities and Exchange Commission

100 F Street, NE

Washington, DC 20549

(duplicating fee required)

| By Email: | publicinfo@sec.gov |

(duplicating fee required)

(“Forum Funds II” for information on the Acquiring Fund)

(“City National Rochdale Funds” for information on the Target Fund)

The following pages give you additional information about the Reorganization and the proposal on which you are being asked to vote.

Your Vote Is Important. Thank You for Promptly Recording Your Vote.

City National Rochdale Socially Responsible Equity Fund, c/o SEI Investments Distribution Co., One Freedom Valley Drive, Oaks, Pennsylvania 19456

City National Rochdale Socially Responsible Equity Fund

(a series of City National Rochdale Funds)

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

A Special Meeting of Shareholders (the "Special Meeting") of the City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds, will be held at the offices of City National Rochdale, LLC, 570 Lexington Avenue, New York, New York 10022, on Monday, December 7, 2015, at 10:30 a.m., Eastern Time.

The purpose of the Special Meeting is to consider and act upon the following proposals:

| 1. | To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of City National Rochdale Socially Responsible Equity Fund (the “Target Fund”), a series of City National Rochdale Funds, to, and the assumption of all of the liabilities of the Target Fund by, the Baywood SociallyResponsible Fund (the “Acquiring Fund”), a newly-created series of Forum Funds II, in exchange for the Acquiring Fund’s shares, which would be distributed pro rata by the Target Fund to the holders of its shares in complete liquidation of the Target Fund; and |

| 2. | To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

The City National Rochdale Funds Board of Trustees has fixed the close of business on September 30, 2015, as the record date for the determination of the shareholders entitled to notice of, and to vote at, the Special Meeting and any adjournments thereof.

By order of the Board of Trustees,

Kurt Hawkesworth, Secretary

_______________, 2015

Your vote is important — please vote your shares promptly.

Shareholders are invited to attend the Special Meeting in person. Any shareholder who does not expect to attend the Special Meeting is urged to vote using the touch-tone telephone or Internet voting instructions found below or indicate voting instructions on each enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary calls to solicit your vote, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON DECEMBER 7, 2015: This Notice, Proxy Statement and the Target Fund’s most recent Annual Report to shareholders are available on the internet at www.citynationalrochdalefunds.com

INSTRUCTIONS FOR EXECUTING PROXY CARDS

The following general rules for executing proxy cards may assist you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

| 1. | Individual Accounts: Your name should be signed exactly as it appears in the registration on the Proxy Card. |

| 2. | Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

| 3. | All other accounts: Show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the Proxy Card. For example: |

| | | REGISTRATION | VALID SIGNATURE |

| | | | |

| A. | 1) | ABC Corp. | John Smith, Treasurer |

| | | | |

| | 2) | ABC Corp. c/o John Smith, Treasurer | John Smith, Treasurer |

| | | | |

| B. | 1) | ABC Corp. Profit Sharing Plan | Ann B. Collins, Trustee |

| | | | |

| | 2) | ABC Trust | Ann B. Collins, Trustee |

| | | | |

| | 3) | Ann B. Collins, Trustee u/t/d 12/28/78 | Ann B. Collins, Trustee |

| | | | |

| C. | 1) | Anthony B. Craft, Cust. f/b/o Anthony B. Craft, Jr. UGMA | Anthony B. Craft |

INSTRUCTIONS FOR VOTING BY TOUCH-TONE TELEPHONE

OR THROUGH THE INTERNET

| 1. | Read the Proxy Statement, and have your Proxy Card handy. |

| 2. | Call the toll-free number or visit the web site indicated on your Proxy Card. |

| 3. | Enter the number found in the shaded box on the front of your Proxy Card. |

| 4. | Follow the recorded or on-line instructions to cast your vote. |

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

City National Rochdale Socially Responsible Equity Fund

(a series of City National Rochdale Funds)

TO BE HELD ON DECEMBER 7, 2015

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees (the "Board") of City National Rochdale Funds (the "Trust") to be used at the special meeting of shareholders of the City National Rochdale Socially Responsible Equity Fund, a series of the Trust (the "Target Fund"), and at any adjournments thereof (the "Special Meeting"), to be held on Monday, December 7, 2015, at 10:30 a.m., Eastern time, at the offices of City National Rochdale, LLC, 570 Lexington Avenue, New York, New York 10022.

At the Special Meeting, shareholders of the Target Fund will be asked:

| 1. | To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of the Target Fund to, and the assumption of all of the liabilities of the Target Fund by, the Baywood SociallyResponsible Fund (the “Acquiring Fund”), a newly-created series of Forum Funds II, in exchange for the Acquiring Fund’s shares, which would be distributed pro rata by the Target Fund to the holders of its shares in complete liquidation of the Target Fund; and |

| 2. | To transact such other business as may properly come before the Special Meeting or any adjournments thereof. |

Shareholders who execute proxies may revoke them at any time before they are voted, either by writing to the Trust, in person at the time of the Special Meeting, by voting the proxy again through the toll-free number or through the Internet address listed in the enclosed voting instructions or by mailing a proxy later dated to the Trust.

Shareholders of record at the close of business on the record date established as September 30, 2015 (the "Record Date"), are entitled to notice of, and to vote at, the Special Meeting. The Notice of Special Meeting of Shareholders (the "Notice"), this proxy statement and the enclosed proxy card are being mailed to shareholders on or about November 2, 2015.

PROPOSAL — TO APPROVE AN AGREEMENT AND PLAN OF REORGANIZATION

Based on the recommendation of City National Rochdale, LLC (“CNR”), and SKBA Capital Management, LLC (“SKBA”), the investment adviser and sub-adviser of the Target Fund, respectively, at a meeting held on August 27, 2015, the Board of Trustees of City National Rochdale Funds (the "Trust"), including a majority of the Trustees who are not "interested persons" of the Trust (the "Independent Trustees") as that term is defined under the Investment Company Act of 1940, as amended (the "1940 Act"), considered and approved the reorganization of the Target Fund into the Acquired Fund, as presented at the meeting (the “Reorganization”). CNR has agreed to sell to SKBA CNR’s assets, rights and benefits that pertain to the management, administration and operation of the Target Fund, as well as copies of all books and records owned by CNR relating to the Fund.

A form of Agreement and Plan of Reorganization (the "Plan of Reorganization"), which sets forth the terms of the Reorganization, is attached to this proxy statement as Appendix A. Under the Plan of Reorganization, the Target Fund, a series of the Trust, will transfer all of its assets to the Acquiring Fund, a newly organized series of Forum Funds II ("Forum"), in exchange for (i) a number of Acquiring Fund shares of each class with an aggregate net asset value equal to the aggregate net asset value of the shares of the Target Fund of the corresponding class outstanding immediately prior to the Closing Date (as defined below) and (ii) assumption of the Target Fund’s liabilities by the Acquiring Fund, followed by a distribution of those shares to Target Fund shareholders so that each Target Fund shareholder would receive shares of each applicable class of the Acquiring Fund equal in value to the Target Fund shares of the corresponding class held by such shareholder on the closing date of the transaction, which is currently set to be on or about December 11, 2015 (the "Closing Date"). The Target Fund will then be liquidated. Shareholders of Institutional Class shares of the Target Fund will receive Institutional Class shares of the Acquiring Fund and shareholders of Class N shares of the Target Fund will receive Investor Class shares of the Acquiring Fund. Forum filed an amendment to its registration statement establishing the Acquiring Fund as a new series with the U.S. Securities and Exchange Commission (the "SEC") on September 16, 2015, which amendment will be effective prior to the Closing Date. The Reorganization will not occur until the amendment to Forum’s registration statement with respect to the Acquiring Fund is effective.

If the Reorganization is approved and implemented, shareholders of the Target Fund will become shareholders of the Acquiring Fund. The Acquiring Fund's investment objective and principal investment strategies are identical to those of the Target Fund. In addition, the current sub-adviser to the Target Fund, SKBA, will become the investment adviser to the Acquiring Fund. The investment advisory fee for the Acquiring Fund will be lower than the advisory fee of the Target Fund. In addition, SKBA will agree, for a two-year period following the Closing Date, to waive its fees or reimburse the Acquiring Fund for its expenses to the extent necessary to maintain the net annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of the Acquiring Fund at 0.89% with respect to Institutional Class shares and 1.14% with respect to Investor Class shares (the “Expense Cap”). These are the levels at which CNR, the investment adviser to the Target Fund, is voluntarily capping the expenses of the Target Fund.

There are some differences between the Target Fund and the Acquiring Fund. The Acquiring Fund will employ a different administrator, custodian, transfer agent, and distributor ("Third Party Service Providers") than the Third Party Service Providers utilized by the Target Fund. In addition, none of the members of the Board of Trustees of the Trust will serve on the Board of Trustees of Forum. If approved, the Reorganization is expected to take effect on or about December 11, 2015, although the date may be adjusted in accordance with the Plan of Reorganization. The Reorganization is not expected to result in U.S. federal income tax for the Target Fund or its shareholders.

| B. | COMPARISON OF THE TARGET FUND AND THE ACQUIRING FUND |

PRINCIPAL INVESTMENT STRATEGIES

Each Fund attempts to achieve its investment objectives by investing at least 80% of net assets (plus any borrowings for investment purposes) in common stocks of U.S. issuers that meet certain socially responsible criteria. Each Fund may change this investment strategy at any time, with 60 days’ prior notice to shareholders. Up to 50% of each of the Funds’ net assets may consist of securities of mid-capitalization companies. For this purpose, CNR, the investment adviser to the Target Fund, and SKBA, the investment adviser to the Acquiring Fund, each considers a mid-capitalization company to be a company with a market capitalization between $1 billion and $5 billion at the time of investment. In addition to investing in U.S. corporations, each Fund invests in U.S. dollar denominated American Depositary Receipts of foreign corporations (“ADRs”).

In selecting investments for each Fund, SKBA considers social criteria such as an issuer’s community relations, corporate governance, employee diversity, employee relations, environmental impact and sustainability, human rights record, and product safety. Using both quantitative and qualitative data, SKBA also evaluates an issuer’s involvement in specific revenue-generating activities to determine whether the issuer’s involvement was meaningful or simply incidental with respect to that activity.

SKBA applies vigorous valuation screens that identify issuers for further in-depth fundamental analysis for potential inclusion in each Fund. The investment strategy typically emphasizes securities that SKBA believes have one or more of the following characteristics: a price significantly below the intrinsic value of the issuer; below average price to sales and price to cash flow ratios; and sound overall financial condition of the issuer.

SKBA may determine to sell a security when its target value is realized, its earnings deteriorate, changing circumstances affect the original reasons for the security’s purchase, or more attractive investment alternatives are identified.

Each Fund seeks to avoid investing in any issuer that derives more than 5% of its total revenue from tobacco, alcohol, gambling, abortion or weaponry (whether sold to consumers or the military), or that is involved in nuclear power. Because information on an issuer’s involvement in those activities may not be publicly available, it is possible that the Fund’s holdings may include an issuer that does not meet its criteria for socially responsible investing. When SKBA discovers that a holding does not meet its criteria for socially responsible investing, it will divest that holding as soon as reasonably practicable.

PRINCIPAL INVESTMENT RISKS

Market Risk of Equity Securities – By investing in common stocks, each Fund may experience a sudden decline in the share price of a particular portfolio holding or to an overall decline in the stock market. In addition, each Fund’s principal market segment may underperform other segments or the market as a whole. The value of an investment in each Fund will fluctuate daily and cyclically based on movements in the stock market and the activities of individual companies in the Fund’s portfolio. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Medium Capitalization (Mid-Cap) Companies – Investments in mid-cap companies may involve greater risks to each Fund than investments in larger, more established companies, such as limited product lines, markets and financial or managerial resources. In addition, the securities of mid-cap companies may have greater price volatility and less liquidity than the securities of larger capitalized companies.

Foreign Investments (American Depositary Receipts) – Foreign investments tend to be more volatile than domestic securities, and subject each Fund to risks that are not typically associated with domestic securities (e.g., unfavorable political and economic developments and the possibility of seizure or nationalization of companies, or the imposition of withholding taxes on income). There may be less government supervision of foreign markets. As a result, foreign issuers may not be subject to the uniform accounting, auditing, and financial reporting standards and practices applicable to domestic issuers, and there may be less publicly available information about foreign issuers. Each Fund invests in ADRs which are sponsored by the foreign issuers. ADRs are subject to the risks of changes in currency or exchange rates (which affect the value of the issuer even though ADRs are denominated in U.S. dollars) and the risks of investing in foreign securities.

Investment Style – SKBA primarily uses a value style to select investments for each Fund. This style may fall out of favor, may underperform other styles and may increase the volatility of each Fund’s share price.

Sector Concentration – Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect all the securities in a single sector. Each Fund may invest a larger portion of its assets in one or more sectors than many other mutual funds and thus may be more susceptible to negative events affecting those sectors.

Management – Each Fund’s performance depends on SKBA’s skill in making appropriate investments. As a result, each Fund may underperform the markets in which it invests or similar funds.

Socially Responsible Investments – Socially responsible investment criteria may limit the number of investment opportunities available to each Fund, and as a result, at times each Fund’s investment returns may be lower than those funds that are not subject to such investment considerations.

Defensive Investments – During unusual economic or market conditions, or for temporary defensive or liquidity purposes, each Fund may invest up to 100% of its assets in cash or cash equivalents that would not ordinarily be consistent with the Fund’s investment goals.

FUNDAMENTAL LIMITATIONS

Each of the Target Fund and the Acquiring Fund (each a “Fund”) has adopted the following restrictions as fundamental policies, which may not be changed without the affirmative vote of the holders of a “majority of the Fund’s outstanding voting securities” as defined in the 1940 Act. Under the 1940 Act, the “vote of the holders of a majority of the outstanding voting securities” means the vote of the holders of the lesser of (i) 67% of the shares of the Fund represented at a meeting at which the holders of more than 50% of its outstanding shares are represented, or (ii) more than 50% of the outstanding shares of the Fund.

Neither Fund may:

| · | Issue senior securities as defined in the 1940 Act or borrow money, except that a Fund may borrow from banks for temporary or emergency purposes (but not for investment) in an amount up to 10% of the value of its total assets (including the amount borrowed) less liabilities (not including the amount borrowed) at the time the borrowing was made. While any such borrowings exist for a Fund, it will not purchase securities. (However, a Fund which is authorized to do so by its investment policies may lend securities, enter into repurchase agreements without limit and reverse repurchase agreements in an amount not exceeding 10% of its total assets, purchase securities on a when-issued or delayed delivery basis and enter into forward foreign currency contracts.) |

| · | Purchase a security, other than government securities, if as a result of such purchase more than 5% of the value of the Fund's assets would be invested in the securities of any one issuer, or the Fund would own more than 10% of the voting securities, or of any class of securities, of any one issuer, except that all of the investable assets of a Fund may be invested in another registered investment company having the same investment objective and substantially the same investment policies as the Fund. For purposes of this restriction, all outstanding indebtedness of an issuer is deemed to be a single class. |

| · | Purchase a security, other than government securities, if as a result of such purchase 25% or more of the value of the Fund's total assets would be invested in the securities of issuers in any one industry or group of industries, except that all of the investable assets of a Fund may be invested in another registered investment company having the same investment objective and substantially the same investment policies as the Fund. |

| · | Purchase the securities (other than government securities) of an issuer having a record, together with predecessors, of less than three years' continuous operations, if as a result of such purchase more than 5% of the value of the Fund's total assets would be invested in such securities, except that this shall not prohibit a Fund from investing all of its investable assets in another registered investment company having the same investment objective and substantially the same investment policies as the Fund. |

| · | Make short sales of securities or purchase securities on margin, except for such short-term loans as are necessary for the clearance of purchases of securities. |

| · | Engage in the underwriting of securities except insofar as a Fund may be deemed an underwriter under the 1933 Act in disposing of a security and except that all of the investable assets of a Fund may be invested in another registered investment company having the same investment objective and substantially the same investment policies as the Fund. |

| · | Purchase or sell real estate or interests therein, or purchase oil, gas or other mineral leases, rights or royalty contracts or development programs, except that a Fund may invest in the securities of issuers engaged in the foregoing activities and may invest in securities secured by real estate or interests therein. |

| · | Make loans of money or securities, except through the purchase of permitted investments (including repurchase and reverse repurchase agreements) and through the loan of securities (in an amount not exceeding one-third of total assets) by any Fund. |

| · | Purchase or sell commodities or commodity contracts, except that the Fund may purchase and sell financial futures contracts and options on such contracts and may enter into forward foreign currency contracts and engage in the purchase and sale of foreign currency options and futures. |

| · | Invest more than 5% of the value of a Fund's total assets in warrants, including not more than 2% of such assets in warrants not listed on a U.S. stock exchange. (Rights and warrants attached to, received in exchange for, or as a distribution on, other securities are not subject to this restriction.) |

| · | Pledge, hypothecate, mortgage or otherwise encumber its assets, except as necessary to secure permitted borrowings. (Collateral arrangements and initial margin with respect to permitted options on securities, financial futures contracts and related options, and arrangements incident to other permitted practices, are not deemed to be subject to this restriction.) |

The foregoing percentages (other than the limitation on borrowing) will apply at the time of the purchase of a security and will not be considered violated unless an excess or deficiency occurs immediately after or as a result of a purchase of such security. Except as otherwise indicated, these investment limitations and the goal of each Fund as set forth in its Prospectus are fundamental policies of the Fund and may not be changed without shareholder approval. Although the fundamental policies permit the Funds to enter into reverse repurchase agreements, the Funds do not currently intend to do so. Up to 1/3 of a Fund's assets may be pledged to secure permitted borrowings by the Fund.

NON-FUNDAMENTAL POLICIES

Each Fund has adopted the following restrictions which are non-fundamental and may be changed by its Board of Trustees without a vote of the Fund’s shareholders.

Neither Fund may:

| · | Purchase or acquire securities that are illiquid or are otherwise not readily marketable (i.e., securities that cannot be disposed of for their approximate carrying value in seven days or less, which term includes repurchase agreements and time deposits maturing in more than seven days) if, in the aggregate, more than 15% of its net assets would be invested in illiquid securities. (As a matter of non-fundamental policy, repurchase agreements maturing in more than seven days, certain time deposits and over-the-counter options are considered to be illiquid.) |

| · | Invest for the purpose of exercising control or management of another company except that all the investable assets of a Fund may be invested in another registered investment company having the same investment objective and substantially the same investment policies as the Fund. |

| · | Invest, under normal circumstances, less than 80% of the value of its net assets (plus borrowings for investment purposes) in a particular type of investment that is suggested by the Fund's name. A Fund will notify its shareholders at least 60 days prior to any change in such policy. |

| · | Borrow money in an amount exceeding 10% of its total assets. A Fund will not borrow money for leverage purposes. For the purpose of this investment restriction, the use of options and futures transactions and the purchase of securities on a when-issued or delayed delivery basis shall not be deemed the borrowing of money. A Fund will not make additional investments while its borrowings exceed 5% of total assets. |

In addition, the Target Fund may not purchase the stock or bonds of companies identified by the tobacco service of the RiskMetrics Group Social Issues Services. This service identifies those companies engaged in growing, processing or otherwise handling tobacco. If the Target Fund holds any such securities of an issuer which is subsequently identified by RiskMetrics as engaged in such activities, the securities will be sold within a reasonable time period, consistent with prudent investment practice. This non-fundamental policy of the Target Fund will not be adopted by the Acquiring Fund.

Each of the foregoing percentage limitations (except with respect to the limitations on borrowing and investing in illiquid and not readily marketable securities) applies at the time of purchase. If, subsequent to a Fund's purchase of an illiquid security, more than 15% of the Fund's net assets are invested in illiquid securities because of changes in valuations or net outflows, the Fund will consider what actions, if any, are necessary to maintain adequate liquidity. These limitations are non-fundamental and may be changed with respect to a Fund by its Board of Trustees without a vote of shareholders.

| C. | COMPARISON OF FEES AND EXPENSES AND EXAMPLES |

The table of Fees and Expenses and the Example show fees and expenses based on the Target Fund’s average net assets for the year ended September 30, 2014. The Reorganization is not expected to result in an increase in shareholder fees and expenses. The following table is designed to help you understand the fees and expenses that you may pay, both directly and indirectly, by investing in the Acquiring Fund as compared to the Target Fund.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | Target Fund | Acquiring Fund (Pro Forma) |

| | Institutional Class | Class N | Institutional Class | Investor Class |

| Management Fees | 0.75% | 0.75% | 0.70% | 0.70% |

| Distribution (12b-1) Fee | None | 0.25% | None | 0.25% |

| Other Expenses | | | | |

| Shareholder Servicing Fee | None | 0.25% | None | 0.10% |

| Other Fund Expenses | 0.21% | 0.21% | 0.16% | 0.27% |

| Total Other Expenses | 0.21% | 0.46% | 0.16% | 0.37% |

| Total Annual Fund Operating Expenses | 0.96% | 1.46% | 0.86% | 1.32% |

Fee Waiver and/or Expense Reimbursement(1) | — | (0.25%) | (0.01%) | (0.18%) |

| Net Annual Fund Operating Expenses | 0.96% | 1.21% | 0.85% | 1.14% |

| (1) | CNR has contractually agreed to waive the shareholder servicing fees for the Target Fund’s Class N shares until January 31, 2016. Prior to that date, this arrangement may be terminated without penalty by the Target Fund’s Board of Trustees upon 60 days’ written notice to CNR, and it will terminate automatically upon the termination of the shareholder services agreement between CNR and the Target Fund. Any shareholder servicing fees waived by CNR pursuant to this arrangement will not be eligible for reimbursement by the Target Fund to CNR. |

SKBA has contractually agreed to waive its fee and/or reimburse Acquiring Fund expenses to limit Total Annual Fund Operating Expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of Investor Shares to 1.14% and Institutional Shares to 0.89%, through December 31, 2017 (the “Expense Cap”). SKBA may be reimbursed by the Acquiring Fund for fees waived and expenses reimbursed by SKBA pursuant to the Expense Cap if such payment (1) is made within three years of the fee waiver or expense reimbursement, (2) is approved by the Acquiring Fund’s Board, and (3) does not cause the Net Annual Fund Operating Expenses of a class to exceed the Expense Cap in place at the time the fees were waived. The Expense Cap may only be raised or eliminated with the consent of the Acquiring Fund’s Board of Trustees. Net Annual Fund Operating Expenses will increase if exclusions from the Expense Cap apply.

EXAMPLE

This Example is intended to help you compare the cost of investing in each Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | 1 Year | 3 Years | 5 Years | 10 Years |

| Target Fund | Institutional Class | $98 | $306 | $531 | $1,178 |

| Class N | $123 | $437 | $774 | $1,725 |

Acquiring Fund (pro forma) | Institutional Class | $89 | $278 | $482 | $1,073 |

| Investor Class | $122 | $381 | $724 | $1,692 |

| D. | PERFORMANCE INFORMATION |

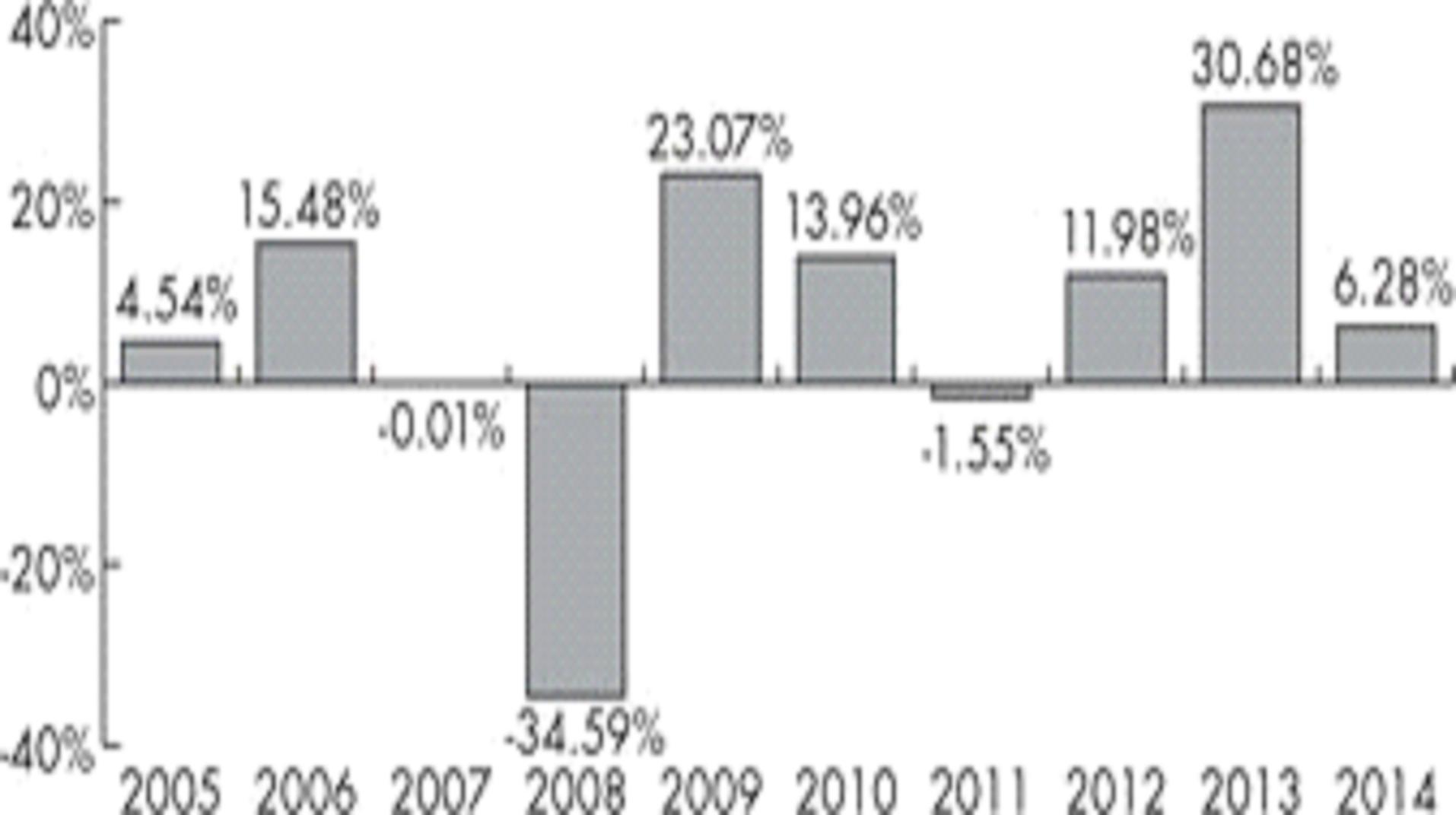

The following chart and table show the past performance of the Target Fund and provide some indication of the risks of investing in the Target Fund by showing changes in the Target Fund’s performance from year to year and by showing how the Target Fund’s average annual returns for one year, five years and since inception compare with those of a broad measure of market performance, as well as an index that reflects the market sectors in which the Target Fund invests. The Acquiring Fund has not yet commenced operations and has no performance history. However, if the Reorganization is approved by shareholders, the Acquiring Fund will acquire all of the assets and liabilities of the Target Fund and will adopt the financial statements and performance history of the Target Fund.

Year to Date Total Returns as of December 31, 2014

Performance information represents only past performance, before and after taxes, and does not necessarily indicate future results.

During the period of time shown in the bar chart, the Target Fund’s highest quarterly return was 18.47% for the quarter ended June 30, 2009, and the lowest quarterly return was -25.79% for the quarter ended December 31, 2008.

The following table compares the Target Fund's average annual total return as of December 31, 2014, to the MSCI KLD 400 Social Index, the Target Fund's primary benchmark, and the Russell 1000® Value Index.

Average Annual Total Returns

(for the periods ended December 31, 2014) | One Year | Five Years | Since Inception(1) |

| Institutional Class | | | |

| Return Before Taxes | 6.28% | 11.78% | 5.43% |

| Return After Taxes on Distributions | 5.22% | 10.53% | 4.60% |

| Return After Taxes on Distributions and Sale of Fund Shares | 4.37% | 9.34% | 4.32% |

| Class N | | | |

| Return Before Taxes | 6.03% | 11.52% | 5.18% |

MSCI KLD 400 Social Index (net)

(Reflects no deduction for fees, expenses or taxes) | 12.72% | 14.71% | 7.49% |

Russell 1000® Value Index

(Reflects no deduction for fees, expenses or taxes) | 13.45% | 15.42% | 7.30% |

| (1) | Performance for “Since Inception” for all classes is shown for periods beginning January 3, 2005, which is the date the predecessor to the Target Fund (the “Predecessor Fund”) commenced operations. On September 30, 2005, the Predecessor Fund reorganized into the Target Fund. The performance results for Institutional Class shares of the Target Fund before September 30, 2005, reflect the performance of the Predecessor Fund’s Class I shares. Class A shares of the Predecessor Fund, the predecessor to the Class N shares of the Fund, commenced operations on August 12, 2005. |

The performance results for Class N shares of the Target Fund for the period of August 12, 2005, to September 29, 2005, reflect the performance of the Predecessor Fund’s Class A shares. The performance results for Class N shares of the Target Fund for the period of January 3, 2005, to August 12, 2005, reflect the performance of the Predecessor Fund’s Class I shares. The performance of the Predecessor Fund’s Class I shares has not been adjusted to reflect the higher Rule 12b-1 fees and expenses applicable to the Target Fund’s Class N shares. If it had, the performance of the Target Fund’s Class N shares would have been lower than that shown.

The measurement period used in computing the returns of the indices shown for the “Since Inception” period begins on December 31, 2004.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The performance of Institutional Class shares does not reflect Class N shares’ Rule 12b-1 fees and expenses. After-tax returns for Class N shares will vary from the after-tax returns shown above for Institutional Class shares. The after-tax returns shown are not relevant to investors who hold their Target Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

| E. | COMPARISON OF SHAREHOLDER SERVICES |

Purchase and Redemption Procedures

The Acquiring Fund will offer the same or substantially similar shareholder purchase and redemption services as the Target Fund, including telephone purchases and redemptions. Shares of the Acquiring Fund may be purchased and redeemed at the net asset value per share (“NAV”) as next determined following receipt of a purchase and redemption order, provided the order is received in proper form. Payment of redemption proceeds generally will be made the next business day after processing by the Acquiring Fund's transfer agent after receipt of a redemption request in proper form.

Minimum Initial and Subsequent Investment Amounts

You can open an account and add to your account in either Fund by mailing a check or by wiring money into your account. You may also perform transactions by using the Internet. The Acquiring Fund will offer different account minimums from the Target Fund. The initial minimum and subsequent investments for each Fund and account type are summarized below:

| | Acquiring Fund Investor Shares | Acquiring Fund Institutional Shares |

| | Minimum

Initial

Investment | Minimum

Additional

Investment | Minimum

Initial

Investment | Minimum

Additional

Investment |

| Standard Accounts | $2,500 | $100 | $100,000 | None |

| Retirement Accounts | $1,000 | $250 | $100,000 | None |

| | Target Fund Class N Shares | Target Fund Institutional Shares |

| | Minimum

Initial

Investment | Minimum

Additional

Investment | Minimum

Initial

Investment | Minimum

Additional

Investment |

| Standard Accounts | $1,000 | None | $1,000,000 | None |

| Retirement Accounts | $1,000 | None | $1,000,000 | None |

Institutional Class shares of each Fund are available only to institutional investors that meet the minimum initial investment requirement and certain tax-deferred retirement plans. The Class N shares of the Target Fund and Investor Shares of the Acquiring Fund are available to individual investors (and in the case of Class N Shares of the Target Fund, to partnerships, corporations and other accounts) and certain tax-deferred retirement plans. The Funds reserve the right to change the minimum amount required to open an account or to add to an existing account without prior notice. Each Fund may accept investments of smaller amounts at its discretion; however, your financial institution or financial professional may establish higher minimum investment requirements than the Fund and may also independently charge you transaction fees and additional amounts in return for its services.

Redemptions

The shares of each Fund are redeemable. You may redeem some or all of your shares on any day the NYSE is open for regular session trading. Each Fund ordinarily pays redemption proceeds on the business day following the redemption of your shares. However, each Fund reserves the right to make payment within seven days of the redemption request. Redemption proceeds will be sent to you via check to your address of record or will be wired to your bank via the instructions on your account.

Dividends and Distributions

The Acquiring Fund will have the same dividend and distribution policy as the Target Fund. Shareholders who have elected to have dividends and capital gains reinvested in the Target Fund will continue to have dividends and capital gains reinvested in the Acquiring Fund following the Reorganization.

Fiscal Year

The Target Fund currently operates on a fiscal year ending September 30. Following the Reorganization, the Acquiring Fund will assume the financial history of the Target Fund and continue to operate on a fiscal year ending November 30 of each year.

Business Structure

Each of the Trust and Forum is organized as a Delaware statutory trust. The differences between governing documents of the Trust and Forum will not significantly affect the operations of the Target Fund or the Acquiring Fund or change the responsibilities, powers or the fiduciary duty owed to shareholders by a trust’s board of trustees and officers.

The Trust and Forum are operated by their respective Boards of Trustees and officers appointed by each Board. The composition of the Boards of Trustees and the officers for the Trust and Forum differ. Further information about and a comparison of the current structure of the Trust and Forum are contained in Appendix B and in their respective governing documents.

| F. | COMPARISON OF VALUATION PROCEDURES |

Generally, the procedures by which Forum intends to value the securities of the Acquiring Fund are very similar to the procedures used by the Trust to value the securities of the Target Fund. In all cases in which a price is not readily available, both Forum and the Trust turn to their fair value procedures for guidance. Applying Forum's valuation policies after the Reorganization to the Acquiring Fund will not result in material differences in the Acquiring Fund's NAVs compared to applying the Trust's valuation policies to the Target Fund prior to the Reorganization.

The Adviser and Sub-Adviser

CNR, located at City National Center, 400 North Roxbury Drive, Beverly Hills, California 90210, is the Target Fund’s investment adviser and will not continue to serve as the investment adviser to the Acquiring Fund if the Reorganization is approved by the shareholders of the Target Fund. CNR is a wholly-owned subsidiary of City National Bank (“CNB”) with approximately $26 billion in assets under management as of December 31, 2014. CNB, a federally chartered commercial bank founded in the early 1950s, is itself a wholly-owned subsidiary of City National Corporation (“CNC”), a New York Stock Exchange listed company. CNB has provided trust and fiduciary services, including investment management services, to individuals and businesses for over 50 years. CNB currently provides investment management services to individuals, pension and profit sharing plans, endowments and foundations. As of December 31, 2014, CNB and its affiliates had approximately $60.8 billion in assets under administration, which includes approximately $48.1 billion in assets under management. On January 22, 2015, City National Corporation announced that it had entered into a definitive agreement by which Royal Bank of Canada will acquire all outstanding shares of City National Corporation. The transaction is expected to close before the end of 2015 subject to customary closing conditions.

CNR or its predecessor has provided investment advisory services to the Target Fund since the Target Fund’s inception on January 3, 2005. Under its advisory agreement with the Target Fund, CNR receives an advisory fee equal to 0.75% of the Fund’s average daily net assets. For the fiscal year ended September 30, 2014, CNR waived or reimbursed a portion of its management fee for the Target Fund such that CNR received a fee of 0.68% of the Target Fund’s average daily net assets. CNR pays SKBA a sub-advisory fee with respect to the Target Fund out of CNR’s advisory fees.

CNR has contractually agreed to limit its fees or reimburse the Target Fund for expenses to the extent necessary to keep the Fund’s net annual fund operating expenses (excluding taxes, interest, brokerage commissions, extraordinary expenses and acquired fund fees and expenses) through January 31, 2016, at or below 1.25% for Institutional Class shares and 1.50% for Class N shares. Prior to that date, this arrangement may be terminated without penalty by the Target Fund’s Board of Trustees upon 60 days’ written notice to CNR, and it will terminate automatically upon the termination of the investment management agreement between CNR and the Target Fund. In addition, CNR has voluntarily agreed to limit its fees or reimburse expenses to the extent necessary to keep the Target Fund’s total annual fund operating expenses (with the same exclusions applicable to the contractual expense cap) at or below 0.89% for Institutional Class shares and 1.14% for Class N shares. Any fee reductions or reimbursements pursuant to the contractual or voluntary expense caps may be repaid to CNR within three years after they occur if the Fund’s Board of Trustees approves the repayment. To the extent the Target Fund incurs any expenses excluded from the expense limitations, the Target Fund’s total annual fund operating expenses will increase.

SKBA is the sub-adviser to the Target Fund and will become the investment adviser to the Acquiring Fund if the Reorganization is approved. SKBA is a majority employee owned firm. Effective May 16, 2011, SKBA employee shareholders became majority owners of SKBA, and Convergent Capital Management LLC, a wholly-owned subsidiary of CNC which previously was a majority owner of SKBA, holds a minority ownership interest in SKBA.

The advisory fee for the Acquiring Fund is 0.70%. SKBA plans to contractually waive a portion or all of its management fees and pay the Acquiring Fund expenses to ensure that the net annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of the Acquiring Fund do not exceed 1.14% of the Acquiring Fund’s average daily net assets with respect to Investor Class Shares and 0.89% of the Acquiring Fund’s average daily net assets with respect to Institutional Class Shares at least through December 31, 2017. This is the same level as the expense cap that is currently in place with respect to the Target Fund, including the effect of CNR’s voluntary fee waivers. Any waiver of management fees or payment of Acquiring Fund expenses made by SKBA may be recouped in subsequent fiscal years if SKBA so requests. This recoupment may be requested if the aggregate amount actually paid by the Acquiring Fund toward operating expenses for such fiscal year (taking into account the recoupment) does not exceed the Expense Cap. SKBA is permitted to recoup waived management fees and expense payments made in the prior three fiscal years from the date the management fees were waived and Acquiring Fund expenses were paid. The Acquiring Fund must pay current ordinary operating expenses before SKBA is entitled to any recoupment of management fees and/or expenses. SKBA is not entitled to recoup any fees or expenses waived for the benefit of the Target Fund after it is reorganized into the Acquiring Fund.

Other Service Providers

U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, Wisconsin 53202, is the Target Fund's transfer agent. U.S. Bank National Association, 1555 N. River Center Drive, Suite 302, Milwaukee, Wisconsin 53212, is the custodian for the portfolio securities, cash and other assets of the Target Fund. Beginning with the fiscal year ended September 30, 2015, BBD, LLP, 1835 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, will serve as the Target Fund's independent registered public accounting firm and will audit the financial statements and the financial highlights of the Target Fund. SEI Investments Distribution Co., One Freedom Valley Drive, Oaks, Pennsylvania 19456, is the Target Fund's distributor. SEI Investments Global Funds Services, One Freedom Valley Drive, Oaks, Pennsylvania 19456, is the Target Fund’s administrator and fund accountant.

Atlantic Fund Services, Three Canal Plaza, Portland, Maine 04101, will serve as the Acquiring Fund's administrator, transfer agent, fund accountant and dividend disbursing agent. Union Bank, N.A., 350 California Street, 6th Floor, San Francisco, California 94104, will serve as the custodian for the portfolio securities, cash and other assets of the Acquiring Fund. BBD, LLP, 1835 Market Street, 26th Floor, Philadelphia, Pennsylvania 19103, will serve as the Acquiring Fund's independent registered public accounting firm and will audit the financial statements and the financial highlights of the Acquiring Fund. Foreside Fund Services, LLC (“Foreside”), Three Canal Plaza, Suite 100, Portland, Maine 04101, will serve as the Acquiring Fund's distributor.

The following table sets forth as of September 17, 2015: (1) the unaudited capitalization of the Target Fund, and (2) the unaudited pro forma combined capitalization of the Acquiring Fund assuming the Reorganization has been approved. If the Reorganization is consummated, the capitalizations are likely to be different on the Closing Date as a result of daily share purchase and redemption activity in the Target Fund and changes in NAV.

| | Target Fund | Pro Forma Acquiring Fund |

| Net Assets | | |

| Institutional Class | $246,600,788 | $246,600,788 |

| Class N* | $24,139,629 | $24,139,629 |

| | | |

| Shares Outstanding | | |

| Institutional Class | 23,124,569 | 23,124,569 |

| Class N* | 2,270,062 | 2,270,062 |

| | | |

| NAV | | |

| Institutional Class | $10.6640 | $10.6640 |

| Class N* | $10.6339 | $10.6339 |

| * | Class N shares of the Target Fund will be exchanged for Investor Class shares of the Acquiring Fund. |

| I. | SUMMARY OF THE AGREEMENT AND PLAN OF REORGANIZATION |

Below is a summary of the important terms of the Plan of Reorganization. This summary is qualified in its entirety by reference to the Plan of Reorganization itself, which is set forth in Appendix A to this Proxy Statement, and which you are encouraged to read in its entirety.

General Plan of Reorganization

The Plan of Reorganization outlines several steps that will occur on the Closing Date, provided the Reorganization is approved by shareholders. First, the Target Fund will transfer all of its assets to the Acquiring Fund in exchange solely for shares of the Acquiring Fund and an assumption by the Acquiring Fund of all liabilities of the Target Fund. Immediately thereafter, the Target Fund will liquidate and distribute the shares received from the Acquiring Fund to its shareholders in exchange for their shares of the Target Fund. This will be accomplished by opening an account on the books of the Acquiring Fund in the name of each shareholder of record of the Target Fund and by crediting to each such account the shares due to the shareholder in the Reorganization. Every shareholder will own the same number of shares of the corresponding class of the Acquiring Fund as the number of Target Fund shares held by the shareholder immediately before the Reorganization. For example, if you held 100 Class N shares of the Target Fund immediately prior to the Closing Date, those shares would be canceled and you would receive 100 Investor Class shares of the Acquiring Fund. Shareholders owning Institutional Class shares of the Target Fund would receive Institutional Class shares of the Acquiring Fund. The value of your investment immediately after the Reorganization will be the same as it was immediately prior to the Reorganization. All of these transactions would occur as of the Closing Date.

Other Provisions

The Reorganization is subject to a number of conditions set forth in the Plan of Reorganization. Certain of these conditions may be waived by the Board of Trustees of each of the Trust and Forum. The significant conditions, neither of which is waivable, include: (a) the receipt by the Trust and Forum of an opinion of counsel as to certain federal income tax aspects of the Reorganization, and (b) the approval of the Plan of Reorganization by shareholders of the Target Fund. The Plan of Reorganization may be terminated and the Reorganization abandoned at any time prior to the Closing Date, before or after approval by the shareholders of the Target Fund, by the Board of Trustees of the Trust or the Board of Trustees of Forum. In addition, the Plan of Reorganization may be amended upon mutual agreement. However, shareholder approval would be required in order to amend the Plan of Reorganization subsequent to the shareholders' meeting in a manner that would change the method for determining the number of shares to be issued to shareholders of the Target Fund.

| J. | REASONS FOR THE REORGANIZATION |

Based on the recommendation of CNR and SKBA at a meeting held on August 27, 2015, the Board of Trustees of the Trust, including a majority of the Independent Trustees, considered and approved the Reorganization, as presented at the meeting. At its meeting, the Board received and evaluated materials regarding Forum and the Acquiring Fund, including the expense structure of the Acquiring Fund and the effect of the Reorganization on Target Fund shareholders. The Independent Trustees were assisted in their consideration of the Reorganization by their independent legal counsel. Based on the recommendation of CNR and SKBA, the Board’s evaluation of the relevant information prepared by CNR, Atlantic, SKBA and Foreside, and in light of its fiduciary duties under federal and state law, the Board, including the Independent Trustees, determined that the Reorganization would be in the best interests of the Target Fund and its shareholders.

In considering the Reorganization, the Board noted that after the closure of another series of the Trust (which took place in September 2015), the Target Fund will be the last open series of a fund family sponsored by the American Hospital Association that reorganized into the Trust in 2005; the Target Fund’s investor base is largely made up of religious hospital retirement plans the investment mandates of which include investing in socially responsible companies; and because the Trust has not historically focused on this market segment, the asset growth of the Target Fund has been primarily a result of inflows primarily from these retirement plans and promotional efforts of SKBA. The Board considered CNR’s and SKBA’s recommendation that the Target Fund be reorganized out of the Trust into Forum, with SKBA assuming the role of investment adviser to the Fund, and noted CNR’s and SKBA’s belief that this change would be beneficial to the Target Fund’s shareholders in part because the Fund’s investment strategy and the management of the Fund would be a core focus of SKBA’s fund team, rather than one of multiple fund product offerings.

The Board also considered the following additional matters, among others, in approving the Reorganization:

| · | SKBA would continue to manage the fund as investment adviser to the Acquiring Fund and the existing investment team would continue to be responsible for the day-to-day management of the Acquiring Fund; |

| · | the investment objectives, policies and restrictions of the Target Fund are materially the same as those of the Acquiring Fund; |

| · | the advisory fee for the Acquiring Fund would be five basis points lower than the advisory fee for the Target Fund; |

| · | the net annual fund operating expenses of each class of the Acquiring Fund are expected to be the same as or lower than those of the corresponding class of the Target Fund for at least two years following the Reorganization; |

| · | the Reorganization will be structured so that shareholders likely would not experience any tax consequences as a result; |

| · | shareholders who do not wish to become shareholders of the Acquiring Fund may redeem their shares before the Reorganization; |

| · | a liquidation of the Target Fund would be a taxable event, forcing shareholders to recognize a gain or loss on their investment for tax purposes; |

| · | the cost of the Reorganization will not be borne by the Target Fund or its shareholders; |

| · | the Reorganization will not result in the dilution of the value of the outstanding shares of the Target Fund; and |

| · | the Reorganization would be submitted to the shareholder of the Target Fund for approval. |

The Board also considered that the proposed Reorganization might provide certain benefits to SKBA, including providing SKBA with a better opportunity to retain its assets under management than a liquidation of the Target Fund. In addition, to the extent the fees and expenses of the Acquiring Fund are less than those of the Target Fund, SKBA’s required level of waiver/reimbursement to the Acquiring Fund necessary to maintain the Expense Cap will decrease.

After consideration of these and other factors it deemed appropriate, the Board of Trustees of the Target Fund, including the Independent Trustees, approved the Reorganization and has recommended that the Plan of Reorganization be submitted to shareholders of the Target Fund for their approval. In approving the Reorganization, the Board determined that the proposed Reorganization would be in the best interests of each of the Target Fund and its shareholders, and that shareholder interests would not be diluted as a result of the Reorganization.

The Board now submits to shareholders of the Target Fund a proposal to approve the Reorganization. If shareholders approve the Proposal, the Reorganization is expected to take effect on or about 4:00 p.m. Eastern Time on the Closing Date, although that date may be adjusted in accordance with the Plan of Reorganization. Following the Reorganization, the Target Fund will be dissolved. If shareholders of the Target Fund fail to approve the Reorganization, the Target Fund will not be reorganized into the Acquiring Fund and the Board Trust will consider what steps to take, including liquidating the Target Fund.

| K. | FEDERAL INCOME TAX CONSEQUENCES |

The following is a general summary of some of the important U.S. federal income tax consequences of the Reorganization and is based upon the current provisions of the Internal Revenue Code of 1986, as amended (the "Code"), the existing U.S. Treasury Regulations thereunder, current administrative rulings of the Internal Revenue Service (the “IRS”) and published judicial decisions, all of which are subject to change, possibly with retroactive effect. These considerations are general in nature and individual shareholders should consult their own tax advisers as to the federal, state, local, and foreign tax considerations applicable to them and their individual circumstances. These same considerations generally do not apply to shareholders who hold their shares in a tax-advantaged account, such as an individual retirement account or qualified retirement plan.

The Target Fund has qualified since its inception, and the Acquiring Fund intends to qualify each year, for treatment as a “regulated investment company” under Subchapter M of Chapter 1 of the Code.

The Reorganization is intended to be a “reorganization” described in Section 368(a)(1)(F) of the Code. The principal federal income tax consequences that are expected to result from the Reorganization of the Target Fund into the Acquiring Fund are generally as follows:

| · | pursuant to Sections 361(a), 361(c)(1) and 354(a) of the Code, no gain or loss will be recognized by the Target Fund or the shareholders of the Target Fund as a direct result of the Reorganization; |

| · | pursuant to Section 1032(a) of the Code, no gain or loss will be recognized by the Acquiring Fund as a direct result of the Reorganization; |

| · | pursuant to Section 362(b) of the Code, the tax basis of the assets of the Target Fund received by the Acquiring Fund will be the same as the tax basis of these assets in the hands of the Target Fund immediately prior to the exchange; |

| · | pursuant to Section 1223(2) of the Code, the holding period of the assets of the Target Fund received by the Acquiring Fund will include the period during which such assets were held by the Target Fund; |

| · | pursuant to Section 358(a)(1) of the Code, the aggregate tax basis of the shares of the Acquiring Fund to be received by a shareholder of the Target Fund as part of the Reorganization will be the same as the shareholder’s aggregate tax basis of the shares of the Target Fund; |

| · | pursuant to Section 1223(1) of the Code, the holding period of the shares of the Acquiring Fund received by a shareholder of the Target Fund as part of the Reorganization will include the period that a shareholder held the shares of the Target Fund (provided that such shares of the Target Fund are capital assets in the hands of such shareholder as of the closing); and |

| · | the taxable year of the Target Fund will not end on the Closing Date. |

Neither the Target Fund nor the Acquiring Fund has requested or will request an advance ruling from the IRS as to the U.S. federal tax consequences of the Reorganization. As a condition to closing, Stradley, Ronon, Stevens & Young, LLP will render a favorable opinion to the Target Fund and the Acquiring Fund as to the foregoing federal income tax consequences of the Reorganization, which opinion will be conditioned upon, among other things, the accuracy, as of the Closing Date, of certain representations of the Target Fund and the Acquiring Fund upon which Stradley, Ronon, Stevens & Young, LLP will rely in rendering its opinion.

Opinions of counsel are not binding upon the IRS or the courts. If the Reorganization were consummated but the IRS or the courts were to determine that the Reorganization did not qualify as a “reorganization” under the Code, and thus was a taxable transaction, the Target Fund would recognize gain or loss on the transfer of its assets to the Acquiring Fund and each shareholder of the Target Fund that held shares in a taxable account would recognize a taxable gain or loss equal to the difference between its tax basis in its Target Fund shares and the fair market value of the shares of the Acquiring Fund it received and would have a holding period for its Acquiring Fund shares commencing with the Reorganization.

The ability of the Acquiring Fund to carry forward capital losses (if any) of the Target Fund and use such losses to offset future gains generally will not be limited as a direct result of the Reorganization.

Although the Trust is not aware of any adverse state income tax consequences, the Trust has not made any investigation as to those consequences for the shareholders. Because each shareholder may have unique tax issues, shareholders should consult their own tax advisors.

| L. | CERTAIN INFORMATION REGARDING THE TRUSTEES AND OFFICERS |