SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

City National Rochdale Funds

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1) Title of each class of securities to which transaction applies: N/A

(2) Aggregate number of securities to which transaction applies: N/A

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): N/A

(4) Proposed maximum aggregate value of transaction: N/A

(5) Total fee paid: $0

| [ ] | Fee paid previously with preliminary materials. N/A |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) Amount Previously Paid: N/A

(2) Form, Schedule or Registration Statement No.: N/A

(3) Filing Party: N/A

(4) Date Filed: N/A

CITY NATIONAL ROCHDALE FUNDS

City National Rochdale Municipal High Income Fund

April 22, 2016

Dear Shareholder:

The shareholders of the City National Rochdale Municipal High Income Fund (the “Fund”) are being asked to approve an amended investment management agreement for the Fund that would increase the annual advisory fee rate payable by the Fund to City National Rochdale, LLC (“CNR”), the Fund’s investment adviser, by 0.05% (the “Amended Management Agreement”).

The Fund is a series of City National Rochdale Funds (the “Trust”). As described further in the enclosed proxy statement, in February 2016, upon the recommendation of CNR and after careful consideration, the Trust’s Board of Trustees approved the Amended Management Agreement, subject to approval by the shareholders of the Fund.

If shareholders approve the proposal, the Fund expects that the Amended Management Agreement will become effective as soon as reasonably practicable.

If you owned shares of the Fund as of the close of business on March 31, 2016, you are entitled to vote on the proposal.

The Board of Trustees has concluded that approving the Amended Management Agreement would serve the best interests of the Fund and its shareholders. The Board of Trustees recommends that you vote FOR this proposal after carefully reviewing the enclosed materials.

Your vote is important. Upon completing your review, please take a moment to sign and return your proxy card in the enclosed postage paid return envelope. If we do not hear from you after a reasonable amount of time, you may receive a telephone call from us reminding you to vote your shares. On behalf of the Board of Trustees, we thank you for your continued investment in the Fund.

Sincerely,

Garrett R. D’Alessandro

President and Chief Executive Officer

President and Chief Executive Officer

1

QUESTIONS AND ANSWERS

What proposal am I being asked to vote on?

You are being asked to approve an amended investment management agreement (the “Amended Management Agreement”) for City National Rochdale Municipal High Income Fund (the “Fund”) to increase the fee rate payable by the Fund to City National Rochdale, LLC (“CNR”), the Fund’s investment adviser, from 0.45% to 0.50% of the Fund’s average daily net assets (the “Proposal”). No other amendment is proposed to be made to the current investment management agreement with CNR.

Has the Fund’s Board of Trustees approved the Proposal?

Yes. After careful consideration, the Board of Trustees (the “Board”) unanimously approved the Proposal and is submitting it for approval by the Fund’s shareholders. The Board considered a variety of factors in approving the Amended Management Agreement, which are discussed in the enclosed proxy statement under “Consideration of Proposed Amended Management Agreement.”

Why am I being asked to approve the Amended Management Agreement?

CNR requested that the Board approve the Amended Management Agreement in order to increase the advisory fee rate payable by the Fund, subject to shareholder approval, because, among other things:

| · | Prior to April 1, 2016, the Fund’s investment portfolio was managed by Waddell & Reed pursuant to a sub-advisory agreement with CNR. CNR has hired a new team of highly experienced municipal high yield investment professionals who began managing the Fund directly on April 1, 2016. The proposed fee increase is intended to compensate CNR for the substantial increased costs CNR anticipates that it will incur as a result of internalizing management of the Fund, including, among others, providing the new municipal high yield team with new or additional facilities and equipment, support staff, technology and research resources, new and ongoing employee compensation expenses to attract and retain high quality professionals, and increased oversight and use of compliance and legal resources. |

| · | CNR believes that the proposed fee increase will allow it to provide high quality services to the Fund while maintaining a competitive expense ratio for shareholders, and to remain well-resourced to meet evolving needs as the Fund’s assets grow. |

| · | Although the Fund’s annual advisory fee rate would increase by 0.05% under the Proposal, as a result of CNR’s rebate structure for its separately managed account clients (who currently comprise most of the Fund’s shareholders) the net advisory fees paid by those clients with respect to their investments in the Fund will either remain the same or be reduced for at least a period of two years following the effective date of the Amendment Management Agreement, as described in greater detail in the enclosed proxy statement. |

2

Because the Amended Management Agreement would increase the advisory fee rate payable by the Fund, shareholder approval of the agreement is required by federal law in order for the agreement to be effective.

I am a client of CNR who invests in the Fund through my separately managed account. How will the Proposal affect my account fees?

CNR currently rebates a portion of the separately managed account fees (“Account Fees”) it charges to the majority of its separately managed account clients that invest in the Fund and other City National Rochdale Funds (the “CNR Funds”) in order to offset the advisory fees paid by those CNR Funds that are retained by CNR. Although the Fund’s gross advisory fee would increase, due to CNR’s rebate structure the net advisory fees those separately managed account clients will pay with respect to their investments in the Fund will be reduced from 0.38% to 0.25%.

The Fund’s current advisory fee is 0.45%. Prior to April 1, 2016, approximately 0.38% of the Fund’s advisory fee was paid by CNR to the Fund’s then-current sub-adviser. While the Fund was sub-advised CNR rebated the difference of approximately 0.07% to the majority of its separately managed account clients invested in the Fund, leaving a net advisory fee of 0.38%. Although the Fund is no longer sub-advised, CNR has continued to rebate such amounts to those clients. The Proposal will increase the Fund’s annual gross advisory fee from 0.45% to 0.50%, but CNR plans to rebate 0.25% of the fee back to the majority of its separately managed account clients invested in the Fund so they will pay CNR an annual net advisory fee of 0.25% rather than 0.38%. CNR is committed to maintaining this 0.25% rebate for a period of at least two years from the effective date of the Amended Management Agreement, and it has no current intention to change the fee credits after that two-year period.

Certain separately managed account clients of CNR whose assets are custodied at City National Bank and who pay lower Account Fees than CNR’s standard Account Fee pursuant to a historical fee schedule that has been discontinued (representing approximately 18% of the Fund’s assets) will receive a rebate from CNR equal to 0.05% of the advisory paid with respect to their investment in the Fund. For those CNR clients, the net annual advisory fee rate paid with respect to the Fund will remain the same. CNR is committed to maintaining this 0.05% rebate for a period of at least two years from the effective date of the Amended Management Agreement, and it has no current intention to change the fee credits after that two-year period.

Will my vote make a difference?

Your vote is very important no matter how many shares you own. Your vote can help ensure that the proposal recommended by the Board of Trustees can be implemented. Voting your shares early will eliminate the need for follow-up mail and telephone solicitation.

3

I am a separately managed account client of CNR and CNR has proxy voting discretion with respect to the Fund shares I own. How will CNR vote my proxy with respect to the Proposal?

Currently, approximately 96% of the Fund’s shares are owned by separately managed account clients of CNR; in most cases, CNR has proxy voting discretion with respect to CNR Fund shares held in such accounts. CNR intends to “echo vote” its clients’ shares of the Fund with respect to the Proposal in cases where CNR has proxy voting discretion. This means CNR will vote any Fund shares held by such separately managed account clients, for which it does not receive voting instructions, in the same proportion as the vote of its other separately managed account clients that do provide voting instructions.

Who is paying for preparation, printing and mailing of the Proxy Statement?

The costs associated with the Proxy Statement, including the mailing and proxy solicitation costs, will be borne by CNR, not by the Fund.

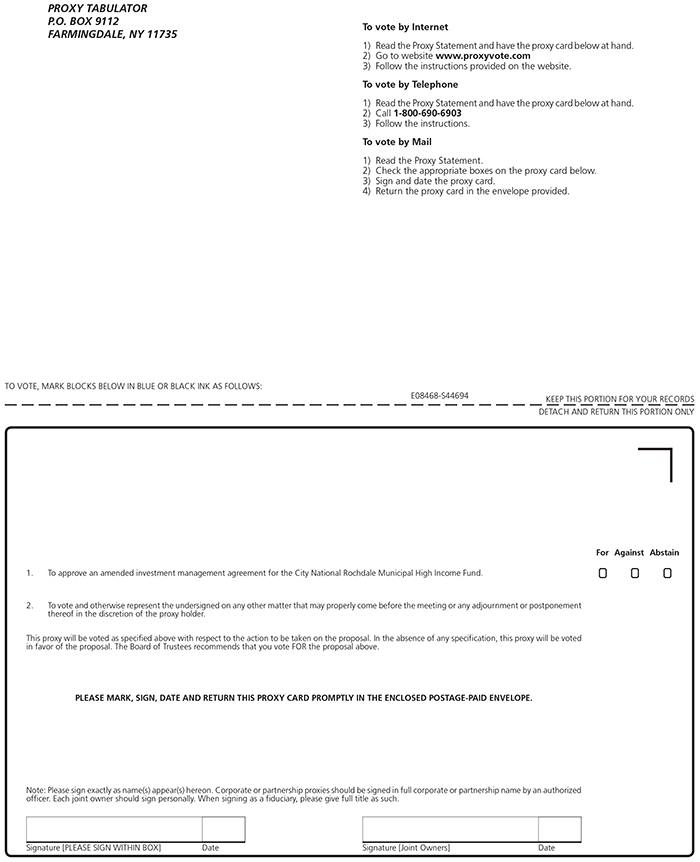

How do I vote my shares?

You can vote your shares by completing and signing the enclosed proxy ballot, and mailing the proxy ballot in the enclosed postage paid envelope. You also may vote your shares by telephone or via the internet by following the instructions on the attached proxy ballot and accompanying materials. If you need assistance, or have any questions regarding the proposals or how to vote your shares, please call our proxy information line toll-free at 1-800-690-6903.

4

CITY NATIONAL ROCHDALE FUNDS

City National Rochdale Municipal High Income Fund

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held On June 15, 2016

To Be Held On June 15, 2016

A Special Meeting of Shareholders of the City National Rochdale Municipal High Income Fund (the “Fund”) will be held on June 15, 2016, at 10:00 a.m., local time, at the office of City National Rochdale, LLC, at 570 Lexington Avenue, New York, New York 10022. At the meeting, shareholders of the Fund will be asked to vote on the following proposals:

| 1. | To approve an amended investment management agreement for the Fund; and |

| 2. | Any other matters that properly come before the meeting or any adjournment thereof. |

The Board of Trustees of City National Rochdale Funds (the “Trust”) has unanimously approved Proposal 1 with respect to the Fund. ACCORDINGLY, THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE FOR PROPOSAL 1.

Please read the accompanying Proxy Statement for a more complete discussion of Proposal 1.

Shareholders of the Fund of record as of the close of business on March 31, 2016, are entitled to notice of, and to vote at, the Fund’s Special Meeting or any adjournment thereof.

YOUR VOTE IS IMPORTANT. PLEASE SIGN, DATE AND RETURN YOUR PROXY PROMPTLY.

You are invited to attend the Special Meeting. If you cannot do so, please complete and return in the enclosed postage-paid return envelope the accompanying proxy, which is being solicited by the Board of Trustees of the Trust, on behalf of the Fund, as promptly as possible. This is important for the purpose of ensuring a quorum at the Special Meeting. You may revoke your proxy at any time before it is exercised by signing and submitting a revised proxy, by giving written notice of revocation to the Trust at any time before the proxy is exercised, or by voting in person at the Special Meeting.

By order of the Board of Trustees,

Garrett R. D’Alessandro

President and Chief Executive Officer

April 22, 2016

5

PROXY STATEMENT

City National Rochdale Municipal High Income Fund

City National Rochdale Municipal High Income Fund

The Board of Trustees of City National Rochdale Funds (the “Trust”) is sending this Proxy Statement to the shareholders of the City National Rochdale Municipal High Income Fund, a series of the Trust (the “Fund”), in connection with the solicitation of voting instructions for use at a special meeting of shareholders of the Fund (the “Meeting”) for the purposes set forth below and in the accompanying Notice of Special Meeting of Shareholders.

This Proxy Statement is being mailed on or about April 29, 2016, to the shareholders of the Fund of record as of March 31, 2016 (the “Record Date”). The number of shares of each Class of the Fund outstanding on the Record Date was as follows:

| Class | Number of Issued and Outstanding Shares |

| Servicing Class | 34,128,677.6640 |

| Class N | 41,224,665.0070 |

| Total | 75,353,342.6710 |

Shareholders of the Fund are entitled to one vote for each whole share held and fractional votes for fractional shares held on the Record Date. Information on shareholders that owned beneficially more than 5% of the shares of each Class of the Fund as of the Record Date is in Appendix A. To the knowledge of the Trust, the executive officers and trustees of the Trust as a group owned less than 1% of the outstanding shares of the Fund and of the Trust as of the Record Date.

Important Notice Regarding Availability of Proxy Materials for the Meeting to be Held on June 15, 2016. This Proxy Statement is available on the Internet at www.citynationalrochdalefunds.com.

INTRODUCTION

The Fund began operation on December 30, 2013. City National Rochdale, LLC (“CNR”) serves as the Fund’s investment adviser. Subject to the general supervision of the Board of Trustees of the Trust, CNR is responsible for managing the Fund in accordance with the Fund’s investment objectives and the policies described in the Fund’s current Prospectus. As the Fund’s investment adviser, CNR may delegate day-to-day portfolio management responsibilities to one or more sub-advisers, subject to the approval of the Board of Trustees, and in that connection is responsible for making recommendations to the Board of Trustees with respect to hiring, termination and replacement of any sub-adviser of the Fund. From the Fund’s inception to March 31, 2016, Waddell & Reed Investment Management Co. (“Waddell”) served as the sub-adviser to the Fund.

6

At a meeting of the Trust’s Board of Trustees held on February 18, 2016, CNR proposed to terminate the services of Waddell and to assume direct management of the Fund with a new CNR team of highly experienced municipal high yield bond investment professionals. In that connection, upon the recommendation of CNR and after careful consideration, the Trust’s Board of Trustees, including the Trustees who are not “interested persons” of the Trust as defined in the Investment Company of 1940, as amended (the “1940 Act”) (the “Independent Trustees”), approved an amended investment management agreement (the “Amended Management Agreement”) between the Trust, on behalf of the Fund, and CNR that would increase the investment advisory fee paid by the Fund to CNR. Effective April 1, 2016, Waddell no longer serves as the sub-adviser to the Fund and CNR has assumed direct management of the Fund.

A copy of the Amended Management Agreement is attached as Appendix B. The 1940 Act requires approval by the Fund’s shareholders for the Amended Management Agreement to be effective.

Current and Pro Forma Fees and Expenses

The tables of Fees and Expenses and the Examples shown below are based on the Fund’s current fees and expenses as shown in the Fund’s Prospectus and on the increase in the Fund’s advisory fee if the shareholders approve the Amended Management Agreement.

The tables below describe the fees and expenses you may pay if you buy and hold shares of the Fund.

Current Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| Servicing Class | Class N | |||

| Management Fees | 0.45% | 0.45% | ||

| Distribution (12b-1) Fee | None | 0.25% | ||

| Other Expenses | ||||

| Shareholder Servicing Fee | 0.25% | 0.25% | ||

| Other Fund Expenses | 0.09% | 0.08% | ||

| Total Other Expenses | 0.34% | 0.33% | ||

| Acquired Fund Fees and Expenses | 0.01% | 0.01% | ||

| Total Annual Fund Operating Expenses | 0.80% | 1.04% | ||

7

Pro Forma Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

(expenses that you pay each year as a percentage of the value of your investment)

| Servicing Class | Class N | |||

| Management Fees | 0.50% | 0.50% | ||

| Distribution (12b-1) Fee | None | 0.25% | ||

| Other Expenses | ||||

| Shareholder Servicing Fee | 0.25% | 0.25% | ||

| Other Fund Expenses | 0.09% | 0.08% | ||

| Total Other Expenses | 0.34% | 0.33% | ||

| Acquired Fund Fees and Expenses | 0.01% | 0.01% | ||

| Total Annual Fund Operating Expenses | 0.85% | 1.09% | ||

The following Examples are intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

Each Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. Each Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

(Current Annual Fund Operating Expenses)

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Servicing Class | $82 | $255 | $444 | $990 |

| Class N | $106 | $331 | $574 | $1,271 |

(Pro Forma Annual Fund Operating Expenses)

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Servicing Class | $87 | $271 | $471 | $1,049 |

| Class N | $111 | $347 | $601 | $1,329 |

Current Investment Management Agreement

CNR, located at City National Center, 400 North Roxbury Drive, Beverly Hills, California 90210, serves as the investment adviser to the Fund pursuant to an investment management agreement with the Trust (the “Current Management Agreement”) effective with respect to the Fund as of December 31, 2013, which was approved by the Board on December 4, 2013, and by the initial shareholder of the Fund on December 27, 2013.

8

Pursuant to the terms of the Current Management Agreement, CNR provides the Fund with investment advice; supervises investments of the Fund in accordance with the investment objectives, programs and restrictions of the Fund as provided in the Trust’s governing documents and the Fund’s Prospectus and Statement of Additional Information; and retains, recommends employment and termination of, and monitors the performance of any sub-advisers, subject to the ultimate supervision and oversight of the Trust’s Board of Trustees.

Pursuant to the Current Management Agreement, the Fund is obligated to pay CNR an annual investment advisory fee equal to 0.45% of the Fund’s average annual daily net assets. For the fiscal year ended September 30, 2015, the Fund paid CNR $2,565,032 in advisory fees, including recovery of $12,596 in previously waived fees. If the proposed advisory fee of 0.50% had been in effect, CNR would have received $2,848,636 in advisory fees, including the recovery of the previously waived fees, which would represent an 11.1% increase.

Certain Payments to CNR Affiliates

City National Bank (“CNB”), an affiliate of CNR, has entered into a Shareholder Services Agreement with the Trust. Pursuant to the Shareholder Services Agreement, CNB will provide, or will arrange for others to provide, certain specified shareholder services to shareholders of all classes of the Fund except for the Institutional Class shares. As compensation for the provision of such services, the Fund pays CNB a fee of 0.25% of the average daily net assets of the applicable classes on an annual basis, payable monthly. CNB may pay certain banks, trust companies, broker-dealers, and other institutions (each a “Participating Organization”) out of the fees CNB receives from the Fund under the Shareholder Services Agreement to the extent that the Participating Organization performs shareholder servicing functions for the Fund with respect to shares of the Fund owned from time to time by customers of the Participating Organization. For the fiscal year ended September 30, 2015, pursuant to the Shareholder Services Agreement, the Class N and Servicing Class shares of the Fund paid CNB $737,167 and $680,646, respectively.

As a Participating Organization, City National Securities, Inc. (“CNS”), a wholly-owned subsidiary of CNB, has entered into a Shareholder Service Provider Agreement with CNB to provide shareholder servicing functions for the Fund with respect to shares of the Fund owned from time to time by customers of CNS. For the fiscal year ended September 30, 2015, pursuant to the Shareholder Service Provider Agreement, CNB paid CNS $43,896.

Such services will continue to be provided regardless of whether the Proposal is approved.

PROPOSAL 1: APPROVAL OF PROPOSED AMENDED MANAGEMENT AGREEMENT

The purpose of this Proposal is to approve the Amended Management Agreement between CNR and the Fund. The terms of the Amended Management Agreement are substantially identical to those of the Current Management Agreement, except that, if approved, the advisory fee rate payable by the Fund under the Amended Management Agreement will be higher than the rate payable under the Current Management Agreement.

9

Under the Current Management Agreement, CNR is paid an annual advisory fee equal to 0.45% of the average annual daily net assets of the Fund. Pursuant to the Amended Management Agreement, the proposed annual fee would be 0.50% of the average annual daily net assets of the Fund. No other changes are being proposed to the Current Management Agreement and the Fund’s investment objective will not change.

At an in-person meeting on February 18, 2016, the Board of Trustees considered the Amended Management Agreement. The Board, including the Independent Trustees, voted unanimously to approve the Amended Management Agreement, and to recommend approval of the Amended Management Agreement to the shareholders of the Fund.

Consideration of Proposed Amended Management Agreement

In advance of the meeting, the Board received information about the proposed Amended Management Agreement from CNR and SEI Investments Global Funds Services, the Trust’s administrator, certain portions of which are discussed below. The materials, among other things, included a memorandum from CNR setting forth CNR’s rationale for recommending approval of the Amended Management Agreement and the termination of Waddell, the Fund’s then-current sub-adviser; information regarding the background and experience of the team of municipal high yield bond investment professionals (the “CNR Muni High Yield Team”) that had been recently hired by CNR and would be providing portfolio management services to the Fund; reports of the performance of the Invesco High Yield Municipal Fund, a mutual fund previously co-managed by the CNR Muni High Yield Team using the same investment strategies and investment style they would use to manage the Fund (the “Invesco Fund”) over various periods ended December 31, 2015, compared to the returns of the Barclays High Yield Municipal Bond Index (the “Index”); and information regarding the proposed advisory fee and total expenses of the Fund compared with those of a group of comparable funds selected by CNR (the “Peer Group”) from Lipper, Inc.’s High Yield Municipal Debt Funds universe (the “Expense Universe”). Before voting on the proposed Amended Management Agreement, the Independent Trustees met with their independent counsel in a private session at which no representatives of CNR were present.

In approving the Amended Management Agreement, the Board and the Independent Trustees considered a variety of factors, including those discussed below. The Board and the Independent Trustees also took into account information they received at past meetings of the Board and its committees with respect to the services provided by CNR. In their deliberations, the Board and the Independent Trustees did not identify any particular factor that was controlling, and each Trustee may have attributed different weights to the various factors.

10

CNR’s Recommendation

In considering the Amended Management Agreement, the Board considered the following information provided by CNR with respect to the Fund’s investment advisory arrangements:

| · | CNR had hired the CNR Muni High Yield Team, a team of three senior experienced municipal high yield bond investment professionals, that was proposed to manage the Fund commencing April 1, 2016. |

| · | The Invesco Fund, a mutual fund previously co-managed by the CNR Muni High Yield Team members, had outperformed the Index for most periods reviewed since the Invesco Fund’s inception, as described below. |

| · | When the Fund was established, CNR expected the day-to-day management of the Fund would be carried out by a sub-adviser (subject to CNR’s oversight) rather than directly by CNR. CNR anticipated that it would incur substantial increased costs as a result of internalizing the management of the Fund in connection with the following items, among others: providing the new municipal high yield team with new or additional facilities and equipment, support staff, technology and research resources; new and ongoing employee compensation expenses to attract and retain high quality professionals; and increased oversight and use of compliance and legal resources. |

| · | CNR believes the proposed advisory fee increase will allow CNR to continue to provide high quality services while maintaining a competitive expense ratio for shareholders, and will ensure the Fund can remain well-resourced to meet evolving needs as the Fund grows. |

| · | Although the Fund’s advisory fee rate would increase by 0.05%, due to CNR’s rebate structure for its separately managed account clients, the net advisory fees paid by the majority of CNR’s separately managed account clients (who comprise most of the Fund’s current shareholders) with respect to their investments in the Fund will be reduced for at least a period of two years following the effective date of the Amended Management Agreement. |

| · | CNR will bear the fees and expenses incurred by the Fund in connection with the approval of the Amended Management Agreement, including legal fees relating to the preparation of the proxy statement and any expenses in connection with the solicitation of proxies. |

Nature, Extent and Quality of Services to be Provided by CNR

The Board considered the returns of the Invesco Fund. The meeting materials reviewed by the Board indicated that the annualized total returns of the Invesco Fund, which commenced in January 2008, for the one-, three-, five- and seven-year and since inception periods ended December 31, 2015, were higher than the returns of the Index. The materials also indicated that the returns of the Invesco Fund, compared to the returns of funds in Morningstar, Inc.’s High Yield Municipal Fund Group, performed in the top 10th percentile over the trailing 1- and 3-year periods ended December 31, 2015; in the top 20th percentile over the trailing 5- and 7-year periods; and in the top 7th percentile since its inception on January 1, 2008.

11

The Board also considered the overall quality of services proposed to be provided by CNR to the Fund under the Amended Management Agreement. In doing so, the Board considered CNR’s specific responsibilities in management of the Fund, including the day-to-day portfolio management of the Fund, as well as the qualifications, experience and responsibilities of the personnel who would be involved in the activities of the Fund. The Board also considered its familiarity with CNR as the investment adviser to the other series of City National Rochdale Funds (the “CNR Funds”) and the overall quality of CNR’s organization and operations and CNR’s compliance structure. The Board and the Independent Trustees concluded that, based on the various factors they had reviewed, the nature, overall quality, and extent of the management and oversight services expected to be provided by CNR to the Fund under the Amended Management Agreement would be satisfactory.

Advisory Fee and Total Expenses

In reviewing the proposed advisory fee of the Fund, the Board considered information included in the meeting materials with respect to the Fund’s proposed advisory fee and total expenses. With respect to the proposed advisory fee, the meeting materials indicated that the proposed fee was lower than the average fees (gross of fee waivers) of the Peer Group and the Expense Universe, although the advisory fee was slightly above the average fees (net of fee waivers) of the Peer Group and the Expense Universe by 0.041% and 0.049%, respectively. The Board noted, however, that the proposed advisory fee for the Fund was within the middle 60% of advisory fees (net of fee waivers) of funds in the Expense Universe. The Board considered that CNR does not manage assets for any other clients using the same investment strategies as those used by the Fund, and therefore it could not compare the proposed advisory fee of the Fund with those of any other clients of CNR. The Board noted, however, that the proposed advisory fee for the Fund was within the range of fees charged by CNR to manage various other CNR Funds that also invest in fixed income securities, and that the proposed advisory fee was lower than the advisory fee of the Invesco Fund.

The Board considered that CNR currently rebates a portion of the advisory fees it charges to the majority of its separately managed account clients (“Account Fees”) that invest in the CNR Funds, including the Fund, in order to offset the advisory fees paid by those CNR Funds to and retained by CNR, and that although the Fund’s advisory fee would increase by 0.05% under the Amended Management Agreement, due to CNR’s rebate structure, the net advisory fee paid by those CNR separately managed account clients with respect to their investments in the Fund would be reduced.

12

The Board considered that approximately 0.38% of the Fund’s current advisory fee of 0.45% was paid to Waddell, the Fund’s then-current sub-adviser, and that CNR currently rebates the difference of approximately 0.07% to the majority of its separately managed account clients invested in the Fund, so that those managed account clients invested in the Fund in effect pay a net advisory fee of 0.38%. The Board noted that although CNR proposes to increase the Fund’s advisory fee from 0.45% to 0.50%, for the majority of its separately managed account clients invested in the Fund, CNR plans to rebate 0.25% of the fee back to those clients, so that those clients will in effect pay a net advisory fee of 0.25%. The Board considered CNR’s commitment to maintaining this 0.25% rebate for a period of at least two years, and noted that CNR has no current intention to change the fee credits after that two-year period. The Board noted that certain CNR separately managed account clients whose assets are custodied at City National Bank (representing approximately 18% of the Fund’s assets), pay lower Account Fees than CNR’s standard Account Fee pursuant to a historical fee schedule that has been discontinued, and those managed account clients would not receive any rebate with respect to their investments in the Fund. Subsequent to the February meeting, CNR informed the Board that it would rebate to such separately managed account clients amounts equal to 0.05% of the advisory fee paid with respect to their investment in the Fund. For those CNR clients, the net annual advisory fee rate paid with respect to the Fund will therefore remain the same. CNR is committed to maintaining this 0.05% rebate for a period of at least two years from the effective date of the Amended Management Agreement, and it has no current intention to change the fee credits after that two-year period.

With respect to the total expenses proposed to be paid by the Fund, the meeting materials reviewed by the Board indicated that the total expenses for the Fund (Servicing Class shares) were below the average expenses (net of fee waivers) of the Expense Universe, but above the Peer Group average expenses (net of fee waivers) by 0.40%.

The Board and the Independent Trustees concluded that the compensation payable to CNR by the Fund under the Amended Management Agreement is fair and reasonable in light of the nature and quality of the services CNR was expected to provide to the Fund.

Profitability, Benefits to CNR and Economies of Scale

The Board considered information prepared by CNR relating to its current costs and profits with respect to the Fund and its estimated costs and profits with respect to the Fund under the Amended Management Agreement, for a three-year period. The Board noted that CNR anticipates it will not realize a profit with respect to the Fund until after the first year following the proposed implementation of the advisory fee, and determined that the level of profitability under the Amended Management Agreement was reasonable. The Board also considered the benefits received by CNR and its affiliates as a result of its relationship with the Fund (other than investment advisory fees paid to CNR), including fees paid to affiliates of CNR such as City National Bank, City National Securities, Inc. and RIM Securities, LLC for providing certain shareholder servicing and sub-distribution services to the Fund; benefits to City National Bank’s brokerage and wealth management businesses as a result of the availability of the Fund to its customers; research services made available to CNR by broker-dealers that provide execution services to the Fund; and the intangible benefits to CNR and its affiliates of their association with the Fund generally and any favorable publicity arising in connection with the Fund’s performance. The Board concluded that although there were no advisory fee breakpoints, significant economies of scale were not likely to be realized with respect to the Fund until the asset levels of the Fund were significantly higher than its current levels.

13

Conclusion

Based on these and other factors, the Board and the Independent Trustees concluded that approval of the Amended Management Agreement is in the best interests of the Fund and its shareholders and, accordingly, approved the Amended Management Agreement.

Terms of the Proposed Amended Management Agreement

The terms of the Amended Management Agreement are substantially identical to those of the Current Management Agreement, except that, if approved, the annual advisory fee rate payable by the Fund under the Amended Management Agreement would be 0.50% of the average daily net assets of the Fund, compared to the annual advisory fee rate of 0.45% under the Current Management Agreement.

Under the Current Management Agreement and the Amended Management Agreement, CNR is not subject to liability to the Trust or the Fund or to any shareholder of the Fund for any act in connection with rendering services under the Agreement, or for any losses that may be sustained in the purchase, holding or sale of any security or other asset or instrument by the Fund, except in the case of CNR’s willful misfeasance, bad faith, gross negligence, or reckless disregard of its obligations or duties.

If approved by the shareholders of the Fund, the Amended Management Agreement would continue in force for a period of two years after the effective date of the Agreement with respect to the Fund (which will be no earlier than the date approval by the shareholders of the Fund is obtained), unless sooner terminated as provided in the Agreement. The Amended Management Agreement would continue in force with respect to the Fund from year to year thereafter so long as it is specifically approved for the Fund at least annually in the manner required by the 1940 Act.

The Amended Management Agreement could be terminated with respect to the Fund at any time without the payment of any penalty, by the Board, by a vote of a majority of the outstanding voting securities of the Fund, or by CNR, in each case with 60 days’ written notice. The Amended Management Agreement would automatically terminate with respect to the Fund in the event of its assignment (as defined in the 1940 Act).

14

Information Regarding CNR

CNR, located at City National Center, 400 North Roxbury Drive, Beverly Hills, California 90210, is a registered investment adviser that specializes in investment management for high-net-worth individuals, families and foundations. As of December 31, 2015, CNR had approximately $27.8 billion in assets under management. CNR is a wholly-owned subsidiary of City National Bank (“CNB”), a federally chartered commercial bank founded in the early 1950s. As of December 31, 2015, CNB and its affiliates had approximately $61.2 billion in assets under administration, which includes approximately $48.4 billion in assets under management. CNB is a wholly-owned indirect subsidiary of RBC USA Holdco Corporation, which is a wholly-owned indirect subsidiary of Royal Bank of Canada. Royal Bank of Canada has approximately $4,609 billion Canadian dollars in assets under administration, which includes $498 billion Canadian dollars in assets under management, as of October 31, 2015. The principal offices for Royal Bank of Canada and RBC USA Holdco Corporation are located at 200 Bay Street, Royal Bank Plaza, Toronto, ON, Canada, M5J 2J5.

The names, addresses and principal occupations of each principal executive officer and director of CNR are listed below.

| Name | Principal Occupation/Title with CNR | Principal Occupation |

| Garrett R. D’Alessandro* | President, Chief Executive Officer and Board Member | Same |

| Kurt A. Hawkesworth* | Chief Operating Officer and Board Member | Same |

| Richard S. Gershen** | Board Member | Executive Vice President, City National Bank (2009-Present) |

| William J. Freeman** | Board Member | Senior Vice President, City National Bank (1996-Present) |

| F. Michael Gozzillo* | Chief Compliance Officer | Same |

| * | The principal business address for this individual is 570 Lexington Avenue, New York, New York 10022. |

| ** | The principal business address for this individual is 400 North Roxbury Drive, Beverly Hills, California 90210. |

15

CNR does not serve as investment adviser or sub-adviser to any other mutual funds with investment objectives similar to those of the Fund.

Required Vote

Approval of the Amended Management Agreement will require the vote of a “majority of the outstanding voting securities” of the Fund as defined in the 1940 Act. This means the lesser of (1) 67% or more of the shares of the Fund present at the meeting if the owners of more than 50% of the Fund’s shares then outstanding are present in person or by proxy, or (2) more than 50% of the outstanding shares of the Fund entitled to vote at the meeting. If the Amended Management Agreement is not approved, CNR will continue to manage the Fund under the Current Management Agreement. However, CNR may reconsider its separately managed account rebate policy, and the Board of Trustees will take such action as it deems necessary and in the best interests of the Fund and its shareholders.

THE BOARD OF TRUSTEES RECOMMENDS THAT THE SHAREHOLDERS OF THE FUND APPROVE THE AMENDED MANAGEMENT AGREEMENT.

VOTING PROCEDURES

How to Vote

This Proxy is being solicited by the Board of Trustees of the Trust. You can vote by mail, touch-tone telephone, Internet, or in person at the Meeting.

| · | To vote by mail, sign and send us the enclosed Proxy voting card in the postage paid return envelope provided. If you vote by Proxy, you can revoke your Proxy by notifying the Secretary of the Trust in writing, or by returning a Proxy with a later date. You also can revoke a Proxy by voting in person at the Meeting. Even if you plan to attend the Meeting and vote in person, please return the enclosed Proxy card. This will help us ensure that an adequate number of shares are present at the Meeting. |

| · | To vote by telephone, call 1-800-690-6903. |

| · | To vote by Internet, vote at www.proxyvote.com. |

| · | To vote in person, attend the Meeting. |

Currently, approximately 96% of the Fund’s shares are owned by separately managed account clients of CNR; in most cases, CNR has proxy voting discretion with respect to CNR Fund shares held in such accounts. CNR intends to “echo vote” its clients’ shares of the Fund with respect to the Proposal in cases where CNR has proxy voting discretion. This means CNR will vote any Fund shares held by such separately managed account clients, for which it does not receive voting instructions, in the same proportion as the vote of its other separately managed account clients that do provide voting instructions.

16

Proxy Solicitation

CNR will bear the expenses incurred in connection with preparing this Proxy Statement. In addition to the solicitation of proxies by mail, officers of the Trust and officers and employees of CNR, without additional compensation, may solicit proxies in person or by telephone.

Quorum and Voting Requirements

The presence in person or by proxy of one third of the outstanding shares of the Fund entitled to vote will constitute a quorum for the Meeting. If a quorum is not present, sufficient votes are not received by the date of the Meeting, or the holders of shares present in person or by proxy determine to adjourn the Meeting for any other reason, a person named as proxy may propose one or more adjournments from time to time to permit further solicitation of proxies. The Fund will count all shares represented by proxies that reflect abstentions and “broker non-votes” (i.e., shares held by brokers or nominees as to which instructions have not been received from the beneficial owners or the person entitled to vote, and the broker or nominee does not have discretionary voting power on the matter) as shares that are present and entitled to vote for purposes of determining a quorum.

A majority of shares of the Fund represented at the meeting can adjourn the meeting without further notice to the shareholders, provided that the meeting is held no later than August 8, 2016. The persons named as proxies will vote in favor of adjournment those shares of the Fund which they represent if adjournment is necessary to obtain a quorum or to obtain a favorable vote on any proposal. “Broker non-votes” and abstentions will have the effect of votes against adjournment.

The Fund will count the number of votes cast “for” approval of each proposal to determine whether sufficient affirmative votes have been cast with respect to the proposal. Assuming the presence of a quorum, abstentions and broker non-votes have the effect of negative votes.

Information Regarding the Officers and Trustees of the Trust

The officers of the Trust set forth in the following table are officers of CNR.

| Name | Position with the Trust | Position with CNR |

| Garrett R. D’Alessandro | President and Chief Executive Officer | President, Chief Executive Officer and Board Member |

| Kurt A. Hawkesworth | Vice President and Secretary | Chief Operating Officer and Board Member |

| F. Michael Gozzillo | Vice President; Chief Compliance Officer; Anti-Money Laundering Officer & Identity Theft Program Officer | Senior Vice President and Chief Compliance Officer |

| Anthony Sozio | Vice President and Assistant Secretary | Assistant Vice President of Registered Fund Operations |

17

No Trustees of the Trust are officers, employees, directors, general partners or shareholders of CNR. In addition, since October 1, 2014, no Trustee has had, directly or indirectly, a material interest in a material transaction or a material proposed transaction to which CNR, any of its parents or subsidiaries, or any subsidiaries of a parent of any such entities, was or is to be a party, that is related to the business and operations of the Trust, and to which the Trust is a party; and no Trustee has made any purchases or sales of securities of CNR, any of its parents or subsidiaries, or any subsidiaries of a parent of any such entities.

GENERAL INFORMATION

The principal executive offices of the Trust and CNR are located at 400 North Roxbury Drive, Beverly Hills, California 90210. The Trust’s administrator is SEI Investments Global Funds Services, located at One Freedom Valley Drive, Oaks, Pennsylvania 19456. The Trust’s distributor is SEI Investments Distribution Co., located at the same address. The Trust’s transfer agent is U.S. Bancorp Fund Services, LLC, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202. The Trust’s custodian is U.S. Bank, N.A., located at 1555 N. Rivercenter Drive, Milwaukee, Wisconsin 53212. Counsel to the Trust is Morgan, Lewis & Bockius LLP, 300 South Grand Avenue, 22nd Floor, Los Angeles, California 90071. Counsel to the Independent Trustees is Dechert LLP, 2010 Main Street, Suite 500, Irvine, California 92614.

Shareholders who want to communicate with the Board or any individual Trustee should write to City National Rochdale Funds, Attention: Board of Trustees of City National Rochdale Funds, 400 North Roxbury Drive, Beverly Hills, California 90210. The letter should indicate that the writer is a shareholder of a series of the Trust. The Trust will ensure that this communication (assuming it is properly marked care of the Board or care of a specific Trustee) is delivered to the Board or the specified Trustee, as the case may be.

The Trust will furnish, without charge, a copy of the most recent Annual Report and Semi-Annual Report to Shareholders of the Trust upon request. Requests for such reports should be directed to City National Rochdale Funds, c/o SEI Investments Distribution Co., One Freedom Valley Drive, Oaks, Pennsylvania 19456, by calling 1-888-889-0799, or on the internet at www.citynationalrochdalefunds.com.

18

Submission of Proposals for Next Meeting of Shareholders

The Fund does not hold shareholder meetings annually. Any shareholder who wishes to submit a proposal to be included in a proxy statement and form of proxy card for the Fund’s next meeting of shareholders should send the proposal to the Fund so that it will be received within a reasonable time before the Fund begins to print and mail its proxy materials relating to such meeting.

Householding

As permitted by law, only one copy of this Proxy Statement is being delivered to shareholders residing at the same address, unless such shareholders have notified the Trust of their desire to receive multiple copies of the reports and proxy statements that the Trust sends. If you would like to receive an additional copy, please contact the Trust by writing to City National Rochdale Municipal High Income Fund, c/o SEI Investments Distribution Co., One Freedom Valley Drive, Oaks, Pennsylvania 19456, or by calling 1 (888) 889-0799. The Trust will then promptly deliver a separate copy of the Proxy Statement to any shareholder residing at an address to which only one copy was mailed. Shareholders wishing to receive separate copies of the Fund’s reports and proxy statements in the future, and shareholders sharing an address that wish to receive a single copy if they are receiving multiple copies, should also direct requests as indicated.

19

APPENDIX A

Shareholders Owning Beneficially or of Record More than 5%

of each Class of the City National Rochdale Municipal High Income Fund

as of March 31, 2016

| Shareholder Name and Address | Class | Number of Shares Owned | Percentage of Total Outstanding Shares of Class |

Mutual Fund Administrator c/o City National Bank SEI Private Trust Company One Freedom Valley Drive Oaks, PA 19456-9989 | Servicing Class | 33,712,612.100 | 98.90% |

Pershing LLC 1 Pershing Plz Jersey City, NJ 07399-0001 | Class N | 21,680,628.877 | 52.80% |

NFS LLC FEBO Assetmark Trust Company FBO Assetmark & Mutual Clients FBO Other Custodial Clients 3200 N Central Ave Fl 7 Phoenix, AZ 85012 | Class N | 13,424,424.593 | 17.86% |

20

APPENDIX B

Form of Amended Management Agreement

CITY NATIONAL ROCHDALE FUNDS

AMENDED AND RESTATED INVESTMENT MANAGEMENT AGREEMENT

This AMENDED AND RESTATED INVESTMENT MANAGEMENT AGREEMENT is made and effective as of the 27th day of August, 2015, by and between CITY NATIONAL ROCHDALE FUNDS, a Delaware statutory trust (hereinafter called the “Trust”), on behalf of each series of the Trust listed in Appendix A hereto, as such Appendix may be amended from time to time (each series hereinafter referred to individually as a “Fund” and collectively as the “Funds”) and City National Rochdale, LLC (hereinafter called the “Adviser”), a limited liability company organized under laws of the State of Delaware.

WITNESSETH:

WHEREAS, the Trust is an open-end management investment company, registered as such under the Investment Company Act of 1940, as amended (the “1940 Act”); and

WHEREAS, the Adviser is an investment adviser registered with the Securities and Exchange Commission; and

WHEREAS, the Trust, on behalf of the City National Rochdale Government Money Market Fund, City National Rochdale Prime Money Market Fund, City National Rochdale California Tax-Exempt Money Market Fund, City National Rochdale Government Bond Fund, City National Rochdale Corporate Bond Fund, City National Rochdale California Tax-Exempt Bond Fund, City National Rochdale Municipal High Income Fund, City National Rochdale High Yield Bond Fund, City National Rochdale Multi-Asset Fund and City National Rochdale U.S. Core Equity Fund, has previously entered into an Investment Management Agreement with City National Bank, dated as of April 1, 1999, as amended (the “Legacy CNI Agreement”); and

WHEREAS, City National Bank and City National Asset Management, Inc. have previously entered into an Assumption Agreement dated as of May 21, 2001, pursuant to which City National Bank transferred all of its rights and delegated all of its obligations under the Legacy CNI Agreement to City National Asset Management, Inc., and City National Asset Management, Inc. assumed and agreed to perform the obligations and liabilities of City National Bank pursuant to the Legacy CNI Agreement; and

WHEREAS, the Trust, on behalf of the City National Rochdale Limited Maturity Fund and City National Rochdale Socially Responsible Equity Fund, has previously entered into an Investment Management Agreement with CCM Advisors, LLC, dated as of October 1, 2005, as amended (the “Legacy CCMA Agreement”); and

WHEREAS, effective as of January 1, 2011, CCM Advisors, LLC and its affiliates entered into a number of simultaneous transactions, as set forth in the Consent to Assignment and Assumption between the Trust and CCM Advisors LLC dated December 21, 2010, which transactions resulted in the assignment of all of CCM Advisors LLC’s rights and the delegation of all of its obligations under the Legacy CCMA Agreement to City National Asset Management, Inc.; and

21

WHEREAS, the Trust, on behalf of the City National Rochdale Dividend & Income Fund, City National Rochdale Intermediate Fixed Income Fund, City National Rochdale Fixed Income Opportunities Fund, and City National Rochdale Emerging Markets Fund, has previously entered into an Investment Management Agreement with Rochdale Investment Management LLC, dated as of March 28, 2013, as amended (the “Legacy Rochdale Agreement”); and

WHEREAS, effective September 10, 2013, City National Asset Management, Inc. reorganized into Rochdale Investment Management LLC, which changed its name to City National Rochdale, LLC; and

WHEREAS, the parties to this Agreement agree that this Agreement will replace and supersede each of the Legacy CNI Agreement and the Legacy CCMA Agreement, each of which is hereby terminated, and that the Legacy Rochdale Agreement is amended and restated in its entirety as follows:

NOW, THEREFORE, in consideration of the covenants and the mutual promises hereinafter set forth, the parties hereto, intending to be legally bound hereby, mutually agree as follows:

1. Appointment of Adviser. The Trust hereby employs the Adviser, and the Adviser hereby accepts such employment, to render investment advice and management services with respect to the assets of the Funds for the period and on the terms set forth in this Agreement, subject to the supervision and direction of the Trust’s Board of Trustees. Consistent with the 1940 Act and subject to prior approval of the Board of Trustees, the Adviser may retain one or more investment management organizations (“Sub-advisers”) to make specific investment decisions and to execute all portfolio transactions with respect to all or a portion of the assets of a particular Fund. The Adviser may allocate portions of a Fund’s assets among such Sub-adviser(s). The Adviser shall monitor the performance of such Sub-adviser(s) and shall have the authority to allocate and reallocate assets among Sub-advisers of Funds with multiple Sub-advisers and to recommend the employment or termination of a particular Sub-adviser, as Adviser may deem advisable. The investment advisory fee payable to any Sub-adviser retained by the Adviser under this paragraph 1 shall be paid by the Adviser and not the Trust.

2. Duties of Adviser.

(a) The Adviser shall act as investment manager to the Funds and shall supervise investments of the Funds on behalf of the Funds in accordance with the investment objectives, programs and restrictions of the Funds as provided in the Trust’s governing documents, including, without limitation, the Trust’s Agreement and Declaration of Trust, By-Laws, Prospectus, and Statement of Additional Information, and such other limitations as the Trustees may impose from time to time in writing to the Adviser. Without limiting the generality of the foregoing, the Adviser shall: (i) furnish the Funds with advice and recommendations with respect to the investment of each Fund’s assets and the purchase and sale of portfolio securities for the Funds, including the taking of such other steps as may be necessary to implement such advice and recommendations; (ii) retain, recommend employment and termination of, and monitor the performance of any Sub-advisers pursuant to Section 1 of this Agreement, subject to the ultimate supervision and oversight of the Trust’s Board of Trustees; (iii) furnish the Funds with reports, statements and other data on securities, economic conditions and other pertinent subjects which the Trust’s Board of Trustees may reasonably request; (iv) upon request of the Board of Trustees, provide persons satisfactory to the Trust’s Board of Trustees to act as officers of the Trust, but not including personnel to provide administrative services to the Funds; and (v) render to the Trust’s Board of Trustees such periodic and special reports with respect to each Fund’s investment activities as the Board may reasonably request.

22

(b) With respect to those Funds and portions of Funds not managed by a Sub-adviser, the Adviser shall place orders for the purchase and sale of securities either directly with the issuer or with a broker or dealer selected by the Adviser. In placing each Fund’s securities trades, it is recognized that the Adviser will give primary consideration to securing the most favorable price and efficient execution, in a reasonable effort to ensure that each Fund’s total cost or proceeds in each transaction will be the most favorable under all the circumstances. Within the framework of this policy, the Adviser may consider the financial responsibility, research and investment information, and other services provided by brokers or dealers who may effect or be a party to any such transaction or other transactions to which other clients of the Adviser may be a party.

It is also understood that it is desirable for the Funds that the Adviser have access to investment and market research and securities and economic analyses provided by brokers and others. It is also understood that brokers providing such services may execute brokerage transactions at a higher cost to the Funds than might result from the allocation of brokerage to other brokers on the basis of seeking the most favorable price and efficient execution. Therefore, the purchase and sale of securities for the Funds may be made with brokers who provide such research and analysis, subject to review by the Trust’s Board of Trustees from time to time and consistent with Section 28(e) of the Securities and Exchange Act of 1934, as amended (as interpreted by the SEC and its staff). It is understood by both parties that the Adviser may select broker-dealers for the execution of the Funds’ portfolio transactions that provide research and analysis which the Adviser may lawfully and appropriately use in its investment management and advisory capacities, whether or not such research and analysis may also be useful to the Adviser in connection with its services to other clients.

On occasions when the Adviser deems the purchase or sale of a security to be in the best interest of one or more of the Funds as well as of other clients, the Adviser, to the extent permitted by applicable laws and regulations, may aggregate the securities to be so purchased or sold in order to obtain the most favorable price or lower brokerage commissions and the most efficient execution. In such event, allocation of the securities so purchased or sold, as well as the expenses incurred in the transaction, will be made by the Adviser in the manner it considers to be the most equitable under the circumstances and consistent with its fiduciary obligations to the Funds and to such other clients.

23

3. Best Efforts and Judgment. The Adviser shall use its best judgment and efforts in rendering the advice and services to the Funds as contemplated by this Agreement.

4. Independent Contractor. The Adviser shall, for all purposes herein, be deemed to be an independent contractor, and shall, unless otherwise expressly provided and authorized to do so, have no authority to act for or represent the Trust or the Funds in any way, or in any way be deemed an agent for the Trust or for the Funds. It is expressly understood and agreed that the services to be rendered by the Adviser to the Funds under the provisions of this Agreement are not to be deemed exclusive, and the Adviser shall be free to render similar or different services to others so long as its ability to render the services provided for in this Agreement shall not be materially impaired thereby.

5. Adviser’s Personnel. The Adviser shall, at its own expense, maintain such staff and employ or retain such personnel and consult with such other persons as it shall from time to time determine to be reasonably necessary to the performance of its obligations under this Agreement. Without limiting the generality of the foregoing, the staff and personnel of the Adviser shall be deemed to include persons employed or retained by the Adviser to furnish statistical information, research, and other factual information, advice regarding economic factors and trends, information with respect to technical and scientific developments, and such other information, advice and assistance as the Adviser or the Trust’s Board of Trustees may desire and reasonably request.

6. Reports by Funds to Adviser. Each Fund will furnish (or cause to be furnished) to the Adviser detailed statements of its investments and assets as the Adviser may reasonably request, and information as to its investment objective or objectives and needs, and will make available to the Adviser such financial reports, proxy statements, legal and other information relating to its investments as may be in its possession or available to it, together with such other information as the Adviser may reasonably request.

7. Expenses.

(a) With respect to the operation of each Fund, the Adviser is responsible for (i) the compensation of any of the Trust’s Trustees, officers, and employees who are affiliates of the Adviser (but not the compensation of employees performing services in connection with expenses which are the Fund’s responsibility under Subparagraph 7(b) below) and (ii) providing office space and equipment reasonably necessary for the operation of the Funds.

(b) Each Fund is responsible for and has assumed the obligation for payment of all of its expenses, other than as stated in paragraphs 1 and subparagraph 7(a) above, including but not limited to: fees and expenses incurred in connection with the issuance, registration and transfer of its shares; brokerage and commission expenses; all expenses of transfer, receipt, safekeeping, servicing and accounting for the case, securities and other property of the Trust for the benefit of the Fund including all fees and expenses of its custodian, shareholder services agent and accounting services agent; interest charges on any borrowings; costs and expenses of pricing and calculating its daily net asset value and of maintaining its books of account required under the 1940 Act; taxes, if any; expenditures in connection with meetings of each Fund’s shareholders and the Trust’s Board of Trustees that are properly payable by the Fund; salaries and expenses of officers and fees and expenses of members of the Trust’s Board of Trustees or members of any advisory board or committee who are not members of, affiliated with or interested persons of the Adviser; insurance premiums on property or personnel of each Fund which inure to its benefit, including liability and fidelity bond insurance; the cost of preparing and printing reports, proxy statements, prospectuses and statements of additional information of the Fund or other communications for distribution to existing shareholders; legal, auditing and accounting fees; trade association dues; fees and expenses (including legal fees) of registering and maintaining registration of its shares for sale under federal and applicable state and foreign securities laws; all expenses of maintaining and servicing shareholder accounts, including all charges for transfer, shareholder recordkeeping, dividend disbursing, redemption, and other agents for the benefit of the Funds (including, without limitation, fund accounting and administration agents), if any; and all other charges and costs of its operation plus any extraordinary and non-recurring expenses, except as herein otherwise prescribed.

24

(c) To the extent the Adviser incurs any costs by assuming expenses which are an obligation of a Fund as set forth herein, such Fund shall promptly reimburse the Adviser for such costs and expenses, except to the extent the Adviser has otherwise agreed to bear such expenses. To the extent the services for which a Fund is obligated to pay are performed by the Adviser, the Adviser shall be entitled to recover from such Fund to the extent of the Adviser’s actual costs for providing such services.

8. Investment Advisory and Management Fee.

(a) Each Fund shall pay to the Adviser, and the Adviser agrees to accept, as full compensation for all investment management and advisory services furnished or provided to such Fund pursuant to this Agreement, a management fee as set forth in the Fee Schedule attached hereto as Appendix B, as may be amended in writing from time to time by the Trust and the Adviser, subject to the requirements of the 1940 Act.

(b) The management fee shall be accrued daily by each Fund and paid to the Adviser monthly.

(c) The initial fee under this Agreement shall be payable monthly following the effective date of this Agreement and shall be prorated as set forth below. If this Agreement is terminated prior to the end of a month, the fee to the Adviser shall be prorated for the portion of any month in which this Agreement is in effect which is not a complete month according to the proportion which the number of calendar days in the month during which the Agreement is in effect bears to the number of calendar days in the month, and shall be payable within ten (10) days after the date of termination.

(d) The Adviser voluntarily may reduce any portion of the compensation or reimbursement of expenses due to it pursuant to this Agreement and may agree to make payments to limit the expenses which are the responsibility of a Fund under this Agreement. Any such reduction or payment shall be applicable only to such specific reduction or payment and shall not constitute an agreement to reduce any future compensation or reimbursement due to the Adviser hereunder or to continue future payments. Any such reduction will be agreed upon prior to accrual of the related expense or fee and will be estimated daily. Any fee withheld shall be voluntarily reduced and any Fund expense paid by the Adviser voluntarily or pursuant to an agreed expense limitation shall be reimbursed by the appropriate Fund to the Adviser in the first, second, or third (or any combination thereof) fiscal year next succeeding the fiscal year of the withholding, reduction, or payment to the extent permitted by applicable law and only if such reimbursements by a Fund (i) are requested by the Adviser, (ii) are approved by the Trust’s Board of Trustees, and (iii) can be achieved within a Fund’s then current expense limits, if any, for that succeeding first, second, or third fiscal year as the case may be; provided that such reimbursements shall only be paid after a Fund’s current expenses of the fiscal year have been paid and if such reimbursements do not require the Adviser to waive or reduce its fees hereunder or to pay current Fund expenses.

25

(e) The Adviser may agree not to require payment of any portion of the compensation or reimbursement of expenses otherwise due to it pursuant to this Agreement prior to the time such compensation or reimbursement has accrued as a liability of the Fund. Any such agreement shall be applicable only with respect to the specific items covered thereby and shall not constitute an agreement not to require payment of any future compensation or reimbursement due to the Adviser hereunder.

9. Books and Records. In compliance with the requirements of Rule 31a-3 under the 1940 Act, the Adviser hereby agrees that any records which it maintains for the Trust are the property of the Trust, and further agrees to surrender promptly to the Trust or its agents any of such records upon the Trust’s request. The Adviser further agrees to arrange for the preservation of the records required to be maintained by Rule 31a-1 under the 1940 Act for the periods prescribed by Rule 31a-2 under the 1940 Act.

10. Fund Share Activities of Adviser’s Officers and Employees. The Adviser agrees that neither it nor any of its officers or employees shall take any short position in the shares of the Funds. This prohibition shall not prevent the purchase of such shares by any of the officers or bona fide employees of the Adviser or any trust, pension, profit-sharing or other benefit plan for such persons or affiliates thereof, at a price not less than the net asset value thereof at the time of purchase, as allowed pursuant to rules promulgated under the 1940 Act.

11. Conflicts with Trust’s Governing Documents and Applicable Laws. Nothing herein contained shall be deemed to require the Trust or the Funds to take any action contrary to the Trust’s Agreement and Declaration of Trust, By-Laws, or any applicable statute or regulation, or to relieve or deprive the Board of Trustees of the Trust of its responsibility for and control of the conduct of the affairs of the Trust and Funds.

12. Adviser’s Liabilities.

(a) In the absence of willful misfeasance, bad faith, gross negligence, or reckless disregard of the obligations or duties hereunder on the part of the Adviser, the Adviser shall not be subject to liability to the Trust or the Funds or to any shareholder of the Funds for any act or omission in the course of, or connected with, rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security or other asset or instrument by the Funds.

26

(b) Each party to this Agreement shall indemnify and hold harmless the other party and the shareholders, members, directors, managers, trustees, officers and employees of the other party (any such person, an ‘Indemnified Party’) against any loss, liability, claim, damage or expense (including the reasonable cost of investigating and defending any alleged loss, liability, claim, damage or expenses and reasonable counsel fees incurred in connection therewith) arising out of the Indemnified Party’s performance or non-performance of any duties under this Agreement provided, however, that nothing herein shall be deemed to protect any Indemnified Party against any liability to which such Indemnified Party would otherwise be subject by reason of willful misfeasance, bad faith or gross negligence in the performance of duties hereunder or by reason of reckless disregard of obligations and duties under this Agreement.

(c) No provision of this Agreement shall be construed to protect any Trustee or officer of the Trust, or officer of the Adviser, from liability in violation of Sections 17(h) or (i) of the 1940 Act.

(d) The Adviser shall have responsibility for the accuracy and completeness (and liability for the lack thereof) of the statements in each Fund’s offering materials (including the prospectus, the statement of additional information, advertising and sales materials), except for information provided by the administrator of the Trust or another third party for inclusion therein.

(e) The Adviser shall be liable to each Fund for any loss (including brokerage charges) incurred by that Fund as a result of any improper investment made by the Adviser.

13. Non-Exclusivity. The Trust’s employment of the Adviser is not an exclusive arrangement, and the Trust may from time to time employ other individuals or entities to furnish it with the services provided for herein. In the event this Agreement is terminated with respect to any Fund, this Agreement shall remain in full force and effect with respect to any and all other Funds listed on Appendix A hereto, as the same may be amended.

14. Term. This Agreement shall become effective with respect to each Fund as of the corresponding effective date set forth in Appendix A, and shall remain in effect for a period of two (2) years, unless sooner terminated as hereinafter provided. This Agreement shall continue in effect as to each Fund after such initial two-year period for additional periods not exceeding one (1) year so long as such continuation is approved with respect to such Fund at least annually by (i) the Board of Trustees of the Trust or by the vote of a majority of the outstanding voting securities of such Fund and (ii) the vote of a majority of the Trustees of the Trust who are not parties to this Agreement nor interested persons thereof, cast in person at a meeting called for the purpose of voting on such approval.

15. Termination. This Agreement may be terminated by the Trust on behalf of any one or more of the Funds, without payment of any penalty, by the Board of Trustees of the Trust or by vote of a majority of the outstanding voting securities of a Fund, upon sixty (60) days’ prior written notice to the Adviser, and by the Adviser upon sixty (60) days’ prior written notice to a Fund.

27

16. Termination by Assignment. This Agreement shall terminate automatically in the event of any assignment thereof, as defined in the 1940 Act.

17. Assignment. This Agreement may not be transferred, assigned, sold, or in any manner hypothecated or pledged with respect to a Fund without the affirmative vote or written consent of the holders of a majority of the outstanding voting securities of such Fund.

18. Confidentiality. The Adviser agrees that it will not disclose or use any records or information obtained pursuant to this Agreement in any manner whatsoever except as authorized in this Agreement and that it will keep confidential any information obtained pursuant to this agreement and disclose such information only if the Trust has authorized such disclosure, or if such disclosure is required by federal or state regulatory authorities.

19. Severability. If any provision of this Agreement shall be held or made invalid by a court decision, statute, or rule, or shall be otherwise rendered invalid, the remainder of this Agreement shall not be affected thereby.

20. Definitions. The terms “majority of the outstanding voting securities” and “interested persons” shall have the meanings as set forth in the 1940 Act.

21. Notice of Declaration of Trust. The Adviser acknowledges and agrees that the Trust’s obligations under this Agreement with respect to any Fund shall be limited to the Fund and its respective assets, and that the Adviser shall not seek satisfaction of any such obligation from the shareholders of the Fund nor from any trustee, officer, employee or agent of the Trust or the Funds.

22. Names. The Trust and the Adviser acknowledge and agree that the name “City National Rochdale” is the property of City National Bank.

23. Captions. The captions in this Agreement are included for convenience of reference only and in no way define or limit any of the provisions hereof or otherwise affect their construction or effect.

24. Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of California without giving effect to the conflict of laws principles thereof; provided that nothing herein shall be construed to preempt, or to be inconsistent with, any federal law, regulation or rule, including the 1940 Act and the Investment Advisers Act of 1940, as amended, and any rules and regulations promulgated thereunder.

28

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and attested by their duly authorized officers, all on the day and year first above written.

| CITY NATIONAL ROCHDALE FUNDS | CITY NATIONAL ROCHDALE | ||

| INVESTMENT | LLC | ||

| By: | /s/ Anthony Sozio | By: | /s/ Kurt Hawkesworth |

| Name: | Anthony Sozio | Name: | Kurt Hawkesworth |

| Title: | Vice President | Title: | Chief Operating Officer |

29

CITY NATIONAL ROCHDALE FUNDS

APPENDIX A

to the Amended and Restated Investment Management Agreement

to the Amended and Restated Investment Management Agreement

The provisions of the Amended and Restated Investment Management Agreement between the Trust and the Adviser apply to the following series of the Trust:

| Fund | Effective Date |

| City National Rochdale Government Money Market Fund | April 1, 1999 |

| City National Rochdale Prime Money Market Fund | April 1, 1999 |

| City National Rochdale California Tax Exempt Money Market Fund | April 1, 1999 |

| City National Rochdale Government Bond Fund | December 9, 1999 |

| City National Rochdale Corporate Bond Fund | December 9, 1999 |

| City National Rochdale California Tax Exempt Bond Fund | December 9, 1999 |

| City National Rochdale Municipal High Income Fund | December 30, 2013 |

| City National Rochdale High Yield Bond Fund | December 9, 1999 |

| City National Rochdale Intermediate Fixed Income Fund | March 28, 2013 |

| City National Rochdale Fixed Income Opportunities Fund | March 28, 2013 |

| City National Rochdale Multi-Asset Fund | May 1, 2010 |

| City National Rochdale Dividend & Income Fund | March 28, 2013 |

| City National Rochdale U.S. Core Equity Fund | August 30, 2012 |

| City National Rochdale Emerging Markets Fund | March 28, 2013 |

Dated as of February 18, 2016

30

CNI CHARTER FUNDS

APPENDIX B

to the Amended and Restated Investment Management Agreement

to the Amended and Restated Investment Management Agreement

Each Fund shall pay to the Adviser, as full compensation for all investment management and advisory services furnished or provided to such Fund pursuant to the Amended and Restated Investment Management Agreement, a management fee based upon each Fund’s average daily net assets at the following per annum rates:

| Fund | Fee |

| City National Rochdale Government Money Market Fund | 0.26% |

| City National Rochdale Prime Money Market Fund | 0.25% |

| City National Rochdale California Tax Exempt Money Market Fund | 0.27% |

| City National Rochdale Government Bond Fund | 0.43% |

| City National Rochdale Corporate Bond Fund | 0.40% |

| City National Rochdale California Tax Exempt Bond Fund | 0.27% |

| City National Rochdale Municipal High Income Fund | 0.50% |

| City National Rochdale High Yield Bond Fund | 0.60% |

| City National Rochdale Intermediate Fixed Income Fund | 0.40% |

| City National Rochdale Fixed Income Opportunities Fund | 0.50% |

| City National Rochdale Multi-Asset Fund | 0.50% |

| City National Rochdale Dividend & Income Fund | 0.50% |

| City National Rochdale U.S. Core Equity Fund | 0.40% |

| City National Rochdale Emerging Markets Fund | 1.00% |