UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. [__])

| Filed by the Registrant [X] | Filed by a party other than the Registrant [ ] |

Check the appropriate box:

| | | |

| [X] | | Preliminary Proxy Statement |

| | |

| [ ] | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [ ] | | Definitive Proxy Statement |

| | |

| [ ] | | Definitive Additional Materials |

| | |

| [ ] | | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

CITY NATIONAL ROCHDALE FUNDS

CITY NATIONAL ROCHDALE SELECT STRATEGIES FUND

CITY NATIONAL ROCHDALE STRATEGIC CREDIT FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND TEI

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES MASTER FUND

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | |

| [ ] | Fee paid previously with preliminary materials. |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

CITY NATIONAL ROCHDALE FUNDS

CITY NATIONAL ROCHDALE SELECT STRATEGIES FUND

CITY NATIONAL ROCHDALE STRATEGIC CREDIT FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND TEI

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES MASTER FUND

Dear Shareholder/Member:

A special joint meeting of shareholders of City National Rochdale Funds (the “CNR Funds”), City National Rochdale Select Strategies Fund (the “Select Strategies Fund”) and City National Rochdale Strategic Credit Fund (the “Strategic Credit Fund”), and of members of City National Rochdale High Yield Alternative Strategies Fund LLC and City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “Feeder Funds”), and City National Rochdale High Yield Alternative Strategies Master Fund LLC (the “Master Fund” and together with the Feeder Funds, the “High Yield Funds”) (each of the CNR Funds, Select Strategies Fund, Strategic Credit Fund and High Yield Funds may be referred to herein as a “Fund” and collectively as the “Funds”), will be held on [_________], 2021, at [___] a.m., Pacific Time (together with any postponement or adjournments, the “Meeting”). Due to the coronavirus (COVID-19) pandemic and to support the health and well-being of the Funds’ shareholders or members, employees, and community, the Meeting will be conducted as a virtual meeting hosted by means of a live [teleconference]. Shareholders or members, as applicable, will not have to travel to attend the Meeting, but will be able to [listen to the Meeting live, ask questions, and cast their votes remotely by ____________].

Each of the CNR Funds, Select Strategies Fund and Strategic Credit Fund is a Delaware statutory trust, and each High Yield Fund is a Delaware limited liability company. For ease of reference throughout, the Board of Directors of each High Yield Fund will be referred to as a “Board of Trustees,” the Directors of each High Yield Fund will be referred to as “Trustees,” and members of each High Yield Fund will be referred to as “shareholders.”

At the Meeting, shareholders of each Fund will be asked to consider and vote on a proposal to elect nominees as members of the Board of Trustees of the Fund (each, a “Board” and the members of which are referred to as “Trustees”), and shareholders of the CNR Funds will be asked to consider and vote on a proposal to adopt an amended and restated agreement and declaration of trust for that Fund (each, a “Proposal” and collectively, the “Proposals”), as set forth in the table below.

| Proposal | Fund(s) |

| 1) To elect six nominees to the Board of Trustees of each Fund. | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund City National Rochdale Select Strategies Fund City National Rochdale Strategic Credit Fund City National Rochdale High Yield Alternative Strategies Fund LLC City National Rochdale High Yield Alternative Strategies Fund TEI LLC City National Rochdale High Yield Alternative Strategies Master Fund LLC |

| 2) To approve an amended and restated agreement and declaration of trust for CNR Funds. | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund |

| 3) To transact any other business that may properly come before the Meeting. | All Funds. |

Proposal 1 (all Funds). Each Board is responsible for overseeing the management and operations of the relevant Fund and protecting the interests of its shareholders. Each Board meets regularly to oversee the business affairs of the relevant Fund and review the activities of the Fund’s officers, who are responsible for the day-to-day operations of the Fund. We are fortunate to have six nominees committed to carrying out these functions. All of the nominees are already Trustees of the Funds, as set forth below:

| 1. | James Wolford has served as a Trustee of the CNR Funds since 1999, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013; |

| 2. | Andrew S. Clare has served as a Trustee of the CNR Funds since 2013, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013; |

| 3. | Daniel A. Hanwacker has served as a Trustee of the CNR Funds since 2013, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013; |

| 4. | Jon C. Hunt has served as a Trustee of the CNR Funds since 2013, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013; |

| 5. | Jay C. Nadel has served as a Trustee of the CNR Funds since 2013, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013; and |

| 6. | Julie C. Miller has served as a Trustee of the CNR Funds, the Select Strategies Fund, the Strategic Credit Fund, and each High Yield Fund since May 2020. |

Proposal 2 (CNR Funds only). The CNR Funds’ existing amended and restated agreement and declaration of trust (the “Declaration of Trust”) governs the management and operations of the CNR Funds. City National Rochdale, LLC, the Funds’ investment adviser, and the Board believe that the existing Declaration of Trust contains many outmoded provisions and does not provide the Board with the flexibility to govern the Fund that more modern declarations of trust provide. Accordingly, the Board is proposing the amendment and restatement of the Declaration of Trust for shareholder approval in order to facilitate more efficient management of the CNR Funds.

After careful consideration, each Board has unanimously approved the applicable Proposal(s) and believes that each Proposal is in the best interests of the applicable Fund and its shareholders. Each Board unanimously recommends that you vote FOR each Proposal applicable to your Fund(s).

Your vote is important. The attached Joint Proxy Statement describes the voting process for shareholders. We ask that you carefully review the Joint Proxy Statement and vote FOR each Proposal applicable to your Fund(s). Upon completing your review, please take a moment to vote your shares:

| • | By completing and returning the enclosed proxy card in the envelope provided, |

| • | By touch-tone telephone by calling 1-800-690-6903, or |

| • | By Internet voting at www.proxyvote.com. |

If we do not hear from you after a reasonable amount of time, you may receive a telephone call from us reminding you to vote your shares. On behalf of each Board, we thank you for your continued investment.

Sincerely,

Garrett R. D’Alessandro

President and Chief Executive Officer

CITY NATIONAL ROCHDALE FUNDS

CITY NATIONAL ROCHDALE SELECT STRATEGIES FUND

CITY NATIONAL ROCHDALE STRATEGIC CREDIT FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND TEI

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES MASTER FUND

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS/MEMBERS

TO BE HELD ON [_________], 2021

NOTICE IS HEREBY GIVEN THAT A SPECIAL JOINT MEETING of shareholders of City National Rochdale Funds (the “CNR Funds”), City National Rochdale Select Strategies Fund (the “Select Strategies Fund”) and City National Rochdale Strategic Credit Fund (the “Strategic Credit Fund”), and of members of City National Rochdale High Yield Alternative Strategies Fund LLC and City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “Feeder Funds”), and City National Rochdale High Yield Alternative Strategies Master Fund LLC (the “Master Fund” and together with the Feeder Funds, the “High Yield Funds”) (each of the CNR Funds, Select Strategies Fund, Strategic Credit Fund and High Yield Funds may be referred to herein as a “Fund” and collectively as the “Funds”), will be held on [_________], 2021, at [___] a.m., Pacific Time (together with any postponement or adjournments, the “Meeting”). Due to the coronavirus (COVID-19) pandemic and to support the health and well-being of the Funds’ shareholders or members, employees, and community, the Meeting will be conducted as a virtual meeting hosted by means of a live [teleconference]. Shareholders or members, as applicable, will not have to travel to attend the Meeting, but will be able to [listen to the Meeting live, ask questions, and cast their votes remotely by _____________].

The CNR Funds, Select Strategies Fund and Strategic Credit Fund are each a Delaware statutory trust, and the High Yield Funds are each a Delaware limited liability company. For ease of reference throughout, the Board of Directors of each High Yield Fund will be referred to as a “Board of Trustees,” the Directors of each High Yield Fund will be referred to as “Trustees,” and members of each High Yield Fund will be referred to as “shareholders.” At the Meeting, and as specified in greater detail in the joint proxy statement (the “Joint Proxy Statement”) accompanying this Notice, shareholders will be asked to consider and vote on the following proposals (each, a “Proposal” and collectively, the “Proposals”), as set forth in the table below.

| Proposal | Fund |

| 1) To elect six nominees to the Board of Trustees of each Fund (to be voted on by the shareholders of all series of CNR Funds voting together, and by the shareholders of each other Fund separately). | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund City National Rochdale Select Strategies Fund City National Rochdale Strategic Credit Fund City National Rochdale High Yield Alternative Strategies Fund LLC City National Rochdale High Yield Alternative Strategies Fund TEI LLC City National Rochdale High Yield Alternative Strategies Master Fund LLC |

| 2) To approve an amended and restated agreement and declaration of trust for CNR Funds (to be voted on by the shareholders of all series of CNR Funds voting together). | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund |

| 3) To transact any other business that may properly come before the Meeting. | All Funds. |

After careful consideration, each Board has unanimously approved and recommends that shareholders vote FOR each Proposal applicable to your Fund(s). Please read the Joint Proxy Statement for a more complete discussion of each Proposal.

The Boards have set [__________], as the date (the “Record Date”) for the determination of shareholders entitled to notice of and to vote at the Meeting.

Shareholders who do not expect to attend the Meeting virtually are requested to complete and return in the enclosed postage paid return envelope the accompanying proxy card, which is being solicited by each Board, or vote by telephone or Internet, as promptly as possible. This is important to ensure a quorum at the Meeting with respect to each Fund. You may revoke your proxy at any time before it is exercised by signing and submitting a revised proxy, by giving written notice of revocation to the applicable Fund at any time before the proxy is exercised, or by voting at the Meeting.

By Order of the Board of each Fund,

Anthony Sozio

Secretary of the CNR Funds, Select Strategies Fund, Strategic Credit Fund, and High Yield Funds

[_______], 2021

FUNDS PARTICIPATING IN THE MEETING

TO BE HELD ON [__________], 2021

City National Rochdale Funds

| - | City National Rochdale Government Money Market Fund |

| - | City National Rochdale Government Bond Fund |

| - | City National Rochdale Corporate Bond Fund |

| - | City National Rochdale California Tax Exempt Bond Fund |

| - | City National Rochdale Municipal High Income Fund |

| - | City National Rochdale Intermediate Fixed Income Fund |

| - | City National Rochdale Short Term Emerging Markets Debt Fund |

| - | City National Rochdale Fixed Income Opportunities Fund |

| - | City National Rochdale Dividend & Income Fund |

| - | City National Rochdale U.S. Core Equity Fund |

City National Rochdale Select Strategies Fund

City National Rochdale Strategic Credit Fund

City National Rochdale High Yield Alternative Strategies Fund LLC

City National Rochdale High Yield Alternative Strategies Fund TEI LLC

City National Rochdale High Yield Alternative Strategies Master Fund LLC

QUESTIONS AND ANSWERS

Question: Why am I receiving these proxy materials?

Answer: You are receiving these proxy materials—a booklet that includes the Notice of Special Joint Meeting of Shareholders/Members (the “Notice”), the Joint Proxy Statement and your proxy card—because you are a shareholder of one or more Funds and have the right to notice of, and to vote on, important matters concerning the governance of the applicable Fund(s). In particular, you are being asked to consider and vote on a proposal to elect nominees as members of the Board, and, if applicable, a proposal to approve an amended and restated agreement and declaration of trust (the “New Declaration”) for CNR Funds.

Question: Why are the Fund having the Meeting?

Answer: Each Board called the Meeting to present two proposals to shareholders for their approval, as applicable. Proposal 1 asks shareholders to elect six nominees to the Board, and Proposal 2 asks shareholders of the CNR Funds to approve the New Declaration. After careful consideration, each Board believes that approval of each applicable Proposal is in the best interests of the Fund and its shareholders.

Question: How does the Board recommend that I vote?

Answer: Each Board unanimously recommends that you vote FOR each Proposal applicable to your Fund(s).

Question: Who are the nominees for Trustee that shareholders of the Funds are being asked to elect in Proposal 1?

Answer: There are six nominees. They are Mr. Andrew S. Clare, Mr. Daniel A. Hanwacker, Mr. Jon C. Hunt, Ms. Julie C. Miller, Mr. Jay C. Nadel, and Mr. James Wolford. All nominees currently serve as Trustees of the Funds.

Question: Why are shareholders being asked to elect Trustees?

Answer: The Investment Company Act of 1940, as amended (the “1940 Act”), requires that at least a majority of an investment company’s board members be elected by its shareholders. In addition, the 1940 Act allows trustees to fill a vacancy on a board if, after filling the vacancy, at least two-thirds of such board’s members have been elected by shareholders. Five of the six current Trustees have been previously elected by shareholders of the Funds.

When the shareholders of the CNR Funds and High Yield Funds elected five of the six current Trustees in 2013, each Trustee had a specified term limit. In 2017, the sole shareholder of the Select Strategies Fund elected five of the six current Trustees to specific terms.

In December 2020, each Board approved the proposed election of all of the Trustees with no term limits. Each Trustee would continue to be subject to the current retirement policy which provides that, under normal circumstances, each Trustee will hold office until December 31 of the year in which he or she reaches age 75, unless such period is extended by the Board for a period of up to two years. The removal of the current term limits would be effective upon the election by each Fund’s shareholders of the Trustee nominees.

Each Board believes it is in the best interests of the Fund for the shareholders to elect Ms. Miller and re-elect the remaining Trustees with no set term limits, but subject to effective term limits established by the retirement policy, so that all members of the Board will have been elected by the shareholders with no term limit and the Board will have greater flexibility to appoint additional Trustees in the future to fill vacancies without incurring the expense of additional shareholder meetings.

Question: Why are the shareholders being asked to approve the New Declaration for CNR Funds in Proposal 2?

Answer: The CNR Funds trust was formed in 1996 pursuant to a declaration of trust, which has been amended from time to time (the “Existing Declaration”). City National Rochdale, LLC, the Funds’ investment adviser, and the Board believe that the Existing Declaration contains many outmoded provisions and does not provide the Board with the flexibility to govern the CNR Funds trust that more modern declarations of trust provide. Accordingly, the Board is proposing the adoption of the New Declaration for shareholder approval in order to facilitate more efficient management of the CNR Funds trust and its series by providing a more modern declaration of trust with greater flexibility to govern the trust. The New Declaration has been drafted in a manner that affords Trustees broad flexibility and powers to take actions that they, as fiduciaries for the CNR Funds trust, deem to be in the best interests of the trust and to minimize the number of circumstances in which shareholder approvals would be required. The proposed changes are designed to enable the CNR Funds trust to take full advantage of the flexibility conferred by Delaware law and the Investment Company Act of 1940, as amended (the “1940 Act”). Under the terms of the Existing Declaration, approval of the CNR Funds trust’s shareholders is necessary to amend the Existing Declaration in this manner. Therefore, the Board is asking shareholders of the CNR Funds trust to adopt the New Declaration by approving Proposal 2.

Question: Why should I vote?

Answer: Every vote is important. We encourage all shareholders to participate in the governance of their Fund(s). Additionally, your immediate response on the enclosed proxy card, on the Internet or over the phone will help save the costs of any further solicitations.

Question: How do I place my vote?

Answer: Voting is quick and easy. Everything you need is enclosed. You may provide the Funds with your vote: (i) by mail with the enclosed proxy card; (ii) by telephone using the toll-free number listed in the proxy voting instructions included on your proxy card; (iii) by Internet by following the instructions in the proxy voting instructions included on your proxy card; or (iv) at the Meeting. You may use the enclosed postage-paid envelope to mail your proxy card. Please follow the enclosed instructions to vote using any of the enumerated methods.

If we do not hear from you after a reasonable amount of time, you may receive a telephone call from us reminding you to vote your shares.

Question: How do I attend and vote at the Meeting?

Answer: You may virtually attend and vote at the Meeting by [following the instructions on your proxy card].

Question: What if I have questions regarding a Proposal?

Answer: If you have questions regarding a Proposal, please feel free to call 1-212-702-3577 between the hours of [8:00 a.m. and 8:00 p.m. Pacific Time, Monday through Friday].

TABLE OF CONTENTS

Page

| PROPOSAL 1: ELECTION OF TRUSTEES | 3 |

| Introduction | 3 |

| Trustee Nominees | 5 |

| Officers of the Funds | 9 |

| Nomination Considerations | 12 |

| Board Meetings and Committees | 12 |

| Leadership Structure and Risk Oversight | 13 |

| Equity Securities Owned by Trustees | 14 |

| Independent Trustees | 14 |

| Interested Trustee | 14 |

| Trustee Compensation | 14 |

| Transactions in Securities of City National Rochdale or its Affiliates | 15 |

| PROPOSALS 2A THROUGH 2D: ADOPTION OF THE SECOND AMENDED AND RESTATED AGREEMENT AND DECLARATION OF TRUST | 16 |

| General | 16 |

| PROPOSAL 2A – FUTURE AMENDMENTS | 17 |

| PROPOSAL 2B – REORGANIZATIONS THROUGH MERGERS, CONSOLIDATIONS, SALES OF ASSETS, OR CONVERSIONS | 17 |

| PROPOSAL 2C – REDEMPTIONS OF SHARES | 18 |

| PROPOSAL 2D – OTHER CHANGES | 18 |

| Shares and Shareholders | 18 |

| Board of Trustees | 19 |

| Shareholder Voting and Meetings | 21 |

| Imposition of Redemption and Other Fees | 22 |

| Limitation of Liability and Indemnification | 22 |

| Derivative and Direct Actions | 23 |

| Applicable Law, Forum Selection, and Jury Waiver | 24 |

| Effect of Disapproval | 25 |

| OTHER INFORMATION | 25 |

| Independent Registered Public Accounting Firm | 25 |

| Audit Fees | 25 |

| Audit-Related Fees | 26 |

| Tax Fees | 26 |

| All Other Fees | 26 |

| Audit Committee Pre-Approval Policies and Procedures | 26 |

| Non-Audit Fees | 27 |

| Outstanding Shares | 27 |

| Shareholder Nomination of Trustees | 28 |

| Other Matters | 29 |

| VOTING PROCEDURES | 29 |

| How to Vote | 29 |

TABLE OF CONTENTS

(continued)

| Proxy Solicitation | 29 |

| Quorum and Adjournments | 30 |

| CNR Funds | 30 |

| Select Strategies Fund and Strategic Credit Fund | 30 |

| High Yield Funds | 30 |

| Effect of Abstentions and Broker “Non-Votes” | 30 |

| City National Rochdale Proxy Voting Authority | 31 |

| Required Vote | 31 |

| CNR Funds | 31 |

| Select Strategies Fund and Strategic Credit Fund | 32 |

| High Yield Funds | 32 |

| GENERAL INFORMATION | 32 |

| Service Providers | 32 |

| Shareholder Communications | 33 |

| Shareholders Sharing the Same Address | 33 |

| APPENDIX A | 1 |

| APPENDIX B | 1 |

| APPENDIX C | 1 |

| APPENDIX D | 1 |

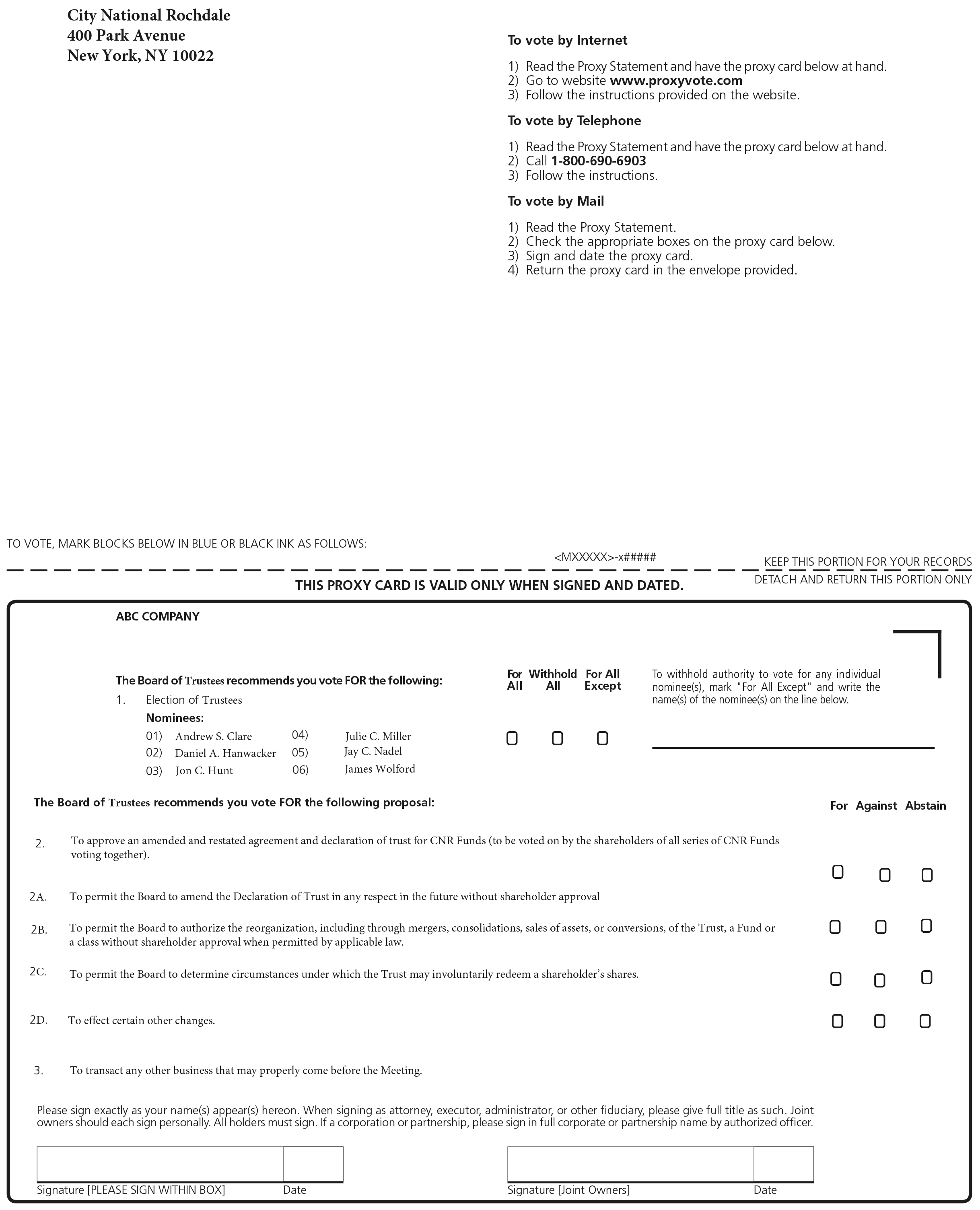

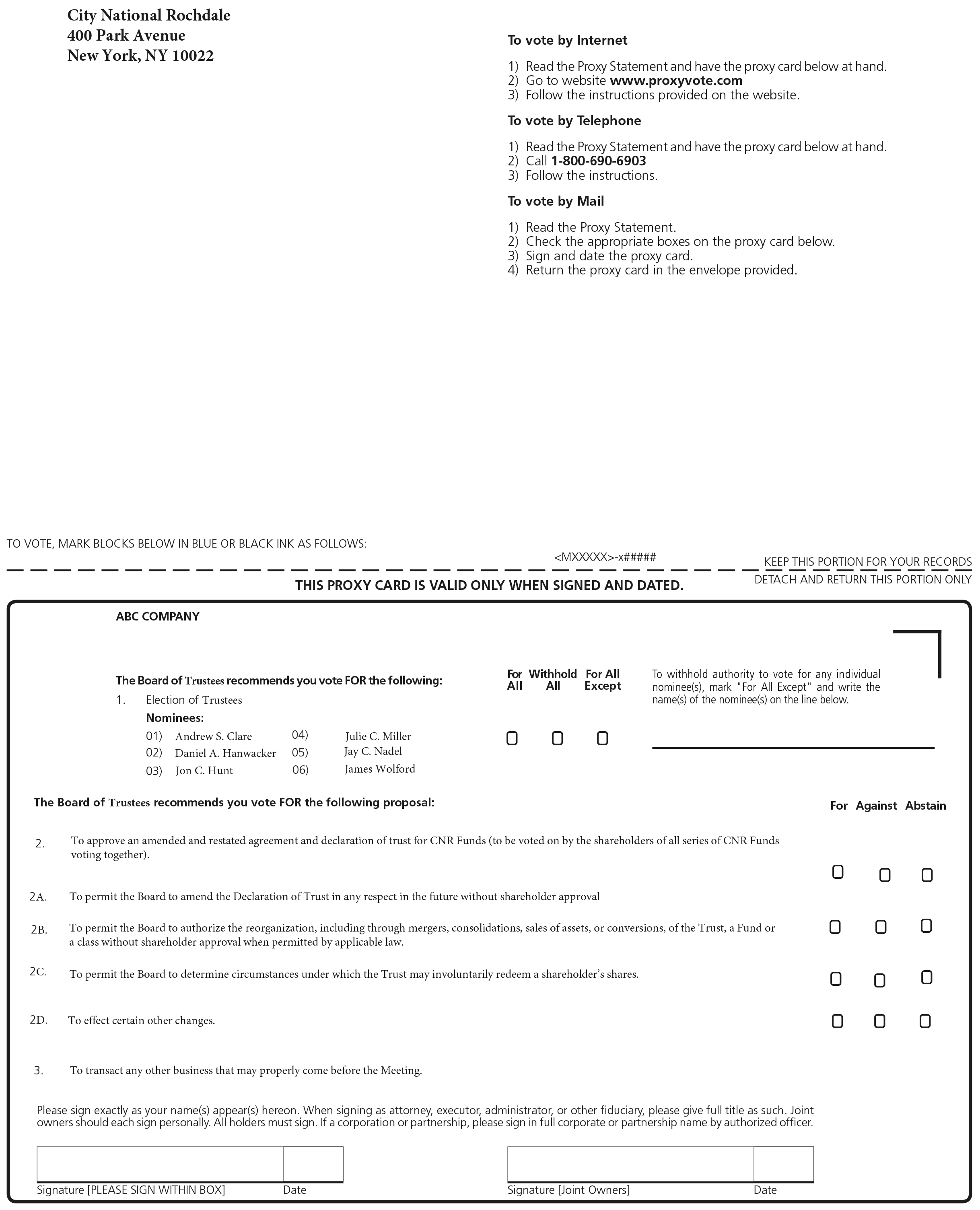

| PROXY CARD | 1 |

CITY NATIONAL ROCHDALE FUNDS

CITY NATIONAL ROCHDALE SELECT STRATEGIES FUND

CITY NATIONAL ROCHDALE STRATEGIC CREDIT FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES FUND TEI

CITY NATIONAL ROCHDALE HIGH YIELD ALTERNATIVE STRATEGIES MASTER FUND

JOINT PROXY STATEMENT

This Joint Proxy Statement and enclosed Notice of Special Joint Meeting of Shareholders/Members (the “Notice”) and proxy card are being furnished in connection with the solicitation of proxies by and on behalf of the Board of Trustees of City National Rochdale Funds (the “CNR Funds”), City National Rochdale Select Strategies Fund (the “Select Strategies Fund”) and City National Rochdale Strategic Credit Fund (the “Strategic Credit Fund”), and the Board of Directors of City National Rochdale High Yield Alternative Strategies Fund LLC and City National Rochdale High Yield Alternative Strategies Fund TEI LLC (the “Feeder Funds”), and City National Rochdale High Yield Alternative Strategies Master Fund LLC (the “Master Fund” and together with the Feeder Funds, the “High Yield Funds”) (each of the CNR Funds, Select Strategies Fund, Strategic Credit Fund and High Yield Funds may be referred to herein as a “Fund” and collectively as the “Funds”). Each of the CNR Funds, Select Strategies Fund and Strategic Credit Fund is a Delaware statutory trust, and each of the High Yield Funds is a Delaware limited liability company. For ease of reference throughout, the Board of Directors of each High Yield Fund will be referred to as a “Board of Trustees,” the Directors of each High Yield Fund will be referred to as “Trustees,” and members of each High Yield Fund will be referred to as “shareholders.” The proxies are being solicited for use at a special joint meeting of shareholders of each Fund on the list attached to the Notice to be held on [__________], 2021, at [10:00 a.m. Pacific Time] (with any postponements or adjournments, the “Meeting”). Due to the coronavirus (COVID-19) pandemic and to support the health and well-being of the Funds’ shareholders, employees, and community, the Meeting will be conducted as a virtual meeting hosted by means of a live [teleconference]. Shareholders will not have to travel to attend the Meeting, but will be able to [listen to the Meeting live, ask questions, and cast their votes remotely by ____________].

At the Meeting, and as described in the Joint Proxy Statement, shareholders will be asked to consider and vote on the following proposal(s) applicable to their Fund(s) (each, a “Proposal” and collectively, the “Proposals”), as set forth in the table below.

| Proposal | Fund |

| 1) To elect six nominees to the Board of Trustees of each Fund (to be voted on by the shareholders of all series of CNR Funds voting together, and by the shareholders of each other Fund separately). | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund City National Rochdale Select Strategies Fund City National Rochdale Strategic Credit Fund City National Rochdale High Yield Alternative Strategies Fund LLC City National Rochdale High Yield Alternative Strategies Fund TEI LLC City National Rochdale High Yield Alternative Strategies Master Fund LLC |

| 2) To approve an amended and restated agreement and declaration of trust for CNR Funds (to be voted on by the shareholders of all series of CNR Funds voting together). | City National Rochdale Funds - City National Rochdale Government Money Market Fund - City National Rochdale Government Bond Fund - City National Rochdale Corporate Bond Fund - City National Rochdale California Tax Exempt Bond Fund - City National Rochdale Municipal High Income Fund - City National Rochdale Intermediate Fixed Income Fund - City National Rochdale Short Term Emerging Markets Debt Fund - City National Rochdale Fixed Income Opportunities Fund - City National Rochdale Dividend & Income Fund - City National Rochdale U.S. Core Equity Fund |

| 3) To transact any other business that may properly come before the Meeting. | All Funds. |

After careful consideration, each Board has unanimously approved and recommends that shareholders vote FOR each Proposal applicable to your Fund(s).

This Joint Proxy Statement is being mailed on or about [____________], 2021, to the shareholders of record of the Funds as of [___________] (the “Record Date”). [Each Fund will bear its pro rata portion, based on net assets, of the expenses incurred in connection with Proposal 1. Each series of CNR Funds will bear its pro rata portion, based on net assets, of the expenses incurred in connection with Proposal 2.]

Important Notice Regarding the Internet Availability of Proxy Materials for the Special Joint Meeting of Shareholders To Be Held on [__________], 2021. These proxy materials are available at [www.citynationalrochdalefunds.com].

In the “Outstanding Shares” section of this Joint Proxy Statement, the number of shares of each Fund that were outstanding at the close of business on the Record Date is listed. Shareholders of the CNR Funds as of that time are entitled to one vote for each dollar of net asset value of the Fund represented by the shareholder’s shares of the applicable Fund (with proportional fractional votes for fractional shares). Shareholders of the Select Strategies Fund and Strategic Credit Fund are entitled to one vote for each whole share held and fractional votes for fractional shares held on the Record Date. Shareholders of the High Yield Funds are entitled to a number of votes equivalent to such shareholder’s percentage ownership in the applicable Fund as of the Record Date. With respect to the High Yield Funds, when a Feeder Fund shareholder votes with respect to Proposal 1, that vote will also constitute instructions for the Feeder Fund to vote in the same manner on Proposal 1 for the Master Fund. Information on shareholders owning beneficially or of record more than 5% of the outstanding shares of each class of each Fund as of the Record Date is set forth in Appendix A.

PROPOSAL 1: ELECTION OF TRUSTEES

Introduction

Each Board is responsible for overseeing the management and operation of the relevant Fund. Each Board meets regularly to oversee the business affairs of the relevant Fund and review the activities of the Fund’s officers, who are responsible for day-to-day operations of the Fund. Each Board is currently comprised of six Trustees. Five of the Trustees are not “interested persons” of the Fund (“Independent Trustees”) as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”). James Wolford has served as a Trustee of the CNR Funds since 1999, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013. Each of Andrew S. Clare, Daniel A. Hanwacker, Jon C. Hunt and Jay C. Nadel has served as a Trustee of the CNR Funds since 2013, the Select Strategies Fund since 2016, the Strategic Credit Fund since 2018, and each High Yield Fund since 2013. Julie C. Miller has served as a Trustee of the CNR Funds, the Select Strategies Fund, the Strategic Credit Fund, and each High Yield Fund since May 2020.

When the shareholders of the CNR Funds and High Yield Funds elected five of the six current Trustees in 2013, each Trustee had a specified term limit. In 2017, the sole shareholder of the Select Strategies Fund elected five of the six current Trustees to specific terms. A term of office ending May 14, 2030, was adopted for Ms. Miller when she joined the Boards of the CNR Funds, the Select Strategies Fund, the Strategic Credit Fund and the High Yield Funds in 2020. None of the other current Trustees of the Strategic Credit Fund are subject to term limits. The Trustees intended to voluntarily stagger their terms to ensure that the entire Board of these Funds would not be replaced at the same time.

The current end of term of office for each Trustee is included in the table below.

| Name of Trustee | Current End of Term of Office |

| Andrew S. Clare | December 31, 2022(1) |

| Daniel A. Hanwacker | March 29, 2023(2) |

| Jon C. Hunt | March 29, 2023(2) |

| Julie C. Miller | May 14, 2030(3) |

| Jay C. Nadel | March 29, 2023(2) |

| James Wolford | March 29, 2023(2) |

___________________

| (1) | Each Board has granted Mr. Clare a two-year exception from the Fund retirement policy, and the date shown in the table is Mr. Clare’s current end of term of office date applicable to all Funds. |

| (2) | The date applies to all Funds except the Strategic Credit Fund. |

| (3) | The date applies to all Funds. |

At meetings of each Board and its Nominating and Governance Committee held on December 2 and 3, 2020, the Nominating and Governance Committee recommended that the Board approve the proposed election of the Trustee nominees with no set term limits. The removal of the current term limits would be effective upon the election by each Fund’s shareholders of the Trustee nominees. In determining to propose the election of Trustees with no term limits, each Board considered that continuing the term limits could require highly productive Trustees to leave the Board at a time when they are continuing to add value to the Board, and that any time a new Trustee is added to the Board to fill a vacancy, the Fund must determine whether shareholder approval would be required, and that holding shareholder meetings to elect new Trustees is time-consuming and costly.1 Each Board also considered that because it had adopted a Trustee retirement policy (discussed further below) which effectively establishes a term limit for each Trustee, it was not necessary to maintain term limits for Trustees.

Each Board had adopted a Trustee retirement policy setting a retirement date for Trustees of December 31 of the year in which the Trustee reaches age 75. Exceptions to the retirement age may be made by each Board in individual cases for a period of up to two years, based on the recommendation of the Board’s Nominating and Governance Committee, in certain circumstances (such as the need to provide for proper leadership transition or to avoid the cost of a shareholder meeting that otherwise would not be necessary). In December 2020, each Board simplified its retirement policy to state that exceptions to the retirement age may be made by the Board in individual cases for a period of up to two years, in the discretion of the Board.

The nominees for election include all of the current Trustees of the Funds. Five of the six current Trustees have been previously elected by shareholders of the Funds. No Fund’s governing documents require the periodic re-election of Trustees who have previously been elected by shareholders and, in accordance with Section 16(a) of the 1940 Act, each Board may appoint Trustees to fill vacancies if after doing so at least two-thirds of the Trustees have been elected by the shareholders of the Fund.

Each Board believes it is in the best interests of the Fund for the shareholders to elect Ms. Miller and re-elect the remaining Trustees with no set term limits, but subject to effective term limit established by the retirement policy so that all members of the Board will have been elected by the shareholders with no term limit and the Board will have greater flexibility to appoint additional Trustees in the future to fill vacancies without incurring the expense of additional shareholder meetings.

In considering the nomination of new Trustees, the CNR Funds’ Board has taken into consideration that because the CNR Funds’ trust has adopted a plan of distribution pursuant to Rule 12b-1 under the 1940 Act, at least a majority of the Board must be comprised of Independent Trustees.

| 1 | Under the 1940 Act, a vacancy on a fund board may be filled by election by the current trustees, provided that immediately after filling the vacancy, at least 2/3 of the board has been elected by shareholders. If at any time, less than a majority of trustees has been elected by shareholders, the 1940 Act requires a board to call a meeting of shareholders to elect trustees within 60 days, or 150 days if there has been a death, disqualification, or bona fide resignation of any director which results in the fund not being able to meet the 1940 Act requirements regarding the composition of the board of trustees. |

After taking all of the foregoing matters into consideration, each Board, upon the recommendation of its Nominating and Governance Committee, has unanimously nominated the follow persons for election or re-election as Trustees:

Andrew S. Clare*

Daniel A. Hanwacker

Jon C. Hunt

Julie C. Miller

Jay C. Nadel

James Wolford

| * | An “interested person” of the Funds as defined in the 1940 Act. |

Further information about these nominees is in the next section of this Joint Proxy Statement. The persons named as proxies on your proxy card will vote for the election of all of these nominees unless authority to vote for any or all of the nominees is withheld on the proxy card. The nominees, if elected, will continue as Trustees of each Fund following the Meeting. Each of the nominees listed below has consented to serve as a Trustee of each Fund, if elected. However, if any nominee should become unavailable for election due to events not known or anticipated, the persons named as proxies will vote for such other nominees as each Board may recommend.

Trustee Nominees

The names and ages of the Trustee nominees, their principal occupations during the past five years and information about certain of their other affiliations are provided below. The address of each Trustee nominee for purposes of business relating to the Funds is c/o City National Rochdale, LLC, 400 North Roxbury Drive, Beverly Hills, California 90210. The person listed as “Interested Trustee Nominee” is an “interested person” of each Fund as defined in the 1940 Act; persons listed as “Independent Trustee Nominees” are not “interested persons” of the Funds.

| Name and Age of Nominees | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation for the Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustee | Other Directorships Held by Trustee |

| Independent Trustee Nominees |

Daniel A. Hanwacker Age: 69 | Trustee | Since 2013 (CNR Funds and High Yield Funds) Since 2016 (Select Strategies Fund) Since 2018 (Strategic Credit Fund) | CEO and President, Hanwacker Associates, Inc. (asset management consulting and executive search services) (2001 - present). Managing Director - Asset Management, Putnam Lovell Securities (2000-2001). Co-Founding Partner, Constellation Financial Management Co., LLC (1995-2000). | 15 | None. |

Jon C. Hunt Age: 69 | Trustee | Since 2013 (CNR Funds and High Yield Funds) Since 2016 (Select Strategies Fund) Since 2018 (Strategic Credit Fund) | Retired (2013 to present). Consultant to Management, Convergent Capital Management, LLC (“CCM”) (2012 to 2013). Managing Director and Chief Operating Officer, CCM (1998 - 2012). | 15 | Advisor’s Inner Circle Fund III (2014 – present). Gallery Trust (2016-present). Schroder Series Trust and Schroder Global Series Trust, Lead Independent Trustee (2017-present). |

Julie C. Miller Age: 63 | Trustee | Since May 2020 (All Funds) | Certified Public Accountant (CPA) and Partner, Holthouse, Carlin & Van Trigt LLP (accounting firm) (2006 – present). | 15 | None. |

| Name and Age of Nominees | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation for the Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustee | Other Directorships Held by Trustee |

Jay C. Nadel Age: 62 | Trustee and Chairperson | Since 2013 (Trustee: CNR Funds and High Yield Funds) Since 2016 (Trustee: Select Strategies Fund) Since 2018 (Trustee: Strategic Credit Fund) Since 2019 (Chairperson: All Funds) | Financial Services Consultant (2005 - present). Executive Vice President, Bank of New York Broker-Dealer and Member of the Operating Committee (2002-2004). Weiss, Peck & Greer, Partner, Managing Director and Chair of the Operations Committee (1986-2001). | 15 | Advisor’s Inner Circle Fund III (2016-present). Gallery Trust (2016-present). Schroder Series Trust and Schroder Global Series Trust, Independent Trustee (2017-present). |

| Name and Age of Nominees | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation for the Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustee | Other Directorships Held by Trustee |

James R. Wolford Age: 66 | Trustee | Since 1999 (CNR Funds) Since 2013 (High Yield Funds) Since 2016 (Select Strategies Fund) Since 2018 (Strategic Credit Fund) | Chief Executive Officer of Corinthian Development Company (2013 – present). President, Chief Operating Officer and Chief Financial Officer, Thompson National Properties (2011- 2013). Chief Financial Officer, Pacific Office Properties, a real estate investment trust (2010- 2011). Chief Financial Officer, Bixby Land Company, a real estate company (2004-March 2010). Regional Financial Officer, AIMCO, a real estate investment trust (2004). Chief Financial Officer, DBM Group, a direct mail marketing company (2001-2004). Senior Vice President and Chief Operating Officer, Forecast Commercial Real Estate Service, Inc. (2000-2001). Senior Vice President and Chief Financial Officer, Bixby Ranch Company (1985-2000). | 15 | None. |

| Name and Age of Nominees | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation for the Past Five Years | Number of Portfolios in Fund Complex(2) Overseen by Trustee | Other Directorships Held by Trustee |

| Interested Trustee Nominee |

Andrew S. Clare(3) Age: 75 | Trustee | Since 2013 (CNR Funds and High Yield Funds) Since 2016 (Select Strategies Fund) Since 2018 (Strategic Credit Fund) | Attorney and partner, Loeb & Loeb LLP (law firm) (1972-present). | 15 | None. |

___________________

| (1) | Each Trustee currently serves until December 31 of the year in which the Trustee reaches age 75, unless an exception is made by the applicable Board, for a period of up to two years; until the next meeting of shareholders, if any, called for the purpose of electing trustees and the election and qualification of his or her successor; or until death, resignation, declaration of bankruptcy or incompetence by a court of competent jurisdiction, or removal by a majority vote of the Trustees or the shares entitled to vote. At a meeting held on December 3, 2020, each Board approved an exception to the retirement age for Mr. Clare, who may continue to serve as Trustee until December 31, 2022. |

| (2) | “Fund complex” is defined as two or more registered investment companies that hold themselves out to investors as related companies or have a common investment adviser or affiliated investment advisers and in this case includes the CNR Funds, the Select Strategies Fund, the Strategic Credit Fund, and the High Yield Funds. |

| (3) | Mr. Clare is an “interested person” of each Fund, as defined in the 1940 Act, by virtue of the provision of significant legal services by him and his law firm to City National Bank, an affiliated person of City National Rochdale, LLC, each Fund’s investment adviser. Each Board has granted Mr. Clare a two-year exception from the Fund retirement policy. |

Officers of the Funds

The names and ages of the current officers and certain prospective officers of each Fund, their principal occupations during the past five years and certain of their other affiliations are provided below. The officers of each Fund do not receive any compensation from the Fund for their services. Certain officers of the Funds are officers of City National Rochdale, LLC (“City National Rochdale”), each Fund’s investment adviser.

| Name, Address and Age of Officers | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation(s) for the Past 5 Years |

Garrett R. D’Alessandro City National Rochdale, LLC 400 N. Roxbury Drive Beverly Hills, California 90210 Age: 62 | President and Chief Executive Officer | Since 2013 (CNR Funds and High Yield Funds) Since 2016 (Select Strategies Fund) Since 2018 (Strategic Credit Fund) | Chief Executive Officer, City National Rochdale (1986-present). Chief Investment Officer, City National Rochdale (2016-2018). President and Chief Executive Officer, CNR Funds and High Yield Funds (2013-present), Select Strategies Fund (2016-present), and Strategic Credit Fund (2018-present). |

Stephen Connors SEI Investments One Freedom Valley Drive Oaks, Pennsylvania 19456 Age: 36 | Treasurer (Principal Financial and Accounting Officer and Controller) | Since November 2020 (CNR Funds, Select Strategies Fund and Strategic Credit Fund) | Director of Fund Accounting, SEI Investments Company (2014-present). Treasurer (Principal Financial and Accounting Officer and Controller), CNR Funds, Select Strategies Fund, and Strategic Credit Fund (November 2020-present). |

Don Andrews City National Rochdale, LLC 400 N. Roxbury Drive Beverly Hills, California 90210 Age: 61 | Vice President; Chief Compliance Officer (“CCO”) and Anti-Money Laundering Officer (“AML Officer”) | Since 2019 (CNR Funds, Select Strategies Fund, Strategic Credit Fund and High Yield Funds) | Senior Vice President and CCO, City National Bank Wealth Management Division (2019-present). Vice President, CCO and AML Officer, CNR Funds, Select Strategies Fund, Strategic Credit Fund and High Yield Funds (2019-present). CCO, City National Rochdale (2019-2020). Global Practice Leader for Risk and Compliance, Reed Smith (2017-2019). Co-Head of Risk and Compliance, Venable (2015-2017). |

| Name, Address and Age of Officers | Position(s) with the Funds | Term of Office(1) and Length of Time Served | Principal Occupation(s) for the Past 5 Years |

Mitchell Cepler City National Rochdale, LLC 400 N. Roxbury Drive Beverly Hills, California 90210 Age: 37 | Vice President and Assistant Treasurer Treasurer and Chief Financial Officer | Since 2015 (Vice President and Assistant Treasurer: CNR Funds) Since 2016 (Vice President and Assistant Treasurer: Select Strategies Fund) Since 2018 (Vice President and Assistant Treasurer: Strategic Credit Fund) Since 2016 (Treasurer and Chief Financial Officer: High Yield Funds) | Group Finance Manager, City National Rochdale (2011-present). Vice President and Assistant Treasurer, CNR Funds (2015-present), Select Strategies Fund (2016-present), and Strategic Credit Fund (2018-present). Treasurer and Chief Financial Officer, High Yield Funds (2016-present). |

Anthony Sozio

City National Rochdale, LLC 400 N. Roxbury Drive Beverly Hills, California 90210 Age: 48 | Vice President and Secretary | Since 2013 (Vice President and Secretary: CNR Funds) Since 2016 (Vice President: Select Strategies Fund) Since 2018 (Vice President: Strategic Credit Fund) Since 2020 (Secretary: Select Strategies Fund, Strategic Credit Fund, and High Yield Funds) | Assistant Vice President of Registered Fund Operations, City National Rochdale (1998-present). Vice President, CNR Funds (2013-present), Select Strategies Fund (2016-present), and Strategic Credit Fund (2018-present). Secretary, CNR Funds (2019-present), Select Strategies Fund (2020-present), Strategic Credit Fund (2020-present), and High Yield Funds (2020-present). Assistant Secretary, CNR Funds (2013-2019), High Yield Funds (2013-2020), Select Strategies Fund (2016-2020), and Strategic Credit Fund (2018-2020). |

Matthew M. Maher SEI Investments One Freedom Valley Drive Oaks, Pennsylvania 19456 Age: 44 | Assistant Secretary | Since 2019 (CNR Funds, Select Strategies Fund and Strategic Credit Fund) | Counsel, SEI Investments Company (2018-present). Assistant Secretary, CNR Funds, Select Strategies Fund and Strategic Credit Fund (2019-present). Attorney, Blank Rome LLP (2015-2018). |

___________________

| (1) | Each officer serves until removed by a Board or the principal executive officer of a Fund, or until such officer resigns. |

Nomination Considerations

The current Trustees were selected with a view towards establishing boards that would have the broad experience needed to oversee registered investment companies comprised of multiple series employing a variety of different investment strategies. As a group, the current Trustees have extensive experience in many different aspects of the financial services and asset management industries.

The Trustees were selected to join the Boards based upon the following factors, among others: character and integrity; willingness to serve and willingness and ability to commit the time necessary to perform the duties of a Trustee; and with respect to certain persons, satisfying the criteria for not being classified as an “interested person” of the Funds as defined in the 1940 Act. In addition, the following specific experience, qualifications, attributes and/or skills apply as to each nominee:

| • | Mr. Clare, legal background and experience as a corporate and litigation lawyer. |

| • | Mr. Hanwacker, experience in the asset management industry and as a trustee of Rochdale Investment Trust, a registered investment company the series of which reorganized into the Intermediate Fixed Income Fund, the Fixed Income Opportunities Fund and the Dividend & Income Fund on March 29, 2013. |

| • | Mr. Hunt, executive investment management experience and experience in management of the Funds and affiliated entities of City National Bank. |

| • | Ms. Miller, experience in financial planning and business management in an accounting firm. |

| • | Mr. Nadel, experience in the financial services field and as a trustee of Rochdale Investment Trust. |

| • | Mr. Wolford, experience as a chief financial officer of various companies and a Trustee of the Funds. |

Ms. Miller, who is the only Trustee nominee standing for election by Fund shareholders for the first time, was considered and recommended for election by each Board by the Nominating and Governance Committee.

Board Meetings and Committees

During the fiscal year ended September 30, 2020, the CNR Funds’ Board held six regular meetings and three special meetings, all of which were attended by all of the then-current Trustees. During the fiscal year ended January 31, 2020, the Select Strategies Fund’s Board held six regular meetings, all of which were attended by all of the then-current Trustees. During the fiscal year ended May 31, 2020, the Strategic Credit Fund’s Board held six regular meetings, all of which were attended by all of the then-current Trustees. During the fiscal year ended March 31, 2020, the High Yield Funds’ Board held six regular meetings, all of which were attended by all of the then-current Trustees.

Each Board has an Audit Committee, comprised solely of the Independent Trustees. Each Committee makes recommendations to the Board with respect to the engagement of the Fund’s independent registered public accounting firm, approves all auditing and other services provided to the Fund by its independent registered public accounting firm, and reviews with the independent registered public accounting firm the plan and results of the audit engagement and matters having a material effect on the Fund’s financial operations. During the fiscal year ended September 30, 2020, the CNR Funds’ Audit Committee held four meetings. During the fiscal year ended January 31, 2020, the Select Strategies Fund’s Audit Committee held five meetings. During the fiscal year ended May 31, 2020, the Strategic Credit Fund’s Audit Committee held five meetings. During the fiscal year ended March 31, 2020, the High Yield Funds’ Audit Committee held two meetings. Each Board has designated James R. Wolford as the Fund’s “audit committee financial expert,” as defined in Form N-CSR under the 1940 Act, based on the Board’s review of his qualifications.

Each Board has an Investment Committee, comprised of all of the Trustees. The Committees monitor on an ongoing basis the investment operations of the Funds, including matters such as the Funds’ adherence to their investment mandates, historical performance of City National Rochdale and each sub-adviser, as applicable, changes in investment processes and personnel, appropriate benchmarks, and proposed changes in investment objectives and strategies. The Committees also review any changes in a Fund’s sub-advisers proposed by City National Rochdale, including hiring of new sub-advisers and termination of sub-advisers, and makes such recommendations to the applicable Board regarding the proposed changes as it deems appropriate. During the fiscal year ended September 30, 2020, the Investment Committee of the Board of all Funds held four meetings.

Each Board has a Nominating and Governance Committee, comprised solely of the Independent Trustees. Each Committee operates pursuant to a Nominating and Governance Committee Charter (the “Charter”). A copy of the Charter is attached to this Joint Proxy Statement as Appendix B. Each Committee periodically reviews such issues as the Board’s composition, responsibilities, committees and other relevant issues, and recommends any appropriate changes to the Board. During the fiscal year ended September 30, 2020, the Nominating and Governance Committee of the Board of all Funds held five meetings.

Leadership Structure and Risk Oversight

Five of the six Trustees on each Board are Independent Trustees. Jay Nadel, an Independent Trustee, serves as Chairperson of each Board. The Chairperson serves as a key point person for dealings between each Fund’s management and the other Independent Trustees. Through the committees of each Board the Independent Trustees consider and address important matters involving each Fund, including those presenting conflicts or potential conflicts of interest. The Independent Trustees also regularly meet outside the presence of management and are advised by independent legal counsel. Each Board has determined that its organization and leadership structure are appropriate in light of its fiduciary and oversight obligations and the special obligations of the Independent Trustees. Each Board believes that its structure facilitates the orderly and efficient flow of information to the Independent Trustees from management.

Consistent with its responsibility for oversight of the Fund in the interests of shareholders, each Board, among other things, oversees risk management of each Fund’s investment program and business affairs directly and through the Audit Committee. Each Board has emphasized to City National Rochdale the importance of maintaining vigorous risk management programs and procedures.

Each Fund faces a number of risks, such as investment risk, valuation risk, reputational risk, risk of operational failure or lack of business continuity, and legal, compliance and regulatory risk. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of a Fund. Under the overall supervision of each Board, City National Rochdale and other service providers to the Fund employ a variety of processes, procedures and controls to identify various of those possible events or circumstances, to ensure such risks are appropriate, and where appropriate to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Different processes, procedures and controls are employed with respect to different types of risks. Various personnel, including each Fund’s CCO, City National Rochdale’s management, and other service providers (such as each Fund’s independent registered public accounting firm) make periodic reports to the Board or to the Audit Committee with respect to various aspects of risk management. Each Board recognizes that not all risks that may affect the Fund can be identified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve a Fund’s investment objectives, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. As a result of the foregoing and other factors, each Board’s risk management oversight is subject to substantial limitations.

Equity Securities Owned by Trustees

The following table sets forth the dollar range of equity securities beneficially owned by each Trustee as of [_________], 2021.

Independent Trustees

| Name of Trustee | Dollar Range of Equity Securities in each Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee in Family of Investment Companies |

| Daniel A. Hanwacker | [Government Money Fund $10,001-$50,000 Fixed Income Opportunities Fund $10,001-$50,000] | [$10,001-$50,000] |

| Jon C. Hunt | [Fixed Income Opportunities Fund Over $100,000] | [Over $100,000] |

| Julie C. Miller | [None] | [None] |

| Jay C. Nadel | [Muni High Income Fund Over $100,000 Fixed Income Opportunities Fund Over $100,000] | [Over $100,000] |

| James R. Wolford | [None] | [Over $100,000] |

Interested Trustee

| Name of Trustee | Dollar Range of Equity Securities in each Fund | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Trustee in Family of Investment Companies |

| Andrew S. Clare | [None] | [Over $100,000] |

Trustee Compensation

The following table sets forth the compensation of the current Trustees for the fiscal years ended (i) September 30, 2020, with respect to the CNR Funds; (ii) January 31, 2020, with respect to the Select Strategies Fund; (iii) May 31, 2020, with respect to the Strategic Credit Fund; and (iv) March 31, 2020, with respect to the High Yield Funds.

| Name of Trustee | Aggregate Compensation from Registrant | Pension or Retirement Benefits Accrued As Part of Funds’ Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From Registrant and Fund Complex Paid to Trustee |

| Independent Trustees |

| Daniel A. Hanwacker | CNR Funds: $109,502 Select Strategies Fund: $165.01 Strategic Credit Fund: $115.17 High Yield Funds: $[___] | N/A | N/A | $[_____] |

| Jon C. Hunt | CNR Funds: $97,770 Select Strategies Fund: $146.06 Strategic Credit Fund: $102.67 High Yield Funds: $[___] | N/A | N/A | $[_____] |

| Julie C. Miller(1) | CNR Funds: $26,276 Select Strategies Fund: None Strategic Credit Fund: $1.56 High Yield Funds: None | N/A | N/A | $[_____] |

| Jay C. Nadel | CNR Funds: $114,880 Select Strategies Fund: $157.11 Strategic Credit Fund: $120.91 High Yield Funds: $[___] | N/A | N/A | $[_____] |

| James R. Wolford | CNR Funds: $109,502 Select Strategies Fund: $165.01 Strategic Credit Fund: $115.17 High Yield Funds: $[___] | N/A | N/A | $[_____] |

| Interested Trustee |

| Andrew S. Clare | CNR Funds: $97,770 Select Strategies Fund: $146.06 Strategic Credit Fund: $102.67 High Yield Funds: $[___] | N/A | N/A | $[_____] |

___________________

| (1) | Ms. Miller began her service as Trustee in May 2020. |

Transactions in Securities of City National Rochdale or its Affiliates

[None of the Trustees have purchased or sold any securities of City National Rochdale, its parent companies or subsidiaries of its parent companies, since October 1, 2019.]

EACH BOARD UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR PROPOSAL 1 (THE ELECTION OF EACH NOMINEE).

PROPOSALS 2A THROUGH 2D: ADOPTION OF THE SECOND AMENDED AND RESTATED AGREEMENT AND DECLARATION OF TRUST

CITY NATIONAL ROCHDALE FUNDS ONLY

General

CNR Funds (for purposes of this Proposal 2, the “Trust,” and the series of the Trust, the “Funds”) was established pursuant to an agreement and declaration of trust dated October 25, 1996, as amended from time to time and as amended and restated on August 20, 2020 (the “Existing Declaration”). The Existing Declaration contains many outmoded provisions and does not provide the Board with the flexibility to govern the Trust that more modern declarations of trust provide. Having a more up to date, “state-of-the-art” declaration of trust is important to the Trust, the Board and CNR.

For these reasons, it is now proposed that the Trust amend and restate its Existing Declaration in its entirety by adopting a new Amended and Restated Agreement and Declaration of Trust (the “New Declaration”). At its meeting on December 3, 2020, the Board considered and approved the adoption of the New Declaration in place of the Existing Declaration. Under the terms of the Existing Declaration, approval of the Trust’s shareholders is necessary to adopt the New Declaration. At the same meeting, the Board also approved new amended and restated By-Laws (the “New By-Laws”) to replace the Trust’s existing By-Laws (the “Existing By-Laws”) upon the adoption of the New Declaration. Shareholder approval is not required for the adoption of the New By-Laws.

Certain of the changes reflected in the New Declaration set forth as Proposals 2A, 2B, and 2C below are being submitted for a separate vote by the shareholders of the Trust. The remaining changes will be voted on as one proposal, Proposal 2D, by shareholders of the Trust. In order for any of the four proposals to become effective for the Trust each of them must be approved by shareholders of the Trust. Therefore, if one or more of these four proposals are not approved by shareholders of the Trust, none of them will be implemented for the Trust. That is, the New Declaration will not be considered to be approved by the shareholders of the Trust and will not be adopted by the Trust.

In approving the New Declaration and recommending its approval to shareholders of the Trust, the Board compared and contrasted the provisions of the Existing Declaration with those of the New Declaration, and carefully considered the advantages and disadvantages of each. Based on these considerations, the Board believes that the Existing Declaration does not provide the Board with the flexibility to govern the Trust that more modern declarations provide.

The New Declaration has been drafted in a manner that affords Trustees broad flexibility and powers to take actions that they, as fiduciaries for the Funds, deem to be in the best interests of the Funds and to minimize the number of circumstances in which shareholder approvals would be required.

Generally, the 1940 Act requires a vote of shareholders on matters that Congress has determined might have a material effect on shareholders and their investments. For example, shareholder consent is required under the 1940 Act to approve new investment advisory agreements in most cases, an increase in an advisory fee or a 12b-1 distribution fee, changes to fundamental investment policies, the election of directors or trustees in certain circumstances, and the merger or reorganization of a fund in certain circumstances, including in many instances where the merger or consolidation involves an affiliated party. The New Declaration requires a shareholder vote on those matters when the 1940 Act requires a shareholder vote, but otherwise generally permits the Board to take actions without seeking the consent of shareholders.

The proposed amendments to the Existing Declaration are designed to enable the Trust to take full advantage of the flexibility conferred by Delaware law and the 1940 Act. It is anticipated that the overall effect of the adoption of the New Declaration will be to make the administration of the Funds more efficient and economical and to make it easier for the Funds to adapt to changing circumstances, within the limits of applicable law. Among other changes, the proposed amendments to the Existing Declaration will provide the Trustees with additional flexibility to make decisions that they believe are in shareholders’ interests without causing a Fund to incur the cost and delay of soliciting shareholder approval. Accordingly, it is expected that, if approved, the New Declaration will save the Trust and its shareholders the considerable expense associated with future shareholder meetings.

Adoption of the New Declaration will not alter in any way the Trustees’ existing fiduciary obligations to act in good faith and in the best interests of the Funds. The proposal is not intended to affect the day-to-day management of the Funds or result in a material change to the manner in which the Funds are managed.

Summarized below are some of the key provisions of the New Declaration and a discussion that compares and contrasts the New Declaration with the Existing Declaration in certain respects. Shareholders should review the form of New Declaration, which is found in Appendix D. The discussion below is qualified in its entirety by reference to the form of New Declaration.

PROPOSAL 2A – FUTURE AMENDMENTS

Consistent with the broad grant of authority to the Board, the New Declaration provides that the Trustees may amend the New Declaration in any respect without shareholder approval. The New Declaration, however, prohibits amendments that impair the exemption from personal liability granted in the New Declaration to persons who are or have been shareholders, Trustees, officers or employees of the Trust, or that limit the rights to indemnification or insurance provided in the New Declaration, in each case with respect to actions, omissions, or alleged actions or omissions of persons entitled to indemnification under the New Declaration prior to the amendment. The New Declaration also permits the Trustees to amend the Trust’s Certificate of Trust without shareholder approval. These amendment provisions are intended to provide the Trustees with greater flexibility to react more quickly to changes in competitive and regulatory conditions, as well as to provide greater clarity and reduce costs by eliminating the need for shareholder votes in many circumstances.

The Existing Declaration grants to the Board the power to amend the Existing Declaration without the need for shareholder approval, provided that, before adopting any amendment without shareholder approval, the Board determines that such amendment is consistent with the fair and equitable treatment of all shareholders or that shareholder approval is not otherwise required by the 1940 Act or other applicable law. The Existing Declaration requires shareholder approval to adopt any amendments to the Existing Declaration of Trust that would adversely affect to a material degree the rights and preferences of the shares of any Fund or class or to increase or decrease the par value of the shares of any Fund or class. The Existing Declaration also requires shareholder approval for amendments to the Trust’s Certificate of Trust.

PROPOSAL 2B – REORGANIZATIONS THROUGH MERGERS, CONSOLIDATIONS, SALES OF ASSETS, OR CONVERSIONS

The New Declaration permits the Board to authorize the reorganization, including a merger or consolidation, of the Trust, a Fund or a class; the sale of all or substantially all of the assets of the Trust, a Fund or a class; or the conversion of shares of the Trust, a Fund or a class, without a shareholder vote, except as otherwise required under the 1940 Act. The New Declaration also clarifies that these provisions are in addition to the authority of the Trustees to combine two or more classes of a Fund into a single class. These provisions allow the Board the flexibility, when considering reorganizations, sales, conversions or consolidations, to make decisions that it believes are in the best interests of shareholders, without causing the Funds to incur the time and expense of soliciting shareholder approval.

The Existing Declaration provides that the Trustees may authorize the reorganization of the Trust, a Fund or a class, including via a merger, consolidation, conversion, or share exchange, but requires that any such reorganization be approved by shareholders.

PROPOSAL 2C – REDEMPTIONS OF SHARES

Both the Existing Declaration and the New Declaration provide that a shareholder may redeem his or her shares of a Fund at net asset value. The New Declaration clarifies that any fees and/or charges established by the Trustees may be deducted from a shareholder’s redemption proceeds. The Existing Declaration also permits involuntary redemptions if a shareholder’s account balance falls below a certain minimum or to comply with certain provisions of the Internal Revenue Code. The New Declaration provides that, subject to the provisions of the 1940 Act, the Trust may redeem a shareholder’s shares for any reason, including if a shareholder’s account balance falls below a certain minimum or to comply with certain provisions of the Internal Revenue Code. The New Declaration provides the Board with more flexibility that may be needed in a variety of circumstances, such as the redemption of a shareholder’s shares to comply with applicable laws and regulations. For example, a shareholder’s shares may be redeemed if the Trust is unable to verify a shareholder’s identity.

Both the Existing Declaration and the New Declaration explain that the redemption price of shares may be paid wholly or partly in kind. The Existing Declaration states that the fair value, selection and quantity of securities or other property to be paid or delivered may be determined by or under the authority of the Trustees. In comparison, the New Declaration clarifies that the composition of such redemption payment may be in cash or in property or a combination thereof, may be different among shareholders (including differences among shareholders in the same Fund or class), and that such payment will be made at such time and in the manner as specified in the applicable Fund prospectus.

PROPOSAL 2D – OTHER CHANGES

Shares and Shareholders

Both the Existing Declaration and the New Declaration permit the establishment and designation of any Fund or class of shares upon a resolution approved by a majority of the Trustees. The New Declaration clarifies that additions or modifications to a designation, including the termination of an existing Fund or class, will be made upon a resolution approved by a majority of the Trustees. The New Declaration also clarifies that shares may be issued from time to time to such persons, either for cash or for such other consideration and on such terms as the Trustees, from time to time, may deem advisable, and that the Trust may, in connection with an issuance of shares, acquire other assets, and that all shares so issued under the New Declaration shall be fully paid and non-assessable. Both the Existing Declaration and the New Declaration provide that shareholders are not entitled to any title in Trust property, or the right to call for a partition or division of the same or for an accounting, and that shareholders are not considered partners. The New Declaration also clarifies that shareholders have no rights, privileges, claims or remedies under any agreement entered into by the Trust or any Fund with any service provider, agent or contractor, including any third party beneficiary rights, except as may be expressly provided in such agreement. The Existing Declaration contains no similar provision.

The New Declaration provides that, except as required by federal law, no shareholders shall have any right to inspect the records, documents, accounts and books of the Trust, except as may be granted by the Trustees. The Existing Declaration contains no comparable provision.

The New Declaration provides that shareholders shall upon demand disclose to the Trust in writing such information with respect to direct and indirect ownership of shares or other securities of the Trust as the Trustees deem necessary to comply with the provisions of the Internal Revenue Code or the requirements of any other law or regulation or as the Trustees may otherwise decide, and ownership of shares may be disclosed by the Trust if so required by applicable law or as the Trustees may otherwise decide. The Existing Declaration contains no comparable provision.

The New Declaration provides that any notices, reports, statements, or communications with shareholders (or their counsel or other representatives) of any kind required under the New Declaration, or otherwise made by or on behalf of the Trust, is governed by the applicable provisions in the New By-Laws. In comparison, the Existing Declaration contains certain specific provisions related to providing notices and other communications to shareholders.

Board of Trustees

The Existing Declaration permits the Trustees to establish and change the number of Trustees by a vote of the majority of the Trustees, and states that the number of Trustees shall be no less than one nor more than 15. The New Declarations provides that, by a two-thirds vote or consent of the Trustees, the Trustees may from time to time establish the number of Trustees. The New Declaration also clarifies that no decrease in the number of Trustees will have the effect of removing any Trustee from office prior to the expiration of his or her term, but that the number of Trustees may be decreased in conjunction with the removal of a Trustee pursuant to the New Declaration. The Existing Declaration and the New Declaration have similar provisions relating to the term and election of Trustees and the filling of vacancies. Neither the Existing Declaration nor the New Declaration imposes a term limit on Trustees. The Existing Declaration provides that each Trustee will serve until he or she dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner, until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his or her successor. Under the Existing Declaration, vacancies on the Board may be filled by action of a majority of the Trustees, and shareholders may elect Trustees at any meeting of shareholders called by the Trustees for that purpose. Under the New Declaration, unless a Trustee sooner resigns, retires or is removed under the terms of the New Declaration, each Trustee shall hold office until the next meeting of shareholders called for the purpose of considering the election or re-election of such Trustee or of a successor to such Trustee, and until his successor, if any, is elected, qualified and serving as a Trustee. The New Declaration provides that any Trustee vacancy may be filled by the vote or consent of a majority of the Trustees then in office, except as prohibited by the 1940 Act, or, if for any reason there are no Trustees then in office, vacancies may be filled by the officers of the Trust, or may be filled in any other manner permitted by the 1940 Act.

The Existing Declaration also provides that a shareholder meeting to elect or remove one or more Trustees may be called by the Trustees upon their own vote, or upon the demand of shareholders owning 10% or more of the voting interests of the Trust (as defined in the Existing Declaration and as used hereinafter in this Proposal 2, “Voting Interests” mean (i) the number of shares outstanding multiplied by the net asset value per share when two or more series or classes of shares of the Trust are voted in the aggregate, or (ii) the number of shares of each series or class when shareholders vote by separate series or classes). The New Declaration contains no similar provision.