Item 1. Identity of Directors, Senior Management and Advisers

Item 2. Offer Statistics and Expected Timetable

Item 3. Key Information

Royal Standard Minerals Inc.

(An Exploration Stage Enterprise)

Consolidated Financial Statement Data

For the Years Ended January 31

(Expressed in US Currency)

Item 5. Operating and Financial Review and Prospects

A. Operating results.

Royal Standard is an exploration and pre-development stage enterprise and is in the process of exploring its resource properties and has not determined whether the properties contain economically recoverable reserves. The recovery of the amounts shown for the resource properties and the related deferred expenditures is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration, and upon future profitable production.

Royal Standard is an exploration-pre-development stage enterprise and, as such, currently has no producing properties and no operating income or cash flow, other than interest earned on funds invested in short-term deposits (see Item 3.D. – Key Information - Risk Factors).

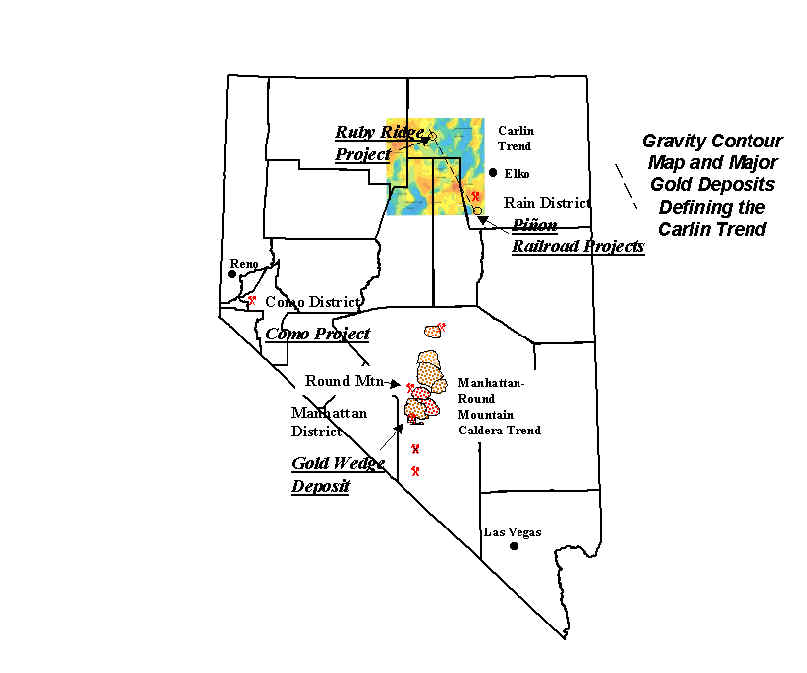

Nevada Projects

In fiscal 2002, the Company entered into certain option agreements to purchase 100% interests in patented and unpatented lode-mining claims in Nye, Elko and Como-Lyon Counties, Nevada. Details of the option agreements are as follows:

Project | Required Cash

Payments to Optionors |

Royalty |

Exercise of Option |

Gold Wedge

Nye County | Commencing in fiscal 2002. $5,000 each in first two years; $10,000 in third year; $15,00 in fourth year and $20,000 in fifth and sixth years | 3% NSR | July 2006

$200,000 |

Manhattan

Nye County | Commencing in fiscal 2002. $1,000 per month from August 2001 to August 2002; $2,000 per month from September 2002 to July, 2006 | 5% NSR | August 2006

$500,000 |

Ruby Ridge

Elko County | Commencing in fiscal 2002. $34,000 from August 2001 to August 2005 | 2.5% NSR | August 2006

$400,000 |

Como

Como-Lyon County | Commencing in fiscal 2003. $25,000in years one and two covering years three and four, $20,000 in year five, $25,000 in year six | 4% NSR | May 2008

$1,000,000 |

Railroad

Elko County | Commencing in fiscal 2003. $15,000 in the first year and increases by $5,000 each of the next six years | 5% NSR | August 2008

$2,000,000 |

Pinon Project – Cord Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko county, Nevada for a period of five years. The lessors will retain a 5% net smelter royalty with no option to purchase.

Pinon Project – Tomera Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of seven years. The lessor will retain a 5% net smelter royalty.

In addition, the Company entered into an irrevocable lease agreement with the surface and minerals rights owners of the Pinon Project properties.

B. Liquidity and capital resources.

The only source of capital presently available to the Company is equity financing. In order for the Company to raise funds to carry on its ongoing exploration programs, the Company has in the past and may in the future arrange private placement subscriptions, either for shares, flow-through shares, special warrants or units comprised of shares and share purchase warrants.

On April 17, 2002, the Company entered into an agreement with an unrelated party (the "Lender") to obtain a $5,000,000 financing facility. The agreement stipulated that the Company deposit with the Lender an interest earning refundable contingency fee of 1.5% of the facility ($75,000) which will be held in trust until the loan is advanced.

On May 2, 2002, the Company completed a private placement of 7 million shares of the Company at Canadian $0.15 per share for proceeds of Canadian $1,050,000 (approximately US $650,000).

Due to the nature of the Company’s mining business, the acquisition, exploration, and, if warranted, the development of mining properties requires significant expenditures prior to achieving commercial production. Royal Standard will seek to finance such expenditures through the sale of equity, joint venture arrangements with other mining companies or the sale of interests in its properties. There can be no assurance, however, that the Company will be successful in raising capital on acceptable terms or in amounts sufficient to finance exploration expenditures and/or satisfy its commitments under its agreements with third parties. In the event that the Company does not raise capital as planned, it will forfeit its rights to the properties, including the sums expended through the dates of such forfeitures. See Item 3.D. – Key Information - Risk Factors.

C. Research and development, patents and licenses, etc.

See Items 4.B. and 5. A. above.

D. Trend information.

See Items 4.B. and 5. A. above.

Item 6. Directors, Senior Management and Employees A. Directors and senior management.

The following table sets out the names of and related information concerning each of the officers and directors of Royal Standard.

NAME | OFFICE HELD | SINCE |

Roland M. Larsen

Heathsville, VA | President, Chief Executive Officer and Director | May, 1996 |

Kimberly L. Koerner

Jersey City, NJ | Director & Treasurer | May, 2001 |

MacKenzie I. Watson

Monteral, Quebec | Director | May, 1996 |

James C. Dunlop

Toronto, Ontario | Director | May, 1996 |

The following discussion provides information on the principal occupations of the above-named directors and executive officers of the Company within the preceding five years.

Roland M. Larsen

Mr. Larsen has 30 years of experience in the natural resource industry, both in exploration and management roles. From November 1993 to the present, he has been serving as the President of Sharpe Resources Corporation, a junior natural resource issuer. From 1981 to 1991, Mr. Larsen served District/Regional Exploration Manager with Inc. and BHP Minerals, Inc., both of which are junior natural resource issuers. Earlier in his career, he worked with BHP Minerals International Inc. for a period of ten years, where he was the Exploration Manager of the Eastern United States and the North Atlantic Region. Prior to that he was the Senior Geologist for NL Industries, Inc. In addition, he has several years of experience working with consulting engineering firms including Derry, Michner and Booth, and Watts Griffis & McOuat Limited. He is a member of the Society of Economic Geologists, the American Association of Professional Geologists and the Society of American Institute of Mining, Metallurgy, and Exploration Inc.. Mr. Larsen holds a B.Sc. and M.Sc. degrees in geology.

Kimberly L. Koerner

Ms. Koerner is a Financial Coordinator with Argent Ventures, LLC in New York, New New York. She has been serving as the Treasurer of the Company from May 1996 to the present. Ms. Koerner has also been serving as the Secretary and Treasurer of Sharpe Energy Company, a U.S. subsidiary of Sharpe Resources Corporation, from November, 1995 to the present. From April 1992 to February 1994, she served as the Assistant Director of the National Association of Printing and Publishing Technology, a trade association. Mrs. Koerner has B.Sc. degree in Finance from the University of South Carolina.

MacKenzie I. Watson

From October 1986 to the present, Mr. Watson has been the Chief Executive Officer and a director of Freewest Resources Inc., a junior natural resource issuer. A geological consultant, he also serves as a director of Sharpe and as President and a director of Consolidated Gold Hawk Resources Inc., a junior natural resource issuer. He was involved in the discovery of the Holloway Gold deposit in the Province of Ontario with Hemlo Gold Mines. Earlier in his career, he was President and Exploration Manager of Lynx-Canada Exploration Ltd., which, under his leadership, discovered numerous precious, base metals and coal deposits. Prior thereto, he was a project geologist for the Icon Syndicate, where he participated in the discovery of the Sullivan Mines in Chibougamau, Quebec. He is currently a director of the Prospectors and Developers Association of Canada. Mr. Watson holds a B.Sc. from the University of New Brunswick.

James C. Dunlop

From October 1994 to the present, Mr. Dunlop has been serving as the Managing Director of Canada Trust Investment Group Inc., a subsidiary of Canada Trust. He also serves as a director of Sharpe. From October 1986 to October 1994, he served as the Senior Vice President of CIBC-Investment Management Corp. Since graduating with a B.A. from University of Western Ontario in 1972, Mr. Dunlop has worked at increasingly senior positions within the Canadian investment community. Royal Standard benefits from Mr. Dunlop’s counsel on economic and commodity matters and from his contacts in the investment community.

B. Compensation.

Compensation of Officers

The following table, presented in accordance with the Regulation made under the Securities Act (Ontario), sets forth all annual and long-term compensation for services rendered in all capacities to the Corporation for the 12 months ended January 31, 2003, 2002, and 2001 in respect of the individual who was, as at January 31, 2002, the President and Chief Executive Officer of the corporation (the "Named Executive Officer"). Other than the Named Executive Officer, no executive officer received salary and bonuses in excess of $100,000 in any such periods.

| | Annual Compensation | Long Term Compensation | |

Name and Principal Position | Year | Salary (US$) | Bonus (US$) | Other Annual Compensation (US$) | Securities Under Options Granted (#) | Restricted Shares or Restricted Share Units (US$) | LTIP Payouts (US$) | All Other Compensation(1) (US$) |

| Roland M. Larsen President & CEO | 2003(2)

2002(4)

2001(6) | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil | 480,000(3)

500,000(5)

265,000(7) | Nil

Nil

Nil | Nil

Nil

Nil | Nil

Nil

Nil |

Notes:

1. The aggregate value of all other compensation paid to the Named Executive Officer did not exceed $50,000 or 10% of the total of such officer's respective salary and bonus in any year.

2. For the twelve months ended January 31, 2003.

3. Options issued on April 24, 2002 having an exercise price of $0.26 and expiry date on April 24, 2007.

4. For the twelve months ended January 31, 2002.

5. Options issued on May 25, 2001, having an exercise price of $0.17 and an expiry date on May 25, 2006.

6. For the twelve months ended January 31, 2001.

7. Options issued on May 4, 2000, having an exercise price of $0.15 and an expiry date of May 4, 2005.

Stock Option Plan

The Corporation maintains a stock option plan (the "Stock Option Plan") for directors, officers, consultants who provide ongoing services, and employees of the Corporation and its affiliates. The purpose of the Stock Option Plan is to attract, retain and motivate management, staff and consultants by providing them with the opportunity, through options, to acquire a proprietary interest in the corporation and benefit from its growth. The Stock Option Plan provides that a total of 4,000,000 Common shares are reserved for grants of options and that the number of common Shares reserved for issuance to any one person pursuant to options shall not exceed 5% of the issued and outstanding Common Shares of the Corporation.

With respect to insiders, the Stock Option Plan provides that Common Shares reserved for issuance pursuant to options granted to insiders shall not exceed 10% of the issued and outstanding Common Shares of the Corporation and that the number of Common shares which may be issued to insiders under the Stock Option Plan within a one-year period shall be limited to 10% of the issued and outstanding Common Shares of the Corporation, with no more than 5% issued to any one insider and his associates. The options are non-assignable and may be granted for a term not exceeding ten years. The exercise price of the options is fixed by the board of directors at the market price of the Common Shares at the time of grant, subject to all applicable regulatory requirements.

Under the terms of the Stock Option Plan, the board of directors may, at its discretion, grant financial assistance to holders wishing to exercise their options. Any such financial assistance will include, as part of its conditions, the grant of a lien on the Common Shares issuable on exercise of the options.

The following table sets forth details with respect to options to purchase Common Shares that are outstanding under the Stock Option Plan as of January 31, 2003.

Holder |

Date of Grant

| Common shares Under Option (#) | Exercise Price

($/Share) |

Expiration Date

|

| Executive Officers as a group (2 in total) | April 25, 2002

April 25, 2002

May 13, 2002

May 25, 2001

May 4, 2000

May 4, 2000 | 480,000

480,000

405,000

380,000

265,000

100,000 | 0.26

0.26

0.40

0.17

0.23

0.23 | April 25, 2007

April 25, 2007

May 13, 2007

May 25, 2006

May 4, 2005

May 4, 2005 |

| Directors who are not also executive officers, as a group (2 in total) | May 13, 2002

May 13, 2002

May 4, 2000

May 4, 2000 | 100,000

150,000

125,000

105,000 | 0.40

0.40

0.23

0.23 | May 13, 2007

May 13, 2007

May 4, 2005

May 4, 2005 |

| Others | May 25, 2001 | 500,000 | 0.17 | May 25, 2006 |

The following options were exercised during the fiscal year ended January 31, 2003.

Name

| Securities Acquired on Exercise (#) | Aggregate Value Realized

($) |

Executive Officers as a group

(2 in total) |

660,000

|

$104,600

|

Directors who are not also executive officers, as a group

(2 in total) |

250,000

|

$42,500

|

Compensation of Directors

Directors who are not officers of the corporation are not currently paid any fees for their services as directors; however, such directors are entitled to receive compensation from the corporation to the extent that they provide services to the corporation. Any such compensation is based on rates that would be charged by such a director for such services to an arm's length party. During the twelve months ended January 31, 2003, no such services were rendered and, accordingly, no compensation was paid.

Directors who are not officers are also entitled to participate in the Corporation's Stock Option Plan and, at the time of joining the board, directors may be granted options to purchase Common Shares. During the twelve months ended January 31, 2003, options were granted to acquire 1,615,000 common shares of the Corporation to directors of the Corporation under the Corporation's Stock Option Plan, 960,000 at an exercise price of $0.26 and 655,000 at an exercise price of $0.40.

Other Compensation Matters

There were no long-term incentive awards made to the executive officers of the Corporation during the twelve months ended January 31, 2003. There are no pension plan benefits in place for the Named Executive Officer and none of the Named Executive Officer, officers or directors of the Corporation are indebted to the Corporation. In addition, there are no plans in place with respect to the Named Executive Officer for termination of employment or change in responsibilities.

Compensation Policy

The executive compensation policy of the Corporation is determined with a view to securing the best possible talent to run the Corporation. Executives expect to reap additional income from the appreciation in the value of the Common Shares they hold in the Corporation, including stock options.

Salaries are commensurate with those in the industry with additional options awarded to executive officers in lieu of higher salaries. Bonuses may be paid in the future for significant and specific achievements, which have a strategic impact on the fortunes of the Corporation. Salaries and bonuses are determined on a judgmental basis after review by the board of directors of the contribution of each individual, including the executive officers of the Corporation. Although they may be members of the board of directors, the executive officers do not individually make any decisions with respect to their respective salary or bonus. In certain cases, bonuses of certain individuals, other than the executive officers, may be tied to specific criteria put in place at the time of engagement.

The grant of stock options under the Corporation’s Stock Option Plan is designed to give each option holder an interest in preserving and maximizing shareholder value in the longer term and to reward employees for both past and future performance. Individual grants are determined by an assessment of an individual's current and expected future performance, level of responsibilities and the importance of his/her position with and contribution to the Corporation.

C. Board practices.

In April 2003 the Company implemented new corporate governance policies pursuant to which the Company has begun to implement new, improved corporate governance practices.

Responsibilities of the Board of Directors

The Board recognizes it is responsible for the stewardship of the business and affairs of the Company and has adopted a set of principles and practices setting out its stewardship responsibilities. Under its mandate, the Board seeks to discharge such responsibility by reviewing, discussing and approving the Company’s strategic planning and organizational structure, and supervising management to ensure that the foregoing enhance and preserve the underlying value of the Company for the benefit of all shareholders. As part of the strategic planning process, the Board contributes to the development of a strategic direction for the Company by reviewing, on an annual basis, the Company’s principal opportunities, the processes that are in place to identify such opportunities and the full range of business risks facing the Company, including strategic, financial, operational, leadership, partnership and reputation risks. On an ongoing basis, the Board also reviews with management how the strategic environment is changing, what key business risks and opportunities are appearing and how they are managed, including the implementation of appropriate systems to manage these risks and opportunities. The performance of management, including the Company’s Chief Executive Officer, is also supervised to ensure that the affairs of the Company are conducted in an ethical manner. The Board, directly and through its committees, ensures that the Company puts in place, and reviews at least on an annual basis, comprehensive communication policies to address how the Company (i) interacts with analysts, investors, other key stakeholders and the public, and (ii) complies with its continuous and timely disclosure obligations and avoids selective. Finally, the Board monitors the integrity of corporate internal control procedures and management information systems to manage such risks and ensure that the value of the underlying asset base is not eroded.

The Board from time to time delegates to senior executives the authority to enter into certain types of transactions, including financial transactions, subject to specified limits. According to the Company’s policy, investments and other similar expenditures above the specified limits, including major capital projects as well as material transactions outside the ordinary course of business, whether on or off balance sheet, are reviewed by, and subject to, the prior approval of the Board.

Following are the principles of the Company’s corporate governance arrangements:

- Subject to the relatively small size of the Company and to business needs, the size of the Board must be kept to a sufficiently low number to facilitate open and effective dialogue and full participation and contribution of each Director.

- The Board must function as a cohesive team, with shared responsibilities and accountabilities that are clearly defined, understood and respected.

- The Board must have the ability to exercise all its supervisory responsibilities independent of any influence by management.

- The Board must have access to all the information needed to carry out its full responsibilities. Information must be available in a timely manner and in a format conducive to effective decision making.

- The Board must develop, implement, and measure effective corporate governance practices, processes and procedures.

Committees of the Board

There currently are two committees of the board of directors. The board does not have, nor does it currently intend to form, a nominating committee. It is the view of the board of directors that its current size (four) is small enough to make such additional committees counter productive. In addition to regularly scheduled meetings of the board, its members are in continuous contact with one another and with the members of senior management. If the size of the board were to be enlarged or if the Company were to undergo a substantial change in its business and operations, consideration would at that point be given to the formation of additional committees, including a nominating committee. The mandate and activities of each of the Company’s committees are as follows:

Audit Committee

The objectives of the Audit Committee include the following:

- to assist the Board in the discharge of its responsibilities to monitor the audit process and the integrity of the Company’s financial reporting;

- to provide independent and direct communication channels between the Board, the committee, and the external auditors;

- to enhance the quality of the Company’s financial reporting;

- to ensure that the external auditors remain ultimately accountable to the Board and the Audit Committee as representatives of the shareholders;

- to monitor the independence of the external auditors and of the director of internal audit; and

- to maintain the credibility and objectivity of financial reports and to satisfy itself as to the adequacy of the supporting systems of internal accounting controls.

In order to achieve such objectives, after reviewing the Company’s annual financial statements with management and the external auditors, the Audit Committee recommends their approval to the Board. The Audit Committee oversees the Company’s continuing compliance with its obligations relating to the disclosure of financial and related information. The committee also reviews the selection of, and changes in, accounting policies and practices, including from a quality and an acceptability standpoint, the use of any alternative treatments of financial information discussed with management and the ramification of their use and the external auditors’ preferred treatment, and satisfies itself as to the effectiveness of the audit plan developed by the Company’s external auditors and of the control systems and procedures developed and implemented by the Company’s internal audit department. The committee meets with external auditors, with and without management, to consider the results of their audits (including appropriate internal controls) and to review management’s financial stewardship.

The Audit Committee may, whenever it may be appropriate to do so, retain and receive advice from experts, and the Company must ensure that funding is available to the committee in respect of such activities. As part of its function, the Audit Committee reviews and approves estimated audit and non-audit related fees and expenses, including all non-audit services, permitted by securities legislation and stock exchange rules, that are proposed to be provided by the external auditors prior to the commencement of such services. The committee also recommends to the Board the selection of the Company’s external auditors for appointment by the shareholders, is responsible for the evaluation of the external auditors and to ensure that they receive appropriate compensation from the Company.

Corporate Governance Committee

The Corporate Governance Committee is responsible for the development, maintenance, and disclosure of the Company’s corporate governance practices. The mandate of the committee includes:

- developing criteria governing the size and overall composition of the Board;

- conducting an annual review of the structure of the Board and its committees, as well as of the mandates of such committees;

- recommending new nominees for the Board (in consultation with the Chairman and the Chief Executive Officer); and

- recommending the compensation of directors

- ensuring that the Company’s policy on disclosure and insider trading, including communication to the different stakeholders about the Company and its subsidiaries, documents filed with securities regulators, written statements made in documents pertaining to the Company’s continuous disclosure obligations, information contained on the Company’s Web site and other electronic communications, relationships with investors, the media and analysts is timely, factual and accurate, and broadly disseminated in accordance with all applicable legal and regulatory requirements.

The committee also coordinates the annual evaluation of the Board, the committees of the Board and individual directors. All issues identified through this evaluation process are then discussed by the Corporate Governance Committee and are reported to the Board. Finally, it also has the responsibility for annually initiating a discussion at the Board level on the performance evaluation and remuneration of the President and Chief Executive Officer.

Conflicts of Interest

Some of the directors and officers of Royal Standard also serve as directors and officers of other companies involved in the resource exploration sector. Consequently, there exists a possibility for any such officer or director to be placed in a position of conflict. Each such director or officer is subject to fiduciary duties and obligations to act honestly and in good faith with a view to the best interests of the Company. Similar duties and obligations will apply to such other companies. Thus any future transaction between the Company and such other companies will be for bona fide business purposes and approved by a majority of disinterested directors of the Company.

D. Employees.

In addition to the officers and directors, the company has one full time employee, Timothy D. Master, Exploration Manager. He has more than 25 years of experience in exploration and development of gold-silver, base metals and uranium deposits in the US. He has spent the last 13 years in Nevada gold exploration and reserve delineation. He has worked as a staff geologist for Chevron Resources, Gencor, Western States Minerals, Atlas Minerals, Callahan Mining and Western Mine Development. Consulting-contract positions were held with Weyerhaeuser, Kennecott, Glamis and Echo Bay. His experience includes generative prospect identification, acquisitions and reserve definition, both surface and underground. His current position has focused on the acquisition and delineation of shallow underground mineable reserves at Manhattan and other promising projects in Nevada. He is a member of SEG and has a M.S. degree in geology from the University of Wyoming.

E. Share ownership.

Name |

Office Held | Number of Common Shares Beneficially Owned or Over Which Control is Exercised1 |

| Roland M. Larsen | President, CEO & Director | 661,487 |

| | |

| Mackenzie I. Watson | Director | 373,000 |

| | |

| James C. Dunlop | Director | 76,000 |

| | |

| Kimberly L. Koerner | Director | 163,000 |

1. The information as to shares beneficially owned or over which control or direction is exercised not being within the knowledge of the corporation has been furnished by the respective individuals.

Item 7. Major Shareholders and Related Party Transactions Major Shareholders

The following table shows as at May 13, 2003, each person who is known to the Corporation, or its directors and officers to beneficially own, directly or indirectly, or to exercise control or direction over securities carrying more than 10% of the voting rights attached to any class of outstanding voting securities of the Corporation entitled to be voted.

Name of Shareholder |

Securities Owned, Controlled or Directed

| Percentage of the Class of Outstanding Voting Securities of the Corporation (1) |

CDS & Co. (2)

Toronto, Ontario | 13,304,398

Common Shares |

47.28%

|

- Based on 28,141,338 Common Shares issued and outstanding as at May 13, 2003.

- This is a nominee account. To the knowledge of the Corporation, there is no beneficial ownership of these shares by this nominee. The shares are held by a number of securities dealers and other intermediaries holding shares on behalf of their clients who are the beneficial owners.

B. Related party transactions.

No director, senior officer, principal holder of securities or any associate or affiliate thereof of Royal Standard or the Company has any interest, directly or indirectly, in any material transaction or in any proposed material transaction with Royal Standard.

C. Interests of experts and counsel.

Not Applicable.

Item 8. Financial Information

A. Consolidated Statements and Other Financial Information

Following is a list of financial statements filed as part of the annual report under Item #17 :

- Auditor's Report for Royal Standard Minerals Inc. for the year ended January 31, 2003

- Consolidated Balance Sheets of Royal Standard Minerals Inc. as at January 31, 2003 and 2002

- Consolidated Statements of Operations and Deficit of Royal Standard Minerals Inc. for the years ended January 31, 2003, 2002, 2001

- Consolidated Statements of Cash Flows of Royal Standard Minerals Inc. for the years ended January 31, 2003, 2002, 2001

- Notes to the Consolidated Financial Statements of Royal Standard Minerals Inc.

The consolidated financial statements of Royal Standard Minerals Inc. were prepared in accordance with generally accepted accounting principles in Canada and are expressed in United States dollars. For a discussion of the reconciliation of such financial statements to United States generally accepted accounting principles, see note #13 of the notes to the consolidated financial statements of Royal Standard Minerals Inc.

B. Significant Changes.

In April 2002, the Company entered into an Option to Purchase Agreement for the Como gold-silver project located in Lyon County Nevada. The terms of the transaction include payments of $25,000 in years one and two (paid up for four years) commencing May 2002 for a seven year option and a 4% net smelter royalty. The Company can acquire the property and the royalty for $1 million or a production payout capped at $2 million.

On May 2, 2002, the company completed a private placement of 7 million shares of the Company at Canadian $0.15 per share for proceeds of Canadian $1,050,000 (approximately US $650,000).

In October 20, 2002 the Company purchased a 30% non-operating interest in the Pinon Project from Crown Resources Corporation for 1 million common shares of the Company. RSM currently controls 100% interest in this project.

Item 9. The Offer and Listing Offer and listing details.

The only share capital of Royal Standard is its Common Shares. The Common Shares of Royal Standard are without nominal or par value. Each Common Share ranks equally with all other Common Shares with respect to dissolution, liquidation or winding-up of Royal Standard and payment of dividends. The holders of Common Shares are entitled to one vote for each share held of record on all matters to be voted on by such holders and are entitled to receive pro rata such dividends as may be declared by the board of directors of Royal Standard out of funds legally available therefor and to receive pro rata the remaining property of Royal Standard on dissolution. The holders of Common Shares have no pre-emptive or conversion rights. The rights attaching to the Common Shares can only be modified by the affirmative vote of at least two-thirds of the votes cast at a meeting of shareholders called for that purpose.

The following table sets forth the reported high and low sales prices (stated in Canadian currency) and the average daily trading volume of the outstanding Common Shares on the Montreal Exchange for the periods January 1997 through September 2001 and the TSX Venture Exchange for the periods October 2001 through December 2002.

| | |

High

|

Low

| Average Daily Volume |

| January 1, 1997 | to | March 31, 1997 | $1.20 | $0.70 | 20,200 |

| April 1, 1997 | to | June 30, 1997 | $1.14 | $0.70 | 17,200 |

| July 1, 1997 | to | September 30, 1997 | $0.85 | $0.50 | 19,533 |

| October 1, 1997 | to | December 31, 1997 | $1.50 | $0.50 | 30,200 |

| January 1, 1998 | to | March 31, 1998 | $0.80 | $0.27 | 10,533 |

| April 1, 1998 | to | June 30, 1998 | $0.45 | $0.15 | 14,033 |

| July 1, 1998 | to | September 30, 1998 | $0.40 | $0.10 | 23,100 |

| October 1, 1998 | to | December 31, 1998 | $0.20 | $0.05 | 22,200 |

| January 1, 1999 | to | March 31, 1999 | $0.25 | $0.10 | 32,900 |

| April 1, 1999 | to | June 30, 1999 | $0.13 | $0.05 | 14,666 |

| July 1, 1999 | to | September 30, 1999 | $0.19 | $0.05 | 43,833 |

| October 1, 1999 | to | December 31, 1999 | $0.12 | $0.03 | 21,133 |

| January 1, 2000 | to | March 31, 2000 | $0.17 | $0.03 | 42,933 |

| April 1, 2000 | to | June 30, 2000 | $0.39 | $0.13 | 57,033 |

| July 1, 2000 | to | September 30, 2000 | $0.28 | $0.11 | 10,467 |

| October 1, 2000 | to | December 31, 2000 | $0.27 | $0.11 | 25,867 |

| January 1, 2001 | to | March 31, 2001 | $0.30 | $0.11 | 11,500 |

| April 1, 2001 | to | June 30, 2001 | $0.18 | $0.06 | 7,789 |

| July 1, 2001 | to | September 30, 2001 | $0.13 | $0.06 | 7,667 |

| October 1, 2001 | to | December 31, 2001 | $0.09 | $0.04 | 9,750 |

| January 1, 2002 | to | March 31, 2002 | $0.34 | $0.07 | 52,546 |

| April 1, 2002 | to | June 30, 2002 | $0.48 | $0.20 | 76,899 |

| July 1, 2002 | to | September 30, 2002 | $0.35 | $0.17 | 51,437 |

| October 1, 2002 | to | December 31, 2002 | $0.36 | $0.20 | 31,354 |

| January 1, 2003 | to | March 31, 2003 | 0 | 0 | 0 |

B. Plan of Distribution

Not Applicable

C. Markets

The Common Shares have been listed for trading on the TSX Venture Exchange (formerly the CDNX) since October 2001 under the trading symbol "RSM". The common shares were traded on the Montreal Exchange from June 28, 1996 until October 2001. Prior to such date, there was no established trading market for the Common Shares and no quotations or prices are available because of the sporadic and very limited trading that took place.

The common shares are also listed on the US-OTC Bulletin Board under the symbol "RYSMF".

D. Selling shareholders.

Not Applicable

E. Dilution.

Not Applicable

F. Expenses of the issue

Not Applicable

Item 10. Additional Information

A. Share capital.

Not applicable

B. Memorandum and articles of association.

These documents were filed with the registration statement in November 1996.

C. Material contracts.

There are no material contracts.

D. Exchange controls.

There is no law, governmental decree or regulation in Canada that restricts the export or import of capital, including foreign exchange controls, or that affects the remittance of dividends, interest or other payments to non-resident holders of Common Shares, other than withholding tax requirements and potential capital gain on the disposition of the Common Shares under certain circumstances. (See Item 10. E. - Taxation.)

There is no limitation imposed by Canadian law or by the Articles or other charter documents of the Company on the right of a non-resident to hold or vote Common Shares, other than as provided by the Investment Canada Act (Canada) as amended, including as amended by the World Trade Organization Implementation Act (Canada). The following summarizes the principal features of the Investment Canada Act for non-Canadians who propose to acquire Common Shares.

The Investment Canada Act (the "Act") enacted on June 20, 1985, as amended, including as amended by the World Trade Organization Implementation Act (Canada), requires notification and, in certain cases, advance review and approval by the Government of Canada of the acquisition by a "non-Canadian" of "control" of a "Canadian business," all as defined in the Act. "Non-Canadian" generally means an individual who is not a Canadian citizen or permanent resident, or a Corporation, partnership, trust or joint venture that is ultimately controlled by non-Canadians. For purposes of the Act, "control" can be acquired through the acquisition of all or substantially all of the assets used in the Canadian business, or the direct or indirect acquisition of voting interests or shares in an entity that carries on a Canadian business or which controls the entity which carries on the Canadian business whether or not the controlling entity is Canadian. Under the Act, control of a Corporation is deemed to be acquired through the acquisition of a majority of the voting shares of a Corporation, and is presumed to be acquired where at least one-third, but less than a majority, of the voting shares of a Corporation or of an equivalent undivided ownership interest in the voting shares of a Corporation are acquired unless it can be established that the Corporation is not controlled in fact through the ownership of voting shares. Other rules apply with respect to the acquisition of non-corporate entities.

All investments to acquire control of a Canadian business are notifiable, unless they are reviewable. Investments requiring review and approval include: (i) a direct acquisition of control of a Canadian business with assets with a value of Cdn. $5,000,000 or more; (ii) an indirect acquisition of control of a Canadian business where the value of the assets of the Canadian business and of all other Canadian entities the control of which is acquired directly or indirectly is Cdn. $50,000,000 or more; and (iii) an indirect acquisition of control of a Canadian business and of all other Canadian entities the control of which is acquired directly or indirectly is Cdn. $5,000,000 or more and represents greater than 50% of the total value of the assets of all of the entities, control of which is being acquired. Subject to certain exceptions, where an investment is made by a "WTO Investor" (generally, nationals or permanent residents of World Trade Organization member states, or entities controlled by residents or nationals of WTO member states) or the Canadian business is controlled by a WTO Investor, the monetary thresholds discussed above are higher. In these circumstances the monetary threshold with regard to direct acquisitions is Cdn. $160,000,000 in constant 1995 dollars as determined in accordance with the Act. Indirect acquisitions of Canadian businesses by or from WTO Investors are not subject to review. The United States is a WTO member state.

Special rules apply with respect to investments by non-Canadians (including WTO Investors) to acquire control of Canadian businesses that engage in certain specified activities, including financial services, transportation services and activities relating to Canada’s cultural heritage or national identity.

If an investment is reviewable, an application for review in the form prescribed by regulation is normally required to be filed with the Investment Review Division of Industry Canada prior to the investment taking place and the investment may not be normally implemented until the review has been completed and ministerial approval obtained.

The Investment Review Division will submit the application for review to the Minister of Industry (Canada), together with any other information or written undertakings given by the acquirer and any representations submitted to the division by a province that is likely to be significantly affected by the investment. The Minister will then determine whether the investment is likely to be of "net benefit to Canada," taking into account the information provided and having regard to certain factors of assessment prescribed under the Act. Among the factors considered are: (i) the effect of the investment on the nature and level of economic activity in Canada, including the effect on employment, on resource processing, on the utilization of parts, components and services produced in Canada, and on exports from Canada; (ii) the degree and significance of participation by Canadians in the Canadian business and in any industry in Canada of which it forms a part; (iii) the effect of the investment on productivity, industrial efficiency, technological development, product innovation and product variety in Canada; (iv) the effect of the investment on competition within any industry or industries in Canada; (v) the compatibility of the investment with national industrial, economic and cultural objectives enunciated by the government or legislature of any province likely to be significantly affected by the investment; and (vi) the contribution of the investment to Canada’s ability to compete in world markets.

Within 45 days after completed application for review has been received, the Minister must notify the investor that (a) he is satisfied that the investment is likely to be of "net benefit to Canada," or (b) he is unable to complete his review in which case he shall have 30 additional days to complete his review (unless the investor agrees to a longer period) or (c) he is not satisfied that the investment is likely to be of "net benefit to Canada." If the Minister is unable to complete his review and no decision has been taken within the prescribed or agreed upon time, the Minister is deemed to be satisfied that the investment is likely to be of "net benefit to Canada."

Where the Minister has advised the investor that he is not satisfied that the investment is likely to be of "net benefit to Canada," the acquirer has the right to make representations and submit undertakings within 30 days of the date of notice (or any further period that is agreed upon between the investor and the Minister). On the expiration of the 30-day period (or an agreed extension), the Minister must notify the investor whether or not he is satisfied that the investment is likely to be of "net benefit to Canada." In the latter case, the investor may not proceed with the investment, or if the investment has already been implemented, must divest itself of control of the Canadian business.

No securities of the Company are subject to escrow.

Pursuant to an escrow agreement dated June 17, 1996, (the "Escrow Agreement"), among the Company, Montreal Trust Company (the "Trustee"), and Sharpe, as the escrowed shareholder, an aggregate of 5,061,615 Common Shares of the Company are held by the Trustee in escrow. The Escrow Agreement was entered into as a condition of the Montreal Exchange approving the listing of the Company's Common Shares on the Montreal Exchange. The first 250,000 Common Shares are released in accordance with the provisions of Section 5 of General Policy Q-4 of the Quebec Securities Commission, and the balance are released upon a mineral property being placed in commercial production. The escrow agreement expired on November 30, 2001 and as a result the Quebec Securities Commission canceled all of the escrow shares granted under the June 17, 1996 agreement.

E. Taxation.

The following is a summary of certain Canadian federal income tax provisions applicable to United States corporations, citizens and resident alien individuals purchasing Common Shares. The discussion is only a general summary and does not purport to deal with all aspects of Canadian federal taxation that may be relevant to shareholders, including those subject to special treatment under the income tax laws. Shareholders are advised to consult their own tax advisors regarding the Canadian federal income tax consequences of holding and disposing of the Company’s Common Shares, as well as any consequences arising under US federal, state or local tax laws or tax laws of other jurisdictions outside the United States. The summary is based on the assumption that, for Canadian tax purposes, the purchasers or shareholders (i) deal at arm’s-length with the Company, (ii) are not residents of Canada, (iii) hold the Common Shares as capital property and (iv) do not use or hold Common Shares in, or in the course of, carrying on business in Canada (a "Non-Resident Holder").

Dividends paid to US residents by the Company on the Common Shares generally will be subject to Canadian non-resident withholding taxes. For this purpose, dividends will include amounts paid by the Company in excess of the paid-up capital of the Common Shares on redemption or a purchase for cancellation of such shares by the Company (other than purchases on the open market). For US corporations owning at least 10% of the voting stock of the Company, the dividends paid by the Company are subject to a withholding tax rate of 6% in 1996 and 5% thereafter under the Canada-U.S. Income Tax Convention (1980), as amended by the Protocol signed on March 17, 1995 (the "Treaty"). For all other US shareholders, the Treaty reduces the withholding tax rate from 25% to 15% of the gross dividend. Other applicable tax treaties may reduce the Canadian tax rate for other Non-Resident Holders.

A Non-Resident Holder will generally not be subject to tax in Canada on capital gains realized from disposition of Common Shares, unless such shares are "taxable Canadian property" within the meaning of the Income Tax Act (Canada). Generally, the Common Shares would not be taxable Canadian property unless the Non-Resident Holder, together with related parties, at any time during the five years prior to the disposition of the Common Shares owned not less than 25% of the issued shares of any class of the capital stock of the Company. Under the Treaty, a resident of the United States will not be subject to tax under the Income Tax Act (Canada) in respect of gains realized on the sale of Common Shares which constitute "taxable Canadian property", provided that the value of the Common Shares at the time of disposition is not derived principally from real property located in Canada.

F. Dividends and paying agents.

Not applicable.

G. Statement by experts.

Not applicable.

H. Documents on display.

Company documents can be reviewed at 3258 Mob Neck Road, Heathsville, VA 22473 or 1311 N. McCarran Blvd., Suite 105, Sparks, NV 89431. You can also obtain copies by writing to either of these addresses.

I. Subsidiary Information.

Not applicable.

Item 11. Quantitative and Qualitative Disclosures about Market Risk.

At January 31, 2003, the Company's financial instruments consisted of cash and cash equivalents, common shares of Sharpe Resources, receivables and payables and accruals. The Shares of Sharpe Resources have been written down to market value. The Company estimates that the fair value of its other financial assets and liabilities approximates the carrying values due to their short-term nature.

It is management's opinion that the Company is not exposed to significant interest, currency or credit risks arising from these financial instruments.

Item 12. Description of Securities Other than Equity Securities.

Not applicable.

PART II

Item 13. Defaults, Dividend Arrearages and Delinquencies.

There have been none.

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds.

There have been none.

Item 15. Controls and Procedures

Based on their evaluation as of a date within ninety days of the filing date of this Annual Report on Form 20-F, the Company's principal executive officer and principal financial officer have concluded that the Company's disclosure controls and procedures (as defined in Rules 13a-14(c) and 15d-14(c) under the Securities Exchange of 1934 (the "Exchange")) are effective to ensure that the information required to be disclosed by the Company in reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time period specified in Securities and Exchange Commission rules and forms. There were no significant changes in the Company's internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

Item 16. [Reserved]

PART III

Item 17. Financial Statements.

Following is a list of financial statements filed as part of the annual report.

- Auditor's Report for Royal Standard Minerals Inc. for the year ended January 31, 2003

- Consolidated Balance Sheets of Royal Standard Minerals Inc. as at January 31, 2003 and 2002

- Consolidated Statements of Operations and Deficit of Royal Standard Minerals Inc. for the years ended January 31, 2003, 2002, 2001

- Consolidated Statements of Cash Flows of Royal Standard Minerals Inc. for the years ended January 31, 2003, 2002, 2001

- Notes to the Consolidated Financial Statements of Royal Standard Minerals Inc.

The consolidated financial statements of Royal Standard Minerals Inc. were prepared in accordance with generally accepted accounting principles in Canada and are expressed in United States dollars. For a discussion of the reconciliation of such financial statements to United States generally accepted accounting principles, see note #13 of the notes to the consolidated financial statements of Royal Standard Minerals Inc.

Auditors' Report

To the Shareholders of

Royal Standard Minerals Inc.

We have audited the consolidated balance sheets of Royal Standard Minerals Inc. as at January 31, 2003 and 2002 and the consolidated statements of exploration properties, operations and deficit and cash flows for each of the years in the three year period ended January 31, 2003. These consolidated financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in Canada and in the United States of America. Those standards require that we plan and perform an audit to obtain reasonable assurance as to whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the company as at January 31, 2003 and 2002 and the results of its operations and its cash flows for each of the years in the three year period ended January 31, 2003 in accordance with Canadian generally accepted accounting principles.

| \s\ Grant Thornton LLP |

| Toronto, Canada | Grant Thornton LLP |

| April 17, 2003 | Chartered Accountants |

Comments by Auditors on United States of America-Canada Reporting Difference

United States of America reporting standards require the addition of an explanatory paragraph when the financial statements are affected by conditions and events that cast doubt on the company’s ability to continue as a going concern, such as those described in note 1 to the financial statements. Although we conducted our audit in accordance with both United States of America and Canadian generally accepted auditing standards, our report to the shareholders dated April 17, 2003 is expressed in accordance with Canadian reporting standards which do not permit a reference to such conditions and events in the auditor’s report when these are adequately disclosed in the financial statements.

| \s\ Grant Thornton LLP |

| Toronto, Canada | Grant Thornton LLP |

| April 17, 2003 | Chartered Accountants |

Royal Standard Minerals Inc.

Consolidated Balance Sheets

(Expressed in United States Dollars)

| January 31 | 2003 | | 2002 |

Assets | | | |

Current | | | |

Cash and cash equivalents | $283,030 | | $554,925 |

Funds held in trust (Note 3) | 75,000 | | - |

Marketable securities (Note 4) | 8,000 | | 47,000 |

Receivables | 11,723 | | 18,043 |

| 377,753 | | 619,968 |

| | | |

Exploration properties (Note 5) | 781,039 | | 113,078 |

Equipment (Note 6) | 53,688 | | - |

| | | |

| $1,212,480 | | $733,046 |

| | | |

Liabilities

| | | |

Current | | | |

Payables and accruals | $82,300 | | $45,905 |

| | | |

Shareholders’ Equity | | | |

Capital stock (Notes 7) | 6,527,565 | | 5,667,723 |

Contributed surplus (Note 7) | 1,425,413 | | 1,425,413 |

Deficit | (6,822,798) | | (6,405,995) |

| 1,130,180 | | 687,141 |

| | | |

| $1,212,480 | | $733,046 |

| | | |

The Company and operations (Note 1)

Commitments (Note 5)

On behalf of the Board

\s\ Roland M. Larsen | Director |

| |

\s\ Kimberley L. Koerner | Director |

| |

Royal Standard Minerals Inc.

Consolidated Statements of Exploration Properties

(Expressed in United States Dollars)

| Opening

Balance | | Additions | | Written Off | | Closing

Balance |

| | | | | | | |

Year Ended January 31, 2003 | | | | | | | |

| | | | | | | |

Gold Wedge Project | $14,821 | | $166,248 | | $ - | | $181,069 |

Manhattan Project | 87,313 | | 49,243 | | - | | 136,556 |

Ruby Ridge Project | 4,007 | | 23,440 | | - | | 27,447 |

Como Project | - | | 52,132 | | - | | 52,132 |

Railroad Project | - | | 70,983 | | - | | 70,983 |

Pinon Project | - | | 299,456 | | - | | 299,456 |

Other | 6,937 | | 6,459 | | - | | 13,396 |

| | | | | | | |

| $113,078 | | $667,961 | | $ - | | $781,039 |

| | | | | | | |

Year Ended January 31, 2002 | | | | | | | |

| | | | | | | |

Gold Wedge Project | $ - | | $14,821 | | $ - | | $14,821 |

Manhattan Project | - | | 87,313 | | - | | 87,313 |

Minnesota-Duluth Project | 15,500 | | 9,530 | | 25,030 | | - |

Ruby Ridge Project | - | | 4,007 | | - | | 4,007 |

Simba Project | 33,880 | | - | | 33,880 | | - |

Other | - | | 6,937 | | - | | 6,937 |

| | | | | | | |

| $49,380 | | $122,608 | | $58,910 | | $113,078 |

| | | | | | | |

| | | | | | | |

Year Ended January 31, 2001 | | | | | | | |

| | | | | | | |

Bend Project | $ - | | $19,717 | | $19,717 | | $ - |

Bousquet and Chibex Properties | 872,068 | | - | | 872,068 | | - |

Minnesota-Duluth Project | - | | 15,500 | | - | | 15,500 |

Pinon Project | 1,502,719 | | 27,188 | | 1,529,907 | | - |

Simba Project | - | | 33,880 | | - | | 33,880 |

Victoria East Project | 75,070 | | - | | 75,070 | | - |

Other | 500 | | - | | 500 | | - |

| | | | | | | |

| $2,450,357 | | $96,285 | | $2,497,262 | | $49,380 |

| | | | | | | |

Royal Standard Minerals Inc.

Consolidated Statements of Operations and Deficit

(Expressed in United States Dollars)

Years Ended January 31 | 2003 | | 2002 | 2001 |

| | | | |

Revenue | | | | |

Interest | $- | | $10,332 | $8,282 |

| | | | |

Expenses | | | | |

General and administrative | 294,083 | | 59,830 | 70,696 |

General exploration | 27,752 | | 84,860 | (13,538) |

Depreciation | 8,763 | | - | - |

| 330,598 | | 144,690 | 57,158 |

| | | | |

Loss before the following | (330,598) | | (134,358) | (48,876) |

Recovery of advances to related company | | | | |

previously written off (Note 4) | - | | 479,340 | - |

Write off of exploration properties | - | | (58,910) | (2,497,262) |

Recovery of (write down of) marketable securities | (39,000) | | 11,000 | (41,477) |

Repayment of interest (Note 4) | (67,117) | | - | - |

Foreign exchange (loss) gain | 19,912 | | (1,424) | (9,877) |

| | | | |

| Net (loss) earnings before income taxes | (416,803) | | 295,648 | (2,597,492) |

| | | | |

Income taxes (Note 10) | - | | - | - |

| | | | |

Net (loss) earnings | $(416,803) | | $295,648 | $(2,597,492) |

| | | | |

Earnings (loss) per common share (Note 9 | | | | |

Basic | $(0.02) | | $0.02 | $(0.15) |

| | | | |

Diluted | $(0.02) | | $0.01 | $(0.15) |

| | | | |

| | | | |

| | | | |

Deficit at beginning of year | $(6,405,995) | | $(6,701,643) | $(4,104,151) |

| | | | |

Net (loss) earnings | (416,803) | | 295,648 | (2,597,492) |

| | | | |

Deficit at end of year | $(6,822,798) | | $(6,405,995) | $(6,701,643) |

| | | | |

Royal Standard Minerals Inc.

Consolidated Statements of Cash Flows

(Expressed in United States Dollars)

Years Ended January 31

| 2003 | 2002 | 2001 |

| | | |

| Increase (decrease) in cash and cash equivalents | | |

| | | |

Operating activities | | | |

Net (loss) earnings | $(416,803) | $295,648 | $(2,597,492) |

Operating items not involving cash | | | |

Depreciation | 8,763 | - | - |

Write off of exploration properties | - | 58,910 | 2,497,262 |

Write down of (recovery of) | | | |

marketable securities | 39,000 | (11,000) | 41,477 |

Decrease (increase) in receivables | 6,320 | (3,809) | (3,092) |

| Increase (decrease) in payables and accruals | 36,395 | 13,004 | (28,543) |

| (326,325) | 352,753 | (90,388) |

Financing activity | | | |

Increase in funds held in trust | (75,000) | - | - |

Issue of common shares, net of issue costs | 688,717 | 123,052 | 377,614 |

| 613,717 | 123,052 | 377,614 |

Investing activities | | | |

Exploration properties | (496,836) | (122,608) | (96,285) |

Purchase of equipment | (62,451) | - | - |

| (559,287) | (122,608) | (96,285) |

Cash and cash equivalents | | | |

Net (decrease) increase | (271,895) | 353,197 | 190,941 |

Beginning of year | 554,925 | 201,728 | 10,787 |

| | | |

End of year | $283,030 | $554,925 | $201,728 |

| | | |

Supplemental cash flow information | | | |

| | | |

Cash and cash equivalent consists of: | | | |

Cash | $94,540 | 403,002 | 8,839 |

Term deposits | 188,490 | 151,923 | 192,890 |

| 283,030 | 554,925 | 201,728 |

| | | |

Interest paid | $ - | $ - | $ - |

| | | |

Income taxes paid | $ - | $ - | $ - |

Non-cash financing and investing activity: | | | |

Issue of common shares for exploration | | | |

properties | $171,125 | $ - | $ - |

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

1. The Company and operations

Royal Standard Minerals Inc. (the "Company") is a publicly held company, engaged in the acquisition, exploration and development of resource properties. The Company is continued under the New Brunswick Business Corporations Act and its common shares are listed on the TSX Venture Exchange and traded on the OTC Bulletin Board.

The business of mining and exploring for minerals involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The recoverability of the carrying value of exploration properties and the Company’s continued existence is dependent upon the preservation of its interest in the underlying properties, the discovery of economically recoverable reserves, the achievement of profitable operations, or the ability of the Company to raise alternative financing, if necessary, or alternatively upon the Company’s ability to dispose of its interests on an advantageous basis. Changes in future conditions could require material write downs of the carrying values.

These financial statements have been prepared on the basis of accounting principles applicable to a going concern, which assume that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities in the normal course of operations. These financial statements do not include adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue in business.

2. Summary of significant accounting policies

The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in Canada and include the accounts of the Company and its wholly-owned subsidiaries, Southeastern Resources Inc., Pinon Exploration Corporation Standard Energy Inc., and Manhattan Mining Co., all United States companies.

A summary of the differences between accounting principles generally accepted in Canada ("Canadian GAAP") and those generally accepted in the United States ("US GAAP") which affect the Company is contained in Note 13.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

2. Summary of significant accounting policies (continued)

Cash and cash equivalents

Cash and cash equivalents includes cash and term deposits at Canadian and United States financial institutions.

Equipment

Equipment is recorded at cost less accumulated depreciation. Depreciation is provided using the declining balance method using the following rates:

Exploration equipment | - 30% |

Office equipment | - 20% |

Exploration properties

All direct costs associated with exploration properties are capitalized as incurred. If a property proceeds to development, these costs become part of preproduction and development costs of the mine. If a property is abandoned or continued exploration is not deemed appropriate in the foreseeable future, the related costs and expenditures are written off.

The amounts capitalized at any time represent costs to be charged against future operations and do not necessarily reflect the present or future values of particular properties.

Stock-based compensation plans

Effective February 1, 2002, the Company adopted the new recommendations of the CICA Handbook Section 3870, Stock-based Compensation and Other Stock-based Payments. This section established standards for the recognition, measurement and disclosure of stock-based compensation and other stock-based payments made in exchange for goods and services. These new recommendations require that compensation for all awards made to non-employees and certain awards made to employees be measured and recorded in the financial statements at fair value. This section also sets out a fair value based method of accounting for stock options issued to employees and applies to awards granted on or after fiscal years beginning January 1, 2002.

The Company, as permitted by Section 3870, has chosen not to use the fair value method to account for stock-based employee compensation plans, but to disclose pro-forma information for options granted after February 1, 2002. The Company records no compensation expense when options are issued to employees. Any consideration paid by employees on the exercise of the options is credited to capital stock.

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

2. Summary of significant accounting policies (continued)

Income taxes

Income taxes are calculated using the asset and liability method of tax accounting. Under this method, current income taxes are recognized for the estimated income taxes payable for the current period. Future income tax assets and liabilities are determined based on differences between the financial reporting and tax bases of assets and liabilities and on unclaimed losses carried forward and are measured using the substantially enacted tax rates that will be in effect when the differences are expected to reverse or losses are expected to be utilized. A valuation allowance is recognized to the extent that the recoverability of future income tax assets is not considered more likely than not.

Earnings (loss) per common share

Basic earnings (loss) per share is computed by dividing the earnings (loss) for the period by the weighted average number of common shares outstanding during the period, including contingently issuable shares which are included when the conditions necessary for issuance have been met. Diluted earnings per share is calculated in a similar manner, except that the weighted average number of common shares outstanding is increased to include potentially issuable common shares from the assumed exercise of common share purchase options and warrants, if dilutive. The number of additional shares included in the calculation is based on the treasury stock method for options and warrants.

Foreign currency translation

The Company uses the United States Dollar as its reporting currency, as the majority of its transactions are denominated in this currency and the operations of its subsidiaries are considered to be of an integrated nature.

Monetary assets and liabilities of the parent company denominated in Canadian funds are translated into United States funds at period end rates of exchange. Other assets and liabilities and capital stock of the parent company are translated at historical rates. Revenues and expenses of the parent company are translated at the average exchange rate for the period. Gains and losses on foreign exchange are recorded in operations.

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

3. Funds held in trust

On April 17, 2002, the Company entered into an agreement with an unrelated party (the "Lender") to obtain a $5,000,000 financing facility. The agreement stipulated that the Company deposit with the Lender an interest earning refundable contingency fee of 1.5% of the facility ($75,000) which will be held in trust until the loan is advanced.

The agreement’s closing date originally set to June 30, 2002, was later extended to June 17, 2003. If this agreement is closed on or before May 1, 2003, the Lender will disburse the funds to the Company, net of closure fees of 3.5% of the facility ($175,000). In addition, the Company will issue 1,000,000 share purchase warrants to the Lender. Each warrant will entitle the Lender to acquire one common share of the Company. The price of the warrants will be set, based upon the 10 day moving average of the stock price prior to the closing date and will have a two year term from the date of closing.

4. Sharpe Resources Corporation

Marketable securities

Marketable securities consist of common shares of Sharpe Resources Corporation ("Sharpe Resources") a publicly held Canadian company, engaged in the exploration for and production of petroleum and natural gas properties in the United States. Sharpe Resources is considered to be related to the Company because of common management.

The shares are carried at the lower of cost and quoted market values.

Advances

At January 31, 2001, advances to Sharpe Resources amounted to $476,594. The advances, which were unsecured and bore interest at prime plus 2% per annum, were fully written off in fiscal 1999, having been written down in previous years.

In fiscal 2002, the Company recovered $479,340 from Sharpe Resources representing the outstanding balance plus accrued interest which recovery was recorded in the operations for that year.

In fiscal 2003, the Company agreed to repay the interest collected from Sharpe Resources in connection with the $479,340 recovered in fiscal 2002. The interest amounted to $67,117 of which $31,000 has been repaid. The balance of $36,117 at January 31, 2003 has been included in payables and accruals.

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

5. Exploration properties

Nevada Projects

In fiscal 2002 and 2003, the Company entered into certain option agreements to purchase up to 100% interests in patented and unpatented lode mining claims in Nye, Elko and Como-Lyon Counties, Nevada. Details of the option agreements are as follows:

Project | Required Cash Payments to Optionors | Royalty | Exercise of Option |

Gold Wedge

Nye County | Commencing in fiscal 2002. $5,000 each

in first two years; $10,000 in third year,

$15,000 in fourth year and

$20,000 each in fifth and sixth years | 3% NSR | July 2006 - $200,000 |

| | | |

Manhattan

Nye County | Commencing in fiscal 2002. $1,000 per

month from August 2001 to August 2002;

$2,000 per month from

September 2002 to July, 2006. | 5% NSR | August 2006 - $500,000 |

| | | |

Ruby Ridge

Elko County | Commencing in fiscal 2002. $34,000

from August 2001 to August, 2005. | 2.5% NSR | August 2006 - $400,000 |

| | | |

Como

Como-Lyon County | Commencing in fiscal 2003. $25,000 in

years one and two covering years three

and four, $20,000 in year five $25,000

in year six | 4% NSR | May 2008 - $1,000,000 |

| | | |

Railroad

Elko County | Commencing in fiscal 2003. $15,000 in

the first year and increases by $5,000

each of the next six years | 5% NSR | August 2008 - $2,000,000 |

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

5. Exploration properties (continued)

Pinon Project - Cord Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of five years. The lessors will retain a 5% net smelter royalty with no option to purchase.

Pinon Project - Tomera Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of seven years. The lessor will retain a 5% net smelter royalty.

In addition, the Company entered into an irrevocable lease agreement with the surface and minerals rights owners of the Pinon Project properties.

6. Equipment

| 2003 | | 2002 |

Cost | | | |

Exploration equipment | $50,346 | | $ - |

Office equipment | 12,105 | | - |

| 62,451 | | - |

| | | |

Accumulated depreciation | | | |

Exploration equipment | 7,552 | | - |

Office equipment | 1,211 | | - |

| 8,763 | | - |

| | | |

Net carrying value | | | |

Exploration equipment | 42,794 | | - |

Office equipment | 10,894 | | - |

| $53,688 | | $ - |

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

7. Capital stock

Authorized:

The authorized capital of the Company consists of an unlimited number of common shares without par value.

Common shares issued | Shares | | Amount |

| | | |

Outstanding at January 31, 2000 | 20,072,792 | | $6,592,470 |

Shares issued for cash, less share issue costs of $54,246 | 3,043,667 | | 377,614 |

| | | |

Outstanding at January 31, 2001 | 23,116,459 | | 6,970,084 |

Shares issued for cash on exercise of warrants | 951,494 | | 123,052 |

Cancellation of shares held in escrow | (4,836,615) | | (1,425,413) |

| | | |

Outstanding at January 31, 2002 | 19,231,338 | | 5,667,723 |

Shares issued for cash less share issue costs of $ 55,258 | 7,000,000 | | 600,427 |

Shares issued for cash on exercise of stock options | 910,000 | | 88,290 |

Shares issued for interest in Pinon Project | 1,000,000 | | 171,125 |

| | | |

Outstanding at January 31, 2003 | 28,141,338 | | 6,527,565 |

In November 2001, 4,836,615 escrowed common shares of the Company owned by Sharpe Resources were cancelled under the terms of a 1996 escrow agreement. Upon the cancellation $1,425,413 was transferred from common stock to contributed surplus.

On September 18, 2002, the company issued 1,000,000 of its common shares to an unrelated party, in exchange for the vendor's 30 % interest in the leases of the Pinon Project exploration properties. The issuance of these shares is considered a non-monetary exchange transaction, and the fair value of the Company's share price at the date of issuance was used as the basis to account for the value of the acquisition.

8. Common share options

Under the Company’s stock option plan (the "Option Plan"), the directors of the Company can grant options to acquire common shares of the Company to directors, employees and others who provide ongoing services to the Company. Exercise prices cannot be less than the closing price of the Company’s shares on the trading day preceding the date of grant and the maximum term of any option cannot exceed ten years.

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

8. Common share options (continued)

The number of common shares under option at any time under the Option Plan or otherwise cannot exceed 4,000,000 nor more than 5% of the then outstanding common shares of the Company for any optionee. In addition, options granted to insiders of the Company cannot exceed more than 10% of the then outstanding common shares of the Company. The options vest when granted.

| Number of

Common Shares | Weighted Average

Exercise Price |

| 2003 | 2002 | 2001 | 2003 | 2002 | 2001 |

| | | | | | |

| Outstanding at beginning of year | 2,385,000 | 2,385,000 | 1,790,000 | $0.18 | $0.17 | $0.15 |

| Granted during year | 1,615,000 | 1,410,000 | 595,000 | $0.32 | $0.17 | $0.23 |

| Exercised during year | (910,000) | - | - | $0.16 | - | - |

| Cancelled or expired during year | - | (1,410,000) | - | - | $0.15 | - |

| | | | | | |

| Outstanding at end of year | 3,090,000 | 2,385,000 | 2,385,000 | $0.26 | $0.18 | $0.17 |

Exercise prices are in Canadian dollars.

At January 31, 2003, options to acquire 595,000 common shares of the Company at a price of Canadian $0.23 per share until May 2005, options to acquire 880,000 common shares of the Company at a price of Canadian $0.17 per share until May 2006, options to acquire 960,000 common shares of the Company at a price of Canadian $0.26 per share until April 2007 and options to acquire 655,000 common shares of the Company at a price of Canadian $0.40 per share until May 2007 were outstanding.

Stock option compensation adjustment

The Company applies the intrinsic value based method of accounting for stock-based compensation awards to employees and accordingly no compensation cost is recognized. Had stock-based compensation for the 1,615,000 options granted to employees under the Plan since February 1, 2002 been determined on the basis of fair value at the date of grant in accordance with the fair value method of accounting for stock-based compensation, the Company’s net loss and pro forma net loss per share for the year ended December 31, 2002 would have been as follows:

Net loss for the year ended January 31, 2003 | $416,803 |

Unrecorded stock option compensation adjustment | 237,999 |

| |

Pro forma net loss for the year ended January 31, 2003 | $653,803 |

| |

Pro forma basic and diluted loss per share | $0.03 |

Royal Standard Minerals Inc.

Notes to the Consolidated Financial Statements

(Expressed in United States Dollars)

Years Ended January 31, 2003, 2002 and 2001

8. Common share options (continued)

For purposes of pro forma disclosures, the following assumptions were used under the Black-Scholes option pricing model: dividend yield of 0%; expected volatility of 100%; risk-free interest rate of 2.50%; and, an expected average life of 4.84 years.

9. Per share amounts

The weighted average number of common shares outstanding in 2003, 2002 and 2001 used in computing basic earnings (loss) per share were 25,537,033, 19,140,099 and 17,295,565 respectively.