| OMB APPROVAL |

| OMB Number: 3235-0288 |

UNITED STATES | Expires: March 31, 2007 |

SECURITIES AND EXCHANGE COMMISSION | Estimated average burden |

Washington, D.C. 20549 | Hours per response: 2579.00 |

FORM 20-F

(Mark One)

___ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

|

X__ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended January 31, 2004 |

| |

OR |

|

___ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission file number 0-28980 |

ROYAL STANDARD MINERALS INC. (Exact name of Registrant as specified in its charter) |

(Translation of Registrant's name into English) |

CANADA (Jurisdiction of incorporation or organization) |

3258 MOB NECK ROAD HEATHSVILLE, VIRGINIA 22473 (Address of principal executive offices) |

|

Securities registered or to be registered pursuant to Section 12(b) of the Act. |

| |

Title of each class ____________________________________ ____________________________________ | Name of each exchange on which registered ____________________________________ ____________________________________ |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act. |

COMMON SHARES |

(Title of Class) |

|

(Title of Class) |

|

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. |

|

(Title of Class) |

SEC 1852 (6-04) | Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. |

34,141,338 Common Shares |

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

______Yes __X___No |

Indicate by check mark which financial statement item the registrant has elected to follow. |

___X___ Item 17 _____ Item 18 |

|

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS) |

|

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. |

______Yes _____No |

PART 1 | | |

ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 5 |

ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 5 |

ITEM 3 | KEY INFORMATION | 5 |

A. | Selected financial data | 5 |

B. | Capitalization and indebtedness | 6 |

C. | Reasons for the offer and use of proceeds | 6 |

D. | Risk factors | 6 |

ITEM 4 | INFORMATION ON THE COMPANY | 9 |

A. | History and development of the company | 9 |

B. | Business overview | 9 |

C. | Organizational structure | 15 |

D. | Property, plants and equipment | 15 |

ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 16 |

A. | Operating results | 16 |

B. | Liquidity and capital resources | 18 |

C. | Research and development, patents and licenses, etc. | 19 |

D. | Trend information | 19 |

E. | Off balance sheet arrangements | 19 |

F. | Tabular disclosures of contractual obligations | 19 |

G. | Safe harbor | 19 |

ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 20 |

A. | Directors and senior management | 20 |

B. | Compensation | 22 |

C. | Board practices | 24 |

D. | Employees | 27 |

E. | Share ownership | 28 |

ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 28 |

A. | Major shareholders | 28 |

B. | Related party transactions | 29 |

C. | Interests of experts and counsel | 29 |

ITEM 8 | FINANCIAL INFORMATION | 29 |

A. | Consolidated statements and other financial information | 29 |

B. | Significant changes | 29 |

ITEM 9 | THE OFFER AND LISTING | 30 |

A. | Offer and listing details | 30 |

B. | Plan of distribution | 31 |

C. | Markets | 31 |

D. | Selling shareholders | 31 |

E. | Dilution | 31 |

F. | Expense of the issue | 32 |

ITEM 10 | ADDITIONAL INFORMATION | 32 |

A. | Share capital | 32 |

B. | Memorandum and articles of association | 32 |

C. | Material contracts | 32 |

D. | Exchange controls | 32 |

E. | Taxation | 34 |

F. | Dividends and paying agents | 35 |

G. | Statements by experts | 35 |

H. | Documents on display | 35 |

I. | Subsidiary information | 35 |

ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 36 |

ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 36 |

PART II | | |

ITEM 13 | DEFAULTS, DIVIDENT ARREARAGES AND DELINQUENCIES | 36 |

ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 36 |

ITEM 15 | CONTROLS AND PROCEDURES | 37 |

ITEM 16 | [RESERVED] | 37 |

ITEM 16A | AUDIT COMMITTEE FINANCIAL REPORT | 37 |

ITEM 16B | CODE OF ETHICS | 37 |

ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 37 |

ITEM 16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 37 |

ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 37 |

| | |

PART III | | |

ITEM 17 | FINANCIAL STATEMENTS | 37 |

ITEM 18 | FINANCIAL STATEMENTS | 61 |

ITEM 19 | EXHIBITS | 61 |

| | |

| SIGNATURES | 61 |

| CERTIFICATIONS | 62 |

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable

Item 2. Offer Statistics and Expected Timetable

Not Applicable

Item 3. Key Information

A. Selected financial data.

The table below presents selected statement of operations and balance sheet data for Royal Standard Minerals Inc. as at and for the fiscal years ended January 31, 2004, 2003, and 2002. The selected financial data presented herein is prepared in accordance with accounting principles generally accepted in Canada ("Canadian GAAP") and include the accounts of the Company and its wholly-owned subsidiaries, Southeastern Resources Inc., Pinon Exploration Corporation and Standard Energy Inc., and Manhattan Mining Co., all United States Companies.

A summary of the differences between accounting principles generally accepted in Canada ("Canadian GAAP") and those generally accepted in the United States ("US GAAP") which affect the Company is contained in Note 14 of the Consolidated Financial Statements included with this report.

Royal Standard Minerals Inc.

(An Exploration Stage Enterprise)

Consolidated Financial Statement Data

For the Years Ended January 31

(Expressed in US Currency)

| 2004 | 2003 | 2002 | 2001 | 2000 |

Statement of Operations | | | | | |

Revenue | $0 | $0 | $10,332 | $8,282 | $0 |

Administrative Expenses | $565,907 | $330,598 | $144,690 | $57,158 | $85,580 |

Net loss for the year | $(554,626) | $(416,803) | $295,648 | $(2,597492) | $(629,554) |

Deficit, beginning of year | $(6,822,798) | $(6,405,995) | $(6,701,643) | $(4,104,151) | $(3,474,597) |

Deficit, end of year | $(7,377,424) | $(6,822,798) | $(6,405,995) | $(6,701,643) | $(4,104,151) |

Earnings (loss) per common share | | | | | |

Basic | $(0.02) | $(0.02) | $0.02 | $(0.15) | $(0.04) |

Diluted | $(0.02) | $(0.02) | $0.01 | $(0.15) | $(0.04) |

Weighted Average Shares Outstanding | 31,330,379 | 25,537,033 | 27,031,338 | 23,116,459 | 19,478,108 |

| | | | | |

Balance Sheet | Year Ended January 31 |

| 2004 | 2003 | 2002 | 2001 | 2000 |

Current Assets | $273,291 | $377,753 | $619,968 | $251,962 | $99,406 |

| | | | | |

Interest in Mineral Properties and Related Deferred Exploration Costs | $1,253,444 | $781,039 | $113,078 | $49,380 | $2,450,357 |

Equipment | $52,656 | $53,688 | $ - | $ - | $ - |

Currency Exchange Rates

Except where otherwise indicated, all of the dollar figures in this annual report on Form 20-F, including the financial statements, refer to United States currency. The following table sets forth, for the periods indicated, certain exchange rates based on the exchange rates reported by the Federal Reserve Bank of New York as the noon buying rates in New York City for cable transfers in foreign currencies as certified for customs purposes (the “Noon Buying Rate”). Such rates quoted are the number of U.S. dollars per Cdn $1.00 and are the inverse of rates quoted by the Federal Reserve Bank of New York for the number of Canadian dollars per U.S. $1.00.

| Year Ended December 31, |

| 1999 | 2000 | 2001 | 2002 | 2003 |

High for the period | .6925 | .6973 | .6696 | .8532 | .7738 |

Low for the period | .6618 | .6413 | .6266 | .7992 | .6329 |

Average rate for the period(1) | .6744 | .6735 | .6446 | .8308 | .7186 |

Rate at end of period | .6925 | .6666 | .6279 | .8358 | .7738 |

_______________

- (1) Based on the average exchange rates on the last day of each month during the applicable period.

B. Capitalization and indebtedness.

Not Applicable

C. Reasons for the offer and use of proceeds.

Not Applicable

- D. Risk factors.

The operations of Royal Standard involve a number of substantial risks and the securities of Royal Standard are highly speculative in nature. The following risk factors should be considered:

Absence of Public Market

Trading of the Common Shares of Royal Standard on the TSX.V and OTC:BB has been sporadic and very limited and no assurance can be given that an active trading market will develop or be sustained. The securities of Royal Standard are quoted on the OTC:BB trading system in the United States. Investment in Royal Standard is, therefore, not suitable for any investors who may have to liquidate their investments on a timely basis and should only be considered by investors who are able to make a long term investment in Royal Standard.

Risk Inherent to Royal Standard’s Proposed Mining Activities

1.Royal Standard is engaged in the business of acquiring and exploring mineral properties in the hope of locating an economic deposit or deposits of minerals. The property interests of the Company are in the exploration stage only and are without a known body of commercial ore. There can be no assurance that the Company will generate any revenues or be profitable or that the Company will be successful in locating an economic deposit of minerals.

2. There are a number of uncertainties inherent in any exploration and development program, including the location of economic ore bodies, the development of appropriate metallurgical processes, the receipt of necessary governmental permits, and the construction of mining and processing facilities. Substantial expenditures will be required to pursue such exploration and development activities. Assuming discovery of an economic ore body, and depending on the type of mining operation involved, several years may elapse from the initial stages of development until commercial production is commenced. New mining operations frequently experience unexpected problems during the exploration and development stages and during the initial production phase. In addition, preliminary reserve estimates may prove inaccurate. Accordingly, there can be no assurance that the Company’s current exploration and development programs will result in any commercial mining operations.

3. The Company may become subject to liability for cave-ins and other hazards of mineral exploration against which it cannot insure or against which it may elect not to insure because of high premium costs or other reasons. Payment of such liabilities would reduce funds available for acquisition of mineral prospects or exploration and development and would have a material adverse effect on the financial position of the Company.

History of Losses

At January 31, 2004, the Company had an accumulated deficit of U.S. $7,377,424. There can be no assurance that the Company will ever achieve revenues from operations or that its operations will ever be profitable.

Additional Capital

The terms of the Company’s rights to its properties require that the Company expend significant funds on exploratory and other pre-production activities. Should the Company fail to make these expenditures on a timely basis, it would forfeit its rights to the particular projects, including the sums expended through the dates of such forfeitures. The Company’s present capital resources are sufficient to fund these costs. There can be no assurance that the Company will be able to raise additional capital on acceptable terms or at all. In any event, any additional issuance of equity would be dilutive to the Company’s current shareholders.

No History of Operations

The Company is an exploration stage enterprise with no history of prior operations and no earnings. There can be no assurance that the Company’s operations will become profitable in the future. The success of the Company will be dependent on the expertise of its management, the quality of its properties, and its ability to raise the necessary capital to carry out its business plan. If financing is unavailable for any reason, the Company will be unable to acquire and retain its mineral concessions and carry out its business plan.

Regulatory and Economic Factors

Any exploration operations carried on by the Company are subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labor standards. In addition, the profitability of any mining prospect is affected by the market for minerals which is influenced by many factors including changing production costs, the supply and demand for minerals, the rate of inflation, the inventory of mineral producers, the political environment and changes in international investment patterns.

Competition

There is significant competition for the acquisition of properties producing or capable of producing gold and precious minerals. The Company may be at a competitive disadvantage in acquiring additional mining properties since it must compete with other individuals and companies, many of which have greater financial resources and larger technical staffs than the Company. As a result of this competition, the Company may be unable to acquire attractive mining properties on terms it considers acceptable.

Title to Properties

The validity of unpatented mining claims on public lands, which constitute most of the property holdings is often uncertain and may be contested and subject to title defects.

Conflict of Interest

Certain directors and officers of the Company are also directors and officers of other natural resource and base metal exploration and development companies. As a result, conflicts may arise between the obligations of these directors to the Company and to such other companies.

Dependence on Key Personnel

The Company’s success will be dependent upon the services of its President and Chief Executive Officer, Mr. Roland Larsen.

Effect of Outstanding Warrants and Options; Negative Effect of Substantial Sales

As of January 31, 2004, the Company had outstanding options and warrants to purchase an aggregate of 34,141,338 Common Shares. All of the foregoing securities represent the right to acquire Common Shares of the Company during various periods of time and at various prices. Holders of these securities are given the opportunity to profit from a rise in the market price of the Common Shares and are likely to exercise its securities at a time when the Company would be able to obtain additional equity capital on more favorable terms. Substantial sales of Common Shares pursuant to the exercise of such options and warrants could have a negative effect on the market price for the Common Shares.

Dividends

The Company does not anticipate paying dividends in the foreseeable future.

Item 4. Information on the Company

- A. History and development of the company.

Royal Standard Minerals Inc. herein referred to as "Royal Standard" or the “Company”, was incorporated pursuant to the laws of Canada by articles of incorporation dated December 10, 1986 under its former name, Ressources Minières Platinor Inc. (“Ressources”). On April 30, 1996, Royal Standard shareholders approved the acquisition of all the issued and outstanding shares of Southeastern Resources, Inc. (“Southeastern”) in a reverse take-over transaction. Pursuant to this transaction, articles of amendment were filed effective May 14, 1996, pursuant to which the name of Royal Standard was changed to its current form of name and its shares issued and outstanding at that time were consolidated on a 7.5:1 basis. On June 28, 1996, the Common Shares commenced trading on the Montreal Exchange. The Company is continued under the New Brunswick Business Corporations Act and its common shares are listed on the TSX Venture Exchange. The Company also trades in the Unit ed States Over-the-Counter Bulletin Board.

The registered office of Royal Standard is located at 56 Temperance Street, Fourth Floor, Toronto, Ontario M5G 2V5 and the principal office of Royal Standard is located at 3258 Mob Neck Road, Heathsville, Virginia 22473.

B. Business overview.

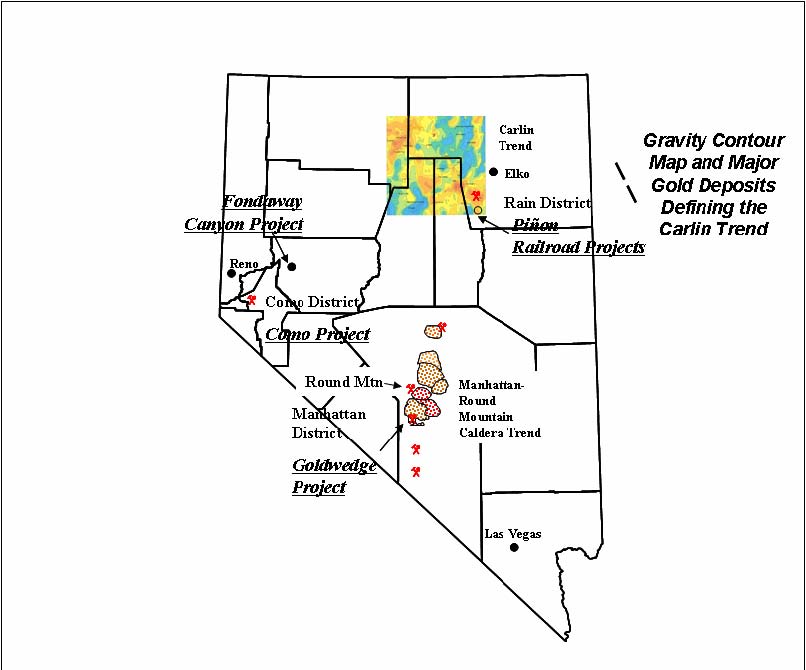

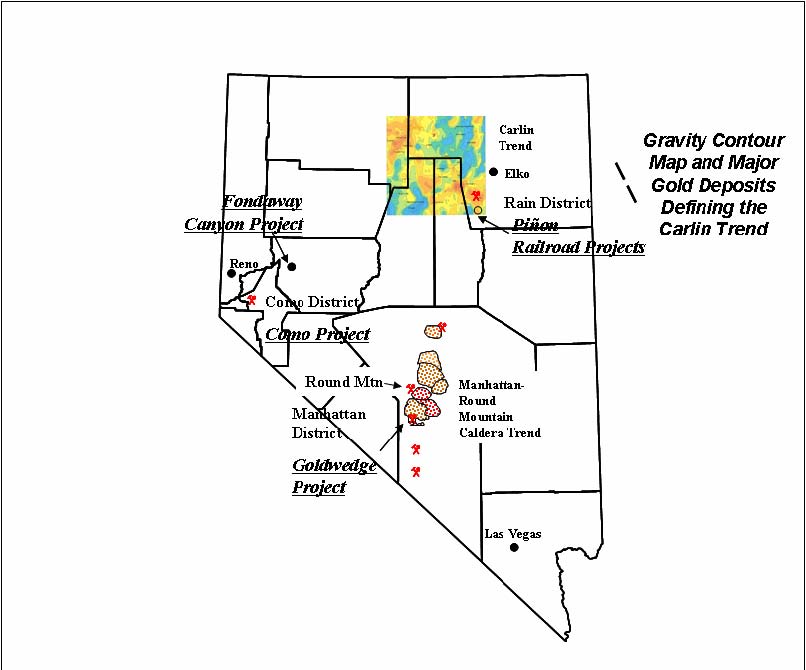

Royal Standard is a mineral exploration company engaged in locating, acquiring exploring and the development of gold and precious metal deposits in the state of Nevada. Royal Standard currently has five advanced and exploration-stage projects, the Manhattan/Round Mountain Caldera and Goldwedge program in Nye County, the Pinon and Railroad projects in Elko County, the Fondaway project in Churchill County, Nevada and the Como project in Lyon County.

At the present time, the Company’s activities are limited to exploratory searches for ore and energy minerals. The Company has not generated any revenues from operations at this time. The Company is evaluating the potential for economic extraction of known deposits of ore grade material on the Company’s mineral exploration properties. See Item # 3.D. - Risk Factors.

Manhattan/Round Mountain Caldera

The Manhattan/Round Mountain Caldera program is the Company’s most advanced district play. The first potential mine development program is the 100% owned Goldwedge deposit located within the Manhattan Mining District. The Goldwedge deposit is located approximately 8 miles south of the large Round Mountain gold mine. All of the mine and mill (plant) and water use permits were achieved in early, 2003. Subject to financing, plans include the construction of a decline and bulk-sampling program of the central zone to be completed in 2004. If feasible, subject to positive results with the underground sampling and evaluation program, the project is expected to initiate production in the same year. The scale of the mining and milling operation will be decided based upon the results of the underground sampling and drilling program. This program will be completed in conjunction with a surface drilling program to test the size and quality of known ore grade extensions to the deposit.

The land position in the Manhattan Mining District is comprised of 70 patented and unpatented lode-mining claims. Drill testing the extensions of the Gold Wedge deposit in addition to the evaluation of several additional lode and placer properties that the Company controls in the district could significantly increase the gold resource estimates.

Gold was discovered at Manhattan in 1905 and the district soon developed into a number of productive high-grade underground “vein” deposits containing free gold and numerous placer deposits. This type of production continued until 1947 and produced a total of 330,000 ounces of gold up to 1967. The district has produced approximately 1 million ounces of gold.

Recent exploration (1980’s-90’s) was focused toward building large bulk tonnage open pit reserves in a district noted for coarse vein-type deposits. Houston Oil and Minerals, Freeport Exploration and Echo Bay Mines Ltd. completed major programs to delineate open pit reserves. This exploration resulted in the development of the East and West Pit Deposits which produced approximately 260,000 ounces at an average grade of approximately 0.06 opt gold during 1990-1996. The occurrence of the mineralization was not well suited for open pit bulk tonnage mining as excessive dilution caused a reduction of the overall head grades that probably impacted overall profitability.

Freeport Gold, Tenneco (Echo Bay) recognized the potential of the district (to include the Goldwedge deposit that is currently under control by RSM) however, these deposits were not suited for open pit mining. At that time the large mining companies did not consider the underground development projects feasible. Although Sunshine Mining Co. considered an underground mine development in 1988 on the Goldwedge deposit, continued exploration by Crown Resources and others on MMC claims indicated sections (5+’-30’) of potentially mineable grades greater than 0.5 opt gold. The continued downturn in the gold market, tightened corporate budgets and high holding costs for the properties forced many companies to turn back the land positions to the claim owners. Currently, MMC controls approximately 4,000 feet of strike length. Approximately 1,000-1,200 feet of this strike length has been drill tested indicating positive results.The possibility of identifying a volcanic hosted gold deposit simila r to the nearby (9 million ounce) Round Mountain mine is unknown at present.

Goldwedge Deposit

The Goldwedge, one of several deposits in the area, is considered the best known deposit in the district for development of an underground mine. The deposit contains excellent exploration potential for future growth. Based upon the results of 60 drill holes primarily within the central zone over a strike length of 1,000+ feet and 100’-500’ of vertical extent reveal continuous gold oxide mineralization of potential mineable thickness and quality. RSM has analyzed all of the drill data as part of a detailed geologic inventory of the deposit.

The Goldwedge deposit is considered to be the northern, high-grade, underground extension of Echo Bay’s Ltd. West Pit deposit. The deposit occurs at the intersection of north and northwest trending faults. In the deposit area, the north trending Reliance fault is mineralized within the Ordovician Zanzibar limestone and siltstone. The Zanzibar limestone is a very favorable host rock preserved in the upper plate of a thrust fault. Echo Bay’s deposit occurs in the Cambrian Gold Hill siltstone, which underlies the Zanzibar limestone. RSM has evaluated all of the pertinent drill data as part of a detailed inventory of the deposit geometry, size and overall grade. The current exploration model suggests that the Goldwedge deposit and the extensions may contain large gold resources at depth near the contact with the Manhattan Caldera margin. This area has never been drill tested. RSM plans to carry out such a program during the underground feasibility study of the central zone development in 200 4-2005.

Piñon and Railroad Projects-Carlin Trend South

The Piñon properties are located on the southern portion of the Carlin gold belt about 10 miles south of Newmont’s Rain mine Since its inception, various joint-venture partners have spent more than $10 MM on the project.

The Pinon and Railroad projects are located on the southern portion of the Carlin Trend immediately south of Newmont’s Rain gold district. The Carlin Trend is one of the most prolific gold trends in the world and has produced more than 50 million ounces of gold. The properties are located within a well-mineralized region, which only adds to the potential for expanding the known gold deposits and making new discoveries. Much of the district wide exploration was undertaken prior to the start of the 1980’s and 1990’s. Since the mid-1990’s the cumulative knowledge of “Carlin-type” gold deposits has expanded tremendously. This expanded knowledge can be used to re-interpret all of the available data, which will likely identify new exploration targets on the ground controlled by RSM. Also, during the past 10+ years numerous high-grade gold deposits have been discovered along the Carlin Trend that can be mined using underground techniques. Many of these deeper deposits are associated with surface oxidized gold deposits. Essentially no deeper exploration has been conducted under the Pinon and Railroad deposits, or at other places on the property. The exploration opportunity offers the possibility for discovery of additional gold deposits at Pinon-Railroad.

Exploration to date has identified several low grade (0.02-0.04 opt) potentially bulk-mineable gold-silver deposits (South Bullion and North Pod ) and a geologic mineral inventory approaching 1.0 million contained ounces of gold within the project area. In 1999, RSM reduced its land position in the area (40 claims) to conserve costs. It now controls two smaller, but potentially economic, near-surface oxide deposits (Main zone and North pod, mineral inventory of approximately 200,000 ounces of contained gold) in the South Bullion resource area which is part of a larger deeper resource of approximately 800,000 ounces, based upon approximately 300 drill holes. The potential for the discovery of a high-grade “feeder” ore deposit under the currently known deposits as well as the potential to identify new deeper stratagraphic high-grade deep targets on this property is high.

The Railroad project increased the property position within the district to approximately 16,000 acres of leases, unpatented and patented mining claims. This effort included the acquisition of nearly 500 unpatented and 19 patented mining claims that lie immediately south of Newmont’s Minings Rain district in Elko County, Nevada.

The geologic environment is very similar between the Pinon and Rain extension deposits. Pinon is located directly on the Carlin Trend corridor of mineralization south of the Rain Extension deposit (4 million ounces at 0.45 opt gold grade) less than 10 miles north of the Pinon Project. Both deposits occur in graben faulted areas. The Rain Deposit occurs within the fault bounded margin of the graben and Pinon occurs in the siltstone beds within the graben. The Web Formation is mineralized above the Devils Gate limestone at both deposits. At Rain, the mineralization occurs in and closely associated with the Rain Fault. At Pinon, the known mineralization has not been connected to a strongly mineralized fault. However, higher-gradeeconomic mineralization has been encountered at very shallow depths, mineralized oxide zones occur along a 1,300 feet strike length and occur less than 90 feet below the surface.

The Pinon and Railroad projects include approximately 16,000 acres comprising unpatented BLM lode mining claims, patents and leased fee lands. The focus of RSM’s current effort is to identify and develop near surface oxide gold-silver deposits. More than 600 drill holes, mostly less than 600 feet in drill length have been completed on the currently identified shallow gold-silver deposits. The near surface oxide measured resources which are part of larger-deeper gold-silver resources within each deposit as indicated in a previous Pinion project technical report by DeMatties, 2003, filed with the SEC. The current technical report recently completed by Steininger, 2003 has concentrated on the drilled controlled near surface measured oxide gold-silver resources that have the potential for near term open pit mining by RSM and is filed with the SEC.

RSM has undertaken a study directed toward evaluating the potential of mining the gold-silver resources from both the Pinon and Railroad projects at the same time and processing the gold at a central location. The initial development will include a combined total oxide gold resource inventory measured to a depth of 300 feet is 6.25 million tons at an average grade of 0.043 troy opt gold per short ton (269,447 ounces) at a 0.010 opt gold cutoff grade. All of these resources represent a portion of a much larger deposit(s) where the near surface higher grade portions will be the focus of the initial resource and metallurgical evaluation for potential open pit mining. The likelihood of increasing the near surface oxide gold resources as part of the current drilling and metallurgical program is considered to be very good. The ongoing metallurgical study is concentrated on the optimization of the crush size to maximize gold recoveries as part of a heap leach recovery process. This work is being completed by Kappes, Cassiday & Associates of Reno, Nevada.

The current objectives are to complete a feasibility study for the Pinon and Railroad properties in 2003-2004. Additionally, the property position has a number of prospective targets that indicate potential for deeper gold deposits. RSM plans to evaluate these opportunities in the near future. The Company believes that this property position offers very good potential for a near term development project in addition to the under explored potential for larger tonnage higher grade deeper gold deposits on this large land position.

Fondaway Canyon Project

The 100% controlled Fondaway Canyon gold project is located in Churchill County, Nevada in the Stillwater range. As part of a program to update the resource and exploration potential of its properties in Nevada, the Company has recently completed a SEC filed Technical Report by Donald Strachan, et.al., 2003.

The Fondaway Canyon gold property consists of 148 unpatented BLM lode mining claims (approximately 3,000 acres) located on the western slope of the Stillwater Range. Nearly-vertical, east-west trending mineralized shear zones host the Half Moon, Paperweight, Hamburger Hill and South Pit gold resources. According to a recently SEC filed report (Strachan, 2003), the Fondaway gold resource inventory includes indicated resources of 390,636 tons of 0.428 opt (167,193) ounces of gold and inferred gold resources of 372,849 tons of 0.409 opt gold (152,621) ounces of gold at a 0.20 opt cutoff grade.

The vertical extent tested by recent drilling of the higher grade gold mineralized shear zones is greater than 1,000 feet. Horizontal continuation of gold mineralization as at the Paperweight and Hamburger Hill mineralized shear zone is 3,700 feet with widths commonly between 5’-20+ feet. Drilling and assay records indicate that 568 holes have been drilled for a total estimated footage of 200,000 feet of RC drilling and 22,000 feet of core drilling to include 455 reverse circulation, 49 core holes and 64 air track holes. Tenneco Minerals Inc., the most active company, drilled approximately 350 holes (130,000 feet) and drove a 500’ adit for sulfide metallurgical sampling during the period 1987-1996. Tenneco also operated a small oxide gold open pit mine for a short time during this period. Nevada Contact Inc. (NCI) acquired the property in 2001 and drilled 11 reverse circulation holes, RSM acquired the property from NCI in early 2003 as part of a property swap with NCI retaining a 1% NSR ove rriding royalty in the Fondaway Canyon property and $25,000 advance minimum royalty payments to the claim holder until 2006 at which time the payments increase to $35,000 per year that includes a 3% NSR royalty until buyout. There is a buyout option of $600,000 for the owners’ interest.

RSM plans to further drill test the sulfide resource as part of a program to upgrade the indicated and inferred resources on the property. This effort will involve drilling underground within the Tenneco adit along with a surface drilling program. A bulk sampling program for metallurgical analysis of the sulfide resource will also be included as part of an effort to develop a gold recovery process that will achieve the desired results.

RSM management believes that this property has potential to add additional resources within the currently identified deposits as well as the discovery of new oxide and sulfide gold deposits on this large intrusive related, structurally controlled, gold and tungsten mineralized system that extends for more than 12,000 feet.

Como District

The property is located approximately 8 miles southeast of the famous Comstock Lode (which has produced about 8.4 million ounces of gold and 193 million ounces of silver) and includes 47 unpatented lode claims and 5 patented claims.

The Como district consists of at least eight gold-silver bearing structures that occur within an andesitic volcanic sequence that hosts the mineralization. Prospectors looking for mineralization similar to the Comstock Lode discovered Como in 1860. The property has had some historical gold and silver underground production with the Como vein producing about 20,000 ounces of gold and 500,000 ounces of silver at a gold equivalent grade of nearly 0.3 opt. The higher-grade underground vein extensions are largely undrilled and will be tested by RSM. Over the past 20 years modern exploration methods have continued to advance the understanding of the geologic framework and have identified two bulk mineable gold-silver deposits that will require further work to ascertain the economic potential. Since the 1960’s several large companies have explored the property to include St. Joe American, Amoco, Meridian Gold and Amax Gold Inc. (who identified a low-grade open pit resource, based on 46 holes.) for a lar ge tonnage bulk mineable gold deposit. More recently (2000) Anglo Gold Corp. explored the property for a potential multi-million ounce deposit. Anglo released the property in 2001 after drilling 8 holes and completing considerable surface geologic mapping, rock chip and geochemical sampling.

Several multi-ounce gold (grades of up to 4.86 opt) rock chip samples occur on the property that require follow-up work. Additionally, Anglo’s drilling program discovered a “new” high grade (0.45 opt over 10’ within a mineralized zone that is 40-70’ in thickness) vein system on this property that requires additional exploration. Surface rock chip samples on this vein have returned values up to 0.417 opt gold.

RSM acquired its option on the Como gold-silver project based upon the previous exploration results. This district has potential for the discovery of more than one economic bulk mineable open pit and underground gold-silver deposit(s).

- C. Organizational structure.

The Company has four wholly owned subsidiaries, Southeastern Resources Inc., Pinon Exploration Corporation, Standard Energy Inc., and Manhattan Mining Co., all United States Companies.

- D. Property, plants and equipment.

The registered office of Royal Standard is located at 56 Temperance Street, Fourth Floor, Toronto, Ontario M5G 2V5 and the principal office of Royal Standard is located at 3258 Mob Neck Road, Heathsville, Virginia 22473. The Company also has an office at 1311 N. McCarran Blvd., Unit 102, Sparks, Nevada 89431.

Item 5. Operating and Financial Review and Prospects

- A. Operating results.

Royal Standard is an exploration and pre-development stage enterprise and is in the process of exploring its resource properties and has not determined whether the properties contain economically recoverable reserves. The recovery of the amounts shown for the resource properties and the related deferred expenditures is dependent upon the existence of economically recoverable reserves, confirmation of the Company's interest in the underlying mineral claims, the ability of the Company to obtain necessary financing to complete the exploration, and upon future profitable production.

Royal Standard is an exploration-pre-development stage enterprise and, as such, currently has no producing properties and no operating income or cash flow, other than interest earned on funds invested in short-term deposits (see Item 3.D. – Key Information - Risk Factors).

The net loss for the year ended January 31, 2004 was $516,869 as compared to $416,803 for the year ended January 31, 2003. The increase of $100,066 in net loss for the year is primarily attributable to an increase in expenses of the Corporation for the year ended January 31, 2004. Expenses were $565,907 for the year ended January 31, 2004 as compared to $330,598 for the year ended January 31 2003. The increase of $235,309 in the expenses of the Corporation for the year ended January 31, 2004 is attributable to, among other things, increased operating expenses on the Corporation’s properties. In order to maintain the ongoing activities on the highest priority projects in Nevada the Corporation will contribute a minimum of $1,800,000 to maintain progress toward the Gold Wedge development program in 2004.

The Corporation owns 100% interest in five (5) projects in four (4) gold-silver districts in Nevada. These projects include the Goldwedge, Nye County, Pinon and Railroad Projects, Elko County, Fondaway Canyon, Churchill County and Como, Lyon County, Nevada. The Gold Wedge project represents the most advanced project located in the Manhattan district about eight (8) miles south of the Round Mountain mine and has been issued a mine and mill permit by the Nevada Department of Environmental Protection (NDEP). The Corporation plans to commence the construction of a decline to access the deposit underground as a means to complete a feasibility study in 2004. This work will include the collection of a bulk sample to be processed on site possibly during the third quarter, 2004. The advanced exploration decline program is scheduled to commence in June, 2004. Expenditures for this segment of the program are expected to cost between $1.1-1.3 million to complete. The decline is expected to be completed in the fa ll, 2004.

The Corporation focused its efforts in 2003 on the Pinon and Railroad projects located on the southern portion of the Carlin Trend in Elko County, Nevada. The current land position includes more than 16,000 acres of unpatented, patented and fee leases. The effort in 2003 focused on the four (4) drilled out (600 drill holes) near surface measured oxide gold-silver resources. This work included drilling, trenching, pit modeling, plant and heap leach facility design and metallurgical (column) leach testing of the deposits. All of this work was to establish the economic potential of an open pit heap leach project and to develop the data necessary to complete a mine permit application to the US Bureau of Land Management (BLM) by mid-year 2004. Expenditures on this project in 2003 were about $1 million. An additional $100,000 will be invested to complete the mine permit application.

The Corporation carried out a detailed evaluation of all of the available data for the Fondaway gold and Como gold-silver projects and NI-43-101 reports were prepared for each project in 2003. These reports are filed on SEDAR along with the Goldwedge and Pinon-Railroad project reports.

Nevada Projects

In fiscal 2003 and 2002, the Company entered into certain option agreements to purchase 100% interests in patented and unpatented lode-mining claims in Nye, Elko and Lyon Counties, Nevada. Details of the option agreements are as follows:

Project | Required Cash Payments to Optionors | Royalty | Exercise of Option |

| | | |

Goldwedge Nye County | Commencing in fiscal 2002. $5,000 each in first two years; $10,000 in third year; $15,000 in fourth year and $20,000 in fifth and sixth years | 3% NSR | July 2006 $200,000 |

| | | |

Manhattan Nye County | Commencing in fiscal 2002. $1,000 per month from August 2001 to August 2002; $2,000 per month from September 2002 to July, 2006 | 5% NSR | August 2006 $500,000 |

| | | |

Fondaway Canyon Churchill County | Commencing in fiscal 2003. $25,000 in year one, $30,000 in years two and three and $35,000 each of the next seven years | 3% NSR | July 2013 $600,000 |

| | | |

Como Lyon County | Commencing in fiscal 2003. $25,000in years one and two covering years three and four, $20,000 in year five, $25,000 in year six | 4% NSR | May 2008 $1,000,000 |

| | | |

Railroad Elko County | Commencing in fiscal 2003. $15,000 in the first year and increases by $5,000 each of the next six years | 5% NSR | August 2008 $2,000,000 |

Pinon Project – Cord Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of five years. The lessors will retain a 5% net smelter royalty with no option to purchase.

Pinon Project – Tomera Lease

In August 2002, the Company entered into a mining lease agreement to lease certain properties located in Elko County, Nevada for a period of seven years. The lessor will retain a 5% net smelter royalty.

In addition, the Company entered into an irrevocable lease agreement with the surface and minerals rights owners of the Pinon Project properties.

- B. Liquidity and capital resources.

The Corporation’s cash balance as of January 31, 2004 was $189,732 compared to $283,030 at January 31, 2003. The fact that there is little change in the cash balance is attributable to the completion of a C$1.5 million equity financing in July, 2003 coupled with large expenditures before yearend. Current assets as at January 31, 2004 were $273,291 Total assets as at January 31, 2004 were $1,617,148 representing an increase of $404,668 from 2002 due to the addition of the Fondaway Canyon project and additional expenditures on the Corporation’s Pinon-Railroad project. Current liabilities as at January 31, 2004 were $106,178 compared to $82,300 and represent current trade payables as at January 31, 2003.

On a forward going basis equity and debt financings will remain the single major source of cash flow for the Corporation. The primary reason is that current production cash flow is insufficient to allow the Corporation to grow at a rate to increase the necessary production capacity to achieve profitability in the near term. As revenue from operations improve the capital requirement of the Corporation will also improve. However, debt and equity financings will continue to be a source of capital to expand the Corporation’s activities in the future.

The Corporation is authorized to issue an unlimited number of Common Shares of which 41,886,016 are outstanding as at May 11, 2004. As at January 31, 2004 the Corporation had outstanding options to purchase 3,410,000 common shares with exercise prices from $0.17-0.40 per share and expiration dates ranging from May 2005 to December 2008.

On April 17, 2002, the Company entered into an agreement with an unrelated party (the "Lender") to obtain a $5,000,000 financing facility. The agreement stipulated that the Company deposit with the Lender an interest earning refundable contingency fee of 1.5% of the facility ($75,000) which will be held in trust until the loan is advanced.

The agreement's closing date originally set to June 31, 2002, was later extended to June 17, 2003. If this agreement had closed on or before May 1, 2003, the Lender would have disbursed the funds to the Company, net of closure fees of 3.5% of the facility ($175,000). In addition, the Company was to issue 1,000,000 share purchase warrants to the Lender. Each warrant would have entitled the Lender to acquire one common share of the Company. The price of the warrants would have been set, based upon the 10 day moving average of the stock price prior to the closing date and would have had a two year term from the date of closing.

The agreement expired without the closing of the $5,000,000 financing facility. As at January 31, 2004, the $75,000 held in trust has not been returned to the Company.

On May 2, 2002, the Company completed a private placement of 7 million shares of the Company at Canadian $0.15 per share for proceeds of Canadian $1,050,000 (approximately US $650,000).

Due to the nature of the Company’s mining business, the acquisition, exploration, and, if warranted, the development of mining properties requires significant expenditures prior to achieving commercial production. Royal Standard will seek to finance such expenditures through the sale of equity, joint venture arrangements with other mining companies or the sale of interests in its properties. There can be no assurance, however, that the Company will be successful in raising capital on acceptable terms or in amounts sufficient to finance exploration expenditures and/or satisfy its commitments under its agreements with third parties. In the event that the Company does not raise capital as planned, it will forfeit its rights to the properties, including the sums expended through the dates of such forfeitures. See Item 3.D. – Key Information - Risk Factors.

C. Research and development, patents and licenses, etc.

See Items 4.B. and 5. A. above.

D. Trend information.

See Items 4.B. and 5. A. above.

- E. Off balance sheet arrangements.

There are none.

- F. Tabular disclosures of contractual obligations.

Not applicable.

- G. Safe harbor.

Not applicable.

Item 6. Directors, Senior Management and Employees

- A. Directors and senior management.

The following table sets out the names of and related information concerning each of the officers and directors of Royal Standard.

NAME | OFFICE HELD | SINCE |

| | |

Roland M. Larsen Heathsville, VA | President, Chief Executive Officer and Director | May, 1996 |

| | |

Kimberly L. Koerner Brambleton, VA | Director & Treasurer | May, 2001 |

| | |

MacKenzie I. Watson Monteral, Quebec | Director | May, 1996 |

| | |

James C. Dunlop Toronto, Ontario Roger D. Steininger | Director Director | May, 1996 January, 2004 |

The following discussion provides information on the principal occupations of the above-named directors and executive officers of the Company within the preceding five years.

Roland M. Larsen

Mr. Larsen has 30 years of experience in the natural resource industry, both in exploration and management roles. From November 1993 to the present, he has been serving as the President of Sharpe Resources Corporation, a junior natural resource issuer. From 1981 to 1991, Mr. Larsen served District/Regional Exploration Manager with Inc. and BHP Minerals, Inc., both of which are junior natural resource issuers. Earlier in his career, he worked with BHP Minerals International Inc. for a period of ten years, where he was the Exploration Manager of the Eastern United States and the North Atlantic Region. Prior to that he was the Senior Geologist for NL Industries, Inc. In addition, he has several years of experience working with consulting engineering firms including Derry, Michner and Booth, and Watts Griffis & McOuat Limited. He is a member of the Society of Economic Geologists, the American Association of Professional Geologists and the Society of American Institute of Mining, Metallurgy, and Exploration Inc. Mr. Larsen holds a B.Sc. and M.Sc. degrees in geology.

Kimberly L. Koerner

Ms. Koerner is a Financial Analyst and Consultant. She has been serving as the Treasurer of the Company from May 1996 to the present. Ms. Koerner has also been serving as the Secretary and Treasurer of Sharpe Energy Company, a U.S. subsidiary of Sharpe Resources Corporation, from November, 1995 to the present. From April 1992 to February 1994, she served as the Assistant Director of the National Association of Printing and Publishing Technology, a trade association. Mrs. Koerner has B.Sc. degree in Finance from the University of South Carolina.

MacKenzie I. Watson

From October 1986 to the present, Mr. Watson has been the Chief Executive Officer and a director of Freewest Resources Inc., a junior natural resource issuer. A geological consultant, he also serves as a director of Sharpe and as President and a director of Consolidated Gold Hawk Resources Inc., a junior natural resource issuer. He was involved in the discovery of the Holloway Gold deposit in the Province of Ontario with Hemlo Gold Mines. Earlier in his career, he was President and Exploration Manager of Lynx-Canada Exploration Ltd., which, under his leadership, discovered numerous precious, base metals and coal deposits. Prior thereto, he was a project geologist for the Icon Syndicate, where he participated in the discovery of the Sullivan Mines in Chibougamau, Quebec. He is currently a director of the Prospectors and Developers Association of Canada. Mr. Watson holds a B.Sc. from the University of New Brunswick.

James C. Dunlop

From October 1994 to the present, Mr. Dunlop has been serving as the Managing Director of Canada Trust Investment Group Inc., a subsidiary of Canada Trust. He also serves as a director of Sharpe. From October 1986 to October 1994, he served as the Senior Vice President of CIBC-Investment Management Corp. Since graduating with a B.A. from University of Western Ontario in 1972, Mr. Dunlop has worked at increasingly senior positions within the Canadian investment community. Royal Standard benefits from Mr. Dunlop’s counsel on economic and commodity matters and from his contacts in the investment community.

Roger D Steininger, Ph.D.

Dr. Steininger has more than 30 years experience in mineral exploration, property development, evaluation and mine geology and ore reserve analysis. He has been associated with the discovery of several mineral deposits, most of which were eventually mined. The most significant discovery was Royal Gold’s South Pipeline deposit in central a Nevada which contains more than 5 million ounces of gold. Dr. Steininger was employed with Climax Molybdenum for 14 years (1967-81) and Amselco for 6 years (1981-87). He is a member of AIPG and several other professional organizations and holds a Ph.D. from Colorado State University.

- B. Compensation.

Compensation of Officers

The following table, presented in accordance with the Regulation made under the Securities Act (Ontario), sets forth all annual and long-term compensation for services rendered in all capacities to the Corporation for the 12 months ended January 31, 2004, 2003, and 2002 in respect of the individual who was, as at January 31, 2004, the President and Chief Executive Officer of the corporation (the "Named Executive Officer"). Other than the Named Executive Officer, no executive officer received salary and bonuses in excess of $100,000 in any such periods.

Summary Compensation Table

Name and Principal Position | Year | Annual Compensation | Long Term Compensation | All Other Compen-sation(1) (US$) |

Other Annual Salary Bonus Compensation (US$) (US$) (US$) | Securities Under Options Granted (#) | Restricted Shares or Restricted Share Units (US$) | LTIP Payouts (US$) |

Roland M Larsen, President and CEO | 2004(2) 2003(4) 2002(6) | Nil Nil 60,000 Nil Nil Nil Nil Nil Nil | 220,000(3) 480,000(5) 380,000(7) | Nil Nil Nil | Nil Nil Nil | 36,000 Nil Nil |

Notes:

(1) The aggregate value of all other compensation paid to the Named Executive Officer did not exceed $96,000 or 20% of the total of such officer's respective salary and bonus in any year.

(2) For the twelve months ended January 31, 2004.

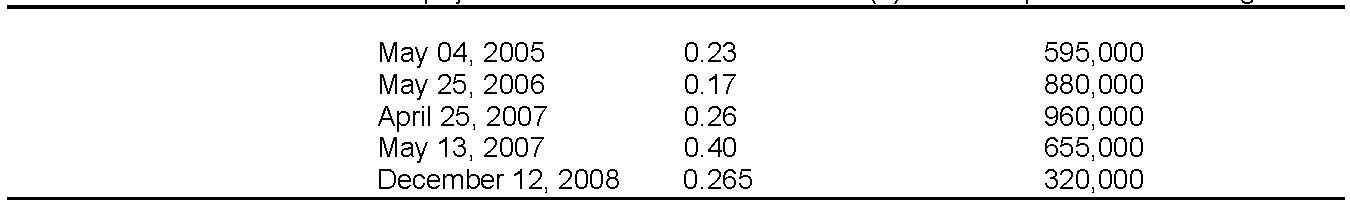

(3) Options issued on December 12, 2003, having an exercise price of $0.265 and an expiry date on December 12, 2008.

(4) For the twelve months ended January 31, 2003.

(5) Options issued on April 25, 2002, having an exercise price of $0.26 and an expiry date on April 25, 2007

(6) For the twelve months ended January 31, 2002.

(7) Options issued on May 25, 2001, having an exercise price of $0.17 and an expiry date on May 25, 2006.

Stock Option Plan

The Corporation maintains a stock option plan (the "Stock Option Plan") for directors, officers, consultants who provide ongoing services, and employees of the Corporation and its affiliates. The purpose of the Stock Option Plan is to attract, retain and motivate management, staff and consultants by providing them with the opportunity, through options, to acquire a proprietary interest in the corporation and benefit from its growth. The Stock Option Plan provides that a total of 4,188,602 Common shares are reserved for grants of options and that the number of common Shares reserved for issuance to any one person pursuant to options shall not exceed 5% of the issued and outstanding Common Shares of the Corporation.

With respect to insiders, the Stock Option Plan provides that Common Shares reserved for issuance pursuant to options granted to insiders shall not exceed 10% of the issued and outstanding Common Shares of the Corporation and that the number of Common shares which may be issued to insiders under the Stock Option Plan within a one-year period shall be limited to 10% of the issued and outstanding Common Shares of the Corporation, with no more than 5% issued to any one insider and his associates. The options are non-assignable and may be granted for a term not exceeding ten years. The exercise price of the options is fixed by the board of directors at the market price of the Common Shares at the time of grant, subject to all applicable regulatory requirements.

Under the terms of the Stock Option Plan, the board of directors may, at its discretion, grant financial assistance to holders wishing to exercise their options. Any such financial assistance will include, as part of its conditions, the grant of a lien on the Common Shares issuable on exercise of the options.

Compensation of Directors

Directors who are not officers of the corporation are not currently paid any fees for their services as directors; however, such directors are entitled to receive compensation from the corporation to the extent that they provide services to the corporation. Any such compensation is based on rates that would be charged by such a director for such services to an arm's length party. During the twelve months ended January 31, 2004, no such services were rendered and, accordingly, no compensation was paid.

All directors are reimbursed for their expenses and travel incurred in connection with attending directors meetings. Special remuneration, at per diem rates, may be paid to any director (other than executive officers of the Corporation) undertaking special services, at the request of the directors, any committee of the directors or the President of the Corporation, beyond those services ordinarily required of a director of the Corporation.

Directors who are not officers are also entitled to participate in the Corporation's Stock Option Plan and, at the time of joining the board, directors may be granted options to purchase Common Shares. During the twelve months ended January 31, 2004, options were granted to acquire 320,000 common shares of the Corporation to directors of the Corporation under the Corporation's Stock Option Plan.

Other Compensation Matters

There were no long-term incentive awards made to the executive officers of the Corporation during the twelve months ended January 31, 2004. There are no pension plan benefits in place for the Named Executive Officer and none of the Named Executive Officer, officers or directors of the Corporation are indebted to the Corporation. In addition, there are no plans in place with respect to the Named Executive Officer for termination of employment or change in responsibilities.

Compensation Policy

The executive compensation policy of the Corporation is determined with a view to securing the best possible talent to run the Corporation. Executives expect to reap additional income from the appreciation in the value of the Common Shares they hold in the Corporation, including stock options.

Salaries are commensurate with those in the industry with additional options awarded to executive officers in lieu of higher salaries. Bonuses may be paid in the future for significant and specific achievements, which have a strategic impact on the fortunes of the Corporation. Salaries and bonuses are determined on a judgmental basis after review by the board of directors of the contribution of each individual, including the executive officers of the Corporation. Although they may be members of the board of directors, the executive officers do not individually make any decisions with respect to their respective salary or bonus. In certain cases, bonuses of certain individuals, other than the executive officers, may be tied to specific criteria put in place at the time of engagement.

The grant of stock options under the Corporation’s Stock Option Plan is designed to give each option holder an interest in preserving and maximizing shareholder value in the longer term and to reward employees for both past and future performance. Individual grants are determined by an assessment of an individual's current and expected future performance, level of responsibilities and the importance of his/her position with and contribution to the Corporation.

- C. Board practices.

In April 2003 the Company implemented new corporate governance policies pursuant to which the Company has begun to implement new, improved corporate governance practices.

Responsibilities of the Board of Directors

The Board recognizes it is responsible for the stewardship of the business and affairs of the Company and has adopted a set of principles and practices setting out its stewardship responsibilities. Under its mandate, the Board seeks to discharge such responsibility by reviewing, discussing and approving the Company’s strategic planning and organizational structure, and supervising management to ensure that the foregoing enhance and preserve the underlying value of the Company for the benefit of all shareholders. As part of the strategic planning process, the Board contributes to the development of a strategic direction for the Company by reviewing, on an annual basis, the Company’s principal opportunities, the processes that are in place to identify such opportunities and the full range of business risks facing the Company, including strategic, financial, operational, leadership, partnership and reputation risks. On an ongoing basis, the Board also reviews with management how the strategi c environment is changing, what key business risks and opportunities are appearing and how they are managed, including the implementation of appropriate systems to manage these risks and opportunities. The performance of management, including the Company’s Chief Executive Officer, is also supervised to ensure that the affairs of the Company are conducted in an ethical manner. The Board, directly and through its committees, ensures that the Company puts in place, and reviews at least on an annual basis, comprehensive communication policies to address how the Company (i) interacts with analysts, investors, other key stakeholders and the public, and (ii) complies with its continuous and timely disclosure obligations and avoids selective. Finally, the Board monitors the integrity of corporate internal control procedures and management information systems to manage such risks and ensure that the value of the underlying asset base is not eroded.

The Board from time to time delegates to senior executives the authority to enter into certain types of transactions, including financial transactions, subject to specified limits. According to the Company’s policy, investments and other similar expenditures above the specified limits, including major capital projects as well as material transactions outside the ordinary course of business, whether on or off balance sheet, are reviewed by, and subject to, the prior approval of the Board.

Following are the principles of the Company’s corporate governance arrangements:

- • Subject to the relatively small size of the Company and to business needs, the size of the Board must be kept to a sufficiently low number to facilitate open and effective dialogue and full participation and contribution of each Director.

- • The Board must function as a cohesive team, with shared responsibilities and accountabilities that are clearly defined, understood and respected.

- • The Board must have the ability to exercise all its supervisory responsibilities independent of any influence by management.

- • The Board must have access to all the information needed to carry out its full responsibilities. Information must be available in a timely manner and in a format conducive to effective decision making.

- • The Board must develop, implement, and measure effective corporate governance practices, processes and procedures.

Committees of the Board

There are currently two committees of the board of directors. The board does not have, nor does it currently intend to form, a nominating committee. It is the view of the board of directors that its current size (five) is small enough to make such additional committees counter productive. In addition to regularly scheduled meetings of the board, its members are in continuous contact with one another and with the members of senior management. If the size of the board were to be enlarged or if the Company were to undergo a substantial change in its business and operations, consideration would at that point be given to the formation of additional committees, including a nominating committee. The mandate and activities of each of the Company’s committees are as follows:

Audit Committee

The objectives of the Audit Committee include the following:

- • to assist the Board in the discharge of its responsibilities to monitor the audit process and the integrity of the Company’s financial reporting;

- • to provide independent and direct communication channels between the Board, the committee, and the external auditors;

- • to enhance the quality of the Company’s financial reporting;

- • to ensure that the external auditors remain ultimately accountable to the Board and the Audit Committee as representatives of the shareholders;

- • to monitor the independence of the external auditors and of the director of internal audit; and

- • to maintain the credibility and objectivity of financial reports and to satisfy itself as to the adequacy of the supporting systems of internal accounting controls.

In order to achieve such objectives, after reviewing the Company’s annual financial statements with management and the external auditors, the Audit Committee recommends their approval to the Board. The Audit Committee oversees the Company’s continuing compliance with its obligations relating to the disclosure of financial and related information. The committee also reviews the selection of, and changes in, accounting policies and practices, including from a quality and an acceptability standpoint, the use of any alternative treatments of financial information discussed with management and the ramification of their use and the external auditors’ preferred treatment, and satisfies itself as to the effectiveness of the audit plan developed by the Company’s external auditors and of the control systems and procedures developed and implemented by the Company’s internal audit department. The committee meets with external auditors, with and without management, to consider the result s of their audits (including appropriate internal controls) and to review management’s financial stewardship.

The Audit Committee may, whenever it may be appropriate to do so, retain and receive advice from experts, and the Company must ensure that funding is available to the committee in respect of such activities. As part of its function, the Audit Committee reviews and approves estimated audit and non-audit related fees and expenses, including all non-audit services, permitted by securities legislation and stock exchange rules, that are proposed to be provided by the external auditors prior to the commencement of such services. The committee also recommends to the Board the selection of the Company’s external auditors for appointment by the shareholders, is responsible for the evaluation of the external auditors and to ensure that they receive appropriate compensation from the Company.

Corporate Governance Committee

The Corporate Governance Committee is responsible for the development, maintenance, and disclosure of the Company’s corporate governance practices. The mandate of the committee includes:

- • developing criteria governing the size and overall composition of the Board;

- • conducting an annual review of the structure of the Board and its committees, as well as of the mandates of such committees;

- • recommending new nominees for the Board (in consultation with the Chairman and the Chief Executive Officer); and

- • recommending the compensation of directors

- • ensuring that the Company’s policy on disclosure and insider trading, including communication to the different stakeholders about the Company and its subsidiaries, documents filed with securities regulators, written statements made in documents pertaining to the Company’s continuous disclosure obligations, information contained on the Company’s Web site and other electronic communications, relationships with investors, the media and analysts is timely, factual and accurate, and broadly disseminated in accordance with all applicable legal and regulatory requirements.

The committee also coordinates the annual evaluation of the Board, the committees of the Board and individual directors. All issues identified through this evaluation process are then discussed by the Corporate Governance Committee and are reported to the Board. Finally, it also has the responsibility for annually initiating a discussion at the Board level on the performance evaluation and remuneration of the President and Chief Executive Officer.

Conflicts of Interest

Some of the directors and officers of Royal Standard also serve as directors and officers of other companies involved in the resource exploration sector. Consequently, there exists a possibility for any such officer or director to be placed in a position of conflict. Each such director or officer is subject to fiduciary duties and obligations to act honestly and in good faith with a view to the best interests of the Company. Similar duties and obligations will apply to such other companies. Thus any future transaction between the Company and such other companies will be for bona fide business purposes and approved by a majority of disinterested directors of the Company.

D. Employees.

In addition to the officers and directors, the company has one full time employee, Timothy D. Master, Exploration Manager. He has more than 25 years of experience in exploration and development of gold-silver, base metals and uranium deposits in the US. He has spent the last 13 years in Nevada gold exploration and reserve delineation. He has worked as a staff geologist for Chevron Resources, Gencor, Western States Minerals, Atlas Minerals, Callahan Mining and Western Mine Development. Consulting-contract positions were held with Weyerhaeuser, Kennecott, Glamis and Echo Bay. His experience includes generative prospect identification, acquisitions and reserve definition, both surface and underground. His current position has focused on the acquisition and delineation of shallow underground mineable reserves at Manhattan and other promising projects in Nevada. He is a member of SEG and has a M.S. degree in geology from the University of Wyoming.

E. Share ownership.

Name | Office Held | Number of Common Shares Beneficially Owned or Over Which Control is Exercised1 |

Roland M. Larsen | President, CEO & Director | 661,487 |

| | |

Mackenzie I. Watson | Director | 373,000 |

| | |

James C. Dunlop | Director | 76,000 |

| | |

Kimberly L. Koerner | Director | 163,000 |

| | |

Roger Steininger | Director | Nil |

1. The information as to shares beneficially owned or over which control or direction is exercised not being within the knowledge of the corporation has been furnished by the respective individuals.

Item 7. Major Shareholders and Related Party Transactions

- A. Major Shareholders

The following table shows as at May 2, 2004, each person who is known to the Corporation, or its directors and officers to beneficially own, directly or indirectly, or to exercise control or direction over securities carrying more than 10% of the voting rights attached to any class of outstanding voting securities of the Corporation entitled to be voted.

Name of Shareholder | Securities Owned, Controlled or Directed | Percentage of the Class of Outstanding Voting Securities of the Corporation(1) |

| | |

CDS & Co.(2) Toronto, Ontario | 13,304,398 Common Shares | 31.8% |

- (1) Based on 41,886,018 Common Shares issued and outstanding as at May 2, 2004.

- (2) This is a nominee account. To the knowledge of the Corporation, there is no beneficial ownership of these shares by this nominee. The shares are held by a number of securities dealers and other intermediaries holding shares on behalf of their clients who are the beneficial owners.

B. Related party transactions.

No director, senior officer, principal holder of securities or any associate or affiliate thereof of Royal Standard or the Company has any interest, directly or indirectly, in any material transaction or in any proposed material transaction with Royal Standard.

C. Interests of experts and counsel.

Not Applicable.

Item 8. Financial Information

- A. Consolidated Statements and Other Financial Information

Following is a list of financial statements filed as part of the annual report under Item #17

- − Auditor's Report for Royal Standard Minerals Inc. for the year ended January 31, 2004

- − Consolidated Balance Sheets of Royal Standard Minerals Inc. as at January 31, 2004 and 2003

- − Consolidated Statements of Operations and Deficit of Royal Standard Minerals Inc. for the years ended January 31, 2004, 2003, 2002

- − Consolidated Statements of Cash Flows of Royal Standard Minerals Inc. for the years ended January 31, 2004, 2003, 2002

- − Notes to the Consolidated Financial Statements of Royal Standard Minerals Inc.

The consolidated financial statements of Royal Standard Minerals Inc. were prepared in accordance with generally accepted accounting principles in Canada and are expressed in United States dollars. For a discussion of the reconciliation of such financial statements to United States generally accepted accounting principles, see note #14 of the notes to the consolidated financial statements of Royal Standard Minerals Inc.

B. Significant Changes.

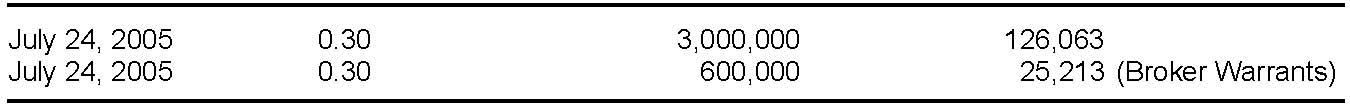

On February 3, 2004, the Company closed a private placement offering of 1,075,000 units at a price of CDN $0.25 per unit for gross proceeds of $268,750 CDN. Each unit consists of one common share and one-half common share purchase warrant. Each whole purchase warrant entitles the holder to subscribe for one additional common share at a price of CDN $0.30 for a period of 12 months from the date of closing. The fair value of the common share purchase warrants were estimated using the Black-Scholes pricing model based on the following assumptions: dividend yield of 0%, expected volatility of 55%, risk-free interest rate of 4.5% and an expected life of 12 months.

On April 16, 2004, the Company closed a private placement offering of 6,320,000 units at a price of CDN $0.35 per unit for gross proceeds of $2,212,000 CDN. Each unit consists of one common share and one-half common share purchase warrant. Each whole purchase warrant entitles the holder to subscribe for one additional common share at a price of CDN $0.50 for a period of 24 months from the date of closing. The fair value of the common share purchase warrants were estimated using the Black-Scholes pricing model based on the following assumptions: dividend yield of 0%, expected volatility of 55%, risk-free interest rate of 4.5% and an expected life of 24 months.

Item 9. The Offer and Listing

- A. Offer and listing details.

The only share capital of Royal Standard is its Common Shares. The Common Shares of Royal Standard are without nominal or par value. Each Common Share ranks equally with all other Common Shares with respect to dissolution, liquidation or winding-up of Royal Standard and payment of dividends. The holders of Common Shares are entitled to one vote for each share held of record on all matters to be voted on by such holders and are entitled to receive pro rata such dividends as may be declared by the board of directors of Royal Standard out of funds legally available therefor and to receive pro rata the remaining property of Royal Standard on dissolution. The holders of Common Shares have no pre-emptive or conversion rights. The rights attaching to the Common Shares can only be modified by the affirmative vote of at least two-thirds of the votes cast at a meeting of shareholders called for that purpose.

The following table sets forth the reported high and low sales prices (stated in Canadian currency) and the average daily trading volume of the outstanding Common Shares on the Montreal Exchange for the periods January 1998 through September 2001 and the TSX Venture Exchange for the periods October 2001 through June 2004.

| | | High | Low | Average Daily Volume |

January 1, 1998 | to | March 31, 1998 | $0.80 | $0.27 | 10,533 |

April 1, 1998 | to | June 30, 1998 | $0.45 | $0.15 | 14,033 |

July 1, 1998 | to | September 30, 1998 | $0.40 | $0.10 | 23,100 |

October 1, 1998 | to | December 31, 1998 | $0.20 | $0.05 | 22,200 |

January 1, 1999 | to | March 31, 1999 | $0.25 | $0.10 | 32,900 |

April 1, 1999 | to | June 30, 1999 | $0.13 | $0.05 | 14,666 |

July 1, 1999 | to | September 30, 1999 | $0.19 | $0.05 | 43,833 |

October 1, 1999 | to | December 31, 1999 | $0.12 | $0.03 | 21,133 |

January 1, 2000 | to | March 31, 2000 | $0.17 | $0.03 | 42,933 |

April 1, 2000 | to | June 30, 2000 | $0.39 | $0.13 | 57,033 |

July 1, 2000 | to | September 30, 2000 | $0.28 | $0.11 | 10,467 |

October 1, 2000 | to | December 31, 2000 | $0.27 | $0.11 | 25,867 |

January 1, 2001 | to | March 31, 2001 | $0.30 | $0.11 | 11,500 |

April 1, 2001 | to | June 30, 2001 | $0.18 | $0.06 | 7,789 |

July 1, 2001 | to | September 30, 2001 | $0.13 | $0.06 | 7,667 |

October 1, 2001 | to | December 31, 2001 | $0.09 | $0.04 | 9,750 |

January 1, 2002 | to | March 31, 2002 | $0.34 | $0.07 | 52,546 |

April 1, 2002 | to | June 30, 2002 | $0.48 | $0.20 | 76,899 |

July 1, 2002 | to | September 30, 2002 | $0.35 | $0.17 | 51,437 |

October 1, 2002 | to | December 31, 2002 | $0.36 | $0.20 | 31,354 |

January 1, 2003 | to | March 31, 2003 | $0.00 | $0.00 | 0 |

April 1, 2003 | | June 30, 2003 | $0.40 | $0.21 | 13,728 |

July 1, 2003 | | September 30, 2003 | $0.40 | $0.20 | 151,583 |

October 1, 2003 | | December 31, 2003 | $0.47 | $0.25 | 53,416 |

January 1, 2004 | | March 31, 2004 | $0.46 | $0.25 | 78,814 |

April 1, 2004 | | June, 30, 2004 | $0.46 | $0.30 | 79,530 |

- B. Plan of Distribution

Not Applicable

- C. Markets

The Common Shares have been listed for trading on the TSX Venture Exchange (formerly the CDNX) since October 2001 under the trading symbol "RSM". The common shares were traded on the Montreal Exchange from June 28, 1996 until October 2001. Prior to such date, there was no established trading market for the Common Shares and no quotations or prices are available because of the sporadic and very limited trading that took place.

The common shares are also listed on the US-OTC Bulletin Board under the symbol "RYSMF".

- D. Selling shareholders.

Not Applicable

- E. Dilution.

Not Applicable

- F. Expenses of the issue.

Not Applicable

Item 10. Additional Information

- A. Share capital.

Not applicable

- B. Memorandum and articles of association.

These documents were filed with the registration statement in November 1996.

- C. Material contracts.

There are no material contracts.

- D. Exchange controls.

There is no law, governmental decree or regulation in Canada that restricts the export or import of capital, including foreign exchange controls, or that affects the remittance of dividends, interest or other payments to non-resident holders of Common Shares, other than withholding tax requirements and potential capital gain on the disposition of the Common Shares under certain circumstances. (See Item 10. E. - Taxation.)

There is no limitation imposed by Canadian law or by the Articles or other charter documents of the Company on the right of a non-resident to hold or vote Common Shares, other than as provided by the Investment Canada Act (Canada) as amended, including as amended by the World Trade Organization Implementation Act (Canada). The following summarizes the principal features of the Investment Canada Act for non-Canadians who propose to acquire Common Shares.