QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

EPIQ SYSTEMS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF ANNUAL MEETING

on

JUNE 4, 2003

and

PROXY STATEMENT

501 Kansas Avenue

Kansas City, Kansas 66105

April 25, 2003

Dear Shareholder:

The Annual Meeting of Shareholders of EPIQ Systems, Inc. will be held at 10:00 a.m., local time, on Wednesday, June 4, 2003, at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri 64112. The enclosed notice of the meeting and proxy statement contain detailed information about the business to be transacted at the meeting.

On behalf of the Board of Directors and Management of the Company, I cordially invite you to attend the Annual Meeting of Shareholders.

The prompt return of your Proxy in the enclosed business reply envelope or voting by telephone or via the Internet (as described on the Proxy card) will help ensure that as many shares as possible are represented at the Annual Meeting.

I personally look forward to seeing you at the Annual Meeting.

Sincerely,

EPIQ SYSTEMS, INC.

Tom W. Olofson

Chairman and

Chief Executive Officer

EPIQ SYSTEMS, INC.

501 Kansas Avenue

Kansas City, Kansas 66105

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on June 4, 2003

TO THE SHAREHOLDERS OF EPIQ SYSTEMS, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of EPIQ Systems, Inc. (the "Company") will be held at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri 64112 at 10:00 a.m., local time, on Wednesday, June 4, 2003, for the following purposes:

- 1.

- To elect five Directors to the Board of Directors of the Company, each for a term of one year and until their successors are elected and qualified;

- 2.

- To consider a proposal to amend the 1995 Stock Option Plan to increase the number of shares of Common Stock available for issuance under the plan from 3,000,000 to 4,500,000; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on April 15, 2003, are entitled to notice of and to vote at the meeting or any adjournment or postponement thereof. On April 15, 2003, the record date for the Annual Meeting, there were 17,613,117 shares of Common Stock outstanding. Each outstanding share is entitled to one vote.

The Board of Directors of the Company encourages you to sign, date and promptly mail the Proxy in the enclosed postage prepaid envelope or to vote by telephone or via the Internet (as described on the Proxy card), regardless of whether or not you intend to be present at the Annual Meeting. You are urged, however, to attend the Annual Meeting.

Kansas City, Kansas

April 25, 2003

EPIQ SYSTEMS, INC.

501 Kansas Avenue

Kansas City, Kansas 66105

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To be held Wednesday, June 4, 2003

SOLICITATION AND REVOCABILITY OF PROXIES

This Proxy Statement and the enclosed Proxy card are furnished to the shareholders of EPIQ Systems, Inc., a Missouri corporation, in connection with the solicitation of proxies by the Company for use at the Company's Annual Meeting of Shareholders, and any adjournments or postponement thereof, to be held at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri at 10:00 a.m., local time, on Wednesday, June 4, 2003. The mailing of this Proxy Statement, the Proxy, the Notice of Annual Meeting and the accompanying 2002 Annual Report to Shareholders is expected to commence on April 25, 2003. All costs of solicitation will be borne by the Company.

You are requested to vote your shares by following the instructions on the Proxy for voting by telephone or via the Internet or by completing, signing and returning the Proxy promptly in the enclosed postage prepaid envelope. Your Proxy may be revoked by written notice of revocation delivered to the Secretary of the Company, by executing and delivering a later dated Proxy or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not constitute a revocation of your Proxy unless you vote in person at the Annual Meeting or deliver an executed and later dated Proxy. Proxies duly executed and received in time for the Annual Meeting will be voted in accordance with the shareholders' instructions. If no instructions are given, Proxies will be voted as follows:

- a.

- to elect Tom W. Olofson, Christopher E. Olofson, W. Bryan Satterlee, Edward M. Connolly, Jr. and James A. Byrnes as Directors to serve for one-year terms until the 2004 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; and

- b.

- to amend the 1995 Stock Option Plan to increase the number of shares of Common Stock available for issuance under the plan to 4,500,000; and

- c.

- in the discretion of the proxy holder as to any other matter coming before the Annual Meeting.

1

OUTSTANDING VOTING SECURITIES OF THE COMPANY

Only the holders of record of shares of Common Stock as of the close of business on April 15, 2003, are entitled to vote on the matters to be presented at the Annual Meeting, either in person or by proxy. At the close of business on April 15, 2003, there were outstanding and entitled to vote a total of 17,613,117 shares of Common Stock, constituting all of the outstanding voting securities of the Company.

The presence at the Annual Meeting, in person or by proxy, of the holders of at least a majority of the shares of Common Stock as of the record date is necessary to constitute a quorum. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum at the Annual Meeting. Each share of Common Stock is entitled to one vote for each director to be elected and upon all other matters to be brought to a vote of the shareholders at the Annual Meeting. The affirmative vote of a plurality of the shares of Common Stock present or represented at the Annual Meeting is required to elect the directors. The affirmative vote of a majority of the shares of Common Stock present or represented at the Annual Meeting is required to approve the proposed amendment to the 1995 Stock Option Plan. Broker non-votes are not deemed to be represented at the Annual Meeting for purposes of the vote on the proposal to amend the 1995 Stock Option Plan. Abstentions have the effect of a negative vote on the proposal to amend the 1995 Stock Option Plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of shares of Common Stock as of April 15, 2003, for (i) each director and nominee for election as a director of the Company; (ii) each officer named in the Summary Compensation Table, (iii) all directors and executive officers as a group, and (iv) each person known to the Company to be the beneficial owner of more than 5% of the outstanding shares. Except as otherwise indicated, each shareholder has sole voting and investment power with respect to the shares beneficially owned.

Name and Address of Beneficial Owner

|

|

Amount and Nature

of Beneficial

Ownership

|

|

Percent of Shares

Outstanding

|

|

|---|

| Named Officers and Directors(1) | | | | | |

| | Tom W. Olofson | | 2,775,000 | (2) | 15.49 | % |

| | Christopher E. Olofson | | 905,000 | (3) | 4.93 | % |

| | Robert C. Levy | | 71,875 | (4) | * | |

| | W. Bryan Satterlee | | 36,122 | (5) | * | |

| | Edward M. Connolly, Jr. | | 9,250 | (6) | * | |

| | James A. Byrnes | | — | (7) | — | |

| | Thomas L. Layton | | 15,379 | (8) | * | |

| | Victoria A. Holmes | | 3,000 | (9) | * | |

| | Leah G. Workman | | 4,813 | (10) | * | |

| | All directors and executive officers as a group (12 persons) | | 4,309,044 | (11) | 22.99 | % |

| 5% Shareholders(12) | | | | | |

| | Deutsche Bank AG | | 1,382,650 | (13) | 7.85 | % |

| | Taunusanlage 12, D-60325 | | | | | |

| | Frankfurt am Main | | | | | |

| | Federal Republic of Germany | | | | | |

| | FMR Corp. | | 973,300 | (13) | 5.53 | % |

| | (Fidelity Management & Research Company) | | | | | |

| | 82 Devonshire Street | | | | | |

| | Boston, MA 02109 | | | | | |

| | The Northwestern Mutual Life Insurance Company | | 887,050 | (13) | 5.04 | % |

| | 720 East Wisconsin Avenue | | | | | |

| | Milwaukee, WI 53202-4797 | | | | | |

- *

- Less than one percent

2

- (1)

- The address of all of the named individuals is c/o EPIQ Systems, Inc., 501 Kansas Avenue, Kansas City, Kansas 66105.

- (2)

- Includes 50,000 shares owned by Mr. Olofson's spouse, Jeanne H. Olofson, as to which Mr. Olofson disclaims beneficial ownership, 105,000 shares owned by the Tom W. and Jeanne H. Olofson Foundation, as to which shares Mr. Olofson shares beneficial ownership, and 300,000 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 84,000 shares owned by Mr. Olofson's son, Scott W. Olofson, as to which shares Mr. Olofson disclaims beneficial ownership.

- (3)

- Includes 743,750 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days.

- (4)

- Includes 21,250 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 17,500 shares of Common Stock issuable upon exercise of options held by Mr. Levy that are not currently exercisable and will not become exercisable within 60 days.

- (5)

- Includes 17,875 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 22,500 shares of Common Stock issuable upon exercise of options held by Mr. Satterlee that are not currently exercisable and will not become exercisable within 60 days.

- (6)

- Includes 7,750 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 19,125 shares of Common Stock issuable upon exercise of options held by Mr. Connolly that are not currently exercisable and will not become exercisable within 60 days.

- (7)

- Excludes 7,500 shares of Common Stock issuable upon exercise of options held by Mr. Byrnes that are not currently exercisable and will not become exercisable within 60 days.

- (8)

- Includes 15,000 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 41,300 shares of Common Stock issuable upon exercise of options held by Mr. Layton that are not currently exercisable and will not become exercisable within 60 days.

- (9)

- Includes 3,000 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 14,000 shares of Common Stock issuable upon exercise of options held by Ms. Holmes that are not currently exercisable and will not become exercisable within 60 days.

- (10)

- Includes 4,813 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 19,562 shares of Common Stock issuable upon exercise of options held by Ms. Workman that are not currently exercisable and will not become exercisable within 60 days.

- (11)

- Includes 1,133,438 shares of Common Stock issuable upon exercise of options that are currently exercisable or exercisable within 60 days. Excludes 271,487 shares of Common Stock issuable upon exercise of options held by directors or executive officers that are not currently exercisable and will not become exercisable within 60 days.

- (12)

- Excludes 5% shareholders listed above as executive officers or directors.

- (13)

- Based solely on Schedule 13G filings with the Securities and Exchange Commission.

ELECTION OF DIRECTORS

At the Annual Meeting, the shareholders will elect five directors to hold office for one-year terms ending at the Company's 2004 Annual Meeting of Shareholders and until their successors are duly elected and qualified. It is intended that the names of the nominees listed below will be placed in nomination at the Annual Meeting to serve as directors and that the persons named in the Proxy will vote for their election. All nominees listed below are currently members of the Board of Directors. Each nominee has consented to being named in this Proxy Statement and to serve if elected. If any nominee becomes unavailable to serve as a director for any reason, the shares represented by the Proxies will be voted for the person, if any, designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unavailable to serve.

3

The nominees for directors of the Company, as well as certain information about them, are as follows:

Name

|

|

Age

|

|

Position

|

|---|

| Tom W. Olofson | | 61 | | Chairman, Chief Executive Officer, and Director |

| Christopher E. Olofson | | 33 | | President, Chief Operating Officer, and Director |

| W. Bryan Satterlee * | | 68 | | Director |

| Edward M. Connolly, Jr. * | | 60 | | Director |

| James A. Byrnes * | | 56 | | Director |

- *

- Member of Audit Committee and Compensation Committee

Tom W. Olofson led a private investor group that acquired the Company in July 1988, and has served as Chief Executive Officer and Chairman of the Board since that time. During his business career, Mr. Olofson has held various management positions with Xerox Corporation and was a Senior Vice President and member of the Office of the President of Marion Laboratories, Inc. Mr. Olofson also serves as a director of various private companies in which he is an investor. He earned a BBA from the University of Pittsburgh, and is currently a member of the Board of Visitors of the Katz Graduate School of Business at the University of Pittsburgh. He is the father of Christopher E. Olofson.

Christopher E. Olofson joined the Company as a Vice President in June 1993, and was a part-time employee of the Company from 1988 to 1993. In January 1994, he was named Senior Vice President—Operations, and became Executive Vice President and a member of the Board of Directors effective January 1, 1995. Effective July 1, 1996, Mr. Olofson also assumed the duties of Chief Operating Officer, and effective October 1, 1998, Mr. Olofson was named President of the Company. He earned an AB degree from Princeton University, summa cum laude. He was named a Fulbright Scholar and completed a one-year program of study at the Stanford University Center in Taipei, Taiwan. He is the son of Tom W. Olofson.

W. Bryan Satterlee was elected to the Company's Board of Directors in February 1997. Mr. Satterlee has been a partner since 1989 in NorthEast Ventures, a consulting firm based in Hartford, Connecticut, which specializes in business development services and financial evaluations of technology-based venture companies. Mr. Satterlee's background includes ten years of management experience with IBM, as well as having been a founder of a computer leasing/software business, a telecommunications company and a venture investment services business. He earned a BS degree from Lafayette College.

Edward M. Connolly, Jr. was elected to the Company's Board of Directors in January 2001. He currently serves as Executive Vice President of Right Management Consultants, Heartland Region. Mr. Connolly retired from Aventis Pharmaceuticals in October 2000, where he served as President of the Aventis Pharmaceuticals Foundation and Vice President of Community Affairs. Prior to that, he held various executive human resources positions at Hoechst Marion Roussel, Marion Merrell Dow, and Marion Laboratories, predecessor companies to Aventis. He holds a BA degree in psychology from Bellarmine University.

James A. Byrnes was elected to the Company's Board of Directors in January 2003. He served as Vice President of International Marketing for Hoechst Marion Roussel, Inc. until his retirement in 1996. Prior to that, he was Vice President of Global Commercial Development for Marion Merrell Dow. Prior to these positions, he held several executive sales and marketing positions at Marion Merrell Dow and Marion Laboratories, predecessor companies to Hoechst Marion Roussel. Mr. Byrnes holds a BS degree in general science from Gannon University and an MBA degree from Rockhurst College.

The Board of Directors recommends a vote FOR

the election of the nominees for director named above.

4

Board and Committee Meetings

The Board of Directors has established Audit and Compensation Committees of the Board of Directors. The Board of Directors does not have a Nominating Committee. During 2002, the Board of Directors met seven times. Each director attended all of the meetings of the Board of Directors and the committees on which he served. The Audit Committee and the Compensation Committee of the Board of Directors each consisted of Robert C. Levy, W. Bryan Satterlee and Edward M. Connolly, Jr. in 2002 and presently consists of Mr. Levy, Mr. Satterlee, Mr. Connolly and James A. Byrnes. Each member of the Audit Committee and the Compensation Committee is, and throughout 2002 was, an "independent director" as defined in Nasdaq Rule 4200(a)(14). The function of the Audit Committee is set forth below under "Report of the Audit Committee of the Board of Directors." The Audit Committee met five times in 2002. The Compensation Committee was formed in June 2002 and met two times in 2002. The function of the Compensation Committee is set forth below under "Report of the Compensation Committee of the Board of Directors."

Director Compensation

In 2002, the Company paid its non-employee directors a fee of $5,000 per quarter. In 2003, the non-employee directors will receive a fee of $7,500 per quarter. The Company also reimburses non-employee directors for out-of-pocket expenses incurred in attending Board and committee meetings. Historically, the Company has granted to each of its non-employee directors 7,500 options upon joining the Board and 5,000 options annually for service as a director. In 2002, the Company granted Robert C. Levy, W. Bryan Satterlee and Edward M. Connolly, Jr. each a 10-year option to acquire 5,000 shares of Common Stock at an exercise price of $18.04 per share, which vests 20% per year over five years. Upon joining the Board in January 2003, James A. Byrnes received a 10-year option to acquire 7,500 shares of Common Stock at an exercise price of $16.99, which vests 20% per year over five years.

Section 16(a) Beneficial Ownership Reporting Compliance

The Company is required to identify any director, officer or 10% or greater beneficial owner of Common Stock who failed to file timely a report with the Securities and Exchange Commission required under Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") relating to ownership and changes in ownership of the Company's Common Stock. The required reports consist of initial statements on Form 3, statements of changes on Form 4 and annual statements on Form 5. Based solely upon a review of reports filed under Section 16(a) of the Exchange Act and certain written representations of directors and officers of the Company, the Company is not aware of any director, officer or 10% or greater beneficial owner of Common Stock who failed to file on a timely basis any report required by Section 16(a) of the Exchange Act for calendar year 2002.

5

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the cash and other compensation paid in 2002, 2001 and 2000 to the Company's Chief Executive Officer and the Company's top four most highly compensated officers who earned in excess of $100,000 in 2002 (the "Named Officers").

| |

| |

| |

| |

| | Long Term Compensation

| |

|

|---|

| | Annual Compensation

| |

|

|---|

| | Securities

Underlying

Options/SARs

(#)

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other

Annual

Compensation(1)

| | All Other

Compensation(2)

|

|---|

Tom W. Olofson

Chairman/CEO | | 2002

2001

2000 | | $

| 300,000

175,000

125,000 | | $

| 100,000

250,000

60,000 | | $

| 53,645

53,522

3,063 | | 300,000

—

— | | $

| 25,991

15,348

10,649 |

Christopher E. Olofson

President/COO |

|

2002

2001

2000 |

|

$

|

300,000

225,000

172,500 |

|

$

|

100,000

250,000

60,000 |

|

$

|

6,500

6,500

4,245 |

|

200,000

142,500

56,250 |

|

$

|

9,744

6,300

6,000 |

Thomas L. Layton

Senior Vice President—

Bankruptcy Services |

|

2002

2001

2000 |

|

$

|

175,000

145,000

127,710 |

|

$

|

20,000

15,000

— |

|

$

|

7,500

6,000

6,000 |

|

17,000

6,000

22,500 |

|

$

|

9,731

6,300

6,000 |

Victoria A. Holmes(3)

Vice President—Infrastructure

Software |

|

2002

2001

2000 |

|

$

|

150,000

18,182

— |

|

$

|

—

50,000

— |

|

$

|

7,500

—

— |

|

2,000

15,000

— |

|

$

|

7,607

—

— |

Leah G. Workman(4)

Vice President—Bankruptcy

Services |

|

2002

2001

2000 |

|

$

|

125,000

98,769

7,692 |

|

$

|

20,000

—

— |

|

$

|

6,875

—

— |

|

12,000

12,375

— |

|

$

|

8,714

4,480

— |

- (1)

- Includes for Tom W. Olofson $3,438 in 2002, $3,315 in 2001 and $3,063 in 2000 for personal use of a Company automobile. Also included for Tom W. Olofson $50,207 in 2002 and 2001 for payment of annual life insurance premiums on policies owned by Tom W. Olofson. Includes for Christopher E. Olofson $6,500 in 2002 and 2001 and $4,245 in 2000 for personal use of a Company automobile. For Mr. Layton, Ms. Holmes and Ms. Workman, consists solely of an automobile allowance.

- (2)

- Includes for Tom W. Olofson $2,838 in 2002 for group life insurance premium and $15,953 in 2002 for financial and tax planning services. The financial and tax planning services were not provided by the Company's independent auditors. Also included for Tom W. Olofson $9,048 in 2001 and $4,649 in 2000 for payment by the Company of the employee portion of the Company's group health insurance premium and $7,200 in 2002, $6,300 in 2001 and $6,000 in 2000 for Company matching contributions under the 401(k) plan. Includes for Christopher E. Olofson $3,144 in 2002 for group life insurance premium paid by the Company and $6,600 in 2002, $6,300 in 2001 and $6,000 in 2000 for Company matching contributions under the 401(k) plan. Includes for Thomas L. Layton $2,621 in 2002 for group life insurance premium paid by the Company and $7,110 in 2002, $6300 in 2001 and $6,000 in 2000 for Company matching contributions under the 401(k) plan. Includes for Victoria A. Holmes $2,331 in 2002 for group life insurance premium paid by the Company and $5,276 in 2002 for Company matching contributions under the 401(k) plan. Includes for Leah G. Workman $2,114 in 2002 for group life insurance premium paid by the Company and $6,600 in 2002 and $4,480 in 2001 for Company matching contributions under the 401(k) plan.

- (3)

- Ms. Holmes joined the Company in November 2001 as Vice President—Infrastructure Software with an annual salary of $150,000.

- (4)

- Ms. Workman joined the Company in December 2000 and was promoted to Vice President—Bankruptcy Services in January 2002 with an annual salary of $125,000.

6

Stock Options

The following table sets forth information concerning stock option grants made to the Named Officers in the year ended December 31, 2002. Options granted to the Named Officers are for 10-year terms, were all granted at an option exercise price equal to fair market value of the Common Stock on the date of grant, and vest at the rate of 20% per year over five years beginning one year after the date of grant, other than the options to Tom W. Olofson and Christopher E. Olofson, which vested 90 days after the date of grant.

Option Grants

| | Individual Grants

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted

(#)

| |

| |

| |

| |

| |

|

|---|

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

| | Potential Realizable Value at

Assumed Annual Rates of Stock Price

Appreciation for Option Term

|

|---|

Name

|

|

Exercise Price

($/sh)

|

|

Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Tom W. Olofson | | 300,000 | (1) | 44.83 | % | $ | 16.50 | | 11/8/12 | | $ | 3,113,028 | | $ | 7,889,025 |

Christopher E. Olofson |

|

50,000

75,000

75,000 |

|

7.47

11.21

11.21 |

|

$

|

18.04

12.85

16.50 |

|

1/14/12

6/13/12

11/8/12 |

|

$

|

567,263

625,522

778,257 |

|

$

|

1,437,556

1,596,748

1,972,256 |

Thomas L. Layton |

|

15,000

2,000 |

|

2.24

0.30 |

|

$

|

12.85

14.62 |

|

6/13/12

12/13/12 |

|

$

|

121,219

18,389 |

|

$

|

307,194

46,601 |

Victoria A. Holmes |

|

2,000 |

|

0.30 |

|

$ |

14.62 |

|

12/13/12 |

|

$ |

18,389 |

|

$ |

46,601 |

Leah G. Workman |

|

5,000

5,000

2,000 |

|

0.75

0.75

0.30 |

|

$

|

18.04

12.85

14.62 |

|

1/14/12

6/13/12

12/13/12 |

|

$

|

56,726

40,406

18,389 |

|

$

|

143,756

102,398

46,601 |

- (1)

- Prior to 2002, at the recommendation of Tom W. Olofson, the independent members of the Board of Directors had not granted any stock options to Tom W. Olofson at any time since or in anticipation of the Company's initial public offering in February 1997. The Compensation Committee approved a 300,000 option grant to Tom W. Olofson in 2002 in view of (1) the absence of any previous option grants, (2) the strong financial performance of the Company since its initial public offering in 1997, (3) the efforts of the Chief Executive Officer in numerous strategic acquisitions over the preceding years, and (4) the significant growth in shareholder value since 1997.

7

The following table sets forth information concerning stock options exercised by the Named Officers during the year ended December 31, 2002, and the number of shares and the value of options outstanding as of December 31, 2002, for each Named Officer.

Aggregate Option Exercises and

Option Values as of December 31, 2002

| |

| |

| | Number of Securities

Underlying

Unexercised Options at

12/31/02(#)

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-The-Money Options at

12/31/02($)(1)

|

|---|

Name

|

|

Shares

Acquired on

Exercise(#)

|

|

Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Tom W. Olofson | | — | | | — | | — | | 300,000 | | | — | | | — |

| Christopher E. Olofson | | 56,250 | | $ | 733,500 | | 593,750 | | 75,000 | | $ | 4,586,663 | | | — |

| Thomas L. Layton | | — | | | — | | 11,100 | | 45,200 | | | 115,461 | | $ | 322,981 |

| Victoria A. Holmes | | — | | | — | | 3,000 | | 14,000 | | | — | | | 1,300 |

| Leah G. Workman | | — | | | — | | — | | 24,375 | | | — | | | 104,728 |

- (1)

- Based on the closing sales price of the Common Stock on the Nasdaq National Market of $15.27 per share on December 31, 2002, less the option exercise price.

Report of the Compensation Committee of the Board of Directors

The Compensation Committee of the Board of Directors was formed in June 2002 and consists of the independent directors of the Board of Directors. The Compensation Committee, whether acting as a committee or as the independent members of the Board of Directors, is responsible for approving the compensation of the Chief Executive Officer, the President and the members of the Board of Directors. The Board of Directors delegates to the Chief Executive Officer responsibility for determining the cash compensation for all other executive officers of the Company. Stock option grants for employees are approved by the Board of Directors under the Company's Stock Option Plan. The members of the Compensation Committee approve the grant of stock options to directors and executive officers. Prior to the formation of the Compensation Committee, the independent members of the Board of Directors determined matters of executive compensation. Although Tom W. Olofson and Christopher E. Olofson participated in those compensation discussions, they abstained from any votes on their compensation or concerning stock option grants to either of them.

In setting base salary and awarding bonuses and stock option grants, the Compensation Committee considers the overall performance of the Chief Executive Officer and the President, the overall financial performance of the Company, increases in shareholder value and the efforts of the Chief Executive Officer and the President in identifying, evaluating and completing strategic initiatives for the Company. The Compensation Committee has determined base compensation for the Chief Executive Officer and the President based on knowledge of executive compensation levels at other comparable publicly traded companies. The Compensation Committee has increased the base salary of the Chief Executive Officer and the President over the past few years to align their base annual compensation to more competitive levels in the judgment of the Committee or independent Board members. Bonuses paid to the Chief Executive Officer and the President for 2002 were based one-half on the financial performance of the Company and one-half on their efforts in identifying, evaluating and completing strategic acquisitions.

In 2002, the Compensation Committee supplemented the cash compensation of Tom W. Olofson and Christopher E. Olofson with stock option grants. Prior to 2002, at the recommendation of Tom W. Olofson, the independent members of the Board of Directors had not granted any stock options to Tom W. Olofson at any time since or in anticipation of the Company's initial public offering in February 1997. The Compensation Committee approved a 300,000 option grant to Tom W. Olofson in 2002 in view of (1) the absence of any previous option grants, (2) the strong financial performance of

8

the Company since its initial public offering in 1997, (3) the efforts of the Chief Executive Officer in numerous strategic acquisitions over the preceding years, and (4) the significant growth in shareholder value since 1997. Stock option grants to the President reflected (1) the strong financial performance of the Company in 2002, and (2) the efforts of the President in identifying, evaluating and completing strategic acquisitions during the year.

Robert C. Levy

W. Bryan Satterlee

Edward M. Connolly, Jr.

Compensation Committee of the Board of Directors

Additional Information with Respect to Compensation Committee Interlocks and Insider Participation in Compensation Decisions

As discussed above, both Tom W. Olofson and Christopher E. Olofson are members of the Board of Directors and have historically participated in Board discussions concerning compensation (including stock option grants) for those two executives, but have abstained from voting on any matters relating to their compensation. The members of the Compensation Committee, formed in 2002, are independent, non-employee directors of the Board of Directors. Robert C. Levy, a director of the Company and a member of the Audit and Compensation Committees, is a director, shareholder and executive committee member of the law firm of Seigfreid, Bingham, Levy, Selzer & Gee, P.C. in Kansas City, Missouri. Seigfreid, Bingham, Levy, Selzer & Gee, P.C. serves as general counsel to the Company. Mr. Levy is not standing for reelection at the Annual Meeting. Although Mr. Levy is an independent director under current Securities and Exchange Commission and Nasdaq rules, the Company anticipates that he will not be considered an independent director if currently proposed Nasdaq rule changes are adopted. Accordingly, the Company and Mr. Levy have agreed that Mr. Levy will not be renominated as a director of the Company. His term of office will expire on the Annual Meeting date.

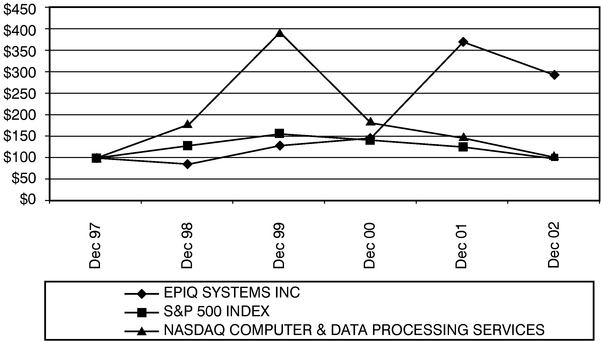

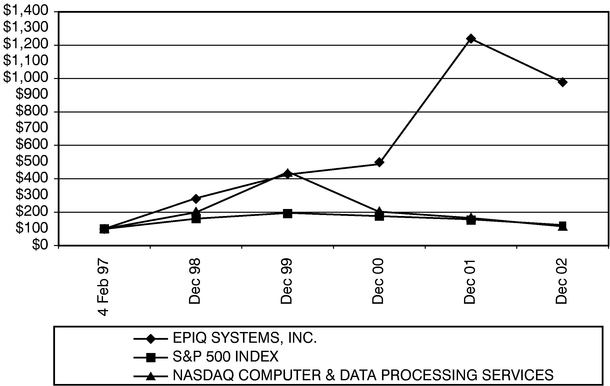

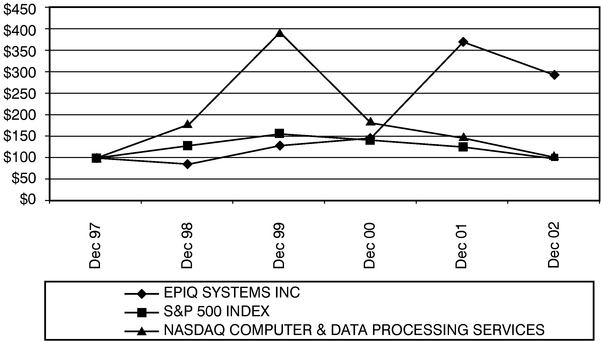

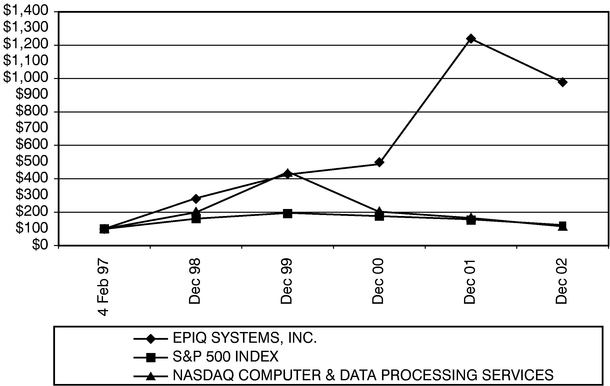

Performance Graph

The following graphs show the total shareholder return of an investment of $100 in cash for (i) the Company's Common Stock, (ii) the Nasdaq Stock Market Computer and Data Processing Services Index (the "Nasdaq Computer Index"), and (iii) the Standard & Poor's 500 Index (the "S&P 500 Index") for the Company's last five fiscal years (December 31, 1997 through December 31, 2002) and for the period beginning on the date of the Company's initial public offering through the end of the last fiscal year (February 4, 1997 through December 31, 2002). All values assume reinvestment of the full amount of any dividends. The Nasdaq Computer Index and the S&P 500 Index are calculated by Standard & Poor's Institutional Market Services.

The five-year graph assumes that $100.00 was invested in the Company's Common Stock on December 31, 1997, at the price of $5.22 per share, the closing sales price on that date (after giving effect to the stock splits effected as stock dividends paid by the Company on February 23, 2001 and November 30, 2001). The second graph assumes that $100.00 was invested in the Company's Common Stock on February 4, 1997, the date of the Company's initial public offering, at the price of $1.56 per share, the closing sales price on that date (after giving effect to the stock splits and stock dividends paid by the Company). The closing sales prices were used for each index on December 31, 1997 or February 4, 1997, as applicable, and all dividends were reinvested. No cash dividends have been declared on the Company's Common Stock. Shareholder returns over the indicated period should not be considered indicative of future shareholder returns.

9

Five-Year Performance Graph

Performance Graph Since Initial Public Offering

10

EXECUTIVE OFFICERS

Officers are elected on an annual basis by the Board of Directors and serve at the discretion of the Board. Certain biographical information about the Named Officers and the other executive officers of the Company follows:

Name

|

|

Age

|

|

Position

|

|---|

| Tom W. Olofson* | | 61 | | Chairman, Chief Executive Officer, and Director |

| Christopher E. Olofson* | | 33 | | President, Chief Operating Officer, and Director |

| Elizabeth M. Braham | | 44 | | Vice President, Chief Financial Officer and Corporate Secretary |

| Kathleen S. Gerber | | 49 | | Senior Vice President—Bankruptcy Services, LLC |

| Victoria A. Holmes | | 38 | | Vice President—Infrastructure Software |

| Ron L. Jacobs | | 46 | | President—Bankruptcy Services, LLC |

| Thomas L. Layton | | 60 | | Senior Vice President—Bankruptcy Services |

| Leah G. Workman | | 39 | | Vice President—Bankruptcy Services |

- *

- Information is provided under the heading "Election of Directors" above for Tom W. Olofson and Christopher E. Olofson. Information relating to the Company's other executive officers with respect to their principal occupations and positions during the past five years is as follows:

Elizabeth M. Braham joined EPIQ Systems in July 2002 as Vice President and Chief Financial Officer and was elected Corporate Secretary in January 2003. Prior to joining the Company, Ms. Braham was Assistant Vice President of Planning and Analysis for H&R Block, Inc., a diversified financial services company, from March 2001 to July 2002. Prior to that, she was employed by Aventis Pharmaceuticals, Inc. and the predecessor companies of Hoechst Marion Roussel, Marion Merrell Dow and Marion Laboratories for over 13 years, where she last served as Vice President of North America Integration. Ms. Braham earned a BBA degree in accounting and marketing from Washburn University and an MBA degree from the University of Kansas.

Kathleen S. Gerber joined the Company in January 2003 as Senior Vice President of Bankruptcy Services, LLC ("BSI"), as a result of the Company's acquisition of BSI. Prior to the acquisition, Ms. Gerber served as Director of Operations for BSI since October 1994. Prior to joining BSI, she was employed by Integrated Resources, Inc. for over 15 years, where she last served as Vice President of Administration.

Victoria A. Holmes joined the Company in November 2001 as Vice President—Infrastructure Software. Prior to joining the Company, she was Vice President, Sales and Marketing for NuParadigm Systems, Inc., an EAI/middleware, workflow and document management software and services company, from 1999 to 2001. Prior to that, she was Vice President, Sales and Marketing for Intercard, Inc., a CRM/customer loyalty software and hardware company from 1993 to 1999. Ms. Holmes earned a BA in Business Administration from Drury University and her MBA from Keller Graduate School of Management.

Ron L. Jacobs joined the Company in January 2003, as a result of the Company's acquisition of BSI. He is President of BSI and has served in this capacity since BSI's inception in 1994. Prior to joining BSI, Mr. Jacobs served as First Vice President of Integrated Resources, Inc. He is an attorney and received a BA degree from Union College and a JD degree from Brooklyn Law School.

Thomas L. Layton joined the Company as Vice President—Chapter 7 Services in September 1999. He was promoted to Senior Vice President—Bankruptcy Services in April 2000. Prior to joining the Company, he was a Vice President and General Manager for Automatic Data Processing, Inc. from 1989 to 1999. Mr. Layton has a BA degree from St. Mary's College, Winona, Minnesota.

11

Leah G. Workman joined the Company in December 2000 as Director, Client Services. She was promoted to Vice President—Bankruptcy Services in February 2002. Prior to joining the Company, she was Vice President for Executive Teleconferencing Services, a teleconferencing and communications company, from 1993 to 2000. Ms. Workman earned a BA in Business Administration from the University of Missouri-Kansas City and her MBA from the University of Missouri-Kansas City.

Employment Agreements

In connection with the purchase of membership interests in Bankruptcy Services LLC on January 31, 2003, the Company and BSI entered into substantially similar employment agreements with BSI members Ron L. Jacobs and Kathleen S. Gerber. The complete employment agreements are filed as exhibits to the Company's Current Report on Form 8-K filed with the Securities and Exchange Commission on February 10, 2003.

Ron L. Jacobs—On January 31, 2003, the Company and BSI entered into an employment agreement with Ron L. Jacobs, pursuant to which Mr. Jacobs serves as President of BSI, a wholly-owned indirect subsidiary of the Company. The initial term of the employment agreement is five years and can be extended by written agreement of Mr. Jacobs and BSI. The Company has agreed to guaranty all obligations of BSI under the employment agreement.

Mr. Jacob's annual base salary is $500,000. Mr. Jacobs is also eligible to receive a bonus each year up to a maximum of $279,000 based on BSI's profitability (as defined in the employment agreement), although such bonus will only be payable if Mr. Jacobs is an employee of BSI on December 31 of the year in which the bonus is to be paid. Pursuant to Mr. Jacob's employment agreement, Mr. Jacobs was granted a 10-year nonqualifed option to purchase 100,000 shares of Common Stock at an exercise price of $17.10 per share. The stock option was 20% vested on January 31, 2003, the grant date thereof, and continues to vest 20% per year on each anniversary of the grant date until fully vested on January 31, 2007. The stock option was granted to induce Mr. Jacobs to continue as an executive of BSI after it was acquired by the Company.

If Mr. Jacobs' employment is terminated without cause or Mr. Jacobs resigns for good reason (as defined in the employment agreement), Mr. Jacobs will continue to be paid his base salary in periodic installments for the remainder of the initial term of the employment agreement without an obligation to mitigate. If Mr. Jacobs' employment is terminated as a result of his death or disability, Mr. Jacobs will receive only any accrued but unpaid base salary and benefits for his service prior to death or disability. If Mr. Jacobs voluntarily terminates his employment with BSI, other than for death, disability or good reason (as defined in the employment agreement), or is terminated by BSI for cause (as defined in the employment agreement), before January 31, 2008, Mr. Jacobs, Ms. Gerber and the other two individuals who sold BSI membership interests to the Company will forfeit their respective portions of the contingent purchase price for the BSI interests. The amount subject to forfeiture by all four former BSI owners is $4,000,000 if termination occurs prior to January 31, 2004, and decreases annually thereafter.

The employment agreement includes a 10-year covenant not to compete or solicit customers of BSI or EPIQ Systems Acquisition, Inc. or personnel of the Company, BSI or EPIQ Systems Acquisition, Inc. The employment agreement also incorporates an on-going covenant not to disclose confidential information regarding BSI. The covenants are set forth in and incorporated from the BSI Membership Interest Purchase Agreement. If any payment to Mr. Jacobs under the employment agreement is deemed to be a "Golden Parachute Payment" as defined in Section 280G of the Internal Revenue Code of 1986, as amended, as it relates to a change in control of the Company that results in the termination of Mr. Jacobs prior to the end of the initial five-year term, as it may be extended by the parties, BSI agrees to reimburse Mr. Jacobs for any excise tax that may be assessed against him as a result of that payment.

12

Kathleen S. Gerber—On January 31, 2003, the Company and BSI entered into an Employment Agreement with Kathleen S. Gerber, pursuant to which Ms. Gerber serves as Senior Vice President of BSI. The initial term of the employment agreement is five years and can be extended by written agreement of Ms. Gerber and BSI. The Company has agreed to guaranty all obligations of BSI under the employment agreement.

Ms. Gerber's annual base salary under the employment agreement is $300,000. Ms. Gerber is also eligible to receive a bonus each year up to a maximum of $156,000 based on BSI's profitability (as defined in the employment agreement). Ms. Gerber did not receive an option to purchase shares of the Company's Common Stock. If Ms. Gerber voluntarily terminates her employment with BSI, other than for death, disability or good reason or is terminated by BSI for cause before January 31, 2008, Mr. Jacobs, Ms. Gerber and the other two individuals who sold BSI membership interests to the Company will forfeit their respective portions of the contingent purchase price for the BSI interests. The amount subject to forfeiture by all four former BSI owners is $4,000,000 if termination occurs prior to January 31, 2004, and decreases annually thereafter. Otherwise, the terms of her employment agreement are substantially similar to the terms of Mr. Jacobs' employment agreement described above.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Robert C. Levy, a director of the Company, is a director, shareholder and executive committee member of the law firm of Seigfreid, Bingham, Levy, Selzer & Gee, P.C. in Kansas City, Missouri. Seigfreid, Bingham, Levy, Selzer & Gee, P.C. serves as general counsel to the Company.

PROPOSAL TO AMEND THE 1995 STOCK OPTION PLAN

In accordance with the terms of the Company's 1995 Stock Option Plan (the "1995 Plan"), the Board of Directors has amended the 1995 Plan to increase the maximum number of shares of Common Stock that may be issued upon the exercise of stock options granted under the 1995 Plan from 3,000,000 to 4,500,000. Shareholder approval of this amendment is required for it to become effective.

Additionally, the Board amended the 1995 Plan to clarify that "repricing" of options granted under the 1995 Plan is not permitted. The Company has never repriced stock options. The Board also amended the 1995 Plan to delete a provision that previously permitted non-qualified stock options to be priced at less than 100% of fair market value of the Common Stock on the date of grant, but not less than 85% of fair market value. The 1995 Plan now provides that all options be granted at an exercise price of not less than 100% of fair market value of the Common Stock on the date of grant.

General

The 1995 Plan was adopted by the Board of Directors on October 17, 1995 and approved by the shareholders of the Company on that day. Currently the maximum number of shares of Common Stock available for stock option grants under the 1995 Plan is 3,000,000, which gives effect to the stock splits effected as stock dividends paid by the Company on February 23, 2001 and November 30, 2001.

The Company believes that long-term equity compensation in the form of stock options is an important employee benefit to attract and retain qualified employees to the Company and to encourage their commitment to the business and financial success of the Company. The Board believes that stock based compensation has had and will continue to have a positive effect in promoting strong financial performance and significant growth in shareholder value for the Company. As of April 15, 2003 there were 685,935 shares available for future grants under the Plan. The Board of Directors believes the number of shares currently available under the Plan is insufficient in light of potential continued growth in the Company's operations. For this reason, the Board of Directors has determined that it is in the best interests of the Company and its shareholders to increase the number of shares available for issuance under the Plan by 1,500,000 shares.

13

As of April 15, 2003, 484,476 shares had been issued upon the exercise of options granted under the 1995 Plan (including 146,700 shares issued to current executive officers and directors as a group), options for 1,829,589 shares were outstanding under the 1995 Plan (including 1,304,925 shares issued to current executive officers and directors as a group) and 685,935 shares are available for future issuance of options under the 1995 Plan. As of April 15, 2003, unexercised options for 113,500 shares have been granted to the independent directors as a group and unexercised options for 524,664 shares have been granted to all employees who are not current executive officers of the Company. For information with respect to options granted to and exercised by the Company's Directors and Named Officers under the 1995 Plan, see "Election of Directors—Director Compensation" and "Executive Compensation—Stock Options."

Equity Compensation Plan Information

The following table sets forth as of December 31, 2002 (a) the number of securities to be issued upon exercise of outstanding options, warrants and rights, (b) the weighted average exercise price of outstanding options, warrants and rights and (c) the number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)).

| | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a))(1)

|

|---|

| Equity compensation plans approved by security holders | | 1,744,000 | | $ | 6.87 | | 794,000 |

Equity compensation plans not approved by security holders |

|

0 |

|

|

0 |

|

0 |

Total |

|

1,744,000 |

|

|

|

|

794,000 |

- (1)

- Reflects the number of securities remaining available under the 1995 Plan prior to the increase in the maximum number of shares of Common Stock that may be issued upon the exercise of stock options granted under the 1995 Plan for which shareholder approval is being sought.

The Company's 1995 Plan is the Company's only equity compensation plan or arrangement for purposes of the foregoing table.

Purpose

The purposes of the 1995 Plan are to associate closely the interests of the directors, officers and other employees of the Company with the interests of the shareholders by reinforcing the relationship between participants' rewards and shareholder gains; provide directors, officers and other employees with an equity ownership in the Company commensurate with corporate performance, as reflected in increased shareholder value; maintain competitive compensation levels; and provide an incentive to officers and other employees for continuous employment with the Company.

Administration

The 1995 Plan is administered by the Board of Directors. The Board of Directors has the authority in its sole discretion, subject to the express provisions of the 1995 Plan, to administer the 1995 Plan and to exercise all the powers and authorities either specifically granted to it under the 1995 Plan or necessary or advisable in the administration of the 1995 Plan, including, without limitation, the

14

authority to grant options, to determine the persons to whom and the time or times at which options will be granted, to determine the type and number of options to be granted and the terms, conditions and restrictions relating to any option, to construe and interpret the 1995 Plan, to prescribe rules and regulations relating to the 1995 Plan, and to make all other determinations deemed necessary or advisable for the administration of the 1995 Plan.

Securities Offered Under the 1995 Plan

The shares of Common Stock to be purchased upon the exercise of options under the 1995 Plan will be issued from either authorized and unissued shares of Common Stock or any issued shares of Common Stock reacquired by the Company. If an option terminates or expires without a distribution in full of shares to the optionee, the shares of Common Stock with respect to the unexercised portion of the option will again be available for future grants of options under the 1995 Plan.

Eligibility

Persons eligible for the grant of options under the 1995 Plan are the officers, directors and employees of the Company. The Board of Directors determines those persons to whom and the time or times at which options will be granted, the type and number of options to be granted and the terms, conditions and restrictions relating to any option. There are, however, no requirements imposed by the 1995 Plan with respect to the number of options to be granted to any persons, other than the maximum number of shares available for issuance upon the exercise of all options issued under the 1995 Plan.

Option Price

Stock options granted under the 1995 Plan are evidenced by a written stock option agreement ("Option Agreement") in such form and containing such terms and conditions as the Board of Directors from time to time approves, subject to the 1995 Plan. Each Option Agreement states the number of shares to which it relates, whether the option constitutes an incentive stock option ("ISO") qualified under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or a non-qualified stock option ("NSO"), and the option price. Under the 1995 Plan, the option price may not be less than 100% of the fair market value of the Common Stock on the date of grant of the option for an ISO or a NSO. In the case of an ISO granted to a person owning more than 10% of the voting stock of the Company, the option price may not be less than 110% of the fair market value of the Common Stock on the date of grant. The fair market value of the Common Stock as of a particular date means the last reported sales price or the closing bid price of a share of Common Stock on the day on which the option is granted. Except for adjustments in connection with certain changes in capitalization, the purchase price for any outstanding NSO or ISO granted under the Plan may not be decreased after the date of grant nor may an outstanding NSO or ISO granted under the Plan be surrendered to the Company as consideration for the grant of a new option with a lower exercise price.

Payment for Common Stock Subject to Options

Payment for Common Stock purchased upon the exercise of options granted under the 1995 Plan is to be made in full, at the time of exercise (i) in cash, or (ii) in shares of Common Stock already owned by the optionee having a fair market value equal to the option exercise price, or (iii) in a combination of cash and shares of Common Stock. All required state and federal withholding taxes are also payable by the optionee.

Term and Exercise of Options

The Board of Directors has discretion to determine the term of an option, except that an option may not be exercised more than 10 years after its date of grant. In the case of an ISO granted to a

15

person owning more than 10% of the voting stock of the Company, the term may not exceed five years from the date of grant. Options may be exercised in full at any time or in part from time to time in accordance with the 1995 Plan and the provisions of any applicable Option Agreement. The Board of Directors may require in its discretion that any option granted becomes exercisable only in installments or after some minimum period of time, or both. Options may not be transferred by an optionee except by will or the laws of descent and distribution and are exercisable during the lifetime of an optionee only by the optionee or the optionee's guardian or legal representatives.

With respect to ISOs, the aggregate fair market value (determined as of the date the ISO is granted) of the shares of Common Stock with respect to which ISOs granted under this 1995 Plan and all other plans of the Company become exercisable for the first time by an optionee during any calendar year may not exceed $100,000.

Effect of Termination of Employment, Disability, Death

On the optionee's termination of employment with the Company for any reason other than death, disability or termination for cause, the optionee will have the right to exercise the unexercised option, or portion thereof, at any time within three months after termination. On the optionee's termination of employment with the Company by reason of death or disability, the option may be exercised at any time within one year after termination. In the event of the death of an optionee, the executors, administrators, legatees or distributees of the estate of such optionee, and in the event of an optionee's disability, the guardian or legal representatives of the optionee, have the right to exercise the option.

Certain Adjustments

Options granted under the 1995 Plan are subject to adjustment by the Board of Directors as to the number and price of shares subject to the options in the event of changes in the outstanding shares of Common Stock by reason of stock dividends, stock splits, recapitalization, reorganizations, mergers, consolidations, combinations, exchanges or other relevant changes in capitalization occurring after the date of grant of any option. In the event of any such change in the outstanding shares of Common Stock, the aggregate number of shares available under the 1995 Plan will be appropriately adjusted by the Board of Directors, whose determination will be conclusive. The maximum number of shares available for issuance under the 1995 Plan and the shares and option exercise prices for outstanding options were adjusted twice in 2001 to give effect to stock splits effected as stock dividends paid by the Company on February 23, 2001 and November 30, 2001.

Duration, Termination and Amendment of the 1995 Plan

The Board of Directors may at any time alter, amend, suspend or terminate the 1995 Plan in whole or in part, except that no amendment may adversely affect any of the rights of any optionee, without the optionee's consent, under any option then outstanding under the 1995 Plan. The power to grant options under the 1995 Plan will automatically terminate on October 16, 2005. If the 1995 Plan is terminated, any unexercised options will continue to be exercisable in accordance with their terms and the terms of this 1995 Plan in effect immediately prior to such termination.

Certain Federal Income Tax Consequences

The following discusses certain of the federal income tax consequences associated with (i) the grant of a stock option under the 1995 Plan, (ii) the exercise of options, and (iii) the disposition of shares received upon the exercise of an option.

Non-Qualified Stock Options. The grant of an NSO (including any option that exceeds the limitations on ISOs described below) to an optionee will not be a taxable event. Accordingly, the optionee will not be subject to any income tax consequences with respect to an NSO until the option is

16

exercised. Upon the exercise of an NSO, the optionee generally will recognize ordinary income equal to the "spread" between the exercise price and the fair market value of the Common Stock on the date of exercise. Generally, the Company will be entitled to a federal income tax deduction in the amount of the "spread" recognized by the optionee as ordinary income.

On the delivery by an optionee of shares of Common Stock already owned by the optionee as payment for the exercise price of an NSO, the number of shares received on exercise of the option equal to the number of shares of Common Stock surrendered is a tax-free exchange with no resulting recognition of income to the optionee. Any additional shares the optionee receives on exercise of the option in excess of the number of shares surrendered will be recognized by the optionee as ordinary compensation income in an amount equal to the fair market value of such shares. The tax basis of the shares received on surrender of the previously owned shares of Common Stock is the tax basis of the shares so surrendered, and the tax basis of the additional shares received is the amount recognized as ordinary compensation income by the optionee, that is, the fair market value of such additional shares.

The payment by an optionee of the exercise price of an NSO by means of surrender of the existing option will result in the optionee recognizing ordinary compensation income on the "spread" between the exercise price of the option surrendered and the fair market value of the shares of Common Stock on the date of exercise. Generally, the Company will be entitled to a deduction in the amount of this "spread." The tax basis of the shares of Common Stock the optionee receives on exercise will be the fair market value of such shares on the date of exercise.

The amount and character (whether long-term or short-term) of any gain or loss realized on a subsequent disposition of Common Stock by the optionee generally will depend on, among other things, whether such disposition occurred before or after such Common Stock vested, whether an election under Code Section 83(b) with respect to such shares had been made, and the length of time such shares were held by the optionee.

Incentive Stock Options. Under the Code, ISOs may be granted only to employees of the Company. There are no federal income tax consequences associated with the grant of the option to an employee. In contrast to the exercise of an NSO, the exercise of an ISO will not cause an employee to recognize taxable income for federal income tax purposes. If the employee holds the shares acquired upon exercise of the ISO for a minimum of two years from the date of the grant of the ISO, and for at least one year after exercise, any gain realized on the subsequent sale or exchange of the shares generally will be treated as long-term capital gain. If the shares are sold or otherwise disposed of prior to the expiration of those periods (a "disqualifying disposition"), then a portion of any gain recognized by the employee which would otherwise be characterized as capital gain would instead be taxable as ordinary income, and the Company would be entitled to a federal income tax deduction in that amount. The amount of gain that would be characterized as ordinary income will not exceed an amount equal to the excess of (i) the fair market value of such shares as of the date the option was exercised over (ii) the amount paid for such shares. Any loss recognized upon a taxable disposition of the shares generally will be characterized as a capital loss.

On the delivery by an optionee of shares of Common Stock already owned by the optionee as payment of the exercise price of an ISO, the number of shares received on exercise of the ISO equal to the shares of the Common Stock surrendered is a tax-free exchange with no resulting recognition of income to the optionee. Any additional shares the optionee receives on exercise of the ISO in excess of the number of shares surrendered will be treated as the exercise of an ISO and will not cause the optionee to recognize taxable income for regular income tax purposes. The tax basis of the shares received on surrender of the previously owned shares of Common Stock is the tax basis of the shares so surrendered, and the basis of any additional shares received on exercise of the ISO is the amount of any cash or other property paid on such exercise. However, if stock received on exercise of an ISO is used in connection with the exercise of an ISO when the holding period with respect to such stock is not met, such use will be considered a disqualifying disposition.

17

The payment by an optionee of the exercise price of an ISO by means of surrender of such ISO will result in the optionee recognizing ordinary compensation income on the spread between the exercise price and the fair market value with respect to that number of options so surrendered less the number of options exercised for shares. Generally, the Company will be entitled to a deduction in the amount of this "spread." The tax basis of the shares of Common Stock the optionee receives on exercise of the option in this manner will be the amount paid for such shares.

Board Recommendation

The Board of Directors believes that, as proposed, the approval of the amendment to the 1995 Plan is in the best interests of the shareholders of the Company. Approval of this proposal requires a vote in favor of the amendment by the holders of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting. A copy of the Company's 1995 Stock Option Plan is attached hereto asAppendix A.

The Board of Directors recommends that shareholders voteFOR

the proposal to amend the Company's Stock Option Plan to increase the number of shares

of Common Stock available for the grant of stock options thereunder.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors is responsible for overseeing management's financial reporting practices and internal controls. The Audit Committee acts under a written charter that was first adopted and approved by the Board of Directors on June 7, 2000.

In connection with the consolidated financial statements for the fiscal year ended December 31, 2002, the Audit Committee has:

- •

- reviewed and discussed the audited financial statements with management and with representatives of Deloitte & Touche LLP, independent auditors;

- •

- discussed with the independent auditors the matters required to be discussed byStatement On Auditing Standards No. 61 (Communications with Audit Committees); and

- •

- received from the independent auditors the written disclosures regarding Deloitte & Touche LLP's independence as required byIndependence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed the independence of Deloitte & Touche LLP with representatives of the independent auditors.

Based on these actions, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission.

A copy of the Audit Committee's charter was attached to the Company's Proxy Statement for its 2001 Annual Meeting of Shareholders and will be provided to any shareholder upon request.

18

INDEPENDENT AUDITORS

Deloitte & Touche LLP has audited the 2001 and 2002 fiscal year financial statements of the Company, and the Audit Committee intends to reappoint Deloitte & Touche LLP as independent auditors for the year ending December 31, 2003. A representative of Deloitte & Touche LLP will be present at the Annual Meeting with the opportunity to make a statement if he desires and will be available to respond to questions.

Audit Fees. The aggregate fees billed by Deloitte & Touche LLP for professional services rendered for the audit of the annual financial statements for the year ended December 31, 2002 and for the reviews of the financials statements included in the quarterly reports on Form 10-Q for 2002 were $77,740.

Audit Related Fees. The aggregate fees billed by Deloitte & Touche for professional services rendered for audit related services for the year ended December 31, 2002 were $149,532. Audit related services include fees for work on SEC registration statements and filings, consents and acquisition related services.

Tax Fees. The aggregate fees billed by Deloitte & Touche for professional services rendered for tax fees were $69,975. Tax services include tax return preparation and other tax consulting.

All Other Fees. The aggregate fees billed by Deloitte & Touche for services rendered to the Company, other than the services described above under "Audit Fees," "Audit Related Fees" and "Tax Fees," for the year ended December 31, 2002 were $0.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal auditor's independence.

2004 SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the Annual Meeting of Shareholders to be held in 2004 must be received by the Secretary of the Company, at EPIQ Systems, Inc., 501 Kansas Avenue, Kansas City, Kansas 66105-1309, no later than December 15, 2003, to be eligible for inclusion in the Company's Proxy Statement and Proxy related to that meeting.

FINANCIAL STATEMENTS

The Annual Report to Shareholders of the Company for the year ended December 31, 2002, is enclosed with this Proxy Statement.

OTHER MATTERS

The Board of Directors is not aware of any matter that will be presented for action at the Annual Meeting other than the matters set forth herein. If other matters properly come before the meeting, it is intended that the holders of the proxies hereby solicited will vote thereon in accordance with their best judgment.

April 25, 2003

19

APPENDIX A

EPIQ SYSTEMS, INC.

1995 STOCK OPTION PLAN

AS AMENDED THROUGH APRIL 7, 2003

I. PURPOSE

The purposes of the EPIQ Systems, Inc. 1995 Stock Option Plan (the "Plan") are to: (1) closely associate the interests of the directors, officers and all other employees of EPIQ Systems, Inc. (the "Corporation") with the interests of the shareholders by reinforcing the relationship between participants' rewards and shareholder gains; (2) provide directors, officers and all other employees with an equity ownership in the Corporation commensurate with corporate performance, as reflected in increased shareholder value; (3) maintain competitive compensation levels; and (4) provide an incentive to officers and all other employees for continuous employment with the Corporation.

II. ADMINISTRATION

- (a)

- The Plan shall be administered by the Board of Directors of the Corporation (the "Board") or a Stock Option Plan Committee ("Committee") of the Board. Unless the Committee is composed solely of not less than two members of the Board who qualify as "Non-Employee Directors" under Rule 16b-3 or its successors promulgated under the Securities Exchange Act of 1934, as amended ("Rule 16b-3"), all grants of stock options under the Plan to officers and directors of the Corporation shall be made by the Board. (The administrator of the Plan shall be referred to herein as the "Committee", regardless of whether the Plan is administered by the Board or the Committee). In addition to its duties with respect to the Plan stated elsewhere in the Plan, the Committee shall have full authority, consistent with the Plan, to interpret the Plan, to promulgate such rules and regulations with respect to the Plan as it deems desirable, to delegate its ministerial responsibilities hereunder to appropriate persons and to make all other determinations necessary or desirable for the administration of the Plan. All decisions, determinations and interpretations of the Committee shall be binding upon all persons.

- (b)

- Stock options granted pursuant to the Plan ("Options") shall be either incentive stock options ("ISOs") intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), or nonqualified stock options ("NSOs") not intended to qualify under Section 422 of the Code. References in this Plan to Options shall include both ISOs and NSOs.

- (c)

- The Committee shall administer the Plan in a manner necessary to establish and maintain the Options intended to constitute ISOs as ISOs, and the Options intended to constitute NSOs as NSOs. Accordingly, only employees of the Corporation will be eligible for grants of ISOs. However, the Corporation makes no representation that the Options designated as ISOs and the Options designated as NSOs will qualify at the time of grant as ISOs and NSOs, respectively, or will continue to qualify as ISOs and NSOs respectively. Nor does the Corporation make any representation concerning the tax consequences to any person upon receipt or exercise of any Option hereunder or the subsequent sale of Common Stock acquired thereunder.

A-1

III. SHARES SUBJECT TO THE PLAN

Shares of common stock that may be issued under the Plan shall be the common stock, one cent ($.01) par value, of the Corporation ("Common Stock"). The aggregate number of shares of Common Stock, subject to adjustment pursuant to Article XVI, which may be delivered on exercise of the Options is 4,500,000 and such amounts of shares of Common Stock shall be, and hereby are reserved for such purpose. Such shares may be previously issues shares reacquired by the Corporation or authorized but unissued shares. If any Option expires, terminates or is canceled for any reason, without having been exercised in full, the shares covered by the unexercised portion of such Option shall again be available for Options, within the limit specified above.

IV. PARTICIPANTS

All members of the Board and all employees of the Corporation, or, if applicable, its subsidiaries, including employees who are members of the Board, shall be eligible to participate in the Plan; provided, however, that only employees of the Corporation shall be granted ISOs. Subject to the foregoing, the Committee shall, from time to time, determine, in its discretion, the directors and employees, who shall be eligible for participation in the Plan (the "Participants"). (For purposes of the Plan, the term "Participant(s)" shall, when appropriate, include any person permitted to exercise an Option in accordance with the terms of the Plan.) A member of the Board who is not an employee of the Corporation shall not be eligible to receive ISOs.

V. GRANTS OF OPTIONS

- (a)

- The Committee shall in its discretion determine the time or times when Options shall be granted and the number of shares of Common Stock to be subject to each Option, except that no Option may be granted more than ten years after the effective date hereof.

- (b)

- The Committee may in its discretion grant to Participants who are employees of the Corporation either ISOs, NSOs or a combination of both and shall at the time the Option is granted designate whether the Option is an ISO or NSO.

- (c)

- The Committee may only grant NSOs to Participants who are not employees of the Corporation.

- (d)

- At any given time, a share of Common Stock may be subject to only one of the two types of Options that may be issued under the Plan.

- (e)

- With respect to ISOs granted under the Plan, the aggregate fair market value (determined as of the date the Option is granted) of the Common Stock with respect to which ISOs are exercisable for the first time by the Participant during any calendar year under all stock option plans of the Corporation and its subsidiaries shall not exceed $100,000. Notwithstanding the provisions for acceleration of the date an Option is first exercisable in Article VII and Article VIII, in no event shall the date that an ISO is first exercisable be accelerated under this Plan if the acceleration would cause an ISO of a Participant to exceed the limit set forth in this paragraph.

- (f)

- No Option intended to constitute an ISO shall be granted to an employee who, at the time the Option is granted, owns (within the meaning of Section 422(b)(6) of the Code) Common Stock possessing more than 10 percent of the total combined voting power of all classes of stock of the Corporation or, if applicable, any of its subsidiaries (hereinafter referred to as a "Ten Percent Shareholder") unless (1) the purchase price of the Common Stock subject to such Option shall be, subject to adjustment pursuant to Article XVI, at least 110 percent of the fair market value of the Common Stock on the day the Option is granted determined in accordance with Article VI which relates to the method for determining the fair market value

A-2

VI. OPTION PRICE

- (a)

- The purchase price of a share of Common Stock subject to an NSO shall be, subject to adjustment pursuant to Article XVI, an amount equal to the fair market value of the Common Stock on the day the NSO is granted.

- (b)