QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

EPIQ SYSTEMS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

NOTICE OF ANNUAL MEETING

on

JUNE 2, 2004

and

PROXY STATEMENT

501 Kansas Avenue

Kansas City, Kansas 66105

April 28, 2004

Dear Shareholder:

The Annual Meeting of Shareholders of EPIQ Systems, Inc. will be held at 10:00 a.m., local time, on Wednesday, June 2, 2004, at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri 64112. The enclosed notice of the meeting and proxy statement contain detailed information about the business to be transacted at the meeting.

On behalf of the Board of Directors and Management of the Company, I cordially invite you to attend the Annual Meeting of Shareholders.

The prompt return of your Proxy in the enclosed business reply envelope or voting by telephone or via the Internet (as described on the Proxy card) will help ensure that as many shares as possible are represented at the Annual Meeting.

I personally look forward to seeing you at the Annual Meeting.

Sincerely,

EPIQ SYSTEMS, INC.

Tom W. Olofson

Chairman and

Chief Executive Officer

EPIQ SYSTEMS, INC.

501 Kansas Avenue

Kansas City, Kansas 66105

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on June 2, 2004

TO THE SHAREHOLDERS OF EPIQ SYSTEMS, INC.

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of EPIQ Systems, Inc. (the "Company") will be held at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri 64112 at 10:00 a.m., local time, on Wednesday, June 2, 2004, for the following purposes:

- 1.

- To elect five Directors to the Board of Directors of the Company, each for a term of one year and until their successors are elected and qualified;

- 2.

- To consider a proposal to approve the 2004 Equity Incentive Plan adopted by the Company's Board of Directors to replace the 1995 Stock Option Plan prior to its scheduled expiration;

- 3.

- To consider a proposal to amend the Company's Articles of Incorporation as permitted by The General and Business Law of Missouri to limit the personal liability of directors in certain circumstances, in order to enable the Company to attract and retain qualified independent directors; and

- 4.

- To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only shareholders of record at the close of business on April 7, 2004, are entitled to notice of and to vote at the meeting or any adjournment or postponement thereof. On April 7, 2004, the record date for the Annual Meeting, there were 17,827,627 shares of common stock outstanding. Each outstanding share is entitled to one vote.

The Board of Directors of the Company encourages you to sign, date and promptly mail the Proxy in the enclosed postage prepaid envelope or to vote by telephone or via the Internet (as described on the Proxy card), regardless of whether or not you intend to be present at the Annual Meeting. You are urged, however, to attend the Annual Meeting.

By Order of the Board of Directors

Elizabeth M. Braham, Secretary

Kansas City, Kansas

April 28, 2004

EPIQ SYSTEMS, INC.

501 Kansas Avenue

Kansas City, Kansas 66105

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

To be held Wednesday, June 2, 2004

SOLICITATION AND REVOCABILITY OF PROXIES

This Proxy Statement and the enclosed Proxy card are furnished to the shareholders of EPIQ Systems, Inc., a Missouri corporation, in connection with the solicitation of proxies by the Company for use at the Company's Annual Meeting of Shareholders, and any adjournments or postponement thereof, to be held at the Fairmont Hotel, 401 Ward Parkway, Kansas City, Missouri at 10:00 a.m., local time, on Wednesday, June 2, 2004. The mailing of this Proxy Statement, the Proxy, the Notice of Annual Meeting and the accompanying 2003 Annual Report to Shareholders is expected to commence on April 28, 2004. All costs of solicitation will be borne by the Company.

You are requested to vote your shares by following the instructions on the Proxy for voting by telephone or via the Internet or by completing, signing and returning the Proxy promptly in the enclosed postage prepaid envelope. Your Proxy may be revoked by written notice of revocation delivered to the Secretary of the Company, by executing and delivering a later dated Proxy or by voting in person at the Annual Meeting. Attendance at the Annual Meeting will not constitute a revocation of your Proxy unless you vote in person at the Annual Meeting or deliver an executed and later dated Proxy. Proxies duly executed and received in time for the Annual Meeting will be voted in accordance with the shareholders' instructions. If no instructions are given, Proxies will be voted as follows:

- a.

- to elect Tom W. Olofson, Christopher E. Olofson, W. Bryan Satterlee, Edward M. Connolly, Jr. and James A. Byrnes as directors to serve for one-year terms until the 2005 Annual Meeting of Shareholders and until their respective successors are duly elected and qualified; and

- b.

- to approve the 2004 Equity Incentive Plan adopted by the Company's Board of Directors to replace the 1995 Stock Option Plan prior to its scheduled expiration;

- c.

- to approve an amendment to the Company's Articles of Incorporation as permitted by The General and Business Law of Missouri to limit the personal liability of directors in certain circumstances, in order to enable the Company to attract and retain qualified independent directors; and

- d.

- in the discretion of the proxy holder as to any other matter coming before the Annual Meeting.

1

OUTSTANDING VOTING SECURITIES OF THE COMPANY

Only the holders of record of shares of common stock as of the close of business on April 7, 2004, are entitled to vote on the matters to be presented at the Annual Meeting, either in person or by proxy. At the close of business on April 7, 2004, there were outstanding and entitled to vote a total of 17,827,627 shares of common stock, constituting all of the outstanding voting securities of the Company.

The presence at the Annual Meeting, in person or by proxy, of the holders of at least a majority of the shares of common stock as of the record date is necessary to constitute a quorum. Abstentions and broker non-votes are counted for purposes of determining the presence of a quorum at the Annual Meeting. Each share of common stock is entitled to one vote for each director to be elected and upon all other matters to be brought to a vote of the shareholders at the Annual Meeting. The affirmative vote of a plurality of the shares of common stock present or represented at the Annual Meeting is required to elect the directors. The affirmative vote of a majority of the shares of common stock present or represented at the Annual Meeting is required to approve the adoption of the 2004 Equity Incentive Plan. The affirmative vote of a majority of the outstanding shares of common stock as of the record date is required to approve the amendment to the Company's Articles of Incorporation. Broker non-votes are not deemed to be represented at the Annual Meeting for purposes of the vote on the proposal to approve the 2004 Equity Incentive Plan. Broker non-votes have the effect of a negative vote on the proposal to amend the Company's Articles of Incorporation. Abstentions have the effect of a negative vote on the proposal to approve the 2004 Equity Incentive Plan and on the proposal to amend the Company's Articles of Incorporation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of shares of common stock for (i) each director and nominee for election as a director of the Company, (ii) each officer named in the Summary Compensation Table, (iii) all directors and executive officers as a group, and (iv) each person known to the Company to be the beneficial owner of more than 5% of the outstanding shares. Beneficial ownership for directors and officers is shown as of March 19, 2004, and beneficial ownership for other 5% or greater shareholders is shown as of December 31, 2003. Except as

2

otherwise indicated, each shareholder has sole voting and investment power with respect to the shares beneficially owned.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership(1) | Percent of Shares Outstanding(2) | ||||

|---|---|---|---|---|---|---|

| Named Officers and Directors(3) | ||||||

| Tom W. Olofson(4) | 2,900,000 | 15.9 | % | |||

| Christopher E. Olofson | 990,000 | 5.3 | % | |||

| W. Bryan Satterlee | 42,622 | * | ||||

| Edward M. Connolly, Jr. | 14,625 | * | ||||

| James A. Byrnes | 2,000 | * | ||||

| Elizabeth M. Braham | 10,000 | * | ||||

| Ron L. Jacobs | 403,182 | 2.3 | % | |||

| Kathleen S. Gerber | 109,423 | * | ||||

| All directors and executive officers as a group (9 persons) | 4,471,852 | 23.5 | % | |||

| 5% Shareholders(5) | ||||||

| Wasatch Advisors, Inc. 150 Social Hall Avenue Salt Lake City, UT 84111 | 1,899,506 | 10.7 | % | |||

| Waddell & Reed Investment Management Company 6300 Lamar Avenue Overland Park, KS 66202 | 1,524,121 | 8.5 | % | |||

| St. Denis J. Villere & Co., LLC(6) 210 Baronne Street, Suite 808 New Orleans, LA 70112-1727 | 1,131,750 | 6.3 | % | |||

- *

- Less than one percent

- (1)

- Includes shares of common stock issuable upon the exercise of options that are currently exercisable or exercisable within 60 days after the record date.

- (2)

- Computed for each officer and director as of March 19, 2004, on the basis of shares of common stock outstanding plus the options currently exercisable or exercisable in the next 60 days, and computed for the other 5% shareholders on the basis of the shares outstanding on the record date.

- (3)

- The address of all of the named individuals is c/o EPIQ Systems, Inc., 501 Kansas Avenue, Kansas City, Kansas 66105.

- (4)

- Includes 50,000 shares owned by Mr. Olofson's spouse, Jeanne H. Olofson, as to which Mr. Olofson disclaims beneficial ownership, 105,000 shares owned by the Tom W. and Jeanne H. Olofson Foundation, as to which shares Mr. Olofson shares beneficial ownership. Excludes 84,000 shares owned by Scott W. Olofson, Mr. Olofson's son, as to which shares Mr. Olofson disclaims beneficial ownership.

- (5)

- Excludes 5% shareholders listed above as executive officers or directors. Beneficial ownership of common stock is based solely on Schedule 13G filings with the Securities and Exchange Commission.

- (6)

- Has shared voting and dispositive power for a portion of the shares beneficially owned.

3

Section 16(a) Beneficial Ownership Reporting Compliance

The Company is required to identify any director, officer or 10% or greater beneficial owner of common stock who failed to file timely a report with the Securities and Exchange Commission required under Section 16(a) of the Securities Exchange Act of 1934 (the "Exchange Act") relating to ownership and changes in ownership of the Company's common stock. The required reports consist of initial statements on Form 3, statements of changes on Form 4 and annual statements on Form 5. Based solely upon a review of reports filed under Section 16(a) of the Exchange Act and certain written representations of directors and officers of the Company, the Company is not aware of any director, officer or 10% or greater beneficial owner of common stock who failed to file on a timely basis any report required by Section 16(a) of the Exchange Act for calendar year 2003.

At the Annual Meeting, the shareholders will elect five directors to hold office for one-year terms until the Company's 2005 Annual Meeting of Shareholders and until their successors are duly elected and qualified. It is intended that the names of the nominees listed below will be placed in nomination at the Annual Meeting to serve as directors and that the persons named in the Proxy will vote for their election. All nominees listed below are currently members of the Board of Directors. Each nominee has consented to being named in this Proxy Statement and to serve if elected. If any nominee becomes unavailable to serve as a director for any reason, the shares represented by the Proxies will be voted for the person, if any, designated by the Board of Directors. The Board of Directors has no reason to believe that any nominee will be unavailable to serve.

The nominees for directors of the Company, as well as certain information about them, are as follows:

| Name | Age | Position | ||

|---|---|---|---|---|

| Tom W. Olofson | 62 | Chairman, Chief Executive Officer and Director | ||

| Christopher E. Olofson | 34 | President, Chief Operating Officer and Director | ||

| W. Bryan Satterlee | 69 | Director | ||

| Edward M. Connolly, Jr. | 61 | Director | ||

| James A. Byrnes | 57 | Director |

Tom W. Olofson led a private investor group that acquired the Company in July 1988, and has served as Chief Executive Officer and Chairman of the Board since that time. During his business career, Mr. Olofson has held various management positions with Xerox Corporation and was a Senior Vice President and member of the Office of the President of Marion Laboratories, Inc. Mr. Olofson has also served as a director of and advisor to various private companies in which he has been an investor. He earned a BBA from the University of Pittsburgh, and is currently a member of the Board of Visitors of the Katz Graduate School of Business at the University of Pittsburgh. He is the father of Christopher E. Olofson.

Christopher E. Olofson joined the Company as a Vice President in June 1993, and was a part-time employee of the Company from 1988 to 1993. In January 1994, he was named Senior Vice President—Operations, and became Executive Vice President and a member of the Board of Directors effective January 1, 1995. Effective July 1, 1996, Mr. Olofson also assumed the duties of Chief Operating Officer, and effective October 1, 1998, Mr. Olofson was named President of the Company. He earned an AB degree from Princeton University, summa cum laude. He is the son of Tom W. Olofson.

W. Bryan Satterlee was elected to the Company's Board of Directors in February 1997. Mr. Satterlee has been a partner since 1989 in NorthEast Ventures, a consulting firm that specializes in

4

business development services and financial evaluations of technology-based venture companies. Mr. Satterlee's background includes ten years of management experience with IBM, as well as having been a founder of a computer leasing/software business, a telecommunications company and a venture investment services business. He earned a BS degree from Lafayette College.

Edward M. Connolly, Jr. was elected to the Company's Board of Directors in January 2001. Mr. Connolly is a retired executive from Aventis Pharmaceuticals, where he served as President of the Aventis Pharmaceuticals Foundation and Vice President of Community Affairs. Prior to that, he held various executive human resources positions at Hoechst Marion Roussel, Marion Merrell Dow, and Marion Laboratories, predecessor companies to Aventis. He holds a BA degree in psychology from Bellarmine University.

James A. Byrnes was elected to the Company's Board of Directors in January 2003. He served as Vice President of International Marketing for Hoechst Marion Roussel, Inc. until his retirement in 1996. Prior to that, he was Vice President of Global Commercial Development for Marion Merrell Dow. Prior to these positions, he held several executive sales and marketing positions at Marion Merrell Dow and Marion Laboratories, predecessor companies to Hoechst Marion Roussel. Mr. Byrnes holds a BS degree in general science from Gannon University and an MBA degree from Rockhurst College.

The Board of Directors recommends a voteFOR

the election of the nominees for director named above.

Board and Committee Meetings

During 2003, the Board of Directors met eight times. Each director attended all the meetings of the Board of Directors. The Company expects all directors to attend each Annual Meeting of Shareholders, and all directors attended the 2003 Annual Meeting of Shareholders. The Board of Directors has established an Audit Committee, a Nominating Committee and a Compensation Committee. In 2003, each director attended all the meetings of the Board committees on which he served. The Board of Directors has determined that all members of the Audit, Nominating and Compensation Committees are "independent directors" as defined in Nasdaq Rule 4200(a)(14), and all directors who served on those committees in 2003 were independent throughout 2003.

Director Compensation

In 2003, the Company paid its non-employee directors a fee of $7,500 per quarter. The Company also reimburses non-employee directors for out-of-pocket expenses incurred in attending Board and committee meetings. The Company grants to each of its non-employee directors 7,500 options upon joining the Board and 5,000 options annually for service as a director. In accordance with this policy, James A. Byrnes received an option to acquire 7,500 shares upon joining the Board in January 2003, and W. Bryan Satterlee and Edward M. Connolly, Jr. each received an option to acquire 5,000 shares of common stock. All director options are exercisable for 10 years from the date of grant, vest 20% per year over five years, and were granted at an option exercise price equal to fair market value of the common stock on the date of grant.

Audit Committee

The Audit Committee consists of W. Bryan Satterlee, Chairman, Edward M. Connolly and James A. Byrnes. The Board of Directors has determined that Mr. Satterlee qualifies as an "audit committee financial expert" as defined by the rules of the Securities and Exchange Commission. The

5

function of the Audit Committee is set forth below under "Report of the Audit Committee of the Board of Directors." The Audit Committee met six times in 2003.

Audit and Other Service Fees

Deloitte & Touche LLP has audited the financial statements of the Company for 2002 and 2003, and the Audit Committee has reappointed Deloitte & Touche LLP as independent auditors for the year ending December 31, 2004. A representative of Deloitte & Touche LLP will be present at the Annual Meeting with the opportunity to make a statement if he desires and will be available to respond to questions.

The following table sets forth the aggregate fees billed to the Company for fiscal years ended December 31, 2003, and 2002 by the Company's principal accounting firm, Deloitte & Touche LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, "Deloitte & Touche"):

| | 2003 | 2002 | ||||

|---|---|---|---|---|---|---|

| Audit fees(1) | $ | 97,040 | $ | 144,400 | ||

| Audit-related fees(2) | 155,843 | 82,772 | ||||

| Total audit and audit-related fees | 252,883 | 227,172 | ||||

| Tax fees(3) | 81,983 | 69,975 | ||||

| All other fees(4) | 7,090 | 0 | ||||

| Total | $ | 341,956 | $ | 297,147 | ||

- (1)

- Includes services rendered for the audit of the Company's annual financial statements, work on SEC registration statements, filings and consents, and review of financial statements included in quarterly reports on Form 10-Q.

- (2)

- Includes acquisition-related services and employee benefit plan audits.

- (3)

- Includes tax return preparation and other tax consulting.

- (4)

- Consists of services other than the services described above under "Audit Fees," "Audit Related Fees" and "Tax Fees," primarily related to consultation regarding benefit plan amendments.

The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal auditor's independence. Additionally, the Audit Committee approved of all non-audit services performed by Deloitte & Touche in 2003 in accordance with the Pre-Approval Policy of the Audit Committee described below.

In 2003, the Audit Committee adopted a policy (the "Pre-Approval Policy") under which audit and non-audit services to be rendered by the Company's independent public accountants are pre-approved by the Audit Committee. Pursuant to the Pre-Approval Policy, the Audit Committee pre-approves audit and non-audit services to be provided by the independent auditors, at specified dollar levels, which dollars levels are reviewed by the Committee periodically, and no less often than annually. Additionally, the Audit Committee may provide explicit prior approval of specific engagements not within the scope of a previous pre-approval resolution. The services performed by the Company's independent auditor in 2003 were all within the pre-approval limits adopted by the Audit Committee. The Pre-Approval Policy also specifies certain services (consistent with the SEC rules and regulations) that may not be provided by the Company's independent auditors in any circumstance. The Pre-Approval Policy also includes an exception from the pre-approval requirement for certain de minimus non-audit engagements that are not otherwise prohibited by the Policy. Engagements in reliance upon that de minimus exception must be promptly brought to the attention of the Audit Committee and approved by the Audit Committee or

6

one or more designated representatives. No services were provided by Deloitte & Touche in 2003 in reliance upon this de minimus exception.

Audit Committee Report

The Audit Committee of the Board of Directors is responsible for overseeing management's financial reporting practices and internal controls. The Audit Committee acts under a written charter that was first adopted by the Board of Directors on June 7, 2000. The Charter was reviewed by the Committee in 2003 and substantially revised in order to conform to numerous regulatory initiatives of the SEC. A copy of the Audit Committee's charter, as amended in 2003, is attached asExhibit C to this Proxy Statement.

In connection with the consolidated financial statements for the fiscal year ended December 31, 2003, the Audit Committee has:

- •

- reviewed and discussed the audited financial statements with management and with representatives of Deloitte & Touche LLP, independent auditors;

- •

- discussed with the independent auditors the matters required to be discussed byStatement On Auditing Standards No. 61 (Communications with Audit Committees); and

- •

- received from the independent auditors the written disclosures regarding Deloitte & Touche LLP's independence as required byIndependence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and discussed the independence of Deloitte & Touche LLP with representatives of the independent auditors.

Based on these actions, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in its Annual Report on Form 10-K for the year ended December 31, 2003, for filing with the Securities and Exchange Commission.

W. Bryan Satterlee, Chairman

Edward M. Connolly, Jr.

James A. Byrnes

Audit Committee of the Board of Directors

Nominating Committee

The Nominating Committee consists of Edward M. Connolly, Chairman, W. Bryan Satterlee and James A. Byrnes. Each member of the Nominating Committee is independent as discussed above. The Nominating Committee was established by the Board of Directors in March 2004, and adopted a Nominating Committee Charter at that time. The Nominating Committee Charter can be found on the Company's corporate website. Its functions include assisting the Board in determining the desired qualifications of directors, identifying potential individuals meeting those qualification criteria, proposing to the Board a slate of nominees for election by the shareholders and reviewing candidates nominated by shareholders.

The Nominating Committee will meet at least once annually to discuss, among other things, identification and evaluation of potential candidates for nomination as a director. Potential candidates will be evaluated according to the qualification criteria as set forth in the Nominating Committee Charter, which include:

- •

- High personal and professional ethics, integrity, practical wisdom and mature judgment;

- •

- Board training and experience in business, government, education or technology;

7

- •

- Expertise that is useful to the Company and complementary to the background and experience of other Board members;

- •

- Willingness to devote the required amount of time to carrying out the duties and responsibilities of Board membership;

- •

- Commitment to serve on the Board over a period of several years to develop knowledge about the Company and its operations;

- •

- Willingness to represent the best interests of all shareholders and objectively appraise management's performance; and

- •

- Board diversity, and other relevant factors as the Board may determine.

The five nominees for election at the 2004 Annual Meeting of Shareholders were nominated by the Board at the recommendation of the Nominating Committee. All nominees are already serving as directors of the Company.

The Nominating Committee will consider nominees recommended by shareholders for the 2005 Annual Meeting of Shareholders, provided that the names of such nominees are submitted in writing, no later than January 15, 2005, to the Corporate Secretary, EPIQ Systems, Inc., 501 Kansas Avenue, Kansas City, Kansas 66105-1309. Each such submission must include a statement of the qualifications of the nominee, a consent signed by the nominee evidencing a willingness to serve as a director, if elected, and a commitment by the nominee to meet personally with the Nominating Committee.

Other than the submission requirements set forth above, there are no differences in the manner in which the Nominating Committee evaluates a nominee for director recommended by a shareholder.

Compensation Committee

The Compensation Committee consists of Edward M. Connolly, Chairman, W. Bryan Satterlee and James A. Byrnes. Each member of the Compensation Committee is independent as discussed above. The Compensation Committee met five times in 2003. The Compensation Committee is responsible for establishing compensation, including the adjustment of base salary, bonus and other incentive compensation programs for the Company's Chairman of the Board/Chief Executive Officer ("CEO") and President/Chief Operating Officer ("President") and will authorize all awards to those individuals under those programs. The CEO is authorized to set the compensation and bonuses of the other executive officers and officers of the Company. The CEO will report to and confer with the Compensation Committee regarding the salary and bonus levels for those other officers. The Compensation Committee is responsible for the approval of all compensation, bonus and incentive compensation programs for any employee of the Company who is a member of the immediate family (as defined in SEC Rule 16a-1(e)) of either the CEO or the President. In accordance with this policy, the Compensation Committee also reviews and approves the salary, bonus and option grants for Scott W. Olofson, who is an employee of the Company and the son of the CEO and the brother of the President of the Company.

The Compensation Committee regularly evaluates the performance of the CEO and the President. The Compensation Committee also determines the fees and other forms of compensation paid to members of the Board of Directors for board and committee service. The Compensation Committee is designated as the Stock Option Plan Committee under the Company's stock option plan or plans. As the Stock Option Plan Committee, the Compensation Committee determines (i) the times when options will be granted, (ii) the number of shares of Common Stock of the Company to be subject to each option granted to directors, officers and other employees of the Company, and (iii) the option exercise price for each option granted under the plan. The Compensation Committee will exercise all other rights granted to the Stock Option Plan Committee or the Board of Directors under the Company's stock option plans. The Report of the Compensation Committee is set forth below under "Executive Compensation."

8

Summary Compensation Table

The following table sets forth the cash and other compensation paid in 2003, 2002 and 2001 to the Company's Chief Executive Officer and the Company's top four most highly compensated officers in 2003 (the "Named Officers"). Scott W. Olofson, the son of Tom W. Olofson and the brother of Christopher E. Olofson, is the Company's Director of Business Development and Corporate Counsel. In 2003, Scott Olofson received salary and bonus of $150,250 and options to acquire 20,000 shares of common stock at an option exercise price equal to fair market value on the dates of the option grants. The Compensation Committee approves all salary, bonus and option grants for Scott W. Olofson.

| | Annual Compensation | Long Term Compensation | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation(1) | Securities Underlying Options/SARs (#) | All Other Compensation(2) | ||||||||||

| Tom W. Olofson Chairman/CEO | 2003 2002 2001 | $ | 516,667 300,000 175,000 | $ | 545,000 100,000 250,000 | $ | 81,423 53,645 53,522 | 125,000 300,000 — | $ | 18,570 25,991 15,348 | ||||||

| Christopher E. Olofson President/COO | 2003 2002 2001 | $ | 516,667 300,000 225,000 | $ | 545,000 100,000 250,000 | $ | 7,658 6,500 6,500 | 200,000 200,000 142,500 | $ | 9,582 9,744 6,300 | ||||||

| Elizabeth M. Braham(3) Senior Vice President/CFO/Secretary | 2003 2002 | $ | 245,833 68,333 | $ | 175,000 25,000 | $ | 7,500 3,125 | 70,000 30,000 | $ | 9,232 176 | ||||||

| Ron L. Jacobs(4) President—Bankruptcy Services | 2003 | $ | 458,333 | $ | 279,000 | $ | 6,875 | 110,000 | $ | 7,387 | ||||||

| Kathleen S. Gerber(5) Senior VP—Bankruptcy Services | 2003 | $ | 275,000 | $ | 156,000 | $ | 6,875 | 25,000 | $ | 5,812 | ||||||

- (1)

- Includes for Tom W. Olofson $7,250 in 2003, $3,438 in 2002 and $3,315 in 2001 for personal use of a Company automobile. Also included for Tom W. Olofson $74,173 in 2003 and $50,207 in each of 2002 and 2001 for payment of annual life insurance premiums on policies owned by Tom W. Olofson. Includes for Christopher E. Olofson $7,658 in 2003 and $6,500 in each of 2002 and 2001 for personal use of a Company automobile. For Ms. Braham, Mr. Jacobs and Ms. Gerber, consists solely of an automobile allowance.

- (2)

- Includes for Tom W. Olofson $2,382 in 2003 and $2,838 in 2002 for group life insurance premium and $7,788 in 2003 and $15,953 in 2002 for financial and tax planning services. The financial and tax planning services were not provided by the Company's independent auditors. Also includes for Tom W. Olofson $9,048 in 2001 for payment by the Company of the employee portion of the Company's group health insurance premium and $8,400 in 2003, $7,200 in 2002 and $6,300 in 2001 for Company matching contributions under the 401(k) plan. Includes for Christopher E. Olofson $2,382 in 2003 and $3,144 in 2002 for group life insurance premium paid by the Company and $7,200 in 2003, $6,600 in 2002 and $6,300 in 2001 for Company matching contributions under the 401(k) plan. Includes for Elizabeth M. Braham $2,382 in 2003 and $176 in 2002 for group life insurance premium paid by the Company and $6,850 in 2003 for Company matching contributions under the 401(k) plan. Includes for Ron L. Jacobs $187 for group life insurance premium paid by the Company and $7,200 for Company matching contributions under the 401(k) plan. Includes for

9

Kathleen S. Gerber $187 for group life insurance premium paid by the Company and $5,625 for Company matching contributions under the 401(k) plan.

- (3)

- Ms. Braham joined the Company in July 2002.

- (4)

- Mr. Jacobs joined the Company in January 2003 as a result of the Company's acquisition of Bankruptcy Services, LLC ("BSI").

- (5)

- Ms. Gerber joined the Company in January 2003 as a result of the Company's acquisition of BSI.

Stock Options

The following table sets forth information concerning stock option grants made to the Named Officers in the year ended December 31, 2003. Options granted to the Named Officers are for 10-year terms, were all granted at an option exercise price equal to fair market value of the common stock on the date of grant, and vest at the rate of 20% per year over five years beginning one year after the date of grant, other than (i) the initial 100,000 option grant to Mr. Jacobs, which vested 20% on the date of grant and 20% per year over the next four years, and (ii) the options to Tom W. Olofson and Christopher E. Olofson, which vested 90 days after the date of grant.

Option Grants

| | Individual Grants | | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | ||||||||||||||

| | Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | | | |||||||||||

| Name | Exercise Price ($/sh) | Expiration Date | |||||||||||||

| 5% ($) | 10% ($) | ||||||||||||||

| Tom W. Olofson | 125,000 | 17.18 | % | $ | 15.99 | 12/12/13 | $ | 1,257,003 | $ | 3,185,493 | |||||

Christopher E. Olofson | 75,000 125,000 | 10.31 17.18 | 17.00 15.99 | 1/17/13 12/12/13 | $ | 801,841 1,257,003 | $ | 2,032,022 3,185,493 | |||||||

Elizabeth M. Braham | 20,000 20,000 30,000 | 2.75 2.75 4.12 | 17.00 18.92 15.99 | 1/17/13 5/19/13 12/12/13 | $ | 213,824 237,974 301,681 | $ | 541,872 603,072 764,518 | |||||||

Ron L. Jacobs | 100,000 10,000 | 13.75 1.37 | 17.10 15.99 | 1/31/13 12/12/13 | $ | 1,075,410 100,560 | $ | 2,725,300 254,839 | |||||||

Kathleen S. Gerber | 20,000 5,000 | 2.75 ..69 | 18.92 15.99 | 5/19/13 12/12/13 | $ | 237,974 50,280 | $ | 603,072 127,420 | |||||||

The following table sets forth information concerning stock options exercised by the Named Officers during the year ended December 31, 2003, and the number of shares and the value of options outstanding as of December 31, 2003, for each Named Officer. All of the information set forth below relates to the grant of stock options under the Company's 1995 Stock Option Plan, except for 100,000 stock options granted to Mr. Jacobs under a separate inducement stock option.

10

Aggregate Option Exercises and

Option Values as of December 31, 2003

| | | | Number of Securities Underlying Unexercised Options at 12/31/03 (#) | Value of Unexercised In-The-Money Options at 12/31/03 ($)(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise (#) | Value Realized | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Tom W. Olofson | — | — | 300,000 | 125,000 | $ | 186,000 | $ | 141,250 | |||||||

| Christopher E. Olofson | 56,250 | $ | 999,563 | 687,500 | 125,000 | 4,854,975 | 141,250 | ||||||||

| Elizabeth M. Braham | — | — | 6,000 | 94,000 | 9,360 | 73,740 | |||||||||

| Ron L. Jacobs | 20,000 | 35,200 | — | 90,000 | — | 12,900 | |||||||||

| Kathleen S. Gerber | — | — | — | 25,000 | — | 5,650 | |||||||||

- (1)

- Based on the closing sales price of the common stock on the Nasdaq National Market of $17.12 per share on December 31, 2003, less the option exercise price.

Compensation Committee Report

The Compensation Committee of the Board of Directors was formed in June 2002 and consists of three independent members of the Board of Directors. The Compensation Committee is responsible for approving the compensation of the Chief Executive Officer, the President and the members of the Board of Directors. See "Other Board Information—Compensation Committee" above for a further description of the functions of the Compensation Committee. The Compensation Committee also serves as the stock option committee under the Company's stock option plan, and as such, approves all stock option grants to directors, officers and all other employees of the Company.

In setting base salary and awarding bonuses and stock option grants, the Compensation Committee considers the overall performance of the Chief Executive Officer and the President, the overall financial performance of the Company, increases in shareholder value and the efforts of the Chief Executive Officer and the President in identifying, evaluating and completing strategic initiatives for the Company. The Compensation Committee also considers the willingness of the Chief Executive Officer and the President to consider, but not complete, strategic initiatives that are evaluated by management. The Compensation Committee believes that it is critical to the long-term success of the Company and its shareholders that senior management have equal incentive to complete attractive acquisitions and to abandon undesirable acquisition opportunities. The Compensation Committee has determined base compensation for the Chief Executive Officer and the President based on knowledge of executive compensation levels at other comparable publicly traded companies. The Compensation Committee has increased the base salary of the Chief Executive Officer and the President over the past few years to align their base annual compensation to more competitive levels in the judgment of the Committee. Bonuses paid to the Chief Executive Officer and the President for 2003 were based approximately 20% on the financial performance of the Company and approximately 80% on the efforts of those executives in identifying, evaluating and completing strategic acquisitions.

In 2003, the Compensation Committee supplemented the cash compensation of the Chief Executive Officer and the President with stock option grants. The Compensation Committee approved option grants to the Chief Executive Officer and the President in 2003 in view of (1) the strong financial performance of the Company in 2003, (2) the efforts of those executives in identifying,

11

evaluating and completing strategic acquisitions during the year, and (3) the growth in shareholder value in 2003.

Edward M. Connolly, Jr., Chairman

James A. Byrnes

W. Bryan Satterlee

Compensation Committee of the Board of Directors

Additional Information with Respect to Compensation Committee Interlocks and Insider Participation in Compensation Decisions

The Company does not have any Compensation Committee interlocks or insider participation in compensation decisions required to be disclosed by the proxy rules.

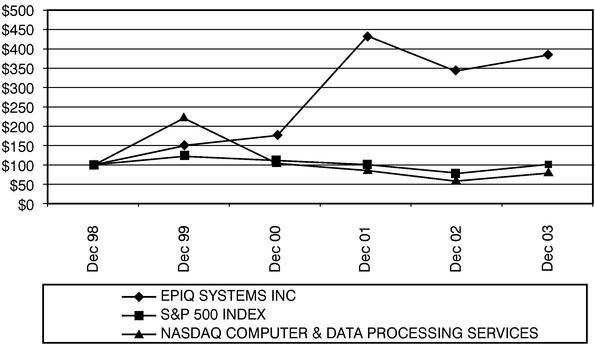

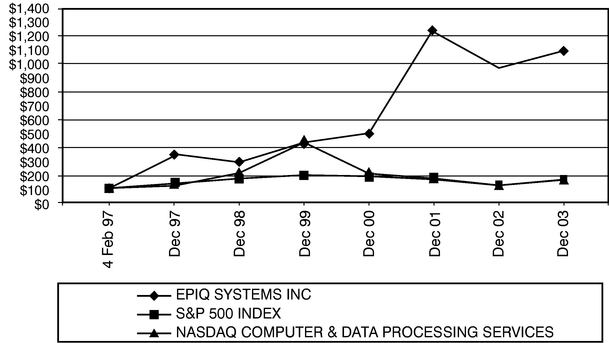

Performance Graph

The following graphs show the total shareholder return of an investment of $100 in cash for (i) the Company's common stock, (ii) the Nasdaq Stock Market Computer and Data Processing Services Index (the "Nasdaq Computer Index"), and (iii) the Standard & Poor's 500 Index (the "S&P 500 Index") for the Company's last five fiscal years (December 31, 1998 through December 31, 2003) and for the period beginning on the date of the Company's initial public offering through the end of the last fiscal year (February 4, 1997 through December 31, 2003). All values assume reinvestment of the full amount of any dividends. The Nasdaq Computer Index and the S&P 500 Index are calculated by Standard & Poor's Institutional Market Services.

The five-year graph assumes that $100.00 was invested in the Company's common stock on December 31, 1998, at the price of $4.44 per share, the closing sales price on that date (after giving effect to the stock splits effected as stock dividends paid by the Company on February 23, 2001 and November 30, 2001). The second graph assumes that $100.00 was invested in the Company's common stock on February 4, 1997, the date of the Company's initial public offering, at the price of $1.56 per share, the closing sales price on that date (after giving effect to the stock splits and stock dividends paid by the Company). The closing sales prices were used for each index on December 31, 1998 or February 4, 1997, as applicable, and all dividends were reinvested. No cash dividends have been declared on the Company's common stock. Shareholder returns over the indicated period should not be considered indicative of future shareholder returns.

12

Performance Graph Since Initial Public Offering

13

Officers are elected on an annual basis by the Board of Directors and serve at the discretion of the Board. Certain biographical information about the executive officers of the Company follows:

| Name | Age | Position | ||

|---|---|---|---|---|

| Tom W. Olofson* | 62 | Chairman, Chief Executive Officer and Director | ||

| Christopher E. Olofson* | 34 | President, Chief Operating Officer and Director | ||

| Elizabeth M. Braham | 45 | Senior Vice President, Chief Financial Officer and Corporate Secretary | ||

| Jeffrey B. Baker | 50 | Chief Executive Officer—Poorman-Douglas Corporation | ||

| Ron L. Jacobs | 47 | President—Bankruptcy Services, LLC |

- *

- Information is provided under the heading "Election of Directors" above for Tom W. Olofson and Christopher E. Olofson. Information relating to the Company's other executive officers with respect to their principal occupations and positions during the past five years is as follows:

Elizabeth M. Braham joined EPIQ Systems in July 2002 and serves as Senior Vice President, Chief Financial Officer and Corporate Secretary. Prior to joining the Company, Ms. Braham was Assistant Vice President of Planning and Analysis for H&R Block, Inc. from March 2001 to July 2002. Prior to that, she was employed by Aventis Pharmaceuticals, Inc. and the predecessor companies of Hoechst Marion Roussel, Marion Merrell Dow and Marion Laboratories for over 13 years, where she last served as Vice President of North America Integration. Ms. Braham earned a BBA degree in accounting and marketing from Washburn University and an MBA degree from the University of Kansas.

Jeffrey B. Baker joined the Company in January 2004 as Chief Executive Officer of Poorman-Douglas Corporation ("Poorman-Douglas") upon the Company's acquisition of Poorman-Douglas. Mr. Baker has served Poorman-Douglas in a variety of marketing and managerial positions since 1977 and was named President of Poorman-Douglas in 1991 and Chief Executive Officer in 2001. Mr. Baker earned a BA in business from Washington State University and an MBA from the University of Washington.

Ron L. Jacobs joined the Company in January 2003, upon the Company's acquisition of BSI. He is President of Bankruptcy Services LLC ("BSI"), and has served in this capacity since BSI's inception in 1994. Prior to joining BSI, Mr. Jacobs served as First Vice President of Integrated Resources, Inc. He is an attorney and received a BA degree from Union College and a JD degree from Brooklyn Law School.

Employment Agreements

In connection with the Company's acquisition of Poorman-Douglas, on January 30, 2004, the Company and Poorman-Douglas entered into an employment agreement with Jeffrey B. Baker. In connection with the purchase of membership interests in Bankruptcy Services LLC on January 31, 2003, the Company and BSI entered into an employment agreement with Ron L. Jacobs.

Jeffrey B. Baker—On January 30, 2004, Poorman-Douglas entered into an Employment and Non-Competition Agreement with Jeffrey B. Baker, pursuant to which Mr. Baker serves as Chief Executive Officer of Poorman-Douglas. The term of the employment agreement expires on January 30, 2008.

14

Mr. Baker's annual base salary under the employment agreement is $300,000. Mr. Baker is eligible to participate in Poorman-Douglas' "Pay for Performance" and other bonus programs. Mr. Baker's benefits include the payment of dues to certain clubs, supplemental life insurance and participation in the Company's executive car allowance program. As an inducement to enter into the employment agreement, the Company granted a nonqualified stock option to Mr. Baker to acquire 200,000 shares of the Company's common stock at an exercise price of $18.20 per share, which was the fair market value of the common stock on the date of grant. The option is a 10-year option and vests 20% per year on the first five anniversaries of the grant date until fully vested.

If Mr. Baker's employment is terminated without cause or Mr. Baker resigns for good reason (each as defined in the employment agreement), or the agreement is terminated by Mr. Baker's death, Mr. Baker will continue to be paid his base salary in regular installments for the term of the agreement. If Mr. Baker's employment terminates as a result of his disability (as defined in the employment agreement), Mr. Baker will continue to receive, in regular installments, an amount equal to the amount (if any) that his base salary exceeds any disability insurance proceeds received. In addition, for the year in which Mr. Baker's employment is terminated for any of the foregoing reasons, Mr. Baker will receive in accordance with the Company's then standard payroll practice, a pro rated portion of any bonus he would have been eligible to receive had his employment not been terminated. If Mr. Baker's employment is terminated for any other reason, Mr. Baker will be entitled to receive only his base salary through the date of termination.

The employment agreement contains a covenant not to compete or solicit employees or customers of the Company, Poorman-Douglas or any other subsidiary of the Company. The covenant continues until the later of January 30, 2009, or two years after termination of employment. The employment agreement also incorporates an on-going covenant not to disclose confidential information of the Company, Poorman-Douglas or any other subsidiary of the Company.

Ron L. Jacobs—On January 31, 2003, the Company and BSI entered into an employment agreement with Ron L. Jacobs, pursuant to which Mr. Jacobs serves as President of BSI, a wholly-owned indirect subsidiary of the Company. The initial term of the employment agreement is five years and can be extended by written agreement of Mr. Jacobs and BSI.

Mr. Jacob's annual base salary is $500,000. Mr. Jacobs is also eligible to receive a bonus each year up to a maximum of $279,000 based on BSI's profitability (as defined in the employment agreement), although such bonus will only be payable if Mr. Jacobs is an employee of BSI on December 31 of the year in which the bonus is earned. Pursuant to Mr. Jacob's employment agreement, Mr. Jacobs was granted a 10-year nonqualifed option to purchase 100,000 shares of common stock at an exercise price of $17.10 per share. The stock option was 20% vested on January 31, 2003, the grant date thereof, and continues to vest 20% per year on each anniversary of the grant date until fully vested on January 31, 2007. The stock option was granted to induce Mr. Jacobs to continue as an executive of BSI after it was acquired by the Company.

If Mr. Jacobs' employment is terminated without cause or Mr. Jacobs resigns for good reason (as defined in the employment agreement), Mr. Jacobs will continue to be paid his base salary in periodic installments for the remainder of the initial term of the employment agreement without an obligation to mitigate. If Mr. Jacobs' employment is terminated as a result of his death or disability, Mr. Jacobs will receive any accrued but unpaid base salary and benefits for his service prior to death or disability. If Mr. Jacobs voluntarily terminates his employment with BSI, other than for death, disability or good reason (as defined in the employment agreement), or is terminated by BSI for cause (as defined in the employment agreement), before January 31, 2008, Mr. Jacobs, Ms. Gerber and the other two individuals who sold BSI membership interests to the Company will forfeit their respective portions of the contingent purchase price for the BSI interests. The amount subject to forfeiture by all four former BSI owners, which decreases annually, was $4,000,000 if termination had occurred prior to January 31,

15

2004. The employment agreement also includes a covenant not to compete or solicit customers of BSI or personnel of the Company or BSI and a covenant not to disclose confidential information regarding BSI.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

To the Company's knowledge, there were no relationships or related transactions in 2003 required to be disclosed by the proxy rules that are not otherwise described in this Proxy Statement.

PROPOSAL TO APPROVE THE 2004 EQUITY INCENTIVE PLAN

General

The Company believes that long-term equity compensation in the form of stock options, stock appreciation rights and restricted stock awards is an important employee benefit to attract and retain qualified employees to the Company and to encourage their commitment to the business and financial success of the Company. The Board of Directors believes that stock based compensation has had and will continue to have a positive effect in promoting strong financial performance and growth in shareholder value for the Company. As a result, the Board of Directors has determined that it is in the best interests of the Company and its shareholders to adopt the EPIQ Systems, Inc. 2004 Equity Incentive Plan (the "2004 Plan"), to provide the Company with the continued ability to provide these types of long-term equity compensation. On March 30, 2004, the Board of Directors adopted the 2004 Plan, subject to the approval of the Company's shareholders. A copy of the Company's 2004 Equity Incentive Plan is attached hereto asExhibit A.

If approved by the shareholders, the 2004 Plan will replace the EPIQ Systems, Inc. 1995 Stock Option Plan (the "1995 Plan"). The maximum number of shares of common stock available for stock option grants under the 1995 Plan is 4,500,000, after giving effect to the stock splits effected as stock dividends paid by the Company on February 23, 2001 and November 30, 2001, and various amendments to the 1995 Plan increasing the number of shares available for grant thereunder, all of which amendments have been approved by the shareholders of the Company. By its terms, the 1995 Plan expires on October 17, 2005. If the 2004 Plan is approved by the shareholders, the Company will terminate the 1995 Plan and will make no further grants of options pursuant to that Plan. The termination of the 1995 Plan will not affect any of the rights or obligations of any person holding unexercised options granted under the 1995 Plan prior to its termination.

The Company has, since its initial public offering in 1997, granted stock options annually to essentially all full-time employees of the Company. The Company has expanded this broad based equity compensation philosophy to each business the Company has acquired. As of March 19, 2004, 677,859 shares had been issued upon the exercise of options granted under the 1995 Plan (including 195,375 shares issued to current executive officers and directors as a group), options to acquire 2,049,476 shares were outstanding and unexercised under the 1995 Plan (including options to acquire 1,430,875 shares held by current executive officers and directors as a group) and 1,772,665 shares were available for future grant of options under the 1995 Plan. As of April 7, 2004, unexercised options for 83,375 shares have been granted to the independent directors as a group and unexercised options for 618,601 shares have been granted to all employees who are not current executive officers of the Company. For information with respect to options granted to and exercised by the Company's Directors and Named Officers under the 1995 Plan, see "Election of Directors—Director Compensation" and "Executive Compensation—Stock Options."

No stock options, stock appreciation rights or restricted stock awards have been granted or made under the 2004 Plan.

16

Purpose

The purpose of the 2004 Plan is to promote the long-term growth and profitability of the Company and its subsidiaries by (i) providing certain directors, officers and employees of, and certain other individuals who perform services for ("consultants"), or to whom an offer of employment has been extended by, the Company and its subsidiaries with incentives to maximize shareholder value and otherwise contribute to the success of the Company and (ii) enabling the Company to attract, retain and reward the best available persons for positions of responsibility. Grants of incentive stock options ("ISOs"), non-qualified stock options ("NSOs"), stock appreciation rights ("SARs"), either alone or in tandem with options, restricted stock, or any combination of the foregoing may be made under the 2004 Plan. As noted above, the Company's equity compensation philosophy has always been extended to all employees, and options are granted annually to substantially all full-time employees of the Company.

Administration

The Plan will be administered by the Compensation Committee of the Board or such other committee of the Board that consists solely of two or more members of the Board (the "Committee"), each of whom is "a Non-Employee Director" within the meaning of SEC Rule 16b-3 and is an "outside director" within the meaning of Treasury Regulation §1.162-27(e)(3); provided that, if for any reason the Committee is not appointed by the Board to administer the 2004 Plan, all authority and duties of the Committee under the 2004 Plan will be vested in and exercised by the Board, and the term "Committee" will mean the Board for purposes of the Plan. All references in this section to the Committee means, for present purposes, the Compensation Committee of the Board of Directors.

Subject to the provisions of the 2004 Plan, the Committee will be authorized to (i) select persons to participate in the 2004 Plan, (ii) determine the form and substance of grants made under the 2004 Plan to each participant, and the conditions and restrictions, if any, subject to which such grants will be made, (iii) certify that the conditions and restrictions applicable to any grant have been met, (iv) modify the terms of grants made under the 2004 Plan, (v) interpret the 2004 Plan and grants made thereunder, (vi) make any adjustments necessary or desirable in connection with grants made under the 2004 Plan to eligible participants located outside the United States and (vii) adopt, amend, or rescind such rules and regulations, and make such other determinations, for carrying out the 2004 Plan as it may deem appropriate.

Securities Available Under the 2004 Plan

Subject to adjustments as provided in the 2004 Plan, an aggregate of 3,000,000 shares of common stock may be issued pursuant to the 2004 Plan. If any grant under the 2004 Plan expires or terminates unexercised, becomes unexercisable or is forfeited as to any shares, or is tendered or withheld as to any shares in payment of the exercise price of the grant or the taxes payable with respect to the exercise, then such unpurchased, forfeited, tendered or withheld shares will thereafter be available for further grants under the 2004 Plan unless, in the case of options granted under the 2004 Plan, related SARs are exercised.

Eligibility

Participation in the 2004 Plan will be limited to those directors (including non-employee directors), officers (including non-employee officers) and employees of, and consultants performing services for, or individuals to whom an offer of employment has been extended by, the Company and its subsidiaries selected by the Committee (including participants located outside the United States). The Company has included within the 2004 Plan the ability to issue options, SARs and shares of restricted stock to consultants in order to provide future flexibility to the Company if an unusual circumstance arose. The

17

Company has never issued stock options or similar equity awards to any persons other than directors, officers and employees of the Company, and the Board of Directors has no present plans or intentions to issue options or similar awards to any consultants to the Company.

ISOs, NSOs, SARs, alone or in tandem with options, restricted stock awards, or any combination thereof may be granted to such persons and for such number of shares as the Committee determines. Determinations made by the Committee under the 2004 Plan need not be uniform and may be made selectively among eligible individuals under the 2004 Plan, whether or not such individuals are similarly situated.

The Committee may from time to time grant to eligible participants ISOs, NSOs, or any combination thereof; provided that the Committee may grant ISOs only to eligible employees of the Company or its subsidiaries. In any one calendar year, the Committee will not grant to any one participant NSOs, ISOs or SARs to purchase a number of shares of common stock in excess of 10% of the total number of shares authorized under the 2004 Plan.

Option Price

The price per share deliverable upon the exercise of each option ("exercise price") will be established by the Committee and may not be less than 100% of the Fair Market Value of a share of common stock as of the date of grant of the option, and in the case of the grant of any ISO to an employee who, at the time of the grant, owns more than 10% of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries, the exercise price may not be less than 110% of the Fair Market Value of a share of common stock as of the date of grant of the option, in each case unless otherwise permitted by Section 422 of the Code or any successor thereto. For purposes of the 2004 Plan, "Fair Market Value" of a share of common stock of the Company means, as of the date in question, the officially-quoted closing selling price of the stock (or if no selling price is quoted, the bid price) on the principal securities exchange on which the common stock is then listed for trading (including for this purpose the Nasdaq National Market) (the "Market") for the applicable trading day or, if the common stock is not then listed or quoted in the Market, the Fair Market Value will be the fair value of the common stock determined in good faith by the Committee; provided, however, that when shares received upon exercise of an option are immediately sold in the open market, the net sale price received may be used to determine the Fair Market Value of any shares used to pay the exercise price or applicable withholding taxes and to compute the withholding taxes.

The terms of any outstanding award under the 2004 Plan may be amended from time to time by the Committee in its discretion in any manner that it deems appropriate (including acceleration of the date of exercise of any award or of the date of lapse of restrictions on shares subject to restricted stock awards); provided that no such amendment may adversely affect in a material manner any right of a participant under the award without the optionee's written consent. The Committee may not, however, reduce the exercise price of any options or SARs awarded under the 2004 Plan without approval of the stockholders of the Company.

Payment for Common Stock Subject to Options

Options may be exercised, in whole or in part, upon payment of the exercise price of the shares to be acquired. Unless otherwise determined by the Committee, payment will be made (i) in cash (including check, bank draft, money order or wire transfer of immediately available funds), (ii) by delivery of outstanding shares of common stock with a Fair Market Value on the date of exercise equal to the aggregate exercise price payable with respect to the options exercised, (iii) by simultaneous sale through a broker reasonably acceptable to the Committee of shares acquired on exercise, as permitted under Regulation T of the Federal Reserve Board, (iv) by authorizing the Company to withhold from issuance a number of shares issuable upon exercise of the options which, when multiplied by the Fair

18

Market Value of a share of common stock on the date of exercise, is equal to the aggregate exercise price payable with respect to the options so exercised or (v) by any combination of the foregoing.

If a grantee elects to pay the exercise price of an option pursuant to clause (ii) above, the grantee must present evidence acceptable to the Company that he or she has owned any such shares of common stock tendered in payment of the exercise price (and that such tendered shares of common stock have not been subject to any substantial risk of forfeiture) for at least six months prior to the date of exercise. If a grantee elects to pay the exercise price payable with respect to an option pursuant to clause (iv) above, the grantee must present evidence acceptable to the Company that he or she has owned a number of shares of common stock at least equal to the number of shares to be withheld in payment of the exercise price (and that such owned shares of common stock have not been subject to any substantial risk of forfeiture) for at least six months prior to the date of exercise.

Term and Exercise of Options

The term during which each option may be exercised will be determined by the Committee, but no option will be exercisable in whole or in part more than 10 years after the date it is granted, and no ISO granted to an employee who at the time of the grant owns more than 10% of the total combined voting power of all classes of stock of the Company or any of its subsidiaries will be exercisable more than five years after the date it is granted. All rights to purchase shares pursuant to an option will, unless sooner terminated, expire at the date designated by the Committee. The Committee will determine the date on which each option becomes exercisable and may provide that an option will become exercisable in installments. Prior to the exercise of an option and delivery of the shares represented thereby, the optionee will have no rights as a shareholder with respect to any shares covered by such outstanding option (including any dividend or voting rights).

Stock Appreciation Rights (SARs)

The Committee will have the authority to grant SARs under the 2004 Plan, either alone or to any optionee in tandem with options (either at the time of grant of the related option or thereafter by amendment to an outstanding option). No SAR may be exercised unless the Fair Market Value of a share of common stock of the Company on the date of exercise exceeds the exercise price of the SAR or, in the case of SARs granted in tandem with options, the exercise price of any options to which the SARs correspond. Prior to the exercise of the SAR and delivery of the shares represented thereby, the participant will have no rights as a shareholder with respect to shares covered by such outstanding SAR (including any dividend or voting rights).

SARs granted in tandem with options will be exercisable only when, to the extent and on the conditions that any related option is exercisable. The exercise of an option will result in an immediate forfeiture of any related SAR to the extent the option is exercised, and the exercise of an SAR will cause an immediate forfeiture of any related option to the extent the SAR is exercised.

Upon the exercise of a SAR, the participant will be entitled to a distribution in an amount equal to the difference between the Fair Market Value of a share of common stock on the date of exercise and the exercise price of the SAR or, in the case of SARs granted in tandem with options, the exercise price of any option to which the SAR is related, multiplied by the number of shares as to which the SAR is exercised. The Committee will decide whether such distribution will be in cash, in shares having a Fair Market Value equal to such amount, or in a combination thereof.

All SARs will be exercised automatically on the last day prior to the expiration date of the SAR or, in the case of SARs granted in tandem with options, any related option, so long as the Fair Market Value of a share of common stock on that date exceeds the exercise price of the SAR or any related option, as applicable. A SAR granted in tandem with options will expire at the same time as any related option expires and will be transferable only when, and under the same conditions as, any related option is transferable.

19

Restricted Stock

The Committee may at any time and from time to time grant shares of restricted stock under the 2004 Plan to such participants and in such amounts as it determines. Each grant of restricted stock will specify the applicable restrictions on such shares, the duration of such restrictions (which will be at least six months except as otherwise determined by the Committee or provided in the Plan), and the time or times at which such restrictions lapse with respect to all or a specified number of shares that are part of the grant.

Unless otherwise determined by the Committee, certificates representing shares of restricted stock granted under the 2004 Plan will be held in escrow by the Company on the participant's behalf during any period of restriction thereon and will bear an appropriate legend specifying the applicable restrictions thereon, and the participant will be required to execute a blank stock power therefor. Except as otherwise provided by the Committee, during such period of restriction the participant will have all of the rights of a holder of common stock, including but not limited to the rights to receive dividends and to vote, and any stock or other securities received as a distribution with respect to such participant's restricted stock will be subject to the same restrictions as then in effect for the restricted stock.

Unless otherwise determined by the Committee, immediately prior to a Change in Control during any period of restriction, all restrictions on shares granted to such participant shall lapse. At such time as a participant ceases to be, or in the event a participant does not become, a director, officer or employee of, or otherwise performing services for, the Company or its subsidiaries for any other reason, unless otherwise determined by the Committee, all shares of restricted stock granted to such participant on which the restrictions have not lapsed will be immediately forfeited to the Company.

Effect of Termination of Employment

If a participant ceases to be a director, officer or employee of the Company and any subsidiary due to death or disability (as defined in the 2004 Plan), (A) all of the participant's options and SARs that were exercisable on the date of death or disability will remain exercisable for, and will otherwise terminate at the end of, a period of one year from the date of such death or disability, but in no event after the expiration date of the options or SARs; provided that, in the case of disability, the participant does not engage in Competition (as defined in the 2004 Plan) during such one-year period.

If a participant ceases to be a director, officer or employee of the Company and any subsidiary upon his or her retirement (as defined in the 2004 Plan), (A) all of the participant's options and SARs that were exercisable on the date of retirement will remain exercisable for, and will otherwise terminate at the end of, a period of 90 days after the date of retirement, but in no event after the expiration date of the options or SARs; provided that the participant does not engage in Competition (as defined in the 2004 Plan) during such 90-day period.

If a participant ceases to be a director, officer or employee of, or to perform other services for, the Company or a subsidiary due to cause (as defined in the 2004 Plan), or if a participant does not become a director, officer or employee of, or does not begin performing other services for, the Company or a subsidiary for any reason, all of the participant's options and SARs will expire and be forfeited immediately upon such cessation or non-commencement, whether or not then exercisable.

If a participant ceases to be a director, officer or employee of the Company or a subsidiary for any reason other than death, disability, retirement or cause, (A) all of the participant's options and SARs that were exercisable on the date of such cessation will remain exercisable for, and will otherwise terminate at the end of, a period of 30 days after the date of such cessation, but in no event after the expiration date of the options or SARs; provided that the participant does not engage in Competition during such 30-day period.

20

If a consultant (i.e., a participant other than a director, officer or employee of the Company and any subsidiary) ceases to perform services for the Company and any subsidiary, the provisions set forth in such participant's award grant agreement will control the participant's right to exercise the award after the date of termination and until the scheduled expiration date of the award.

Change in Control

If there is a Change in Control of the Company (as defined in the 2004 Plan), all of the participant's options and SARs will become fully vested and exercisable upon such Change in Control and will remain so until the expiration date of the options or SARs, whether or not the grantee is subsequently terminated.

Certain Adjustments

In the event of a reorganization, recapitalization, stock split, stock dividend, combination of shares, merger, consolidation, distribution of assets, or any other change in the corporate structure or shares of the Company, the Committee will make such adjustment as it deems appropriate in the number and kind of shares available for issuance under the 2004 Plan (including, without limitation, the total number of shares available for issuance under the 2004 Plan), and in the number and kind of options, SARs and shares covered by grants previously made under the 2004 Plan, and in the exercise price of outstanding options and SARs. Any such adjustment will be final, conclusive and binding for all purposes of the 2004 Plan. In the event of any merger, consolidation or other reorganization in which the Company is not the surviving or continuing corporation or in which a Change in Control is to occur, all of the Company's obligations regarding options, SARs and restricted stock that were granted hereunder and that are outstanding on the date of such event will, on such terms as may be approved by the Committee prior to such event, be assumed by the surviving or continuing corporation or canceled in exchange for property (including cash).

Duration, Termination and Amendment of the 2004 Plan

The date of commencement of the 2004 Plan will be June 2, 2004, subject to approval by the shareholders of the Company. The 2004 Plan will terminate at the close of business on June 1, 2014. The termination of the 2004 Plan will not affect any of the rights or obligations of any person under any grant of options or other incentives granted under the 2004 Plan prior to its termination.

The Board of Directors or the Committee, without approval of the shareholders, may amend or terminate the 2004 Plan, except that no amendment will become effective without prior approval of the shareholders of the Company if shareholder approval would be required by applicable law or regulations, including if required for continued compliance with the performance-based compensation exception of Section 162(m) of the Code or any successor thereto, under the provisions of Section 422 of the Code or any successor thereto, or by any listing requirement of the principal stock exchange or Market on which the common stock is then listed.

Certain Federal Income Tax Consequences

The following is a brief summary of the federal income tax rules relevant to participants in the 2004 Plan based upon the Internal Revenue Code of 1986, as amended (the "Code"). These rules are highly technical and subject to change in the future. Because federal income tax consequences will vary as a result of individual circumstances, all participants in the 2004 Plan should consult their own tax advisors with regards to the tax consequences of participating in the 2004 Plan. Moreover, the following summary relates only to the participants federal income tax treatment, and the state, local and foreign tax consequences may be substantially different.

21

Non-Qualified Stock Options. The grant of an NSO (including any option that exceeds the limitations on ISOs described below) to an optionee will not be a taxable event. Accordingly, the optionee will not be subject to any income tax consequences with respect to an NSO until the option is exercised. Upon the exercise of an NSO, the optionee generally will recognize ordinary compensation income equal to the "spread" between the exercise price and the fair market value of the shares on the date of exercise. Generally, the Company will be entitled to a federal income tax deduction in the amount of the "spread" recognized by the optionee as ordinary compensation income.

On the delivery by an optionee of shares already owned by the optionee as payment for the exercise price of an NSO, the number of shares received on exercise of the option equal to the number of shares surrendered should be treated as received in a tax-free exchange with no resulting recognition of income to the optionee. Any additional shares the optionee receives on exercise of the option in excess of the number of shares surrendered should result in recognition by the optionee of ordinary compensation income in an amount equal to the fair market value of such shares. The tax basis of the shares received on surrender of the previously owned shares should equal the tax basis of the shares so surrendered, and the tax basis of the additional shares received should equal the amount recognized as ordinary compensation income by the optionee (i.e. the fair market value of such additional shares).

The payment by an optionee of the exercise price of an NSO by means of surrender of the existing option will result in the optionee recognizing ordinary compensation income on the "spread" between the exercise price of the option surrendered and the fair market value of the shares on the date of exercise. Generally, the Company will be entitled to a deduction in the amount of this "spread." The tax basis of the shares the optionee receives on exercise will be the fair market value of such shares on the date of exercise.

The amount and character (whether capital gain or ordinary compensation income, and whether long-term or short-term) of any gain or loss realized on a subsequent disposition of shares by the optionee generally will depend on, among other things, whether such disposition occurs before or after such common stock vests, whether an election under Code Section 83(b) with respect to such shares had been made, and the length of time such shares were held by the optionee.

The Company anticipates that the compensation deemed paid by the Company upon the exercise of NSOs will not have to be taken into account under Code Section 162(m) for purposes of the $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of the Company.