File No. 333-

As Filed With The Securities And Exchange Commission On March 12, 2021

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | ☒ |

Pre-Effective Amendment No.

Post-Effective Amendment No.

EQ Advisors Trust

(Exact Name of Registrant as Specified in Charter)

1290 Avenue of the Americas

New York, New York 10104

(Address of Principal Executive Offices)

(212) 314-5329

(Registrant’s Area Code and Telephone Number)

Steven M. Joenk

Equitable Investment Management Group, LLC

1290 Avenue of the Americas

New York, New York 10104

(Name and Address of Agent for Service)

With copies to:

| | |

William T. MacGregor, Esq. Equitable Investment Management Group, LLC 1290 Avenue of the Americas New York, New York 10104 | | Mark C. Amorosi, Esq. K&L Gates LLP 1601 K Street, N.W. Washington, DC 20006 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class IB and Class K shares of beneficial interest in the series of the Registrant designated as 1290 VT Natural Resources Portfolio, and Class IA and Class IB shares of beneficial interest in the series of the Registrant designated as EQ/Balanced Strategy Portfolio.

No filing fee is required because the registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File Nos. 333-17217 and 811-07953).

EQ ADVISORS TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

Cover Sheet

Contents of Registration Statement

Part A—Combined Proxy Statement and Prospectus

Part B—Statement of Additional Information

Part C—Other Information

Signature Page

Exhibits

EQUITABLE FINANCIAL LIFE INSURANCE COMPANY

1290 Avenue of the Americas

New York, New York 10104

April , 2021

Dear Contractholder:

Enclosed is a notice and Combined Proxy Statement and Prospectus relating to a Joint Special Meeting of Shareholders (the “Meeting”) of each of the following Portfolios:

| | • | | 1290 VT Energy Portfolio (“Energy Portfolio”) |

| | • | | EQ/Franklin Balanced Managed Volatility Portfolio (“Franklin Balanced Portfolio”) |

| | • | | EQ/Global Bond PLUS Portfolio (“Global Bond PLUS Portfolio”) |

(each, an “Acquired Portfolio” and together, the “Acquired Portfolios”).

The Board of Trustees (the “Board”) of EQ Advisors Trust (“EQ Trust”) has called the Meeting to request shareholder approval of the reorganization of each Acquired Portfolio into a corresponding series of EQ Trust or EQ Premier VIP Trust (“VIP Trust,” and together with EQ Trust, the “Trusts”) (each, an “Acquiring Portfolio” and together, the “Acquiring Portfolios”) (each, a “Reorganization”) as set forth below:

| | • | | the Energy Portfolio into the 1290 VT Natural Resources Portfolio (“Natural Resources Portfolio”), a series of EQ Trust |

| | • | | the Franklin Balanced Portfolio into the EQ/Balanced Strategy Portfolio (“Balanced Strategy Portfolio”), a series of EQ Trust |

| | • | | the Global Bond PLUS Portfolio into the EQ/Core Plus Bond Portfolio (“Core Plus Bond Portfolio”), a series of VIP Trust |

Due to COVID-19 health and safety concerns and restrictions, the Joint Special Meeting of Shareholders of the Acquired Portfolios (the “Meeting”) will be conducted by telephone only on June 4, 2021, at 10:00 a.m., Eastern time. Shareholders will not be able to attend the Meeting in person. To participate in the Meeting by telephone, shareholders eligible to vote at the meeting may dial, toll-free, +1 (646) 518-9605 and, at the prompt, enter the following conference ID: #.

At the Meeting, the shareholders of the Acquired Portfolios who are entitled to vote at the Meeting, with shareholders of each Acquired Portfolio voting separately, will be asked to approve the proposals described above.

As an owner of a variable life insurance policy and/or a variable annuity contract or certificate (a “Contract”) that participates in an Acquired Portfolio through the investment divisions of a separate account or accounts established by Equitable Financial Life Insurance Company (“Equitable Financial”) or another insurance company (each, an “Insurance Company), you (a “Contractholder”) are entitled to instruct the Insurance Company that issued your Contract how to vote the Acquired Portfolio shares related to your interest in those accounts as of the close of business on February 26, 2021. The Insurance Company that issued your Contract is the record owner of the Acquired Portfolio shares related to your interest in those accounts and may be referred to as a “shareholder.” The attached Notice of Joint Special Meeting of Shareholders and Combined Proxy Statement and Prospectus describe the matters to be considered at the Meeting. You should read the Combined Proxy Statement and Prospectus prior to completing your voting instruction card.

The Board of each respective Trust has approved the proposals and recommends that you vote “FOR” the proposal(s) relating to the Acquired Portfolio(s) in which you own shares. Although each Board has determined that a vote “FOR” each proposal is in the best interest of each Portfolio and its shareholders, the final decision is yours.

Each Acquired Portfolio and each Acquiring Portfolio is managed by Equitable Investment Management Group, LLC. Each of the Core Plus Bond Portfolio, Franklin Balanced Portfolio, Global Bond PLUS Portfolio and Natural Resources Portfolio is sub-advised by one or more investment sub-advisers. In each case, if the Reorganization involving an Acquired Portfolio is approved and implemented, each Contractholder that invests indirectly in the Acquired Portfolio will automatically become a Contractholder that invests indirectly in the corresponding Acquiring Portfolio.

You are cordially invited to attend the Meeting by telephone. Since it is important that your vote be represented whether or not you are able to attend by telephone, you are urged to consider these matters and to exercise your voting instructions by completing, dating, and signing the enclosed voting instruction card and returning it in the accompanying return envelope at your earliest convenience or by relaying your voting instructions via telephone or the Internet by following the enclosed instructions. For further information on how to instruct an Insurance Company, please see the Contractholder Voting Instructions included herein. We hope that you will be able to attend the Meeting by telephone, and if you wish, you may provide voting instructions at the Meeting, even though you may have already returned a voting instruction card or submitted your voting instructions via telephone or the Internet. Please respond promptly in order to save additional costs of proxy solicitation and in order to make sure you are represented.

|

Very truly yours, Steven M. Joenk Managing Director Equitable Financial Life Insurance Company |

EQ ADVISORS TRUST

1290 VT Energy Portfolio

EQ/Franklin Balanced Managed Volatility Portfolio

EQ/Global Bond PLUS Portfolio

1290 Avenue of the Americas

New York, New York 10104

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON

JUNE 4, 2021

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Joint Special Meeting of Shareholders of each of the following Portfolios, each of which is a series of EQ Advisors Trust (“EQ Trust”), will be conducted by telephone on June 4, 2021, at 10:00 a.m., Eastern time (the “Meeting”):

| | • | | 1290 VT Energy Portfolio (“Energy Portfolio”) |

| | • | | EQ/Franklin Balanced Managed Volatility Portfolio (“Franklin Balanced Portfolio”) |

| | • | | EQ/Global Bond PLUS Portfolio (“Global Bond PLUS Portfolio”) |

(each, an “Acquired Portfolio” and together, the “Acquired Portfolios”).

To participate in the Meeting by telephone, shareholders eligible to vote at the meeting may dial, toll-free, +1 (646) 518-9605 and, at the prompt, enter the following conference ID: #.

The Meeting will be held to act on the following proposals:

For shareholders of the Energy Portfolio only:

| | 1. | | To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the Energy Portfolio, a series of EQ Trust, into the 1290 VT Natural Resources Portfolio, a series of EQ Trust. |

For shareholders of the Franklin Balanced Portfolio only:

| | 2. | | To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the Franklin Balanced Portfolio, a series of EQ Trust, into the EQ/Balanced Strategy Portfolio, a series of EQ Trust. |

For shareholders of the Global Bond PLUS Portfolio only:

| | 3. | | To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the Global Bond PLUS Portfolio, a series of EQ Trust, into the EQ/Core Plus Bond Portfolio, a series of EQ Premier VIP Trust (“VIP Trust”). |

The Board of Trustees of each of EQ Trust and VIP Trust unanimously recommends that you vote in favor of the relevant proposal(s).

Please note that owners of variable life insurance policies and/or variable annuity contracts or certificates (the “Contractholders”) issued by Equitable Financial Life Insurance Company or another insurance company (each, an “Insurance Company) who have invested in shares of an Acquired Portfolio through the investment divisions of a separate account or accounts of an Insurance Company will be given the opportunity to provide the applicable Insurance Company with voting instructions on the above proposals.

i

You should read the Combined Proxy Statement and Prospectus attached to this notice prior to completing your proxy or voting instruction card. The record date for determining the number of shares outstanding, the shareholders entitled to vote, and the Contractholders entitled to provide voting instructions at the Meeting and any adjournments or postponements thereof has been fixed as the close of business on February 26, 2021. If you attend the Meeting by telephone, you may vote or provide your voting instructions at that time.

YOUR VOTE IS IMPORTANT

Please return your proxy card or voting instruction card promptly.

Regardless of whether you plan to attend the Meeting by telephone, you should vote or provide voting instructions by promptly completing, dating, and signing the enclosed proxy or voting instruction card and returning it in the enclosed postage-paid envelope. You also can vote or provide voting instructions through the Internet or by telephone using the 16-digit control number that appears on the enclosed proxy or voting instruction card and following the simple instructions. If you attend the Meeting by telephone, you may change your vote or voting instructions, if desired, at that time. The Board of each respective Trust recommends that you vote or provide voting instructions to vote “FOR” each relevant proposal.

|

By order of the Board of Trustees of EQ Trust, William MacGregor, Secretary |

Dated: April , 2021

New York, New York

ii

EQUITABLE FINANCIAL LIFE INSURANCE COMPANY

CONTRACTHOLDER VOTING INSTRUCTIONS

REGARDING A JOINT SPECIAL MEETING OF SHAREHOLDERS OF

1290 VT ENERGY PORTFOLIO

EQ/FRANKLIN BALANCED MANAGED VOLATILITY PORTFOLIO

EQ/GLOBAL BOND PLUS PORTFOLIO,

EACH A SERIES OF EQ ADVISORS TRUST

TO BE HELD ON JUNE 4, 2021

Dated: April , 2021

GENERAL

These Contractholder Voting Instructions are being furnished by Equitable Financial Life Insurance Company (“Equitable Financial”) or another insurance company (each, an “Insurance Company” and together, the “Insurance Companies”) to owners of its variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contractholders”) who, as of February 26, 2021 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of its separate account or accounts (the “Separate Accounts”) that are invested in shares of one or more of the following Portfolios, each of which is a series of EQ Advisors Trust (“EQ Trust”):

| | • | | 1290 VT Energy Portfolio (“Energy Portfolio”) |

| | • | | EQ/Franklin Balanced Managed Volatility Portfolio (“Franklin Balanced Portfolio”) |

| | • | | EQ/Global Bond PLUS Portfolio (“Global Bond PLUS Portfolio”) |

(each, an “Acquired Portfolio” and together, the “Acquired Portfolios”).

EQ Trust is a Delaware statutory trust that is registered with the Securities and Exchange Commission (the “SEC”) as an open-end management investment company.

Each Insurance Company will offer Contractholders the opportunity to instruct it, as the record owner of all of the shares of beneficial interest in an Acquired Portfolio (the “Shares”) held by its Separate Accounts, as to how it should vote on the respective reorganization proposals (the “Proposals”) that will be considered at the Joint Special Meeting of Shareholders of the Acquired Portfolios referred to in the preceding Notice and at any adjournments or postponements (the “Meeting”). The enclosed Combined Proxy Statement and Prospectus, which you should read and retain for future reference, sets forth concisely information about the proposed reorganization involving each Acquired Portfolio and the corresponding acquiring series of EQ Trust or EQ Premier VIP Trust (“VIP Trust,” and together with EQ Trust, the “Trusts”) that a Contractholder should know before completing the enclosed voting instruction card.

Equitable Financial is a wholly owned subsidiary of Equitable Holdings, Inc. (“Equitable Holdings”), which is a publicly-owned company. The principal offices of Equitable Financial and Equitable Holdings are located at 1290 Avenue of the Americas, New York, New York 10104.

These Contractholder Voting Instructions and the accompanying voting instruction card, together with the enclosed proxy materials, are being mailed to Contractholders on or about April , 2021.

HOW TO INSTRUCT AN INSURANCE COMPANY

To instruct an Insurance Company as to how to vote the Shares held in the investment divisions of its Separate Accounts, Contractholders are asked to promptly complete their voting instructions on the enclosed voting instruction card(s), sign and date the voting instruction card(s), and mail the voting instruction card(s) in the accompanying postage-paid envelope. Contractholders also may provide voting instructions by telephone at 1-866-298-8476 or by Internet at our website at www.proxy-direct.com.

iii

If a voting instruction card is not marked to indicate voting instructions but is signed and timely returned, it will be treated as an instruction to vote the Shares “FOR” the applicable Proposal.

The number of Shares held in the investment division of a Separate Account corresponding to the Acquired Portfolio for which a Contractholder may provide voting instructions was determined as of the Record Date by dividing (i) a Contract’s account value allocable to that investment division by (ii) the net asset value of one Share of the Acquired Portfolio. Each whole Share of an Acquired Portfolio is entitled to one vote as to each matter with respect to which it is entitled to vote and each fractional Share is entitled to a proportionate fractional vote. At any time prior to an Insurance Company’s voting at the Meeting, a Contractholder may revoke his or her voting instructions with respect to that investment division by providing the Insurance Company with a properly executed written revocation of such voting instructions, by properly executing later-dated voting instructions by a voting instruction card, telephone or the Internet, or by attending the Meeting by telephone and providing voting instructions at the Meeting.

HOW AN INSURANCE COMPANY WILL VOTE

An Insurance Company will vote the Shares for which it receives timely voting instructions from Contractholders in accordance with those instructions. Shares in each investment division of a Separate Account for which an Insurance Company receives a voting instruction card that is signed and timely returned but is not marked to indicate voting instructions will be treated as an instruction to vote the Shares “FOR” a Proposal. Shares in each investment division of a Separate Account for which an Insurance Company receives no timely voting instructions from Contractholders, or that are attributable to amounts retained by an Insurance Company as surplus or seed money, will be voted by the applicable Insurance Company either “FOR” or “AGAINST” a Proposal, or as an abstention, in the same proportion as the Shares for which Contractholders have provided voting instructions to the Insurance Company. As a result of such proportional voting by an Insurance Company, it is possible that a small number of Contractholders could determine whether a Proposal is approved.

OTHER MATTERS

The Insurance Companies are not aware of any matters, other than the specified Proposals, to be acted on at the Meeting. If any other matters come before the Meeting, an Insurance Company will vote the Shares upon such matters in its discretion. Voting instruction cards may be solicited by directors, officers and employees of Equitable Investment Management Group, LLC, the investment adviser of the Trusts, or its affiliates as well as officers and agents of EQ Trust. The principal solicitation will be by mail, but voting instructions may also be solicited by telephone, fax, personal interview, the Internet or other permissible means.

If the quorum necessary to transact business at the Meeting is not established with respect to an Acquired Portfolio, or the vote required to approve a Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments or postponements of the Meeting in accordance with applicable law to permit further solicitation of voting instructions. The persons named as proxies will vote in their discretion on any such adjournment or postponement.

It is important that your Contract be represented. Please promptly mark your voting instructions on the enclosed voting instruction card; then sign and date the voting instruction card and mail it in the accompanying postage-paid envelope. You may also provide your voting instructions by telephone at 1-866-298-8476 or by Internet at our website at www.proxy-direct.com.

iv

COMBINED PROXY STATEMENT

for

1290 VT Energy Portfolio

EQ/Franklin Balanced Managed Volatility Portfolio

EQ/Global Bond PLUS Portfolio,

each a series of EQ Advisors Trust

and

PROSPECTUS

for

1290 VT Natural Resources Portfolio

EQ/Balanced Strategy Portfolio,

each a series of EQ Advisors Trust (“EQ Trust”)

and

EQ/Core Plus Bond Portfolio,

a series of EQ Premier VIP Trust (“VIP Trust”)

Dated April , 2021

1290 Avenue of the Americas

New York, New York 10104

1-877-222-2144

This Combined Proxy Statement and Prospectus (the “Combined Proxy Statement/Prospectus”) is being furnished to owners (the “Contractholders”) of variable life insurance policies and/or variable annuity contracts or certificates (the “Contracts”) issued by Equitable Financial Life Insurance Company (“Equitable Financial”) or another insurance company (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of February 26, 2021, had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate account or accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in one or more the following Portfolios, each of which is a series of EQ Trust:

| | • | | 1290 VT Energy Portfolio (“Energy Portfolio”) |

| | • | | EQ/Franklin Balanced Managed Volatility Portfolio (“Franklin Balanced Portfolio”) |

| | • | | EQ/Global Bond PLUS Portfolio (“Global Bond PLUS Portfolio”) |

(each, an “Acquired Portfolio” and together, the “Acquired Portfolios”).

For a free copy of the related Statement of Additional Information dated April , 2021, please call 1-877-222-2144 or write EQ Trust or VIP Trust (together, the “Trusts”) at the address above.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS COMBINED PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

1

This Combined Proxy Statement/Prospectus relates to the solicitation by the Board of Trustees (the “Board”) of EQ Trust of proxies to be used at the Joint Special Meeting of Shareholders of the Acquired Portfolios to be conducted by telephone on June 4, 2021, at 10:00 a.m., Eastern time, or any adjournment or postponement thereof (the “Meeting”). To participate in the Meeting by telephone, shareholders eligible to vote at the Meeting may dial, toll-free, +1 (646) 518-9605 and, at the prompt, enter the following conference ID: #.

Each Trust is an open-end management investment company registered with the Securities and Exchange Commission (the “SEC”).

Contractholders are being provided the opportunity to instruct the applicable Insurance Company to approve or disapprove the proposals contained in this Combined Proxy Statement/Prospectus (each, a “Proposal”) in connection with the solicitation by the Board of EQ Trust of proxies for the Meeting. This Combined Proxy Statement/Prospectus also is being furnished to the Insurance Companies as the record owners of shares and to other shareholders (including retirement plan participants) that were invested in the Acquired Portfolios as of February 26, 2021.

The shareholders of each Acquired Portfolio will vote separately on its reorganization. The Proposals described in this Combined Proxy Statement/Prospectus are as follows:

| | |

| | |

| Proposals | | Shareholders Entitled to Vote on the Proposal |

| 1. To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the Energy Portfolio, a series of EQ Trust, into the 1290 VT Natural Resources Portfolio, a series of EQ Trust. | | Shareholders of the Energy Portfolio. |

| 2. To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the Franklin Balanced Portfolio, a series of EQ Trust, into the EQ/Balanced Strategy Portfolio, a series of EQ Trust. | | Shareholders of the Franklin Balanced Portfolio. |

| 3. To approve the Agreement and Plan of Reorganization and Termination with respect to the reorganization of the EQ/Global Bond PLUS Portfolio, a series of EQ Trust, into the EQ/Core Plus Bond Portfolio, a series of VIP Trust. | | Shareholders of the Global Bond PLUS Portfolio. |

| 4. To transact other business that may properly come before the Meeting or any adjournments thereof. | | Shareholders of each Acquired Portfolio, as applicable. |

Each reorganization referred to in Proposals 1-3 above is referred to herein as a “Reorganization” and together as the “Reorganizations.” Each of the 1290 VT Natural Resources Portfolio (“Natural Resources Portfolio”), EQ/Balanced Strategy Portfolio (“Balanced Strategy Portfolio”), and EQ/Core Plus Bond Portfolio (“Core Plus Bond Portfolio”) is referred to herein as an “Acquiring Portfolio” and together as the “Acquiring Portfolios.”

This Combined Proxy Statement/Prospectus, which you should read and retain for future reference, contains important information regarding the Proposals that you should know before voting or providing voting instructions.

Additional information about each Trust has been filed with the SEC and is available, without charge, upon oral or written request. Distribution of this Combined Proxy Statement/Prospectus and proxy or voting instruction card to the Insurance Companies and other shareholders and to Contractholders is scheduled to begin on or about April , 2021. This Combined Proxy Statement/Prospectus and a proxy or voting instruction card also will be available at www.proxy-direct.com on or about April , 2021. It is expected that one or more representatives of each Insurance Company will attend the Meeting by telephone or by proxy and will vote shares held by the Insurance Company and its affiliates in accordance with voting instructions received from its Contractholders and in accordance with voting procedures established by EQ Trust.

2

The Statement of Additional Information dated April , 2021, relating to the Reorganizations of the Energy Portfolio, Franklin Balanced Portfolio, and Global Bond PLUS Portfolio (File Nos. 333- and 333- ), which includes the financial statements for the fiscal year ended December 31, 2020, for the Acquired Portfolios and the Acquiring Portfolios, has been filed with the SEC and is incorporated by reference into this Combined Proxy Statement/Prospectus. For a free copy of this document, please call 1-877-222-2144 or write the Trusts at the address above.

Each Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, each Trust must file certain reports and other information with the SEC. Reports and other information about each Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov, and copies of this information may be obtained, after paying a duplicating fee, by electronic request at the following email address: publicinfo@sec.gov.

Copies of EQ Trust’s most recent annual and semi-annual reports, including financial statements, previously have been delivered to Contractholders. Contractholders may request additional copies of EQ Trust’s annual or semi-annual reports, free of charge, by writing to EQ Trust at 1290 Avenue of the Americas, New York, New York 10104 or by calling 1-877-522-5035.

3

TABLE OF CONTENTS

| | | | |

SUMMARY | | | 6 | |

PROPOSAL 1: TO APPROVE THE REORGANIZATION AGREEMENT WITH RESPECT TO THE REORGANIZATION OF THE ENERGY PORTFOLIO, A SERIES OF EQ TRUST, INTO THE NATURAL RESOURCES PORTFOLIO, A SERIES OF EQ TRUST. | | | 8 | |

Comparison of Principal Risk Factors | | | 12 | |

Comparative Fee and Expense Tables | | | 12 | |

Example of Portfolio Expenses | | | 13 | |

Portfolio Turnover | | | 14 | |

Comparison of Investment Objectives, Policies and Strategies | | | 14 | |

Comparative Performance Information | | | 16 | |

Capitalization | | | 18 | |

PROPOSAL 2: TO APPROVE THE REORGANIZATION AGREEMENT WITH RESPECT TO THE REORGANIZATION OF THE FRANKLIN BALANCED PORTFOLIO, A SERIES OF EQ TRUST, INTO THE BALANCED STRATEGY PORTFOLIO, A SERIES OF EQ TRUST. | | | 18 | |

Comparison of Principal Risk Factors | | | 23 | |

Comparative Fee and Expense Tables | | | 24 | |

Example of Portfolio Expenses | | | 24 | |

Portfolio Turnover | | | 25 | |

Comparison of Investment Objectives, Policies and Strategies | | | 25 | |

Comparative Performance Information | | | 28 | |

Capitalization | | | 30 | |

PROPOSAL 3: TO APPROVE THE REORGANIZATION AGREEMENT WITH RESPECT TO THE REORGANIZATION OF THE GLOBAL BOND PLUS PORTFOLIO, A SERIES OF EQ TRUST, INTO THE CORE PLUS BOND PORTFOLIO, A SERIES OF VIP TRUST. | | | 30 | |

Comparison of Principal Risk Factors | | | 35 | |

Comparative Fee and Expense Tables | | | 36 | |

Example of Portfolio Expenses | | | 37 | |

Portfolio Turnover | | | 38 | |

Comparison of Investment Objectives, Policies and Strategies | | | 38 | |

Comparative Performance Information | | | 41 | |

Capitalization | | | 42 | |

ADDITIONAL INFORMATION ABOUT THE REORGANIZATIONS | | | 43 | |

Terms of the Reorganization Agreements | | | 43 | |

Board Considerations | | | 44 | |

Potential Benefits of the Reorganizations to EIM and its Affiliates | | | 46 | |

Descriptions of Risk Factors | | | 47 | |

Federal Income Tax Consequences of the Reorganizations | | | 60 | |

Description of the Securities to Be Issued | | | 62 | |

ADDITIONAL INFORMATION ABOUT THE PORTFOLIOS | | | 64 | |

Management of EQ Trust and VIP Trust | | | 64 | |

EQ Trust | | | 64 | |

VIP Trust | | | 64 | |

The Adviser | | | 64 | |

The Sub-Advisers | | | 70 | |

Legal Proceedings | | | 74 | |

Portfolio Services | | | 74 | |

Portfolio Distribution Arrangements | | | 74 | |

Payments to Broker-Dealers and Other Financial Intermediaries | | | 75 | |

Buying and Selling Shares | | | 76 | |

How Portfolio Shares Are Priced | | | 78 | |

4

5

SUMMARY

You should read this entire Combined Proxy Statement/Prospectus carefully. For additional information, you should consult the applicable Agreement and Plan of Reorganization and Termination (each, a “Reorganization Agreement” and together, the “Reorganization Agreements”), copies of the forms of which are attached hereto as Appendix A.

The Proposed Reorganizations

This Combined Proxy Statement/Prospectus is soliciting shareholders with amounts invested in one or more Acquired Portfolios as of February 26, 2021, to approve the Reorganization Agreement (with respect to the Acquired Portfolio(s) in which they are invested), whereby each Acquired Portfolio will be reorganized into a corresponding Acquiring Portfolio, as described below. (Each Acquired Portfolio and each Acquiring Portfolio is sometimes referred to herein as a “Portfolio,” and together, the “Portfolios.”) Each Acquired Portfolio and each Acquiring Portfolio is managed by Equitable Investment Management Group, LLC (“EIM” or the “Adviser”).

Among the Acquired Portfolios’ shares, the Global Bond PLUS Portfolio has three classes of shares, designated Class IA, Class IB, and Class K shares, the Franklin Balanced Portfolio has two classes of shares, designated Class IA and Class IB shares, and the Energy Portfolio has two classes of shares, designated Class IB and Class K shares (together, the “Acquired Portfolio Shares”).

Among the Acquiring Portfolios’ shares, the Core Plus Bond Portfolio has three classes of shares, designated Class A, Class B, and Class K shares, the Balanced Strategy Portfolio has two classes of shares, designated Class IA and Class IB shares, and the Natural Resources Portfolio has two classes of shares, designated Class IB and Class K shares (together, the “Acquiring Portfolio Shares”). The rights and preferences of each class of Acquiring Portfolio Shares are substantially similar in all material respects to the rights and preferences of the corresponding class of Acquired Portfolio Shares.

Each Reorganization Agreement provides, with respect to a Reorganization, for:

| | • | | the transfer of all the assets of the Acquired Portfolio to the corresponding Acquiring Portfolio in exchange solely for Acquiring Portfolio Shares having an aggregate net asset value equal to the Acquired Portfolio’s net assets and the Acquiring Portfolio’s assumption of all the liabilities of the Acquired Portfolio; |

| | • | | the distribution to the shareholders (for the benefit of the Separate Accounts, as applicable, and thus the Contractholders) of those Acquiring Portfolio Shares (the shareholders of each Acquired Portfolio will receive shares of the same class or a corresponding class of the corresponding Acquiring Portfolio in accordance with the procedures provided for in the applicable Reorganization Agreement); and |

| | • | | the complete termination of the Acquired Portfolio. |

The Board of each Trust is proposing the Reorganizations because it believes that the Reorganizations will permit shareholders invested in the Acquired Portfolios, which have limited prospects for future growth and/or are relatively small and therefore have a limited ability to achieve economies of scale, to invest in the corresponding Acquiring Portfolios, which in each case will result in a larger combined portfolio with a similar or substantially similar investment objective that invests in a similar or substantially similar asset class or asset classes and has better prospects for attracting additional assets and lowering expenses. In the case of the proposed Reorganization of the Energy Portfolio, the total net annual operating expense ratio of each class of shares of the Acquiring Portfolio is expected to be the same as that of the corresponding class of shares of the Energy Portfolio (excluding tax expenses) for the one year after the proposed Reorganization; and in the case of the proposed Reorganizations of each of the Franklin Balanced Portfolio and the Global Bond PLUS Portfolio, the total net annual operating expense ratio of each class of shares of the Acquiring Portfolio is expected to be the same as or lower than that of the corresponding class of shares of the Acquired Portfolio for the one year after the proposed Reorganization. There is no assurance that fees and expenses will not increase after April 30, 2022, when the expense limitation arrangement for each Acquiring Portfolio will terminate if it is not renewed by the Adviser and the Board of the relevant Trust. Each Acquiring Portfolio, except for the Core Plus Bond Portfolio, currently has a lower total annual operating expense ratio than its corresponding Acquired Portfolio, regardless of whether an expense limitation arrangement is in effect.

6

For a more detailed comparison of the fees and expenses of the Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Portfolios” below. As further described in “Potential Benefits of the Reorganizations to EIM and its Affiliates” below, the Portfolios’ Adviser may realize benefits in connection with the Reorganizations, such as the reduction or elimination of its obligations to waive or reimburse fees and expenses if an Acquiring Portfolio is below its expense limit or has a lower expense ratio. For a detailed description of the Boards’ reasons for proposing the Reorganizations, see “Additional Information about the Reorganizations — Board Considerations” below.

A comparison of the investment objectives, policies, strategies and principal risks of each Acquired Portfolio and its corresponding Acquiring Portfolio is included in “Comparison of Investment Objectives, Policies and Strategies” and “Comparison of Principal Risk Factors” below.

Each Acquired Portfolio and its corresponding Acquiring Portfolio have identical purchase and redemption procedures, distribution procedures, and exchange rights. Each Portfolio offers its shares to Separate Accounts and certain other eligible investors. Shares of each Portfolio are purchased and redeemed at their net asset value without any sales load. You will not incur any sales loads or similar transaction charges as a result of a Reorganization. Each Portfolio has no minimum initial or subsequent investment requirements. Shares of each Portfolio are redeemable on any business day (normally any day on which the New York Stock Exchange is open) upon receipt of a request. All redemption requests will be processed and payment with respect thereto will normally be made within seven days after tender. Each Portfolio generally distributes most or all of its net investment income and net realized gains, if any, annually. Dividends and other distributions by each Portfolio are automatically reinvested at net asset value in shares of the distributing class of the Portfolio. For a more detailed description of the purchase and redemption procedures, distribution procedures, and exchange rights, please see “Additional Information about the Portfolios” below.

Subject to shareholder approval, the Reorganizations are expected to be effective at the close of business on June 18, 2021, or on a later date each Trust decides upon (the “Closing Date”). As a result of each Reorganization, each shareholder that owns shares of an Acquired Portfolio would become an owner of shares of the corresponding Acquiring Portfolio. Each such shareholder would hold, immediately after the Closing Date, shares of the same class or a corresponding class of the applicable Acquiring Portfolio (as shown in the table below) having an aggregate net asset value equal to the aggregate net asset value of shares of the class of the Acquired Portfolio that were held by the shareholder as of the Closing Date. Similarly, each Contractholder whose Contract values are invested in shares of an Acquired Portfolio would become an indirect owner of shares of the corresponding Acquiring Portfolio. Each such Contractholder would indirectly hold, immediately after the Closing Date, shares of the same class or a corresponding class of the applicable Acquiring Portfolio (as shown in the table below) having an aggregate net asset value equal to the aggregate net asset value of shares of the class of the Acquired Portfolio that were indirectly held by the Contractholder as of the Closing Date.

| | |

Acquired Portfolio/Class of Shares | | Acquiring Portfolio/Class of Shares |

Energy Portfolio/Class IB Energy Portfolio/Class K | | Natural Resources Portfolio/Class IB Natural Resources Portfolio/Class K |

Franklin Balanced Portfolio/Class IA Franklin Balanced Portfolio/Class IB | | Balanced Strategy Portfolio/Class IA Balanced Strategy Portfolio/Class IB |

Global Bond PLUS Portfolio/Class IA* Global Bond PLUS Portfolio/Class IB** Global Bond PLUS Portfolio/Class K | | Core Plus Bond Portfolio/Class A* Core Plus Bond Portfolio/Class B** Core Plus Bond Portfolio/Class K |

| * | | The rights and preferences of Class A of Acquiring Portfolio Shares are substantially similar in all material respects to the rights and preferences of Class IA of Acquired Portfolio Shares. In addition, Class A of Acquiring Portfolio Shares and Class IA of Acquired Portfolio Shares are each subject to a 0.25% Rule 12b-1 fee. |

| ** | | The rights and preferences of Class B of Acquiring Portfolio Shares are substantially similar in all material respects to the rights and preferences of Class IB of Acquired Portfolio Shares. In addition, Class B of Acquiring Portfolio Shares and Class IB of Acquired Portfolio Shares are each subject to a 0.25% Rule 12b-1 fee. |

It is anticipated that the Reorganization of the Energy Portfolio into the Natural Resources Portfolio, and the Reorganization of the Franklin Balanced Portfolio into the Balanced Strategy Portfolio will not qualify, for

7

federal income tax purposes, as tax-free reorganizations, and each such Reorganization will be treated as a taxable transaction. The Reorganization of the Global Bond PLUS Portfolio into the Core Plus Bond Portfolio is intended to qualify, for federal income tax purposes, as a tax-free reorganization, and the Global Bond PLUS Portfolio will receive a legal opinion to that effect. Contractholders who had premiums or contributions allocated to the investment divisions of the Separate Accounts that are invested in Acquired Portfolio shares will not recognize any gain or loss as a result of the Reorganizations, whether such Reorganizations are taxable or tax-free. Please see “Additional Information about the Reorganizations — Federal Income Tax Consequences of the Reorganizations” below for further information.

The Board of each respective Trust has unanimously approved the applicable Reorganization Agreement with respect to each Acquired Portfolio and each Acquiring Portfolio, respectively. Accordingly, the Board of EQ Trust is submitting each Reorganization Agreement for approval by each Acquired Portfolio’s shareholders. In considering whether to approve the Proposals, you should review the discussion of the Proposals set forth below. In addition, you should review the information in this Combined Proxy Statement/Prospectus that relates to each Proposal and Reorganization Agreement generally. The Board of each respective Trust recommends that you vote “FOR” the relevant Proposal(s) to approve the Reorganization Agreement(s).

PROPOSAL 1: TO APPROVE THE REORGANIZATION AGREEMENT WITH RESPECT TO THE REORGANIZATION OF THE ENERGY PORTFOLIO, A SERIES OF EQ TRUST, INTO THE NATURAL RESOURCES PORTFOLIO, A SERIES OF EQ TRUST.

This Proposal 1 requests your approval of a Reorganization Agreement pursuant to which the Energy Portfolio will be reorganized into the Natural Resources Portfolio. In considering whether you should approve the Proposal, you should note that:

| | • | | The Portfolios have substantially the same investment objectives. The Energy Portfolio seeks long-term capital appreciation. The Natural Resources Portfolio seeks to achieve long-term growth of capital. Although the Portfolios’ investment objectives are stated differently, the investment objectives do not differ materially. |

| | • | | Each Portfolio provides significant exposure to the energy sector and invests (either directly or indirectly, as described below) primarily in equity securities. Each Portfolio also may invest (either directly or indirectly, as described below) in securities of domestic and foreign issuers. |

| | • | | There are, however, differences between the two Portfolios’ principal investment policies and strategies of which you should be aware. These are set forth immediately below. For a detailed comparison of the Portfolios’ investment policies and strategies, see “Comparison of Investment Objectives, Policies and Strategies” below. |

| | • | | The Energy Portfolio operates under a “fund-of-funds” structure and invests in securities and other instruments indirectly, though investments in Underlying ETFs (as defined below). The Energy Portfolio, under normal market conditions, invests at least 80% of its net assets, plus borrowings for investment purposes, in securities of companies in the energy sector through investments in exchange-traded securities of other investment companies and investment vehicles (“Underlying ETFs”). The energy sector includes companies engaged in such activities as exploring, developing, mining, refining, producing, distributing, transporting, and dealing in conventional and alternative sources of energy; making and servicing component products for such activities; and energy research and development. The Energy Portfolio invests its assets in ETFs in accordance with weightings determined by EIM. The Energy Portfolio intends to invest, through Underlying ETFs, approximately 90% of its assets in U.S. securities and 10% of its assets in foreign securities, including securities of companies in emerging market countries. |

| | • | | In selecting the Underlying ETFs, the Adviser seeks to construct a diversified portfolio of ETFs that use a variety of indexing methodologies within the energy sector. Individual ETF weights are based on a variety of factors, including the Underlying ETF’s exposure to the desired energy industry or geographic region, investment objective(s), total return, portfolio holdings, volatility, expenses and liquidity. |

8

| | • | | In general, each of the Underlying ETFs in which the Energy Portfolio invests is an index-based ETF designed so that its performance, before fees and expenses, will correspond closely with that of the index it tracks. |

| | • | | The Energy Portfolio concentrates its investments in companies engaged in activities in the energy group of industries. |

| | • | | The Natural Resources Portfolio invests in securities and other instruments directly. The Natural Resources Portfolio, under normal circumstances, invests at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of domestic and foreign companies within the natural resources sector or in other securities or instruments the value of which is related to the market value of some natural resources asset. The Portfolio normally invests in companies that are involved directly or indirectly in the exploration, development, production or distribution of natural resources. This includes companies that provide services that use, or may benefit from, developments in the natural resources sector or companies that develop, design or provide products and services significant to a country’s or region’s infrastructure and its future evolution. For these purposes “natural resources” generally include: energy (such as utilities, producers/developers, refiners, service/drilling), alternative energy (such as hydrogen, wind, solar), industrial products (such as building materials, cement, packaging, chemicals, supporting transport and machinery), forest products (such as lumber, pulp, paper), base metals (such as aluminum, copper, nickel, zinc, iron ore and steel), precious metals and minerals (such as gold, silver, diamonds), and agricultural products (grains and other foods, seeds, fertilizers, water). |

| | • | | The Natural Resources Portfolio may invest in the securities of companies in the energy sector (for example, the Natural Resources Portfolio had approximately 48% and 51% of its net assets invested in the securities of companies in the energy sector as of September 30, 2020 and January 31, 2021, respectively); however, its exposure to investments in the energy sector generally is more limited than the Energy Portfolio (which had approximately 85% and 88% of its net assets invested in the energy sector as of September 30, 2020 and January 31, 2021, respectively). |

| | • | | Unlike the Energy Portfolio, the Natural Resources Portfolio is non-diversified, which means that it may invest a greater portion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified portfolio. |

| | • | | The Natural Resources Portfolio seeks to track the performance, before fees and expenses, of the MSCI World Commodity Producers Index with minimal tracking error. This strategy is commonly referred to as an indexing strategy. Generally, the Natural Resources Portfolio uses a full replication technique, although in certain instances a sampling approach may be utilized for a portion of the Portfolio. The Portfolio also may invest in other instruments (such as ETFs) that provide comparable exposure as the index without buying the underlying securities comprising the index. |

| | • | | The Natural Resources Portfolio concentrates its investments in the natural resources group of industries. |

| | • | | Each Portfolio’s principal risks include equity risk, energy sector risk, ETFs risk, foreign securities risk (including currency risk and emerging markets risk), market risk, natural resources sector risk, portfolio management risk, sector risk, and securities lending risk. The Energy Portfolio also is subject to commodity risk, large-cap company risk, mid-cap, small-cap and micro-cap company risk, and oil and gas sector risk as principal risks, while the Natural Resources Portfolio generally is not. The Natural Resources Portfolio also is subject to derivatives risk, index strategy risk, large shareholder risk, liquidity risk, and non-diversified portfolio risk as principal risks, while the Energy Portfolio generally is not. To the extent the Natural Resources Portfolio generally will invest a greater percentage of its assets in the natural resources sector and a lesser percentage of its assets in the energy sector than the Energy |

9

| | Portfolio, its risk profile will differ from that of the Energy Portfolio with respect to the degree of risk associated with those investments. For a detailed comparison of the Portfolios’ principal risks, see “Comparison of Principal Risk Factors” below. |

| | • | | EIM serves as the investment adviser and administrator for both Portfolios. EIM does not currently employ a sub-adviser for the Energy Portfolio. Subject to EIM’s oversight, AllianceBernstein L.P. (“AllianceBernstein” or the “Sub-Adviser”), an affiliate of EIM, currently serves as the sub-adviser to the Natural Resources Portfolio. EIM will advise and administer, and it is anticipated that AllianceBernstein will continue to sub-advise, the Natural Resources Portfolio after the Reorganization. |

| | • | | EIM has been granted relief by the SEC to hire, terminate and replace sub-advisers and amend sub-advisory agreements subject to the approval of the Board of Trustees and without obtaining shareholder approval. However, EIM may not enter into a sub-advisory agreement on behalf of a Portfolio with an “affiliated person” of EIM, such as AllianceBernstein, unless the sub-advisory agreement, including compensation, is approved by the Portfolio’s shareholders. For a detailed description of the Adviser and the Sub-Adviser to the Natural Resources Portfolio, please see “Additional Information about the Portfolios — The Adviser” and “ — The Sub-Adviser” below. |

| | • | | The Energy Portfolio and the Natural Resources Portfolio had net assets of approximately $4.6 million and $13.4 million, respectively, as of January 31, 2021. Thus, if the Reorganization of the Energy Portfolio into the Natural Resources Portfolio had been in effect on that date, the combined Portfolio would have had net assets of approximately $18.0 million. |

| | • | | As shown in the “Summary” above, the shareholders of Class IB and Class K of the Energy Portfolio will receive Class IB and Class K shares, respectively, of the Natural Resources Portfolio pursuant to the Reorganization. Shareholders will not pay any sales charges in connection with the Reorganization. Please see “Comparative Fee and Expense Tables,” “Additional Information about the Reorganizations” and “Additional Information about the Portfolios” below for more information. |

| | • | | It is estimated that the total net annual operating expense ratios for the Natural Resources Portfolio’s Class IB and Class K shares for the fiscal year following the Reorganization will be 0.90% and 0.65%, respectively, which are the same as the total net annual operating expense ratios (including acquired fund fees and expenses) for the Energy Portfolio’s Class IB and Class K shares for the fiscal year ended December 31, 2020, which were 0.90% and 0.65% (excluding tax expenses), respectively. For a more detailed comparison of the fees and expenses of the Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Portfolios” below. There is no assurance that fees and expenses would not increase after April 30, 2022, when the expense limitation arrangement (described below) for the Natural Resources Portfolio would terminate if it is not renewed by EIM and the Board of Trustees. |

| | • | | The Portfolios are subject to the same advisory fee schedule. The maximum advisory fee for each Portfolio is equal to an annual rate of 0.50% of its average daily net assets. |

| | • | | The Portfolios are subject to the same administration fee schedule. In addition to the advisory fee, each Portfolio pays EIM its proportionate share of an asset-based administration fee, subject to a minimum annual fee of $30,000. For purposes of calculating the asset-based administration fee, the assets of the Portfolios and multiple other “single-advised” portfolios of EQ Trust (together, the “Single-Advised Portfolios”), all of which are managed by EIM, are aggregated together. The asset-based administration fee is equal to an annual rate of 0.100% of the first $30 billion of the aggregate average daily net assets of the Single-Advised Portfolios; 0.0975% on the next $10 billion; 0.0950% on the next $5 billion; and 0.0775% thereafter. A complete list of the Single-Advised Portfolios is provided in “Additional Information about the Portfolios — Management and Administrative Fees” below. |

| | • | | The Portfolios are subject to substantially similar expense limitation arrangements. |

| | • | | Pursuant to a contract, EIM has agreed to make payments or waive its management, administrative and other fees to limit the expenses of the Energy Portfolio through April 30, 2022 |

10

| | (unless the Board of Trustees consents to an earlier revision or termination of this arrangement) so that the annual operating expenses (including acquired fund fees and expenses) of the Portfolio (other than interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, other expenditures that are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Portfolio’s business) do not exceed an annual rate of average daily net assets of 0.90% for Class IB shares and 0.65% for Class K shares of the Portfolio. |

| | • | | Pursuant to a contract, EIM has agreed to make payments or waive its management, administrative and other fees to limit the expenses of the Natural Resources Portfolio through April 30, 2022 (unless the Board of Trustees consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Portfolio (other than interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses on securities sold short, other expenditures that are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Portfolio’s business) do not exceed an annual rate of average daily net assets of 0.90% for Class IB shares and 0.65% for Class K shares of the Portfolio. |

| | • | | The only difference between the Portfolios’ expense limitation arrangements is that, unlike the Energy Portfolio’s contractual expense caps, the Natural Resources Portfolio’s contractual expense caps exclude acquired fund fees and expenses, meaning that any such expenses may cause the Natural Resources Portfolio’s annual operating expenses to exceed its contractual expense caps. Although it is currently expected that the Natural Resources Portfolio will invest in other investment companies (i.e., “acquired funds,” such as ETFs) only to a limited extent, if at all, if Proposal 1 is approved, EIM has undertaken to amend the contractual expense limitation arrangement with respect to the Natural Resources Portfolio so that the contractual expense caps for the Natural Resources Portfolio referred to above would include (rather than exclude) acquired fund fees and expenses through April 30, 2022. |

| | • | | The Class IB shares of the Portfolios are each subject to a Rule 12b-1 fee equal to an annual rate of 0.25% of the average daily net assets of the share class. |

| | • | | For a more detailed description of the fees and expenses of the Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Portfolios” below. |

| | • | | The Class IB and Class K shares of the Natural Resources Portfolio outperformed compared to the Class IB and Class K shares of the Energy Portfolio for the one-year, five-year and since inception periods ended December 31, 2020. Please see “Comparative Performance Information” below. |

| | • | | Following the Reorganization, it is anticipated that EIM will redeem shares that it holds in the combined Portfolio representing seed capital it has previously invested. The withdrawal of such seed capital is not expected to have a material effect on the annual operating expenses of the combined Portfolio. |

| | • | | Following the Reorganization, the combined Portfolio will be managed in accordance with the investment objective, policies and strategies of the Natural Resources Portfolio. It is not expected that the Natural Resources Portfolio will revise any of its investment policies following the Reorganization to reflect those of the Energy Portfolio. If the Reorganization is approved, all of the Energy Portfolio’s assets (“Transferred Assets”) on the Closing Date will be transferred to the Natural Resources Portfolio. However, it is anticipated that immediately prior to the Closing Date, the Energy Portfolio will liquidate substantially all of its securities holdings and hold cash. Therefore, it is anticipated that the Transferred Assets will consist of cash. The sale of portfolio holdings by the Energy Portfolio in connection with the Reorganization may result in the Energy Portfolio selling securities at a disadvantageous time and price and could result in its realizing gains (or losses) that would not otherwise have been realized and its (and indirectly its investors) incurring transaction costs that would not otherwise have been incurred. Such transaction costs could be significant, but EIM intends to implement the Reorganization in a manner that would minimize such costs, to the extent practicable, and believes that such costs would be reasonable in relation to the anticipated benefits of the Reorganization. It is also expected that, over time, the Natural |

11

| | Resources Portfolio will use the Transferred Assets to invest in equity securities, as well as other investments, consistent with its principal investment strategy. Contractholders will not recognize any gain or loss for federal income tax purposes as a result of the Reorganization. |

| | • | | Expenses of the Reorganization are estimated to be $9,500 (excluding portfolio transaction costs) and will be borne by the Energy Portfolio. However, to the extent that the Reorganization expenses exceed the Energy Portfolio’s expense limitation set forth in its expense limitation arrangement, these expenses will be paid by EIM. |

Comparison of Principal Risk Factors

An investment in a Portfolio is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The value of your investment may fall, sometimes sharply, and you could lose money by investing in a Portfolio. There can be no assurance that a Portfolio will achieve its investment objective.

The following table compares the principal risks of an investment in each Portfolio. For ease of comparison, the principal risks are listed alphabetically, but for each Portfolio, the most significant principal risks as of the date of this Combined Proxy Statement/Prospectus are indicated with an asterisk (*). For an explanation of each risk, see “Additional Information about the Reorganizations — Descriptions of Risk Factors” below. The Energy Portfolio is also subject to the risks associated with the Underlying ETFs’ investments; please see the “Information Regarding the Underlying Portfolios and Underlying ETFs” in Appendix C for additional information about these risks.

| | | | | | | | |

Risks | | Natural Resources Portfolio | | | Energy Portfolio | |

Commodity Risk | | | | | | | X | |

Derivatives Risk | | | X | | | | | |

Energy Sector Risk | | | X | * | | | X | * |

Equity Risk | | | X | | | | X | * |

ETFs Risk/Risks Related to Investments in Underlying ETFs | | | X | | | | X | * |

Foreign Securities Risk | | | X | * | | | X | * |

Currency Risk | | | X | | | | X | |

Emerging Markets Risk | | | X | | | | X | |

Index Strategy Risk | | | X | * | | | | |

Large-Cap Company Risk | | | | | | | X | |

Large Shareholder Risk | | | X | | | | | |

Liquidity Risk | | | X | | | | | |

Market Risk | | | X | | | | X | |

Mid-Cap, Small-Cap and Micro-Cap Company Risk | | | | | | | X | * |

Natural Resources Sector Risk | | | X | * | | | X | |

Non-Diversified Portfolio Risk | | | X | * | | | | |

Oil and Gas Sector Risk | | | | | | | X | |

Portfolio Management Risk | | | X | | | | X | |

Sector Risk | | | X | | | | X | |

Securities Lending Risk | | | X | | | | X | |

Comparative Fee and Expense Tables

The following tables show the fees and expenses of the Class IB Shares and Class K Shares of the Energy Portfolio and the Class IB Shares and Class K Shares of the Natural Resources Portfolio and the estimated pro forma fees and expenses of the Class IB Shares and Class K Shares of the Natural Resources Portfolio after giving effect to the proposed Reorganization. Fees and expenses for each Portfolio are based on those incurred by the relevant class of its shares for the fiscal year ended December 31, 2020. The pro forma fees and expenses of the Natural Resources Portfolio shares assume that the Reorganization was in effect for the year ended December 31, 2020. The tables below do not reflect any Contract-related fees and expenses, which would increase overall fees and expenses. See a Contract prospectus for a description of those fees and expenses.

12

Shareholder Fees

(fees paid directly from your investment)

| | | | |

Energy Portfolio | | Natural Resources Portfolio | | Pro Forma Natural Resources Portfolio (assuming the

Reorganization is approved) |

Not Applicable. | | Not Applicable. | | Not Applicable. |

Annual Operating Expenses

(expenses that you may pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Energy Portfolio | | | Natural Resources

Portfolio | | | Pro Forma Natural

Resources Portfolio (assuming the

Reorganization is approved)** | |

| | | Class IB | | | Class K | | | Class IB | | | Class K | | | Class IB | | | Class K | |

Management Fee | | | 0.50% | | | | 0.50% | | | | 0.50% | | | | 0.50% | | | | 0.50% | | | | 0.50% | |

Distribution and/or Service Fees (12b-1 fees) | | | 0.25% | | | | 0.00% | | | | 0.25% | | | | 0.00% | | | | 0.25% | | | | 0.00% | |

Other Expenses | | | 3.28% | * | | | 2.45% | * | | | 1.27% | | | | 1.19% | | | | 1.15% | | | | 1.15% | |

Acquired Fund Fees and Expenses | | | 0.34% | | | | 0.34% | | | | 0.00% | | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Total Annual Portfolio Operating Expenses | | | 4.37% | | | | 3.29% | | | | 2.02% | | | | 1.69% | | | | 1.90% | | | | 1.65% | |

Fee Waiver and/or Expense Reimbursement | | | (3.44 | )%† | | | (2.61 | )%† | | | (1.12 | )%† | | | (1.04 | )%† | | | (1.00 | )%† | | | (1.00 | )%† |

Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement | | | 0.93% | | | | 0.68% | | | | 0.90% | | | | 0.65% | | | | 0.90% | | | | 0.65% | |

| † | | Pursuant to a contract, EIM has agreed to make payments or waive its management, administrative and other fees to limit the expenses of (1) the Energy Portfolio through April 30, 2022 (unless the Board of Trustees consents to an earlier revision or termination of the arrangement) so that the annual operating expenses (including acquired fund fees and expenses) of the Portfolio (exclusive of taxes, interest, brokerage commissions, dividend and interest expenses on securities sold short, capitalized expenses, and extraordinary expenses not incurred in the ordinary course of the Portfolio’s business) do not exceed 0.90% for Class IB shares and 0.65% for Class K shares of the Portfolio, and (2) the Natural Resources Portfolio through April 30, 2022 (unless the Board of Trustees consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Portfolio (exclusive of taxes, interest, brokerage commissions, dividend and interest expenses on securities sold short, capitalized expenses, acquired fund fees and expenses, and extraordinary expenses not incurred in the ordinary course of the Portfolio’s business) do not exceed 0.90% for Class IB shares and 0.65% for Class K shares of the Portfolio. If Proposal 1 is approved, EIM has undertaken to amend the contractual expense limitation arrangement with respect to the Natural Resources Portfolio so that the annual expense limits for the Natural Resources Portfolio referred to in clause (2) above would include (rather than exclude) acquired fund fees and expenses through April 30, 2022. The expense limitation agreements may be terminated by EIM at any time after April 30, 2022. EIM may be reimbursed the amount of any such payments or waivers made after June 30, 2020, in the future provided that the payments or waivers are reimbursed within three years of the payments or waivers being recorded and a Portfolio’s expense ratio, after the reimbursement is taken into account, does not exceed the Portfolio’s expense cap at the time of the waiver or the Portfolio’s expense cap at the time of the reimbursement, whichever is lower. If the Acquired Portfolio is reorganized, EIM will forgo the recoupment of any amounts waived or reimbursed with respect to the Acquired Portfolio prior to its Reorganization. |

| * | | Includes Tax Expense of 0.03% for Class IB shares and Class K shares of the Energy Portfolio. |

| ** | | Pro forma annual operating expenses have been adjusted to reflect the anticipated withdrawal of seed capital by EIM and/or its affiliates from the combined Portfolio subsequent to the Reorganization. |

Example of Portfolio Expenses

This example is intended to help you compare the costs of investing in the Portfolios with the cost of investing in other investment options. The example assumes that:

| | • | | You invest $10,000 in a Portfolio for the time periods indicated; |

| | • | | Your investment has a 5% return each year; |

| | • | | The Portfolio’s operating expenses remain the same; and |

| | • | | The expense limitation arrangement with respect to the Portfolio is not renewed. |

13

This example does not reflect any Contract-related fees and expenses, including redemption fees (if any) at the Contract level. If such fees and expenses were reflected, the total expenses would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | |

| | | 1

Year | | | 3

Years | | | 5

Years | | | 10

Years | |

Energy Portfolio | | | | | | | | | | | | | | | | |

Class IB | | $ | 95 | | | $ | 1.010 | | | $ | 1,937 | | | $ | 4,306 | |

Class K | | $ | 69 | | | $ | 768 | | | $ | 1,490 | | | $ | 3,407 | |

Natural Resources Portfolio | | | | | | | | | | | | | | | | |

Class IB | | $ | 92 | | | $ | 525 | | | $ | 984 | | | $ | 2,258 | |

Class K | | $ | 66 | | | $ | 431 | | | $ | 820 | | | $ | 1,911 | |

Pro Forma Natural Resources Portfolio (assuming the Reorganization is approved) | | | | | | | | | | | | | | | | |

Class IB | | $ | 92 | | | $ | 500 | | | $ | 933 | | | $ | 2,141 | |

Class K | | $ | 66 | | | $ | 422 | | | $ | 803 | | | $ | 1,870 | |

Portfolio Turnover

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Portfolio’s performance. During the fiscal year ended December 31, 2020, the portfolio turnover rates for each of the Energy Portfolio and the Natural Resources Portfolio were 55% and 15%, respectively, of the average value of the Portfolio.

Comparison of Investment Objectives, Policies and Strategies

The following table compares the investment objectives and principal investment policies and strategies of the Energy Portfolio with those of the Natural Resources Portfolio. The Board of EQ Trust may change the investment objective of a Portfolio without a vote of that Portfolio’s shareholders. For more detailed information about each Portfolio’s investment strategies and risks, see Appendix B.

| | |

Acquiring Portfolio | | Acquired Portfolio |

Natural Resources Portfolio | | Energy Portfolio |

| Investment Objective | | Investment Objective |

| |

| Seeks to achieve long-term growth of capital. | | Seeks long-term capital appreciation. |

| |

| Principal Investment Strategies | | Principal Investment Strategies |

| |

| Under normal circumstances, the Portfolio invests at least 80% of its net assets, plus borrowings for investment purposes, in equity securities of domestic and foreign companies within the natural resources sector or in other securities or instruments the value of which is related to the market value of some natural resources asset. | | Under normal market conditions, the Portfolio invests at least 80% of its net assets, plus borrowings for investment purposes, in securities of companies in the energy sector through investments in exchange-traded securities of other investment companies and investment vehicles (“exchange-traded funds” or “ETFs”). The ETFs in which the Portfolio may invest are referred to herein as the “Underlying ETFs.” The Portfolio may invest in ETFs that invest in equity securities of companies of any size in developed and emerging markets throughout the world. |

| |

| Such equity securities may include common stocks, preferred stocks, depositary receipts, rights and warrants. | | No corresponding strategy. |

14

| | |

Acquiring Portfolio | | Acquired Portfolio |

Natural Resources Portfolio | | Energy Portfolio |

| The Portfolio normally invests in companies that are involved directly or indirectly in the exploration, development, production or distribution of natural resources. This includes companies that provide services that use, or may benefit from, developments in the natural resources sector or companies that develop, design or provide products and services significant to a country’s or region’s infrastructure and its future evolution. For these purposes “natural resources” generally include: energy (such as utilities, producers/developers, refiners, service/drilling), alternative energy (such as hydrogen, wind, solar), industrial products (such as building materials, cement, packaging, chemicals, supporting transport and machinery), forest products (such as lumber, pulp, paper), base metals (such as aluminum, copper, nickel, zinc, iron ore and steel), precious metals and minerals (such as gold, silver, diamonds), and agricultural products (grains and other foods, seeds, fertilizers, water). | | The energy sector includes companies engaged in such activities as exploring, developing, mining, refining, producing, distributing, transporting, and dealing in conventional and alternative sources of energy; making and servicing component products for such activities; and energy research and development. |

| |

| No corresponding strategy. | | The Portfolio invests its assets in ETFs in accordance with weightings determined by EIM, the Portfolio’s investment manager. |

| |

| No corresponding strategy. | | The Adviser uses a two-stage allocation process to create an investment portfolio of ETFs for the Portfolio. |

| |

| No corresponding strategy. | | The first stage involves a strategic allocation that is intended to achieve a desired risk/return profile for the Portfolio, while providing broad exposure to the energy sector. In this stage, the Adviser decides what portion of the Portfolio’s assets should be invested in various industries within the energy sector and in which geographic regions based on an evaluation of the potential return characteristics and risks of the particular energy industries and geographic regions. |

| |

| No corresponding strategy. | | Currently, the Portfolio intends to invest (through ETFs) approximately 90% of its assets in traditional energy industries (e.g., oil and gas) and 10% of its assets in alternative energy industries (e.g., solar and wind). The Portfolio also intends to invest (through ETFs) approximately 90% of its assets in U.S. securities and 10% of its assets in foreign securities, including securities of companies in emerging market countries. These percentages can deviate by up to 15% of the Portfolio’s assets. The Adviser may adjust these strategic allocations from time to time. |

| |

| No corresponding strategy. | | The second stage of this process involves the selection of Underlying ETFs to provide exposure to the energy industries and geographic regions identified as a result of the first stage of the investment process. The Adviser seeks to select a combination of Underlying ETFs that together provide the targeted energy industry and geographic exposure for the Portfolio. |

| |

| No corresponding strategy. | | In selecting the Underlying ETFs, the Adviser also seeks to construct a diversified portfolio of ETFs that use a variety of indexing methodologies within the energy sector. Individual ETF weights are based on a variety of factors, including the Underlying ETF’s exposure to the desired energy industry or geographic region, investment objective(s), total return, portfolio holdings, volatility, expenses and liquidity. |

| |

| The Portfolio is non-diversified, which means that it may invest a greater portion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified portfolio. | | No corresponding strategy. |

15

| | |

Acquiring Portfolio | | Acquired Portfolio |

Natural Resources Portfolio | | Energy Portfolio |

| The Portfolio seeks to track the performance (before fees and expenses) of the MSCI World Commodity Producers Index with minimal tracking error. This strategy is commonly referred to as an indexing strategy. Generally, the Portfolio uses a full replication technique, although in certain instances a sampling approach may be utilized for a portion of the Portfolio. The Portfolio also may invest in other instruments, such as exchange-traded funds (“ETFs”), that provide comparable exposure as the index without buying the underlying securities comprising the index. | | ETFs are investment companies or other investment vehicles whose shares are listed and traded on U.S. stock exchanges or otherwise traded in the over-the-counter market and may be purchased and sold throughout the trading day based on their market price. Generally, an ETF seeks to track a securities index or a basket of securities that an “index provider” (such as Standard & Poor’s, Dow Jones, Russell or Morgan Stanley Capital International (“MSCI”)) selects as representative of a market, market segment, industry sector, country or geographic region. An index-based ETF generally holds the same stocks or bonds as the index it tracks (or it may hold a representative sample of such securities). Accordingly, an index-based ETF is designed so that its performance, before fees and expenses, will correspond closely with that of the index it tracks. ETFs may also be actively managed. |

| |

| No corresponding strategy. | | For purposes of complying with the Portfolio’s investment policies, the Adviser will identify Underlying ETFs in which to invest by reference to such Underlying ETFs’ investment policies at the time of investment. An Underlying ETF that changes its investment policies subsequent to the time of the Portfolio’s investment may continue to be considered an appropriate investment for purposes of the policy. The Adviser may add new Underlying ETFs or replace or eliminate existing Underlying ETFs without notice or shareholder approval. The Underlying ETFs have been selected to represent a reasonable spectrum of investment options for the Portfolio. The Adviser may sell the Portfolio’s holdings for a variety of reasons, including to invest in an Underlying ETF believed to offer superior investment opportunities. |

| |

| No corresponding strategy. | | The Portfolio may hold cash or invest in short-term paper and other short-term investments (instead of allocating investments to an Underlying ETF) as deemed appropriate by the Adviser. |

| |

| The Portfolio also may invest in other instruments, such as futures and options contracts, that provide comparable exposure as the index without buying the underlying securities comprising the index. | | No corresponding strategy. |

| |

| The Portfolio will concentrate its investments in the natural resources group of industries. | | The Portfolio will concentrate its investments in companies engaged in activities in the energy group of industries. |

| |

| The Portfolio also may lend its portfolio securities to earn additional income. | | Same. |

The Energy Portfolio and the Natural Resources Portfolio have identical fundamental investment policies relating to borrowing, lending, underwriting, issuing senior securities, and investing in commodities and real estate, but different fundamental investment polices relating to concentration. The Energy Portfolio concentrates its investments in companies engaged in activities in the energy group of industries, whereas the Natural Resources Portfolio concentrates its investments in the natural resources group of industries. Fundamental investment policies may be changed only by a vote of a Portfolio’s shareholders. More detailed information about the fundamental investment policies is available in the Statement of Additional Information.

Comparative Performance Information

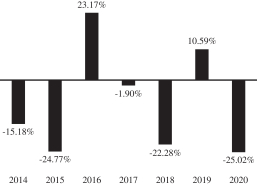

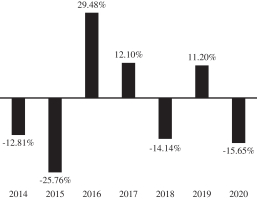

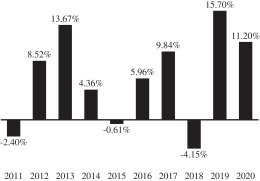

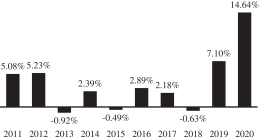

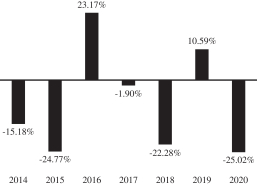

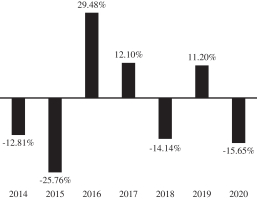

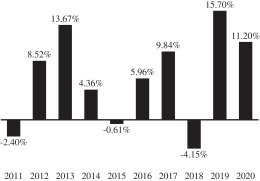

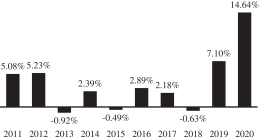

The bar charts and tables below provide some indication of the risks of investing in each Portfolio by showing changes in each Portfolio’s performance from year to year and by showing how the each Portfolio’s average annual total returns for the past one- and five-year and since inception periods through December 31, 2020, compared to the returns of a broad-based securities market index. The additional index for the Energy Portfolio shows how the Portfolio’s performance compared with the returns of another index that has characteristics relevant to the Portfolio’s investment strategies. Past performance is not an indication of future performance.

16

The performance results do not reflect any Contract-related fees and expenses, which would reduce the performance results.

Energy Portfolio — Calendar Year Total Returns (Class IB)

| | |

Best quarter (% and time period) 33.74% (2020 4th Quarter) | | Worst quarter (% and time period) (51.79)% (2020 1st Quarter) |

Natural Resources Portfolio — Calendar Year Total Returns (Class IB)

| | |

Best quarter (% and time period) 23.23% (2020 4th Quarter) | | Worst quarter (% and time period) (38.98)% (2020 1st Quarter) |