The Value Line Fund, Inc.

| | | | | |

Statement of Assets and Liabilities at December 31, 2012 |

| | | | | |

| Assets: | | | | |

| Investment securities, at value (Cost - $72,880,796) (securities on loan, at value, $1,591,832) | | $ | 107,696,524 | |

| Repurchase agreement (Cost - $3,700,974) | | | 3,700,974 | |

| Cash | | | 266,948 | |

| Interest and dividends receivable | | | 40,705 | |

| Prepaid expenses | | | 10,152 | |

| Receivable for securities lending income | | | 4,825 | |

| Receivable for capital shares sold | | | 191 | |

| Other receivables | | | 16,263 | |

| Total Assets | | | 111,736,582 | |

| | | | | |

| Liabilities: | | | | |

| Payable upon return of securities on loan | | | 1,562,425 | |

| Payable for capital shares redeemed | | | 216,044 | |

| Accrued expenses: | | | | |

| Advisory fee | | | 65,107 | |

| Sub-transfer agent fees | | | 657 | |

| Directors’ fees and expenses | | | 512 | |

| Other | | | 93,948 | |

| Total Liabilities | | | 1,938,693 | |

| Net Assets | | $ | 109,797,889 | |

| | | | | |

| Net assets consist of: | | | | |

| Capital stock, at $1.00 par value (authorized 50,000,000, outstanding 10,599,196 shares) | | $ | 10,599,196 | |

| Additional paid-in capital | | | 116,071,285 | |

| Undistributed net investment income | | | 556,189 | |

| Accumulated net realized loss on investments and foreign currency | | | (52,244,498 | ) |

| Net unrealized appreciation of investments and foreign currency translations | | | 34,815,717 | |

| Net Assets | | $ | 109,797,889 | |

| Net Asset Value, Offering and Redemption Price per Outstanding Share ($109,797,889 ÷ 10,599,196 shares outstanding) | | $ | 10.36 | |

| | | | | |

Statement of Operations for the Year Ended December 31, 2012 |

| | | | | |

| Investment Income: | | | | |

| Dividends (net of foreign withholding tax of $22,868) | | $ | 1,735,445 | |

| Securities lending income | | | 68,692 | |

| Interest | | | 2,477 | |

| Total Income | | | 1,806,614 | |

| | | | | |

| Expenses: | | | | |

| Advisory fee | | | 834,131 | |

| Service and distribution plan fees | | | 301,589 | |

| Transfer agent fees | | | 101,674 | |

| Auditing and legal fees | | | 101,083 | |

| Printing and postage | | | 79,037 | |

| Custodian fees | | | 33,197 | |

| Registration and filing fees | | | 29,347 | |

| Directors’ fees and expenses | | | 26,364 | |

| Insurance | | | 16,451 | |

| Sub-transfer agent fees | | | 4,745 | |

| Other | | | 22,139 | |

| Total Expenses Before Fees Waived and Custody Credits | | | 1,549,757 | |

| Less: Service and Distribution Plan Fees Waived | | | (301,589 | ) |

| Less: Custody Credits | | | (227 | ) |

| Net Expenses | | | 1,247,941 | |

| Net Investment Income | | | 558,673 | |

| Net Realized and Unrealized Gain on Investments and Foreign Exchange Transactions: | | | | |

| Net Realized Gain | | | 13,414,151 | |

| Change in Net Unrealized Appreciation/(Depreciation) | | | 3,749,359 | |

| Net Realized Gain and Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Exchange Transactions | | | 17,163,510 | |

| Net Increase in Net Assets from Operations | | $ | 17,722,183 | |

See Notes to Financial Statements.

| | The Value Line Fund, Inc. |

| | |

| Statement of Changes in Net Assets | |

| for the Years Ended December 31, 2012 and 2011 | |

| | | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 558,673 | | | $ | (25,717 | ) |

| Net realized gain on investments and foreign currency | | | 13,414,151 | | | | 7,607,515 | |

| Change in net unrealized appreciation/(depreciation) | | | 3,749,359 | | | | (3,327,050 | ) |

| Net increase in net assets from operations | | | 17,722,183 | | | | 4,254,748 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Net investment income | | | — | | | | (18,709 | ) |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Proceeds from sale of shares | | | 3,226,854 | | | | 49,836,935 | |

| Proceeds from reinvestment of dividends to shareholders | | | — | | | | 17,762 | |

| Cost of shares redeemed | | | (44,487,216 | ) | | | (24,954,879 | ) |

| Net increase/(decrease) in net assets from capital share transactions | | | (41,260,362 | ) | | | 24,899,818 | |

| Total Increase/(Decrease) in Net Assets | | | (23,538,179 | ) | | | 29,135,857 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of year | | | 133,336,068 | | | | 104,200,211 | |

| End of year | | $ | 109,797,889 | | | $ | 133,336,068 | |

| | | | | | | | | |

| Undistributed (distributions in excess of) net investment income, respectively, at end of year | | $ | 556,189 | | | $ | (523 | ) |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| Notes to Financial Statements |

1. Significant Accounting Policies

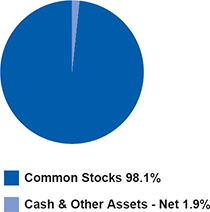

The Value Line Fund, Inc., (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company whose primary investment objective is long term-growth of capital.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

(A) Security Valuation: Securities listed on a securities exchange are valued at the closing sales prices on the date as of which the net asset value is being determined. Securities traded on the NASDAQ Stock Market are valued at the NASDAQ Official Closing Price. In the absence of closing sales prices for such securities and for securities traded in the over-the-counter market, the security is valued at the midpoint between the latest available and representative asked and bid prices. Short-term instruments with maturities of 60 days or less at the date of purchase are valued at amortized cost, which approximates market value. Short-term instruments with maturities greater than 60 days at the date of purchase are valued at the midpoint between the latest available and representative asked and bid prices, and commencing 60 days prior to maturity such securities are valued at amortized cost. Securities for which market quotations are not readily available or that are not readily marketable and all other assets of the Fund are valued at fair value as the Board of Directors may determine in good faith. In addition, the Fund may use the fair value of a security when the closing market price on the primary exchange where the security is traded no longer accurately reflects the value of a security due to factors affecting one or more relevant securities markets or the specific issuer.

(B) Fair Value Measurements: The Fund follows fair valuation accounting standards (FASB ASC 820-10) which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | |

| • | Level 1 - Inputs that reflect unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access at the measurement date; |

| | |

| • | Level 2 - Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active; |

| | |

| • | Level 3 - Inputs that are unobservable. |

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| The Value Line Fund, Inc. |

| |

| December 31, 2012 |

The following table summarizes the inputs used to value the Fund’s investments in securities as of December 31, 2012:

| | | | | | | | | | | | | |

| Investments in | | | | | | | | | | | | |

| Securities: | Level 1 | | Level 2 | | Level 3 | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 107,696,524 | | | $ | 0 | | | $ | 0 | | | $ | 107,696,524 | |

| Short-Term Investments | | | 0 | | | | 3,700,974 | | | | 0 | | | | 3,700,974 | |

| Total Investments in Securities | | $ | 107,696,524 | | | $ | 3,700,974 | | | $ | 0 | | | $ | 111,397,498 | |

The Fund follows the updated provisions surrounding fair value measurements and disclosures on transfers in and out of all levels of the fair value hierarchy on a gross basis and the reasons for the transfers as well as to disclosures about the valuation techniques and inputs used to measure fair value for investments that fall in either Level 2 or Level 3 of the fair value hierarchy.

The amounts and reasons for all transfers in and out of each level within the three-tier hierarchy are disclosed when the Fund had an amount of total transfers during the reporting period that was meaningful in relation to its net assets as of the end of the reporting period.

For the year ended December 31, 2012, there were no Level 3 investments. The Schedule of Investments includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements: In connection with transactions in repurchase agreements, the Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

In December 2011, the Financial Accounting Standards Board issued Accounting Standards Update No. 2011-11 (“ASU 2011-11”), “Balance Sheet (Topic 210): Disclosures about Offsetting Assets and Liabilities.” The ASU 2011-11 requires disclosure of both gross and net balances for certain investments and transactions entered into under master netting agreements, better aligning US GAAP requirements with International Financial Reporting Standards. The ASU 2011-11 is effective for annual periods beginning on or after January 1, 2013. The Fund’s management is evaluating the effect of this guidance on the financial statements.

(D) Federal Income Taxes: It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions available to regulated investment companies, as defined in applicable sections of the Internal Revenue Code, and to distribute all of its investment income and capital gains to its shareholders. Therefore, no provision for federal income tax is required.

Management has analyzed the Fund’s tax positions taken on federal and state income tax returns for all open tax years (fiscal years ended December 31, 2009 through December 31, 2012), and has concluded that no provision for federal or state income tax is required in the Fund’s financial statements. The Fund’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

| The Value Line Fund, Inc. |

| |

| Notes to Financial Statements |

(E) Security Transactions and Distributions: Security transactions are accounted for on the date the securities are purchased or sold. Interest income is accrued as earned. Realized gains and losses on sales of securities are calculated for financial accounting and federal income tax purposes on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

(F) Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Fund does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Fund, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/ (depreciation) on investments.

(G) Representations and Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(H) Foreign Taxes: The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(I) Securities Lending: Under an agreement with State Street Bank & Trust (“State Street”), the Fund can lend its securities to brokers, dealers and other financial institutions approved by the Board of Directors. By lending its investment securities, the Fund attempts to increase its net investment income through receipt of interest on the loan.

Any gain or loss in the market price of the securities loaned that might occur and any interest or dividends declared during the term of the loan would accrue to the account of the Fund. Risks of delay in recovery of the securities or even loss of rights in the collateral may occur should the borrower of the securities fail financially. Generally, in the event of a counter-party default, the Fund has the right to use the collateral to offset the losses incurred. The lending fees received and the Fund’s portion of the interest income earned on the cash collateral are included in the Statement of Operations.

| The Value Line Fund, Inc. |

| |

| December 31, 2012 |

Upon entering into a securities lending transaction, the Fund receives cash or other securities as collateral in an amount equal to or exceeding 102% of the current market value of the loaned securities. Any cash received as collateral is invested by State Street Global Advisors, acting in its capacity as securities lending agent (the “Agent”), in The Value Line Funds collateral account, which is subsequently invested into joint repurchase agreements. A portion of the dividends received on the collateral is rebated to the borrower of the securities and the remainder is split between the Agent and the Fund.

The Fund enters into a joint repurchase agreement whereby its uninvested cash collateral from securities lending is deposited into a joint cash account with other funds managed by the investment adviser and is used to invest in one or more repurchase agreements. The value and face amount of the joint repurchase agreement are allocated to the funds based on their pro-rata interest. A repurchase agreement is accounted for as a loan by the fund to the seller, collateralized by securities which are delivered to the fund’s custodian. The market value, including accrued interest, of the initial collateralization is required to be at least 102% of the dollar amount invested by the funds, with the value of the underlying securities marked to market daily to maintain coverage of at least 100%. The joint repurchase agreement held by the Fund at year end had been entered into on December 31, 2012.

As of December 31, 2012, the Fund loaned securities which were collateralized by cash. The value of the securities on loan and the value of the related collateral were as follows:

| | | | | | | |

| Value of | | | | | Total Collateral | |

| Securities | | Value of | | | (including | |

| Loaned | | Collateral | | | Calculated Mark) | |

| $1,591,832 | | $ | 1,562,425 | | | $ | 1,630,700 | |

(J) Subsequent Events: Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued and has determined that no additional items require disclosure.

2. Capital Share Transactions, Dividends and Distributions to Shareholders

Transactions in capital stock were as follows:

| | | | | |

| | Year Ended December 31, 2012 | | | Year Ended December 31, 2011 | |

| Shares sold | | | 328,898 | | | | 5,328,951 | |

| Shares issued on reinvestment of dividends and distributions | | | — | | | | 1,976 | |

| Shares redeemed | | | (4,481,149 | ) | | | (2,772,173 | ) |

| Net increase/decrease | | | (4,152,251 | ) | | | 2,558,754 | |

| Dividends per share from net investment income | | $ | — | | | $ | 0.0013 | |

3. Purchases and Sales of Securities

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | | |

| | | Year Ended December 31, 2012 | |

| Purchases: | | | | |

| Investment Securities | | $ | 6,897,939 | |

| Sales: | | | | |

| Investment Securities | | $ | 48,394,940 | |

| The Value Line Fund, Inc. |

| |

| Notes to Financial Statements |

4. Income Taxes

At December 31, 2012, information on the tax components of capital is as follows:

| | | | | |

| Cost of investments for tax purposes | | $ | 76,754,854 | |

| Gross tax unrealized appreciation | | $ | 35,245,710 | |

| Gross tax unrealized depreciation | | | (603,066 | ) |

| Net tax unrealized appreciation on investments | | $ | 34,642,644 | |

| Undistributed ordinary income | | $ | 556,189 | |

| Capital loss carryforward, expires | | | | |

| December 31, 2016 | | $ | 10,353,178 | |

| December 31, 2017 | | $ | 41,718,238 | |

During the year ended December 31, 2012, as permitted under federal income tax regulations, the Fund utilized $13,062,104 of capital loss carryforwards.

To the extent that current or future capital gains are offset by capital losses, the Fund does not anticipate distributing any such gains to shareholders.

It is uncertain whether the Fund will be able to realize the benefits of the losses before they expire.

The differences between book basis and tax basis unrealized appreciation/(depreciation) on investments were primarily attributed to wash sales.

Permanent book-tax differences relating to the current year were reclassified within the composition of the net asset accounts. The Fund decreased undistributed net investment income by $1,961 and decreased accumulated realized loss by $1,961. These reclassifications were primarily due to differing treatments of foreign currency translation and investment in REITs.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was signed by the President. Under the Act, net capital losses recognized by the Fund after December 31, 2010, may get carried forward indefinitely, and retain their character as short-term and/or long term losses. Prior to this Act, pre-enactment net capital losses incurred by the Fund were carried forward for eight years and treated as short-term losses. The Act requires under the transition that post-enactment net capital losses are used before pre-enactment net capital losses.

The tax composition of distributions to shareholders for the years ended December 31, 2012 and December 31, 2011 were as follows:

| | | | | | | |

| | 2012 | | 2011 | |

| Ordinary income | | $ | — | | | $ | 18,709 | |

5. Investment Advisory Fee, Service and Distribution Fees, Sub-Transfer Agent Fee and Transactions With Affiliates

An advisory fee of $834,131 was paid or payable to EULAV Asset Management (the “Adviser”) for the year ended December 31, 2012. This was computed at an annual rate of 0.70% of the first $100 million of the Fund’s average daily net assets plus 0.65% of the excess thereof, and paid monthly. The Adviser provides research, investment programs, and supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping, and clerical personnel necessary for managing the affairs of the Fund. The Adviser also provides persons, satisfactory to the Fund’s Board of Directors, to act as officers and employees of the Fund and pays their salaries. Effective December 16, 2011 the Fund no longer waives Advisory fees.

| The Value Line Fund, Inc. |

| |

| December 31, 2012 |

The Fund has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities LLC (the “Distributor”) for advertising, marketing and distributing the Fund’s shares and for servicing the Fund’s shareholders at an annual rate of 0.25% of the Fund’s average daily net assets. For the year ended December 31, 2012, fees amounting to $301,589 before fee waivers were accrued under the Plan. Effective May 1, 2009, and renewed annually, the Distributor contractually agreed to waive the Fund’s 12b-1 fee. For the year ended December 31, 2012 all 12b-1 fees were waived. The Distributor has no right to recoup prior waivers.

Effective July 5, 2012, the Fund has a Sub-Transfer Agent Plan (the “sub TA plan”) which compensates financial intermediaries that provide sub-transfer agency and related services to investors that hold their Fund shares in omnibus accounts maintained by the financial intermediaries with the Fund. The sub-transfer agency fee, which may be paid directly to the financial intermediary or indirectly via the Distributor, is equal to the lower of (i) the aggregate amount of additional transfer agency fees and expenses that the Fund would otherwise pay to the transfer agent if each subaccount in the omnibus account maintained by the financial intermediary with the Fund were a direct account with the Fund and (ii) the amount by which the fees charged by the financial intermediary for including the Fund on its platform and providing shareholder, sub-transfer agency and related services exceed the amount paid under the Fund’s Plan with respect to Fund assets attributable to shares held by the financial intermediary in the omnibus account. In addition, the amount of sub-transfer agency fees payable by the Fund to all financial intermediaries in the aggregate is subject to a maximum cap of 0.05% of the Fund’s average daily net assets. If the sub-transfer agency fee is paid to financial intermediaries indirectly via the Distributor, the Distributor does not retain any amount thereof and such fee otherwise reduces the amount that the Distributor is contractually obligated to pay to the financial intermediary. For the year ended December 31, 2012, fees amounting to $4,745 were paid under the sub TA plan.

For the year ended December 31, 2012, the Fund’s expenses were reduced by $227 under a custody credit arrangement with the custodian.

Direct expenses of the Fund are charged to the Fund while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Fund bears all other costs and expenses.

Certain officers and a Trustee of the Adviser are also officers and a director of the Fund. At December 31, 2012, the officers and directors of the Fund as a group owned 1,074 shares, representing less than 1% of the outstanding shares.

| The Value Line Fund, Inc. |

| |

| Financial Highlights |

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2012 | | 2011 | | 2010 | | 2009 | | 2008 | |

| Net asset value, beginning of year | | $ | 9.04 | | $ | 8.55 | | $ | 6.81 | | $ | 6.22 | | $ | 12.83 | |

| | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | |

| Net investment income/(loss) | | | 0.05 | | | (0.00 | )(1) | | 0.00 | (1) | | (0.01 | ) | | (0.03 | ) |

| Net gains or (losses) on securities (both realized and unrealized) | | | 1.27 | | | 0.49 | | | 1.74 | | | 0.60 | | | (6.30 | ) |

| Total from investment operations | | | 1.32 | | | 0.49 | | | 1.74 | | | 0.59 | | | (6.33 | ) |

| | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | — | | | (0.00 | )(1) | | — | | | — | | | — | |

| Distributions from net realized gains | | | — | | | — | | | — | | | — | | | (0.28 | ) |

| Total distributions | | | — | | | (0.00 | )(1) | | — | | | — | | | (0.28 | ) |

| Net asset value, end of year | | $ | 10.36 | | $ | 9.04 | | $ | 8.55 | | $ | 6.81 | | $ | 6.22 | |

| | | | | | | | | | | | | | | | | |

| Total return | | | 14.60 | % | | 5.75 | % | | 25.55 | % | | 9.49 | % | | (49.28 | )% |

| | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 109,798 | | $ | 133,336 | | $ | 104,200 | | $ | 92,680 | | $ | 93,099 | |

Ratio of expenses to average net assets(2) | | | 1.28 | % | | 1.29 | % | | 1.31 | %(3) | | 1.36 | % | | 1.17 | % |

Ratio of expenses to average net assets(4) | | | 1.03 | % | | 0.94 | % | | 0.91 | %(5) | | 1.04 | % | | 0.92 | % |

| Ratio of net investment income/(loss) to average net assets | | | 0.46 | % | | (0.02 | )% | | 0.02 | % | | (0.22 | )% | | (0.26 | )% |

| Portfolio turnover rate | | | 6 | % | | 18 | % | | 27 | % | | 122 | % | | 273 | % |

| (1) | Amount is less than $.01 per share. |

| | |

| (2) | Ratio reflects expenses grossed up for custody credit arrangement and grossed up for the waiver of the advisory fees by the Adviser and the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets net of custody credits, but exclusive of the fee waivers would have been unchanged for the years shown. |

| | |

| (3) | Ratio reflects expenses grossed up for the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

| | |

| (4) | Ratio reflects expenses net of the custody credit arrangement and net of the waiver of the advisory fee by the Adviser and the service and distribution plan fees by the Distributor. |

| | |

| (5) | Ratio reflects expenses net of the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

See Notes to Financial Statements.

| The Value Line Fund, Inc. |

| |

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of The Value Line Fund, Inc.:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of The Value Line Fund, Inc. (the “Fund”) at December 31, 2012, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 22, 2013