UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 4th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(626) 914-7235

Registrant's telephone number, including area code

Date of fiscal year end: February 28, 2025

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

| | |

| Pzena Mid Cap Value Fund | |

| Investor Class | PZVMX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Mid Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $64 | 1.24% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $155,599,088 |

Number of Holdings | 44 |

Portfolio Turnover | 19% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Universal Health Services, Inc. - Class B | 4.2% |

Dow, Inc. | 3.7% |

Baxter International, Inc. | 3.7% |

Lear Corp. | 3.7% |

CNO Financial Group, Inc. | 3.1% |

Charter Communications, Inc. - Class A | 3.0% |

Equitable Holdings, Inc. | 3.0% |

Humana, Inc. | 2.9% |

Tyson Foods, Inc. - Class A | 2.9% |

SS&C Technologies Holdings, Inc. | 2.9% |

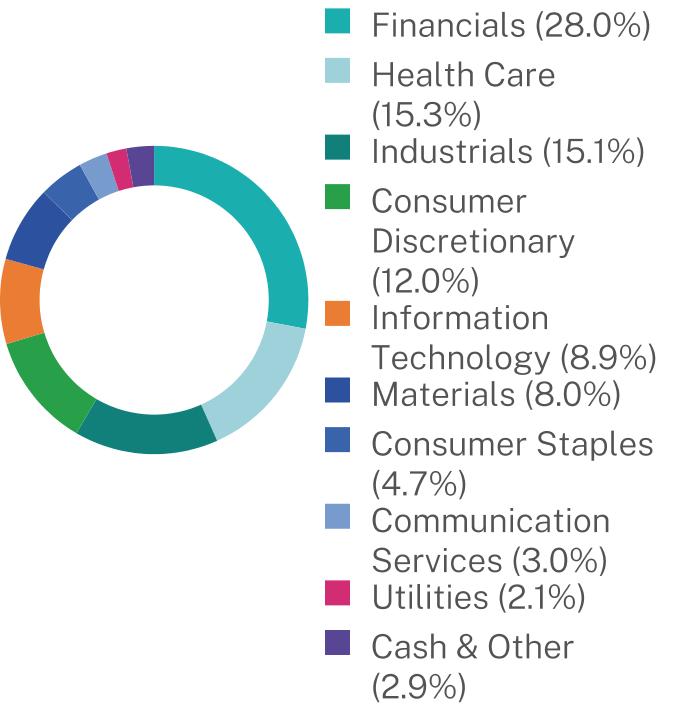

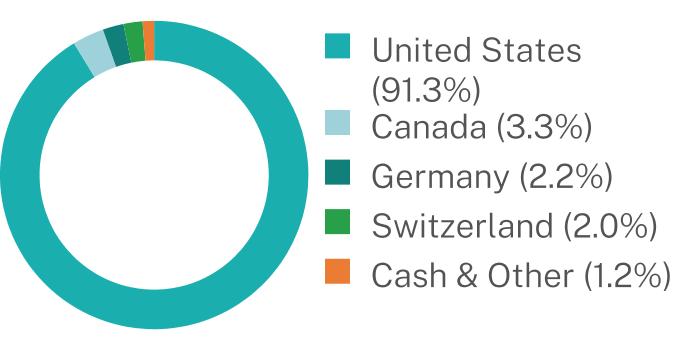

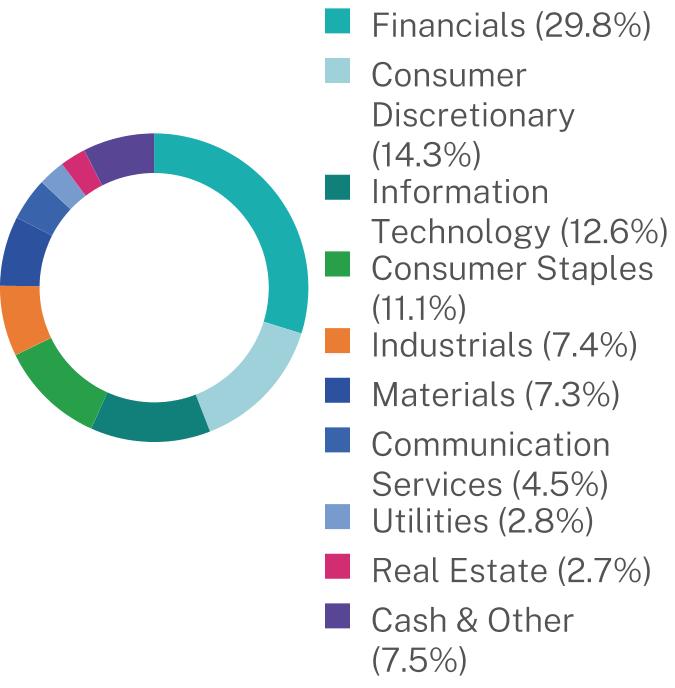

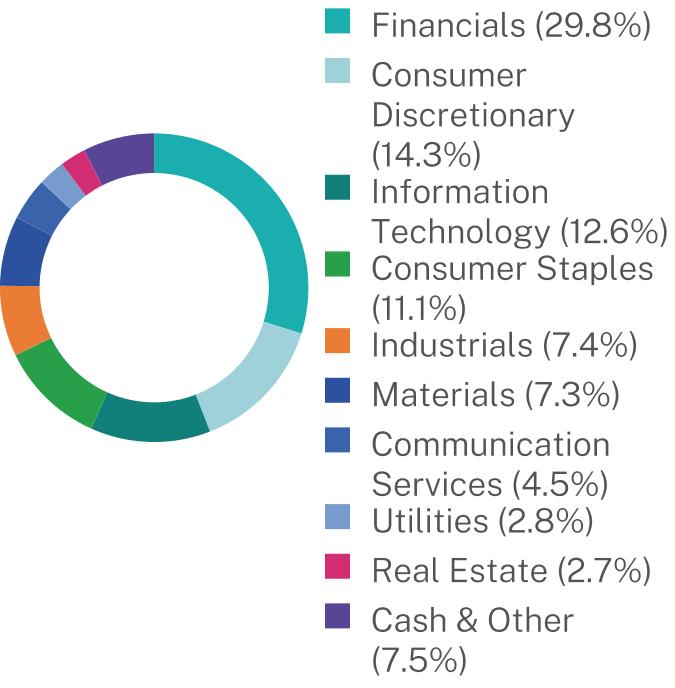

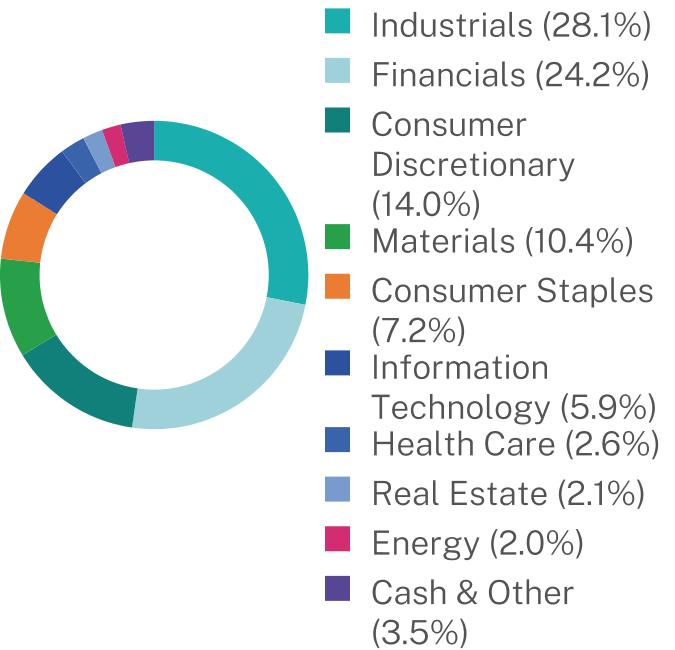

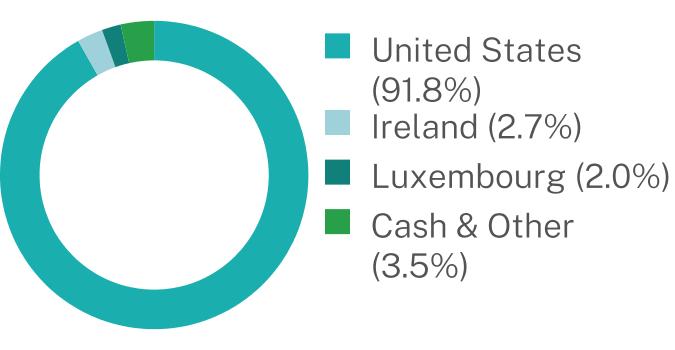

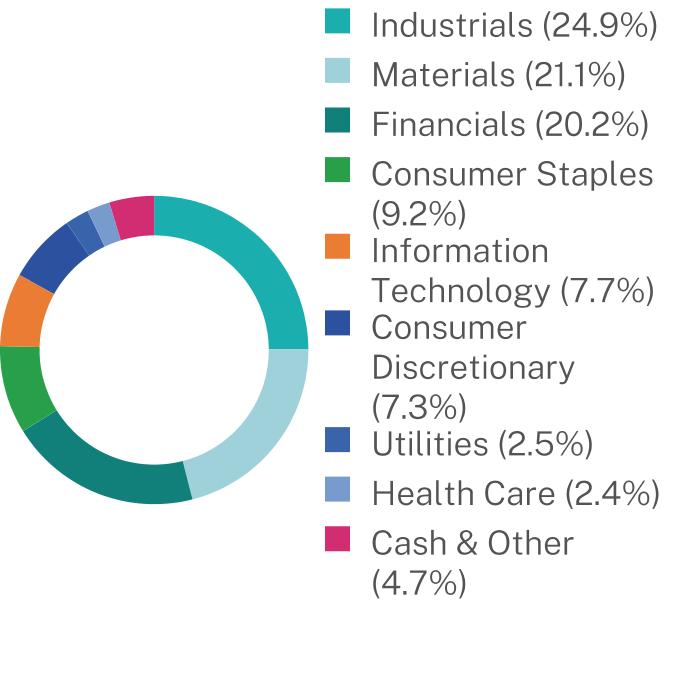

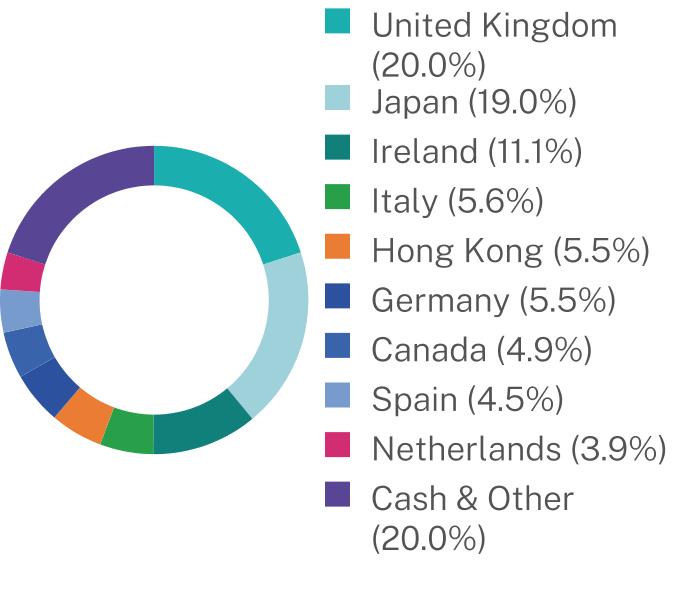

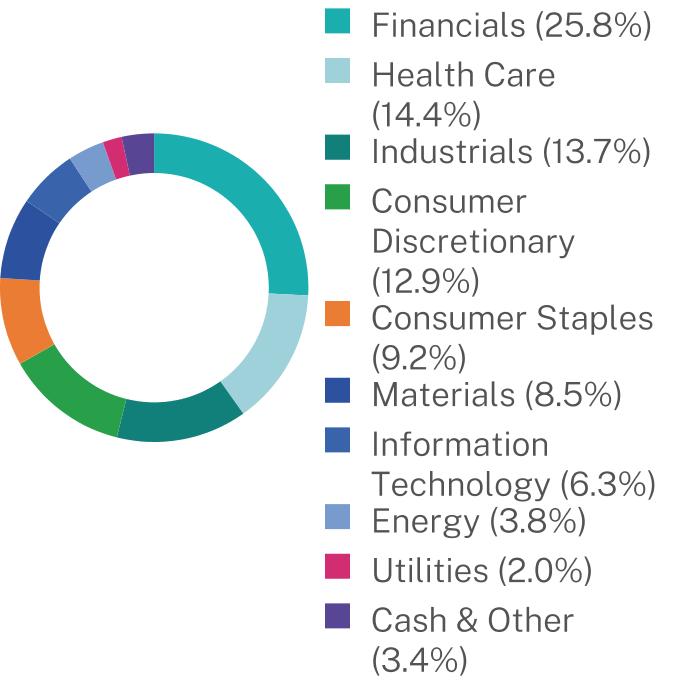

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena Mid Cap Value Fund | PAGE 1 | TSR-SAR-00770X667 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Mid Cap Value Fund | PAGE 2 | TSR-SAR-00770X667 |

28.015.315.112.08.98.04.73.02.12.991.33.32.22.01.2

| | |

| Pzena Mid Cap Value Fund | |

| Institutional Class | PZIMX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Mid Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $47 | 0.90% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $155,599,088 |

Number of Holdings | 44 |

Portfolio Turnover | 19% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Universal Health Services, Inc. - Class B | 4.2% |

Dow, Inc. | 3.7% |

Baxter International, Inc. | 3.7% |

Lear Corp. | 3.7% |

CNO Financial Group, Inc. | 3.1% |

Charter Communications, Inc. - Class A | 3.0% |

Equitable Holdings, Inc. | 3.0% |

Humana, Inc. | 2.9% |

Tyson Foods, Inc. - Class A | 2.9% |

SS&C Technologies Holdings, Inc. | 2.9% |

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena Mid Cap Value Fund | PAGE 1 | TSR-SAR-00770X659 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Mid Cap Value Fund | PAGE 2 | TSR-SAR-00770X659 |

28.015.315.112.08.98.04.73.02.12.991.33.32.22.01.2

| | |

| Pzena Emerging Markets Value Fund | |

| Investor Class | PZVEX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Emerging Markets Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $74 | 1.43% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $2,039,029,754 |

Number of Holdings | 66 |

Portfolio Turnover | 11% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

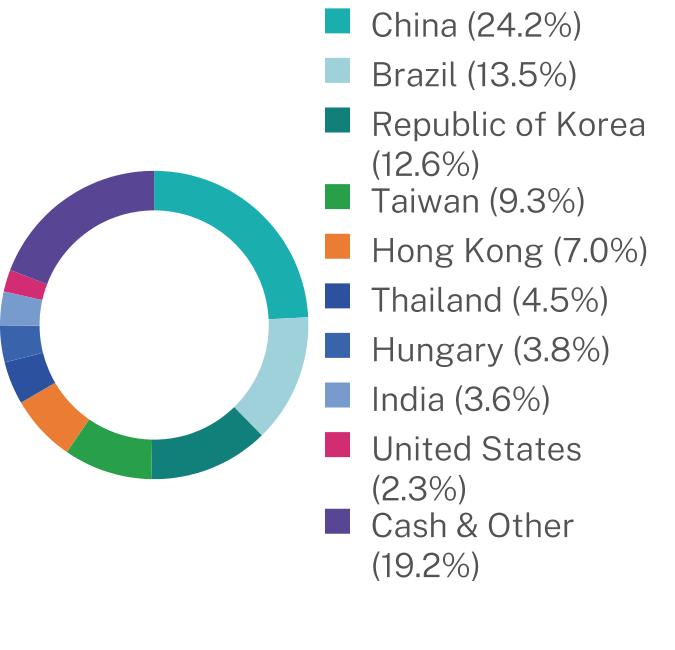

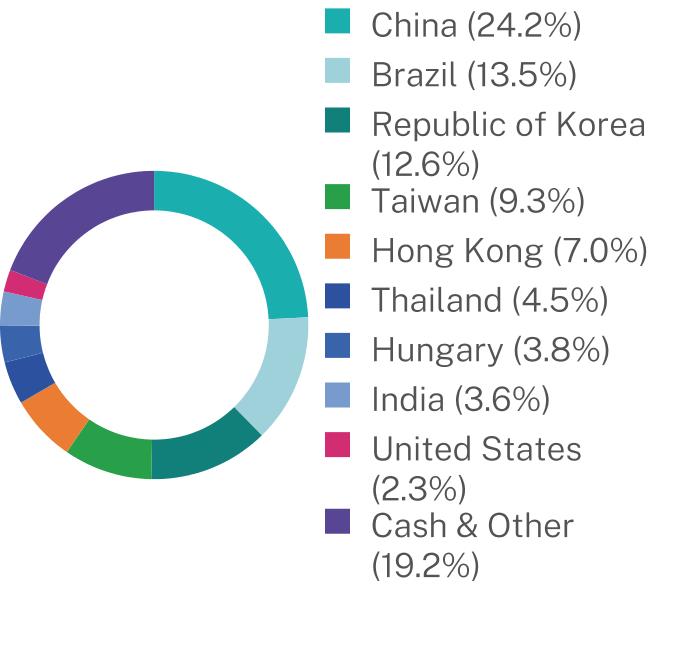

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Taiwan Semiconductor Manufacturing Co., Ltd. | 4.0% |

Fidelity Institutional Government Portfolio - Institutional Class | 3.7% |

Alibaba Group Holding, Ltd. | 3.1% |

Ambev S.A. | 3.0% |

Samsung Electronics Co., Ltd. | 2.8% |

China Overseas Land & Investment, Ltd. | 2.7% |

WH Group, Ltd. | 2.5% |

Weichai Power Co., Ltd. | 2.4% |

Cognizant Technology Solutions Corp. - Class A | 2.3% |

Bank Rakyat Indonesia Persero Tbk | 2.2% |

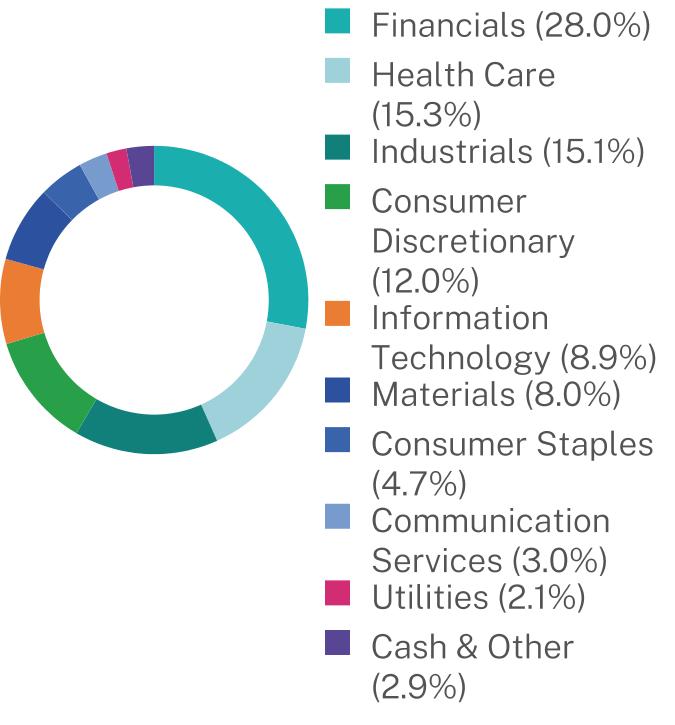

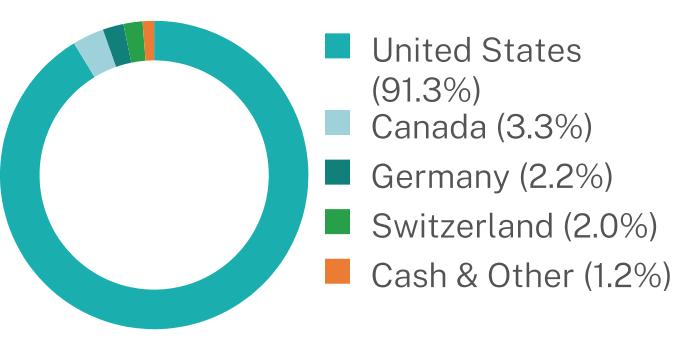

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

| Pzena Emerging Markets Value Fund | PAGE 1 | TSR-SAR-00770X683 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Emerging Markets Value Fund | PAGE 2 | TSR-SAR-00770X683 |

29.814.312.611.17.47.34.52.82.77.524.213.512.69.37.04.53.83.62.319.2

| | |

| Pzena Emerging Markets Value Fund | |

| Institutional Class | PZIEX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Emerging Markets Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $56 | 1.08% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $2,039,029,754 |

Number of Holdings | 66 |

Portfolio Turnover | 11% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Taiwan Semiconductor Manufacturing Co., Ltd. | 4.0% |

Fidelity Institutional Government Portfolio - Institutional Class | 3.7% |

Alibaba Group Holding, Ltd. | 3.1% |

Ambev S.A. | 3.0% |

Samsung Electronics Co., Ltd. | 2.8% |

China Overseas Land & Investment, Ltd. | 2.7% |

WH Group, Ltd. | 2.5% |

Weichai Power Co., Ltd. | 2.4% |

Cognizant Technology Solutions Corp. - Class A | 2.3% |

Bank Rakyat Indonesia Persero Tbk | 2.2% |

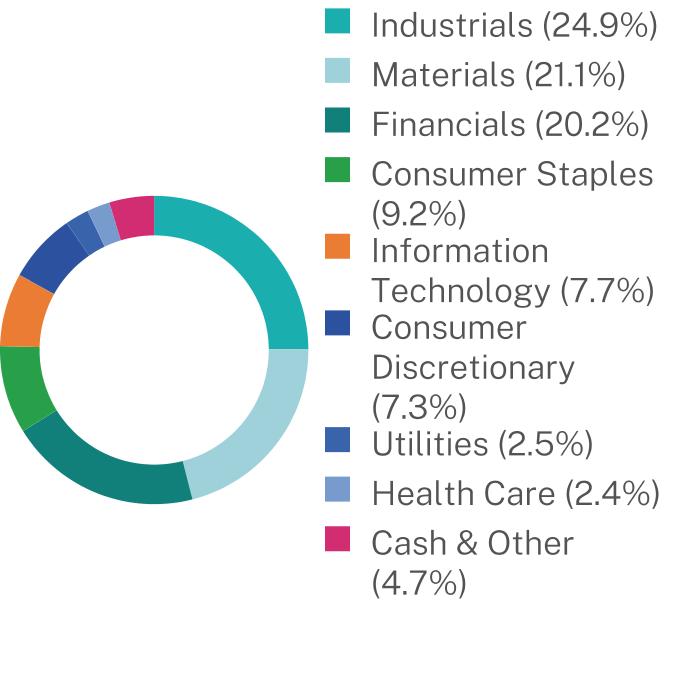

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

| Pzena Emerging Markets Value Fund | PAGE 1 | TSR-SAR-00770X675 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Emerging Markets Value Fund | PAGE 2 | TSR-SAR-00770X675 |

29.814.312.611.17.47.34.52.82.77.524.213.512.69.37.04.53.83.62.319.2

| | |

| Pzena Small Cap Value Fund | |

| Investor Class | PZVSX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Small Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $67 | 1.30% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $59,487,795 |

Number of Holdings | 51 |

Portfolio Turnover | 16% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

CNO Financial Group, Inc. | 4.0% |

Fidelity Institutional Government Portfolio - Institutional Class | 3.4% |

Spectrum Brands Holdings, Inc. | 3.0% |

Steelcase, Inc. - Class A | 3.0% |

MRC Global, Inc. | 3.0% |

Korn Ferry | 2.9% |

Olin Corp. | 2.9% |

Adient PLC | 2.7% |

TriMas Corp. | 2.6% |

Columbia Banking System, Inc. | 2.6% |

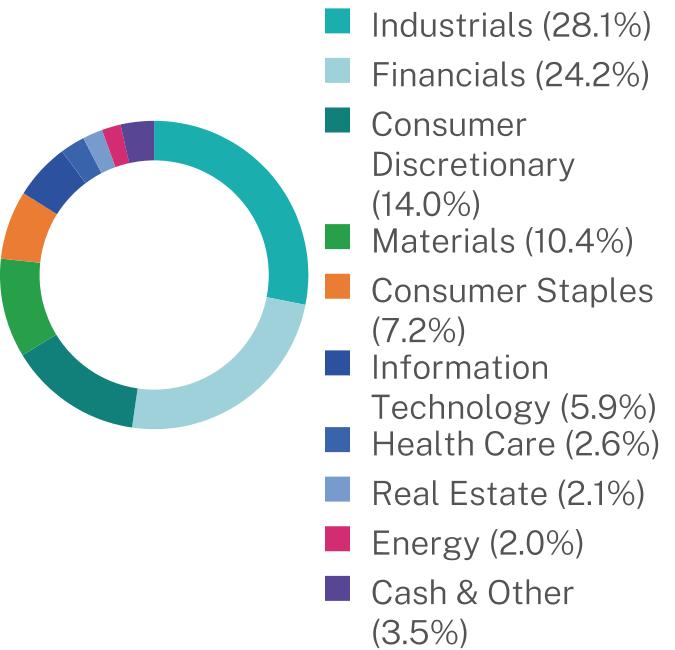

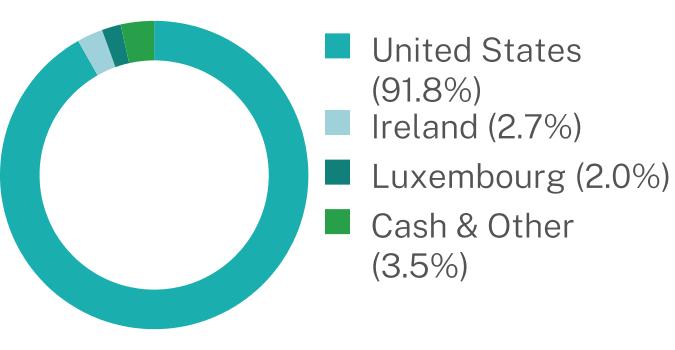

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena Small Cap Value Fund | PAGE 1 | TSR-SAR-00770X410 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Small Cap Value Fund | PAGE 2 | TSR-SAR-00770X410 |

28.124.214.010.47.25.92.62.12.03.591.82.72.03.5

| | |

| Pzena Small Cap Value Fund | |

| Institutional Class | PZISX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena Small Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $52 | 1.00% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $59,487,795 |

Number of Holdings | 51 |

Portfolio Turnover | 16% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

CNO Financial Group, Inc. | 4.0% |

Fidelity Institutional Government Portfolio - Institutional Class | 3.4% |

Spectrum Brands Holdings, Inc. | 3.0% |

Steelcase, Inc. - Class A | 3.0% |

MRC Global, Inc. | 3.0% |

Korn Ferry | 2.9% |

Olin Corp. | 2.9% |

Adient PLC | 2.7% |

TriMas Corp. | 2.6% |

Columbia Banking System, Inc. | 2.6% |

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena Small Cap Value Fund | PAGE 1 | TSR-SAR-00770X394 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena Small Cap Value Fund | PAGE 2 | TSR-SAR-00770X394 |

28.124.214.010.47.25.92.62.12.03.591.82.72.03.5

| | |

| Pzena International Small Cap Value Fund | |

| Investor Class | PZVIX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena International Small Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $77 | 1.44% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $31,009,245 |

Number of Holdings | 46 |

Portfolio Turnover | 16% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Fidelity Institutional Government Portfolio - Institutional Class | 4.4% |

Ibstock PLC | 4.0% |

Origin Enterprises PLC | 3.8% |

Anima Holding S.p.A. | 3.3% |

Transcontinental, Inc. - Class A | 3.1% |

Permanent TSB Group Holdings PLC | 3.0% |

Signify N.V. | 2.9% |

Rexel S.A. | 2.9% |

C&C Group PLC | 2.8% |

KH Neochem Co., Ltd. | 2.8% |

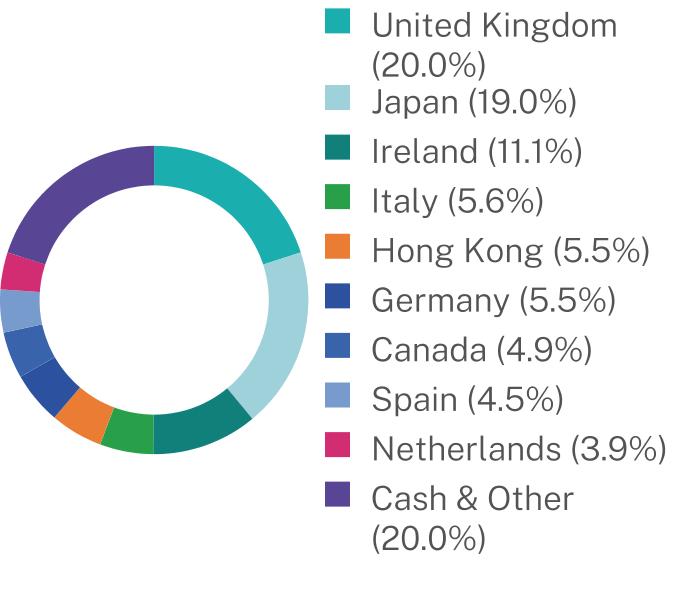

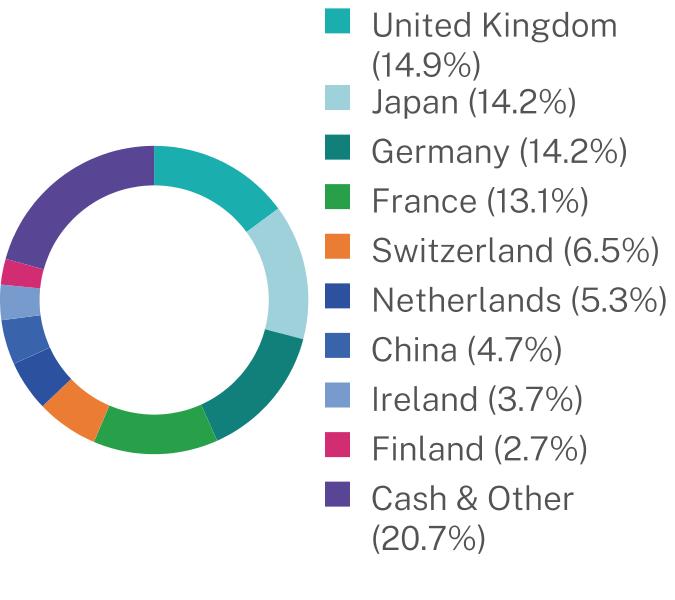

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

| Pzena International Small Cap Value Fund | PAGE 1 | TSR-SAR-00770X352 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena International Small Cap Value Fund | PAGE 2 | TSR-SAR-00770X352 |

24.921.120.29.27.77.32.52.44.720.019.011.15.65.55.54.94.53.920.0

| | |

| Pzena International Small Cap Value Fund | |

| Institutional Class | PZIIX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena International Small Cap Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $62 | 1.17% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $31,009,245 |

Number of Holdings | 46 |

Portfolio Turnover | 16% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Fidelity Institutional Government Portfolio - Institutional Class | 4.4% |

Ibstock PLC | 4.0% |

Origin Enterprises PLC | 3.8% |

Anima Holding S.p.A. | 3.3% |

Transcontinental, Inc. - Class A | 3.1% |

Permanent TSB Group Holdings PLC | 3.0% |

Signify N.V. | 2.9% |

Rexel S.A. | 2.9% |

C&C Group PLC | 2.8% |

KH Neochem Co., Ltd. | 2.8% |

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

| Pzena International Small Cap Value Fund | PAGE 1 | TSR-SAR-00770X345 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena International Small Cap Value Fund | PAGE 2 | TSR-SAR-00770X345 |

24.921.120.29.27.77.32.52.44.720.019.011.15.65.55.54.94.53.920.0

| | |

| Pzena International Value Fund | |

| Investor Class | PZVNX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena International Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Investor Class | $53 | 0.99% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $89,244,028 |

Number of Holdings | 73 |

Portfolio Turnover | 12% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Roche Holding AG | 3.2% |

Sanofi | 2.9% |

Daimler Truck Holding AG | 2.7% |

Teleperformance SE | 2.6% |

Fidelity Institutional Government Portfolio - Institutional Class | 2.5% |

Reckitt Benckiser Group PLC | 2.4% |

BASF SE | 2.4% |

CaixaBank S.A. | 2.4% |

Cie Generale des Etablissements Michelin SCA | 2.4% |

ING Groep N.V. | 2.3% |

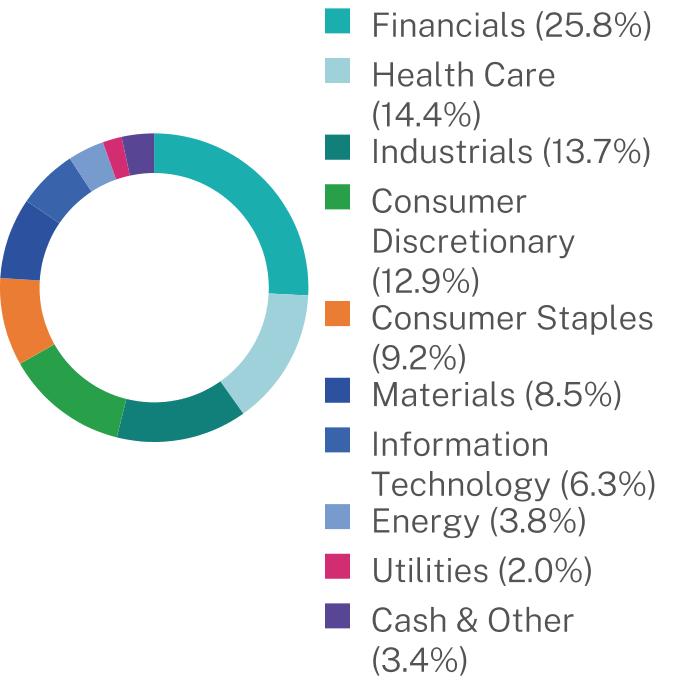

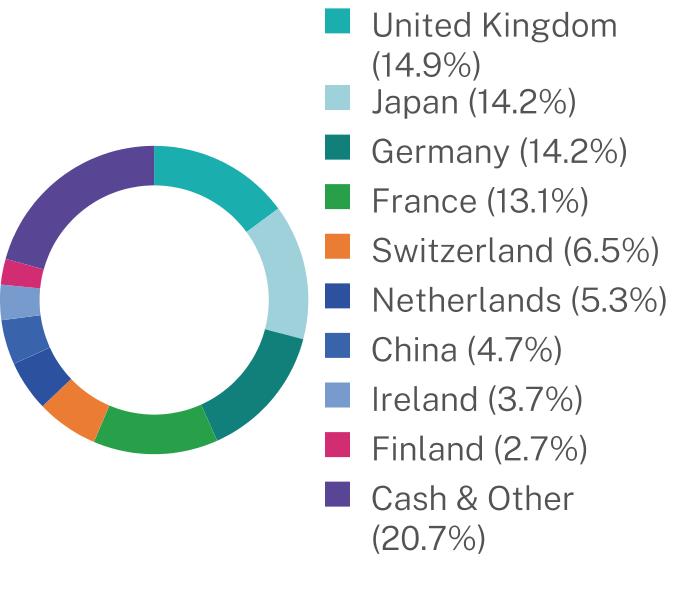

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena International Value Fund | PAGE 1 | TSR-SAR-00770X287 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena International Value Fund | PAGE 2 | TSR-SAR-00770X287 |

25.814.413.712.99.28.56.33.82.03.414.914.214.213.16.55.34.73.72.720.7

| | |

| Pzena International Value Fund | |

| Institutional Class | PZINX |

| Semi-Annual Shareholder Report | August 31, 2024 |

This semi-annual shareholder report contains important information about the Pzena International Value Fund for the period of March 1, 2024, to August 31, 2024. You can find additional information about the Fund at https://www.pzena.com/institutional/investments/mutual-funds/. You can also request this information by contacting us at 1-844-796-1996.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $40 | 0.74% |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $89,244,028 |

Number of Holdings | 73 |

Portfolio Turnover | 12% |

Visit https://www.pzena.com/institutional/investments/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Issuers | (%) |

Roche Holding AG | 3.2% |

Sanofi | 2.9% |

Daimler Truck Holding AG | 2.7% |

Teleperformance SE | 2.6% |

Fidelity Institutional Government Portfolio - Institutional Class | 2.5% |

Reckitt Benckiser Group PLC | 2.4% |

BASF SE | 2.4% |

CaixaBank S.A. | 2.4% |

Cie Generale des Etablissements Michelin SCA | 2.4% |

ING Groep N.V. | 2.3% |

Sector Breakdown (% of net assets)

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

Based on the recommendation of Pzena Investment Management, LLC (the “Adviser”), the Audit Committee and Board of Trustees (“Board”) of Advisors Series Trust approved a change of the independent registered public accounting firm for the Fund, from Tait, Weller and Baker, LLP (“Tait”) to Deloitte LLP (“Deloitte”). At a meeting of the Board held on June 26, 2024, the Board accepted Tait’s resignation effective June 27, 2024. Deloitte’s engagement was approved by the Board. The Board noted that there were no disagreements or issues with Tait, but that the request was being made because the Adviser indicated that they had a preference for a larger independent public accounting firm for the Fund.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pzena.com/institutional/investments/mutual-funds/

| Pzena International Value Fund | PAGE 1 | TSR-SAR-00770X279 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pzena Investment Management, LLC documents not be householded, please contact Pzena Investment Management, LLC at 1-844-796-1996, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pzena Investment Management, LLC or your financial intermediary.

| Pzena International Value Fund | PAGE 2 | TSR-SAR-00770X279 |

25.814.413.712.99.28.56.33.82.03.414.914.214.213.16.55.34.73.72.720.7

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| | (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

PZENA FUNDS

Pzena Mid Cap Value Fund

Pzena Emerging Markets Value Fund

Pzena Small Cap Value Fund

Pzena International Small Cap Value Fund

Pzena International Value Fund

Core Financial Statements

August 31, 2024

TABLE OF CONTENTS

Pzena Mid Cap Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 98.8%

| | | | | | |

Basic Materials - 8.0%

| | | | | | |

Dow, Inc. | | | 108,414 | | | $5,808,822 |

FMC Corp. | | | 46,641 | | | 3,012,076 |

Olin Corp. | | | 83,923 | | | 3,664,917 |

| | | | | | 12,485,815 |

Consumer Discretionary - 18.9%

| | | | | | |

Advance Auto Parts, Inc. | | | 59,510 | | | 2,696,398 |

Charter Communications, Inc. - Class A(a) | | | 13,593 | | | 4,724,111 |

Delta Air Lines, Inc. | | | 75,729 | | | 3,217,725 |

Dollar General Corp. | | | 34,177 | | | 2,835,666 |

Gap, Inc. | | | 40,552 | | | 909,581 |

Gildan Activewear, Inc. | | | 35,435 | | | 1,616,899 |

Lear Corp. | | | 49,147 | | | 5,732,998 |

Magna International, Inc. | | | 85,391 | | | 3,588,984 |

Newell Brands, Inc. | | | 266,306 | | | 1,888,110 |

PVH Corp. | | | 22,915 | | | 2,261,481 |

| | | | | | 29,471,953 |

Consumer Staples - 2.9%

| | | | | | |

Tyson Foods, Inc. - Class A | | | 69,462 | | | 4,467,101 |

Energy - 1.7%

| | | | | | |

NOV, Inc. | | | 146,001 | | | 2,594,438 |

Financials - 23.3%

| | | | | | |

Axis Capital Holdings, Ltd. | | | 30,403 | | | 2,428,592 |

CNO Financial Group, Inc. | | | 136,122 | | | 4,753,380 |

Comerica, Inc. | | | 27,060 | | | 1,545,397 |

Corebridge Financial, Inc. | | | 100,893 | | | 2,982,397 |

Equitable Holdings, Inc. | | | 108,912 | | | 4,630,938 |

Fidelity National Financial, Inc. | | | 59,978 | | | 3,536,303 |

Fifth Third Bancorp | | | 99,320 | | | 4,239,971 |

Globe Life, Inc. | | | 39,556 | | | 4,155,358 |

KeyCorp | | | 130,835 | | | 2,232,045 |

MetLife, Inc. | | | 31,649 | | | 2,452,164 |

Voya Financial, Inc. | | | 47,312 | | | 3,351,109 |

| | | | | | 36,307,654 |

Health Care - 15.2%

| | | | | | |

Baxter International, Inc. | | | 151,269 | | | 5,739,146 |

Fresenius Medical Care AG & Co. KGaA - ADR | | | 178,797 | | | 3,466,874 |

Henry Schein, Inc.(a) | | | 47,888 | | | 3,378,498 |

Humana, Inc. | | | 12,745 | | | 4,517,720 |

Universal Health Services, Inc. - Class B | | | 27,781 | | | 6,611,045 |

| | | | | | 23,713,283 |

| | | | | | | |

| | | | | | | |

Industrials - 12.1%

| | | | | | |

Capital One Financial Corp. | | | 23,524 | | | $3,456,381 |

CH Robinson Worldwide, Inc. | | | 41,395 | | | 4,284,796 |

Global Payments, Inc. | | | 34,347 | | | 3,812,861 |

JELD-WEN Holding, Inc.(a) | | | 244,811 | | | 3,486,109 |

Robert Half, Inc. | | | 59,502 | | | 3,728,990 |

| | | | | | 18,769,137 |

Technology - 14.6%

| | | | | | |

Avnet, Inc. | | | 78,704 | | | 4,342,887 |

Cognizant Technology Solutions Corp. - Class A | | | 46,993 | | | 3,654,646 |

Concentrix Corp. | | | 58,326 | | | 4,387,865 |

Skyworks Solutions, Inc. | | | 25,428 | | | 2,786,654 |

SS&C Technologies Holdings, Inc. | | | 59,183 | | | 4,444,051 |

TE Connectivity, Ltd. | | | 19,843 | | | 3,047,885 |

| | | | | | 22,663,988 |

Utilities - 2.1%

| | | | | | |

Edison International | | | 37,573 | | | 3,269,978 |

TOTAL COMMON STOCKS

(Cost $132,505,345) | | | | | | 153,743,347 |

SHORT-TERM INVESTMENT - 1.0%

|

Money Market Fund - 1.0%

| | | | | | |

Fidelity Institutional Government Portfolio – Institutional Class, 5.21%(b) | | | 1,595,029 | | | 1,595,029 |

TOTAL SHORT-TERM INVESTMENT

(Cost $1,595,029) | | | | | | 1,595,029 |

TOTAL INVESTMENTS - 99.8%

(Cost $134,100,374) | | | | | | 155,338,376 |

Other Assets in Excess of

Liabilities - 0.2% | | | | | | 260,712 |

TOTAL NET ASSETS - 100.0% | | | | | | $155,599,088 |

| | | | | | | |

Percentages are stated as a percent of net assets.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

KGaA - Kommanditgesellschaft Auf Aktien

(a)

| Non-income producing security. |

(b)

| The rate shown represents the 7-day annualized yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena Emerging Markets Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 91.4%

| | | | | | |

Brazil - 8.7%

| | | | | | |

Ambev S.A. | | | 26,879,500 | | | $61,285,422 |

Banco do Brasil S.A. | | | 7,145,700 | | | 35,602,029 |

Natura & Co. Holding S.A. | | | 13,158,500 | | | 31,752,518 |

Neoenergia S.A. | | | 4,525,550 | | | 15,979,284 |

Vale S.A. | | | 3,162,900 | | | 33,256,763 |

| | | | | | 177,876,016 |

China - 24.2%

| | | | | | |

Alibaba Group Holding, Ltd. | | | 5,977,100 | | | 62,432,327 |

Baidu, Inc. - ADR(a) | | | 134,228 | | | 11,358,373 |

Baidu, Inc. - Class A(a) | | | 3,303,900 | | | 35,145,619 |

Beijing Oriental Yuhong Waterproof Technology Co. Ltd. -

A Shares | | | 10,986,766 | | | 16,895,086 |

China Merchants Bank Co., Ltd. - H Shares | | | 8,248,000 | | | 34,217,703 |

China Overseas Land & Investment, Ltd. | | | 35,296,118 | | | 56,037,080 |

CIMC Enric Holdings, Ltd. | | | 11,310,000 | | | 9,137,577 |

GF Securities Co., Ltd. -

H Shares | | | 15,409,400 | | | 12,350,759 |

Haier Smart Home Co., Ltd. - H Shares | | | 14,265,400 | | | 43,997,393 |

Ping An Insurance Group Co. of China, Ltd. - A Shares | | | 625,800 | | | 3,887,302 |

Ping An Insurance Group Co. of China, Ltd. - H Shares | | | 5,518,500 | | | 26,467,965 |

Shandong Weigao Group Medical Polymer Co., Ltd. - H Shares | | | 19,392,000 | | | 10,967,032 |

Tencent Holdings, Ltd. | | | 916,000 | | | 44,873,169 |

Weichai Power Co., Ltd. -

H Shares | | | 31,964,000 | | | 48,943,312 |

Zhejiang Longsheng Group Co., Ltd. - A Shares | | | 22,709,405 | | | 29,186,913 |

Zhongsheng Group Holdings,

Ltd. | | | 15,482,500 | | | 17,770,188 |

ZTO Express Cayman, Inc. -

ADR | | | 1,378,959 | | | 29,564,881 |

| | | | | | 493,232,679 |

Hong Kong - 7.0%

| | | | | | |

Galaxy Entertainment Group,

Ltd. | | | 8,107,000 | | | 31,397,497 |

Man Wah Holdings, Ltd. | | | 26,254,245 | | | 15,588,647 |

Pacific Basin Shipping, Ltd. | | | 113,252,066 | | | 31,225,723 |

WH Group, Ltd.(b) | | | 69,136,700 | | | 50,359,903 |

Yue Yuen Industrial (Holdings),

Ltd. | | | 7,769,500 | | | 13,470,933 |

| | | | | | 142,042,703 |

Hungary - 3.8%

| | | | | | |

MOL Hungarian Oil & Gas PLC | | | 2,502,197 | | | 18,960,333 |

OTP Bank PLC | | | 763,666 | | | 39,286,562 |

Richter Gedeon PLC | | | 612,380 | | | 18,550,839 |

| | | | | | 76,797,734 |

| | | | | | | |

| | | | | | | |

India - 3.6%

| | | | | | |

Glenmark Pharmaceuticals, Ltd. | | | 127,624 | | | $2,635,145 |

HDFC Bank, Ltd. | | | 1,913,210 | | | 37,339,773 |

Shriram Finance, Ltd. | | | 594,336 | | | 22,708,016 |

UPL Ltd. | | | 1,564,794 | | | 11,163,474 |

| | | | | | 73,846,408 |

Indonesia - 2.2%

| | | | | | |

Bank Rakyat Indonesia Persero

Tbk | | | 134,961,500 | | | 44,972,612 |

Kazakhstan - 1.5%

| | | | | | |

Kaspi.KZ JSC - ADR | | | 228,524 | | | 29,920,647 |

Peru - 2.0%

| | | | | | |

Credicorp, Ltd. | | | 222,974 | | | 39,767,413 |

Republic of Korea - 12.6%

| | | | | | |

DB Insurance Co., Ltd. | | | 381,345 | | | 33,114,511 |

Hankook Tire & Technology Co., Ltd. | | | 1,279,271 | | | 41,561,823 |

Hyundai Mobis Co., Ltd. | | | 235,812 | | | 38,394,363 |

KB Financial Group, Inc. | | | 478,480 | | | 30,768,000 |

Samsung Electronics Co., Ltd. | | | 1,030,401 | | | 57,310,921 |

Shinhan Financial Group Co.,

Ltd. | | | 816,270 | | | 34,279,857 |

WONIK IPS Co., Ltd.(a) | | | 808,951 | | | 20,680,224 |

| | | | | | 256,109,699 |

Romania - 0.5%

| | | | | | |

Banca Transilvania S.A. | | | 1,633,288 | | | 10,429,681 |

Russia - 0.0%(c)

| | | | | | |

Sberbank of Russia PJSC - ADR(a)(d) | | | 408,511 | | | 4,085 |

Singapore - 2.1%

| | | | | | |

Wilmar International, Ltd. | | | 17,918,300 | | | 43,115,416 |

South Africa - 2.0%

| | | | | | |

Sasol, Ltd. | | | 5,272,224 | | | 40,684,433 |

Taiwan - 9.3%

| | | | | | |

Compal Electronics, Inc. | | | 8,441,161 | | | 8,760,442 |

Hon Hai Precision Industry Co., Ltd. | | | 7,022,132 | | | 40,499,636 |

Nien Made Enterprise Co., Ltd. | | | 1,787,000 | | | 26,254,767 |

Taiwan Semiconductor Manufacturing Co., Ltd. | | | 2,765,000 | | | 81,592,998 |

United Integrated Services Co.,

Ltd. | | | 2,977,000 | | | 32,059,284 |

| | | | | | 189,167,127 |

Thailand - 4.5%

| | | | | | |

Bangkok Bank Public Co., Ltd. | | | 5,942,700 | | | 24,757,592 |

Bangkok Bank Public Co., Ltd. - NVDR | | | 4,496,900 | | | 18,734,315 |

Indorama Ventures PCL - NVDR | | | 33,708,600 | | | 17,031,085 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena Emerging Markets Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Thailand - (Continued)

|

SCB X PCL | | | 10,060,900 | | | $31,807,248 |

| | | | | | 92,330,240 |

Turkey - 0.8%

| | | | | | |

Akbank T.A.S. | | | 9,975,402 | | | 17,068,735 |

United Arab Emirates - 1.5%

| | | | | | |

Abu Dhabi Commercial Bank

PJSC | | | 12,475,059 | | | 29,753,874 |

United Kingdom - 0.9%

| | | | | | |

Standard Chartered PLC | | | 1,887,322 | | | 19,318,380 |

United States - 2.3%

| | | | | | |

Cognizant Technology Solutions Corp. - Class A | | | 610,023 | | | 47,441,489 |

Vietnam - 1.9%

| | | | | | |

Vietnam Dairy Products JSC | | | 13,118,900 | | | 38,981,392 |

TOTAL COMMON STOCKS

(Cost $1,789,167,134) | | | | | | 1,862,860,763 |

PREFERRED STOCKS - 4.8%

| | | | | | |

Brazil - 4.8%

| | | | | | |

Cia Energetica de Minas Gerais, 13.59% | | | 20,019,963 | | | 41,205,399 |

Itau Unibanco Holding S.A.,

6.35% | | | 4,903,243 | | | 31,780,883 |

Petroleo Brasileiro S.A., 12.42% | | | 3,569,500 | | | 24,865,119 |

TOTAL PREFERRED STOCKS

(Cost $79,949,292) | | | | | | 97,851,401 |

SHORT-TERM INVESTMENT - 3.7%

|

Money Market Fund - 3.7%

| | | | | | |

Fidelity Institutional Government Portfolio – Institutional Class, 5.21%(e) | | | 75,807,028 | | | 75,807,028 |

TOTAL SHORT-TERM INVESTMENT

(Cost $75,807,028) | | | | | | 75,807,028 |

TOTAL INVESTMENTS - 99.9%

(Cost $1,944,923,454) | | | | | | 2,036,519,192 |

Other Assets in Excess of

Liabilities - 0.1% | | | | | | 2,510,562 |

TOTAL NET

ASSETS - 100.0% | | | | | | $2,039,029,754 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

ADR - American Depositary Receipt

JSC - Joint Stock Company

NVDR - Non-Voting Depositary Receipt

PJSC - Private Joint Stock Company

PLC - Public Limited Company

S.A. - Société Anonyme

T.A.S. - Turk Anonim Şirketi

(a)

| Non-income producing security. |

(b)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of August 31, 2024, the value of these securities total $50,359,903 or 2.5% of the Fund’s net assets. |

(c)

| Represents less than 0.05% of net assets. |

(d)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $4,085 or 0.0% of net assets as of August 31, 2024. |

(e)

| The rate shown represents the 7-day annualized effective yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena Emerging Markets Value Fund

Portfolio Diversification

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS

| | | | | | |

Communication Services | | | $91,377,161 | | | 4.5% |

Consumer Discretionary | | | 290,867,938 | | | 14.3% |

Consumer Staples | | | 225,494,651 | | | 11.0% |

Energy | | | 18,960,333 | | | 0.9% |

Financials | | | 576,557,060 | | | 28.3% |

Health Care | | | 32,153,016 | | | 1.6% |

Industrials | | | 150,930,777 | | | 7.4% |

Information Technology | | | 256,285,710 | | | 12.6% |

Materials | | | 148,217,753 | | | 7.3% |

Real Estate | | | 56,037,080 | | | 2.7% |

Utilities | | | 15,979,284 | | | 0.8% |

Total Common Stocks | | | 1,862,860,763 | | | 91.4% |

PREFERRED STOCKS

| | | | | | |

Energy | | | 24,865,119 | | | 1.2% |

Financials | | | 31,780,883 | | | 1.6% |

Utilities | | | 41,205,399 | | | 2.0% |

Total Preferred Stocks | | | 97,851,401 | | | 4.8% |

Short-Term Investment | | | 75,807,028 | | | 3.7% |

Total Investments | | | 2,036,519,192 | | | 99.9% |

Other Assets in Excess of Liabilities | | | 2,510,562 | | | 0.1% |

Total Net Assets | | | $2,039,029,754 | | | 100.0% |

| | | | | | | |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Pzena Investment Management, LLC.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena Small Cap Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 95.5%

| | | | | | |

Basic Materials - 6.4%

| | | | | | |

Koppers Holdings, Inc. | | | 22,084 | | | $874,085 |

Olin Corp. | | | 39,854 | | | 1,740,424 |

Orion S.A. | | | 62,891 | | | 1,172,917 |

| | | | | | 3,787,426 |

Consumer Discretionary - 19.2%

| | | | | | |

Adient PLC(a) | | | 71,166 | | | 1,609,775 |

Advance Auto Parts, Inc. | | | 24,340 | | | 1,102,845 |

Dana, Inc. | | | 84,444 | | | 953,373 |

Gap, Inc. | | | 19,262 | | | 432,047 |

Genesco, Inc.(a) | | | 29,198 | | | 881,488 |

Hooker Furnishings Corp. | | | 23,915 | | | 378,813 |

Interface, Inc. | | | 70,280 | | | 1,326,886 |

Malibu Boats, Inc. - Class A(a) | | | 38,065 | | | 1,384,424 |

Newell Brands, Inc. | | | 86,731 | | | 614,923 |

PVH Corp. | | | 9,671 | | | 954,431 |

Steelcase, Inc. - Class A | | | 127,165 | | | 1,798,113 |

| | | | | | 11,437,118 |

Consumer Staples - 7.2%

| | | | | | |

Spectrum Brands Holdings, Inc. | | | 19,151 | | | 1,806,323 |

Universal Corp. | | | 27,831 | | | 1,511,223 |

USANA Health Sciences, Inc.(a) | | | 24,251 | | | 989,926 |

| | | | | | 4,307,472 |

Energy - 5.0%

| | | | | | |

MRC Global, Inc.(a) | | | 135,412 | | | 1,782,022 |

NOV, Inc. | | | 65,808 | | | 1,169,408 |

| | | | | | 2,951,430 |

Financials - 22.0%

| | | | | | |

Associated Banc-Corp. | | | 64,954 | | | 1,486,147 |

Axis Capital Holdings, Ltd. | | | 16,612 | | | 1,326,966 |

CNO Financial Group, Inc. | | | 67,750 | | | 2,365,830 |

Columbia Banking System, Inc. | | | 60,372 | | | 1,520,167 |

Globe Life, Inc. | | | 5,851 | | | 614,647 |

Old National Bancorp of Indiana | | | 73,401 | | | 1,457,010 |

Synovus Financial Corp. | | | 18,040 | | | 832,005 |

Univest Financial Corp. | | | 33,930 | | | 965,648 |

Webster Financial Corp. | | | 27,906 | | | 1,323,582 |

WSFS Financial Corp. | | | 22,040 | | | 1,206,470 |

| | | | | | 13,098,472 |

Health Care - 2.6%

| | | | | | |

Phibro Animal Health Corp. - Class A | | | 34,533 | | | 725,193 |

Varex Imaging Corp.(a) | | | 67,798 | | | 846,119 |

| | | | | | 1,571,312 |

Industrials - 25.5%(b)

| | | | | | |

ABM Industries, Inc. | | | 15,752 | | | 900,227 |

American Woodmark Corp.(a) | | | 12,098 | | | 1,084,102 |

Axalta Coating Systems, Ltd.(a) | | | 23,708 | | | 865,342 |

Belden, Inc. | | | 8,117 | | | 870,792 |

Bread Financial Holdings, Inc. | | | 22,175 | | | 1,289,920 |

Douglas Dynamics, Inc. | | | 42,327 | | | 1,178,383 |

| | | | | | | |

| | | | | | | |

GMS, Inc.(a) | | | 1,301 | | | $112,914 |

JELD-WEN Holding, Inc.(a) | | | 106,433 | | | 1,515,606 |

Korn Ferry | | | 23,845 | | | 1,741,877 |

Masterbrand, Inc.(a) | | | 50,470 | | | 809,539 |

Resideo Technologies, Inc.(a) | | | 71,143 | | | 1,434,243 |

Shyft Group, Inc. | | | 86,405 | | | 1,226,087 |

TriMas Corp. | | | 60,995 | | | 1,555,982 |

TrueBlue, Inc.(a) | | | 72,113 | | | 574,740 |

| | | | | | 15,159,754 |

Real Estate - 1.1%

| | | | | | |

Marcus & Millichap, Inc. | | | 16,268 | | | 645,352 |

Technology - 6.5%

| | | | | | |

Avnet, Inc. | | | 24,376 | | | 1,345,068 |

Concentrix Corp. | | | 16,260 | | | 1,223,240 |

ScanSource, Inc.(a) | | | 25,444 | | | 1,296,117 |

| | | | | | 3,864,425 |

TOTAL COMMON STOCKS

(Cost $51,902,135) | | | | | | 56,822,761 |

REAL ESTATE INVESTMENT TRUST - 1.0%

|

Real Estate – 1.0%

| | | | | | |

DiamondRock Hospitality Co. | | | 66,333 | | | 583,067 |

TOTAL REAL ESTATE INVESTMENT TRUST

(Cost $594,493) | | | | | | 583,067 |

SHORT-TERM INVESTMENT - 3.4%

|

Money Market Fund - 3.4%

| | | | | | |

Fidelity Institutional Government Portfolio – Institutional Class, 5.21%(c) | | | 2,029,894 | | | 2,029,894 |

TOTAL SHORT-TERM INVESTMENT

(Cost $2,029,894) | | | | | | 2,029,894 |

TOTAL INVESTMENTS - 99.9%

(Cost $54,526,522) | | | | | | 59,435,722 |

Other Assets in Excess of

Liabilities - 0.1% | | | | | | 52,073 |

TOTAL NET ASSETS - 100.0% | | | | | | $59,487,795 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

S.A. - Société Anonyme

(a)

| Non-income producing security. |

(b)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors. |

(c)

| The rate shown represents the 7-day annualized yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Small Cap Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 95.3%

| | | | | | |

Australia - 2.5%

| | | | | | |

Elders Ltd. | | | 125,417 | | | $780,975 |

Austria - 2.3%

| | | | | | |

ams-OSRAM AG(a) | | | 575,069 | | | 706,278 |

Canada - 4.9%

| | | | | | |

Linamar Corp. | | | 11,814 | | | 554,035 |

Transcontinental, Inc. - Class A | | | 77,823 | | | 969,575 |

| | | | | | 1,523,610 |

Denmark - 2.1%

| | | | | | |

Solar A/S - Class B | | | 13,009 | | | 644,850 |

Finland - 2.3%

| | | | | | |

Nokian Renkaat Oyj | | | 73,998 | | | 701,331 |

France - 2.9%

| | | | | | |

Rexel S.A. | | | 35,690 | | | 901,077 |

Germany - 5.5%

| | | | | | |

Aurubis AG | | | 10,412 | | | 786,094 |

Deutz AG | | | 45,864 | | | 240,512 |

Duerr AG | | | 30,897 | | | 674,532 |

| | | | | | 1,701,138 |

Hong Kong - 5.5%

| | | | | | |

Pacific Basin Shipping, Ltd. | | | 1,345,929 | | | 371,098 |

VTech Holdings, Ltd. | | | 101,000 | | | 656,685 |

Yue Yuen Industrial (Holdings), Ltd. | | | 395,500 | | | 685,727 |

| | | | | | 1,713,510 |

Ireland - 11.1%

| | | | | | |

Bank of Ireland Group PLC | | | 39,508 | | | 452,880 |

C&C Group PLC | | | 430,216 | | | 882,535 |

Origin Enterprises PLC | | | 324,511 | | | 1,180,171 |

Permanent TSB Group Holdings

PLC(a) | | | 527,907 | | | 933,677 |

| | | | | | 3,449,263 |

Israel - 1.6%

| | | | | | |

Ituran Location and Control, Ltd. | | | 17,845 | | | 504,121 |

Italy - 5.6%

| | | | | | |

Anima Holding S.p.A.(b) | | | 183,704 | | | 1,023,455 |

BPER Banca | | | 129,490 | | | 724,279 |

| | | | | | 1,747,734 |

Japan - 19.0%

| | | | | | |

DIC Corp. | | | 27,700 | | | 593,639 |

Fukuoka Financial Group, Inc. | | | 21,200 | | | 555,704 |

Hokkoku Financial Holdings, Inc. | | | 6,900 | | | 232,218 |

Kanto Denka Kogyo Co., Ltd. | | | 115,100 | | | 771,585 |

KH Neochem Co., Ltd. | | | 61,300 | | | 869,664 |

Open House Group Co., Ltd. | | | 8,300 | | | 326,118 |

Sankyu, Inc. | | | 18,900 | | | 616,038 |

Sawai Group Holdings Co. Ltd. | | | 17,700 | | | 750,425 |

| | | | | | | |

| | | | | | | |

Teijin, Ltd. | | | 74,700 | | | $696,209 |

Zeon Corp. | | | 57,000 | | | 468,469 |

| | | | | | 5,880,069 |

Netherlands - 3.8%

| | | | | | |

Flow Traders, Ltd. | | | 14,165 | | | 273,389 |

Signify N.V.(b) | | | 36,940 | | | 908,136 |

| | | | | | 1,181,525 |

Republic of Korea - 1.7%

| | | | | | |

WONIK IPS Co., Ltd.(a) | | | 20,958 | | | 535,775 |

Spain - 4.5%

| | | | | | |

Cia de Distribucion Integral Logista Holdings S.A. | | | 20,141 | | | 618,935 |

Unicaja Banco S.A.(b) | | | 560,902 | | | 759,526 |

| | | | | | 1,378,461 |

United Kingdom - 20.0%

| | | | | | |

Balfour Beatty PLC | | | 102,922 | | | 566,352 |

Direct Line Insurance Group PLC | | | 185,862 | | | 464,265 |

Ferrexpo PLC(a) | | | 236,110 | | | 142,328 |

Hays PLC | | | 618,929 | | | 753,096 |

Ibstock PLC(b) | | | 516,869 | | | 1,247,643 |

Pennon Group PLC | | | 96,453 | | | 764,465 |

Sabre Insurance Group PLC(b) | | | 411,083 | | | 841,126 |

Senior PLC | | | 306,720 | | | 663,035 |

Travis Perkins PLC | | | 46,229 | | | 550,663 |

Wizz Air Holdings PLC(a)(b) | | | 11,774 | | | 206,274 |

| | | | | | 6,199,247 |

TOTAL COMMON STOCKS

(Cost $27,391,170) | | | | | | 29,548,964 |

SHORT-TERM INVESTMENT - 4.4%

|

Money Market Fund - 4.4%

| | | | | | |

Fidelity Institutional Government Portfolio – Institutional Class, 5.21%(c) | | | 1,367,931 | | | 1,367,931 |

TOTAL SHORT-TERM INVESTMENT

(Cost $1,367,931) | | | | | | 1,367,931 |

TOTAL INVESTMENTS - 99.7%

(Cost $28,759,101) | | | | | | 30,916,895 |

Other Assets in Excess of

Liabilities - 0.3% | | | | | | 92,350 |

TOTAL NET ASSETS - 100.0% | | | | | | $31,009,245 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Small Cap Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)(Continued)

AG - Aktiengesellschaft

A/S - Aksjeselskap

N.V. - Naamloze Vennootschap

Oyj - Julkinen osakeyhtiö

PLC - Public Limited Company

S.A. - Société Anonyme

S.p.A - Società per Azioni

(a)

| Non-income producing security. |

(b)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of August 31, 2024, the value of these securities total $4,986,160 or 16.1% of the Fund’s net assets. |

(c)

| The rate shown represents the 7-day annualized yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Small Cap Value Fund

Portfolio Diversification

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS

| | | | | | |

Consumer Discretionary | | | $2,267,210 | | | 7.3% |

Consumer Staples | | | 2,843,681 | | | 9.2% |

Financials | | | 6,260,519 | | | 20.2% |

Health Care | | | 750,425 | | | 2.4% |

Industrials | | | 7,714,598 | | | 24.9% |

Information Technology | | | 2,402,860 | | | 7.7% |

Materials | | | 6,545,206 | | | 21.1% |

Utilities | | | 764,465 | | | 2.5% |

Total Common Stocks | | | 29,548,964 | | | 95.3% |

Short-Term Investment | | | 1,367,931 | | | 4.4% |

Total Investments | | | 30,916,895 | | | 99.7% |

Other Assets in Excess of Liabilities | | | 92,350 | | | 0.3% |

Total Net Assets | | | $31,009,245 | | | 100.0% |

| | | | | | | |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Pzena Investment Management, LLC.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 97.2%

| | | | | | |

Brazil - 1.8%

| | | | | | |

Ambev S.A. | | | 415,600 | | | $947,570 |

Ambev S.A. - ADR | | | 13,543 | | | 30,743 |

Banco do Brasil S.A. | | | 122,500 | | | 610,332 |

| | | | | | 1,588,645 |

Canada - 1.7%

| | | | | | |

Magna International, Inc. | | | 26,252 | | | 1,103,338 |

Magna International, Inc.(c) | | | 9,721 | | | 408,574 |

| | | | | | 1,511,912 |

China - 4.7%

| | | | | | |

Alibaba Group Holding, Ltd. | | | 162,400 | | | 1,696,309 |

Alibaba Group Holding, Ltd. - ADR | | | 563 | | | 46,920 |

China Merchants Bank Co., Ltd. - H Shares | | | 103,000 | | | 427,306 |

China Overseas Land & Investment, Ltd. | | | 368,500 | | | 585,041 |

Haier Smart Home Co., Ltd. -

H Shares | | | 266,600 | | | 822,249 |

Weichai Power Co., Ltd. - H Shares | | | 415,000 | | | 635,449 |

| | | | | | 4,213,274 |

Denmark - 1.4%

| | | | | | |

Danske Bank A/S | | | 39,976 | | | 1,247,602 |

Finland - 2.7%

| | | | | | |

Nokia Oyj | | | 107,014 | | | 470,570 |

Nokia Oyj - ADR | | | 426,021 | | | 1,900,054 |

| | | | | | 2,370,624 |

France - 13.1%

| | | | | | |

Accor S.A. | | | 27,838 | | | 1,171,495 |

Amundi S.A.(a) | | | 23,145 | | | 1,739,745 |

Cie Generale des Etablissements Michelin SCA | | | 53,667 | | | 2,106,577 |

Rexel S.A. | | | 72,737 | | | 1,836,415 |

Sanofi | | | 22,762 | | | 2,546,305 |

Teleperformance SE | | | 21,318 | | | 2,329,627 |

| | | | | | 11,730,164 |

Germany - 14.2%

| | | | | | |

BASF SE | | | 42,139 | | | 2,135,713 |

Bayer AG | | | 58,544 | | | 1,803,270 |

Continental AG | | | 19,481 | | | 1,315,315 |

Covestro AG(a)(b) | | | 22,401 | | | 1,371,818 |

Daimler Truck Holding AG | | | 62,615 | | | 2,398,979 |

Evonik Industries AG | | | 52,486 | | | 1,163,261 |

Fresenius Medical Care AG & Co. KGaA | | | 33,577 | | | 1,293,864 |

Mercedes-Benz Group AG | | | 16,499 | | | 1,136,957 |

Siemens AG | | | 357 | | | 67,055 |

| | | | | | 12,686,232 |

Hong Kong - 1.1%

| | | | | | |

Galaxy Entertainment Group, Ltd. | | | 256,000 | | | 991,459 |

| | | | | | | |

| | | | | | | |

Hungary - 0.5%

| | | | | | |

OTP Bank PLC | | | 9,105 | | | $468,404 |

Indonesia - 0.8%

| | | | | | |

Bank Rakyat Indonesia Persero Tbk | | | 2,179,900 | | | 726,398 |

Ireland - 3.7%

| | | | | | |

Bank of Ireland Group PLC | | | 164,265 | | | 1,882,969 |

Medtronic PLC | | | 15,496 | | | 1,372,636 |

| | | | | | 3,255,605 |

Italy - 2.0%

| | | | | | |

Enel S.p.A. | | | 238,917 | | | 1,812,774 |

Japan - 14.2%

| | | | | | |

Bridgestone Corp. | | | 9,500 | | | 369,239 |

Fukuoka Financial Group, Inc. | | | 24,000 | | | 629,099 |

Iida Group Holdings Co., Ltd. | | | 25,000 | | | 384,688 |

Komatsu, Ltd. | | | 54,400 | | | 1,509,313 |

Minebea Mitsumi, Inc. | | | 60,100 | | | 1,257,582 |

MS&AD Insurance Group Holdings, Inc. | | | 2,400 | | | 54,915 |

Olympus Corp. | | | 63,300 | | | 1,151,559 |

Resona Holdings, Inc. | | | 185,000 | | | 1,304,073 |

Sumitomo Mitsui Financial Group,

Inc. | | | 6,500 | | | 424,619 |

Suntory Beverage & Food, Ltd. | | | 44,400 | | | 1,624,872 |

T&D Holdings, Inc. | | | 18,000 | | | 301,477 |

Takeda Pharmaceutical Co., Ltd. | | | 28,200 | | | 835,834 |

TDK Corp. | | | 25,900 | | | 1,744,560 |

Toray Industries, Inc. | | | 214,200 | | | 1,099,498 |

| | | | | | 12,691,328 |

Luxembourg - 2.0%

| | | | | | |

ArcelorMittal S.A. | | | 77,270 | | | 1,808,220 |

Netherlands - 5.3%

| | | | | | |

ING Groep N.V. | | | 111,878 | | | 2,027,445 |

Koninklijke Philips N.V.(b) | | | 32,865 | | | 988,511 |

Randstad N.V. | | | 34,841 | | | 1,677,252 |

| | | | | | 4,693,208 |

Norway - 1.9%

| | | | | | |

Equinor ASA | | | 64,431 | | | 1,710,157 |

Republic of Korea - 0.6%

| | | | | | |

Shinhan Financial Group Co., Ltd. | | | 8,620 | | | 362,003 |

Shinhan Financial Group Co., Ltd. - ADR | | | 3,710 | | | 157,490 |

| | | | | | 519,493 |

Spain - 2.4%

| | | | | | |

CaixaBank S.A. | | | 350,085 | | | 2,112,932 |

Switzerland - 6.5%

| | | | | | |

Julius Baer Group, Ltd. | | | 27,047 | | | 1,575,315 |

Roche Holding AG | | | 8,409 | | | 2,841,086 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Value Fund

Schedule of Investments

August 31, 2024 (Unaudited)(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Switzerland - (Continued)

|

UBS Group AG | | | 46,041 | | | $1,406,605 |

| | | | | | 5,823,006 |

Taiwan - 1.7%

| | | | | | |

Hon Hai Precision Industry Co., Ltd. - GDR | | | 50,236 | | | 575,202 |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 31,000 | | | 914,786 |

| | | | | | 1,489,988 |

United Kingdom - 14.9%

| | | | | | |

Aviva PLC - Class B(b) | | | 9,490 | | | 62,890 |

Barclays PLC | | | 401,950 | | | 1,205,681 |

HSBC Holdings PLC | | | 191,169 | | | 1,673,833 |

J Sainsbury PLC | | | 420,217 | | | 1,613,672 |

NatWest Group PLC | | | 301,418 | | | 1,366,483 |

Reckitt Benckiser Group PLC | | | 37,818 | | | 2,168,436 |

Shell PLC | | | 47,059 | | | 1,670,070 |

Standard Chartered PLC | | | 123,046 | | | 1,259,483 |

Tesco PLC | | | 388,666 | | | 1,805,410 |

Travis Perkins PLC | | | 40,169 | | | 478,479 |

| | | | | | 13,304,437 |

TOTAL COMMON STOCKS

(Cost $76,311,810) | | | | | | 86,755,862 |

SHORT-TERM INVESTMENT - 2.5%

|

Money Market Fund - 2.5%

| | | | | | |

Fidelity Institutional Government Portfolio – Institutional Class, 5.21%(d) | | | 2,245,194 | | | 2,245,194 |

TOTAL SHORT-TERM INVESTMENT

(Cost $2,245,194) | | | | | | 2,245,194 |

TOTAL INVESTMENTS - 99.7%

(Cost $78,557,004) | | | | | | 89,001,056 |

Other Assets in Excess of

Liabilities - 0.3% | | | | | | 242,972 |

TOTAL NET ASSETS - 100.0% | | | | | | $89,244,028 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services.

A/S - Aksjeselskap

ADR - American Depositary Receipt

AG - Aktiengesellschaft

GDR - Global Depository Receipt

KGaA - Kommanditgesellschaft Auf Aktien

N.V. - Naamloze Vennootschap

Oyj - Julkinen osakeyhtiö

PLC - Public Limited Company

S.A. - Société Anonyme

S.p.A - Società per Azioni

SCA - Société en Commandite par Actions

SE - Societas Europea

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of August 31, 2024, the value of these securities total $3,111,563 or 3.5% of the Fund’s net assets. |

(b)

| Non-income producing security. |

(c)

| U.S. Traded Foreign Security. |

(d)

| The rate shown represents the 7-day annualized effective yield as of August 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena International Value Fund

Portfolio Diversification

August 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS

| | | | | | |

Consumer Discretionary | | | $11,553,118 | | | 12.9% |

Consumer Staples | | | 8,190,703 | | | 9.2% |

Energy | | | 3,380,227 | | | 3.8% |

Financials | | | 23,027,101 | | | 25.8% |

Health Care | | | 12,833,064 | | | 14.4% |

Industrials | | | 12,190,150 | | | 13.7% |

Information Technology | | | 5,605,173 | | | 6.3% |

Materials | | | 7,578,511 | | | 8.5% |

Real Estate | | | 585,041 | | | 0.6% |

Utilities | | | 1,812,774 | | | 2.0% |

Total Common Stocks | | | 86,755,862 | | | 97.2% |

Short-Term Investment | | | 2,245,194 | | | 2.5% |

Total Investments | | | 89,901,056 | | | 99.7% |

Other Assets in Excess of Liabilities | | | 242,972 | | | 0.3% |

Total Net Assets | | | $89,244,028 | | | 100.0% |

| | | | | | | |

Note: For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, as amended, the Fund uses more specific industry classifications.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by Pzena Investment Management, LLC.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PZENA FUNDS

Statements of Assets and Liabilities

August 31, 2024 (Unaudited)

| | | | | | | | | | |

ASSETS:

| | | | | | | | | |

Investments in securities, at value (cost $134,100,374, $1,944,923,454, and $54,526,522, respectively) | | | $155,338,376 | | | $2,036,519,192 | | | $59,435,722 |

Foreign currency, at value (cost $0, $2,937,727, and $0, respectively) | | | — | | | 2,937,727 | | | — |

Receivables:

| | | | | | | | | |

Fund shares sold | | | 45,639 | | | 2,838,785 | | | 59,905 |

Dividends and interest | | | 322,128 | | | 6,835,375 | | | 63,004 |

Dividend tax reclaim | | | 41,294 | | | 23,759 | | | — |

Prepaid expenses | | | 23,387 | | | 124,452 | | | 28,076 |

Total assets | | | 155,770,824 | | | 2,049,279,290 | | | 59,586,707 |

LIABILITIES:

| | | | | | | | | |

Payables:

| | | | | | | | | |

Non-U.S. taxes (Note 10) | | | — | | | 3,432,568 | | | — |

Fund shares redeemed | | | 3,861 | | | 1,740,707 | | | 4,673 |

Securities purchased | | | — | | | 3,120,048 | | | — |

Due to adviser (Note 4) | | | 95,389 | | | 1,587,322 | | | 28,368 |

Audit fees | | | 33,842 | | | 33,842 | | | 33,842 |

Administration fees | | | 13,352 | | | 96,684 | | | 13,833 |

12b-1 distribution fees - Investor Class | | | 7,855 | | | 47,310 | | | 2,783 |

Transfer agent fees and expenses | | | 5,491 | | | 9,638 | | | 5,471 |

Shareholder reporting | | | 3,192 | | | 28,419 | | | 3,690 |

Chief Compliance Officer fee | | | 1,879 | | | 1,879 | | | 1,879 |

Custody fees | | | 1,354 | | | 142,170 | | | 806 |

Legal fees | | | 922 | | | 826 | | | 826 |

Trustee fees and expenses | | | 337 | | | 337 | | | 471 |

Fund accounting fees | | | 245 | | | 477 | | | 251 |

Shareholder servicing fees - Investor Class | | | 111 | | | 2,333 | | | — |

Miscellaneous | | | 3,906 | | | 4,976 | | | 2,019 |

Total liabilities | | | 171,736 | | | 10,249,536 | | | 98,912 |

NET ASSETS | | | $155,599,088 | | | $2,039,029,754 | | | $59,487,795 |

NET ASSETS CONSIST OF:

| | | | | | | | | |

Paid-in capital | | | $116,176,753 | | | $1,799,296,621 | | | $51,176,014 |

Total distributable earnings | | | 39,422,335 | | | 239,733,133 | | | 8,311,781 |

Net assets | | | $155,599,088 | | | $2,039,029,754 | | | $59,487,795 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PZENA FUNDS

Statements of Assets and Liabilities

August 31, 2024 (Unaudited)(Continued)

| | | | | | | | | | |

CALCULATION OF NET ASSET VALUE PER SHARE

| | | | | | | | | |

Investor Class:

| | | | | | | | | |

Net assets | | | $7,605,620 | | | $46,796,628 | | | $4,802,228 |

Shares outstanding [unlimited number of shares (par value $0.01) authorized] | | | 494,615 | | | 3,614,692 | | | 312,329 |

Net asset value, offering and redemption price per share | | | $15.38 | | | $12.95 | | | $15.38 |

Institutional Class:

| | | | | | | | | |

Net assets | | | $147,993,468 | | | $1,992,233,126 | | | $54,685,567 |

Shares outstanding [unlimited number of shares (par value $0.01) authorized] | | | 9,755,526 | | | 152,990,306 | | | 3,521,811 |

Net asset value, offering and redemption price per share | | | $15.17 | | | $13.02 | | | $15.53 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PZENA FUNDS

Statements of Assets and Liabilities

August 31, 2024 (Unaudited)(Continued)

| | | | | | | |

ASSETS:

| | | | | | |

Investments in securities, at value (cost $28,759,101 and $78,557,004, respectively) | | | $30,916,895 | | | $89,001,056 |

Foreign currency, at value (cost $4,334 and $74,657, respectively) | | | 4,316 | | | 74,657 |

Receivables:

| | | | | | |

Fund shares sold | | | 19,470 | | | 1,367 |

Dividends and interest | | | 89,965 | | | 149,504 |

Dividend tax reclaim | | | 34,631 | | | 158,023 |

Prepaid expenses | | | 22,073 | | | 25,117 |

Total assets | | | 31,087,350 | | | 89,409,724 |

LIABILITIES:

| | | | | | |

Payables:

| | | | | | |

Securities purchased | | | — | | | 69,027 |

Due to adviser (Note 4) | | | 9,572 | | | 30,520 |

Audit fees | | | 33,842 | | | 33,842 |

Administration fees | | | 14,099 | | | 13,966 |

12b-1 distribution fees - Investor Class | | | 5,544 | | | 1,499 |

Transfer agent fees and expenses | | | 4,754 | | | 4,718 |

Shareholder reporting | | | 231 | | | 342 |

Chief Compliance Officer fee | | | 1,879 | | | 1,879 |

Custody fees | | | 2,763 | | | 3,543 |

Legal fees | | | 922 | | | 922 |

Trustee fees and expenses | | | 338 | | | 337 |

Fund accounting fees | | | 2,241 | | | 505 |

Miscellaneous | | | 1,920 | | | 4,596 |

Total liabilities | | | 78,105 | | | 165,696 |

NET ASSETS | | | $31,009,245 | | | $89,244,028 |

NET ASSETS CONSIST OF:

| | | | | | |

Paid-in capital | | | $26,529,818 | | | $74,572,429 |

Total distributable earnings | | | 4,479,427 | | | 14,671,599 |

Net assets | | | $31,009,245 | | | $89,244,028 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

PZENA FUNDS

Statements of Assets and Liabilities

August 31, 2024 (Unaudited)(Continued)

| | | | | | | |

CALCULATION OF NET ASSET VALUE PER SHARE

| | | | | | |

Investor Class:

| | | | | | |

Net assets | | | $4,125,986 | | | $1,203,908 |

Shares outstanding [unlimited number of shares (par value $0.01) authorized] | | | 335,912 | | | 107,256 |

Net asset value, offering and redemption price per share | | | $12.28 | | | $11.22 |

Institutional Class:

| | | | | | |

Net assets | | | $26,883,259 | | | $88,040,120 |

Shares outstanding [unlimited number of shares (par value $0.01) authorized] | | | 2,179,709 | | | 7,826,785 |

Net asset value, offering and redemption price per share | | | $12.33 | | | $11.25 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Pzena Funds

Statements of Operations

For the Period Ended August 31, 2024 (Unaudited)

| | | | | | | | | | |

INVESTMENT INCOME:

| | | | | | | | | |

Dividends (net of foreign taxes withheld and issuance fees of $43,484, $4,230,314, and $559, respectively) | | | $1,669,060 | | | $61,602,001 | | | $425,649 |

Interest income | | | 69,439 | | | 1,619,744 | | | 33,934 |

Total investment income | | | 1,738,499 | | | 63,221,745 | | | 459,583 |

EXPENSES:

| | | | | | | | | |

Investment advisory fees (Note 4) | | | 597,996 | | | 9,565,379 | | | 248,392 |

Administration fees (Note 4) | | | 40,923 | | | 357,312 | | | 40,012 |

Federal and state registration fees | | | 15,782 | | | 77,934 | | | 15,109 |

Transfer agent fees and expenses (Note 4) | | | 15,485 | | | 53,804 | | | 15,392 |

Audit fees | | | 11,343 | | | 11,343 | | | 11,343 |

12b-1 distribution fees - Investor Class (Note 5) | | | 9,515 | | | 56,437 | | | 5,384 |

Trustee fees and expenses | | | 8,274 | | | 8,274 | | | 8,144 |

Custody fees (Note 4) | | | 6,499 | | | 570,084 | | | 3,390 |

Chief Compliance Officer fees (Note 4) | | | 5,546 | | | 5,546 | | | 5,546 |

Legal fees | | | 3,317 | | | 3,416 | | | 3,416 |

Shareholder servicing fees - Investor Class (Note 6) | | | 3,286 | | | 21,062 | | | 1,009 |

Insurance expense | | | 2,398 | | | 12,145 | | | 1,883 |